Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FG Financial Group, Inc. | pih-8k_032216.htm |

1347 PROPERTY INSURANCE HOLDINGS, INC. 8-K

Exhibit 99.1

1 I NVESTOR P RESENTATION March 2016

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH S AFE H ARBOR This document contains forward - looking statements and management may make additional forward looking statements in response to your questions . Forward - looking statements include statements regarding the intent, belief or current expectations of the Company and its management about the Company’s business, financial condition and results of operations, among other factors . In some cases you can identify these statements by forward - looking words such as “may,” “might,” “will,” “will likely result,” “should,” “anticipates,” “expects,” “intends,” “plans,” “seeks,” “estimates,” “potential,” “continue,” “believes” and similar expressions, although some forward - looking statements are expressed differently . These forward - looking statements are based on the Company’s current expectations and assumptions that are subject to risks and uncertainties that may cause its actual results, performance, or achievements to differ materially from any expected future results, performance, or achievements expressed or implied by such forward - looking statements . All statements other than statements of historical fact are statements that could be deemed forward - looking statements . These risks and uncertainties include, but are not limited to the level of demand for the Company’s coverage and the incidence of catastrophic events related to its coverage ; the Company’s ability to grow and remain profitable in the competitive insurance industry ; its ability to access additional capital ; its ability to attract and retain qualified personnel ; changes in general economic, business and industry conditions ; and legal, regulatory, and tax developments . 2

3 A homeowners insurance company in states where we believe there is a significant potential for generating high returns on equity with controlled risk Ticker (NASDAQ: PIH) Stock Price $5.56 (as of 3/18/2016 ) Shares Outstanding 6.11 million (as of 3/18/2016) Market Cap $34.0 million (as of 3/18/2016) Sector / Industry Insurance A T A G LANCE

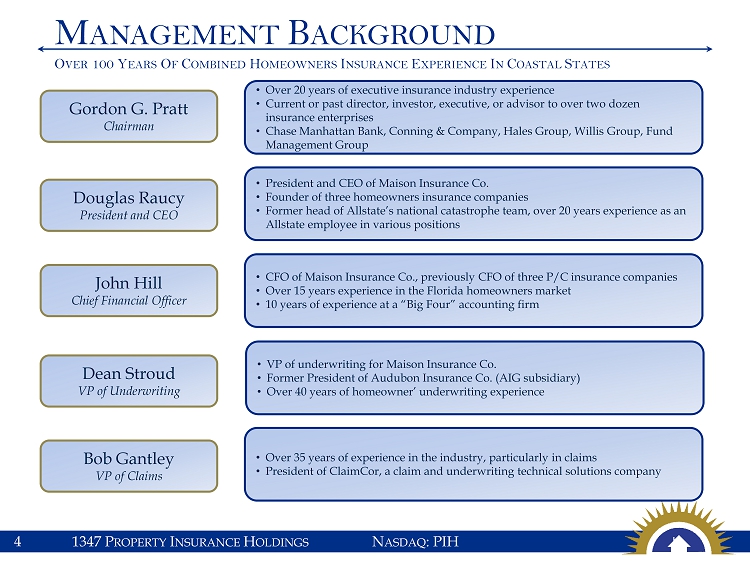

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Gordon G. Pratt Chairman Douglas Raucy President and CEO John Hill Chief Financial Officer Dean Stroud VP of Underwriting Bob Gantley VP of Claims • Over 20 years of executive insurance industry experience • Current or past director, investor, executive, or advisor to over two dozen insurance enterprises • Chase Manhattan Bank, Conning & Company, Hales Group, Willis Group, Fund Management Group • President and CEO of Maison Insurance Co. • Founder of three homeowners insurance companies • Former head of Allstate’s national catastrophe team, over 20 years experience as an Allstate employee in various positions • CFO of Maison Insurance Co., previously CFO of three P/C insurance companies • Over 15 years experience in the Florida homeowners market • 10 years of experience at a “Big Four” accounting firm • VP of underwriting for Maison Insurance Co. • Former President of Audubon Insurance Co. (AIG subsidiary) • Over 40 years of homeowner’ underwriting experience • Over 35 years of experience in the industry, particularly in claims • President of ClaimCor, a claim and underwriting technical solutions company 4 M ANAGEMENT B ACKGROUND O VER 100 Y EARS O F C OMBINED H OMEOWNERS I NSURANCE E XPERIENCE I N C OASTAL S TATES

