Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYRIAD GENETICS INC | d162634d8k.htm |

| EX-99.1 - EX-99.1 - MYRIAD GENETICS INC | d162634dex991.htm |

Myriad Genetics Fiscal Third-Quarter 2016 Earnings Call 05/03/2016 Exhibit 99.2

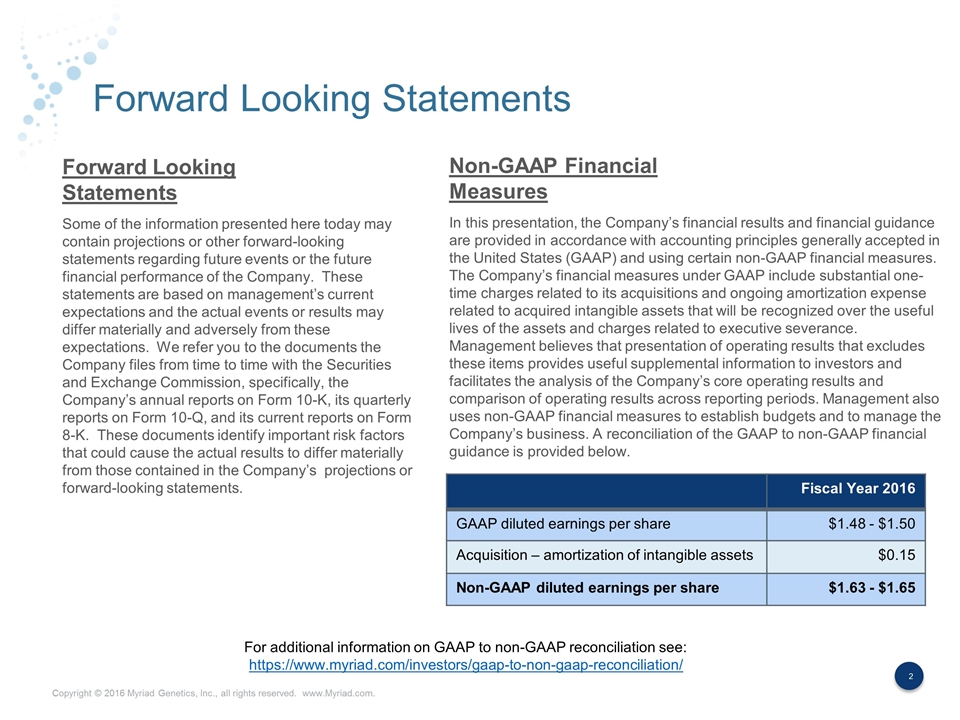

Forward Looking Statements Some of the information presented here today may contain projections or other forward-looking statements regarding future events or the future financial performance of the Company. These statements are based on management’s current expectations and the actual events or results may differ materially and adversely from these expectations. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically, the Company’s annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K. These documents identify important risk factors that could cause the actual results to differ materially from those contained in the Company’s projections or forward-looking statements. In this presentation, the Company’s financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. The Company’s financial measures under GAAP include substantial one-time charges related to its acquisitions and ongoing amortization expense related to acquired intangible assets that will be recognized over the useful lives of the assets and charges related to executive severance. Management believes that presentation of operating results that excludes these items provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company’s business. A reconciliation of the GAAP to non-GAAP financial guidance is provided below. Forward Looking Statements Non-GAAP Financial Measures Fiscal Year 2016 GAAP diluted earnings per share $1.48 - $1.50 Acquisition – amortization of intangible assets $0.15 Non-GAAP diluted earnings per share $1.63 - $1.65 For additional information on GAAP to non-GAAP reconciliation see: https://www.myriad.com/investors/gaap-to-non-gaap-reconciliation/

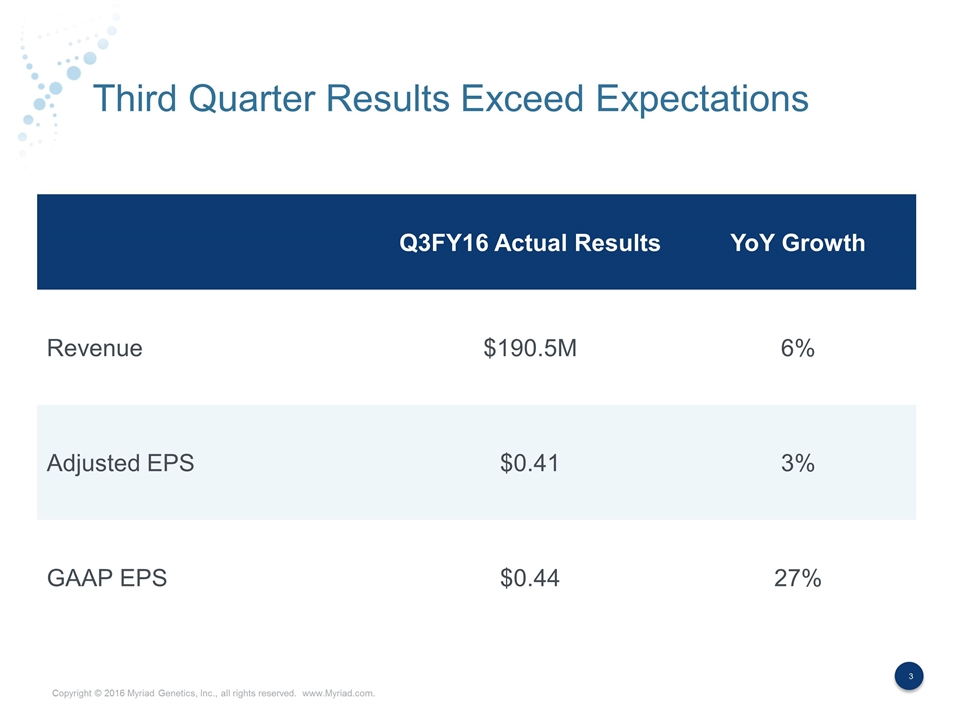

Third Quarter Results Exceed Expectations Q3FY16 Actual Results YoY Growth Revenue $190.5M 6% Adjusted EPS $0.41 3% GAAP EPS $0.44 27%

