Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - POTOMAC FUTURES FUND LP | d101874dex312.htm |

| EX-32.2 - EX-32.2 - POTOMAC FUTURES FUND LP | d101874dex322.htm |

| EX-31.1 - EX-31.1 - POTOMAC FUTURES FUND LP | d101874dex311.htm |

| EX-3.2(C) - EX-3.2(C) - POTOMAC FUTURES FUND LP | d101874dex32c.htm |

| EX-32.1 - EX-32.1 - POTOMAC FUTURES FUND LP | d101874dex321.htm |

| EX-3.1(K) - EX-3.1(K) - POTOMAC FUTURES FUND LP | d101874dex31k.htm |

| EX-10.5(D) - EX-10.5(D) - POTOMAC FUTURES FUND LP | d101874dex105d.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-50735

| POTOMAC FUTURES FUND L.P. | ||||

| (Exact name of registrant as specified in its charter) |

| New York | 13-3937275 | |||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| c/o Ceres Managed Futures LLC 522 Fifth Avenue New York, New York 10036 |

||||

| (Address and Zip Code of principal executive offices) | ||||

|

(855) 672-4468 |

||||

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Redeemable Units of Limited Partnership Interest

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to section 13 or section 15(d) of the Act.

Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.)

Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [X].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated filer Non-accelerated filer X Smaller reporting company

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes No X

Limited Partnership Redeemable Units with an aggregate value of $27,476,555 were outstanding and held by non-affiliates as of the last business day of the registrants most recently completed second fiscal quarter.

As of February 29, 2016, 16,662.0958 Limited Partnership Redeemable Units were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

[None]

PART I

Item 1. Business.

(a) General Development of Business. Potomac Futures Fund L.P. (the “Partnership”) is a limited partnership organized on March 14, 1997 under the partnership laws of the State of New York to engage, directly or indirectly, in the speculative trading of a diversified portfolio of commodity interests including futures, forward, option and swap contracts. The sectors traded include currencies, energy, grains, indices, U.S. and non-U.S. interest rates, livestock, metals and softs. The Partnership commenced trading operations on October 1, 1997. The commodity interests that are traded indirectly by the Partnership through its investment in CMF Campbell Master Fund L.P. (the “Master”) are volatile and involve a high degree of market risk. The General Partner (defined below) may also determine to invest up to all of the Partnership’s assets (directly or indirectly through its investment in the Master) in United States (“U.S.”) Treasury bills and/or money market mutual funds, including money market mutual funds managed by Morgan Stanley or its affiliates.

Beginning April 22, 1997, 200,000 redeemable units of limited partnership interest (“Redeemable Units”) were offered to qualified investors at $1,000 per Redeemable Unit for a period of ninety days, subject to increase for up to an additional sixty days at the sole discretion of the general partner. Between April 22, 1997 (commencement of the offering period) and September 30, 1997, 1,383 Redeemable Units were sold. Proceeds of the offering were held in an escrow account and were transferred, along with the general partner’s contribution of $1,400,000 to the Partnership’s trading account on October 1, 1997 when the Partnership commenced trading. The Partnership privately and continuously offers Redeemable Units in the Partnership to qualified investors. There is no maximum number of Redeemable Units that may be sold by the Partnership. Subscriptions and redemptions of Redeemable Units and general partner contributions and redemptions for the years ended December 31, 2015, 2014 and 2013 are reported in the Statements of Changes in Partners’ Capital on page 36 under “Item 8. Financial Statements and Supplementary Data.”

Ceres Managed Futures LLC, a Delaware limited liability company, acts as the general partner (the “General Partner”) and commodity pool operator of the Partnership. The General Partner is wholly owned by Morgan Stanley Smith Barney Holdings LLC (“MSSB Holdings”). MSSB Holdings is ultimately owned by Morgan Stanley. Morgan Stanley is a publicly held company whose shares are listed on the New York Stock Exchange. Morgan Stanley is engaged in various financial services and other businesses. Prior to June 28, 2013, Morgan Stanley indirectly owned a majority equity interest in MSSB Holdings and Citigroup Inc. indirectly owned a minority interest in MSSB Holdings. Prior to July 31, 2009, the date as of which MSSB Holdings became its owner, the General Partner was wholly owned by Citigroup Financial Products Inc., a wholly owned subsidiary of Citigroup Global Markets Holdings Inc., the sole owner of which is Citigroup Inc. All trading decisions for the Partnership are made by Campbell & Company, Inc. (the “Advisor”).

On January 1, 2005, the Partnership allocated substantially all of its capital to the Master, a limited partnership organized under the partnership laws of the State of New York. The Partnership purchased 173,788.6446 units of the Master with cash equal to $172,205,653 and a contribution of open commodity futures and forward contracts with a fair value of $1,582,992. The Master permits accounts managed by the Advisor using the Campbell Managed Futures Portfolio Program (formerly, Financial, Metal & Energy Large Portfolio Program), a proprietary, systematic trading program, to invest together in one trading vehicle. A description of the trading activities and focus of the Advisor is included on page 15 under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The General Partner is also the general partner of the Master. During the years ended December 31, 2015 and 2014, the Master’s commodity broker was Morgan Stanley & Co. LLC (“MS&Co.”), a registered futures commission merchant. During prior periods included in this report, Citigroup Global Markets Inc. (“CGM”) also served as a commodity broker. Individual and pooled accounts currently managed by the Advisor, including the Partnership, are permitted to be limited partners of the Master. The General Partner and the Advisor believe that trading through this master/feeder structure promotes efficiency and economy in the trading process. Expenses to investors as a result of the investment in the Master are approximately the same and redemption rights are not affected.

The financial statements of the Master, including the Condensed Schedules of Investments, are contained elsewhere in this report and should be read together with the Partnership’s financial statements.

1

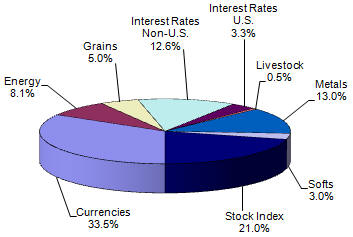

For the period January 1, 2015 through December 31, 2015, the approximate average market sector allocation for the Partnership was as follows:

Potomac

As of December 31, 2015 and 2014, the Partnership owned approximately 100.0% of the Master. The Partnership intends to continue to invest substantially all of its assets in the Master. The performance of the Partnership is directly affected by the performance of the Master.

The Master’s trading of futures, forward, swap and option contracts, if applicable, on commodities is done primarily on U.S. commodity exchanges and foreign commodity exchanges. During the years ended December 31, 2015 and 2014, the Master engaged in such trading through commodity brokerage accounts maintained with MS&Co. a registered futures commission merchant. During a prior period included in this report, CGM also served as a commodity broker.

The General Partner and each limited partner share in the profits and losses of the Partnership in proportion to the amount of Partnership interest owned by each, except that no limited partner shall be liable for obligations of the Partnership in excess of its initial capital contribution and profits, if any, net of distributions and losses, if any

The Partnership will be liquidated upon the first of the following to occur: December 31, 2017; the net asset value per Redeemable Unit falls below $400 as of the close of any business day; or under certain other circumstances as defined in the Limited Partnership Agreement of the Partnership, as amended or restated from time to time (the “Limited Partnership Agreement”).

