Attached files

| file | filename |

|---|---|

| S-1/A - S-1/A - Randolph Bancorp, Inc. | d124682ds1a.htm |

| EX-1.2 - EX-1.2 - Randolph Bancorp, Inc. | d124682dex12.htm |

| EX-3.2 - EX-3.2 - Randolph Bancorp, Inc. | d124682dex32.htm |

| EX-2.1 - EX-2.1 - Randolph Bancorp, Inc. | d124682dex21.htm |

| EX-23.3 - EX-23.3 - Randolph Bancorp, Inc. | d124682dex233.htm |

| EX-23.4 - EX-23.4 - Randolph Bancorp, Inc. | d124682dex234.htm |

| EX-99.4 - EX-99.4 - Randolph Bancorp, Inc. | d124682dex994.htm |

Exhibit 99.5

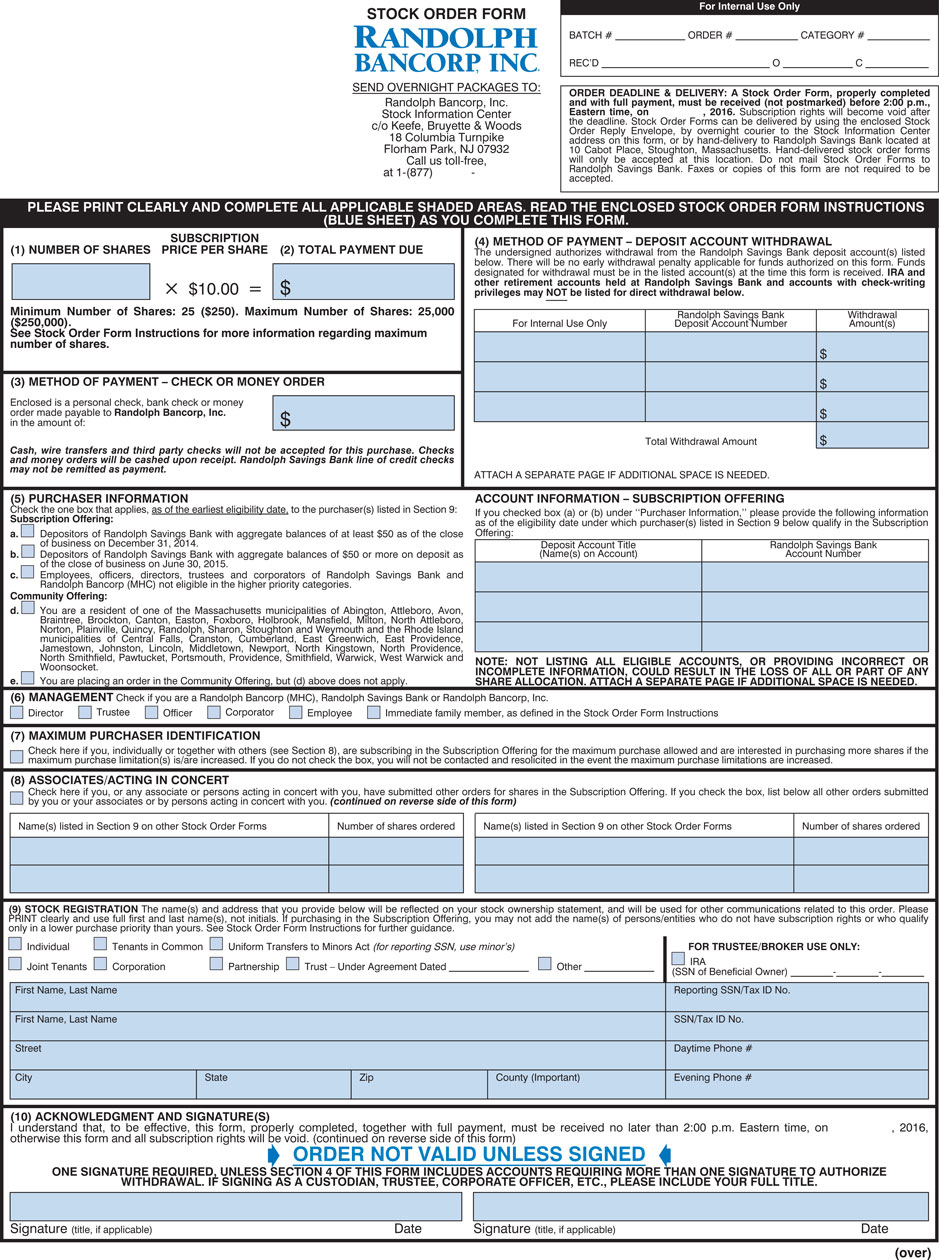

For Internal Use Only STOCK ORDER FORM BATCH # ORDER # CATEGORY # REC’D O C SEND OVERNIGHT PACKAGES TO: ORDER DEADLINE & DELIVERY: A Stock Order Form, properly completed Randolph Bancorp, Inc. and with full payment, must be received (not postmarked) before 2:00 p.m., Stock Information Center Eastern time, on , 2016. Subscription rights will become void after c/o Keefe, Bruyette & Woods the deadline. Stock Order Forms can be delivered by using the enclosed Stock Order Reply Envelope, by overnight courier to the Stock Information Center 18 Columbia Turnpike address on this form, or by hand-delivery to Randolph Savings Bank located at Florham Park, NJ 07932 10 Cabot Place, Stoughton, Massachusetts. Hand-delivered stock order forms Call us toll-free, will only be accepted at this location. Do not mail Stock Order Forms to at 1-(877) - Randolph Savings Bank. Faxes or copies of this form are not required to be accepted. PLEASE PRINT CLEARLY AND COMPLETE ALL APPLICABLE SHADED AREAS. READ THE ENCLOSED STOCK ORDER FORM INSTRUCTIONS (BLUE SHEET) AS YOU COMPLETE THIS FORM. SUBSCRIPTION (4) METHOD OF PAYMENT – DEPOSIT ACCOUNT WITHDRAWAL (1) NUMBER OF SHARES PRICE PER SHARE (2) TOTAL PAYMENT DUE The undersigned authorizes withdrawal from the Randolph Savings Bank deposit account(s) listed below. There will be no early withdrawal penalty applicable for funds authorized on this form. Funds designated for withdrawal must be in the listed account(s) at the time this form is received. IRA and × $10.00 = $ other retirement accounts held at Randolph Savings Bank and accounts with check-writing privileges may NOT be listed for direct withdrawal below. Minimum Number of Shares: 25 ($250). Maximum Number of Shares: 25,000 Randolph Savings Bank Withdrawal ($250,000). For Internal Use Only Deposit Account Number Amount(s) See Stock Order Form Instructions for more information regarding maximum number