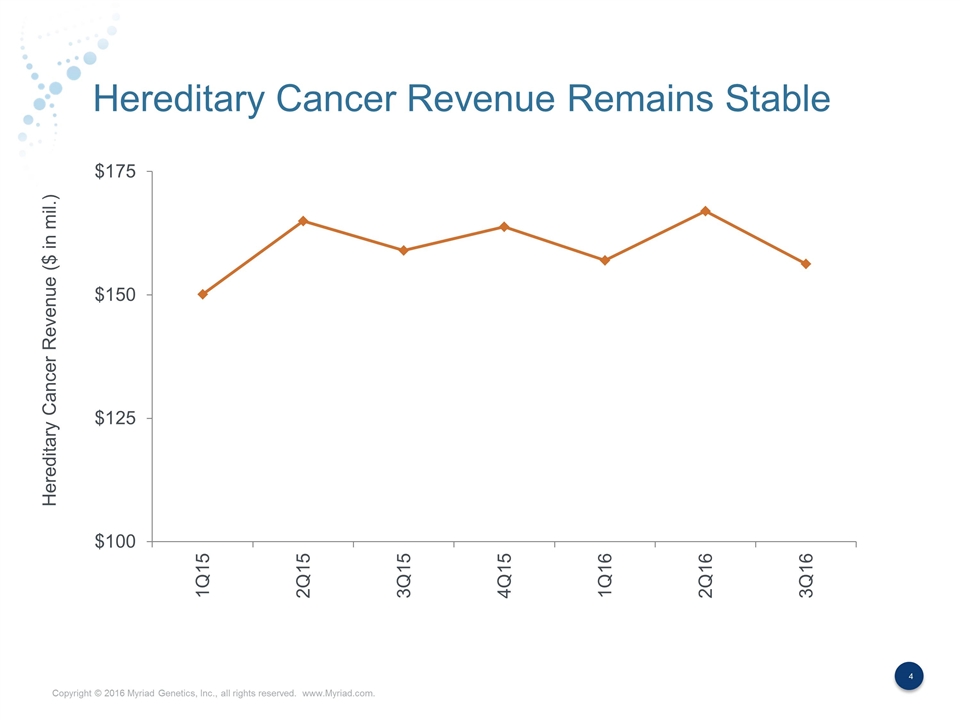

Hereditary Cancer Revenue Remains Stable Hereditary Cancer Revenue ($ in mil.)

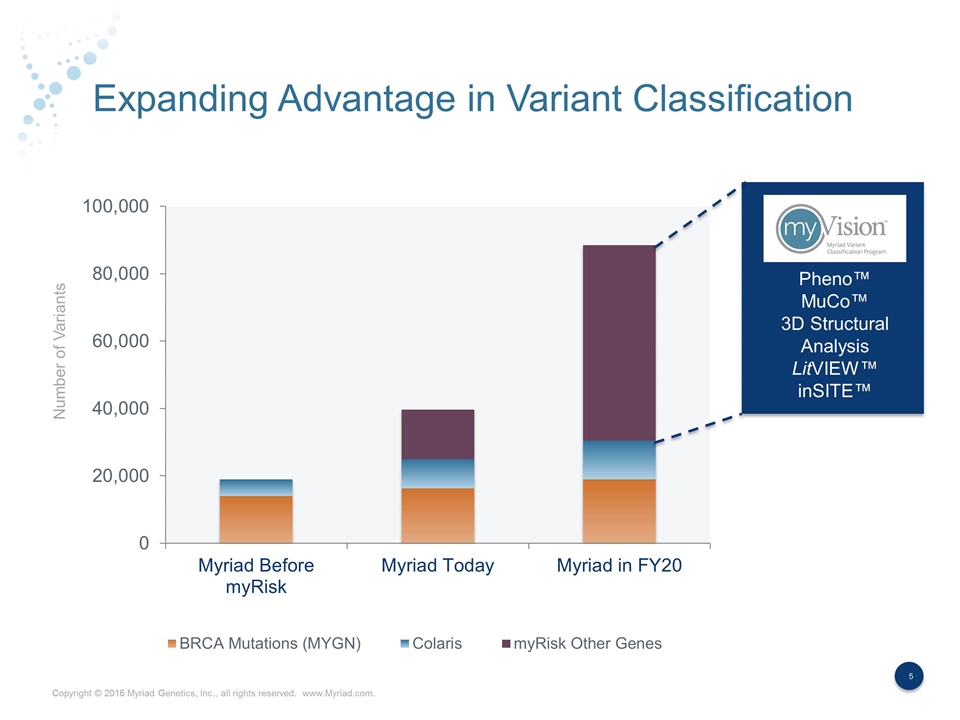

Expanding Advantage in Variant Classification Number of Variants Pheno™ MuCo™ 3D Structural Analysis LitVIEW™ inSITE™

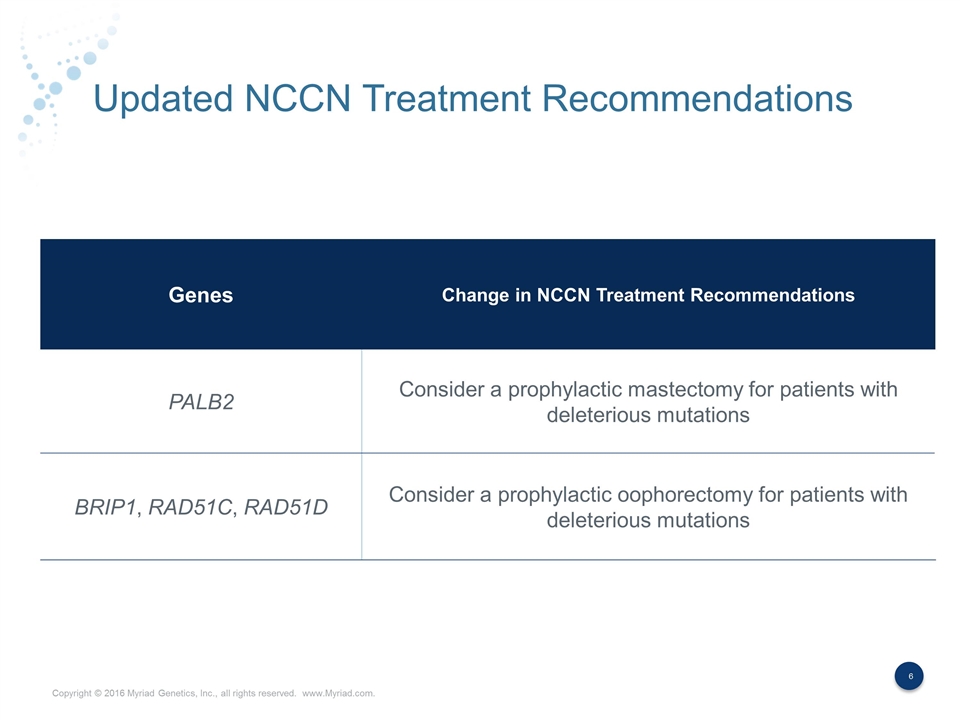

Updated NCCN Treatment Recommendations Genes Change in NCCN Treatment Recommendations PALB2 Consider a prophylactic mastectomy for patients with deleterious mutations BRIP1, RAD51C, RAD51D Consider a prophylactic oophorectomy for patients with deleterious mutations