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Creating a homeowners insurance company in states where we believe there is a significant potential for generating high returns on equity with controlled risk Market Criteria Includes: » Target states with high property premiums in U . S . » Seek favorable legislative environment » Areas where industry giants (State Farm, Allstate, Farmers) are looking to decrease coastal risk exposure » Locations where management has experience in writing and managing wind - risk and independent and captive agent contacts » Ability to grow to scale quickly in part due to an existing state - run depopulation program – State - run insurer provides property insurance to marketplace and looks to shrink over time by allowing private insurers to “take out” policies and assume that risk T ARGETING T HE C ORRECT M ARKETS 5

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Integrated Insurance Company Targeting High Potential Markets Management Team with Experience Establishing and Managing Coastal Business Favorable Reinsurance Market Plan for Expansion into Coastal States C OMPELLING I NVESTMENT O PPORTUNITY 6

7 B USINESS O VERVIEW

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH » PIH is a holding company that owns an admitted property and casualty insurance company based in Louisiana, doing business as Maison Insurance Company ; a managing general agency (MGA) doing business in Louisiana, Maison Managers Inc .; and a claims handling company ClaimCor, LLC » Maison Insurance Company provides full coverage to personal residential dwellings on a multi - peril form to single family structures including manufactured housing units . Additionally it provides reduced coverage and wind/hail only coverage » Company is currently writing in Louisiana and Texas, while seeking entry into other coastal markets » ClaimCor, LLC is a claims and underwriting technical solutions company, acquired in January 2015 . The Company provides turnkey, customized, client centric claim and underwriting technical solutions to its business partners W HAT I S 1347 PIH Corporate structure: 1347 Property Insurance Holdings, Inc Maison Insurance Company Maison Managers, Inc ClaimCor, LLC P OLICY C OUNT T OTAL A SSETS 28,400 at 12/31/15 $82.1 million 8

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH 9 * Note: 1347 Advisors LLC is a wholly owned subsidiary of Kingsway America Inc. C OMPANY H ISTORY October 2012 Doug Raucy, CEO, forms Company December 2012 Company participates in “wind/hail - only” depopulation from Louisiana Citizens yielding 3,000 policies September 2013 Company reports profitable operations in Q3, begins to achieve necessary scale December 2013 Company assumes another 3,500 policies from Louisiana Citizens March 2014 IPO: $17.4M Company listed on NASDAQ: PIH June 2014 Company completes secondary offering of $23.0M December 2014 Company announces stock repurchase program Company signs definitive agreement to acquire ClaimCor, LLC 11,500 policies - in - force 23,600 policies - in - force March 2015 Company reports 2014 results; highlighted by profit of $3.6M, and $32.7M in direct premiums written February 2015 Company terminates management services agreement with 1347 Advisors, LLC. * 2012 2013 2014 2015 June 2015 Company finalizes partnership with Brotherhood Mutual and expands into Texas September 2015 Company begins writing wind/hail only and homeowners policies in Texas 28,400 policies - in - force

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH » Among the high est overall property insurance rates in the country » Low loss costs and attritional (non - catastrophe) loss ratios » Wind/hail - only policies are limited to providing coverage for these types of weather » Favorable regulatory environment » Significant opportunity to rapidly expand independent agent distribution network through Chief Underwriting Officer’s 40 years of experience in Louisiana homeowner market Population 4.7 million Total Number of Households Approximately 1.8 million Homeowners Direct Premiums Written $2.6 Billion* 4 - year CAGR for Direct Premiums Written (2011 - 2014) 3.11% Top Three in Market Share State Farm / Allstate LA Citizens * Source : U . S . Census, SNL Financial (Louisiana Homeowners Lines of Business) December 1 , 2015 Personal Property – Homeowner Multi - peril, fire, allied lines L OUISIANA M ARKET 10

