Attached files

| file | filename |

|---|---|

| EX-31.01 - EXHIBIT 31.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex31011231201510-ka.htm |

| EX-31.02 - EXHIBIT 31.02 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex31021231201510-ka.htm |

| EX-31.03 - EXHIBIT 31.03 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex31031231201510-ka.htm |

| EX-32.01 - EXHIBIT 32.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex32011231201510-ka.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1 to Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

BERMUDA | 98-0438382 | |

(State or other jurisdiction of incorporation and organization) | (IRS Employer Identification No.) | |

O'Hara House, 3 Bermudiana Road, Hamilton, Bermuda | HM 08 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: +1 441 296-1431

Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(b) of the Act: | ||

CLASS A COMMON STOCK, $0.08 PAR VALUE | NASDAQ Global Select Market, Prague Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

UNIT WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK | None | |

15.0% FIXED RATE NOTES DUE 2017 | None | |

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the securities Act. Yes £ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” or “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ | Accelerated filer T | Non-accelerated filer £ | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes £ No T

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2015 (based on the closing price of US$ 2.18 of the registrant's Class A Common Stock, as reported by the NASDAQ Global Select Market on June 30, 2015) was US$ 160.9 million.

Number of shares of Class A Common Stock outstanding as of April 22, 2016: 135,899,778

EXPLANATORY NOTE

This is Amendment No. 1 to the Annual Report on Form 10-K for the year ended December 31, 2015 of Central European Media Enterprises Ltd., as originally filed on February 22, 2016 (the “Form 10-K”). We are filing this Amendment No. 1 to amend Part III of our Form 10-K to include information that we previously intended to incorporate by reference to the proxy statement for our 2016 annual general meeting of shareholders. This Amendment No. 1 does not update information contained in the Form 10-K to reflect facts or events that may have occurred subsequent to the filing of the Form 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Form 10-K.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

AMENDMENT NO. 1 TO FORM 10-K

For the year ended December 31, 2015

TABLE OF CONTENTS

Page | ||||

Part III | ||||

Part IV | ||||

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors are elected to serve until the next annual general meeting of shareholders or until their successors are elected or appointed.

Directors

John K. Billock, 67, has served as a Director and as our Chairman of the Board since April 15, 2014. Mr. Billock is a member of the Board of Advisors of Simulmedia, Inc. He served as a Director of TRA Inc. and TiVo Research and Analytics, Inc. from 2007 to 2011 and as a Director of Juniper Content Corporation from January 2007 to December 2008. From October 2001 until July 2005, he was Vice Chairman and Chief Operating Officer of Time Warner Cable Enterprises LLC. Before joining Time Warner Cable, Mr. Billock was with Home Box Office from 1978 to 2001 and served as President of its US Network Group from 1997 to 2001 and President of Sales and Marketing from 1995 to 1997. Before joining HBO, Mr. Billock was a product manager with Colgate Palmolive Company. Mr. Billock received a BA degree in English and Religion from Wesleyan University and an MBA from Boston University. Mr. Billock brings to our Board experience from his many years in the media industry as well as extensive executive management experience.

Paul T. Cappuccio, 54, has served as a Director since October 2009. Mr. Cappuccio has been Executive Vice President and General Counsel of Time Warner Inc. since January 2001, in which capacity he oversees the worldwide management of Time Warner Inc.'s legal functions, collaborating with all of its operating businesses. From August 1999 until January 2001, Mr. Cappuccio was Senior Vice President and General Counsel at America Online. Before joining AOL, Mr. Cappuccio was a partner at the Washington, D.C. office of Kirkland & Ellis, one of the world's premier litigation and transactional law firms, where he specialized in telecommunications law, appellate litigation and negotiation with government agencies. From 1991 until 1993, Mr. Cappuccio was Associate Deputy Attorney General at the United States Department of Justice, where he advised Attorney General William P. Barr on matters relating to judicial selection, civil litigation, antitrust and civil rights. Prior to his service at the Justice Department, Mr. Cappuccio served as a law clerk at the Supreme Court of the United States and as a law clerk to Judge Alex Kozinski of the United States Court of Appeals for the Ninth Circuit in Pasadena, California. He is a 1986 graduate of Harvard Law School and a 1983 graduate of Georgetown University. Mr. Cappuccio, as general counsel of a global media company, brings significant large public company experience to our Board, including transactional and corporate governance expertise.

Charles R. Frank, Jr., 78, served as a Director from 2001 until July 2009 and from March 2010 to the present. From July 2009 through February 2010, Mr. Frank served as interim Chief Financial Officer of the Company. From 1997 to 2001, Mr. Frank was First Vice President and twice acting President of the European Bank for Reconstruction and Development, which makes debt and equity investments in Central and Eastern Europe and the former Soviet Union. From 1988 to 1997, Mr. Frank was a Managing Director of the Structured Finance Group at GE Capital and a Vice President of GE Capital Services. Mr. Frank served as Chief Executive Officer of Frank and Company from 1987 to 1988, and Vice President of Salomon Brothers from 1978 until 1987. Mr. Frank has held senior academic and government positions, including Deputy Assistant Secretary of State and Chief Economist at the U.S. Department of State, Senior Fellow at the Brookings Institution, Professor of Economics and International Affairs at Princeton University, and Assistant Professor of Economics at Yale University. Mr. Frank graduated from Rensselaer Polytechnic Institute with a B.S. in mathematics and economics before completing a Ph.D. in economics at Princeton University. Mr. Frank brings to the Board 38 years’ experience in the financial services industry, including 19 years relating to Central and Eastern Europe, as well as notable senior management experience.

Iris Knobloch, 53, has served as a Director since April 15, 2014. She has served as President of Warner Bros. France S.A. since 2006, in which capacity she oversees all of Warner Bros.’ business in France, including theatrical production and distribution, television distribution, home video, games, consumer products, online and emerging distribution technologies as well as Warner Bros.’ Home Entertainment business in the Benelux. She is also an independent director of Accor S.A., where she serves on the Audit Committee. From 2001 to 2006, she served as Senior Vice President of International Relations of Time Warner Inc. From 1996 to 2001, Ms. Knobloch was Vice President of Business and Legal Affairs for Warner Home Video’s European management team in London, Los Angeles and Paris. Prior to that, Ms. Knobloch practiced law with Norr, Stiefenhofer & Lutz and O’Melveny & Myers, where she provided strategic counsel on international transactions to major U.S. and European media and entertainment clients. Ms. Knobloch received a J.D. degree from Ludwig-Maxmilians-Universitaet in Munich, Germany in 1987 and L.L.M. degree from New York University in 1992. Ms. Knobloch brings to our Board deep understanding of the media industry, particularly in Europe, as well as significant executive management experience.

Alfred W. Langer, 65, has served as a Director since 2000. Mr. Langer currently serves as a consultant to a number of privately held companies, primarily in Germany, in the areas of mergers and acquisitions, structured financing and organizational matters. From July 2001 until June 2002, Mr. Langer served as Chief Financial Officer of Solvadis AG, a German based chemical distribution and trading company. From October 1999 until May 2001, Mr. Langer served as Treasurer of Celanese AG, a German listed chemical company. From June 1997 until October 1999, Mr. Langer served as Chief Financial Officer of Celanese Corp., a U.S. chemical company. From October 1994 until July 1997, Mr. Langer served as Chief Executive Officer of Hoechst Trevira GmbH, a producer of synthetic fibers. From 1988 until September 1994, Mr. Langer served as a member of the Board of Management of Hoechst Holland N.V., a regional production and distribution company. Mr. Langer received an M.B.A. degree from the University GH Siegen. Mr. Langer brings to our Board and Board committees substantial financial and financial reporting expertise.

