Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - EPIQ SYSTEMS INC | d189345dex321.htm |

| EX-31.1 - EX-31.1 - EPIQ SYSTEMS INC | d189345dex311.htm |

| EX-31.2 - EX-31.2 - EPIQ SYSTEMS INC | d189345dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36633

EPIQ SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Missouri | 48-1056429 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 501 Kansas Avenue, Kansas City, Kansas | 66105-1300 | |

| (Address of principal executive offices) | (Zip Code) | |

913-621-9500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class |

Name of exchange on which registered | |

| Common Stock, $0.01 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting common stock held by non-affiliates of the registrant based upon the last reported sale price on June 30, 2015, was $562.0 million. There were 37,672,402 shares of common stock, $0.01 par value, outstanding at February 25, 2016.

Table of Contents

Explanatory Note

Epiq Systems, Inc. (the “Company” , “we” or “us”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2015 (the “Original Report”) to include Items 10, 11, 12, 13 and 14 of Part III to Form 10-K. No changes are being made to the Original Report. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Report and it does not modify or update in any way the disclosures contained in the Original Report, which speak as of the date of the original filing.

The Report of the Compensation Committee on Executive Compensation included in this Amendment No. 1 on Form 10-K/A is not to be incorporated by reference into any other filings made with the Securities and Exchange Commission (the “SEC”) unless otherwise stated in those filings.

Table of Contents

PART III

| ITEM 10. |

1 | |||||

| ITEM 11. |

8 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

36 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

39 | ||||

| ITEM 14. |

40 | |||||

Table of Contents

PART III

| ITEM 10. | Directors, Executive Officers and Corporate Governance |

Directors and Executive Officers

Set forth below is a description of the age, background and skills qualifications and attributes of our directors and executive officers.

Tom W. Olofson

Director since: 1988

Age: 74

Chief Executive Officer and Chairman of the Board

Experience. Mr. Olofson acquired the Company in July 1988 and has served continuously as the Company’s Chief Executive Officer and Chairman of the Board of Directors (the “Board”) of the Company since that time. In 1997, Mr. Olofson led the Company’s initial public offering, and the Company has been continuously listed on NASDAQ since February 1997. Prior to that, he held various management positions at Xerox Corporation and was a senior vice president and member of the Office of the President of Marion Laboratories, Inc. Mr. Olofson has also served as a director of, and advisor to, various private companies in which he has been an investor. In the past five years, Mr. Olofson has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Olofson earned a BBA from the University of Pittsburgh and is currently an emeritus member of the Board of Visitors of the Katz Graduate School of Business at the University of Pittsburgh.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Olofson’s experience as a senior executive and his general executive management skills and financial acumen are exceedingly valuable to Epiq. He has transformed Epiq from a privately held small business in July 1988 to a publicly traded, global technology services leader. Mr. Olofson has extensive knowledge of all aspects of Epiq’s business, including its management and personnel, financials and operations. He also serves as the cultural leader of Epiq, responsible for guiding Epiq’s business values and senior management and other personnel at Epiq through his committed, ethical and accountable leadership.

James Byrnes

Director since: 2003

Age: 69

Independent

On February 8, 2016, Mr. Byrnes provided notice to Epiq that he would retire from the Board effective as of the date of Epiq’s 2016 Annual Meeting of Shareholders (the “Annual Meeting”).

Experience. Mr. Byrnes served as vice president of international marketing for Hoechst Marion Roussel, Inc. until his retirement in 1996. Prior to that, he was vice president of global commercial development for Marion Merrell Dow. Prior to these positions, he held several executive sales and marketing positions at Marion Merrell Dow and Marion Laboratories, predecessor companies to Hoechst Marion Roussel. In recent years, Mr. Byrnes has served as an advisor to various entrepreneurial companies. In the past five years, Mr. Byrnes has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. He holds a BS degree in general science from Gannon University and an MBA degree from Rockhurst College.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Byrnes brings significant executive-level sales, marketing, global commercial and strategic expertise to the Board.

1

Table of Contents

Charles C. Connely, IV

Director since: 2012

Age: 68

Independent

On February 8, 2016, Mr. Connely provided notice to Epiq that he would retire from the Board effective as of the date of the Annual Meeting.

Experience. Since March 2012, Mr. Connely has served as a Managing Director of EPR Financial Services, a subsidiary of EPR Properties, a real estate investment trust traded on the New York Stock Exchange. Prior to this position, Mr. Connely was the President of C.C. Connely & Associates, a private financial services company. He previously served as the General Manager-Vice President of a division of Butler Manufacturing Company, a steel manufacturing company that was previously traded on the New York Stock Exchange, and was the Chief Executive Officer of the D.H. Pace Company, a private construction company. Mr. Connely has over twenty years of investment banking experience as he previously served as Managing Director of KPMG LLP’s Corporate Finance Group and as Vice President of Corporate Finance with George K. Baum & Company, an investment banking firm. In the past five years, Mr. Connely has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Connely is an associate teaching professor at the University of Missouri-Kansas City Bloch School. He is a graduate of the University of Missouri-Kansas City with BBA and MBA degrees and is also a graduate of the Stonier Graduate School of Banking at Georgetown University. Mr. Connely holds CCIM, CFP and CPM designations.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Connely brings significant accounting, financial and management expertise to the Board.

Edward M. Connolly, Jr.

Director since: 2001

Age: 73

Independent

Experience. Mr. Connolly is a retired executive from Aventis Pharmaceuticals, where he served as president of the Aventis Pharmaceuticals Foundation and vice president of community affairs. Prior to that, he held various executive human resources positions at Hoechst Marion Roussel, Marion Merrell Dow, and Marion Laboratories, predecessor companies to Aventis. Since 2000, Mr. Connolly has served as an executive-level human resources consultant at Rights Management Consultants, and led CEO Groups comprised of executives from various industries. In the past five years, Mr. Connolly has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. He holds a BA degree in psychology from Bellarmine University.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Connolly brings significant executive leadership, human resources and community affairs expertise to the Board.

Douglas M. Gaston

Director since: 2014

Age: 64

Lead Independent Director (effective as of the Annual Meeting)

Experience. In 2014, Mr. Gaston retired as Regional Managing Partner for BKD, LLP, a national accounting and advisory firm where he had been a partner for close to 25 years. In the past five years, Mr. Gaston has not served

2

Table of Contents

on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Gaston holds a master’s degree in accounting from Kansas State University.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Gaston brings significant accounting and finance and management expertise to the Board. In 2016, Mr. Gaston received the distinction of Board Leadership Fellow from the National Association of Corporate Directors (“NACD”).

Paul N. Gorup

Director since: 2016

Age: 64

Independent

Experience. Mr. Gorup is the co-founder and former chief of innovation of Cerner Corporation, a leading provider of health information technologies. He played a critical role in the company’s formative years and in launching Cerner’s first widely available commercial solution. In 1987, Mr. Gorup left Cerner and co-founded Broadcast Data Systems (BDS). He returned to Cerner in 1999 and launched the company into new markets with data services and later analytics solutions for life sciences, biosurveillance technology and medical devices. In the past five years, Mr. Gorup has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Gorup holds a master’s degree in business administration from the Tuck School of Business at Dartmouth College.

