Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - New Asia Holdings, Inc. | ex311.htm |

| EX-32.2 - EXHIBIT 32.2 - New Asia Holdings, Inc. | ex322.htm |

| EX-21.1 - EXHIBIT 21.1 - New Asia Holdings, Inc. | ex211.htm |

| EX-32.1 - EXHIBIT 32.1 - New Asia Holdings, Inc. | ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - New Asia Holdings, Inc. | ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2015

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to _____________

Commission File No. 000-55410

|

New Asia Holdings, Inc.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Nevada

|

45-0460095

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

33 Ubi Avenue 3 #07-58

Vertex Building Tower A, Singapore 408868

|

||

|

(Address of principal executive offices)

|

||

|

+65 6702 3808

|

||

|

(Registrant's telephone number, including area code)

|

||

|

(Former name or former address if changed since last report)

|

||

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer [ ]

|

Accelerated Filer [ ]

|

|

Non-Accelerated Filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. As of June 30, 2015, the aggregate market value was $3,941,426

The number of shares outstanding of each of the issuer's classes of common stock, as of March 29, 2016, is as follows:

|

Classes of Common Stock

|

Shares Outstanding

|

|

|

Common Stock, $0.001 par value

|

68,948,767

|

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

New Asia Holdings, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2015

TABLE OF CONTENTS

PART I

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

14

|

|

Item 1B.

|

Unresolved Staff Comments

|

29

|

|

Item 2.

|

Properties

|

29

|

|

Item 3.

|

Legal Proceedings

|

29

|

|

Item 4.

|

Mine Safety Disclosures

|

29

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

30

|

|

Item 6.

|

Selected Financial Data

|

32

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

32

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

36

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

36

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A.

|

Controls and Procedures

|

37

|

|

Item 9B.

|

Other Information

|

38

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

39

|

|

Item 11.

|

Executive Compensation

|

44

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

44

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

45

|

|

Item 14.

|

Principal Accounting Fees and Services

|

46

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

47

|

Special Note Regarding Forward Looking Statements

Certain statements contained in this annual filing, including, without limitation, statements containing the words "believes", "anticipates", "expects" and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: international, national and local general economic and market conditions: demographic changes; the ability of the Company to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Given these uncertainties, readers of this Form 10-K and investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

PART I

|

ITEM 1.

|

BUSINESS.

|

Overview

Since December 24, 2014, New Asia Holdings, Inc. (the "Company" or "NAHD") has been focusing on developing highly advanced, proprietary, neural trading models for the financial community.

It is our belief that our state-of-the-art, trainable, algorithms in our models will emulate aspects of the human brain, providing our algorithms with a self-training ability to formalize unclassified information and thus develop an enhanced ability to make forecasts based on the historical information and other data available at their disposal. Our neural networks will not make forecasts. Instead, they will analyze price data and uncover opportunities. Using our proprietary neural network, trade decisions will be made based on thoroughly analyzed data (which is not generally possible when using traditional technical analysis methods). We anticipate offering a series of "next-generation" tools that can detect subtle non-linear interdependencies and patterns that other methods of technical analysis are unable to uncover.

We will offer trading software solutions to clients on the basis of a "Software as a Service (SaaS)" licensing and delivery models with licensed users availing themselves of service-based contractual arrangements. In addition, we will utilize our in-house proprietary neural trading models to trade our own funds, thus providing added value to our shareholders.

Our proprietary trading models will be developed by a team of professional engineers in communications, electronic circuitry design and financial engineering. This diverse team will be the key factor of our successful development of non-traditional and innovative trading models. Our systems will be designed to take intelligent positions as the market moves/changes and, upon development, our systems will bring a proven, rigorously tested, track-record. We anticipate that our proprietary algorithmic trading systems will generate superior, risk adjustable, returns for our clients.

The Company's products are a set of assets comprised of three Proprietary Trainable Trading Algorithms:

|

·

|

Series X Pound/Dollar (MQ X1)

|

|

·

|

Series Y Pound/Dollar (MQ Y1)

|

|

·

|

Series Z Multi-asset Currency and Gold (MQ Z1)

|

Technical Description of Algorithm Trading

The programming associated with the MQ X1 and the MQ Y1 are driven by mean reversion whereas the programming of the MQ Z1 is driven by momentum and trend following. All of the algorithms incorporate currency flows and are designed to reduce positions when trends become adverse. We consider that these algorithms are very easy to deploy and operate via the "Software as a Service" model. The combination of this business model and the composition of the algorithms render the trading of currencies and gold nearly effortless: no traders are needed, thereby eliminating the compensation related expenses. In addition to the returns and safety characteristics associated with the subject algorithms, these algorithms are favorable to account holders ("Holders") in that they neither lend themselves to high frequency trading nor to high commissions.

The three primary competitive advantages associated with our proprietary trading algorithms are:

|

●

|

rates of return,

|

|

●

|

efficiency and

|

|

●

|

safety.

|

3

The Company believes that its "Algo's" are the only ones in the market that can be "tuned" to minimize risks, such as variations in the "stop loss" (risk tolerances) per trade between 1% (least risk) to 3% (more moderate risk). The results of over 5 years of development, back-end testing and actual trading operations have demonstrated; winning percentages in the range of 60% to 80% and annual returns of over 60%. Thus our trainable, trading Algo's will achieve much higher returns with a minimum risk on capital.

Algorithm Trading Explained

Algorithmic trading (Algorithmic Trading) has been growing rapidly across all types of financial instruments, accounting for over 84% of U.S. equity volumes in 2014 (Reuters and Bloomberg). A number of closely related computational trading terms that are often used interchangeably has to be clarified in order to fully understand Algorithmic Trading.

Algorithmic Trading relies on sophisticated computer programs and models to make automated decisions regarding the market, without human input. Such models are especially popular in strategies such as managed futures, where trend following is prevalent.

Types of Algorithmic Trading

|

·

|

Systematic trading

|

It refers to any trading strategy that is a "rule-based" systematic/repetitive approach to execution trading behaviors. This is often achieved through utilization of an expert system that replicates previously captured actions of real traders.

|

·

|

High-frequency trading (HFT)

|

HFT is a more specific area, where the execution of computerized trading strategies is characterized by extremely short position-holding periods in excess of a few seconds or milliseconds.

|

·

|

Ultra high-frequency trading

|

Sometimes also known as low-latency trading refers to HFT execution of trades in sub-millisecond times through co-location of servers and stripped down strategies, direct market access, or individual data feeds offered by Exchanges and others to minimize network and other types of latencies.

Algorithmic Trading Strategies

The following are common trading strategies used in Algorithmic Trading:

| · | Trend Following Strategies: |

The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements and related technical indicators. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making any predictions or price forecasts. Trades are initiated based on the occurrence of desirable trends, which are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis.

