Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIMKEN CO | tkrq120168-k.htm |

| EX-99.1 - EXHIBIT 99.1 - TIMKEN CO | tkrq12016exhibit991.htm |

1Q 2016 Earnings Investor Presentation April 27, 2016

2 1Q 2016 EARNINGS CONFERENCE CALL DETAIL Conference Call: Wednesday, Apr. 27, 2016 10:00 a.m. Eastern Time Live Dial-In: 800-500-0920 or 719-457-2731 (Call in 10 minutes prior to be included) Conference ID: Timken’s 1Q Earnings Call Conference Call Replay: Replay Dial-In available through May 11, 2016 888-203-1112 or 719-457-0820 Replay Passcode: 6334899 Live Webcast: www.timken.com/investors

3 FORWARD-LOOKING STATEMENTS SAFE HARBOR AND NON-GAAP FINANCIAL INFORMATION Certain statements in this presentation (including statements regarding the company's forecasts, beliefs, estimates and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements related to Timken’s plans, outlook, future financial performance, targets, projected sales, cash flows, liquidity and expectations regarding the future financial performance of the company, including the information under the headings, “2016 Market Outlook and Drivers”, “Executing our Strategy”, “2016 Outlook Update”, “1Q 2016 Net Income and Diluted EPS”, “2016 Full-Year Outlook” and “Cash Flow, Balance Sheet & Capital Allocation” are forward-looking. The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the finalization of the company's financial statements for the first quarter of 2016; the company's ability to respond to the changes in its end markets that could affect demand for the company's products; unanticipated changes in business relationships with customers or their purchases from the company; changes in the financial health of the company's customers, which may have an impact on the company's revenues, earnings and impairment charges; fluctuations in raw material and energy costs; the impact of the company's last-in, first-out accounting; weakness in global or regional economic conditions and capital markets; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the company’s pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk; the company’s ability to complete and achieve the benefits of announced plans, programs, initiatives, and capital investments; and retention of U.S. Continued Dumping and Subsidy Offset Act distributions. Additional factors are discussed in the company's filings with the Securities and Exchange Commission, including the company's Annual Report on Form 10-K for the year ended Dec. 31, 2015, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation includes certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission. Reconciliation of those measures to the most directly comparable GAAP equivalents are provided in the Appendix to this presentation.

4 1Q 2016 SUMMARY • Sales of $684 million decreased approximately 5% from prior year, or down 2.5% excluding currency Mobile Industries sales down 2%; roughly flat excluding currency Process Industries sales down 9%; down 6% excluding currency • GAAP net income per share of $0.78 versus net loss of $1.54 in same quarter last year Adjusted EPS of $0.46, compared with $0.50 last year Adjusted EBIT margin of 9% • Strong Free Cash Flow Generated $23 million of free cash flow in the quarter, compared with net cash used of $3 million in the same period last year • Balance Sheet and Capital Allocation Purchased 1.2 million shares in the quarter ~29% net debt-to-capital at quarter-end See Appendix for reconciliation of adjusted EPS, adjusted EBIT margin, free cash flow and net debt–to-capital to their most directly comparable GAAP equivalents.

5 Markets Market Drivers/Timken Dynamics Timken Automotive l Gaining share in NA Light Truck l Wind l Market flat; share gains l General Industrial l l Heavy Truck l US OE down; ROW more stable l Defense l Military Marine strong; Aero down l Agriculture l Belts acquisition adds revenue l Construction l l Rail l US market down; share gains mitigate l Metals l l Mining l l Civil Aerospace l Timken PMA divestiture impact l Oil & Gas l l 2016 MARKET OUTLOOK AND DRIVERS decline flat to down slightly growth NOTE: Based on forecast as of April 27, 2016.