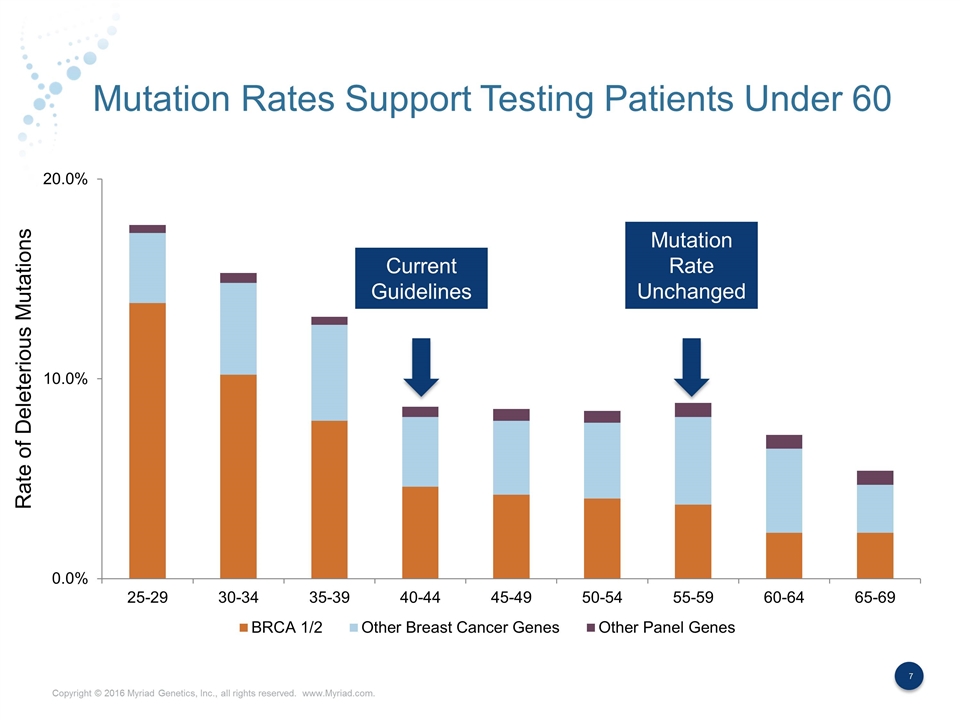

Mutation Rates Support Testing Patients Under 60 Current Guidelines Rate of Deleterious Mutations Mutation Rate Unchanged

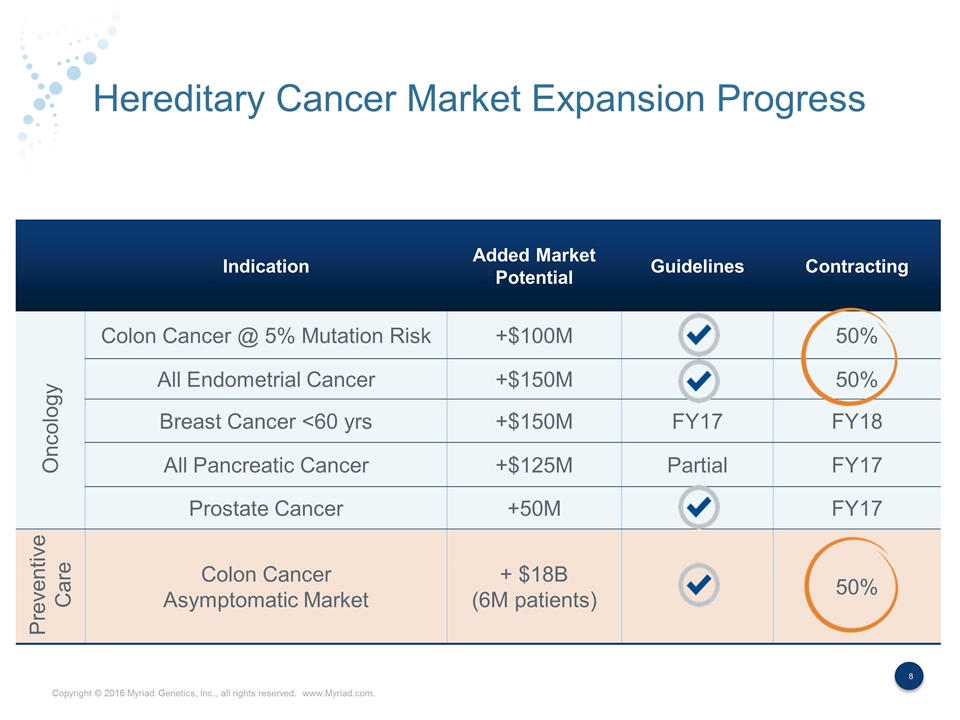

Hereditary Cancer Market Expansion Progress Indication Added Market Potential Guidelines Contracting Colon Cancer @ 5% Mutation Risk +$100M 50% All Endometrial Cancer +$150M 50% Breast Cancer <60 yrs +$150M FY17 FY18 All Pancreatic Cancer +$125M Partial FY17 Prostate Cancer +50M FY17 Colon Cancer Asymptomatic Market + $18B (6M patients) 50% Oncology Preventive Care