4

| · | Arbitrage Opportunities: |

Buying a dual listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. The same operation can be replicated for stocks versus futures instruments, as price differentials do exists from time to time. Implementing an algorithm to identify such price differentials and placing the orders allows profitable opportunities in efficient manner.

| · | Index Fund Rebalancing: |

Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. This creates profitable opportunities for algorithmic traders, who capitalize on expected trades that offer 20-80 basis points profits depending upon the number of stocks in the index fund, just prior to index fund rebalancing. Such trades are initiated via algorithmic trading systems for timely execution and best prices.

| · | Mathematical Model Based Strategies: |

A lot of proven mathematical models, which allow trading on combination of options and its underlying security, where trades are placed to offset positive and negative deltas so that the portfolio delta is maintained at zero.

| · | Trading Range (Mean Reversion): |

Mean reversion strategy is based on the idea that the high and low prices of an asset are a temporary phenomenon that revert to their mean value periodically. Identifying and defining a price range and implementing algorithm based on that allows trades to be placed automatically when price of asset breaks in and out of its defined range.

| · | Volume Weighted Average Price (VWAP): |

Volume weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using stock specific historical volume profiles. The aim is to execute the order close to the Volume Weighted Average Price (VWAP), thereby benefiting on average price.

| · | Time Weighted Average Price (TWAP): |

Time weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. The aim is to execute the order close to the average price between the start and end times, thereby minimizing market impact.

| · | Percentage of Volume (POV): |

Until the trade order is fully filled, this algorithm continues sending partial orders, according to the defined participation ratio and according to the volume traded in the markets. The related "steps strategy" sends orders at a user-defined percentage of market volumes and increases or decreases this participation rate when the stock price reaches user-defined levels.

| · | Implementation Shortfall: |

The implementation shortfall strategy aims at minimizing the execution cost of an order by trading off the real-time market, thereby saving on the cost of the order and benefiting from the opportunity cost of delayed execution. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely.

| · | Beyond the Usual Trading Algorithms: |

There are a few special classes of algorithms that attempt to identify "happenings" on the other side. These "sniffing algorithms," used, for example, by a sell side market maker have the in-built intelligence to identify the existence of any algorithms on the buy side of a large order. Such detection through algorithms will help the market maker identify large order opportunities and enable him to benefit by filling the orders at a higher price. This is sometimes identified as high-tech front-running.

5

NAHD's Design Philosophy

Price is simply a reflection and emotional perception of the respective commodity of value. Mechanical systems have no emotions when it comes to the interpretation of prices. Nothing is actually too high or too low; Its all technically relative.

NAHD uses a multitude of modern tools and technology to making trading simpler, adaptive and intelligent:

Some of the tools we apply include:

|

·

|

Principle Component Analysis (PCA)

|

|

·

|

Neural Networks

|

|

·

|

Removing Linear Trends From Data

|

|

·

|

Detecting Anomaly Activities

|

|

·

|

Market Behavioral Pattern Neural Analysis

|

|

·

|

Co-relational Modeling

|

|

·

|

Multi-Time Frame Signal Analysis

|

Principal Components Analysis (PCA) is a tool in exploratory data analysis to discover the important variables (or a combination of them) that explain the cause of variance in the data and thus enhances the efficiency when there is a large volume of data to be analyzed.

Factor analysis is a statistical method used to describe variability among observed, correlated variables in terms of a potentially lower number of unobserved variables called factors. Factor analysis searches for such joint variations in response to unobserved latent variables. The observed variables are modeled as linear combinations of the potential factors, plus "error" terms. The information gained about the interdependencies between observed variables can be used later to reduce the set of variables in a dataset and thus helps us to reduce complex multi-dimensional modeling data into 2 dimensional outcome for easier analysis.

Factor analysis is related to principal component analysis (PCA), but the two are not identical. Latent variable models, including factor analysis, use regression modeling techniques to test hypotheses producing error terms, while PCA is a descriptive statistical technique.

The artificial neural networks are one of the areas in artificial intelligence research that is based on the attempts to simulate the human nervous system in its ability to learn and adapt. It strives to allow us to build a rough simulation of the human brain in operation. When it comes to trading, it is generally a matter to buy, sell, hold and position sizing. In other words, Algorithm Trading Strategies (ATS) significantly simplify decision making than would otherwise be possible if human beings were doing the trading.

The Company's strived to develop systems which are adaptive and where no two trades are the same. The reason being very simple; the market is changing all the time (every hour, minute and second). Thus, it is imperative to achieve an acceptable level of machine learning adaptability within the confines of the boundaries of trading. This enables our clients to stay in the highly challenging game of trading under most, if not all, market conditions.

The NAHD Strategies refer to the precise nature of the entire spectrum of activities employed by a software system starting from pre-trade analysis, model selection, signal generation, trade execution, and post-trade handling.

|

·

|

Momentum

|

A trend following trading strategy that aims to capitalize on the continuance of existing trends in the market. The algorithm assumes large increases in the price of a security will be followed by additional gains and vice versa for declining values.

6

|

·

|

Mean Reversion

|

A trading strategy assuming prices and returns eventually move back toward the mean or average. A popular strategy is mean reversion (pairs trading) where two historically correlated securities that have diverged are assumed to converge in the future. Statistical Arbitrage ("stat arb") is an equity trading strategy that employs time series methods to identify relative mispricing between stocks. It bets on the convergence of the prices of similar financial instruments whose prices have diverged.

Company Business Model

The Company's focus is to capitalize the volatility of the 24 hours Forex markets to achieve capital appreciation over a medium to long term combined with the usage of a good wealth vehicle in order to control risk, profit from both bull or bear markets, maximize liquidity and economic resilience (recession proof).

The NAHD systems have been designed to constantly adapt themselves and to take intelligent positions as the market moves/changes. The models are subjected to rigorous testing akin to the volatile trading environment of major financial events/crisis that happened in recent history. These models are also programmed to have the ability to learn and adapt new manners of trading; effectively translating the human behavioural of trading into a predictive science. The NAHD cutting edge quantitative strategies and proprietary algorithmic trading system are developed to generate superior risk adjustable returns for the Holders.

NAHD's foreign exchange trading algorithms consist of the following:

|

·

|

MQ X1 (Pound / Dollar)

|

|

·

|

MQ Y1 (Pound / Dollar)

|

|

·

|

MQ Z1 (Multi-Asset Currency and Gold)

|

The three primary competitive advantages associated with the aforementioned trading algorithms are rates of return, efficiency and safety.

