Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CIVISTA BANCSHARES, INC. | d179041d8k.htm |

2016 Shareholder Presentation James O. Miller - Chairman, President & Chief Executive Officer Dennis G. Shaffer - Executive Vice President & President of Civista Bank Richard J. Dutton - Senior Vice President, Chief Operating Officer Exhibit 99.1

Forward-Looking Statements Comments made in this presentation include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to numerous assumptions, risks and uncertainties. Although management believes that the expectations reflected in the forward-looking statements are reasonable, actual results or future events could differ, possibly materially, from those anticipated in these forward-looking statements. For factors that could cause actual results to differ from our forward-looking statements, please refer to “Risk Factors” in the Company’s Form 10-K filed with the SEC on March 15, 2016. The forward-looking statements speak only as of the date of this presentation, and Civista Bancshares, Inc. assumes no duty to update any forward-looking statements to reflect events or circumstances after the date of this presentation, except to the extent required by law.

Contact Information Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol “CIVB.” The Company’s depository shares, each representing 1/40th ownership interest in a Series B Preferred Share, are traded on the NASDAQ Capital Market under the symbol “CIVBP.” Additional information can be found at: www.civb.com James O. Miller Chairman, President & Chief Executive Officer jomiller@civb.com Telephone: 888.645.4121

Corporate Overview 9th Largest Publicly Traded Commercial Bank in Ohio Community Banking Focused Operations in 12 Ohio Counties 27 Branches & 1 Loan Production Office Operations in Stable Ohio Markets Acquisitive Franchise Poised for Future Growth Corporate Overview Full-Service Banking Organization with Diversified Revenue Streams Commercial Banking Retail Banking Wealth Management Mortgage Banking Key Facts Corporate Rebranding NASDAQ: CIVB ¹ Market data as of April 12, 2016.