of shares. $ (3) METHOD OF PAYMENT – CHECK OR MONEY ORDER $ Enclosed is a personal check, bank check or money order made payable to Randolph Bancorp, Inc. $ $ in the amount of: Total Withdrawal Amount $ Cash, wire transfers and third party checks will not be accepted for this purchase. Checks and money orders will be cashed upon receipt. Randolph Savings Bank line of credit checks may not be remitted as payment. ATTACH A SEPARATE PAGE IF ADDITIONAL SPACE IS NEEDED. (5) PURCHASER INFORMATION ACCOUNT INFORMATION – SUBSCRIPTION OFFERING Check the one box that applies, as of the earliest eligibility date, to the purchaser(s) listed in Section 9: If you checked box (a) or (b) under ‘‘Purchaser Information,’’ please provide the following information Subscription Offering: as of the eligibility date under which purchaser(s) listed in Section 9 below qualify in the Subscription a. Depositors of Randolph Savings Bank with aggregate balances of at least $50 as of the close Offering: of business on December 31, 2014. Deposit Account Title Randolph Savings Bank b. Depositors of Randolph Savings Bank with aggregate balances of $ 50 or more on deposit as (Name(s) on Account) Account Number of the close of business on June 30, 2015. c. Employees, officers, directors, trustees and corporators of Randolph Savings Bank and Randolph Bancorp (MHC) not eligible in the higher priority categories. Community Offering: d. You are a resident of one of the Massachusetts municipalities of Abington, Attleboro, Avon, Braintree, Brockton, Canton, Easton, Foxboro, Holbrook, Mansfield, Milton, North Attleboro, Norton, Plainville, Quincy, Randolph, Sharon, Stoughton and Weymouth and the Rhode Island municipalities of Central Falls, Cranston, Cumberland, East Greenwich, East Providence, Jamestown, Johnston, Lincoln, Middletown, Newport, North Kingstown, North Providence, North Smithfield, Pawtucket, Portsmouth, Providence, Smithfield, Warwick, West Warwick and NOTE: NOT LISTING ALL ELIGIBLE ACCOUNTS, OR PROVIDING INCORRECT OR Woonsocket. INCOMPLETE INFORMATION, COULD RESULT IN THE LOSS OF ALL OR PART OF ANY e. You are placing an order in the Community Offering, but (d) above does not apply. SHARE ALLOCATION. ATTACH ASEPARATE PAGE IF ADDITIONAL SPACE IS NEEDED. (6) MANAGEMENT Check if you are a Randolph Bancorp (MHC), Randolph Savings Bank or Randolph Bancorp, Inc. Director Trustee Officer Corporator Employee Immediate family member, asdefined in the Stock Order