Attached files

| file | filename |

|---|---|

| EX-32.01 - EXHIBIT 32.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex320112312016.htm |

| EX-31.03 - EXHIBIT 31.03 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex310312312016.htm |

| EX-31.02 - EXHIBIT 31.02 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex310212312016.htm |

| EX-31.01 - EXHIBIT 31.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex310112312016.htm |

| EX-24.01 - EXHIBIT 24.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex240112312016.htm |

| EX-23.02 - EXHIBIT 23.02 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex230212312016.htm |

| EX-23.01 - EXHIBIT 23.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex230112312016.htm |

| EX-21.01 - EXHIBIT 21.01 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex210112312016.htm |

| EX-10.11 - EXHIBIT 10.11 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex101112312016.htm |

| EX-10.10 - EXHIBIT 10.10 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | ex101012312016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

BERMUDA | 98-0438382 | |

(State or other jurisdiction of incorporation and organization) | (I.R.S. Employer Identification No.) | |

O'Hara House, 3 Bermudiana Road, Hamilton, Bermuda | HM 08 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (441) 296-1431

Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(b) of the Act: | ||

CLASS A COMMON STOCK, $0.08 PAR VALUE | NASDAQ Global Select Market, Prague Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

UNIT WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK | None. | |

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” or “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes £ No T

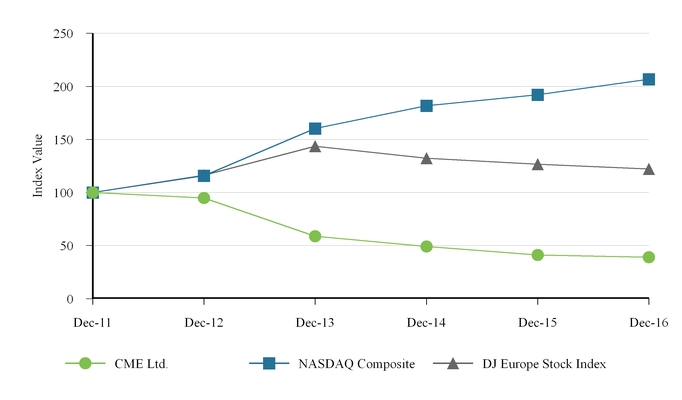

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2016 (based on the closing price of US$ 2.11 of the registrant's Class A Common Stock, as reported by the NASDAQ Global Select Market on June 30, 2016) was US$ 128.1 million.

Number of shares of Class A Common Stock outstanding as of February 6, 2017: 143,450,921

DOCUMENTS INCORPORATED BY REFERENCE

Document | Location in 10-K in Which Document is Incorporated | |

Registrant's Proxy Statement for the 2017 Annual General Meeting of Shareholders | Part III | |

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

FORM 10-K

For the year ended December 31, 2016

TABLE OF CONTENTS | Page | ||

PART I | |||

PART II | |||

PART III | |||

PART IV | |||

I. Forward-looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 22E of the Securities Exchange Act of 1934 (the "Exchange Act"), including those relating to our capital needs, business strategy, expectations and intentions. Statements that use the terms “believe”, “anticipate”, “trend”, “expect”, “plan”, “estimate”, “forecast”, “should”,“intend” and similar expressions of a future or forward-looking nature identify forward-looking statements for purposes of the U.S. federal securities laws or otherwise. In particular, information appearing under the sections entitled "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" includes forward looking-statements. For these statements and all other forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even be anticipated. Forward-looking statements reflect our current views with respect to future events and because our business is subject to such risks and uncertainties, actual results, our strategic plan, our financial position, results of operations and cash flows could differ materially from those described in or contemplated by the forward-looking statements contained in this report.

Important factors that contribute to such risks include, but are not limited to, those factors set forth under "Risk Factors” as well as the following: the effect of global economic uncertainty and Eurozone instability in our markets and the extent, timing and duration of any recovery; levels of television advertising spending and the rate of development of the advertising markets in the countries in which we operate; the extent to which our liquidity constraints and debt service obligations restrict our business; our exposure to additional tax liabilities as well as liabilities resulting from regulatory or legal proceedings initiated against us; our ability to refinance our existing indebtedness; our success in continuing our initiatives to diversify and enhance our revenue streams; our ability to make cost-effective investments in our television businesses, including investments in programming; our ability to develop and acquire necessary programming and attract audiences; and changes in the political and regulatory environments where we operate and in the application of relevant laws and regulations. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included in this report. All forward-looking statements speak only as of the date of this report. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

1

Defined Terms

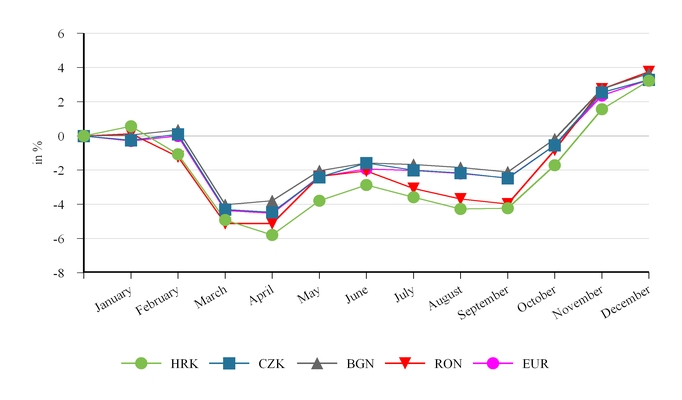

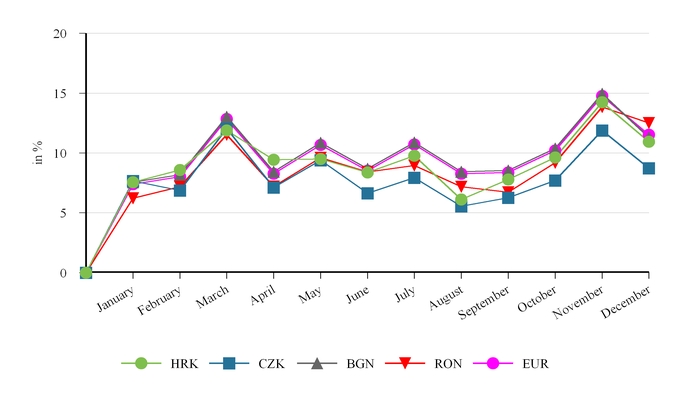

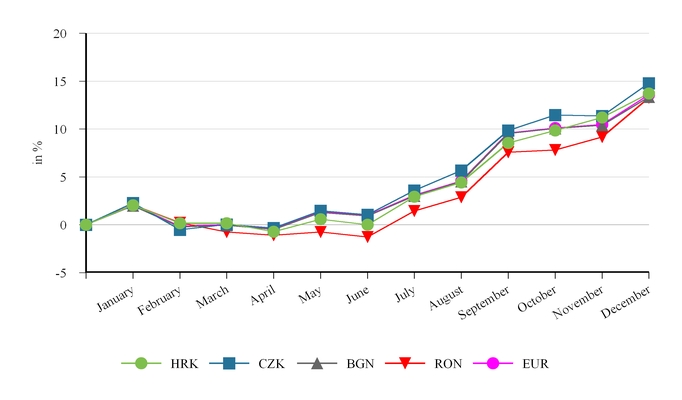

Unless the context otherwise requires, references in this report to the “Company”, “CME”, “we”, “us” or “our” refer to Central European Media Enterprises Ltd. (“CME Ltd.”) or CME Ltd. and its consolidated subsidiaries listed in Exhibit 21.01 hereto. Unless otherwise noted, all statistical and financial information presented in this report has been converted into U.S. dollars using period-end exchange rates. All references in this report to “US$” or “dollars” are to U.S. dollars, all references to “BGN” are to Bulgarian lev, all references to “HRK” are to Croatian kuna, all references to “CZK” are to Czech koruna, all references to “RON” are to the New Romanian lei and all references to “Euro” or “EUR” are to the European Union Euro. The exchange rates as at December 31, 2016 used in this report are US$/BGN 1.86; US$/HRK 7.22; US$/CZK 25.64; US$/RON 4.30; and US$/EUR 0.95.