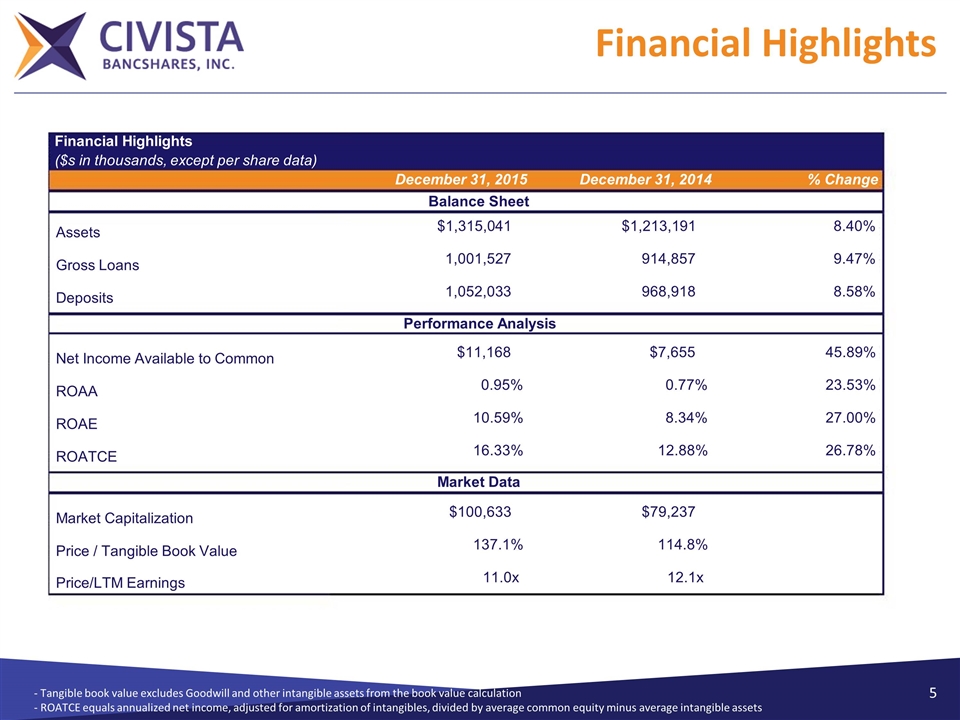

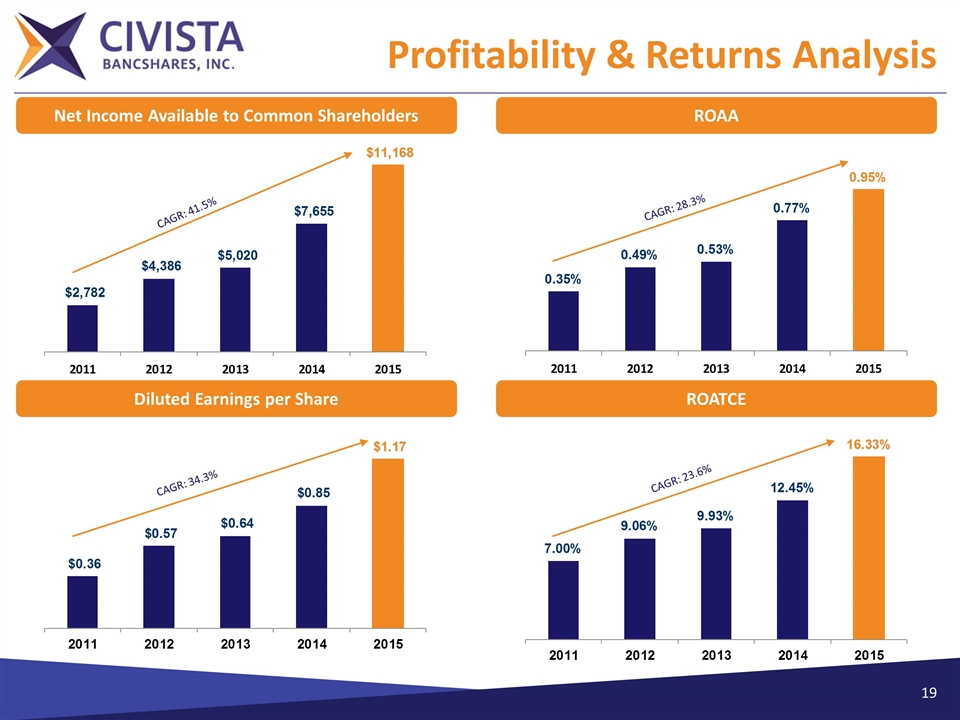

Financial Highlights - Tangible book value excludes Goodwill and other intangible assets from the book value calculation - ROATCE equals annualized net income, adjusted for amortization of intangibles, divided by average common equity minus average intangible assets Financial Highlights ($s in thousands, except per share data) December 31, 2015 December 31, 2014 % Change Balance Sheet Assets $1,315,041 $1,213,191 8.40% Gross Loans 1,001,527 914,857 9.47% Deposits 1,052,033 968,918 8.58% Performance Analysis Net Income Available to Common $11,168 $7,655 45.89% ROAA 0.95% 0.77% 23.53% ROAE 10.59% 8.34% 27.00% ROATCE 16.33% 12.88% 26.78% Market Data Market Capitalization $100,633 $79,237 Price / Tangible Book Value 137.1% 114.8% Price/LTM Earnings 11.0x 12.1x

Investment Highlights Experienced management team with strong track record Leading Ohio community bank franchise focused on rural and targeted urban markets Gather attractive low-cost rural deposits and lend in select urban markets Demonstrated organic growth and proven acquirer Opened Loan Production Office on east side of Cleveland (Mayfield Heights) in Q1 2015 Completed TCNB Financial Corp. acquisition and successful operational integration in Q1 2015 Successful unification into Civista brand in Q2 2015 Continued focus on credit quality Decline in NPAs1 to Assets of 70% from 3.39% in 2011 to 1.01% in 2015 1 Defined as nonaccrual loans and leases, renegotiated loans and leases and other real estate owned