In July 2015, the General Partner delegated certain administrative functions to SS&C Technologies, Inc., a Delaware corporation, currently doing business as SS&C GlobeOp (the “Administrator”). Pursuant to a Master Services Agreement, the Administrator furnishes certain administrative, accounting, regulatory, reporting, tax and other services as agreed from time to time. In addition, the Administrator maintains certain books and records of the Partnership. The costs of retaining the Administrator will be allocated among the pools operated by the General Partner, including the Partnership.

The General Partner administers the business and affairs of the Partnership. Effective October 1, 2014, the Partnership pays the General Partner a monthly General Partner fee (formerly, the administrative fee) in return for its services to the Partnership equal to 1/12 of 1% (1% per year) of month-end Net Assets of the Partnership. Month-end Net Assets, for the purpose of calculating the General Partner fees, are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s incentive fee accruals, the monthly management fee, the General Partner fee and any redemptions or distributions as of the end of such month. This fee may be increased or decreased at the discretion of the General Partner.

The General Partner, on behalf of the Partnership, has entered into a management agreement (the “Management Agreement”) with the Advisor, a registered commodity trading advisor. The advisor is not affiliated with the General Partner or MS&Co./CGM. The Advisor is not responsible for the organization or operation of the Partnership. The Management Agreement provides that the Advisor has discretion in determining the investment of the assets of the Partnership allocated to the Advisor by the General Partner. The Partnership pays a monthly management fee equal to 1/12 of 1.5% (1.5% per year) of month-end Net Assets allocated to the Advisor as of the end of each month. Prior to June 1, 2014, the Partnership paid a monthly management fee equal to 1/6 of 1% (2% per year) of month-end Net Assets allocated to the Advisor. Month-end Net Assets, for the purpose of calculating management fees, are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s incentive fee accrual, the monthly management fee, the General Partner fee and any redemptions or distributions as of the end of such month. The Management Agreement may be terminated upon notice by either party.

2

In addition, the Partnership is obligated to pay the Advisor an incentive fee, payable quarterly, equal to 20% of the New Trading Profits, as defined in the Management Agreement, earned by the Advisor for the Partnership during each calendar quarter. The Advisor will not be paid incentive fees until the Advisor recovers the net loss incurred and earns additional new trading profits for the Partnership.

In allocating substantially all of the assets of the Partnership to the Advisor, the General Partner considered the Advisor’s past performance, trading style, volatility of markets traded and fee requirements. The General Partner may modify or terminate the allocation of assets to the Advisor at any time.

During the third quarter of 2013, the Partnership entered into a Customer Agreement with MS&Co. (the “MS&Co. Customer Agreement”) and during the fourth quarter of 2013, the Partnership entered into a Selling Agent Agreement with Morgan Stanley Smith Barney LLC, doing business as Morgan Stanley Wealth Management (“Morgan Stanley Wealth Management”) (the “Selling Agreement”). Prior to and during part of the third quarter of 2013, the Partnership was party to a Customer Agreement with CGM (the “CGM Customer Agreement”). The Partnership has terminated the CGM Customer Agreement.

Under the CGM Customer Agreement, the Partnership paid CGM a monthly brokerage fee equal to 5.5% per year of month-end Net Assets in lieu of brokerage fees on a per trade basis. Month-end Net Assets, for the purpose of calculating brokerage fees, were Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s brokerage fees, incentive fee accrual, the monthly management fee and other expenses and any redemptions or distributions as of the end of such month. The Partnership paid exchange, service, clearing, user, give-up, floor brokerage and National Futures Association (“NFA”) fees (collectively the “CGM clearing fees”) through its investment in the Master. The CGM clearing fees were allocated to the Partnership based on its proportionate share of the Master. During the term of the CGM Customer Agreement, all of the Partnership’s assets that were not held in the Master’s accounts at CGM were deposited in the Partnership’s account at CGM. The Partnership’s cash was deposited by CGM in segregated bank accounts to the extent required by Commodity Futures Trading Commission regulations. CGM paid the Partnership interest on 80% of the average daily equity maintained in cash in the Partnership’s (or the Partnership’s allocable portion of the Master’s) brokerage account at a 30-day U.S. Treasury bill rate determined weekly by CGM based on the average non-competitive yield on 3-month U.S. Treasury bills maturing 30 days from the date on which such weekly rate is determined.

Under the MS&Co. Customer Agreement and the foreign exchange brokerage account agreement (described in Note 4, “Trading Activities”), the Partnership pays trading fees for the clearing and, where applicable, the execution of transactions as well as exchange, clearing, user, give-up, floor brokerage and NFA fees (collectively the “MS&Co. clearing fees” and together with the CGM clearing fees, the “clearing fees”) through its investment in the Master. Clearing fees will be paid for the life of the Partnership, although the rate at which such fees are paid may be changed. The MS&Co. clearing fees are allocated to the Partnership based on its proportionate share of the Master. All of the Partnership’s assets not held in the Master’s accounts at MS&Co. are deposited in the Partnership’s account at MS&Co. The Partnership’s cash is deposited by MS&Co. in segregated bank accounts to the extent required by Commodity Futures Trading Commission regulations. MS&Co. has agreed to pay the Partnership interest on 80% of the average daily equity maintained in cash in the Partnership’s (or the Partnership’s allocable portion of the Master’s) brokerage account at the rate equal to the monthly average of the 4-week U.S. Treasury bill discount rate. The MS&Co. Customer Agreement may generally be terminated upon notice by either party.

Under the Selling Agreement with Morgan Stanley Wealth Management, the Partnership paid Morgan Stanley Wealth Management a monthly ongoing selling agent fee. Prior to April 1, 2014 the monthly ongoing selling agent fee was paid at a rate equal to 5.5% per year of month-end Net Assets. Effective April 1, 2014, the monthly ongoing selling agent fee was reduced to 3% per year of month-end Net Assets. Effective October 1, 2014, the monthly ongoing selling agent fee was reduced to 2% per year of month-end Net Assets. Morgan Stanley Wealth Management will pay a portion of its ongoing selling agent fees to properly registered or exempted financial advisors who have sold Redeemable Units. Month-end Net Assets, for the purpose of calculating ongoing selling agent fees are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s ongoing selling agent fee, management fee, the incentive fee accrued, the General Partner fee and other expenses and any redemptions or distributions as of the end of such month.

3

Generally, the limited partner in the Master withdraws all or part of its capital contribution and undistributed profits, if any, from the Master as of the end of any month (the “Redemption Date”) after a request has been made to the General Partner at least three days in advance of the Redemption Date. Such withdrawals are classified as a liability when the limited partner in the Master elects to redeem and informs the Master. However, a limited partner in the Master may request a withdrawal as of the end of any day if such request is received by the General Partner at least three days in advance of the proposed withdrawal day.

(b) Financial Information about Segments. The Partnership’s business consists of only one segment: speculative trading of commodity interests. The Partnership does not engage in sales of goods or services. The Partnership’s net income (loss) from operations for the years ended December 31, 2015, 2014, 2013, 2012 and 2011 is set forth under “Item 6. Selected Financial Data.” The Partnership’s Capital as of December 31, 2015 was $26,761,029.

