Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Extended Stay America, Inc. | stay-8xkq12016forfiling.htm |

| EX-99.3 - EXHIBIT 99.3 - Extended Stay America, Inc. | exhibit993stayq1dividend.htm |

| EX-99.1 - EXHIBIT 99.1 - Extended Stay America, Inc. | stayq1_16earningsreleasevt.htm |

2016 Q1 Earnings Call Summary April 26, 2016 9:00 AM ET

2 Important Disclosure Information This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements related to, among other things, future financial performance, including our 2016 outlook, expected performance, free cash flow, debt reduction, distribution growth, and growth opportunies as such, involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results or performance to differ from those projected in the forward-looking statements, possibly materially. For a description of factors that may cause the Company’s actual results or performance to differ from future results or performance implied by forward-looking statements, please review the information under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” included in the combined annual report on Form 10-K of Extended Stay America, Inc. and ESH Hospitality, Inc. (collectively, the “Company”) filed with the SEC on February 23, 2016 and other documents of the Company on file with or furnished to the SEC. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company, its business or operations. Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. We caution you that actual outcomes and results may differ materially from what is expressed, implied or forecasted by the Company’s forward-looking statements. This presentation includes certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Hotel Operating Profit and Hotel Operating Margin. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP.

3 1Comparable Hotels include the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for both the three months ended March 31, 2016 and 2015. 2See Appendix for Hotel Operating Margin and Adjusted EBITDA reconciliations. Q1 2016 Comparable Hotel1 Highlights $42.70 $44.83 Q1 2015 Q1 2016 Revenue Per Available Room (“RevPAR”) $60.85 $64.47 Q1 2015 Q1 2016 Average Daily Rate (“ADR”) 70.2% 69.5% Q1 2015 Q1 2016 Occupancy (%) +5.0% +5.9% -70bps $270.6 $287.6 Q1 2015 Q1 2016 Total Revenues $115.7 $122.8 Q1 2015 Q1 2016 Hotel Operating Margin2 (%) 50.6% 50.4% Q1 2015 Q1 2016 Adjusted EBITDA2 (millions) +6.3% -20bps +6.1%

4 Renovation Update Remain on track to complete renovation of all remaining ESA properties by early 2017 495 Completed Renovations at end of Q1 2016 Expected Renovation Timeline1 Renovation Room Night Displacement Outlook2 1Status at end of quarter. 2Room nights removed or expected to be removed from inventory due to renovation during the quarter.

5 Q1 2016 Segmentation & Channel Data Length of Stay Revenue Mix Q1 2016 Comparable Hotel RevPAR Growth by Property Type 1 Includes 463 renovated hotels as of 12/31/2015. 2 Includes 110 unrenovated hotels owned as of 3/31/16. 3 Includes 56 hotels under renovation at any point during Q1 2016. 4 Includes 629 hotels owned and operated during Q1 2016 and 2015. 5 May not add to 100% due to rounding. Channel Mix5 1-6 nights % 32% 35% 7-29 nights % 25% 23% 30+ nights % 43% 42% Q1 2016 Q1 2015 Proprietary Channels 79% 77% OTAs 15% 18% Other 5% 5% Q1 2015 Property Status RevPAR ADR Occupancy Renovated1 6.0% 5.6% +20 bps Unrenovated2 6.2% 4.4% +130 bps Under Renovation3 -10.9% 8.6% -1,210 bps Comparable Hotels4 5.0% 5.9% -70 bps

