Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNIFI INC | ufi20160420_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UNIFI INC | ex99-1.htm |

Exhibit 99.2

|

Third Quarter Ended March 27, 2016 Conference Call Slide Presentation (Unaudited Preliminary Results) Exhibit 99.2

CautionaryStatement Certainstatementsincludedhereincontainforward-lookingstatementswithinthemeaningoffederalsecuritieslawsaboutthefinancialconditionandresultsofoperationsofUnifi,Inc.(the“Company”)thatarebasedonmanagement’sbeliefs,assumptionsandexpectationsaboutourfutureeconomicperformance,consideringtheinformationcurrentlyavailabletomanagement.Thewords“believe,”“may,”“could,”“will,”“should,”“would,”“anticipate,”“estimate,”“project,”“expect,”“intend,”“seek,”“strive,”andwordsofsimilarimport,orthenegativeofsuchwords,identifyorsignalthepresenceofforward-lookingstatements.Thesestatementsarenotstatementsofhistoricalfact;theyinvolveriskanduncertaintiesthatmaycauseouractualresults,performanceorfinancialconditiontodiffermateriallyfromtheexpectationsoffutureresults,performanceorfinancialconditionthatweexpressorimplyinanyforward-lookingstatement. Factorsthatcouldcontributetosuchdifferencesinclude,butarenotlimitedto:thecompetitivenatureofthetextileindustryandtheimpactofworldwidecompetition;changesinthetraderegulatoryenvironmentandgovernmentalpoliciesandlegislation;theavailability,sourcingandpricingofrawmaterials;generaldomesticandinternationaleconomicandindustryconditionsinmarketswheretheCompanycompetes,suchasrecessionandothereconomicandpoliticalfactorsoverwhichtheCompanyhasnocontrol;changesinconsumerspending,customerpreferences,fashiontrendsandend-uses;thefinancialconditionoftheCompany’scustomers;thelossofasignificantcustomer;thesuccessoftheCompany’sstrategicbusinessinitiatives;thecontinuityoftheCompany’sleadership;volatilityoffinancialandcreditmarkets;theabilitytoserviceindebtednessandfundcapitalexpendituresandstrategicinitiatives;availabilityofandaccesstocreditonreasonableterms;changesincurrencyexchange,interestandinflationrates;theabilitytoreduceproductioncosts;theabilitytoprotectintellectualproperty;employeerelations;theimpactofenvironmental,healthandsafetyregulations;theoperatingperformanceofjointventuresandotherequityinvestments;andtheaccuratefinancialreportingofinformationfromequitymethodinvestees. Allsuchfactorsaredifficulttopredict,containuncertaintiesthatmaymateriallyaffectactualresultsandmaybebeyondourcontrol.Newfactorsemergefromtimetotime,anditisnotpossibleformanagementtopredictallsuchfactorsortoassesstheimpactofeachsuchfactorontheCompany.Anyforward-lookingstatementspeaksonlyasofthedateonwhichsuchstatementismade,andwedonotundertakeanyobligationtoupdateanyforward-lookingstatementtoreflecteventsorcircumstancesafterthedateonwhichsuchstatementismade,exceptasmayberequiredbyfederalsecuritieslaw.TheaboveandotherrisksanduncertaintiesaredescribedintheCompany’smostrecentannualreportonForm10-K,andadditionalrisksoruncertaintiesmaybedescribedfromtimetotimeinotherreportsfiledbytheCompanywiththeSecuritiesandExchangeCommissonpursuanttotheSecuritiesExchangeActof1934,asamended.Non-GAAPFinancialMeasures Certainnon-GAAPfinancialmeasuresincludedhereinaredesignedtocomplementthefinancialinformationpresentedinaccordancewithgenerallyacceptedaccontingprinciplesintheUnitedStatesofAmerica("GAAP")becausemanagementbelievessuchmeasuresareusefultoinvestors.Thesenon-GAAPfinancialmeasuresinclude,EarningsBeforeInterest,Taxes,DepreciationandAmortization(“EBITDA”),AdjustedEBITDAIncludingEquityAffiliates,AdjustedEBITDA,AdjustedNetIncome,AdjustedEPSandAdjustedWorkingCapital. •EBITDArepresentsNetincomeorlossattributabletoUnifi,Inc.beforenetinterestexpense,incometaxexpense,anddepreciationandamortizationexpense.AdjustedEBITDAIncludingEquityAffiliatesrepresentsEBITDAadjustedtoexcludenon-cashcompensationexpense,lossesonextinguishmentofdebtandcertainotheradjustments.Suchotheradjustmentsincluderestructuringchargesandstart-upcosts,gainsorlossesonsalesordisposalsofproperty,plantandequipment,currencyandderivativegainsorlosses,andotheroperatingornon-operatingincomeorexpenseitemsnecessarytounderstandandcomparetheunderlyingresultsoftheCompany.AdjustedEBITDArepresentsAdjustedEBITDAIncludingEquityAffiliatesadjustedtoexcludeequityinloss(earnings)ofParkdaleAmerica,LLC. •AdjustedNetIncomeexcludescertainamountswhichmanagementbelievesdonotreflecttheongoingoperationsandperformanceoftheCompany.AdjustedNetIncomerepresentsNetincomeattributabletoUnifi,Inc.calculatedunderGAAP,adjustedtoexcludetheapproximateafter-taximpactofcertainincomeorexpenseitems(aswellasspecificimpactstotheprovisionforincometaxes)necessarytounderstandandcomparetheunderlyingresultsoftheCompany.SuchamountsareexcludedfromAdjustedNetIncomeinordertobetterreflecttheCompany’sunderlyingoperationsandperformance. •AdjustedEPSrepresentsAdjustedNetIncomedividedbytheCompany’sbasicweightedaveragecommonsharesoutstanding. •Adjusted Working Capital represents receivables plus inventory, less accounts payable and accrued expenses. Thesenon-GAAPfinancialmeasuresarealternativeviewsofperformanceusedbymanagement,andwebelievethatinvestors’understandingofourperformanceisenhancedbydisclosingtheseperformancemeasures.Webelievethattheuseofthesenon-GAAPfinancialmeasuresasoperatingperformancemeasuresprovidesinvestorsandanalystswithameasureofoperatingresultsunaffectedbydifferncesincapitalstructures,capitalinvestmentcycles,andagesofrelatedassets,amongotherwisecomparablecompanies.TheCompanymay,fromtimetotime,changetheitemsincludedwithinthesenon-GAAPfinancialmeasures. ManagementusesAdjustedEBITDA:(i)asameasurementofoperatingperformancebecauseitassistsusincomparingouroperatingperformanceonaconsistentbasis,asitremovestheimpactof(a)itemsdirectlyrelatedtoourassetbase(primarilydepreciationandamortization)and(b)itemsthatwewouldnotexpecttooccurasapartofournormalbusinessonaregularbasis;(ii)forplanningpurposes,includingthepreparationofourannualoperatingbudget;(iii)asavaluationmeasureforevaluatingouroperatingperformanceandourcapacitytoincurandservicedebt,fundcapitalexpendituresandexpandourbusiness;and(iv)asonemeasureindeterminingthevalueofotheracquisitionsanddispositions.AdjustedEBITDAisalsoakeyperformancemetricutilizedinthedeterminationofvariablecompensation.WealsobelieveAdjustedEBITDAisanappropriatesupplementalmeasureofdebtservicecapacity,becausecashexpendituresoninterestare,bydefinition,availabletopayinterest,andtaxexpenseisinverselycorrelatedtointerestexpensebecausetaxexpensedecreasesasdeductibleinterestexpenseincreases;anddepreciationandamortizationarenon-cashcharges.EquityinearningsofParkdaleAmerica,LLCisexcludedbecausesuchearningsdonotreflectouroperatingperformance.Theotheritemsexcludedfromthesenon-GAAPfinancialmeasuresareexcludedinordertobetterreflecttheperformanceofourcontinuingoperations. Inevaluatingnon-GAAPfinancialmeasures,youshouldbeawarethat,inthefuture,wemayincurexpensessimilartotheadjustmentsincludedherein.Ourpresentationofnon-GAAPfinancialmeasuresshouldnotbeconstruedasindicatingthatourfutureresultswillbeunaffectedbyunusualornon-recurringitems.Eachofournon-GAAPfinancialmeasureshaslimitationsasananalyticaltool,andyoushouldnotconsideritinisolationorasasubstituteforanalysisofourresultsorliquiditymeasuresasreportedunderGAAP.Someoftheselimitationsare(i)itisnotadjustedforallnon-cashincomeorexpenseitemsthatarereflectedinourstatementsofcashflows;(ii)itdoesnotreflecttheimpactofearningsorchargesresultingfrommattersweconsidernotindicativeofourongoingoperations;(iii)itdoesnotreflectchangesin,orcashrequirementsfor,ourworkingcapitalneeds;(iv)itdoesnotreflectthecashrequirementsnecessarytomakepaymentsonourdebt;(v)itdoesnotreflectourfuturerequirementsforcapitalexpendituresorcontractualcommitments;(vi)itdoesnotreflectlimitationsonorcostsrelatedtotransferringearningsfromoursubsidiariestous;and(vii)othercompaniesinourindustrymaycalculatethismeasuredifferentlythanwedo,limitingitsusefulnessasacomparativemeasure. Becauseoftheselimitations,thesenon-GAAPfinancialmeasuresshouldnotbeconsideredasameasureofdiscretionarycashavailabletoustoinvestinthegrowthofourbusinessorasameasurofcashthatwillbeavailabletoustomeetourobligations,includingthoseunderouroutstandingdebtobligations.YoushouldcompensatefortheselimitationsbyrelyingprimarilyonourGAAPresultsandusingthesemeasuresonlyassupplementalinformation. Non-GAAPreconciliationsareincludedintheAppendixofthispresentation. 2