(c) Narrative Description of Business.

See Paragraphs (a) and (b) above.

(i) through (xii)— Not applicable.

(xiii) — The Partnership has no employees.

(d) Financial Information About Geographic Areas. The Partnership does not engage in sales of goods or services or own any long-lived assets, and therefore this item is not applicable.

(e) Available Information. The Partnership does not have an Internet address. The Partnership will provide paper copies of its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports free of charge upon request.

(f) Reports to Security Holders. Not applicable.

(g) Enforceability of Civil Liabilities Against Foreign Persons. Not applicable.

(h) Smaller Reporting Companies. Not applicable.

4

Item 1A. Risk Factors.

As a result of leverage, small changes in the price of the Partnership’s positions may result in major losses.

The trading of commodity interests is speculative, volatile and involves a high degree of leverage. A small change in the market price of a commodity interest contract can produce major losses for the Partnership. Market prices can be influenced by, among other things, changing supply and demand relationships, governmental, agricultural, commercial and trade programs and policies, national and international political and economic events, weather and climate conditions, insects and plant disease, purchases and sales by foreign countries and changing interest rates.

An investor may lose all of its investment.

Due to the speculative nature of trading commodity interests, an investor could lose all of its investment in the Partnership.

The Partnership will pay substantial fees and expenses regardless of profitability.

Regardless of its trading performance, the Partnership will incur fees and expenses, including clearing, ongoing selling agent, General Partner and management fees.

An investor’s ability to redeem or transfer units is limited.

An investor’s ability to redeem units is limited and no market exists for the Redeemable Units.

Conflicts of interest exist.

The Partnership is subject to numerous conflicts of interest, including those that arise from the facts that:

| 1. | The General Partner and the Partnership’s/Master’s commodity broker are affiliates; |

| 2. | The Advisor, the Partnership’s/Master’s commodity broker and their respective principals and affiliates may trade in commodity interests for their own accounts; and |

| 3. | An investor’s financial advisor will receive ongoing compensation for providing services to the investor’s account with respect to Class A Redeemable Units. |

| 4. | The General Partner, on behalf of the Partnership, may purchase money market mutual fund shares from mutual funds affilliated and/or unaffiliated with the General Partner. |

Investing in Redeemable Units might not provide the desired diversification of an investor’s overall portfolio.

One of the Partnership’s objectives is to add an element of diversification to a traditional stock and bond portfolio, but any benefit of portfolio diversification is dependent upon the Partnership achieving positive returns and such returns being independent of stock and bond market returns.

Past performance is no assurance of future results.

The Advisor’s trading strategies may not perform as they have performed in the past. The Advisor has from time to time incurred substantial losses in trading on behalf of clients.

An investor’s tax liability may exceed cash distributions.

Investors are taxed on their share of the Partnership’s income, even though the Partnership does not intend to make any distributions.

5

Regulatory changes could restrict the Partnership’s operations and increase its operational costs.

Regulatory changes could adversely affect the Partnership by restricting its markets or activities, limiting its trading and/or increasing the costs or taxes to which investors are subject. Pursuant to the mandate of the Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law on July 21, 2010, the CFTC and the Securities and Exchange Commission (the “SEC”) have promulgated rules to regulate swap dealers and to mandate additional reporting and disclosure requirements and continue to promulgate rules regarding capital and margin requirements, to require that certain swaps be traded on an exchange or a swap execution facility and to require that derivatives (such as those traded by the Partnership) be moved into central clearinghouses. The CFTC and the prudential regulators that oversee swap dealers have adopted rules regarding margin requirements for certain derivatives. In addition, the CFTC and such prudential regulators have proposed or adopted, respectively, rules regarding capital requirements for swap dealers. These rules may negatively impact the manner in which swap contracts are traded and/or settled, increase the costs of such trades, and limit trading by speculators (such as the Partnership) in futures and over-the-counter (“OTC”) markets.

Speculative position and trading limits may reduce profitability.

The CFTC and U.S. commodity exchanges have established “speculative position limits” on the maximum net long or net short positions which any person or a group of persons may hold or control in particular futures, options on futures and swaps that perform a significant price discovery function. Most commodity exchanges also limit the amount of fluctuation in commodity futures contract prices on a single trading day. The Advisor believes that established speculative position and trading limits will not have a materially adverse effect on trading for the Partnership. The trading instructions of the Advisor, however, may have to be modified, and positions held by the Partnership may have to be liquidated in order to avoid exceeding these limits. Such modification or liquidation could adversely affect the operations and profitability of the Partnership by increasing transaction costs to liquidate positions and limiting potential profits on the liquidated positions.

In November 2013, the CFTC proposed new rules that, if adopted in substantially the same form, will impose position limits on certain futures and option contracts and physical commodity swaps that are “economically equivalent” to such contracts. If enacted, these rules could require the Advisor to alter the trading strategies it employs on behalf of the Partnership.

Item 2. Properties.

The Partnership does not own or lease any properties. The General Partner operates out of facilities provided by Morgan Stanley and/or one of its subsidiaries.

6

Part I. Item 3. Legal Proceedings.

This section describes the major pending legal proceedings, other than ordinary routine litigation incidental to the business, to which MS&Co. or its subsidiaries is a party or to which any of their property is subject. There are no material legal proceedings pending against the Partnership or the General Partner.

On June 1, 2011, Morgan Stanley & Co. Incorporated converted from a Delaware corporation to a Delaware limited liability company. As a result of that conversion, Morgan Stanley & Co. Incorporated is now named Morgan Stanley & Co. LLC (“MS&Co.” or the “Company”).

MS&Co. is a wholly-owned, indirect subsidiary of Morgan Stanley, a Delaware holding company. Morgan Stanley files periodic reports with the Securities and Exchange Commission (“SEC”) as required by the Securities Exchange Act of 1934 (the “Exchange Act”), which include current descriptions of material litigation and material proceedings and investigations, if any, by governmental and/or regulatory agencies or self-regulatory organizations concerning Morgan Stanley and its subsidiaries, including MS&Co. As a consolidated subsidiary of Morgan Stanley, MS&Co. does not file its own periodic reports with the SEC that contain descriptions of material litigation, proceedings and investigations. As a result, we refer you to the “Legal Proceedings” section of Morgan Stanley’s SEC 10-K filings for 2015, 2014, 2013, 2012 and 2011.

In addition to the matters described in those filings, in the normal course of business, each of Morgan Stanley and MS&Co. has been named, from time to time, as a defendant in various legal actions, including arbitrations, class actions, and other litigation, arising in connection with its activities as a global diversified financial services institution. Certain of the legal actions include claims for substantial compensatory and/or punitive damages or claims for indeterminate amounts of damages. Each of Morgan Stanley and MS&Co. is also involved, from time to time, in investigations and proceedings by governmental and/or regulatory agencies or self-regulatory organizations, certain of which may result in adverse judgments, fines or penalties. The number of these investigations and proceedings has increased in recent years with regard to many financial services institutions, including Morgan Stanley and MS&Co.