Specific Qualifications, Skills and Attributes. Mr. Gorup was appointed to the Board in 2016 upon recommendation of the Nominating and Corporate Governance Committee of the Board (the “Nominating and Corporate Governance Committee”) after being brought to the attention of one of the Company’s independent directors and considered by the Nominating and Corporate Governance Committee. The Board believes that Mr. Gorup brings significant industry-specific experience as well as experience in the management and leadership of complex technology-oriented public organizations.

Joel Pelofsky

Director since: 2004

Age: 78

Independent

Experience. Mr. Pelofsky is currently Of Counsel with Berman, DeLeve, Kuchan & Chapman, L.C. Prior to that, he was Of Counsel with Spencer Fane Britt & Browne LLP from 2003 through 2009. From 1995 through 2003 he served as United States Trustee for Missouri, Arkansas and Nebraska. From 1986 through 1995, Mr. Pelofsky was a partner and chairman of the bankruptcy department of Shugart Thomson & Kilroy. From 1980 through 1985, Mr. Pelofsky was a United States Bankruptcy Judge in the United States Bankruptcy Court for the Western District of Missouri. In the past five years Mr. Pelofsky has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Pelofsky holds a BA degree from Harvard College and a LLB degree from Harvard Law School.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Pelofsky brings significant bankruptcy and legal expertise to the Board.

3

Table of Contents

Kevin L. Robert

Director since: 2014

Age: 59

Independent

Experience. Mr. Robert served as Global Chief Executive Officer of Wolters Kluwer Tax and Accounting from 2010 to 2013. He previously served as the firm’s President/Chief Executive Officer, North America and as President/Chief Executive Officer, North America and Asia Pacific, where he developed strategies to increase revenue and profit growth and drove marketing and growth strategies. Mr. Robert began his career with Wolters Kluwer after it acquired CCH in 1995, where he held multiple positions, including Vice President of Sales and Marketing, Head of Customer Management and Vice President of Sales and Marketing for CCH Publishing. Mr. Robert also serves on the board of directors of Vertex, Inc., a privately held integrated tax technology solutions provider. Mr. Robert graduated from the University of New Orleans with a BS in Marketing and holds an MBA from Pepperdine University. In the past five years, Mr. Robert has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Robert brings extensive experience driving business development and expansion after working in the accounting and tax industry for over 30 years. In 2015, Mr. Robert received the distinction of Board Leadership Fellow from the NACD.

W. Bryan Satterlee

Director since: 1997

Age: 81

Lead Independent Director (up to the date of the Annual Meeting)

Experience. Mr. Satterlee has been a partner at NorthEast Ventures, a strategic consulting firm that specializes in business development services and financial evaluations of technology-based venture companies since 1989. Mr. Satterlee’s background includes ten years of management experience with IBM, as well as having been a founder of a computer leasing/software business, a telecommunications company, and a venture investment services business. In the past five years, Mr. Satterlee has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Satterlee earned a BS degree from Lafayette College.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Satterlee brings significant executive leadership, financial, and technological expertise to the Board.

Brad D. Scott

Director since: 2015

Age: 62

President and Chief Operating Officer

Experience. Mr. Scott was appointed as President and Chief Operating Officer in May 2014. Prior to that, he served as the Executive Vice President, Co-Chief Operating Officer and Chief of Staff since January 2014 and prior to that, as an executive officer of Epiq since February 28, 2013. His previous position with Epiq was Senior Vice President, Chief Human Resources Officer. Mr. Scott was President of De Novo Legal, LLC prior to joining Epiq in December 2011 upon acquisition of that company. Prior to that, he served in various executive leadership roles at WilmerHale, LLP, Heller Ehrman, LLP and Weil, Gotshal and Manges, LLP and served as a strategic consultant and executive at IBM. In the past five years, Mr. Scott has not served on the board of any other

4

Table of Contents

publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Scott holds a BS degree in engineering from the United States Military Academy at West Point and an MS degree from the University of Illinois.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Scott brings significant experience in the management and leadership of complex organizations and skills in risk management, business development and strategic planning to the Board.

Michael Suchsland

Director since: 2016

Age: 56

Independent

Experience. Mr. Suchsland is the former president of the legal business segment of Thomson Reuters. Mr. Suchsland served in that capacity from 2012 to 2014. Prior to that, he was senior vice president, then president, of Thomson Reuters’ corporate/government/academic business. Mr. Suchsland founded Joplin Consulting in 2014, a boutique consulting firm serving private equity firms and companies in information, software, and services. In the past five years, Mr. Suchsland has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. He holds a master’s degree in business administration from Northwestern University.

Specific Qualifications, Skills and Attributes. Mr. Suchsland was appointed to the Board in 2016 upon recommendation of the Nominating and Corporate Governance Committee after being brought to the attention of the Company and considered by the Nominating and Corporate Governance Committee. The Board believes that Mr. Suchsland brings critical expertise in legal technology and strategic direction as well as industry-specific experience in the management and leadership of complex, technology-oriented organizations.

Karin-Joyce Tjon

Age: 54

Executive Vice President and Chief Financial Officer

Experience. Ms. Tjon was appointed as Executive Vice President and Chief Financial Officer effective July 1, 2014. Ms. Tjon has extensive financial management and leadership experience, most recently as the Chief Financial Officer of Hawker Beechcraft Corporation (“HBC”), an international manufacturer of business and special mission aircraft. Prior to joining HBC in 2011, Ms. Tjon served for close to 10 years at Alvarez & Marsal (“A&M”) as Director, Senior Director and Managing Director. A&M is a global professional services firm specializing in business turnaround and business advisory services. Ms. Tjon holds an MBA in management and finance from Columbia University’s Graduate School of Business and a B.S.S. degree in Organizational Behavior and Management from Ohio University.

Jayne L. Rothman

Age: 46

Executive Senior Vice President, General Counsel and Secretary

Experience. Ms. Rothman has served as Epiq’s senior legal advisor since 2006. Ms. Rothman is responsible for the legal affairs of Epiq worldwide. Prior to joining Epiq, Ms. Rothman worked at the law firm Weil Gotshal & Manges LLP representing corporate and bankruptcy clients. Prior to that, Ms. Rothman worked at Dewey Ballantine LLP on several major Chapter 11 cases. Ms. Rothman holds a juris doctor degree from New York Law School and is a member of the New York and California bars. She is admitted to practice before the United States District Courts for the Eastern and Southern Districts of New York.

5

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

We are required to identify any director, officer or 10% or greater beneficial owner of common stock who failed to timely file a report with the SEC required under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), relating to ownership and changes in ownership of our common stock. The required reports consist of initial statements on Form 3, statements of changes on Form 4 and annual statements on Form 5 (if applicable). Based solely upon a review of reports filed under Section 16(a) of the Exchange Act and certain written representations of directors and officers of Epiq, we are not aware of any director, officer or beneficial owner of more than 10% of our common stock who failed to file on a timely basis any report required by Section 16(a) of the Exchange Act for calendar year 2015.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is reviewed periodically by the Nominating and Corporate Governance Committee and the Board; most recently in February 2016. Our Code of Business Conduct and Ethics applies to all of our officers, directors and associates, and specifically our principal executive officer, president, principal financial officer and principal accounting officer. Shareholders may access a copy of our Code of Business Conduct and Ethics in the Investors section of our Internet website at www.epiqsystems.com. We will promptly disclose any waivers of our Code of Business Conduct and Ethics involving our directors or executive officers. We intend to satisfy any disclosure requirements regarding any amendment or waiver of our Code of Business Conduct and Ethics by posting the information on our Internet website at http://www.epiqsystems.com and in our public filings with the SEC as legally required.