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Population 26.9 million Total Number of Households Approximately 8.8 million Homeowners Direct Premiums Written $11.4 billion 4 - year CAGR for Direct Premiums Written (2011 - 2014) 5.80% Top Three in Market Share State Farm/ Allstate / Farmer’s * Source : U . S . Census, SNL Financial (Texas Homeowners Lines of Business) December 1 , 2015 Personal Property – Homeowner Multi - peril, fire, allied lines T EXAS M ARKET 11 » Texas Windstorm Insurance Association (TWIA) is the state's insurer of last resort for wind and hail coverage. The Company is currently developing a program to assist TWIA policyholders in obtaining coverage from the private insurance market. » Large market opportunity » Potential partnership opportunities in addition to existing partnership with Brotherhood Mutual » Underserved markets for homeowners and “wind - only” policies

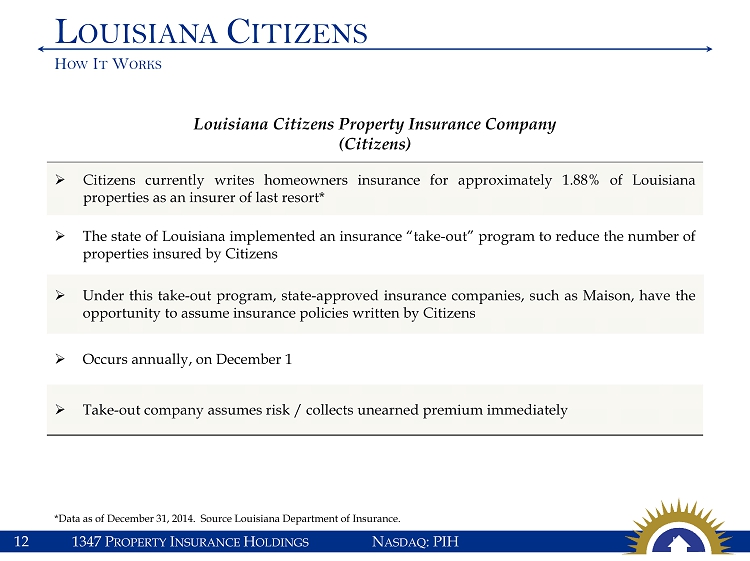

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Louisiana Citizens Property Insurance Company ( Citizens) » Citizens c urrently writes homeowners insurance for approximately 1 . 88 % of Louisiana properties as an insurer of last resort* » The state of Louisiana implemented an insurance “take - out” program to reduce the number of properties insured by Citizens » Under this take - out program, state - approved insurance companies, such as Maison, have the opportunity to assume insurance policies written by Citizens » Occurs annually, on December 1 » Take - out company assumes risk / collects unearned premium immediately L OUISIANA C ITIZENS H OW I T W ORKS 12 *Data as of December 31, 2014. Source Louisiana Department of Insurance.

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH » Homeowners : owner occupied dwellings, obtained through network of independent agents » Wind / Hail : protects insured from perils resulting only from wind and / or hail events, obtained through Louisiana Citizens depopulations » Manufactured Home : began writing policies through a partnership with American Modern Insurance Group and through independent broker - dealers » Dwelling Fire : non - owner occupied dwellings Policy Breakdown as of December 31, 2015 D IVERSE B OOK O F P OLICIES 13 Type of Policy Policy Count % of Total Policies in Force Homeowners 14,517 51.14% Wind/Hail 8,723 30.73% Manufactured Home 4,343 15.30% Dwelling Fire 806 2.84% Total 28,389 100.0% Homeowners 51% Wind/Hail 31% Manufactured Home 15% Dwelling Fire 3%