MS&Co. is a Delaware limited liability company with its main business office located at 1585 Broadway, New York, New York 10036. Among other registrations and memberships, MS&Co. is registered as a futures commission merchant and is a member of the National Futures Association.

Regulatory and Governmental Matters.

The Company has received subpoenas and requests for information from certain federal and state regulatory and governmental entities, including among others various members of the RMBS Working Group of the Financial Fraud Enforcement Task Force, such as the United States Department of Justice, Civil Division and several state Attorney General’s Offices, concerning the origination, financing, purchase, securitization and servicing of subprime and non-subprime residential mortgages and related matters such as residential mortgage backed securities (“RMBS”), collateralized debt obligations (“CDOs”), structured investment vehicles (“SIVs”) and credit default swaps backed by or referencing mortgage pass-through certificates. These matters, some of which are in advanced stages, include, but are not limited to, investigations related to the Company’s due diligence on the loans that it purchased for securitization, the Company’s communications with ratings agencies, the Company’s disclosures to investors, and the Company’s handling of servicing and foreclosure related issues.

On February 25, 2015, the Company reached an agreement in principle with the United States Department of Justice, Civil Division and the United States Attorney’s Office for the Northern District of California, Civil Division (collectively, the “Civil Division”) to pay $2.6 billion to resolve certain claims that the Civil Division indicated it intended to bring against the Company. That settlement was finalized on February 10, 2016.

In May 2014, the California Attorney General’s Office (“CAAG”), which is one of the members of the RMBS Working Group, indicated that it has made certain preliminary conclusions that the Company made knowing and material misrepresentations regarding RMBS and that it knowingly caused material misrepresentations to be made regarding the Cheyne SIV (defined below), which issued securities marketed to the California Public Employees Retirement System. The CAAG has further indicated that it believes the Company’s conduct violated California law and that it may seek treble damages, penalties and injunctive relief. The Company does not agree with these conclusions and has presented defenses to them to the CAAG.

7

In October 2014, the Illinois Attorney General’s Office (“ILAG”) sent a letter to the Company alleging that the Company knowingly made misrepresentations related to RMBS purchased by certain pension funds affiliated with the State of Illinois and demanding that the Company pay ILAG approximately $88 million. The Company and ILAG reached an agreement to resolve the matter on February 10, 2016.

On January 13, 2015, the New York Attorney General’s Office (“NYAG”), which is also a member of the RMBS Working Group, indicated that it intends to file a lawsuit related to approximately 30 subprime securitizations sponsored by the Company. NYAG indicated that the lawsuit would allege that the Company misrepresented or omitted material information related to the due diligence, underwriting and valuation of the loans in the securitizations and the properties securing them and indicated that its lawsuit would be brought under the Martin Act. The Company and NYAG reached an agreement to resolve the matter on February 10, 2016.

On June 5, 2012, the Company consented to and became the subject of an Order Instituting Proceedings Pursuant to Sections 6(c) and 6(d) of the Commodity Exchange Act, as amended, Making Findings and Imposing Remedial Sanctions by the Commodity Futures Trading Commission (“CFTC”) to resolve allegations related to the failure of a salesperson to comply with exchange rules that prohibit off-exchange futures transactions unless there is an Exchange for Related Position (“EFRP”). Specifically, the CFTC found that from April 2008 through October 2009, the Company violated Section 4c(a) of the Commodity Exchange Act (the “CEA”) and CFTC Regulation 1.38 by executing, processing and reporting numerous off-exchange futures trades to the Chicago Mercantile Exchange (“CME”) and Chicago Board of Trade (“CBOT”) as EFRPs in violation of CME and CBOT rules because those trades lacked the corresponding and related cash, OTC swap, OTC option, or other OTC derivative position. In addition, the CFTC found that the Company violated CFTC Regulation 166.3 by failing to supervise the handling of the trades at issue and failing to have adequate policies and procedures designed to detect and deter the violations of the CEA and CFTC Regulations. Without admitting or denying the underlying allegations and without adjudication of any issue of law or fact, the Company accepted and consented to entry of findings and the imposition of a cease and desist order, a fine of $5,000,000, and undertakings related to public statements, cooperation and payment of the fine. The Company entered into corresponding and related settlements with the CME and CBOT in which the CME found that the Company violated CME Rules 432.Q and 538 and fined the Company $750,000 and CBOT found that the Company violated CBOT Rules 432.Q and 538 and fined the Company $1,000,000.

On July 23, 2014, the SEC approved a settlement by MS&Co. and certain affiliates to resolve an investigation related to certain subprime RMBS transactions sponsored and underwritten by those entities in 2007. Pursuant to the settlement, MS&Co. and certain affiliates were charged with violating Sections 17(a)(2) and 17(a)(3) of the Securities Act of 1933 (the “Securities Act”), agreed to pay disgorgement and penalties in an amount of $275 million and neither admitted nor denied the SEC’s findings.

On April 21, 2015, the Chicago Board Options Exchange, Incorporated (“CBOE”) and the CBOE Futures Exchange, LLC (“CFE”) filed statements of charges against the Company in connection with trading by one of the Company’s former traders of EEM options contracts that allegedly disrupted the final settlement price of the November 2012 VXEM futures. CBOE alleged that the Company violated CBOE Rules 4.1, 4.2 and 4.7, Sections 9(a) and 10(b) of the Exchange Act, and Rule 10b-5 thereunder. CFE alleged that the Company violated CFE Rules 608, 609 and 620. Both matters are ongoing.

On June 18, 2015, the Company entered into a settlement with the SEC and paid a fine of $500,000 as part of the MCDC Initiative to resolve allegations that the Company failed to form a reasonable basis through adequate due diligence for believing the truthfulness of the assertions by issuers and/or obligors regarding their compliance with previous continuing disclosure undertakings pursuant to Rule 15c2-12 in connection with offerings in which the Company acted as senior or sole underwriter.

On August 6, 2015, the Company consented to and became the subject of an order by the CFTC to resolve allegations that the Company violated CFTC Regulation 22.9(a) by failing to hold sufficient U.S. Dollars in cleared swap segregated accounts in the U.S. to meet all U.S. Dollar obligations to cleared swaps customers. Specifically, the CFTC found that while the Company at all times held sufficient funds in segregation to cover its obligations to its customers, on certain days during 2013 and 2014, it held currencies, such as euros, instead of U.S. dollars, to meet its U.S. dollar obligations. In addition, the CFTC found that the Company violated CFTC Regulation 166.3 by failing to have in place adequate procedures to ensure that it complied with CFTC Regulation 22.9(a). Without admitting or denying the findings or conclusions and without adjudication of any issue of law or fact, the Company accepted and consented to the entry of findings, the imposition of a cease and desist order, a civil monetary penalty of $300,000, and undertakings related to public statements, cooperation, and payment of the monetary penalty.

