Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PACIFIC CONTINENTAL CORP | d186618d8k.htm |

| EX-99.1 - EX-99.1 - PACIFIC CONTINENTAL CORP | d186618dex991.htm |

Pacific Continental Corporation to Acquire Foundation Bancorp, Inc. Pacific Continental Corporation (NASDAQ: PCBK) Roger S. Busse President and Chief Executive Officer Investor Presentation April 26, 2016 Foundation Bancorp, Inc. (OTC Pink: FDNB) Duane C. Woods Vice Chairman and Interim Chief Executive Officer Expanding PCBK’s presence in the attractive Seattle metropolitan area Exhibit 99.2

Forward-Looking Statement This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). Such forward-looking statements include but are not limited to statements about the benefits of the business combination transaction involving Pacific Continental Corporation and Foundation Bancorp, Inc., including future financial and operating results, the combined company’s plans, objectives, market share, expectations and intentions, expectations regarding the timing of the closing of the transaction and its impact on Pacific Continental’s earnings, expectations regarding pro forma combined assets, loans and deposits and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Pacific Continental Corporation and Foundation Bancorp, Inc. operate; the ability to promptly and effectively integrate the businesses of Pacific Continental and Foundation Bancorp, Inc.; the reaction to the transaction of the companies’ customers, employees, and counterparties; and the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Pacific Continental Corporation undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this presentation. This statement is included for the express purpose of invoking PSLRA's safe harbor provisions.

Merger Rationale Financially attractive combination – effective use of capital will enhance returns and shareholder value Meaningfully accretive to EPS – double-digit EPS accretion when cost savings fully phased-in Attractive business banking franchise in the Seattle metropolitan area with $422.4 million in assets Foundation is one of the few independently-owned business banking franchises in the Seattle-Tacoma-Bellevue MSA PCBK allocating capital to the Seattle market – attractive geography given the growth prospects and economic trends Recognized as one of the best economies in the country, which presents important opportunities for a business banking franchise Provides PCBK with an enhanced platform in the Seattle metropolitan area Pro forma will have $561.9 million of deposits and $443.8 million of loans in the Seattle metropolitan area Larger size in Seattle will help PCBK attract and retain talented bankers Foundation’s key relationship bankers expected to be retained Meaningful cost savings opportunities, including branch consolidation – estimated cost savings in excess of 40.0% Enhances PCBK’s scarcity value as a bank with pro forma assets of $2.4 billion which is located in 3 of the Pacific Northwest’s largest metropolitan markets of Eugene, Portland and Seattle Well positioned for continued growth Supports PCBK’s strategic goal for quality organic growth and acquisitions Source: SNL Financial, PCBK earnings release and Foundation earnings release, as of 3/31/2016

