Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-k033116earningsfinal.htm |

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991march312016.htm |

04.27.2016 SANTANDER CONSUMER USA HOLDINGS INC. First Quarter 2016

2 IMPORTANT INFORMATION Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimates,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q fi led by us with the SEC. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are: (a) we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business; (b) our ability to remediate any material weaknesses in internal controls over financial reporting completely and in a timely manner; (c) adverse economic conditions in the United States and worldwide may negatively impact our results; (d) our business could suffer if our access to funding is reduced; (e) we face significant risks implementing our growth strategy, some of which are outside our control; (f) we may incur unexpected costs and delays in connection with exiting our personal lending portfolio; (g) our agreement with FCA US LLC may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (h) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (i) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (j) loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; (k) we are subject to certain regulations, including oversight by the Office of the Comptroller of the Currency, the CFPB, the European Central Bank, and the Federal Reserve, which oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (l) future changes in our relationship with Santander could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

3 1Q16 HIGHLIGHTS » Net income of $201 million, or $0.56 per diluted common share » Adjusted net income1 of $213 million, or $0.59 per diluted common share, excluding impairment of intangible assets » Net interest income of $1.3 billion, up 11% YoY » ROA of 2.2% » Total auto originations of $6.8 billion, seasonally up 14% vs. prior quarter and down 8% vs. prior year first quarter » Underwriting standards remain disciplined in a competitive environment leading to a decline in market share vs. Q1 2015 » Expense ratio of 2.3%; adjusted expense ratio1 of 2.2% excluding impairment on intangible assets » Consistent access to the capital markets, as evidenced by the execution of two securitizations totaling $1.6 billion » Personal lending asset sale of $869 million; additional sales of $860 million through existing auto loan sale programs » Retail installment contract ("RIC") net charge-off ratio of 8.2%; year-over-year increase driven by mix shift, slower portfolio growth, lower recovery rates and less benefit from bankruptcy sales » Serviced for others portfolio of $14.2 billion, up 27% YoY » CET1 ratio of 12.0%, up 190 basis points vs. prior year first quarter 1 Adjusted items includes a $20.3mm intangible impairment (recognized in other operating expenses); pre-tax figure. Adjusted net income and expense ratio are non-GAAP measures; reconciliation in Appendix Drive shareholder value by executing on our strategy of expanding the vehicle finance platform, focusing on the serviced for others portfolio, and diversifying funding with a strong capital, while remaining disciplined in a competitive environment.

4 ECONOMIC INDICATORS U.S. Auto Sales1 ($ Mill ions) 1 St. Louis Fed Research 2 University of Michigan 3 Bloomberg 4 Bureau of Labor Statistics Consumer Confidence2 (Index Q1 1966=100) U.S. GDP3 (SA, YOY%) U.S. Unemployment Rate4 (SA, %) 16.5 Max 18.1 Min 9.0 Mar'06 Mar'07 Mar'08 Mar'09 Mar'10 Mar'11 Mar'12 Mar'13 Mar'14 Mar'15 Mar'16 [VALUE] Max 10.0 Min 4.4 Mar'06 Mar'07 Mar'08 Mar'09 Mar'10 Mar'11 Mar'12 Mar'13 Mar'14 Mar'15 Mar'16 [VALUE] Max 98.1 Min 55.3 Mar'06 Mar'07 Mar'08 Mar'09 Mar'10 Mar'11 Mar'12 Mar'13 Mar'14 Mar'15 Mar'16 O R IG IN A TI O N S C R ED IT 1.4 Max 3.2 Min -4.1 Dec'06 Dec'07 Dec'08 Dec'09 Dec'10 Dec'11 Dec'12 Dec'13 Dec'14 Dec'15

5 49% Min [VALUE] Max [VALUE] Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 AUTO INDUSTRY ANALYSIS Manheim Used Vehicle Index1 1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels 2 Includes all auto-related recoveries including inorganic/purchased receivables 3 Standard & Poor’s Rating Services (ABS Auto Trust Data – two-month lag on data) SC Recovery Rates2 Industry Net Loss Rates3 (Nonprime) Industry + Day Delinquency Rates3 (Nonprime) [VALUE] Max [VALUE] Min [VALUE] Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 SE V ER IT Y C R ED IT Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Min 2.8% 7.4% Max 13.3% Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Max 5.4% Min 1.6% 4.6%