3 Q3 -Income Before Income Taxes Note: The above graphic represents management’s analysis of the amounts which drove changes in income before income taxes forthe noted comparative periods. (1) –Approximates the change from the comparative period due to devaluation of the Brazilian Real. (dollars in millions) -($1.3)($0.6) ($0.4) -+$1.0 ---+$2.2 $12.5$13.4Q3 FY 2015PY Loss onExtinguishment ofDebtParkdale America,LLCBrazil Currency(1)Provision for BadDebtsRest of CompanyQ3 FY 2016

4 YTD -Income Before Income Taxes Note: The above graphic represents management’s analysis of the amounts which drove changes in income before income taxes forthe noted comparative periods. “PY PAL Bargain Purchase” –reflects the Company’s portion of a bargain purchase gain recognized by Parkdale America, LLC duringfiscal year 2015. (1) –Approximates the change from the comparative period due to devaluation of the Brazilian Real. (dollars in millions) -($1.5) ($4.7) ($2.4) ($0.9) -+$1.0 ----+$6.3 $35.6$33.4YTD Q3 FY 2015PY Loss onExtinguishmentof DebtPY PAL BargainPurchaseParkdaleAmerica, LLCBrazil Currency(1)Provision forBad DebtsRest ofCompanyYTD Q3 FY 2016

5 Net Sales and Gross Profit Highlights1 1Excluding the ‘All Other’ category; see non-GAAP reconciliation on slide 12. Note: The “Prior Period” ended on March 29, 2015. The “Current Period” ended on March 27, 2016. (dollars in thousands) Three Month Comparison (Q3) Net SalesPolyesterNylonInternationalSubtotalPrior Period98,759$ 40,754$ 31,017$ 170,530$ Volume Change(3.1%)(12.6%)10.2% (0.5%)Price Change(1.1%)(4.3%)(10.0%)(5.9%)Current Period94,659$ 33,871$ 31,092$ 159,622$ Gross ProfitPrior Period12,842$ 4,187$ 5,014$ 22,043$ Margin Rate13.0%10.3%16.2%12.9%Current Period12,794$ 4,051$ 6,649$ 23,494$ Margin Rate13.5%12.0%21.4%14.7%

6 Net Sales and Gross Profit Highlights1 1Excluding the ‘All Other’ category; see non-GAAP reconciliation on slide 12. Note: The “Prior Period” ended on March 29, 2015. The “Current Period” ended on March 27, 2016. (dollars in thousands) Nine Month Comparison (YTD) Net SalesPolyesterNylonInternationalSubtotalPrior Period282,168$ 124,676$ 101,017$ 507,861$ Volume Change(0.4%)(5.8%)(2.3%)(1.5%)Price Change(2.1%)(2.0%)(13.3%)(4.9%)Current Period275,041$ 114,914$ 85,275$ 475,230$ Gross ProfitPrior Period35,450$ 14,964$ 15,404$ 65,818$ Margin Rate12.6%12.0%15.2%13.0%Current Period33,896$ 15,947$ 16,621$ 66,464$ Margin Rate12.3%13.9%19.5%14.0%