6 Outgrowing our Markets • Be the technical leader in solving customers’ friction and power transmission challenges • Expand both our product portfolio and geographic presence • Deliver an exceptional customer service experience including a differentiated technical sales model Operating with Excellence • Drive enterprise-wide lean and continuous improvement efforts • Build a more cost-effective global manufacturing footprint • Deliver efficiencies across our supply chains • Optimize processes and SG&A efficiency Deploying Capital to Drive Shareholder Value • Invest in organic growth and productivity initiatives • Grow dividend with earnings • Broaden portfolio and reach through value-accretive M&A • Return capital through share repurchases EXECUTING OUR STRATEGY G R O WT H E XE C UTIO N C A P IT A L

7 UPDATE ON TIMKEN BELTS ACQUISITION • Integration of business largely complete • Broadens our mechanical power transmission products portfolio • Pursuing channel synergies • Driving Operational Excellence − Inventory −SG&A A 100-year-old supplier of power transmission belts for industrial, commercial and consumer applications, headquartered in Springfield, MO; acquired Sept. 1, 2015

8 2016 OUTLOOK UPDATE Net Sales -4 to -5% -5% Organic -5 to -6% -6% • Weaker end-market demand Acquisitions (net) +3% +3% Currency -2% -2% • Impact of slightly weaker US dollar FY GAAP EPS $1.35 to $1.45 $1.65 to $1.75 • CDSOA income, net of related expenses FY Adjusted EPS $1.90 to $2.00 $1.90 to $2.00 January Outlook Change Reflects April Outlook

Financial Review

10 1Q-15 Organic Currency Acquisitions/ Divestitures 1Q-16 1Q 2016 FINANCIAL HIGHLIGHTS - SALES • Sales of $684 million, down 5.3% from a year ago Excluding currency impact of 2.8%, sales declined 2.5% Decline driven by market weakness across most sectors partially offset by growth in automotive and the net benefit of acquisitions and divestitures Organically, sales were down roughly 6% 1Q-16 1Q-15 $684.0 $722.5 $ B/(W) Net Sales % B/(W) $(38.5) (5.3)% ($M) $(20) $25 $723 $684 $(44) Belts acquisition, net of aerospace PMA divestiture * N America -7% excl. acquisitions/divestitures 1Q-16 Excluding vs. impact Region 1Q-15 of currency N America -1% -1% EMEA -4% 0% APac -17% -12% LatAm -15% -1% Geographic Sales Comparison

11 1Q 2016 FINANCIAL HIGHLIGHTS - ADJUSTED EBIT 180.9 202.5 Gross Profit 118.3 128.5 SG&A 6.2 Impairment & restructuring $(148.8) EBIT % of sales 17.3% 17.8% % of sales 26.4% 28.0% (160) bps 50 bps See Appendix for reconciliation of EBIT, adjusted EBIT, and EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. (1) Includes rationalization costs recorded in cost of products sold. (1.4) 10.2 10.5 $98.6 -- $247.4 (21.6) 215.2 Pension settlement charges 1.2 - Impairment & restructuring(1) Adjustments: $61.4 $73.0 EBIT after adjustments $(11.6) 9.0% 10.1% EBIT Margins (110) bps 6.6 10.7 - Pension settlement charges 1.2 215.2 -- CDSOA income, net of related expenses 47.7 - CDSOA income, net of related exps. (47.7) -- Other (expense) income, net 1Q-16 1Q-15 $684.0 $722.5 $ B/(W) Net Sales % B/(W) $(38.5) (5.3)% ($M) - Gain on dissolution of a subsidiary (1.4) --

12 1Q 2016 EARNINGS COMPARISON • Adjusted EBIT of $61.4 million or 9.0% of sales compares with $73.0 million or 10.1% of sales in the same period a year ago Driven by the impact of lower volume, unfavorable price/mix and currency, partially offset by the impact of lower raw material and operating costs and lower SG&A expenses Certain data contained in the graph above has been rounded for presentation purposes. See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margin to their most directly comparable GAAP equivalents. 1Q-15 Volume Price / Mix Costs of Production SG&A Expenses Currency 1Q-16 Adjusted EBIT - ($M) $73 $61 $(5) $(34) $17 $10 Lower raw material and operating costs partially offset by the impact of lower volume

13 1Q 2016 NET INCOME AND DILUTED EPS 1Q-16 $63.0 $0.78 Net Income (Loss) Net Income, after adjustments $36.9 $0.46 $M EPS 1Q-15 $(135.2) $(1.54) $44.2 $0.50 EPS Adjusted tax rate: Quarter 31% 32% - Pension settlement charges 1.2 215.2 0.02 • Adjusted EPS of $0.46, versus $0.50 in the same period last year EPS benefited from share buybacks • Adjusted tax rate of 31% in 1Q-16 driven primarily by geographic mix of earnings Adjusted tax rate of ~31% expected for balance of 2016 2.45 - Impairment & restructuring charges 10.7 6.6 0.13 - CDSOA income, net of related expenses (47.7) (0.59) -- 0.07 -- $M - Provision (benefit) for income taxes 11.1 0.14 (42.4) (0.48) Average diluted shares outstanding: Quarter 80.4 million 88.6 million - Gain on dissolution of a subsidiary (1.4) (0.02) -- -- Adjustments*: *Adjustments are pre-tax, with net tax provision (benefit) listed separately. Total adjustments (26.1) (0.32) 179.4 2.04

