Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM - Attis Industries Inc. | f10k2017ex23-1_meridianwaste.htm |

| EX-32.2 - CERTIFICATION - Attis Industries Inc. | f10k2017ex32-2_meridianwaste.htm |

| EX-32.1 - CERTIFICATION - Attis Industries Inc. | f10k2017ex32-1_meridianwaste.htm |

| EX-31.2 - CERTIFICATION - Attis Industries Inc. | f10k2017ex31-2_meridianwaste.htm |

| EX-31.1 - CERTIFICATION - Attis Industries Inc. | f10k2017ex31-1_meridianwaste.htm |

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM - Attis Industries Inc. | f10k2017ex23-2_meridianwaste.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-13984

MERIDIAN WASTE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| New York | 13-3832215 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

12540 Broadwell Road, Suite 1203

Milton, GA 30004

(Address of principal executive offices)

(770)-691-6350

(Issuer’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, par value $0.025 | The NASDAQ Capital Market | |

| Warrant

to purchase Common Stock (expiring January 30, 2022) |

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of registrant’s voting and non-voting common equity held by non-affiliates (as defined by Rule 12b-2 of the Exchange Act) computed by reference to the average bid and asked price of such common equity on June 30, 2017, was $12,800,000. As of April 13, 2018, the registrant has one class of common equity, and the number of shares issued and outstanding of such common equity was 17,123,416.

Documents Incorporated By Reference: None.

MERIDIAN WASTE SOLUTIONS, INC.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

| i |

PART I

FORWARD LOOKING STATEMENTS

Except for historical information, this document contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our revenue mix, anticipated costs and expenses, development, relationships with strategic partners and other factors discussed under “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These forward-looking statements may include declarations regarding our belief or current expectations of management, such as statements indicating that “we expect,” “we anticipate,” “we intend,” “we believe,” and similar language. We caution that any forward-looking statement made by us in this Form 10-K or in other announcements made by us are further qualified by important factors that could cause actual results to differ materially from those projected in the forward-looking statements, including without limitation the risk factors set forth in this Form 10-K beginning on page 26.

As used in this Annual Report, “we,” “us,” “our,” “Meridian,” “Company” or “our Company” refers to Meridian Waste Solutions, Inc.

Our Company

Historically, Meridian has generally operated three lines of business: (1) non-hazardous solid waste collection, transfer and disposal services (the “Waste Business”); (2) technologies, centering on creating community-based synergies through healthcare collaborations and software solutions, through its wholly-owned subsidiary, Mobile Science Technologies, Inc. (the “Technologies Business”); and (3) innovations, striving to create value from recovered resources, through advanced byproduct technologies and assets found in downstream production, through its wholly-owned subsidiary, Attis Innovations, LLC (the “Innovations Business”).

Late in the Summer of 2017, the Company began to explore the possibility of selling the Waste Business in order to reduce the Company’s leverage, dedicating resources to further growth in the Technologies Business and Innovations Business, where the Company saw robust pipelines for further opportunity. Such sale of the Waste Business was expected to clear the bottleneck caused by the debt encumbering the Waste Business, while, the Company believed, significantly increasing its enterprise value, and thereby paving the way to aggressively pursue acquisitions.

On February 20, 2018, the Company entered into an agreement for the sale of the Waste Business. Such sale of the Waste Business is expected to close on or about April 17, 2018.

We built the Company by providing everyday products and services that contribute to the lives of all people. We will continue to do so moving forward, but in new and, we believe, more profitable ways that capitalize on untapped opportunities and changing market conditions in healthcare and energy to build strategically compatible revenue lines in our Technologies Business and Innovations Business.

History

Meridian Waste Solutions, Inc. was incorporated in November 1993 in New York. Prior to October 17, 2014, the Company derived revenue by licensing its trademarks to a third party (the “Legacy Business”).

On October 17, 2014, the Company entered into that certain Membership Interest Purchase Agreement (the “Purchase Agreement”) by and among Here to Serve Holding Corp., a Delaware corporation, as seller (“Here to Serve”), the Company, as parent, Brooklyn Cheesecake & Dessert Acquisition Corp., a wholly-owned subsidiary of the Company, as buyer (the “Acquisition Corp.”), the Chief Executive Officer of the Company (the “Company Executive”), the majority shareholder of the Company (the “Company Majority Shareholder”) and certain shareholders of Here to Serve (the “Here to Serve Shareholders”), pursuant to which the Acquisition Corp acquired from Here to Serve all of Here to Serve’s right, title and interest in and to (i) 100% of the membership interests of Here to Serve – Missouri Waste Division, LLC d/b/a Meridian Waste, a Missouri limited liability company (“HTS Waste”); (ii) 100% of the membership interests of Here to Serve Technology, LLC, a Georgia limited liability company (“HTS Tech”); and (iii) 100% of the membership interests of Here to Serve Georgia Waste Division, LLC, a Georgia limited liability company (“HTS Waste Georgia”, and together with HTS Waste and HTS Tech, collectively, the “Membership Interests”). As consideration for the Membership Interests, on October 31, 2014 (the “Closing Date”) (i) the Company issued to Here to Serve 452,707 shares of the Company’s common stock (the “HTS Common Stock”); (ii) the Company issued to the holder of Class A Preferred Stock of Here to Serve (“Here to Serve’s Class A Preferred Stock”) 51 shares of the Company’s Series A Preferred Stock (the “Series A Preferred Stock”); (iii) the Company issued to the holder of Class B Preferred Stock of Here to Serve (“Here to Serve’s Class B Preferred Stock”) an aggregate of 71,120 shares of the Company’s Series B Preferred Stock (the “Series B Preferred Stock,” together with the HTS Common Stock and the Series A Preferred Stock, the “Purchase Price Shares”); and (iv) the Company assumed certain liabilities.

| 1 |

As further consideration, on the Closing Date of the transaction contemplated under the Purchase Agreement, (i) in satisfaction of all accounts payable and shareholder loans, Here to Serve paid to the Company Majority Shareholder $70,000 and (ii) Here to Serve purchased from the Company Majority Shareholder 11,500 shares of the Company’s common stock for a purchase price of $230,000. Pursuant to the Purchase Agreement, to the extent Purchase Price Shares are issued to individual shareholders of Here to Serve at or upon closing of the Purchase Agreement: (i) shares of common stock of Here to Serve held by the individuals listed on Schedule 2.2 of the Purchase Agreement valued at $2,564,374.95 were cancelled in accordance with such Schedule 2.2; (ii) 50,000 shares of Here to Serve’s Class A Preferred Stock valued at $1,000 were cancelled; and (iii) 71,120 shares of Here to Serve’s Class B Preferred Stock valued at $7,121,000 were cancelled.

The closing of the Purchase Agreement resulted in a change of control of the Company and the Legacy Business was spun out to a shareholder in connection with the same.

On March 27, 2015, the Company filed a Certificate of Amendment of the Certificate of Incorporation to change the name of the Company from Brooklyn Cheesecake & Desserts Company, Inc. to Meridian Waste Solutions, Inc. (the “Name Change”).

