Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Mattersight Corp | matr-ex991_15.htm |

| 8-K - 8-K - Mattersight Corp | matr-8k_20160504.htm |

Q1 2016 Earnings Webinar May 4, 2016 Exhibit 99.2

Safe Harbor Language During today’s call we will be making both historical and forward-looking statements in order to help you better understand our business. These forward-looking statements include references to our plans, intentions, expectations, beliefs, strategies and objectives. Any forward-looking statements speak only as of today’s date. In addition, these forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements. The risks and uncertainties associated with our business are highlighted in our filings with the SEC, including our Annual Report filed on Form 10-K for the year ended December 31, 2015, our quarterly reports on Form 10-Q, as well as our earnings press release issued earlier today. Mattersight Corporation undertakes no obligation to publicly update or revise any forward-looking statements in this call. Also, be advised that this call is being recorded and is copyrighted by Mattersight Corporation. © 2016 Mattersight Corporation.

Overview Positives Increasing market tailwinds Record rolling four quarters Bookings Record Book of Business Strongest ever pipeline New sales people gaining traction Breadth and depth of our product footprint Massive, underpenetrated market opportunity Growing Pains Greater than expected seasonality Lower than expected new deployed revenue Forecasting processes Summary Most encouraging outlook ever Exit Q4 at consensus revenue and EBITDA estimates End 2016 with $70M+ Book of Business © 2016 Mattersight Corporation.

Q1 Highlights Bookings and Book of Business $5.4M in current quarter ACV Record $25.1M in rolling four quarter ACV 47% year/year increase in ACV bookings 2 new logos, both from routing Signed reseller agreement with very, very large Consulting/SI firm ~80% of revenues came from new QCs ~80% of bookings from new accounts Record Book of Business Other Highlights Signed partnership agreement with Voci Executed new debt agreement with Silicon Valley Bank © 2016 Mattersight Corporation.

Growth Levers and Pipeline Discussion Growth Lever #1: Routing Driven New Logos Shortening sales cycles with new logos 80%-90% hit rate when PBR technology gets installed Growth Lever #2: Major Opportunities at Existing Accounts Our account penetration remains low Broad product footprint creating numerous expansion discussions We have line of sight to $20M+ of expansion opportunities over the next 4-6 quarters across our largest accounts Growth Lever # 3: Emerging Partnership with Very Large SI Signed a reseller agreement Pursuant to this agreement, purchased an option to buy up to 15,000 routing seats through the end of 2017 Pipeline Largest total $ pipeline…up 29% year/year Largest total deals in pursuit Largest number of large deals (deals >$750k in ACV) Largest number of new logos © 2016 Mattersight Corporation.

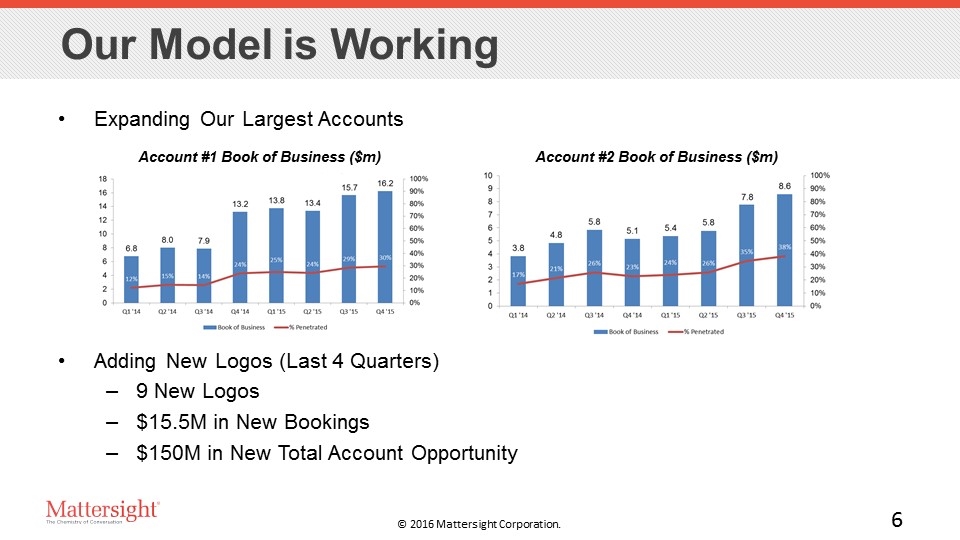

Our Model is Working Expanding Our Largest Accounts Adding New Logos (Last 4 Quarters) 9 New Logos $15.5M in New Bookings $150M in New Total Account Opportunity © 2016 Mattersight Corporation. Account #1 Book of Business ($m) Account #2 Book of Business ($m)