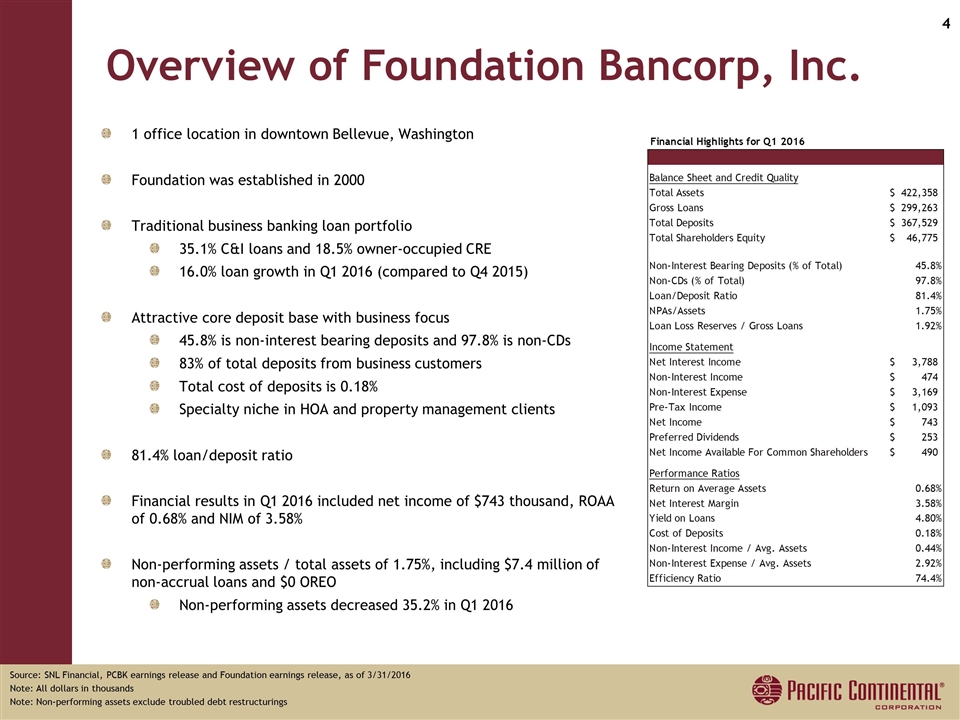

Overview of Foundation Bancorp, Inc. 1 office location in downtown Bellevue, Washington Foundation was established in 2000 Traditional business banking loan portfolio 35.1% C&I loans and 18.5% owner-occupied CRE 16.0% loan growth in Q1 2016 (compared to Q4 2015) Attractive core deposit base with business focus 45.8% is non-interest bearing deposits and 97.8% is non-CDs 83% of total deposits from business customers Total cost of deposits is 0.18% Specialty niche in HOA and property management clients 81.4% loan/deposit ratio Financial results in Q1 2016 included net income of $743 thousand, ROAA of 0.68% and NIM of 3.58% Non-performing assets / total assets of 1.75%, including $7.4 million of non-accrual loans and $0 OREO Non-performing assets decreased 35.2% in Q1 2016 Source: SNL Financial, PCBK earnings release and Foundation earnings release, as of 3/31/2016 Note: All dollars in thousands Note: Non-performing assets exclude troubled debt restructurings