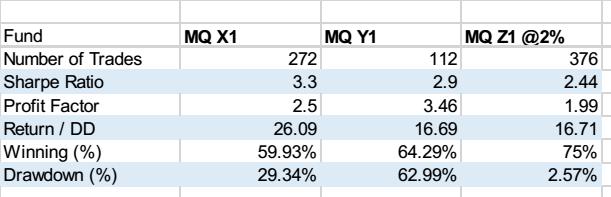

Below is a snapshot of the performance of the three subject Forex trading algorithms which have been tested since April of 2010.

The backend programming associated with the MQ X1 and the MQ Y1 are driven by mean reversion whereas the backend of the MQ Z1 is driven by momentum and trend following. All of the algorithms incorporate currency flows and are designed to reduce positions when trends become adverse.

These algorithms are designed to be very easy to deploy in that they are operated via the "Software as a Service" model. The combination of this business model and the composition of the algorithms render the trading of currencies and gold nearly effortless; no traders are needed, thereby eliminating the compensation related expenses. In addition to the returns and safety characteristics associated with the subject algorithms, these algorithms are favorable to account holders in that they neither lend themselves to high frequency trading nor to high commissions.

The Company's business model reflects two major activities:

7

|

1.

|

The Company has entered into a world-wide Exclusive License with New Asia Momentum Ltd (NAML). NAML, in turn, offers these proprietary, trainable, algorithm trading software solutions to broker-dealers, banks, funds and other clients on the basis of a "Software as a Service" (SaaS) licensing and delivery model, with sub-licensed users availing themselves of service-based contractual arrangements.

The exclusive licensing agreement calls for NAML to pay MQL royalty fees equal to 20% of the trading profits achieved by the SaaS contract agreements that NAML executes with its clients. NAHD's market strategy revolves around it's licensee(s) sub-licensing its algorithms to asset managers that each have between $1 million and $100 million in assets under management. The targeted geographic market is Asia, with an initial emphasis on Singapore, Hong Kong, Indonesia, and Australia.

|

|

2.

|

The Company will utilize its proprietary trainable trading algorithms to trade in its own funds through a wholly-owned subsidiary that will be established at an appropriate time.

|

The Company's strategy is based on the key features summarized below:

| · | A USD 6 trillion per day market that is categorized as the market closest to the ideal of perfect competition; a market that is unique because of the following characteristics: |

| o | It reflects a huge trading volume, representing the largest asset class in the world leading to high liquidity; |

| o | Its broad geographical dispersion; |

| o | Its continuous operation: 24 hours a day except weekends, i.e., trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT Friday (New York); |

| o | The low margins of relative profit compared with other markets of fixed income; and |

| o | The use of leverage to enhance profit and loss margins and with respect to account size. |

| · | Risk minimization since our "Algo's" are the only ones that can be "tuned" to minimize risks |

| · | Competitive advantage as a result of the team's local operating experience |

The Software as a Service (SaaS) Public Market Performance

Software as a service (SaaS) is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted. It is sometimes referred to as "on-demand software". SaaS is typically accessed by users using a thin client via a web browser. SaaS has become a common delivery model for many business applications, including financial services, office and messaging software, payroll processing software, DBMS software, management software, CAD software, development software, gamification, virtualization, accounting, collaboration, customer relationship management (CRM), management information systems (MIS), enterprise resource planning (ERP), invoicing, human resource management (HRM), talent acquisition, content management (CM), antivirus software, and service desk management. SaaS has been incorporated into the strategy of all leading enterprise software companies.

According to a Gartner Group estimate, SaaS revenue will be more than USD 20 billion in 2015. The Martin Wolfe IT Index showed that companies in the SaaS category were experiencing accelerated growth that led to a 163% premium in revenue valuation multiple based on 12 months trailing revenue, compared to traditional software companies.

The Martin Wolfe Report expected that this accelerated growth in the SaaS category would continue for the foreseeable future. For example, it expected that SaaS companies generally would continue outpacing traditional software in growth and valuation multiples.

8

The SEG Software Index Public Market Multiples:

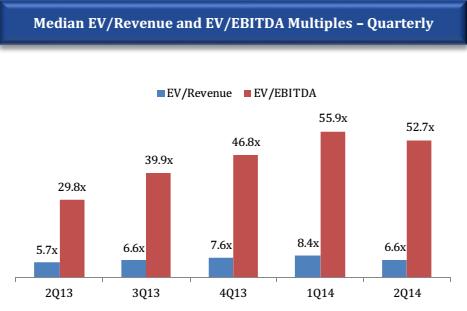

At the close of the second quarter of 2014 (2Q14), according to the SEG Software Index, the median enterprise value (EV)/Revenue multiple for public SaaS companies was 6.6x, up 16% year over year. Over 34% of the companies in the SEG SaaS Index achieved a median EV/Revenue multiple of 8x or higher in 2Q14, and public SaaS companies continued to trade at a significant premium to their on-premise peers (6.6x vs. 3.0x median EV/Revenue).

Public SaaS companies have historically enjoyed trading multiples at least twice that of their on-premise peers. According to the SEG report, a premium market valuation multiple can be largely justified by comparing the relative lifetime value of a SaaS customer vs. an on-premise licensee. A SaaS company with a mission critical hosted app and strong customer retention will garner significantly greater cash over time from its average customer than will its on-premise counterpart. In the meantime, according to the SEG Software Industry report, investors are placing their bets on the next wave of SaaS category leaders that are positioned to displace incumbent on-premise providers across multiple product categories.

9

Company (NAHD) and Business Structure

10

The Company (NAHD) is partnered with world-class firms:

| · | GAIN Capital was founded in 1999 with a mission to provide traders with low cost access to foreign exchange markets. Since then, GAIN Capital has expanded its product offering and global reach, and now provides a diverse mix of both retail and institutional investors access to thousands of OTC and exchange-traded markets. |

| · |

Straits Financial Group ("SF Group") is headquartered in Singapore and they are the brokering division of the CWT Group, the largest publicly listed logistics company in South East Asia. Their US subsidiary, Straits Financial LLC, is a full Clearing Member of the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). Through their Asian branches and global partnerships, they are focused on delivering a wide range of financial services and ensuring that Holders will have a positive and consistent customer experience.