6 FOCUSED BUSINESS MODEL Realize full value of Chrysler Capital and other core auto (direct and indirect) Full-spectrum auto lender Substantial dealer network throughout the United States Vehicle Finance Highly scalable and capital-efficient serviced for others platform Opportunity for organic and inorganic growth Originations, acquisitions and/or conversions of more than $136 billion of assets since 2008 Serviced for Others Diverse and stable funding sources Strong capital base Funding and Liquidity Leveraging compliance and technology is integral to the three pillars of our focused business model

7 ($ in Millions) Q1 2015 Q1 2016 YoY % Variance Total Core Retail Auto 3,066 2,614 (15%) Chrysler Capital Loans (<640)1 1,349 1,242 (8%) Chrysler Capital Loans (≥640)1 1,181 1,307 11% Total Chrysler Capital Retail 2,530 2,549 1% Total Leases2 1,186 1,619 2% Total Facilitated for an Affiliate 404 - - Total Auto Originations 7,186 6,782 (6%) Total Personal Lending 166 - - Total Originations 7,352 6,782 (8%) Asset Sales 1,480 1,729 17% Serviced for Others Portfolio 11,221 14,235 27% Average Managed Assets 44,782 53,152 19% DISCIPLINED LOAN UNDERWRITING CONTINUES IN 2016 1 Approximate FICO score 2 Includes $56 million and $2 million in Capital Leases, respectively. Year-over-year increase in total leases of 2% includes $404 million in leases facilitated for others Average managed assets and serviced for others portfolio continue to demonstrate strong growth . Growth in leasing and prime offset by lower volumes and capture rates in core nonprime originations.

8 3% 3% 3% 4% 4% 14% 15% 15% 12% 14% 20% 17% 14% 12% 15% 23% 25% 22% 20% 22% 13% 13% 12% 12% 13% 28% 27% 33% 39% 32% 1Q15 2Q15 3Q15 4Q15 1Q16 Originations by Credit (RIC only) ($ in mill ions) >640 600-639 540-599 <540 No FICO Commercial RECENT TRENDS EXHIBIT HIGHER CREDIT QUALITY 46% 50% 55% 61% 51% 54% 50% 45% 39% 49% 1Q15 2Q15 3Q15 4Q15 1Q16 Originations by New/Used (RIC only) ($ in mill ions) Used New $5,596 $5,694 $4,929 $5,162 $5,894 $5,596 $5,694 $4,929 $5,162 $5,894 1 Loans to commercial borrowers; no FICO score obtained 1 RICs <600 FICO have declined YoY Consistent with disciplined pricing strategy and track record of leveraging performance and data into new originations YoY increase in loans >600 FICO driven by growth in FCA relationship Year-over-year increase in originations of new vehicles related to growth in FCA relationship Consistent with slight growth in average loan balance Average loan balance $20,675 $21,316 $22,165 $23,721 $21,745

9 FCA had record 2015 sales of more than 2 million units YTD 2016 sales of 550,000 units Consistent sales growth since the start of FCA’s relationship with SC in 2009 March 2016 penetration rate of 27% Accomplishments and Improvements SC continues to be the largest provider in prime and nonprime for FCA FCA and SC’s relationship provides a unique offering for nonprime consumers in comparison to other original equipment manufacturers (“OEMs”) Incremental success in dealer VIP pilot program; looking for opportunities to grow The VIP program is leading to an increase in application views without impacting underwriting standards Recent opportunities in lease have led to increased originations Continued refinement of off-lease processes as SC anticipates incremental off-lease volume due to launch of Chrysler Capital three years ago CHRYSLER CAPITAL 1.1 1.4 1.7 1.8 2.1 2.2 0.6 2010 2011 2012 2013 2014 2015 YTD 2016 Chrysler Sales (units in millions) 1 1 FCA filings; total sales SC continues to work strategically and collaboratively with FIAT Chrysler (“FCA”) to continue to strengthen the relationship and create value within the Chrysler Capital program.

