Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Regional Management Corp. | d185933d8k.htm |

| EX-99.1 - EX-99.1 - Regional Management Corp. | d185933dex991.htm |

Exhibit 99.2

Exhibit 99.2

Regional

Management Corp.

1Q 2016 Earnings Presentation

April 28, 2016

RM LISTED NYSE

Safe Harbor Statement

This presentation and the responses to various questions contain forward-looking statements, which reflect our current views with respect to, among other things,

the Company’s operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words

or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in

these statements. These factors include but are not limited to those described under “Risk Factors” in the Company’s Annual Report on Form 10-K. We cannot guarantee future events, results, actions, levels of activity, performance or

achievements.

Neither the Company nor any of its respective agents, employees or advisors undertake any duty or obligation to supplement, amend, update or revise

any forward-looking statement, whether as a result of new information or otherwise.

The information and opinions contained in this document are provided as of the

date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority.

2

RM LISTED NYSE

Regional Management Corp.

1Q16 Highlights – A Solid Quarter

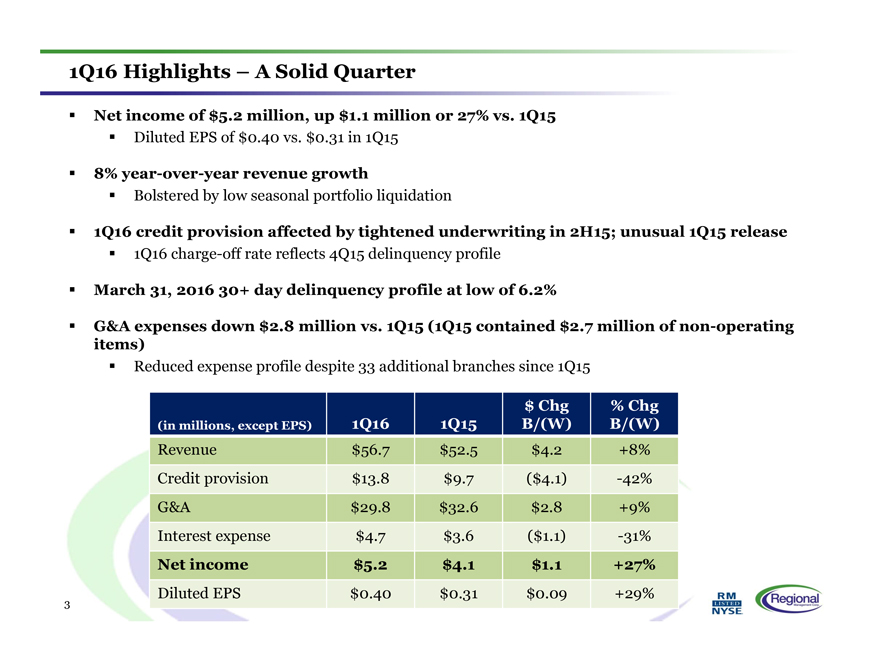

Net income of $5.2 million, up $1.1 million or 27% vs. 1Q15

Diluted EPS of $0.40 vs. $0.31 in

1Q15

8% year-over-year revenue growth

Bolstered by low seasonal portfolio

liquidation

1Q16 credit provision affected by tightened underwriting in 2H15; unusual 1Q15 release

1Q16 charge-off rate reflects 4Q15 delinquency profile

March 31, 2016 30+ day delinquency

profile at low of 6.2%

G&A expenses down $2.8 million vs. 1Q15 (1Q15 contained $2.7 million of non-operating items)

Reduced expense profile despite 33 additional branches since 1Q15

(in millions, except EPS)

1Q16

1Q15

$ Chg

B/(W)

% Chg

B/(W)

Revenue

$56.7

$52.5

$4.2

+8%

Credit provision

$13.8

$9.7

($4.1)

-42%

G&A

$29.8

$32.6

$2.8

+9%

Interest expense

$4.7

$3.6

($1.1)

-31%

Net income

$5.2

$4.1

$1.1

+27%

Diluted EPS

$0.40

$0.31

$0.09

+29%

3

RM LISTED NYSE

Regional Management Corp.