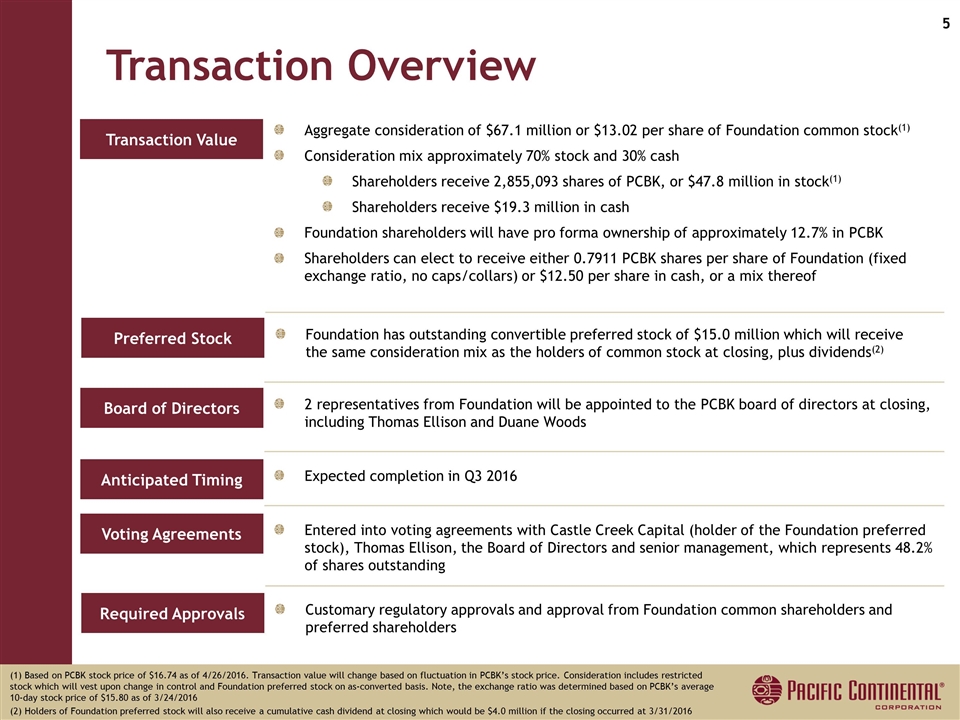

Transaction Overview Transaction Value Aggregate consideration of $67.1 million or $13.02 per share of Foundation common stock(1) Consideration mix approximately 70% stock and 30% cash Shareholders receive 2,855,093 shares of PCBK, or $47.8 million in stock(1) Shareholders receive $19.3 million in cash Foundation shareholders will have pro forma ownership of approximately 12.7% in PCBK Shareholders can elect to receive either 0.7911 PCBK shares per share of Foundation (fixed exchange ratio, no caps/collars) or $12.50 per share in cash, or a mix thereof Anticipated Timing Expected completion in Q3 2016 Required Approvals Customary regulatory approvals and approval from Foundation common shareholders and preferred shareholders Board of Directors 2 representatives from Foundation will be appointed to the PCBK board of directors at closing, including Thomas Ellison and Duane Woods (1) Based on PCBK stock price of $16.74 as of 4/26/2016. Transaction value will change based on fluctuation in PCBK’s stock price. Consideration includes restricted stock which will vest upon change in control and Foundation preferred stock on as-converted basis. Note, the exchange ratio was determined based on PCBK’s average 10-day stock price of $15.80 as of 3/24/2016 (2) Holders of Foundation preferred stock will also receive a cumulative cash dividend at closing which would be $4.0 million if the closing occurred at 3/31/2016 Preferred Stock Foundation has outstanding convertible preferred stock of $15.0 million which will receive the same consideration mix as the holders of common stock at closing, plus dividends(2) Voting Agreements Entered into voting agreements with Castle Creek Capital (holder of the Foundation preferred stock), Thomas Ellison, the Board of Directors and senior management, which represents 48.2% of shares outstanding