The following defined terms are used in this Annual Report on Form 10-K:

• | the term “2015 Convertible Notes” refers to our 5.0% senior convertible notes due November 2015, redeemed in November 2015; |

• | the term “2016 Fixed Rate Notes” refers to our 11.625% senior notes due 2016, redeemed in June 2014; |

• | the term “2017 Fixed Rate Notes” refers to the 9.0% senior secured notes due 2017 issued by our wholly owned subsidiary, CET 21 spol. s r.o. (“CET 21”), redeemed in December 2014; |

• | the term "2017 PIK Notes" refers to our 15.0% senior secured notes due 2017, redeemed in April 2016; |

• | the term "2017 Term Loan" refers to our 15.0% term loan facility due 2017, repaid in April 2016; |

• | the term "2018 Euro Term Loan" refers to our floating rate senior unsecured term credit facility due 2018 guaranteed by Time Warner, dated as of November 14, 2014 and amended on February 19, 2016; |

• | the term "2019 Euro Term Loan" refers to our floating rate senior unsecured term credit facility due 2019 guaranteed by Time Warner, dated as of September 30, 2015 and amended on February 19, 2016; |

• | the term "2021 Euro Term Loan" refers to our floating rate senior unsecured term credit facility due 2021 entered into by CME BV (as defined below), guaranteed by Time Warner and CME Ltd., dated as of February 19, 2016; |

• | the term "Euro Term Loans" refers collectively to the 2018 Euro Term Loan, 2019 Euro Term Loan and 2021 Euro Term Loan; |

• | the term "2021 Revolving Credit Facility" refers to our amended and restated revolving credit facility dated as of February 28, 2014, as amended and restated as of November 14, 2014 and further amended and restated on February 19, 2016; |

• | the term "Guarantee Fees" refers to amounts accrued and payable to Time Warner as consideration for Time Warner's guarantees of the Euro Term Loans; |

• | the term “Reimbursement Agreement" refers to an agreement with Time Warner which provides that we will reimburse Time Warner for any amounts paid by them under any guarantee or through any loan purchase right exercised by Time Warner, dated as of November 14, 2014 and amended and restated on February 19, 2016; |

• | the term "CME BV" refers to CME Media Enterprises B.V., our 100% owned subsidiary; |

• | the term "CME NV" refers to Central European Media Enterprises N.V., our 100% owned subsidiary; |

• | the term "Time Warner" refers to Time Warner Inc.; and |

• | the term “TW Investor” refers to Time Warner Media Holdings B.V. |

PART I

ITEM 1. BUSINESS

Central European Media Enterprises Ltd., a Bermuda company limited by shares, is a media and entertainment company operating in Central and Eastern Europe. Our assets are held through a series of Dutch and Curaçao holding companies. We manage our business on a geographical basis, with six operating segments, Bulgaria, Croatia, the Czech Republic, Romania, the Slovak Republic and Slovenia, which are also our reportable segments and our main operating countries. We own 94% of our Bulgaria operations and 100% of our broadcast operating and license companies in our remaining countries.

Our main operating countries are members of the European Union (the “EU”). However, as emerging economies, they have adopted Western-style democratic forms of government within the last twenty-five years and have economic structures, political and legal systems, systems of corporate governance and business practices that continue to evolve. As the economies of our operating countries converge with more developed nations and their economic and commercial infrastructures continue to develop, we believe the business risks of operating in these countries will continue to decline.

We operate market leading television networks in each of these six countries, broadcasting a total of 36 television channels to approximately 50 million people living in the region. Each segment also develops and produces content for their television channels. We generate advertising revenues in our country operations primarily through entering into agreements with advertisers, advertising agencies and sponsors to place advertising on the television channels that we operate. We generate additional revenues by collecting fees from cable, direct-to-home (“DTH”) and internet protocol television ("IPTV") operators for carriage of our channels.

Our strategy is to maintain or increase our audience leadership in each of our countries in order to pursue sales strategies designed to maximize our revenues. We have built our audience leadership in each of our markets by operating a multi-channel business model with a diversified portfolio of television channels which appeal to a broad audience.

Content that consistently generates high audience shares is crucial to maintaining the success of each of our country operations. While content acquired from the Hollywood studios remains popular, our audiences increasingly demand content that is produced in their local language and reflects their society, attitudes and culture. We believe developing and producing local content is key to being successful in prime time and supporting market-leading channels and that maintaining a regular stream of popular local content at the lowest possible cost is operationally important over the long term.

As the distribution platforms in our region develop and become more diversified, our television channels and content will increasingly reach viewers through new distribution offerings, such as internet TV and smart devices. We offer viewers the choice of watching premium television content through a series of portals, including through Voyo, our subscription video-on-demand service, and advertising supported catch-up services on our websites.

2

Sales

We generate advertising revenues primarily through entering into agreements with advertisers, advertising agencies and sponsors to place advertising on our television channels.

Our main unit of inventory is the commercial gross rating point (“GRP”), a measure of the number of people watching television when an advertisement is aired. We generally contract with a client to provide an agreed number of GRPs for an agreed price (“cost per point” or “CPP”). Much less frequently, and usually only for small niche channels, we may sell on a fixed spot basis where an advertisement is placed at an agreed time for a negotiated price that is independent of the number of viewers. The CPP varies depending on the season and time of day the advertisement is aired, the volume of GRPs purchased, requests for special positioning of the advertisement, the demographic group that the advertisement is targeting and other factors. Our larger advertising customers generally enter into annual contracts which set the pricing for a committed volume of GRPs.

We operate our television networks based on a business model of audience leadership, brand strength and strong local content. Our sales strategy is to maximize the monetization of our advertising time by leveraging our high brand power and applying an optimal mix of pricing and sell-out rate. The effectiveness of our sales strategy is measured by our share of the television advertising market, which represents the proportion of our television advertising revenues in the market compared to the total television advertising market. We also generate additional revenues by collecting carriage fees from cable, satellite and IPTV operators for broadcasting our channels.

The public broadcasters in the countries in which we operate are restricted in the amount of advertising that they may sell. See “Regulation of Television Broadcasting” below for additional information.

Programming

Our programming strategy in each country is tailored to match the expectations of key audience demographics by scheduling and marketing an optimal mix of programs in a cost effective manner. The programming that we provide drives our audience shares and ratings (see "Audience Share and Ratings" below) and consists of locally-produced news, current affairs, fiction, and reality and entertainment shows as well as acquired foreign movies, series and sports programming.

We focus our programming investments on securing leading audience share positions during prime time, where the majority of advertising revenues are delivered, and improving our cost efficiency through optimizing the programming mix and limiting the cost of programming scheduled off-prime time while maintaining all day audience shares.

Audience Share and Ratings

The following sets forth the channels operated by each of our segments. The tables below provide a comparison of all day and prime time audience shares for 2016 in the target demographic of each of our leading channels to the primary channels of our main competitors.

