Attached files

| file | filename |

|---|---|

| 8-K - 8-K (3.22.2016) - Bristow Group Inc | bristow8-k3222016.htm |

Scotia Howard Weil 2016 Energy Conference Bristow Group Inc. March 21 – 23, 2016

2 Forward-looking statements Statements contained in this presentation that state the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. These forward-looking statements include statements regarding earnings guidance and earnings growth, expected contract revenue and margins, customer activity levels, capital deployment strategy, operational and capital performance, expense reduction initiatives, shareholder return, liquidity, market and industry conditions and the financial impact of Nigeria accident and duration of temporary suspension of operations of the S-76 fleet in Nigeria. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Risks and uncertainties include without limitation: fluctuations in the demand for our services; fluctuations in worldwide prices of and supply and demand for oil and natural gas; fluctuations in levels of oil and natural gas production, exploration and development activities; the impact of competition; actions by clients and regulators including prolonged suspension of operations of aircraft by Nigerian regulators and any termination of contracts by clients; the risk of reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and regulations; changes in foreign exchange rates and controls; risks associated with international operations; operating risks inherent in our business, including the possibility of declining safety performance; general economic conditions including the capital and credit markets; our ability to obtain financing; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our ability to mitigate the effect of the downturn in the oil and gas industry through fixed wing and U.K. SAR operations; our ability to re-deploy our aircraft to regions with greater demand; our ability to acquire additional aircraft and dispose of older aircraft through sales into the aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment and Operational Excellence programs; the risk that we do not realize anticipated cost savings; availability of employees with the necessary skills; and political instability, war or acts of terrorism in any of the countries in which we operate. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s annual report on Form 10-K for the fiscal year ended March 31, 2015 and the report on Form 10-Q for the quarter ended December 31, 2015. Bristow Group Inc. disclaims any intention or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events or otherwise.

3 • Ticker: BRS; stock price1 of $19.90/share with a market cap ~$700 million • 360 aircraft in ~20 countries with ~5,000 employees2 • Successful launch of $2.5 billion revenue U.K. SAR contract (not tied to oil and gas) • Continuing successful execution of cost reduction and capital efficiency initiatives $67 1) Based on stock price as of March 18, 2016. 2) As of December 31, 2015. Bristow transports crews for oil and gas companies and provides search and rescue (SAR) services for them and governments alike Bristow is a leader in oilfield aviation services while our U.K. SAR contract provides meaningful non-energy cash flows

4 • Industry leading Target Zero safety program since 2006 • Heightened focus on our operations in light of FY16 accidents • Controlled water landing in Nigeria on February 3, 2016 Investigations ongoing – cooperating with authorities Lifting of temporary suspension of our S-76 aircraft in Nigeria – working with clients on return to service and assessing financial impact Our Target Zero safety culture is the key component of our corporate core values

5 Bristow provides service to the entire energy value chain, with a bias towards production • Largest share of revenues (~60%) relates to oil and gas production • There are ~8,000 offshore production installations worldwide — compared with >600 exploratory drilling rigs • ~1,900 helicopters are servicing the worldwide oil and gas industry, of which Bristow’s fleet is approximately twenty percent • Bristow revenues are primarily driven by our clients’ operating expenses

