Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WEYERHAEUSER CO | a20168-k31516citiconference.htm |

Doyle Simons, President & Chief Executive Officer CITI 2016 GLOBAL PROPERTY CEO CONFERENCE March 15, 2016 | Hollywood, FL 1

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES 2 This presentation contains statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, with respect to future prospects, business strategies, revenues, earnings, cash flow, taxes, funds available for distribution, pricing, production, supply, dividend levels, share repurchases, business priorities, performance, cost reductions, operational excellence initiatives, costs and operational synergies, demand drivers and levels, margins, growth, housing markets, capital structure, credit ratings, capital expenditures, cash position, debt levels, and harvests and export markets. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. We may use words such as “anticipate,” “believe,”, “continue”, “could,” “forecast,” “estimate,” “outlook,” “goal,” “will,” “plan,” “expect,” “target,” “plan,” “would” and similar terms and phrases, or we may refer to assumptions, goals or targets or reference expected performance through a future date, to identify forward-looking statements. Forward-looking statements are made based on management’s current expectations and assumptions concerning future events. These are inherently subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and often beyond the company’s control. Many factors could cause actual results to differ materially from those expressed or implied in these forward-looking statements, including, without limitation, our ability to successfully integrate the Plum Creek merger, our ability to successfully execute our performance plans, including cost reductions and other operational excellence initiatives, the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, strength of the U.S. dollar, market demand for our products, which is related to the strength of the various U.S. business segments and U.S. and international economic conditions, domestic and foreign competition, raw material prices, energy prices, the effect of weather, the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters, transportation availability and costs, federal tax policies, the effect of forestry, land use, environmental and other governmental regulations, legal proceedings, performance of pension fund investments and related derivatives, the effect of timing of retirements and changes in market price of our common stock on charges for share-based compensation, changes in accounting principles, and the other risk factors described in filings we make with the SEC, including in our annual report on Form 10-K for the year ended December 31, 2015. There is no guarantee that any of the anticipated events or results will occur or, if they occur, what effect they will have on the company’s operations or financial condition. The forward-looking statements contained herein apply only as of the date of this presentation and we do not undertake any obligation to update these forward-looking statements. Nothing on our website is included or incorporated by reference herein. Included in this presentation are certain non-GAAP financial measures which management believes complement the financial information presented in accordance with U.S. generally accepted accounting principles. Management believes such measures may be useful to investors. Our non-GAAP financial measures may not be comparable to similarly titled captions of other companies due to potential inconsistencies in the metrics of calculation. For a reconciliation of non-GAAP measures to GAAP measures see the appendices to this presentation.

MERGER WITH PLUM CREEK 3 • Shareholders overwhelmingly approved merger - 99% of Plum Creek voted “for” - 98% of Weyerhaeuser voted “for” • Closed on February 19, 2016 MERGER APPROVAL • New Senior Management Team in place • New Board of Directors in place • $100 million “run rate” cost synergies by end of year one • Operational synergies being identified INTEGRATION UNDERWAY • $2.5 billion bank term loan financing complete • $2.5 billion stock buyback authorization - Approximately $500 million complete • Credit ratings Baa2/BBB- CAPITAL STRUCTURE

• Board of Directors authorized exploration of strategic alternatives for Cellulose Fibers business in November 2015 • Review is proceeding as planned • Additional information forthcoming as process unfolds CELLULOSE FIBERS: STRATEGIC ALTERNATIVES 4 Creating the World’s Premier Timber, Land & Forest Products Company

WEYERHAEUSER’S TRANSFORMATION 5 TIMBERLANDS WOOD PRODUCTS CELLULOSE FIBERS WOOD PRODUCTS WRECO • Acquired Longview Timber • Divested WRECO • Merged with Plum Creek • Cellulose Fibers under strategic review *Book value of assets by business segment. Excludes Unallocated Items. Timberlands includes Real Estate and Energy and Natural Resources assets. Source: 2012 assets from WY 10-K. 2015 assets from WY 10-K and pro forma condensed combined financial information for the year ended Dec 31, 2015, excluding Cellulose Fibers assets of approximately $2.0 billion. 6.3 MILLION ACRES 13.2 MILLION ACRES WOOD PRODUCTS TIMBERLANDS WOOD PRODUCTS CELLULOSE FIBERS TIMBERLANDS WRECO ASSETS $18.5 BILLION* TODAY 2012 ASSETS $10.4 BILLION*

6

WEYERHAEUSER’S INVESTMENT THESIS • Most value from every acre • Operational excellence • Return cash to shareholders • Invest in our businesses • Maintain appropriate capital structure • Premier timber, land, and wood products assets Superior relative total shareholder return PORTFOLIO PERFORMANCE CAPITAL ALLOCATION SHAREHOLDER VALUE FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 7

PORTFOLIO

THREE BUSINESS SEGMENTS LEADING WOOD PRODUCTS MANUFACTURER • Lumber, OSB, Engineered Wood, Distribution • Low-cost LEADER IN MAXIMIZING VALUE FROM EVERY ACRE • Premium recreation and conservation lands • Valuable surface and subsurface resources LARGEST PRIVATE TIMBERLAND OWNER IN THE U.S. • 13.2 million acres • Unparalleled scale • Highly productive • Sustainably certified TIMBERLANDS REAL ESTATE, ENERGY & NATURAL RESOURCES WOOD PRODUCTS 9

UNMATCHED TIMBERLAND PORTFOLIO Western Region Southern Region Northern Region Note: 13.2 million acres includes 323,000 acres owned in Uruguay (not shown). Source: WY 2015 10-K, PCL 2015 10-K 10 13.2 MILLION ACRES

DIVERSE AND PRODUCTIVE TIMBERLANDS 56% 7.3 million acres Southern Region 22% 3.0 million acres Pacific Northwest 56% 7.3 million acres 22% 3.0 million acres 20% 2.6 million acres 13.2 MILLION ACRES TOTAL Highly productive Southern Yellow Pine forests High-value softwood sawlogs, mostly Douglas fir High-value hardwood sawlog & pulpwood URUGUAY 2% 323,000 acres WESTERN REGION NORTHERN REGION SOUTHERN REGION 11