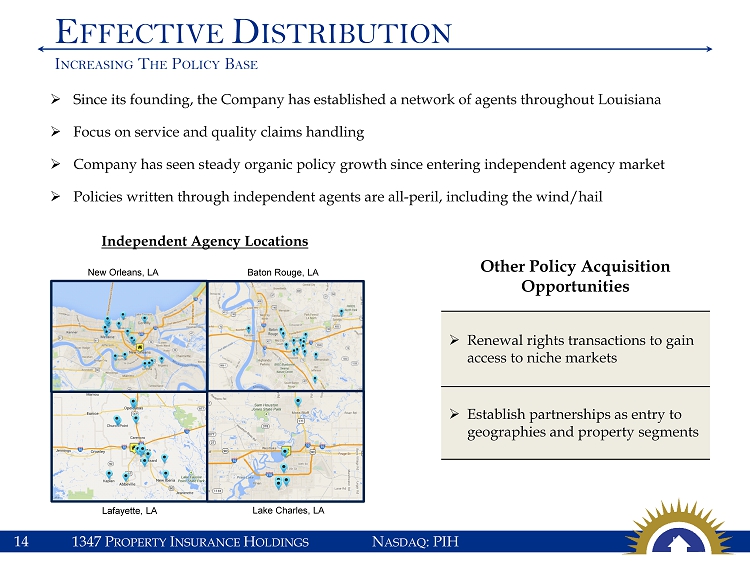

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH » Since its founding, the Company has established a network of agents throughout Louisiana » Focus on service and quality claims handling » Company has seen steady organic policy growth since entering independent agency market » Policies written through independent agents are all - peril, including the wind/hail New Orleans, LA Baton Rouge, LA Lafayette, LA Lake Charles, LA Other Policy Acquisition Opportunities » Renewal rights transactions to gain access to niche markets » Establish partnerships as entry to geographies and property segments Independent Agency Locations E FFECTIVE D ISTRIBUTION I NCREASING T HE P OLICY B ASE 14

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Underwriting discipline to select quality risks for wind / hail - only and full coverage policies » Develop products tailored for the market » Utilize technology to adequately assess insurance to value » Physically inspect every insured risk written organically through independent agents » Manage catastrophe risks through reinsurance, periodic modeling of in - force exposures and individual policy characteristics, e . g . , roof engineering » Address classes of risks and rate adequacy with annual rate filings » Responsive, highly efficient, and experienced claims operation » As a result of the acquisition of ClaimCor, PIH will begin to realize efficiencies and a direct cost savings from internalizing claims services during 2015 D ISCIPLINED U NDERWRITING P RACTICES 15

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Factors Influencing Global Supply of Reinsurance + Record levels of reinsurer capital + Increased investor interest in catastrophe bonds and similar collateralized facilities - Continued low market valuations of reinsurers’ shares = High reinsurance market supply F AVORABLE R EINSURANCE M ARKET The largest cost in homeowners insurance is reinsurance. 16

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH » Company has created a reinsurance program focused on preserving capital » Expects to utilize traditional reinsurance and the insurance - linked securities market to minimize reinsurance costs with 1 - in - 100 year event coverage and reinstatements R EINSURANCE S TRUCTURE 17 Maison Catastrophe Reinsurance Structure Treaty Year 2015 - 2016 Retention XOL w/RPP $121 M xs $4 M Top, Drop & Agg. $15 M xs $125 M 1 st EVENT Retention XOL w/RPP $121 M xs $4 M Top, Drop & Agg. $12 M xs $125 M $137 M $125 M $1 M 2 nd EVENT Top, Drop & Agg $3 M xs $1 M $4 M $12 M $140 M $125 M $4 M Top, Drop & Agg $12 M xs $0 3 rd EVENT Note: Aggregate retention of $5 million

