Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a8kearningsreleasedoc033116.htm |

| EX-99.1 - EARNINGS RELEASE - ENTERPRISE FINANCIAL SERVICES CORP | ex991financialstatementsan.htm |

Enterprise Financial Services Corp 2016 FIRST QUARTER EARNINGS RELEASE

2 Some of the information in this report contains “forward-looking statements” within the meaning of and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some forward- looking statements are expressed differently. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those contained in the forward- looking statements due to a number of factors, including, but not limited to: credit risk; changes in the appraised valuation of real estate securing impaired loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid increases or decreases in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in accounting regulation or standards applicable to banks; and other risks discussed under the caption “Risk Factors” of our most recently filed Form 10-K and in Part II, 1A of our most recently filed Form 10-Q, all of which could cause the Company’s actual results to differ from those set forth in the forward-looking statements. Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from time to time with the Securities and Exchange Commission which are available on our website at www.enterprisebank.com. FORWARD-LOOKING STATEMENT

3 SUSTAIN CORE GROWTH TRENDS CONTINUE INVESTMENT IN BANKING BUSINESS – SOLIDIFY LOAN AND DEPOSIT GENERATION CAPABILITIES ELEVATE FOCUS ON GROWTH IN WEALTH & OTHER FEE BUSINESSES 2016 OBJECTIVES

4 PORTFOLIO LOAN TRENDS $2,436 $2,543 $2,602 $2,751 $2,833 3/31/2015 6/30/2015 9/30/2015 12/31/2015 3/31/2016 In Millions

5 $1,260 $1,329 $1,365 $1,484 $1,545 3/31/2015 6/30/2015 9/30/2015 12/31/2015 3/31/2016 COMMERCIAL & INDUSTRIAL LOAN TRENDS In Millions

6 PORTFOLIO LOAN DETAILS 3/31/16 12/31/15 QTR CHANGE 3/31/15 LTM CHANGE ENTERPRISE VALUE LENDING $ 360 $ 350 $ 10 $ 229 $ 131 C&I GENERAL 760 732 28 665 95 LIFE INSURANCE PREMIUM FINANCING 272 265 7 230 42 TAX CREDIT 153 137 16 136 17 COMMERCIAL REAL ESTATE 949 932 17 890 59 RESIDENTIAL 202 197 5 180 22 OTHER 137 138 (1) 106 31 PORTFOLIO LOANS $ 2,833 $ 2,751 $ 82 $ 2,436 $ 397 In Millions