Higher and Better Use (HBU) • Capture premium values above timberland value – Recreation – Conservation – Development Energy & Natural Resources • Capture value of all surface and subsurface assets – Oil and natural gas – Construction materials and minerals – Wind resources 12 REAL ESTATE: Maximize value of each of our 13.2 million acres

• Continued improvement through operational excellence • Well-positioned to benefit from improving housing markets 13 LEADING WOOD PRODUCTS PORTFOLIO * Capacity if mills produce exclusively solid section product. Three engineered wood products facilities also produce engineered I-Joists to meet market demand. 2015 production of I-Joists was 185 million lineal feet. 20 LUMBER MILLS 4.9 billion board feet capacity 6 OSB MILLS 3.0 billion square feet capacity 1 MEDIUM DENSITY FIBERBOARD MILL 265 million square feet capacity 5 VENEER / PLYWOOD FACILITIES 680 million square feet plywood capacity 6 ENGINEERED WOOD MILLS 43 million cubic feet solid section capacity* 17 DISTRIBUTION FACILITIES (not shown)

PERFORMANCE

Cost synergies of $100 million • Primarily corporate and regional overhead cost savings • Confident we will meet or exceed our target • Run rate at 12 months after close Operational synergies will be part of OpX targets • Apply best practices across the portfolio • Optimize harvest and log merchandising • Increase operating efficiencies in transportation and logging • Leverage forest management scale and infrastructure 15 COST AND OPERATIONAL SYNERGIES

GAINS FROM OPERATIONAL EXCELLENCE 16 Timberlands Lumber OSB ELP Distribution Cellulose Fibers $39 MM $21 MM $24 MM $35 MM EBITDA $8 MM EBITDA $47 MM $25 MM $25 MM $10 MM $35 MM EBITDA $28 MM $34 MM EBITDA OpX CAPTURED THROUGH 2015 $157 MM $174 MM $330 MILLION 2014 RESULTS 2015 RESULTS

17 TIMBERLANDS: OpX Performance 2016 OpX INITIATIVES • Logging productivity and costs • Transportation cost • Road maintenance & construction spending • Merchandising and marketing to capture full value of every log segment OPERATIONAL EXCELLENCE SIGNIFICANTLY INCREASING OpX TARGET TO INCLUDE OPERATIONAL SYNERGIES FOR PLUM CREEK MERGER 2 0 1 4 2 0 1 5 2 0 1 6 PROGRESS GOAL $25 MM $39 MM $10-20 MM $50-70 MM ORIGINAL GOAL ACHIEVED $20-30 MM ORIGINAL 2016 TARGET ADDITIONAL $200 MM TOTAL GOAL

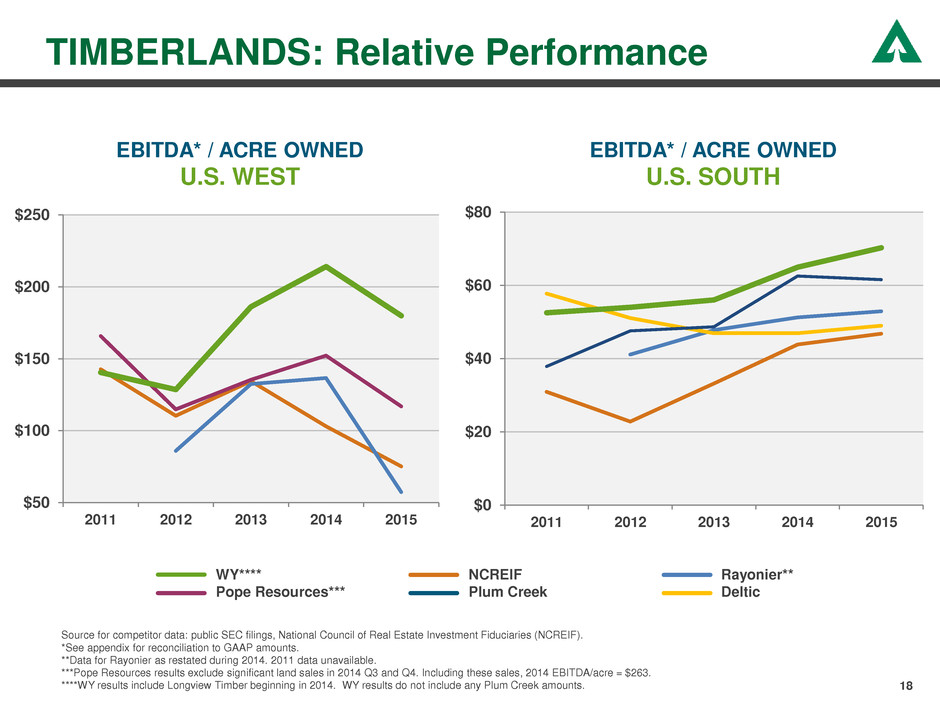

18 TIMBERLANDS: Relative Performance EBITDA* / ACRE OWNED U.S. WEST EBITDA* / ACRE OWNED U.S. SOUTH Source for competitor data: public SEC filings, National Council of Real Estate Investment Fiduciaries (NCREIF). *See appendix for reconciliation to GAAP amounts. **Data for Rayonier as restated during 2014. 2011 data unavailable. ***Pope Resources results exclude significant land sales in 2014 Q3 and Q4. Including these sales, 2014 EBITDA/acre = $263. ****WY results include Longview Timber beginning in 2014. WY results do not include any Plum Creek amounts. $50 $100 $150 $200 $250 2011 2012 2013 2014 2015 $0 $20 $40 $60 $80 2011 2012 2013 2014 2015 WY**** NCREIF Rayonier** Pope Resources*** Plum Creek Deltic

