Attached files

| file | filename |

|---|---|

| EX-99.2 - PRINT VERSION OF QUARTERLY INVESTOR UPDATE - SPRINT Corp | fiscal4q15sprintquarterlyinv.pdf |

| EX-99.2 - QUARTERLY INVESTOR UPDATE - SPRINT Corp | sprint4qfy15investorupdate.htm |

| 8-K - FORM 8-K - SPRINT Corp | sprint4qfy158-kearningsrel.htm |

News Release |  | |

SPRINT FINISHES FISCAL YEAR 2015 BY GENERATING POSITIVE ANNUAL OPERATING INCOME FOR THE FIRST TIME IN NINE YEARS AND DELIVERING MORE POSTPAID PHONE NET ADDITIONS THAN VERIZON AND AT&T FOR THE FIRST TIME ON RECORD IN THE FISCAL FOURTH QUARTER

• | Fiscal year 2015 operating income of $310 million was positive for the first time in nine years; Fiscal year 2015 Adjusted EBITDA* of $8.1 billion grew 36 percent year-over-year |

◦ | Fiscal fourth quarter operating income of $8 million included charges of $258 million; Adjusted EBITDA* of $2.2 billion grew 24 percent year-over-year |

• | Fiscal year 2015 Sprint platform postpaid net additions of more than 1.2 million, including phone net additions of 438,000 which improved nearly two million year-over-year |

◦ | Fiscal fourth quarter postpaid phone net additions of 22,000 are the third consecutive quarter of positive net additions and more than both Verizon and AT&T for the first time on record |

◦ | Fiscal year 2015 Sprint platform postpaid churn of 1.61 percent and phone churn of 1.52 percent are the best in company history and both improved by approximately 50 basis points year-over-year |

• | Delivered substantial financial flexibility with $11 billion in currently committed liquidity, up from $6 billion at the end of the fiscal third quarter |

◦ | Ended fiscal year 2015 with $5.7 billion of available liquidity, including $2.6 billion of cash |

◦ | Successfully raised an additional $5.3 billion in April, including $2.2 billion of network-related financing, $1.1 billion from the second transaction with Mobile Leasing Solutions, LLC (MLS), and $2 billion of bridge financing |

OVERLAND PARK, Kan. - May 3, 2016 - Sprint Corporation (NYSE: S) today reported operating results for fiscal year 2015 fourth quarter and full year, including a nearly two million year-over-year improvement in Sprint platform postpaid phone net additions and the lowest annual Sprint platform postpaid phone churn in company history. The company also reported fiscal year 2015 net operating revenue of $32.2 billion, operating income of $310 million, and Adjusted EBITDA* of $8.1 billion, which grew 36 percent year-over-year.

For the fiscal fourth quarter, the company reported net operating revenue of $8.1 billion, operating income of $8 million, and Adjusted EBITDA* of $2.2 billion, which grew 24 percent year-over-year.

“Fiscal 2015 was a transformational year in the turnaround of Sprint. We significantly reduced our operating expenses and stabilized operating revenues, leading to positive operating income for the first time in nine years. At the same time, we generated positive postpaid phone net additions for the first time in three years, capped off by surpassing both Verizon and AT&T for the first time on record this quarter,” said Sprint CEO Marcelo Claure. “These accomplishments provide positive momentum heading into fiscal year 2016 and put the business on a path to sustainable free cash flow.”

Cost Reduction Effort Showing Results

Sprint has a multi-year plan to transform the way it does business and significantly lower its cost structure. The company has realized a $1.3 billion reduction in cost of services and selling, general and administrative (SG&A) expenses in fiscal year 2015.

Moving forward, Sprint expects a sustainable reduction of $2 billion or more of run rate operating expenses exiting fiscal year 2016 and has already realized a portion of these reductions with its fiscal 2015 fourth quarter results, as about half of the approximately $500 million year-over-year reduction in cost of services and SG&A expenses was related to these fiscal year 2016 initiatives. The company continues to expect approximately $1 billion of transformation program costs, split between both operating expenses and capital expenditures, to be incurred to achieve the $2 billion or more of run rate benefit. Approximately $200 million of the expected transformation program costs, mostly related to severance, were incurred in fiscal year 2015.

News Release |  | |

The company also reported the following financial results:

• | Net operating revenues of $8.1 billion in the quarter decreased three percent year-over-year, as growth in equipment revenue, mostly driven by higher leasing revenue, helped offset lower wireless and wireline service revenue. Net operating revenues have stabilized around $8 billion per quarter during fiscal year 2015. |

For the full year, net operating revenues of $32.2 billion decreased seven percent year-over-year. The decline was largely due to Brightstar sourcing some devices in Sprint’s indirect channels, resulting in less equipment revenues than if Sprint had fulfilled these channels. While the impact to Adjusted EBITDA* was not material due to the offsetting reduction in cost of products expense, net operating revenues would have declined less year-over-year when adjusting for this change.

• | Wireless service revenue plus installment plan billings and lease revenue, which represents the total recurring cash flows from customers, was $7.1 billion in the fiscal fourth quarter and increased one percent from the prior year period, as growth in both postpaid phone customers and postpaid average billings per user* were partially offset by lower prepaid service revenue. |

For the full year, wireless service revenue plus installment plan billings and lease revenue of $28.4 billion was up slightly from the prior year.

• | Consolidated Adjusted EBITDA* of $2.2 billion in the fiscal fourth quarter grew 24 percent from the prior year period, as expense reductions, including approximately $500 million in cost of services and SG&A expenses, more than offset the decline in net operating revenues. |

For the full year, Consolidated Adjusted EBITDA* was $8.1 billion and grew 36 percent year-over-year.

• | Operating income of $8 million in the fiscal fourth quarter included $258 million of charges and compared to operating income of $318 million in the year-ago quarter. The charges were mostly related to severance and lease exit costs, including the shutdown of legacy WiMAX service that will free up valuable spectrum and immediately lower network costs. Adjusting for the charges in both periods, operating income would have been relatively flat year-over-year. |

For the full year, operating income of $310 million improved by approximately $2.2 billion and was positive for the first time in nine years.

• | Net loss of $554 million, or $0.14 per share, in the fiscal fourth quarter compared to a net loss of $224 million, or $0.06 per share, in the year-ago period. Adjusting for the aforementioned charges, net loss per share would have been relatively flat year-over-year. |

For the full year, net loss was approximately $2 billion, or $0.50 per share, compared to a net loss of approximately $3.3 billion, or $0.85 per share, in the prior year, which is an improvement of $1.3 billion, or $0.35 per share.