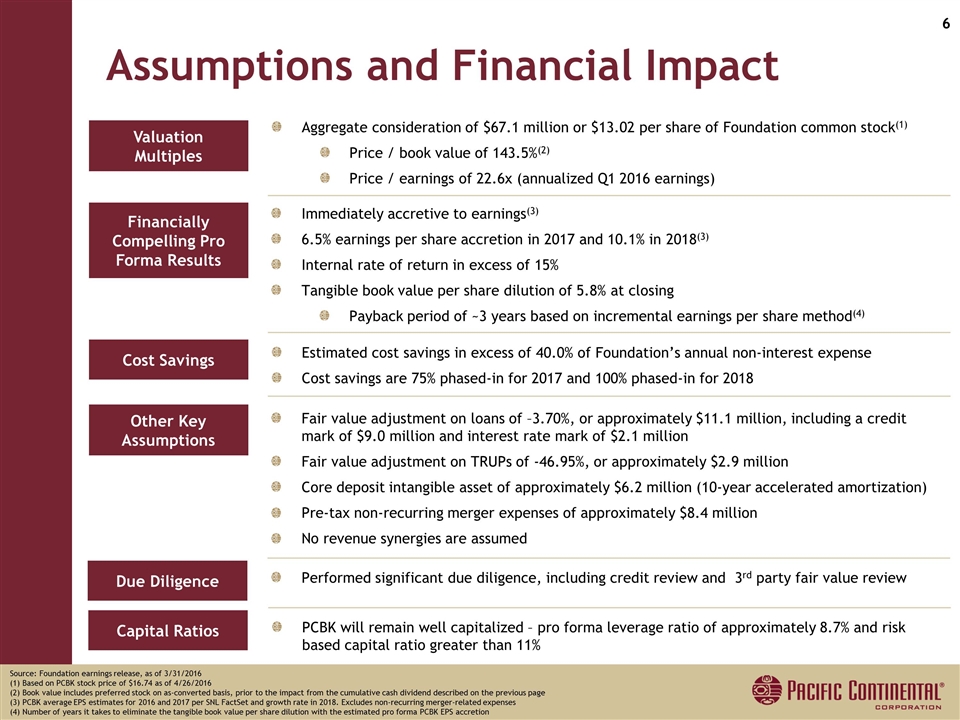

Assumptions and Financial Impact Valuation Multiples Aggregate consideration of $67.1 million or $13.02 per share of Foundation common stock(1) Price / book value of 143.5%(2) Price / earnings of 22.6x (annualized Q1 2016 earnings) Financially Compelling Pro Forma Results Immediately accretive to earnings(3) 6.5% earnings per share accretion in 2017 and 10.1% in 2018(3) Internal rate of return in excess of 15% Tangible book value per share dilution of 5.8% at closing Payback period of ~3 years based on incremental earnings per share method(4) Source: Foundation earnings release, as of 3/31/2016 (1) Based on PCBK stock price of $16.74 as of 4/26/2016 (2) Book value includes preferred stock on as-converted basis, prior to the impact from the cumulative cash dividend described on the previous page (3) PCBK average EPS estimates for 2016 and 2017 per SNL FactSet and growth rate in 2018. Excludes non‐recurring merger-related expenses (4) Number of years it takes to eliminate the tangible book value per share dilution with the estimated pro forma PCBK EPS accretion Cost Savings Estimated cost savings in excess of 40.0% of Foundation’s annual non-interest expense Cost savings are 75% phased-in for 2017 and 100% phased-in for 2018 Other Key Assumptions Fair value adjustment on loans of –3.70%, or approximately $11.1 million, including a credit mark of $9.0 million and interest rate mark of $2.1 million Fair value adjustment on TRUPs of -46.95%, or approximately $2.9 million Core deposit intangible asset of approximately $6.2 million (10-year accelerated amortization) Pre-tax non-recurring merger expenses of approximately $8.4 million No revenue synergies are assumed Performed significant due diligence, including credit review and 3rd party fair value review Due Diligence PCBK will remain well capitalized – pro forma leverage ratio of approximately 8.7% and risk based capital ratio greater than 11% Capital Ratios