Form Instructions (7) MAXIMUM PURCHASER IDENTIFICATION Check here if you, individually or together with others (see Section 8), are subscribing in the Subscription Offering for the maximumpurchase allowed and are interested in purchasing more shares if the maximum purchase limitation(s) is/are increased. If you do not check the box, you will not be contacted and resolicited in the event the maximum purchase limitations are increased. (8) ASSOCIATES/ACTING IN CONCERT Check here if you, or any associate or persons acting in concert with you, have submitted other orders for shares in the Subscription Offering. If you check the box, list below all other orders submitted by you or your associates or by persons acting in concert with you. (continued on reverse side of this form) Name(s) listed in Section 9 on other Stock Order Forms Number of shares ordered Name(s) listed in Section 9 on other Stock Order Forms Number of shares ordered (9) STOCK REGISTRATION The name(s) and address that you provide below will bereflected on your stock ownership statement, and will be used for other communications related to this order. Please PRINT clearly and use full first and last name(s), not initials. If purchasing in the Subscription Offering, you may not add the name(s) of persons/entities who do not have subscription rights or who qualify only in a lower purchase priority than yours. See Stock Order Form Instructions for further guidance. Individual Tenants in Common Uniform Transfers to Minors Act (for reporting SSN, use minor’s)FOR TRUSTEE/BROKER USE ONLY: Joint Tenants Corporation Partnership Trust – Under Agreement Dated Other IRA(SSN of Beneficial Owner) - - First Name, Last Name Reporting SSN/Tax ID No. First Name, Last Name SSN/Tax ID No. Street Daytime Phone # City State Zip County (Important) Evening Phone # (10) ACKNOWLEDGMENT AND SIGNATURE(S) I understand that, to be effective, this form, properly completed, together with full payment, must be received no later than 2:00 p.m. Eastern time, on , 2016, otherwise this form and all subscription rights will be void. (continued on reverse side of this form) ORDER NOT VALID UNLESS SIGNED ONE SIGNATURE REQUIRED, UNLESS SECTION 4 OF THIS FORM INCLUDES ACCOUNTS REQUIRING MORE THAN ONE SIGNATURE TO AUTHORIZE WITHDRAWAL. IF SIGNING AS A CUSTODIAN, TRUSTEE, CORPORATE OFFICER, ETC., PLEASE INCLUDE YOUR FULL TITLE. Signature (title, if applicable) Date Signature (title, if applicable) Date (over)