14 MOBILE INDUSTRIES Heavy Truck Automotive Aerospace Rail ($M) 2016 2015 Change Sales $383.2 $393.0 $(9.8) EBIT $30.2 $35.4 $(5.2) Margin 7.9% 9.0% (110) bps Adjusted(1): EBIT $35.9 $36.4 $(0.5) Margin 9.4% 9.3% 10 bps 1Q YOY Commentary 1Q Performance • Sales down 2.5%; excluding currency, sales were roughly flat Driven by automotive growth and the net benefit of acquisitions/divestitures, offset by market-related declines in off-highway, rail and aerospace Organically, sales were down 3.3% • Slight decline in adjusted EBIT reflects lower organic volume and unfavorable price/mix, mostly offset by lower raw material and operating costs and lower SG&A expenses Off-Highway Acquisitions (net) +2% (1) See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. 1Q YOY Sales Walk 2016 Full-Year Outlook 1Q-15 Organic Currency Acquisitions (net) 1Q-16 $(11) $14 $393 $383 $(13) Currency Organic down ~6% Sales: Down ~6% -2%

15 PROCESS INDUSTRIES Original Equipment Aftermarket ($M) 2016 2015 Change Sales $300.8 $329.5 $(28.7) EBIT $32.6 $45.2 $(12.6) Margin 10.8% 13.7% (290) bps Adjusted(1): EBIT $36.2 $50.8 $(14.6) Margin 12.0% 15.4% (340) bps 1Q YOY Commentary 1Q Performance • Sales down 8.7%; excluding currency, sales down 5.9% Driven by weaker demand in the heavy industries sector and industrial aftermarket, partially offset by the benefit of acquisitions Organically, sales were down 9.4% • Decrease in adjusted EBIT driven by the impact of lower volume and currency, partially offset by lower raw material costs and SG&A expenses (1) See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. 1Q YOY Sales Walk 2016 Full-Year Outlook Acquisitions +3% 1Q-15 Organic Currency Acquisitions 1Q-16 $(9) $12 $329 $301 $(31) Currency -2% Organic down ~5% Sales: Down ~4%

