Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 05-03-2016 - KADANT INC | kaiform8k05032016.htm |

First Quarter 2016 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO

2 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our expected future financial and operating performance, demand for our products, and economic and industry outlook. Our actual results may differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the year ended January 2, 2016 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; the variability and uncertainties in sales of capital equipment in China; the effect of currency fluctuations on our financial results; our customers’ ability to obtain financing for capital equipment projects; changes in government regulations and policies; oriented strand board market and levels of residential construction activity; development and use of digital media; price increases or shortages of raw materials; dependence on certain suppliers; international sales and operations; disruption in production; our acquisition strategy; our internal growth strategy; competition; soundness of suppliers and customers; our effective tax rate; future restructurings; soundness of financial institutions; our debt obligations; restrictions in our credit agreement; loss of key personnel; reliance on third-party research; protection of patents and proprietary rights; failure of our information systems or breaches of data security; fluctuations in our share price; and anti-takeover provisions. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

3 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenues excluding the effect of acquisitions and foreign currency translation, adjusted operating income, adjusted net income, adjusted diluted EPS, and adjusted earnings before interest, taxes, depreciation, and amortization. A reconciliation of those numbers to the most directly comparable U.S. GAAP financial measures is shown in our 2016 first quarter earnings press release issued May 2, 2016, which is available in the Investors section of our website at www.kadant.com under the heading Recent News.

4 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. BUSINESS REVIEW Jonathan W. Painter President & CEO

