Attached files

| file | filename |

|---|---|

| 8-K - STALKING HORSE ASSET PURCHASE AGREEMENT - QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC. | a8-kxstalkinghorseassetpur.htm |

| EX-10.2 - EXHIBIT 10.2 - QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC. | exhibit102firstamendmentto.htm |

Exhibit 10.1

ASSET PURCHASE AGREEMENT

among

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

and

DOUGLAS ACQUISITIONS LLC

THE K&M DOUGLAS TRUST,

THE DOUGLAS IRREVOCABLE DESCENDANT’S TRUST

dated as of

April 8, 2016

TABLE OF CONTENTS

ARTICLE I PURCHASE AND SALE.......................................................................2

1.01Purchase and Sale of Assets..................................................................................................2

1.02Excluded Assets......................................................................................................................3

1.03Assumed Liabilities...............................................................................................................5

1.04Excluded Liabilities...............................................................................................................5

1.05Purchase Price........................................................................................................................6

1.06Allocation of Purchase Price.................................................................................................7

1.07Third Party Consents............................................................................................................8

ARTICLE II CLOSING..............................................................................................8

2.01Closing....................................................................................................................................8

2.02Closing Deliverables..............................................................................................................8

ARTICLE III REPRESENTATIONS AND WARRANTIES OF SELLER...............9

3.01Organization and Qualification of Seller............................................................................9

3.02Subsidiaries............................................................................................................................9

3.03Authority of Seller...............................................................................................................10

3.04No Conflicts; Consents........................................................................................................10

3.05Financial Statements...........................................................................................................10

3.06Absence of Certain Changes, Events and Conditions......................................................11

3.07Business Contracts...............................................................................................................12

3.08Title to Purchased Assets....................................................................................................13

3.09Condition and Sufficiency of Assets...................................................................................13

3.10Real Property.......................................................................................................................14

3.11Intellectual Property............................................................................................................15

3.12Inventory..............................................................................................................................16

3.13Accounts Receivable............................................................................................................17

3.14Insurance..............................................................................................................................17

3.15Legal Proceedings; Governmental Orders........................................................................17

3.16Compliance With Laws; Permits.......................................................................................18

3.17Environmental Matters.......................................................................................................18

3.18Employee Benefit Matters..................................................................................................18

3.19Employment Matters...........................................................................................................20

3.20Taxes.....................................................................................................................................21

3.21Brokers.................................................................................................................................22

3.22Affiliate Interests.................................................................................................................22

3.23Bank Accounts.....................................................................................................................22

3.24Seller SEC Documents.........................................................................................................22

3.25Product Liability..................................................................................................................23

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER..............23

4.01Organization of Buyer.........................................................................................................23

4.02Authority of Buyer..............................................................................................................23

4.03No Conflicts; Consents........................................................................................................23

4.04Brokers.................................................................................................................................24

4.05Sufficiency of Funds............................................................................................................24

4.06Legal Proceedings................................................................................................................24

4.07Disclaimer.............................................................................................................................24

ARTICLE V COVENANTS.....................................................................................24

5.01Conduct of Business Prior to the Closing..........................................................................24

5.02Access to Information..........................................................................................................25

5.03Notice of Certain Events.....................................................................................................26

5.04Employees.............................................................................................................................26

5.05Confidentiality.....................................................................................................................27

5.06Governmental Approvals and Consents............................................................................28

5.07Closing Conditions...............................................................................................................28

5.08Transfer Taxes......................................................................................................................28

5.09Buyer’s Financial Information...........................................................................................28

5.10Trust’s Assignment of Senior Secured Notes.....................................................................29

5.11Sale of Schneider..................................................................................................................29

ii

5.12Bankruptcy Matters............................................................................................................29

5.13Assumption and Rejection of Executory Contracts and Leases.....................................31

5.14Maintenance of Business.....................................................................................................31

5.15Disclosure Schedules; Notice of Developments.................................................................32

5.16Further Assurances..............................................................................................................32

ARTICLE VI CONDITIONS TO CLOSING..........................................................32

6.01Conditions to Obligations of All Parties............................................................................32

6.02Conditions to Obligations of Buyer....................................................................................33

6.03Conditions to Obligations of Seller....................................................................................34

ARTICLE VII TERMINATION...............................................................................35

7.01Termination..........................................................................................................................35

7.02Effect of Termination..........................................................................................................36

ARTICLE VIII MISCELLANEOUS.......................................................................37

8.01Survival of Representations, Warranties and Covenants................................................37

8.02Waivers and Releases..........................................................................................................37

8.03Expenses...............................................................................................................................37

8.04Notices...................................................................................................................................37

8.05Interpretation.......................................................................................................................38

8.06Headings...............................................................................................................................39

8.07Severability...........................................................................................................................39

8.08Entire Agreement.................................................................................................................39

8.09Successors and Assigns........................................................................................................39

8.10No Third-Party Beneficiaries.............................................................................................39

8.11Amendment and Modification; Waiver.............................................................................40

8.12Governing Law; Submission to Jurisdiction; Waiver of Jury Trial...............................40

8.13Counterparts........................................................................................................................40

iii

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”), dated as of April 8, 2016 is entered into among Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation (“Seller”) and Douglas Acquisitions LLC, a California limited liability company (“Douglas”), the K&M Douglas Trust, and the Douglas Irrevocable Descendant’s Trust (collectively referred to as the “Trusts”). The Douglas and the Trusts are collectively referred to as “Buyer”. Capitalized terms used but not otherwise defined herein have the meanings specified or referred to in Exhibit A attached hereto.

RECITALS

WHEREAS, Seller is engaged in (i) building and selling compressed natural gas (“CNG”) storage tanks and packaged fuel storage modules and systems for a variety of light-, medium-, and heavy-duty trucks and passenger vehicles across a full range of industries and hydrogen refueling systems and dispensers, (ii) providing engineering services, including design and support, to Original Equipment Manufacturers (“OEMs”) and other customers specializing in natural gas and hydrogen products and material science, and (iii) licensing related software (collectively, the “Business”);

WHEREAS, on March 22, 2016 (the “Petition Date”), the Seller filed a voluntary petition (“Petition”) for relief under Chapter 11 of Title 11 of the United States Code, 11 U.S.C. §§ 101, et seq. (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Central District of California (the “Bankruptcy Court”) and continues to manage its property as debtor and debtor-in-possession pursuant to Sections 1107 and 1108 of the Bankruptcy Code (the “Bankruptcy Case”);

WHEREAS, the Trusts are the holders of certain Convertible Secured Notes of the Seller identified on Exhibit B, attached hereto (the “Senior Secured Notes”), and the Senior Secured Notes are secured by substantially all of the assets of the Seller, with certain limited exceptions;

WHEREAS, pursuant to an Interim Order Authorizing Debtor To Obtain Post-Petition Financing Pursuant To 11 U.S.C. §§ 105, 361, 362 And 364 And Granting Related Relief, entered by the Bankruptcy Court in the Bankruptcy Case on March 29, 2016 (as amended, including pursuant to any final order entered in connection therewith, the “DIP Order”), Douglas is providing post-petition financing to Seller pursuant to the DIP Facility;