• | Adjusted free cash flow* was $603 million in the fiscal fourth quarter compared to negative $914 million in the prior year, an improvement of approximately $1.5 billion, which was driven by improved business trends and lower capital spending. |

For the full year, Adjusted free cash flow* of negative $1.4 billion compared to negative $3.3 billion in the prior year, an improvement of nearly $2 billion.

Postpaid Phone Customer Growth Continues

Sprint has been focused on attracting and retaining higher value postpaid phone customers and added 22,000 of these customers in a highly competitive fiscal fourth quarter, bringing the fiscal year total to 438,000 - an improvement of nearly two million from the prior year and the third consecutive quarter of positive postpaid phone net additions.

News Release |  | |

Significant network improvements, a more compelling value proposition, and better customer quality have led to higher customer retention, with postpaid phone churn reaching a record low of 1.52 percent in fiscal year 2015 and improving by approximately 50 basis points year-over-year. For the fiscal fourth quarter, postpaid phone churn of 1.56 percent improved 22 basis points year-over-year.

In addition, the company also saw year-over-year growth in postpaid phone gross additions for both the fiscal fourth quarter and full year.

The company also reported the following Sprint platform results:

• | Total net additions were 447,000 in the fiscal fourth quarter, including postpaid net additions of 56,000, prepaid net losses of 264,000, and wholesale and affiliate net additions of 655,000. |

For the full year, total net additions were nearly 2.7 million, including postpaid net additions of more than 1.2 million, prepaid net losses of 1.3 million, and wholesale and affiliate net additions of over 2.7 million.

• | Postpaid churn of 1.72 percent in the fiscal fourth quarter improved by 12 basis points year-over-year and was the lowest ever for a fiscal fourth quarter. |

For the full year, postpaid churn of 1.61 percent was also the best in company history and improved by approximately 50 basis points year-over-year.

$11 Billion of Committed Liquidity

Sprint has taken several actions to improve its financial flexibility and currently has $11 billion of committed liquidity, up from $6 billion at the end of the fiscal third quarter. The company also has an additional $1.2 billion of availability under vendor financing agreements that can be used toward the purchase of 2.5 GHz network equipment.

• | Total liquidity at the end of fiscal year 2015 was $5.7 billion, including $2.6 billion of cash and cash equivalents, $3 billion of undrawn borrowing capacity under the revolving bank credit facility, and approximately $100 million of undrawn availability under the receivables facility. |

• | Sprint received $2.2 billion from the sale and lease-back of certain existing network assets at an attractive cost of funding in the mid-single digits. This transaction did not include any of the company’s spectrum assets. |

• | The company executed its second sale-leaseback transaction of certain leased devices with MLS, providing a $1.1 billion cash infusion. |

• | Sprint signed an 18-month bridge financing facility for $2 billion with better terms than its alternatives in the high-yield debt market. |

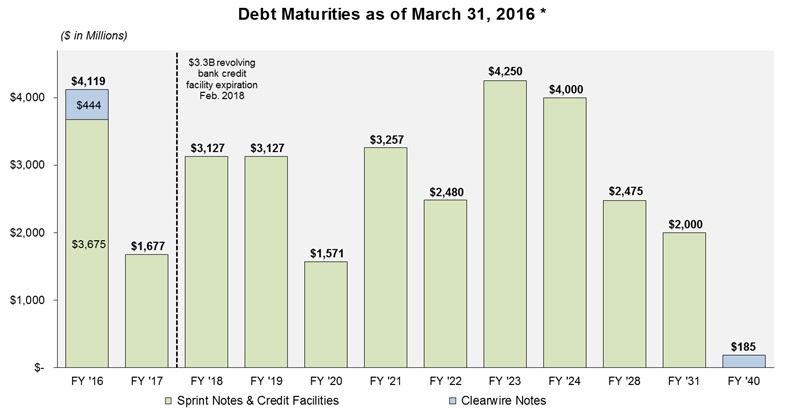

These sources of liquidity are expected to provide the resources for the company to execute its transformation plan and fully fund the repayment of the $3.3 billion of note maturities that come due in fiscal year 2016. The company continues to consider financing initiatives, including structures that would involve a small portion of its spectrum assets, as well as additional transactions with MLS to fund its transformation, continue to improve the network, and meet its future financial obligations.

LTE Plus Network Expanding and Outperforming the Competition

The Sprint LTE Plus Network, which takes advantage of the company’s rich tri-band spectrum portfolio and uses some of the world’s most advanced technologies in wireless such as carrier aggregation and antenna beamforming, is now available in 204 markets across the country, including recent launches in New York City, Boston, and Philadelphia.

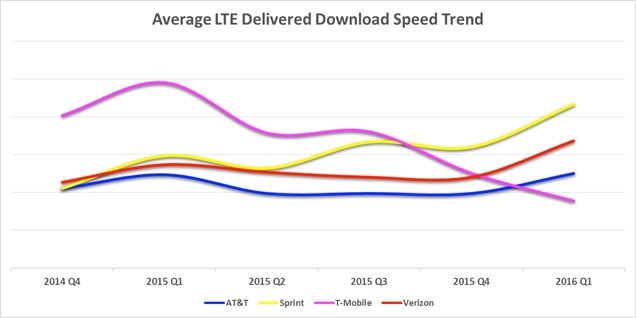

The expansion is driving network performance that is beating the competition. An analysis of Nielsen Mobile Performance crowd-sourced data from January through March 2016 showed that Sprint’s LTE Plus Network continued to outperform Verizon, AT&T and T-Mobile by delivering the fastest LTE download speeds.

News Release |  | |

Source: Sprint analysis of Nielsen NMP data for total LTE downloads 150 KB+ in 44 markets (over 155M POPs).

Total LTE coverage now reaches nearly 300 million people, including approximately 70 percent being covered by the 2.5 GHz spectrum deployment.