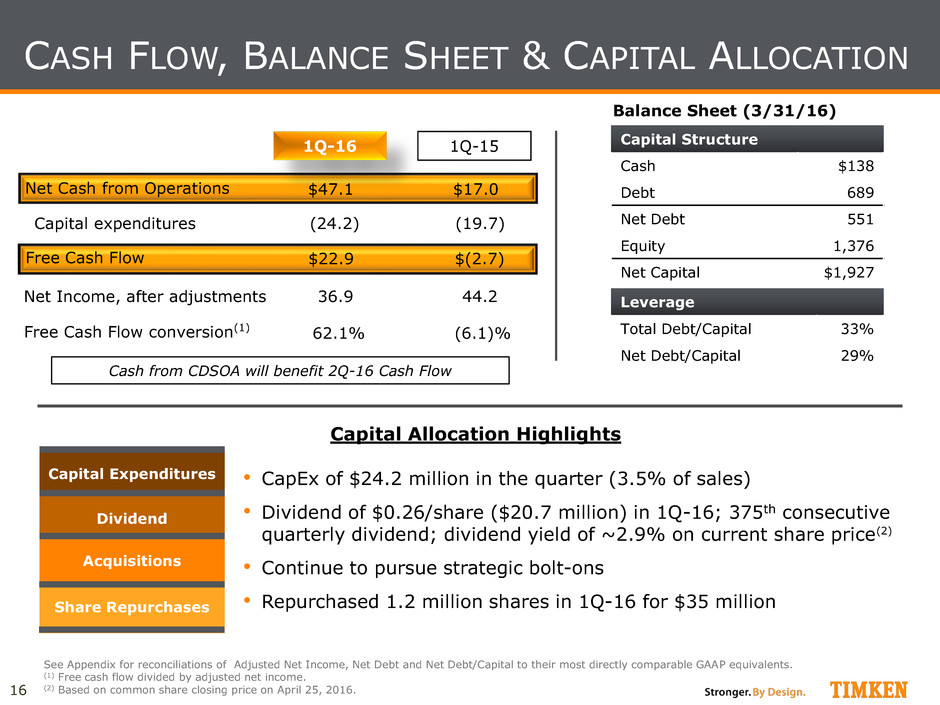

16 Capital Expenditures Dividend Share Repurchases Acquisitions Capital Structure Cash $138 Debt 689 Net Debt 551 Equity 1,376 Net Capital $1,927 Leverage Total Debt/Capital 33% Net Debt/Capital 29% ($M) Balance Sheet (3/31/16) See Appendix for reconciliations of Adjusted Net Income, Net Debt and Net Debt/Capital to their most directly comparable GAAP equivalents. (1) Free cash flow divided by adjusted net income. (2) Based on common share closing price on April 25, 2016. CASH FLOW, BALANCE SHEET & CAPITAL ALLOCATION • CapEx of $24.2 million in the quarter (3.5% of sales) • Dividend of $0.26/share ($20.7 million) in 1Q-16; 375th consecutive quarterly dividend; dividend yield of ~2.9% on current share price(2) • Continue to pursue strategic bolt-ons • Repurchased 1.2 million shares in 1Q-16 for $35 million Capital Allocation Highlights $47.1 $17.0 Net Cash from Operations (19.7) (24.2) Capital expenditures 1Q-16 1Q-15 $22.9 $(2.7) Free Cash Flow 44.2 36.9 Net Income, after adjustments 62.1% (6.1)% Free Cash Flow conversion(1) Cash from CDSOA will benefit 2Q-16 Cash Flow

17 2016 FULL-YEAR OUTLOOK (1) Free cash flow divided by adjusted net income. Free cash flow is defined as net cash provided by operating activities (includes pension contributions) minus capital expenditures. Adjusted net income excludes pension settlement charges, restructuring charges and CDSOA income. Net Sales (vs. 2015) Organic Acquisitions (net) Currency Mobile Industries -6% +2% -2% Down ~6% Process Industries -5% +3% -2% Down ~4% Timken -6% +3% -2% Down ~5% Earnings Per Share (EPS) - GAAP $1.65 - $1.75 Includes (expense) / income, after-tax: - Restructuring charges $(0.30) - Pension settlement charges (non-cash) $(0.30) - CDSOA income, net of related expenses $0.35 Adjusted EPS - excluding unusual items $1.90 - $2.00 Free Cash Flow (FCF) >$210M FCF Conversion(1) >135% • Sales down ~5% Decline driven primarily by weakness across most market sectors offset partially by growth in automotive and wind, and the net benefit of acquisitions Negative impact from currency of ~2% • GAAP EPS estimate of $1.65- $1.75 per diluted share • Adjusted EPS estimate of $1.90- $2.00 per diluted share excluding unusual items • Free Cash Flow >$210 million CapEx of 4.5% of sales