On February 20, 2018, the Company entered into an Equity Securities Purchase Agreement (the “Purchase Agreement”) with Meridian Waste Operations, Inc., a New York corporation (“Seller”) and a wholly-owned subsidiary of Meridian, Meridian Waste Acquisitions, LLC, a Delaware limited liability company (“Buyer”) and solely for purposes of Sections 6.4, 6.7 and 11.18 thereof, Jeffrey S. Cosman, the Chief Executive Officer and Chairman of Meridian, providing for, subject to the satisfaction or waiver (if permissible under applicable law) of specified conditions, the purchase of all of the membership interests of each of the direct wholly-owned subsidiaries of Seller (collectively, the “Acquired Parent Entities” and together with their direct and indirect subsidiaries, the “Acquired Entities”), comprising, with the Acquired Parent Entities’ subsidiaries, the Company’s Waste Business and constituting substantially all of the assets of the Company (such acquisition, the “Transaction”). Pursuant to the Purchase Agreement, at the time the Transaction closes (the “Closing”) in consideration of $100,000, the Company will issue to the Buyer a warrant (the “Warrant”) to purchase shares of common stock, par value $0.025 (“Common Stock”), of the Company, equal to two percent of the issued and outstanding shares of capital stock of the Company on a fully-diluted basis as of the time of issuance of the Warrant (subject to adjustment as set forth therein).

At the time of the Closing, Buyer will have satisfied $75.8 million of the Company’s outstanding indebtedness under the Amended and Restated Credit and Guaranty Agreement dated February 15, 2017 among certain of the Acquired Entities, Meridian, and Goldman Sachs Specialty Lending Group, L.P. (as amended, the “Credit Agreement”) and assume the Acquired Entities’ obligations under certain equipment leases and other operating indebtedness. Meridian estimates that it will retain approximately $6.6 million of indebtedness under the Credit Agreement or a successor agreement and certain promissory notes payable for an aggregate amount of $1.475 million (the “Legacy Notes”).

This will leave the Company to operate its two remaining lines of business, the Technologies Business and the Innovations Business, unencumbered by $75.8 million of debt that was previously outstanding.

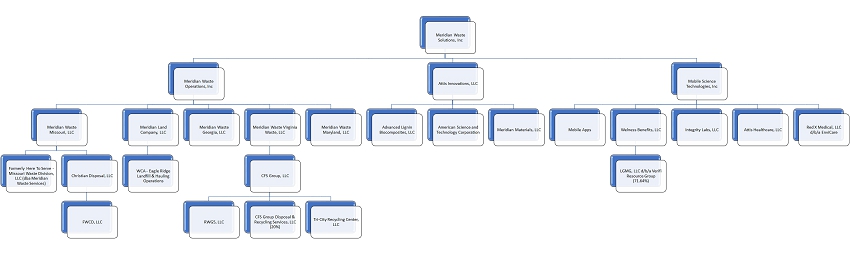

Corporate Structure

Technologies Division

The Technologies Division of the Company, sometimes referred to herein as “Attis Healthcare”, is comprised of two divisions — (i) healthcare and (ii) Bright City, a mobile application. Our healthcare group focuses on improving patient care and providing cost-saving opportunities through innovative, compliant, and comprehensive diagnostic and therapeutic solutions for patients and healthcare providers. We understand the challenges that come with trying to improve patient outcomes while driving down the cost of care, which is why we offer a broad portfolio of what we believe to be best-in-class solutions, combined with insight and expertise, to give providers tools that lead to healthier patients and communities. Attis Healthcare offers products and services in a variety of areas, including hospital consulting services for both laboratory services and emergency department revenue enhancement, polymerase chain reaction (“PCR”) molecular testing, pharmacogenetics (“PGx”) testing, and medication therapy management.

Bright City is an all-in-one citizen engagement mobile application that allows cities and their residents to communicate more directly. This allows to make for safer communities, community leadership to be more proactive, and citizens to be more connected. Bright City provides direct and two-way communication, which means citizens can reply and communicate directly with local law enforcement and town, city or municipal staff. Bright City is specific and targeted, which prevents communications from becoming lost in the clutter of social media and allows for communications from citizens to be routed directly to the appropriate city staff for response and resolution. Bright City includes camera, video, and GPS locator functionality, which provides specific location data and a more accurate description of the reported activity, expediting the flow of information. Bright City acts as the eyes and ears of the city, allowing towns, cities and municipalities to expand security and increase connectivity.

| 2 |

Customers

Currently, within our Technologies Division, we have agreements with three (3) hospitals to manage their laboratory services. As part of those agreements, we provide consulting services in the areas of equipment procurement, materials management, staffing, training, billing and laboratory compliance. In addition to the three (3) hospitals we currently work with, we have a plan in place to bring on at least another four (4) hospital laboratories during the remainder of 2018, but cannot guarantee that we will be able to reach agreement with these laboratories. We are also working several large hospital groups regarding emergency services coding, where we provide expertise in connection with billing in the emergency department with an expectation of growing revenue for the hospital through improved billing and coding.

In connection with our PCR testing services, we focus on long term care facilities, home healthcare agencies and physician practices. We expect to continue expanding our footprint in this business, both by adding additional physician practices and long term care facilities in the Southeast, as well as expanding across the country to the Midwest, Northeast, and beyond.

Our PGx services are designed to assist large employers with reducing the amount of money they spend in pharmacy costs for their workforce. Specifically, Attis Healthcare has engaged multiple health benefits brokers who work with large employers to help drive this technology to these employers. Attis Healthcare is currently analyzing pharmacy data for multiple large employers.

Attis Healthcare is also currently working directly with both community pharmacies and large pharmacy corporations to offer PGx and medication therapy management to patient customers of the pharmacies. Attis Healthcare has an agreement with four (4) community pharmacies in the Southeast and is engaged in discussions with corporations about adding this technology to their pharmacy shelves.

Bright City is currently in the pilot phase, with delivery to the first municipality, located in the Southeast U.S., scheduled for the early second quarter of 2018. The Company expects to add two (2) additional pilot municipalities in either the second quarter or third quarter of 2018 and will then concentrate on a larger scale sales pipeline across the U.S.

Growth Strategy

Growth in Existing Markets

We currently provide laboratory testing services to a variety of physician offices and long term care facilities and we currently manage hospital laboratories in three (3) hospitals, all largely concentrated in the Southeast U.S. We are focused on increasing our sales in these markets by growing our customer base through increased market penetration and expanding existing customers through use of our other services. We have also begun engaging large employers on the PGx portion of our business and will continue to look to expand the number of employers who utilize our PGx and medication therapy management solution as a means of reducing their pharmacy costs.

| 3 |

Expanding into New Markets

In 2018 and beyond, we plan to expand into new markets, specifically targeting the Midwest United States and the Western part of the United States. We have and will continue to engage sales professionals that have strong relationships in all areas of the United States and will utilize those relationships to build our business into previously untapped markets.

Integration

Our growth strategy also includes the plan to become more integrated across our business lines by purchasing long term care facilities, nursing homes, and rural hospitals, which will allow us to further integrate our laboratory testing in the markets where the testing is most effective. We also plan to offer billing services and other consulting services, further integrating our various service offerings in the healthcare market.

Acquisition

Our revenue model is based on organic growth of operations, the acquisition of established operations in new markets, as well as being able to execute value-adding, tuck-in acquisitions. We hope to direct acquisition efforts towards those markets in which we would be able to provide vertically integrated services. Prior to acquisition, we analyze each prospective target for cost savings through the elimination of inefficiencies and excesses that are typically associated with private companies competing in fragmented industries. We aim to realize synergies from consolidating businesses into our existing operations, which we hope will allow us to reduce capital and expense requirements.

