Attached files

| file | filename |

|---|---|

| 8-K - KIMBALL INTERNATIONAL, INC. FORM 8-K - KIMBALL INTERNATIONAL INC | form8-kearningsrelease0331.htm |

| EX-99.1 - KIMBALL INTERNATIONAL, INC. EXHIBIT 99.1 - KIMBALL INTERNATIONAL INC | a8kexhibit991pressrelease0.htm |

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Third Quarter Fiscal Year 2016 Exhibit 99.2

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 1 Safe Harbor Statement Certain statements contained within this presentation may be considered forward-looking under the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties including, but not limited to, the risk that any projections or guidance, including revenues, margins, earnings, or any other financial results are not realized, the successful completion of the restructuring plan, our ability to fully realize the expected benefits of the restructuring plan, adverse changes in the global economic conditions, significant volume reductions from key contract customers, significant reduction in customer order patterns, financial stability of key customers and suppliers, and availability or cost of raw materials. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of the Company are contained in the Company’s Form 10-K filing for the fiscal year ended June 30, 2015 and other filings with the Securities and Exchange Commission.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 2 Company Snapshot Headquarters: Jasper, IN, USA Founded: 1950 Employees: ~3,000 Furniture focused since Oct 31, 2014 Spin-off FYTD’16 Revenue: $470M (9 months of FY’16) FYTD’16 Adj. Pro Forma Operating Profit: $29.8M / 6.3% FY ‘15 Revenue: $601M FY ’15 Adj. Pro Forma Operating Profit: $29.3M / 4.9%

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 3 Design Driven and Award Winning Furniture Brands Evolving Office Environment Driving Demand / Strong Hospitality Industry Leading Indicators Increased Dividend 10% September, 2015 – Dividend Yield Approximates 2% Restructuring Plan – Expected Completion Sooner Than Planned Accelerating Revenue From New Product Introductions - Increasing Market Share Why Invest in Us Improving Financial Performance – Strong Return on Capital Relative to Competitors Capital Available for Growth

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 4 Kimball International, Inc. creates design driven, innovative furnishings sold through our family of brands: Kimball Office, National Office Furniture, and Kimball Hospitality. Our diverse portfolio offers solutions for the workplace, learning, healing, and hospitality environments. Dedicated to our Guiding Principles, our values and integrity are evidenced by public recognition as a highly trusted company and an employer of choice. “We Build Success” by establishing long-term relationships with customers, employees, suppliers, share owners and the communities in which we operate. Who We Are We Build Success

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 5 Where We Play Government Healthcare Finance Hospitality

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 6 How We Are Recognized Contract Magazine Top 10 Brand in Desks/Credenzas

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 7 Market Changes Driving Office Furniture Demand Increased mobility/technology requires flexible work space Shifting to more open and collaborative office layouts to promote teamwork Promotion of healthy work environments Real Estate Optimization Change is driving furniture demand New Work Areas

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Furniture Industry Indicators

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 9 Mixed U.S. Furniture Leading Indicators S ou rc e U S B ur ea u of E co no m ic A na ly si s S ou rc e: U S B ur ea u of L ab or S ta tis tic s S ou rc e: A IA Architectural Billing Index Continued Growth 3.9% 7.2% -35.0% -30.0% -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 0 2000 4000 6000 8000 10000 12000 14000 16000 BIFMA ($millions) 0 200 400 600 800 1000 1200 1400 1600 1800 D ec -0 2 Ju n- 03 D ec -0 3 Ju n- 04 D ec -0 4 Ju n- 05 D ec -0 5 Ju n- 06 D ec -0 6 Ju n- 07 D ec -0 7 Ju n- 08 D ec -0 8 Ju n- 09 D ec -0 9 Ju n- 10 D ec -1 0 Ju n- 11 D ec -1 1 Ju n- 12 D ec -1 2 Ju n- 13 D ec -1 3 Ju n- 14 D ec -1 4 Ju n- 15 D ec -1 5 US Corporate Profit After Tax With IVA and CCA adjustment ($billion) 100 105 110 115 120 125 130 D ec -0 3 Jul -0 4 F eb -0 5 S ep -0 5 A pr -0 6 N ov -0 6 Ju n- 07 Ja n- 08 A ug -0 8 M ar -0 9 O ct -0 9 M ay -1 0 D ec -1 0 Jul -1 1 F eb -1 2 S ep -1 2 A pr -1 3 N ov -1 3 Ju n- 14 Ja n- 15 A ug -1 5 M ar -1 6 Service Sector Employement (millions workers) Positive 2nd consecutive month in March at 51.9