Appendix

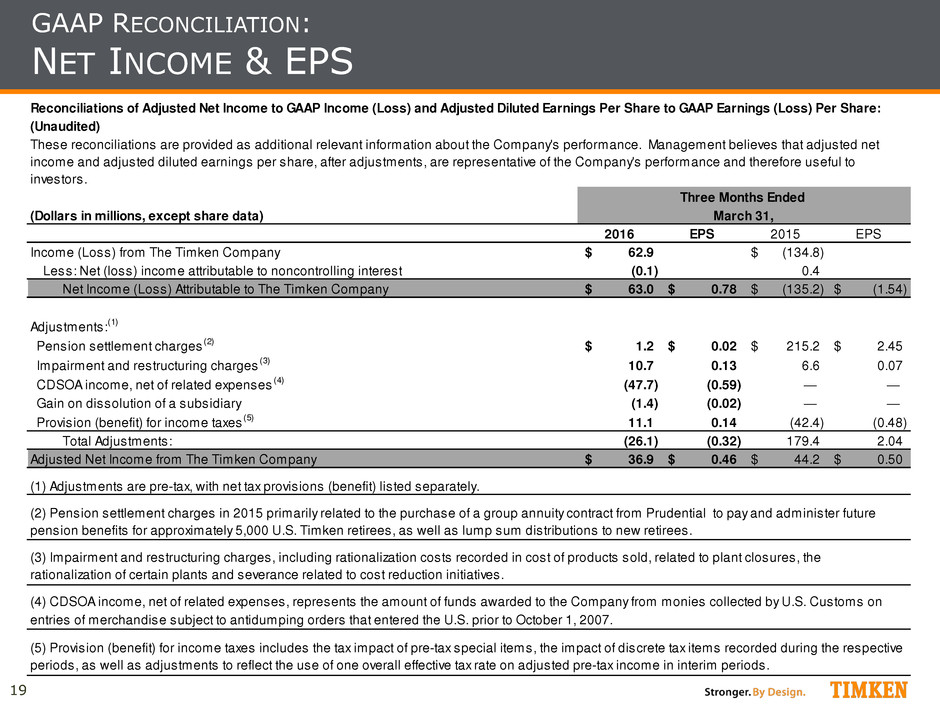

19 GAAP RECONCILIATION: NET INCOME & EPS (Unaudited) (Dollars in millions, except share data) 2016 EPS 2015 EPS Income (Loss) from The Timken Company 62.9$ (134.8)$ Less: Net (loss) income attributable to noncontrolling interest (0.1) 0.4 Net Income (Loss) Attributable to The Timken Company 63.0$ 0.78$ (135.2)$ (1.54)$ Adjustments: (1) Pension settlement charges (2) 1.2$ 0.02$ 215.2$ 2.45$ Impairment and restructuring charges (3) 10.7 0.13 6.6 0.07 CDSOA income, net of related expenses (4) (47.7) (0.59) — — Gain on dissolution of a subsidiary (1.4) (0.02) — — Provision (benefit) for income taxes (5) 11.1 0.14 (42.4) (0.48) Total Adjustments: (26.1) (0.32) 179.4 2.04 Adjusted Net Income from The Timken Company 36.9$ 0.46$ 44.2$ 0.50$ (5) Provision (benefit) for income taxes includes the tax impact of pre-tax special items, the impact of discrete tax items recorded during the respective periods, as well as adjustments to reflect the use of one overall effective tax rate on adjusted pre-tax income in interim periods. Reconciliations of Adjusted Net Income to GAAP Income (Loss) and Adjusted Diluted Earnings Per Share to GAAP Earnings (Loss) Per Share: These reconciliations are provided as additional relevant information about the Company's performance. Management believes that adjusted net income and adjusted diluted earnings per share, after adjustments, are representative of the Company's performance and therefore useful to investors. Three Months Ended March 31, (2) Pension settlement charges in 2015 primarily related to the purchase of a group annuity contract from Prudential to pay and administer future pension benefits for approximately 5,000 U.S. Timken retirees, as well as lump sum distributions to new retirees. (3) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants and severance related to cost reduction initiatives. (4) CDSOA income, net of related expenses, represents the amount of funds awarded to the Company from monies collected by U.S. Customs on entries of merchandise subject to antidumping orders that entered the U.S. prior to October 1, 2007. (1) Adjustments are pre-tax, with net tax provisions (benefit) listed separately.