Outlook

• | The company expects fiscal year 2016 Adjusted EBITDA* to be $9.5 billion to $10 billion. |

• | The company expects fiscal year 2016 operating income to be $1 billion to $1.5 billion. |

• | The company expects fiscal year 2016 cash capital expenditures, excluding indirect channel device leases, to be approximately $3 billion, as non-network expenditures are expected to decline year-over-year and more of the cash outlays related to network densification are expected to be incurred in fiscal year 2017. The company’s deep spectrum position and its small cell focused densification are also expected to improve overall capital efficiency. |

• | The company expects fiscal year 2016 Adjusted free cash flow* to be around break-even. |

Conference Call and Webcast

• | Date/Time: 8:30 a.m. (ET) Tuesday, May 3, 2016 |

• | Call-in Information |

◦ | U.S./Canada: 866-360-1063 (ID: 83132816) |

◦ | International: 706-634-7849 (ID: 83132816) |

• | Webcast available via the Internet at www.sprint.com/investors |

• | Additional information about results, including the “Quarterly Investor Update,” is available on our Investor Relations website |

Contact Information

• | Media Contact: Dave Tovar, 913-315-1451, David.Tovar@sprint.com |

• | Investor Contact: Jud Henry, 800-259-3755, Investor.Relations@sprint.com |

News Release |  | |

Wireless Operating Statistics (Unaudited)

Quarter To Date | Year To Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Sprint platform (1): | ||||||||||||||||

Net additions (losses) (in thousands) | ||||||||||||||||

Postpaid | 56 | 501 | 211 | 1,245 | (212 | ) | ||||||||||

Prepaid | (264 | ) | (491 | ) | 546 | (1,309 | ) | 449 | ||||||||

Wholesale and affiliate | 655 | 481 | 492 | 2,733 | 2,349 | |||||||||||

Total Sprint platform wireless net additions | 447 | 491 | 1,249 | 2,669 | 2,586 | |||||||||||

End of period connections (in thousands) | ||||||||||||||||

Postpaid | 30,951 | 30,895 | 29,706 | 30,951 | 29,706 | |||||||||||

Prepaid | 14,397 | 14,661 | 15,706 | 14,397 | 15,706 | |||||||||||

Wholesale and affiliate | 13,458 | 12,803 | 10,725 | 13,458 | 10,725 | |||||||||||

Total Sprint platform end of period connections | 58,806 | 58,359 | 56,137 | 58,806 | 56,137 | |||||||||||

Churn | ||||||||||||||||

Postpaid | 1.72 | % | 1.62 | % | 1.84 | % | 1.61 | % | 2.09 | % | ||||||

Prepaid | 5.65 | % | 5.82 | % | 3.84 | % | 5.39 | % | 3.99 | % | ||||||

Supplemental data - connected devices | ||||||||||||||||

End of period connections (in thousands) | ||||||||||||||||

Retail postpaid | 1,771 | 1,676 | 1,320 | 1,771 | 1,320 | |||||||||||

Wholesale and affiliate | 8,575 | 7,930 | 5,832 | 8,575 | 5,832 | |||||||||||

Total | 10,346 | 9,606 | 7,152 | 10,346 | 7,152 | |||||||||||

Supplemental data - total company | ||||||||||||||||

End of period connections (in thousands) | ||||||||||||||||

Sprint platform (1) | 58,806 | 58,359 | 56,137 | 58,806 | 56,137 | |||||||||||

Transactions (2) | — | — | 1,004 | — | 1,004 | |||||||||||

Total | 58,806 | 58,359 | 57,141 | 58,806 | 57,141 | |||||||||||

Sprint platform ARPU (1) (a) | ||||||||||||||||

Postpaid | $ | 51.68 | $ | 52.48 | $ | 56.94 | $ | 53.39 | $ | 59.63 | ||||||

Prepaid | $ | 27.72 | $ | 27.44 | $ | 27.50 | $ | 27.66 | $ | 27.30 | ||||||

NON-GAAP RECONCILIATION - ABPA*, POSTPAID PHONE ARPU AND ABPU* (Unaudited)

(Millions, except accounts, connections, ABPA*, ARPU, and ABPU*)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Sprint platform ABPA* (1) | ||||||||||||||||

Postpaid service revenue | $ | 4,793 | $ | 4,813 | $ | 5,049 | $ | 19,463 | $ | 21,181 | ||||||

Add: Installment plan billings | 287 | 300 | 294 | 1,190 | 877 | |||||||||||

Add: Lease revenue | 662 | 531 | 129 | 1,838 | 164 | |||||||||||

Total for Sprint platform postpaid connections | $ | 5,742 | $ | 5,644 | $ | 5,472 | $ | 22,491 | $ | 22,222 | ||||||

Sprint platform postpaid accounts (in thousands) | 11,358 | 11,261 | 11,199 | 11,248 | 11,453 | |||||||||||

Sprint platform postpaid ABPA* (b) | $ | 168.49 | $ | 167.11 | $ | 162.89 | $ | 166.63 | $ | 161.67 | ||||||

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Sprint platform postpaid phone ARPU and ABPU* (1) | ||||||||||||||||

Postpaid phone service revenue | $ | 4,512 | $ | 4,529 | $ | 4,772 | $ | 18,331 | $ | 20,095 | ||||||

Add: Installment plan billings | 268 | 280 | 281 | 1,116 | 835 | |||||||||||

Add: Lease revenue | 649 | 522 | 125 | 1,799 | 159 | |||||||||||

Total for Sprint platform postpaid phone connections | $ | 5,429 | $ | 5,331 | $ | 5,178 | $ | 21,246 | $ | 21,089 | ||||||

Sprint platform postpaid average phone connections (in thousands) | 25,297 | 25,040 | 24,946 | 25,020 | 25,420 | |||||||||||

Sprint platform postpaid phone ARPU (a) | $ | 59.45 | $ | 60.30 | $ | 63.76 | $ | 61.05 | $ | 65.88 | ||||||

Sprint platform postpaid phone ABPU* (c) | $ | 71.53 | $ | 70.99 | $ | 69.19 | $ | 70.77 | $ | 69.14 | ||||||

(a) ARPU is calculated by dividing service revenue by the sum of the monthly average number of connections in the applicable service category. Changes in average monthly service revenue reflect connections for either the postpaid or prepaid service category who change rate plans, the level of voice and data usage, the amount of service credits which are offered to connections, plus the net effect of average monthly revenue generated by new connections and deactivating connections.

Sprint platform postpaid phone ARPU represents revenues related to our postpaid phone connections.

(b) Sprint platform postpaid ABPA* is calculated by dividing service revenue earned from connections plus installment plan billings and lease revenue by the sum of the monthly average number of accounts during the period.

(c) Sprint platform postpaid phone ABPU* is calculated by dividing postpaid phone service revenue earned from postpaid phone connections plus installment plan billings and lease revenue by the sum of the monthly average number of postpaid phone connections during the period.