8

Civil Litigation

On December 23, 2009, the Federal Home Loan Bank of Seattle filed a complaint against the Company and another defendant in the Superior Court of the State of Washington, styled Federal Home Loan Bank of Seattle v. Morgan Stanley & Co. Inc., et al. The amended complaint, filed on September 28, 2010, alleges that defendants made untrue statements and material omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sold to plaintiff by the Company was approximately $233 million. The complaint raises claims under the Washington State Securities Act and seeks, among other things, to rescind the plaintiff’s purchase of such certificates. By orders dated June 23, 2011 and July 18, 2011, the court denied defendants’ omnibus motion to dismiss plaintiff’s amended complaint and on August 15, 2011, the court denied the Company’s individual motion to dismiss the amended complaint. On March 7, 2013, the court granted defendants’ motion to strike plaintiff’s demand for a jury trial. The defendants’ joint motions for partial summary judgment were denied on November 9, 2015. At December 25, 2015, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $46 million, and the certificates had not yet incurred actual losses. Based on currently available information, the Company believes it could incur a loss in this action up to the difference between the $46 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On March 15, 2010, the Federal Home Loan Bank of San Francisco filed a complaint against the Company and other defendants in the Superior Court of the State of California styled Federal Home Loan Bank of San Francisco v. Deutsche Bank Securities Inc. et al. An amended complaint, filed on June 10, 2010, alleges that defendants made untrue statements and material omissions in connection with the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of certificates allegedly sold to plaintiff by the Company was approximately $276 million. The complaint raises claims under both the federal securities laws and California law and seeks, among other things, to rescind the plaintiff’s purchase of such certificates. On August 11, 2011, plaintiff’s federal securities law claims were dismissed with prejudice. On February 9, 2012, defendants’ demurrers with respect to all other claims were overruled. On December 20, 2013, plaintiff’s negligent misrepresentation claims were dismissed with prejudice. At December 25, 2015, the current unpaid balance of the mortgage pass-through certificates at issue in these cases was approximately $59 million, and the certificates had incurred actual losses of approximately $1 million. Based on currently available information, the Company believes it could incur a loss for this action up to the difference between the $59 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, or upon sale, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On July 15, 2010, China Development Industrial Bank (“CDIB”) filed a complaint against the Company, styled China Development Industrial Bank v. Morgan Stanley & Co. Incorporated et al., which is pending in the Supreme Court of the State of New York, New York County (“Supreme Court of NY”). The complaint relates to a $275 million credit default swap referencing the super senior portion of the STACK 2006-1 CDO. The complaint asserts claims for common law fraud, fraudulent inducement and fraudulent concealment and alleges that the Company misrepresented the risks of the STACK 2006-1 CDO to CDIB, and that the Company knew that the assets backing the CDO were of poor quality when it entered into the credit default swap with CDIB. The complaint seeks compensatory damages related to the approximately $228 million that CDIB alleges it has already lost under the credit default swap, rescission of CDIB’s obligation to pay an additional $12 million, punitive damages, equitable relief, fees and costs. On February 28, 2011, the court denied the Company’s motion to dismiss the complaint. Based on currently available information, the Company believes it could incur a loss of up to approximately $240 million plus pre- and post-judgment interest, fees and costs.

On October 15, 2010, the Federal Home Loan Bank of Chicago filed a complaint against the Company and other defendants in the Circuit Court of the State of Illinois, styled Federal Home Loan Bank of Chicago v. Bank of America Funding Corporation et al. A corrected amended complaint was filed on April 8, 2011. The corrected amended complaint alleges that defendants made untrue statements and material omissions in the sale to plaintiff of a number of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans and asserts claims under Illinois law. The total amount of certificates allegedly sold to plaintiff by the Company at issue in the action was approximately $203 million. The complaint seeks, among other things, to rescind the plaintiff’s purchase of such certificates. The defendants filed a motion to dismiss the corrected amended complaint on May 27, 2011, which was denied on September 19, 2012. On December 13, 2013, the court entered an order dismissing all claims related to one of the securitizations at issue. After that dismissal, the remaining amount of certificates allegedly issued by the Company or sold to plaintiff by the Company was approximately $78 million. At December 25, 2015, the current unpaid balance of the mortgage pass-through

9

certificates at issue in this action was approximately $51 million, and the certificates had not yet incurred actual losses. Based on currently available information, the Company believes it could incur a loss in this action up to the difference between the $51 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On April 20, 2011, the Federal Home Loan Bank of Boston filed a complaint against the Company and other defendants in the Superior Court of the Commonwealth of Massachusetts styled Federal Home Loan Bank of Boston v. Ally Financial, Inc. F/K/A GMAC LLC et al. An amended complaint was filed on June 29, 2012 and alleges that defendants made untrue statements and material omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly issued by the Company or sold to plaintiff by the Company was approximately $385 million. The amended complaint raises claims under the Massachusetts Uniform Securities Act, the Massachusetts Consumer Protection Act and common law and seeks, among other things, to rescind the plaintiff’s purchase of such certificates. On May 26, 2011, defendants removed the case to the United States District Court for the District of Massachusetts. The defendants’ motions to dismiss the amended complaint were granted in part and denied in part on September 30, 2013. On November 25, 2013, July 16, 2014, and May 19, 2015, respectively, the plaintiff voluntarily dismissed its claims against the Company with respect to three of the securitizations at issue. After these voluntary dismissals, the remaining amount of certificates allegedly issued by the Company or sold to plaintiff by the Company was approximately $332 million. At December 25, 2015, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $55 million, and the certificates had not yet incurred actual losses. Based on currently available information, the Company believes it could incur a loss in this action up to the difference between the $55 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, or upon sale, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On May 3, 2013, plaintiffs in Deutsche Zentral-Genossenschaftsbank AG et al. v. Morgan Stanley et al. filed a complaint against the Company, certain affiliates, and other defendants in the Supreme Court of NY. The complaint alleges that defendants made material misrepresentations and omissions in the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by the Company to plaintiff currently at issue in this action was approximately $644 million. The complaint alleges causes of action against the Company for common law fraud, fraudulent concealment, aiding and abetting fraud, negligent misrepresentation, and rescission and seeks, among other things, compensatory and punitive damages. On June 10, 2014, the court granted in part and denied in part the Company’s motion to dismiss the complaint. The Company perfected its appeal from that decision on June 12, 2015. At December 25, 2015, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $269 million, and the certificates had incurred actual losses of approximately $83 million. Based on currently available information, the Company believes it could incur a loss in this action up to the difference between the $269 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, or upon sale, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses.

