Attached files

| file | filename |

|---|---|

| 8-K - 8-K - METLIFE INC | d137570d8k.htm |

| EX-99.1 - EX-99.1 - METLIFE INC | d137570dex991.htm |

| EX-99.2 - EX-99.2 - METLIFE INC | d137570dex992.htm |

Exhibit 99.3

Description of Video First Quarter 2016 Financial Update

From Chief Financial Officer John Hele

This exhibit (video transcript and slides) contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or that are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

This exhibit (video transcript and slides) also contains measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures is provided in the company’s first quarter 2016 Financial Supplement, and/or the company’s earnings news release dated May 4, 2016 for the three months ended March 31, 2016. Each of the Financial Supplement, the news release, and this exhibit (video transcript and slides) accompany one another as they are each exhibits to the company’s Current Report on Form 8-K, dated May 4, 2016.

Video Transcript and Description:

[Shows slide 1 below]

[MetLife Executive Vice President & CFO John Hele speaks from a studio at MetLife’s corporate headquarters in New York City]

Hi, I’m John Hele and I am joining you from MetLife’s global headquarters in New York City.

Before I discuss our first quarter 2016 results, I want to take a moment to talk about MetLife Foundation, our philanthropic arm, which released its Annual Report last month. [Shows slide 2 below]

Since its inception in 1976, MetLife Foundation has provided more than 700 million dollars in grants to a variety of organizations and causes. [Shows slides 3 and 4 below]

Making a positive impact around the world is the core mission of the Foundation. And in 2013, the Foundation made a commitment to spend 200 million dollars over five years to advance financial inclusion globally.

An example is our partnership with Trickle Up, a nonprofit organization in India that provides underserved individuals with the tools and services they need to escape poverty. [Accompanied by approximately 8 seconds of video footage of Trickle Up organization]

The Foundation also supports a variety of other causes, including medical research, education, and arts & culture.

In fact, MetLife Foundation is a founding donor for the newest museum on the National Mall in Washington, DC, the Smithsonian National Museum of African American History and Culture. [Shows slide 5 below]

We are proud of the work the Foundation is doing, and it is clear that investors take note of companies that are good corporate citizens.

Now, turning to our first quarter results…

MetLife’s first quarter 2016 results were impacted by unfavorable market conditions.

Operating earnings for the quarter were 1.3 billion dollars. On a per share basis, operating earnings were 1 dollar and 20 cents.

The combination of weak equity markets for most of the quarter, continued strength in the U.S. dollar, and low interest rates reduced operating earnings by 16 cents per share versus the prior year period. In addition, variable investment income declined by 12 cents per share.

Net income for the quarter was 2.2 billion dollars, up 3 percent.

In the Americas, we generated first quarter operating earnings of 1.1 billion dollars, down 18 percent on a reported basis and 16 percent on a constant currency basis, due to unfavorable market performance, lower investment margins, and higher catastrophe losses in property & casualty. [Shows slides 6 and 7 below]

In Asia, we delivered first quarter operating earnings of 305 million dollars, down 7 percent on a reported basis and down 5 percent on a constant currency basis, including the impact of a favorable tax item in Japan, as well as lower variable investment income in the region. Business growth was more than offset by expected lower fixed annuity surrenders in Japan and higher project costs and other expenses in the region. [Shows slides 8 and 9 below]

And in EMEA, we achieved operating earnings of 63 million dollars, down 10 percent on a reported basis and down 3 percent on a constant currency basis. The first quarter of 2015 benefitted from favorable underwriting margins and lower expenses. Underlying business growth in EMEA for the first quarter of 2016 was in line with expectations. [Shows slides 10 and 11 below]

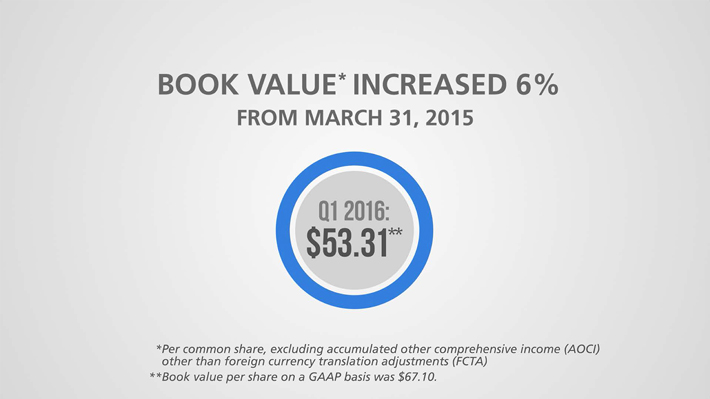

Book value per common share was up 6 percent to 53 dollars and 31 cents. [Shows slide 12 below]

Despite a challenging quarter and a weak global economy, we are pleased that MetLife continued to generate business growth. In the first quarter, we estimate overall volume growth was 3 percent, driven by 11 percent growth in our non-U.S. businesses. Moreover, the value generated from business growth has improved as a result of our Accelerating Value initiative.

Thank you for watching.

[Shows slides 13, 14 and 15 below]

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7

Slide 8

Slide 9

Slide 10

Slide 11

Slide 12

Slide 13

Slide 14

Slide 15