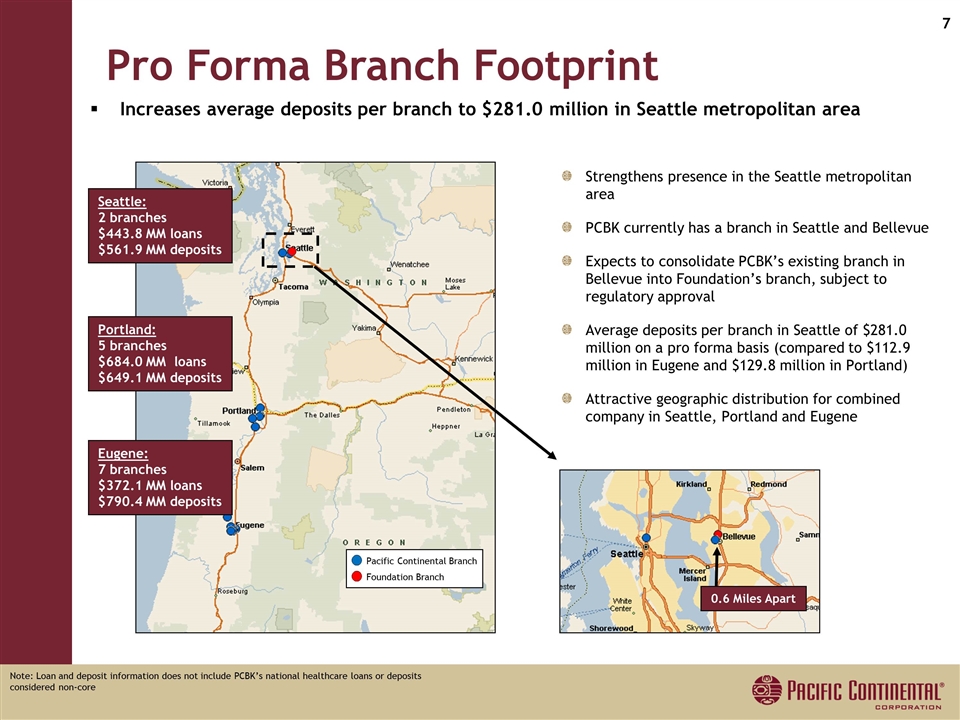

Pro Forma Branch Footprint Pacific Continental Branch Foundation Branch Strengthens presence in the Seattle metropolitan area PCBK currently has a branch in Seattle and Bellevue Expects to consolidate PCBK’s existing branch in Bellevue into Foundation’s branch, subject to regulatory approval Average deposits per branch in Seattle of $281.0 million on a pro forma basis (compared to $112.9 million in Eugene and $129.8 million in Portland) Attractive geographic distribution for combined company in Seattle, Portland and Eugene Note: Loan and deposit information does not include PCBK’s national healthcare loans or deposits considered non-core Seattle: 2 branches $443.8 MM loans $561.9 MM deposits Portland: 5 branches $684.0 MM loans $649.1 MM deposits Eugene: 7 branches $372.1 MM loans $790.4 MM deposits 0.6 Miles Apart Increases average deposits per branch to $281.0 million in Seattle metropolitan area

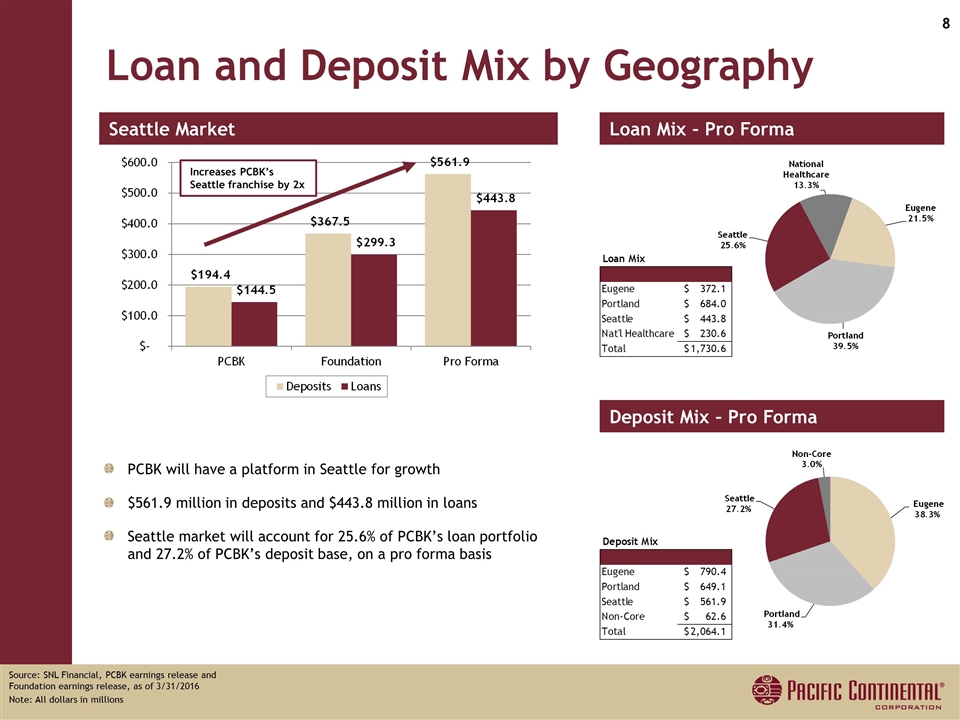

Loan and Deposit Mix by Geography Seattle Market Loan Mix – Pro Forma Deposit Mix – Pro Forma Source: SNL Financial, PCBK earnings release and Foundation earnings release, as of 3/31/2016 Note: All dollars in millions PCBK will have a platform in Seattle for growth $561.9 million in deposits and $443.8 million in loans Seattle market will account for 25.6% of PCBK’s loan portfolio and 27.2% of PCBK’s deposit base, on a pro forma basis Increases PCBK’s Seattle franchise by 2x