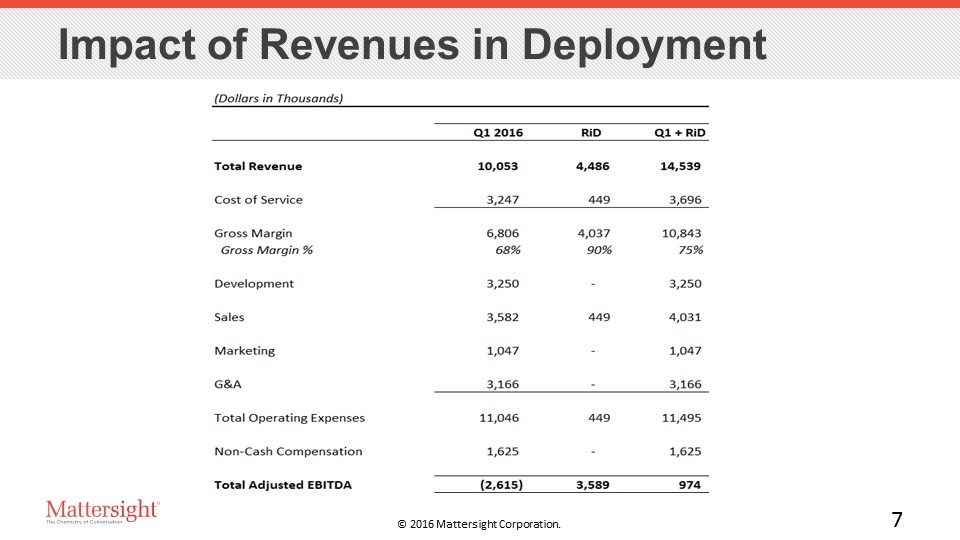

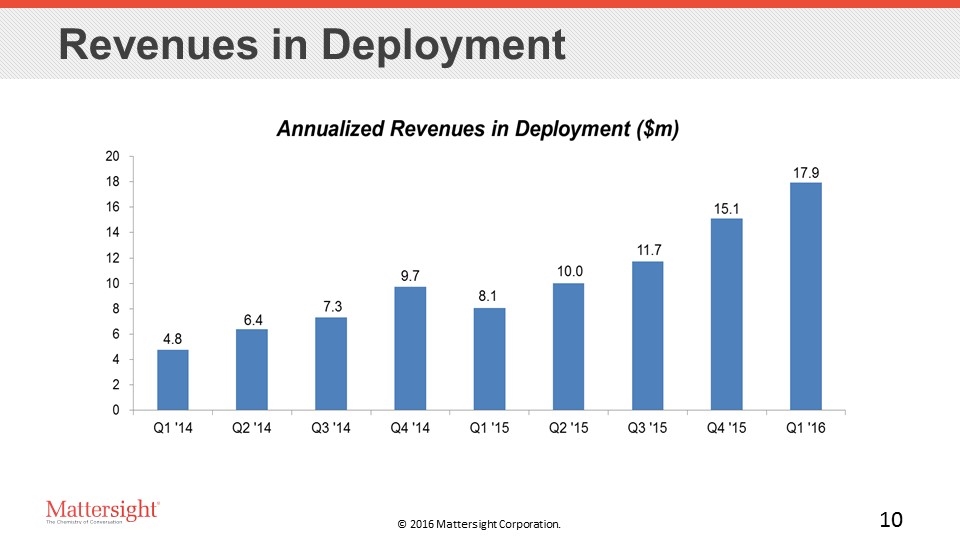

Impact of Revenues in Deployment © 2016 Mattersight Corporation.