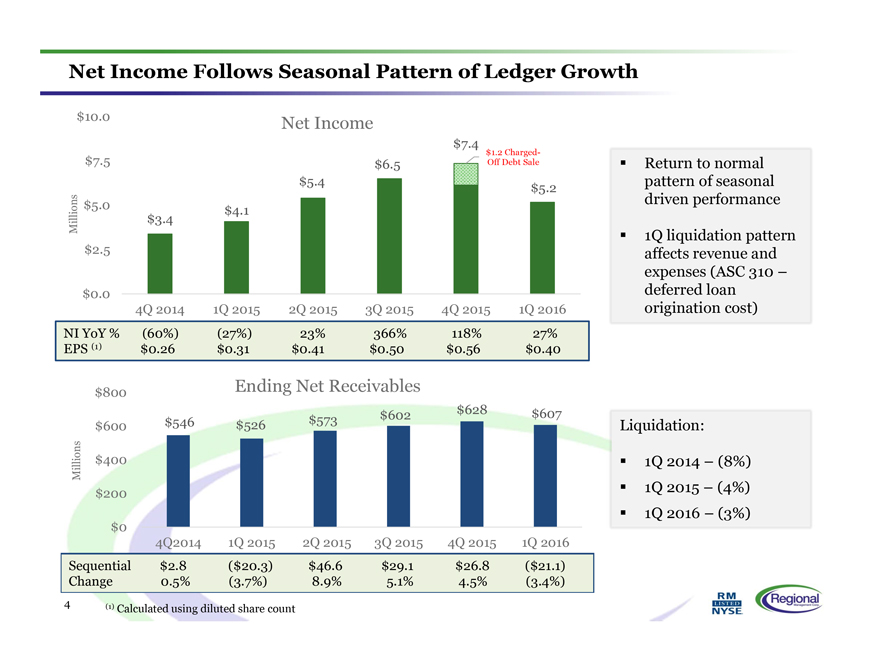

Net Income Follows Seasonal Pattern of Ledger Growth

Net Income

Millions

$10.0

$7.5

$5.0

$2.5

$0.0

$3.4

$4.1

$5.4

$6.5

$7.4

$1.2 Charged-Off Debt Sale

$5.2

4Q 2014

1Q 2015

2Q 2015

3Q 2015

4Q 2015

1Q 2016

NI YoY%

(60%)

(27%)

23%

366%

118%

27%

EPS (1)

$0.26

$0.31

$0.41

$0.50

$0.56

$0.40

Ending Net Receivables

Millions

$800

$600

$400

$200

$0

$546

$526

$573

$602

$628

$607

4Q2014

1Q 2015

2Q 2015

3Q 2015

4Q 2015

1Q 2016

Sequential

$2.8

($20.3)

$46.6

$29.1

$26.8

($21.1)

Change

0.5%

(3.7%)

8.9%

5.1%

4.5%

(3.4%)

Return to normal pattern of seasonal driven performance

1Q liquidation pattern affects revenue and expenses (ASC 310 – deferred loan origination cost)

Liquidation:

1Q 2014 – (8%)

1Q 2015 – (4%)

1Q 2016 – (3%)

(1) Calculated using diluted share count

4

RM LISTED NYSE

Regional Management Corp.