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 10 Strong Hospitality Leading Indicators 6.3% 5.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Luxury Upper Scale Upscale Upper Middle Scale Midscale Economy Independents US 2015 2016 Source: PWC Hospitality Directions May 2015 Revenue Per Available Room (RevPAR) Growth Rates (Estimated) 2016 occupancy levels expected to remain at 65.7%, the highest since 1981 Average Daily Rate Contribution to RevPAR growth By 2016, ADR contribution is expected to reach approximately 95%, similar to 2006 levels.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Kimball International Financial Overview Basis of financial information is Continuing Operations adjusted for certain non-operating and non-recurring transactions for comparability. Financial information included throughout is unaudited.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 12 Improving Performance (1) Unaudited Significant improvement in operating income since FY’2013 Annual Net Sales and Operating Income (1)

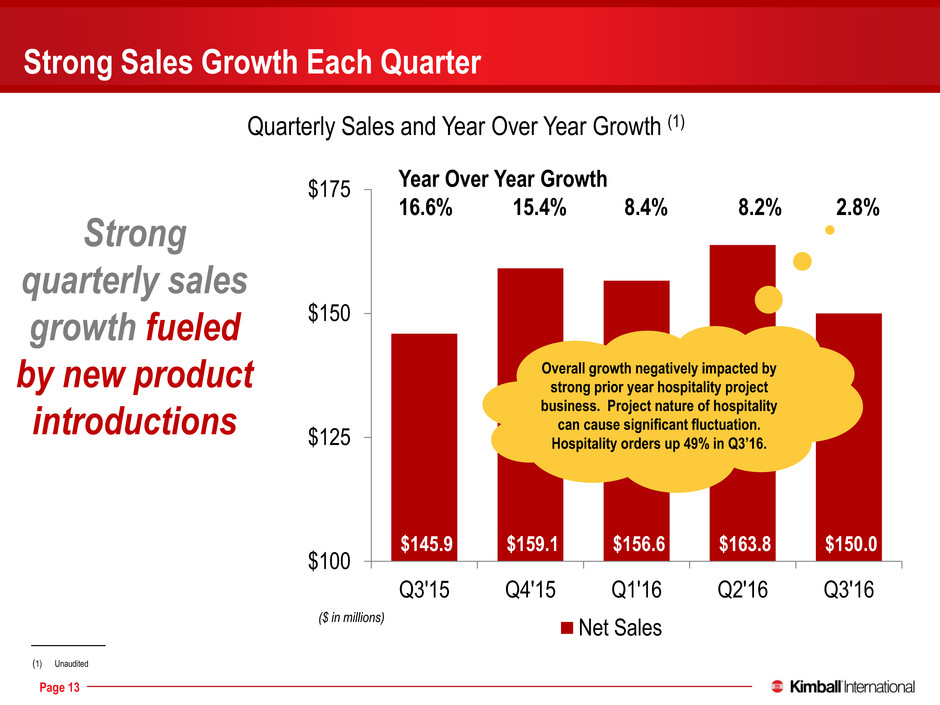

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 13 Strong Sales Growth Each Quarter $145.9 $159.1 $156.6 $163.8 $150.0 $100 $125 $150 $175 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Net Sales ($ in millions) (1) Unaudited Strong quarterly sales growth fueled by new product introductions Quarterly Sales and Year Over Year Growth (1) Year Over Year Growth 16.6% 15.4% 8.4% 8.2% 2.8% Overall growth negatively impacted by strong prior year hospitality project business. Project nature of hospitality can cause significant fluctuation. Hospitality orders up 49% in Q3’16.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 14 Strong Sales Growth in New Product Introductions – Office Furniture (1) $21 $19 $19 $27 $28 $28 $29 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 ($ in millions) (1) Unaudited Year Over Year Growth 5% 21% 26% 57% 33% 45% 54%

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 15 Strong Order Growth Each Quarter $130.9 $172.3 $165.9 $168.2 $148.4 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Orders Received ($ in millions) (1) Unaudited Year Over Year Growth 15% 15% 2% 6% 13% Quarterly Orders and Year Over Year Growth (1) Or 16% excluding unusually large ($13.8M) prior year Q2’15 hospitality vertical order. Strong quarterly order growth fueled by new product introductions

