Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CareDx, Inc. | d184817d8k.htm |

| EX-99.1 - EX-99.1 - CareDx, Inc. | d184817dex991.htm |

CareDx - Allenex Building a Comprehensive Global Transplant Diagnostics Leader Investor Conference Call April 19, 2016 ® Exhibit 99.2

Safe Harbor Statement These slides and the accompanying oral presentation contain forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding future financial position of CareDx, Inc. (“CareDx” or the “Company”), including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. CareDx has based these forward-looking statements on its estimates and assumptions and its current expectations and projections about future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those that may be described in greater detail in a registration statement (including a prospectus) that the Company may subsequently file with the U.S. Securities and Exchange Commission (the “SEC”) for the transaction to which this communication relates. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. CareDx undertakes no obligation to update publicly or revise any forward-looking statements for any reason after the date of this presentation, to conform these statements to actual results or to changes in CareDx’s expectations. CareDx is an “emerging growth company” as defined under the Securities Act of 1933, as amended (the “Act”). These slides and the accompanying oral presentation are intended to qualify as communications permitted pursuant to Section 5(d) of the Act. The Company may file a registration statement (including a prospectus) under the Act with the SEC for the transaction to which this communication relates. In the event the Company conducts an offering, before you invest you should read the prospectus in the registration statement and other documents that the Company files with the SEC for more complete information about the Company and the offering. When available, you may obtain those documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Certain data in this presentation was obtained from various external sources, and neither the Company nor its affiliates, advisers or representatives has verified such data with independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data or to update such data after the date of this presentation. Such data involves risks and uncertainties and is subject to change based on various factors. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company or the proposed offering. ®

Agenda CareDx Strategy Peter Maag Allenex Product Portfolio Anders Karlson Financial InformationCharles Constanti OutlookPeter Maag Q&A

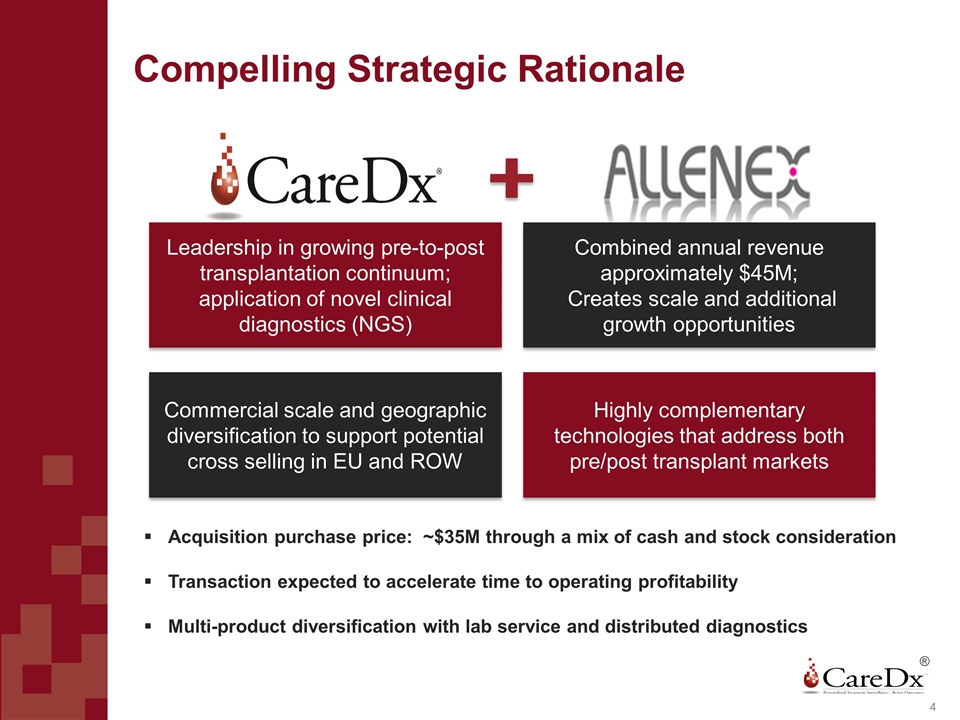

Compelling Strategic Rationale Highly complementary technologies that address both pre/post transplant markets Combined annual revenue approximately $45M; Creates scale and additional growth opportunities Commercial scale and geographic diversification to support potential cross selling in EU and ROW Leadership in growing pre-to-post transplantation continuum; application of novel clinical diagnostics (NGS) ® Acquisition purchase price: ~$35M through a mix of cash and stock consideration Transaction expected to accelerate time to operating profitability Multi-product diversification with lab service and distributed diagnostics

