Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d152541d8k.htm |

Exhibit 99.1

CALIFORNIA STRONG

2015 Annual Report

Partnership Schools Parent College Graduation

CGI America

WE ARE

CALIFORNIA’S BANK.

Community Development

Employee Team Building

Banc Basketball on Women Clinics

USC Trojan Kid’s Corner

Billboard Campaign

JVS BankWork$ Graduation

F I N A N C I A L H I G H L I G H T S

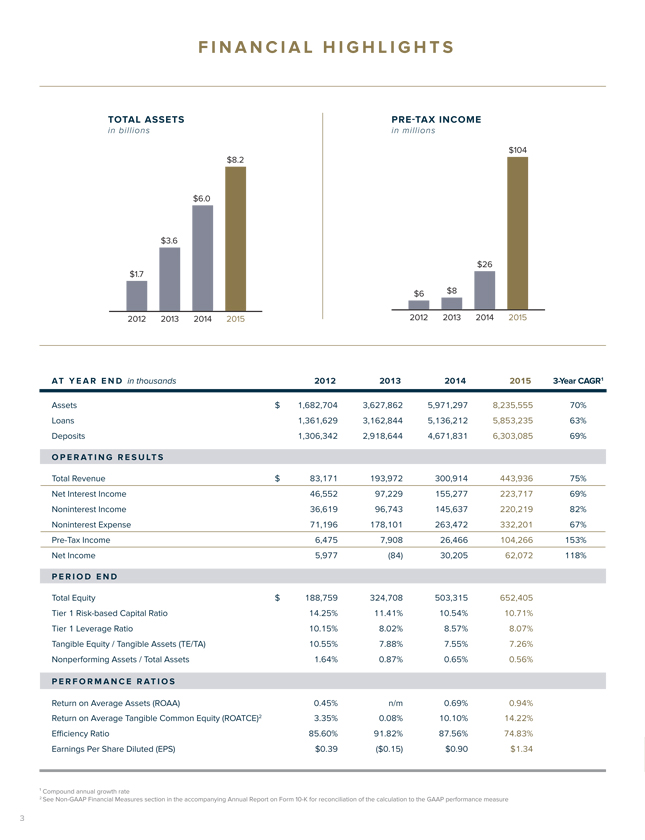

TOTAL ASSETS PRE-TAX INCOME in billions in millions

$104

$8.2

$6.0

$3.6

$26 $1.7

$6 $8

2012 2013 2014 2015 2012 2013 2014 2015

AT Y E A R E N D in thousands 2012 2013 2014 2015 3-Year CAGR1

Assets $ 1,682,704 3,627,862 5,971,297 8,235,555 70% Loans 1,361,629 3,162,844 5,136,212 5,853,235 63% Deposits 1,306,342 2,918,644 4,671,831 6,303,085 69%

OPERAT I N G R E S U LT S

Total Revenue $ 83,171 193,972 300,914 443,936 75% Net Interest Income 46,552 97,229 155,277 223,717 69% Noninterest Income 36,619 96,743 145,637 220,219 82% Noninterest Expense 71,196 178,101 263,472 332,201 67% Pre-Tax Income 6,475 7,908 26,466 104,266 153% Net Income 5,977 (84) 30,205 62,072 118%

P E R I O D E N D

Total Equity $ 188,759 324,708 503,315 652,405 Tier 1 Risk-based Capital Ratio 14.25% 11.41% 10.54% 10.71% Tier 1 Leverage Ratio 10.15% 8.02% 8.57% 8.07% Tangible Equity / Tangible Assets (TE/TA) 10.55% 7.88% 7.55% 7.26% Nonperforming Assets / Total Assets 1.64% 0.87% 0.65% 0.56%

P E R F O R M A N C E R AT I O S

Return on Average Assets (ROAA) 0.45% n/m 0.69% 0.94% Return on Average Tangible Common Equity (ROATCE)2 3.35% 0.08% 10.10% 14.22% Efficiency Ratio 85.60% 91.82% 87.56% 74.83% Earnings Per Share Diluted (EPS) $0.39 ($0.15) $0.90 $1.34

¹ Compound annual growth rate

2 See Non-GAAP Financial Measures section in the accompanying Annual Report on Form 10-K for reconciliation of the calculation to the GAAP performance measure

3

CALIFORNIA STRONG.