On May 17, 2013, plaintiff in IKB International S.A. in Liquidation, et al. v. Morgan Stanley, et al. filed a complaint against the Company and certain affiliates in the Supreme Court of NY. The complaint alleges that defendants made material misrepresentations and omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by the Company to plaintiff was approximately $132 million. The complaint alleges causes of action against the Company for common law fraud, fraudulent concealment, aiding and abetting fraud, and negligent misrepresentation, and seeks, among other things, compensatory and punitive damages. On October 29, 2014, the court granted in part and denied in part the Company’s motion to dismiss. All claims regarding four certificates were dismissed. After these dismissals, the remaining amount of certificates allegedly issued by the Company or sold to plaintiff by the Company was approximately $116 million. On August 26, 2015, the Company perfected its appeal from the court’s October 29, 2014 decision. At December 25, 2015, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $28 million, and the certificates had incurred actual losses of $58 million. Based on currently available information, the Company believes it could incur a loss in this action up to the difference between the $28 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against the Company, or upon sale, plus pre- and post-judgment interest, fees and costs. The Company may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

10

Settled Civil Litigation

On August 25, 2008, the Company and two ratings agencies were named as defendants in a purported class action related to securities issued by a structured investment vehicle called Cheyne Finance PLC and Cheyne Finance LLC (together, the “Cheyne SIV”). The case was styled Abu Dhabi Commercial Bank, et al. v. Morgan Stanley & Co. Inc., et al. The complaint alleged, among other things, that the ratings assigned to the securities issued by the Cheyne SIV were false and misleading, including because the ratings did not accurately reflect the risks associated with the subprime residential mortgage backed securities held by the Cheyne SIV. The plaintiffs asserted allegations of aiding and abetting fraud and negligent misrepresentation relating to approximately $852 million of securities issued by the Cheyne SIV. On April 24, 2013, the parties reached an agreement to settle the case, and on April 26, 2013, the court dismissed the action with prejudice. The settlement does not cover certain claims that were previously dismissed.

On March 15, 2010, the Federal Home Loan Bank of San Francisco filed a complaint against the Company and other defendants in the Superior Court of the State of California styled Federal Home Loan Bank of San Francisco v. Credit Suisse Securities (USA) LLC, et al. An amended complaint filed on June 10, 2010 alleged that defendants made untrue statements and material omissions in connection with the sale to plaintiff of a number of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of certificates allegedly sold to plaintiff by the Company was approximately $704 million. The complaint raised claims under both the federal securities laws and California law and sought, among other things, to rescind the plaintiff’s purchase of such certificates. On January 26, 2015, as a result of a settlement with certain other defendants, the plaintiff requested and the court subsequently entered a dismissal with prejudice of certain of the plaintiff’s claims, including all remaining claims against the Company.

On July 9, 2010 and February 11, 2011, Cambridge Place Investment Management Inc. filed two separate complaints against the Company and/or its affiliates and other defendants in the Superior Court of the Commonwealth of Massachusetts, both styled Cambridge Place Investment Management Inc. v. Morgan Stanley & Co., Inc., et al. The complaints asserted claims on behalf of certain clients of plaintiff’s affiliates and allege that defendants made untrue statements and material omissions in the sale of a number of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly issued by the Company and/or its affiliates or sold to plaintiff’s affiliates’ clients by the Company and/or its affiliates in the two matters was approximately $263 million. On February 11, 2014, the parties entered into an agreement to settle the litigation. On February 20, 2014, the court dismissed the action.

On October 25, 2010, the Company, certain affiliates and Pinnacle Performance Limited, a special purpose vehicle (“SPV”), were named as defendants in a purported class action in the United States District Court for the Southern District of New York (“SDNY”), styled Ge Dandong, et al. v. Pinnacle Performance Ltd., et al. On January 31, 2014, the plaintiffs in the action, which related to securities issued by the SPV in Singapore, filed a second amended complaint, which asserted common law claims of fraud, aiding and abetting fraud, fraudulent inducement, aiding and abetting fraudulent inducement, and breach of the implied covenant of good faith and fair dealing. On July 17, 2014, the parties reached an agreement to settle the litigation, which received final court approval on July 2, 2015.

On July 5, 2011, Allstate Insurance Company and certain of its affiliated entities filed a complaint against the Company in the Supreme Court of NY, styled Allstate Insurance Company, et al. v. Morgan Stanley, et al. An amended complaint was filed on September 9, 2011, and alleges that the defendants made untrue statements and material omissions in the sale to the plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly issued and/or sold to the plaintiffs by the Company was approximately $104 million. The complaint raised common law claims of fraud, fraudulent inducement, aiding and abetting fraud, and negligent misrepresentation and seeks, among other things, compensatory and/or recessionary damages associated with the plaintiffs’ purchases of such certificates. On March 15, 2013, the court denied in substantial part the defendants’ motion to dismiss the amended complaint, which order the Company appealed on April 11, 2013. On May 3, 2013, the Company filed its answer to the amended complaint. On January 16, 2015, the parties reached an agreement to settle the litigation.

On July 18, 2011, the Western and Southern Life Insurance Company and certain affiliated companies filed a complaint against the Company and other defendants in the Court of Common Pleas in Ohio, styled Western and Southern Life Insurance Company, et al. v. Morgan Stanley Mortgage Capital Inc., et al. An amended complaint was filed on April 2, 2012 and alleges that defendants made untrue statements and material omissions in the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of the certificates allegedly sold to plaintiffs by the Company was approximately $153 million. On June 8, 2015, the parties reached an agreement to settle the litigation.

11

On September 2, 2011, the Federal Housing Finance Agency (“FHFA”), as conservator for Fannie Mae and Freddie Mac, filed 17 complaints against numerous financial services companies, including the Company and certain affiliates. A complaint against the Company and certain affiliates and other defendants was filed in the Supreme Court of NY, styled Federal Housing Finance Agency, as Conservator v. Morgan Stanley et al. The complaint alleges that defendants made untrue statements and material omissions in connection with the sale to Fannie Mae and Freddie Mac of residential mortgage pass-through certificates with an original unpaid balance of approximately $11 billion. The complaint raised claims under federal and state securities laws and common law and seeks, among other things, rescission and compensatory and punitive damages. On February 7, 2014, the parties entered into an agreement to settle the litigation. On February 20, 2014, the court dismissed the action.

On April 25, 2012, Metropolitan Life Insurance Company and certain affiliates filed a complaint against the Company and certain affiliates in the Supreme Court of NY, styled Metropolitan Life Insurance Company, et al. v. Morgan Stanley, et al. An amended complaint was filed on June 29, 2012, and alleges that the defendants made untrue statements and material omissions in the sale to the plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten, and/or sold by the Company was approximately $758 million. The amended complaint raised common law claims of fraud, fraudulent inducement, and aiding and abetting fraud and seeks, among other things, rescission, compensatory, and/or rescissionary damages, as well as punitive damages, associated with the plaintiffs’ purchases of such certificates. On April 11, 2014, the parties entered into a settlement agreement.

On April 25, 2012, The Prudential Insurance Company of America and certain affiliates filed a complaint against the Company and certain affiliates in the Superior Court of the State of New Jersey, styled The Prudential Insurance Company of America, et al. v. Morgan Stanley, et al. On October 16, 2012, plaintiffs filed an amended complaint. The amended complaint alleged that defendants made untrue statements and material omissions in connection with the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by the Company was approximately $1.073 billion. The amended complaint raises claims under the New Jersey Uniform Securities Law, as well as common law claims of negligent misrepresentation, fraud, fraudulent inducement, equitable fraud, aiding and abetting fraud, and violations of the New Jersey RICO statute, and includes a claim for treble damages. On January 8, 2016, the parties reached an agreement to settle the litigation.

In re Morgan Stanley Mortgage Pass-Through Certificates Litigation, which had been pending in the SDNY, was a putative class action involving allegations that, among other things, the registration statements and offering documents related to the offerings of certain mortgage pass-through certificates in 2006 and 2007 contained false and misleading information concerning the pools of residential loans that backed these securitizations. On December 18, 2014, the parties’ agreement to settle the litigation received final court approval, and on December 19, 2014, the court entered an order dismissing the action.