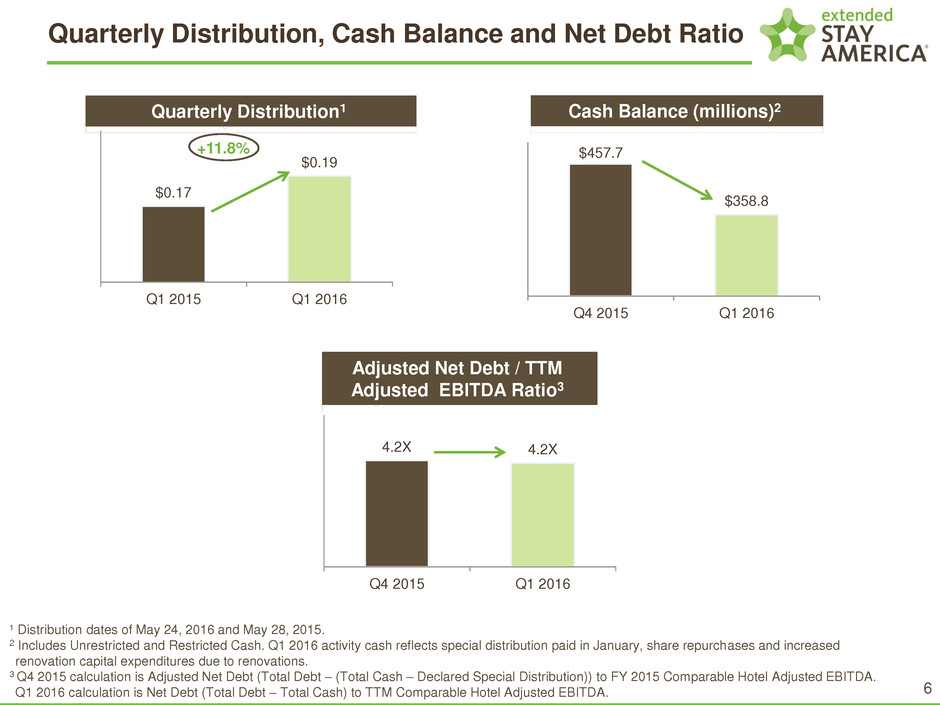

6 Quarterly Distribution, Cash Balance and Net Debt Ratio Quarterly Distribution1 $0.17 $0.19 Q1 2015 Q1 2016 +11.8% Adjusted Net Debt / TTM Adjusted EBITDA Ratio3 4.2X 4.2X Q4 2015 Q1 2016 ¹ Distribution dates of May 24, 2016 and May 28, 2015. 2 Includes Unrestricted and Restricted Cash. Q1 2016 activity cash reflects special distribution paid in January, share repurchases and increased renovation capital expenditures due to renovations. 3 Q4 2015 calculation is Adjusted Net Debt (Total Debt – (Total Cash – Declared Special Distribution)) to FY 2015 Comparable Hotel Adjusted EBITDA. Q1 2016 calculation is Net Debt (Total Debt – Total Cash) to TTM Comparable Hotel Adjusted EBITDA. Cash Balance (millions)2 $457.7 $358.8 Q4 2015 Q1 2016

7 Q1 2016 Actual Comparable Hotel Results and Full Year 2016 Outlook1 1,266$ to 1,290$ 600$ 620$ 220$ 215$ 158$ 153$ 23.5% 22.5% 151$ 180$ 240$ 260$ Updated 2016 Outlook1 1Outlook as of April 26, 2016. 2Guidance as of Q4 earnings call on February 23, 2016. (In millions) Total Revenues $281 to 287 | 287.6$ Adjusted EBITDA $118 to $123 | 122.8$ Q1 2016 Guidance2 | Actual (In millions) Q2 2015 Comparable Hotels Total Revenues $322 332$ to 338$ Adjusted EBITDA $163 165$ to 170$ Q2 2016 Outlook1 (In millions) Total Revenues 1,266$ to 1,290$ Adjusted EBITDA 600$ 620$ Depreciation and Amortization 220$ 215$ Net Interest Expense 140$ 135$ Effective Tax Rate 24.0% 23.0% Net Income 163$ 192$ Capital Expenditures 240$ 260$ Prior 2016 Outlook2