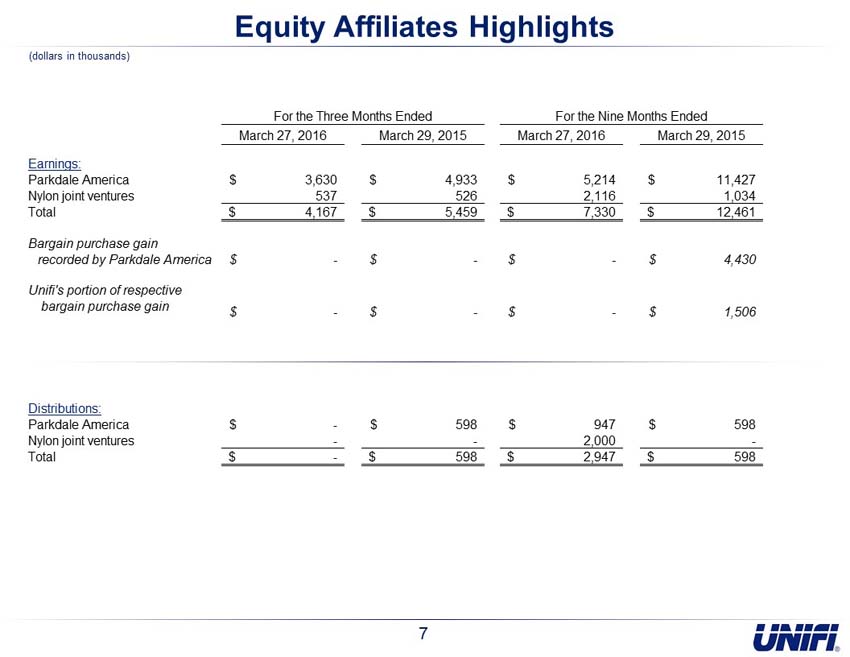

7 Equity Affiliates Highlights (dollars in thousands)March 27, 2016March 29, 2015March 27, 2016March 29, 2015Earnings:Parkdale America3,630$ 4,933$ 5,214$ 11,427$ Nylon joint ventures537 526 2,116 1,034 Total4,167$ 5,459$ 7,330$ 12,461$ Bargain purchase gainrecorded by Parkdale America-$ -$ -$ 4,430$ Unifi's portion of respective bargain purchase gain-$ -$ -$ 1,506$ Distributions:Parkdale America -$ 598$ 947$ 598$ Nylon joint ventures- - 2,000 - Total-$ 598$ 2,947$ 598$ For the Three Months EndedFor the Nine Months Ended

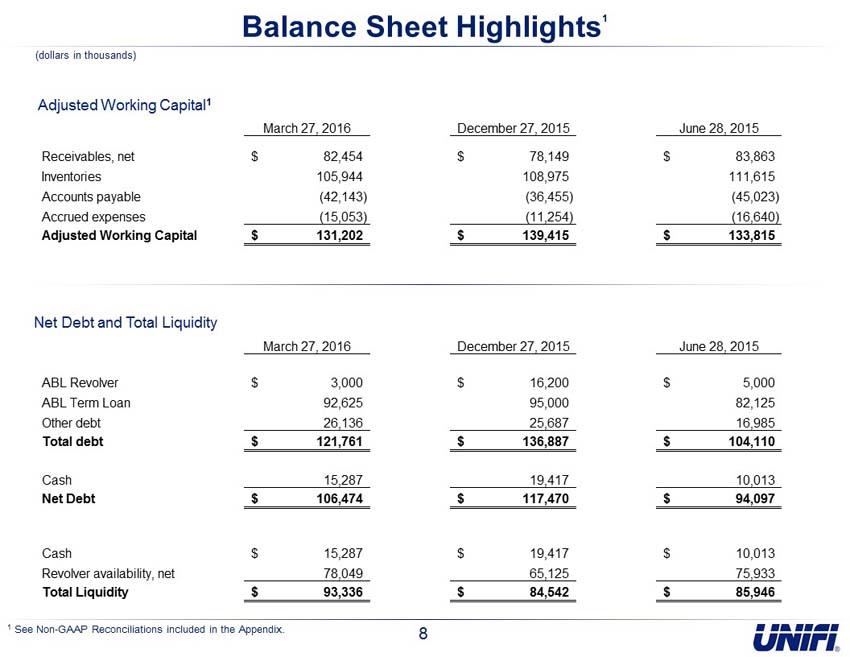

1See Non-GAAP Reconciliations included in the Appendix. 8 Balance Sheet Highlights1 Adjusted Working Capital1 Net Debt and Total Liquidity (dollars in thousands)March 27, 2016December 27, 2015June 28, 2015Receivables, net82,454$ 78,149$ 83,863$ Inventories105,944 108,975 111,615 Accounts payable(42,143) (36,455) (45,023) Accrued expenses(15,053) (11,254) (16,640) Adjusted Working Capital131,202$ 139,415$ 133,815$ March 27, 2016December 27, 2015June 28, 2015ABL Revolver3,000$ 16,200$ 5,000$ ABL Term Loan92,625 95,000 82,125 Other debt26,136 25,687 16,985 Total debt121,761$ 136,887$ 104,110$ Cash15,287 19,417 10,013 Net Debt106,474$ 117,470$ 94,097$ Cash15,287$ 19,417$ 10,013$ Revolver availability, net78,049 65,125 75,933 Total Liquidity93,336$ 84,542$ 85,946$