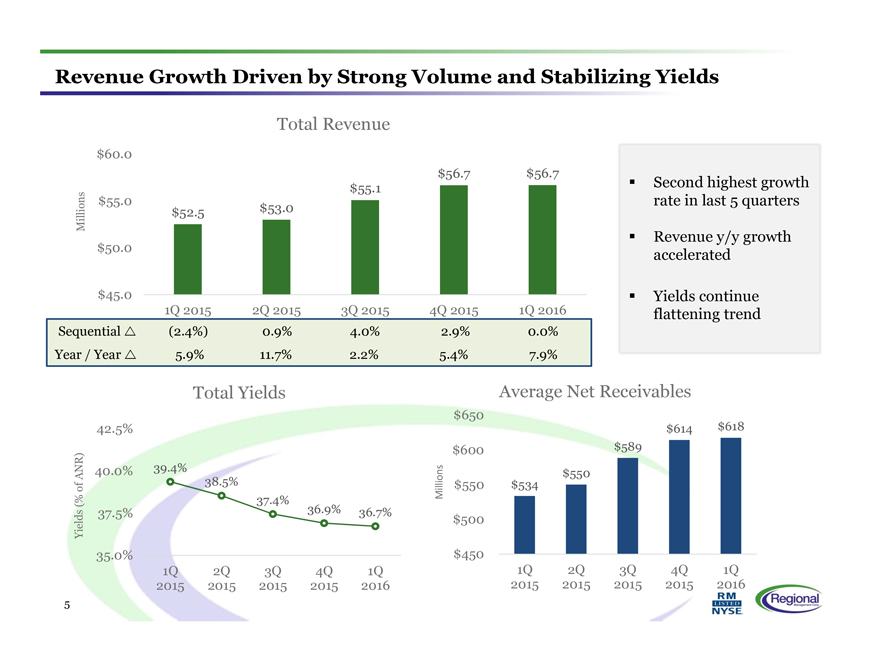

Revenue Growth Driven by Strong Volume and Stabilizing Yields

Total Revenue

Millions

$60.0

$55.0

$50.0

$45.0

$52.5

$53.0

$55.1

$56.7

$56.7

1Q 2015

2Q 2015

3Q 2015

4Q 2015

1Q 2016

Sequential

(2.4%)

0.9%

4.0%

2.9%

0.0%

Year / Year

5.9%

11.7%

2.2%

5.4%

7.9%

Total Yields

Yields (% of ANR)

42.5%

40.0%

37.5%

35.0%

39.4%

38.5%

37.4%

36.9%

36.7%

1Q

2015

2Q

2015

3Q

2015

4Q

2015

1Q

2016

Average Net Receivables

Millions

$650

$600

$550

$500

$450

$534

$550

$589

$614

$618

1Q

2015

2Q

2015

3Q

2015

4Q

2015

1Q

2016

Second highest growth rate in last 5 quarters

Revenue y/y growth accelerated

Yields continue flattening trend

5

RM LISTED NYSE

Regional Management Corp.

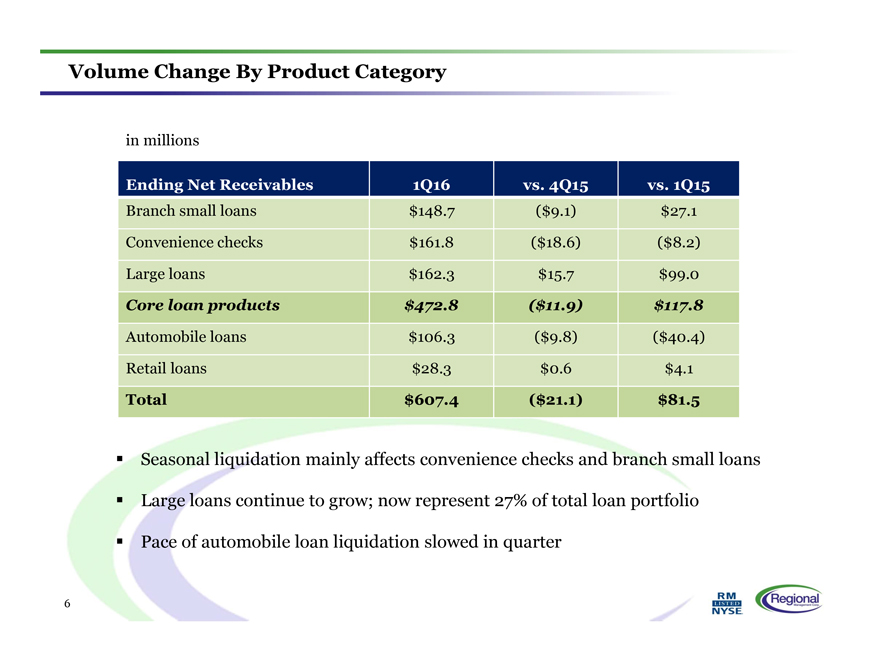

Volume Change By Product Category

in millions

Ending Net Receivables

1Q16

vs. 4Q15

vs. 1Q15

Branch small loans

$148.7

($9.1)

$27.1

Convenience checks

$161.8

($18.6)

($8.2)

Large loans

$162.3

$15.7

$99.0

Core loan products

$472.8

($11.9)

$117.8

Automobile loans

$106.3

($9.8)

($40.4)

Retail loans

$28.3

$0.6

$4.1

Total

$607.4

($21.1)

$81.5

Seasonal liquidation mainly affects convenience checks and branch small loans

Large loans continue to grow; now represent 27% of total loan portfolio

Pace

of automobile loan liquidation slowed in quarter

6

RM LISTED NYSE

Regional Management Corp.