WHEREAS, Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, substantially all the assets, and certain specified liabilities, of the Business, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

DWT 29158998v11 0091125-000010

ARTICLE I

PURCHASE AND SALE

PURCHASE AND SALE

1.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from Seller, free and clear of any Encumbrances other than Permitted Encumbrances, all of Seller’s right, title and interest in, to and under all of the assets, properties and rights of every kind and nature, whether real, personal or mixed, tangible or intangible (including goodwill), wherever located and whether now existing or hereafter acquired (other than the Excluded Assets), which relate to, or are used or held for use in connection with, the Business (collectively, the “Purchased Assets”), including without limitation all of Seller’s right, title and interest in and to the following (other than the Excluded Assets):

(a) all inventory, finished goods, raw materials, work in progress, packaging, supplies, parts and other inventories (“Inventory”);

(b) all furniture, fixtures, equipment, machinery, tools, vehicles, office equipment, supplies, computers, telephones and other tangible personal property (the “Tangible Personal Property”);

(c) all Intellectual Property Assets, including all Marks, Works, Websites, Software, Trade Secrets and Patents included therein;

(d) all leasehold improvements located at Leased Real Property, the lease for which becomes an Assumed Executory Contract;

(e) originals, or where not available, copies, of all books and records, including customer lists, books of account, ledgers and general, financial and accounting records, machinery and equipment maintenance files, customer purchasing histories, price lists, distribution lists, supplier lists, production data, quality control records and procedures, customer complaints and inquiry files, research and development files, records and data (including all correspondence with any Governmental Authority), sales material and records (including pricing history, total sales, terms and conditions of sale, sales and pricing policies and practices), strategic plans, internal financial statements, marketing and promotional surveys, material and research and files relating to the Intellectual Property Assets and the Intellectual Property Agreements (“Books and Records”);

(f) all interests of Seller under all Business Contracts, to the extent assignable, that are not Excluded Executory Contracts provided that Seller has no further obligations pursuant to any such assigned Business Contract;

(g) all interests of Seller under executory Business Contracts that are designated by the Buyer to be assumed by the Seller and assigned to the Buyer in accordance with Section 5.11 (“Assumed Executory Contracts”), which Assumed

2

Executory Contracts shall be identified on Schedule 1.01(g), as it may be amended from time to time as provided in Section 5.13;

(h) all Permits to the extent transferable which are held by Seller and required for the conduct of the Business as currently conducted or for the ownership and use of the Purchased Assets, including those listed on Schedule 3.16(b);

(i) cash and cash equivalents;

(j) all accounts or notes receivable held by Seller, and any security, claim, remedy or other right related to any of the foregoing (“Accounts Receivable”);

(k) all rights to any Actions of any nature available to or being pursued by Seller to the extent related to the Business, the Purchased Assets or the Assumed Liabilities, whether arising by way of counterclaim or otherwise;

(l) all prepaid expenses, credits, advance payments, claims, security, refunds, rights of recovery, rights of set-off, rights of recoupment, deposits, security deposits, charges, sums and fees (including any such item relating to the payment of Taxes, to the extent transferable), not including any arising out of an Excluded Executory Contract;

(m) all of Seller’s rights under warranties, indemnities and all similar rights against third parties arising from or relating to the Business, the Purchased Assets or the Assumed Liabilities;

(n) all insurance benefits, including rights and proceeds, arising from or relating to the Business, the Purchased Assets or the Assumed Liabilities, not including any insurance benefits from any Director and Officer Liability insurance policies or relating to the Benefit Plans;

(o) Unless disposed of in accordance with Section 5.11, the stock held by Seller in Schneider Power, Inc., an Ontario corporation (“Schneider”), and any other incidents of ownership related thereto, and all other equity interests; and

(p) all goodwill and the going concern value of the Business.

All of the Purchased Assets shall be sold, assigned, transferred, conveyed and delivered to Buyer free and clear of all liens, claims and interests, whether arising before or after the Petition Date, except for Permitted Encumbrances.

1.02 Excluded Assets. Notwithstanding the foregoing, the Purchased Assets shall not include the following assets (collectively, the “Excluded Assets”):

(a) all executory Business Contracts that are not designated by the Buyer to be assumed by the Seller in accordance with Section 5.11 (“Excluded Executory Contracts”);

3

(b) the corporate seals, organizational documents, minute books, stock books, Tax Returns, books of account or other records having to do with the corporate organization of Seller;

(c) all Benefit Plans and assets attributable thereto, except for Benefit Plans and assets related thereto identified on Schedule 1.02(c) as such Schedule may be amended by Buyer up until the Bid Deadline;

(d) the rights which occur or arise from any and all insurance policies related to Directors and Officers liability insurance;

(e) the assets, properties and rights specifically set forth on Schedule 1.02(e), as such Schedule may be amended by Buyer up until the Bid Deadline;

(f) any avoidance claims arising under the Bankruptcy Code or applicable state law, including without limitation all rights and avoidance claims of Sellers arising under Chapter 5 of the Bankruptcy Code, provided that Seller agrees to waive any such claims against customers or vendors of the Business the effective as of Closing, including without limitation claims arising out of Seller’s post-petition payments to vendors and post-petition performance of warranty service for customers;

(g) tax returns and Books and Records to the extent related to tax returns, and tax refunds;

(h) any (i) professional retainers, or (ii) prepayments, prepaid expenses and security deposits relating to any Excluded Asset;

(i) (i) any attorney-client privilege and attorney work-product protection of Seller as a result of legal counsel representing Seller to the extent in connection with the Contemplated Transactions or any Excluded Asset; (ii) all documents maintained by legal counsel as a result of representation of Seller to the extent in connection with the Contemplated Transactions or any Excluded Asset; (iii) all documents subject to the attorney client privilege and work product protection described in subsections (i) and (ii); and (iv) all documents maintained by Seller to the extent in connection with the transactions contemplated by the Agreement or any Excluded Asset.

(j) all of Sellers’ claims, warranties, guarantees, refunds, causes of action, choses in action, rights of recovery, rights of set-off and rights of recoupment of every kind and nature (whether or not known or unknown or contingent or non-contingent) relating to any Excluded Asset; and

(k) the rights which accrue or will accrue to Seller under the Transaction Documents.

4

1.03 Assumed Liabilities. Subject to the terms and conditions set forth herein, Buyer shall assume and agree to pay, perform and discharge only the following Liabilities of Seller (collectively, the “Assumed Liabilities”), and no other Liabilities:

(a) Cure Amounts and Liabilities first arising after Closing under the Assumed Executory Contracts, but only to the extent that such Liabilities (other than Cure Amounts) do not relate to any failure to perform, improper performance, warranty or other breach, default or violation by Seller on or prior to the Closing;

(b) all ordinary course post-petition vacation accruals of Seller’s employees to the extent that they remain outstanding as of Closing;

(c) Sellers’ trade accounts payable and accrued operating expenses incurred post-petition in the ordinary course of business;

(d) those Liabilities of Seller set forth on Schedule 1.03(d) as such Schedule may be amended by Buyer up until entry of the Sale Order.