10 Flow Programs 1,384 1,385 1,137 919 995 1,348 1,081 860 CCART 1,028 768 788 Residual Sales 1,710 Leased Vehicles 369 561 756 Other 18 253(877)2 Capital-efficient, higher-ROE strategy continues to generate incremental returns, and will contribute more meaningfully to ROA as we continue to grow over time Scalability of our IT platform and operations allow us to efficiently execute serviced for others growth SERVICED FOR OTHERS PLATFORM Composition at 3/31/2016 RIC 72 % Leases 21 % RV/Marine 7 % Total 100 % 1 Runoff includes principal paid or charged-off from 3/31/2014 to 3/31/2016 2 On October 1, 2014, the Company transferred $877 million of dealer loans serviced for others to SHUSA 1 - 6,223 7,976 10,407 10,667 12,147 14,919 17,977 19,846 6,471 6,223 1,753 2,431 260 1,480 2,772 3,058 1,869 860 14,235 - 5,000 10,000 15,000 20,000 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Runoff Ending Balance ($ in mill ions)

11 Three Months Ended (Unaudited, Dollars in Thousands, except per share) March 31, 2016 December 31, 2015 March 31, 2015 QoQ % Variance YoY % Variance Interest on finance receivables and loans $ 1,341,763 $ 1,365,262 $ 1,230,002 (2%) 9% Net leased vehicle income 111,013 88,817 59,882 25% 85% Other finance and interest income 3,912 (5,251) 7,341 NM (47%) Interest expense 184,735 157,893 148,856 17% 24% Net finance and other interest income 1,271,953 1,290,935 1,148,369 (1%) 11% Provision for credit losses 706,574 902,526 674,687 (22%) 5% Profit sharing 11,394 10,649 13,516 7% (16%) Total other income (loss) 72,678 (96,649) 147,183 NM (51%) Total operating expenses 309,841 252,346 245,379 23% 26% Income before tax 316,822 28,765 361,970 NM (12%) Income tax expense 116,129 16,627 115,688 NM NM Net income $ 200,693 $ 12,138 $ 246,282 NM (19%) Diluted EPS ($) $ 0.56 $ 0.03 $ 0.69 NM (19%) Adjust: Intangible impairment $ 0.03 - - Adjusted EPS2 ($) $ 0.59 $ 0.03 $ 0.69 NM (14%) Total assets 37,904,607 36,570,373 34,653,809 3% 9% Average managed assets 53,152,491 52,485,567 44,782,142 1% 19% Q1 2016 FINANCIAL RESULTS Adjustment (before tax) Total operating expenses $ 309,841 Deduct: Intangible impairment1 (20,300) Adjusted total operating expenses $ 289,541 1 Intangible impairment recognized in Other operating expenses 2 Adjusted EPS is a non-GAAP measure; reconciliation in Appendix NM= Not Meaningful

12 Q1 2016 EXCLUDING PERSONAL LENDING 1 Additional details can be found in Appendix Three Months Ended (Unaudited, Dollars in Thousands) March 31, 2016 December 31, 2015 March 31, 2015 QoQ $ QoQ % YoY $ YoY % Interest on finance receivables and loans $ 1,244,095 $ 1,249,910 $ 1,118,046 $ (5,815) (0%) $ 126,049 11% Net leased vehicle income 111,013 88,817 59,882 22,196 25% 51,131 85% Other finance and interest income 3,912 (5,251) 7,341 9,163 (175%) (3,429) (47%) Interest expense 172,252 142,299 134,715 29,953 21% 37,537 28% Net finance and other interest income 1,186,768 1,191,177 1,050,554 (4,409) (0%) 136,214 13% Provis ion for credit losses 706,574 902,526 576,984 (195,952) (22%) 129,590 22% Profi t sharing 9,685 10,649 7,156 (964) (9%) 2,529 35% Investment gains , net 2,602 6,663 21,247 (4,594) (69%) (19,178) (90%) Servicing fee income 44,494 42,357 24,803 2,137 5% 19,691 79% Fees, commissions and other 47,382 39,047 48,444 8,335 21% (1,062) (2%) Total other income $ 94,478 $ 88,067 $ 94,494 $ 5,878 7% $ (549) (1%) Assets $ 36,971,369 $ 34,712,830 $ 32,679,805 $ 2,258,539 7% $ 4,291,564 13%