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH C URRENT P REMIUM G ROWTH $32.7 $43.9 $9.6 $11.8 $0M $5M $10M $15M $20M $25M $30M $35M $40M $45M $50M YE 2014 YE 2015 Q4 2014 Q4 2015 Gross Premiums Written $18.5 $25.9 $5.2 $7.3 $0M $2M $4M $6M $8M $10M $12M $14M $16M $18M $20M $22M $24M $26M $28M YE 2014 YE 2015 Q4 2014 Q4 2015 Net Premiums Earned » Q4 2015 – 23.2% increase in gross premiums written to $11.8 million » 2015 - 34.2% year - over - year increase to $43.9 million in gross premiums written 18

19 G ROWTH S TRATEGY

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Mississippi Texas (Admitted and Writing) Florida E XPANSION I NTO N EW M ARKETS PIH intends, either organically or through acquisition, to expand into other coastal states that fit their selection criteria. » Possible first - ever depopulation from Texas Windstorm Insurance Association (TWIA) in 2015 » Large market opportunity » Potential partnership opportunities » Company would seek homeowners and “wind - only” policies and other underserved markets » Favorable legislative environment » Large market opportunity » Florida Citizens monthly depopulations » Company would seek homeowners and “wind - only” policies and other underserved markets » Company would seek homeowners and “wind - only” policies and other underserved markets » Mississippi Windstorm Underwriting Association depopulation potential » Potential partnership opportunities 20

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH State Aggregate Premium in Targeted Markets % of Targeted Market Florida (personal property) $13,144 47.5% Texas (commercial multi - peril / personal property ) $11,359 41.1% Louisiana (personal property) $2,633 9.5% Mississippi (personal property) $927 1.9% Total $28,063 100.0% Source : SNL Financial M ARKET O PPORTUNITIES 21 PIH’s goal is to capture between 2% and 3% of the Louisiana market in its first three years (approximately $78.9M) » The following represents the approximate aggregate industry premiums for targeted markets in the states that PIH anticipates writing (in millions):

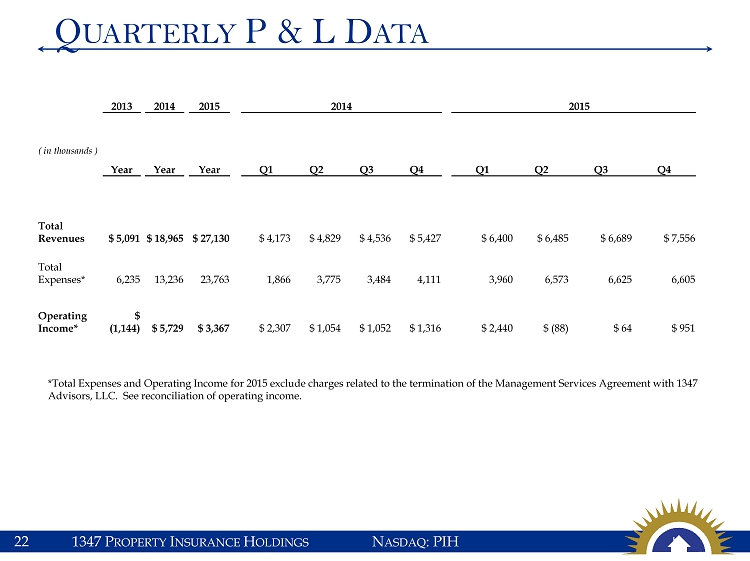

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH 2013 2014 2015 2014 2015 ( in thousands ) Year Year Year Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Total Revenues $ 5,091 $ 18,965 $ 27,130 $ 4,173 $ 4,829 $ 4,536 $ 5,427 $ 6,400 $ 6,485 $ 6,689 $ 7,556 Total Expenses* 6,235 13,236 23,763 1,866 3,775 3,484 4,111 3,960 6,573 6,625 6,605 Operating Income* $ (1,144) $ 5,729 $ 3,367 $ 2,307 $ 1,054 $ 1,052 $ 1,316 $ 2,440 $ (88) $ 64 $ 951 *Total Expenses and Operating Income for 2015 exclude charges related to the termination of the Management Services Agreement wi th 1347 Advisors, LLC. See reconciliation of operating income. Q UARTERLY P & L D ATA 22

