Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bristow Group Inc. | eraq12016earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Bristow Group Inc. | exhibit991q12016earningsre.htm |

Q1 2016 Earnings Presentation 0May 4, 2016 Exhibit 99.2

I. Introduction Shefali Shah, SVP and General Counsel II. Operational Highlights Chris Bradshaw, President and CEO III. Financial Review Andy Puhala, SVP and CFO IV. Concluding Remarks Chris Bradshaw, President and CEO V. Questions & Answers Q1 2016 Earnings Call Agenda 1

2 Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of, offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of customers and reduction of the Company’s customer base resulting from consolidation; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record; the Company’s ability to successfully expand into other geographic and helicopter service markets; the impact of increased United States (“U.S.”) and foreign government regulation and legislation, including potential government implemented moratoriums on drilling activities; risks of engaging in competitive processes or expending significant resources, with no guaranty of recoupment; risks of a grounding of all or a portion of the Company’s fleet for extended periods of time or indefinitely; risks that the Company’s customers reduce or cancel contracted services or tender processes; the Company’s reliance on a small number of helicopter manufacturers and suppliers; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of our assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange rates on the Company’s cost to purchase helicopters, spare parts and related services and on asset values; the Company’s credit risk exposure; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of older helicopters; the Company’s reliance on information technology; the impact of allocation of risk between the Company and its customers; the liability, legal fees and costs in connection with providing emergency response services; risks associated with the Company’s debt structure; operational and financial difficulties of the Company’s joint ventures and partners; conflict with the other owners of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; adverse weather conditions and seasonality; the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact the Company’s business. Except to the extent required by law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3 This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest (includes interest income, interest expense and interest expense on advances from SEACOR), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other special items that occurred during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be a measure of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. A reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDA further adjusted to exclude gains on asset dispositions is included in this presentation. This presentation also includes the Company’s interest coverage ratio and funded debt to EBITDA ratio. The interest coverage ratio is a trailing 12-month quotient of (x) EBITDA (as defined in the Company’s credit facility) less dividends and distributions divided by (y) interest expense. The funded debt to EBITDA ratio is calculated by dividing (x) the sum of total debt for borrowed money, capital lease obligations and guaranties of obligations of non-consolidated entities by (y) EBITDA (as defined in the Company’s credit facility). Neither the interest coverage ratio nor the funded debt to EBITDA ratio is a measure of operating performance or liquidity defined by GAAP and may not be comparable to similarly titled measures presented by other companies. Non-GAAP Financial Measures Reconciliation

4 Operational Highlights

• Era achieved its objective of ZERO air accidents in Q1 2016 ̶ Extended clean sheet of ZERO air accidents in FY2014 and FY2015 • On April 29, 2016, an accident occurred outside of Bergen, Norway with an Airbus Helicopters H225 operated by another helicopter company ̶ 13 fatalities reported ̶ The cause is not yet known; investigation ongoing ̶ The Civil Aviation Authorities in Norway and the U.K. issued safety directives requiring the suspension of EC225LP model (a.k.a. H225) flight operations in those countries (with exception for SAR flights) ̶ Operators and customers in other countries have voluntarily suspended H225 operations • Era owns 9 H225 helicopters: 5 currently in the U.S., 3 currently in Brazil and 1 currently on dry-lease in Norway ̶ The Company does not expect the near-term impact of the H225 suspension to be material to its financial condition or results of operations • More than ever, Era remains staunchly committed to its leadership role in HeliOffshore and the mission to improve safety in the global offshore helicopter industry through collaboration ̶ More than 85 members worldwide ̶ Annual meeting May 13-15, 2016 5 Safety Update