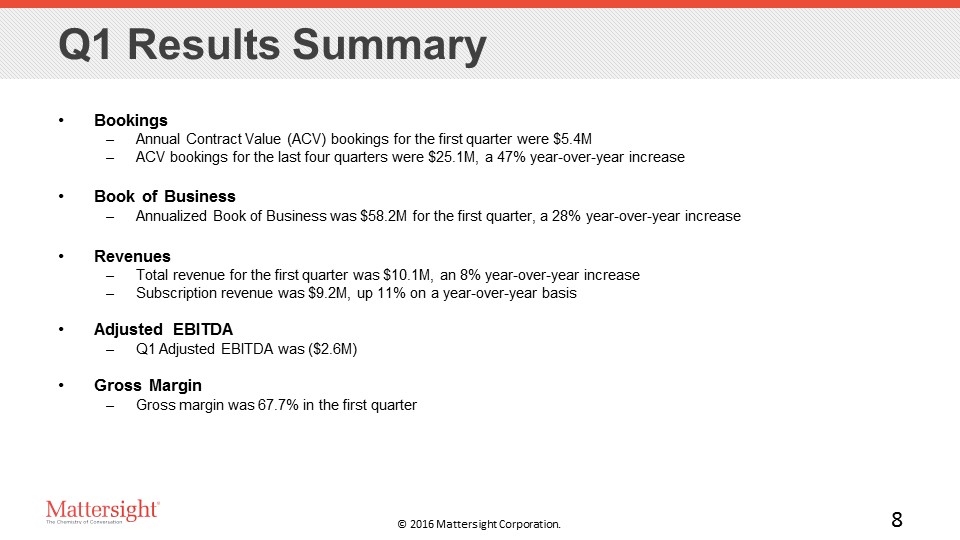

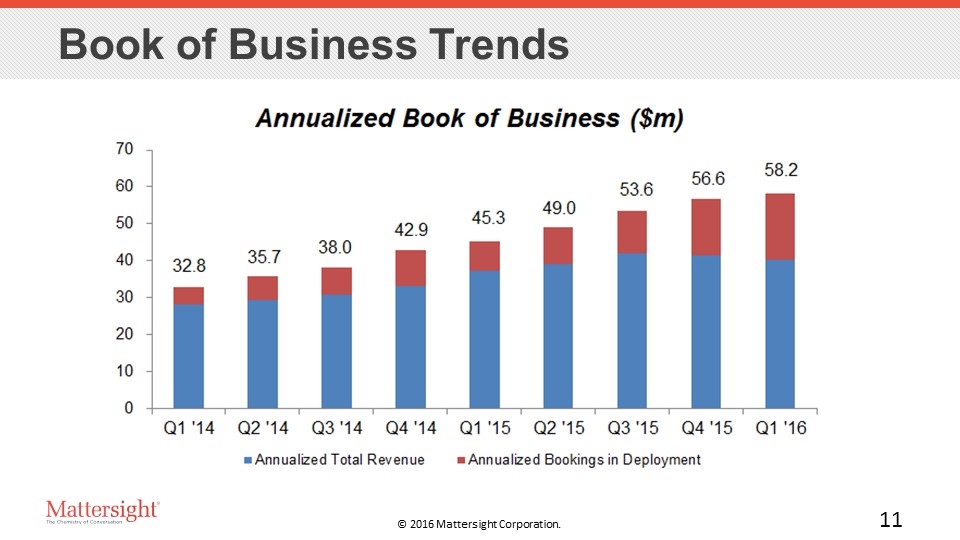

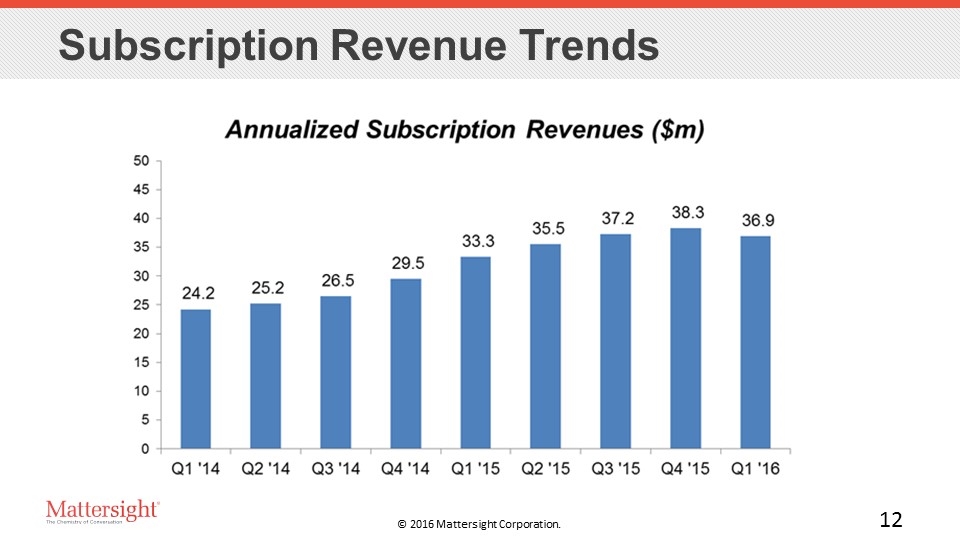

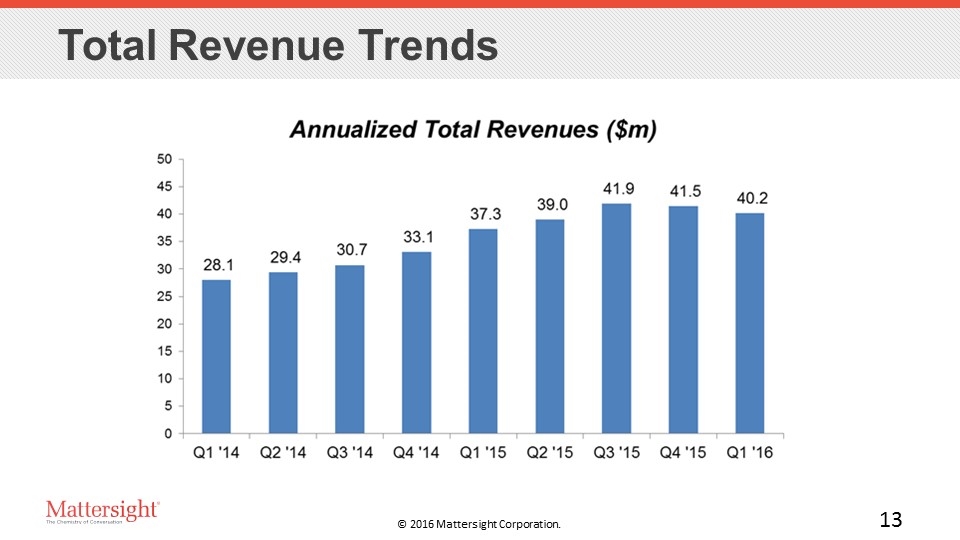

Q1 Results Summary Bookings Annual Contract Value (ACV) bookings for the first quarter were $5.4M ACV bookings for the last four quarters were $25.1M, a 47% year-over-year increase Book of Business Annualized Book of Business was $58.2M for the first quarter, a 28% year-over-year increase Revenues Total revenue for the first quarter was $10.1M, an 8% year-over-year increase Subscription revenue was $9.2M, up 11% on a year-over-year basis Adjusted EBITDA Q1 Adjusted EBITDA was ($2.6M) Gross Margin Gross margin was 67.7% in the first quarter © 2016 Mattersight Corporation.