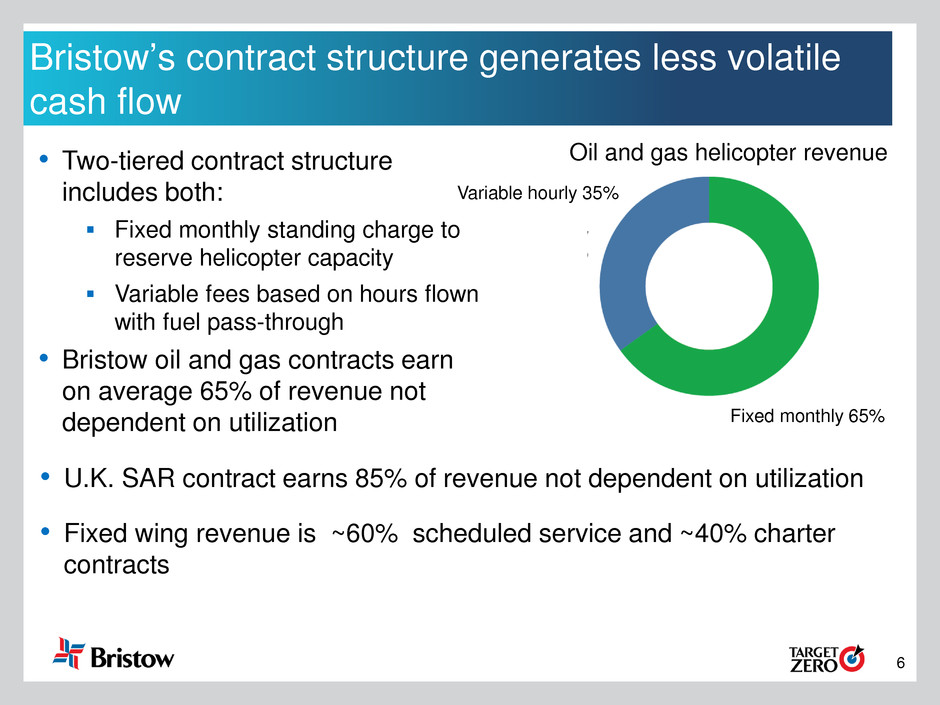

6 Bristow’s contract structure generates less volatile cash flow • Two-tiered contract structure includes both: Fixed monthly standing charge to reserve helicopter capacity Variable fees based on hours flown with fuel pass-through • Bristow oil and gas contracts earn on average 65% of revenue not dependent on utilization • U.K. SAR contract earns 85% of revenue not dependent on utilization • Fixed wing revenue is ~60% scheduled service and ~40% charter contracts Oil and gas helicopter revenue Variable hourly 35% Fixed monthly 65%

7 We have multiple levers to improve our operational and financial position • U.K. SAR and fixed wing contribution helping to mitigate the effect of the downturn • We have taken actions to improve our liquidity and financial flexibility through the downturn, including: Capex deferral Company-wide cost reduction initiatives Dividend reduction • Further actions have been identified: Incremental company-wide cost reductions Return of leased aircraft upon expiry Sale-leaseback of three AW139s with one closed and funded; total expected proceeds of ~$30 million once complete Total liquidity of $365 million as of March 18, 2016

8 - 200 400 600 800 1,000 1,200 1,400 YTD FY14 YTD FY15 YTD FY16 U.K. SAR Fixed wing Oil and gas We continue to employ our aviation competencies to diversify into complementary and growing businesses 98% 2% 79% 12% 9% Operating revenue by business line $ in m ill io ns • Successful diversification with non-oil and gas revenue up to ~21% this year, compared to ~2% in FY14 • Nine of ten U.K. SAR bases operational with total remaining capital of ~$175 million (including aircraft) • Consistent fixed wing businesses expected to contribute ~$45 million of EBITDAR in FY16 88% 3% 9%

9 Flexibility to reduce our fixed lease costs in future years • Modern fleet (average age ~8 years) requires limited ongoing renewal capital investment • Our mix of owned and leased aircraft gives us the option to return leased aircraft at expiry; reducing annual fixed cash costs while meeting demand with owned fleet and committed orders 2 20 45 76 5 14 23 38 0 5 10 15 20 25 30 35 40 0 10 20 30 40 50 60 70 80 FY17 FY18 FY19 FY20 LA C E c ou nt $ in m ill io ns Cumulative rent savings ($M) Cumulative LACE roll off

10 Addressing challenges to emerge with strength • We are focused on improving safety performance and reinforcing Target Zero programs • Successful FY16 cost reductions provide confidence that we can continue to be competitive and maintain our financial flexibility • The FY17 oil and gas industry outlook is expected to be more challenging: Company-wide productivity gains are needed to improve our competitiveness Other identified measures to maintain margins include efficiencies with our OEM and lessor partners • The long term outlook shows increasing benefits of our diversification and cost reduction efforts creating a path towards improved free cash flow, independent of industry recovery

11 We are Bristow

12 Bristow Group Inc. (NYSE: BRS) 2103 City West Blvd., 4th Floor Houston, Texas 77042 t 713.267.7600 f 713.267.7620 bristowgroup.com Contact us