Identifying and Evaluating Director Candidates

The Nominating and Corporate Governance Committee is responsible for identifying, recruiting, and recommending candidates for the Board and is responsible for reviewing and evaluating any candidates recommended by shareholders. The Nominating and Corporate Governance Committee is responsible for developing the criteria for, and reviewing periodically with the Board, the requisite skills and characteristics of nominees, as well as the composition of the Board as a whole. These criteria include independence, diversity, age, skills, and experience in the context of the needs of the Board. The Nominating and Corporate Governance Committee considers a combination of factors for each nominee, including the nominee’s ability to represent all shareholders without a conflict of interest; the nominee’s ability to work in and promote a productive environment; whether the nominee has sufficient time and willingness to fulfill the substantial duties and responsibilities of a director; whether the nominee has demonstrated a high level of character and integrity; whether the nominee possesses the broad professional and leadership experience and skills necessary to effectively respond to complex issues encountered by a publicly-traded company; and the nominee’s ability to apply sound and independent business judgment.

Our Amended and Restated Bylaws contain a procedure allowing for the nomination by shareholders of proposed directors. The Nominating and Corporate Governance Committee considers all director candidates, including candidates proposed by shareholders in accordance with our Amended and Restated Bylaws, based on the same criteria.

The Nominating and Corporate Governance Committee may engage third-party search firms to identify potential director nominees. Messrs. Gorup and Suchsland were recruited to our Board following the consideration and recommendation of their candidacies by the Nominating and Corporate Governance Committee after initially being brought to the attention of the Company including through one of the Company’s independent directors.

Audit Committee

The Audit Committee of the Board (the “Audit Committee”) is responsible for overseeing management’s financial reporting practices and internal controls. The Audit Committee will act in a manner intended to fulfill

6

Table of Contents

its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting and reporting practices of Epiq, and to fulfill its duty to assess the quality and integrity of the financial reports of Epiq. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication among the directors, the independent auditor, the internal auditors (if any) and the financial management of Epiq.

The Audit Committee’s responsibilities include, but are not limited to, the following:

| • | selecting and evaluating the independent auditor; |

| • | reviewing the adequacy and effectiveness of the accounting and financial controls of Epiq; |

| • | reviewing financial disclosure and accounting principles with financial management of Epiq and the independent auditor; |

| • | reviewing the independent auditor’s communications regarding management’s internal controls; |

| • | reviewing with financial management and the independent auditor Epiq’s financial statements and SEC filings; |

| • | reviewing and approving all material related party transactions; |

| • | administering Epiq’s whistleblower policy; and |

| • | investigating any other matter brought to the Audit Committee’s attention within the scope of its duties. |

At the end of each quarter, the Audit Committee reviews and discusses with management and Epiq’s independent registered public accounting firm Epiq’s financial results, audit assurance processes, press releases concerning Epiq’s financial performance and earnings estimates, any control deficiencies identified and steps management has taken or plans to take to remediate any control deficiencies, significant estimates and proposed audit adjustments, audit activities, reports to Epiq’s ethics hotline, risk management and corporate governance best practices, and the results of Epiq’s independent registered public accounting firm’s review or audit of its financial statements, among other things.

Each year Epiq evaluates the performance of Epiq’s independent registered public accounting firm and considers whether it is in the best interests of Epiq and its shareholders to engage the firm for another year. As part of its evaluation, the Audit Committee considers the qualifications of the persons who will be staffed on Epiq’s engagement, including the lead partner, quality of work, audit assurance services, Public Company Accounting Oversight Board inspections, firm reputation, independence, fees, retail experience, and understanding of Epiq’s financial reporting processes, policies, and procedures. The Audit Committee solicits feedback from management as part of its evaluation process.

The Board has affirmatively determined that (1) each of the Audit Committee members meets the definition of “independent director” for purposes of serving on the Audit Committee under both Rule 10A-3 of the Exchange Act, and the NASDAQ rules, and (2) Mr. Robert qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. The SEC has determined that the audit committee financial expert designation does not impose on the person with that designation any duties, obligations or liability that are greater than the duties, obligations or liabilities imposed on such person as a member of the Audit Committee of the Board in the absence of such designation.

The Audit Committee acts under a written charter that was adopted by the Board and is amended as necessary to conform to the regulatory initiatives of the SEC and NASDAQ. The Audit Committee charter can be found on Epiq’s corporate website at www.epiqsystems.com. The Audit Committee conducts a formal self-evaluation each year that is led by its Chairman and generally includes a review of the committee charter, the committee’s activities during the calendar year relative to the annual agenda and the committee’s overall effectiveness.

Our separately designated standing Audit Committee was established in accordance with all applicable rules of the SEC, including Section 3(a)(58)(A) of the Exchange Act.

7

Table of Contents

| ITEM 11. | Executive Compensation |

Executive Compensation

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis (the “CD&A”) describes the principles, objectives, and features of our executive compensation program, which is generally applicable to each of our senior officers. However, this CD&A focuses primarily on the program as applied to our named executive officers (“NEOs”). For 2015, our NEOs were:

| Name |

Position | |

| Tom W. Olofson |

Chairman and Chief Executive Officer | |

| Brad D. Scott |

President and Chief Operating Officer and Director; former Executive Vice President and Co-Chief Operating Officer and Chief of Staff | |

| Karin-Joyce Tjon |

Executive Vice President and Chief Financial Officer |

Overview of Fiscal 2015 Business Results and Changes in Board Leadership and Membership

Epiq is a leading provider of professional services and integrated technology for the legal profession. Epiq combines expert services, proprietary and select third-party software, and a global infrastructure to serve its clients as a strategic partner. Epiq’s innovative solutions and professional services are designed for a variety of client legal matters, including litigation, investigations, financial transactions and regulatory compliance as well as the administration of corporate restructuring and bankruptcies, class action and mass tort proceedings, federal regulatory actions and data breach responses. Key business results and activities during 2015 included:

| • | Achievement of operating revenue of $505.9 million, a 14% increase from 2014, and Adjusted EPS of $0.86, an 8% increase from 2014. In 2015, operating revenues and Adjusted EPS were used to measure our NEOs performance for purposes of short-term incentive awards. See “—What We Pay and Why: Elements of Compensation—Short-Term Performance-Based Incentive Awards.” |

| • | Achievement of Adjusted EBITDA of $108.4 million in 2015, a 12% increase from 2014. For 2015, Adjusted EBITDA was used to measure our NEOs’ performance for purposes of long-term incentive awards. See “—What We Pay and Why: Elements of Compensation—Long-Term Performance-Based Equity Incentive Awards.” |

| • | Payment of quarterly cash dividends in an aggregate amount equal to $0.36 per share. |

| • | Expansion of international operations into Germany, Poland and India and expansion of managed services and Relativity® products and services offerings to Hong Kong. |

During 2015, we made the following key changes in Board leadership positions and Board membership:

| • | Appointment of new independent directors Kevin L. Robert and Douglas M. Gaston as chairs of the Audit Committee and Compensation Committee of the Board (the “Compensation Committee”), respectively. |

| • | Selection of Douglas M. Gaston to succeed W. Bryan Satterlee as lead independent director, effective as of the Annual Meeting. |

| • | Establishment of a Risk Committee of the Board, chaired by independent director Joel Pelofsky. |

| • | Search for new independent directors, culminating in the appointments of Paul N. Gorup and Michael Suchsland to the Board effective March 2, 2016. |

8

Table of Contents

In addition, in October 2015, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) to be its independent compensation consultant. Based on feedback from shareholder outreach program initiated in 2015 and input from Meridian, the Compensation Committee approved new short- and long-term executive compensation programs for 2016 for our executive officers and made other improvements to Epiq’s executive compensation program. The new programs and improvements are discussed below.