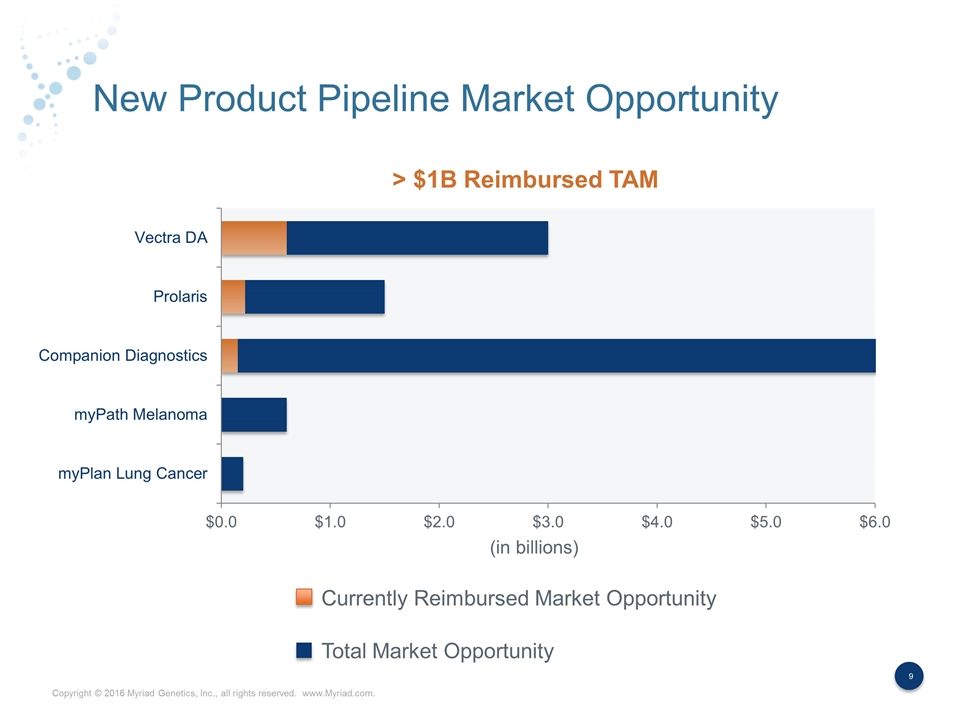

New Product Pipeline Market Opportunity Currently Reimbursed Market Opportunity Total Market Opportunity (in billions) > $1B Reimbursed TAM

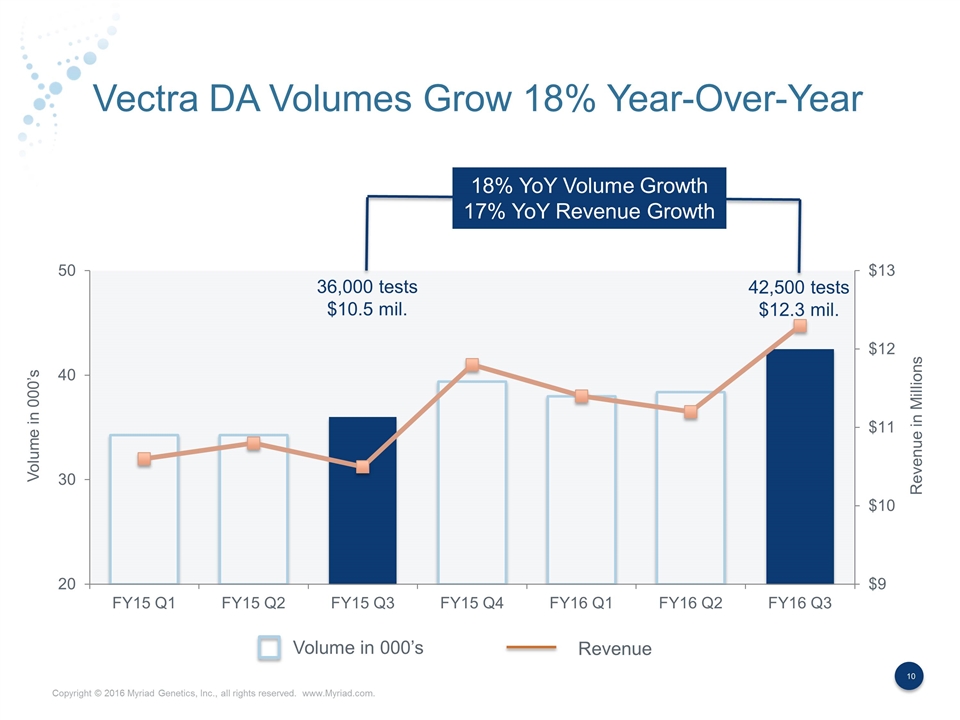

Vectra DA Volumes Grow 18% Year-Over-Year 18% YoY Volume Growth 17% YoY Revenue Growth Volume in 000’s Revenue Volume in 000’s Revenue in Millions 36,000 tests $10.5 mil. 42,500 tests $12.3 mil.

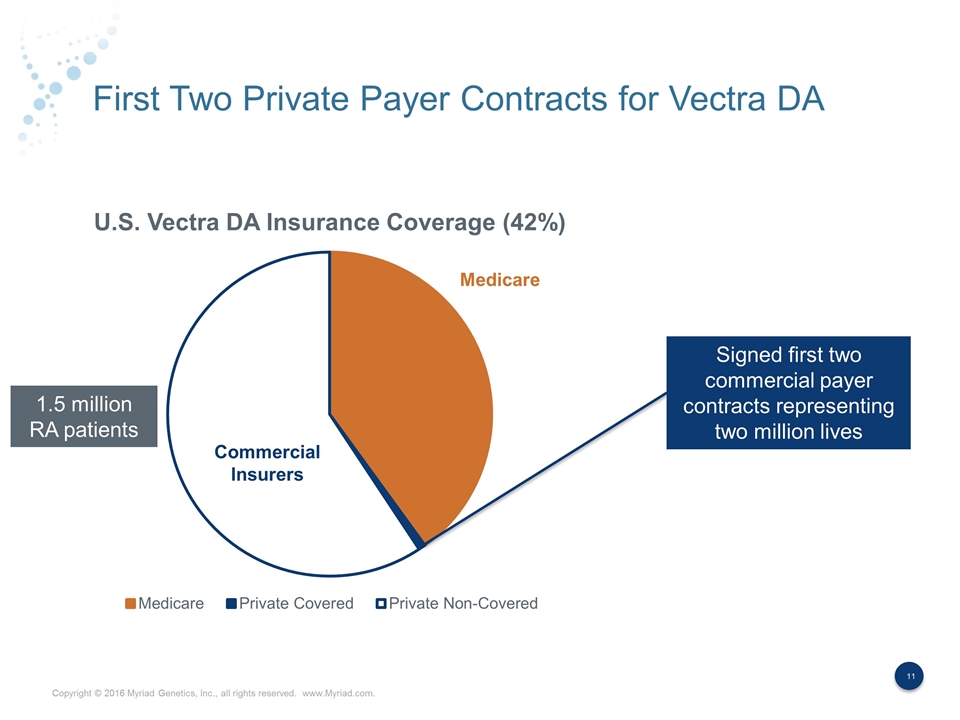

First Two Private Payer Contracts for Vectra DA Medicare Commercial Insurers Signed first two commercial payer contracts representing two million lives 1.5 million RA patients

Prolaris Volumes Grow 90% Year-Over-Year 90% YoY Volume Growth Volume Revenue Prolaris Volume Revenue in Millions *Excludes Medicare retrospective claim revenue 2,250 tests 4,300 tests