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH (figures in millions, except per share data) Company Ticker Price (as of 3/17/2016) Market Cap Price/ Book Value (12/31/15) Universal Insurance Holdings Inc. UVE $18.95 $660.77 2.2 HCI Group, Inc. HCI $32.24 $356.40 1.4 United Insurance Holdings Corp. UIHC $18.33 $383.89 1.6 Federated National Holding Company FNHC $20.12 $276.94 1.2 Heritage Insurance Holdings, Inc. HRTG $15.99 $481.89 1.5 1347 Property Insurance Holdings, Inc. PIH $5.56 $35.25 0.72 Source: Bloomberg and Wall Street Research Note: LTM = Latest Twelve Months P EER C OMPARISON 23

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH Announced December 1, 2014; Extended to December 31, 2016 Up to 500,000 shares of common stock over 12 month period Repurchases will be made from time to time in open market transactions, privately - negotiated transactions, block purchases, or otherwise in accordance with Federal securities laws at the discretion of the Company’s management . S TOCK R EPURCHASE P ROGRAM 24 “While investing in the expansion of our business operations remains our first priority, the Board’s consent to initiate the program is a sign of the importance we place in the Company’s ability to create long - term profitable growth.” - CEO Doug Raucy From June 15, 2015 to December 31, 2015, the Company purchased approximately 224,000 shares at an average price of $7.73 per share.

1347 S 25

1347

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH 2013 2014 2015 2014 2015 ( in thousands ) Year Year Year Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 U.S. GAAP net (loss) income $ (748) $ 3,646 $ (1,673) $ 1,703 $ 616 $ 632 $ 695 $ (2,024) $ (125) $ (103) $ 579 Plus: Income tax (benefit) expense (396) 2,083 (663) 604 438 420 621 (957) (72) 82 284 Plus: Loss on Termination of MSA - - 5,421 - - - - 5,421 - - - Plus: Accretion of discount on Series B Preferred Shares - - 282 - - - - - 109 85 88 Operating (loss) Income $ (1,144) $ 5,729 $ 3,367 $ 2,307 $ 1,054 $ 1,052 $ 1,316 $ 2,440 $ (88) $ 64 $ 951 Operating Income Reconciliation 27