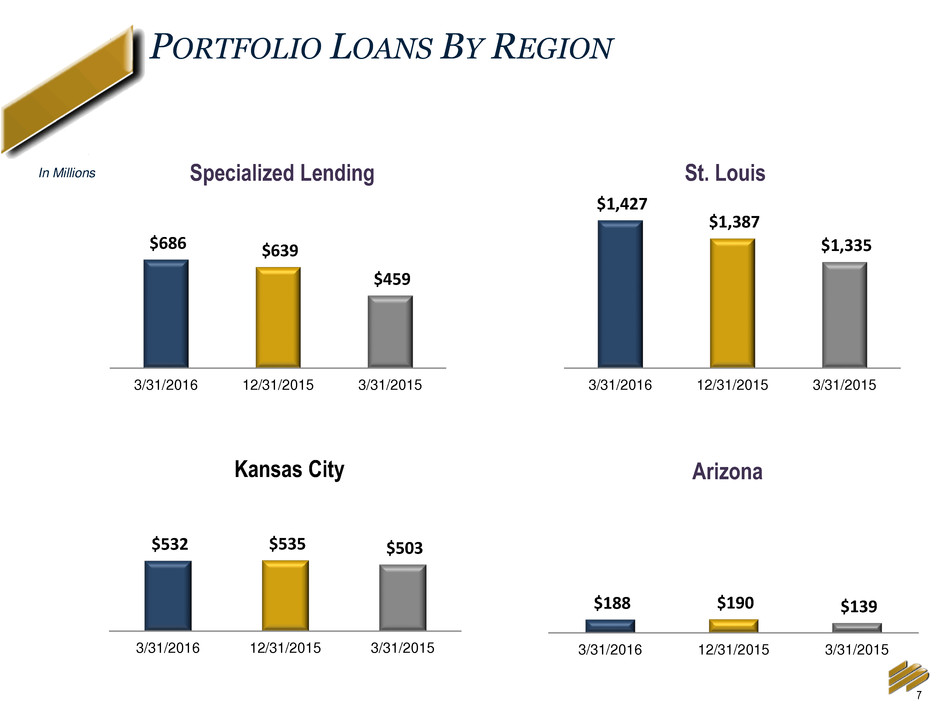

7 PORTFOLIO LOANS BY REGION $1,427 $1,387 $1,335 $1,100 $1,150 $1,200 $1,250 $1,300 $1,350 $1,400 $1,450 3/31/2016 12/31/2015 3/31/2015 St. Louis $532 $535 $503 0 200 400 600 800 1000 1200 1400 3/31/2016 12/31/2015 3/31/2015 $188 $190 $139 0 500 1000 1500 3/31/2016 12/31/2015 3/31/2015 Arizona In Millions Kansas City $686 $639 $459 $- $200 $400 $600 $800 $1,000 3/31/2016 12/31/2015 3/31/2015 Specialized Lending

8 DEPOSIT TRENDS $2,675 $2,692 $2,814 $2,785 $2,932 25.5% 24.5% 24.6% 25.8% 24.5% -30.0% -5.0% 20.0% Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Deposits DDA % LTM Growth Rate = 10%

9 EARNINGS PER SHARE $22,387 $0.54 <$0.07 > $0.47 EPS Non-Core Acquired Assets Core EPS In Millions * A Non GAAP Measure, Refer to Appendix for Reconciliation REPORTED VS. CORE EPS* Q1 2016 Loss share extinguishment charge from Q4 2015 earned back 100% in Q1 2016

10 EARNINGS PER SHARE TREND $0.49 $0.03 < $0.01> < $0.03 > < $0.01 > $0.47 Q4 '15 Net Interest Income Portfolio Loan Loss Provision Non Interest Income Non Interest Expense Q1 '16 In Millions CHANGES IN CORE EPS* Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

11 POSITIVE MOMENTUM IN CORE* EARNINGS PER SHARE $0.35 $0.38 $0.44 $0.49 $0.47 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation 34% Core EPS Growth from Q1 2015 to Q1 2016 Two-year CAGR – 30%

12 CORE NET INTEREST INCOME TRENDS* In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $25.6 $26.3 $27.1 $28.7 $29.6 3.46% 3.46% 3.41% 3.50% 3.54% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% $18.0 $19.0 $20.0 $21.0 $22.0 $23.0 $24.0 $25.0 $26.0 $27.0 $28.0 $29.0 $30.0 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Core Net Interest Income* FTE Net Interest Margin*

13 CREDIT TRENDS FOR PORTFOLIO LOANS 25 bps 11 bps 2 bps -10 bps -1 bps Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Net Charge-offs (1) (1) Portfolio loans only, excludes PCI (Purchased Credit Impaired) loans $1.6 $2.2 $0.6 $0.5 $0.8 $- $0.6 $1.2 $1.8 $2.4 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Provision for Portfolio Loans Q1 2016 EFSC PEER(2) NPA’S/ASSETS = 0.52% 0.64% NPL’S/LOANS = 0.34% 0.62% ALLL/NPL’S = 361% 175% ALLL/LOANS = 1.21% 1.10% (2) Peer data as of 12/31/2015 (source: SNL Financial) In Millions 2015 NCO = 6 bps $1.6 $107 $59.6 $149 $81.9 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Portfolio Loan Growth In Millions Net Charge-offs (1)

14 OPERATING EXPENSES TRENDS* In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $5.9 $6.1 $6.2 $6.5 $6.1 $1.7 $1.6 $1.6 $1.7 $1.7 $11.5 $11.3 $11.5 $11.8 $12.6 60.7% 57.6% 58.6% 56.1% 57.4% 0 5 10 15 20 25 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Other Occupancy Employee compensation and benefits Core Efficiency Ratio* $19.1 $19.0 $19.3 $20.0 $20.4