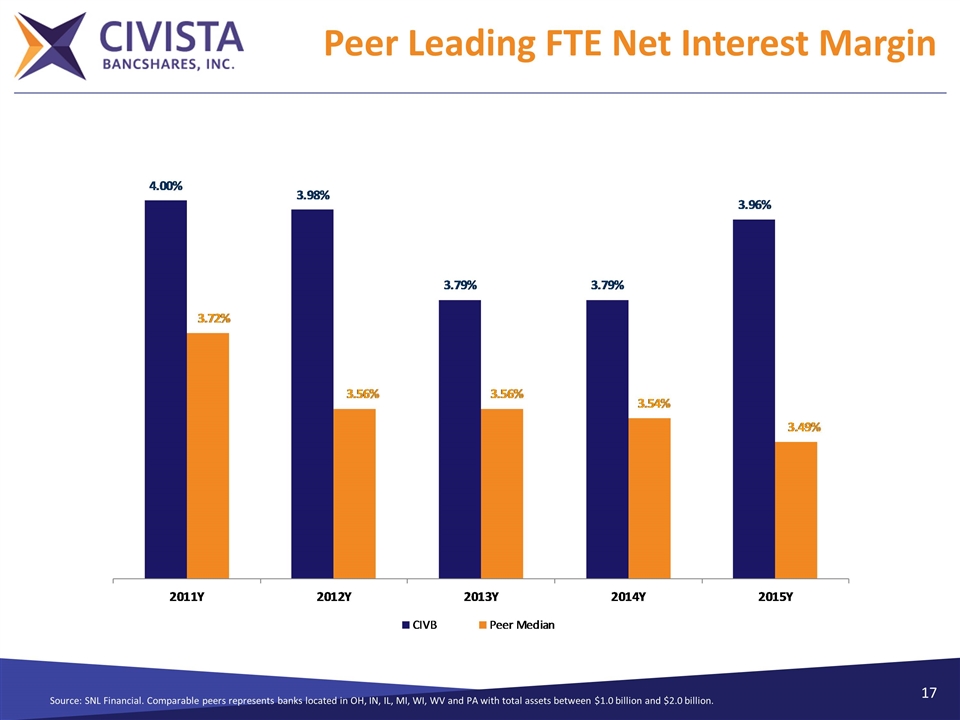

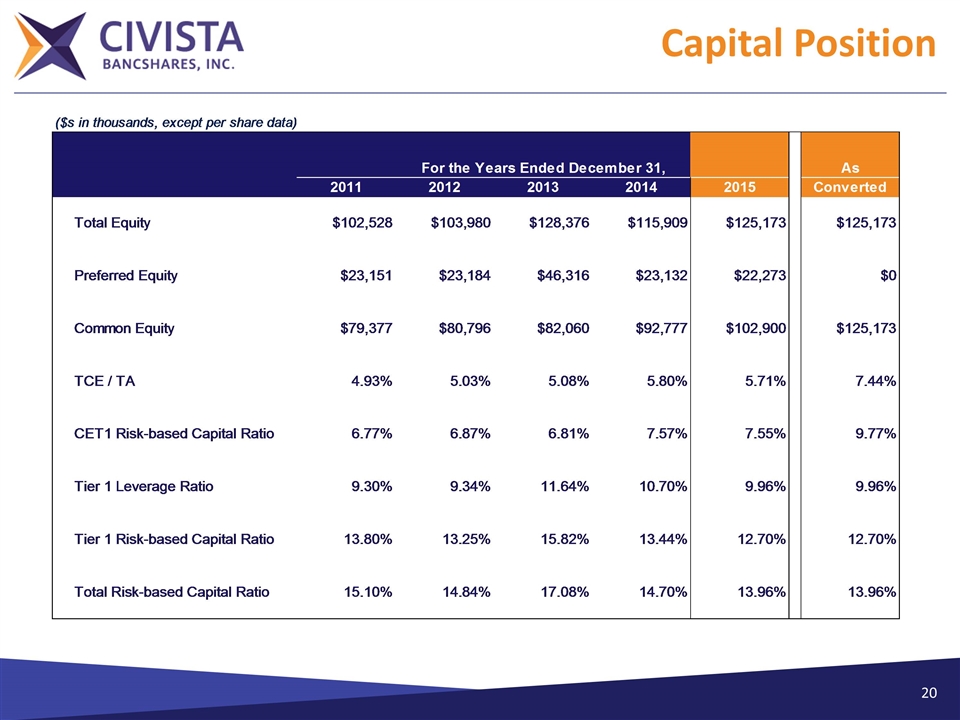

Investment Highlights Demonstrated earnings growth Expanded FTE Net Interest Margin to 3.96% in 2015 from 3.79% in 2014 through careful balance sheet management Strong noninterest income growth enhanced by unique tax refund processing platform Y-o-Y net income available to common shareholders growth of ~46% ROATCE of 16.33% for 2015 Improving operating leverage 68% growth in gain on sale of mortgage loans from 2014 to 2015 Continued focus on costs Achieved cost synergy targets in TCNB acquisition within first year while maintaining revenue and loan growth goals Capital Demonstrated ability to be good stewards of Capital – 2013 Series B preferred stock issuance $50 million shelf registration statement went effective with SEC in August 2015 Shareholders recently approved proposals to eliminate preemptive rights and cumulative voting Approved by greater than 88% of CIVB shareholders - ROATCE equals annualized net income, adjusted for amortization of intangibles, divided by average common equity minus average intangible assets

Experienced Management Team Chairman, President & CEO 41 years of banking experience Joined in 1986 James O. Miller SVP & Chief Operating Officer 30 years of banking experience Joined in 2007 Richard J. Dutton SVP & Chief Lending Officer 27 years of banking experience Joined in 2016 Charles A. Parcher SVP & General Counsel 14 years of banking experience Joined in 2002 James E. McGookey SVP & Controller 27 years of banking experience Joined in 1988 Todd A. Michel SVP & Chief Risk Officer 20 years of banking experience Joined in 2013 John A. Betts SVP & Chief Credit Officer 31 years of banking experience Joined in 2010 Paul J. Stark Dennis G. Shaffer EVP President, Civista Bank 30 years of banking experience Joined in 2009