STOCK ORDER FORM – SIDE 2

(8) ASSOCIATES/ACTING IN CONCERT (continued from front of Stock Order Form)

Associates/Acting in Concert:

Associate – The term “associate” of a person means:

| (1) | any corporation or organization, other than Randolph Bancorp (MHC), Randolph Savings Bank or Randolph Bancorp, Inc. or a majority-owned subsidiary of these entities, of which the person is an officer, partner or 10% beneficial shareholder or more of any class of equity securities; |

| (2) | any trust or other estate in which the person, directly or indirectly, has a substantial beneficial interest or serves as a trustee or in a fiduciary capacity, excluding any employee stock benefit plan in which the person has a substantial beneficial interest or serves as trustee or in a fiduciary capacity; and |

| (3) | any relative or spouse of the person, or any relative of the spouse, who either has the same home as the person or who is a trustee, director or officer of Randolph Bancorp (MHC), Randolph Savings Bank or Randolph Bancorp, Inc. |

Acting in Concert – The term “acting in concert” means:

Persons seeking to combine or pool their voting or other interests in the securities of an issuer for a common purpose, pursuant to any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise. When persons act together for such purpose, their group is deemed to have acquired their stock. The determination of whether a group is acting in concert shall be made solely by us and may be based on any evidence upon which we choose to rely, including, without limitation, joint account relationships or the fact that such persons have filed joint Schedules 13D with the SEC with respect to other companies; provided, however, that the determination of whether a group is acting in concert remains subject to review by the Massachusetts Commissioner of Banks. Persons who have the same address, whether or not related, will be deemed to be acting in concert unless otherwise determined by us.

A person or company that acts in concert with another person or company (“other party”) shall also be deemed to be acting in concert with any person or company who is also acting in concert with that other party, except that any tax-qualified employee stock benefit plan will not be deemed to be acting in concert with its trustee or a person who serves in a similar capacity solely for the purpose of determining whether common stock held by the trustee and common stock held by the employee stock benefit plan will be aggregated.

Our directors and trustees are not treated as associates of each other solely because of their membership on the Board of Directors

Please see the Prospectus section entitled “The Conversion; Plan of Distribution – Additional Limitations of Common Stock Purchases” for more information on purchase limitations.

(10) ACKNOWLEDGMENT AND SIGNATURE(S) (continued from front of Stock Order Form)

I agree that, after receipt by Randolph Bancorp, Inc., this Stock Order Form may not be modified or canceled without Randolph Bancorp, Inc.’s consent, and that if withdrawal from a deposit account has been authorized, the authorized amount will not otherwise be available for withdrawal. Under penalty of perjury, I certify that (1) the Social Security or Tax ID information and all other information provided hereon are true, correct and complete, (2) I am purchasing shares solely for my own account and that there is no agreement or understanding regarding the sale or transfer of such shares, or my right to subscribe for shares, and (3) I am not subject to backup withholding tax [cross out (3) if you have been notified by the IRS that you are subject to backup withholding]. I acknowledge that my order does not conflict with the overall purchase limitation of $500,000 in all categories of the offering combined, for any person or entity, together with any associate or group of persons acting in concert, as set forth in the Plan of Conversion and the Prospectus dated , 2016.

Subscription rights pertain to those eligible to subscribe in the Subscription Offering. Subscription rights are only exercisable by completing and submitting a Stock Order Form, with full payment for the shares subscribed for. Federal regulations prohibit any person from transferring or entering into any agreement directly or indirectly to transfer the legal or beneficial ownership of conversion subscription rights, or the underlying securities, to the account of another.

I ACKNOWLEDGE THAT THE SHARES OF COMMON STOCK ARE NOT DEPOSITS OR SAVINGS ACCOUNTS AND ARE NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, ANY OTHER GOVERNMENT AGENCY OR THE DEPOSITORS INSURANCE FUND.

If anyone asserts that the shares of common stock are federally insured or guaranteed, or are as safe as an insured deposit, I should call the Federal Reserve Bank of Boston or the Massachusetts Division of Banks.