1.04 Excluded Liabilities. Notwithstanding any other provision in this Agreement to the contrary, Buyer shall not assume and shall not be responsible to pay, perform or discharge any Liabilities of Seller or any of its Affiliates of any kind or nature whatsoever other than the Assumed Liabilities (the “Excluded Liabilities”), including but not limited to any and all Liabilities under Excluded Executory Contracts and any executory Contract (including any executory Business Contract) which is not an Assumed Executory Contract and any and all Liabilities of Seller associated with Schneider. Seller shall discharge all Excluded Liabilities as required by and in connection with the Bankruptcy Case. Without limiting the foregoing, neither Buyer nor any of its Affiliates shall assume or be deemed to have assumed, any claim, as that term is defined in Section 101(5) of the Bankruptcy Code, (each, a “Claim”), against Seller or the Purchased Assets, regardless of when or by whom asserted (other than Assumed Liabilities), any of the following liabilities:

(a) any and all Claims that arise out of or are related to Excluded Assets;

(b) any and all Claims that arise out of or are related to Excluded Executory Contracts;

(c) any and all Claims that arise out of or are related to the purchase of goods and services by Seller prior to the Petition Date;

(d) any and all Claims that arise out of or are related to the sale of goods and services by Seller prior to the Petition Date, including without limitation, claims for breach of warranty and product liability claims;

(e) any and all Claims for Taxes arising out of or related to the conduct of the Business prior to the Closing Date or the Contemplated Transactions;

(f) any Environmental Claim;

5

(g) any and all Claims arising out of or related to infringement or misappropriation of any intellectual property by Seller;

(h) any Claims arising out of or related to any legal, accounting, investment banking, brokerage or similar services, including any Claims asserted by Craig-Hallum Capital Group LLC or Amory Securities and their respective Affiliates;

(i) any Claims arising out of or related to the issuance of any equity securities of Seller, including without limitation stock options or warrants;

(j) except as provided in Section 1.03(b), any Claims by current or former employees or independent contractors of Seller, arising out of or related to employment of work for the Seller, including without limitation, with respect to payroll, vacation, sick leave, worker’s compensation, unemployment benefits, pension benefits, employee stock option or profit sharing plans, health care plans and benefits (including COBRA), termination or severance payments, rights under employment agreements, or Law;

(k) any Claims arising out of or related to any inaction under the WARN Act;

(l) any Claims arising out of or related to Benefits Plans;

(m) any Claims arising out of or related to the failure of Seller to comply with any Law; and

(n) any Claims for indemnification, reimbursement or advancement to any officer, director, employee or agent of Seller;

1.05 Purchase Price.

(a) The aggregate purchase price for the Purchased Assets (the “Purchase Price”) shall equal the sum of:

(i) the amount required to satisfy in full all of Seller’s obligations to Western Alliance Bank, including without limitation, principal, interest, and attorney’s fees and costs, through and as of Closing;

(ii) the amount required to satisfy in full all of Seller’s obligations to Douglas in connection with the DIP Facility, including without limitation, principal, interest, and attorney’s fees and costs, through and as of Closing;

(iii) the amount required to satisfy in full all of Seller’s obligations to the holders of the Senior Secured Notes, including without limitation, principal, interest, and attorney’s fees and costs, through and as of Closing;

6

(iv) the amount required to pay Cure Amounts associated with the assumption of the Assumed Executory Contracts;

(v) cash in the amount of $250,000 (which may take the form of the final disbursement under the DIP Facility); and

(vi) the Assumed Liabilities.

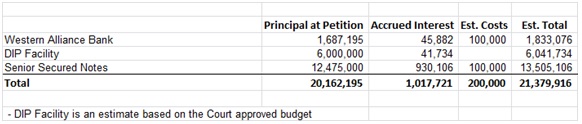

As of the date of this Agreement, the estimated amounts that will be outstanding on each of the obligations in subsections (i), (ii), and (iii) are set forth on Schedule 1.05(a).

(b) The cash component of the Purchase Price (the “Cash Consideration”), shall equal the amounts necessary to fund items (a)(i) through (v), subject to adjustment under subsection (c) below.

(c) The amount of the Cash Consideration payable to Seller will be reduced on a dollar-for-dollar basis by (i) the amount of all advances under the DIP Facility (and, pursuant to the terms of the DIP Facility, Seller’s obligation to repay such amounts shall be forgiven), and (ii) the amount necessary to satisfy the Senior Secured Notes held by a Buyer or its Affiliates, which amount will be applied in reduction of the balances due on such Senior Secured Notes.

(d) Douglas, for itself and on behalf of the Trusts or the Trusts on their own behalf, shall, pursuant to Section 363(k) of the Bankruptcy Code, credit bid the amounts that are owed to Douglas and/or the Trusts under the DIP Facility and Senior Secured Notes.

1.06 Allocation of Purchase Price. Seller and Buyer agree that the Purchase Price and the Assumed Liabilities (plus other relevant items) shall be allocated among the Purchased Assets for all purposes (including Tax and financial accounting) as shown on the allocation schedule (the “Allocation Schedule”). A draft of the Allocation Schedule shall be prepared by Buyer and delivered to Seller within 140 days following the Closing Date. If Seller notifies Buyer in writing that Seller objects to one or more items reflected in the Allocation Schedule, Seller and Buyer shall negotiate in good faith to resolve such dispute; provided, however, that if Seller and Buyer are unable to resolve any dispute with respect to the Allocation Schedule within 30 days following Buyer’s delivery of the Allocation Schedule to Seller, such dispute shall be resolved by the Independent Accountants. The fees and expenses of the Independent Accountant shall be borne equally by Seller and Buyer. Buyer and Seller shall file all Tax Returns (including amended returns and claims for refund) and information reports in a manner consistent with the Allocation Schedule.

1.07 Third Party Consents. If any Purchased Asset or Seller’s rights with respect to any Purchased Assets by its terms or applicable Law may not be assigned to Buyer without the consent of another Person, the Seller shall use its commercially reasonable efforts to obtain, or cause to be obtained, on or prior to the Closing, any approvals or consents necessary

7

to convey to the Buyer the benefit thereof. The Buyer shall cooperate with the Seller in such manner as may be reasonably requested in connection therewith. In the event any consent or approval to an assignment contemplated hereby is not obtained on or prior to the Closing Date, the Seller shall continue to use commercially reasonable efforts to obtain any such approval or consent after the Closing Date and the Seller agrees to enter into any appropriate and commercially reasonable arrangement to provide that the Buyer shall receive the Seller’s interest in the benefits under any such Purchased Asset or right with respect thereto. Notwithstanding any provision in this Section 1.07 to the contrary, Buyer shall not be deemed to have waived its rights under Section 6.02(d) hereof unless and until Buyer either provides written waivers thereof or elects to proceed to consummate the Contemplated Transactions at Closing.

ARTICLE II

CLOSING

CLOSING

2.01 Closing. Subject to the terms and conditions of this Agreement, the consummation of the Contemplated Transactions (the “Closing”) shall take place at the offices of Foley & Lardner, LLP, 555 S. Flower Street, Suite 3500, Los Angeles, California, at 10:00 a.m., Pacific time, within five Business Days after all of the conditions to Closing set forth in ARTICLE VI are either satisfied or waived (other than conditions which, by their nature, are to be satisfied on the Closing Date), or at such other time, date or place as Seller and Buyer may mutually agree upon in writing. The date on which the Closing is to occur is herein referred to as the “Closing Date”.