News Release |  | |

Wireless Device Financing Summary (Unaudited)

(Millions, except sales, connections, and sales and connections mix)

Quarter To Date | Year To Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Postpaid sales (in thousands) | 3,438 | 4,799 | 4,057 | 16,394 | 17,326 | |||||||||||

Postpaid sales mix | ||||||||||||||||

Subsidy/other | 37 | % | 35 | % | 47 | % | 36 | % | 61 | % | ||||||

Installment plans | 18 | % | 10 | % | 16 | % | 13 | % | 22 | % | ||||||

Leasing | 45 | % | 55 | % | 37 | % | 51 | % | 17 | % | ||||||

Postpaid connections (in thousands) | 30,951 | 30,895 | 29,706 | 30,951 | 29,706 | |||||||||||

Postpaid connections mix | ||||||||||||||||

Subsidy/other | 54 | % | 56 | % | 75 | % | 54 | % | 75 | % | ||||||

Installment plans | 13 | % | 14 | % | 15 | % | 13 | % | 15 | % | ||||||

Leasing | 33 | % | 30 | % | 10 | % | 33 | % | 10 | % | ||||||

Installment plans | ||||||||||||||||

Installment sales financed | $ | 311 | $ | 251 | $ | 347 | $ | 1,059 | $ | 2,200 | ||||||

Installment billings | 287 | 300 | 294 | 1,190 | 877 | |||||||||||

Installment receivables, net | — | — | 1,396 | — | 1,396 | |||||||||||

Leasing | ||||||||||||||||

Lease revenue | $ | 662 | $ | 531 | $ | 129 | $ | 1,838 | $ | 164 | ||||||

Lease depreciation | 550 | 535 | 150 | 1,781 | 206 | |||||||||||

Leased device additions: | ||||||||||||||||

Cash paid for capital expenditures - leased devices | $ | 568 | $ | 607 | $ | 439 | $ | 2,292 | $ | 582 | ||||||

Transfers from inventory - leased devices | 621 | 1,073 | 543 | 3,244 | 1,246 | |||||||||||

Total leased device additions | $ | 1,189 | $ | 1,680 | $ | 982 | $ | 5,536 | $ | 1,828 | ||||||

Leased devices in property, plant and equipment, net | $ | 3,645 | $ | 3,321 | $ | 1,777 | $ | 3,645 | $ | 1,777 | ||||||

Leased device net proceeds | ||||||||||||||||

Proceeds from MLS sale | $ | — | $ | 1,136 | $ | — | $ | 1,136 | $ | — | ||||||

Repayments to MLS | — | — | — | — | — | |||||||||||

Proceeds from lease securtization | 600 | — | — | 600 | — | |||||||||||

Repayments of lease securtization | — | — | — | — | — | |||||||||||

Net proceeds from the sale-leaseback of devices and sales of future lease receivables | $ | 600 | $ | 1,136 | $ | — | $ | 1,736 | $ | — | ||||||

News Release |  | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Millions, except per share data)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Net operating revenues | ||||||||||||||||

Service revenue | $ | 6,574 | $ | 6,683 | $ | 7,138 | $ | 27,174 | $ | 29,542 | ||||||

Equipment revenue | 1,497 | 1,424 | 1,144 | 5,006 | 4,990 | |||||||||||

Total net operating revenues | 8,071 | 8,107 | 8,282 | 32,180 | 34,532 | |||||||||||

Net operating expenses | ||||||||||||||||

Cost of services (exclusive of depreciation and amortization below) | 2,245 | 2,348 | 2,381 | 9,439 | 9,660 | |||||||||||

Cost of products (exclusive of depreciation and amortization below) | 1,551 | 1,589 | 1,827 | 5,795 | 9,309 | |||||||||||

Selling, general and administrative | 1,939 | 2,129 | 2,331 | 8,479 | 9,563 | |||||||||||

Depreciation | 1,592 | 1,549 | 1,091 | 5,794 | 3,797 | |||||||||||

Amortization | 300 | 316 | 363 | 1,294 | 1,552 | |||||||||||

Impairments (3) | — | — | — | — | 2,133 | |||||||||||

Other, net | 436 | 373 | (29 | ) | 1,069 | 413 | ||||||||||

Total net operating expenses | 8,063 | 8,304 | 7,964 | 31,870 | 36,427 | |||||||||||

Operating income (loss) | 8 | (197 | ) | 318 | 310 | (1,895 | ) | |||||||||

Interest expense | (552 | ) | (546 | ) | (523 | ) | (2,182 | ) | (2,051 | ) | ||||||

Other income, net | 5 | 4 | 8 | 18 | 27 | |||||||||||

Loss before income taxes | (539 | ) | (739 | ) | (197 | ) | (1,854 | ) | (3,919 | ) | ||||||

Income tax (expense) benefit | (15 | ) | (97 | ) | (27 | ) | (141 | ) | 574 | |||||||

Net loss | $ | (554 | ) | $ | (836 | ) | $ | (224 | ) | $ | (1,995 | ) | $ | (3,345 | ) | |

Basic and diluted net loss per common share | $ | (0.14 | ) | $ | (0.21 | ) | $ | (0.06 | ) | $ | (0.50 | ) | $ | (0.85 | ) | |

Weighted average common shares outstanding | 3,972 | 3,970 | 3,962 | 3,969 | 3,953 | |||||||||||

Effective tax rate | -2.8 | % | -13.1 | % | -13.7 | % | -7.6 | % | 14.6 | % | ||||||

NON-GAAP RECONCILIATION - NET LOSS TO ADJUSTED EBITDA* (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Net loss | $ | (554 | ) | $ | (836 | ) | $ | (224 | ) | $ | (1,995 | ) | $ | (3,345 | ) | |

Income tax expense (benefit) | 15 | 97 | 27 | 141 | (574 | ) | ||||||||||

Loss before income taxes | (539 | ) | (739 | ) | (197 | ) | (1,854 | ) | (3,919 | ) | ||||||

Other income, net | (5 | ) | (4 | ) | (8 | ) | (18 | ) | (27 | ) | ||||||

Interest expense | 552 | 546 | 523 | 2,182 | 2,051 | |||||||||||

Operating income (loss) | 8 | (197 | ) | 318 | 310 | (1,895 | ) | |||||||||

Depreciation | 1,592 | 1,549 | 1,091 | 5,794 | 3,797 | |||||||||||

Amortization | 300 | 316 | 363 | 1,294 | 1,552 | |||||||||||

EBITDA* (4) | 1,900 | 1,668 | 1,772 | 7,398 | 3,454 | |||||||||||

Impairments (3) | — | — | — | — | 2,133 | |||||||||||

Loss from asset dispositions and exchanges, net (5) | 81 | — | — | 166 | — | |||||||||||