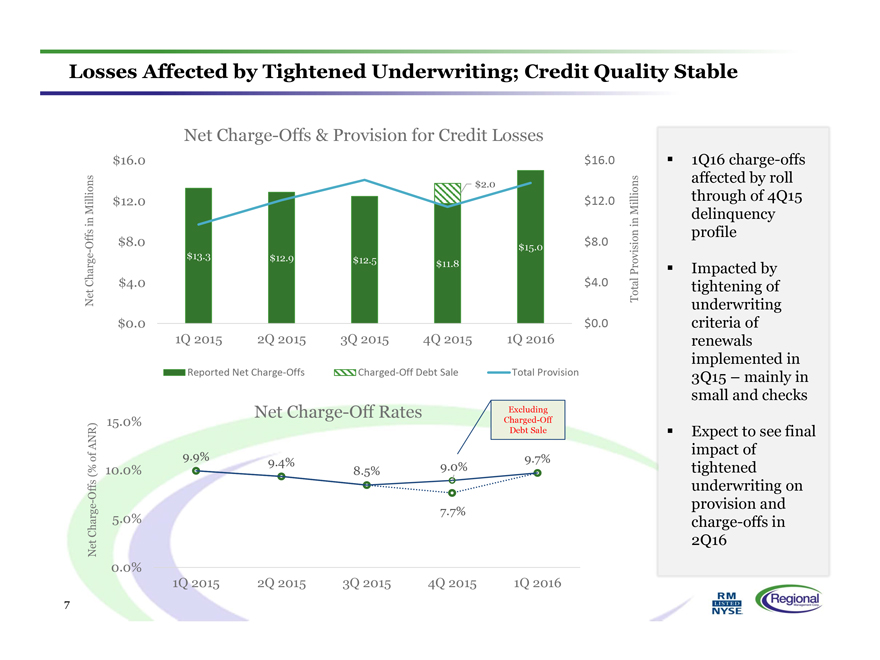

Losses Affected by Tightened Underwriting; Credit Quality Stable

Net Charge-Offs & Provision for Credit Losses

Net Charge-Offs in Millions

$16.0

$12.0

$8.0

$4.0

$0.0

$13.3

$12.9

$12.5

$11.8

$2.0

$15.0

$16.0

$12.0

$8.0

$4.0

$0.0

Total Provision in Millions

1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016

Reported Net Charge Offs

Charged Off Debt Sale

Total Provision

Net Charge-Off Rates

Net Charge-Offs (% of ANR)

15.0%

10.0%

5.0%

0.0%

9.9%

9.4%

8.5%

9.0%

Excluding Charged-Off Debt Sale

9.7%

7.7%

1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016

1Q16 charge-offs affected by roll

through of 4Q15 delinquency profile

Impacted by tightening of underwriting criteria of renewals implemented in 3Q15 – mainly in small and checks

Expect to see final impact of tightened underwriting on provision and charge-offs in 2Q16

7

RM LISTED NYSE

Regional Management Corp.