4

Bruce Maggin, 73, has served as a Director since 2002. Mr. Maggin has served, since its inception, as Managing Partner and Principal of the H.A.M Media Group, LLC, an international investment and advisory firm he founded in 1997 that specializes in the entertainment and communications industries. Until 2009, he also served as Executive Vice President and Secretary of Media and Entertainment Holdings, Inc. and was a Director of the company from 2005 until 2007. From 1999 to 2002, Mr. Maggin served as Chief Executive Officer of TDN Media, Inc., a joint venture between Thomson Multimedia, NBC Television and Gemstar-TV Guide International that sold advertising on proprietary interactive television platforms. Prior to that, Mr. Maggin had a long career with Capital Cities/ABC serving in a variety of financial and operational roles culminating as Head of the Multimedia Group, one of the company’s five operating divisions. He also represented Capital Cities/ABC on the Board of Directors of several companies, including ESPN, Lifetime Cable Television and In-Store Advertising, among others. From 1987 until 2015, Mr. Maggin served as a Director of PVH Corp. and for 18 years was Chairman of its Audit Committee. Mr. Maggin is a member of the Board of Trustees of Lafayette College, from which he received a B.A. degree. He also earned J.D. and M.B.A. degrees from Cornell University. Mr. Maggin’s qualifications to serve on our Board and Board committees include his long career as a corporate financial executive, chief operating officer and private investor in the media industry, as well as his service as a director and chairman of the audit and compensation committees of several companies.

Parm Sandhu, 47, has served as a Director since September 2009. Mr. Sandhu is a non-executive director of Eir, Ireland’s incumbent telecoms service provider, a non-executive director of Hibu and acting Chairman of Largo Limited, the holding company for Wind Hellas, a mobile operator in Greece. He served as Chief Executive Officer of Unitymedia, Europe’s third largest cable operator, from 2003 to 2010. Prior to that, Mr. Sandhu was a Finance Director with Liberty Media International, where he pursued numerous strategic acquisitions, and held a number of senior finance and strategy positions during his six years with Telewest Communications plc. Before entering the technology, media and telecommunications sector, Mr. Sandhu worked at PricewaterhouseCoopers in London, where he qualified as a Chartered Accountant. He is a graduate of Cambridge University and holds an MA Honours degree in Mathematics. Mr. Sandhu brings to the Board and Audit Committee significant executive management experience in the European media and telecoms sector and considerable expertise in the cable industry, as well as extensive knowledge of financial and accounting matters.

Douglas S. Shapiro, 47, has served as a Director since April 15, 2014. Mr. Shapiro has been Executive Vice President and Chief Strategy Officer of Turner, Inc., a division of Time Warner Inc., since July 2015. Before that, he was Senior Vice President of International and Corporate Strategy at Time Warner from September 2013 to June 2015. From 2008 to September 2013, he ran the Time Warner Investor Relations group. Prior to joining Time Warner, from 1999 to 2007, Mr. Shapiro was the senior analyst covering the cable and satellite TV and media conglomerate sectors at Banc of America Securities and was the head of the Media and Telecommunications research team. Before that, he was the senior analyst covering the cable and satellite communications sectors at Deutsche Banc Securities. Early in his career, he also served as an economic consultant at KPMG Peat Marwick and as an economist at the U.S. Department of Labor. Mr. Shapiro received a B.A. degree in economics from the University of Michigan and is a Chartered Financial Analyst. Mr. Shapiro brings to the Board his broad experience in television distribution, public equity capital markets, including investor relations in a publicly traded global media company, and corporate strategy.

Kelli Turner, 45, has served as a Director since May 2011. She is EVP, Operations, Corporate Development and CFO at SESAC, INC., a music rights licensing company. She is also general partner of RSL Venture Partners, a venture capital fund whose principal investor is Ronald Lauder. She was previously President and Chief Financial Officer of RSL Management Corporation from February 2011 to April 2012. Ms. Turner previously was Chief Financial Officer and Executive Vice President of Martha Stewart Living Omnimedia, Inc. (“MSLO”), a diversified media and merchandising company, from 2009 to 2011, where she was responsible for all aspects of the company’s financial operations, while working closely with the executive team in shaping MSLO’s business strategy and capital allocation process. She also had oversight responsibility for financial planning, treasury, financial compliance and reporting, and investor relations, as well as key administrative functions. A lawyer and a registered CPA with significant experience in the media industry, Ms. Turner joined MSLO in 2009 from Time Warner Inc., where she held the position of Senior Vice President, Operations in the Office of the Chairman and CEO. Prior to that, she served as SVP, Business Development for New Line Cinema from 2006 to 2007 after having served as Time Warner Inc.’s Vice President, Investor Relations from 2004 to 2006. Ms. Turner worked in investment banking for many years with positions at Allen & Company and Salomon Smith Barney prior to joining Time Warner Inc. Early in her career, she also gained tax and audit experience as a CPA at Ernst & Young, LLP. Ms. Turner received her undergraduate business degree and her law degree from the University of Michigan. Ms. Turner brings to our Board a strong financial and business background in the media industry.

Gerhard Zeiler, 60, has served as a Director since April 15, 2014. Since 2012 Mr. Zeiler has served as President of Turner Broadcasting System, Inc., a Time Warner Inc. affiliate. He served as non-executive chairman of GAGFAH S.A., one of the largest residential property companies listed in Germany, from March 2014 until its acquisition in March 2015 by Vonovia (formerly known as Deutsche Annington), the largest listed residential property company in Germany. Since April 2015, he has served as a Non-Executive Board member of Vonovia. Prior to joining Turner Broadcasting, he was Chief Executive Officer of RTL Group from 2003 to 2012 and a member of the Executive Board of international media group Bertelsmann SE & Co. KGaA from 2005 to 2012. Mr. Zeiler was Chief Executive Officer of RTL Television from 1998 to 2005 and Chief Executive Officer of ORF, the Austrian broadcasting corporation, from 1994 until 1998. Before that, he was Chief Executive Officer of RTL II from 1992 to 1994, Chief Executive Officer of Tele 5 from 1991 to 1992, and Secretary General of ORF from 1986 to 1990. He started his career as a journalist and later spokesman for two Austrian Chancellors. Mr. Zeiler brings to our Board his extensive experience in television broadcasting in Europe as the principal executive officer of two major media companies.

There is no arrangement or understanding between any director and any other person pursuant to which such person was selected as a director other than (i) Paul T. Cappuccio, who was nominated by Time Warner Inc. pursuant to the terms of an investor rights agreement dated as of May 18, 2009, as amended, among the Company, Time Warner Media Holdings B.V. and certain other parties and (ii) Iris Knobloch, Douglas Shapiro and Gerhard Zeiler, who were also nominated by Time Warner Inc. pursuant to the terms of a framework agreement dated as of February 28, 2014, among the Company, Time Warner Inc. and Time Warner Media Holdings B.V.

Corporate Governance and Board of Director Matters

We abide by the corporate governance principles outlined below to ensure that the Board of Directors is independent from management, that the Board of Directors adequately performs its function as the overseer of management and that the interests of the Board of Directors and management are aligned with those of shareholders.

5

On an annual basis, directors and executive officers complete questionnaires that are used to establish the independence of independent directors as well as of the members of the Audit Committee and the Compensation Committee, to confirm the qualifications of the members of our Audit Committee and to disclose any transaction with us or our subsidiaries in which a director or executive officer (or any member of his or her immediate family) has a direct or indirect material interest.