Severance and exit costs (6) | 162 | 209 | (29 | ) | 409 | 304 | ||||||||||

Litigation (7) | 15 | 21 | — | 193 | 91 | |||||||||||

Partial pension settlement (8) | — | — | — | — | 59 | |||||||||||

Reduction in liability - U.S. Cellular asset acquisition (9) | — | — | — | (20 | ) | (41 | ) | |||||||||

Adjusted EBITDA* (4) | $ | 2,158 | $ | 1,898 | $ | 1,743 | $ | 8,146 | $ | 6,000 | ||||||

Adjusted EBITDA margin* | 32.8 | % | 28.4 | % | 24.4 | % | 30.0 | % | 20.3 | % | ||||||

Selected items: | ||||||||||||||||

Cash paid for capital expenditures - network and other | $ | 722 | $ | 994 | $ | 1,608 | $ | 4,680 | $ | 5,422 | ||||||

Cash paid for capital expenditures - leased devices | $ | 568 | $ | 607 | $ | 439 | $ | 2,292 | $ | 582 | ||||||

News Release |  | |

WIRELESS STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Net operating revenues | ||||||||||||||||

Service revenue | ||||||||||||||||

Sprint platform (1): | ||||||||||||||||

Postpaid | $ | 4,793 | $ | 4,813 | $ | 5,049 | $ | 19,463 | $ | 21,181 | ||||||

Prepaid | 1,203 | 1,224 | 1,272 | 4,986 | 4,905 | |||||||||||

Wholesale, affiliate and other | 155 | 182 | 189 | 703 | 724 | |||||||||||

Total Sprint platform | 6,151 | 6,219 | 6,510 | 25,152 | 26,810 | |||||||||||

Total transactions (2) | 3 | 27 | 118 | 219 | 527 | |||||||||||

Total service revenue | 6,154 | 6,246 | 6,628 | 25,371 | 27,337 | |||||||||||

Equipment revenue | 1,497 | 1,424 | 1,144 | 5,006 | 4,990 | |||||||||||

Total net operating revenues | 7,651 | 7,670 | 7,772 | 30,377 | 32,327 | |||||||||||

Net operating expenses | ||||||||||||||||

Cost of services (exclusive of depreciation and amortization below) | 1,922 | 2,031 | 2,006 | 8,069 | 7,945 | |||||||||||

Cost of products (exclusive of depreciation and amortization below) | 1,551 | 1,589 | 1,827 | 5,795 | 9,309 | |||||||||||

Selling, general and administrative | 1,868 | 2,041 | 2,242 | 8,141 | 9,179 | |||||||||||

Depreciation | 1,541 | 1,496 | 1,044 | 5,593 | 3,560 | |||||||||||

Amortization | 300 | 316 | 362 | 1,294 | 1,549 | |||||||||||

Impairments (3) | — | — | — | — | 1,900 | |||||||||||

Other, net | 434 | 353 | (29 | ) | 1,045 | 349 | ||||||||||

Total net operating expenses | 7,616 | 7,826 | 7,452 | 29,937 | 33,791 | |||||||||||

Operating income (loss) | $ | 35 | $ | (156 | ) | $ | 320 | $ | 440 | $ | (1,464 | ) | ||||

WIRELESS NON-GAAP RECONCILIATION (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Operating income (loss) | $ | 35 | $ | (156 | ) | $ | 320 | $ | 440 | $ | (1,464 | ) | ||||

Impairments (3) | — | — | — | — | 1,900 | |||||||||||

Loss from asset dispositions and exchanges, net (5) | 81 | — | — | 166 | — | |||||||||||

Severance and exit costs (6) | 160 | 189 | (29 | ) | 385 | 263 | ||||||||||

Litigation (7) | 15 | 21 | — | 193 | 84 | |||||||||||

Partial pension settlement (8) | — | — | — | — | 43 | |||||||||||

Reduction in liability - U.S. Cellular asset acquisition (9) | — | — | — | (20 | ) | (41 | ) | |||||||||

Depreciation | 1,541 | 1,496 | 1,044 | 5,593 | 3,560 | |||||||||||

Amortization | 300 | 316 | 362 | 1,294 | 1,549 | |||||||||||

Adjusted EBITDA* (4) | $ | 2,132 | $ | 1,866 | $ | 1,697 | $ | 8,051 | $ | 5,894 | ||||||

Adjusted EBITDA margin* | 34.6 | % | 29.9 | % | 25.6 | % | 31.7 | % | 21.6 | % | ||||||

Selected items: | ||||||||||||||||

Cash paid for capital expenditures - network and other | $ | 577 | $ | 869 | $ | 1,518 | $ | 4,089 | $ | 4,860 | ||||||

Cash paid for capital expenditures - leased devices | $ | 568 | $ | 607 | $ | 439 | $ | 2,292 | $ | 582 | ||||||

News Release |  | |

WIRELINE STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Net operating revenues | ||||||||||||||||

Voice | $ | 194 | $ | 201 | $ | 264 | $ | 840 | $ | 1,174 | ||||||

Data | 37 | 42 | 52 | 171 | 213 | |||||||||||

Internet | 316 | 317 | 335 | 1,284 | 1,353 | |||||||||||

Other | 15 | 21 | 17 | 87 | 74 | |||||||||||

Total net operating revenues | 562 | 581 | 668 | 2,382 | 2,814 | |||||||||||

Net operating expenses | ||||||||||||||||

Cost of services (exclusive of depreciation and amortization below) | 467 | 466 | 538 | 1,962 | 2,338 | |||||||||||

Selling, general and administrative | 74 | 82 | 90 | 328 | 363 | |||||||||||

Depreciation and amortization | 50 | 50 | 46 | 194 | 232 | |||||||||||

Impairments (3) | — | — | — | — | 233 | |||||||||||

Other, net | 3 | 20 | (2 | ) | 25 | 61 | ||||||||||

Total net operating expenses | 594 | 618 | 672 | 2,509 | 3,227 | |||||||||||

Operating loss | $ | (32 | ) | $ | (37 | ) | $ | (4 | ) | $ | (127 | ) | $ | (413 | ) | |

WIRELINE NON-GAAP RECONCILIATION (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Operating loss | $ | (32 | ) | $ | (37 | ) | $ | (4 | ) | $ | (127 | ) | $ | (413 | ) | |