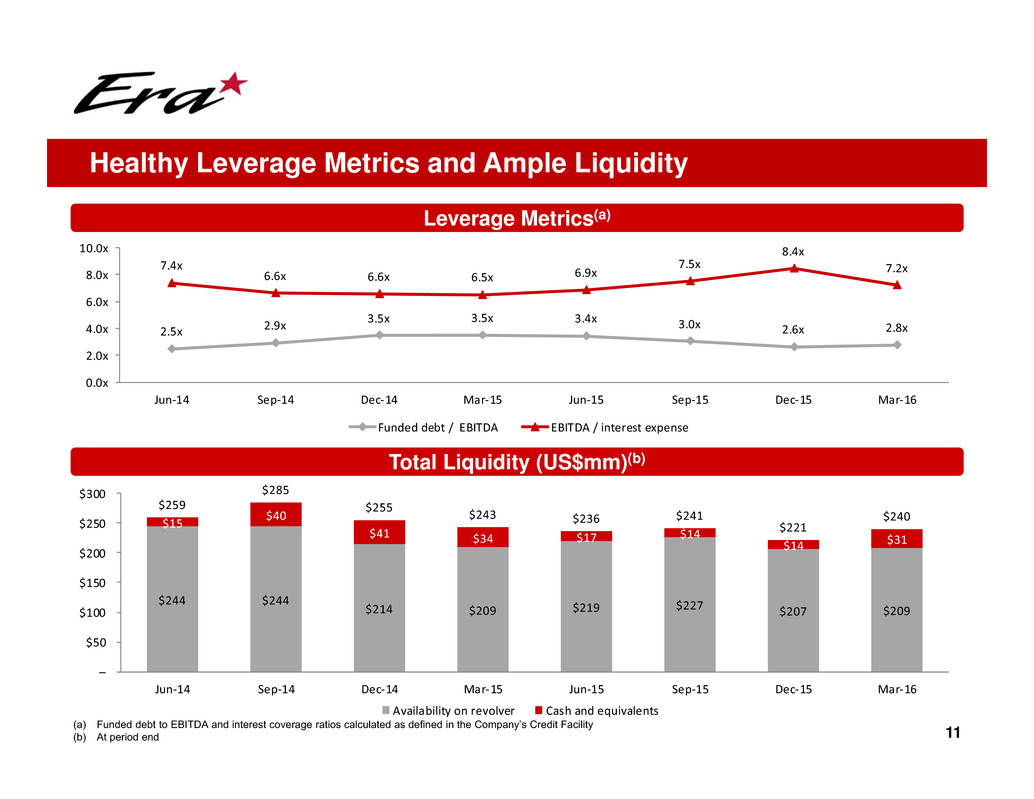

• Generated positive operating cash flow of almost $15 million in Q1 2016 ̶ Combined with $2.6 million net cash provided by investing activities, Era generated over $17 million in free cash flow Cash Flow from Operating Activities ($mm) • Continue to protect the balance sheet(a) ̶ Total liquidity = $240 million, an increase of $18 million since year end ̶ Funded debt to EBITDA = 2.8x ̶ Interest coverage = 7.2x 6 Financial Stability (a) Total liquidity includes unrestricted cash and the amounts available under the Company’s senior secured revolving credit facility (the “Credit Facility”); Funded debt to EBITDA and interest coverage ratios calculated as defined in the Credit Facility as of 3/31/2016 $17.9 $9.9 $20.6 $16.0 $9.7 $21.6 $30.7 $16.3 $6.8 $13.9 $15.1 $8.6 $14.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2013 2014 2015 2016

7 Financial Review

$14,338 $12,249 – $10,000 $20,000 $30,000 Q1 2015 Q1 2016 $67,415 $62,582 – $25,000 $50,000 $75,000 $100,000 $125,000 Q1 2015 Q1 2016 • Revenues of $62.6mm ̶ $4.8mm lower than Q1 2015 due to fewer helicopters on contract and lower average rates as well as the sale of the FBO in Alaska ̶ Partially offset by increased revenues resulting from the consolidation of Aeróleo • Operating expenses up $0.7mm ̶ Increase primarily due to the consolidation of Aeróleo and timing of repairs ̶ Partially offset by lower fuel, insurance and other operating expenses in the U.S. • G&A expenses down $0.5mm ̶ Decrease primarily due to reduced headcount and termination of shared services agreement ̶ Partially offset by the consolidation of Aeróleo • Excluding the impact of the consolidation of Aeróleo: ̶ $6.8mm (16%) decrease in operating expenses ̶ $1.5mm (15%) decrease in G&A expenses • Gains of $2.9mm on the sale of a hangar, two helicopters and related equipment • Tax benefit $1.0mm • Adjusted EBITDA of $12.2mm • Net loss of $3.8mm and loss per share of $0.19 8 Q1 2016 Highlights – Quarter-over-Quarter Comparison Revenues ($000s) Adjusted EBITDA ($000s) 15% 7%