19 LUMBER: OpX Performance EBITDA MARGIN* RELATIVE PERFORMANCE Source for competitor data: public SEC filings | *See appendix for reconciliation to GAAP amounts Note: WY results do not include any Plum Creek amounts. . 2016 INITIATIVES • Rigorous cost control • Improved recovery • Capture full benefit of focused capital investments OPERATIONAL EXCELLENCE CONTROLLABLE MANUFACTURING COST -5% 0% 5% 10% 15% 20% 2011 2012 2013 2014 2015 Canfor Lumber Interfor Lumber West Fraser Lumber WY Lumber PROGRESS GOAL $25 MM $21 MM $15-20 MM 2 0 1 4 2 0 1 5 2 0 1 6 $100 MM TOTAL GOAL

20 OSB: OpX Performance EBITDA MARGIN* RELATIVE PERFORMANCE Source for competitor data: public SEC filings | *See appendix for reconciliation to GAAP amounts. 2016 INITIATIVES • Reliability • Controllable costs • Enhanced product mix OPERATIONAL EXCELLENCE CONTROLLABLE MANUFACTURING COST -10% 0% 10% 20% 30% 40% 2011 2012 2013 2014 2015 Ainsworth OSB LPX OSB Norbord OSB WY OSB PROGRESS GOAL $10 MM $24 MM $15-20 MM 2 0 1 4 2 0 1 5 2 0 1 6 $60 MM TOTAL GOAL

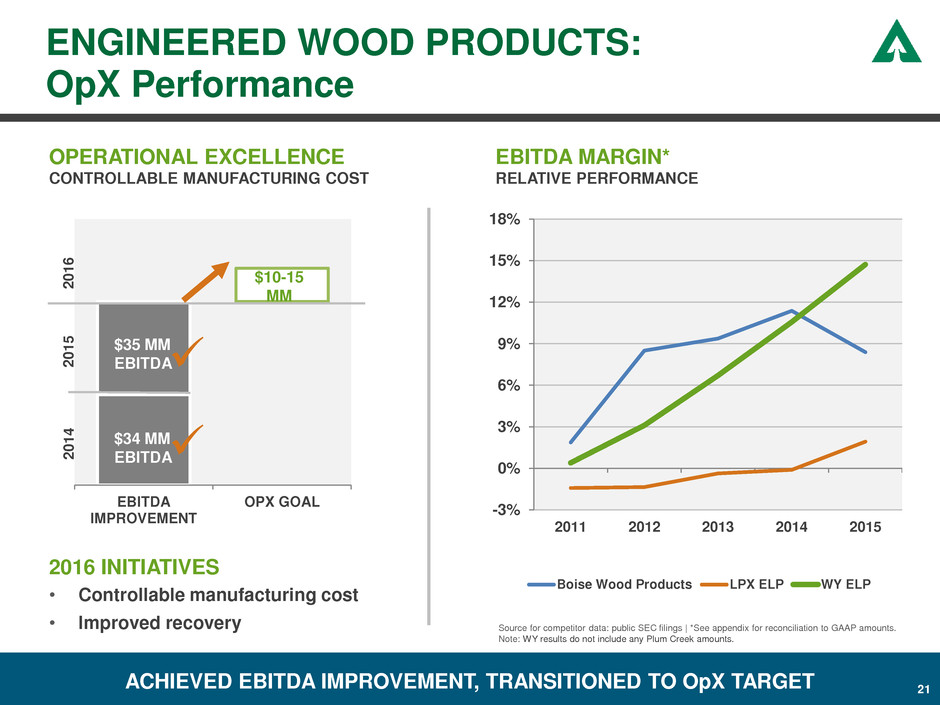

ENGINEERED WOOD PRODUCTS: OpX Performance EBITDA MARGIN* RELATIVE PERFORMANCE Source for competitor data: public SEC filings | *See appendix for reconciliation to GAAP amounts. Note: WY results do not include any Plum Creek amounts. 2016 INITIATIVES • Controllable manufacturing cost • Improved recovery OPERATIONAL EXCELLENCE CONTROLLABLE MANUFACTURING COST -3% 0% 3% 6% 9% 12% 15% 18% 2011 2012 2013 2014 2015 Boise Wood Products LPX ELP WY ELP ACHIEVED EBITDA IMPROVEMENT, TRANSITIONED TO OpX TARGET EBITDA IMPROVEMENT OPX GOAL $34 MM EBITDA $35 MM EBITDA $10-15 MM 2 0 1 4 2 0 1 5 2 0 1 6 21

22 DISTRIBUTION: Turnaround Performance EBITDA MARGIN* RELATIVE PERFORMANCE Source for competitor data: public SEC filings | *See appendix for reconciliation to GAAP amounts. ** Blue Linx results through 2015 Q3. 2015 Q4 results not yet available. 2016 INITIATIVES • Improved product margins • Reduced operating costs (warehouse and delivery) • Lower selling expenses DISTRIBUTION TURNAROUND CONTINUE EBITDA IMPROVEMENT -10% -8% -6% -4% -2% 0% 2% 4% 2011 2012 2013 2014 2015 Boise Distribution Blue Linx Distribution** WY Distribution EBITDA IMPROVEMENT $35 MM $8 MM $15-20 MM 2 0 1 4 2 0 1 6 2 0 1 5

• Disciplined process to identify higher-value lands • Complete portfolio review using Asset Value Optimization over next 12 months • Best NPV outcome wins REAL ESTATE STRATEGY TO CAPTURE HIGHEST VALUE PER ACRE FOR ALL TIMBERLANDS 23