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 16 Order Trend Relative to Office Furniture Market * Sales and order data are not available for the Hospitality furniture industry (BIFMA industry data excludes Hospitality furniture). Therefore, to get a comparable industry comparison, sales and orders for the Hospitality vertical are excluded from the Kimball International numbers presented in this graph. 17% 7% 8% 13% 6% 9% 4% 2% 0% -2% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Orders * Kimball Int'l (excluding Hospitality vertical) Office Furniture Industry (BIFMA) Growth in orders exceeded industry growth for each of the last 5 quarters

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 17 Sales by Vertical – Good Diversification Sales Mix by End Market Vertical (1) _____________________ (1) Unaudited. $49.8 $50.2 $18.6 $22.1 $42.0 $32.9 $13.1 $14.0 $14.5 $23.2 $7.9 $7.6 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q3'15 Q3'16 Commercial Government Hospitality Finance Healthcare Education ($ in millions) 60% growth

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 18 Orders by Vertical Order Mix by End Market Vertical (1) _____________________ (1) Unaudited. $52.3 $48.9 $18.8 $22.0 $23.1 $34.5 $13.2 $11.1 $15.3 $21.9 $8.2 $10.0 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q3'15 Q3'16 Commercial Government Hospitality Finance Healthcare Education 43% growth ($ in millions) 49% growth

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 19 Gross Profit Gross Profit from Continuing Operations (1) ($ in millions) $44.0 $51.1 $51.1 $53.3 $45.8 30.2% 32.1% 32.6% 32.5% 30.5% 25.0% 27.0% 29.0% 31.0% 33.0% 35.0% $30 $40 $50 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Gross Profit % of Net Sales Cyclically lower sales in Q3 results in lower Gross Profit. Gross Profit % improved year over year despite inefficiencies related to restructuring. _____________________ (1) Unaudited.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 20 $38.3 $40.7 $40.2 $41.2 $38.8 $37.9 $40.6 $40.8 $40.9 $38.7 26.0% 25.5% 26.1% 25.0% 25.8% 20.0% 22.0% 24.0% 26.0% 28.0% 30.0% $30 $35 $40 $45 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Adjusted S&A (1) Adjusted Pro Forma S&A (1) Adjusted Pro Forma S&A % of Sales (1) Selling and Administrative Expenses (1) ($ in millions) _____________________ (1) Unaudited. Adjusted pro forma amounts exclude spin-off expenses and SERP revaluation.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 21 Progress Being Made Towards 8% to 9% Operating Income Guidance _____________________ (1) Unaudited. See Appendix for Non-GAAP reconciliation. 1.3% -1.0% 2.0% 4.9% 6.3% 4.6% 4.0% 4.2% 6.6% 6.6% 7.5% 4.8% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2012 2013 2014 2015 2016 YTD Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Fiscal Year Quarterly Best Q3 in 10 years. Cyclically lower sales in Q3 results in lower Operating Income.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 22 Free Cash Flow (1) _____________________ (1) Unaudited. Defined as adjusted pro forma operating income, less pro-forma taxes, plus depreciation and amortization, less capital expenditures, plus non-cash stock compensation. Pro forma taxes are reported taxes adjusted for the tax effect of the adjustments to operating income to arrive at pro forma operating income as shown in the appendix. See Appendix for Non-GAAP adjustments. $3.6 $2.8 $5.5 $9.9 $5.1 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 -$10.0 -$8.0 -$6.0 -$4.0 -$2.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Adjusted Pro-Forma Operating Income After Tax Depreciation/Amortization Capital Expenditures Non-Cash Stock Comp Adjusted Free Cash Flow ($ in millions)

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Financial Outlook

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 24 Targeting 8% to 9% Operating Income by Q1’17 Q1’17 Outlook (Quarter Ending September 2016) Sales $170 to $180 million Operating Income 8.0% to 9.0% Operating Income $’s $14 to $16 million Tax Rate 35% to 38% Earnings Per Diluted Share $0.23 to $0.27 Return on Capital* Exceeding 20% * Defined as Annualized Adjusted Pro Forma Operating Income After Normalized Tax Divided by Capital. Capital is defined as Total Equity plus Total Debt. US 2016 GDP Growth of ~2.25% to 2.75% Consolidated Sales Growth in the High Single Digits No Acquisitions Planned in this Time Frame Commodity Pricing Stable Post Falls Idaho Restructuring completed by end of FY Q4’16 (June 2016) Planning Assumptions