$17,307 $12,249 – $10,000 $20,000 $30,000 Q4 2015 Q1 2016 $73,943 $62,582 – $25,000 $50,000 $75,000 $100,000 $125,000 Q4 2015 Q1 2016 • Revenues were $11.4mm lower than Q4 2015 primarily due to lower utilization, including the end of several contracts in December 2015 as previously disclosed • Operating expenses down $0.8mm ̶ Primarily due to reduced headcount and fewer flight hours ̶ Partially offset by an increase in repairs and maintenance expenses due to vendor credits received in the preceding quarter and an increase in insurance expense due to credits received in the preceding quarter • G&A expenses down $1.8mm primarily due to lower bad debt expense, lower professional service fees, and other cost control measures • Equity earnings improved by $1.2mm due to improved results at the Company’s DART joint venture • Adjusted EBITDA decreased by $5.1mm 9 Q1 2016 Highlights – Sequential Quarter Comparison Revenues ($000s) Adjusted EBITDA ($000s) 29% 15%

10 • Prior to October 2015, revenues from Aeróleo were only recognized when Era received cash from Aeróleo and were reported in Era’s Dry-leasing line of service • Beginning October 1, 2015, Aeróleo’s financials are included in Era’s consolidated results; revenues from end-customers are reported in the International Oil & Gas line of service • All intercompany accounts and transactions are eliminated in consolidation Summary of Aeróleo Consolidation Impact in Q1 2016 ($000s) Q1 2015 As Reported Non-Aeróleo Variances Aeróleo Consolidation Impact Q1 2016 As Reported $ Change Q1 2016 Pre-Aeróleo Consolidation Operating Revenues $67,415 ($12,650) $7,817 $62,582 ($4,833) $54,765 Operating Expenses 43,605 (6,818) 7,520 44,307 702 36,787 G&A Expenses 9,743 (1,466) 950 9,227 (516) 8,277 Depreciation 11,602 1,133 31 12,766 1,164 12,735 Gain/Loss on Asset Sales 3,388 (475) - 2,913 (475) 2,913 Operating Income $5,853 ($5,974) ($684) ($805) ($6,658) ($121)

11 Leverage Metrics(a) Total Liquidity (US$mm)(b) Healthy Leverage Metrics and Ample Liquidity (a) Funded debt to EBITDA and interest coverage ratios calculated as defined in the Company’s Credit Facility (b) At period end $244 $244 $214 $209 $219 $227 $207 $209 $15 $40 $41 $34 $17 $14 $14 $31 $259 $285 $255 $243 $236 $241 $221 $240 – $50 $100 $150 $200 $250 $300 Jun‐14 Sep‐14 Dec‐14 Mar‐15 Jun‐15 Sep‐15 Dec‐15 Mar‐16 Availability on revolver Cash and equivalents 2.5x 2.9x 3.5x 3.5x 3.4x 3.0x 2.6x 2.8x 7.4x 6.6x 6.6x 6.5x 6.9x 7.5x 8.4x 7.2x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x Jun‐14 Sep‐14 Dec‐14 Mar‐15 Jun‐15 Sep‐15 Dec‐15 Mar‐16 Funded debt / EBITDA EBITDA / interest expense

12 Appendix

13 Owned Leased-In Managed Total Average Age(a) Heavy: H225 9 – – 9 6 S92 2 – – 2 0 AW189 2 – – 2 0 Total Heavy 13 – – 13 Medium: AW139 38 – – 38 6 S76 C+/C++ 5 – 1 6 9 B212 8 – – 8 37 B412 1 – – 1 35 Total Medium 52 – 1 53 Light – twin engine: A109 7 – – 7 10 EC135 14 2 1 17 8 EC145 3 – 2 5 8 BK-117 – 2 1 3 N/A BO-105 3 – – 3 27 Total Light – twin engine 27 4 4 35 Light – single engine: A119 14 – – 14 9 AS350 29 – – 29 20 Total Light – single engine 43 – – 43 Total Helicopters 135 4 5 144 12 Note: Fleet presented as of 3/31/2016 (a) Average for owned fleet Fleet Overview