Competition

Competition in the lab services industry is dominated by two large national laboratories, Quest Diagnostics and Labcorp, with multiple regional laboratories providing laboratory services as well. However, because of their size, these laboratories struggle to provide high quality customer service. Our focus in building out hospital laboratories is to improve the customer service available to physician practices and other healthcare facilities, including turnaround time for test results, while bolstering the healthcare services offered in rural America and offering jobs in underserved communities.

Sales & Marketing

We focus our marketing efforts on increasing and extending business with existing customers, as well as increasing our new customer base. We target physician practices, hospitals, long term care facilities, and large employers. With respect to hospitals, we particularly focus on rural hospitals, which are historically underserved. We believe that by improving the healthcare in the rural community, we can help stimulate job growth and improve the quality of life in this historically underserved population. We have a seasoned sales force of both executives and direct line sales employees with a wealth of experience in the healthcare sector. We utilize relationships across the United States to build our sales force, relying on relationships with strong sales professionals.

Government Contracts

We currently have one (1) governmental contract with a municipality in connection with Bright City. Bright City is still in the pilot phase; we expect to grow the number of governmental contracts in the second and third quarters of 2018.

| 4 |

Regulation

Our business is subject to extensive and evolving federal, state and local environmental, health, safety and healthcare laws and regulations. Governmental agencies have the authority to enforce compliance with these laws and regulations and to obtain injunctions or impose civil or criminal penalties in cases of violations. We believe that regulation of the healthcare industry will continue to evolve, and we will adapt to future legal and regulatory requirements to ensure compliance. Attis Healthcare strives to operate under the regulations and laws put in place to protect our medical communities and to comply with all regulations and laws that are put in place. Because compliance is important to us, we constantly review and assess our policies, practices and procedures. This compliance is, and may in the future continue to be, costly. In particular, the governing laws regarding medical laboratories are strictly enforced and reviewed frequently. Clinical Laboratory Improvement Amendments (“CLIA”) inspections take place every two years, and the laboratories we manage or own must be in strict compliance. The section of the federal regulations titled "Standards and Certification: Laboratory Requirements" is issued by the Centers for Medicare & Medicaid Services (“CMS”) to enact the CLIA law passed by Congress. In general terms, the CLIA regulations establish quality standards for laboratory testing performed on specimens from humans, such as blood, body fluid and tissue, for the purpose of diagnosis, prevention, or treatment of disease, or assessment of health.

The federal Health Insurance Portability and Accountability Act of 1996 and the regulations issued thereunder (collectively, “HIPAA”) impose extensive requirements on the way in which health plans, health care providers, health care clearinghouses (known as “covered entities”) and their business associates use, disclose and safeguard protected health information (“PHI”). Criminal penalties and civil sanctions may be imposed for failing to comply with HIPAA standards. The Health Information Technology for Economic and Clinical Health Act (the “HITECH Act”), enacted as part of the American Recovery and Reinvestment Act of 2009, amended HIPAA to impose additional restrictions on third-party funded communications using PHI and the receipt of remuneration in exchange for PHI. It also extended HIPAA privacy and security requirements and penalties directly to business associates. In addition to HIPAA, state health privacy laws apply to the extent they are more protective of individual privacy than is HIPAA.

Finally, the Health Insurance Marketplaces (formerly known as the “exchanges”) are required to adhere to privacy and security standards with respect to PII, and to impose privacy and security standards that are at least as protective of PII as those the Health Insurance Marketplace has implemented for itself or non-Health Insurance Marketplace entities, which include insurers offering plans through the Health Insurance Marketplaces and their designated downstream entities, including PBMs and other business associates. These standards may differ from, and be more stringent than, HIPAA.

Attis Healthcare aims to strictly comply with HIPAA regulations. Annual certification for all employees with a reasonable expectation of coming into contact with protected health information is required. Our customers and prospective customers are “Covered Entities” under HIPAA and its accompanying regulations. As such, Customer is required to make reasonable efforts to limit as necessary the disclosure of PHI as defined by HIPAA. To the extent that a Vendor or Customer has access to such PHI while supplying products or services or otherwise performing under the Order or complying with these Terms, Vendor or Customer will treat such PHI in accordance with the applicable Business Associate Addendum between the parties, including but not limited to the use of commercially reasonable safeguards to prevent the use or disclosure of PHI except as provided under the Order.

The Joint Commission on the Accreditation of Healthcare Organizations (JCAHO) applies, or may apply, to some of the laboratories that Attis Healthcare manages. When JCAHO does have an oversight role, the hospital laboratories that we manage are in compliance with their safety regulations. JCAHO’s focus is on healthcare systems. Today, most hospitals are accredited by JCAHO. Laboratories are part of these healthcare systems and are thereby required to comply with the JCAHO safety regulations. JCAHO regulations are extensive and numerous. They have very specific requirements on many safety matters. JCAHO also has a “deemed status” acknowledgement by the federal government.

Passed in 2010, the Affordable Care Act (“ACA”) affects virtually every aspect of health care in the country. In addition to establishing the framework for every individual to have health coverage, ACA enacted a number of significant health care reforms. Many of these reforms affect the coverage and plan designs that are provided by our health plan clients. As a result, these reforms impact a number of our services and business practices. Some significant ACA provisions are still being finalized (e.g., implementation of the excise tax on high-cost employer-sponsored health coverage has been delayed by Congress) and parts of ACA may still face potential Congressional changes, so the full impact of ACA on our Company is still uncertain.

| 5 |

Innovations Division

Attis Innovations, LLC

Attis Innovations (“Innovations”) focuses on producing sustainable materials and fuels from renewable sources at costs equal to or less than those otherwise produced from fossil fuels. By processing targeted feedstocks, we believe Innovations will be able to produce materials used in the following markets: bioplastics, consumer goods, adhesives, carbon fiber, renewable fuels, and green chemicals, among others.

We intend to leverage our expertise in waste streams and our technology development experience to harvest value from biomass. To this end, we have assembled a growing portfolio of technologies that are being designed and developed to refine biomass in a series of process steps that are analogous to petroleum refining, in which crude oil is sequentially processed into a wide range of products. Our patented and patent-pending lignin conversion and refining processes, which fractionate and convert cellulosic biomass into ethanol or butanol and a renewable alternative for petroleum-derived resins, were recently awarded a $3 million grant from the USDA.

Our ultimate plan for this business is to finance, build, own and operate facilities based on our technologies to generate shareholder value by producing and selling renewable fuels, plastics, resins and other carbon-neutral offsets from low-value lignin and other cellulosic feedstocks; including pulp and paper by-products, first generation biofuel by-products, and other overlooked carbon-containing residuals. The Company is continuing to evaluate acquisitions and other transactions, some of which include existing production assets that are ideal for co-location of facilities based on our technologies. First generation biofuel plants can be particularly favorable targets inasmuch as our technologies have been proven to have the potential to generate more income by converting and refining existing by-products as compared to the income of current plants using traditional methods.

Innovations is comprised of three divisions:

| ● | Attis R&D Services | |

| ● | Attis Biomaterials | |

| ● | Attis Biofuels |

Attis R&D Services

Beginning in January 2018, Attis R&D Services, through American Science and Technology Corporation (AST), holds a ‘for hire’ 15,000 sq. ft. R&D facility (the “AST Facility”) capable of processing almost any form of biomass and converting it into targeted materials for testing and evaluation purposes. This facility is a full-service pilot test facility, available to this industry and dedicated to developing innovative biobased products using its patented AST-Organosolv process to convert lignocellulosic biomass into high-value, bio-based chemicals and products. The AST Facility, located in Wausau, Wisconsin, operates at various scales from a laboratory level to multi-ton batches and is equipped with a wide range of biomass processing equipment to provide a unique opportunity to accelerate the advancement of the bio-based economy. The AST Facility was built through a series of grants and private funding to generate slightly positive cash flow on annual testing revenues between $0.9 to $1.3 million over the past three years. Innovations is in the process of executing its plan to upgrade the AST Facility to generate improved revenues.