Codes of Conduct

The Company has codes of conduct that are applicable to employees and directors. These policies reinforce the importance of integrity and ethical conduct in our business, reflect the more robust policy framework that now exists within the Company and clarify the procedures for handling whistleblower complaints and other concerns. The Standards of Business Conduct applies to the Company’s employees and sets forth policies pertaining to employee conduct in the workplace, including the accuracy of books, records and financial statements, insider trading, electronic communications and information security, confidentiality, conflicts of interest, anti-bribery and competition laws. The Standards of Business Conduct also includes information on how employees may report whistleblower complaints or raise concerns regarding questionable conduct or policy violations and provides for the anonymous, confidential submission by employees or others of any complaints or concerns about us or our accounting, internal accounting controls or auditing matters. The Standards of Business Conduct prohibits retaliation against employees who avail themselves of the policy. Failure to observe the terms of the Standards of Business Conduct can result in disciplinary action (including termination of employment).

The Company also has a Code of Conduct for Non-Employee Directors, which assists the Company’s non-employee directors in fulfilling their fiduciary and other duties to the Company. In addition to affirming the directors’ obligations to act ethically and honestly, the code also addresses conflicts of interest, compliance with applicable laws and confidentiality.

Both the Standards of Business Conduct and the Code of Conduct for Non-Employee Directors are available on our website at www.cme.net. They are also available in print to any shareholder upon request.

Audit Committee

The Audit Committee is composed of Messrs. Langer (Chairman), Frank, Sandhu and Ms. Turner. The members of the Audit Committee satisfy the relevant independence and expertise requirements set forth in the SEC regulations and the NASDAQ Marketplace Rules. In addition, the Board has determined that Messrs. Frank, Langer, Sandhu and Ms. Turner each qualify as “audit committee financial experts”. The responsibilities of the Audit Committee include (i) selecting and overseeing the independent registered public accounting firm to be retained by us; (ii) approving the engagement of the independent registered public accounting firm for audit, audit-related, tax-related and other services; (iii) reviewing with the independent registered public accounting firm the scope and results of these engagements; (iv) overseeing our financial reporting activities and internal controls and procedures and reviewing the risk register with management; (v) reviewing complaints under the Standards of Business Conduct relating to accounting, internal accounting controls or auditing matters; and (vi) conducting other reviews relating to compliance by us and our employees with our policies and any applicable laws. In addition, the Audit Committee is responsible for advising on the Company’s corporate finance activities, including its capital structure, equity and debt financings, banking activities and relationships, foreign exchange and stock repurchase activities. During the fiscal year ended December 31, 2015, the Audit Committee met on eight occasions.

The Audit Committee acts under a written charter first adopted and approved by the Board of Directors in June 2000. An amended and restated Audit Committee charter was subsequently adopted by the Board of Directors on November 20, 2002 and amended on March 27, 2003, April 6, 2004, February 2, 2006, February 14, 2007, December 12, 2011, December 9, 2013 and September 9, 2014. The Audit Committee charter is available on our website at www.cme.net. It is also available in print to any shareholder on request.

Executive Officers

Michael Del Nin, 45, has served as the Company’s co-Chief Executive Officer since September 2013. From October 2009 until September 15, 2013 he was a member of the Company’s Board of Directors. Prior to his appointment as co-Chief Executive Officer of the Company, Mr. Del Nin was the Senior Vice President of International and Corporate Strategy at Time Warner Inc. from April 2008 until September 2013, in which capacity he helped drive Time Warner Inc.’s global strategy and business development initiatives, with a particular focus on international operations and investments. From 2006 to 2008, Mr. Del Nin was the Senior Vice President responsible for Mergers and Acquisitions. Prior to joining Time Warner Inc., Mr. Del Nin was Senior Vice President, Business Development, at New Line Cinema. In that role Mr. Del Nin analyzed the economics of the studio’s film and television projects while helping to develop and implement New Line Cinema’s long-term business plan. Prior to joining New Line Cinema, Mr. Del Nin was an investment banker focused on the media industry at Salomon Smith Barney in New York. Mr. Del Nin holds an undergraduate business degree from Bocconi University and a law degree from the University of New South Wales.

Christoph Mainusch, 53, has served as the Company’s co-Chief Executive Officer since September 2013. Prior to joining the Company, he was an advisor to the President of Turner Broadcasting International, a wholly-owned subsidiary of Time Warner Inc., where he consulted on various projects from April 2013 until September 2013. From March 2004 to December 2012, Mr. Mainusch was a member of the Operational Management Committee of the RTL Group, a European entertainment network. From September 2009 to February 2012, Mr. Mainusch served as Chief Executive Officer of the Alpha Media Group in Greece, a terrestrial broadcast company partly owned by the RTL Group. Mr. Mainusch served as Chief Executive Officer of RTL Televizija in Croatia from 2004 to 2009. From 1996 until 2004, Mr. Mainusch served as Chief Executive Officer of ACS Media GmbH. Mr. Mainusch started his career as a freelancer for the public broadcaster Bayerischer Rundfunk in 1987, followed by several positions at commercial broadcasters SAT.1, Tele 5, and RTL 2.

Daniel Penn, 50, joined the Company in 2002 and has served as General Counsel and Company Secretary since 2004. Mr. Penn was named an Executive Vice President of the Company in February 2010. Prior to joining the Company, he served as General Counsel and Head of Developments/Business Affairs in an internet publishing business and in a multinational telecommunications company. He began his career in private practice with the law firm Mayer Brown, where he worked in their offices in New York, London and Tashkent, Uzbekistan. Mr. Penn graduated from Princeton University with a B.A. from the Woodrow Wilson School of Public and International Affairs and a Certificate of Achievement in Russian Studies. He received a J.D. from the Columbia University School of Law, where he served as Editor-in-Chief of the Columbia Law Review.

6

David Sturgeon, 46, has served as the Company’s Chief Financial Officer since June 5, 2014 when he was also named an Executive Vice President of the Company. Prior to that, he served as Acting Chief Financial Officer from October 29, 2013 and as Deputy Chief Financial Officer from July 2009. He oversees all of the Company's finance, accounting, business systems, internal audit, treasury and tax activities. Mr. Sturgeon joined the Company as Group Financial Controller in 2005, prior to which he was with Equant N.V., from 2002. From 1990 to 2002, Mr. Sturgeon was a member of Arthur Andersen’s Technology, Media and Communications practice, advising clients primarily in the areas of financial reporting and control, corporate finance and capital markets transactions. Mr. Sturgeon graduated from Oxford University with an M.A. in Philosophy, Politics and Economics and is a Chartered Accountant.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers, directors and persons who beneficially own greater than 10% of a registered class of our equity securities to file certain reports (“Section 16 Reports”) with the SEC with respect to ownership and changes in ownership of shares of our common stock and other equity securities. Based solely on our review of the Section 16 Reports furnished to us and written representations from certain reporting persons, we believe that, during the fiscal year ended December 31, 2015, all filing requirements under Section 16(a) applicable to our officers, directors and greater than 10% beneficial owners were complied with on a timely basis.

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information about the Company’s compensation programs and policies for our Named Executive Officers. In 2015, our Named Executive Officers were the co-Chief Executive Officers, the Chief Financial Officer and the General Counsel.

Philosophy and Objectives of Compensation Programs

General Philosophy

We believe the total compensation of our Named Executive Officers as well as other members of management and employees should support the following objectives:

• | Attract, retain and motivate personnel with the experience and expertise to drive us to achieve our objectives. We provide opportunities to earn significant compensation to key executives and other managers who are able to deliver competitive results. |

• | Create a mix of short-term and long-term compensation to promote attention to both annual and multi-year business objectives without encouraging unnecessary or excessive risk-taking. The mix between short-term and long-term compensation is also designed to reflect the roles and responsibilities of individual managers, with a substantially higher percentage of the total potential compensation of senior executives tied to variable (versus fixed) pay than other employees. |

• | Reward executives for creating shareholder value. This means that our long-term incentives are equity-based, including performance-based awards, and represent a significant percentage of the total potential compensation that senior executives may earn. |

• | Create a strong culture that rewards results. This means that compensation is designed to reward the achievement of specific performance goals of the Company and that the opportunity to earn an annual incentive and performance-based awards requires a threshold level of performance. |

• | Ensure compensation is appropriate in light of our profile, strategy and anticipated performance. This means that the Compensation Committee places significant emphasis on our specific strategy and performance in the ultimate determination of compensation decisions. |

Key Compensation Actions in 2015

The Company made a number of enhancements to the executive compensation program in 2015 that are designed to secure the achievement of the objectives of its compensation programs. The most significant of these has been the transitioning of the Company’s pay practices for Named Executive Officers to increase the percentage of compensation tied to objective performance measures, including the adoption of a performance-based long-term incentive program for Named Executive Officers. In addition, the Compensation Committee instituted a Board-level annual performance review for the co-CEOs.

