Attached files

Exhibit 99.1

CHRISTIAN DISPOSAL, LLC

AND SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED

DECEMBER 31, 2014 and 2013

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

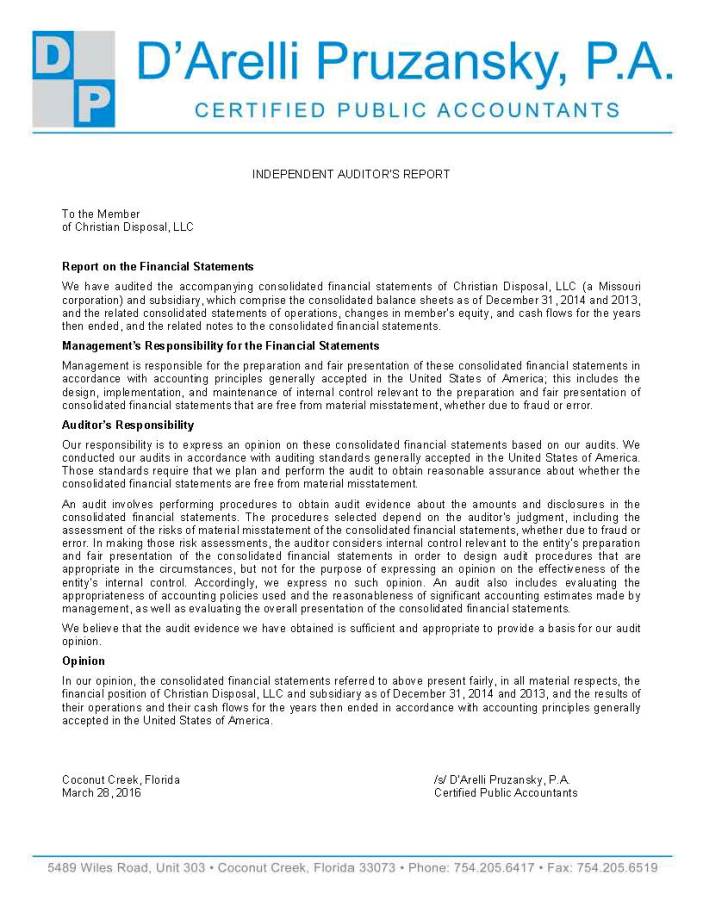

| INDEPENDENT AUDITOR’S REPORT | |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Consolidated Statements of Changes in Member’s Equity | |

| Consolidated Statements of Cash Flows | |

| Notes to Consolidated Financial Statements |

2

3

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2014 AND 2013

|

Assets

|

2014

|

2013

|

||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 182,784 | $ | 633,598 | ||||

|

Accounts receivable, net of allowance of $456,633 and $401,326, respectively

|

1,153,269 | 1,105,254 | ||||||

|

Prepaid expenses

|

214,302 | 75,065 | ||||||

|

Total current assets

|

1,550,355 | 1,813,917 | ||||||

|

Property, plant and equipment

|

||||||||

|

At cost, net of accumulated depreciation of $7,666,308 and $6,823,993, respectively

|

4,148,282 | 4,056,800 | ||||||

|

Other assets:

|

||||||||

|

Deposits

|

20,000 | 30,000 | ||||||

|

Total other assets

|

20,000 | 30,000 | ||||||

|

Total assets

|

$ | 5,718,637 | $ | 5,900,717 | ||||

|

Liabilities and Member's Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 246,058 | $ | 550,724 | ||||

|

Deferred revenue

|

948,826 | 1,036,012 | ||||||

|

Current portion of long-term debt

|

308,814 | 218,211 | ||||||

|

Total current liabilities

|

1,503,698 | 1,804,947 | ||||||

|

Long-term debt, net of current portion

|

622,126 | 447,682 | ||||||

|

Total liabilities

|

2,125,824 | 2,252,629 | ||||||

|

Member's equity:

|

||||||||

|

Member's equity

|

3,592,813 | 3,648,088 | ||||||

|

Total liabilities and member's equity

|

$ | 5,718,637 | $ | 5,900,717 | ||||

See accompanying notes to the financial statements.