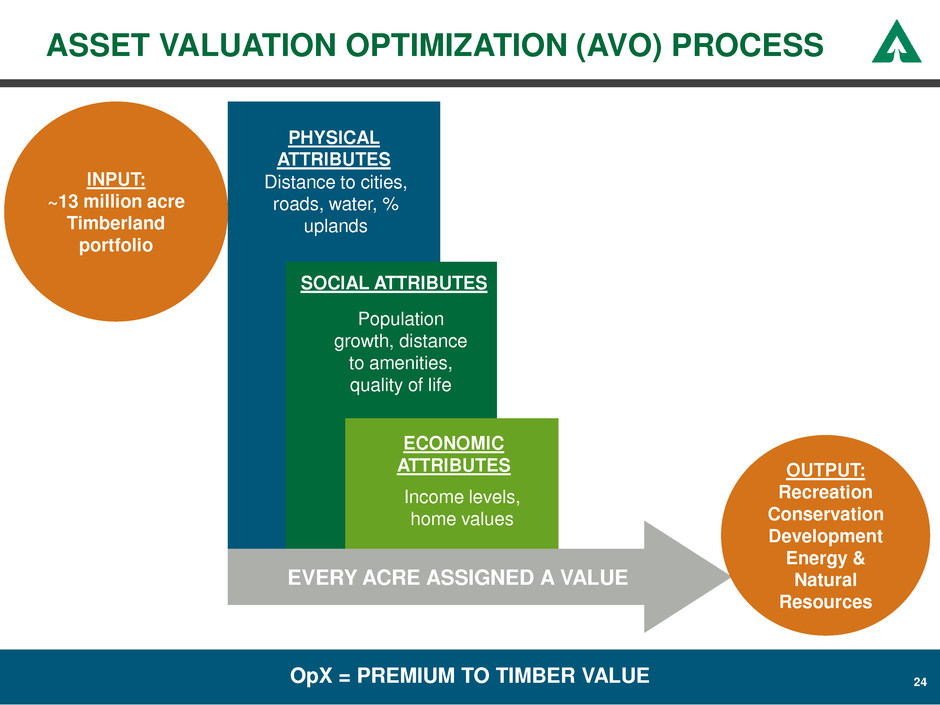

ASSET VALUATION OPTIMIZATION (AVO) PROCESS 24 EVERY ACRE ASSIGNED A VALUE PHYSICAL ATTRIBUTES Distance to cities, roads, water, % uplands ECONOMIC ATTRIBUTES Income levels, home values SOCIAL ATTRIBUTES Population growth, distance to amenities, quality of life INPUT: ~13 million acre Timberland portfolio OUTPUT: Recreation Conservation Development Energy & Natural Resources OpX = PREMIUM TO TIMBER VALUE 24

CAPITAL ALLOCATION

26 CAPITAL ALLOCATION PRIORITIES • Sustainable and growing dividend • Opportunistic share repurchases INVEST IN OUR BUSINESSES • Timberlands - Improve productivity • Wood Products - Reduce costs MAINTAIN APPROPRIATE CAPITAL STRUCTURE • Committed to a solid investment grade rating RETURN CASH TO SHAREHOLDERS

RETURNING CASH TO SHAREHOLDERS 27 • MORE THAN DOUBLED quarterly dividend since 2011 • COMMITTED to a sustainable and growing dividend $0.15 $0.17 $0.20 $0.22 $0.29 $0.31 2011 Q1 2012 Q4 2013 Q2 2013 Q3 2014 Q3 2015 Q3 QUARTERLY DIVIDEND PER SHARE

RETURNING CASH TO SHAREHOLDERS: Share repurchase 28 • $2.5 billion share repurchase authorization - $2.0 billion to be completed on an accelerated basis $2.5 BILLION AUTHORIZED $500 MILLION COMPLETE • Approx. $500 million completed - Over 20 million shares - Average price of approx. $26 per share - Over 20% of outstanding authorization

• Timberlands – Silviculture – Roads and infrastructure • Wood Products – Projects to reduce costs and improve productivity – Maintenance CAPEX • Real Estate, Energy and Natural Resources – Primarily entitlement activities 29 INVESTING IN OUR BUSINESSES * Excludes Cellulose Fibers. 2015 capital expenditures for Cellulose Fibers totaled $118 million. Estimated 2016 CAPEX for Combined Company* $150 million $300 million Minimal

• Post-transaction financing completed – Raised $2.5 billion of 18-month bank term loans at favorable floating rate (LIBOR +1.05%) – Term loans to be paid down primarily through asset sales • Committed to solid investment grade credit rating – Target net debt / EBITDA < 3.5x 30 CAPITAL STRUCTURE $0 $400 $800 $1,200 $1,600 $2,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 $ m il li o n s Legacy WY Debt Legacy PCL Debt *Excludes $2.5 billion of 18 month term loans entered into in Feb/Mar 2016. Weighted average cost of long-term debt approximately 6.0%. Weighted average cost of debt including $2.5 billion term loans approximately 4.8%. LONG-TERM DEBT* approximately $6.7 Billion

• Continued improvement in US housing – Economic expansion and rising employment boost household formations – Anticipate over 1.2 million housing starts in 2016 – Growth in single-family share • Moderate increase in Western and Southern log prices – Strengthening US housing market – Continued strong Japanese demand • Improving wood products demand and pricing 31 2016 OUTLOOK