2.02 Closing Deliverables.

(a) At the Closing, Seller shall deliver to Buyer the following:

(i) All documents and instruments necessary or desirable to convey the Purchased Assets to Buyer, in accordance with Section 1.01 hereof, in form and substance acceptable to Buyer, all duly executed by Seller and duly acknowledged, where applicable, including (i) bills of sale, (ii) assignments of Intellectual Property Assets, (iii) domain name transfer forms, and (iv) login names and passwords for all Websites;

(ii) the Seller Closing Certificate;

(iii) the FIRPTA Certificate; and

(iv) such other instruments of transfer, assumption, filings or documents as Buyer may reasonably request to give effect to this Agreement.

(b) At the Closing, Buyer shall deliver to Seller the following:

(i) the Cash Consideration, as adjusted under Section 1.05(c);

8

(ii) executed counterparts of the documents referenced in Section 2.02(a)(i), as applicable;

(iii) the Buyer Closing Certificate; and

(iv) such other instruments of transfer, assumption, filings or documents as Seller may reasonably request to give effect to this Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Buyer that the statements contained in this ARTICLE III are true and correct as of the date hereof. All representations and warranties of the Company are made subject to and modified by the exceptions noted in the schedules delivered by the Company to Purchaser concurrently herewith and identified as the “Disclosure Schedules”. Any matter set forth in any section of the Disclosure Schedules shall qualify other sections and subsections in this ARTICLE III only to the extent it is readily apparent from a reading of the disclosure that such disclosure is applicable to such other sections. . The inclusion of any item in the Disclosure Schedules is not evidence of the materiality of such item for purposes of this Agreement.

3.01 Organization and Qualification of Seller. Seller is a corporation duly organized, validly existing and in good standing under the Laws of the state of Delaware and has full corporate power and authority to own, operate or lease the properties and assets now owned, operated or leased by it and to carry on the Business as currently conducted. Section 3.01 of the Disclosure Schedules sets forth each jurisdiction in which Seller is licensed or qualified to do business, and Seller is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the ownership of the Purchased Assets or the operation of the Business as currently conducted makes such licensing or qualification necessary and where the failure to be so licensed or qualified would reasonably be expected to result in a Material Adverse Effect.

3.02 Subsidiaries. Except as set forth in Section 3.02 of the Disclosure Schedules, Seller has no Subsidiaries, and has no direct or indirect equity, debt or other interest in any Person, or any right, warrant or option to acquire any such interest. No Subsidiary owns or operates any portion of the Business or has any right, title or interest in, to or under any asset, property or right that is used in or useful for the operation of the Business.

3.03 Authority of Seller. Subject to the Sale Order having become a Final Order at the time of Closing, Seller has full corporate power and authority to enter into this Agreement and the other Transaction Documents to which Seller is a party, to carry out its obligations hereunder and thereunder and to consummate the Contemplated Transactions. The execution and delivery by Seller of this Agreement and any other Transaction Document to which Seller is a party, the performance by Seller of its obligations hereunder and thereunder and the consummation by Seller of the Contemplated Transactions have been duly authorized by all requisite corporate action on the part of Seller. Subject to the Sale

9

Order having become a Final Order at the time of Closing, (i) this Agreement has been duly executed and delivered by Seller, and (ii) (assuming due authorization, execution and delivery by Buyer) this Agreement constitutes a legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms. Subject to the Sale Order having become a Final Order at the time of Closing, when each other Transaction Document to which Seller is or will be a party has been duly executed and delivered by Seller (assuming due authorization, execution and delivery by each other party thereto), such Transaction Document will constitute a legal and binding obligation of Seller enforceable against it in accordance with its terms.

3.04 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the Contemplated Transactions, do not and will not: (a) conflict with or result in a violation or breach of, or default under, any provision of the certificate of incorporation, by-laws or other organizational documents of Seller; (b) conflict with or result in a material violation or material breach of any provision of any Law or Governmental Order applicable to Seller, the Business or the Purchased Assets; (c) except as set forth in Section 3.04 of the Disclosure Schedules, and except for the Sale Order having become a Final Order at the time of Closing, require the consent, notice or other action by any Person under, conflict with, result in a violation or breach of, constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of or create in any party the right to accelerate, terminate, modify or cancel any material Contract or material Permit to which Seller is a party or by which Seller or the Business is bound or to which any of the Purchased Assets are subject (including any Assumed Executory Contract); or (d) result in the creation or imposition of any Encumbrance on the Purchased Assets. Except for the Sale Order having become a Final Order at the time of Closing, no consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Seller in connection with the execution and delivery of this Agreement or any of the other Transaction Documents and the consummation of the Contemplated Transactions.

3.05 Financial Statements. Complete copies of the audited financial statements consisting of the balance sheet of the Seller as at December 31 for each of the years 2013 and 2014 and un-audited financial statements consisting of the Balance Sheet of the Seller at December 31, 2015 and the related statements of income and retained earnings, stockholders’ equity and cash flow for the years then ended (the “Financial Statements”), have been delivered to Buyer. Except as set forth in Section 3.05 of the Disclosure Schedules, the Financial Statements have been prepared in accordance with GAAP, applied on a consistent basis throughout the period involved. The Financial Statements are based on the books and records of the Business, and fairly present the financial condition of the Business as of the respective dates they were prepared and the results of the operations of the Business for the periods indicated. The balance sheet of the Business as of December 31, 2015 is referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet Date.” Except as set forth in Section 3.05 of the Disclosure Schedules, Seller maintains a standard

10

system of accounting for the Business established and administered in accordance with GAAP.

3.06 Absence of Certain Changes, Events and Conditions. Since the Balance Sheet Date, and other than in the ordinary course of business consistent with past practice or as described on Section 3.06 of the Disclosure Schedules, there has not been any:

(a) Material Adverse Effect, other than the filing of the Bankruptcy Case;

(b) transfer, assignment, sale or other disposition of any of the Purchased Assets shown or reflected in the Balance Sheet, except for the sale of Inventory in the ordinary course of business;

(c) cancellation of any debts or claims or amendment, termination or waiver of any rights constituting Purchased Assets;

(d) transfer, assignment or grant of any license or sublicense of any material rights under or with respect to any Intellectual Property Assets or Intellectual Property Agreements other than non-exclusive licenses to customers in the ordinary course of business;

(e) material damage, destruction or loss, or any material interruption in use, of any Purchased Assets, whether or not covered by insurance;

(f) acceleration, termination, material modification to or cancellation of any Material Business Contract or Permit;

(g) imposition of any Encumbrance upon any of the Purchased Assets;

(h) (i) grant of any bonuses, whether monetary or otherwise, or increase in any wages, salary, severance, pension or other compensation or benefits in respect of any employees, officers, directors, independent contractors or consultants of the Business, other than as provided for in any written agreements or required by applicable Law, or (ii) action to accelerate the vesting or payment of any compensation or benefit for any employee, officer, director, consultant or independent contractor of the Business;

(i) adoption of any plan of merger or consolidation;

(j) any Contract to do any of the foregoing, or any action or omission that would result in any of the foregoing.