Audience share represents the viewers watching a channel in proportion to the total audience watching television. Ratings represent the number of people watching a channel in proportion to the total population. Audience share and ratings information are measured in each market by international measurement agencies using peoplemeters, which quantify audiences for different demographics and subgeographies of the population measured throughout the day. Our channels schedule programming intended to attract audiences within specific target demographics that we believe will be attractive to advertisers.

Bulgaria

We operate one general entertainment channel, BTV, and five other channels, BTV CINEMA, BTV COMEDY, RING, BTV ACTION and BTV LADY.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

18-49 | BTV | CME | 30.5% | 31.5% | 33.6% | 36.6% | ||||||

NOVA TV | MTG | 19.2% | 19.4% | 21.1% | 21.8% | |||||||

BNT 1 | Public television | 7.0% | 5.8% | 8.9% | 7.0% | |||||||

Source: GARB

The combined all day and prime time audience shares of our Bulgaria operations in 2016 were 39.6% and 42.6%, respectively.

Croatia

We operate one general entertainment channel, NOVA TV (Croatia) and three other channels, DOMA (Croatia), NOVA WORLD and MINI TV.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

18-54 | Nova TV (Croatia) | CME | 20.9% | 21.8% | 27.0% | 28.3% | ||||||

RTL | RTL | 14.9% | 16.4% | 17.5% | 19.1% | |||||||

HTV 1 | Public television | 11.5% | 12.5% | 10.1% | 11.6% | |||||||

Source: AGB Nielsen Media Research

The combined all day and prime time audience shares of our Croatia operations in 2016, excluding NOVA WORLD and MINI TV, were 27.2% and 34.0%, respectively.

3

Czech Republic

We operate one general entertainment channel, TV NOVA (Czech Republic), and seven other channels, NOVA CINEMA, NOVA SPORT 1, NOVA SPORT 2, NOVA ACTION (formerly FANDA), NOVA 2 (formerly SMICHOV), NOVA GOLD (formerly TELKA) and NOVA INTERNATIONAL, a general entertainment channel broadcasting in the Slovak Republic.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

15-54 | TV NOVA (Czech Republic) | CME | 23.7% | 24.9% | 28.2% | 29.2% | ||||||

Prima | MTG / GME | 10.8% | 10.9% | 13.1% | 12.2% | |||||||

CT 1 | Public television | 12.3% | 12.2% | 14.7% | 14.5% | |||||||

Source: ATO - Nielsen Admosphere; Mediaresearch

The combined all day and prime time audience shares of our Czech Republic operations in 2016, excluding NOVA SPORT 1, NOVA SPORT 2 and NOVA INTERNATIONAL, were 34.1% and 37.7%, respectively.

Romania

We operate one general entertainment channel, PRO TV, and eight other channels, ACASA, ACASA GOLD, PRO CINEMA, SPORT.RO, MTV ROMANIA, PRO TV INTERNATIONAL, PRO TV CHISINAU, a general entertainment channel broadcasting in Moldova, and ACASA IN MOLDOVA.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

18-49 Urban | PRO TV | CME | 20.6% | 18.9% | 25.0% | 23.9% | ||||||

Antena 1 | Intact group | 15.7% | 14.7% | 15.9% | 14.0% | |||||||

TVR 1 | Public television | 1.3% | 1.8% | 1.5% | 1.9% | |||||||

Source: Kantar Media

The combined all day and prime time audience shares of our Romania operations in 2016, excluding PRO TV INTERNATIONAL, PRO TV CHISINAU and ACASA IN MOLDOVA, were 25.1% and 29.1%, respectively.

Slovak Republic

We operate one general entertainment channel, TV MARKIZA, and three other channels, DOMA (Slovak Republic), DAJTO and MARKIZA INTERNATIONAL, a general entertainment channel broadcasting in the Czech Republic.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

12-54 | TV MARKIZA | CME | 22.3% | 22.9% | 23.3% | 24.9% | ||||||

TV JOJ | J&T Media Enterprises | 15.4% | 16.5% | 18.8% | 20.0% | |||||||

Jednotka | Public Television | 7.8% | 7.5% | 9.5% | 8.8% | |||||||

Source: PMT/ TNS SK

The combined all day and prime time audience shares of our Slovak Republic operations in 2016, excluding MARKIZA INTERNATIONAL, were 30.7% and 32.2%, respectively.

4

Slovenia

We operate two general entertainment channels, POP TV and KANAL A, and three other channels, KINO, BRIO and OTO.

Target Demographic | Channel | Ownership | All day audience share | Prime time audience share | ||||||||

2016 | 2015 | 2016 | 2015 | |||||||||

18-54 | POP TV | CME | 21.3% | 19.5% | 31.6% | 27.8% | ||||||

Planet TV | Antenna Group / TSmedia | 8.1% | 8.6% | 10.4% | 11.7% | |||||||

SLO 1 | Public Television | 9.0% | 8.6% | 9.6% | 9.4% | |||||||

Source: AGB Nielsen Media Research

The combined all day and prime time audience shares of our Slovenia operations in 2016 were 38.1% and 47.5%, respectively.

Seasonality

We experience seasonality, with advertising sales tending to be lowest during the third quarter of each calendar year due to the summer holiday period (typically July and August), and highest during the fourth quarter of each calendar year due to the holiday season.

Regulation of Television Broadcasting

Television broadcasting in each of the countries in which we operate is regulated by a governmental authority or agency. In this report, we refer to such agencies individually as a “Media Council” and collectively as “Media Councils”. Media Councils generally supervise broadcasters and their compliance with national broadcasting legislation, as well as control access to the available frequencies through licensing regimes.

Programming and Advertising Regulation

Our main operating countries are member states of the EU, and as such, our broadcast operations in such countries are subject to relevant EU legislation relating to media.

The EU Audiovisual Media Services Directive (the “AVMS Directive”) came into force in March 2010 and provides the legal framework for audiovisual media services generally in the EU. The AVMS Directive covers both linear (i.e., broadcasting) and non-linear (e.g., video-on-demand and catch-up) transmissions of audiovisual media services, with the latter subject to significantly less stringent regulation. Among other things, the AVMS Directive requires broadcasters to comply with rules related to, but not limited to, program content, advertising content and quotas, product placement, sponsorship, teleshopping, accessibility by persons with a visual or hearing disability, and minimum quotas with respect to “European works” (defined as originating from an EU member state or a signatory to the Council of Europe's Convention on Transfrontier Television as well as being written and produced mainly by residents of the EU or Council of Europe member states or pursuant to co-production agreements between such states and other countries). In addition, the AVMS Directive requires that at least 10% of either broadcast time or programming budget is dedicated to programs made by European producers who are independent of broadcasters. News, sports, games, advertising, teletext services and teleshopping are excluded from the calculation of these quotas. In respect of advertising, the AVMS Directive provides that the proportion of television advertising spots and teleshopping spots within a given hour shall not exceed 20% (what is commonly referred to as the ‘12 minute per hour rule’). The AVMS Directive does not otherwise restrict when programming may be interrupted by advertising in linear broadcasting, except in the case of films and news programming (where programming may be interrupted once every thirty minutes or more) and children’s programming (where the same restriction applies providing that the program is greater than thirty minutes) and religious programming (where no advertising or teleshopping shall be inserted). Under the AVMS Directive, product placement is prohibited subject to certain exceptions (for example it is permitted in films and series, sports programs and light entertainment programs) and providing that the use of product placement is not ‘unduly’ prominent, is not promotional and is appropriately identified to viewers.