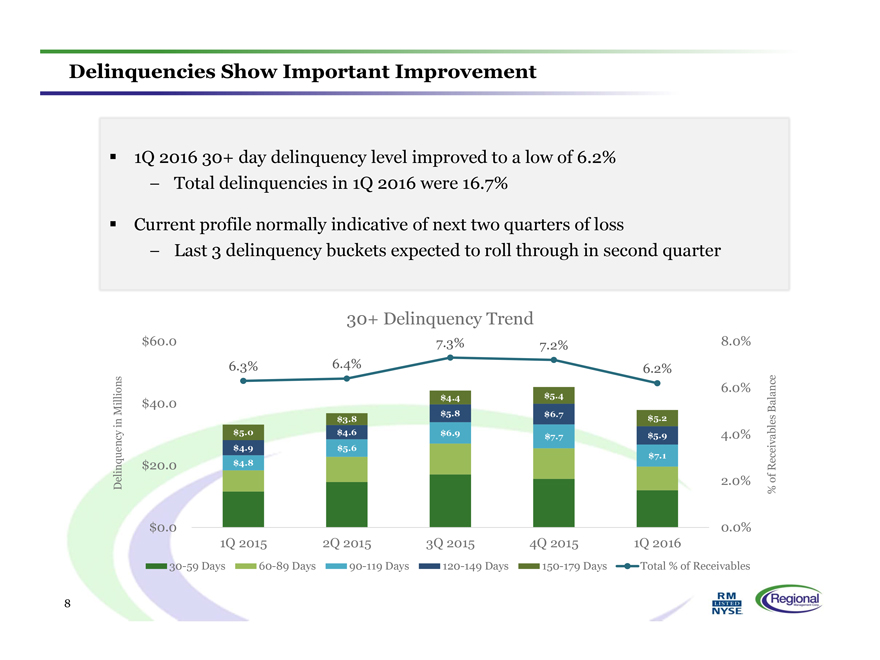

Delinquencies Show Important Improvement

1Q 2016 30+ day delinquency level improved to a low of 6.2%

- Total delinquencies in 1Q 2016

were 16.7%

Current profile normally indicative of next two quarters of loss

-

Last 3 delinquency buckets expected to roll through in second quarter

30+ Delinquency Trend

Delinquency in Millions

$60.0

$40.0

$20.0

$0.0

6.3%

6.4%

7.3%

7.2%

6.2%

$5.0

$4.9

$4.8

$3.8

$4.6

$5.6

$4.4

$5.8

$6.9

$5.4

$6.7

$7.7

$5.2

$5.9

$7.1

8.0%

6.0%

4.0%

2.0%

0.0%

% of Receivables Balance

1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016

30-59 Days 60-89 Days 90-119 Days 120-149 Days 150-179 Days Total % of Receivables

8

RM LISTED NYSE

Regional Management Corp.

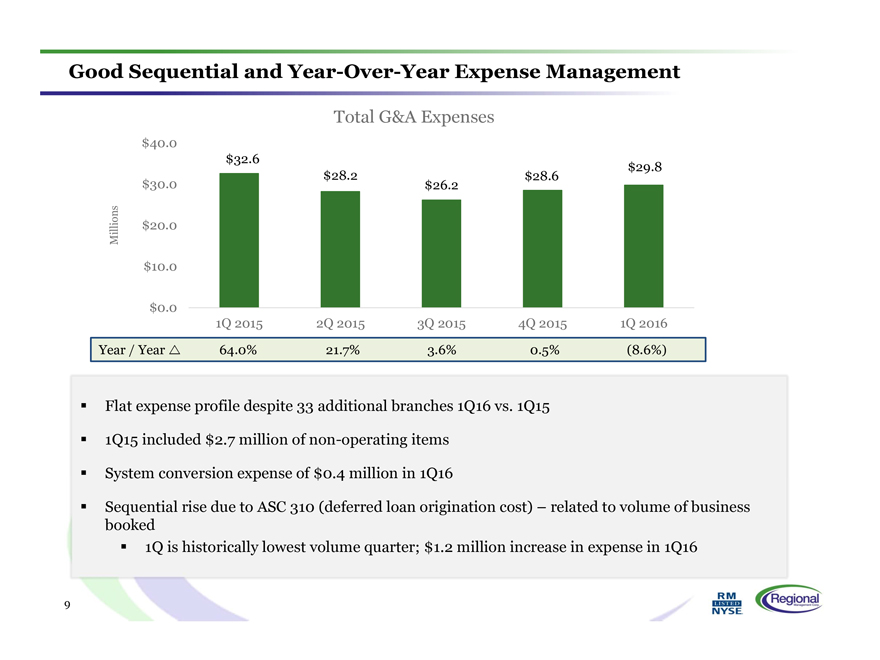

Good Sequential and Year-Over-Year Expense Management

Total G&A Expenses

Millions

$40.0

$30.0

$20.0

$10.0

$0.0

$32.6

$28.2

$26.2

$28.6

$29.8

1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016

Year / Year

64.0%

21.7%

3.6%

0.5%

(8.6%)

Flat expense profile despite 33 additional branches 1Q16 vs. 1Q15

1Q15 included $2.7 million of non-operating items

System conversion expense

of $0.4 million in 1Q16

Sequential rise due to ASC 310 (deferred loan origination cost) – related to volume of business booked

1Q is historically lowest volume quarter; $1.2 million increase in expense in 1Q16

9

RM LISTED NYSE

Regional Management Corp.