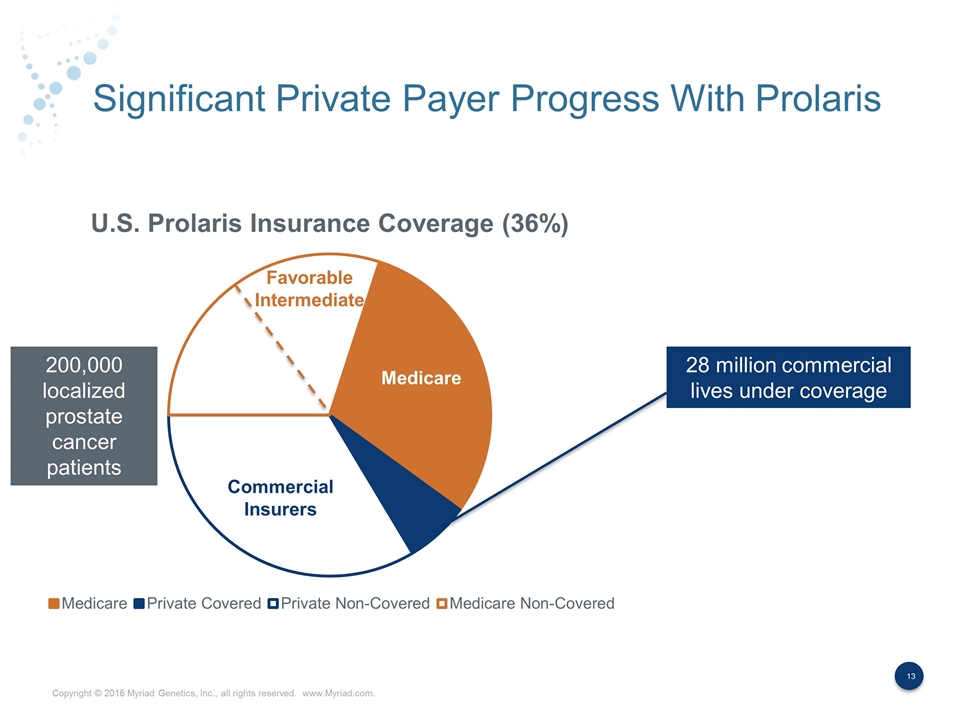

Significant Private Payer Progress With Prolaris Commercial Insurers 28 million commercial lives under coverage 200,000 localized prostate cancer patients Medicare Favorable Intermediate

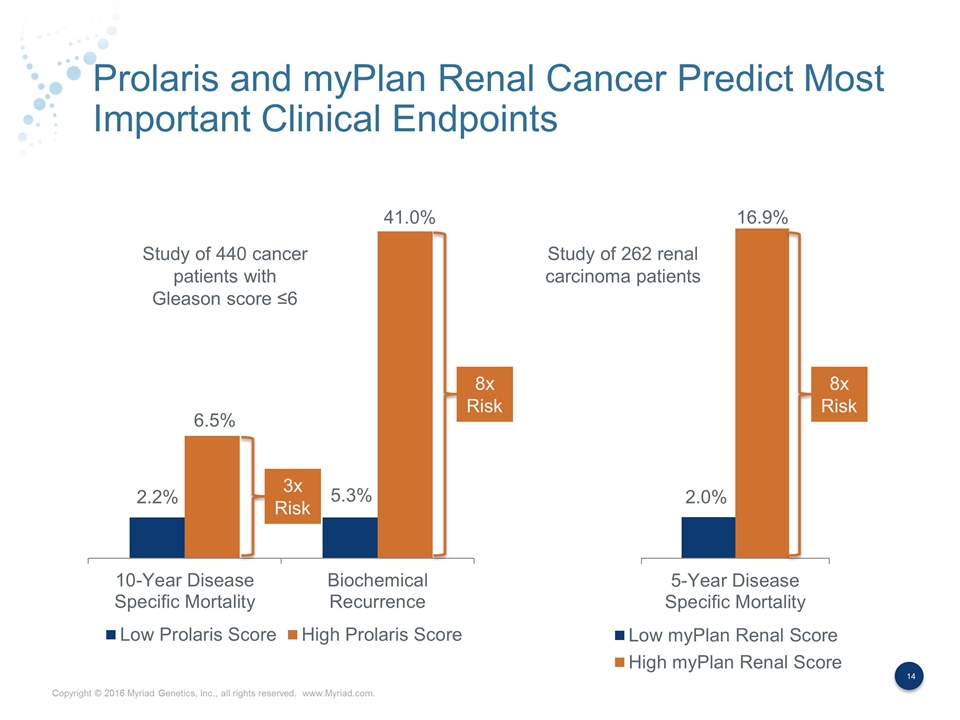

Prolaris and myPlan Renal Cancer Predict Most Important Clinical Endpoints 3x Risk 8x Risk 8x Risk Study of 440 cancer patients with Gleason score ≤6 Study of 262 renal carcinoma patients 2.2% 6.5% 5.3% 41.0% 2.0% 16.9%