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Appendix

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 26 Annual Non-GAAP Reconciliation (Unaudited) (millions $) 2012 2013 2014 2015 Operating Income from Continuing Operations $5.0 -$10.6 $1.9 $17.3 Add: Spin Cost – Included in SGA Add: Restructuring $1.5 $3.2 $5.3 Adjusted Operating Income from Continuing Operations $5.0 -$10.6 $3.4 $25.8 Adjusted Operating Income from Continuing Operations as a % of Sales 1.0% -2.1% .6% 4.3% Add: Employee Retirements – Included in SGA (1) Add: Other Non-operational – Included in SGA (2) Add: SERP –Included in SGA (3) $3.2 $5.0 $1.7 $6.8 -$.5 $2.6 $3.3 $0.6 Adjusted Pro Forma Operating Income from Continuing Operations before External Reverse Synergies $8.2 -$3.9 $12.3 $29.7 Deduct: External Reverse Synergies (4) -$1.3 -$1.3 -$1.2 -$0.4 Adjusted Pro Forma Operating Income from Continuing Operations (4) $6.9 -$5.2 $11.1 $29.3 Adjusted Pro Forma Operating Income from Continuing Operations as a % of Sales 1.3% -1.0% 2.0% 4.9% _____________________ (1) Estimated cost associated with the retirement and separation of people due to spin. Costs include that for salary, incentive compensation, performance shares, retirement contribution, and payroll tax. (2) Includes: pre-tax airplane write-off $1.2M and gain from sale of idle property of $1.7M in FY’14. (3) SERP expense is added back to adjusted operating income because amount is offset in other income (expense) section of income statement. Net Income is not affected by SERP. (4) Adjusted pro forma operating income includes external reverse synergies representing estimated increases to the cost structure necessitated by the split into two companies. For example, pre-spin Kimball had one board of directors, and such costs were allocated to Furniture and Electronics. Post spin, there are two boards with each company experiencing a cost increase merely because of the separation. Other examples include IT expenditures and certain insurance cost among others. The $1.3M per year reflected in the table above is a mid-point of a range estimated to be from $1.0M to $1.5M adjusting the adjusted pro forma operating income from continuing operations to reflect this estimated increase in cost structure post spin. In addition to external cost, internal reverse synergy cost also exist and are embedded in the calculation of Operating Income from continuing operations reducing income. Different than external cost, these costs do not have to be separately deducted in this reconciliation because by way of the discontinued operation calculation this cost increase remains within the computed Operating Income from continuing operations. As an example for this type of cost, pre-spin Kimball had an SEC financial reporting function, and such costs were allocated to Furniture and Electronics. Post spin, there are two separate functions experiencing a cost increase as it takes more resource to perform this function for two separate companies than one. This cost increase is estimated to be $500k to $1M. So in total, it is estimated that reverse synergy cost will increase cost structure post spin by $1.5 to $2.5M per year as already reflected in the adjusted results included in the reconciliation above.

176 0 0 137 132 126 237 23 23 46 46 46 51 132 156 252 202 59 Page 27 Quarterly Non-GAAP Reconciliation (Unaudited) (millions $) Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Operating Income from Continuing Operations $5.1 $8.6 $9.7 $10.0 $4.3 Add: Spin Cost – Included in SGA Add: Restructuring $.2 $.4 $.2 $1.6 $1.2 $2.0 $2.8 Adjusted Operating Income from Continuing Operations $5.7 $10.4 $10.9 $12.0 $7.1 Adjusted Operating Income from Continuing Operations as a % of Sales 3.9% 6.5% 7.0% 7.3% 4.7% Add: SERP –Included in SGA (1) $.4 -$.6 $.3 $.1 Adjusted Pro Forma Operating Income from Continuing Operations $6.1 $10.4 $10.3 $12.3 $7.2 Adjusted Pro Forma Operating Income from Continuing Operations as a % of Sales 4.2% 6.6% 6.6% 7.5% 4.8% _____________________ (1) SERP expense is added back to adjusted operating income because amount is offset in other income (expense) section of income statement. Net Income is not affected by SERP.