15 CONTINUED GROWTH IN CORE EPS DRIVE NET INTEREST INCOME GROWTH IN DOLLARS WITH FAVORABLE LOAN GROWTH TRENDS DEFEND NET INTEREST MARGIN MAINTAIN HIGH QUALITY CREDIT PROFILE ACHIEVE FURTHER IMPROVEMENT IN OPERATING LEVERAGE ENHANCE DEPOSIT LEVELS TO SUPPORT GROWTH FINANCIAL SCORECARD 34% 16% 8 bps 28 bps NPLs/Loans 3% 10% Q1 2016 Compared to Q1 2015

Appendix

17 USE OF NON-GAAP FINANCIAL MEASURES The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as Core net interest margin and other Core performance measures, in this presentation that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its Core performance measures presented in presentation as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of PCI loans and related income and expenses, the impact of nonrecurring items, and the Company's operating performance on an ongoing basis. Core performance measures include contractual interest on PCI loans but exclude incremental accretion on these loans. Core performance measures also exclude the Change in FDIC receivable, Gain or loss of other real estate from PCI loans and expenses directly related to the PCI loans and other assets formerly covered under FDIC loss share agreements. Core performance measures also exclude certain other income and expense items the Company believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached tables contain a reconciliation of these Core performance measures to the GAAP measures. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measure for the periods indicated. Peer group data consists of publicly traded banks with total assets from $1-$10 billion with commercial loans greater than 20% and consumer loans less than 20%.

18 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Mar 31, Dec 31, Sep 30, Jun 30, Mar 31, (in thousands) 2016 2015 2015 2015 2015 CORE PERFORMANCE MEASURES Net interest income 32,428$ 32,079$ 30,006$ 29,280$ 29,045$ Less: Incremental accretion income 2,834 3,412 2,919 3,003 3,458 Core net interest income 29,594 28,667 27,087 26,277 25,587 Total noninterest income 6,005 6,557 4,729 5,806 3,583 Less: Change in FDIC loss share receivable - (580) (1,241) (945) (2,264) Less (Plus): Gain (loss) on sale of other real estate from PCI loans - 81 31 10 (15) Less: Gain on sale of investment securities - - - - 23 Core noninterest income 6,005 7,056 5,939 6,741 5,839 Total core revenue 35,599 35,723 33,026 33,018 31,426 Provision for portfolio loans 833 543 599 2,150 1,580 Total noninterest expense 20,762 22,886 19,932 19,458 19,950 Less: FDIC clawback - - 298 50 412 Less: FDIC loss share termination - 2,436 Less: Other loss share expenses 327 423 287 378 470 Core noninterest expense 20,435 20,027 19,347 19,030 19,068 Core income before income tax expense 14,331 15,153 13,080 11,838 10,778 Core income tax expense 4,897 5,073 4,204 4,134 3,647 Core net income 9,434$ 10,080$ 8,876$ 7,704$ 7,131$ Core diluted earnings per share 0.47$ 0.49$ 0.44$ 0.38$ 0.35$ Core return on average assets 1.04% 1.13% 1.03% 0.93% 0.88% Core return on average common equity 10.66% 11.46% 10.41% 9.34% 8.99% Core return on average tangible common equity 11.76% 12.68% 11.56% 10.41% 10.06% Core efficiency ratio 57.40% 56.06% 58.58% 57.64% 60.67% NET INTEREST MARGIN TO CORE NET INTEREST MARGIN Net interest income (fully tax equivalent) 32,887$ 32,546$ 30,437$ 29,691$ 29,467$ Less: Incremental accretion income 2,834 3,412 2,919 3,003 3,458 Core net interest income (fully tax equivalent) 30,053$ 29,134$ 27,518$ 26,688$ 26,009$ Average earning assets 3,413,792$ 3,304,827$ 3,201,181$ 3,096,294$ 3,047,815$ Reported net interest margin (fully tax equivalent) 3.87% 3.91% 3.77% 3.85% 3.92% Core net interest margin (fully tax equivalent) 3.54% 3.50% 3.41% 3.46% 3.46% For the Quarter ended

19 Q & A FIRST QUARTER 2016 EARNINGS RELEASE