20 GAAP RECONCILIATION: CONSOLIDATED EBIT & EBIT MARGIN Adjustments, to Net Income (Loss): (Unaudited) (Dollars in millions, except share data) 2016 Percentage to Net Sales 2015 Percentage to Net Sales Net Income (Loss) 62.9$ 9.2 % (134.8)$ (18.7)% Provision (benefits) for income taxes 27.6 4.0 % (21.3) (2.9)% Interest expense 8.4 1.2 % 8.0 1.1 % Interest income (0.3) —% (0.7) (0.1)% Consolidated earnings (loss) before interest and taxes (EBIT) 98.6$ 14.4 % (148.8)$ (20.6)% Adjustments: Pension settlement charges (1) 1.2$ —% 215.2$ 29.8 % Impairment and restructuring charges (2) 10.7 1.6 % 6.6 0.9 % CDSOA income, net of related expenses (3) (47.7) (7.0)% — —% Gain on dissolution of a subsidiary (1.4) —% — —% Total Adjustments (37.2) (5.4)% 221.8 30.7 % Consolidated earnings before interest and taxes (EBIT), after adjustments 61.4$ 9.0 % 73.0$ 10.1 % (3) CDSOA income, net of related expenses, represents the amount of funds awarded to the Company from monies collected by U.S. Customs on entries of merchandise subject to antidumping orders that entered the U.S. prior to October 1, 2007. Reconciliation of EBIT to GAAP Net Income (Loss), and EBIT Margin, After Adjustments, to Net Income (Loss) as a Percentage of Sales and EBIT, After March 31, Three Months Ended The following reconciliation is provided as additional relevant information about the Company's performance. Management believes consolidated earnings (loss) before interest and taxes (EBIT) is representative of the Company's performance and that it is appropriate to compare GAAP net income (loss) to consolidated EBIT. Management also believes that EBIT and EBIT margin, after adjustments, are representative of the Company's core operations and therefore useful to investors. (1) Pension settlement charges in 2015 primarily related to the purchase of a group annuity contract from Prudential to pay and administer future pension benefits for approximately 5,000 U.S. Timken retirees, as well as lump sum distributions to new retirees. (2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants and severance related to cost reduction initiatives.

21 GAAP RECONCILIATION: NET DEBT AND FREE CASH FLOW (Dollars in millions) March 31, 2016 December 31, 2015 Short-term debt, including current portion of long-term debt 15.3$ 77.1$ Long-term debt 673.4 579.4 Total Debt 688.7$ 656.5$ Less: Cash, cash equivalents and restricted cash (137.5) (129.8) Net Debt 551.2$ 526.7$ Total equity 1,375.6$ 1,344.6$ Ratio of Total Debt to Capital 33.4% 32.8% Ratio of Net Debt to Capital 28.6% 28.1% (Unaudited) (Dollars in millions) 2016 2015 Net cash provided by operating activities 47.1$ 17.0$ Less: capital expenditures (24.2) (19.7) Free cash flow 22.9$ (2.7)$ Three Months Ended March 31, Reconciliation of Total Debt to Net Debt and the Ratio of Net Debt to Capital to the Ratio of Total Debt to Capital: (Unaudited) These reconciliations are provided as additional relevant information about the Company's financial position. Capital, used for the ratio of total debt to capital, is defined as total debt plus total shareholders' equity. Capital, used for the ratio of net debt to capital, is defined as total debt less cash, cash equivalents and restricted cash plus total shareholders' equity. Management believes Net Debt and the Ratio of Net Debt to Capital are important measures of the Company's financial position, due to the amount of cash and cash equivalents. Reconciliation of Free Cash Flow to GAAP Net Cash Provided by Operating Activities: Management believes that free cash flow is useful to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of its business strategy.

22 GAAP RECONCILIATION: SEGMENT EBIT & EBIT MARGIN (Unaudited) Mobile Industries (Dollars in millions) Three Months Ended March 31, 2016 Percentage to Net Sales Three Months Ended March 31, 2015 Percentage to Net Sales Earnings before interest and taxes (EBIT) 30.2$ 7.9 % 35.4$ 9.0% Impairment and restructuring charges (1) 7.1 1.9 % 1.0 0.3% Gain on dissolution of a subsidiary (1.4) (0.4)% - —% Earnings before interest and taxes (EBIT), after adjustments 35.9$ 9.4 % 36.4$ 9.3% Process Industries (Dollars in millions) Three Months Ended March 31, 2016 Percentage to Net Sales Three Months Ended March 31, 2015 Percentage to Net Sales Earnings before interest and taxes (EBIT) $ 32.6 10.8 % 45.2$ 13.7% Impairment and restructuring charges (1) 3.6 1.2 % 5.6 1.7% Earnings before interest and taxes (EBIT), after adjustments 36.2$ 12.0 % 50.8$ 15.4% Reconciliation of segment EBIT Margin, After Adjustments, to segment EBIT as a Percentage of Sales and segment EBIT, After Adjustments, The following reconciliation is provided as additional relevant information about the Company's Mobile Industries and Process Industries segment performance. Management believes that segment EBIT and EBIT margin, after adjustments, are representative of the segment's core operations and therefore useful to investors. (1) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants and severance related to cost reduction initiatives.