Impairments (3) | — | — | — | — | 233 | |||||||||||

Severance and exit costs (6) | 3 | 20 | (2 | ) | 25 | 39 | ||||||||||

Litigation (7) | — | — | — | — | 6 | |||||||||||

Partial pension settlement (8) | — | — | — | — | 16 | |||||||||||

Depreciation and amortization | 50 | 50 | 46 | 194 | 232 | |||||||||||

Adjusted EBITDA* | $ | 21 | $ | 33 | $ | 40 | $ | 92 | $ | 113 | ||||||

Adjusted EBITDA margin* | 3.7 | % | 5.7 | % | 6.0 | % | 3.9 | % | 4.0 | % | ||||||

Selected items: | ||||||||||||||||

Cash paid for capital expenditures - network and other | $ | 74 | $ | 74 | $ | 70 | $ | 279 | $ | 275 | ||||||

News Release |  | |

CONDENSED CONSOLIDATED CASH FLOW INFORMATION (Unaudited)**

(Millions)

Year to Date | ||||||

3/31/16 | 3/31/15 | |||||

Operating activities | ||||||

Net loss | $ | (1,995 | ) | $ | (3,345 | ) |

Impairments (3) | — | 2,133 | ||||

Depreciation and amortization | 7,088 | 5,349 | ||||

Provision for losses on accounts receivable | 455 | 892 | ||||

Share-based and long-term incentive compensation expense | 75 | 86 | ||||

Deferred income tax expense (benefit) | 123 | (609 | ) | |||

Amortization of long-term debt premiums, net | (316 | ) | (303 | ) | ||

Loss on disposal of property, plant and equipment | 487 | — | ||||

Other changes in assets and liabilities: | ||||||

Accounts and notes receivable | (1,663 | ) | (644 | ) | ||

Inventories and other current assets | (3,065 | ) | (1,573 | ) | ||

Deferred purchase price from sale of receivables | 2,478 | — | ||||

Accounts payable and other current liabilities | (574 | ) | 481 | |||

Non-current assets and liabilities, net | 111 | (199 | ) | |||

Other, net | 693 | 182 | ||||

Net cash provided by operating activities | 3,897 | 2,450 | ||||

Investing activities | ||||||

Capital expenditures - network and other | (4,680 | ) | (5,422 | ) | ||

Capital expenditures - leased devices | (2,292 | ) | (582 | ) | ||

Expenditures relating to FCC licenses | (98 | ) | (163 | ) | ||

Reimbursements relating to FCC licenses | — | 95 | ||||

Change in short-term investments, net | 166 | 1,054 | ||||

Proceeds from sales of assets and FCC licenses | 62 | 315 | ||||

Proceeds from sale-leaseback transaction | 1,136 | — | ||||

Other, net | (29 | ) | (11 | ) | ||

Net cash used in investing activities | (5,735 | ) | (4,714 | ) | ||

Financing activities | ||||||

Proceeds from debt and financings | 755 | 1,930 | ||||

Repayments of debt, financing and capital lease obligations | (899 | ) | (574 | ) | ||

Proceeds from sales of future lease receivables | 600 | — | ||||

Debt financing costs | (11 | ) | (87 | ) | ||

Proceeds from issuance of common stock, net | 10 | 35 | ||||

Other, net | 14 | — | ||||

Net cash provided by financing activities | 469 | 1,304 | ||||

Net decrease in cash and cash equivalents | (1,369 | ) | (960 | ) | ||

Cash and cash equivalents, beginning of period | 4,010 | 4,970 | ||||

Cash and cash equivalents, end of period | $ | 2,641 | $ | 4,010 | ||

RECONCILIATION TO CONSOLIDATED FREE CASH FLOW* (NON-GAAP) (Unaudited)

(Millions)

Quarter to Date | Year to Date | |||||||||||||||

3/31/16 | 12/31/15 | 3/31/15 | 3/31/16 | 3/31/15 | ||||||||||||

Net cash provided by operating activities | $ | 1,294 | $ | 806 | $ | 976 | $ | 3,897 | $ | 2,450 | ||||||

Capital expenditures - network and other | (722 | ) | (994 | ) | (1,608 | ) | (4,680 | ) | (5,422 | ) | ||||||

Capital expenditures - leased devices | (568 | ) | (607 | ) | (439 | ) | (2,292 | ) | (582 | ) | ||||||

Expenditures relating to FCC licenses, net | (23 | ) | (30 | ) | (42 | ) | (98 | ) | (68 | ) | ||||||

Proceeds from sales of assets and FCC licenses | 26 | 32 | 201 | 62 | 315 | |||||||||||

Other investing activities, net | (4 | ) | (4 | ) | (2 | ) | (29 | ) | (11 | ) | ||||||

Free cash flow* | $ | 3 | $ | (797 | ) | $ | (914 | ) | $ | (3,140 | ) | $ | (3,318 | ) | ||

Net proceeds from the sale-leaseback of devices and sales of future lease receivables | 600 | 1,136 | — | 1,736 | — | |||||||||||

Adjusted free cash flow* | $ | 603 | $ | 339 | $ | (914 | ) | $ | (1,404 | ) | $ | (3,318 | ) | |||

**Certain prior period amounts have been reclassified to conform to the current period presentation.

News Release |  | |

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Millions)

3/31/16 | 3/31/15 | |||||

ASSETS | ||||||

Current assets | ||||||

Cash and cash equivalents | $ | 2,641 | $ | 4,010 | ||

Short-term investments | — | 166 | ||||

Accounts and notes receivable, net | 1,099 | 2,290 | ||||

Device and accessory inventory | 1,173 | 1,359 | ||||

Deferred tax assets | — | 62 | ||||

Prepaid expenses and other current assets | 1,920 | 1,890 | ||||

Total current assets | 6,833 | 9,777 | ||||

Property, plant and equipment, net | 20,297 | 19,721 | ||||

Goodwill | 6,575 | 6,575 | ||||

FCC licenses and other | 40,073 | 39,987 | ||||

Definite-lived intangible assets, net | 4,469 | 5,893 | ||||

Other assets (10) | 728 | 888 | ||||

Total assets | $ | 78,975 | $ | 82,841 | ||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||

Current liabilities | ||||||

Accounts payable | $ | 2,899 | $ | 4,347 | ||

Accrued expenses and other current liabilities | 4,374 | 5,293 | ||||

Current portion of long-term debt, financing and capital lease obligations | 4,690 | 1,300 | ||||