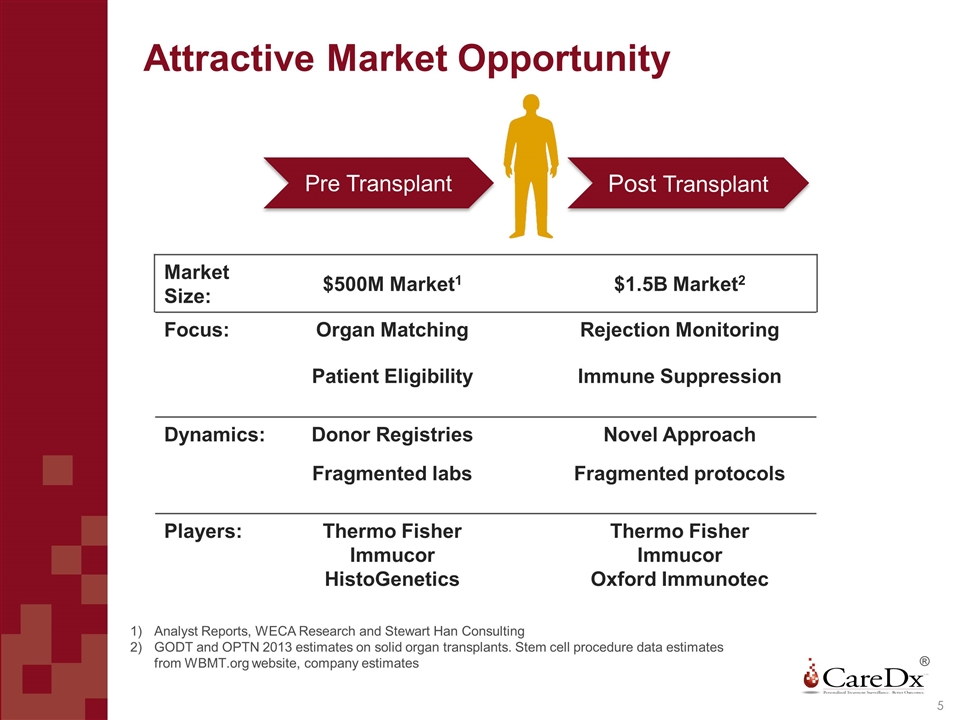

Attractive Market Opportunity Post Transplant Pre Transplant Market Size: $500M Market1 $1.5B Market2 Focus: Organ Matching Rejection Monitoring Patient Eligibility Immune Suppression Dynamics: Donor Registries Novel Approach Fragmented labs Fragmented protocols Players: Thermo Fisher Immucor HistoGenetics Thermo Fisher Immucor Oxford Immunotec Analyst Reports, WECA Research and Stewart Han Consulting GODT and OPTN 2013 estimates on solid organ transplants. Stem cell procedure data estimates from WBMT.org website, company estimates ®

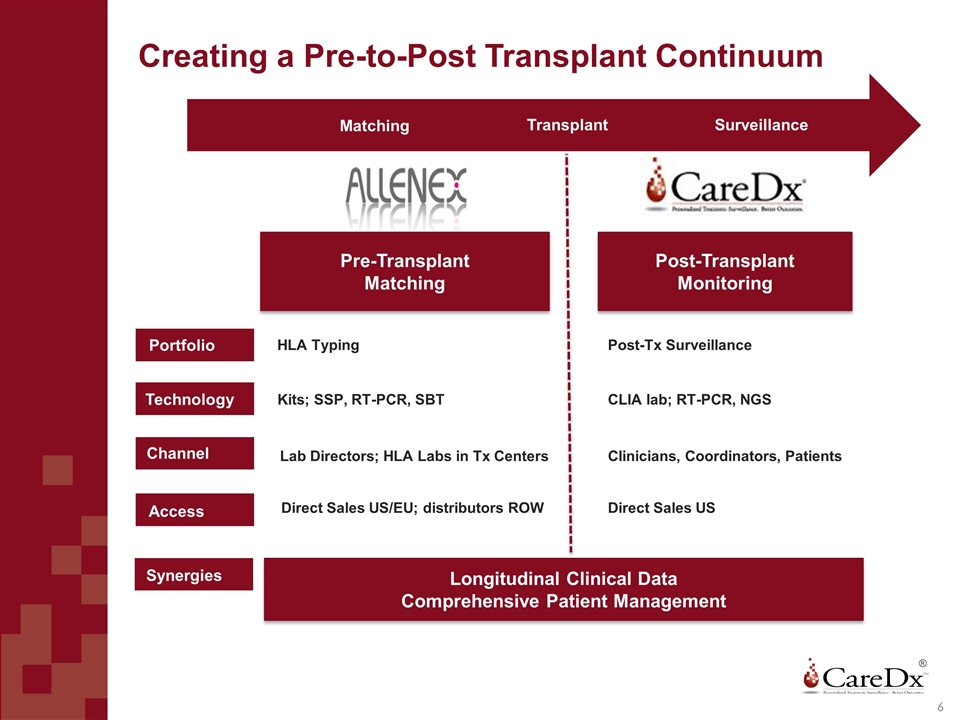

Creating a Pre-to-Post Transplant Continuum Longitudinal Data Reimbursement (Bundled Offering) Pre-Transplant Matching HLA Typing Kits; SSP, RT-PCR, SBT Lab Directors; HLA Labs in Tx Centers Direct Sales US/EU; distributors ROW Technology Portfolio Channel Access Synergies Post-Transplant Monitoring Post-Tx Surveillance CLIA lab; RT-PCR, NGS Direct Sales US Clinicians, Coordinators, Patients ® Surveillance Transplant Matching Longitudinal Clinical Data Comprehensive Patient Management