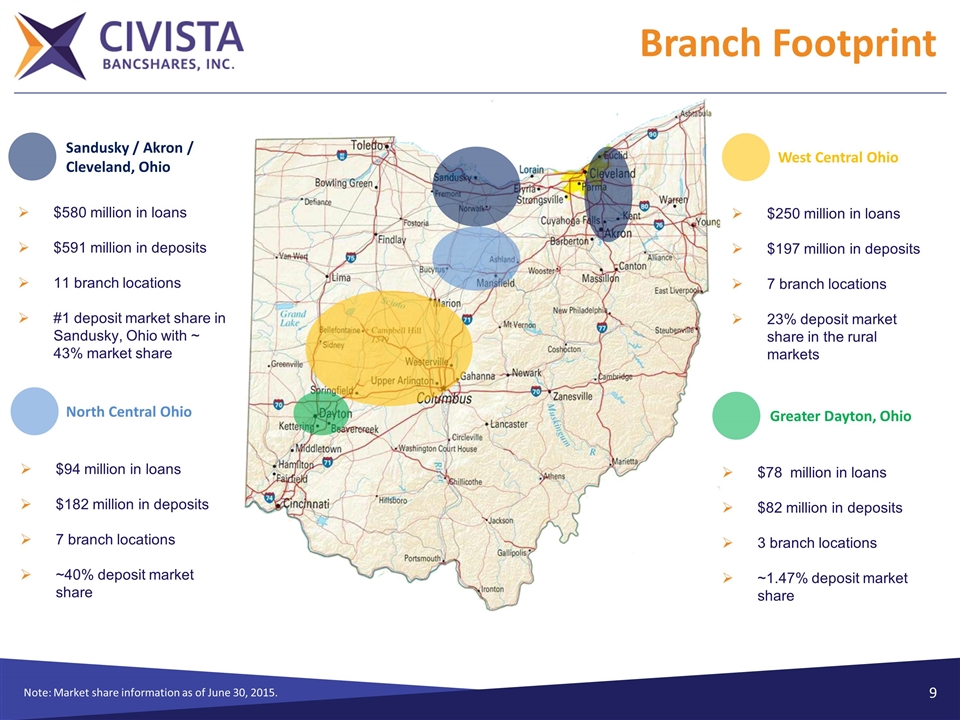

Branch Footprint Note: Market share information as of June 30, 2015. Sandusky / Akron / Cleveland, Ohio $580 million in loans $591 million in deposits 11 branch locations #1 deposit market share in Sandusky, Ohio with ~ 43% market share North Central Ohio $94 million in loans $182 million in deposits 7 branch locations ~40% deposit market share $250 million in loans $197 million in deposits 7 branch locations 23% deposit market share in the rural markets West Central Ohio Greater Dayton, Ohio $78 million in loans $82 million in deposits 3 branch locations ~1.47% deposit market share

Attractive Target Markets Sandusky / Akron / Cleveland North Central Ohio West Central Ohio Greater Dayton Ohio

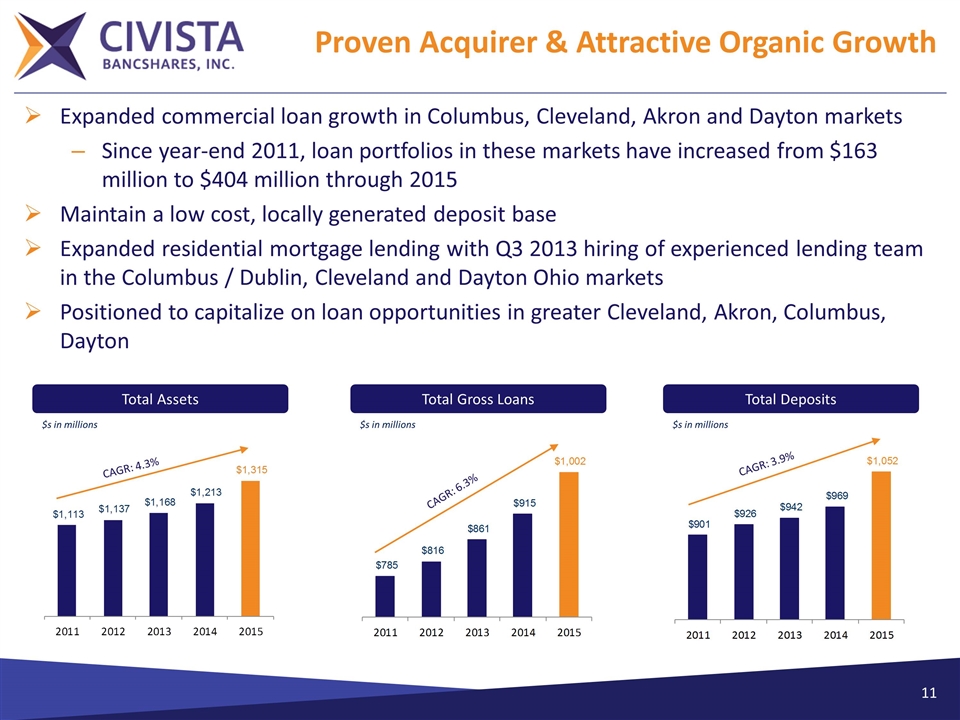

Proven Acquirer & Attractive Organic Growth Expanded commercial loan growth in Columbus, Cleveland, Akron and Dayton markets Since year-end 2011, loan portfolios in these markets have increased from $163 million to $404 million through 2015 Maintain a low cost, locally generated deposit base Expanded residential mortgage lending with Q3 2013 hiring of experienced lending team in the Columbus / Dublin, Cleveland and Dayton Ohio markets Positioned to capitalize on loan opportunities in greater Cleveland, Akron, Columbus, Dayton Total Assets $s in millions Total Gross Loans $s in millions Total Deposits $s in millions CAGR: 4.3% CAGR: 6.3% CAGR: 3.9%