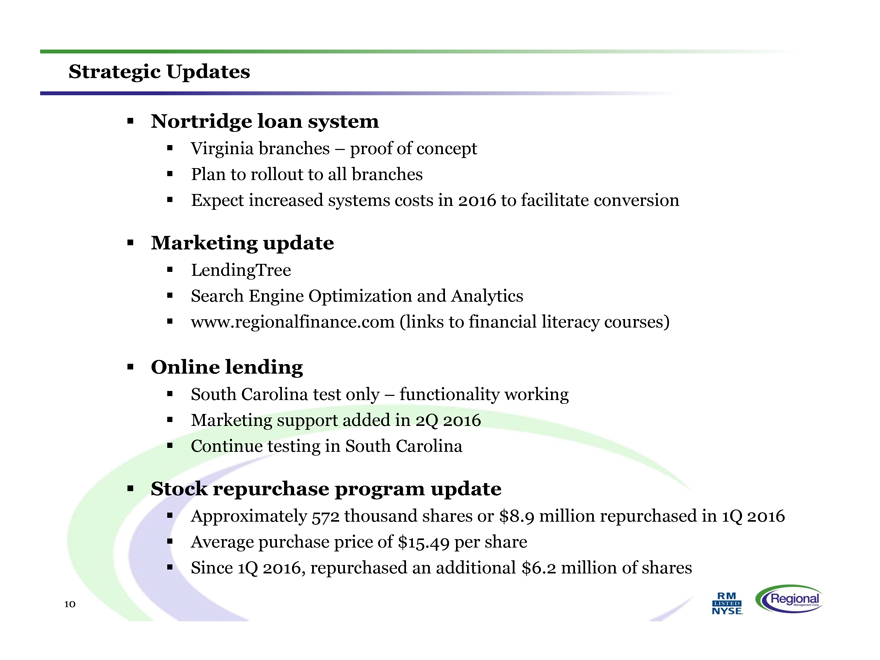

Strategic Updates

Nortridge loan system

Virginia branches – proof of concept

Plan to rollout to all branches

Expect increased systems costs in 2016 to facilitate

conversion

Marketing update

LendingTree

Search Engine Optimization and Analytics

www.regionalfinance.com (links to financial literacy

courses)

Online lending

South Carolina test only – functionality working

Marketing support added in 2Q 2016

Continue testing in South Carolina

Stock repurchase program update

Approximately 572 thousand shares or $8.9

million repurchased in 1Q 2016

Average purchase price of $15.49 per share

Since 1Q 2016, repurchased an additional $6.2 million of shares

10

RM LISTED NYSE

Regional Management Corp.

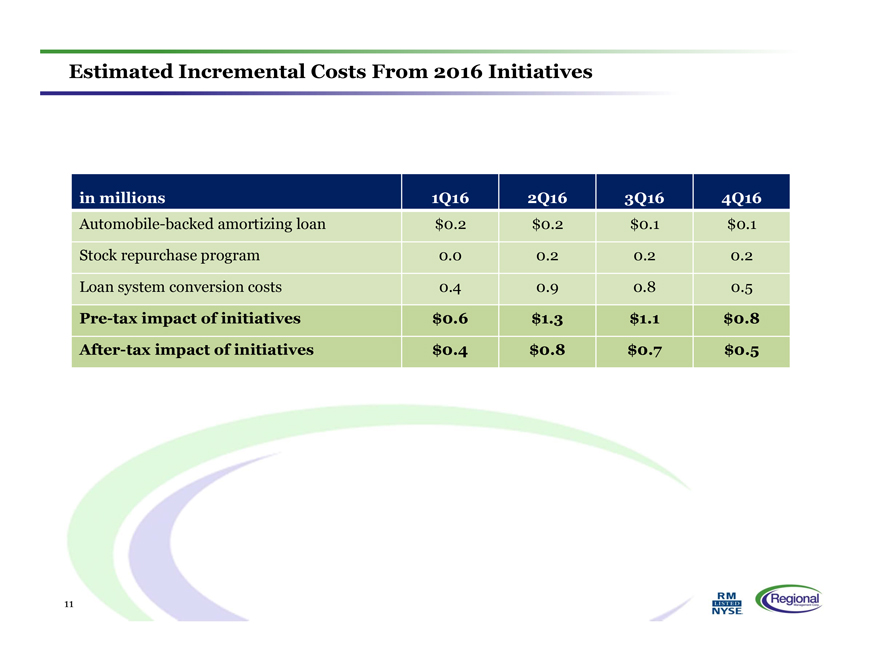

Estimated Incremental Costs From 2016 Initiatives

in millions

1Q16

2Q16

3Q16

4Q16

Automobile-backed amortizing loan

$0.2

$0.2

$0.1

$0.1

Stock repurchase program

0.0

0.2

0.2

0.2

Loan system conversion costs

0.4

0.9

0.8

0.5

Pre-tax impact of initiatives

$0.6

$1.3

$1.1

$0.8

After-tax impact of initiatives

$0.4

$0.8

$0.7

$0.5

11

RM LISTED NYSE

Regional Management Corp.

Regional Management Corp.

CONFIDENTIAL

12

RM LISTED NYSE

Regional Management Corp.