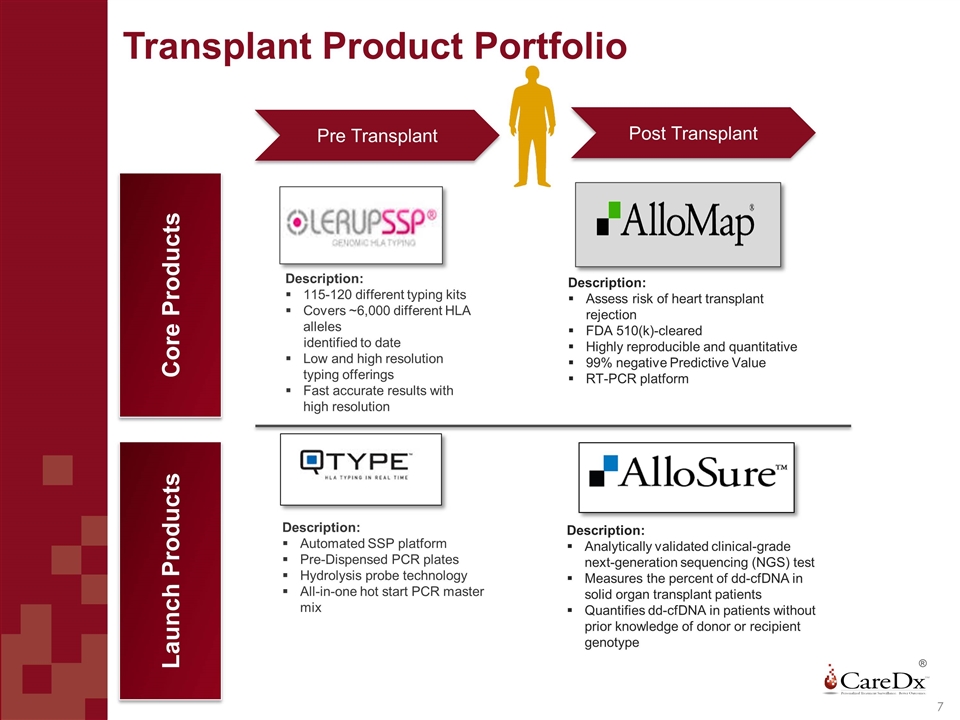

Transplant Product Portfolio ® Description: Automated SSP platform Pre-Dispensed PCR plates Hydrolysis probe technology All-in-one hot start PCR master mix Description: 115-120 different typing kits Covers ~6,000 different HLA alleles identified to date Low and high resolution typing offerings Fast accurate results with high resolution Core Products Description: Assess risk of heart transplant rejection FDA 510(k)-cleared Highly reproducible and quantitative 99% negative Predictive Value RT-PCR platform Description: Analytically validated clinical-grade next-generation sequencing (NGS) test Measures the percent of dd-cfDNA in solid organ transplant patients Quantifies dd-cfDNA in patients without prior knowledge of donor or recipient genotype Launch Products Post Transplant Pre Transplant