On November 4, 2011, the Federal Deposit Insurance Corporation (“FDIC”), as receiver for Franklin Bank S.S.B, filed two complaints against the Company in the District Court of the State of Texas. Each was styled Federal Deposit Insurance Corporation as Receiver for Franklin Bank, S.S.B v. Morgan Stanley & Company LLC F/K/A Morgan Stanley & Co. Inc. and alleged that the Company made untrue statements and material omissions in connection with the sale to plaintiff of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of certificates allegedly underwritten and sold to plaintiff by the Company in these cases was approximately $67 million and $35 million, respectively. On July 2, 2015, the parties reached an agreement to settle the litigation.

On February 14, 2013, Bank Hapoalim B.M. filed a complaint against the Company and certain affiliates in the Supreme Court of NY, styled Bank Hapoalim B.M. v. Morgan Stanley et al. The complaint alleges that defendants made material misrepresentations and omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by the Company to plaintiff was approximately $141 million. On July 28, 2015, the parties reached an agreement to settle the litigation, and on August 12, 2015, the plaintiff filed a stipulation of discontinuance with prejudice.

On September 23, 2013, the plaintiff in National Credit Union Administration Board v. Morgan Stanley & Co. Inc., et al. filed a complaint against the Company and certain affiliates in the SDNY. The complaint alleged that defendants made untrue statements of material fact or omitted to state material facts in the sale to the plaintiff of certain mortgage pass-through certificates issued by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold

12

by the Company to plaintiffs in the matter was approximately $417 million. The complaint alleged violations of federal and various state securities laws and sought, among other things, rescissionary and compensatory damages. On November 23, 2015, the parties reached an agreement to settle the matter.

On September 16, 2014, the Virginia Attorney General’s Office filed a civil lawsuit, styled Commonwealth of Virginia ex rel. Integra REC LLC v. Barclays Capital Inc., et al., against the Company and several other defendants in the Circuit Court of the City of Richmond related to RMBS. The lawsuit alleged that the Company and the other defendants knowingly made misrepresentations and omissions related to the loans backing RMBS purchased by the Virginia Retirement System. The complaint asserts claims under the Virginia Fraud Against Taxpayers Act, as well as common law claims of actual and constructive fraud, and seeks, among other things, treble damages and civil penalties. On January 6, 2016, the parties reached an agreement to settle the litigation. An order dismissing the action with prejudice was entered on January 28, 2016.

Additional lawsuits containing claims similar to those described above may be filed in the future. In the course of its business, MS&Co., as a major futures commission merchant, is party to various civil actions, claims and routine regulatory investigations and proceedings that the General Partner believes do not have a material effect on the business of MS&Co. MS&Co. may establish reserves from time to time in connections with such actions.

Item 4. Mine Safety Disclosures. Not applicable.

13

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information. The Partnership has issued no stock. There is no public market for the Redeemable Units.

(b) Holders. The number of holders of Redeemable Units as of February 29, 2016 was 362.

(c) Dividends. The Partnership did not declare any distributions in 2015 or 2014. The Partnership does not intend to declare distributions in the foreseeable future.

(d) Securities Authorized for Issuance Under Equity Compensation Plans. None.

(e) Performance Graph. Not applicable.

(f) Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities. For the year ended December 31, 2015, there were additional subscriptions of 1,277.0790 Redeemable Units totaling $2,182,466. For the year ended December 31, 2014, there were additional subscriptions of 2,757.6500 Redeemable Units totaling $3,736,764. For the year ended December 31, 2013, there were additional subscriptions of 7,217.7550 Redeemable Units totaling $10,199,904.

The Redeemable Units were issued upon applicable exemptions from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated thereunder. The Redeemable Units were purchased by accredited investors as described in Regulation D. In determining the applicability of the exemption, the General Partner relied on the fact that the Redeemable Units were purchased by accredited investors in a private offering.

Proceeds from the sale of additional Redeemable Units are used in the trading of commodity interests including futures contracts, swaps, options on futures and forward contracts.

(g) Purchases of Equity Securities by the Issuer and Affiliated Purchasers.

The following chart sets forth the purchases of Redeemable Units by the Partnership.

| Period | (a) Total Number of Reedemable Units Purchased * |

(b) Average Price Paid per Redeemable Unit ** |

(c) Total Number of Redeemable Units Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or | ||||

| October 1, 2015 - October 31, 2015 |

81.6000 | $ 1,561.40 | N/A | N/A | ||||

| November 1, 2015 - November 30, 2015 |

80.8460 | $ 1,636.79 | N/A | N/A | ||||

| December 1, 2015 - December 31, 2015 |

110.2900 | $ 1,571.03 | N/A | N/A | ||||

| 272.7360 | $ 1,587.64 |

* Generally, limited partners are permitted to redeem their Redeemable Units as of the end of each month on three business days’ notice to the General Partner. Under certain circumstances, the General Partner can compel redemption, although to date the General Partner has not exercised this right. Purchases of Redeemable Units by the Partnership reflected in the chart above were made in the ordinary course of the Partnership’s business in connection with effecting redemptions for limited partners.

** Redemptions of Redeemable Units are effected as of the end of each month at the net asset value per Redeemable Unit as of that day. No fee will be charged for redemptions.

14

Item 6. Selected Financial Data.

Total trading results allocated from Master, interest income allocated from Master, total expenses, net income (loss) and increase (decrease) in net asset value per Redeemable Unit for the years ended December 31, 2015, 2014, 2013, 2012 and 2011 and the net asset value per Redeemable Unit and total assets at December 31, 2015, 2014, 2013, 2012 and 2011 were as follows:

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Total trading results allocated from Master |

$ | (24,523) | $ | 6,464,660 | $ | 4,919,188 | $ | 2,996,774 | $ | 174,442 | ||||||||||

| Interest income allocated from Master |

2,081 | 4,188 | 8,604 | 17,225 | 10,345 | |||||||||||||||

| Total expenses |

(1,865,782) | (2,042,094) | (2,826,807) | (3,110,895) | (3,530,324) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (1,888,224) | $ | 4,426,754 | $ | 2,100,985 | $ | (96,896) | $ | (3,345,537) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase (decrease) in net asset value per |

||||||||||||||||||||

| Redeemable Unit |

$ | (105.58) | $ | 265.30 | $ | 98.58 | $ | (17.31) | $ | (117.37) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value per Redeemable Unit |

$ | 1,571.03 | $ | 1,676.61 | $ | 1,411.31 | $ | 1,312.73 | $ | 1,330.04 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 27,155,807 | $ | 30,832,872 | $ | 30,800,308 | $ | 30,575,456 | $ | 40,398,807 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

The Partnership, through its investment in the Master, aims to achieve substantial capital appreciation through speculative trading, directly and indirectly, in U.S. and international markets for currencies, interest rates, stock indices, agricultural and energy products and precious and base metals. The Partnership, through its investment in the Master, may employ futures, options on futures, and forward, spot and swap contracts in those markets.