3.07 Business Contracts.

(a) Each Contract for which the Seller has any continuing liabilities or obligations to perform other than continuing obligations for indemnity or confidentiality that (x) by which any of the Purchased Assets are bound or affected

11

or (y) to which Seller is a party or by which it is bound in connection with the Business or the Purchased Assets is a “Business Contract.” Section 3.07(a) of the Disclosure Schedules contains a complete and accurate list of all Business Contracts (the “Material Business Contracts”) that:

(i) involve aggregate consideration in excess of $200,000;

(ii) require Seller to purchase or sell a stated portion of the requirements or outputs of the Business or that contain “take or pay” provisions;

(iii) provide for the indemnification of any Person or the assumption of any Tax, environmental or other Liabilities of any Person;

(iv) are broker, distributor, dealer, manufacturer’s representative, franchise, agency, sales promotion, market research, marketing consulting and advertising Business Contracts;

(v) are employment agreements and Business Contracts with independent contractors or consultants (or similar arrangements);

(vi) relate to Indebtedness (including, without limitation, guarantees);

(vii) are with any Governmental Authority;

(viii) limit or purport to limit the ability of Seller to compete in any line of business or with any Person or in any geographic area or during any period of time;

(ix) are joint venture, partnership or similar Business Contracts;

(x) are for the sale of any of the Purchased Assets, other than to customers in the ordinary course of business, or for the grant to any Person of any option, right of first refusal or preferential or similar right to purchase any of the Purchased Assets;

(xi) involves the procurement of goods and the counterparty is for practical purposes the Buyer’s sole source of supply for such goods; and

(xii) are collective bargaining agreements or Business Contracts with any Union.

(b) Except as set forth in Section 3.07(b) of the Disclosure Schedules, each Material Business Contract is valid and binding on Seller in accordance with its terms and is in full force and effect. Except (i) to the extent that the filing of the Bankruptcy Case constitutes a breach or default, (ii) with respect to breaches or

12

defaults arising from nonpayment and (iii) as disclosed in Section 3.07(b) of the Disclosure Schedules, Seller is not in material breach of or material default under (or is alleged to be in material breach of or material default under) any Material Business Contract, and no event or circumstance has occurred that, with notice or lapse of time or both, would constitute an event of default under any Material Business Contract or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of any benefit thereunder. Seller has not received any notice of any intention to terminate, any Material Business Contract. To Seller’s Knowledge, no counterparty to any Material Business Contract is in breach of or default under (or is alleged to be in breach of or default under), or has provided any notice of any intention to terminate any Material Business Contract. Complete and correct copies of each Material Business Contract (including all modifications, amendments and supplements thereto and waivers thereunder) have been made available to Buyer. There are no material disputes pending or, to Seller’s Knowledge, threatened under any Material Business Contract.

3.08 Title to Purchased Assets. Seller has good and marketable title to, or a valid leasehold interest in, all of the Purchased Assets, free and clear of Encumbrances except for those Encumbrances disclosed on Section 3.08 of the Disclosure Schedules. Subject to the Sale Order having become a Final Order at Closing, at Closing Seller will convey to Buyer good and marketable title to, or in the case of leased assets, valid leasehold interests in, all Purchased Assets except for Permitted Encumbrances. On the Closing Date, Buyer will have sufficient title in and to the Purchased Assets to operate and conduct the Business in substantially the same manner it was conducted before the Closing Date.

3.09 Condition and Sufficiency of Assets. The Tangible Personal Property included in the Purchased Assets are adequate for the uses to which they are being put. The Tangible Personal Property included in the Purchased Assets are, in all material respects, structurally sound and, except as described in Section 3.09 of the Disclosure Schedules in good operating condition and repair, and none of such Tangible Personal Property is in need of maintenance or repairs except for ordinary, routine maintenance and repairs that are not material in nature or cost. The Purchased Assets are sufficient for the continued conduct of the Business after the Closing in substantially the same manner as conducted by Seller prior to the Closing and constitute all of the rights, property and assets necessary to conduct the Business as currently conducted.

13

3.10 Real Property.

(a) Seller owns no real property. Section 3.10(a) of the Disclosure Schedules sets forth each parcel of real property leased by Seller and used in or necessary for the conduct of the Business as currently conducted (together with all rights, title and interest of Seller in and to leasehold improvements relating thereto, including, but not limited to, security deposits, reserves or prepaid rents paid in connection therewith, collectively, the “Leased Real Property”), and a true and complete list of all leases, subleases, licenses, concessions and other agreements (whether written or oral), including all amendments, extensions renewals, guaranties and other agreements with respect thereto, pursuant to which Seller holds any Leased Real Property (collectively, the “Leases”). Seller has delivered to Buyer a true and complete copy of each Lease. With respect to each Lease, except as set forth on Section 3.10(a) of the Disclosure Schedules:

(i) such Lease is valid, binding, enforceable and in full force and effect, and Seller enjoys peaceful and undisturbed possession of the Leased Real Property;

(ii) Seller is not in material breach or material default under such Lease (except to the extent that the filing of the Bankruptcy Case constitutes a material breach or material default) and Seller has paid all rent due and payable under such Lease;

(iii) Seller has not received nor given any notice of any default or event that with notice or lapse of time, or both, would constitute a default by Seller under any of the Leases and, to the Knowledge of Seller, no other party is in default thereof, and no party to any Lease has exercised any termination rights with respect thereto;

(iv) Except as disclosed in Section 3.10(a) of the Disclosure Schedules, Seller has not subleased, assigned or otherwise granted to any Person the right to use or occupy any Leased Real Property or any portion thereof; and

(v) Except as disclosed in Section 3.10(a) of the Disclosure Schedules, Seller has not pledged, mortgaged or otherwise granted an Encumbrance on its leasehold interest in any Leased Real Property.

(b) Except as disclosed in Section 3.10(b) of the Disclosure Schedules, Seller has not received any written notice of (i) material violations of building codes and/or zoning ordinances or other governmental or regulatory Laws affecting the Leased Real Property, (ii) existing, pending or threatened condemnation proceedings affecting the Leased Real Property, or (iii) existing, pending or threatened material zoning, building code or other moratorium proceedings, or similar matters which could reasonably be expected to adversely affect the ability to operate the Leased

14

Real Property as currently operated. Neither the whole nor any material portion of any Leased Real Property has been damaged or destroyed by fire or other casualty.

(c) The Leased Real Property is sufficient for the continued conduct of the Business after the Closing in substantially the same manner as conducted prior to the Closing and constitutes all of the real property necessary to conduct the Business as currently conducted.

3.11 Intellectual Property.

(a) Section 3.11(a) of the Disclosure Schedules lists all (i) Intellectual Property Registrations and (ii) Intellectual Property Assets, including Software, that are not registered but that are material to the operation of the Business. Except as set forth in Section3.11(a) of the Disclosure Schedules, all required filings and fees related to the Intellectual Property Registrations have been timely filed with and paid to the relevant Governmental Authorities and authorized registrars, and all Intellectual Property Registrations are otherwise in good standing.