With over $8 billion in assets and over 100 banking and lending locations in California and across the West, we are large enough to meet your banking needs, yet small enough to serve you well. Banc of California’s core values of entrepreneurialism, operational excellence, and superior analytics form the foundation of our success.

In 2015, Banc of California was recognized as one of the Best Banks in America by Forbes Magazine1, the largest independent California bank with an Outstanding CRA Rating, and one of the country’s strongest, most secure banks as evidenced by our Investment Grade credit rating from Kroll Bond Rating Agency.

1,700+

Employees

BE S 2 $8.2+ Billion

R 0

O 1 Assets

F 6

BEST BANKS IN AMERICA 100+

B I A Locations

A

N R N

C O

OF CALIF

$7+ Billion

WE ARE Lending

CALIFORNIA’S BANK.

Empowering California’s Diverse Businesses, Entrepreneurs and Communities

We Believe in Empowering Dreams. We Believe in Strong Partnerships.

We Believe in California.

E N T R E P R E N E U R I A L I S M • O P E R AT I O N A L E X C E L L E N C E • S U P E R I O R A N A LY T I C S

1 As named by Forbes magazine on January 7, 2016. ©2016, Forbes Media LLC. Used with permission.

4

Steven Sugarman

Chairman, President and Dear Shareholders Chief Executive Officer

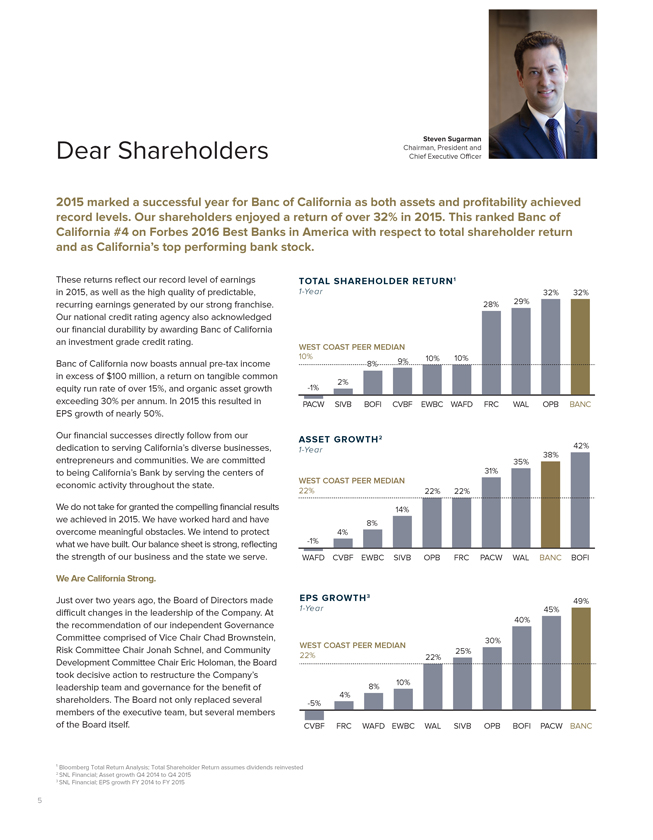

2015 marked a successful year for Banc of California as both assets and profitability achieved record levels. Our shareholders enjoyed a return of over 32% in 2015. This ranked Banc of California #4 on Forbes 2016 Best Banks in America with respect to total shareholder return and as California’s top performing bank stock.

These returns re?ect our record level of earnings TOTAL SHAREHOLDER RETURN1 in 2015, as well as the high quality of predictable, 1-Year 32% 32% recurring earnings generated by our strong franchise. 28% 29% Our national credit rating agency also acknowledged our ?nancial durability by awarding Banc of California an investment grade credit rating.

WEST COAST PEER MEDIAN

10% 10% 10%

Banc of California now boasts annual pre-tax income 8% 9% in excess of $100 million, a return on tangible common

2% equity run rate of over 15%, and organic asset growth -1% exceeding 30% per annum. In 2015 this resulted in PACW SIVB BOFI CVBF EWBC WAFD FRC WAL OPB BANC EPS growth of nearly 50%.