4

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

|

2014

|

2013

|

|||||||

|

Revenue

|

$ | 12,639,143 | $ | 10,901,319 | ||||

|

Cost of sales and services:

|

||||||||

|

Cost of sales and services

|

8,168,193 | 7,143,192 | ||||||

|

Depreciation

|

1,110,239 | 793,584 | ||||||

|

Total cost of sales and services

|

9,278,432 | 7,936,776 | ||||||

|

Gross profit

|

3,360,711 | 2,964,543 | ||||||

|

Expenses:

|

||||||||

|

Compensation and related expense

|

536,390 | 491,302 | ||||||

|

Depreciation and amortization

|

79,706 | 141,560 | ||||||

|

Impairment of goodwill and other intangibles

|

- | 1,396,711 | ||||||

|

Selling, general and administrative

|

1,793,129 | 1,404,696 | ||||||

|

Total expenses

|

2,409,225 | 3,434,269 | ||||||

|

Other income (expenses):

|

||||||||

|

Gain on disposal of assets

|

47,668 | 10,678 | ||||||

|

Miscellaneous income

|

50,464 | 7,629 | ||||||

|

Interest (expense)

|

(31,042 | ) | (25,174 | ) | ||||

|

Total other income (expenses)

|

67,090 | (6,867 | ) | |||||

|

Net income (loss)

|

$ | 1,018,576 | $ | (476,593 | ) | |||

See accompanying notes to the financial statements.

5

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN MEMBER'S EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

|

Member's equity - January 1, 2013

|

$ | 3,151,603 | ||

|

Net loss

|

(476,593 | ) | ||

|

Member's contributions

|

1,902,999 | |||

|

Member's distributions

|

(929,921 | ) | ||

|

Member's equity - December 31, 2013

|

3,648,088 | |||

|

Net income

|

1,018,576 | |||

|

Member's contributions

|

102,729 | |||

|

Member's distributions

|

(1,176,580 | ) | ||

|

Member's equity - December 31, 2014

|

$ | 3,592,813 |

See accompanying notes to the financial statements.

6

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

|

2014

|

2013

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income (loss)

|

$ | 1,018,576 | $ | (476,593 | ) | |||

|

Adjustments to reconcile net income to net cash provided

|

||||||||

|

from operating actives:

|

||||||||

|

Depreciation and amortization

|

1,188,686 | 935,144 | ||||||

|

Impairment of goodwill and other intangibles

|

- | 1,396,711 | ||||||

|

Gain on disposal of assets

|

(47,668 | ) | (10,678 | ) | ||||

|

Other assets

|

10,000 | (30,000 | ) | |||||

|

Changes in working capital items:

|

||||||||

|

Accounts receivable

|

(48,015 | ) | (495,362 | ) | ||||

|

Prepaid expenses

|

(139,237 | ) | (12,259 | ) | ||||

|

Accounts payable and accrued expenses

|

(304,666 | ) | (222,792 | ) | ||||

|

Deferred revenue

|

(87,186 | ) | 496,533 | |||||

|

Net cash provided from operating activities

|

1,590,490 | 2,026,288 | ||||||

|

Cash flows from investing activities:

|

||||||||

|

Assets purchased through acquisition

|

- | (1,609,429 | ) | |||||

|

Proceeds from sale of property, plant and equipment

|

85,987 | 10,678 | ||||||

|

Acquisition of property, plant and equipment

|

(1,318,487 | ) | (1,226,139 | ) | ||||

|

Net cash used in investing activities

|

(1,232,500 | ) | (2,824,890 | ) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from debt

|

265,047 | 293,891 | ||||||

|

Principal payments on notes payable

|

- | (154,460 | ) | |||||

|

Member's contributions

|

102,729 | 1,902,999 | ||||||

|

Member's distributions

|

(1,176,580 | ) | (929,921 | ) | ||||

|

Net cash (used in) provided from financing activities

|

(808,804 | ) | 1,112,509 | |||||

|

Net change in cash

|

(450,814 | ) | 313,907 | |||||

|

Beginning cash - January 1

|

633,598 | 319,691 | ||||||

|

Ending cash - December 31

|

$ | 182,784 | $ | 633,598 | ||||

|

Supplemental Disclosures of Cash Flow Information:

|

||||||||

|

Cash paid for income tax

|

$ | - | $ | - | ||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

See accompanying notes to the financial statements.