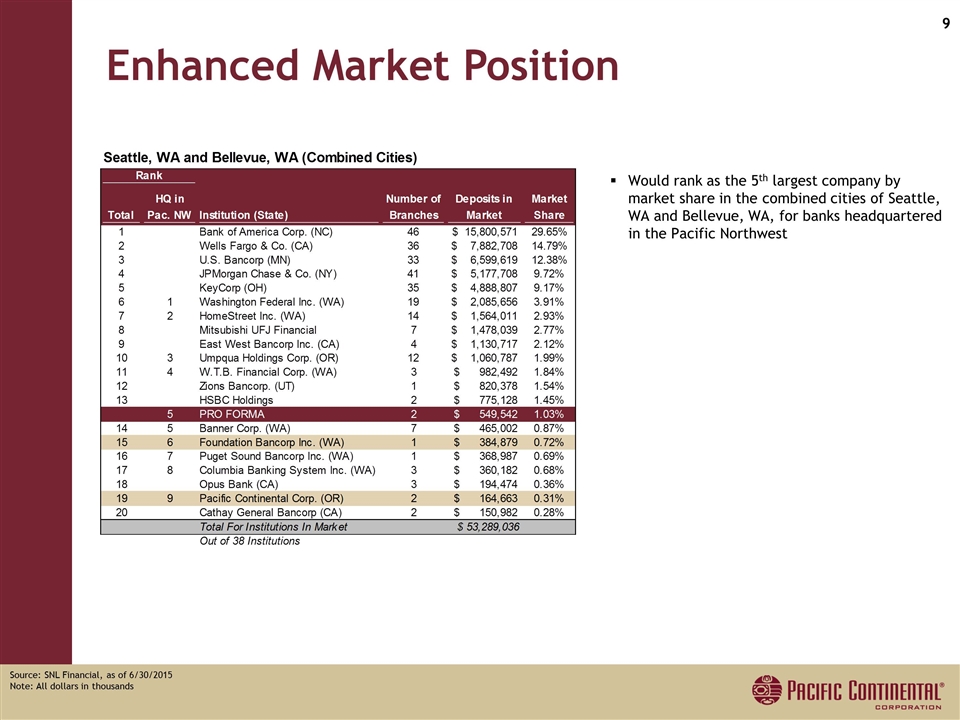

Enhanced Market Position Would rank as the 5th largest company by market share in the combined cities of Seattle, WA and Bellevue, WA, for banks headquartered in the Pacific Northwest Source: SNL Financial, as of 6/30/2015 Note: All dollars in thousands

Attractive Economic Profile of Seattle Job Growth Thriving local economy with job growth in technology and aerospace Seattle ranked 4th among major U.S. cities for job growth in 2015 by adding 78,082 jobs. Three of the five most demanded jobs are in tech, particularly software engineering(1,2) Economic Profile 10 companies on the Fortune 500 list headquartered in Seattle-Tacoma-Bellevue MSA, including Amazon, Costco, Microsoft and Starbucks The Seattle-Tacoma-Bellevue MSA ranked 11th largest in the country by GDP in 2014, increasing 16.8% since 2010(3) Real median household income in Seattle was $71,273 in 2014, 16.1% higher than the Washington State average and 38.8% above the national average(4) Seattle had the highest income growth for households in the 95th percentile during 2013 – median income grew 15% to $278,084(5) Demographic Trends Seattle was the 3rd fastest growing city among the top-50 U.S. cities with 2.3% population growth in 2014. Bellevue population grew at 1.8%(6) 57% of adult residents in Seattle have a bachelor’s degree or higher, nearly 2.0x the national average(7) 37.2% of Seattle residents are between ages 25 and 44(4) Source: Puget Sound Business Journal Source: MYNorthwest News Source: U.S. Census Bureau Source: Bureau of Economic Analysis Brookings Institution Source: The Seattle Times Source: Seattle Economic Development Council