(b) Section 3.11(b) of the Disclosure Schedules lists all Intellectual Property Agreements. Seller has provided Buyer with true and complete copies of all such Intellectual Property Agreements, including all modifications, amendments and supplements thereto and waivers thereunder. Each Intellectual Property Agreement is valid and binding on Seller in accordance with its terms and is in full force and effect. Except for a default that may have resulted from the Bankruptcy Case, Seller’s payment default or as set forth in Section 3.11(b) of the Disclosure Schedules, neither Seller nor, to Seller’s Knowledge, any other party thereto is in material breach of or material default under (or is alleged to be in breach of or default under), or has provided or received any notice of material breach or material default of or any intention to terminate, any Intellectual Property Agreement, nor has any event or circumstance occurred that, with notice or lapse of time or both, would constitute an event of default under any Intellectual Property Agreement or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of any benefit thereunder.

(c) Except as disclosed in Section 3.11(c) of the Disclosure Schedules, Seller is the sole and exclusive legal and beneficial, and with respect to the Intellectual Property Registrations, record, owner of all right, title and interest in and to the Intellectual Property Assets, and has the valid right to use all other Intellectual Property used in or necessary for the conduct of the Business as currently conducted, in each case, free and clear of Encumbrances. Without limiting the generality of the foregoing, Seller has entered into binding, written agreements with every current and former employee of Seller, and with every current and former independent contractor whereby such employees and independent contractors (i) assign to Seller any ownership interest and right they may have in the Intellectual Property Assets; and (ii) acknowledge Seller’s exclusive ownership of all Intellectual Property Assets.

15

Seller has provided Buyer with a true and complete copy of the form of such agreement.

(d) To Seller’s Knowledge, the Intellectual Property Assets and Intellectual Property licensed under the Intellectual Property Agreements are all of the Intellectual Property necessary to operate the Business as presently conducted. Except as set forth in Section 3.11(d) of the Seller’s Disclosure Schedules, the consummation of the Contemplated Transactions will not result in the loss or impairment of or payment of any additional amounts with respect to, nor require the consent of any other Person in respect of, the Buyer’s right to own, use or hold for use any Intellectual Property as owned, used or held for use in the conduct of the Business as currently conducted.

(e) Seller’s rights in the Intellectual Property Assets are valid, subsisting and enforceable. Seller has taken all commercially reasonable steps to maintain the Intellectual Property Assets and to protect and preserve the confidentiality of all trade secrets included in the Intellectual Property Assets, including requiring all Persons having access thereto to execute written non-disclosure agreements.

(f) To Seller’s Knowledge, the conduct of the Business as currently and formerly conducted, and the Intellectual Property Assets and Intellectual Property licensed under the Intellectual Property Agreements as currently or formerly owned, licensed or used by Seller, have not infringed, misappropriated, diluted or otherwise violated, and have not, do not and will not infringe, dilute, misappropriate or otherwise violate, the Intellectual Property or other rights of any Person. Except as set forth in Section 3.11(f) of the Disclosure Schedules, to Seller’s Knowledge, no Person has infringed, misappropriated, diluted or otherwise violated, or is currently infringing, misappropriating, diluting or otherwise violating, any Intellectual Property Assets.

(g) Except as set forth in Section (b)(g) of the Disclosure Schedules, there are no Actions (including any oppositions, interferences or re-examinations) settled, pending or threatened (including in the form of offers to obtain a license): (i) alleging any infringement, misappropriation, dilution or violation of the Intellectual Property of any Person by Seller in connection with the Business; (ii) challenging the validity, enforceability, registrability or ownership of any Intellectual Property Assets or Seller’s rights with respect to any Intellectual Property Assets; or (iii) by Seller or any other Person alleging any infringement, misappropriation, dilution or violation by any Person of any Intellectual Property Assets. Seller is not subject to any outstanding or prospective Governmental Order (including any motion or petition therefor) that does or would materially restrict or impair the use of any Intellectual Property Assets.

3.12 Inventory. Except as set forth in Section 3.12 of the Disclosure Schedules, all Inventory, whether or not reflected in the Balance Sheet, consists of a quality and quantity usable and salable in the ordinary course of business consistent with past practice, except

16

for Inventory returned by customers that is not restockable into resale Inventory, obsolete, damaged, defective or slow-moving items, all of which have been written off or written down to fair market value or for which adequate reserves have been established in accordance with GAAP. Except as set forth in Section 3.12 of the Disclosure Schedules, all Inventory is owned by Seller free and clear of all Encumbrances, and no Inventory is held on a consignment basis.

3.13 Accounts Receivable. Except as set forth on Section 3.13 of the Disclosure Schedules, the Accounts Receivable reflected on the Interim Balance Sheet and the Accounts Receivable arising after the date thereof (a) have arisen from bona fide transactions entered into by Seller involving the sale of goods or the rendering of services in the ordinary course of business consistent with past practice; (b) constitute only valid, undisputed claims of Seller not subject to claims of set-off or other defenses or counterclaims other than normal cash discounts accrued in the ordinary course of business consistent with past practice and (c) subject to the reserve for bad debts reflected on the Interim Balance Sheet, are collectible in full within 90 days after billing. Accounts Receivable arising from unclaimed property and unasserted legal claims are not reflected on the Balance Sheet.

3.14 Insurance. Seller has provided Buyer with copies of all (a) current policies or binders of fire, liability, product liability, umbrella liability, real and personal property, workers’ compensation, vehicular, fiduciary liability and other casualty and property insurance maintained by Seller and relating to the Business, the Purchased Assets or the Assumed Liabilities (collectively, the “Insurance Policies”); and (b) with respect to the Business, the Purchased Assets or the Assumed Liabilities, all pending claims and the claims history for Seller since January 1, 2012. Except as set forth on 3.14 of the Disclosure Schedules, there are no claims related to the Business, the Purchased Assets or the Assumed Liabilities pending under any such Insurance Policies as to which coverage has been questioned, denied or disputed or in respect of which there is an outstanding reservation of rights. Neither Seller nor any of its Affiliates has received any written notice of cancellation of, premium increase with respect to, or alteration of coverage under, any of such Insurance Policies.

3.15 Legal Proceedings; Governmental Orders.

(a) Except for the Bankruptcy Case, demands for payment received from suppliers, or as set forth on Section 3.15 of the Disclosure Schedules, there are no Actions pending or, to Seller’s Knowledge, threatened against or by Seller (a) relating to or affecting the Business, the Purchased Assets or the Assumed Liabilities; or (b) that challenge or seek to prevent, enjoin or otherwise delay the Contemplated Transactions.

(b) There are no outstanding Governmental Orders and no unsatisfied judgments, penalties or awards against, relating to or affecting the Business.

17

3.16 Compliance With Laws; Permits.

(a) Except as set forth in Section 3.16 of the Disclosure Schedules, Seller has complied, and is now complying, in all material respects with all material Laws applicable to the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets.

(b) Except as set forth in Section 3.16 of the Disclosure Schedules, all material Permits required for Seller to conduct the Business as currently conducted or for the ownership and use of the Purchased Assets have been obtained by Seller and are valid and in full force and effect. All fees and charges with respect to such Permits as of the date hereof have been paid in full. Section 3.16 of the Disclosure Schedules lists all current material Permits issued to Seller which are related to the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets, including the names of the Permits and their respective dates of issuance and expiration.