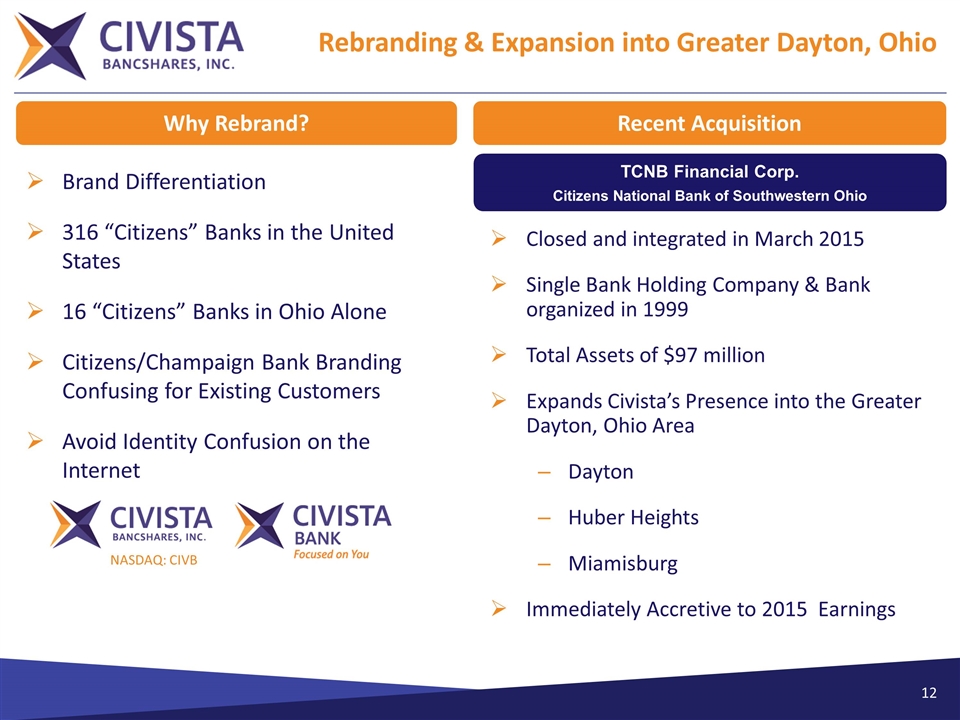

Brand Differentiation 316 “Citizens” Banks in the United States 16 “Citizens” Banks in Ohio Alone Citizens/Champaign Bank Branding Confusing for Existing Customers Avoid Identity Confusion on the Internet Rebranding & Expansion into Greater Dayton, Ohio TCNB Financial Corp. Citizens National Bank of Southwestern Ohio Closed and integrated in March 2015 Single Bank Holding Company & Bank organized in 1999 Total Assets of $97 million Expands Civista’s Presence into the Greater Dayton, Ohio Area Dayton Huber Heights Miamisburg Immediately Accretive to 2015 Earnings Recent Acquisition Why Rebrand? NASDAQ: CIVB

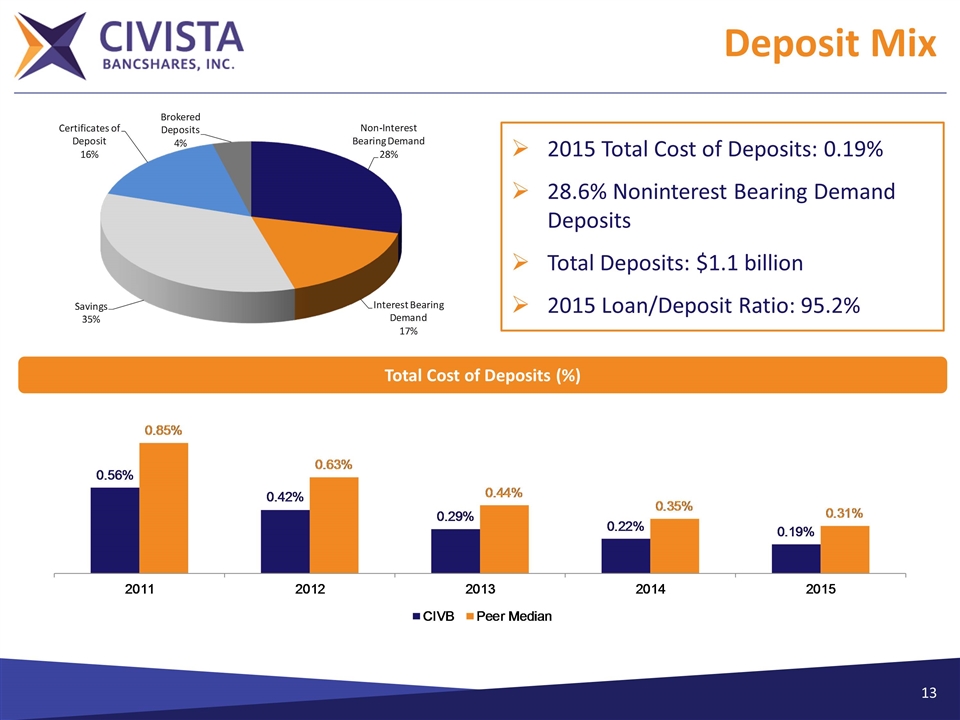

Deposit Mix 2015 Total Cost of Deposits: 0.19% 28.6% Noninterest Bearing Demand Deposits Total Deposits: $1.1 billion 2015 Loan/Deposit Ratio: 95.2% Total Cost of Deposits (%)