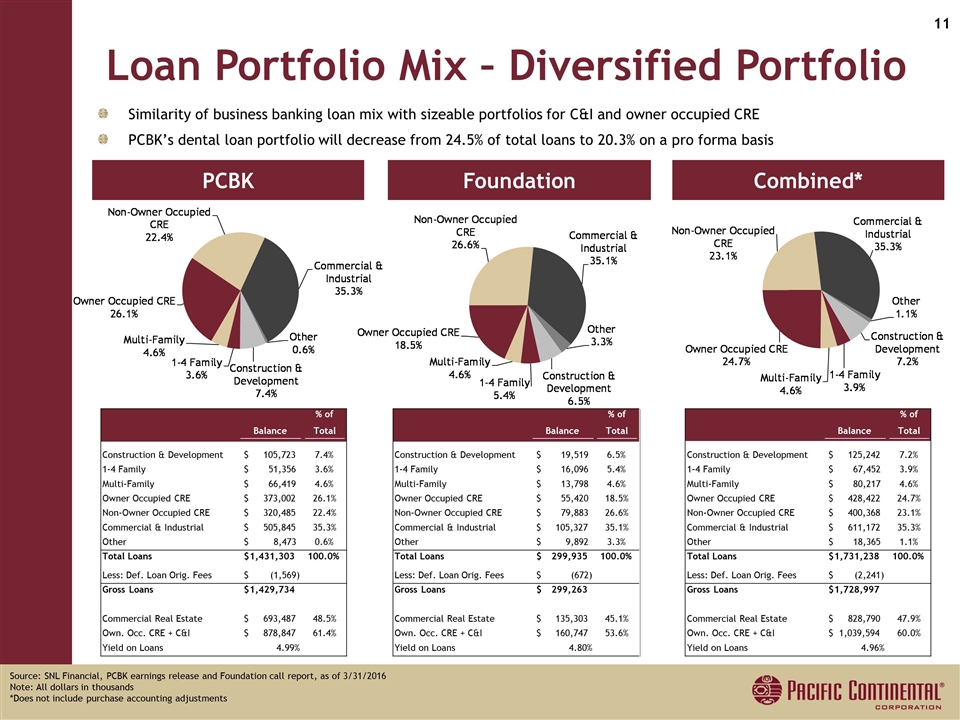

Loan Portfolio Mix – Diversified Portfolio PCBK Foundation Combined* Source: SNL Financial, PCBK earnings release and Foundation call report, as of 3/31/2016 Note: All dollars in thousands *Does not include purchase accounting adjustments Similarity of business banking loan mix with sizeable portfolios for C&I and owner occupied CRE PCBK’s dental loan portfolio will decrease from 24.5% of total loans to 20.3% on a pro forma basis Balance % of Total Balance % of Total Balance % of Total Construction & Development 105,723 $ 7.4% Construction & Development 19,519 $ 6.5% Construction & Development 125,242 $ 7.2% 1-4 Family 51,356 $ 3.6% 1-4 Family 16,096 $ 5.4% 1-4 Family 67,452 $ 3.9% Multi-Family 66,419 $ 4.6% Multi-Family 13,798 $ 4.6% Multi-Family 80,217 $ 4.6% Owner Occupied CRE 373,002 $ 26.1% Owner Occupied CRE 55,420 $ 18.5% Owner Occupied CRE 428,422 $ 24.7% Non-Owner Occupied CRE 320,485 $ 22.4% Non-Owner Occupied CRE 79,883 $ 26.6% Non-Owner Occupied CRE 400,368 $ 23.1% Commercial & Industrial 505,845 $ 35.3% Commercial & Industrial 105,327 $ 35.1% Commercial & Industrial 611,172 $ 35.3% Other 8,473 $ 0.6% Other 9,892 $ 3.3% Other 18,365 $ 1.1% Total Loans 1,431,303 $ 100.0% Total Loans 299,935 $ 100.0% Total Loans 1,731,238 $ 100.0% Less: Def. Loan Orig. Fees (1,569) $ Less: Def. Loan Orig. Fees (672) $ Less: Def. Loan Orig. Fees (2,241) $ Gross Loans 1,429,734 $ Gross Loans 299,263 $ Gross Loans 1,728,997 $ Commercial Real Estate 693,487 $ 48.5% Commercial Real Estate 135,303 $ 45.1% Commercial Real Estate 828,790 $ 47.9% Own. Occ. CRE + C&I 878,847 $ 61.4% Own. Occ. CRE + C&I 160,747 $ 53.6% Own. Occ. CRE + C&I 1,039,594 $ 60.0% Yield on Loans 4.99% Yield on Loans 4.80% Yield on Loans 4.96%