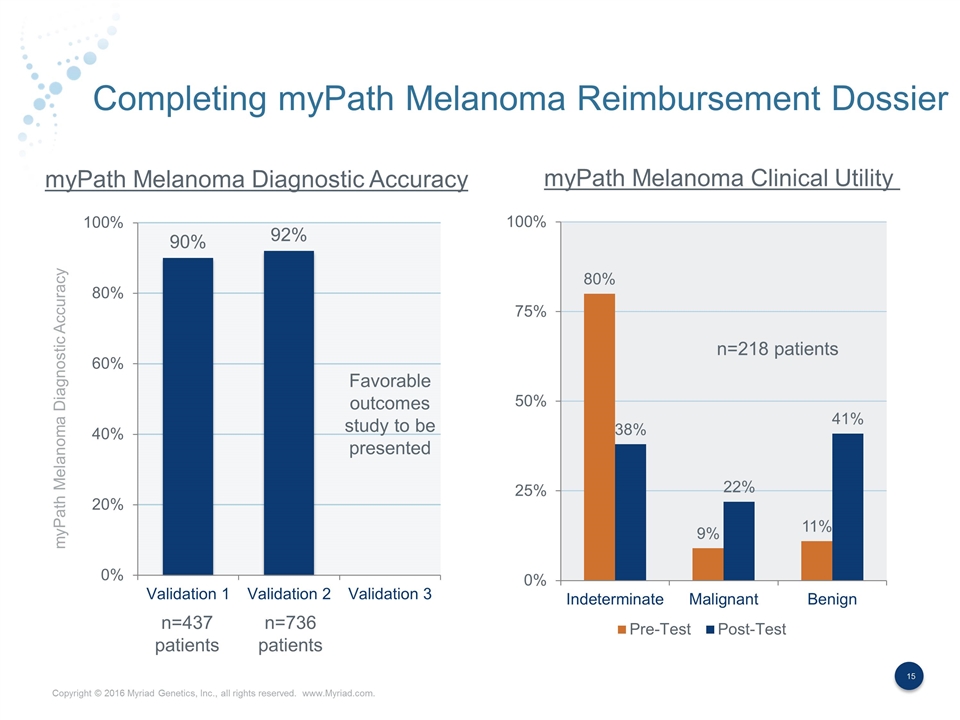

Completing myPath Melanoma Reimbursement Dossier myPath Melanoma Diagnostic Accuracy myPath Melanoma Diagnostic Accuracy myPath Melanoma Clinical Utility n=437 patients n=736 patients n=218 patients Favorable outcomes study to be presented

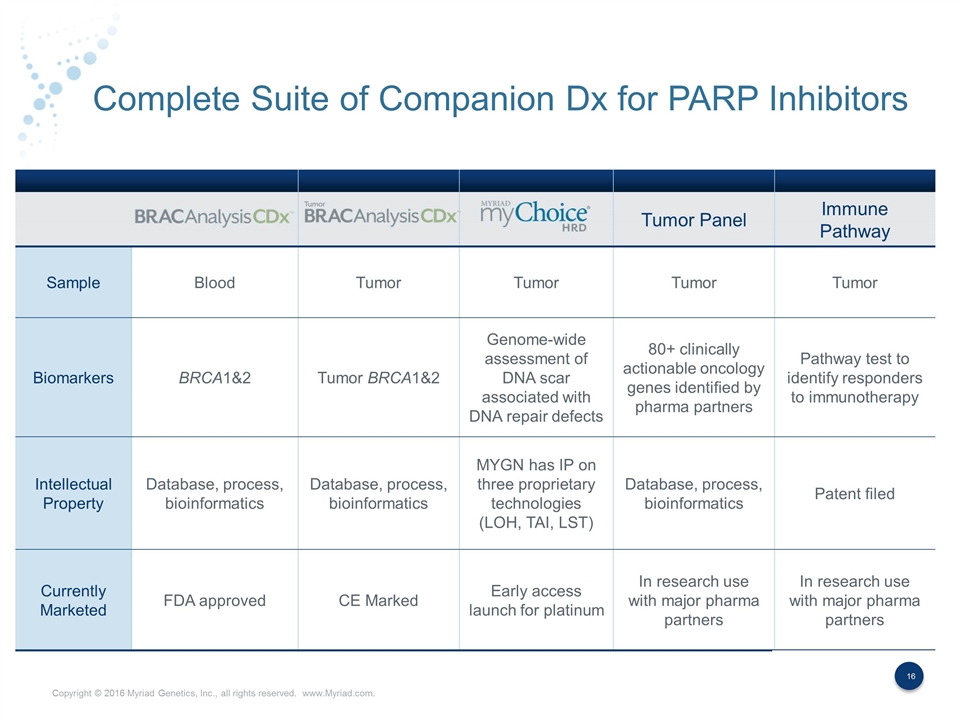

Complete Suite of Companion Dx for PARP Inhibitors Tumor Panel Immune Pathway Sample Blood Tumor Tumor Tumor Tumor Biomarkers BRCA1&2 Tumor BRCA1&2 Genome-wide assessment of DNA scar associated with DNA repair defects 80+ clinically actionable oncology genes identified by pharma partners Pathway test to identify responders to immunotherapy Intellectual Property Database, process, bioinformatics Database, process, bioinformatics MYGN has IP on three proprietary technologies (LOH, TAI, LST) Database, process, bioinformatics Patent filed Currently Marketed FDA approved CE Marked Early access launch for platinum In research use with major pharma partners In research use with major pharma partners

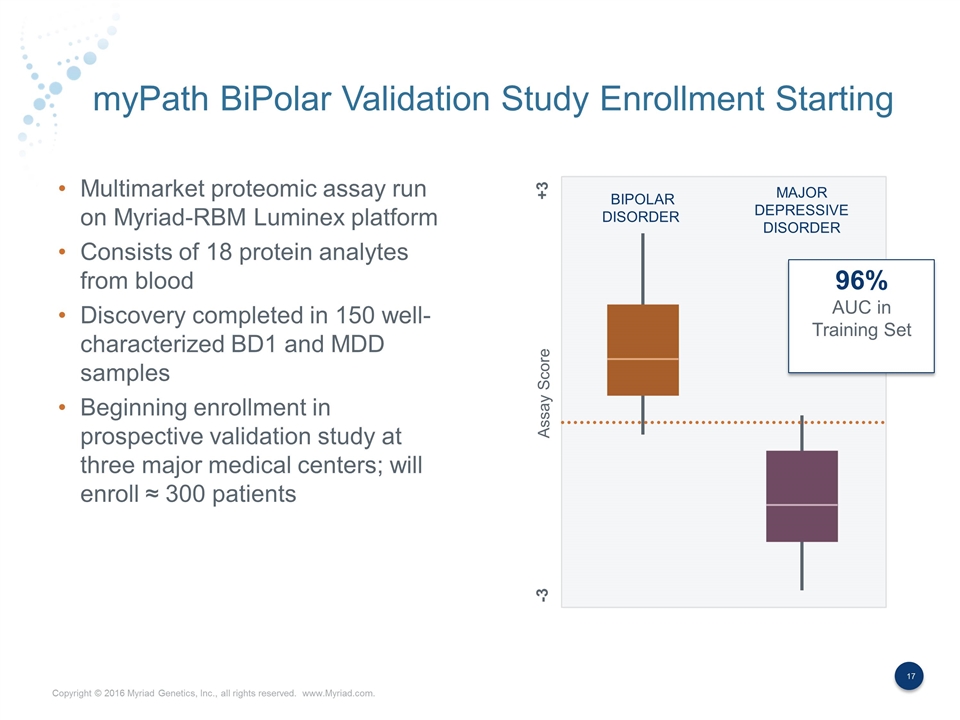

myPath BiPolar Validation Study Enrollment Starting Multimarket proteomic assay run on Myriad-RBM Luminex platform Consists of 18 protein analytes from blood Discovery completed in 150 well- characterized BD1 and MDD samples Beginning enrollment in prospective validation study at three major medical centers; will enroll ≈ 300 patients BIPOLAR DISORDER MAJOR DEPRESSIVE DISORDER Assay Score +3 -3 96% AUC in Training Set