Attis Biomaterials

Attis Biomaterials is intended to provide for the recovery and conversion of practically any form of biomass into targeted bio-based materials. Attis Biomaterials plans to produce and supply high-performance plant-derived materials, chemicals, and molecularly consistent feedstocks to manufacturing industries at costs competitive with those for materials otherwise derived from fossil fuels. Plastic, adhesives, and transportation fuels are typically produced from non-renewable materials such as crude oil and natural gas. Innovations is focusing on providing the same materials directly from biomass, which can be sustainably harvested and replanted. We believe Attis Biomaterials can cost-effectively recover greater amounts of high-quality sources of carbon-based feedstocks from biomass than those previously available, thereby substantially increasing the revenues and profits generated per unit of biomass harvested.

In addition to processing virgin biomass feedstocks, we believe Attis Biomaterials will also be able to recover lignin from byproduct streams from the pulp and paper industry, as well as from the cellulosic ethanol industry. Presently, these pulp and paper producers and biorefineries typically burn their lignin byproduct generating only about $50 per ton for its energy content, whereas Attis Biomaterials is expected to be able to result in the recovery of about 50% of the byproduct stream as a valuable lignin polymer that can instead be sold for $500 to $800 per ton.

| 6 |

The United States produces about 73 million metric tons of paper from about 219 million metric tons of trees. This paper industry does not target the recovery of lignin from its byproduct leaving more than 35 million metric tons of lignin available from this industry alone. Innovations’ technology is capable of recovering up to 30% of this lignin for use in higher valued markets. While the global demand for biomaterials cannot currently consume this volume of material, Innovations is collaborating with various entities to integrate our bio-based materials into traditional product offerings.

As an example, the team working with Innovations on a $3 million USDA grant to develop lignin into residential siding products is comprised of Oak Ridge National Laboratory, the University of Tennessee’s Center for Renewable Carbon, University of Wisconsin-Stevens Point, the Natural Resource Research Institute, Long Trail Sustainability, and Innovations’ research and development unit, American Science and Technology Corporation.

Innovations is engaging partners for services agreements for Attis Biomaterials, with revenue-generating operations expected to begin in the fourth quarter of 2018, following the Company’s acquisition of certain property. Additionally, Innovations has hired Emerging Fuels Technology to develop a method to convert the Innovations lignin into transportation fuels such as diesel and gasoline.

In order to meet the EPA’s biofuel production goals, more than 500 new traditional cellulosic ethanol facilities would need to be built by 2022. Because these traditional facilities do not currently recover a valuable form of lignin, they are unable to compete against fossil fuels due to the low revenues generated per unit of biomass consumed. Like pulp and paper producers, these cellulosic biorefineries burn the lignin they produce for an energy value of only about $50 per ton. Attis Biomaterials can allow these facilities to increase revenue and value by adding technology that would enable such facilities to recover the lignin. Further, the availability of this technology could result in the EPA requiring more strict compliance with existing regulations and granting fewer waivers for non-compliance, which in turn would cause a greater demand of Attis Biomaterials’ technology.

Attis Biofuels

Attis Biofuels is intended to produce biofuels from low-cost feedstocks. These feedstocks include cellulose, hemicellulose lignin, sugars, fats and vegetable oils.

Attis Biofuels plans to purchase sugars from Attis Biomaterials and to convert this sugar into ethanol. This form of ethanol is referred to as cellulosic ethanol and sold at a premium to corn derived ethanol due the additional renewable energy credits it receives.

In addition, Attis Biofuels plans to use its capital and energy efficient biodiesel and renewable diesel process technology to convert fats and oils into fuels. Attis Biofuels has designed a hybrid process technology that allows for the production of either biodiesel or renewable diesel depending on the market demand for each.

When producing biodiesel, Attis Biofuels’ process does not require the use of a catalyst; as a result, the system is able to produce biodiesel at an advantage of about a 10 to 30 cents per gallon over companies that use such other catalysts.

When producing renewable diesel, Attis Biofuels’ process consumes about 30-50% less hydrogen than those processes currently in production. This is accomplished by stripping glycerin from the triglycerides prior to hydroprocessing. Hydrogen accounts for between 25 and 60 cents of the processing cost associated with producing a single gallon of renewable diesel and the Attis Biofuels technology provides a cost advantage by reducing the amount of hydrogen consumed. Furthermore, the use of less hydrogen, reduces the energy conversion requirement and can increase incentive payments from places like California where Low Carbon Fuel Standards (“LCFS”) are in place to incentives more efficient fuel conversion.

Innovations is engaging partners for services agreements for Attis Biofuels, with revenue-generating operations expected to begin in the fourth quarter of 2018, following the Company’s acquisition of certain property. Attis Biofuels would use the same property and same facility as Attis Biomaterials.

Attis IP Holdings

In addition to the three divisions of Innovations, Attis IP Holdings is a company designated to hold and manage Innovations’ patent portfolio. This business unit will charge each of Innovations’ process subsidiaries a royalty fee to be used to account for the cost associated with managing and prosecuting the patents. The objective of this business unit is to be cash flow neutral.

Customers

Presently, Innovations does not have a fully commercialized system in operation; therefore, it currently has a limited customer base that is solely associated with its contract R&D service work out of its Wausau, WI biomass processing facility. Our plan is to target customers that will be feedstock providers for its fully commercialized process technologies once we have a fully commercialized system in operation.

| 7 |

Our Operating Strengths

Experienced Leadership

Innovations has an experienced management team that has a successful track record in multiple industries including waste and byproduct recovery, renewable fuel production, intellectual property development, plastics, federal and state policy initiatives and process and chemical engineering. Innovations division president is David Winsness who has over 25 years of experience in process engineering and technology development. Over the last 15 years, Mr. Winsness has worked in the corn-based ethanol industry in the US where he and his team developed and commercialized a patented process to extract corn oil from the backend of dry mill ethanol facilities for use as a feedstock in renewable fuel production and animal feed. Today, that technology is deployed at an estimated 92% in the US ethanol industry and is responsible for an estimated $750 million in annual revenue.

Innovations draws on the deep experience of its team and relies heavily on years of industry experience across multiple competencies to drive the development of its patented and patent-pending technologies to full commercialization as well as various biobased end product offerings.

Vertically Integrated Operations

Innovations vertically integrated operations enable us to control the entire biobased supply chain from feedstock to end product, allowing us to maximize revenues by tightly controlling input costs and increasing the gross margin on finished products. This starts with identifying and forming strategic partnerships with biomass suppliers who possess high-quality materials that are not currently being processed due to location or scale.

With a steady stream of inexpensive, high-quality biomass feedstock, Innovations is able to capitalize on its AST process technology that cost-effectively and efficiently processes and converts biomass into refined forms of commodities such as sugar and lignin polymers. Providing further flexibility is our technologies’ ability to process at varying scales economically, opening opportunities to process biomass feedstocks previously thought too difficult due to quantity available or location.