Improvements to Executive Compensation Program as a Result of Shareholder Engagement

At our 2015 annual meeting of shareholders, we held a shareholder advisory vote on executive compensation, which was approved by a majority of our shareholders. Epiq regularly engages with its shareholders and shares their feedback with the Compensation Committee. In 2015, as in prior years, the Compensation Committee asked management to seek shareholder input on our executive compensation program. Prior to our 2015 annual meeting of shareholders, management contacted our top 25 shareholders. Eight of these shareholders responded and provided constructive feedback. Following our 2015 annual meeting of shareholders, management commissioned an investor perception study, which included questions related to our executive compensation program. The perception study was conducted by our independent investor relations consultant, Catalyst Global. We invited 25 of our largest shareholders to participate in the study and provide feedback. Seven of such shareholders participated. The pre-annual meeting and post-annual meeting outreach resulted in feedback from a total of 15 shareholders that collectively beneficially owned approximately 48 percent of our shares of common stock outstanding.

The Compensation Committee carefully considered the feedback received from Epiq’s shareholders and, in consultation with Meridian, made modifications to the design of our executive compensation program for 2016 to continue to modernize it in a way that is most responsive to the most prevalent comments of our shareholders. The Compensation Committee did a similar exercise in 2014 that also resulted in positive changes and, together with the changes made in 2016, have resulted in a modern executive compensation program that advances shareholder interests. Below is a summary of the key improvements made to our executive compensation program based on comments from our shareholders.

Improvements to Executive Compensation Program in 2015

Following are the key improvements to our executive compensation program made in 2015:

| • | Adopted multi-year vesting period for restricted stock awards. |

Commencing in 2015, we granted to our NEOs performance-based restricted stock awards that vest over a three-year period (we previously used a one-year vesting period). The total number of awards that vest is based on achieved performance against pre-determined performance measures over the first year of vesting. Generally, an NEO must be continuously employed through the entire three-year vesting period to be eligible to receive payment of the award. Moving from a one-year to a three-year vesting schedule enhances the retentive value of performance-based restricted stock awards and better aligns NEOs with the interests of shareholders by incentivizing NEOs to enhance long-term shareholder value and attain key operational goals.

| • | Adopted director and executive stock ownership guidelines. |

Effective February 2015, our executive officers and non-employee directors are required to hold stock equivalent in value to five times annual base salary in the case of our Chief Executive Officer, three times annual base salary in the case of our other executive officers, and three times annual cash retainer in the case of our non-employee directors. We believe the stock ownership guidelines build commonality of interest between management and shareholders and encourage executives to think and act like owners.

| • | Included disclosure of clawback policy. |

In our 2015 proxy statement as well as in this Amendment and in this year’s proxy statement, we are, and will be, as applicable, disclosing the existence of our clawback policy, which we further revised in 2016 as described below.

9

Table of Contents

| • | Included additional peer companies. |

In February 2015, with the assistance of our then-independent compensation consultant, Exequity, LLP (“Exequity”), we modified our peer group of companies to remove one company and add two companies to the peer group. In November 2015, we again reviewed the peer group with the assistance of our new independent compensation consultant, Meridian, focusing on the key functions of the peer group (pay comparisons, compensation structure and design and performance comparisons). Based on this review, we removed one company from and added seven companies to our peer group, resulting in a peer group of 18 companies for 2016, which is consistent with general market practice.

Further Improvements to Executive Compensation Program in 2016

Building on the improvements made in 2015 and in response to shareholder feedback, the following are additional key improvements to our executive compensation program made in 2016:

| • | Approved individualized threshold, target and maximum levels for short-term annual incentive awards for executive officers based on achievement of two performance measures that each weigh 50%. |

Before 2016, executive officers received short-term annual incentive awards based on whether Epiq achieved threshold, target or maximum performance levels for two financial measures (operating revenue and Adjusted EPS). The Compensation Committee created two general pools to fund the awards for each respective measure. Upon achievement of the financial measures, the Compensation Committee allocated the awards among individual executive officers from the two general pools at its discretion, taking into account various factors, including the executive’s level of authority and responsibility within Epiq. Because individual awards were not determined until certification by the Compensation Committee that the measures had been met, the proportion of the awards that would be awarded to each executive officer could not be determined in advance.

In 2016, the Compensation Committee adopted a new short-term annual incentive program. Under the new program, the Compensation Committee approves a single, individualized target short-term incentive award for each executive officer at the beginning of the year. Fifty percent of the award is based on achievement of one financial measure, and fifty percent of the award is based on achievement of the other measure. The executive receives the full target short-term award if Epiq achieves target levels for both financial measures. If Epiq achieves only the threshold levels for both measures, the executive receives 67% of the target short-term award. If Epiq achieves the maximum levels for both measures, the executive receives 167% of the short-term award. If Epiq does not achieve the threshold levels for either measure, the executive does not receive a payout. If Epiq achieves different levels for each measure, fifty percent of the award is determined by achievement of one measure and fifty percent is determined based upon achievement of the other measure. The payout curve is aggressive. Significant improvement in performance is required in order for higher payout levels to be achieved. Under this new program, each individual executive officer’s payment for each performance level can be determined in advance.

The table below presents the payout curve for short-term annual incentive awards approved by the Compensation Committee for 2016:

| Performance Measures for Short-Term |

Operating Revenue for 2016 | Adjusted EPS for 2016 | ||

| Weighting |

50% | 50% | ||

| Payout Curve (percentage of target—sliding scale) |

||||

| Threshold (Low) |

$500 million/67% | $0.86/67% | ||

| Target (Medium) |

$530 million/100% | $0.90/100% | ||

| Maximum (High) |

$560 million/167% | $0.96/167% | ||

10

Table of Contents

The table below presents the individualized target short-term annual incentive awards approved by the Compensation Committee for each of our NEOs for 2016:

| Name |

Title |

Target Bonus (at 100% on the Payout Curve) | ||

| Tom W. Olofson |

Chief Executive Officer | $1,462,500 | ||

| Brad D. Scott |

President and Chief Operating Officer | $1,275,000 | ||

| Karin-Joyce Tjon |

Executive Vice President and Chief Financial Officer | $600,000 |

| • | Approved individualized target value of long-term incentive awards and modified payment mix. |