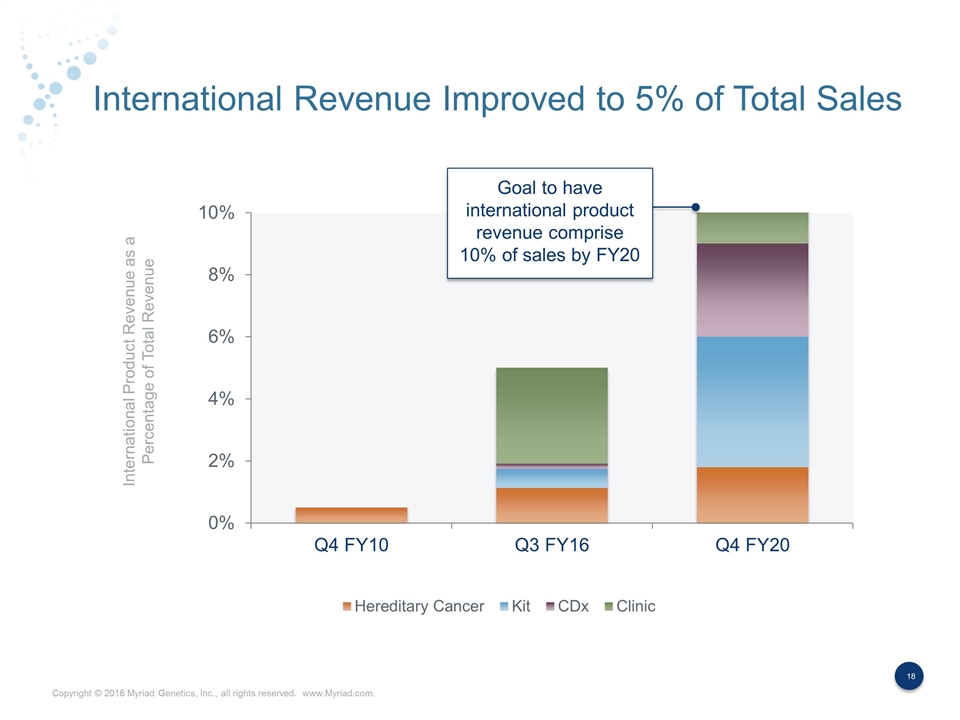

International Revenue Improved to 5% of Total Sales International Product Revenue as a Percentage of Total Revenue Goal to have international product revenue comprise 10% of sales by FY20

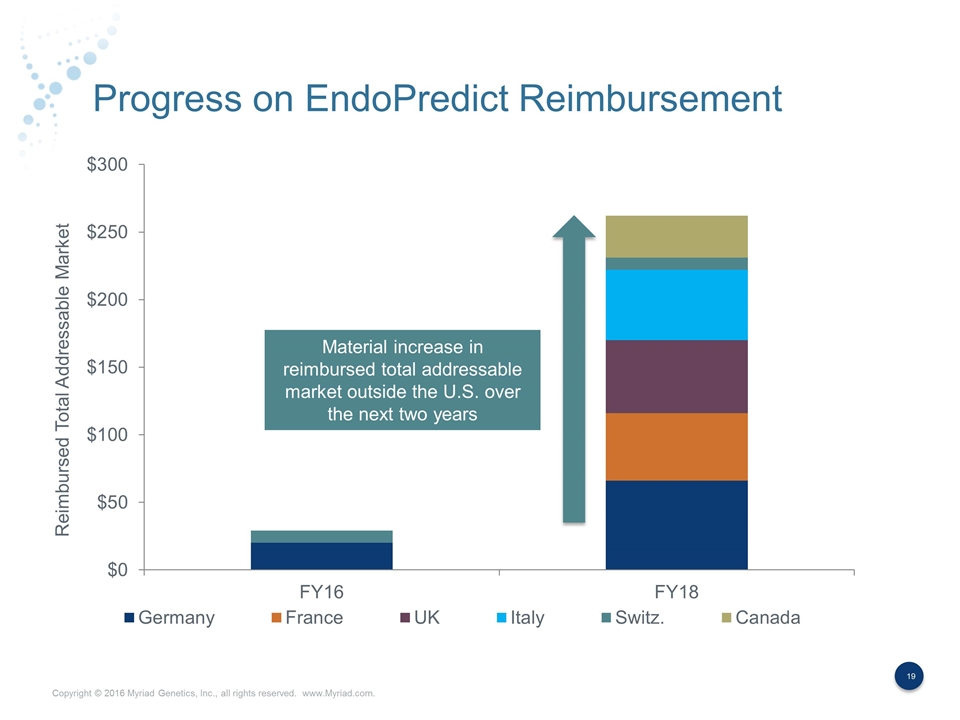

Progress on EndoPredict Reimbursement Material increase in reimbursed total addressable market outside the U.S. over the next two years Reimbursed Total Addressable Market