In particular, Straits (Singapore), a subsidiary of the SF Group, by capitalizing on SF Group's strengths and global network, Straits (Singapore) is able to offer a comprehensive and integrated spectrum of trade services including brokerage, risk management, commodities collateralization, warehousing and logistics. Straits (Singapore) is also an approved Inter-Dealer Broker (IDB) with SGX Asia clear, they provide intermediary services to empower transactions between buy and sell sides for both OTC and exchange-cleared products. They provide both standardized and bilateral agreements, with a strong focus on OTC Rubber and Iron Ore Swaps.

|

| · | CWT is a leading provider of integrated logistics and supply chain solutions. They serve the spectrum from small establishments to multinational corporations across multiple markets and geographies. Leveraging their strength and scale in logistics competencies, infrastructure and global network, they deliver business solutions that help customers succeed and communities thrive. CWT has built a diversified portfolio around its core logistics capabilities. They also provide commodity marketing for base metals and energy products. In addition, they are engaged in engineering services for buildings, facilities and equipment fleet; property management; brokering services for exchange listed products; and asset and trust management for Cache Logistics Trust, a logistics property REIT. CWT is committed to sustainable development and acts as a socially and ethically responsible corporate citizen. CWT is traded on the Singapore Exchange since 1993. CWT employs around 6,000 people and reported revenue of S$9.1 billion in 2013. CWT is a Singapore corporation established in 1970. |

Corporate History

We were incorporated on March 1, 2001 under the laws of the state of Nevada under the name Effective Sports Nutrition Corporation. At formation, the Company was authorized to issue 25,000,000 shares of $.001 par value common stock, par value $0.001 per share.

On April 11, 2005, we changed our name from Effective Sports Nutrition Corporation to Midwest E.S.W.T. Corp. and increased the number of authorized shares of common stock, par value $0.001 per share, from 25,000,000 to 110,000,000.

On July 18, 2005, we entered into a share exchange agreement (the "Share Exchange Agreement") with Direct Success, Inc., a California corporation. As a result of the Share Exchange Agreement, we issued shares of common stock to the shareholders of Direct Success, Inc. in exchange ("Share Exchange") for all of the issued and outstanding common stock in Director Success, Inc. On December 14, 2005, we changed our name from Midwest E.S.W.T. Corp. to DM Products, Inc. As a result of the Share Exchange, Direct Success, Inc. became our wholly owned subsidiary. At the time of the Share Exchange, Direct Success, Inc. had an accumulated loss of $6,195,881.

On April 7, 2006, we increased the number of authorized shares of common stock, par value $0.001 per share, from 110,000,000 to 300,000,000 and we authorized 30,000,000 shares of preferred stock, par value $0.001 per share.

11

On December 6, 2011, we filed with the Secretary of State of the State of Nevada a Certificate of Amendment to our Articles of Incorporation. The Amendment: (i) changed the number of authorized shares of common stock, par value $0.001 per share, from 300,000,000 to 400,000,000, and (ii) granted the board of directors' authority to prescribe and issue 30,000,000 shares of Preferred Stock, par value $0.001 per share, in one or more series. In addition, on December 6, 2011, the Company filed with the Secretary of State of the State of Nevada a Certificate of Designation of Series A Preferred Stock, designating 5,000,000 of the Company's authorized preferred stock.

Prior to April 2013, we were in the business of locating inventive products and introducing these products through a Direct Response Model, a form of marketing that allows potential consumers direct access to the seller without the necessity of traditional retail. Our primary focus was on infomercials (long-form television commercials, typically five minute or longer). The Company operated the Direct Response Model through its wholly owned subsidiary Direct Success, Inc. until its dissolution on April 23, 2013. Within the five year period prior to April 2013, we had only marketed one product, a fishing lure product known as the Banjo Minnow Fishing Lure System ("Banjo Minnow"). Direct Success, Inc. owned 75% interest in a joint venture, known as Direct Success LLC #3, which held the exclusive rights to manufacture, use, distribute, sell, advertise, promote and otherwise exploit the Banjo Minnow until June 30, 2012. The exclusive rights to the Banjo Minnow were obtained through a Manufacturing, Marketing and Distribution Agreement entered into between Direct Success LLC #3 and Banjo Buddies, the inventor and owner of the intellectual property rights of the Banjo Minnow, in October, 2003. This Agreement, together with modifications made pursuant to an Arbitration settlement, required Direct Success, LLC#3 to pay Banjo Buddies a royalty in the amount 5% for the sale of all products through December 31, 2011, with DM Products maintaining an option to extend, and extended the licensing period for an additional six (6) months.

The Company dissolved both Direct Success, Inc. and Direct Success LLC #3 respectively on April 23, 2013 and April 5, 2013, since it no longer received income from the Banjo Minnow and was no longer participating in infomercial projects.

From April 2013 until December 2014, the Company had been considering changing its business model.

On May 29, 2013, a majority of shareholders and our board of directors approved an amendment to our Articles of Incorporation for the purpose of approving a reverse split of one to one hundred eighty eight in which each shareholder was issued one common share in exchange for every one hundred eighty eight common shares of their currently issued common stock.

On December 24, 2014, the board of directors authorized the Company to enter into a Stock Purchase Agreement (the "Agreement") with four accredited investors, pursuant to which the Company issued an aggregate of 58,904,964 shares of common stock, or approximately 97% of the issued and outstanding common stock of the Company, at an aggregate purchase price of $350,000 resulting in a change of control. The stock was issued as follows: 54,957,724 shares of common stock to New Asia Holdings Limited for $326,546, 1,821,803 shares of common stock to Wong Kai Fatt for $10,825, 1,518,169 shares of common stock to Earth Heat Ltd. for $9,021, and 607,268 shares of common stock to Kline Law Group PC for $3,608.

Effective as of December 24, 2014, Kurt L. Cockrum and James Clark resigned from all offices of the Company while Lin Kok Peng was appointed as a member of the Board of Directors of the Company and as the President, Chief Executive Officer, Chief Financial Officer and Secretary of the Company and Allister Lim Wee Sing was appointed as a member of the Board of Directors of the Company.

Since we went through a change of control on December 24, 2014, we have been focusing on developing highly advanced, proprietary, neural trading models for the financial community.

12

On January 21, 2015, Lin Kok Peng resigned from the position of Secretary of the Company while Scott C. Kline was appointed as the Secretary, replacing Lin Kok Peng, and as General Counsel of the Company. On January 23, 2015, we filed a Certificate of Amendment with the Secretary of State of the State of Nevada effecting a name change of the Company from DM Products, Inc. to New Asia Holdings, Inc. (the "Name Change"). The Company notified the Financial Industry Regulatory Authority ("FINRA") of the Name Change and a new trading symbol, "NAHD", was assigned effective February 13, 2015 as well as a new CUSIP number (64202A109) for the Company's common stock.

On August 19, 2015, the Board of Directors of the Company approved a resolution acknowledging that New Asia Holdings Ltd, the principal controlling shareholder of the Company, (i) had been advancing funds in the amount of $220,000 to the Company since December 24, 2014 to pay for operating expenses of the Company and (ii) would be required to advance an additional $80,000 to the Company to fund further operating expenses of the Company. The Board further resolved that these advances would constitute an interest-free loan to the Company to be repaid by the close of business on October 31, 2015. However, if the Company was unable to repay these advances by such date, New Asia Holdings Ltd, at its sole discretion, would have the option to extend the repayment deadline or convert all or a portion of the above advances into common stock of the Company at a conversion price of $0.02 per share. As of December 31, 2015, New Asia Holdings Ltd, had not yet acted to exercise its option to convert the Advances to shares of common stock, thus the Advances remained as an interest-free loan to the Company.