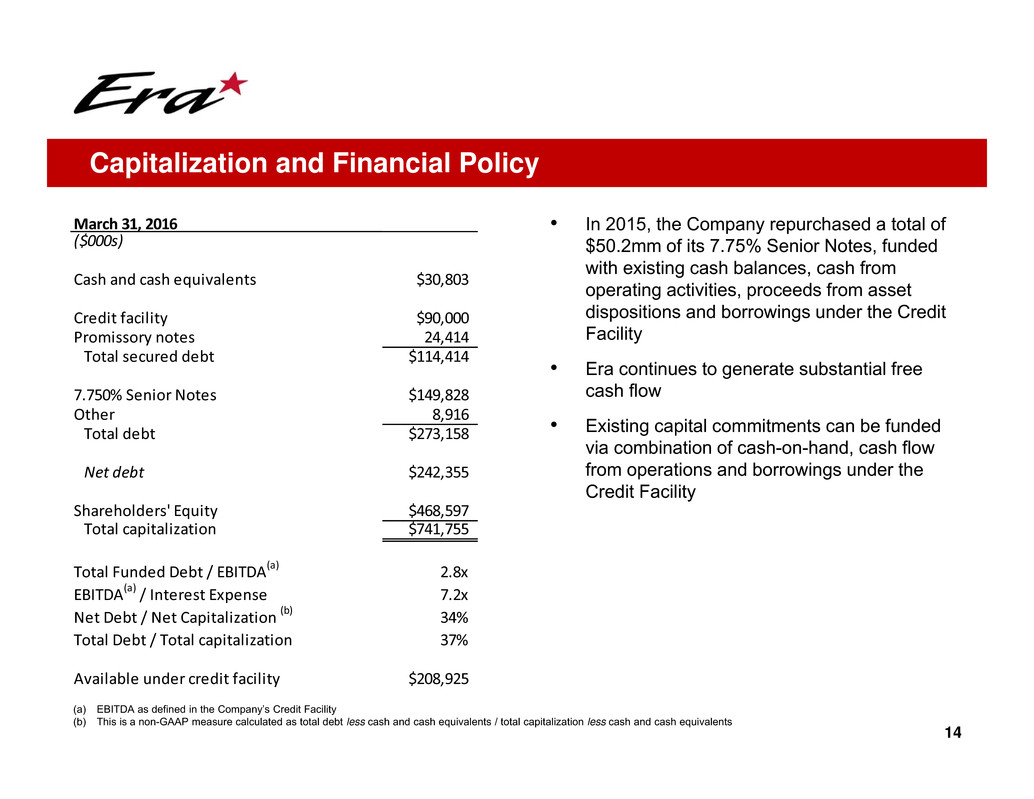

14 • In 2015, the Company repurchased a total of $50.2mm of its 7.75% Senior Notes, funded with existing cash balances, cash from operating activities, proceeds from asset dispositions and borrowings under the Credit Facility • Era continues to generate substantial free cash flow • Existing capital commitments can be funded via combination of cash-on-hand, cash flow from operations and borrowings under the Credit Facility Capitalization and Financial Policy (a) EBITDA as defined in the Company’s Credit Facility (b) This is a non-GAAP measure calculated as total debt less cash and cash equivalents / total capitalization less cash and cash equivalents March 31, 2016 ($000s) Cash and cash equivalents $30,803 Credit facility $90,000 Promissory notes 24,414 Total secured debt $114,414 7.750% Senior Notes $149,828 Other 8,916 Total debt $273,158 Net debt $242,355 Shareholders' Equity $468,597 Total capitalization $741,755 Total Funded Debt / EBITDA(a) 2.8x EBITDA(a) / Interest Expense 7.2x Net Debt / Net Capitalization (b) 34% Total Debt / Total capitalization 37% Available under credit facility $208,925

15 Operating Revenues and Flight Hours by Line of Service Note: Flight hours exclude hours flown by helicopters in the Dry-leasing line of service (a) Primarily oil and gas services, but also includes revenues and flight hours from activities such as firefighting and utility support Three Months Ended Revenue ($000s) 31-Mar-16 31-Dec-15 30-Sep-15 30-Jun-15 31-Mar-15 Oil and gas:(a) U.S. Gulf of Mexico $36,812 $40,368 $42,132 $41,821 $41,913 Alaska 932 3,309 5,429 6,009 3,801 International 14,054 18,865 60 47 – Total oil and gas $51,798 $62,542 $47,621 $47,877 $45,714 Dry-Leasing 3,995 4,643 11,925 12,233 11,956 Search and rescue 4,891 4,955 4,418 4,989 5,238 Air medical services 1,898 1,803 1,854 1,914 2,367 Flightseeing – – 3,923 3,118 – Fixed Base Operations – – – 614 2,146 Eliminations – – – (7) (6) $62,582 $73,943 $69,741 $70,738 $67,415 Three Months Ended Flight Hours 31-Mar-16 31-Dec-15 30-Sep-15 30-Jun-15 31-Mar-15 Oil and gas:(a) U.S. Gulf of Mexico 7,290 8,255 9,435 8,717 7,612 Alaska 77 380 797 732 290 International 2,332 3,055 22 14 – Total oil and gas 9,699 11,690 10,254 9,463 7,902 Search and rescue 201 275 265 260 300 Air medical services 618 748 949 826 825 Flightseeing – – 1,502 1,118 – 10,518 12,713 12,970 11,667 9,027