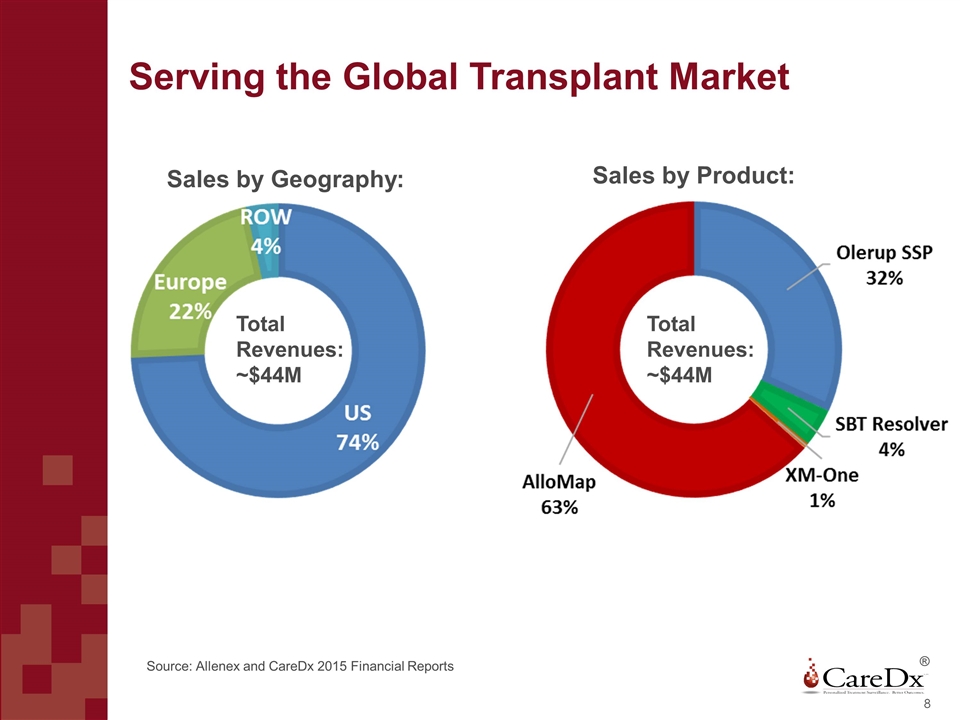

Serving the Global Transplant Market ® Total Revenues: ~$44M Sales by Geography: Sales by Product: Total Revenues: ~$44M Source: Allenex and CareDx 2015 Financial Reports

Agenda CareDx Strategy Peter Maag Allenex Product Portfolio Anders Karlson Financial InformationCharles Constanti OutlookPeter Maag Q&A

Introduction: Allenex/Olerup Innovation in Transplantation Diagnostics Olerup SSP AB pioneered the field of HLA typing in the early ’90s with the introduction of its invention: PCR-SSP (Sequence Specific Primer HLA typing) The invention by Assoc Prof Olle Olerup, founder and CEO of the company, quickly became the world standard and made transplantation labs swith to molecular typing techniques. Olerup SSP AB has since then continued to develop its product line and today the company has world recognition due to: Kit performance => quarterly updates for new alleles – ”best in class” Interpretation program Olerup SSP ScoreTM

Olerup SSP: Pioneer of SSP Technology for Rapid HLA typing ® Olerup SSP HLA Typing Kits Score 6 Interpretation Software Description: Approx. 350 different typing kits / SKU’s Covers ~14.000 different HLA alleles identified to date Both low and high resolution typing offerings Fast accurate results with a high level of resolution Commercial Impact: Allenex flagship product Strong base in small-to-medium sized hospital and reference labs

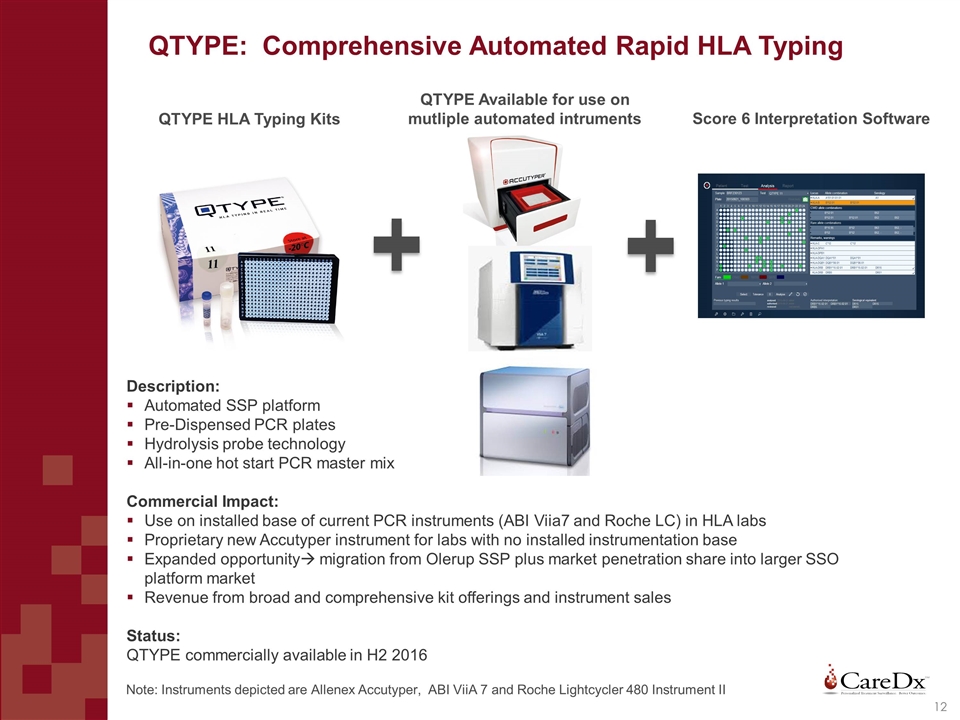

QTYPE: Comprehensive Automated Rapid HLA Typing QTYPE HLA Typing Kits Score 6 Interpretation Software Description: Automated SSP platform Pre-Dispensed PCR plates Hydrolysis probe technology All-in-one hot start PCR master mix Commercial Impact: Use on installed base of current PCR instruments (ABI Viia7 and Roche LC) in HLA labs Proprietary new Accutyper instrument for labs with no installed instrumentation base Expanded opportunityà migration from Olerup SSP plus market penetration share into larger SSO platform market Revenue from broad and comprehensive kit offerings and instrument sales Status: QTYPE commercially available in H2 2016 QTYPE Available for use on mutliple automated intruments Note: Instruments depicted are Allenex Accutyper, ABI ViiA 7 and Roche Lightcycler 480 Instrument II