13 TOTAL OTHER INCOME SC’s strategy is to price loans sold under flow agreements close to par, with minimal investment gains, to generate further growth in the serviced for others platform and drive increased fee income In Q3 2015, SC designated the personal lending portfolio as held for sale and released any allowance associated with the portfolio; any lower of cost or market (“LOCM”) impact related to personal lending in the third quarter was recognized through provision for credit losses In Q4 2015 and Q1 2016, net investment gains (losses) include the impact of personal lending assets Customer defaults, as part of LOCM adjustments on the personal lending portfolio designated as held for sale, are recognized through net investment gains (losses) Seasonal balances will impact magnitude of LOCM adjustments; this quarter included lower LOCM adjustments driven by seasonal declines in the personal lending portfolio Denotes quarters with CCART sales 1 Q4 2015 includes $123 million in customer default activity and $109 million related to market discount on the personal lending portfolio designated as held for sale; Q1 2016 includes $101 million in customer default activity offset by $33 million in benefit from change in market discount on the personal lending portfolio designated as held for sale 2 Fees, commissions and other includes fee income from the personal lending and auto portfolios Three Months Ended (Unaudited, Dollars in Thousands) ($ in thousands) March 31, 2015 June 30, 2015 September 30, 2015 December 31, 2015 March 31, 2016 Reported Total Other Income (Loss) $ 147,183 $ 208,978 $ 130,553 $ (96,649) $ 72,678 Reported Investment Gains (Losses), Net 21,247 86,667 1,567 (225,608) (73,151) Add back: Personal Lending LOCM Adjustments1 - - - 232,271 68,338 Other - - 6,000 8,226 6,451 Normalized Investment Gains, Net 21,247 86,667 7,567 14,889 1,638 Servicing Fee Income 24,803 28,043 35,910 42,357 44,494 Fees, Commissions, and Other2 101,133 94,268 93,076 86,602 101,335 Normalized Total Other Income $ 147,183 $ 208,978 $ 136,553 $ 143,848 $ 147,467

14 ASSET QUALITY: PROVISION AND RESERVES $675 $616 $772 $903 $707 11.5% 12.0% 11.5% 12.3% 12.4% 10.00% 10.50% 11.00% 11.50% 12.00% 12.50% 13.00% 13.50% 14.00% $- $200 $400 $600 $800 $1,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Provision Expense and Allowance Ratio ($ in millions) Provision for credit losses Al lowance ratio 3,317 3,441 151 88 27 8 ([VALUE]) Q4 2015 New Volume TDR Migration Qualitative Reserve & Other Performance Deterioration Liquidat ions Q1 2016 Q4 2015 to Q1 2016 ALLL Reserve Walk ($ in millions) Allowance to loans ratio increased slightly to 12.4% QoQ Provision for credit loss increased year over year primarily driven by mix shift, portfolio aging and lower recoveries which increased net losses for the quarter QoQ allowance increase of $124 million Driven by new volume, TDR migration (additional allowance coverage required for loans now classified as TDR) offset by liquidations

15 CREDIT QUALITY: LOSS AND DELINQUENCY 14.6 % 12.4 % 16.0 % 17.3 % 16.8 % 6.1 % 4.5 % 8.8 % 9.6 % 8.2 % [VALUE]1 [VALUE]1 45 % 45 % 51 % —% 10 % 20 % 30 % 40 % 50 % 60 % 70 % —% 2.0 % 4.0 % 6.0 % 8.0 % 10.0 % 12.0 % 14.0 % 16.0 % 18.0 % 20.0 % Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Credit: Individually Acquired Retail Installment Contracts, Held for Investment Gross Charge- off Ratio Net Charge-off Ratio Recovery Rate 6.7 % 7.7 % 8.1 % 9.1 % 6.9 % 2.9 % 3.3 % 3.8 % 4.4 % 3.1 % —% 2.0 % 4.0 % 6.0 % 8.0 % 10.0 % Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Delinquency: Individually Acquired Retail Installment Contracts, Held for Investment 31-60 61+ Delinquencies consistent with seasonal trends Marginally higher year-over-year Year-over-year gross loss increase driven by mix shift and slower portfolio growth Gross losses increased 220 basis points Net losses also affected by lower recovery rates than in prior year first quarter Recovery rates in Q1 2015 and Q2 2015 benefitted by proceeds from large bankruptcy sales 1 Excluding bankruptcy sales, recovery rates would have been 55% and 56%, respectively