Total current liabilities | 11,963 | 10,940 | ||||

Long-term debt, financing and capital lease obligations (10) | 29,268 | 32,342 | ||||

Deferred tax liabilities | 13,959 | 13,898 | ||||

Other liabilities | 4,002 | 3,951 | ||||

Total liabilities | 59,192 | 61,131 | ||||

Stockholders' equity | ||||||

Common stock | 40 | 40 | ||||

Treasury shares, at cost | (3 | ) | (7 | ) | ||

Paid-in capital | 27,563 | 27,468 | ||||

Accumulated deficit | (7,378 | ) | (5,383 | ) | ||

Accumulated other comprehensive loss | (439 | ) | (408 | ) | ||

Total stockholders' equity | 19,783 | 21,710 | ||||

Total liabilities and stockholders' equity | $ | 78,975 | $ | 82,841 | ||

NET DEBT* (NON-GAAP) (Unaudited)

(Millions)

3/31/16 | 3/31/15 | |||||

Total debt | $ | 33,958 | $ | 33,642 | ||

Less: Cash and cash equivalents | (2,641 | ) | (4,010 | ) | ||

Less: Short-term investments | — | (166 | ) | |||

Net debt* | $ | 31,317 | $ | 29,466 | ||

News Release |  | |

SCHEDULE OF DEBT (Unaudited)

(Millions)

3/31/16 | |||||

ISSUER | COUPON | MATURITY | PRINCIPAL | ||

Sprint Corporation | |||||

7.25% Notes due 2021 | 7.250% | 09/15/2021 | $ | 2,250 | |

7.875% Notes due 2023 | 7.875% | 09/15/2023 | 4,250 | ||

7.125% Notes due 2024 | 7.125% | 06/15/2024 | 2,500 | ||

7.625% Notes due 2025 | 7.625% | 02/15/2025 | 1,500 | ||

Sprint Corporation | 10,500 | ||||

Sprint Communications, Inc. | |||||

Export Development Canada Facility (Tranche 4) | 5.914% | 12/15/2017 | 250 | ||

Export Development Canada Facility (Tranche 3) | 4.164% | 12/17/2019 | 300 | ||

6% Senior notes due 2016 | 6.000% | 12/01/2016 | 2,000 | ||

9.125% Senior notes due 2017 | 9.125% | 03/01/2017 | 1,000 | ||

8.375% Senior notes due 2017 | 8.375% | 08/15/2017 | 1,300 | ||

9% Guaranteed notes due 2018 | 9.000% | 11/15/2018 | 3,000 | ||

7% Guaranteed notes due 2020 | 7.000% | 03/01/2020 | 1,000 | ||

7% Senior notes due 2020 | 7.000% | 08/15/2020 | 1,500 | ||

11.5% Senior notes due 2021 | 11.500% | 11/15/2021 | 1,000 | ||

9.25% Debentures due 2022 | 9.250% | 04/15/2022 | 200 | ||

6% Senior notes due 2022 | 6.000% | 11/15/2022 | 2,280 | ||

Sprint Communications, Inc. | 13,830 | ||||

Sprint Capital Corporation | |||||

6.9% Senior notes due 2019 | 6.900% | 05/01/2019 | 1,729 | ||

6.875% Senior notes due 2028 | 6.875% | 11/15/2028 | 2,475 | ||

8.75% Senior notes due 2032 | 8.750% | 03/15/2032 | 2,000 | ||

Sprint Capital Corporation | 6,204 | ||||

Clearwire Communications LLC | |||||

14.75% First-priority senior secured notes due 2016 | 14.750% | 12/01/2016 | 300 | ||

8.25% Exchangeable notes due 2040 | 8.250% | 12/01/2040 | 629 | ||

Clearwire Communications LLC | 929 | ||||

Secured equipment credit facilities | 2.020% - 2.745% | 2017 - 2021 | 805 | ||

Financing obligations | 2.016% - 6.098% | 2017 - 2021 | 828 | ||

Capital lease obligations and other | 2.348% - 10.517% | 2016 - 2023 | 265 | ||

Total principal | 33,361 | ||||

Net premiums and debt financing costs | 597 | ||||

Total debt | $ | 33,958 | |||

*This table excludes (i) our unsecured revolving bank credit facility, which will expire in 2018 and has no outstanding balance, (ii) $320 million in letters of credit outstanding under the unsecured revolving bank credit facility, (iii) all capital leases and other financing obligations, and (iv) net premiums and debt financing costs.

News Release |  | |

NOTES TO THE FINANCIAL INFORMATION (Unaudited)

(1) | Sprint platform refers to the Sprint network that supports the wireless service we provide through our multiple brands. |

(2) | Postpaid and prepaid connections from transactions are defined as retail postpaid and prepaid connections acquired from Clearwire in July 2013 who had not deactivated or been recaptured on the Sprint platform. |

(3) | For the third quarter of fiscal year 2014, impairment losses were recorded after determining that the carrying value exceeded estimated fair value of both the Sprint trade name and Wireline asset group, which consists primarily of property, plant and equipment. |

(4) | As more of our customers elect to lease a device rather than purchasing one under our subsidized program, there is a positive impact to EBITDA* and Adjusted EBITDA* primarily due to the fact the cost of the device is not recorded as cost of products but rather is depreciated over the customer lease term. Under our device leasing program for the direct channel, devices are transferred from inventory to property and equipment and the cost of the leased device is recognized as depreciation expense over the customer lease term to an estimated residual value. The customer payments are recognized as revenue over the term of the lease. Under our subsidized program, the cash received from the customer for the device is recognized as equipment revenue at the point of sale and the cost of the device is recognized as cost of products. During the three and twelve-month periods ended March 31, 2016, we leased devices through our Sprint direct channels totaling approximately $600 million and $3.2 billion, respectively, which would have increased cost of products and reduced EBITDA* if they had been purchased under our subsidized program. Also, during the three and twelve-month periods ended March 31, 2016, the equipment revenue derived from customers electing to finance their devices through device leasing or installment billing programs in our direct channel was 58% and 51%, respectively. |

The impact to EBITDA* and Adjusted EBITDA* resulting from the sale of devices under our installment billing program is neutral except for the impact from the time value of money element related to the imputed interest on the installment receivable.