The General Partner manages all business of the Partnership/Master. The General Partner has delegated its responsibility for the investment of the Partnership’s assets to the Advisor. The Partnership has invested these assets in the Master. The General Partner engages a team of approximately 30 professionals whose primary emphasis is on attempting to maintain quality control among the advisors to the funds operated or managed by the General Partner. A full-time staff of due diligence professionals uses proprietary technology and on-site evaluations to monitor new and existing futures money managers. The accounting and operations staff provides processing of subscriptions and redemptions and reporting to limited partners and regulatory authorities. The General Partner also includes staff involved in marketing and sales support. In selecting the Advisor for the Partnership/Master, the General Partner considered past performance, trading style, volatility of markets traded and fee requirements. The General Partner may modify or terminate the allocation of assets to the Advisor at any time.

Responsibilities of the General Partner include:

| • | due diligence examinations of the Advisor; |

| • | selection, appointment and termination of the Advisor; |

| • | negotiation of the Management Agreement; and |

| • | monitoring the activity of the Advisor. |

In addition, the General Partner prepares, or assists the Administrator in preparing, the books and records and provides, or assists the Administrator in providing, the administrative and compliance services that are required by law or regulation from time to time, in connection with the operation of the Partnership/Master.

15

While the Partnership and the Master have the right to seek lower commission rates and fees from other commodity brokers at any time, the General Partner believes that the customer agreement and other arrangements with the commodity broker are fair, reasonable, and competitive.

The Partnership’s assets allocated to the Advisor for trading are not invested in commodity interests directly. The Advisor’s allocation of the Partnership’s assets is currently invested in the Master. The Advisor trades the Master’s, and thereby the Partnership’s, assets in accordance with its Campbell Managed Futures Portfolio Program (formerly, Financial, Metal & Energy Large Portfolio Program), a proprietary, systematic trading system. The Advisor’s trading models are designed to detect and exploit medium-term to long-term price changes, while also applying risk management and portfolio management principles.

The Advisor believes that utilizing multiple trading models provides an important level of diversification, and is most beneficial when multiple contracts of each market are traded. Every trading model may not trade every market. It is possible that one trading model may signal a long position while another trading model signals a short position in the same market. It is the Advisor’s intention to offset those signals to reduce unnecessary trading, but if the signals are not simultaneous, both trades will be taken and since it is unlikely that both positions would prove profitable, in retrospect, one or both trades will appear to have been unnecessary. It is the Advisor’s policy to follow trades signaled by each trading model independently of the other models.

As a managed futures partnership, the Partnership’s/Master’s performance is dependent upon the successful trading of the Advisor to achieve the Partnership’s/Master’s objectives. It is the business of the General Partner to monitor the Advisor’s performance to assure compliance with the Partnership’s/Master’s trading policies and to determine if the Advisor’s performance is meeting the Partnership’s/Master’s objectives.

(a) Liquidity.

The Partnership does not engage in sales of goods or services. Its only assets are its investment in the Master and cash. The Master does not engage in sales of goods or services. The Master’s only assets are its equity in its trading account, consisting of cash, cash margin, net unrealized appreciation on open futures contracts, net unrealized appreciation on open forward contracts, options purchased, and investment in U.S. Treasury bills at fair value, if applicable. Because of the low margin deposits normally required in commodity trading, relatively small price movements may result in substantial losses to the Partnership, through its investment in the Master. While substantial losses could lead to a material decrease in liquidity, no such illiquidity occurred during the year ended December 31, 2015.

To minimize the risk relating to low margin deposits, the Master follows certain trading policies, including:

| (i) | The Master invests its assets only in commodity interests that the Advisor believes are traded in sufficient volume to permit ease of taking and liquidating positions. Sufficient volume, in this context, refers to a level of liquidity that the Advisor believes will permit it to enter and exit trades without noticeably moving the market. |

| (ii) | The Advisor will not initiate additional positions in any commodity if these positions would result in aggregate positions requiring a margin of more than 66 2/3% of the Master’s net assets allocated to the Advisor. |

| (iii) | The Master may occasionally accept delivery of a commodity. Unless such delivery is disposed of promptly by retendering the warehouse receipt representing the delivery to the appropriate clearinghouse, the physical commodity position is fully hedged. |

| (iv) | The Master does not employ the trading technique commonly known as “pyramiding,” in which the speculator uses unrealized profits on existing positions as margin for the purchases or sale of additional positions in the same or related commodities. |

| (v) | The Master does not utilize borrowings other than short-term borrowings if the Master takes delivery of any cash commodities. |

| (vi) | The Advisor may, from time to time, employ trading strategies such as spreads or straddles on behalf of the Master. “Spreads” and “straddles” describe commodity futures trading strategy involving the simultaneous buying and selling of futures contracts on the same commodity but involving different delivery dates or markets. |

| (vii) | The Master will not permit the churning of its commodity trading account. The term “churning” refers to the practice of entering and exiting trades with a frequency unwarranted by legitimate efforts to profit from the trades, indicating the desire to generate commission income. |

From January 1, 2015 through December 31, 2015, the Partnership’s average margin to equity ratio (i.e., the percentage of assets on deposit required for margin) was approximately 13.7%. The foregoing margin to equity ratio takes into account cash held in the Partnership’s name, as well as the allocable value of the positions and cash held on behalf of the Partnership in the name of the Master.

16

In the normal course of its business, the Partnership, through its investment in the Master, is party to financial instruments with off-balance sheet risk, including derivative financial instruments and derivative commodity instruments. These financial instruments may include futures, forwards, options and swaps, whose values are based upon an underlying asset, index, or reference rate, and generally represent future commitments to exchange currencies or cash balances, to purchase or sell other financial instruments at specific terms at specified future dates, or, in the case of derivative commodity instruments, to have a reasonable possibility to be settled in cash, through physical delivery or with another financial instrument. These instruments may be traded on an exchange, a swap execution facility or OTC. Exchange-traded instruments include futures and certain standardized forward, option and swap contracts. Certain swap contracts may also be traded on a swap execution facility or OTC. OTC contracts are negotiated between contracting parties and also include certain forward and option contracts. Specific market movements of commodities or futures contracts underlying an option cannot be accurately predicted. The purchaser of an option may lose the entire premium paid for the option. The writer or seller of an option has unlimited risk. Each of these instruments is subject to various risks similar to those related to the underlying financial instruments including market and credit risk. In general, the risks associated with OTC contracts are greater than those associated with exchange-traded instruments because of the greater risk of default by the counterparty to an OTC contract. The General Partner estimates that at any given time approximately 0.0% to 54.6% of the Master’s contracts are traded OTC.

The risk to the limited partners that have purchased Redeemable Units is limited to the amount of their share of the Partnership’s net assets and undistributed profits. This limited liability is a result of the organization of the Partnership as a limited partnership under New York law.

Market risk is the potential for changes in the value of the financial instruments traded by the Master due to market changes, including interest and foreign exchange rate movements and fluctuations in commodity or security prices. Market risk is directly impacted by the volatility and liquidity in the markets in which the related underlying assets are traded. The Master is exposed to a market risk equal to the value of futures and forward contracts purchased and unlimited liability on such contracts sold short.