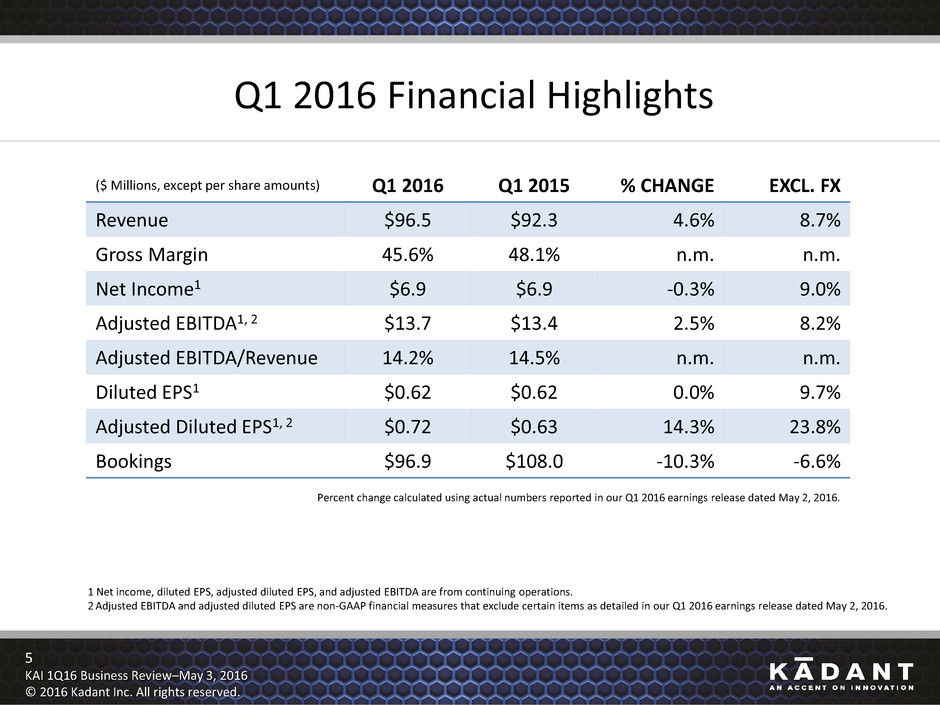

5 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Q1 2016 Financial Highlights ($ Millions, except per share amounts) Q1 2016 Q1 2015 % CHANGE EXCL. FX Revenue $96.5 $92.3 4.6% 8.7% Gross Margin 45.6% 48.1% n.m. n.m. Net Income1 $6.9 $6.9 -0.3% 9.0% Adjusted EBITDA1, 2 $13.7 $13.4 2.5% 8.2% Adjusted EBITDA/Revenue 14.2% 14.5% n.m. n.m. Diluted EPS1 $0.62 $0.62 0.0% 9.7% Adjusted Diluted EPS1, 2 $0.72 $0.63 14.3% 23.8% Bookings $96.9 $108.0 -10.3% -6.6% 1 Net income, diluted EPS, adjusted diluted EPS, and adjusted EBITDA are from continuing operations. 2 Adjusted EBITDA and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our Q1 2016 earnings release dated May 2, 2016. Percent change calculated using actual numbers reported in our Q1 2016 earnings release dated May 2, 2016.

6 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. FX Translation and Acquisition Impact Q1 2016, $ in millions except EPS Revenue Adjusted EPS4 Bookings Parts & Consumables Revenue Parts & Consumables Bookings As reported $96.5 $0.72 $96.9 $63.2 $61.9 Growth1 4.6% 14.3% -10.3% -3.4% -8.9% Growth excluding FX translation2 8.7% 23.8% -6.6% 0.4% -5.3% Growth excluding FX translation and acquisitions3 8.7% 23.8% -6.6% 0.4% -5.3% 1 Growth is the year-over-year percent change between the current period and the comparable prior period. 2 Represents the year-over-year percent change excluding the impact of current period versus prior period exchange rates. 3 Represents the year-over-year percent change excluding the impact of acquisitions and current period versus prior period exchange rates. Acquired businesses are classified above as Acquisitions for the first four quarters after acquisition. 4 Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our Q1 2016 earnings press release issued May 2, 2016.

7 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Bookings and Revenues US$ (millions) $0 $20 $40 $60 $80 $100 $120 Bookings Booking Reversal Revenues Q415 bookings were $76 million, which included new orders of $92 million and a booking reversal of $16 million. * *

8 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Parts and Consumables Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

9 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. ACQUISITION UPDATE PAALGROUP–MANUFACTURER OF BALERS & RELATED EQUIPMENT

10 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Europe’s Largest Supplier of Balers • Revenue: €48 million (2015) • Large installed base in recycling and waste management industries • Well-established, well-managed • Aftermarket represents 30% of revenue

11 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Full Line of Horizontal Balers for Recycling and Waste Handling

12 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Demand Drivers for Baling Machinery • Rising standards of living and population growth • Shortage and cost of landfilling • Increased recycling rates • Environmental regulations

13 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Fits Well With Our Acquisition Strategy and Business Model • Technology leader with high quality products and excellent market reputation • Addresses a critical process requirement where failure is expensive • Innovative product roadmap to address market needs • Stable revenue enhanced by strong aftermarket

14 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Potential Synergies and Opportunities • Opportunity to leverage European leadership position with Kadant’s platform in North America, South America, and China • Potential sourcing and manufacturing synergies • Highly fragmented market allows for potential follow-on acquisitions

15 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. REGIONAL PERFORMANCE

16 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. North America Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

17 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Europe Bookings and Revenues US$ (millions) $0 $5 $10 $15 $20 $25 $30 Bookings Revenues

18 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Asia Bookings and Revenues US$ (millions) -$10 -$5 $0 $5 $10 $15 $20 $25 $30 $35 $40 Bookings New Orders Revenues Q415 Asia bookings were negative $6 million, which included new orders of $10 million and a booking reversal of $16 million. * *

19 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Rest-of-World Bookings and Revenues US$ (millions) $0 $2 $4 $6 $8 $10 $12 $14 $16 Bookings Revenues

20 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Guidance for Continuing Operations • FY 2016 GAAP diluted EPS of $2.75 to $2.85 • FY 2016 adjusted diluted EPS of $2.97 to $3.07 • FY 2016 revenues of $412 to $422 million • Q2 2016 GAAP diluted EPS of $0.50 to $0.53 • Q2 2016 adjusted diluted EPS of $0.62 to $0.65 • Q2 2016 revenues of $103 to $105 million