(5) | During the fourth and second quarters of fiscal year 2015, we recorded losses on dispositions of assets primarily related to network development costs that are no longer relevant as a result of changes in the Company's network plans. |

(6) | Severance and exit costs consist of lease exit costs primarily associated with tower and cell sites, access exit costs related to payments that will continue to be made under our backhaul access contracts for which we will no longer be receiving any economic benefit, and severance costs associated with reduction in our work force. |

(7) | For the fourth and third quarters of fiscal year 2015, litigation activity is a result of unfavorable developments in connection with pending litigation. |

(8) | The partial pension settlement resulted from amounts paid to eligible terminated participants who voluntarily elected to receive lump sum distributions as a result of an approved plan amendment to the Sprint Retirement Pension Plan by the Board of Directors in June 2014. |

(9) | As a result of the U.S. Cellular asset acquisition, we recorded a liability related to network shut-down costs, which primarily consisted of lease exit costs, for which we agreed to reimburse U.S. Cellular. During the third quarter of fiscal year 2014, we identified favorable trends in actual costs and, as a result, reduced the liability resulting in a gain of approximately $41 million. During the first quarter of fiscal year 2015, we revised our estimate and, as a result, reduced the liability resulting in approximately $20 million of income. |

(10) During the fourth quarter of fiscal year 2015, the Company elected to adopt accounting guidance which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. Also addressed in this guidance is the presentation and subsequent measurement of debt issuance costs associated with line-of-credit arrangements. We elected to adopt the guidance early with full retrospective application. Debt issuance costs associated with our revolving credit facility remain in "Other assets" on the consolidated balance sheet and continue to be amortized over the term of the facility as allowed by the guidance. For the year ended March 31, 2015 debt issuance costs for all other debt totaling $189 million have been reclassified from "Other assets" to "Long-term debt, financing and capital lease obligations" on the consolidated balance sheet.

News Release |  | |

*FINANCIAL MEASURES

Sprint provides financial measures determined in accordance with GAAP and adjusted GAAP (non-GAAP). The non-GAAP financial measures reflect industry conventions, or standard measures of liquidity, profitability or performance commonly used by the investment community for comparability purposes. These measurements should be considered in addition to, but not as a substitute for, financial information prepared in accordance with GAAP. We have defined below each of the non-GAAP measures we use, but these measures may not be synonymous to similar measurement terms used by other companies.

Sprint provides reconciliations of these non-GAAP measures in its financial reporting. Because Sprint does not predict special items that might occur in the future, and our forecasts are developed at a level of detail different than that used to prepare GAAP-based financial measures, Sprint does not provide reconciliations to GAAP of its forward-looking financial measures.

The measures used in this release include the following:

EBITDA is operating income/(loss) before depreciation and amortization. Adjusted EBITDA is EBITDA excluding severance, exit costs, and other special items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by non-equipment net operating revenues for Wireless and Adjusted EBITDA divided by net operating revenues for Wireline. We believe that Adjusted EBITDA and Adjusted EBITDA Margin provide useful information to investors because they are an indicator of the strength and performance of our ongoing business operations. While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent non-cash current period costs associated with the use of long-lived tangible and definite-lived intangible assets. Adjusted EBITDA and Adjusted EBITDA Margin are calculations commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the periodic and future operating performance and value of companies within the telecommunications industry.

Sprint Platform Postpaid ABPA is average billings per account and calculated by dividing postpaid service revenue earned from postpaid customers plus installment plan billings and lease revenue by the sum of the monthly average number of postpaid accounts during the period. We believe that ABPA provides useful information to investors, analysts and our management to evaluate average Sprint platform postpaid customer billings per account as it approximates the expected cash collections, including installment plan billings and lease revenue, per postpaid account each month.

Sprint Platform Postpaid Phone ABPU is average billings per postpaid phone user and calculated by dividing service revenue earned from postpaid phone customers plus installment plan billings and lease revenue by the sum of the monthly average number of postpaid phone connections during the period. We believe that ABPU provides useful information to investors, analysts and our management to evaluate average Sprint platform postpaid phone customer billings as it approximates the expected cash collections, including installment plan billings and lease revenue, per postpaid phone user each month.

Free Cash Flow is the cash provided by operating activities less the cash used in investing activities other than short-term investments, including changes in restricted cash, if any, and excluding the sale-leaseback of devices. Adjusted Free Cash Flow is Free Cash Flow plus the proceeds from the sale-leaseback of devices and sales of future lease receivables, net of repayments. We believe that Free Cash Flow and Adjusted Free Cash Flow provide useful information to investors, analysts and our management about the cash generated by our core operations and net proceeds obtained to fund certain leased devices, respectively, after interest and dividends, if any, and our ability to fund scheduled debt maturities and other financing activities, including discretionary refinancing and retirement of debt and purchase or sale of investments.

Net Debt is consolidated debt, including current maturities, less cash and cash equivalents, short-term investments and, if any, restricted cash. We believe that Net Debt provides useful information to investors, analysts and credit rating agencies about the capacity of the company to reduce the debt load and improve its capital structure.

News Release |  | |

SAFE HARBOR

This release includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan, “outlook,” “providing guidance,” and similar expressions are intended to identify information that is not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future - including statements relating to our network, connections growth, and liquidity; and statements expressing general views about future operating results - are forward-looking statements. Forward-looking statements are estimates and projections reflecting management’s judgment based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. With respect to these forward-looking statements, management has made assumptions regarding, among other things, the development and deployment of new technologies and services; efficiencies and cost savings of new technologies and services; customer and network usage; connection growth and retention; service, speed, coverage and quality; availability of devices; availability of various financings, including any leasing transactions; the timing of various events and the economic environment. Sprint believes these forward-looking statements are reasonable; however, you should not place undue reliance on forward-looking statements, which are based on current expectations and speak only as of the date when made. Sprint undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our company's historical experience and our present expectations or projections. Factors that might cause such differences include, but are not limited to, those discussed in Sprint Corporation’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015 and, when filed, its Annual Report on Form 10-K for the fiscal year ended March 31, 2016. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

About Sprint:

Sprint (NYSE: S) is a communications services company that creates more and better ways to connect its customers to the things they care about most. Sprint served more than 58.8 million connections as of March 31, 2016 and is widely recognized for developing, engineering and deploying innovative technologies, including the first wireless 4G service from a national carrier in the United States; leading no-contract brands including Virgin Mobile USA, Boost Mobile, and Assurance Wireless; instant national and international push-to-talk capabilities; and a global Tier 1 Internet backbone. Sprint has been named to the Dow Jones Sustainability Index (DJSI) North America for the past five years. You can learn more and visit Sprint at www.sprint.com or www.facebook.com/sprint and www.twitter.com/sprint.

###