Attached files

| file | filename |

|---|---|

| 8-K - INTERSECTIONS 8K - INTERSECTIONS INC | p16-0167_8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED MARCH 22, 2016 - INTERSECTIONS INC | p16-0167_ex991.htm |

| EX-99.3 - PRESS RELEASE ISSUED MARCH 21, 2016 - INTERSECTIONS INC | p16-0167_ex993.htm |

Exhibit 99.2

2

Forward-Looking Statements

Statements in this presentation relating to future plans, results, performance, expectations, achievements and the

like are considered “forward-looking statements.” You can identify forward-looking statements by the fact that they

do not relate strictly to historical or current facts. These statements may include words such as “anticipate,”

“estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words

and terms of similar meaning in connection with any discussion of the timing or nature of future operating or

financial performance or other events. Those forward-looking statements involve known and unknown risks and

uncertainties and are subject to change based on various factors and uncertainties that may cause actual results to

differ materially from those expressed or implied by those statements, including the timing and success of new

product launches, including our Identity Guard®, Voyce® and Voyce Pro™ platforms, and other growth initiatives;

the continuing impact of the regulatory environment on our business; the continued dependence on a small

number of financial institutions for a majority of our revenue and to service our U.S. financial institution customer

base; our ability to execute our strategy and previously announced transformation plan; our incurring additional

restructuring and/or impairment charges; our ability to control costs; and our needs for additional capital to grow

our business, including our ability to maintain compliance with the covenants under our new term loan or seek

additional sources of debt and/or equity financing. Factors and uncertainties that may cause actual results to differ

include but are not limited to the risks disclosed under “Forward-Looking Statements,” “Item 1.

Business—Government Regulation” and “Item 1A. Risk Factors” in the Company’s most recent Annual Report on

Form 10-K, and in its Quarterly Reports on Form 10-Q and other filings with the U.S. Securities and Exchange

Commission. The Company undertakes no obligation to revise or update any forward-looking statements unless

required by applicable law.

like are considered “forward-looking statements.” You can identify forward-looking statements by the fact that they

do not relate strictly to historical or current facts. These statements may include words such as “anticipate,”

“estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words

and terms of similar meaning in connection with any discussion of the timing or nature of future operating or

financial performance or other events. Those forward-looking statements involve known and unknown risks and

uncertainties and are subject to change based on various factors and uncertainties that may cause actual results to

differ materially from those expressed or implied by those statements, including the timing and success of new

product launches, including our Identity Guard®, Voyce® and Voyce Pro™ platforms, and other growth initiatives;

the continuing impact of the regulatory environment on our business; the continued dependence on a small

number of financial institutions for a majority of our revenue and to service our U.S. financial institution customer

base; our ability to execute our strategy and previously announced transformation plan; our incurring additional

restructuring and/or impairment charges; our ability to control costs; and our needs for additional capital to grow

our business, including our ability to maintain compliance with the covenants under our new term loan or seek

additional sources of debt and/or equity financing. Factors and uncertainties that may cause actual results to differ

include but are not limited to the risks disclosed under “Forward-Looking Statements,” “Item 1.

Business—Government Regulation” and “Item 1A. Risk Factors” in the Company’s most recent Annual Report on

Form 10-K, and in its Quarterly Reports on Form 10-Q and other filings with the U.S. Securities and Exchange

Commission. The Company undertakes no obligation to revise or update any forward-looking statements unless

required by applicable law.

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

3

Company Overview

The Company operates through three main segments:

• Personal Information Services (Identity Guard®):

• Identity Guard® offers identity theft, privacy protection and credit monitoring services for consumers to understand, monitor, manage, and protect

their personal information and privacy. This segment also offers breach response services to organizations responding to compromises of sensitive

personal information.

their personal information and privacy. This segment also offers breach response services to organizations responding to compromises of sensitive

personal information.

• Insurance and Other Services:

• Habits at Work™ (“Habits at Work”), the d/b/a for wholly owned subsidiary Intersections Insurance Services Inc., leverages proprietary tools and

analytics to provide health and wellness services to insurers, employers and wellness groups through innovative behavior-linked products &

solutions.

analytics to provide health and wellness services to insurers, employers and wellness groups through innovative behavior-linked products &

solutions.

• Captira Analytical, a wholly-owned subsidiary, provides SaaS solutions for the bail bonds industry that automate common tasks and provide easy

and efficient ways for bail bondsmen, general agents and sureties to organize and share data and make better underwriting decisions.

and efficient ways for bail bondsmen, general agents and sureties to organize and share data and make better underwriting decisions.

• Pet Health Monitoring Services (Voyce®):

• Voyce® (“Voyce”), the d/b/a for wholly-owned subsidiary i4c Innovations Inc. , offers a health and wellness management platform that connects

pets and their owners, veterinarians, and other caregivers with pet health monitoring data, pet health related content, and information

management tools.

pets and their owners, veterinarians, and other caregivers with pet health monitoring data, pet health related content, and information

management tools.