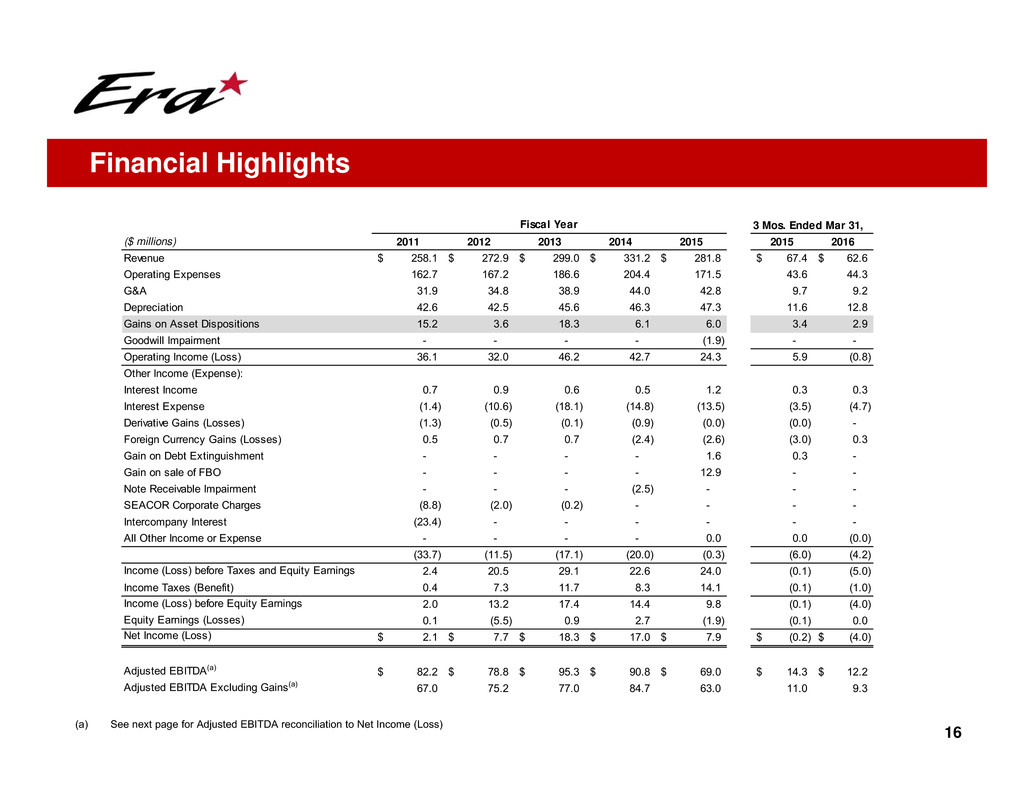

16 (a) See next page for Adjusted EBITDA reconciliation to Net Income (Loss) Financial Highlights Fiscal Year 3 Mos. Ended Mar 31, ($ millions) 2011 2012 2013 2014 2015 2015 2016 Revenue 258.1$ 272.9$ 299.0$ 331.2$ 281.8$ 67.4$ 62.6$ Operating Expenses 162.7 167.2 186.6 204.4 171.5 43.6 44.3 G&A 31.9 34.8 38.9 44.0 42.8 9.7 9.2 Depreciation 42.6 42.5 45.6 46.3 47.3 11.6 12.8 Gains on Asset Dispositions 15.2 3.6 18.3 6.1 6.0 3.4 2.9 Goodwill Impairment - - - - (1.9) - - Operating Income (Loss) 36.1 32.0 46.2 42.7 24.3 5.9 (0.8) Other Income (Expense): Interest Income 0.7 0.9 0.6 0.5 1.2 0.3 0.3 Interest Expense (1.4) (10.6) (18.1) (14.8) (13.5) (3.5) (4.7) Derivative Gains (Losses) (1.3) (0.5) (0.1) (0.9) (0.0) (0.0) - Foreign Currency Gains (Losses) 0.5 0.7 0.7 (2.4) (2.6) (3.0) 0.3 Gain on Debt Extinguishment - - - - 1.6 0.3 - Gain on sale of FBO - - - - 12.9 - - Note Receivable Impairment - - - (2.5) - - - SEACOR Corporate Charges (8.8) (2.0) (0.2) - - - - Intercompany Interest (23.4) - - - - - - All Other Income or Expense - - - - 0.0 0.0 (0.0) (33.7) (11.5) (17.1) (20.0) (0.3) (6.0) (4.2) Income (Loss) before Taxes and Equity Earnings 2.4 20.5 29.1 22.6 24.0 (0.1) (5.0) Income Taxes (Benefit) 0.4 7.3 11.7 8.3 14.1 (0.1) (1.0) Income (Loss) before Equity Earnings 2.0 13.2 17.4 14.4 9.8 (0.1) (4.0) Equity Earnings (Losses) 0.1 (5.5) 0.9 2.7 (1.9) (0.1) 0.0 Net Income (Loss) 2.1$ 7.7$ 18.3$ 17.0$ 7.9$ (0.2)$ (4.0)$ Adjusted EBITDA(a) 82.2$ 78.8$ 95.3$ 90.8$ 69.0$ 14.3$ 12.2$ Adjusted EBITDA Excluding Gains(a) 67.0 75.2 77.0 84.7 63.0 11.0 9.3

• Adjusted EBITDA reflects special items: – Executive severance adjustments of $4.2 million, $0.7 million, and $2.5 million in 2011, 2012, and 2014, respectively – An adjustment for IPO related fees and expenses of $2.9 million in 2012 – A pre-tax impairment of $5.9 million related to the Company’s investment in Aeróleo in 2012 – A one-time charge of $2.0 million related to operating leases on certain air medical helicopters in 2013 – A pre-tax impairment charge of $2.5 