Before 2016, long-term incentive awards were granted to our executive officers solely in the form of performance-based restricted stock (as described on page 20 of this Amendment). In 2016, the Compensation Committee granted to our executive officers a combination of time-based and performance-based restricted stock. Each executive officer’s individualized target value of long-term incentive awards was allocated one-third to time-based restricted stock and two-thirds to performance-based restricted stock awards as described below. The mix of time-based and performance-based vesting awards retains the incentives inherent in performance-driven compensation while also placing an emphasis on retention value. Issuance of the 2016 shares of time-vesting restricted stock is contingent on shareholder approval of the amendment and restatement of the Equity Incentive Plan we intend to submit for approval at the Annual Meeting. If approval is not obtained, the time-vesting restricted stock awards will be paid in cash in an amount equal to the number of shares of restricted stock granted to the executive multiplied by the price per share of our common stock on the applicable vesting date.

| • | Approved individualized threshold, target and maximum levels for long-term performance-based restricted stock awards for executive officers based on achievement of two performance measures that each weigh 50% and that must be met in a two-year performance period. |

Before 2016, executive officers earned long-term incentive awards based on whether Epiq achieved a target goal for either of two financial measures (Adjusted EBITDA or cash flows from operations) within a one-year performance period. Long-term awards were earned upon achievement of the target goal for one measure even if the other measure had not been met. The Compensation Committee then allocated the awards among individual executive officers at its discretion, taking into account various factors, including the executive’s level of authority and responsibility within Epiq. Because individual awards were not determined until certification by the Compensation Committee that one of the measures had been met, the proportion of the awards that would be awarded to each officer could not be determined in advance.

In 2016, the Compensation Committee approved a single, individualized target performance-based restricted stock award for each executive officer. Fifty percent of the award is based on achievement of the Adjusted EBITDA measure over a two-year performance period, and fifty percent of the award is based on achievement of the cash flows from operations measure over the same two-year period. Each executive receives the full target performance-based award if Epiq achieves target levels for both financial measures. If Epiq achieves only the threshold levels for both measures, the executive receives 67% of the target award. If Epiq achieves the maximum levels for both measures, the executive receives 167% of the target award. If Epiq does not achieve the threshold levels for either measure, the executive does not receive a payout. If Epiq achieves different levels for each measure, fifty percent of the award is determined by achievement of one measure and fifty percent is determined based upon achievement of the other measure. The payout curve is aggressive. Significant improvement in performance is required in order for higher payout levels to be achieved. Under this new program, each individual executive officer’s payment for each performance level can be determined in advance.

11

Table of Contents

The table below presents the payout curve for long-term performance-based restricted stock awards approved by the Compensation Committee for 2016:

| Performance Measures for Performance-Based Long-Term Incentive Awards |

Cumulative Adjusted EBITDA for Years 2016 and 2017 |

Cumulative Cash Flows From Operations for Years 2016 and 2017 | ||

| Weighting |

50% | 50% | ||

| Payout Curve (percentage of target—sliding scale) |

||||

| Threshold (Low) |

$220 million (3% CAGR)/67% | $140 million/67% | ||

| Target (Medium) |

$232.5 million (5% CAGR)/100% | $155 million/100% | ||

| Maximum (High) |

$245 million (8.5% CAGR)/167% | $165 million/167% | ||

The table below presents the individualized target value of performance-based restricted stock awards approved by the Compensation Committee for each of our NEOs for 2016:

| Name |

Title |

Target Value of |

Target Number of Shares of | |||

| Tom W. Olofson |

Chief Executive Officer | $1,560,000 | 132,765 | |||

| Brad D. Scott |

President and Chief Operating Officer | $1,246,667 | 106,099 | |||

| Karin-Joyce Tjon |

Executive Vice President and Chief Financial Officer | $400,000 | 34,042 |

The number of shares issued to each NEO at the conclusion of the two-year performance period will be equal to the NEO’s target number of performance-based restricted stock awards (as set forth in the above table) multiplied by the payout curve percentage achieved (as described above). Issuance of these 2016 shares is contingent on shareholder approval of the amendment and restatement of the Equity Incentive Plan we intend to submit for approval at the Annual Meeting. If approval is not obtained, the awards will be paid in cash in an amount equal to the number of shares of performance-based restricted stock that would have been earned in accordance with the foregoing multiplied by the price per share of our common stock on the applicable vesting date.

| • | Modified our peer group to include companies with revenues closer to Epiq’s. |

Effective 2016, our peer group includes 18 companies. These companies had median revenues $894.0 million for the four quarters ending September 30, 2015. For information regarding Epiq’s peer group, see “—How We Determine Executive Compensation—The Role of Peer Companies and Benchmarking.”

| • | Adopted revised standalone clawback policy applicable to former and current executive officers. |

Before 2016, our clawback policy applied only to our Chief Executive Officer and Chief Financial Officer. Our current revised and standalone clawback policy, extends to all executive officers and allows us to recapture any cash or bonus incentive compensation paid to former or current executive officers in the event of a restatement of our financial statements due to fraud or intentional misconduct of such officers, which discourages inappropriate risk-taking behavior. In addition, the amendment and restatement of the Epiq Systems, Inc. 2004 Equity Incentive Plan (the “Equity Incentive Plan”) we intend to submit for approval at the Annual Meeting will include a clawback provision with respect to awards granted under the Equity Incentive Plan that further reinforces the purpose of our clawback policy to discourage excessive risk taking.

12

Table of Contents

| • | Engaged Meridian as independent compensation consultant. |

Meridian has worked with the Compensation Committee to modernize our executive compensation program. For 2016, our executive’s compensation package includes the feedback and insights of Meridian.

Executive Compensation Objectives and Practices

The core objectives that serve as the foundation for our compensation program are:

| Program Objective |

Achievement of Objective | |

| Pay for Performance |

• A significant portion of our executives’ pay is not guaranteed and is tied to business performance.

• A majority of NEO pay opportunity is variable (delivered through the combination of short-term and long-term incentive awards) where the value is linked to achievement of Company financial performance measures.

• Our performance measures are based on budget and are challenging, yet achievable. For information regarding Epiq’s 2015 performance measures and their effect on 2015 pay, see “—What We Pay and Why: Elements of Compensation.” | |

| Pay Competitively |

• Our executive compensation program is designed to enable us to compete effectively for the executive talent we need to be able to successfully execute our strategic plans.

• Executives are rewarded when Company performance measures are met or exceeded. | |

| Pay Responsibly—Shareholder Alignment |

• Each of our NEOs is subject to stock ownership requirements. Short-term incentive compensation is typically awarded in stock and as a result of the stock ownership requirements, our NEOs are required to hold such stock to meet required holdings.

• Restricted stock awards vest in three years and only if the executive continues to be employed by us. | |

| Pay Responsibly—Discourage Excessive Risk Taking |

• Our long-term incentives discourage executives from maximizing short-term performance at the expense of long-term performance.

• Our short-term incentive plan has performance measures based on operating revenue or Adjusted EPS and our long-term incentive plan has performance measures based on Adjusted EBITDA and operating cash flows. This balanced approach in setting financial performance measures incentivizes our NEOs to focus on profitable growth and enhancement of shareholder value without engaging in undue risk taking.

• Our NEOs are subject to policies prohibiting hedging and other speculative activity.