On August 28, 2015, the Company completed the acquisition of Magdallen Quant Pte Ltd., a Singapore-based company, which is focused on the research, development and deployment of advanced, proprietary, state-of-the-art, trainable trading algorithms. The acquisition was accomplished through a share exchange with Mr. Anthony Ng Zi Qin of 7,422,000 new restricted shares of common stock of the Company with a fair value of $3,043,020 in exchange for the entire issued and outstanding capital of Magdallen Quant Pte Ltd., held by Mr. Anthony Ng Zi Qin, consisting of 8,000,100 shares issued at par value of SGD$1.00 per share, or USD$0.714 on the acquisition date and additional contingent consideration of $4,099,837.

On September 7, 2015, Mr. Scott C. Kline ("Mr. Kline") resigned as Secretary and General Counsel of the Company. The resignation was not as a result of any disagreement with the Company on any matter relating to the Company's operations, policies or practices. On that date, Mr. Jose A. Capote ("Mr. Capote") was appointed to serve as the Company's Secretary and remained as well in his existing position as the Company's Chief Technical Officer. There is no family relationship between Mr. Capote and any of the Company's directors or officers. Mr. Capote is currently a shareholder of the Company through his 50% ownership of Earth Heat Ltd.

Employees

The Company currently has no employees. Management of the Company expects to use consultants, attorneys and accountants as necessary, and expects to hire full-time staff as the SaaS and Forex trading business expands. The need for employees and their availability will be addressed in connection with the expansion of the Company's core business.

Smaller Reporting Company Status

We qualify as a "smaller reporting company" under Rule 12b-2 of the Exchange Act, which is defined as a company with a public equity float of less than $75 million. To the extent that we remain a smaller reporting company at such time as are no longer an emerging growth company, we will still have reduced disclosure requirements for our public filings, some of which are similar to those of an emerging growth company, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements.

13

|

ITEM 1A.

|

RISK FACTORS.

|

Certain factors may have a material adverse effect on our business, financial condition and results of operations. Investors should carefully consider the risks and uncertainties described below, together with all of the other information contained in this Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, including our historical and financial statements and related notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business. If any of the following risks or uncertainties actually occurs, our business, financial condition, results of operations, liquidity, cash flows and prospects could be materially and adversely affected. As a result, the price of our common stock could decline significantly and an investor could lose all or part of its investment in our common stock. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risk Related to Our Business and Our Industry

General Risks

The use of the Company's software ("Software") will be subjected to different degrees of economic, political, foreign exchange, interest rates, liquidity, repatriation, volatility default and regulatory risks, depending on each relevant models. NAHD's proprietary trainable trading algorithm software signals generated are based on factual inputs and information from the market and are not deemed as financial advices. Past results are not necessarily indicative of future results. Notwithstanding the use of our Proprietary Trainable Trading Algorithms ("Series of Algorithms"), the value of investments may fall as well as rise and a holder may not recoup its capital. There can be no assurance that the performance of a Series of Algorithms will be profitable. On establishment, a Series of Algorithms will normally have no operating history upon which Holders may base an evaluation of performance.

Change in Strategies

The strategies, approaches and techniques discussed herein may evolve over time due to, amongst other things, market developments and trends, the emergence of new or enhanced products, changing industry practice and/or technological innovation. As a result, these strategies, approaches and techniques may not reflect the strategies, approaches and techniques actually employed by NAHD or or its Software. Nevertheless, the strategies employed in the Software will be consistent with the NAHD's objective.

Fundamental Strategies

Fundamental analysis, which posits that markets are imperfect and that mis-pricings can be identified between prevailing market prices and those indicated by underlying fundamental data, is subject to the risk of inaccurate or incomplete market information, as well as the difficulty of predicting prices based on such information. Furthermore, even if an analyst is able to successfully identify mis-pricings on the basis of fundamental factors, there is the additional uncertainty of predicting the duration or degree of such mis-pricings and, accordingly, when or whether to enter so as to profit from them. Positions made based on fundamental analysis are subject to significant losses when market sentiment leads to the market price of the Software being materially discounted from the level indicated by Software fundamental analysis or technical factors, such as price momentum or option expirations, dominate the market.

14

Model and Data risk

NAHD relies heavily on quantitative models ("Models") and information and data ("Data"). Models and Data are used to construct sets of transactions, to evaluate potential opportunities, to provide risk management insights and to assist in hedging the Software's trades. Models and Data are known to have errors, omissions, imperfections and malfunctions (collectively, "System Events"). System Events in third-party Models are generally entirely outside of the control of NAHD.

NAHD seeks to reduce the incidence and impact of System Events through a certain degree of internal testing and real-time monitoring, and the use of independent safeguards in the overall portfolio management system and often, with respect to proprietary models, in the software code itself. Despite such testing, monitoring and independent safeguards, System Events will result in, among other things, the execution of unanticipated trades, the failure to execute anticipated trades, delays in the execution of anticipated trades, the failure to properly allocate trades, the failure to properly gather and organize available data, the failure to take certain hedging or risk reducing actions and/or the taking of actions which increase certain risk(s)—all of which may have materially negative effects on the Software and/or its returns.

The strategies of the Software are highly reliant on the gathering, cleaning, culling and analysis of large amounts of Data. Accordingly, Models rely heavily on appropriate Data inputs. However, it is not possible or practicable to factor all relevant, available Data into forecasts and/or trading decisions of the Models. NAHD uses its discretion to determine what Data to gather with respect to each Strategy and what subset of that Data the Models take into account to produce forecasts which may have an impact on ultimate trading decisions. In addition, due to the automated nature of Data gathering, the volume and depth of Data available, the complexity and often manual nature of Data cleaning, and the fact that the substantial majority of Data comes from third-party sources, it is inevitable that not all desired and/or relevant Data will be available to, or processed by, NAHD (the "Manager") at all times. If incorrect Data is fed into even a well-founded Model, it may lead to a System Event subjecting the Software to loss. Further, even if Data is input correctly, "model prices" anticipated by the Data through the Models may differ substantially from market prices.