16 CREDIT QUALITY: LOSS DETAIL 384 582 112 53 26 7 Q1 2015 Portfolio Growth, Aging and Mix Shift Recovery Rates Bankruptcy Sales Other Q1 2016 Q1 2015 to Q1 2016 Net Charge-Off Walk ($ in millions) Overall increase is primarily due to a combination of portfolio growth, portfolio aging and mix shift Industry-wide softening of recovery rates also impacting losses Also, larger bankruptcy and deficiency asset sales occurred in Q1 2015, leading to higher recoveries in that time period

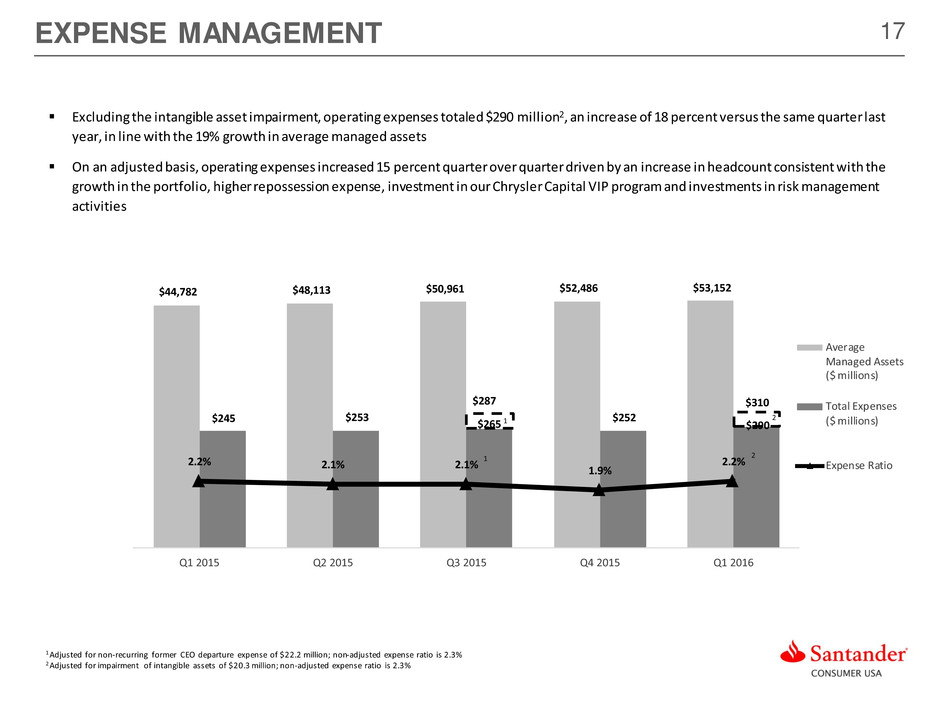

17 $44,782 $48,113 $50,961 $52,486 $53,152 $245 $253 $265 $252 $290 2.2% 2.1% 2.1% 1.9% 2.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% $2 $20 $200 $2,000 $20,000 $200,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Average Managed Assets ($ millions) Total Expenses ($ millions) Expense Ratio 1 2 $287 1 $310 2 EXPENSE MANAGEMENT 1 Adjusted for non-recurring former CEO departure expense of $22.2 million; non-adjusted expense ratio is 2.3% 2 Adjusted for impairment of intangible assets of $20.3 million; non-adjusted expense ratio is 2.3% Excluding the intangible asset impairment, operating expenses totaled $290 million2, an increase of 18 percent versus the same quarter last year, in line with the 19% growth in average managed assets On an adjusted basis, operating expenses increased 15 percent quarter over quarter driven by an increase in headcount consistent with the growth in the portfolio, higher repossession expense, investment in our Chrysler Capital VIP program and investments in risk management activities