7

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 1

|

-

|

Nature of Business and Summary of Significant Accounting Policies

|

|

|

Nature of Business

|

|

|

Christian Disposal LLC and its affiliates (the “Company”) provide waste management services, including collection, transfer, recycling and disposal services. The Company’s customers include residential, commercial and municipal customers in the St. Louis area and surrounding counties.

|

|

|

Principles of Consolidation

|

|

|

The consolidated financial statements consist of the accounts of Christian Disposal LLC., consolidated with the results of FWCD, LLC (“FWCD”). All significant intercompany accounts and transactions have been eliminated in combination.

|

|

|

On January 31, 2013 an Operating Agreement for Hwy 79 became effective between FWCD, as its sole Member and Manager.

|

|

|

Basis of Presentation

|

|

|

The Company follows accounting standards set by the Financial Accounting Standards Board (“FASB”) in ASC 115, Generally Accepted Accounting Principles, which establishes the FASB Accounting Standards Codification (“ASC”), as the sole source of authoritative U.S. generally, accepted accounting principles.

|

|

|

Concentration of credit risk

|

|

|

The Company generates accounts receivable in the normal course of business and grants credit to customers and does not require collateral to secure accounts receivable.

|

|

|

Cash

|

|

|

The Company maintains cash accounts, which are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000. At times, cash balances may be in excess of the FDIC insurance limits.

|

|

|

Accounts receivable

|

|

|

Accounts receivable are recorded at management’s estimate of net realizable value. Management evaluates the adequacy of the allowance for doubtful accounts based on historical customer trends, type of customer, such as municipal or commercial, the age of the outstanding receivables and existing economic conditions. Accounts are written off when all collection efforts have been exhausted.

|

|

|

At December 31, 2014 and 2013, the Company had balances of approximately $1,153,000 and $1,105,000 of net receivables, respectively.

|

8

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 1

|

-

|

Nature of Business and Summary of Significant Accounting Policies (Continued)

|

|

|

Property, plant and equipment

|

|

|

Property and equipment is stated at cost. Repairs and maintenance costs are expensed as incurred and additions and improvements that significantly extend the lives of assets are capitalized. Upon disposition, cost and accumulated depreciation are eliminated from the related accounts and any gain or loss is reflected in the statement of operations. Depreciation is computed on a straight-line basis over the estimated useful lives of the assets of three to thirty-nine years.

|

Deferred revenue

|

|

Deferred revenue represents amounts billed to customers in advance of services performed.

|

Fair value of financial instruments

|

|

In accordance with ASC 820, financial instruments, including cash, accounts receivable, prepaid expenses, accounts payable and accrued expenses and deferred revenue are carried at cost, which approximates fair value, due to the short-term nature of these instruments.

|

|

|

|

|

The Company has determined the fair value of notes payable through the use of significant other observable inputs. The carrying value of the Company’s notes payable approximates fair value based on current rates offered for debt with similar terms.

|

|

|

|

|

There were no triggering events that required fair value measurements of the Company’s nonfinancial assets and liabilities at December 31, 2014 and 2013.

|

|

|

Long-lived assets

|

|

|

If facts and circumstances suggest that a long-lived asset may be impaired, the carrying value is reviewed. If this review indicates that the carrying value of the asset will not be recovered, as determined based on projected undiscounted cash flows related to the asset over its remaining life, the carrying value of the asset is reduced to its estimated fair value. There were no impairment charges for the year ended December 31, 2014 or 2013.