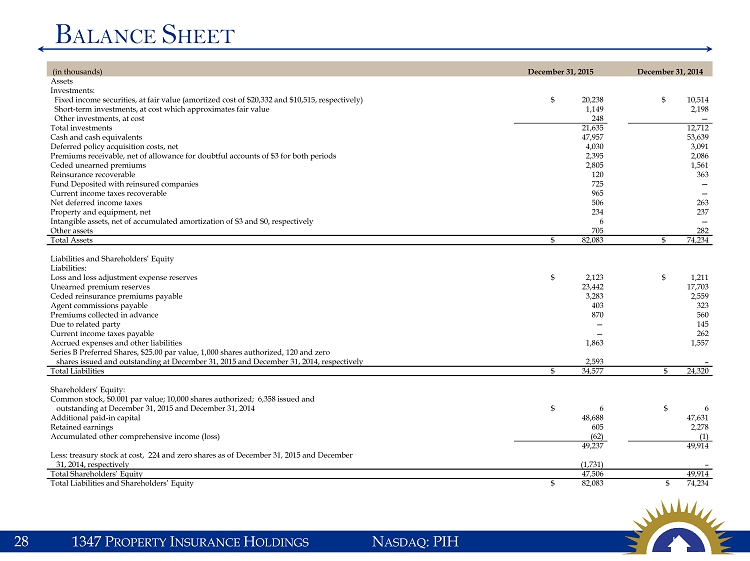

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH B ALANCE S HEET 28 (in thousands) December 31, 2015 December 31, 2014 Assets Investments : Fixed income securities, at fair value (amortized cost of $ 20 , 332 and $ 10 , 515 , respectively) $ 20,238 $ 10,514 Short - term investments, at cost which approximates fair value 1,149 2,198 Other investments, at cost 248 — Total investments 21,635 12,712 Cash and cash equivalents 47,957 53,639 Deferred policy acquisition costs, net 4,030 3,091 Premiums receivable, net of allowance for doubtful accounts of $ 3 for both periods 2,395 2,086 Ceded unearned premiums 2,805 1,561 Reinsurance recoverable 120 363 Fund Deposited with reinsured companies 725 — Current income taxes recoverable 965 — Net deferred income taxes 506 263 Property and equipment, net 234 237 Intangible assets, net of accumulated amortization of $ 3 and $ 0 , respectively 6 — Other assets 705 282 Total Assets $ 82,083 $ 74,234 Liabilities and Shareholders’ Equity Liabilities : Loss and loss adjustment expense reserves $ 2,123 $ 1,211 Unearned premium reserves 23,442 17,703 Ceded reinsurance premiums payable 3,283 2,559 Agent commissions payable 403 323 Premiums collected in advance 870 560 Due to related party — 145 Current income taxes payable — 262 Accrued expenses and other liabilities 1,863 1,557 Series B Preferred Shares, $ 25 . 00 par value, 1 , 000 shares authorized, 120 and zero shares issued and outstanding at December 31 , 2015 and December 31 , 2014 , respectively 2,593 – Total Liabilities $ 34,577 $ 24,320 Shareholders’ Equity : Common stock, $ 0 . 001 par value ; 10 , 000 shares authorized ; 6 , 358 issued and outstanding at December 31 , 2015 and December 31 , 2014 $ 6 $ 6 Additional paid - in capital 48,688 47,631 Retained earnings 605 2,278 Accumulated other comprehensive income (loss) (62) (1) 49,237 49,914 Less : treasury stock at cost, 224 and zero shares as of December 31 , 2015 and December 31 , 2014 , respectively (1,731) – Total Shareholders’ Equity 47,506 49,914 Total Liabilities and Shareholders’ Equity $ 82,083 $ 74,234

1347 P ROPERTY I NSURANCE H OLDINGS N ASDAQ : PIH C ONSOLIDATED S TATEMENT O F I NCOME 29 Three months ended December 30, Twelve months ended December 31, (in thousands, except per share data) 2015 2014 2015 2014 (Unaudited) (Audited) Revenue : Net premiums earned $ 7,264 $ 5,182 $ 25,934 $ 18,463 Net investment income 160 54 362 130 Other income 132 191 834 372 Total revenue 7,556 5,427 27,130 18,965 Expenses : Net losses and loss adjustment expenses 2,968 1,109 9,939 3,612 Amortization of deferred policy acquisition costs 1,798 1,475 6,571 4,529 General and administrative expenses 1,839 1,527 7,253 5,095 Loss on termination of Management Services Agreement — — 5,421 — Accretion of discount on Series B Preferred Shares 88 — 282 — Total expenses 6,693 4,111 29,466 13,236 (Loss) Income before income tax (benefit) expense 863 1,316 (2,336) 5,729 Income tax (benefit) expense 284 621 (663) 2,083 Net (loss) income 579 695 (1,673) 3,646 Less : beneficial conversion feature on convertible preferred shares — — — 500 Net (loss) income attributable to common shareholders $ 579 $ 695 $ (1,673) $ 3,146 (Loss) Earnings per share – net (loss) income attributable to common shareholders : Basic $ 0.09 $ 0.11 $ (0.27) $ 0.71 Diluted $ 0.09 $ 0.11 $ (0.27) $ 0.71 Weighted average common shares outstanding (in ‘ 000 s) Basic 6,174 6,358 6,287 4,454 Diluted 6,174 6,358 6,287 4,454 Consolidated Statements of Comprehensive (Loss) Income Net (loss) income $ 579 $ 695 $ (1,673) $ 3,645 Unrealized gains (losses) on fixed income securities, net of tax (121) 10 (62) (1) Comprehensive (loss) income $ 458 $ 705 $ (1,735) $ 3,644

30 For Additional Information At The

| |