Legislation implementing the AVMS Directive has been adopted across our operating countries. On May 25, 2016, the European Commission adopted a proposal amending the AVMS Directive. As proposed the legislation liberalises many of the AVMS Directive requirements, including, for example, in respect of hourly advertising limits, product placement, teleshopping and sponsorship. The proposal is subject to consultation, review by the European Commission committees and voting in the European Parliament. Any amendments to the AVMS Directive would then need to be implemented by our countries of operation.

Please see below for more detailed information on programming and advertising regulations that impact our channels.

Bulgaria: In Bulgaria, privately owned broadcasters are permitted to broadcast advertising for up to 12 minutes per hour. The public broadcaster, BNT, which is financed through a compulsory television license fee and by the government, is restricted to broadcasting advertising for four minutes per hour and no more than 15 minutes per day, of which only five minutes may be in prime time. There are also restrictions on the frequency of advertising breaks (for example, news and children's programs shorter than 30 minutes cannot be interrupted). These restrictions apply to both publicly and privately owned broadcasters. Further restrictions relate to advertising content, including a ban on tobacco advertising and restrictions on alcohol advertising, regulations on medical products advertising and regulations on advertising targeted at children or during children's programming. In addition, members of the news department of our channels are prohibited from appearing in advertisements. Our channels in Bulgaria are required to comply with several restrictions on programming, including regulations on the origin of programming. These channels must ensure that 50% of a channel's total annual broadcast time consists of EU- or locally-produced programming and 12% of such broadcast time consists of programming produced by independent producers in the EU. News, sports, games and teleshopping programs, as well as advertising and teletext services, are excluded from these restrictions.

Croatia: In Croatia, privately owned broadcasters are permitted to broadcast advertising for up to 12 minutes per hour with no daily limit, and direct sales advertising has to last continuously for at least 15 minutes. Additional restrictions apply to children's programming and movies. The public broadcaster, HRT, which is financed through a compulsory television license fee, is restricted to broadcasting nine minutes of advertising per hour generally and four minutes per hour from 6 p.m. to 10 p.m. HRT is not permitted to broadcast spots for teleshopping. There are other restrictions that relate to advertising content, including a ban on tobacco and alcohol advertising. NOVA TV (Croatia) is required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 20% of broadcast time consists of locally produced programming and 50% of such locally produced programming be shown during prime time (between 4:00 p.m. and 10:00 p.m.). These restrictions are not applicable to DOMA (Croatia).

5

Czech Republic: Privately owned broadcasters in the Czech Republic are permitted to broadcast advertising for up to 12 minutes per hour. In September 2011, legislation was implemented in the Czech Republic which restricts the amount of advertising that may be shown on channels of the public broadcaster, CT. Pursuant to the regulation, no advertising may be shown on the public channels CT 1 and CT 24, while the channels CT 2 and CT 4 may show a limited amount of advertising. Also included in the legislation is the requirement that national private broadcasters must contribute annually to a Czech cinematography fund in an amount equal to 2% of their net advertising revenues. We are entitled to apply for financing from the fund. In the Czech Republic, all broadcasters are restricted with respect to the frequency of advertising breaks during and between programs, as well as being subject to restrictions that relate to advertising content, including a ban on tobacco advertising and limitations on advertisements of alcoholic beverages, pharmaceuticals, firearms and munitions.

Romania: Privately owned broadcasters in Romania are permitted to broadcast advertising and direct sales advertising for up to 12 minutes per hour. There are also restrictions on the frequency of advertising breaks (for example, news and children's programs shorter than 30 minutes cannot be interrupted). Broadcasters are also required that from the total broadcasting time (except for the time allocated to news, sports events, games, advertising and teleshopping) (a) at least 50% must be European-origin audio-visual works and (b) at least 10% (or, alternatively, at least 10% of their programming budget) must be European audio-visual works produced by independent producers. The public broadcaster, TVR, is restricted to broadcasting advertising for eight minutes per hour and only between programs. Further restrictions relate to advertising content, including a ban on tobacco advertising and restrictions on alcohol advertising, and regulations on advertising targeted at children or during children's programming. In addition, news anchors of all channels are prohibited from appearing in advertisements and teleshopping programming.

Slovak Republic: Privately owned broadcasters in the Slovak Republic are permitted to broadcast advertising for up to 12 minutes per hour but not for more than 20% of their total daily broadcast time. Since January 2013, the public broadcaster RTVS, which is financed through a compulsory license fee, can broadcast advertising for up to 0.5% of its total broadcast time (up to 2.5% of total broadcast time including teleshopping programming), but between 7:00 p.m. and 10:00 p.m. may broadcast only eight minutes of advertising per hour. There are restrictions on the frequency of advertising breaks during and between programs. RTVS is not permitted to broadcast advertising breaks during programs. There are also restrictions that relate to advertising content, including a ban on tobacco, pharmaceuticals, firearms and munitions advertising and a ban on advertisements of alcoholic beverages (excluding beer and wine) between 6:00 a.m. and 10:00 p.m. Our operations in the Slovak Republic are also required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 50% of the station's monthly broadcast time must be European-origin audio-visual works and at least 10% of a station's monthly broadcast time must be European audio-visual works produced by independent producers, at least 10% of which must be broadcast within five years of production.

Slovenia: Privately owned broadcasters in Slovenia are allowed to broadcast advertising for up to 12 minutes in any hour. The public broadcaster, SLO, which is financed through a compulsory television license fee and commercial activities, is allowed to broadcast advertising for up to 10 minutes per hour, but is only permitted up to seven minutes per hour between the hours of 6:00 p.m. and 11:00 p.m. There are also restrictions on the frequency of advertising breaks during programs and restrictions that relate to advertising content, including restrictions on food advertising during children's programming and a ban on tobacco advertising and a prohibition on the advertising of any alcoholic beverages from 7:00 a.m. to 9:30 p.m. and generally for alcoholic beverages with an alcoholic content of more than 15%. Our Slovenia operations are required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 20% of a station's daily programming consist of locally produced programming, of which at least 60 minutes must be broadcast between 6:00 p.m. and 10:00 p.m. In addition, 50% of our niche channels' annual broadcast time must be European-origin audio-visual works and at least 10% of such stations' annual broadcast time must be European audio-visual works produced by independent producers.

Licensing Regulation

The license granting and renewal process in our operating countries varies by jurisdiction and by type of broadcast permitted by the license (i.e., terrestrial, cable, satellite). Depending on the country, terrestrial licenses may be valid for an unlimited time period, may be renewed automatically upon application or may require a more lengthy renewal procedure, such as a tender process. Generally cable and satellite licenses are granted or renewed upon application. We expect each of our licenses will continue to be renewed or new licenses to be granted as required to continue to operate our business. All of the countries in which we operate have transitioned from analog to digital terrestrial broadcasting and we have obtained digital licenses where requested. In January 2017, we ceased terrestrial distribution of our channels in the Slovak Republic and Slovenia, and channels in those countries are now available exclusively on cable, satellite and IPTV platforms. We will apply for additional digital licenses where such applications are prudent and permissible. Please see below for more detailed information on licenses for our channels.

Bulgaria: BTV operates pursuant to a national digital terrestrial license issued by the Council for Electronic Media, the Bulgarian Media Council, that expires in July 2024. BTV ACTION broadcasts pursuant to a national cable registration that is valid for an indefinite time period and also has a digital terrestrial license that expires in January 2025 which is not currently in use. BTV CINEMA, BTV COMEDY, RING and BTV LADY, as well as BTV, each broadcast pursuant to a national cable registration that is valid for an indefinite time period.