18 FUNDING AND LIQUIDITY Total committed liquidity of $35.9 billion at end of Q1 2016 12.7 12.6 Q4 2015 Q1 2016 Asset-Backed Securities ($ Bil l ions) Private Financings ($ Bill ions) Banco Santander & Subsidiaries ($ Bil l ions) Asset Sales ($ Bill ions) Q1 2016: Issued and sold total of $1.6 billion, including: SDART: $1 bil l ion issued (~600 Wtd. Avg. FICO) DRIVE: $639 mill ion issued (~550 Wtd. Avg. FICO) 2.6 2.8 2.2 2.0 Q4 2015 Q1 2016 Used Unused 4.8 4.8 $4.8 billion in total commitment 42% unused capacity at Q1 2016 Q4 2015 included a CCART transaction of $788 million Q1 2016 included $869 million in personal loans 1.9 1.7 Q4 2015 Q1 2016 8.2 7.8 Q4 2015 Q1 2016 6.9 8.4 3.3 2.3 Q4 2015 Q1 2016 Unused Used Amortizing Revolving 10.2 10.7 $18.5 billion in commitments from 13 lenders 22% unused capacity at Q1 2016

19 CONSISTENT CAPITAL GENERATION 1 Common Equity Tier 1 (CET1) Capital Ratio begins with stockholders’ equity and then adjusts for AOCI, goodwill/intangibles, DTAs, cash flow hedges and other regulatory exclusions over risk- weighted assets; Non-GAAP measure. 2 “Tangible common equity to tangible assets" is defined as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets, excluding Goodwill and intangible assets; Non- GAAP measure, reconciliation in Appendix 10 .1 % 11 .0 % 11 .4 % 11 .1 % 1 2 .0 % 10 .8 % 11 .6 % 11 .9 % 11 .8 % 11 .9 % Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 CET1 TCE/TA1 2 Tangible Assets ($ millions) 34,526 36,019 35,943 36,443 37,797 SC has exhibited a strong ability to generate earnings and capital, while growing assets.

APPENDIX

21 CREDIT PROFILES Retail Installment Contracts1 1Held for investment; excludes assets held for sale 3. 3% 9. 8% 24 .4 % 2 9 .8 % 17 .9 % 14 .8 % 3. 6% 1 1 .1 % 24 .7 % 3 0. 6% 17 .5 % 12 .5 % 3. 9% 12 .2 % 23 .8 % 3 0. 4% 17 .1 % 12 .6 % 4. 0% 12 .4 % 23 .4 % 3 0 .9 % 17 .3 % 12 .0 % 4. 2% 12 .6 % 2 3 .2 % 3 1 .0 % 1 7 .1 % 11 .9 % Commercial Unknown <540 540-599 600-639 >=640 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016

22 Q1 2016 EXCLUDING PERSONAL LENDING DETAIL As of and for the Three Months Ended ($ in Thousands) March 31, 2016 December 31, 2015 March 31, 2015 As Reported Personal Lending Excluding Personal Lending As Reported Personal Lending Excluding Personal Lending As Reported Personal Lending Excluding Personal Lending Interest on finance receivables and loans $ 1,341,763 $ 97,668 $ 1,244,095 $ 1,365,262 $ 115,352 $ 1,249,910 $ 1,230,002 $ 111,956 $ 1,118,046 Net leased vehicle income 111,013 - 111,013 88,817 - 88,817 59,882 - 59,882 Other finance and interest income 3,912 - 3,912 (5,251) - (5,251) 7,341 - 7,341 Interest expense 184,735 12,483 172,252 157,893 15,594 142,299 148,856 14,141 134,715 Net finance and other interest income 1,271,953 85,185 1,186,768 1,290,935 99,758 1,191,177 1,148,369 97,815 1,050,554 Provision for credit losses 706,574 - 706,574 902,526 - 902,526 674,687 97,703 576,984 Profit sharing 11,394 1,709 9,685 10,649 - 10,649 13,516 6,360 7,156 Investment gains , net (73,151) (75,753) 2,602 (225,608) (232,271) 6,663 21,247 - 21,247 Servicing fee income 44,494 - 44,494 42,357 - 42,357 24,803 - 24,803 Fees, commissions and other 101,335 53,953 47,382 86,602 47,555 39,047 101,133 52,689 48,444 Total other income $ 72,678 $ (21,800) $ 94,478 $ (96,649) $ (184,716) $ 88,067 $ 147,183 $ 52,689 $ 94,494 Assets $ 37,904,607 $ 933,238 $ 36,971,369 $ 36,570,373 $ 1,857,543 $ 34,712,830 $ 34,653,809 $ 1,974,004 $ 32,679,805