Innovations can market these materials independently or utilize them in downstream conversion systems that enable end-use product manufacturing of siding and other types of durable, thermoplastic products. This provides tremendous flexibility to sell intermediate biomaterials for further processing or end products, allowing us to maximize revenue throughout the supply chain and gain significant competitive advantages.

Technology Assets

Through a combination of intellectual property and proprietary know-how, we are well positioned to maintain and grow our competitive advantage in processing and end product offerings.

Through recent acquisitions and internal development, Innovations has a strong intellectual property base that comprises both issued patents and pending patent applications that cover a range of process and product applications. Below is a list of our current portfolio of issued patents:

| ● | US Patent #9,365,525 – System and Method for Extraction of Chemicals from Lignocellulosic Materials | |

| ● | US Patent #9,382,283 – Oxygen Assisted Organosolv Process, System, and Method for Delignification of Lignocellulosic Materials and Lignin Recovery | |

| ● | US Patent #9,815,985 – High-Performance Lignin-Acrylonitrile Polymer Blend Materials |

| 8 |

In addition to such patents, Innovations has a deep collection of pending patents, all of which are geared towards strengthening our existing issued patents, expanding our capabilities, and protections into other new and emerging applications. Like our issued patents, if granted, these will cover both process and products for various applications that Innovations currently engages in or will evaluate in the future.

Acquisition Integration

Innovations growth strategy includes the acquisition of assets and technologies that create synergies and diversify risk for its core business. We specifically target acquisitions that are either significantly enhanced by our existing technology or enable accelerated market opportunities and increased revenues for our business. These acquisitions include processing technology from American Science and Technology, advanced resin formulations with Advanced Lignin Biocomposites and a portfolio of biobased fillers from Genarex.

Our Growth Strategy

Growth of Existing Markets

We believe as oil prices rise, reserves dwindle, and as consumers become increasingly environmentally conscious, demand for fuels and consumer products generated by sustainable feedstocks will increase. Current federal and state initiatives mandate a gradual increase in low carbon fuels that will drive the market in the short-term. We believe our technology platform provides the most cost-competitive options for biobased fuels and products today, which will result in securing market share as demand increases.

Expand into New Markets

Innovations is currently marketing our products to customers as a simple way to make traditional products cheaper and ecofriendly. Our low CAPEX, low-value feedstocks, and unique conversion technology allow us to manufacture products with high-value properties at a lower cost. These durable, biobased materials will be able to offer solutions in applications that were previously limited due to cost and performance restrictions. In many cases, Innovations’ materials will be less expensive than even petroleum-based products, allowing for more sustainable, durable plastics to reach even more product spaces.

Innovations will continue to expand its renewable diesel technology to include a wider range of feedstocks and further refine its biomass separation byproducts to include various specialty green chemicals.

Industry Overview

During the 21st century, developed nations have prioritized research and commercialization of sustainable biofuels and biomaterials produced from renewable feedstocks. In the United States, the Energy Independence and Security Act of 2007 set statutory volumes of renewable fuels to be mixed into the domestic fuel supply with volumes increasing each year. The Congressional goal set for 2017 was 24 billion gallons of renewable fuel, however the EPA had to reduce the volume to 19.28 billion gallons mainly due to a lack of advanced biofuel production.

A large majority of the existing biofuels and biomaterials market is comprised of materials produced with technology and know-how that has been in use for hundreds of years. Innovation and commercialization efforts have proven to be expensive and insufficient to fuel industrial growth that was predicted at the turn of the 21st century. However, government incentives and increased consumer demand for sustainable materials remain, creating enormous opportunity for those that can develop cost-effective solutions.

| 9 |

Competition

Competition in advanced biofuels and biomaterials is expanding due to the growth of the industry, government incentives and the evolution of new technologies. However, in both its biorefinery and renewable biofuels divisions, Innovations technology platform holds an advantage over its competitors due to its low capital requirements.

Many of our competitors in the biorefining space generate revenue from only one product stream - cellulose. Innovations’ proprietary technology can create high-value products from all constituents of the feedstock - cellulose, lignin and hemicellulose. Innovations is not aware of a commercialized biorefinery that is capable of producing a melt-flowable lignin; most competitors burn their low-quality lignin for energy purposes that yield only about $50 to $100 per ton consumed, whereas Innovations’ melt-flowing lignin is valued at more than $500 per ton in multiple applications. Innovations’ melt-flowable lignin not only has a quality advantage over its competitors, but it is also safer to store and compound, as existing lignin recovery operations are subject to explosion under pneumatic transfer due to the small particle, dust-like properties of the dried lignin.

Sales and Marketing

Innovations is interested in markets that look to increase profits either by extracting the full potential of their byproduct streams or by reducing the costs of their inputs, and we believe Innovations’ technology platform is the solution. Out of our facility in Wausau, WI, contract R&D services are marketed to large agricultural and biomass processors that have underutilized biomass streams in their operations. These customers use our biomass separation and classification services to determine potential high-value applications for their residual byproducts. In many cases, these services are also used to find and evaluate feedstocks for new Innovations biorefineries.

Innovations’ biomaterial business markets plant-based products to companies looking to reduce cost while using sustainable materials. Target industries include large scale producers of durable plastics such as compounders and converters. Our customers are able to replace the more expensive petroleum resins with our plant-based resins and biofillers while retaining physical properties.

Government Controls

The Company is a party to a $3 million USDA grant to further develop the Innovations biorefinery process and end applications for our unique lignin product. The USDA is active in its monetary and political support for the biorefining industry, and the awarded grant demonstrates the agency’s support of Innovations’ technology platform and its ability to offer cost-effective solutions to the bioeconomy.

Regulation

Our business is subject to federal, state and local laws and regulations relating to the production of renewable fuels and materials, the protection of the environment, and the safety of our employees. The Clean Air Act and analogous state laws and regulations impose obligations related to emissions of air pollutants, including greenhouse gases. The Water Pollution Control Act, also known as the Clean Water Act, and analogous state laws and regulations govern discharges into waters. The Occupational Safety and Health Act and analogous state laws and regulations govern the protection of the health and safety of employees.

In addition, some state and federal laws and regulations support the industries in which we operate. The Energy Independence and Security Act of 2007 mandates the increased use of renewable fuels in the US fuel supply which is expected to reach 36 billion gallons in 2022. Compliance with the law is overseen by the EPA and executed through a program called the Renewable Fuel Standard (RFS) where Renewable Identification Numbers (RINs) are used to show compliance. RINs are attached to renewable fuels by producers and detached when the renewable fuel is blended with transportation fuel or traded on the open market. The market price of detached RINs props up the price of eligible renewable fuels.

| 10 |

In California, the state’s Air Resources Board oversees the Low Carbon Fuel Standard Program which was first enacted by executive order in 2007 and since amended by the state legislature. The program requires a 7.5% reduction in average carbon intensity of gasoline and diesel transportation fuels from 2010 to 2020. Eligible fuels, such as renewable diesel, receive a premium when sold into the California market based on their carbon reductions and the daily price of tradable carbon credits.

Seasonality

A potential risk in processing biomass is the degree to which the feedstock varies seasonally and is often harvested over a short period of time. Crops that are harvested once annually pose an additional complication of storage and proper maintenance creating a need for additional infrastructure and handling. We plan to hedge this risk by targeting feedstock streams that are less seasonal and that are consistently available over the course of the year to minimize storage infrastructure and potential feedstock degradation.

WASTE DIVISION

Upon the closing of the Purchase Agreement, which is expected to occur on or about April 17, 2018, the Company will have completely divested the Waste Business and the business described under this section “WASTE DIVISION” will cease to be a part of the Company.