I further certify that, before subscribing for shares of the common stock of Randolph Bancorp, Inc. I received the Prospectus dated , 2016, and I have read the terms and conditions described in the Prospectus, including disclosure concerning the nature of the security being offered and the risks involved in the investment, described by Randolph Bancorp, Inc. in the “Risk Factors” section, beginning on page . Risks include, but are not limited to the following:

| 1. | We may not be able to successfully implement our strategic plan. |

| 2. | We have incurred operating losses in the past several years and the timing of our return to profitability is uncertain. |

| 3. | Our business may be adversely affected by credit risk associated with residential property. |

| 4. | We are focused on growing our loan portfolio. Commercial real estate, commercial and industrial and construction loans generally carry greater credit risk than loans secured by owner occupied one- to four-family real estate, and these risks will increase if we succeed in our plan to increase these types of loans. |

| 5. | Our loan portfolio contains a significant portion of loans that are unseasoned. It is difficult to judge the future performance of unseasoned loans. |

| 6. | If our allowance for loan losses is not sufficient to cover actual loan losses, our earnings and capital could decrease. |

| 7. | The building of market share through de novo branching and expansion of our commercial lending capacity could cause our expenses to increase faster than revenues. |

| 8. | Our wholesale funding sources may prove insufficient to replace deposits at maturity and support our future growth. |

| 9. | Changes in interest rates may hurt our profits and asset value. |

| 10. | Our mortgage banking revenue and the value of our mortgage servicing rights can be volatile. |

| 11. | If we are required to repurchase mortgage loans that we have previously sold, it would negatively affect our earnings. |

| 12. | Strong competition within our market area could hurt our profits and slow growth. |

| 13. | The geographic concentration of our loan portfolio and lending activities makes us vulnerable to a downturn in the local economy. |

| 14. | We are a community bank and our ability to maintain our reputation is critical to the success of our business and the failure to do so may materially adversely affect our performance. |

| 15. | Our banking business is highly regulated, which could limit or restrict our activities and impose financial requirements or limitations on the conduct of our business. |

| 16. | We are subject to more stringent capital requirements. |

| 17. | An increase in FDIC or Depositors Insurance Fund insurance assessments could significantly increase our expenses. |

| 18. | Our cost of operations is high relative to our assets. Our failure to maintain or reduce our operating expenses could hurt our operating results. |

| 19. | Changes in the valuation of our securities could adversely affect us. |

| 20. | We depend on our management team to implement our business strategy and we could be harmed by the loss of their services. |

| 21. | Our growth or future losses may require us to raise additional capital in the future, but that capital may not be available when it is needed or the cost of that capital may be very high. |

| 22. | We may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations. |

| 23. | Systems failures, interruptions or breaches of security could have an adverse effect on our financial condition and results of operations. |

| 24. | Regulations relating to privacy, information security and data protection could increase our costs, affect or limit how we collect and use personal information and adversely affect our business opportunities. |

| 25. | We rely on other companies to provide key components of our business infrastructure. |

| 26. | If our risk management framework does not effectively identify or mitigate our risks, we could suffer losses. |

| 27. | The future price of the shares of common stock may be less than the purchase price in the offering. |

| 28. | Our low return on equity could negatively affect the trading price of our shares of common stock. |

| 29. | We are focused on growth and may not pay dividends or repurchase our stock. |

| 30. | We have broad discretion in allocating the net proceeds of the offering. Our failure to effectively utilize such net proceeds may have an adverse effect on our financial performance and the value of our common stock. |

| 31. | There may be a limited trading market in our common stock, which would hinder your ability to sell our common stock and may lower the market price of the stock. |

| 32. | Our stock-based benefit plans will increase our costs, which will reduce our income. |

| 33. | The implementation of a stock-based benefit plan may dilute your ownership interest. |

| 34. | We will enter into agreements with certain of our officers which may increase our compensation costs upon the occurrence of certain events or increase the cost of acquiring us. |

| 35. | A significant percentage of our common stock will be held by our directors, executive officers and employee benefit plans. |