2015 Company Performance Review

The Company remained market leaders during 2015 in terms of audience share in all of the countries in which it operates. These audience shares give the Company a strong advantage over its competition in terms of monetizing its audiences through advertising, carriage fees and on its platforms. In addition, completing the divestiture of all remaining non-core assets during 2015 allows the Company to continue to focus its efforts on its broadcast assets. Key elements of this are the production of local content, keeping its television stations at the forefront of trends in media consumption and making them market leaders in their respective countries.

7

2015 Financial Highlights

The following tables provide a summary of our consolidated results for the years ended December 31, 2015 and 2014:

For The Year Ending December 31, (US$ 000's) | |||||||||||||

Movement | |||||||||||||

2014 | 2015 | % Act | % Lfl | ||||||||||

Net revenues | $ | 680,793 | $ | 605,841 | (11.0 | )% | 5.9 | % | |||||

OIBDA | 95,446 | 122,815 | 28.7 | % | 52.9 | % | |||||||

Operating income | 38,280 | 94,583 | 147.1 | % | 198.2 | % | |||||||

Consolidated net revenues increased 6% at constant exchange rates in 2015 compared to 2014. Television advertising spending in the Company’s markets grew 6% in 2015 compared to 2014. Television advertising revenues grew 6% at constant rates and the Company’s market share increased in three countries, most notably in its largest market, the Czech Republic. Carriage fees and subscription revenues also increased 9%. However, since the dollar was significantly stronger against the currencies of the Company’s operations during 2015 than it was in 2014, the impact of foreign exchange rates more than offset the underlying improvement in revenues, resulting in a decrease in consolidated net revenues of 11% at actual rates compared to 2014.

On a constant currency basis, costs charged in arriving at OIBDA1 decreased 2% in 2015 compared to 2014. The Company continues to focus on controlling costs, and content costs decreased, which reflected savings from better utilization of its program library, more efficient own production, and foreign programming acquired at better prices and available for additional runs. Costs charged in arriving at OIBDA decreased by 17% at actual rates in 2015 compared to 2014.

OIBDA increased by 53% on a constant currency basis in 2015 compared to 2014 and the OIBDA margin improved to 20% in 2015 from 14% in 2014. This reflects the Company’s continued focus on better monetization of our broadcast assets while maintaining a strict cost discipline.

Free Cash Flow

For The Year Ending December 31, (US$ 000's) | ||||||||||

2014 | 2015 | Movement | ||||||||

Net cash (used in) / generated from operating activities | $ | (65,242 | ) | $ | 85,877 | NM (a) | ||||

Capital expenditures, net | (28,548 | ) | (30,426 | ) | (6.6 | )% | ||||

Free cash flow | $ | (93,790 | ) | $ | 55,451 | NM (a) | ||||

(a) Number is not meaningful.

Free cash flow2 in 2015 was US$ 55.5 million, compared to negative free cash flow of US$ 93.8 million in 2014. The significant improvement in free cash flow during 2015 reflected both the improvement in OIBDA and lower cash interest payments as well as the benefits of having normalized programming payments during 2014.

Financing Transactions

The Company reduced its cost of borrowing and made improvements to its capital structure and the maturity profile of its debt through the financing transactions entered into in 2015 and early 2016. In November 2015, the Company drew its EUR 235.3 million (approximately US$ 267.9 million) term loan, guaranteed by Time Warner, in order to repay the Company’s senior convertible notes at maturity on November 15, 2015. This term loan matures in 2019.

In February 2016, the Company entered into a EUR 468.8 million (approximately US$ 533.7 million) term loan due 2021 (the “2021 Euro Term Loan”), guaranteed by Time Warner, for purposes of refinancing its 15.0% Senior Secured Notes due 2017 (the “2017 PIK Notes”) and its term loan facility due 2017 with Time Warner. The Company applied the 2021 Euro Term Loan, together with corporate cash, to redeem and discharge the US$ 502.5 million aggregate principal amount of the 2017 PIK Notes (plus accrued interest thereon) and repay the US$ 38.2 million term loan with Time Warner (plus accrued interest thereon) in April 2016. The Company also extended the maturity of its EUR 250.8 million (approximately US$ 284.8 million) term loan by one year to November 1, 2018 and extended the maturity of its US$ 115.0 million revolving credit facility (the “2021 Revolving Credit Facility”) from 2017 to 2021, with the size of the facility reduced to $50.0 million from January 1, 2018.

1 OIBDA, which includes program rights amortization costs, is determined as operating income / (loss) before depreciation, amortization of intangible assets and impairment of assets and certain unusual or infrequent items that are not considered by our chief operating decision makers when evaluating our performance. For a quantitative reconciliation of non-GAAP financial measures to the most directly comparable financial measurements in accordance with GAAP, see Part II, Item 8, Note 21 to the Company’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2015.

2 Free cash flow is defined as cash flows from operating activities, less purchases of property, plant and equipment, net of disposals of property plant and equipment and excludes the cash impact of certain unusual or infrequent items that are not included in costs charged in arriving at OIBDA in our financial statements because they are not considered by our chief operating decision makers when evaluating performance.

8

Following these transactions, the Company’s cost of borrowing has decreased significantly and its nearest debt maturity is at the end of 2018. The all-in rate applicable to the 2021 Euro Term Loan and related guarantee fee ranges from 10.5% to 7.0% depending on the Company’s leverage ratio. The initial all-in rate at the time of drawing was 10.5%, an immediate improvement of 450 basis points in the cost of approximately half of the outstanding principal amount of the Company’s debt. The rate will also decrease gradually with reductions in our leverage ratio, falling as low as 7.0% if the Company’s net leverage is below five times. The rate applicable to any balances outstanding under the 2021 Revolving Credit Facility will also decrease from 10.0% in a similar manner. So as the Company's leverage decreases, its cost of borrowing under these instruments automatically decreases as well.

Going forward, the Company remains focused on enhancing the performance of its broadcast assets in each country over the short and medium-term, which is expected to continue to improve operating margins and free cash flow generation. The main elements of that strategy are:

• | leveraging popular content to maintain or increase audience share and advertising market share in all of the Company’s operating countries; |

• | driving growth in advertising revenues through its pricing strategies; |

• | developing additional revenue streams; |

• | optimizing content costs while safeguarding the Company’s brands and competitive strengths; and |

• | maintaining strict cost discipline by controlling other expenses. |

As market leaders with experienced management teams in each country, the Company is uniquely positioned to identify new challenges in a timely manner and adjust its strategy as new opportunities or competitive threats arise.

Compensation Design and Elements of Compensation

Our executive compensation programs, covering Named Executive Officers and other members of senior management, consists principally of base salary, an annual non-equity incentive award and long-term equity incentives, as set out below.

Base Salary

Salary levels for each of our Named Executive Officers are approved by the Compensation Committee and set out in their employment agreements. Employment agreements are customary for all employees in the countries in which we operate. Key considerations in establishing base salary levels and any increases include the overall level of responsibility of a given Named Executive Officer; the importance of the role; the experience, expertise and specific performance of the individual; the general financial performance of the Company; the general economic environment, and in the case of the co-Chief Executive Officers, compensation levels of similarly positioned executives at peer group companies. The Compensation Committee reviews these salary levels each year to determine whether any adjustment is appropriate.