Missouri Waste Operations

Here to Serve – Missouri Waste Division, LLC d/b/a Meridian Waste

Here to Serve – Missouri Waste Division, LLC (“HTS Waste”) is a non-hazardous solid waste management company providing collection services for approximately 45,000 commercial, industrial and residential customers in Missouri. We own one collection operation based out of Bridgeton, Missouri. Approximately 100% of HTS Waste’s 2016 and 2015 revenue was from collection, utilizing over 60 collection vehicles.

HTS Waste began non-hazardous waste collection operations in May 2014 upon the acquisition of nearly all of the assets from Meridian Waste Services, LLC that in turn became the core of our operations. From our formation through today, we have begun to create the infrastructure needed to expand our operations through acquisitions and market development opportunities.

Christian Disposal, LLC; FWCD

Effective December 22, 2015, the Company consummated the closing of the Amended and Restated Membership Interest Purchase Agreement, dated October 16, 2015, by and among the Company, Timothy M. Drury, Christian Disposal LLC (“Christian Disposal”), FWCD, LLC (“FWCD”), Missouri Waste and Georgia Waste, as amended by that certain First Amendment thereto, dated December 4, 2015, pursuant to which Christian Disposal became a wholly-owned subsidiary of the Company in exchange for: (i) Thirteen Million Dollars ($13,000,000), subject to working capital adjustment, (ii) 87,500 shares of the Company’s Common Stock, (iii) a Convertible Promissory Note in the amount of One Million Two Hundred Fifty Thousand Dollars ($1,250,000), bearing interest at 8% per annum and (iv) an additional purchase price of Two Million Dollars ($2,000,000), due upon completion of an extension under a certain contract to which Christian Disposal is party (the “Additional Purchase Price”), each payable to the former stockholders of Christian Disposal. The Additional Purchase Price will not become due, because an extension was not, and will not be, granted in connection with the relevant contract.

| 11 |

Christian Disposal, along with its subsidiary, FWCD, is a non-hazardous solid waste management company providing collection and transfer services for approximately 35,000 commercial, industrial and residential customers in Missouri. Christian Disposal’s collection operation is based out of Winfield, Missouri. Along with operations in Winfield, Christian Disposal operates two transfer stations, in O’Fallon, Missouri and St. Peters, Missouri, and owns one transfer station, in Winfield, Missouri. Almost all of Christian Disposal and FWCD’s 2015 revenue and revenue in 2016 was from collection and transfer, utilizing over 35 collection vehicles.

Christian Disposal began non-hazardous waste collection operations in 1978. Our acquisition of Christian Disposal is a key element of our strategy to create the vertically integrated infrastructure needed to expand our operations.

Meridian Land Company, LLC (Assets of Eagle Ridge Landfill & Hauling)

Effective December 22, 2015, Meridian Land Company, LLC (“Meridian Land Company”), a wholly-owned subsidiary of the Company, consummated the closing of that certain Asset Purchase Agreement, dated November 13, 2015, by and between Meridian Land Company and Eagle Ridge Landfill, LLC (“Eagle”), as amended by that certain Amendment to Asset Purchase Agreement, dated December 18, 2015, to which the Company and WCA Waste Corporation are also party, pursuant to which the Company, through Meridian Land Company, purchased from Eagle a landfill in Pike County, Missouri (the “Eagle Ridge Landfill”) and substantially all of the assets used by Eagle related to the Eagle Ridge Landfill, including certain debts, in exchange for $9,506,500 in cash, subject to a working capital adjustment.

The Eagle Ridge Landfill is currently permitted to accept municipal solid waste. The Eagle Ridge Landfill is located in Bowling Green, Missouri. Meridian Land Company currently owns 265 acres at Eagle Ridge with 56.7 acres permitted and constructed to receive waste.

In addition to the Eagle Ridge Landfill, the Company operates, through Meridian Land Company, hauling operations in Bowling Green, Missouri, servicing commercial, residential and roll off customers in this market. The Company will be looking to expand its footprint in the market through an aggressive sales and marketing strategy, as well as through additional acquisitions.

Virginia Waste Operations

The CFS Group, LLC; The CFS Disposal & Recycling Services, LLC; RWG5, LLC

On February 15, 2017, the Company consummated the closing of the Membership Interest Purchase Agreement (the “Virginia Purchase Agreement”) by and between the Company and Waste Services Industries, LLC ("Seller"), pursuant to which the Company purchased from Seller 100% of the membership interests of The CFS Group, LLC (“CFS”), The CFS Disposal & Recycling Services, LLC (“CFS Disposal”), RWG5, LLC (“RWG5” and, together with CFS and CFS Disposal, the “CFS Companies”), in exchange for the following: (i) $40,000,000 in cash and assumption of certain capital leases, subject to a working capital adjustment in accordance with Section 2.6 of the Virginia Purchase Agreement and (ii) 500,000 shares of the Company’s common stock.

Collectively, the CFS Companies are non-hazardous solid waste management companies providing collection and transfer services for more than 30,000 commercial, industrial and residential customers in Virginia, with its main facility in Petersburg, Virginia and satellite facilities in Lunenberg, Virginia and Prince George, Virginia. Along with the collection operation in Petersburg, the CFS Companies operate a transfer station, in Lunenberg, and two owned landfills, in Petersburg and Lunenberg. Approximately 81% of the CFS Companies’ 2015 revenue was from collection and transfer, utilizing over 60 collection vehicles.

Our acquisition of the CFS Companies is a key element of our strategy to create the vertically integrated infrastructure needed to expand our operations.

| 12 |

Collection Services

Meridian, through its subsidiaries, provides solid waste collection services to approximately 65,000 industrial, commercial and residential customers in the Metropolitan St. Louis, Missouri area, and, recently, approximately 33,000 in Virginia.

In our commercial collection operations, we supply our customers with waste containers of various types and sizes. These containers are designed so that they can be lifted mechanically and emptied into a collection truck to be transported to a disposal facility. By using these containers, we can service most of our commercial customers with trucks operated by a single employee. Commercial collection services are generally performed under service agreements with a duration of one to five years with possible renewal options. Fees are generally determined by such considerations as individual market factors, collection frequency, the type of equipment we furnish, the type and volume or weight of the waste to be collected, the distance to the disposal facility and the cost of disposal.

Residential solid waste collection services often are performed under contracts with municipalities, which we generally secure by competitive bid and which give us exclusive rights to service all or a portion of the homes in these municipalities. These contracts usually range in duration from one to five years with possible renewal options. Generally, the renewal options are automatic upon the mutual agreement of the municipality and the provider; however, some agreements provide for mandatory re-bidding. Alternatively, residential solid waste collection services may be performed on a subscription basis, in which individual households or homeowners’ or similar associations contract directly with us. In either case, the fees received for residential collection are based primarily on market factors, frequency and type of service, the distance to the disposal facility and the cost of disposal.

Additionally, we rent waste containers and provide collection services to construction, demolition, and industrial sites and some larger commercial locations. We load the containers onto our vehicles and transport them with the waste to a landfill, a transfer station, or a recycling facility for disposal. We refer to this as “roll-off” collection. Roll-off collection services are generally performed on a contractual basis. Contract terms tend to be shorter in length, in some cases having terms of only six months, and may vary according to the customers’ underlying projects.