Intersections Inc. (NASDAQ: INTX)

Provider of innovative, information based

solutions that help consumers manage risks

and make better informed life decisions.

solutions that help consumers manage risks

and make better informed life decisions.

• Founded: 1996

• Public Since: 2004

• Headquarters: Chantilly, VA

Company Dynamics Intersections’ private-label identity theft protection and credit monitoring services business was greatly impacted by the regulatory environment that developed following the U.S. recession of 2007 to 2009. The financial institution private-label business was Intersections’ largest business line that provided and distributed identity theft protection and credit monitoring credit services primarily through financial institutions in the U.S.Following the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the Office of the Comptroller of the Currency (OCC) and Consumer Financial Protection Bureau (CFPB) focused on the incremental services offered by financial institutions to their customers which curtailed those offerings.Financial institutions ultimately halted sales of most incremental products, including identity theft protection and credit monitoring.Sales of Intersections’ U.S. private-label identity theft protection and credit monitoring services were halted and became a run-off business for which Intersections expects to continue servicing existing customers.The Company decided to leverage its core competencies of data processing, management, and analytics by investing in:Expansion of our direct-to-consumer Identity Guard® services.Expansion of our insurance and wellness analytics business, now called Habits at Work™.Expansion of our bail bonds industry data management solutions through Captira Analytical’s platform.Development of a new business line focused on pet and animal health, Voyce®, which would become a new platform upon which to utilize the Company’s core capabilities in data processing, management, and analytics.

Strategic Overview Leverage data processing, management and analytics and recurring revenue model competencies.Streamline the operations of the Identity Guard® business and related corporate activities with a plan to significantly reduce our cost base.Reposition our business with a more diversified customer base and product portfolio.Drive growth through data-driven technologies:Identity Guard focusing on personal information security for consumersVoyce® focusing on delivering data to support better decisions in animal healthcareVision of building two high growth, subscription-based businesses operating at scale.Expect further consolidation and leveraging of our Habits at Work™ resources with Identity Guard in 2016

Recent Business Highlights Concluded initial 2014 restructuring plan in 2015 with annualized cost savings of over $15 million.Achieved additional annualized cost reductions of $4 million from actions taken in 2015.Financial institution subscriber base decreased 1.2% per month on average for the second half of 2015, which we believe is a normal attrition rate given the ceased marketing and retention efforts for this population.Identity Guard® revenue increased 16.1% in 2015 compared to 2014 and its subscriber base increased 6.1% to end 2015 with 363 thousand subscribers.Identity Guard secured several new partner relationships which we expect to increase both subscribers and revenue in 2016.Voyce® secured a key distribution agency relationship, developed a base of veterinary clinic relationships including key national accounts, expanded its sales team and attracted many strategic partnership opportunities.

Recent Financing Transactions $7.5 million aggregate gross proceeds from the private placement of common stock in December 2015.$20 million gross proceeds from term loan closed and fully funded in March 2016.$15 million of net term loan proceeds invested in our Voyce business.For the duration of the three year term loan, additional capital needs of Voyce® will be funded by cash provided by Voyce’s operations or a direct third-party equity investment in the Voyce business, subject to limitations in the loan agreement.Remaining net proceeds are to be used for general corporate purposes of Identity Guard and other businesses. $27.5 million gross proceeds raised through two transactions that will provide capital to support the market launch of the Voyce® products and provide Identity Guard® with financial flexibility it needs to execute its plans independent of Voyce’s capital needs.

Identity Guard® Update Provides prevention, detection & resolution products and services to help subscribers protect their personal information from misuse. $26.7 million fourth quarter revenue from subscribers acquired through U.S. financial institutions.829 thousand subscribers (December 31, 2015) decreased at an average rate of 1.2% per month during the fourth quarter which we believe represents a normal attrition rate given ceased marketing and retention efforts.$14.2 million direct-to-consumer Identity Guard fourth quarter 2015 revenue, up 17.2% over fourth quarter 2014.363 thousand U.S. subscribers (December 31, 2015).6.1% subscriber growth compared to December 31, 2014.$3.1 million USD Canada business fourth quarter 2015 revenue, down 7.5% from third quarter 2015 and 53.4% from fourth quarter 2014.Revenue and subscribers were negatively impacted by the cancellation of two financial institution subscriber portfolios in the first half of 2015.

Voyce® Update Voyce® provides data-driven technology to manage canine wellbeing through the use of a Health Monitor and interactive wellness management system. Voyce Pro™, our service for veterinarians, was launched in the third quarter 2015.Began two large research projects in October 2015 with Zoetis Corporation, a leading animal pharmaceutical company, using Voyce Pro.Commenced Voyce Pro programs in October 2015 with two of the three largest U.S. veterinary hospital owners.Entered strategic partnership with Patterson Veterinary in November 2015 to distribute Voyce Pro to veterinary hospitals in the U.S.Added seasoned senior sales executive from the animal health industry in late 2015, who is rapidly building a highly capable sales team.