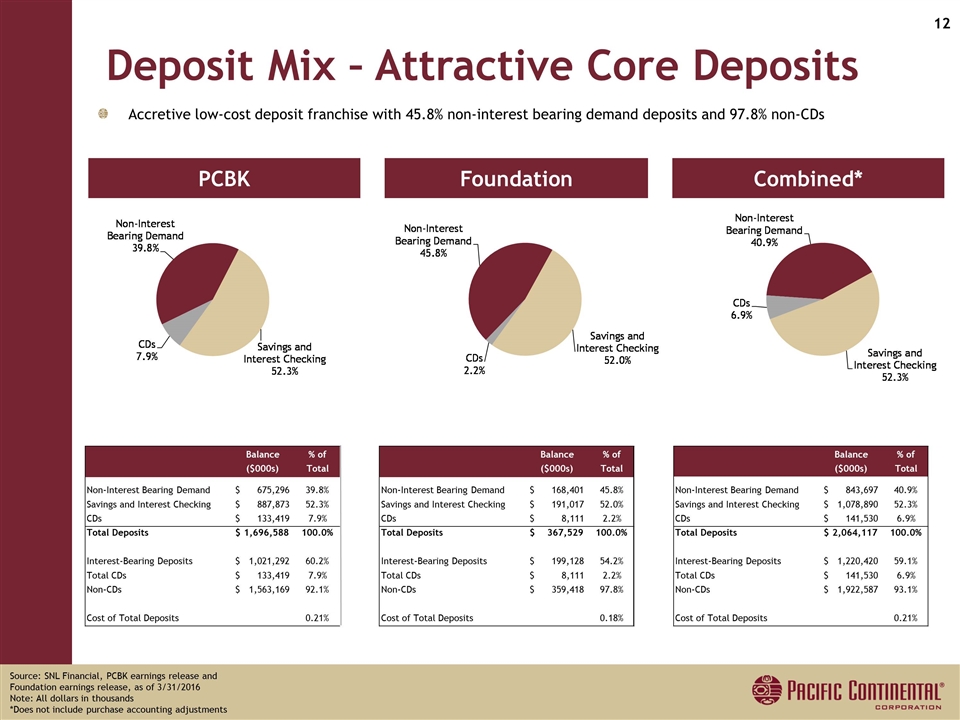

Deposit Mix – Attractive Core Deposits PCBK Foundation Combined* Source: SNL Financial, PCBK earnings release and Foundation earnings release, as of 3/31/2016 Note: All dollars in thousands *Does not include purchase accounting adjustments Accretive low-cost deposit franchise with 45.8% non-interest bearing demand deposits and 97.8% non-CDs Balance ($000s) % of Total Balance ($000s) % of Total Balance ($000s) % of Total Non-Interest Bearing Demand 675,296 $ 39.8% Non-Interest Bearing Demand 168,401 $ 45.8% Non-Interest Bearing Demand 843,697 $ 40.9% Savings and Interest Checking 887,873 $ 52.3% Savings and Interest Checking 191,017 $ 52.0% Savings and Interest Checking 1,078,890 $ 52.3% CDs 133,419 $ 7.9% CDs 8,111 $ 2.2% CDs 141,530 $ 6.9% Total Deposits 1,696,588 $ 100.0% Total Deposits 367,529 $ 100.0% Total Deposits 2,064,117 $ 100.0% Interest-Bearing Deposits 1,021,292 $ 60.2% Interest-Bearing Deposits 199,128 $ 54.2% Interest-Bearing Deposits 1,220,420 $ 59.1% Total CDs 133,419 $ 7.9% Total CDs 8,111 $ 2.2% Total CDs 141,530 $ 6.9% Non-CDs 1,563,169 $ 92.1% Non-CDs 359,418 $ 97.8% Non-CDs 1,922,587 $ 93.1% Cost of Total Deposits 0.21% Cost of Total Deposits 0.18% Cost of Total Deposits 0.21%

Concluding Thoughts Financially attractive combination – effective use of capital will enhance returns and shareholder value Allocating capital to Seattle, which is an attractive market due to demographic and economic trends Seattle has been a “priority” for PCBK’s strategic focus – this represents the ideal opportunity and timing for expanding PCBK’s franchise in this market Significant scarcity value for a business banking franchise in Seattle PCBK management knows the bank and management team and has followed the company for years The pro forma company will be well-positioned for continued growth in the Seattle marketplace PCBK has successful track record for merger integration, most recently with Capital Pacific Bank in Portland, OR