Where incorrect or incomplete Data is available, NAHD may, and often will, continue to generate forecasts and make trading decisions based on the Data available to it. Additionally, it may determine that certain available Data, while potentially useful in generating forecasts and/or making trade decisions, is not cost effective to gather due to either the technology costs or third-party vendor costs and, in such cases, the Manager will not utilize such Data. There is no guarantee that any specific Data or type of Data will be utilized in generating forecasts or making trading decisions with respect to the Models, nor is there any guarantee that the Data actually utilized in generating forecasts or making trading decisions underlying the Models will be the most accurate data available. It is assumed that the Data set used in connection with the Models is limited and should understand that the foregoing risks associated with gathering, cleaning, culling and analysis of large amounts of Data are an inherent part of the development with a process-driven, systematic adviser such as the Manager.

When Models and Data prove to be incorrect, misleading or incomplete, any decisions made in reliance thereon expose the Software to potential losses. For example, by relying on Models and Data, the system may be induced to trade at positions that are too high, to sell at positions that are too low, or to miss favorable opportunities altogether. In addition, Models may incorrectly forecast future behavior, leading to potential losses and/or a mark-to-market basis. Furthermore, in unforeseen or certain low-probability scenarios (often involving a market disruption of some kind), Models may produce unexpected results which may or may not be System Events.

15

Errors in Models and Data are often extremely difficult to detect, and, in the case of proprietary models and third-party models, the difficulty of detecting System Events may be exacerbated by the lack of design documents or specifications. Regardless of how difficult their detection appears in retrospect, some System Events will go undetected for long periods of time and some may never be detected. The degradation or impact caused by these System Events can compound over time. Finally, NAHD will detect certain System Events that it chooses, in its sole discretion, not to address or fix, and the third party software will lead to System Events known to the Manager that it chooses, in its sole discretion, not to address or fix.

The Company believes that the testing and monitoring performed on its models and third party models will enable it to identify and address those System Events that a prudent person managing a process-driven, systematic and computerized software program would identify and address by correcting the underlying issue(s) giving rise to the System Events or limiting the use of proprietary and third party models, generally or in a particular application. Holders should assume that System Events and their ensuing risks and impact are an inherent part of development with a process-driven, systematic investment manager such as NAHD, as the Manager. Accordingly, NAHD does not expect to disclose discovered System Events to the Software or to Holders.

The Software will bear the risks associated with the reliance on Models and Data including that the Software will bear all losses related to System Events other than in relation to losses arising from the Manager's willful default, fraud or gross negligence.

Involuntary disclosure risk

The ability of the system to achieve its goals for the Software is dependent in large part on its ability to develop and protect its models and proprietary research. The models and proprietary research and the Models and Data are largely protected by NAHD through the use of policies, procedures, agreements, and similar measures designed to create and enforce robust confidentiality, non-disclosure, and similar safeguards. However, aggressive position-level public disclosure obligations (or disclosure obligations to exchanges or regulators with insufficient privacy safeguards) could lead to opportunities for competitors to reverse-engineer the Manager's models, and thereby impair the relative or absolute performance of the Software.

Specific Risks

Liquidity Risk

Liquidity represents the volume of Forex transactions that can be executed for a certain currency pair at a certain time. The liquidity depends on the number of Forex market participants and the size of the market participants' offers. The major currencies which are the most traded usually offer a better liquidity than any other currencies. The liquidity is subject to sharp fluctuations depending on the currency, the economic or political events and news such as financial crisis, or to any other events which are beyond the control of NAHD.

A market with low liquidity would increase the risk associated with Forex trading significantly. In a case of low liquidity, the Holder may not be able to buy or sell orders or may need to liquidate all or parts of its positions at high losses.

Volatility Risk

As Forex market is subject to high degree of volatility, the currency prices would also be subjected to extensive fluctuations in response to numerous factors which are often beyond the control of NAHD. The market can move acutely in favor or against the Holder's positions. A drop in market liquidity, any unanticipated changes in economic or political conditions, a financial crisis or any other event can (though it may not) accelerate the market conditions in which currency price could move sharply and unexpectedly higher or lower in a volatile pattern.

16

Market and Price Risks

The Software's strategy is subject to some dimension of market risk: directional price movements, deviations from historical pricing relationships, changes in the regulatory environment, changes in market volatility, "flights to quality", "credit squeezes", etc. The NAHD style of alternative trading may be no less speculative than traditional strategies. On the contrary, due in part to the degree of leverage embedded in software in which the Software may invest, the Software may from time to time incur sudden and dramatic losses.

The particular or general types of market conditions in which the Software may incur losses or experience unexpected performance volatility cannot be predicted, and the Software may materially under-perform. The Holder's position on various transactions may be liquidated at a loss where the Holder will then be liable for any resulting deficit. Under certain circumstances, it may be difficult to liquidate an existing position, assess the value, determine a fair price or assess its exposure to risk.

Foreign Exchange Risk

Transactions involving currencies would incur risks including, but not limited to, the potential for changing political and/or economic conditions that may substantially affect the price or liquidity of a currency. Foreign exchange speculation may also be susceptible to sharp rises and falls as the relevant market values fluctuate.

Leverage Risk

The Software makes use of leverage on relatively small margin deposits. Trading on margin and leverage means that the Holder can buy and sell assets that represent more value than the capital in the Holder's account. A leverage of 50 times means the Holder can buy or sell up to USD $1,000,000 worth with only a capital of USD $20,000. High leverage or low margin can result in significant losses as a relatively small price movement may cause a proportionately larger impact on participating placements. The leveraged nature of the Software means that the Holder would increase his exposure risk the volatility of the market and a change in the market would result in greater change in the position taken by the Holder ("leverage effect"). Holders may get back less than placed and, in the case of higher risk strategies, Holders may lose the entirety of their placement.

Currency Risk

Currency trading presents unique risks. The interbank market consists of a direct dealing market, in which a participant trades directly with a participating bank or dealer, and a brokers' market. The brokers' market differs from the direct dealing market in that the banks or financial institutions serve as intermediaries rather than principals to the transaction. In the brokers' market, brokers may add a commission to the prices they communicate to their customers, or they may incorporate a fee into the quotation of price.

Arbitrage and Spread Trading Risks

Arbitrage and spread strategies attempt to take advantage of perceived price discrepancies of identical or similar financial instruments, on different markets or in different forms. To the extent the price relationships between such positions remain constant, no gain or loss on the positions will occur. If the requisite elements of an arbitrage strategy are not properly analyzed, or unexpected events or price movements intervene, losses can occur which can be magnified to the extent the Software is employing leverage. Arbitrage strategies often depend upon identifying favorable "spreads" which can also be identified, reduced or eliminated by other market participants. In periods of trendless, stagnant markets and/or deflation, many alternative strategies have materially diminished prospects for profitability.