APPENDIX 9

10 Non-GAAP Reconciliations Adjusted EBITDA (dollars in thousands) March 27, 2016March 29, 2015March 27, 2016March 29, 2015Net income attributable to Unifi, Inc.9,689$ 10,016$ 24,178$ 26,511$ Interest expense, net709 962 2,171 2,364 Provision for income taxes4,166 2,729 10,194 10,083 Depreciation and amortization expense4,192 4,154 12,584 12,803 EBITDA18,756 17,861 49,127 51,761 Non-cash compensation expense637 565 2,189 2,462 Loss on extinguishment of debt- 1,040 - 1,040 Other872 520 1,480 1,271 Adjusted EBITDA Including Equity Affiliates20,265 19,986 52,796 56,534 Equity in earnings of Parkdale America, LLC(3,630) (4,933) (5,214) (11,427) Adjusted EBITDA (1)16,635$ 15,053$ 47,582$ 45,107$ For the Three Months EndedFor the Nine Months Ended(1) Adjusted EBITDA includes the Company's portion of income (loss) before income taxes for Repreve Renewables, LLC and equity in earnings of the Company's nylon joint ventures.

11 Non-GAAP Reconciliations Adjusted Net Income and Adjusted EPS (dollars in thousands, except per share) Income Before Income TaxesNet IncomeBasic EPSIncome Before Income TaxesNet IncomeBasic EPSGAAP results13,441$ 9,689$ 0.54$ 12,488$ 10,016$ 0.55$ Key employee transition costs400 268 0.02 - - - Loss on extinguishment of debt- - - 1,040 676 0.03 Renewable energy tax credits- - - - (782) (0.04) Adjusted results (1) (2)13,841$ 9,957$ 0.56$ 13,528$ 9,910$ 0.54$ Income Before Income TaxesNet IncomeBasic EPSIncome Before Income TaxesNet IncomeBasic EPSGAAP results33,449$ 24,178$ 1.35$ 35,639$ 26,511$ 1.46$ Key employee transition costs1,037 682 0.04 - - - Loss on extinguishment of debt- - - 1,040 676 0.03 Renewable energy tax credits- - - - (782) (0.04) Bargain purchase gain for an equity affiliate- - - (1,506) (1,506) (0.08) Adjusted results (1) (2)34,486$ 24,860$ 1.39$ 35,173$ 24,899$ 1.37$ (2) Adjusted EPS represents Adjusted Net Income divided by the Company’s basic weighted average common shares outstanding. For the Nine Months Ended March 27, 2016For the Three Months Ended March 29, 2015For the Nine Months Ended March 29, 2015For the Three Months Ended March 27, 2016(1) Adjusted Net Income represents Net income attributable to Unifi, Inc. calculated under GAAP, adjusted for the approximate after-tax impact of certain events or transactions referenced in the reconciliation which management believes do not reflect the ongoing operations and performance of the Company.

12 Non-GAAP Reconciliations Adjusted Working Capital (dollars in thousands) Consolidated Net Sales Consolidated Gross Profit 1 As presented on slides 5 and 6. 1 1 March 27, 2016 March 29, 2015 March 27, 2016 March 29, 2015 Subtotal of Gross Profit by Segment $ 23,494 $ 22,043 $ 66,464 $ 65,818 Gross Loss for All Other Category (130) (36) (303) (432) Consolidated Gross Profit 23,364 22,007 66,161 65,386 For the Three Months Ended For the Nine Months Ended March 27, 2016 March 29, 2015 March 27, 2016 March 29, 2015 Subtotal of Net Sales by Segment $ 159,622 $ 170,530 $ 475,230 $ 507,861 Net Sales for All Other Category 1,656 1,657 4,549 4,309 Consolidated Net Sales 161,278 172,187 479,779 512,170 For the Three Months Ended For the Nine Months Ended March 27, 2016 December 27, 2015 June 28, 2015 Adjusted Working Capital $ 131,202 $ 139,415 $ 133,815 Cash 15,287 19,417 10,013 Other current assets 6,864 7,762 7,473 Other current liabilities (16,462) (15,705) (13,061) Working capital $ 136,891 $ 150,889 $ 138,240

13