Croatia: NOVA TV (Croatia) broadcasts pursuant to a national terrestrial license granted by the Croatian Media Council, the Electronic Media Council, which expires in April 2025. DOMA (Croatia) broadcasts pursuant to a national terrestrial license that expires in January 2026. MINI TV broadcasts via satellite and cable pursuant to a license that expires in January 2022.

Czech Republic: Our channels in the Czech Republic operate under a variety of licenses granted by the Czech Republic Media Council, The Council for Radio and Television Broadcasting. TV NOVA (Czech Republic) broadcasts under a national terrestrial license that expires in January 2025. TV NOVA (Czech Republic) may also broadcast pursuant to a satellite license that expires in December 2020. NOVA CINEMA broadcasts pursuant to a national terrestrial digital license that expires in 2023. NOVA CINEMA also broadcasts via satellite pursuant to a license that is valid until November 2019. NOVA SPORT 1 broadcasts pursuant to a license that allows for both satellite and cable transmission that expires in October 2020. NOVA SPORT 2 broadcasts pursuant to a satellite license that expires in August 2027. In addition, NOVA SPORT 1 and NOVA SPORT 2 each have a license that permits internet transmission which expires in August 2027. NOVA ACTION (formerly known as FANDA) broadcasts pursuant to a satellite license that expires in July 2024 and a national terrestrial license that expires in September 2023. NOVA 2 (formerly known as SMICHOV) broadcasts pursuant to a national terrestrial license that expires in December 2024 and a satellite license that expires in February 2025. NOVA GOLD (formerly known as TELKA) broadcasts pursuant to a national terrestrial license and a satellite license that each expire in February 2025. NOVA INTERNATIONAL broadcasts pursuant to a license that permits internet transmission which expires in January 2028.

Romania: PRO TV broadcasts pursuant to a national satellite license granted by the Romanian Media Council, the National Audio-Visual Council. Our other Romanian channels (ACASA, ACASA GOLD, PRO CINEMA, SPORT.RO, MTV ROMANIA and PRO TV INTERNATIONAL) each has a national satellite license. PRO TV also broadcasts through the electronic communications networks pursuant to a series of local licenses and ACASA broadcasts in high-definition pursuant to a written consent from the Media Council. Licenses for our Romanian operations expire on dates ranging from April 2018 to January 2025. PRO TV CHISINAU broadcasts pursuant to a cable license granted by the Audio-Visual Coordinating Council of the Republic of Moldova that expires in November 2023 and ACASA IN MOLDOVA broadcasts pursuant to a cable license that expires in December 2017.

6

Slovak Republic: TV MARKIZA, DOMA (Slovak Republic) and DAJTO each broadcast pursuant to a national license for digital broadcasting granted by the Council for Broadcasting and Retransmission, the Media Council of the Slovak Republic, which is valid for an indefinite period. MARKIZA INTERNATIONAL is broadcast pursuant to the license granted to TV MARKIZA.

Slovenia: Our Slovenian channels POP TV, KANAL A, KINO, BRIO and OTO each have licenses granted by the Post and Electronic Communications Agency of the Republic of Slovenia, the Slovenia Media Council, that allow for broadcasting on any platform, including digital, cable and satellite. These licenses are valid for an indefinite time period.

OTHER INFORMATION

Employees

As of December 31, 2016, we had a total of approximately 2,950 employees (including contractors).

Corporate Information

CME Ltd. was incorporated in 1994 under the laws of Bermuda. Our registered offices are located at O'Hara House, 3 Bermudiana Road, Hamilton HM 08, Bermuda, and our telephone number is +1-441-296-1431. Communications can also be sent c/o CME Media Services Ltd. at Krizeneckeho nam. 1078/5, 152 00 Praha 5, Czech Republic, telephone number +420-242-465-605. CME's Class A common stock is listed on the NASDAQ Global Select Market and the Prague Stock Exchange under the ticker symbol “CETV”.

Financial Information by Operating Segment and by Geographical Area

For financial information by operating segment and geographic area, see Part II, Item 8, Note 19, "Segment Data".

Available Information

We make available, free of charge, on our website at http://www.cme.net our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

7

ITEM 1A RISK FACTORS

This report and the following discussion of risk factors contain forward-looking statements as discussed on page 2 of this report. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks and uncertainties described below and elsewhere in this report. These risks and uncertainties are not the only ones we may face. Additional risks and uncertainties of which we are not aware, or that we currently deem immaterial, may also become important factors that affect our financial condition, results of operations and cash flows.

Risks Relating to Our Financial Position

Global or regional economic conditions and the credit crisis have adversely affected our financial position and results of operations. We cannot predict if the recovery in our operating countries will continue or how long it may last. A failure to achieve lasting recoveries will continue to adversely affect our results of operations.

The results of our operations depend heavily on advertising revenue, and demand for advertising is affected by general economic conditions in the region and globally. The economic uncertainty following the onset of the global financial crisis at the beginning of 2009 and the sustained recessionary period that followed had a prolonged adverse impact on consumer and business spending, access to credit, liquidity, investment spending, asset values and employment rates. These adverse economic conditions had a material negative impact on advertising spending in our markets, which negatively impacted our advertising revenues in the periods that followed. Since 2014, our markets have experienced overall growth in real GDP (as adjusted for inflation) and advertising spending; however we cannot predict if the recovery that has begun will continue or how long it will last. Any significant deterioration of general economic conditions in our markets would have an adverse economic impact on our advertising revenues. In addition, although we believe the advertising spend per capita of the countries in which we operate and advertising intensity (the ratio of total ad spend per capita to nominal GDP per capita) will converge with the developed markets (as defined in Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations), such convergence may not occur in the time frame we expect, or at all. Moreover, the occurrence of disasters, acts of terrorism, civil or military conflicts or general political instability and responses to it, such as the imposition of economic sanctions against Russia, may also cause a deterioration in general economic conditions that may reduce advertising spending. Any of these developments would have a significant negative effect on our financial position, results of operations and cash flows.

Concerns regarding the Eurozone and the impact on the region of the United Kingdom’s exit from the European Union (“EU”) may adversely affect our financial position and results of operations.

Continued economic softness in the Eurozone, including a slowdown in the growth of consumer prices, prompted the European Central Bank to embark upon quantitative easing in 2015. Economic events related to the sovereign debt crisis in several EU countries have also highlighted issues relating to the strength of the banking sector in Europe and the Euro. Although the EU has created external funding and stability mechanisms to provide liquidity and financial assistance to Eurozone member states and financial institutions, there can be no assurance that the market disruptions in Europe related to sovereign debt and the banking sector or otherwise, including the increased cost of funding for certain governments and financial institutions, will not continue and there can be no assurance that funding and stability packages utilized previously will be available or, if provided, will be sufficient to stabilize affected economies or institutions.

Economic conditions in the EU will be further impacted by the results of the referendum held in the United Kingdom on June 23, 2016 whereby the United Kingdom electorate voted in favor of the United Kingdom leaving the EU, commonly referred to as “Brexit”. While the overall economic impact of Brexit on the EU and the Euro is difficult to estimate at present, decisions to conserve cash and reduce spending by consumers and businesses in the United Kingdom would have a negative impact on economic growth rates in the United Kingdom and, to a lesser extent, in the EU, in particular those countries that are significant exporters to the United Kingdom. There is also significant uncertainty regarding the timing and terms on which the United Kingdom would leave the EU, and it is expected that a more protracted process to set those terms would have a more prolonged economic impact. In addition, there is concern that other countries may seek to leave the EU following the Brexit decision, increasing uncertainty in the region, which may have a further negative impact on investment and economic growth rates. Furthermore, the departure of the United Kingdom from the EU may affect the budgetary contributions and allocations among the EU member states in the medium term, including the countries in which we operate, which are net recipients of EU funding. Economic uncertainty caused by Brexit or other instability in the EU could cause significant volatility in EU markets and reduce economic growth rates in the countries in which we operate, which would negatively impact our business.