Annual Non-equity Incentive Plans

Pursuant to the Company’s management compensation policy guidelines, which were originally adopted by the Compensation Committee in 2011 (as amended, the “Management Compensation Policy Guidelines”), executives, managers and other key employees are eligible to earn annual non-equity incentive awards. Award opportunities vary by position and level in the organization. Annual non-equity incentive plan award targets for management generally consist of quantitative targets based on the Company’s financial performance goals and qualitative individual performance targets. The split between the financial targets and individual performance targets varies based on the role and level of seniority of an employee in the Company, with specific targets and weightings intended to correlate with the role or responsibilities of the relevant member of management.

Targets for the co-CEOs are set by the Compensation Committee, and targets for the remaining Named Executive Officers are set by the co-CEOs and recommended to the Compensation Committee for approval. In setting targets, the Compensation Committee’s approach is intended to have the Named Executive Officers be accountable for both the overall performance of the business and individual areas of responsibility in respect of key strategic or operational goals of the Company. Taking into consideration the Company’s capital structure and deleveraging strategy, the Compensation Committee believes that OIBDA and free cash flow are key financial metrics for measuring management’s performance. They are among the key measures the Company uses to evaluate its performance on a Company-wide basis.

The target non-equity incentive plan award Named Executive Officers are eligible to earn is equal to 100% of base salary. In addition, Named Executive Officers have the opportunity to earn up to 200% of base salary for exceeding target levels. They are not entitled to earn any non-equity incentive compensation if specified threshold levels are not achieved. The target, maximum and threshold levels for 2015 are set out in “2015 Compensation Decisions - Annual Non-equity Incentive Plan Targets” below.

9

Long-Term Equity Incentive Program

Each year the Compensation Committee reviews and has approved annual grants of equity incentive awards to the Named Executive Officers as well as other senior employees, including time-based restricted stock units, performance-based restricted stock units and options. Long-term equity incentives are an important element of the Company’s compensation programs. Assuming general economic conditions in the countries in which the Company operates remain stable or continue to improve, long-term incentives are the most effective way to link the interests of management and shareholders, and to incentivize management to strive for continued shareholder value creation. During the long recessionary period in our markets following the onset of the global financial crisis in 2009, the Compensation Committee began to use time-based restricted stock units, which expose recipients to downside price risk, as the principal long-term incentive award. Following the Company’s successful financial turnaround over the last two years and the recovery that has been occurring in our markets, the Compensation Committee has changed the mix of long-term equity incentives to Named Executive Officers to include performance-based restricted stock units as well as options, as described below under “2015 Compensation Decisions - 2015 LTIP” and “- Long-Term Equity Incentive Awards”.

Annual grant types and levels are determined on the basis of an individual’s position in the organization and reflect a number of other considerations, including the role the individual plays in setting and achieving long-term company goals, the overall dilution represented by equity grants and the cost of such grants as reflected in our financial statements. As described below under “Other Compensation Practices and Policies - Equity Granting Policy”, the exercise price of all option grants is equal to the fair market value of our shares on the date of grant.

2015 Compensation Decisions

Overview

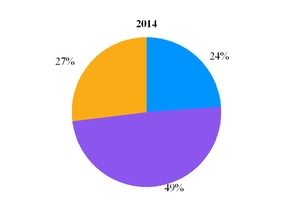

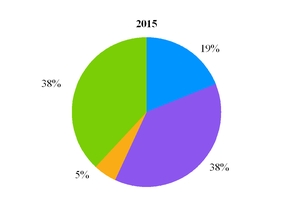

We have been transitioning our compensation practices to increase the percentage of compensation tied to performance in order to more closely align the interest of management and the shareholders to further drive value creation and achieve the long-term goals of the Company. This transition has also increased the proportion of reported compensation that is long-term. The table below illustrates the impact of this transition on the reported compensation of our co-Chief Executive Officers:

Annual Base Salary | ||

Annual Non-Equity Incentive Award | ||

Restricted Stock Unit Awards (time-based) | ||

Performance-based Incentive Awards (a) | ||

(a) | Includes performance-based restricted stock units and options. |

2015 LTIP

A key component of the compensation program is a long-term incentive program adopted by the Compensation Committee in the first quarter of 2015 (the “2015 LTIP”). Under the 2015 LTIP, the payout opportunity for Named Executive Officers ranges between 0% and 200% of target awards of restricted stock units (which are set out below in the “Grants of Plan Based Awards” table) for the achievement of cumulative OIBDA and unlevered free cash flow targets over a four-year period. Under the 2015 LTIP, 50% of the award may be earned for achieving a cumulative four-year OIBDA target and 50% for achieving a cumulative four-year unlevered free cash flow target, in each case measured at constant currency rates set in the Company’s 2015 budget. Named Executive Officers have the opportunity to earn 25% of the target award after two years if a cumulative two-year target for both OIBDA and unlevered free cash flow are reached, and to earn 25% of the target award after three years if a cumulative three-year target for both OIBDA and unlevered free cash flow are reached. Any portion of the target award earned following the second or third year will be netted off any award earned at the end of the performance period. The maximum payout is capped at 200% of the target amount; and in the event specified minimum cumulative thresholds for OIBDA or unlevered free cash flow are not achieved during the four-year period, no awards will be earned in respect of such target.

The Compensation Committee does not intend to grant any further performance-based restricted stock unit awards before the end of the four-year performance period. Accordingly, the award made to each Named Executive Officer under the 2015 LTIP is intended to reflect the cumulative amount of such awards it may have otherwise made over such four-year period.

10

In addition, beginning in 2015 the Compensation Committee has begun incorporating options into grants of long-term equity incentives, which the Compensation Committee believes is a useful tool for incentivizing and rewarding Named Executive Officers for achieving improved share price performance.

Annual Base Salary

The Compensation Committee did not adjust the base salary of any Named Executive Officers in 2015. The Compensation Committee did award base salary increases to Named Executive Officers of between 3% and 6% with effect from January 1, 2016.

On average base salaries accounted for 20% of the total direct compensation of our Named Executive Officers in 2015. (Total direct compensation consists of base salary, non-equity incentive plan awards and annual equity incentive awards based on the grant value.)

Annual Non-equity Incentive Plan Targets

In 2015, each Named Executive Officers was entitled to earn 75% of his non-equity incentive plan award for the achievement of quantitative financial targets based on the Company’s performance and 25% for the achievement of qualitative targets tied to individual performance. The quantitative targets consisted of Consolidated Budgeted OIBDA3 of US$ 120.0 million (with a weighting of 50%) and Direct Free Cash Flow4 of US$ 50.0 million (with a weighting of 25%). The OIBDA and cash flow targets and actuals do not include businesses reported as discontinued operations in the Company’s Annual Report on 10-K for the year ended December 31, 2015. Individual qualitative targets are based on achieving specific annual objectives, including business goals, completion of strategic initiatives, communications, and organizational and employee development.

Each of the Named Executive Officers was entitled to earn an award equal to 100% of target for the achievement of Consolidated Budgeted OIBDA, Direct Free Cash Flow and individual performance targets, with the total opportunity to earn a non-equity incentive plan award ranging of between 0% and 200% of their annual base salary. If Consolidated Actual OIBDA5 reached 115% of Consolidated Budgeted OIBDA and Actual Direct Free Cash Flow6 reached 120% of Direct Free Cash Flow, each Named Executive Officer was entitled to earn an award of 200% of target bonus. No Named Executive Officer was entitled to earn any amount in respect of Consolidated Budgeted OIBDA in the event Consolidated Actual OIBDA was less than 90% of Consolidated Budgeted OIBDA or in respect of Direct Free Cash Flow in the event Actual Direct Free Cash Flow was less than 85% of Direct Free Cash Flow.