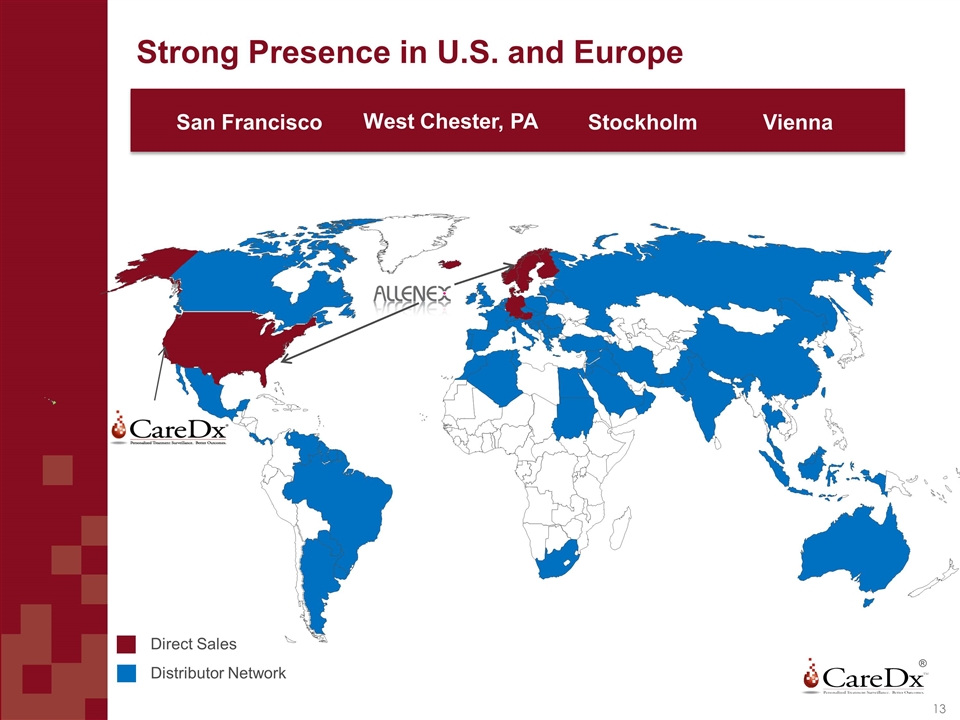

Strong Presence in U.S. and Europe ® Direct Sales Distributor Sales San Francisco Stockholm West Chester, PA Vienna Direct Sales Distributor Network

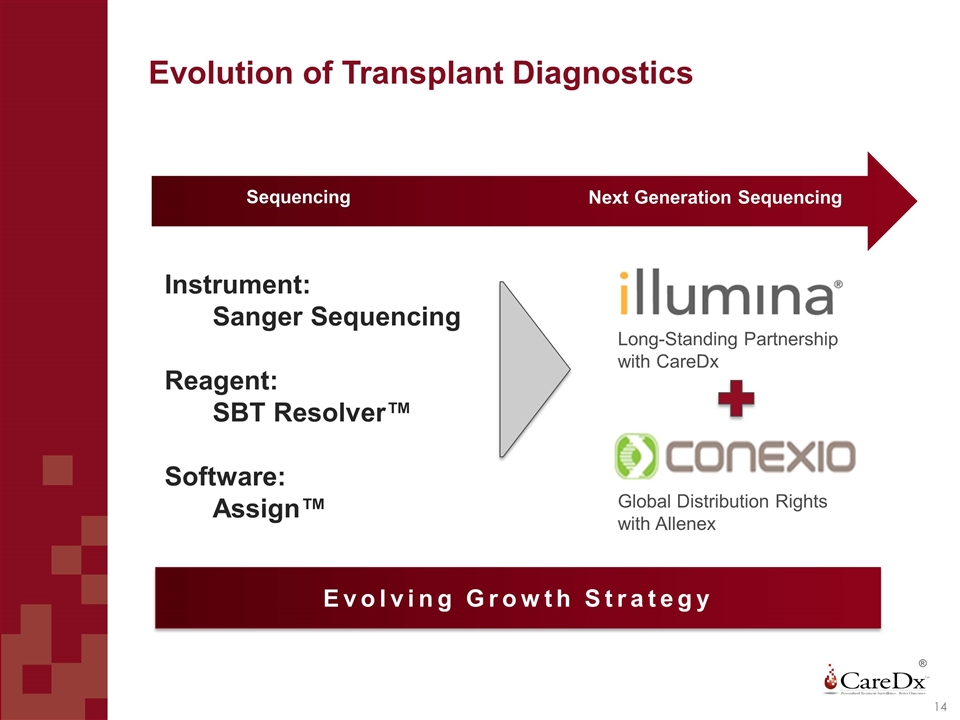

Evolution of Transplant Diagnostics ® Instrument: Sanger Sequencing Reagent: SBT Resolver™ Software: Assign™ Evolving Growth Strategy Long-Standing Partnership with CareDx Global Distribution Rights with Allenex Sequencing Next Generation Sequencing