| 36. | Our articles of organization and bylaws and certain regulations may prevent or make more difficult to pursue certain transactions, including a sale or merger of Randolph Bancorp, Inc. |

| 37. | We are an “emerging growth company,” as defined in the JOBS Act, and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our common stock less attractive to investors and adversely affect the market price of our common stock. |

| 38. | We have elected to delay the adoption of new and revised accounting pronouncements, which means that our financial statements may not be comparable to those of other public companies. |

| 39. | We will incur increased costs as a result of operating as a public company and our management will be required to devote substantial time to new compliance initiatives. |

| 40. | If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock. |

| 41. | You may not revoke your decision to purchase Randolph Bancorp, Inc. common stock in the subscription or community offerings after you send us your order. |

| 42. | The distribution of subscription rights could have adverse income tax consequences. |

| 43. | The contribution to our charitable foundation will dilute your ownership interest and adversely affect operating results in the year we complete the offering. |

| 44. | Our contribution to our charitable foundation may not be tax deductible, which could decrease our profits. |

| 45. | There is no assurance when or even if the acquisition will be completed. |

| 46. | Regulatory approvals may not be received or may take longer than expected. |

| 47. | If the merger is not completed, Randolph Bancorp will have incurred substantial expenses without realizing the expected benefits. |

| 48. | We may be unable to successfully integrate First Eastern Bankshares Corporation’s operations and retain their employees and customers. |

| 49. | Unanticipated costs relating to the merger could reduce Randolph Bancorp’s future earnings per share. |

| 50. | The need to account for certain assets and liabilities at estimated fair value may adversely affect our results of operations. |

By executing this form, the investor is not waiving any rights under federal or state securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934.

See Front of Stock Order Form

RANDOLPH BANCORP, INC.

STOCK INFORMATION CENTER: 1-(877) -

STOCK ORDER FORM INSTRUCTIONS – SIDE 1

Sections (1) and (2) – Number of Shares and Total Payment Due. Indicate the Number of Shares that you wish to purchase and the Total Payment Due. Calculate the Total Payment Due by multiplying the Number of Shares by the $10.00 price per share. The minimum purchase is 25 shares ($250). The maximum allowable purchase by a person or entity (or individuals exercising subscription rights through a single qualifying account held jointly) is 25,000 shares ($250,000). Further, no person or entity, together with any associate or group of persons acting in concert, may purchase more than 50,000 shares ($500,000) in all categories of the offering combined. Please see the Prospectus section entitled “The Conversion; Plan of Distribution – Additional Limitations on Common Stock Purchases” for more specific information. By signing this form, you are certifying that your order does not conflict with these purchase limitations.

Section (3) – Method of Payment – Check or Money Order. Payment may be made by including with this form a personal check, bank check or money order made payable directly to Randolph Bancorp, Inc. These will be deposited upon receipt. The funds remitted by personal check must be available within the account(s) when your Stock Order Form is received. Indicate the amount remitted. Interest will be calculated at our statement savings rate from the date payment is processed until the offering is completed, at which time the purchaser will be issued a check for interest earned. Please do not remit cash, a Randolph Savings Bank line of credit check, wire transfers or third party checks for this purchase.