The Compensation Committee measured the achievement of financial targets against the results delivered by the Company in respect of such targets for 2015, translated where appropriate at exchange rates used in the Company’s 2015 budget. In order to exclude the impact of exchange rate movements on internal performance targets, the OIBDA and cash flow targets and actuals are translated at budgeted exchange rates. The Compensation Committee measures the achievement of individual performance targets against actual performance of the business or based on self-assessments by the Named Executive Officer that are reviewed by the co-CEOs, who make recommendations to the Compensation Committee.

3 Consolidated Budgeted OIBDA is equal to consolidated OIBDA based on the Company’s 2015 budget, translated at exchange rates used in the Company’s 2015 budget.

4 Direct Free Cash Flow is free cash flow based on the Company’s 2015 budget, translated at exchange rates used in the Company’s 2015 budget. In connection with setting the terms of the 2015 LTIP, the Company is moving from using Direct Free Cash Flow to unlevered free cash flow for purposes of setting its annual budgets and any corresponding performance targets. Unlevered free cash flow is free cash flow before the payment of interest. The Company has the ability to pay a substantial portion of interest and fees under its senior debt in kind; as a result, measuring free cash flow before the payment of interest separates elections on the payment of interest from the achievement of performance targets.

5 Consolidated Actual OIBDA is equal to actual consolidated OIBDA for the Company, translated at exchange rates used in the Company’s 2015 budget. Costs charged at arriving at OIBDA for 2015 excludes a release of US$ 12.0 million recorded in the fourth quarter of 2014 relating to tax audits of our Romanian operations (see the Part II, Item 8, Note 22 to the Company’s financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015).

6 Actual Direct Free Cash Flow is actual free cash flow translated at exchange rates used in the Company’s 2015 budget. The purpose of the translation at constant exchange rates is to exclude the impact of exchange rate movements on internal performance targets.

11

2015 Non-equity Incentive Plan Awards

Each of the co-Chief Executive Officers earned a non-equity incentive plan award for 2015 of US$ 1.6 million. The Company achieved Consolidated Actual OIBDA of $138.7 million and Actual Direct Free Cash Flow of $63.1 million7, which exceeded the upper end of the range for earning a non-equity incentive plan award. The Compensation Committee determined that the individual performance targets had been achieved, which included the successful turnaround of the Company’s financial performance, the achievement of operating performance targets, disposing non-core assets, implementing cost saving initiatives and effectively controlling costs, overseeing the successful refinancing of certain senior debt and the negotiation of a refinancing of the Company’s most expensive indebtedness, and overseeing the implementation of improvements to the management of the business through recruitment and development.

The Chief Financial Officer earned a non-equity incentive plan award for 2015 of US$ 1.0 million. The Company achieved the Consolidated Actual OIBDA and Actual Direct Free Cash Flow set out above, which exceeded the upper end of the range for earning a non-equity incentive plan award. The Compensation Committee determined that the individual performance targets had been achieved, which included successful oversight of the Company’s financial reporting obligations and audit processes, contributing to the Company’s successful refinancing efforts, and continuing the implementation of improvements to the financial systems for better budgeting and planning performance.

The General Counsel earned a non-equity incentive plan award for 2015 of US$ 1.0 million. The Company achieved the Consolidated Actual OIBDA and Actual Direct Free Cash Flow set out above, which exceeded the upper end of the range for earning a non-equity incentive plan award. The Compensation Committee also determined that the individual performance targets had been achieved, which included providing effective advice to the co-Chief Executive Officers, the Board and its committees on a number of significant legal issues and strategic initiatives for the Company, successfully managing the negotiation and completion of a series of refinancing transactions, providing advice and assistance with respect to compliance and regulatory matters, expanding the internal compliance program, and strengthening the capacity of his department.

On average non-equity incentive plan awards accounted for 40% of the total direct compensation awarded to our Named Executive Officers in 2015.

While performance targets form the basis for awarding non-equity incentive plan compensation, the Compensation Committee believes that judgment is also an important factor and the Compensation Committee can exercise discretion in determining awards. The prolonged impact of the challenging economic environment in which the Company has been operating, together with the impact of unforeseen macroeconomic events have made forecasting and budgeting much more challenging. Accordingly, the Compensation Committee takes factors such as these into consideration and may reasonably determine ranges or absolute numbers above or below which awards may be earned in respect of specific performance targets. In addition, the Compensation Committee may also award discretionary bonuses or establish other performance criteria for purposes of creating additional incentives for the achievement of specific objectives in addition to the annual incentive plans. The Compensation Committee did not award any discretionary bonuses to Named Executive Officers in 2015.

Long-Term Equity Incentive Awards

Consistent with the transition in 2015 of the Company’s compensation programs to increase the percentage of pay tied to performance, the Compensation Committee elected to award performance-based restricted stock units to the Named Executive Officers following the adoption of the 2015 LTIP as well as to award options in addition to time-based restricted stock units. The Compensation Committee believes that the financial performance targets under the 2015 LTIP are key metrics for measuring the financial strength of the Company and its ability to achieve its strategic objectives, including deleveraging. In addition, the Compensation Committee believes that because of the likelihood of continued pressure on the Company’s share price as a result of the Company’s financing activities and capital structure and the fact that the return to growth in the Company’s markets is expected to be gradual, options will be an effective compensation tool to align the interests of management with shareholders in respect of share price appreciation and will not encourage unnecessary risk taking.

The dates and values of the equity grants to Named Executive Officers are included in the “Grants of Plan Based Awards” table below. One other employee was awarded performance-based restricted stock units under the 2015 LTIP and options, and 13 other employees were awarded time-based restricted stock units. The performance-based awards will only vest if the performance targets are achieved in accordance with the 2015 LTIP. The options and the time-based awards vest in four equal installments on each anniversary of the grant date.

On average, equity incentive awards accounted for 40% of the total direct compensation awarded to our Named Executive Officers in 2015.

7 Because of the significant strengthening of the dollar in 2015, the reported OIBDA and free cash flow of the Company differ from the Consolidated Actual OIBDA and Actual Direct Free Cash Flow, which are measured at constant exchange rates.

12

Reported Pay versus Realized Pay

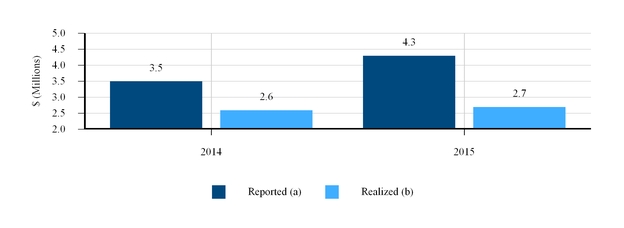

The reported pay of the co-Chief Executive Officers in the Summary Compensation Table below has increased in 2015 compared to 2014, which was the first full year served by the co-Chief Executive Officers. This is due primarily to the decision to increase the proportion of compensation tied to performance, represented by awards of performance-based restricted stock units under the 2015 LTIP as well as option awards. Since a substantial portion of reported compensation in the Summary Compensation Table below represents potential pay which is dependent on financial performance or share price performance, we believe it is useful to compare average reported pay to average realized pay of the co-Chief Executive Officers as set forth below.

(a) | Amounts represent average reported total direct compensation of the co-Chief Executive Officers and average realized pay. Reported compensation consists of base salary, actual annual non-equity incentive plan compensation awarded, the grant date fair value of stock awards and option awards and other compensation. |

(b) | Realized compensation includes base salary, actual non-equity incentive plan compensation awarded, the value of stock awards settled in the relevant year, and other compensation. |

In view of the expectation that the grant made under the 2015 LTIP will not be repeated and future grants of options are likely to follow a similar pattern as time-based restricted stock units, the Compensation Committee believes that the trend in realized pay is more representative of the direction of the compensation of the co-Chief Executive Officers.