23 SANTANDER CONSUMER USA HOLDINGS INC. 1 As of March 31, 2016 2 DDFS LLC is an entity owned by former Chairman and Chief Executive Officer, Tom Dundon. This purchase would result in SHUSA o wning approximately 68.7% of SC. 3 Chrysler Capital or CCAP is dba Santander Consumer USA • Santander Consumer USA Holdings Inc. (NYSE:SC) ("SC") is approximately 58.9%1 owned by Santander Holdings USA, Inc. (“SHUSA”), a wholly-owned subsidiary of Banco Santander, S.A. (NYSE:SAN) • On July 3, 2015, SHUSA elected to exercise its right to purchase all of the shares of SC common stock owned by DDFS LLC, subject to regulatory approval and applicable law2 ▪ SC is a full-service, technology-driven consumer finance company focused on vehicle finance, third-party servicing and providing superior customer service • Historically focused on nonprime markets; established presence in prime and lease ▪ Approximately 5,400 full-time, 500 part-time and 1,000 vendor-based employees across multiple locations in the U.S. and the Caribbean ▪ Our strategy is to leverage our efficient, scalable technology and risk infrastructure and data to underwrite, originate and service profitable assets while treating employees, customers and all stakeholders in a simple, personal and fair manner ▪ Unparalleled compliance and responsible practices focus ▪ Continuously optimizing the mix of assets retained vs. assets sold and serviced for others ▪ Presence in prime markets through Chrysler Capital (“CCAP”)3 ▪ Efficient funding through key third-party relationships, secondary markets and Santander Overview Strategy

24 COMPANY ORGANIZATION Other Subsidiaries 100% Ownership Santander Holdings USA, Inc. (“SHUSA’) 58.9% Ownership Santander Consumer USA Holdings Inc. ("SC") Santander Bank, N.A. Other Subsidiaries 9.8% Ownership (11.5% Beneficial Ownership)1 DDFS LLC2 and Tom Dundon 0.1% Ownership (0.5% Beneficial Ownership)1 31.2% Ownership Other Management Public Shareholders Banco Santander, S.A. Spain **Ownership percentages are approximates as of March 31, 2016 1 Beneficial ownership includes options currently exercisable or exercisable within 60 days of March 31, 2016 2 On July 3, 2015, SHUSA elected to exercise the right to purchase shares of SC common stock owned by DDFS LLC, an entity owned by former Chairman and Chief Executive Officer, Thomas Dundon, subject to regulatory approval and applicable law. This purchase would result in SHUSA owning approximately 68.7% of SC.

25 CONSOLIDATED BALANCE SHEETS (Unaudited, dollars in thousands, except per share amounts) March 31, 2016 December 31, 2015 Assets Cash and cash equivalents $ 42,047 $ 18,893 Finance receivables held for sale, net 2,324,190 2,868,603 Finance receivables held for investment, net 24,082,180 23,479,680 Restricted cash 2,636,216 2,236,329 Accrued interest receivable 369,656 405,464 Leased vehicles, net 7,298,521 6,516,030 Furniture and equipment, net 61,543 58,007 Federal, state and other income taxes receivable 260,687 267,686 Related party taxes receivable 85 — Goodwill 74,056 74,056 Intangible assets, net 33,915 53,316 Due from affiliates 65,062 42,665 Other assets 656,449 549,644 Total assets $ 37,904,607 $ 36,570,373 Liabilities and Equity Liabilities: Notes payable — credit facilities $ 8,389,269 $ 6,902,779 Notes payable — secured structured financings 20,340,959 20,872,900 Notes payable — related party 2,775,000 2,600,000 Accrued interest payable 25,632 22,544 Accounts payable and accrued expenses 374,843 413,269 Federal, state and other income taxes payable 3,088 2,449 Deferred tax liabilities, net 994,024 908,252 Related party taxes payable — 342 Due to affiliates 180,560 145,013 Other liabilities 231,685 277,862 Total liabilities $ 33,315,060 $ 32,145,410 Equity: Common stock, $0.01 par value 3,580 3,579 Additional paid-in capital 1,567,936 1,565,856 Accumulated other comprehensive income (loss), net (36,065) 2,125 Retained earnings 3,054,096 2,853,403 Total stockholders’ equity 4,589,547 4,424,963 Total liabilities and equity $ 37,904,607 $ 36,570,373