Agenda CareDx Strategy Peter Maag Allenex Product Portfolio Anders Karlson Financial InformationCharles Constanti OutlookPeter Maag Q&A

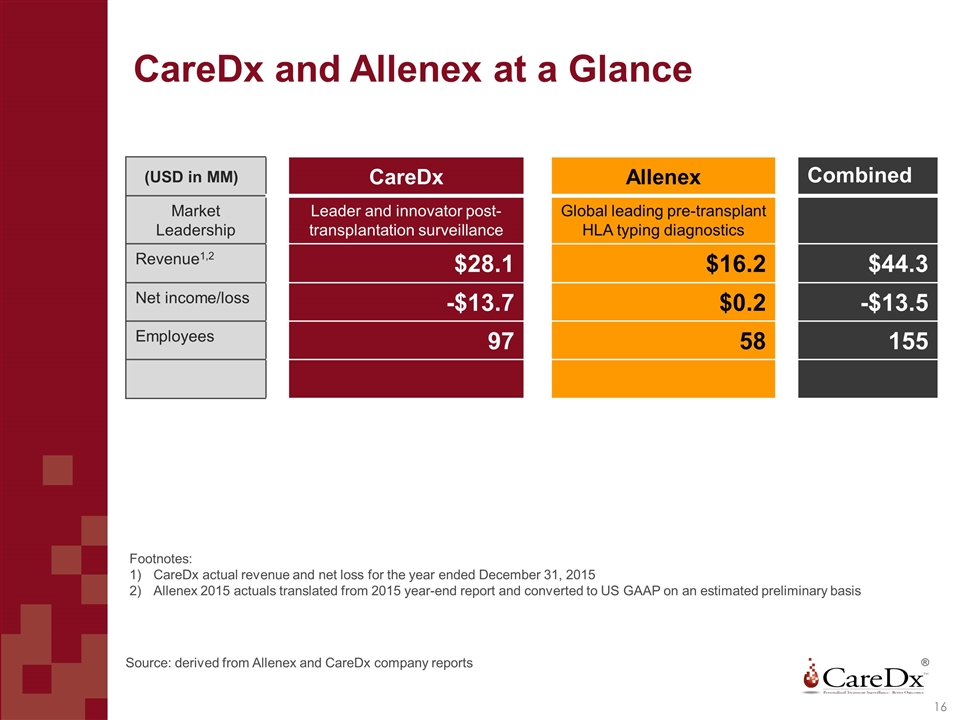

CareDx and Allenex at a Glance (USD in MM) CareDx Allenex Combined Market Leadership Leader and innovator post- transplantation surveillance Global leading pre-transplant HLA typing diagnostics Revenue1,2 $28.1 $16.2 $44.3 Net income/loss -$13.7 $0.2 -$13.5 Employees 97 58 155 Footnotes: CareDx actual revenue and net loss for the year ended December 31, 2015 Allenex 2015 actuals translated from 2015 year-end report and converted to US GAAP on an estimated preliminary basis Source: derived from Allenex and CareDx company reports ® 16