Identity Guard is our flagship platform for growth with notable increases in revenue and subscribers.Two financial institution client losses in the first half of 2015 negatively impacted our Canadian business.U.S. financial institution subscribers declined 3.7% since the end of the third quarter, or 1.2% per month, a rate we believe represents normal attrition.Revenue from other business units was negatively impacted by ceased marketing by our clients of insurance and membership services partially offset by revenue from new products and services offered by our Habits at Work™ business. Year Ended December 31,($ in millions) Subscribers at December 31,(in thousands) 2015 2014 % Change 2015 2014 % Change Identity Guard® $55.6 $47.9 16.1% 363 342 6.1% Canadian Business $17.5 $29.4 -40.5% 165 296 -44.3% U.S. Financial Institutions $115.4 $150.8 -23.5% 829 1,421 -41.7% Sub Total $188.5 $228.1 -17.4% 1,357 2,059 -34.1% Other Business Units $15.3 $18.5 -17.3% Consolidated Revenue $203.8 $246.6 -17.4% 2015 Financial Highlights - Revenue

($ in millions) Year Ended December 31, 2015 2014 Consolidated loss from continuing operations before income taxes $(38.4) $(43.6) Consolidated adjusted EBITDA(a.) $(8.5) $(2.6) Cash and cash equivalents at year end $11.5 $11.3 Consolidated adjusted EBITDA for 2015 was negatively impacted compared to 2014 by lower revenue from our financial institution clients and Canadian partner, a $3.5 million increase in the adjusted EBITDA loss of our Voyce® business and an increase of $839 thousand in severance related charges in 2015 compared to 2014.Adjusted EBITDA includes $(16.9) million adjusted EBITDA for our Voyce business for 2015, compared to $(13.4) million in 2014.Cash flows (used in) operations was $(269) thousand for 2015. Gross proceeds of $7.5 million were raised from a private placement of common shares in the fourth quarter of 2015.Note a. Adjusted EBITDA refers to Adjusted EBITDA before share related compensation and non-cash impairment charges. See reconciliation of non-GAAP financial measures in the back of this presentation. 2015 Financial Highlights, continued

Reconciliation of Non-GAAP Financial Measures: Consolidated Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

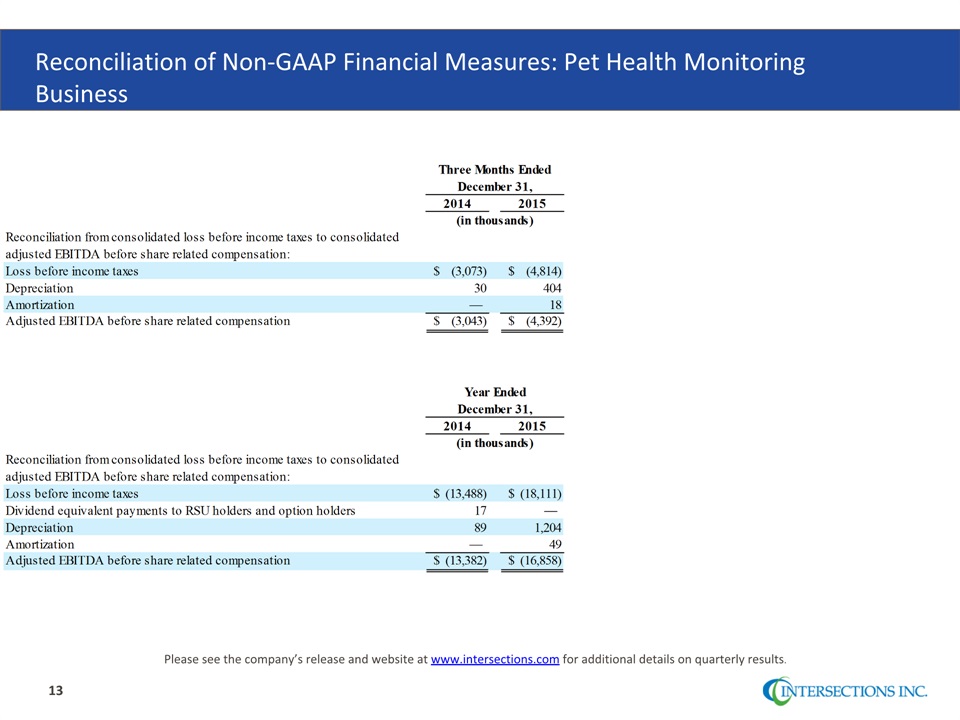

Reconciliation of Non-GAAP Financial Measures: Pet Health Monitoring Business Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

Thank You Corporate HeadquartersIntersections Inc.3901 Stonecroft BoulevardChantilly, VA 20151Toll-free: 800.695.7536www.intersections.com Investor RelationsRon Barden, CFO IR@intersections.com Tel: 703.488.6100