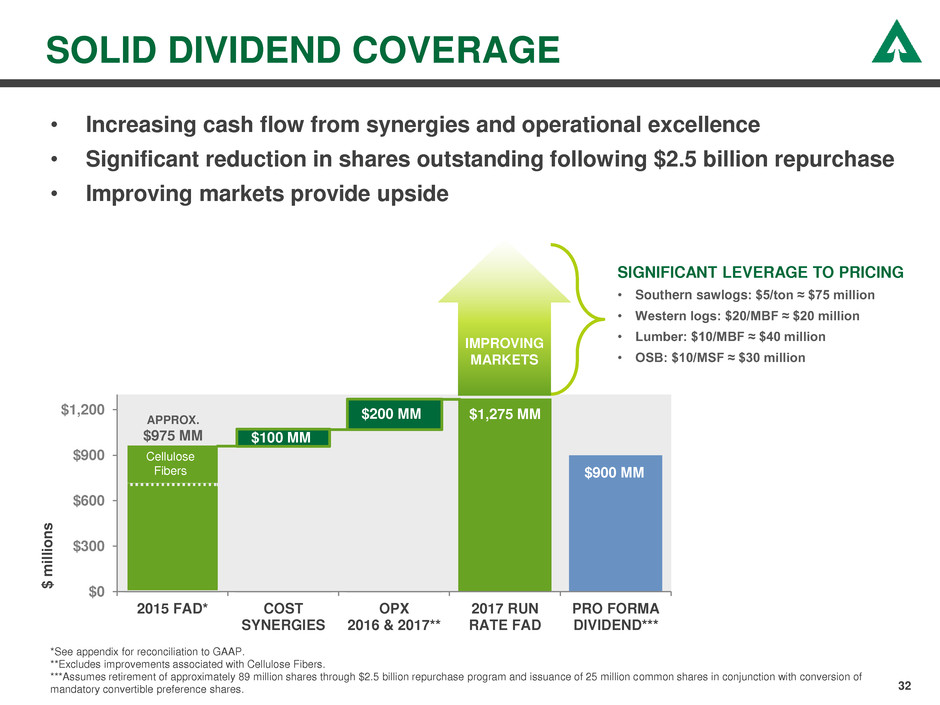

32 SOLID DIVIDEND COVERAGE • Increasing cash flow from synergies and operational excellence • Significant reduction in shares outstanding following $2.5 billion repurchase • Improving markets provide upside *See appendix for reconciliation to GAAP. **Excludes improvements associated with Cellulose Fibers. ***Assumes retirement of approximately 89 million shares through $2.5 billion repurchase program and issuance of 25 million common shares in conjunction with conversion of mandatory convertible preference shares. CELLULOSE FIBERS SIGNIFICANT LEVERAGE TO PRICING • Southern sawlogs: $5/ton ≈ $75 million • Western logs: $20/MBF ≈ $20 million • Lumber: $10/MBF ≈ $40 million • OSB: $10/MSF ≈ $30 million $0 $300 $600 $900 $1,200 2015 FAD* COST SYNERGIES OPX 2016 & 2017** 2017 RUN RATE FAD PRO FORMA DIVIDEND*** Cellulose Fibers IMPROVING MARKETS APPROX. $975 MM $ m il li o n s $200 MM $900 MM $1,275 MM $100 MM

• Driving enhanced performance through combination of two best in class industry leaders • More than 13 million acres of diverse and productive timberland • Low-cost manufacturing assets • Well positioned to capitalize on housing recovery • Committed to disciplined capital allocation • Focused on driving value for shareholders 33 SUMMARY Working together to be the world’s premier timber, land, & forest products company

APPENDIX

35 OUR TEAM DOYLE SIMONS President & Chief Executive Officer TOM LINDQUIST EVP, Real Estate, Energy & Natural Resources RHONDA HUNTER SVP, Timberlands ADRIAN BLOCKER SVP, Wood Products TIM PUNKE SVP, Corporate Affairs DENISE MERLE SVP, Human Resources RUSSELL HAGEN SVP, Chief Financial Officer DEVIN STOCKFISH SVP, General Counsel & Corporate Secretary Working together to be the world’s premier timber, land, & forest products company

U.S. HOUSING OUTLOOK Drives lumber and log demand 36 HOUSING DRIVERS POSITIVE • Economic growth and rising employment driving household formations • US housing starts still well below trend levels 0.0 0.5 1.0 1.5 2.0 2.5 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 *RISI *John Burns *Global Insight (Seasonally Adjusted Annual Rate) Source: Census Forecast* M ill io n U ni ts Quarterly 30 40 50 60 70 80 1995 1997 1999 2001 2003 2 05 2007 2009 2011 2013 2015 2017B ill io n B oa rd F ee t Annual Forecast Source: RISI DEMAND ON NORTH AMERICAN LUMBER MILLS TOTAL US HOUSING STARTS

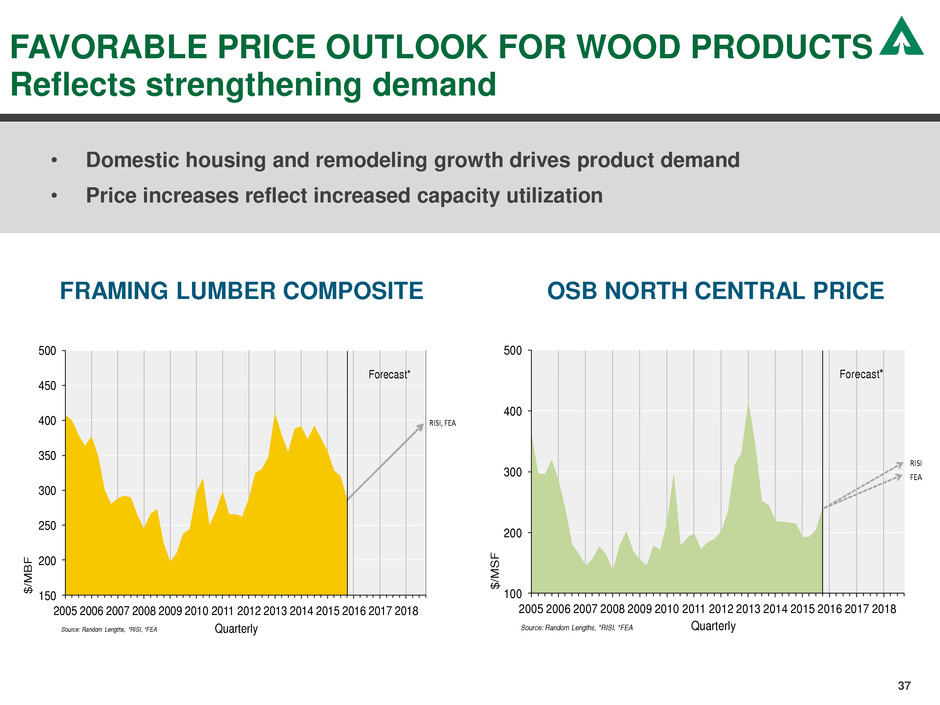

FAVORABLE PRICE OUTLOOK FOR WOOD PRODUCTS Reflects strengthening demand 37 OSB NORTH CENTRAL PRICE FRAMING LUMBER COMPOSITE • Domestic housing and remodeling growth drives product demand • Price increases reflect increased capacity utilization 150 200 250 300 350 400 450 500 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: Random Lengths, *RISI, *FEA $/ M B F Quarterly RISI, FEA Forecast* 100 200 300 400 500 2005 2006 2007 2008 2009 2010 201 2012 2013 2014 2015 6 2017 2018 $/ M S F QuarterlySource: Random Lengths, *RISI, *FEA Forecast* FEA RISI