Our ?nancial successes directly follow from our ASSET GROWTH2 dedication to serving California’s diverse businesses, 42%

1-Year

38% entrepreneurs and communities. We are committed 35% to being California’s Bank by serving the centers of 31% economic activity throughout the state. WEST COAST PEER MEDIAN

22% 22% 22%

We do not take for granted the compelling ?nancial results 14% we achieved in 2015. We have worked hard and have 8% overcome meaningful obstacles. We intend to protect 4% what we have built. Our balance sheet is strong, re?ecting -1% the strength of our business and the state we serve. WAFD CVBF EWBC SIVB OPB FRC PACW WAL BANC BOFI

We Are California Strong.

Just over two years ago, the Board of Directors made EPS GROWTH3

1-Year 49% difficult changes in the leadership of the Company. At 45% 40% the recommendation of our independent Governance Committee comprised of Vice Chair Chad Brownstein, WEST COAST PEER MEDIAN 30% Risk Committee Chair Jonah Schnel, and Community 25% 22% 22%

Development Committee Chair Eric Holoman, the Board took decisive action to restructure the Company’s 10% leadership team and governance for the bene?t of 8% 4% shareholders. The Board not only replaced several -5% members of the executive team, but several members of the Board itself. CVBF FRC WAFD EWBC WAL SIVB OPB BOFI PACW BANC

¹ Bloomberg Total Return Analysis; Total Shareholder Return assumes dividends reinvested 2 SNL Financial; Asset growth Q4 2014 to Q4 2015 3 SNL Financial; EPS growth FY 2014 to FY 2015

5

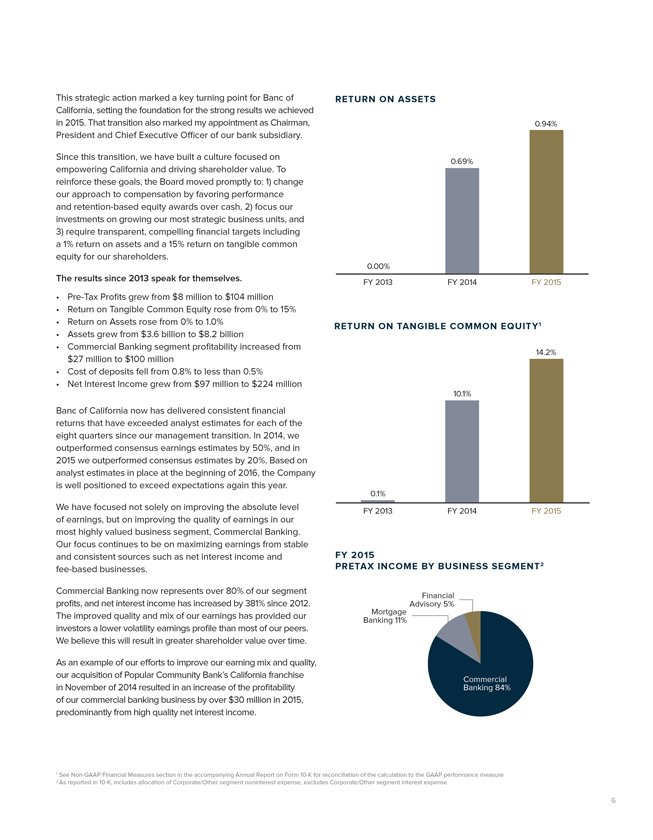

This strategic action marked a key turning point for Banc of RETURN ON ASSETS California, setting the foundation for the strong results we achieved in 2015. That transition also marked my appointment as Chairman, 0.94% President and Chief Executive Officer of our bank subsidiary.

Since this transition, we have built a culture focused on empowering California and driving shareholder value. To 0.69% reinforce these goals, the Board moved promptly to: 1) change our approach to compensation by favoring performance and retention-based equity awards over cash, 2) focus our investments on growing our most strategic business units, and 3) require transparent, compelling ?nancial targets including a 1% return on assets and a 15% return on tangible common equity for our shareholders.

0.00%

The results since 2013 speak for themselves.

FY 2013 FY 2014 FY 2015

Pre-Tax Profits grew from $8 million to $104 million

Return on Tangible Common Equity rose from 0% to 15%

Return on Assets rose from 0% to 1.0% 1

Assets grew from $3.6 billion to $8.2 billion RETURN ON TANGIBLE COMMON EQUITY

Commercial Banking segment pro?tability increased from

14.2% $27 million to $100 million

Cost of deposits fell from 0.8% to less than 0.5%

Net Interest Income grew from $97 million to $224 million

10.1%

Banc of California now has delivered consistent ?nancial returns that have exceeded analyst estimates for each of the eight quarters since our management transition. In 2014, we outperformed consensus earnings estimates by 50%, and in 2015 we outperformed consensus estimates by 20%. Based on analyst estimates in place at the beginning of 2016, the Company is well positioned to exceed expectations again this year.