|

|

|

Revenue recognition

|

|

|

The Company recognizes revenue from fees charged for waste collection, transfer, disposal, and recycling services. The fees charged are generally defined in service agreements and vary based on contract-specific terms such as frequency of service and general market factors influencing a municipality’s rates. The fees charged generally include fuel surcharges based on changes in market prices for fuel. Revenue is recognized as services are performed. Certain services are billed prior to performance, such as on a quarterly basis. These advance billings are included in deferred revenue and recognized as revenue in the period the service is provided.

|

9

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 1

|

-

|

Nature of Business and Summary of Significant Accounting Policies (Continued)

|

|

|

Advertising costs

|

|

|

Advertising costs are expensed as incurred and totaled approximately $10,000 and $16,000 for the year ended December 31, 2014 and 2013, respectively.

|

|

|

|

|

Income taxes

|

|

|

As a limited liability company, the Company is not subject to U.S. federal, state, or local income taxes. Rather, income taxes related to the Company’s operations are the responsibility of its member. As a single member limited liability company, the Company does not file separate income tax returns, rather all income and expense is reported on the member’s personal income tax return.

|

|

|

Use of estimates

|

|

|

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets, liabilities, revenues, expenses, and the disclosure of contingent assets and liabilities. Accordingly, actual results could differ from those estimates.

|

|

|

Note 2

|

-

|

Beck-Tel Asset Purchase Agreement

|

|

|

On August 30, 2013, the Company executed an Asset Purchase Agreement with Beck-Tel Trash Service. On September 25, 2013, the Company executed an additional Asset Purchase Agreement for certain containers and trucks for $36,000. The purchase was made to geographically expand the Company’s market.

|

|

|

The Company accounted for the acquisition utilizing the purchase method of accounting in accordance with ASC 805 "Business Combinations". The Company is the acquirer for accounting purposes and Beck-Tel is the acquired Company.

|

10

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 2

|

-

|

Beck-Tel Asset Purchase Agreement (Continued)

|

|

|

The components of the fair value of the Beck-Tel Acquisition at the date of purchase were as follows:

|

|

Assets acquired:

|

||||

|

Vehicles and equipment

|

$ | 905,900 | ||

|

Goodwill

|

842,100 | |||

|

Small tools

|

25,000 | |||

|

Total assets

|

1,773,000 | |||

|

Liabilities assumed – Deferred revenue

|

(163,573 | ) | ||

|

Cash paid

|

$ | 1,609,427 | ||

|

|

Unaudited proforma results of operations data as if the Company and Beck-Tel had occurred as of January 1, 2013 are as follows:

|

| 2013 | ||||

| Proforma revenue | $ | 12,250,000 | ||

| Proforma gross profit | 4,259,000 | |||

| Proforma operating income | 415,000 | |||

|

|

Note 3

|

-

|

Impairment of Intangible Assets

|

|

|

Intangible assets that are subject to amortization are reviewed for potential impairment whenever events or circumstances indicate that carrying amounts may not be recoverable. Assets not subject to amortization are tested for impairment at least annually. During 2013, the Company determined that, based on estimated future cash flows, the carrying amount of loan origination fees, which exceeds its fair value by approximately $6,000; accordingly, an impairment loss of that amount was recognized and is included in impairment of goodwill and other intangible assets.

|

|

|

Note 4

|

-

|

Impairment of Goodwill

|

|

|

Goodwill is assigned to specific reporting units and is reviewed for possible impairment at least annually or more frequently upon the occurrence of an event or when circumstances indicate that a reporting unit's carrying amount is greater than its fair value. During 2013, the Company determined that the carrying amount of the goodwill exceeded its fair value, which was estimated based on the present value of expected future cash inflows. Accordingly, a goodwill impairment loss of approximately $1,397,000 was recognized and is included in impairment of goodwill and other intangible assets in the Statement of Operations.