FAVORABLE OUTLOOK FOR SOUTHERN LOG PRICES 38 • Domestic housing demand growth drives product prices and raw material • Canadian log supply constrained, limiting production growth and share of US market • Capacity expansions fuel growing log demand 20 30 40 50 60 70 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 $/ G re en T on Annual Forecast* Source: Timber Mart-South, *FEA, *RISI FEA RISI 0.0 5.0 10.0 15.0 20.0 25.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 US South Lumber Production Canadian Shipments to US B B F o f L u m b e r Source: Census, WWPA, COFI Annual US LUMBER SUPPLY SOURCES SOUTHERN LOG PRICE DELIVERED SOUTHERN AVERAGE PINE SAWLOG

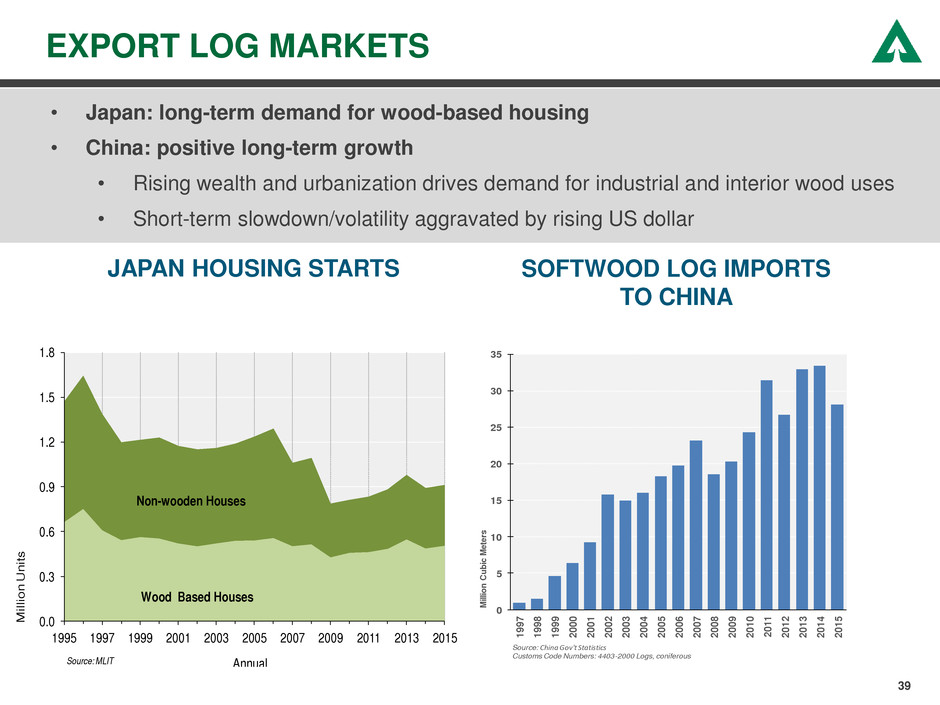

EXPORT LOG MARKETS 39 SOFTWOOD LOG IMPORTS TO CHINA 0 5 10 15 20 25 30 35 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 M ill io n C ub ic M et er s Source: China Gov't Statistics Customs Code Numbers: 4403-2000 Logs, coniferous • Japan: long-term demand for wood-based housing • China: positive long-term growth • Rising wealth and urbanization drives demand for industrial and interior wood uses • Short-term slowdown/volatility aggravated by rising US dollar 0.0 0.3 0.6 0.9 1.2 1.5 1.8 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 M ill io n U ni ts AnnualSource: MLIT Non-wooden Houses Wood Based Houses JAPAN HOUSING STARTS

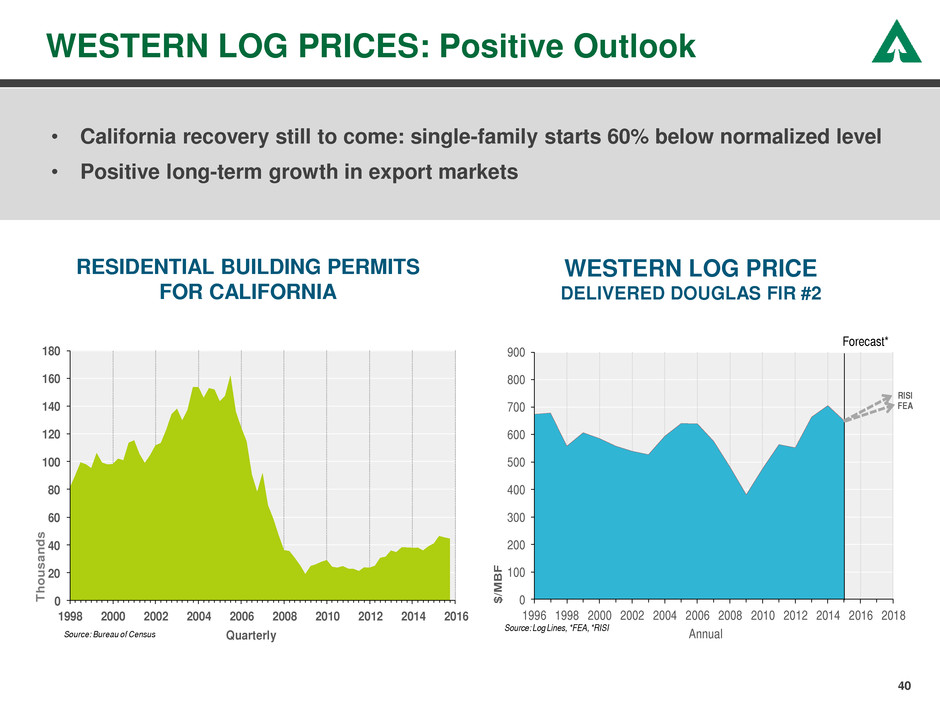

WESTERN LOG PRICES: Positive Outlook 40 • California recovery still to come: single-family starts 60% below normalized level • Positive long-term growth in export markets 0 20 40 60 80 100 120 140 160 180 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 T h o u sa n d s QuarterlySource: Bureau of Census RESIDENTIAL BUILDING PERMITS FOR CALIFORNIA 0 100 200 300 400 500 600 700 800 900 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 $/ M B F Annual Forecast* Source: Log Lines, *FEA, *RISI FEA RISI WESTERN LOG PRICE DELIVERED DOUGLAS FIR #2