0.1%

We have focused not solely on improving the absolute level of earnings, but on improving the quality of earnings in our FY 2013 FY 2014 FY 2015 most highly valued business segment, Commercial Banking.

Our focus continues to be on maximizing earnings from stable and consistent sources such as net interest income and FY 2015 fee-based businesses. PRETAX INCOME BY BUSINESS SEGMENT2

Commercial Banking now represents over 80% of our segment pro?ts, and net interest income has increased by 381% since 2012. Financial Advisory 5%

The improved quality and mix of our earnings has provided our Mortgage investors a lower volatility earnings pro?le than most of our peers. Banking 11% We believe this will result in greater shareholder value over time.

As an example of our efforts to improve our earning mix and quality, our acquisition of Popular Community Bank’s California franchise

Commercial in November of 2014 resulted in an increase of the pro?tability Banking 84% of our commercial banking business by over $30 million in 2015, predominantly from high quality net interest income.

1 See Non-GAAP Financial Measures section in the accompanying Annual Report on Form 10-K for reconciliation of the calculation to the GAAP performance measure 2 As reported in 10-K, includes allocation of Corporate/Other segment noninterest expense, excludes Corporate/Other segment interest expense

6

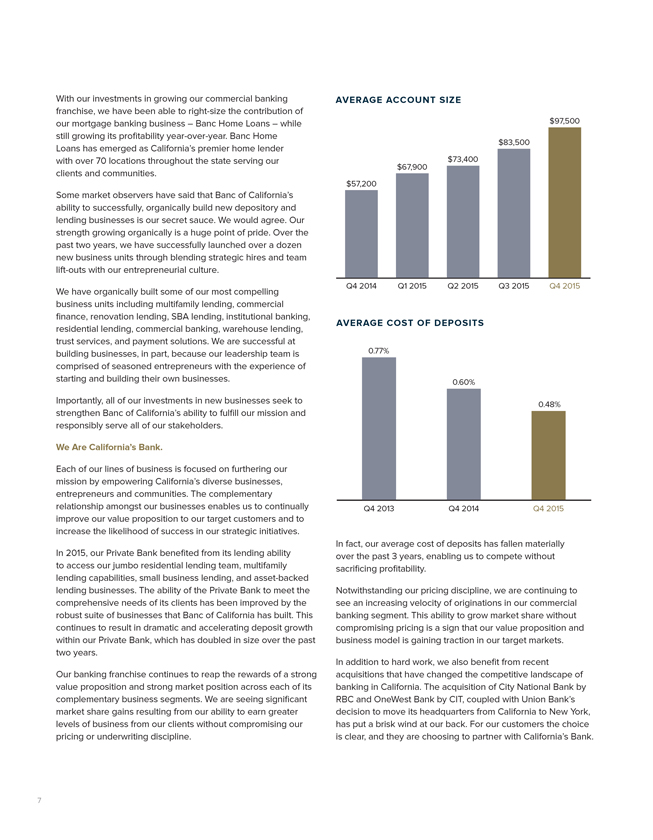

With our investments in growing our commercial banking AVERAGE ACCOUNT SIZE franchise, we have been able to right-size the contribution of our mortgage banking business – Banc Home Loans – while $97,500 still growing its pro?tability year-over-year. Banc Home $83,500 Loans has emerged as California’s premier home lender with over 70 locations throughout the state serving our $73,400 $67,900 clients and communities. $57,200

Some market observers have said that Banc of California’s ability to successfully, organically build new depository and lending businesses is our secret sauce. We would agree. Our strength growing organically is a huge point of pride. Over the past two years, we have successfully launched over a dozen new business units through blending strategic hires and team lift-outs with our entrepreneurial culture.

Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015

We have organically built some of our most compelling business units including multifamily lending, commercial ?nance, renovation lending, SBA lending, institutional banking,

AVERAGE COST OF DEPOSITS residential lending, commercial banking, warehouse lending, trust services, and payment solutions. We are successful at building businesses, in part, because our leadership team is 0.77% comprised of seasoned entrepreneurs with the experience of starting and building their own businesses. 0.60% Importantly, all of our investments in new businesses seek to strengthen Banc of California’s ability to fulfill our mission and 0.48% responsibly serve all of our stakeholders.

We Are California’s Bank.

Each of our lines of business is focused on furthering our mission by empowering California’s diverse businesses, entrepreneurs and communities. The complementary relationship amongst our businesses enables us to continually Q4 2013 Q4 2014 Q4 2015 improve our value proposition to our target customers and to increase the likelihood of success in our strategic initiatives.

In fact, our average cost of deposits has fallen materially In 2015, our Private Bank bene?ted from its lending ability over the past 3 years, enabling us to compete without to access our jumbo residential lending team, multifamily sacri?cing pro?tability. lending capabilities, small business lending, and asset-backed lending businesses. The ability of the Private Bank to meet the Notwithstanding our pricing discipline, we are continuing to comprehensive needs of its clients has been improved by the see an increasing velocity of originations in our commercial robust suite of businesses that Banc of California has built. This banking segment. This ability to grow market share without continues to result in dramatic and accelerating deposit growth compromising pricing is a sign that our value proposition and within our Private Bank, which has doubled in size over the past business model is gaining traction in our target markets. two years.

In addition to hard work, we also benefit from recent Our banking franchise continues to reap the rewards of a strong acquisitions that have changed the competitive landscape of value proposition and strong market position across each of its banking in California. The acquisition of City National Bank by complementary business segments. We are seeing significant RBC and OneWest Bank by CIT, coupled with Union Bank’s market share gains resulting from our ability to earn greater decision to move its headquarters from California to New York, levels of business from our clients without compromising our has put a brisk wind at our back. For our customers the choice pricing or underwriting discipline. is clear, and they are choosing to partner with California’s Bank.

7

COMMERCIAL BANKING SEGMENT 2016 Outlook

GROSS LOAN ORIGINATION Looking toward 2016, we expect to leverage the platform in millions $914 and infrastructure we have built over the past three years to accelerate the growth and pro?tability of the Company. We have the capital, people, and products to support our strategic $729 plan. We have provided guidance that we expect total assets to $629 end 2016 above $10 billion and earnings per share growth for $530 2016 to exceed our 15% long term target rate of growth. $495

The disruptions in our markets from the sale of many of our competitors have positioned Banc of California to be the employer of choice for California’s top banking professionals. We believe the banking teams and talent we have attracted (and continue to attract) is a strong competitive advantage. Banc of California continues to bene?t from the hard work of our dedicated employees. We remain optimistic and enthusiastic Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 about the prospects for Banc of California in 2016 as we continue to deliver upon our mission across our marketplace.

Our banking franchise’s ability to achieve strong organic loan In closing, I would like to thank our valued clients who and deposit growth is a key to our success compounding have chosen Banc of California as their ?nancial partner, investors’ capital. We remain vigilant with respect to credit our employees who dedicate themselves to delivering on quality. Our delinquencies, non-performing assets, and rate our mission every day, our dedicated Board who works of charge-offs all improved during 2015. We continue to see tirelessly on behalf of our stakeholders, our shareholders positive trends within our real estate backed portfolio given who have entrusted us to be stewards of their capital, and our the continued strength of California real estate prices. We communities which make California a great place to conduct also continue to seek to diversify our loan portfolio, including business and grow California’s Bank. through meaningful growth in our C&I lending capabilities.

This will continue to reduce risks associated with concentrations We Are California Strong. within the portfolio.

Understanding that all credit markets go through cycles, we continue to increase our investments in credit oversight and risk analytics to ensure that we are well prepared for any market volatility that could result in increased credit risks for our portfolio. Fortunately, during 2015, our loan portfolio avoided

Steven Sugarman many of the pitfalls that hit the broader credit markets such as Chairman, President and energy lending. Chief Executive Officer

As California’s Bank, what is good for California is good for Banc of California. To that end, we are proud to be California’s largest public bank with an Outstanding Community Development rating.

Our depositors care about the communities within which they live and their bank’s relationship with their community. Our team members, now more than 1,700 strong, live in the communities we serve and share the passion of our customers for giving back. Our rating distinguishes us well in this regard and has been directly correlated with a growing deposit franchise and falling cost of deposits.

8

MAKING

Our Clients CALIFORNIA STRONG.

In 2010, Banc of California was a dream in the minds of a small group of Southern California’s leading business owners, g Fi

i n yment Servic n s Pa es a

entrepreneurs and investors. This group of dreamers u n

o ci

H al

understood the lasting damage to California’s economy l eL

a b i t g B er

resulting from the bank failures that occurred during d in u

o r d si ac n n

the Great Recession. The California Dream was at risk. _ e e y

L s

A e s

t Commercial L

a e t n

These community leaders took action. First, they E s Banking di

a l n

recapitalized one of California’s oldest banking e g

R T r franchises that had served the region since 1941. e s e a Then, they set out to ?ll the crippling credit void i c s u v Private Institutional e r r y that existed throughout the state by building S Banking Banking S t e

California’s preeminent banking franchise–the s u v r bank for those seeking, supporting and living the r c i

T e

California Dream. R s

e g s i i n

d Community d

For each dollar of deposits it holds, Banc of California en n ti Banking e

L

seeks to lend over one dollar per year to California’s al d e s

E L r e i c en u i t

diverse businesses, entrepreneurs and communities. o di e c n

nom ng S m u

With each loan, Banc of California funds California’s i m

c o

engines of growth and strengthens California’s diverse GrC

o A s s e wt dvisory Service e r

economy and communities. h i v

D

Keith Obilana Vin Scully

Rich Jablonski Cheryl Calhoun Steve Shpilsky

Pepperdine Microenterprise Los Angeles Dodgers Sports

Wedbush Securities CBIZ Shpilsky Capital Management Program Broadcaster

Theresa Martinez

Lisette Gaviña Wolfgang Puck David Dressler Harry Veldkamp

Los Angeles Latino

F. Gaviña and Sons, Inc. The Wolfgang Puck Companies Tender Greens Restaurants Polycomp Trust Company Chamber of Commerce

9

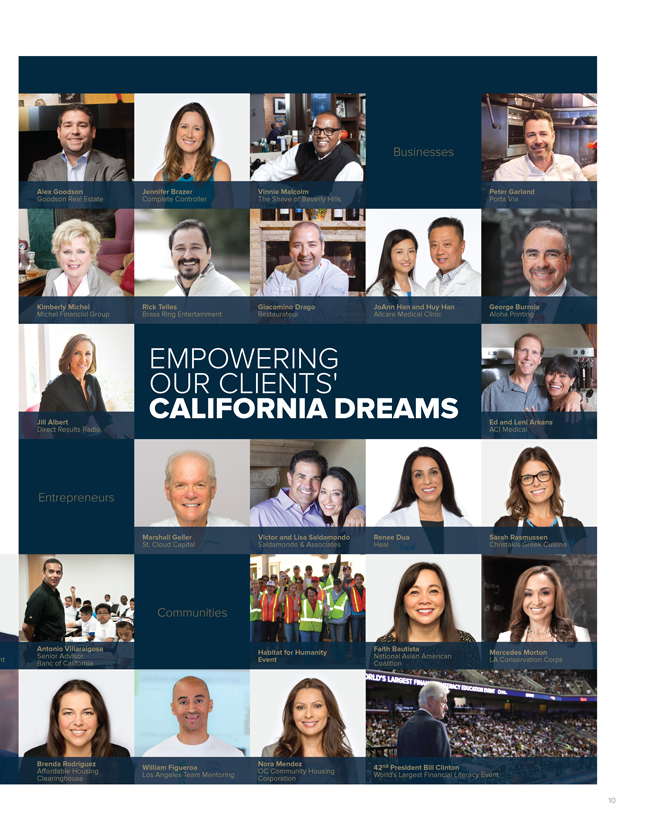

Businesses

Alex Goodson Jennifer Brazer Vinnie Malcolm Peter Garland

Goodson Real Estate Complete Controller The Shave of Beverly Hills Porta Via

Kimberly Michel Rick Telles Giacomino Drago JoAnn Han and Huy Han George Burrola

Michel Financial Group Brass Ring Entertainment Restaurateur Allcare Medical Clinic Aloha Printing

EMPOWERING OUR CLIENTS’

Jill Albert CALIFORNIA DREAMS Ed and Leni Arkans

Direct Results Radio ACI Medical

Entrepreneurs

Marshall Geller Victor and Lisa Saldamondo Renee Dua Sarah Rasmussen

St. Cloud Capital Saldamondo & Associates Heal Christakis Greek Cuisine

Communities

Antonio Villaraigosa Faith Bautista

Habitat for Humanity Mercedes Morton

Senior Advisor National Asian American

Event LA Conservation Corps Banc of California Coalition

Brenda Rodriguez Nora Mendez nd

William Figueroa 42 President Bill Clinton

Affordable Housing OC Community Housing

Los Angeles Team Mentoring World’s Largest Financial Literacy Event Clearinghouse Corporation

10

MAKING

Communities CALIFORNIA STRONG.

Banc of California is committed to working with California’s community leaders to empower the economies and diverse communities we serve. Our programs are designed to foster economic opportunity throughout California.

Small Business Lending and 2 0 1 5 A C H I E V E M E N T S Entrepreneurship

We invest back into the communities we serve through direct lending, education and partnerships 95% 170 with community leaders. We make business loans available to entrepreneurs underserved California Organizations

Loans Supported by traditional banks. Our partnership with The Pepperdine Microenterprise Program is empowering underprivileged members of the Los Angeles community, through education, to ?nd gainful employment and launch micro-businesses. “It’s about more than lending money; it’s about extending a hand and improving lives and creating

Affordable Housing & Job Skills Training

good jobs. Banc of California is

Our collaborations with local organizations stepping up for families in the city’s support community members’ access to affordable highest-need communities.” housing and job skill training opportunities. - Antonio Villaraigosa These partnerships include Habitat for Humanity, 41st Mayor of Los Angeles Senior Advisor, Banc of California

Clearinghouse CDFI, LA Conservation Corps, Neighborhood Housing Services of Los Angeles County, Affordable Housing Clearinghouse, and

Jewish Vocational Service. “Banc of California’s Community Bene?t Plan sets the standard for the industry and is a testament to Financial Literacy Education Banc’s commitment to serve the needs of the diverse neighborhoods

Together with LA 2024 Olympic Organizing the bank will be entering.”

Committee, University of Southern California, and San Diego State University, we’re delivering - Paulina Gonzalez

Executive Director

?nancial literacy education to thousands of

California Reinvestment Coalition youth across California. This empowers the next generation of entrepreneurs, business owners, and homeowners. Additional partners include Junior Achievement, Hollywood Police Activities League, and Los Angeles Team Mentoring.

11

S H A R E H O L D E R I N F O R M AT I O N

Annual Meeting Banc of California, Inc.

May 13, 2016 8:00am

Board of Directors

The Pacific Club

4110 MacArthur Boulevard Steven Sugarman Chair

Newport Beach, California 92660 Chad Brownstein Vice Chair and Lead Independent Director Halle Benett Independent Director Investor Relations Eric Holoman Chair, Community Development Committee Jeffrey Karish Independent Director To obtain information about the Company, Jonah Schnel Chair, Enterprise Risk Committee including a copy of our Annual Report on Robert Sznewajs Chair, Audit Committee Form 10-K, please contact:

Banc of California, Inc. Executive Officers c/o Investor Relations

Steven Sugarman President and Chief Executive Officer 18500 Von Karman Avenue Hugh Boyle Chief Risk Officer Suite 1100 John Grosvenor General Counsel and Corporate Secretary Irvine, California 92612 Brian Kuelbs Chief Investment Officer (855) 361-2262 James McKinney Chief Financial Officer www.bancofcal.com/investor Thedora Nickel Chief Administrative Officer Listing of Common Stock Jeffrey Seabold Chief Banking Officer Francisco Turner Chief Strategy Officer Banc of California, Inc.’s common stock is traded on the New York Stock Exchange. Its symbol is “BANC”.

Transfer Agent and Registrar for Common Stock

Computershare Shareholder Services P.O. Box 30170 College Station, Texas 77842 (800) 522-6645 www.computershare.com

The “C” in BANC represents California.

Our icon is a sculpted ring symbolizing an enduring commitment to our clients and the diverse communities we serve throughout California.

The ring is composed of two C’s representing the symbolic relationship between Banc and California working together to strengthen one another.

The color of the ring and our name represents our heritage in the Golden State and our goal of empowering those in their pursuit of the California Dream.

12

Advisory Board

Branch Openings

WE ARE

CALIFORNIA STRONG.

Financial Literacy Education

Employee Appreciation

Pepperdine Microenterprise Program

SDSU Partnership

LA Conservation Corps Youth Volunteer Recognition

Client Relationship Campaign

Toy Donations

2015

ANNUAL

877-770-2262 • bancofcal.com REPORT