• Our executive officers are subject to a clawback policy. | |

13

Table of Contents

Current Best Practices Employed by Epiq

We have implemented the following principal compensation policies and practices to ensure that our executive compensation program achieves our objectives consistent with sound corporate governance:

| What We DO: |

What We DON’T DO: | |

| þ Pay for Performance

þ Performance-Based Equity Awards over Two-Year Performance Period

þ Set Challenging Performance Targets

þ Stock Ownership Guidelines

þ Annual Advisory Vote on Executive Compensation

þ Clawback Policy

þ Independent Compensation Consultant |

x No Payment of Dividends on Restricted Stock Until Fully Vested Subject to Performance- Based Goals Being Met

x No Guaranteed Bonuses

x No Repricing of Underwater Stock Options

x No Excessive Retirement Benefits

x No Hedging Transactions

x No Pension Plans or Other Post-Employment Defined Benefit Plans |

How We Determine Executive Compensation

Determining Compensation for the Chief Executive Officer

Each year, the Compensation Committee determines and approves the compensation for our Chief Executive Officer. The Compensation Committee takes into account multiple factors when determining Mr. Olofson’s compensation including: our compensation philosophy and objectives, our business strategy, Mr. Olofson’s existing compensation and individual performance, competitive market pay levels and mix of pay, Epiq’s performance and competitor and industry performance. Mr. Olofson does not participate in any deliberations with regard to his own compensation.

Mr. Olofson’s experience, talents, and track record make him a recognized industry leader and have played an important part in our success. Mr. Olofson transformed the Company from a privately held small business in 1988 to a publicly-traded, global technology services leader. In 2015, Mr. Olofson led Epiq’s achievement of record operating revenue and Adjusted EBITDA, expansion of client base and eDiscovery managed services capabilities through the acquisition of Iris Data Services, Inc., expansion of international eDiscovery operations with the launch of Epiq’s first full-service eDiscovery office in continental Europe in Frankfurt, Germany, expansion of international operations in Poland, India and China, and expansion of Epiq’s data breach response group, which resulted in significant client retention.

14

Table of Contents

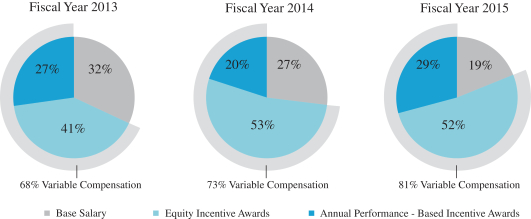

The Compensation Committee believes the most significant portion of Mr. Olofson’s earnings opportunity should reside in the performance-based components of his compensation package. Base salary represents a small portion of Mr. Olofson’s 2015 compensation and is the only component of his total direct compensation (i.e., base, bonus and long-term incentive) that is not tied to performance. Epiq rewards achievement of specific target goals that improve the Company’s financial performance. For 2014 and 2015 performance, the Compensation Committee awarded Mr. Olofson a bonus in common stock in lieu of a cash bonus in order to further align Mr. Olofson’s interests with shareholders. The charts below illustrate the composition of Mr. Olofson’s total direct compensation for 2013, 2014 and 2015.

Determining Compensation for Other NEOs

Each year, the Compensation Committee determines and approves the compensation for each NEO, in addition to the Chief Executive Officer, that is consistent with our compensation philosophy and objectives. The Chief Executive Officer annually reviews the performance of each NEO (other than himself). Following the performance reviews, the Chief Executive Officer presents compensation recommendations to the Compensation Committee for consideration. The recommendations are based on individual performance, compensation data compiled from independent third-party executive compensation surveys and publicly available data from our peer group companies, all of which is summarized and shared with the Compensation Committee. The Compensation Committee considers the recommendations from the Chief Executive Officer in its sole and final determination of the compensation for each of our NEOs (other than himself).

15

Table of Contents

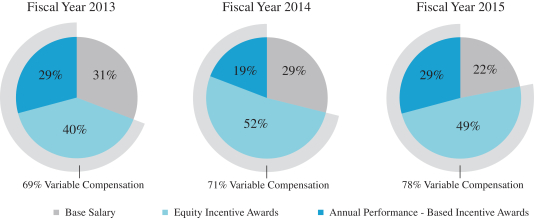

As with our Chief Executive Officer, performance-based compensation represents the largest portion of our NEOs’ total direct compensation. Base salary represents a small portion of 2015 total direct compensation and is the only component of their total compensation that is not tied to performance. For 2015 performance, the Compensation Committee awarded our NEOs a bonus in common stock in lieu of a cash bonus in order to further align their interests with shareholders. The charts below illustrate the composition of our NEO’s (other than our Chief Executive Officer) total direct compensation for 2013, 2014 and 2015. The chart for 2013 includes certain former executive officers and the charts for 2013 and 2014 do not include Ms. Tjon, our Chief Financial Officer, who joined the Company in July 2014.

The Role of Peer Companies and Benchmarking

How The Peer Group is Determined: The Compensation Committee selects our peer group companies used to benchmark NEO compensation based on each companies’ operational and financial similarities to Epiq, taking into account the following factors: business focus, service areas, products and services, competition for executive talent and revenues. The size of the group has been established so as to provide sufficient market data across the range of senior positions at Epiq. The Compensation Committee annually evaluates whether companies should be added to or removed from our peer group companies.

For fiscal 2014 and 2015, our peer group consisted of the following professional service firms focused on technology-based solutions: DST Systems, Inc., Henry (Jack) & Associates, FTI Consulting, Inc., Huron Consulting Group, Inc., Navigant Consulting Inc., MAXIMUS, Inc., Bottomline Technologies (DE) Inc., Computer Task Group Inc., CIBER, ACI Worldwide, Euronet Worldwide, Fair Isaac Corp., and CoreLogic, Inc.

Based on its year-end review of the 2015 peer group and input from Meridian, the Compensation Committee modified the peer group by removing DST Systems, Inc. and adding EPlus, Inc., ICF International Inc., Tyler Technologies Inc., Perficient Inc., Interactive Intelligence Group, NIC Inc., and RPX Corp. DST Systems was removed due to its revenue size relative to Epiq and the other companies were added to the peer group based on the above discussed criteria. The reconstituted peer group was used to benchmark compensation for 2016 pay decisions.

In addition, the Compensation Committee considers, but does not use for benchmarking purposes, compensation information concerning private companies and subsidiaries of larger public companies gleaned as part of past executive recruiting activities. These companies and divisions are either direct competitors or are companies from which we have recruited or sought to recruit senior executives in the past because these companies offer services.

16

Table of Contents

How The Peer Group is Used: The Compensation Committee reviews both compensation and performance at peer companies to inform its decision-making process so it can set total compensation levels that it believes are consistent with our compensation objectives to pay for performance and pay competitively. The Compensation Committee does not strictly set compensation at a given level relative to its peers (e.g., median). However, the Compensation Committee uses information about its peer group to ensure that the objectives of the Company’s compensation program are maintained and applies quantitative tests relative to our peer group, as the ones described under “—How We Determine Executive Compensation—Determining Compensation for the Chief Executive Officer.” The pay positioning of individual executives varies based on their competencies, skills, experience, and performance, as well as internal alignment and pay relationships. Actual total compensation earned is based on Company performance results during the performance period and, in the case of long-term compensation, based on share performance during the applicable performance period.