CHANGES TO BUSINESS SEGMENT REPORTING REAL ESTATE, ENERGY & NATURAL RESOURCES TIMBERLANDS* WOOD PRODUCTS WOOD PRODUCTS CELLULOSE FIBERS UNALLOCATED 41 WEST • Washington • Oregon SOUTH • All Southern States NORTH • Montana • Lake States • New England • West Virginia OTHER • Includes Canada, Uruguay REAL ESTATE (formerly included in WY Timberlands) ENERGY & NATURAL RESOURCES (formerly included in WY Timberlands) LUMBER OSB ENGINEERED WOOD • Solid section • TJI® • Plywood • MDF DISTRIBUTION *Includes recreational lease revenue. UNCHANGED UNCHANGED

42 2015 EBITDA RECONCILIATION: Legacy WY by Segment $ Millions 2015 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $758 $212 $41 $114 $10 ($5) $372 $378 ($86) $1,422 Depletion, Depreciation & Amortization (209) (44) (30) (27) (5) -- (106) (154) (10) (479) Non-Operating Pension & Postretirement Credits -- -- -- -- -- -- -- -- 11 11 Special Items -- -- -- -- -- (8) (8) (27) (35) Operating Income (GAAP) $549 $168 $11 $87 $5 ($13) $258 $224 ($112) $919 Loss from Equity Affiliates -- -- -- -- -- -- -- (105) -- (105) Interest Income and Other -- -- -- -- -- -- -- -- 36 36 Net Contribution to Earnings from Continuing Operations $549 $168 $11 $87 $5 ($13) $258 $119 ($76) $850 Interest Expense, Net (347) Income Taxes 3 Net Earnings (GAAP) $506 Dividends on preference shares (44) Net Earnings to Common Shareholders (GAAP) $462 1. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

EBITDA RECONCILIATION: TIMBERLANDS Legacy WY by Segment $ Millions 2011 2012 2013 2014 2015 West1 $273 $250 $361 $556 $467 South 214 218 225 262 284 Other1 (15) (8) 46 2 7 Adjusted EBITDA2 $472 $460 $632 $820 $758 Depletion, Depreciation & Amortization (137) (142) (166) (207) (209) Special Items 152 -- -- -- -- Operating Income (GAAP) $487 $318 $466 $613 $549 Interest Income and Other 4 3 4 -- -- Loss Attributable to Non- Controlling Interest -- 1 -- -- -- Net Contribution to Earnings $491 $322 $470 $613 $549 1. Results from Longview Timber are included with Western Timberlands for 2014. For 2013, results from Longview Timber are included in Other due to acquisition in July 2013. Other also includes results from international operations and certain administrative charges. 2. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization and special items. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 43

$ Millions 2014 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $820 $319 $46 $79 $2 $-- $446 $447 ($79) $1,634 Depletion, Depreciation & Amortization (207) (41) (31) (41) (6) -- (119) (155) (12) (493) Non-Operating Pension & Postretirement Credits -- -- -- -- -- -- -- -- 45 45 Special Items -- -- -- -- -- -- -- -- 134 134 Operating Income (GAAP) $613 $278 $15 $38 ($4) $-- $327 $292 $88 $1,320 Interest Income and Other -- -- -- -- -- -- -- (1) 38 37 Net Contribution to Earnings from Continuing Operations $613 $278 $15 $38 ($4) $-- $327 $291 $126 $1,357 Interest Expense, Net (344) Income Taxes (185) Earnings from Discontinued Operations, Net of Income Tax 998 Net Earnings (GAAP) $1,826 Dividends on preference shares (44) Net Earnings to Common Shareholders (GAAP) $1,782 2014 EBITDA RECONCILIATION: Legacy WY by Segment 1. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 44