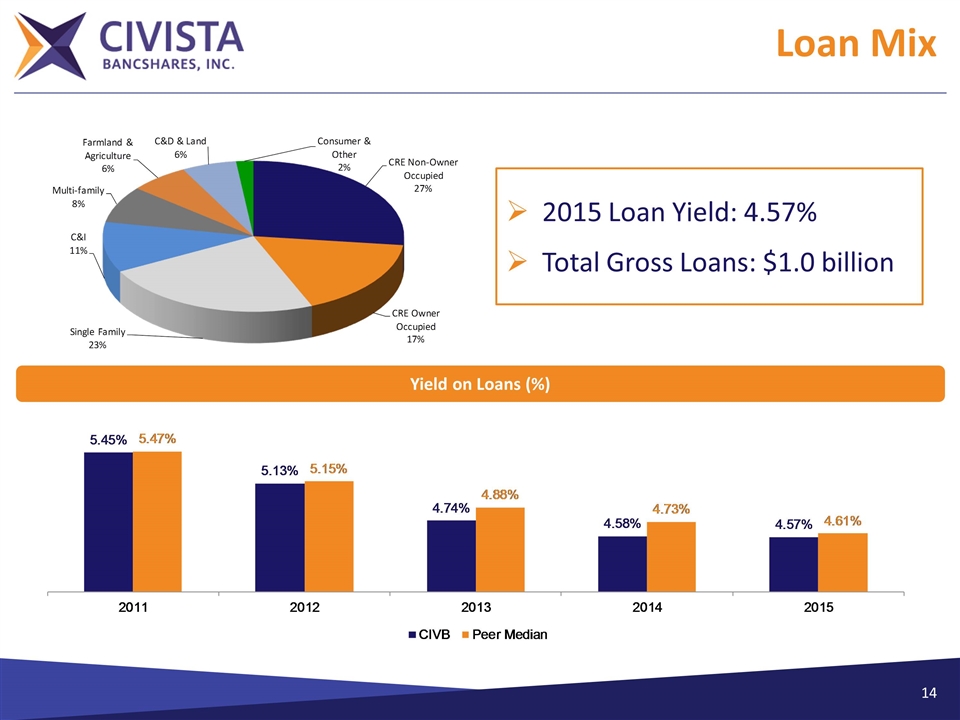

Loan Mix 2015 Loan Yield: 4.57% Total Gross Loans: $1.0 billion Yield on Loans (%)

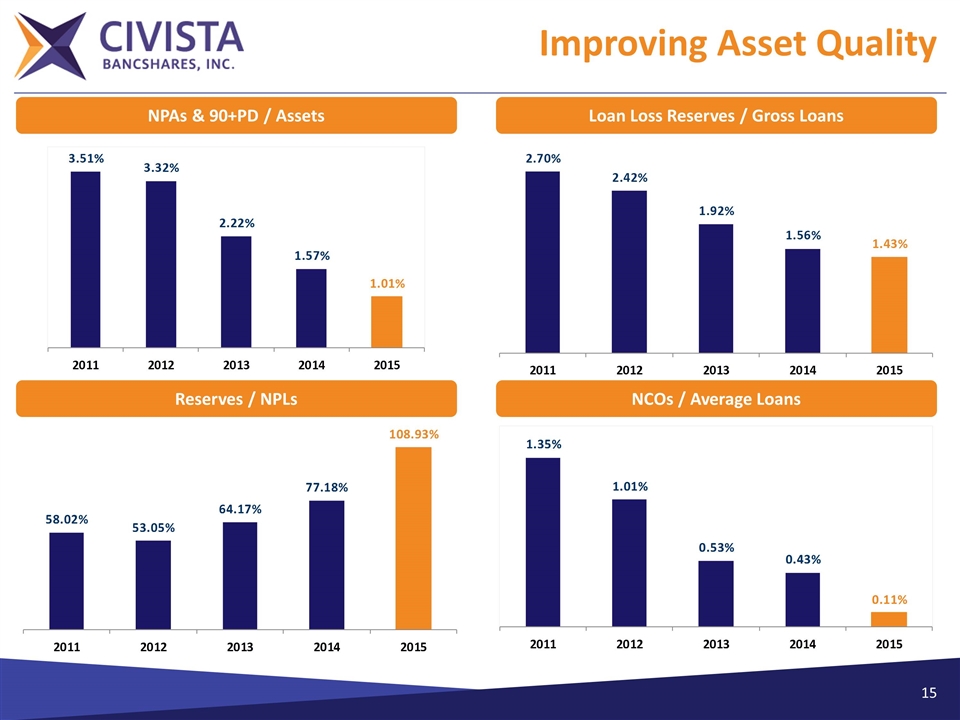

Improving Asset Quality Reserves / NPLs NCOs / Average Loans Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets

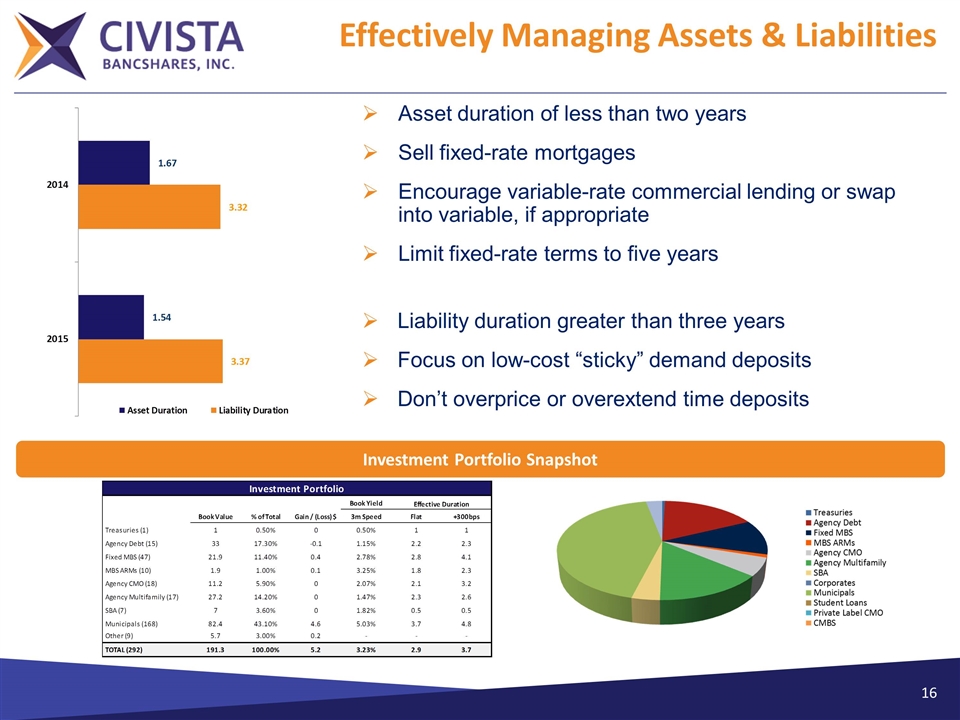

Effectively Managing Assets & Liabilities Asset duration of less than two years Sell fixed-rate mortgages Encourage variable-rate commercial lending or swap into variable, if appropriate Limit fixed-rate terms to five years Liability duration greater than three years Focus on low-cost “sticky” demand deposits Don’t overprice or overextend time deposits Investment Portfolio Snapshot

Peer Leading FTE Net Interest Margin Source: SNL Financial. Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion.

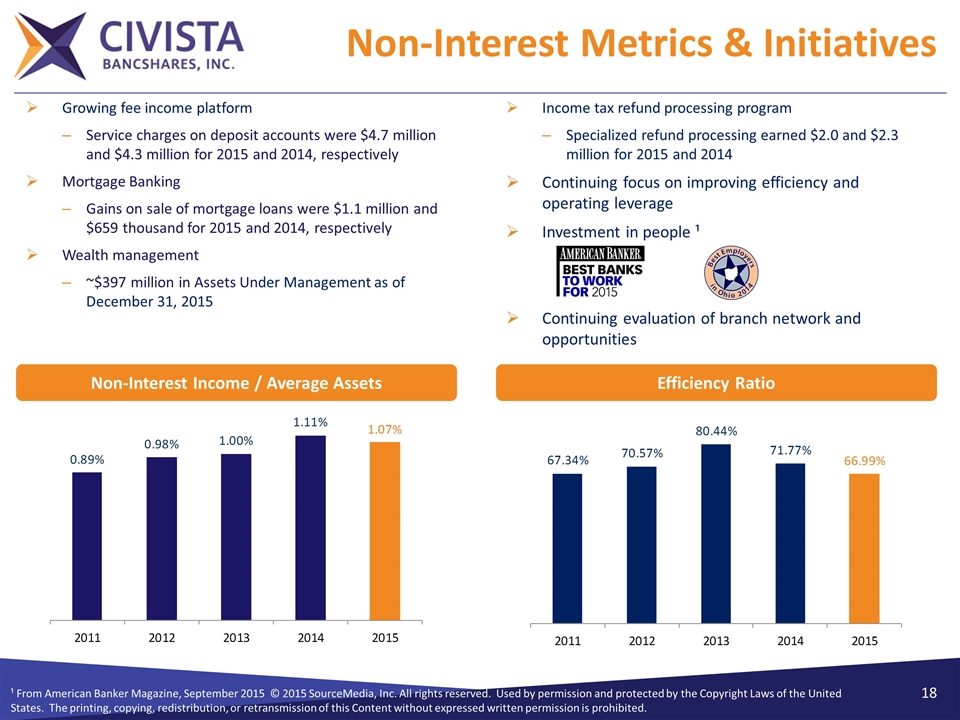

Non-Interest Metrics & Initiatives ¹ From American Banker Magazine, September 2015 © 2015 SourceMedia, Inc. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this Content without expressed written permission is prohibited. Efficiency Ratio Non-Interest Income / Average Assets Growing fee income platform Service charges on deposit accounts were $4.7 million and $4.3 million for 2015 and 2014, respectively Mortgage Banking Gains on sale of mortgage loans were $1.1 million and $659 thousand for 2015 and 2014, respectively Wealth management ~$397 million in Assets Under Management as of December 31, 2015 Income tax refund processing program Specialized refund processing earned $2.0 and $2.3 million for 2015 and 2014 Continuing focus on improving efficiency and operating leverage Investment in people ¹ Continuing evaluation of branch network and opportunities

Profitability & Returns Analysis Diluted Earnings per Share ROATCE ROAA Net Income Available to Common Shareholders CAGR: 41.5% CAGR: 28.3% CAGR: 34.3% CAGR: 23.6%