Peer Group Companies

The Compensation Committee gives consideration to a peer group of companies when making certain decisions regarding compensation. The peer group is used as an input for such compensation elements as base salary, performance-based awards and total direct compensation as well as to benchmark the competitiveness of the Company’s compensation plans. It consists of publicly traded companies in the U.S. and Europe and was established largely using the following selection criteria: (i) companies in industries or businesses similar to the Company and (ii) companies having a comparable size as the Company (based primarily on revenues with consideration of market capitalization as well).

The following companies comprise the peer group:

Discovery Networks International (1) | Sinclair Broadcast Group, Inc. | Crown Media Holdings Inc. |

Modern Times Group | Atresmedia Corporación | Gray Television Inc. |

Starz | Nexstar Broadcasting Group Inc. | Media General Inc. |

AMC Networks Inc. | The E.W. Scripps Company | Radio One Inc. |

(1) | Represents the international division of Discovery Communications Inc. |

This peer group was developed in 2014 with the independent compensation consultant Clearbridge Compensation Group (as described below under "Other Compensation Practices and Policies - Compensation Committee Consultants") and management of the Company in connection with a process to develop benchmarks for the executive compensation program of the co-CEOs. No changes were made to the peer group in 2015 other than exclusion of the following companies: Lin Media LLC (which was merged into Media General Inc.), TVN (which was delisted following its acquisition by Scripps Network Interactive), Journal Communications (whose media businesses were merged into E.W. Scripps) and CTC Media (which will be delisted following a merger approved by its shareholders in December 2015).

Other Compensation Practices and Policies

Executive Compensation Recoupment

The Company has a policy that permits the Compensation Committee to seek recovery of payments of incentive plan compensation awards and bonuses of Named Executive Officers and certain other covered senior executives if the Company is required to restate its financial statements (other than due to a change in accounting rules) or if the performance results leading to a payment of incentive compensation are subject to a material downward adjustment. For purposes of this policy, payment of incentive compensation includes awards of equity compensation under the Company's 2015 Stock Incentive Plan or its Amended and Restated Stock Incentive Plan, under which equity awards were granted prior to June 2015. Under

13

this policy, the Compensation Committee has discretion to determine what action it believes is appropriate, which may include recovery or cancellation of all or a portion of incentive payments, and may consider a number of factors in determining whether to seek recovery, including the degree of responsibility of a covered executive, the amount of excess compensation paid, the costs associated with recovery of compensation, applicable law and other actions the Company or third parties have taken.

Stock Ownership Guidelines

We encourage stock ownership by executives and directors but do not have formal stock ownership guidelines. Under the Company’s insider trading policy, officers, directors, employees and their related persons may not trade in options, warrants, puts and calls or similar instruments on the Company’s shares of Class A Common Stock and other securities and may not sell such shares short. The insider trading policy also requires executives and directors to pre-clear pledges of shares and restricts the ability of executives and directors to pledge shares while they are in possession of material inside information.

Severance

As is customary in our markets, all of our Named Executive Officers have employment agreements with us or one of our subsidiaries and these agreements provide for compensation in the event of involuntary termination. These termination payments, which are typically defined by local practice and are generally derived from the notice period or term of the relevant employment agreement, were negotiated with each Named Executive Officer individually and do not conform to a single policy. The basis for and value of these termination payments is further described and quantified under “Potential Payments Upon Termination or Change of Control” below.

Compensation Committee Consultants

During the third quarter of 2014, the Compensation Committee retained Clearbridge Compensation Group (“Clearbridge”) to serve as an independent advisor on executive compensation matters as well as on compensation plans or programs that are subject to the review or approval of the Compensation Committee. Clearbridge was retained by, and reports directly to, the Compensation Committee and the Compensation Committee has the sole authority to retain and terminate Clearbridge and to approve the terms of its retention and fees. The Compensation Committee assessed the independence of Clearbridge and believes that Clearbridge is independent. All of the work performed by Clearbridge was at the request of the Compensation Committee and Clearbridge has not done any other work for the Company. Clearbridge continued to provide advice and recommendations to the Compensation Committee on the Company’s long-term incentive program in the first half of 2015.

Role of Executives in Establishing Compensation

The co-Chief Executive Officers, the Chief Financial Officer, the General Counsel and other members of senior management have participated in the development and implementation of certain executive compensation programs, particularly the annual incentive and long-term equity incentive programs in the Management Compensation Policy Guidelines, and the establishment of annual targets. The Management Compensation Policy Guidelines and amendments to it are reviewed by the co-Chief Executive Officers and submitted to the Compensation Committee for its review and approval. Certain executives, including the co-Chief Executive Officers, may be invited to attend meetings of the Compensation Committee to discuss Company compensation programs; in addition, the General Counsel may be invited to attend meetings in his capacity as Company Secretary. While these executives may be asked to provide input and perspective, only Compensation Committee members vote on executive compensation matters. These decisions take place when no members of management are in attendance.

Compensation Risk Assessment

In establishing and reviewing executive compensation, the Compensation Committee believes that executive compensation has been designed and allocated among base salary and short- and long-term incentive compensation in a manner that does not encourage excessive risk-taking by management that may harm the value of the Company, reward poor judgment or is reasonably likely to have a material adverse effect on the Company.

Base salaries are designed to be consistent with an executive’s responsibilities and to provide sufficient financial security as a proportion of total compensation so as not to promote unnecessary or excessive risk-taking when earning compensation under the Company’s incentive compensation programs. The mix of incentives under those compensation programs is designed to mitigate potential risks without dampening their incentive nature.

In that regard, the Compensation Committee believes that a number of aspects of the Company’s compensation programs substantially mitigate the risk of short-term risk taking at the expense of long-term performance. First, the Compensation Committee believes the annual budgeting process results in the establishment of annual targets that are based on a longer-term strategic vision for the Company and sustainable value creation. Second, having several targets that serve different goals mitigates the risk that certain Company objectives will be achieved (e.g., significant audience share or market share) at the expense of others (e.g., controlling costs and generating positive free cash flow) and having to achieve a threshold level of Consolidated Budgeted OIBDA and Direct Free Cash Flow in order to earn a non-equity incentive plan award limits the amount of such awards that can be earned in the event of poor overall Company performance. This encourages management to focus on sustained profitable revenue generation. Third, rewarding Named Executive Officers substantially on the basis of achieving Company-wide targets ensures that they are focused on the performance of the Company as a whole. While rewarding senior executives of the Company's operating units for operating performance may result in risk taking, their targets have also been designed to serve different goals, which mitigate this possibility. Moreover, provisions in our Management Compensation Policy Guidelines that permit senior executives to be rewarded for qualitative performance reasons can reduce the influence of formulae in the determination of quantitative performance awards. Fourth, providing a significant earning opportunity to the Named Executive Officers through the 2015 LTIP and awards of options requires that the Named Executive Officers achieve long-term value creation by delivering anticipated financial performance over a multi-year period and achieving meaningful share price appreciation. Finally, we can seek to recoup incentive compensation under the Executive Compensation Recoupment Policy.

The Compensation Committee continues to believe that an appropriate balance of compensation elements will support the achievement of competitive revenues and earnings in variable economic and industry conditions without undue risk.