17

Quantitative Trading

Quantitative trading strategies are highly complex, and, for their successful application, require relatively sophisticated mathematical calculations and relatively complex computer programs. These trading strategies are dependent upon various computer and telecommunications technologies and upon adequate liquidity in the markets traded. The successful execution of these strategies could be severely compromised by, among other things, a diminution in the liquidity of the markets traded, telecommunications failures, power loss and software-related "system crashes." There are also periods when even an otherwise highly successful system incurs major losses due to external factors dominating the market, such as natural catastrophes and political interventions. Transaction costs incurred by quantitative trading strategies may be significant. In addition, the difference between the expected price of a trade and the price at which a trade is executed, or "slippage," may be significant and may result in losses.

Due to the nature of their trading, quantitative trading firms may suffer devastating losses in a very short period of time. For example, in August 2012 Knight Capital accidentally deployed test software code to a production environment, causing a major disruption in the stock prices of over 100 listed companies which in turn resulted in the collapse of Knight Capital's stock price. A similar trading software mistake by the Manager could result in material or even total losses to the Software and NAHD.

Reliance on Technology and Electronic Trading

NAHD relies heavily on computer hardware and software, online services and other computer-related or electronic technology and equipment to facilitate the Software's activities. Specifically, the Software may trade financial instruments through electronic trading or order routing systems, which differ from traditional open outcry pit trading and manual order routing methods. Such electronic trading exposes the Software to risks associated with system or component failure, which could render NAHD unable to enter new orders, execute existing orders or modify or cancel previously entered orders. System or component failure may also result in loss of orders or order priority. Should events beyond NAHD's control cause a disruption in the operation of any technology or equipment, the Software's program may be severely impaired, causing it to experience substantial losses or other adverse effects.

A disaster or a disruption in the infrastructure that supports NAHD's business, including a disruption involving electronic communications or other services used by it or third parties with whom it conducts business, or directly affecting one of its offices or facilities, may have a material adverse effect on its ability to continue to operate the business without interruption. Although the Manager and its affiliates have back-up facilities for their information systems as well as technology and business continuity programs in place, there can be no assurance that these will be sufficient to mitigate the harm that may result from such a disaster or infrastructure disruption. In addition, insurance and other safeguards might only partially mitigate the effects of such a disaster or disruption.

Systems Security

Despite the implementation of operating controls for detecting unauthorized intrusion, security breach and security attack, NAHD will be unable to prevent all forms of unauthorized access to the systems it operates and the systems it uses which are provided by third-party service providers. NAHD will not be held liable for any trading or personal data leakage and any consequences, and will not reimburse the Software for any loss caused by the unauthorized intrusion to its systems which is out of the Manager's control.

Technical Analysis and Trading Systems

NAHD employs technical analysis and/or technical trading systems. Technical strategies rely on information intrinsic to the market itself to determine trades, such as prices, price patterns, momentum, volume and volatility. As discussed above, these strategies can incur major losses when factors exogenous to the markets themselves, including political events, natural catastrophes, acts of war or terrorism, dominate the markets.

18

Failure of Algorithms

NAHD will utilize sophisticated computerized models to automatically determine and execute trade entry and exit conditions and manage risk. NAHD makes efforts to test management and software releases to ensure that these algorithms operate correctly. However, it is possible that a defect in algorithm design or implementation or risk management could unexpectedly manifest and cause sustained long-term or virtually instantaneous catastrophic losses for the Software.

Possible Effects of Technical Trading Systems

There has been, in recent years, a substantial increase in interest in technical futures trading systems, similar to NAHD's systems. As the capital under the management of such trading systems based on the same general principles increases, an increasing number of traders may attempt to initiate or liquidate substantial positions at or about the same time as the Software, or otherwise alter historical trading patterns or affect the execution of trades, to the significant detriment of the Software.

Cybersecurity Risk

NAHD's hardware and software systems are subject to threats from hackers and others, such as a malicious attack, malware or other event that leads to unanticipated interruption or malfunction of such systems. Any interruption of NAHD's hardware or software functionality could lead to material or even complete losses to the Software. Hackers could also theoretically access and steal the Manager's research, models, trading programs or other software or data and implement such programs or software on their own behalf. This could lead to increased competition for, or elimination of, the opportunities sought by the Software or otherwise render the models developed by NAHD obsolete, possibly resulting in material or complete losses to the Software.

Failure of Connectivity

NAHD's models may trade frequently and may depend on low latency to be profitable. As a result, the success of the Manager's models depends on network connectivity. Any disruption or failure of the Manager's network connectivity, or even a delay in transmission speed, could result in substantial or total losses to the Software.

Computer Hardware and Software

Many components of the Manager's critical computer hardware and software may have flaws, may not be redundant, may be leased rather than owned, or may be provided in whole or in part by another party. Should these components fail or be inaccessible, there is no certainty that the Manager will be able to recover promptly and the Software may suffer material or total losses as a result.

Risks of Ineffective Risk Management Systems

NAHD continuously reviews and refines its risk management techniques, strategies and assessment methods. However, such risk management techniques and strategies may not fully mitigate the risk exposure of the Software in all economic or market environments, or against all types of risk, including risks that the Manager might fail to identify or anticipate. Any failures in the Manager's risk management techniques and strategies to accurately quantify such risk exposure could limit its ability to manage risks in the Software or to seek adequate risk-adjusted returns.

19

Accidental, Erroneous and Fraudulent Trades; Slippage

The transactions the Software executes are intended to be based on the bid and ask prices presented to the traders of NAHD by each counterparty. It is anticipated that the prices may be displayed on a computer monitor and that contracts may be executed electronically. The Software has no assurance that the prices displayed will be accurate. Various flaws in communications systems, such as data entry errors and transmission errors, can result in corrupted or inaccurate data. Moreover, the Software has no assurance that a continuous display of electronic connectivity between the Software and its counterparties can be maintained. Communication failures such as electrical outages, computer failures and hard drive failures can result in an inability of the systems to initiate or complete a transaction. There can be no assurance that errors in communication would not lead to erroneously executed transactions or a failure to execute transactions that would have been intended to hedge the Software's positions. The performance of the Software can be affected by data transmissions that are delayed. This phenomenon is sometimes also called latency. The Software has no assurance that performance will not be adversely affected by latency. The Software's counterparties have not made any representation to the Software that any particular level of latency will be maintained, nor that the counterparty would not deliberately degrade latency. Execution of a contract at an erroneous price can therefore affect the performance of the Software.

Impacts of Recent Geopolitical Events

Volatility of the price of oil, current developments in Syria, Iraq, Afghanistan and the Middle East generally, the continued threat of terrorism, the ongoing military and other actions and heightened security measures in response to these threats, international and regional military tensions and instability in the credit and sub-prime markets may cause disruptions to commerce, reduced economic activity and continued volatility in markets throughout the world. Such systemic risks may have an adverse impact on some of the assets in the Software's portfolio in the event that such risks result in a decline in the securities markets and economic activity. NAHD cannot predict at this time the extent and timing of any decreased commercial and economic activity resulting from the above factors, or how any such decrease might affect the value of the Software. The aforementioned factors could also result in incidents or circumstances that would disrupt the normal operations of the Manager and the Partners, which could also have negative effects on the performance of the Software.