The Role of the Compensation Committee’s Compensation Consultant

The Compensation Committee retains an independent executive compensation consultant to advise on executive compensation matters and provide perspectives on market trends that may impact decisions the Compensation Committee makes about our executive compensation program and practices. The Compensation Committee had previously engaged Exequity as its independent compensation consultant for 2015. In the fall of 2015, the Compensation Committee replaced Exequity with its new compensation consultant, Meridian. In late 2015, Meridian began working with the Compensation Committee to analyze the results from our shareholder outreach program and to assist the Compensation Committee in redesigning certain elements of Epiq’s 2016 executive compensation program in response shareholder input.

The Compensation Committee determined that the work of Exequity and Meridian did not raise any conflicts of interest. In making this assessment, the Compensation Committee considered the independence factors enumerated in new Rule 10C-1(b) under the Exchange Act, including the fact that neither Exequity nor Meridian provided any other services to Epiq, the level of fees received from Epiq as a percentage of Exequity’s or Meridian’s total revenue, policies and procedures employed by Exequity and Meridian to prevent conflicts of interest, and whether the individual Exequity or Meridian advisers to the Compensation Committee own any of Epiq’s stock or have any business or personal relationships with members of the Compensation Committee or our executive officers.

Risk Considerations

Each year, the Compensation Committee reviews Epiq’s various incentives and other compensation programs and practices and the processes for implementing these programs to determine whether they encourage decision-making that could expose Epiq to unreasonable risks of material adverse consequences. Based on its review, the Compensation Committee confirmed that Epiq’s compensation program is not likely to encourage unnecessary risk taking and the risks arising from Epiq’s compensation practices and policies are not reasonably likely to have a material adverse effect on Epiq. Refer to “Corporate Governance—Risk Management—Analysis of Risk in our Compensation Program.”

What We Pay and Why: Elements of Compensation

As discussed throughout this CD&A, the compensation policies applicable to our NEOs are reflective of our objective to pay for performance, whereby a significant portion of both cash and equity-based compensation is contingent upon achievement of measurable financial objectives and enhanced equity value, as opposed to base salary and perquisites not directly linked to objective financial performance. This compensation mix is intended to drive executive officers to enhance shareholder value over the long term.

The elements of our compensation program are:

| • | base salary; |

| • | annual performance-based incentive awards; |

17

Table of Contents

| • | equity incentive awards; and |

| • | certain additional executive benefits and perquisites. |

The design of our compensation mix is established to encourage our NEOs to achieve annual performance results and to drive our strategy and build long-term shareholder value. The purpose of each of these compensation elements is summarized in the following table and described in more detail below.

| Compensation |

Designed to Reward |

Relationship to |

2015 Actions/Results | |||||

| Base Salary |

Scope of responsibilities, experience, industry knowledge. | Provides predictable amount of fixed income as short-term compensation. | Base salaries of our NEOs were unchanged for 2015. | |||||

|

|

|

|

| |||||

| Short-term Performance-Based Incentive Awards |

Achievement of financial measures that represent strategic components of Company performance. | Focuses executives on our financial goals and objectives for the year and motivates them to achieve or exceed annual financial performance measures. | For 2015, short-term performance measures were: Operating revenue | |||||

| Threshold | $450 million | |||||||

| Target | $480 million | |||||||

| Maximum | $510 million | |||||||

| Actual | $506 million | |||||||

| and Adjusted EPS | ||||||||

| Threshold | $0.85 | |||||||

| Target | $0.95 | |||||||

| Maximum | $1.05 | |||||||

| Actual | $0.86 | |||||||

| Due to achievement of the target payout for operating revenue and threshold payout for Adjusted EPS, the Compensation Committee awarded our NEOs a bonus in common stock in lieu of a cash bonus for 2015 performance in order to further align their interests with shareholders. | ||||||||

|

|

|

|

| |||||

| Long-term Performance-Based Equity Incentive Awards |

Achievement of financial measures that represent strategic components of the business aimed at increasing long-term shareholder return and value. |

Motivates executives to align their interests with shareholders to increase overall shareholder value and retains executives in an increasingly competitive market for talent. |

For 2015, long-term performance measures were: Adjusted EBITDA | |||||

| Target Goal | $100.0 million | |||||||

| Actual | $108.4 million | |||||||

| or | ||||||||

| Cash Flows from Operating Activities | ||||||||

| Target Goal | $75.0 million | |||||||

| Actual | $81.3 million | |||||||

|

Due to achievement of the target payout for Adjusted EBITDA, the Compensation Committee awarded our NEOs shares of restricted stock with one third of the awarded shares vesting on February 22, 2016 and the remaining two-thirds vesting one-third each on the anniversary of the certification for the next two years. | ||||||||

18

Table of Contents

Base Salary

On an annual basis, the Compensation Committee is responsible for establishing the base salary of our NEOs. Base salary is set primarily upon an assessment of market requirements for similarly positioned executives and the responsibilities of the executives, as well as the base salary of each executive relative to the other executive officers. In addition, the Compensation Committee considers information learned in recruiting new executives to Epiq and shareholder feedback, including the results of the prior year say-on-pay vote. For fiscal year 2015, the Compensation Committee did not increase base salaries.

Short-Term Performance-Based Incentive Awards

The Compensation Committee set 2015 performance objectives with annual threshold, target and maximum levels for each of the following financial measures: operating revenue and Adjusted EPS. For the year ended December 31, 2015, these measures were calculated as follows:

| • | Operating revenue is total revenue before reimbursable expenses. |

| • | Adjusted EPS is calculated as net income adjusted for amortization of acquisition intangibles, share-based compensation expense, intangible asset impairment expense, acquisition and related expense, one-time technology expense, loan fee amortization and write-off, litigation recovery and expense, timing of recognition of expense, reorganization expense, gain or loss on disposition of assets, strategic and financial review expense and the effect of tax adjustments that are outside of Epiq’s anticipated effective tax rate, all net of tax and on a fully diluted per share basis. |

These measures are regularly used by our NEOs to manage and evaluate the business and make operating decisions and are the financial measures consistently communicated to investors during quarterly earnings conference calls. We believe these financial metrics best measure our year-over-year revenue growth objectives and the delivery of current earnings to shareholders relative to our operating budget for a specific fiscal year. We used these varied measures for the annual performance-bonus plan to align our NEOs’ interest with our business goals. Further, the use of these performance measures incentivized our NEOs to grow the business in a balanced manner taking into consideration these interrelated performance measures.