Our operating results will be adversely affected if we cannot generate strong advertising sales.

We generate the majority of our revenues from the sale of advertising airtime on our television channels. The reduction in advertising spending in our markets following the onset of the global financial crisis at the beginning of 2009 and the sustained recessionary period that followed had a negative effect on television advertising spending and prices. While we have attempted to combat this fall in prices by implementing new pricing strategies, the success of these strategies has varied from market to market and continues to be challenged by pressure from advertisers and discounting by competitors. In addition to advertising pricing, other factors that may affect our advertising sales include general economic conditions (described above), competition from other broadcasters and operators of other distribution platforms, changes in programming strategy, changes in distribution strategy, our channels’ technical reach, technological developments relating to media and broadcasting, seasonal trends in the advertising market, changing audience preferences and in how and when people view content and the accompanying advertising, increased competition for the leisure time of audiences and shifts in population and other demographics. Our advertising revenues also depend on our ability to maintain audience ratings and to generate GRPs. This requires us to have a distribution strategy that reaches a significant audience as well as to maintain investments in programming at a sufficient level to continue to attract audiences. Changes in the distribution of our channels, such as our decision to cease broadcasting on DTT in the Slovak Republic and Slovenia, may reduce the number of people who can view our channels, which may negatively impact our audience share and GRPs generated. Furthermore, significant or sustained reductions in investments in programming or other operating costs in response to reduced advertising revenues had and, if continued or repeated, may have an adverse impact on our television viewing levels. Reductions in advertising spending in our markets and resistance to price increases as well as competition for ratings from broadcasters seeking to attract similar audiences have had and may continue to have an adverse impact on our ability to maintain our advertising sales. A failure to maintain and increase advertising sales could have a material adverse effect on our financial position, results of operations and cash flows.

8

Our liquidity constraints and debt service obligations may restrict our ability to fund our operations.

We have significant debt service obligations under the Euro Term Loans as well as the 2021 Revolving Credit Facility (when drawn). Furthermore, we are paying Guarantee Fees to Time Warner as consideration for its guarantees of the Euro Term Loans (collectively, the "TW Guarantees"). Although the entire Guarantee Fee in respect of the 2018 Euro Term Loan and the 2019 Euro Term Loan are, and a portion of the Guarantee Fee in respect of the 2021 Euro Term Loan can be, non-cash pay at our option, accruing such fees will further increase the amounts to be repaid at the maturity of these facilities. Accordingly, the payment of Guarantee Fees in kind will increase our already significant leverage. As a result of our debt service obligations and covenants contained in the related loan agreements, we are restricted under the Reimbursement Agreement and the 2021 Revolving Credit Facility (when drawn) in the manner in which our business is conducted, including but not limited to our ability to obtain additional debt financing to refinance existing indebtedness or to fund future working capital, capital expenditures, business opportunities or other corporate requirements. We may have a proportionally higher level of debt than our competitors, which may put us at a competitive disadvantage by limiting our flexibility in planning for, or reacting to, changes in our business, economic conditions or our industry. For additional information regarding the Reimbursement Agreement and the TW Guarantees, see Part II, Item 8, Note 4, "Long-term Debt and Other Financing Arrangements".

We may be unable to refinance our existing indebtedness and may not be able to obtain favorable refinancing terms.

We have a substantial amount of indebtedness. Under the Reimbursement Agreement and the 2021 Revolving Credit Facility (when drawn), we can incur only limited amounts of additional indebtedness, other than indebtedness incurred to refinance existing indebtedness. In addition, pursuant to the Reimbursement Agreement, the all-in rates on the 2021 Euro Term Loan and the 2018 Euro Term Loan increase to 13% and 11%, respectively, on the date that is 180 days following a change of control of CME Ltd. (as defined therein); and pursuant to the 2021 Revolving Credit Facility, all commitments terminate following a change of control (as defined therein) and the interest rate on amounts outstanding increases to 13% on the date that is 180 days following such change of control. We intend to repay the 2018 Euro Term Loan at maturity with cash flows from operations and the expected proceeds from warrant exercises. In the event the warrants are not exercised in full or cash flows from operations do not meet our forecasts, we would be required to refinance the 2018 Euro Term Loan in whole or in part. Pursuant to the Reimbursement Agreement, all commitments under the 2021 Revolving Credit Facility terminate on the refinancing of any Euro Term Loan. We face the risk that we will not be able to renew, repay or refinance our indebtedness when due, or that the terms of any renewal or refinancing will not be on better terms than those of such indebtedness being refinanced. In the event we are not able to refinance our indebtedness, we might be forced to dispose of assets on disadvantageous terms or reduce or suspend operations, any of which would materially and adversely affect our financial condition, results of operations and cash flows.

We may be subject to changes in tax rates and exposure to additional tax liabilities.

We are subject to taxes in a number of foreign jurisdictions, including in respect of our operations as well as capital transactions undertaken by us. We are subject to regular review and audit by tax authorities, and in the ordinary course of our business there are transactions and calculations where the ultimate tax determination is unknown. Significant judgment is required in determining our provision for taxes. The final determination of our tax liabilities resulting from tax audits, related proceedings or otherwise could be materially different from our tax provisions. Economic and political pressures to increase receipts in various jurisdictions may make taxation and tax rates subject to significant change and the satisfactory resolution of any tax disputes more difficult. The occurrence of any of these events could have a material adverse effect on our financial position, results of operations and cash flows.

A default by us in connection with our obligations under our outstanding indebtedness could result in our inability to continue to conduct our business.

Pursuant to the terms of the agreements governing the Reimbursement Agreement and the 2021 Revolving Credit Facility, we pledged all of the shares of CME NV and of CME BV, which together own substantially all of the interests in our operating subsidiaries, as security for this indebtedness. If we or these subsidiaries were to default under the terms of any of the relevant agreements, the secured parties under such agreements would have the ability to sell all or a portion of the assets pledged to them in order to pay amounts outstanding under such debt instruments. This could result in our inability to conduct our business.

Fluctuations in exchange rates may continue to adversely affect our results of operations.

Our reporting currency is the dollar and CME Ltd.'s functional currency is the Euro. Our consolidated revenues and costs are divided across a range of European currencies. The strengthening of the dollar had a negative impact on reported revenues in 2016 when translated from the functional currencies of our operations. Continued strengthening of the dollar would have a negative impact on our reported revenues. Furthermore, fluctuations in exchange rates may negatively impact programming costs. While local programming is generally purchased in local currencies, a significant portion of our content costs relates to foreign programming purchased pursuant to dollar-denominated agreements. If the dollar appreciates against the functional currencies of our operating segments, the cost of acquiring such content would be adversely affected, which could have a material adverse effect on our results of operations and cash flows.

Our strategies to enhance our carriage fees and diversify our revenues may not be successful.