Section (4) – Method of Payment – Deposit Account Withdrawal. Payment may be made by authorizing a direct withdrawal from your Randolph Savings Bank deposit account(s). Indicate the account number(s) and the amount(s) you wish withdrawn. Attach a separate page, if necessary. Funds designated for withdrawal must be available within the account(s) at the time this Stock Order Form is received. Upon receipt of this order, we will place a hold on the amount(s) designated by you – the funds will be unavailable to you for withdrawal thereafter. The funds will continue to earn interest within the account(s) at the accounts contractual rate. The interest will remain in the accounts when the designated withdrawal is made, at the completion of the offering. There will be no early withdrawal penalty for withdrawal from a Randolph Savings Bank certificate of deposit (CD) account. Note that you may NOT designate accounts with check-writing privileges. Please submit a check instead. If you request direct withdrawal from such accounts, we reserve the right to interpret that as your authorization to treat those funds as if we had received a check for the designated amount, and we will immediately withdraw the amount from your checking account(s). Additionally, you may not designate direct withdrawal from Randolph Savings Bank IRA or other retirement accounts. For guidance on using retirement funds, whether held at Randolph Savings Bank or elsewhere, please contact the Stock Information Center as soon as possible – preferably at least two weeks before the offering deadline. See the Prospectus section entitled “The Conversion; Plan of Distribution – Procedure for Purchasing Shares in the Subscription and Community Offerings – Using Individual Retirement Account Funds.” Your ability to use retirement account funds to purchase shares cannot be guaranteed and depends on various factors, including timing constraints and the institution where those funds are currently held.

Section (5) – Purchaser Information. Please check the one box that applies to the purchaser(s) listed in Section 9 of this form. Purchase priorities in the Subscription Offering are based on eligibility dates. Boxes (a) and (b) refer to the Subscription Offering. If you checked box (a) or (b), list all Randolph Savings Bank deposit account numbers that the purchaser(s) had ownership in as of the applicable eligibility date. Include all forms of deposit account ownership (e.g. individual, joint, IRA, etc.). If purchasing shares for a minor, list only the minor’s eligible accounts. If purchasing shares for a corporation or partnership, list only that entity’s eligible accounts. Attach a separate page, if necessary. Failure to complete this section, or providing incorrect or incomplete information, could result in a loss of part or all of your share allocation in the event of an oversubscription. Boxes (d) and (e) refer to the Community Offering. Orders placed in the Subscription Offering will take priority over orders placed in the Community Offering. See the Prospectus section entitled “The Conversion; Plan of Distribution – Subscription Offering and Subscription Rights” for further details about the Subscription Offering.

Section (6) – Management. Check the box if you are a Randolph Bancorp (MHC), Randolph Savings Bank or Randolph Bancorp, Inc. director, trustee, officer, corporator, employee or a member of their immediate family. Immediate family includes spouse, parents, siblings and children who live in the same house as the director, trustee, officer, corporator or employee.

Section (7) – Maximum Purchaser Identification. Check the box, if applicable. Failure to check the box will result in you not receiving notification in the event the maximum purchase limit(s) is/are increased. If you checked the box but have not subscribed for the maximum amount in the Subscription Offering, you will not receive this notification.

Section (8) – Associates/Acting in Concert. Check the box, if applicable, and provide the requested information. Attach a separate page if necessary.

Section (9) – Stock Registration. Clearly PRINT the name(s) in which you want the shares registered and the mailing address for all correspondence related to your order, including a stock ownership statement. IMPORTANT: Subscription rights are non-transferable. If placing an order in the Subscription Offering, you may not add the names of persons/entities who do not have subscription rights or who qualify only in a lower purchase priority than yours. A Social Security or Tax ID Number must be provided. The first number listed will be identified with the stock for tax reporting purposes. Listing at least one phone number is important in the event we need to contact you about this form. NOTE FOR FINRA MEMBERS (Formerly NASD): If you are a member of the Financial Industry Regulatory Authority (“FINRA”), formerly the National Association of Securities Dealers (“NASD”) or a person affiliated or associated with a FINRA member, you may have additional reporting requirements. Please report this subscription in writing to the applicable department of the FINRA member firm within one day of payment thereof.

(over)

RANDOLPH BANCORP, INC.

STOCK INFORMATION CENTER: 1-(877) -

STOCK ORDER FORM INSTRUCTIONS – SIDE 2

Form of Stock Ownership. For reasons of clarity and standardization, the stock transfer industry has developed uniform stockholder registrations for issuance of stock. Beneficiaries may not be named on stock registrations. If you have any questions on wills, estates, beneficiaries, etc., please consult your legal advisor. When registering stock, do not use two initials – use the full first name, middle initial and last name. Omit words that do not affect ownership such as “Dr.” or “Mrs.” Check the one box that applies.