3.17 Environmental Matters.

(a) The operations of Seller with respect to the Business and the Purchased Assets are currently and have been in compliance in all material respects with all Environmental Laws. Seller has not received from any Person, with respect to the Business or the Purchased Assets, any: (i) Environmental Notice or Environmental Claim; or (ii) written request for information pursuant to Environmental Law, which, in each case, either remains pending or unresolved, or is the source of ongoing obligations or requirements as of the Closing Date.

(b) Seller has not retained or assumed, by contract or operation of Law, any liabilities or obligations of third parties under Environmental Law.

3.18 Employee Benefit Matters.

(a) Section 3.18(a) of the Disclosure Schedules contains a true and complete list of each employee benefit plan, including, without limitation, any “employee benefit plan” within the meaning of Section 3(3) of ERISA (whether or not subject to ERISA), and any other compensation, deferred compensation, incentive, bonus, stock or stock-based, change in control, retention, severance, vacation, paid time off, fringe-benefit and other similar agreement, plan, policy, program or arrangement, in each case whether or not reduced to writing and whether funded or unfunded, which is or has been maintained, sponsored, contributed to, or required to be contributed to by Seller for the benefit of any current or former employee, officer, director, retiree, independent contractor or consultant of the Business or any spouse or dependent of such individual, or under which Seller or any ERISA Affiliate has or may have any Liability, or with respect to which Buyer or any of its Affiliates would reasonably be expected to have any Liability, contingent

18

or otherwise (as listed on Section 3.18(a) of the Disclosure Schedules, each, a “Benefit Plan”).

(b) With respect to each Benefit Plan, Seller has made available to Buyer accurate, current and complete copies of each of the following: (i) the plan document together with all amendments (or, if no plan document is available, a description of the Benefit Plan; (ii) where applicable, any trust agreements or other funding arrangements, custodial agreements, insurance policies and contracts, and administration agreements and similar agreements; (iii) the most recent summary plan descriptions, including summaries of material modifications (if required), employee handbooks and any other written communications relating to any Benefit Plan; (iv) in the case of any Benefit Plan that is intended to be qualified under Section 401(a) of the Code, the most recent determination, opinion or advisory letter from the Internal Revenue Service; (v) in the case of any Benefit Plan for which a Form 5500 is required to be filed, the most recently filed Form 5500, with schedules attached; and (vi) copies of material notices, letters or other correspondence from any Governmental Authority relating to the Benefit Plan.

(c) Except as set forth in Section 3.18(c) of the Disclosure Schedules, each Benefit Plan has been established, administered and maintained in accordance with its terms and in compliance with all applicable Laws (including ERISA and the Code), including any vesting required under Section 411(d)(3) of the Code. Each Benefit Plan that is intended to be qualified under Section 401(a) of the Code (a “Qualified Benefit Plan”) is so qualified and has received a favorable and current determination or opinion letter from the Internal Revenue Service, and nothing has occurred that could reasonably be expected to cause the loss of the tax-qualified status of such Benefit Plan. Nothing has occurred with respect to any Benefit Plan that has subjected or could reasonably be expected to subject Seller or, with respect to any period on or after the Closing Date, Buyer or any of its Affiliates, to a penalty under Section 502 of ERISA or to tax or penalty under Section 4975 of the Code. Except as set forth in Section 3.18(c) of the Disclosure Schedules, all benefits, contributions and premiums relating to each Benefit Plan have been timely paid in accordance with the terms of such Benefit Plan and all applicable Laws and accounting principles, and all benefits accrued under any unfunded Benefit Plan have been paid, accrued or otherwise adequately reserved to the extent required by, and in accordance with GAAP.

(d) Neither Seller nor any of its ERISA Affiliates has incurred or reasonably would be expected to incur, either directly or indirectly, any material Liability under Title I or Title IV of ERISA with respect to any Benefit Plan;.

(e) With respect to each Benefit Plan (i) no such plan is a “multiemployer plan” within the meaning of Section 3(37) of ERISA ; (ii) no such plan is a “multiple employer plan” within the meaning of Section 413(c) of the Code or a “multiple employer welfare arrangement” (as defined in Section 3(40) of ERISA); (iii) no

19

Action has been initiated by the Pension Benefit Guaranty Corporation to terminate any such plan or to appoint a trustee for any such plan; and (iv) no such plan is subject to the minimum funding standards of Section 302 of ERISA or Section 412 of the Code.

(f) Except as set forth in 3.18(f) of the Disclosure Schedules and other than as required under Section 601 et. seq. of ERISA or other applicable Law, no Benefit Plan provides post-termination or retiree welfare benefits to any individual for any reason.

(g) Except as set forth in 3.18(g) of the Disclosure Schedules, neither the execution of this Agreement nor any of the Contemplated Transactions will (either alone or upon the occurrence of any additional or subsequent events): (i) entitle any current or former director, officer, employee, independent contractor or consultant of the Business to severance pay or any other payment; (ii) accelerate the time of payment, funding or vesting, or increase the amount of compensation due to any such individual; (iii) increase the amount payable under or result in any other material obligation pursuant to any Benefit Plan; or (iv) result in “excess parachute payments” within the meaning of Section 280G(b) of the Code.

3.19 Employment Matters.

(a) Seller has provided Buyer a list of all persons who are employees, independent contractors or consultants of the Business as of the date hereof, and sets forth for each such individual the following: (i) name; (ii) title or position (including whether full or part time); (iii) hire date; (iv) current annual base compensation rate; (v) commission, bonus or other incentive-based compensation; and (vi) a description of the fringe benefits provided to each such individual as of the date hereof. As of the date hereof, all compensation, including wages, commissions and bonuses payable to employees, independent contractors or consultants of the Business for services performed on or prior to the date hereof have been paid in full or adequately accrued for in accordance with GAAP and there are no outstanding agreements, understandings or commitments of Seller with respect to any compensation, commissions or bonuses.

(b) Seller is not, and has never been, a party to, bound by, or negotiating any collective bargaining agreement or other Contract with a union, works council or labor organization (collectively, “Union”), and there is not, and has never been, any Union representing or purporting to represent any employee of Seller, and, to Seller’s Knowledge, no Union or group of employees is seeking or has sought to organize employees for the purpose of collective bargaining. There has never been, nor, to Seller’s Knowledge, has there been any threat of, any strike, slowdown, work stoppage, lockout, concerted refusal to work overtime or other similar labor disruption or dispute affecting Seller or any employees of the Business.

20

(c) Except as set forth on Section 3.19(c) of the Disclosure Schedules, since January 1, 2015, Seller has not failed to provide advance notice of layoffs or terminations as required by, or incurred any material Liability under, the Worker Adjustment and Retraining Notification Act of 1988, and including any similar state or local Legal Requirement such as the California Worker Adjustment and Retraining Notification Act (the “WARN Act”), or any applicable Law for employees outside the United States regarding the termination or layoff of employees.