Capital Position

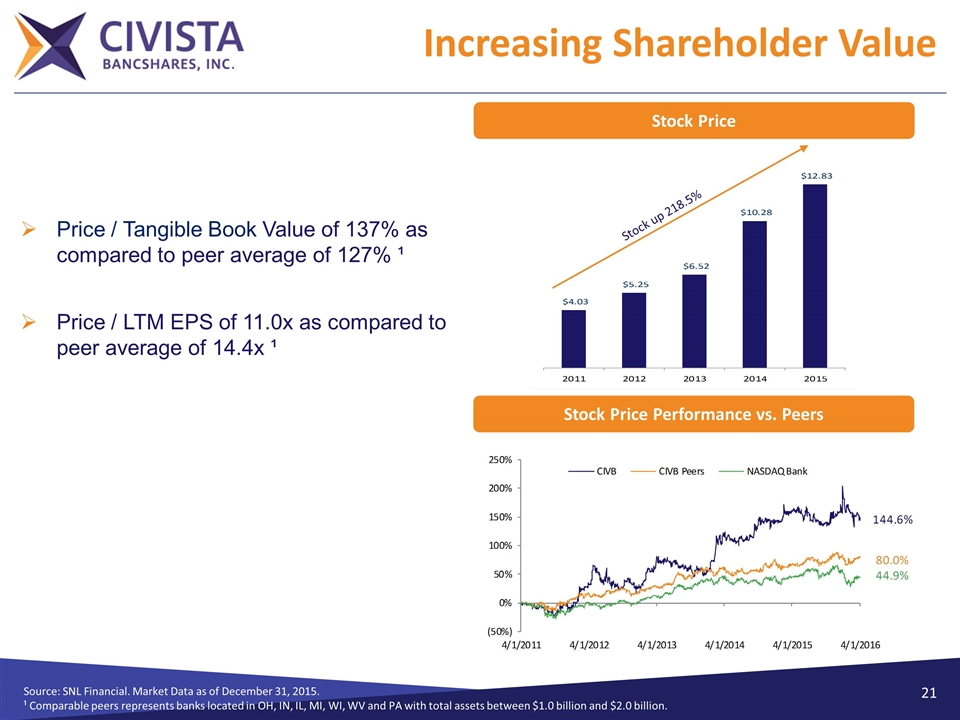

Increasing Shareholder Value Source: SNL Financial. Market Data as of December 31, 2015. ¹ Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion. Stock Price Price / Tangible Book Value of 137% as compared to peer average of 127% ¹ Price / LTM EPS of 11.0x as compared to peer average of 14.4x ¹ Stock up 218.5% Stock Price Performance vs. Peers

Commitment to Shareholders Long-term Shareholder Value through Growth and Profitability

Strategic Focus & Growth Strategy Organic growth Capitalize on commercial and consumer lending opportunities Grow core deposit base in rural and targeted urban markets Identify and evaluate loan production opportunities in select metro markets Acquisition opportunities Rural Urban Asset quality Efficiency and operating leverage Capital

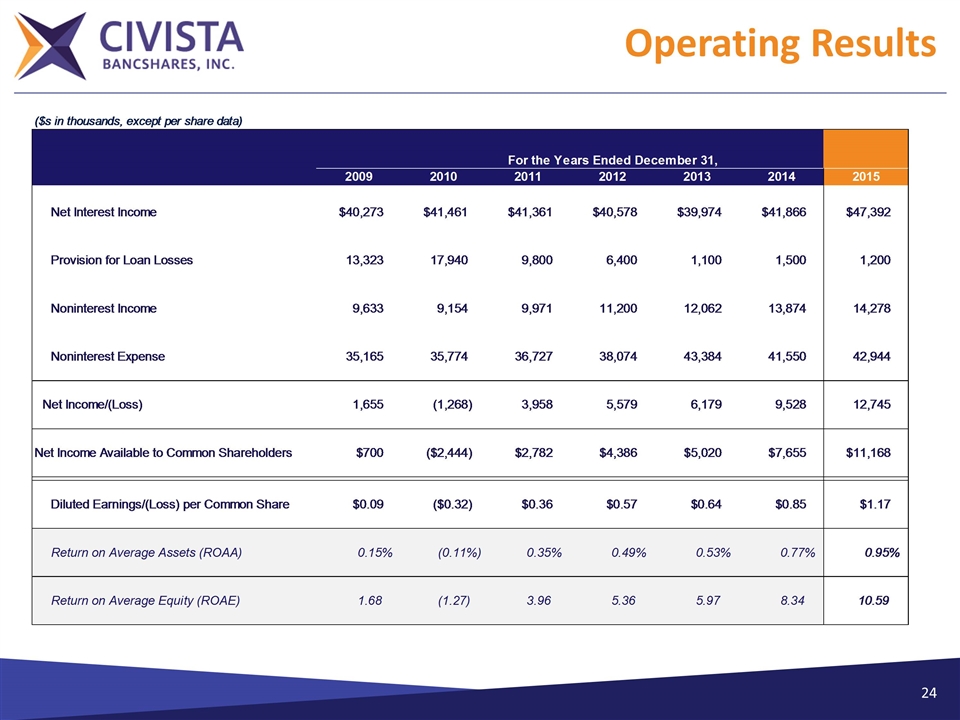

Operating Results

The Civista Story Strong and Seasoned Management Team Leading Ohio Community Banking Franchise Proven and Disciplined Acquirer Attractively Valued Versus Peers Platform to Support Future Growth

Thank You