Transfer and Disposal Services

Landfills are the main depository for solid waste in the United States. Solid waste landfills are built, operated, and tied to a state permit under stringent federal, state and local regulations. Currently, solid waste landfills in the United States must be designed, permitted, operated, closed and maintained after closure in compliance with federal, state and local regulations pursuant to Subtitle D of the Resource Conservation and Recovery Act of 1976, as amended. We do not operate any hazardous waste landfills, which may be subject to even greater regulations. Operating a solid waste landfill includes excavating, constructing liners, continually spreading and compacting waste and covering waste with earth or other inert material as required, final capping, closure and post-closure monitoring. The objectives of these operations are to maintain sanitary conditions, to ensure the best possible use of the airspace and to prepare the site so that it can ultimately be used for other end use purposes.

Our transfer stations allow us to consolidate waste for subsequent transfer in larger loads, thereby making disposal in our otherwise remote landfills economically feasible. A transfer station is a facility located near residential and commercial collection routes where collection trucks take the solid waste that has been collected. The waste is unloaded from the collection trucks and reloaded onto larger transfer trucks for transportation to a landfill for final disposal. As an alternative to operating a transfer station directly, we could negotiate the use of a transfer station owned by a private party or operated by a competitor, which may not be as profitable as operating our own transfer station. In addition to increasing our ability to internalize the waste that our collection operations collect, using transfer stations reduces the costs associated with transporting waste to final disposal sites because the trucks we use for transfer have a larger capacity than collection trucks, thus allowing more waste to be transported to the disposal facility on each trip.

| 13 |

Our Operating Strengths

Vertically Integrated Operations

The vertical integration of our operations allows us to manage the waste stream from the point of collection through disposal, which we hope will enable us to maximize profit by controlling costs and gaining competitive advantages, while still providing high-quality service to our customers. In the St. Louis market, because we have integrated our network of collection, transfer and disposal assets, primarily using our own resources, we generate a steady, predictable stream of waste volume and capture an incremental disposal margin. We charge tipping fees to third-party collection service providers for the use of our transfer stations or landfills, providing a source of recurring revenue. We believe the internalization of waste provides us with a significant cost advantage over our competitors, positioning us well to win additional profitable business through new customer acquisition and municipal contract awards. We also believe this vertically integrated structure enables us to quickly and efficiently integrate future acquisitions of transfer stations, collection operations or landfills into our current operations.

Landfill Assets

We now have three active and strategically located landfills at the core of our integrated operations which we believe provides us a significant competitive advantage, in that we do not need to use our competitors’ landfills. Our landfills have substantial remaining airspace.

The valuation of our landfill assets was based on approximately 4 million cubic yards (cy) total in remaining airspace and approximately 32.7 million cy total in expansion airspace. These landfill assets are comprised of the Eagle Ridge Landfill, the Tri-City Landfill and the Lunenberg Landfill. The Company acquired the Tri-City Landfill and the Lunenberg Landfill on February 15, 2017. There have not been any significant changes.

The Eagle Ridge Landfill has approximately 1.3 million cy of remaining airspace and approximately 30 million cy of expansion airspace, with an estimated life through approximately June 2021. Expenses were recorded based on a blended average rate of $20.71 per ton, and there have been no recent significant changes to such rates.

The Tri-City Landfill has approximately 1.3 million cy of remaining airspace and approximately 700,000 cy of expansion airspace, with an estimated life through approximately September 2021. The Company is also pursuing opportunities to acquire additional expansion airspace. Expenses were recorded based on a blended average rate of $18.74 per ton, and there have been no recent significant changes to such rates.

The Lunenberg Landfill, which has approximately 1.3 million cy of remaining airspace and approximately 4.6 million cy of expansion airspace, with an estimated life through approximately October 2024. The Company is also pursuing opportunities to acquire additional expansion airspace. Expenses were recorded based on a blended average rate of $10.93 per ton, and there have been no recent significant changes to such rates.

| 14 |

The value of our landfills may be further enhanced by synergies associated with our vertically integrated operations, including our transfer stations, which enable us to cover a greater geographic area surrounding the landfills, and provide competitive advantages in that we would not need to use our competitors’ landfills. In our experience there has generally been a shift towards fewer, larger landfills, which has resulted in landfills that are generally located farther from population centers, with waste being transported longer distances between collection and disposal, typically after consolidation at a transfer station. With landfills, transfer stations and collection services in place, we aim to provide vertically integrated operations that cover the substantial geographic area surrounding the landfill.

Long-Term Contracts

In Missouri, we serve approximately 65,000 residential, commercial, and construction and industrial customers, with no single customer representing more than 11% of revenue in 2016. Our municipal customer relationships are generally supported by contracts ranging from three to seven years in initial duration most with subsequent renewal periods, and we have a historical renewal rate of 100% with such customers. Our standard service agreement is a five-year renewable agreement. We believe our customer relationships, long-term contracts and exceptional retention rate provide us with a high degree of stability as we continue to grow.

Customer Service

We maintain a central focus on customer service and we pride ourselves on trying to consistently exceed our customers’ expectations. We believe investing in our customers’ satisfaction will ultimately maximize customer loyalty price stability.

Commitment to Safety

The safety of our employees and customers is extremely important to us and we have a strong track record of safety and environmental compliance. We constantly review and assess our policies, practices and procedures in order to create a safer work environment for our employees and to reduce the frequency of workplace injuries.

Our Strategy

Sale of Waste Assets

Following the approvals of the Special Committee of the Board of Directors of the Company and the Meridian Board, on February 20, 2018, Seller Parties (as defined in the Purchase Agreement), Meridian Waste Acquisitions, LLC (“Buyer”), a Delaware limited liability company formed by Warren Equity Partners Fund II and Jeffrey S. Cosman, an officer, director and majority shareholder of Meridian (“Cosman”), entered into an Equity Securities Purchase Agreement (the “Purchase Agreement”). Upon the terms and subject to the conditions set forth in the Purchase Agreement, Buyer will purchase from Seller (as defined in the Purchase Agreement) all of the membership interests in each of the direct wholly-owned subsidiaries of Seller (the “Acquired Parent Entities” and together with each direct and indirect subsidiary of the Acquired Parent Entities, the “Acquired Entities”), which constitute the Waste Business, and each such Acquired Parent Entity will continue as wholly-owned subsidiary of Buyer (the “Transaction”).

Pursuant to the Purchase Agreement, upon the closing of the Transaction (the “Closing”), Buyer will pay Seller Parties $3.0 million in cash; satisfy $75.8 million of outstanding indebtedness under the Credit Agreement; and assume the Acquired Entities’ obligations under certain equipment leases and other operating indebtedness. Following the Closing, the Seller Parties expect they would retain approximately $6.6 million of outstanding indebtedness under the Credit Agreement and all other assets and obligations of Meridian, the Technologies Business and the Innovations Business. At the Closing, Meridian will issue to Buyer a warrant to purchase shares of common stock, par value $0.025, of Meridian, equal to two percent of the issued and outstanding shares of capital stock of Meridian on a fully-diluted basis as of Closing (subject to adjustment as set forth therein and as more fully described in the Purchase Agreement) on such terms to be determined by Meridian and Buyer. The Purchase Agreement also provides for Meridian shareholders who properly exercise dissenters’ rights under New York law to seek appraisal in accordance with the New York Business Corporation Law, as amended.

| 15 |

The consummation of the Transaction is subject to customary and other closing conditions, including (i) receiving the approval of holders of at least two-thirds majority of the voting power of the outstanding Company common stock pursuant to the New York Business Corporation Law (the “Meridian Shareholder Approval”), (ii) the Buyer receiving the proceeds of its debt financing, and (iii) the absence of legal restraints preventing the consummation of the Transaction.