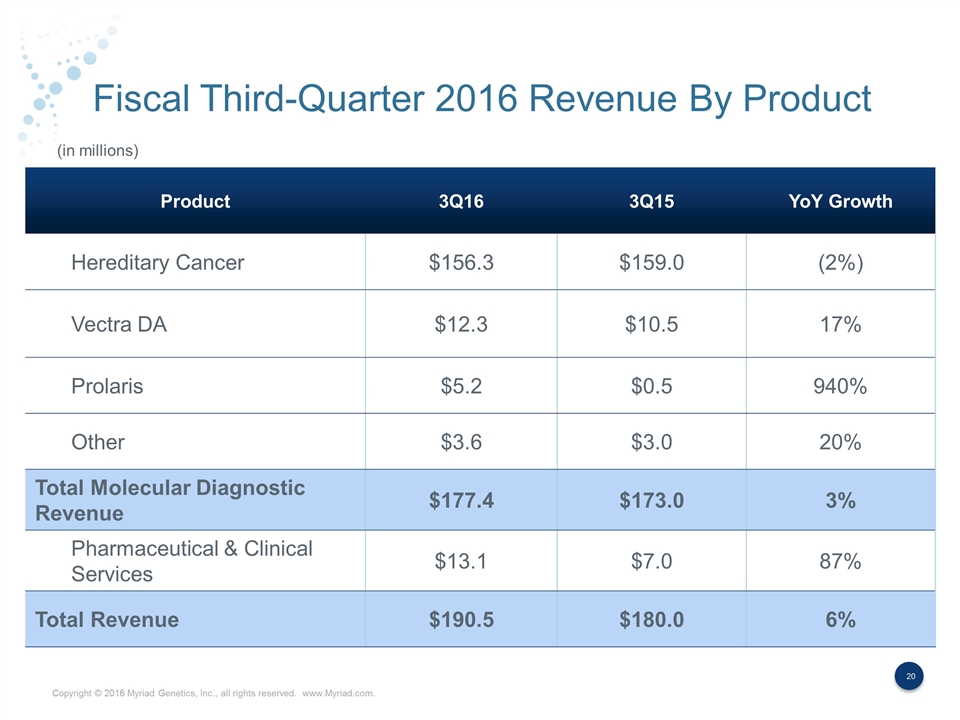

Fiscal Third-Quarter 2016 Revenue By Product Product 3Q16 3Q15 YoY Growth Hereditary Cancer $156.3 $159.0 (2%) Vectra DA $12.3 $10.5 17% Prolaris $5.2 $0.5 940% Other $3.6 $3.0 20% Total Molecular Diagnostic Revenue $177.4 $173.0 3% Pharmaceutical & Clinical Services $13.1 $7.0 87% Total Revenue $190.5 $180.0 6% (in millions)

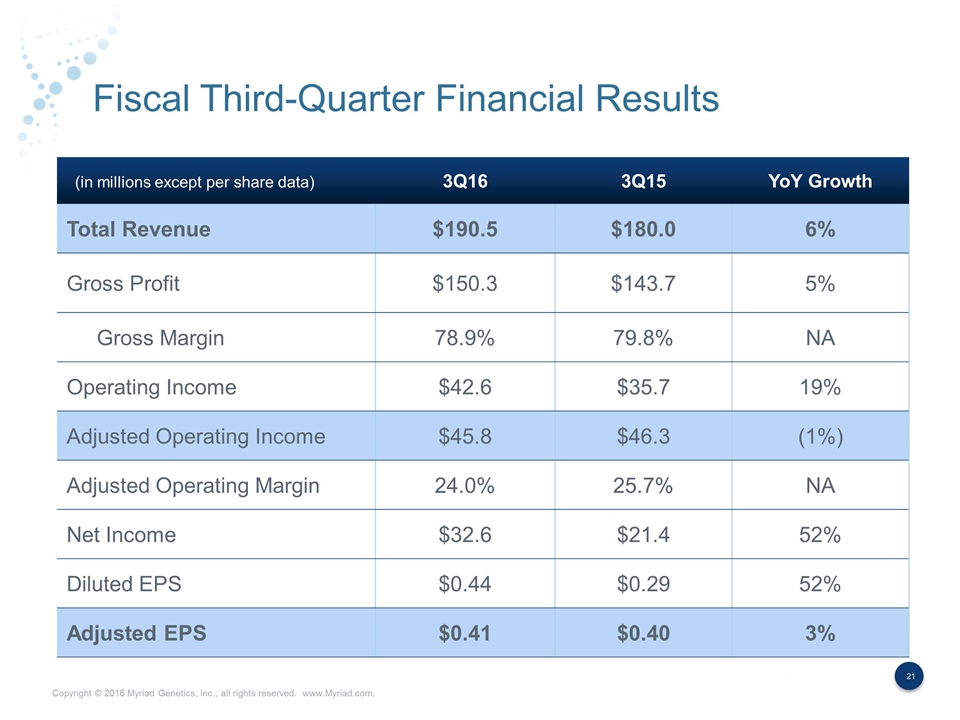

Fiscal Third-Quarter Financial Results 3Q16 3Q15 YoY Growth Total Revenue $190.5 $180.0 6% Gross Profit $150.3 $143.7 5% Gross Margin 78.9% 79.8% NA Operating Income $42.6 $35.7 19% Adjusted Operating Income $45.8 $46.3 (1%) Adjusted Operating Margin 24.0% 25.7% NA Net Income $32.6 $21.4 52% Diluted EPS $0.44 $0.29 52% Adjusted EPS $0.41 $0.40 3% (in millions except per share data)

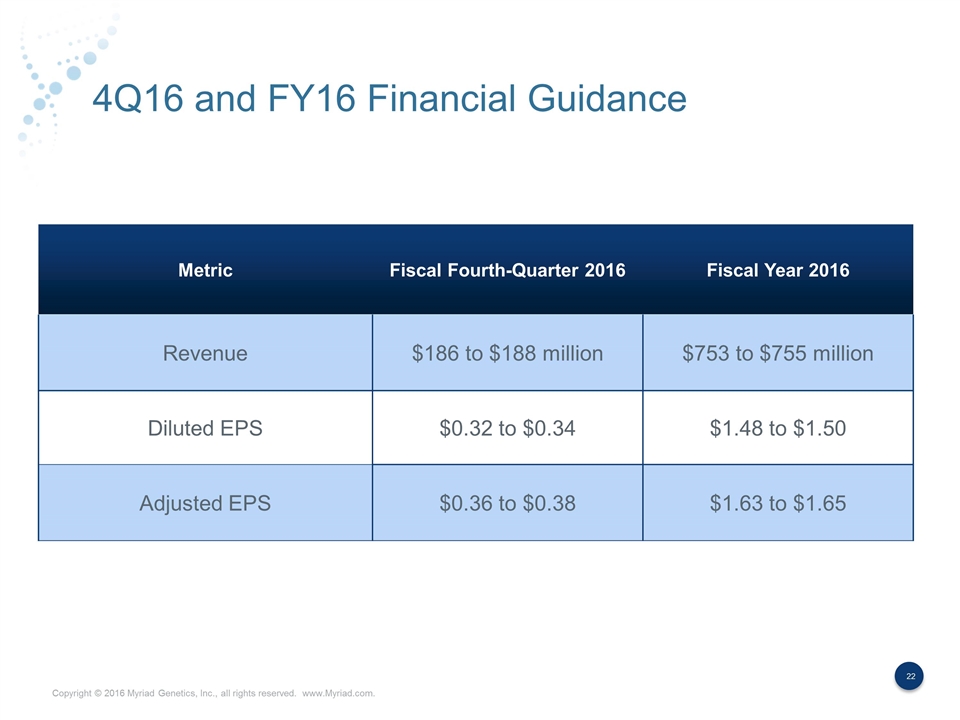

4Q16 and FY16 Financial Guidance Metric Fiscal Fourth-Quarter 2016 Fiscal Year 2016 Revenue $186 to $188 million $753 to $755 million Diluted EPS $0.32 to $0.34 $1.48 to $1.50 Adjusted EPS $0.36 to $0.38 $1.63 to $1.65