Buying Stock Individually – Used when shares are registered in the name of only one owner. To qualify in the Subscription Offering, the individual named in Section 9 of the Stock Order Form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

Buying Stock Jointly – To qualify in the Subscription Offering, the persons named in Section 9 of the Stock Order Form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

Joint Tenants – Joint Tenancy (with Right of Survivorship) may be specified to identify two or more owners where ownership is intended to pass automatically to the surviving tenant(s). All owners must agree to the sale of shares.

Tenants in Common – May be specified to identify two or more owners where, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All owners must agree to the sale of shares.

Buying Stock for a Minor – Shares may be held in the name of a custodian for a minor under the Uniform Transfer to Minors Act. To qualify in the Subscription Offering, the minor (not the custodian) named in Section 9 of the Stock Order Form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

The standard abbreviation for custodian is “CUST.” The Uniform Transfer to Minors Act is “UTMA.” Include the state abbreviation. For example, stock held by John Smith as custodian for Susan Smith under the MA Uniform Transfer to Minors Act, should be registered as John Smith CUST Susan Smith UTMA-MA (list only the minor’s social security number).

Buying Stock for a Corporation/Partnership – On the first name line, indicate the name of the corporation or partnership and indicate the entity’s Tax ID Number for reporting purposes. To qualify in the Subscription Offering, the corporation or partnership named in Section 9 of the Stock Order Form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

Buying Stock in a Trust/Fiduciary Capacity – Indicate the name of the fiduciary and the capacity under which the fiduciary is acting (for example, “Executor”), or name of the trust, the trustees and the date of the trust. Indicate the Tax ID Number to be used for reporting purposes. To qualify in the Subscription Offering, the entity named in Section 9 of the Stock Order Form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

Buying Stock in a Self-Directed IRA (for trustee/broker use only) – Registration should reflect the custodian or trustee firm’s registration requirements. For example, on the first name line, indicate the name of the brokerage firm, followed by CUST or TRUSTEE. On the second name line, indicate the name of the beneficial owner (for example, “FBO John Smith IRA”). You can indicate an account number or other underlying information and the custodian or trustee firm’s address and department to which all correspondence should be mailed related to this order, including a stock ownership statement. Indicate the TAX ID Number under which the IRA account should be reported for tax purposes. To qualify in the Subscription Offering, the beneficial owner named in Section 9 of this form must have had one or more eligible deposit account(s) at Randolph Savings Bank as of the close of business on December 31, 2014 or June 30, 2015.

Section (10) – Acknowledgment and Signature(s). Sign and date the Stock Order Form where indicated. Before you sign, please carefully review the information you provided and read the acknowledgment. Verify that you have printed clearly and completed all applicable shaded areas on the Stock Order Form. Only one signature is required, unless any account listed in Section 4 requires more than one signature to authorize a withdrawal.

Please review the Prospectus carefully before making an investment decision. Deliver your completed Stock Order Form, with full payment or deposit account withdrawal authorization, so that it is received (not postmarked) before 2:00 p.m., Eastern time, on , 2016. Stock Order Forms can be delivered by using the enclosed postage paid Stock Order Reply Envelope, by overnight courier to the Stock Information Center address on the front of the Stock Order Form, or by hand-delivery to Randolph Savings Bank, located at 10 Cabot Place, Stoughton, Massachusetts. Hand-delivered stock order forms will only be accepted at this location. Please do not mail Stock Order Forms to Randolph Savings Bank. We are not required to accept Stock Order Forms that are found to be deficient or incorrect, or that do not include proper payment or the required signature. Faxes or copies of this form are not required to be accepted.

OVERNIGHT DELIVERY can be made to the Stock Information Center address provided on the front of the Stock Order Form.

QUESTIONS? Call our Stock Information Center, toll-free, at 1-(877) - , from 10:00 a.m. to 4:00 p.m., Eastern time, Monday through Friday. The Stock Information Center is not open on bank holidays.