The following table sets forth the threshold, target and maximum levels of our short-term incentive award measures for 2015, potential general payout pools and actual performance.

| Performance Measures |

Threshold | Target | Maximum | Actual Performance |

Actual Compensation Awarded to all NEOs as a group | |||||||

| Operating Revenue | Guidelines |

$450.0 million | $480.0 million | $510.0 million | ||||||||

| Potential Payout Pool | $1.25 million | $2.125 million | $3.0 million | |||||||||

| Actual | $506.0 million | $2.125 million | ||||||||||

| and

|

|

|

|

|

|

| ||||||

| Adjusted EPS |

Guidelines | $0.85 | $0.95 | $1.05 | ||||||||

| Potential Payout Pool | $1.25 million | $2.125 million | $3.0 million | |||||||||

| Actual | $0.86 | $1.25 million | ||||||||||

Our short-term incentive awards are paid in cash and/or stock. Based upon the achievement of financial performance measures in 2015, the Compensation Committee awarded our NEOs a bonus in common stock in lieu of a cash bonus related to 2015 performance to further align their interests with shareholders. As presented in the table above, short-term awards were distributed from two general pools approved by the Compensation Committee to fund the awards. The sizes of the general pools varied depending on whether Epiq achieved the threshold, target or maximum level with respect to each financial measure. The Compensation Committee allocated short-term awards among individual executive officers from the target operating revenue pool

19

Table of Contents

($2,125,000) and threshold Adjusted EPS pool ($1,250,000). The Compensation Committee allocated the awards consistent with prior practice, taking into account various factors, including the NEOs level of authority and responsibility within Epiq. Pursuant to Ms. Tjon’s offer letter, her short-term incentive award was limited to $600,000 and therefore, her award represented 17.8% of the total pool. The remaining portion of the pools was then distributed between Messrs. Olofson and Scott. Mr. Olofson’s award represented 45.2% of the pools and Mr. Scott’s award representing 37% of the pools. This allocation of the pools resulted in the payment of a 2015 short-term incentive award to Messrs. Olofson and Scott of $1,526,243 and $1,248,743, respectively, and Ms. Tjon of $599,990.

Long-Term Performance-Based Equity Incentive Awards

Equity-based compensation is a critical component of the overall compensation of our NEOs. The Compensation Committee is the administrator of our equity incentive plans and determines the type, number of shares, terms and timing of awards to our NEOs. The Compensation Committee primarily uses equity awards to provide continuing incentives that will keep our NEOs engaged and aligned with the shareholder interest. The Compensation Committee generally, but not specifically, considers corporate performance, stock price and individual responsibilities and performance to determine awards. Until 2014, equity awards vested within one year of grant. Since 2015, awards for our NEOs vest within three years of the grant. We believe that the three-year vesting schedule better aligns with the interests of shareholders and long-term investors because it provides retention value and focuses our NEOs on attainment of longer-term performance.

The performance stock-based awards utilize performance measures based on operating cash flows and Adjusted EBITDA. For the year ended December 31, 2015, these measures were calculated as follows:

| • | Operating cash flows is calculated in accordance with U.S. GAAP. |

| • | Adjusted EBITDA is calculated as net income adjusted for depreciation and amortization, share-based compensation expense, intangible asset impairment expense, acquisition and related expense, one-time technology expense, net expense related to financing, litigation recovery and expense, timing of recognition of expense, reorganization expense, gain or loss on disposition of assets, strategic and financial review expense, and provision for income taxes. |

In 2015, our performance-based equity incentive compensation required the achievement of these performance measures at levels which provided growth versus the prior year of at least 8% with respect to our operating cash flows or 3% with respect to our Adjusted EBITDA in order for the performance-based equity incentive awards to vest. These measures are regularly used by our NEOs to manage and evaluate the business and make operating decisions and are the financial measures consistently communicated to investors during quarterly earnings conference calls. These are financial measures that are commonly used by investors to gauge the Company’s enterprise value in the form of fair value per share and also are key measures in determining our ability to generate positive cash flows to fund working capital, fund strategic capital investments, service our indebtedness, support the incurrence of incremental debt for acquisitions and return capital to investors in the form of regular quarterly cash dividends and periodic stock repurchases. We used these varied measures for long-term performance awards to align our NEOs’ interest with our long-term business goals. Further, the use of these performance measures incentivizes our NEOs to grow the business in a balanced manner taking into account these interrelated performance measures.

20

Table of Contents

The following table sets forth our target levels for long-term performance measures for 2015, potential compensation opportunity and actual performance.

| Performance |

Target Level |

Actual |

Potential Compensation Opportunity |

Actual Compensation | ||||

| Adjusted EBITDA

or |

$100.0 million

|

$108.4 million | 0—320,000 shares of performance- based restricted stock awards |

320,000 shares of performance based restricted stock awards were earned based on the achievement of the Adjusted EBITDA performance measure. | ||||

| Operating Cash Flows |

$75.0 million |

$81.3 million |

||||||

Under the Equity Incentive Plan, we are able to grant stock, stock options and performance-based stock awards, which are contingent upon continued employment through the vesting date. As presented in the table above, in 2015, long-term performance-based awards were distributed from a general pool of 320,000 shares of performance-based restricted stock approved by the Compensation Committee to fund the awards. The Compensation Committee allocated the awards consistent with prior practice, taking into account various factors, including the NEOs’ level of authority and responsibility within Epiq. Pursuant to Ms. Tjon’s offer letter, her performance-based long-term incentive award was limited to 50,000 shares of restricted stock and therefore, her award represented 15.6% of the total pool. The remaining portion of the pool was then distributed between Messrs. Olofson and Scott. Mr. Olofson’s award represented 46.9% of the pool and Mr. Scott’s award represented 37.5% of the pool. The fair value amounts reported for fiscal year 2015 in the Stock Awards column in the Summary Compensation Table represent the grant date fair value of the performance-based restricted stock awards determined pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”). The number of shares of performance-based restricted stock awarded to each NEO is set forth in the table below.

| Named Executive Officer |

Restricted Stock (shares)(1) |

|||

| Tom W. Olofson |

150,000 | |||

| Brad D. Scott |

120,000 | |||

| Karin-Joyce Tjon |

50,000 | |||

|

|

|

|||

| Total |

320,000 | |||

| (1) | The shares of restricted stock were earned upon certification by the Compensation Committee of the achievement of an established target level of Adjusted EBITDA of $108.4 million for the year ended December 31, 2015. For Messrs. Olofson and Scott, only one-third of the shares of restricted stock vested on February 22, 2016, with the remaining shares scheduled to vest, subject to continuing employment, in two equal installments in February 2017 and 2018. For Karin-Joyce Tjon, the shares of restricted stock vested on February 22, 2016. |

Perquisites and Other Personal Benefits

We provide our executive officers with perquisites and other personal benefits that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain high quality executives. Our executive officers are provided use of Company automobiles. During 2015, our Chairman and Chief Executive Officer used a corporate aircraft in which we have a fractional interest for personal use and his spouse at times accompanied him on business trips, as permitted by our senior executive business travel policy. For purely personal use, the Chairman and Chief Executive Officer reimburses Epiq for the cost of the flight. On

21

Table of Contents

business trips that included the presence of his spouse in 2015, no incremental costs were incurred by Epiq, and we do not record any compensation for this executive. The incremental cost of the use of aircraft for commuting travel by our Chairman and Chief Executive Officer in excess of any reimbursements to Epiq under this policy is treated as compensation in the Summary Compensation Table in accordance with SEC executive compensation disclosure regulations relating to perquisites. In addition, Epiq pays for certain personal tax services and the premiums on certain personal life insurance for our Chairman and Chief Executive Officer.

Attributed costs of the personal benefits described above for the NEOs for 2013, 2014 and 2015 are included as “All Other Compensation” in the Summary Compensation Table.

Retirement and Other Benefits