The Purchase Agreement contains certain customary covenants, including covenants providing (i) for each of the parties to use reasonable best efforts to cause the transaction to be consummated and (ii) for the Seller Parties to cause the Acquired Entities to conduct their business in the ordinary course consistent with past practice during the interim period between the execution of the Purchase Agreement and completion of the Transaction. The Purchase Agreement also provides that during the period before the Meridian Shareholder Approval is obtained, the Board of Directors of Meridian can consider an unsolicited alternative proposal that it concludes in good faith is more favorable from a financial point of view to the shareholders of Meridian than the Transaction.

The Purchase Agreement contains certain customary termination rights of Seller Parties and Buyer.

In addition, Buyer may terminate the Purchase Agreement if (A) the shareholders representing the requisite majority for the Meridian Shareholder Approval and the written consent of Seller’s sole shareholder shall not have been delivered to the Buyer and the Seller Parties by 12:00 p.m. Eastern Time on the third business day immediately following the date of the Purchase Agreement and (B) at any time prior to the 21st day from the date of the Purchase Agreement, if the Buyer shall have discovered any matter, condition, or circumstance with respect to the Acquired Entities or the business of the Acquired Entities during its due diligence investigation that has a material effect, in the Buyer’s sole discretion, on the Buyer’s willingness to proceed with the transactions contemplated herein and in the other transaction documents under the terms and conditions set forth therein. The Purchase Agreement contains specified termination rights for the parties and provides that, in connection with the termination of the Purchase Agreement under specified circumstances, Seller Parties will be required to pay to Buyer a “termination fee” up to $3.5 million plus certain fees and expenses of Buyer.

On February 23, 2018, certain shareholders of the Company holding in aggregate approximately 66.78% of the outstanding voting shares of the Company as of the record date, February 19, 2018, executed an irrevocable written consent approving the following actions: (the “Written Consent”):

| 1. | the sale of the membership interests of each of the direct wholly-owned subsidiaries of Seller (collectively, the “Acquired Parent Entities”), comprising, with the Acquired Parent Entities’ subsidiaries (collectively, with the Acquired Parent Entities, the “Acquired Entities”), the Company’s Solid Waste Business and constituting substantially all of the assets of the Company, pursuant to the terms and conditions set forth in the Purchase Agreement and the consummation of the transactions described therein; and |

| 2. | the amendment of the Company’s Certificate of Incorporation, as amended, upon the closing of the Transaction to change the Company’s corporate name from Meridian Waste Solutions, Inc. to Attis Industries Inc. |

In the event that the sale of the Waste Business is not consummated, the Company intends to continue operation of the Waste Business as it evaluates further strategic alternatives, including pursuing the sale of the Waste Business to other purchasers.

Waste Industry Overview

The non-hazardous solid waste industry can be divided into the following three categories: collection, transfer and disposal services. In our management’s experience, companies engaging in collection and/or transfer operations of solid waste typically have lower margins than those additionally performing disposal service operations. By vertically integrating collection, transfer and disposal operations, operators seek to capture significant waste volumes and improve operating margins.

During the past four decades, our industry has experienced periods of substantial consolidation activity; however, we believe significant fragmentation remains. We believe that there are two primary factors that lead to consolidation:

| ● | stringent industry regulations have caused operating and capital costs to rise, with many local industry participants finding these costs difficult to bear and deciding to either close their operations or sell them to larger operators; and | |

| ● | larger operators are increasingly pursuing economies of scale by vertically integrating their operations or by utilizing their facility, asset and management infrastructure over larger volumes and, accordingly, larger solid waste collection and disposal companies aim to become more cost-effective and competitive by controlling a larger waste stream and by gaining access to significant financial resources to make acquisitions. |

| 16 |

Competition

The solid waste collection and disposal industry is highly competitive and, following consolidation, remains fragmented, and requires substantial labor and capital resources. The industry presently includes large, publicly-held, national waste companies such as Republic Services, Inc, Waste Connections, Inc., Advanced Disposal, Inc. and Waste Management, Inc., as well as numerous other public and privately-held waste companies. Our existing market and certain of the markets in which we will likely compete are served by one or more of these companies, as well as by numerous privately-held regional and local solid waste companies of varying sizes and resources, some of which have accumulated substantial goodwill in their markets. We also compete with operators of alternative disposal facilities and with counties, municipalities and solid waste districts that maintain their own waste collection and disposal operations. Public sector operations may have financial advantages over us because of potential access to user fees and similar charges, tax revenues and tax-exempt financing.

We compete for collection based primarily on geographic location and the price and quality of our services. From time to time, our competitors may reduce the price of their services in an effort to expand their market share or service areas or to win competitively bid municipal contracts. These practices may cause us to reduce the price of our services or, if we elect not to do so, to lose business.

Our management has observed significant consolidation in the solid waste collection and disposal industry, and, as a result of this perceived consolidation, we encounter competition in our efforts to acquire landfills, transfer stations and collection operations. Competition exists not only for collection, transfer and disposal volume but also for acquisition candidates. We generally compete for acquisition candidates with large, publicly-held waste management companies, private equity backed firms as well as numerous privately-held regional and local solid waste companies of varying sizes and resources. Competition in the disposal industry may also be affected by the increasing national emphasis on recycling and other waste reduction programs, which may reduce the volume of waste deposited in landfills. Accordingly, it may become uneconomical for us to make further acquisitions or we may be unable to locate or acquire suitable acquisition candidates at price levels and on terms and conditions that we consider appropriate, particularly in markets we do not already serve.

Sales and Marketing

We focus our marketing efforts on increasing and extending business with existing customers, as well as increasing our new customer base. Our sales and marketing strategy is to provide prompt, high quality, comprehensive solid waste collection to our customers at competitive prices. We target potential customers of all sizes, from small quantity generators to large companies and municipalities. Because the waste collection and disposal business is a highly localized business, most of our marketing activity is local in nature.

Government Contracts

We are party to contracts with municipalities and other associations and agencies. Many of these contracts are or will be subject to competitive bidding. We may not be the successful bidder, or we may have to substantially lower prices in order to be the successful bidder. In addition, some of our customers may have the right to terminate their contracts with us before the end of the contract term.

Municipalities may annex unincorporated areas within counties where we provide collection services, and as a result, our customers in annexed areas may be required to obtain service from competitors who have been franchised or contracted by the annexing municipalities to provide those services. Some of the local jurisdictions in which we currently operate grant exclusive franchises to collection and disposal companies, others may do so in the future, and we may enter markets where franchises are granted by certain municipalities, thereby reducing the potential market opportunity for us.

| 17 |

Regulation

Our business is subject to extensive and evolving federal, state and local environmental, health, safety and transportation laws and regulations. These laws and regulations are administered by the U.S. Environmental Protection Agency, or EPA, and various other federal, state and local environmental, zoning, air, water, transportation, land use, health and safety agencies. Many of these agencies regularly inspect our operations to monitor compliance with these laws and regulations. Governmental agencies have the authority to enforce compliance with these laws and regulations and to obtain injunctions or impose civil or criminal penalties in cases of violations. We believe that regulation of the waste industry will continue to evolve, and we will adapt to future legal and regulatory requirements to ensure compliance.

The permit for our landfill requires us to post a closure bond, which currently stands at approximately $7.4 million, with premiums in the approximate amount of $250,000.