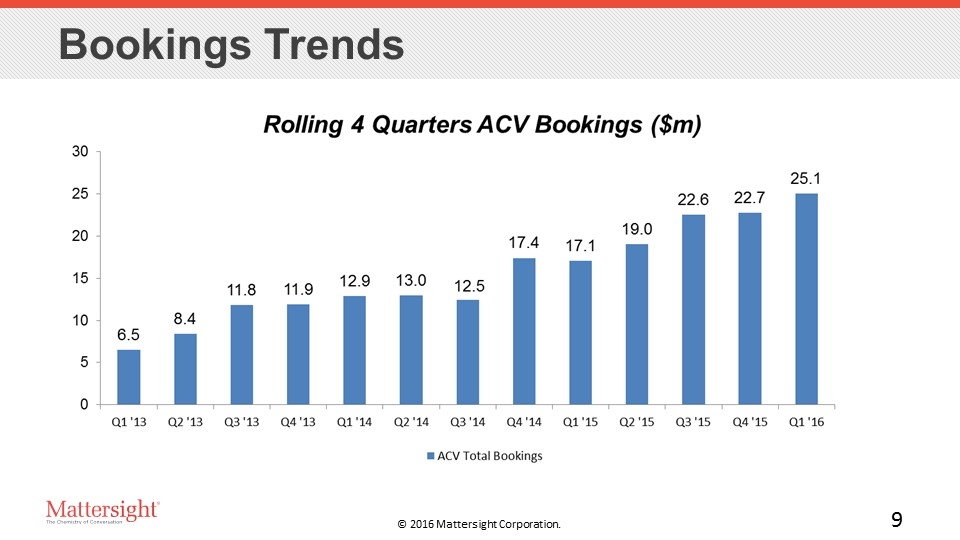

Bookings Trends © 2016 Mattersight Corporation.

Revenues in Deployment © 2016 Mattersight Corporation.

Book of Business Trends © 2016 Mattersight Corporation.

Subscription Revenue Trends © 2016 Mattersight Corporation.

Total Revenue Trends © 2016 Mattersight Corporation.

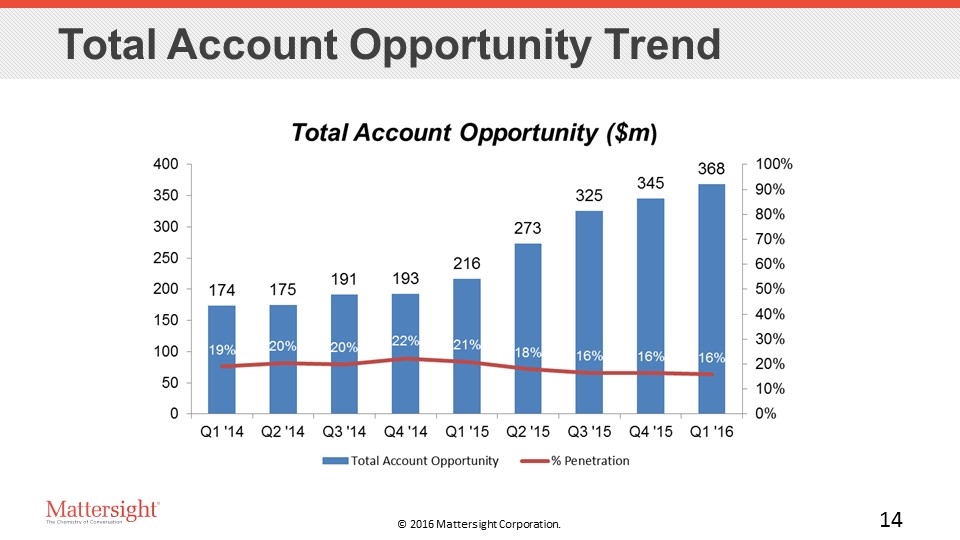

Total Account Opportunity Trend 14 © 2016 Mattersight Corporation.

New SVB Agreement Background EBITDA positive is in sight later this year In the current environment we prefer to use debt to finance the ramp of our business vs. equity SVB Agreement MRR line of 3X revenues up to $15M; interest rate of prime + 1.25% and 2 year term $6M term debt; interest rate of prime + 1.5% and 4 year term © 2016 Mattersight Corporation.

Summary © 2016 Mattersight Corporation. 16 Strong Strategic Outlook Massive emerging market opportunity Impressive, differentiated and growing product footprint to land and expand large accounts Increasing market tailwinds Its Working 47% year/year increase in bookings Record book of business Book of Business at 2 largest accounts increased 138% over last two years 9 new logos which added $11.5M in bookings and $140M+ in account opportunity in last 4 quarters Enter Q2 with our largest ever pipeline Promising Consulting/SI partnership Suffering Growing Pains Slow deployments are hurting current revenue ramp Playing catch up with the size/ volume of new deals Building the Sales Team Over Last 3 Quarters Increased Farmer team from 3 to 9 to improve account management Added 5 hunters to accelerate new logo traction Near Term Actions Continue bookings momentum Deploy signed contracts Hold expenses roughly flat while revenues catch up 2016 Goals Exit Q4 at consensus revenue and EBITDA estimates End 2016 with $70M+ Book of Business

Q&A

Thank You Kelly Conway 847.582.7200 kelly.conway@mattersight.com David Gustafson 847.582.7016 david.gustafson@mattersight.com © 2016 Mattersight Corporation.