14

Equity Granting Policy

Recognizing the importance of adhering to appropriate practices and procedures when granting equity awards, our equity granting policy establishes the following practices:

• | Decisions to award equity grants should only be taken during a period when trading in our shares is permitted in accordance with our Insider Trading Policy. |

• | All grants to Section 16 officers, including grants to new hires, must be approved at a meeting of the Compensation Committee, including telephonic meetings, and may not occur through action by unanimous written consent. |

• | The grant date of any equity award approved at a meeting of the Compensation Committee shall be the date of such meeting or, in connection with an anticipated hire or an award to be granted in several installments, a future date established by the Compensation Committee at such meeting, subject to employment commencing. |

• | The exercise price for all option awards shall not be less than the closing price of our shares on the date of grant. |

Say-on-Pay Proposals

At the Company’s 2011 annual general meeting, shareholders voted on an advisory proposal as to the frequency with which the Company should conduct an advisory vote on executive compensation (a “say-on-pay proposal”). At that meeting, 93.2% of votes cast were in favor of holding such a vote once every three years and the Company intends to hold such vote every three years. At the 2014 annual general meeting, shareholders had an opportunity to vote on executive compensation as disclosed in the 2014 proxy statement. Of the votes cast on the say-on-pay proposal, 92.8% were voted in favor of the proposal. The Compensation Committee considered the results of this advisory vote and it believes that it affirms shareholders’ support of the Company’s approach to executive compensation. The Company will continue to consider the outcome of subsequent say-on-pay votes when making future compensation decisions for Named Executive Officers.

Impact of Tax and Accounting on Compensation Decisions

As a general matter, the Compensation Committee takes into consideration the various tax and accounting implications of compensation vehicles employed by us. When determining amounts of long-term incentive compensation to executives and employees, the Compensation Committee examines the accounting cost associated with the grants. Under Accounting Standards Codification 718, “Compensation - Stock Compensation” (“ASC 718”), grants of stock options, restricted stock and restricted stock units permitted pursuant to the Stock Incentive Plan result in an accounting charge. The accounting charge is equal to the fair value of the number of instruments being issued that are expected to vest. For stock options, the cost is equal to the fair value of the option on the date of grant using a Black-Scholes option pricing model multiplied by the number of options that are expected to vest. For restricted stock or restricted stock units, the cost is equal to the fair value of the stock on the date of grant multiplied by the number of shares or units granted that are expected to vest. This expense is amortized over the requisite service or vesting period.

The Compensation Committee also considers the tax implications of its programs, both to us and to the participants. It is the Compensation Committee’s policy to maximize the effectiveness of our executive compensation plans in this regard. However, the Compensation Committee believes that compensation and benefits decisions should be primarily driven by the needs of the business rather than by tax policy. Therefore, the Compensation Committee may make pay decisions that result in certain tax inefficiencies.

15

Compensation Committee Report

We have reviewed and discussed the Compensation Discussion and Analysis with management, based on our review and discussions, we recommend to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s proxy statement and in this Annual Report on Form 10-K/A for the year ended December 31, 2015.

Submitted by:

JOHN K. BILLOCK

BRUCE MAGGIN

KELLI TURNER

MEMBERS OF THE COMPENSATION COMMITTEE

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has been an officer of the Company or of any of our subsidiaries, or had any relationship with us other than serving as a director. In addition, none of our executive officers served as a director or member of the compensation committee of any other entity one of whose executive officers serves as one of our directors or as a member of the Compensation Committee. The members of the Compensation Committee do not have any relationship that is required to be disclosed under this caption pursuant to SEC rules and regulations. There were no interlocks or other relationships among our executive officers and directors.

Summary Compensation Table

The following table summarizes all plan and non-plan compensation awarded to, earned by, or paid to the Company’s co-CEOs, the Chief Financial Officer and the General Counsel, who were the only executive officers who served in such capacities on December 31, 2015 (collectively, the “Named Executive Officers”), for services rendered while such person was serving as a Named Executive Officer for our last three fiscal years. No non-qualified deferred compensation was awarded to any Named Executive Officer in 2015, 2014 or 2013.

Amounts of salary, bonus, non-equity incentive plan compensation and all other compensation earned by each Named Executive Officer in a currency other than U.S. dollars have been translated using the average exchange rate for 2015, 2014 or 2013, as applicable.

16

Year | Salary (US$) | Bonus (US$)(1) | Stock Awards (US$) (2) | Option Awards (US$) (2) | Non-Equity Incentive Plan Compensation (US$)(1) | All Other Compensation (US$) | Total Compensation (US$) | ||||||||||||||||

Michael Del Nin co-Chief Executive Officer | 2015 | 800,000 | — | 1,000,011 | 770,500 | 1,600,000 | 174,786 | (3) | 4,345,297 | ||||||||||||||

2014 | 800,000 | — | 873,253 | — | 1,600,000 | 226,195 | (4) | 3,499,448 | |||||||||||||||

2013 | 233,242 | — | — | — | 200,000 | 20,389 | (5) | 453,631 | |||||||||||||||

Christoph Mainusch co-Chief Executive Officer | 2015 | 800,000 | — | 1,000,011 | 770,500 | 1,600,000 | 148,048 | (6) | 4,318,559 | ||||||||||||||

2014 | 800,000 | — | 873,253 | — | 1,600,000 | 156,751 | (7) | 3,430,004 | |||||||||||||||

2013 | 233,242 | — | — | — | 200,000 | 78,205 | (8) | 511,447 | |||||||||||||||

David Sturgeon Chief Financial Officer | 2015 | 500,000 | — | 400,009 | 308,200 | 1,000,000 | 132,630 | (9) | 2,340,839 | ||||||||||||||

2014 | 448,277 | — | 250,011 | — | 1,000,000 | 159,648 | (10) | 1,857,936 | |||||||||||||||

2013 | 398,967 | 45,000 | 88,600 | — | — | 173,843 | (11) | 706,410 | |||||||||||||||

Daniel Penn General Counsel | 2015 | 512,068 | — | 500,016 | 385,250 | 1,024,136 | 12,202 | (12) | 2,433,672 | ||||||||||||||

2014 | 551,622 | — | 275,003 | — | 1,103,244 | 11,043 | (12) | 1,940,912 | |||||||||||||||

2013 | 523,765 | 125,000 | 177,200 | — | — | 11,001 | (12) | 836,966 | |||||||||||||||

(1) | Information in respect of bonus awards and non-equity incentive plan awards is summarized below for each Named Executive Officer. |

(2) | These amounts reflect aggregate grant date fair value of restricted stock units granted during the fiscal years ended December 31, 2015, 2014 and 2013 under the 2015 Stock Incentive Plan and the Amended and Restated Stock Incentive Plan, as applicable, in accordance with ASC 718. Assumptions used in the calculation of the aggregate grant date fair value are included in Part II, Item 8, Note 18 to our Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2015. Excludes the value of restricted stock units granted on June 25, 2013 in exchange for outstanding options pursuant to an employee option exchange program. For additional information, see “Outstanding Equity Awards at December 31, 2015” below. |

(3) | Represents US$ 68,261 for overseas housing allowance, US$ 35,568 for school fees, US$ 30,000 for ground transportation, US$ 20,552 for health and life insurance benefits and US$ 20,405 for tax return preparation fees. |

(4) | Represents US$ 75,000 for relocation expenses, US$ 67,463 for overseas housing allowance, US$ 30,000 for ground transportation, US$ 27,538 for health and life insurance benefits, US$ 25,694 for school fees and US$ 500 for tax return preparation fees. |

(5) | Represents US$ 10,000 for legal fees, US$ 5,389 for health insurance and US$ 5,000 for ground transportation. |

(6) | Represents US$ 68,261 for overseas housing allowance, US$ 30,000 for ground transportation, US$ 23,422 for school fees, US$ 20,695 for health and life insurance benefits and US$ 5,670 for tax return preparation fees. |

(7) | Represents US$ 80,955 for overseas housing allowance, US$ 30,000 for ground transportation, US$ 23,872 for school fees, US$ 21,592 for health and life insurance benefits and US$ 332 for tax return preparation fees. |