26 QUARTERLY CONSOLIDATED INCOME STATEMENTS For the Three Months Ended (Unaudited, dollars in thousands, except per share amounts) March 31, 2016 December 31, 2015 March 31, 2015 Interest on finance receivables and loans $ 1,341,763 $ 1,365,262 $ 1,230,002 Leased vehicle income 329,792 295,109 231,616 Other finance and interest income 3,912 (5,251) 7,341 Total finance and other interest income 1,675,467 1,655,120 1,468,959 Interest expense 184,735 157,893 148,856 Leased vehicle expense 218,779 206,292 171,734 Net finance and other interest income 1,271,953 1,290,935 1,148,369 Provision for credit losses 706,574 902,526 674,687 Net finance and other interest income after provision for credit losses 565,379 388,409 473,682 Profit sharing 11,394 10,649 13,516 Net finance and other interest income after provision for credit losses and profit sharing 553,985 377,760 460,166 Investment gains (losses), net (73,151) (225,608) 21,247 Servicing fee income 44,494 42,357 24,803 Fees, commissions, and other 101,335 86,602 101,133 Total other income (loss) 72,678 (96,649) 147,183 Compensation expense 119,842 108,458 100,540 Repossession expense 73,545 66,456 58,826 Other operating costs 116,454 77,432 86,013 Total operating expenses 309,841 252,346 245,379 Income before income taxes 316,822 28,765 361,970 Income tax expense 116,129 16,627 115,688 Net income $ 200,693 $ 12,138 $ 246,282 Net income per common share (basic) $ 0.56 $ 0.03 $ 0.70 Net income per common share (diluted) $ 0.56 $ 0.03 $ 0.69 Weighted average common shares (basic) 357,974,890 357,927,012 349,421,960 Weighted average common shares (diluted) 360,228,272 361,970,082 356,654,466

27 Three Months Ended March 31, 2016 Total operating expenses $ 309,841 Deduct: Impairment on intangible assets 20,300 Adjusted total operating expenses $ 289,541 Average managed assets $ 53,152,491 Expense ratio 2.3% Adjusted expense ratio 2.2% Net income $ 200,693 Add back: Impairment on intangible assets (net of tax) 12,726 Adjusted net income $ 213,419 Weighted average common shares (diluted) 360,228,272 Net income per common share $ 0.56 Adjusted net income per common share $ 0.59 RECONCILIATION OF NON-GAAP MEASURES March 31, 2016 December 31, 2015 September 30, 2015 June 30, 2015 March 31, 2015 Total equity $ 4,589,547 $ 4,424,963 $ 4,412,705 $ 4,314,588 $ 3,842,836 Deduct: Goodwill and intangibles 107,971 127,372 127,766 127,698 127,646 Tangible common equity $ 4,481,576 $ 4,297,591 $ 4,284,939 $ 4,186,890 $ 3,715,190 Total assets $ 37,904,607 $ 36,570,373 $ 36,071,025 $ 36,146,294 $ 34,653,809 Deduct: Goodwill and intangibles 107,971 127,372 127,766 127,698 127,646 Tangible assets $ 37,796,636 $ 36,443,001 $ 35,943,259 $ 36,018,596 $ 34,526,163 Equity to assets ratio 12.1 % 12.1 % 12.2 % 11.9 % 11.1 % Tangible common equity to tangible assets 11.9 % 11.8 % 11.9 % 11.6 % 10.8 %