21 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. FINANCIAL REVIEW Michael J. McKenney Senior Vice President & Chief Financial Officer

22 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Quarterly Gross Margins 45.6% 43.7% 43.4% 43.0% 47.3% 48.6% 43.9% 43.9% 45.2% 43.0% 44.7% 44.7% 48.1% 46.5% 47.5% 43.1% 45.6% 36% 38% 40% 42% 44% 46% 48% 50%

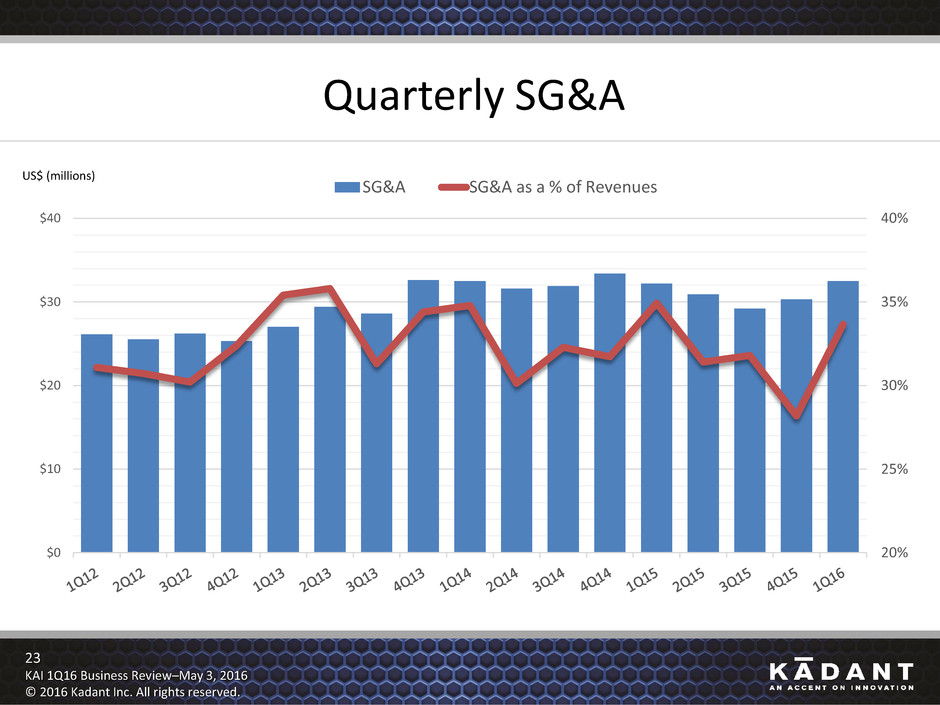

23 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Quarterly SG&A 20% 25% 30% 35% 40% $0 $10 $20 $30 $40 SG&A SG&A as a % of Revenues US$ (millions)