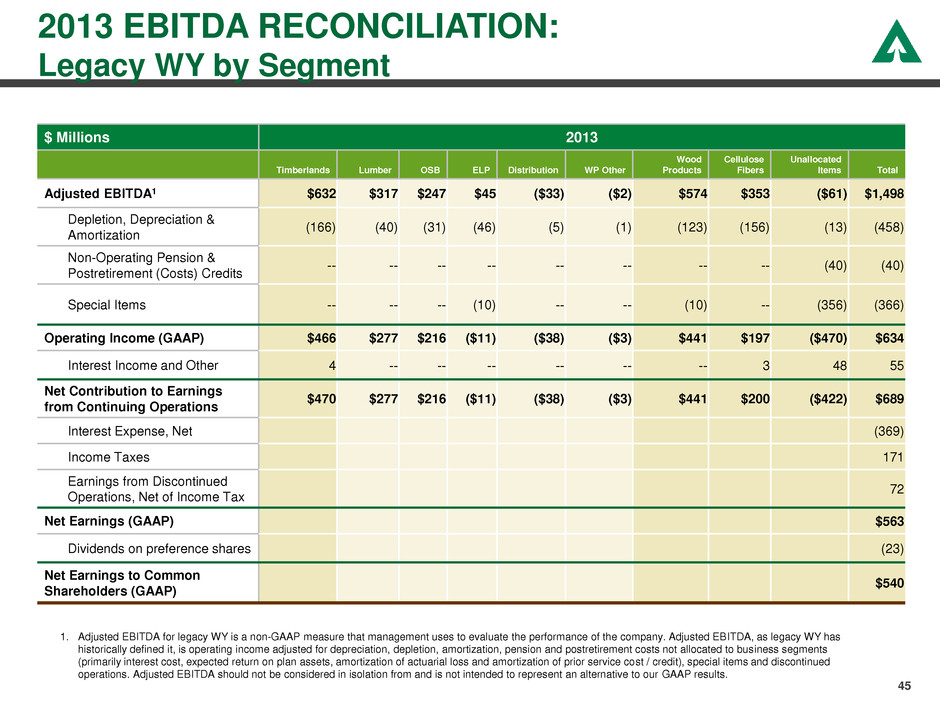

2013 EBITDA RECONCILIATION: Legacy WY by Segment $ Millions 2013 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $632 $317 $247 $45 ($33) ($2) $574 $353 ($61) $1,498 Depletion, Depreciation & Amortization (166) (40) (31) (46) (5) (1) (123) (156) (13) (458) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (40) (40) Special Items -- -- -- (10) -- -- (10) -- (356) (366) Operating Income (GAAP) $466 $277 $216 ($11) ($38) ($3) $441 $197 ($470) $634 Interest Income and Other 4 -- -- -- -- -- -- 3 48 55 Net Contribution to Earnings from Continuing Operations $470 $277 $216 ($11) ($38) ($3) $441 $200 ($422) $689 Interest Expense, Net (369) Income Taxes 171 Earnings from Discontinued Operations, Net of Income Tax 72 Net Earnings (GAAP) $563 Dividends on preference shares (23) Net Earnings to Common Shareholders (GAAP) $540 1. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 45

2012 EBITDA RECONCILIATION: Legacy WY by Segment 1. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. $ Millions 2012 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $460 $130 $143 $17 ($29) ($15) $246 $368 ($78) $996 Depletion, Depreciation & Amortization (142) (45) (31) (51) (5) (1) (133) (150) (19) (444) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (29) (29) Special Items -- -- -- -- -- 6 6 -- 89 95 Operating Income (GAAP) $318 $85 $112 ($34) ($34) ($10) $119 $218 ($37) $618 Interest Income and Other 3 -- -- -- -- 1 1 5 39 48 Loss Attributable to Non- Controlling Interest 1 -- -- -- -- -- -- -- -- 1 Net Contribution to Earnings from Continuing Operations $322 $85 $112 ($34) ($34) ($9) $120 $223 $2 $667 Interest Expense, Net (344) Income Taxes (10) Earnings from Discontinued Operations, Net of Income Tax 72 Net Earnings to Common Shareholders (GAAP) $385 46

2011 EBITDA RECONCILIATION: Legacy WY by Segment $ Millions 2011 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $472 ($7) ($4) $6 ($37) ($1) ($43) $597 ($108) $918 Depletion, Depreciation & Amortization (137) (47) (34) (61) (6) (3) (151) (147) (28) (463) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (26) (26) Special Items 152 (5) (4) (26) (1) (16) (52) -- -- 100 Operating Income (GAAP) $487 ($59) ($42) ($81) ($44) ($20) ($246) $450 ($162) $529 Interest Income and Other 4 -- -- 1 -- 2 3 2 35 44 Net Contribution to Earnings from Continuing Operations $491 ($59) ($42) ($80) ($44) ($18) ($243) $452 ($127) $573 Interest Expense, Net (389) Income Taxes 86 Earnings from Discontinued Operations, Net of Income Tax 61 Net Earnings to Common Shareholders (GAAP) $331 1. Adjusted EBITDA for legacy WY is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as legacy WY has historically defined it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 47

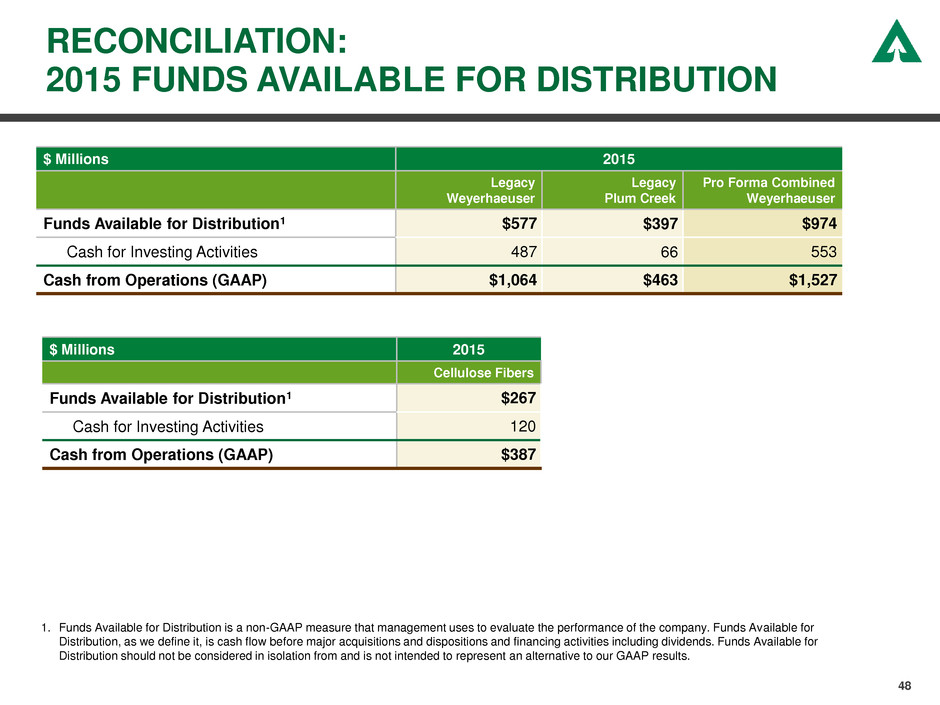

RECONCILIATION: 2015 FUNDS AVAILABLE FOR DISTRIBUTION 48 $ Millions 2015 Legacy Weyerhaeuser Legacy Plum Creek Pro Forma Combined Weyerhaeuser Funds Available for Distribution1 $577 $397 $974 Cash for Investing Activities 487 66 553 Cash from Operations (GAAP) $1,064 $463 $1,527 $ Millions 2015 Cellulose Fibers Funds Available for Distribution1 $267 Cash for Investing Activities 120 Cash from Operations (GAAP) $387 1. Funds Available for Distribution is a non-GAAP measure that management uses to evaluate the performance of the company. Funds Available for Distribution, as we define it, is cash flow before major acquisitions and dispositions and financing activities including dividends. Funds Available for Distribution should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.