million in 2014 representing a reserve against a note receivable – A pre-tax gain of $12.9 million on the sale of the Company’s FBO in Alaska in 2015 – Net pre-tax gains of $1.6 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior Notes in 2015 – A pre-tax charge of $1.9 million on the impairment of the goodwill in 2015 • Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions − These charges have been excluded from Adjusted EBITDA to more accurately reflect Era’s historical results as if the Company had not been a SEACOR subsidiary 17 Reconciliation of Non-GAAP Financial Measures Historical EBITDA and Adjusted EBITDA Fiscal Year 3 Mos. Ended Mar 31, (USD$ in thousands) 2011 2012 2013 2014 2015 2015 2016 Net Income (Loss) 2,108 7,747 18,304 17,021 7,899 (239) (3,950) Depreciation 42,612 42,502 45,561 46,312 47,337 11,602 12,766 Interest Income (738) (910) (591) (540) (1,191) (251) (301) Interest Expense 1,376 10,648 18,050 14,778 13,526 3,545 4,748 Income Tax Expense 434 7,298 11,727 8,285 14,117 (55) (1,014) EBITDA 69,202 67,285 93,051 85,856 81,688 14,602 12,249 Special Items 4,171 9,552 2,045 4,919 (12,697) (264) - Adjusted EBITDA 82,172 78,837 95,264 90,775 68,991 14,338 12,249 Gains on Asset Dispositions, Net ("Gains") (15,172) (3,612) (18,301) (6,101) (5,953) (3,388) (2,913) Adjusted EBITDA Excluding Gains 67,000 75,225 76,963 84,674 63,038 10,950 9,336

18 Quarterly Reconciliation of Non-GAAP Financial Measures Quarterly Historical EBITDA and Adjusted EBITDA (USD$ in thousands) 31-Mar-15 30-Jun-15 30-Sep-15 31-Dec-15 31-Mar-16 Net Income (Loss) (239) 11,105 653 (3,620) (3,950) Depreciation 11,602 11,398 12,186 12,151 12,766 Interest Income (251) (317) (232) (391) (301) Interest Expense 3,545 2,881 3,121 3,979 4,748 Income Tax Expense (Benefit) (55) 8,138 1,343 4,691 (1,014) EBITDA 14,602 33,205 17,071 16,810 12,249 Special Items (264) (12,946) 16 497 - Adjusted EBITDA 14,338 20,259 17,087 17,307 12,249 Gains on Asset Dispositions, Net ("Gains") (3,388) 242 (1,813) (994) (2,913) Adjusted EBITDA Excluding Gains 10,950 20,501 15,274 16,313 9,336