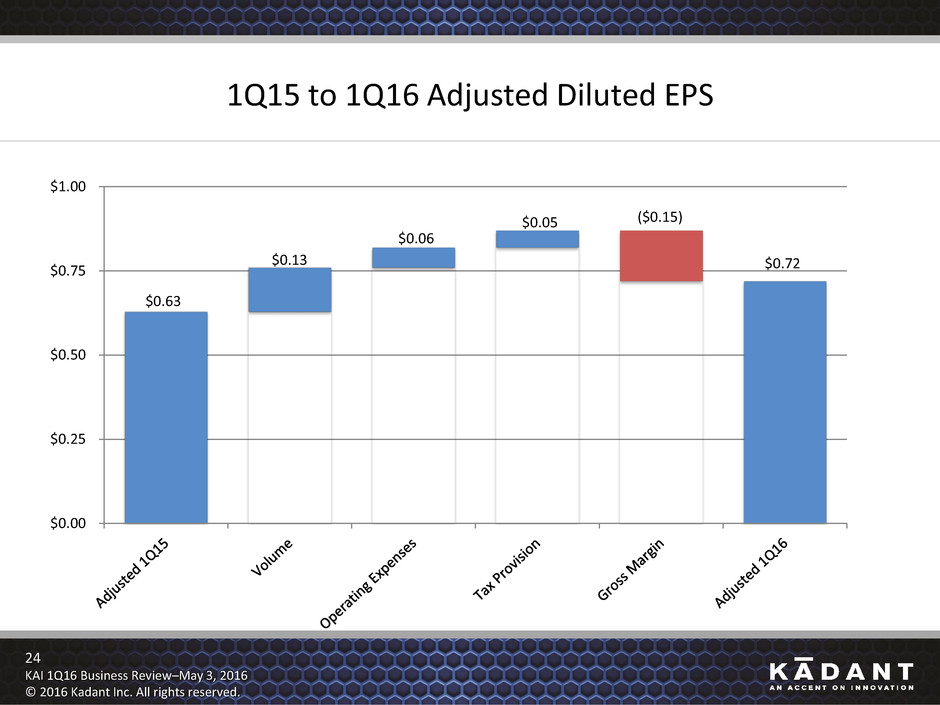

24 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. 1Q15 to 1Q16 Adjusted Diluted EPS $0.63 $0.13 $0.06 $0.05 ($0.15) $0.72 $0.00 $0.25 $0.50 $0.75 $1.00

25 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Cash Flow ($ Millions) 1Q16 1Q15 Income from Continuing Operations $7.0 $6.9 Depreciation and Amortization 2.6 2.9 Stock-Based Compensation 1.3 1.6 Other Items 0.2 (1.6) Change in Current Assets & Liabilities (5.6) (12.0) Cash Provided by Continuing Operations $5.5 ($2.2)

26 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Key Working Capital Metrics 1Q16 4Q15 1Q15 Days in Receivables 60 59 63 Days in Inventory 99 91 109 Days in Payables 41 36 50 63 59 60 109 91 99 50 36 41 20 50 80 110 140 Days in Receivables Days in Inventory Days in Payables

27 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Working Capital and Cash Conversion Days 1Q16 4Q15 1Q15 Working Capital % LTM Revenues* 15.1% 12.0% 15.4% Cash Conversion Days** 118 114 122 *Working Capital is defined as current assets less current liabilities, excluding cash, debt, and the discontinued operation. ** Based on days in receivables plus days in inventory less days in accounts payable. 0 50 100 150 200 0% 5% 10% 15% 20% D AY S % OF REVEN U E Cash Conversion Days Working Capital % LTM Revenues *

28 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Cash and Debt ($ Millions) 1Q16 4Q15 1Q15 Cash, cash equivalents, and restricted cash $106.1 $66.9 $43.2 Debt (72.2) (31.2) (30.7) Net Cash $33.9 $35.7 $12.5 $30.9 $30.1 $41.5 $47.7 $51.8 $48.5 $58.7 $11.6 $14.3 $9.5 $18.7 $19.9 $12.5 $20.1 $27.5 $35.7 $33.9 $0 $10 $20 $30 $40 $50 $60

29 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Leverage Ratio * Calculated by adding or subtracting certain items, as required by our Credit Facility, from Adjusted EBITDA. Under our new Credit Facility entered into on August 3, 2012 total debt is defined as debt less domestic cash of up to $25 million. For periods prior to 3Q12, total debt was not reduced for domestic cash. 0.99 0.00 0.25 0.50 0.75 1.00 1.25 Debt/EBITDA *

30 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Questions & Answers To ask a question, please call 877-703-6107 within the U.S. or +1-857-244-7306 outside the U.S. and reference 83375884. Please mute the audio on your computer.

31 KAI 1Q16 Business Review–May 3, 2016 © 2016 Kadant Inc. All rights reserved. Q1 2016 Key Take-Aways • Excellent internal revenue growth of 9% excluding FX • Integrating PAAL to capitalize on potential synergies • Increasing adjusted diluted EPS for FY 2016

First Quarter 2016 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO