Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d158727d8k.htm |

| EX-2.1 - EX-2.1 - BROCADE COMMUNICATIONS SYSTEMS INC | d158727dex21.htm |

| EX-10.1 - EX-10.1 - BROCADE COMMUNICATIONS SYSTEMS INC | d158727dex101.htm |

| EX-99.1 - EX-99.1 - BROCADE COMMUNICATIONS SYSTEMS INC | d158727dex991.htm |

| EX-99.2 - EX-99.2 - BROCADE COMMUNICATIONS SYSTEMS INC | d158727dex992.htm |

| Exhibit 99.3

|

Brocade to Acquire Ruckus Wireless

Investor Presentation April 4, 2016 BROCADE

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION

|

|

Additional Information and Where to Find It

The exchange offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that Brocade

Communications Systems, Inc. (“Brocade”) and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (“SEC”). At the time the exchange offer is commenced, Brocade and its acquisition subsidiary will file a tender offer statement on Schedule TO and may later file amendments thereto, Brocade will file a registration statement on Form S-4 and may later file amendments thereto, and Ruckus will file a Solicitation/Recommendation Statement on Schedule 14D-9 and may later file amendments thereto, in each case, with the SEC with respect to the exchange offer. Brocade and Ruckus may also file other documents with the SEC regarding the transaction. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. Ruckus STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF Ruckus SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Ruckus stock at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Brocade’s Investor

Relations department at (408) 333-0233 or at ir@Brocade.com. Additional copies of the Solicitation/Recommendation Statement may be obtained for free by contacting Ruckus’ Investor Relations department at (408) 469-4659 or at ir@ruckuswireless.com.

In addition to the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, Brocade and Ruckus file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Brocade and Ruckus at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

Brocade’s and Ruckus’ filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC.

|

|

Cautionary Statements and Disclosures

This presentation contains forward-looking statements that involve a number of risks, uncertainties and assumptions that may cause actual results to differ significantly. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to the expected benefits and costs of the proposed transaction; management plans relating to the proposed transaction; the expected timing of the completion of the proposed transaction; statements of the plans, strategies and objectives of Brocade and Ruckus for future operations; statements concerning the expected development, performance, market share or competitive performance relating to products and services of Brocade, Ruckus or the combined company; statements about expected synergies and market opportunities; statements regarding anticipated operational and financial results; statements r egarding the timing and amount of future share repurchases; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include, but are not limited to, the ability of the parties to consummate the proposed transaction on a timely basis or at all; the satisfaction of the conditions precedent to consummation of the proposed transaction, including the condition that a majority of Ruckus’s shares be validly tendered into the exchange offer; the ability to secure regulatory approvals on the terms expected at all or in a timely manner; the failure of Brocade to obtain the financing described herein; the possibility that the expected benefits of the proposed transaction may not materialize as expected; the possibility that, pri or to the completion of the proposed transaction, Ruckus’s business may not perform as expected due to transaction-related uncertainty or other factors; the ability of Brocade to successfully integrate Ruckus’s operations; the ability of Brocade to achieve its plans, forecasts and other expectations with respect to Ruckus’s business after the completion of the proposed transaction and realize expected synergies; business disruptions following the proposed transaction; and other risks described in Brocade’s and Ruckus’s filings with the

SEC, such as their respective Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K. The forward-looking statements included in this presentation are made only as of the date hereof, and Brocade and Ruckus expressly assume no obligation to update any such forward-looking statements whether as the result of new developments or otherwise.

In addition, this presentation may include various third-party estimates regarding market share and other measures, which do not necessarily reflect the views of Brocade. Further, Brocade does not guarantee the accuracy or reliability of any such information.

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC.

|

|

Agenda

Prepared comments followed by Q&A

Lloyd Carney Selina Lo Dan Fairfax

CEO CEO CFO Brocade Ruckus Brocade Wireless

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 4

|

|

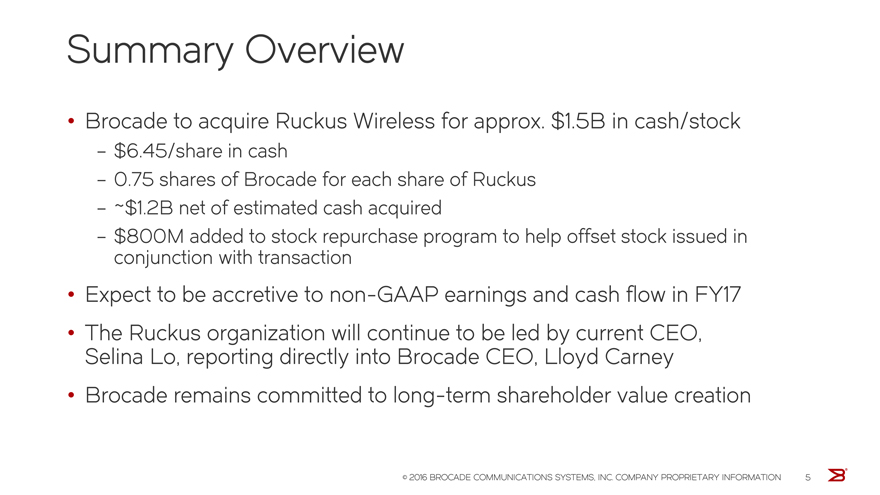

Summary Overview

Brocade to acquire Ruckus Wireless for approx. $1.5B in cash/stock

– $6.45/share in cash

– 0.75 shares of Brocade for each share of Ruckus

– ~$1.2B net of estimated cash acquired

– $800M added to stock repurchase program to help offset stock issued in conjunction with transaction

Expect to be accretive to non-GAAP earnings and cash flow in FY17

The Ruckus organization will continue to be led by current CEO, Selina Lo, reporting directly into Brocade CEO, Lloyd Carney

Brocade remains committed to long-term shareholder value creation

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 5

|

|

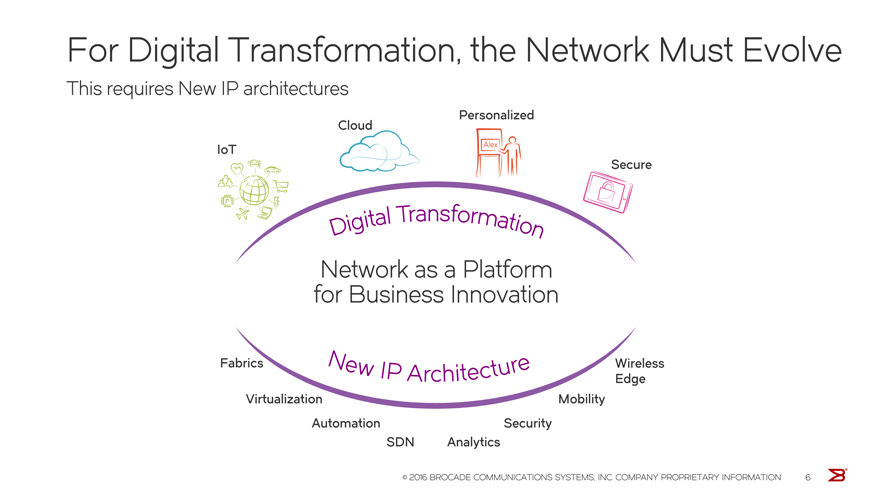

For Digital Transformation, the Network Must Evolve

This requires New IP architectures

Personalized Cloud

IoT

Secure

Network as a Platform for Business Innovation

Fabrics Wireless Edge Virtualization Mobility

Automation Security SDN Analytics

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 6

|

|

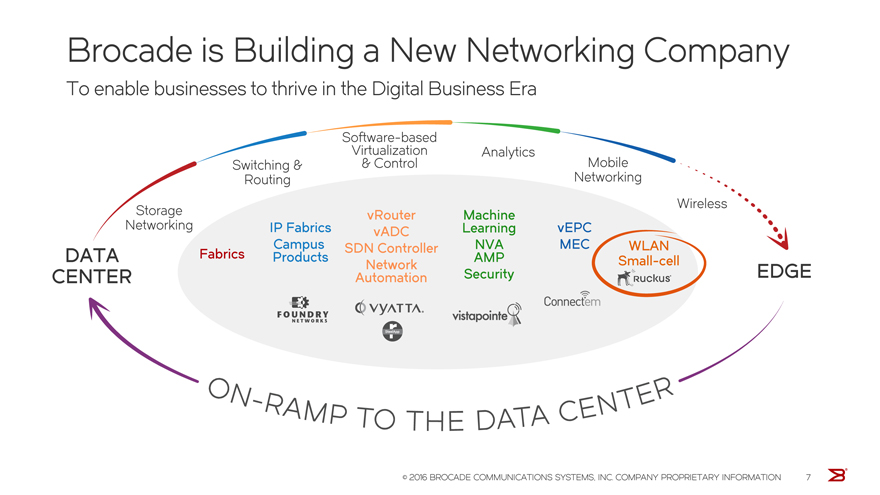

Brocade is Building a New Networking Company

To enable businesses to thrive in the Digital Business Era

Software-based

Virtualization Analytics

Switching & & Control Mobile Routing Networking

Wireless Storage vRouter Machine Networking IP Fabrics Learning vEPC vADC

Fabrics Campus SDN Controller NVA MEC WLAN DATA Products AMP Small-cell

Network EDGE CENTER Automation Security

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 7

|

|

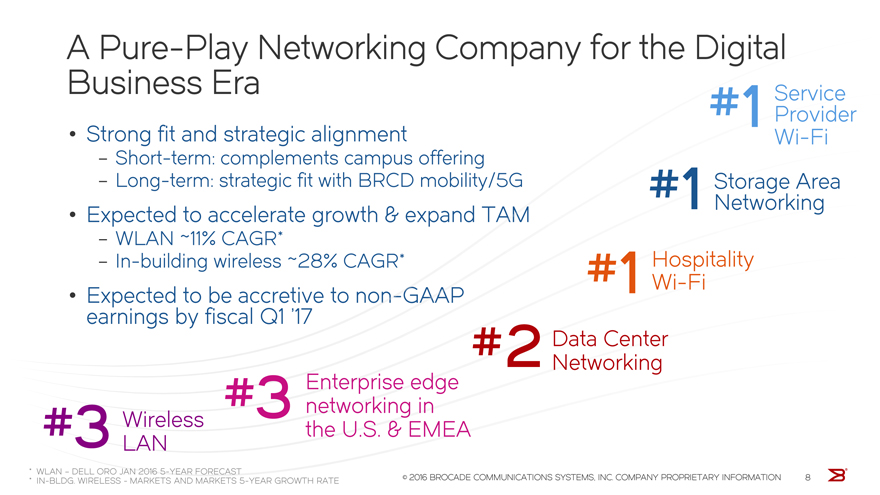

A Pure-Play Networking Company for the Digital Business Era Service

#1 Provider

Strong fit and strategic alignment Wi-Fi

– Short-term: complements campus offering

– Long-term: strategic fit with BRCD mobility/5G #1 Storage Area

Networking

Expected to accelerate growth & expand TAM

– WLAN ~11% CAGR*

– In-building wireless ~28% CAGR* # Hospitality

1 Wi-Fi

Expected to be accretive to non-GAAP earnings by fiscal Q1 ’17

#2Data Center Networking

# Enterprise edge

3 networking in

# Wireless

3 the U.S. & EMEA LAN

* WLAN – DELL ORO JAN 2016 5-YEAR FORECAST © 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 8 * IN-BLDG. WIRELESS—MARKETS AND MARKETS 5-YEAR GROWTH RATE

|

|

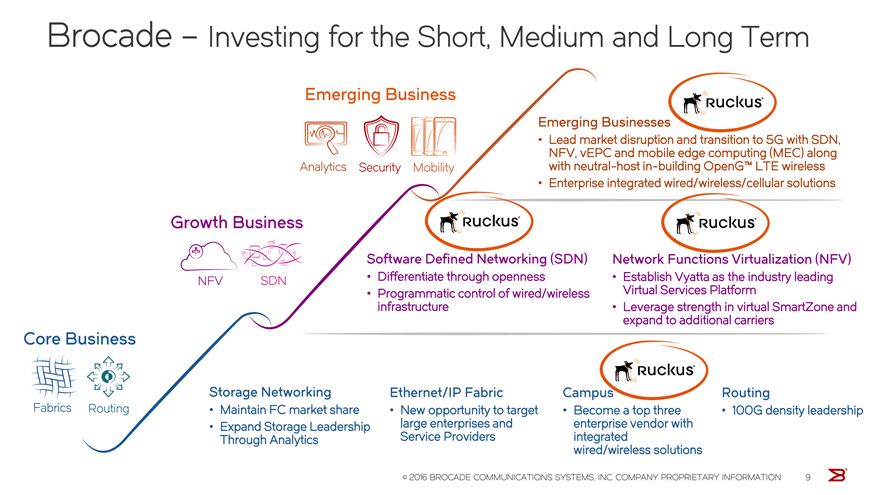

Brocade – Investing for the Short, Medium and Long Term

Emerging Business

Emerging Businesses

Lead market disruption and transition to 5G with SDN, NFV, vEPC and mobile edge computing (MEC) along Analytics Security Mobility with neutral-host in-building OpenG™ LTE wireless

Enterprise integrated wired/wireless/cellular solutions

Growth Business

Software Defined Networking (SDN) Network Functions Virtualization (NFV)

NFV SDN • Differentiate through openness • Establish Vyatta as the industry leading

Programmatic control of wired/wireless Virtual Services Platform infrastructure Leverage strength in virtual SmartZone and expand to additional carriers

Core Business

Storage Networking Ethernet/IP Fabric Campus Routing

Fabrics Routing • Maintain FC market share • New opportunity to target • Become a top three • 100G density leadership

Expand Storage Leadership large enterprises and enterprise vendor with Through Analytics Service Providers integrated wired/wireless solutions

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 9

|

|

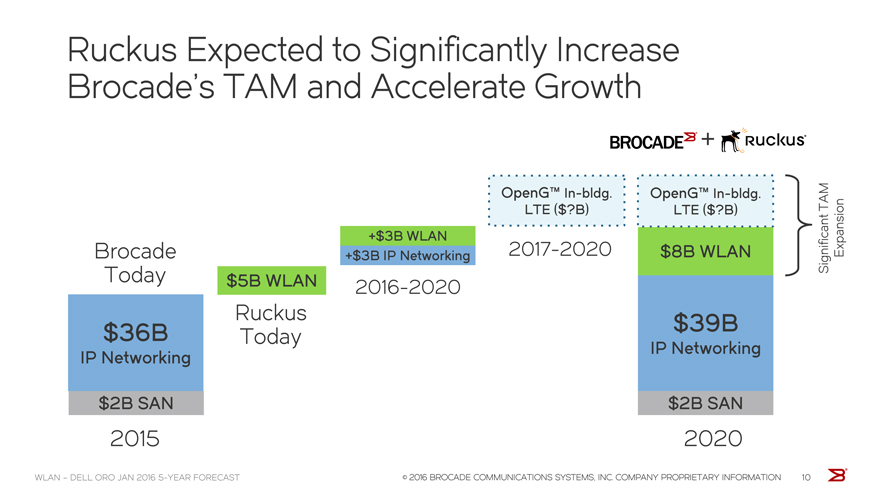

Ruckus Expected to Significantly Increase

Brocade’s TAM and Accelerate Growth

+

OpenG™ In-bldg. OpenG™ In-bldg. TAM LTE ($?B) LTE ($?B)

+$3B WLAN 2017-2020

Brocade +$3B IP Networking $8B WLAN Significant Expansion

Today $5B WLAN

2016-2020

Ruckus

$39B

$36B Today IP Networking IP Networking

$2B SAN $2B SAN

2015 2020

WLAN – DELL ORO JAN 2016 5-YEAR FORECAST © 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 10

|

|

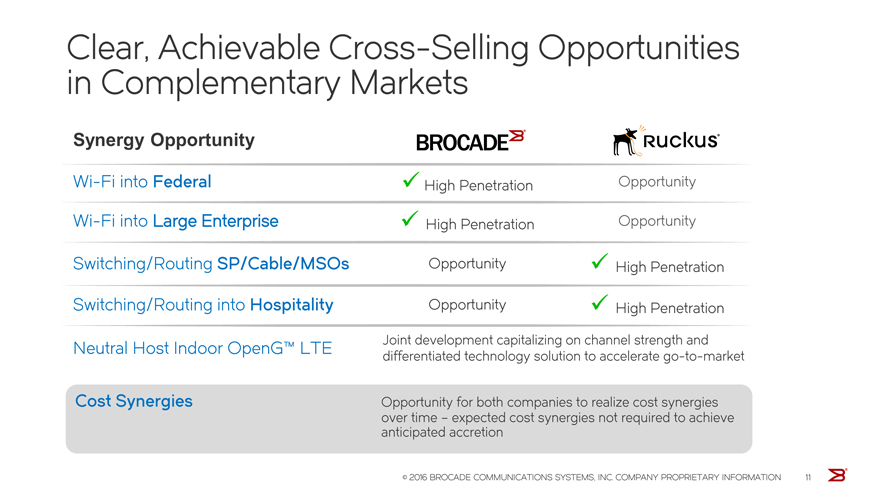

Clear, Achievable Cross-Selling Opportunities in Complementary Markets

Synergy Opportunity

Wi-Fi into Federal High Penetration Opportunity

Wi-Fi into Large Enterprise High Penetration Opportunity

Switching/Routing SP/Cable/MSOs Opportunity High Penetration Switching/Routing into Hospitality Opportunity High Penetration

Joint development capitalizing on channel strength and

Neutral Host Indoor OpenG™ LTE

differentiated technology solution to accelerate go-to-market

Cost Synergies Opportunity for both companies to realize cost synergies over time – expected cost synergies not required to achieve anticipated accretion

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 11

|

|

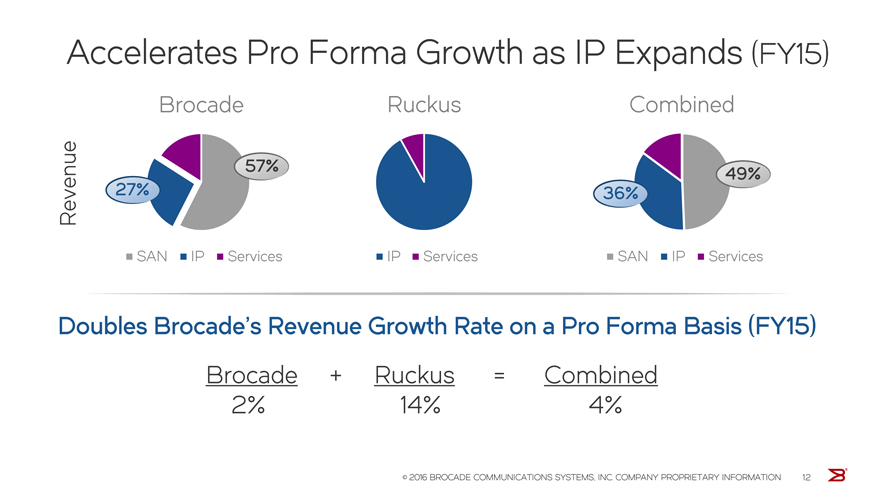

Accelerates Pro Forma Growth as IP Expands (FY15)

Brocade Ruckus Combined

57%

49%

Revenue 27% 36%

SAN IP Services IP Services SAN IP Services

Doubles Brocade’s Revenue Growth Rate on a Pro Forma Basis (FY15)

Brocade + Ruckus = Combined

2% 14% 4%

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 12

|

|

Transaction Details

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION

BROCADE

|

|

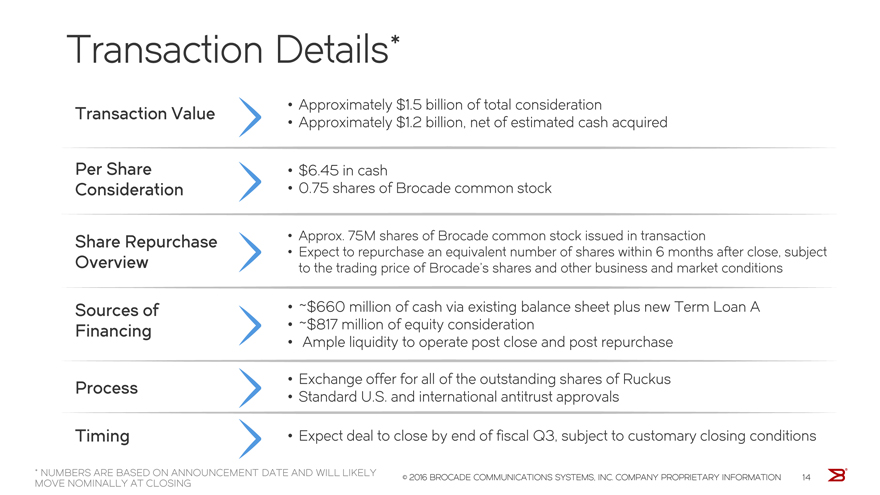

Transaction Details*

Approximately $1.5 billion of total consideration

Transaction Value

Approximately $1.2 billion, net of estimated cash acquired

Per Share • $6.45 in cash

Consideration • 0.75 shares of Brocade common stock

Share Repurchase • Approx. 75M shares of Brocade common stock issued in transaction

Expect to repurchase an equivalent number of shares within 6 months after close, subject

Overview to the trading price of Brocade’s shares and other business and market conditions

Sources of • ~$660 million of cash via existing balance sheet plus new Term Loan A Financing • ~$817 million of equity consideration

Ample liquidity to operate post close and post repurchase

Exchange offer for all of the outstanding shares of Ruckus

Process

Standard U.S. and international antitrust approvals

Timing • Expect deal to close by end of fiscal Q3, subject to customary closing conditions

* NUMBERS ARE BASED ON ANNOUNCEMENT DATE AND WILL LIKELY

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 14

MOVE NOMINALLY AT CLOSING

|

|

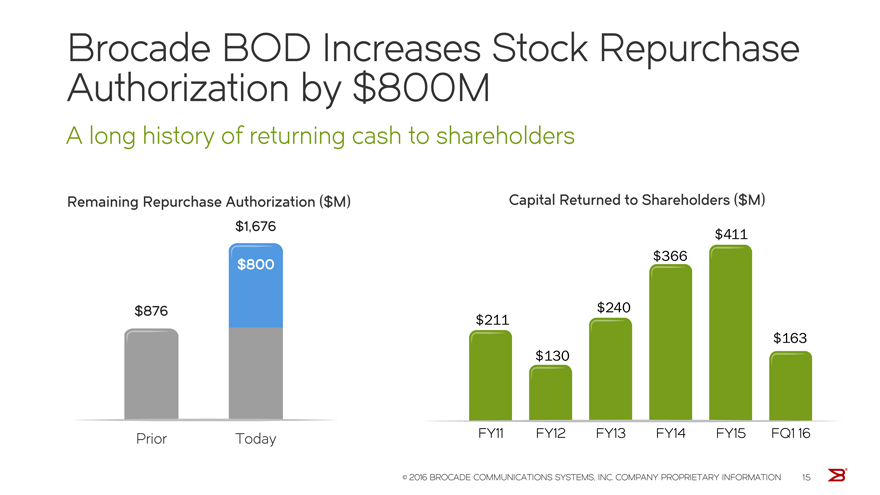

Brocade BOD Increases Stock Repurchase Authorization by $800M

A long history of returning cash to shareholders

Remaining Repurchase Authorization ($M) Capital Returned to Shareholders ($M) $1,676 $411 $366 $800

$876 $240 $211 $163 $130

Prior Today FY11 FY12 FY13 FY14 FY15 FQ1 16

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 15

|

|

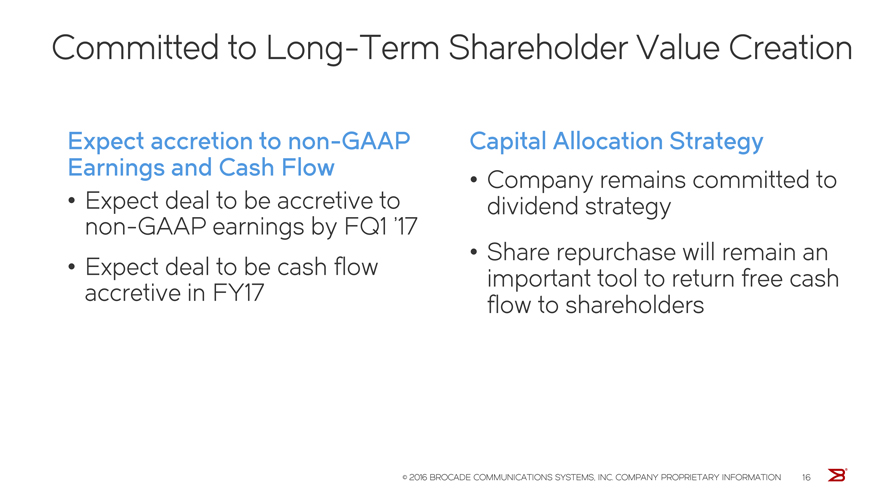

Committed to Long-Term Shareholder Value Creation

Expect accretion to non-GAAP Capital Allocation Strategy Earnings and Cash Flow

Company remains committed to

Expect deal to be accretive to dividend strategy non-GAAP earnings by FQ1 ’17

Share repurchase will remain an

Expect deal to be cash flow important tool to return free cash accretive in FY17 flow to shareholders

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION 16

|

|

Q&A

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION

BROCADE

|

|

Thank you

© 2016 BROCADE COMMUNICATIONS SYSTEMS, INC. COMPANY PROPRIETARY INFORMATION

BROCADE