(d) Except as set forth on Section 3.19(d) of the Disclosure Schedules or as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect or pursuant to procedures established in connection with the Bankruptcy Case, (i) since January 1, 2012, Seller has been in compliance with all applicable Laws relating to labor and employment, including all Laws relating to employment practices; the hiring, promotion, assignment, and termination of employees; discrimination; equal employment opportunities; disability; labor relations; wages and hours; FLSA, classification of independent contractors, hours of work; payment of wages; immigration; workers’ compensation; employee benefits; background and credit checks; working conditions; occupational safety and health; family and medical leave; employee terminations; and data privacy and data protection; and (ii) there are no pending, or to Seller’s Knowledge, threatened, lawsuits, grievances, unfair labor practice charges, arbitrations, charges, investigations, hearings, actions, claims, or proceedings (including any administrative investigations, charges, claims, actions, or proceedings), against Seller brought by or on behalf of any applicant for employment, any current or former employee, any person alleging to be a current or former employee, any representative, agent, consultant, independent contractor, subcontractor, or leased employee, volunteer, or “temp” of Seller, or any group or class of the foregoing, or any Governmental Authority, alleging violation of any labor or employment Law, breach of any collective bargaining agreement, breach of any express or implied contract of employment, wrongful termination of employment, or any other discriminatory, wrongful, or tortious conduct in connection with the employment relationship.

3.20 Taxes. Except as set forth in 3.20 of the Disclosure Schedules:

(a) All Tax Returns required to be filed by Seller for any Pre-Closing Tax Period have been, or will be, timely filed. Such Tax Returns are, or will be, true, complete and correct in all material respects. All Taxes due and owing by Seller (whether or not shown on any Tax Return) have been, or will be, timely paid or reserved for in the Financial Statements in accordance with GAAP.

(b) Seller has withheld and paid each Tax required to have been withheld and paid in connection with amounts paid or owing to any Employee, independent contractor, creditor, customer, shareholder or other party, and has complied with all information reporting and backup withholding provisions of applicable Law.

21

(c) All deficiencies asserted, or assessments made, against Seller as a result of any examinations by any taxing authority have been fully paid.

(d) Seller is not a party to any Action by any taxing authority. There are no pending or, to Seller’s Knowledge, threatened Actions by any taxing authority.

(e) There are no Encumbrances for Taxes upon any of the Purchased Assets nor is any taxing authority in the process of any Tax audit with respect to any of the Purchased Assets (other than for current Taxes not yet due and payable).

(f) Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

(g) None of the Purchased Assets is tax-exempt use property within the meaning of Section 168(h) of the Code.

3.21 Brokers. Except as set forth on Section 3.21 of the Disclosure Schedules, no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the Contemplated Transactions based upon arrangements made by or on behalf of Seller.

3.22 Affiliate Interests. Other than any Benefit Plan and travel advances entered into the ordinary course of business, all Contracts between the Seller and any Affiliate of any Seller (but not including another Seller or a Subsidiary of a Seller) are listed on Section 3.22 of the Disclosure Schedules. Other than employment arrangements, compensation benefits and travel advances entered into in the ordinary course of business, and other than arrangements or relationships that would not be required to be disclosed in the Seller’s SEC filings pursuant to Regulation S-K of the Securities Act, to Seller’s Knowledge, no such Affiliate of any Seller controls or is a director, officer, employee or partner of, or consultant to, or lender to or borrower from or has the right to participate in the profits of, other than through the ownership of any publicly traded entity, (i) any Person which does business with the Seller or is competitive with the Business in any material respect, or (ii) any material property, asset or right which is used by the Seller. All Indebtedness of any such Affiliate to any Seller, and all Indebtedness of any Seller to any Affiliate of any Seller, is listed on Section 3.22 of the Disclosure Schedules.

3.23 Bank Accounts. Section 3.23 of the Disclosure Schedules sets forth a complete list of all bank accounts (including any deposit accounts, securities accounts and any sub-accounts) of the Seller.

3.24 Seller SEC Documents. Except as set forth in Section 3.24 of the Disclosure Schedules, the Seller has filed or furnished with the SEC all filings it has been required to make since January 1, 2014 (collectively the “Seller SEC Documents”). As of their respective filing dates, the Seller SEC Documents complied in all material respects with the requirements of the Securities Act or the Exchange Act, as applicable. None of the Seller SEC Documents filed under the Exchange Act as of their filing dates contained any untrue

22

statement of material fact or omitted to state a material fact required to be stated therein or necessary to make the statements made therein, in light of the circumstances in which they were made, not misleading, except to the extent corrected by a subsequently filed document with the SEC. None of the Seller SEC Documents filed under the Securities Act contained an untrue statement of material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein in light of the circumstances in which they were made not misleading at the time such Seller SEC Documents became effective under the Securities Act.

3.25 Product Liability. Section 3.25 of the Disclosure Schedules sets forth the aggregate cost to Seller of performance under its warranty obligations for each of the previous three years. Except as set forth in Section 3.25 of the Disclosure Schedules or otherwise reserved for in the Balance Sheet (or incurred in the ordinary course of business since such date), all products sold by Seller have been designed, manufactured, labeled and performed so as to meet and comply in all material respects with all applicable standards and specifications of Governmental Authorities, product specifications, contractual commitments, warranties and applicable Law.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the statements contained in this ARTICLE IV are true and correct as of the date hereof.

4.01 Organization of Buyer. Buyer is a limited liability company duly organized, validly existing and in good standing under the Laws of the state of California.

4.02 Authority of Buyer. Buyer has full corporate power and authority to enter into this Agreement and the other Transaction Documents to which Buyer is a party, to carry out its obligations hereunder and thereunder and to consummate the Contemplated Transactions. The execution and delivery by Buyer of this Agreement and any other Transaction Document to which Buyer is a party, the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the Contemplated Transactions have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement has been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by Seller) this Agreement constitutes a legal, valid and binding obligation of Buyer enforceable against Buyer in accordance with its terms. When each other Transaction Document to which Buyer is or will be a party has been duly executed and delivered by Buyer (assuming due authorization, execution and delivery by each other party thereto), such Transaction Document will constitute a legal and binding obligation of Buyer enforceable against it in accordance with its terms.

4.03 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the Contemplated Transactions, do not and will not: (a) conflict with or result in a violation or breach of, or default under, any provision of the certificate of

23

incorporation, by-laws or other organizational documents of Buyer; (b) conflict with or result in a violation or breach of any provision of any Law or Governmental Order applicable to Buyer; or (c) require the consent, notice or other action by any Person under any Contract to which Buyer is a party. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Buyer in connection with the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the Contemplated Transactions.

4.04 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the Contemplated Transactions based upon arrangements made by or on behalf of Buyer.

4.05 Sufficiency of Funds. Buyer has sufficient cash on hand or other sources of immediately available funds to enable it to make payment of the Purchase Price and consummate the Contemplated Transactions.

4.06 Legal Proceedings. There are no Actions pending or, to Buyer’s knowledge, threatened against or by Buyer or any Affiliate of Buyer that challenge or seek to prevent, enjoin or otherwise delay the Contemplated Transactions. No event has occurred or circumstances exist that may give rise or serve as a basis for any such Action.