We are focused on creating additional revenue streams from our broadcast operations as well as increasing revenues generated from broadcast advertising, which is how we generate most of our revenues. Our main efforts with respect to this strategy are on increasing carriage fees from cable, satellite and IPTV operators for carriage of our channels as well as continuing to seek improvements in advertising pricing. Agreements with operators generally have a term of one or more years, at which time agreements must be renewed. There can be no assurance that we will be successful in renewing carriage fee agreements on similar or better terms. During negotiations to implement our carriage fees strategy in prior years, some cable and satellite operators suspended the broadcast of our channels, which negatively affected the reach and audience shares of those operations and, as a result, advertising revenues. There is a risk that operators may refuse to carry our channels while carriage fee negotiations are ongoing, which would temporarily reduce the reach of those channels and may result in clients withdrawing advertising from our channels. The occurrence of any of these events may have an adverse impact on our financial position, results of operations and cash flows. If we are ineffective in negotiations with carriers or in achieving further carriage fee increases, our profitability will continue to be dependent primarily on television advertising revenues, which increases the importance placed on our ability to improve advertising pricing and generate advertising revenues. In addition to carriage fees, we are also working to build-out our offerings of advertising video-on-demand products and other opportunities for advertising online. There can be no assurances that our revenue diversification initiatives will ultimately be successful, and if unsuccessful, this may have an adverse impact on our financial position, results of operations and cash flows.

9

A downgrading of our ratings may adversely affect our ability to raise additional financing.

Moody’s Investors Service rates our corporate credit as B2 with a stable outlook. Standard & Poor’s rates our corporate credit B+ with a stable outlook. Our ratings show each agency's opinion of our financial strength, operating performance and ability to meet our debt obligations as they become due. These ratings take into account the particular emphasis the ratings agencies place on metrics such as leverage ratio and cash flow, which they use as measurements of a company's liquidity and financial strength. They also reflect an emphasis placed by the ratings agencies on a track record of strong financial support from Time Warner. We may be subject to downgrades if our operating performance deteriorates or we fail to maintain adequate levels of liquidity. In addition, our ratings may be downgraded if the agencies form a view that material support from Time Warner is not as strong, or the strategic importance of CME to Time Warner is not as significant as it has been in the past. In the event our corporate credit ratings are lowered by the rating agencies, it will be more difficult for us to refinance our existing indebtedness or raise new indebtedness that may be permitted under the Reimbursement Agreement and the 2021 Revolving Credit Facility (when drawn), and we will have to pay higher interest rates, which would have an adverse effect on our financial position, results of operations and cash flows.

If our goodwill, other intangible assets and long-lived assets become impaired, we may be required to record significant charges to earnings.

We review our long-lived assets for impairment when events or changes in circumstances indicate the carrying amount may not be recoverable. Goodwill and indefinite-lived intangible assets are required to be assessed for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying amount of our goodwill, indefinite-lived intangible assets or long-lived assets may not be recoverable include slower growth rates in our markets, reduced expected future cash flows, increased country risk premium as a result of political uncertainty and a decline in stock price and market capitalization. We consider available current information when calculating our impairment charge. If there are indicators of impairment, our long-term cash flow forecasts for our operations deteriorate or discount rates increase, we may be required to recognize additional impairment charges in later periods. See Part II, Item 8, Note 3, "Goodwill and Intangible Assets" for the carrying amounts of goodwill in each of our reporting units.

Risks Relating to Our Operations

Content may become more expensive to produce or acquire or we may not be able to develop or acquire content that is attractive to our audiences.

Television programming is one of the most significant components of our operating costs. The ability of our programming to generate advertising revenues depends substantially on our ability to develop, produce or acquire programming that matches audience tastes and attracts high audience shares, which is difficult to predict. The commercial success of a program depends on several tangible and intangible factors, including the impact of competing programs, the availability of alternate forms of entertainment and leisure time activities, our ability to anticipate and adapt to changes in consumer tastes and behavior, and general economic conditions. While we have been successful in reducing content costs compared to prior periods, the cost of acquiring content attractive to our viewers, such as feature films and popular television series and formats, may increase in the future. Our expenditures in respect of locally produced programming may also increase due to competition for talent and other resources, changes in audience tastes in our markets or from the implementation of any new laws and regulations mandating the broadcast of a greater number of locally produced programs. In addition, we typically acquire syndicated programming rights under multi-year commitments before knowing how such programming will perform in our markets. In the event any such programming does not attract adequate audience share, it may be necessary to increase our expenditures by investing in additional programming, subject to the availability of adequate financial resources, as well as to write down the value of any underperforming programming. Any material increase in content costs could have a material adverse effect on our financial condition, results of operations or cash flows.

Our operations are vulnerable to significant changes in viewing habits and technology that could adversely affect us.

The television broadcasting industry is affected by rapid innovations in technology. The implementation of these new technologies and the introduction of non-traditional content distribution systems have increased competition for audiences and advertisers. Platforms such as direct-to-home cable and satellite distribution systems, the Internet, subscription and advertising video-on-demand, user-generated content sites and the availability of content on portable digital devices have changed consumer behavior by increasing the number of entertainment choices available to audiences and the methods for the distribution, storage and consumption of content. This development has fragmented television audiences in more developed markets and could adversely affect our ability to retain audience share and attract advertisers as such technologies penetrate our markets. As we adapt to changing viewing patterns, it may be necessary to expend substantial financial and managerial resources to ensure necessary access to new technologies or distribution systems. Such initiatives may not develop into profitable business models. Furthermore, technologies that enable viewers to choose when, how, where and what content to watch, as well as to fast-forward or skip advertisements, may cause changes in consumer behavior that could have a negative impact on our advertising revenues. In addition, compression techniques and other technological developments allow for an increase in the number of channels that may be broadcast in our markets and expanded programming offerings that may be offered to highly targeted audiences. Reductions in the cost of launching new channels could lower entry barriers and encourage the development of increasingly targeted niche programming on various distribution platforms. This could increase the competitive demand for popular programming, resulting in an increase in content costs as we compete for audiences and advertising revenues. A failure to successfully adapt to changes in our industry as a result of technological advances may have an adverse effect on our financial position, results of operations and cash flows.

Our operating results are dependent on the importance of television as an advertising medium.

We generate most of our revenues from the sale of our advertising airtime on television channels in our markets. Television competes with various other media, such as print, radio, the internet and outdoor advertising, for advertising spending. In all of the countries in which we operate, television constitutes the single largest component of all advertising spending. There can be no assurances that the television advertising market will maintain its current position among advertising media in our markets. Furthermore, there can be no assurances that changes in the regulatory environment or improvements in technology will not favor other advertising media or other television broadcasters. Increases in competition among advertising media arising from the development of new forms of advertising media and distribution could result in a decline in the appeal of television as an advertising medium generally or of our channels specifically. A decline in television advertising spending as a component of total advertising spending in any period or in specific markets would have an adverse effect on our financial position, results of operations and cash flows.

10

We are subject to legal compliance risks and the risk of legal or regulatory proceedings being initiated against us.

We are required to comply with a wide variety of laws and other regulatory obligations in the jurisdictions in which we operate and compliance by our businesses is subject to scrutiny by regulators and other government authorities in these jurisdictions. Compliance with foreign as well as applicable U.S. laws and regulations related to our businesses, such as broadcasting content and advertising regulations, competition regulations, tax laws, employment laws, data protection requirements, and anti-corruption laws, increases the costs and risks of doing business in these jurisdictions. We believe we have implemented appropriate risk management and compliance policies and procedures that are designed to ensure our employees, contractors and agents comply with these laws and regulations; however, a violation of such laws and regulations or the Company’s policies and procedures could occur. A failure or alleged failure to comply with applicable laws and regulations, whether inadvertent or otherwise, may result in legal or regulatory proceedings being initiated against us.