|

11

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

Note 5 - Property, Plant and Equipment

The principal categories of property, plant and equipment may be summarized as follows:

| 2014 | 2013 | |||||||

|

Land

|

$ | 164,173 | $ | 164,173 | ||||

|

Building and improvements

|

1,212,375 | 1,187,458 | ||||||

|

Office equipment

|

276,491 | 176,737 | ||||||

|

Vehicles and equipment

|

10,161,551 | 9,352,425 | ||||||

|

Total cost

|

11,814,590 | 10,880,793 | ||||||

|

Less accumulated depreciation

|

(7,666,308 | ) | (6,823,993 | ) | ||||

|

Undepreciated cost

|

$ | 4,148,282 | $ | 4,056,800 | ||||

Depreciation expense was approximately $1,189,000 and $935,000 for the years ended December 31, 2014 and 2013, respectively.

12

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 6

|

-

|

Notes Payable and Long-Term Debt

|

Notes payable consisted of the following at December 31:

| 2014 | 2013 | |||||||

| Note payable - financing company, secured by equipment, payable in monthly installments of $10,044, including principal and interest at 4.65%, due September 2016 | $ | 220,607 | $ | 328,148 | ||||

| Note payable - financing company, secured by equipment, payable in monthly installments of $5,836, including principal and interest at 4.29%, due September 2017 | 181,346 | 242,168 | ||||||

| Note payable - financing company, secured by equipment, payable in monthly installments of $2,899, including principal and interest at 5.75%, due December 2015 | - | 65,557 | ||||||

| Note payable - individual, secured by equipment, payable in monthly installments of $1,500, non-interest bearing, paid in full in 2014 | - | 30,000 | ||||||

| Note payable - financing company, secured by equipment, payable in monthly installments of $3,268, including principal and interest at 4.57%, due July 2020 | 161,892 | - | ||||||

| Note payable - financing company, secured by equipment, payable in monthly installments of $6,821, including principal and interest at 4.35%, due December 2019 | 300,000 | - | ||||||

| Capitalized lease - financing company, secured by equipment, payable in monthly installments of $1,170, including principal and interest at 4.75%, through August 2018 | 67,095 | - | ||||||

| Total | 930,940 | 665,893 | ||||||

| Less current portion of long-term debt | 308,814 | 218,211 | ||||||

| Total debt reflected as long-term | $ | 622,126 | $ | 447,682 | ||||

13

CHRISTIAN DISPOSAL, LLC AND SUBSIDIARY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2014 AND 2013

|

|

Note 6

|

-

|

Notes Payable and Long-Term Debt (Continued)

|

|

|

Interest expense was approximately $31,000 and $25,000 for the years ended December 31, 2014 and 2013, respectively.

|

|

|

Note 7

|

-

|

Concentrations

|

|

|

During the year ended December 31, 2014, one customer accounted for approximately 10% of the Company’s revenues. One customer accounted for approximately 13% of the Company’s accounts receivable balance at December 31, 2014.

|

|

|

During the year ended December 31, 2013, one customer accounted for approximately 10% of the Company’s revenues. Two customers accounted for approximately 26% of the Company’s accounts receivable balance at December 31, 2013.

|

|

|

Note 8

|

-

|

Risks and Uncertainties

|

|

|

While there are no material pending legal proceedings to which the Company is a party, the Company is involved in various claims, legal actions and regulatory proceedings arising in the ordinary course of business. In the opinion of the Company’s management, the resolution of these matters will not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

|

|

|

Note 9

|

-

|

Subsequent Events

|

|

|

In accordance with ASC 855, the Company has evaluated subsequent events through March 29, 2016, which is the date the financial statements were available to be issued and has determined that the following would be include as subsequent events.

|

|

|

Effective December 22, 2015, the Company was purchased by Meridian Waste Solutions, Inc., for thirteen million dollars (Christian Purchase Agreement).

|

|

|

Pursuant to the Christian Purchase Agreement, and simultaneous with the closing thereof, Christian Disposal, and the Company entered into an Employment Agreement with Patrick McLaughlin, pursuant to which Mr. McLaughlin will serve as Area Vice President of Business Development and Marketing for Christian Disposal, for a term of five years (the “Employment Agreement”).

|

14