8 APPENDIX

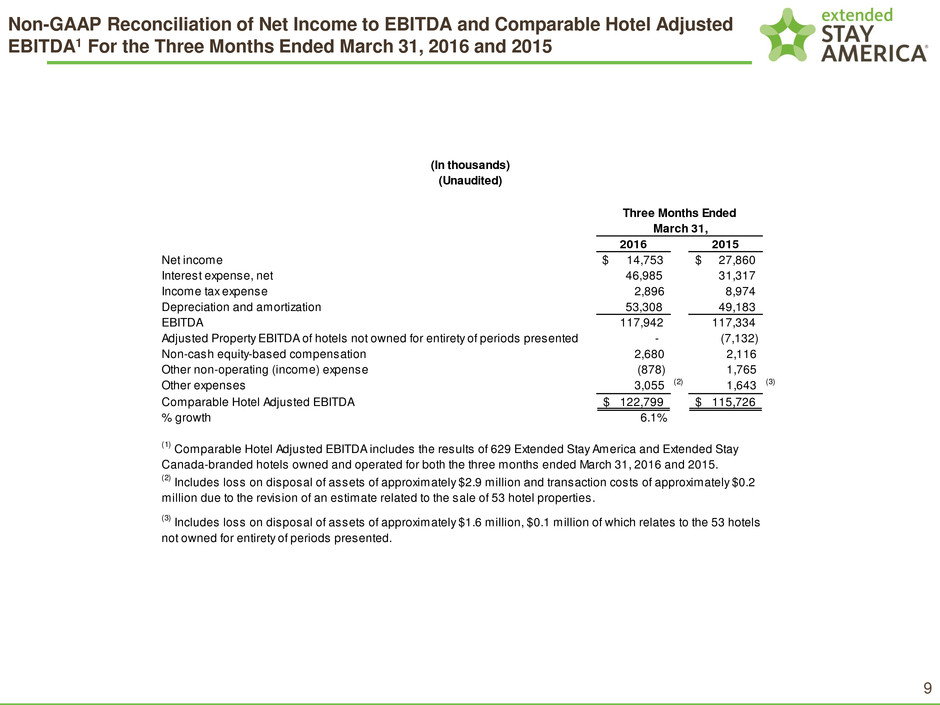

9 Non-GAAP Reconciliation of Net Income to EBITDA and Comparable Hotel Adjusted EBITDA1 For the Three Months Ended March 31, 2016 and 2015 2016 2015 Net income $ 14,753 27,860$ Interest expense, net 46,985 31,317 Income tax expense 2,896 8,974 Depreciation and amortization 53,308 49,183 EBITDA 117,942 117,334 Adjusted Property EBITDA of hotels not owned for entirety of periods presented - (7,132) Non-cash equity-based compensation 2,680 2,116 Other non-operating (income) expense (878) 1,765 Other expenses 3,055 (2) 1,643 (3) Comparable Hotel Adjusted EBITDA 122,799$ 115,726$ % growth 6.1% (3) Includes loss on disposal of assets of approximately $1.6 million, $0.1 million of which relates to the 53 hotels not owned for entirety of periods presented. (In thousands) (Unaudited) (2) Includes loss on disposal of assets of approximately $2.9 million and transaction costs of approximately $0.2 million due to the revision of an estimate related to the sale of 53 hotel properties. Three Months Ended March 31, (1) Comparable Hotel Adjusted EBITDA includes the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for both the three months ended March 31, 2016 and 2015.

10 Non-GAAP Reconciliation of Comparable Hotel Operating Profit and Hotel Operating Margin1 for the Three Months Ended March 31, 2016 and 2015 2016 2015 % Variance Room revenues 283,137$ 283,298$ (0.1)% Other hotel revenues 4,421 4,293 3.0% Total revenues of hotels not owned for entirety of periods presented - (16,949) (100.0)% Comparable Hotel total revenues 287,558 270,642 6.3% Hotel operating expenses (2) 142,664 143,421 (0.5)% Hotel operating expenses of hotels not owned for entirety of periods presented - (9,817) (3) (100.0)% Comparable Hotel operating expenses 142,664 133,604 6.8% Comparable Hotel Operating Profit 144,894$ 137,038$ 5.7% Comparable Hotel Operating Margin 50.4% 50.6% (20) bps (2) Excludes loss on disposal of assets of approximately $2.9 million and $1.6 million, respectively. (3) Excludes loss on disposal of assets of approximately $0.1 million. Three Months Ended March 31, (In thousands) (Unaudited) (1) Comparable Hotel Operating Profit and Comparable Hotel Operating Margin include the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for both the three months ended March 31, 2016 and 2015.