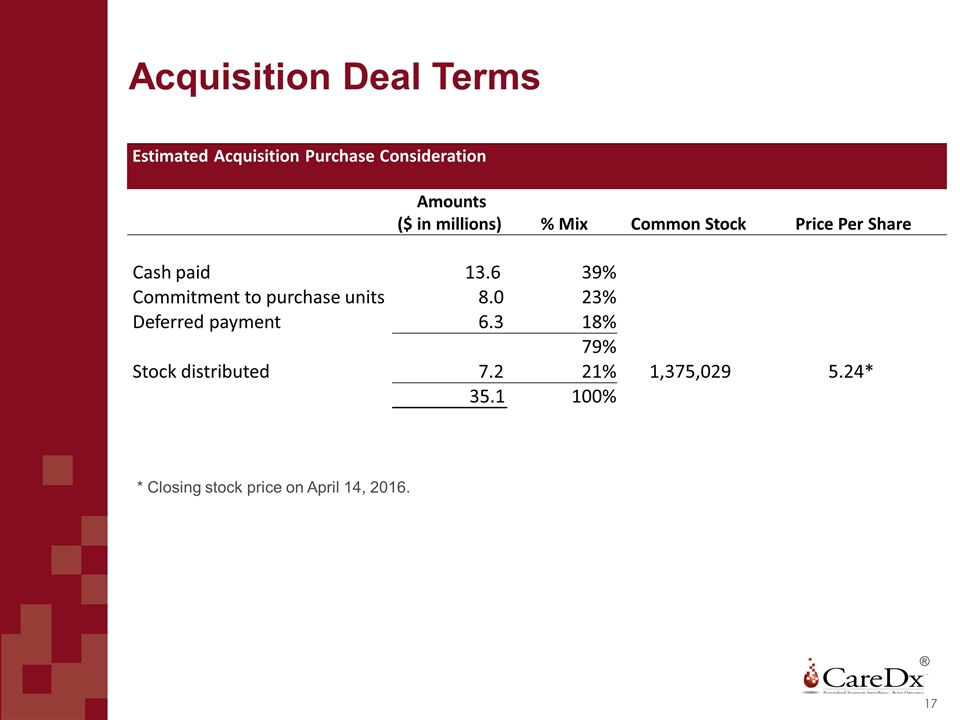

Acquisition Deal Terms ® Estimated Acquisition Purchase Consideration Amounts ($ in millions) % Mix Common Stock Price Per Share Cash paid 13.6 39% Commitment to purchase units 8.0 23% Deferred payment 6.3 18% 79% Stock distributed 7.2 21% 1,375,029 5.24* 35.1 100% * Closing stock price on April 14, 2016.

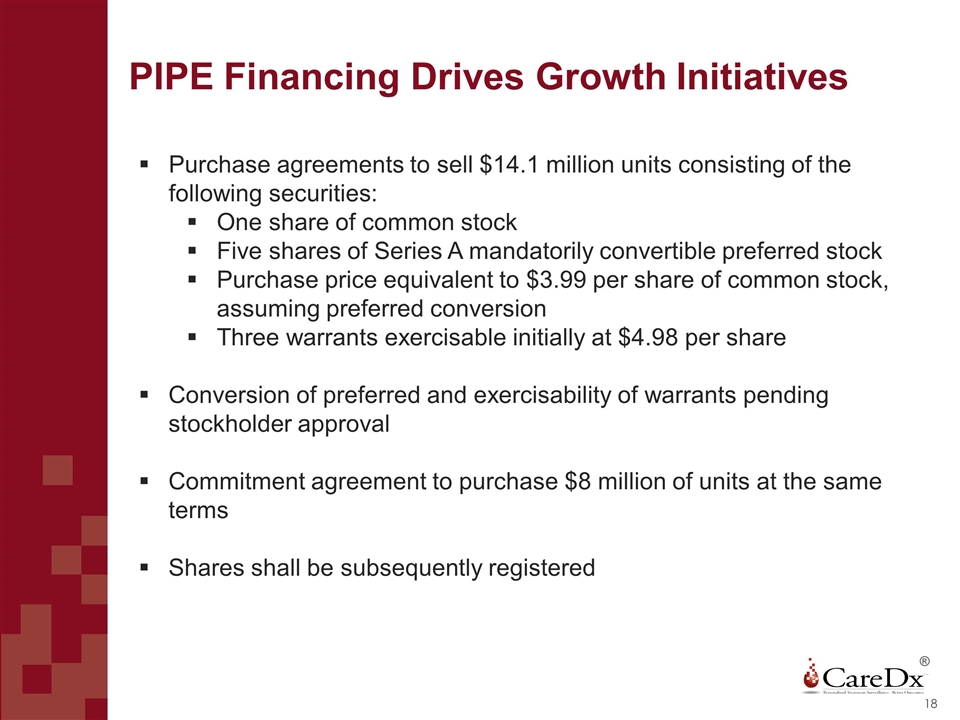

PIPE Financing Drives Growth Initiatives ® Purchase agreements to sell $14.1 million units consisting of the following securities: One share of common stock Five shares of Series A mandatorily convertible preferred stock Purchase price equivalent to $3.99 per share of common stock, assuming preferred conversion Three warrants exercisable initially at $4.98 per share Conversion of preferred and exercisability of warrants pending stockholder approval Commitment agreement to purchase $8 million of units at the same terms Shares shall be subsequently registered