We have become aware of provisions in the tax regulations of one of our markets that shift the liability for taxes on gains resulting from certain capital transactions from the seller to the buyer. This provision may have been applicable to an acquisition made by us, although we do not believe we have any liability connected to this transaction. In addition, the prosecuting authorities in Romania have requested information in respect of an investigation into certain transactions entered into by Pro TV in 2014 primarily with certain related parties. We believe that the transactions under review are fully supported and are cooperating with the authorities in responding to the information request. In Slovenia, the competition authorities have launched an investigation into whether our Slovenian subsidiary is dominant and abused its dominant position when concluding carriage fee agreements with platform operators. The investigation is in an early stage and there has been no determination that a breach of competition law has occurred; notwithstanding that, the competition authorities may seek to apply interim measures prior to any formal determination. If these or other contingencies result in legal or regulatory proceedings being initiated against us, or if developments occur in respect of our compliance with existing laws or regulations, or there are changes in the interpretation or application of such laws or regulations, we may incur substantial costs, be required to change our business practices, our reputation may be damaged or we may be exposed to unanticipated civil or criminal liability, including fines and other penalties that may be substantial. This could have a material adverse effect on our business, financial position, results of operations and cash flows.

Piracy of our content may decrease revenues we can earn from our content and adversely impact our business and profitability.

Piracy of our content poses significant challenges in our markets. Technological developments, including digital copying, file compressing, the use of international proxies and the growing penetration of high bandwidth internet connections, have made it easier to create, transmit and distribute high quality unauthorized copies of content in unprotected digital formats. Furthermore, there are a growing number of video streaming sites, increasing the risk of online transmission of our content without consent. The proliferation of such sites broadcasting content pirated from us could result in a reduction of revenues that we receive from the legitimate distribution of our content, including through video-on-demand and other services. Protection of our intellectual property is in large part dependent on the manner in which applicable intellectual property laws in the countries in which we operate are construed and enforced. We seek to limit the threat of content piracy. However, detecting and policing the unauthorized use of our intellectual property is often difficult and remedies may be limited under applicable law. Steps we take may not prevent the infringement by third parties. There can be no assurance that our efforts to enforce our rights and protect our intellectual property will be successful in preventing piracy, which limits our ability to generate revenues from our content.

Our operations are in developing markets where there are additional risks related to political and economic uncertainty, biased treatment and compliance with evolving legal and regulatory systems.

Our revenue-generating operations are located in Central and Eastern Europe and we may be significantly affected by risks that may be different to those posed by investments in more developed markets. These risks include, but are not limited to, social and political instability, inconsistent regulatory or judicial practice, and increased taxes and other costs. The economic and political systems, legal and tax regimes, regulatory practices, standards of corporate governance and business practices of countries in this region continue to develop. Policies and practices may be subject to significant adjustments, including following changes in political leadership. This may result in social or political instability or disruptions and the potential for political influence on the media as well as inconsistent application of tax and legal regulations, arbitrary treatment before regulatory or judicial authorities and other general business risks. Other potential risks inherent in markets with evolving economic and political environments include exchange controls, higher taxes, tariffs and other levies as well as longer payment cycles. The relative level of development of our markets and the influence of local politics also present a potential for biased treatment of us before regulators or courts in the event of disputes. If such a dispute occurs, those regulators or courts might favor local interests over our interests. Ultimately, this could have a material adverse impact on our business, financial position, results of operations and cash flows.

We rely on network and information systems and other technology that may be subject to disruption or misuse, which could harm our business or our reputation.

We make extensive use of network and information systems and other technologies, including those related to our internal network management as well as our broadcasting operations. These systems are central to many of our business activities. Network and information systems-related events, such as computer hackings, computer viruses, worms or other destructive or disruptive software, process breakdowns, malicious activities or other security breaches could result in a disruption or degradation of our services, the loss of information or the improper disclosure of personal data. The occurrence of any of these events could negatively impact our business by requiring us to expend resources to remedy such a security breach or by harming our reputation. In addition, improper disclosure of personal data could subject us to liability under laws that protect personal data in the countries in which we operate. The development and maintenance of systems to prevent these events from occurring requires ongoing monitoring and updating as efforts to overcome security measures become more sophisticated. As technologies evolve, we will need to expend additional resources to protect our technology and information systems, which could have an adverse impact on our results of operations.

Our broadcasting licenses may not be renewed and may be subject to revocation.

We require broadcasting and, in some cases, other operating licenses as well as other authorizations from national regulatory authorities in our markets in order to conduct our broadcasting business. While our broadcasting licenses for our operations in Slovenia and the Slovak Republic are valid for indefinite time periods, our other broadcasting licenses expire at various times through 2028. While we expect that our material licenses and authorizations will be renewed or extended as required to continue to operate our business, we cannot guarantee that this will occur or that they will not be subject to revocation, particularly in markets where there is relatively greater political risk as a result of less developed political and legal institutions. The failure to comply in all material respects with the terms of broadcasting licenses or other authorizations or with applications filed in respect thereto may result in such licenses or other authorizations not being renewed or otherwise being terminated. Furthermore, no assurances can be given that renewals or extensions of existing licenses will be issued on the same terms as existing licenses or that further restrictions or conditions will not be imposed in the future. Any non-renewal or termination of any other broadcasting or operating licenses or other authorizations or material modification of the terms of any renewed licenses may have a material adverse effect on our financial position, results of operations and cash flows.

11

Our success depends on attracting and retaining key personnel.

Our success depends partly upon the efforts and abilities of our key personnel and our ability to attract and retain key personnel. Our management teams have significant experience in the media industry and have made important contributions to our growth and success. Although we have been successful in attracting and retaining such people in the past, competition for highly skilled individuals is intense. There can be no assurance that we will continue to be successful in attracting and retaining such individuals in the future. The loss of the services of any of these individuals could have an adverse effect on our businesses, results of operations and cash flows.

Risks Relating to Enforcement Rights

We are a Bermuda company and enforcement of civil liabilities and judgments may be difficult.

We are a Bermuda company. Substantially all of our assets and all of our operations are located, and all of our revenues are derived, outside the United States. In addition, several of our directors and officers are non-residents of the United States, and all or a substantial portion of the assets of such persons are or may be located outside the United States. As a result, investors may be unable to effect service of process within the United States upon such persons, or to enforce against them judgments obtained in the United States courts, including judgments predicated upon the civil liability provisions of the United States federal and state securities laws. There is uncertainty as to whether the courts of Bermuda and the countries in which we operate would enforce (a) judgments of United States courts obtained against us or such persons predicated upon the civil liability provisions of the United States federal and state securities laws or (b) in original actions brought in such countries, liabilities against us or such persons predicated upon the United States federal and state securities laws.

Our Bye-laws restrict shareholders from bringing legal action against our officers and directors.

Our Bye-laws contain a broad waiver by our shareholders of any claim or right of action in Bermuda, both individually and on our behalf, against any of our officers or directors. The waiver applies to any action taken or concurred in by an officer or director, or the failure of an officer or director to take any action, in the performance of his or her duties, except with respect to any matter involving any fraud or dishonesty on the part of the officer or director. This waiver limits the right of shareholders to assert claims against our officers and directors unless the act or failure to act involves fraud or dishonesty.

Risks Relating to our Common Stock

Our share price may be adversely affected by sales of unregistered shares or future issuances of our shares.