Disclosure of System Portfolio

The statements of the Software will not include a detailed listing of positions held by the Software. Such confidentiality is maintained to prevent third parties from using information concerning the Managers or the Software's positions to its detriment. Examples of ways in which such information could be used adversely to the Software include: (a) to "front run" the Software on sales, or additional purchases, of such positions; (b) to make it more difficult for the Software to protect its positions by withholding, or causing others to withhold, prospective trades; (c) to make it difficult to acquire or borrow securities; or (d) otherwise to interfere with the Software's objectives. For this reason, NAHD believes it is important to take extra precautions to maintain the confidentiality of the positions in the Software's portfolio. However, NAHD, in its sole discretion, may permit such disclosure on a selective basis to certain Holders, if it determines that there are sufficient confidentiality agreements and procedures in place.

Disaster Recovery

NAHD has only limited disaster recovery plans for our operations, and we rely on outside parties, including the Partners, for some key accounting and operational functions, that in turn may also have limited disaster recovery plans. There is no assurance that any of these disaster recovery plans will work, which could result in significant losses to the Software.

20

Risk Management and Compliance Control

Risk management is about the selection and sizing of exposures, to maximize returns for a given level of risk. The function of risk management in the system process is to determine whether it is more prudent to eliminate or limit the size of each kind of risk exposure and to provide the input into the portfolio construction model.

Reducing risk almost always comes with the cost of reducing return. Risk management activities is focused on reducing or eliminating exposure to unnecessary risks but also taking on risks that offer expected attractive payoffs. The Managers uses a risk model in order to controls and deals with the size of unnecessary risk exposures.

Each Series of Algorithms and its models is tested to be resilient during major financial events as it is back-tested for a minimum of 3 years. Risks from past major financial event/crisis are also applied to test the resilience of these Models. Back-testing is a specific type of historical testing that determines the performance of the Model if it had actually been employed during past periods and market conditions. While back-testing does not allow one to predict how a Model will perform under future conditions, its primary benefit lies in understanding the vulnerabilities of a Model through a simulated encounter with real-world conditions of the past. This enables the Managers to "learn from history" without actually having to make them with actual money.

The Forex markets can move fast, with gains turning into losses in a matter of minutes therefore making it critical for the NAHD Team to properly manage Holder's capital. NAHD makes use of the following methods to control the risk and protect Holders' profits.

Capping Losses

Risk must be predetermined. It is the best way to make sure one's losses are controlled and the most rational time to consider risk is during the design of the model. It is acceptable to sustain a drawdown of 10% if it was the result of five consecutive losing trades that were stopped out at 2% loss each. However, it is inexcusable to lose 10% on one trade.

High Probability Profit Targets

The NAHD Team ensures that the each Series of Algorithms has a winning percentage of above 50%. It means that there would be at least 50% worth of profit trades in total.

High Probability Set Up

The Manager ensures that the each Series of Algorithms has a set up percentage of above 70%. It means that there would be at least 70% probability of each Series of Algorithms achieving its objective.

Tight Money Management

Half of trading is about strategy, the other half is about money management. In order to manage the risk and profits, the Manager needs to ensure that a maximum of 2% of the capital is used per trade.

Other Risks

We will need additional capital to sustain our operations and will likely need to seek further financing to accelerate our growth, which we may not be able to obtain on acceptable terms or at all. If we are unable to raise additional capital, as needed, the future growth of our business and operations would be severely limited.

A factor limiting our growth, including our ability to enter our proposed markets, attract customers, and deliver our proprietary trading software to the financial community, is our limited capitalization overall and as compared to other companies in the industry.

21

We will need additional capital to bring our operations to a sustainable level over the next twelve months. In 2015, we raised approximately $317,000 from advances from our principal shareholder in connection with and after the change of control in February 2015. We believe that, in addition to the capital raised thus far, we will require up to an additional $350,000 to satisfy our operating cash needs for the next 12 months. However, if we are unable to generate the projected amount of revenue and profits from our operations within the next 12 months, we will need to seek additional financing.

We may also seek additional financing to accelerate our growth. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our common stock. If we raise additional capital by incurring debt, this will result in increased interest expense. There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business could suffer if we are unable to raise additional funds on acceptable terms, which would have the effect of limiting our ability to generate and increase our revenues, develop our products, attain profitable operations, or even may result in our business filing for bankruptcy protection or otherwise ending our operations which could result in a significant or complete loss of your investment.

We have incurred significant losses in prior periods, and losses in the future could cause the trading price of our stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due and on our cash flows.

We have incurred significant losses in prior periods. Our accumulated deficit at December 31, 2015 was $11,337,785. We incurred a net loss in 2015 and 2014 of $2,552,337 and $59,964, respectively. If we are not able to attain profitability in the near future and long-term future, the trading price of our stock could decline and our financial condition could deteriorate as we could, among other things, deplete our cash, incur additional indebtedness and issue additional equity that could cause significant dilution, all of which could have a material adverse impact on our business and prospects and result in a significant or complete loss of your investment.

We have unsecured loans that are overdue, and we will likely need to raise capital to repay the loan or will need to convert the loan to our common stock at the discretion of our principal shareholder.

During 2015, we received interest free loans from New Asia Holdings Ltd, our principal shareholder, in the aggregate principal amount of $316,533 to pay for operating expenses and investments of the Company that were due to be repaid on October 31, 2015. However, if the Company was unable to repay these loans by such date, New Asia Holdings Ltd, at its sole discretion, would have the option to extend the repayment deadline or convert all or a portion of the above Advances into Common Stock at a conversion price of $0.02 per share. As of December 31, 2015, New Asia Holdings Ltd had not yet acted to exercise its option to convert the loans to shares of common stock, thus the loans presently remain as an interest-free loan to the Company. If we are unable to repay the loan or convert the loan, this would likely have a material adverse effect on our operations, our ability to raise capital and the price of our stock.

If New Asia Holdings Ltd coverts the loan and/or we raise additional funds through the issuance of equity or convertible debt securities to pay off the loan, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our common stock. If we raise additional capital by incurring debt, this will result in increased interest expense. There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business could suffer if we are unable to raise additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues, develop our products, attain profitable operations, or even may result in our business filing for bankruptcy protection or otherwise ending our operations which could result in a significant or complete loss of your investment.

22

We have a limited operating history, which may make it difficult for investors to predict future performance based on current operations.