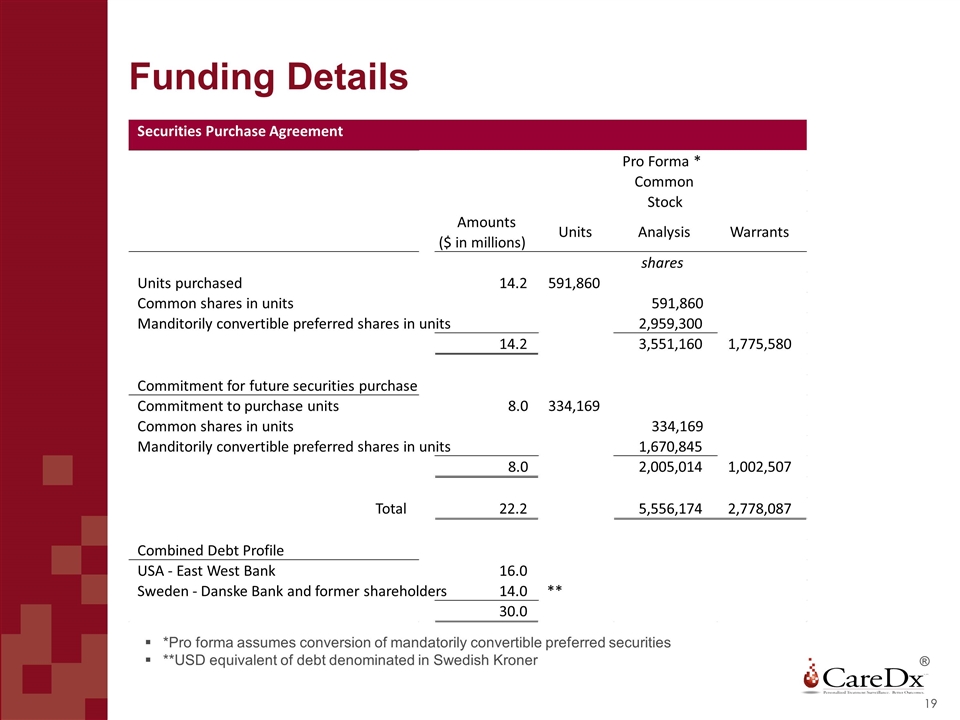

Funding Details ® *Pro forma assumes conversion of mandatorily convertible preferred securities **USD equivalent of debt denominated in Swedish Kroner Securities Purchase Agreement Pro Forma * Common Stock Amounts ($ in millions) Units Analysis Warrants shares Units purchased 14.2 591,860 Common shares in units 591,860 Manditorily convertible preferred shares in units 2,959,300 14.2 3,551,160 1,775,580 Commitment for future securities purchase Commitment to purchase units 8.0 334,169 Common shares in units 334,169 Manditorily convertible preferred shares in units 1,670,845 8.0 2,005,014 1,002,507 Total 22.2 5,556,174 2,778,087 Combined Debt Profile USA - East West Bank 16.0 Sweden - Danske Bank and former shareholders 14.0 ** 30.0

Agenda CareDx Strategy Peter Maag Allenex Product Portfolio Anders Karlson Financial InformationCharles Constanti OutlookPeter Maag Q&A

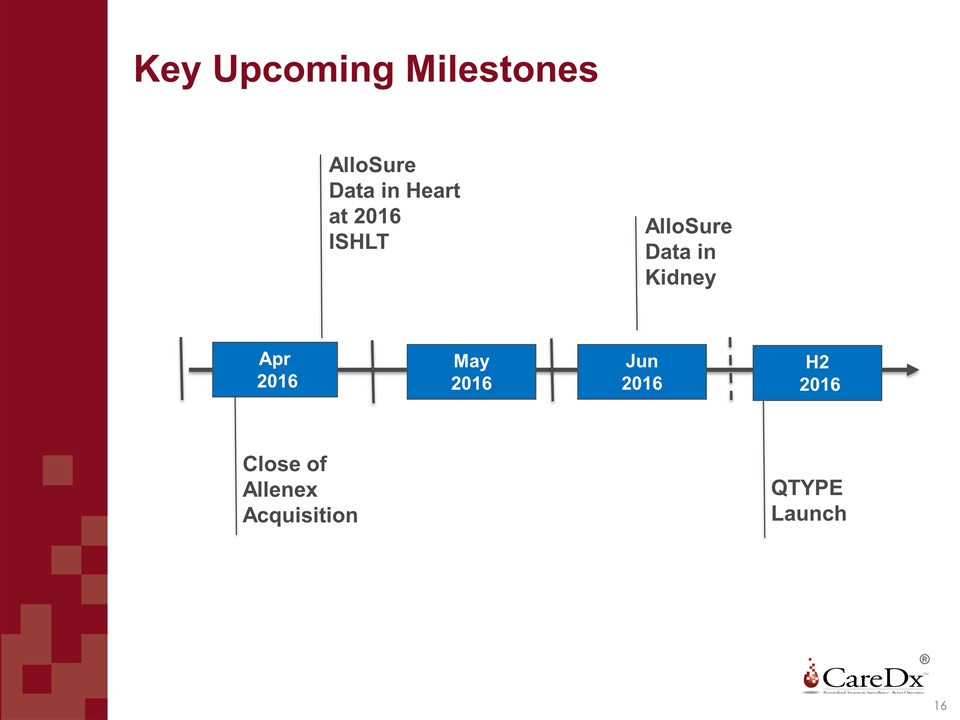

Key Upcoming Milestones ® 16 Apr 2016 Close of Allenex Acquisition AlloSure Data in Heart at 2016 ISHLT AlloSure Data in Kidney QTYPE Launch May 2016 Jun 2016 H2 2016