Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Crimson Wine Group, Ltd | c151-20151231xex311.htm |

| EX-10.12 - EX-10.12 - Crimson Wine Group, Ltd | c151-20151231ex101287d95.htm |

| EX-10.13 - EX-10.13 - Crimson Wine Group, Ltd | c151-20151231ex10137a9b6.htm |

| EX-32.1 - EX-32.1 - Crimson Wine Group, Ltd | c151-20151231xex321.htm |

| EX-32.2 - EX-32.2 - Crimson Wine Group, Ltd | c151-20151231xex322.htm |

| EX-31.2 - EX-31.2 - Crimson Wine Group, Ltd | c151-20151231xex312.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

[_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 000-54866

CRIMSON WINE GROUP, LTD.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

13-3607383 |

|

(State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

2700 Napa Valley Corporate Drive, Suite B

Napa, California 94558

(800) 486-0503

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ] |

Accelerated filer [ x ] |

|

Non-accelerated filer [ ] |

Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Exchange Act). Yes [ ] No [x]

Based upon the closing sales price of the Registrant’s Common Stock as published by the OTC Market Service as of June 30, 2015, the aggregate market value of the Registrant’s Common Stock held by non-affiliates was approximately $186,432,000 on that date.

As of March 4, 2016, there were 24,229,846 outstanding shares of the Registrant’s Common Stock, par value $.01 per share.

|

CRIMSON WINE GROUP, LTD. |

||||

|

ANNUAL REPORT ON FORM 10-K |

||||

|

TABLE OF CONTENTS |

||||

|

Page Number |

||||

|

PART I |

||||

|

Item 1. |

3 |

|||

|

Item 1A. |

8 |

|||

|

Item 1B. |

12 |

|||

|

Item 2. |

12 |

|||

|

Item 3. |

12 |

|||

|

Item 4. |

12 |

|||

|

PART II |

||||

|

Item 5. |

13 |

|||

|

Item 6. |

15 |

|||

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

16 |

||

|

Item 7A. |

23 |

|||

|

Item 8. |

23 |

|||

|

Item 9. |

Changes and Disagreements with Accountants on Accounting and Financial Disclosure |

23 |

||

|

Item 9A. |

Conclusion Regarding Effectiveness of Disclosure Controls and Procedures |

23 |

||

|

Item 9B. |

23 |

|||

|

PART III |

||||

|

Item 10. |

24 |

|||

|

Item 11. |

26 |

|||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

28 |

||

|

Item 13. |

Certain Relationships and Related Transactions and Directors Independence |

30 |

||

|

Item 14. |

31 |

|||

|

PART IV |

||||

|

Item 15. |

33 |

|||

|

35 |

||||

2

EXPLANATORY NOTE

Crimson Wine Group, Ltd. qualifies as an “emerging growth company” pursuant to the provisions of the Jumpstart Our Business Startups Act (the “JOBS Act”), enacted on April 5, 2012. For as long as Crimson Wine Group, Ltd. remains an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other reporting companies which are not “emerging growth companies,” including reduced disclosure obligations regarding executive compensation in this Annual Report on Form 10−K (“Form 10−K”). Therefore, this Form 10−K does not include certain information regarding executive compensation that may be found in the annual reports of other reporting companies.

PART I

Our Company

Unless the context indicates otherwise, the terms the "Company," "Crimson," "we," "our" or "us" as used herein refer to Crimson Wine Group, Ltd. and its subsidiaries. Crimson has been conducting business since 1991. Prior to February 25, 2013, Crimson was a wholly-owned subsidiary of Leucadia National Corporation (“Leucadia”). On February 1, 2013, Leucadia declared a pro rata dividend of all of the outstanding shares of Crimson’s common stock in a manner that was structured to qualify as a tax-free spin-off for U.S. federal income tax purposes (the “Distribution”). Leucadia’s common shareholders received one share of Crimson common stock for every ten common shares of Leucadia, with cash in lieu of fractional shares, on February 25, 2013.

Crimson is in the business of producing and selling ultra-premium and luxury wines (i.e., wines that retail for $14 to $25 and over $25 per 750ml bottle, respectively). Crimson is headquartered in Napa, California and through its subsidiaries owns four wineries: Pine Ridge Vineyards, Archery Summit, Chamisal Vineyards and Seghesio Family Vineyards. In addition, Crimson owns Double Canyon Vineyards which owns land in the Horse Heaven Hills of Washington’s Columbia Valley.

The wine Crimson makes comes from estate grown grapes as well as grapes and bulk wine purchased under contract and on the spot-market. Our business model is a combination of direct to consumer sales and wholesale distributor sales. References to cases of wine herein refer to nine-liter equivalent cases.

Our Strategy

Our strategy is built on three pillars: Quality, Focus and Growth.

Quality. We believe we own some of the highest quality vineyards in the U.S. We farm our vineyards in a thoughtful, sustainable way with the goal of producing the highest quality grapes and the highest quality wines possible. As part of executing this strategy, Crimson currently owns or leases approximately 895 plantable acres of vineyard land in California, Oregon and Washington. The Company continues to assess other opportunities to enhance the quality of our vineyard holdings and wine portfolio.

Focus. We currently own five complementary estate-based winegrowing operations, with each having a unique varietal focus best suited to its specific appellation and region. We have a group of accomplished winegrowing teams who are each responsible for crafting benchmark wines from their respective wine regions. Many of Crimson’s brands are issued ratings or scores by local and national wine rating organizations and we believe our scores are a reflection of our focus on what we do best.

Growth. To support our quality and focus goals, all of our teams, including winegrowing, sales, marketing and administrative are driven towards continuous improvement. Our direct to consumer business continued to grow in 2015, with net sales in this channel increasing 5% as compared to 2014. The direct to consumer business generally generates higher gross margins and we intend to continue building this distribution channel in order to further our growth. Our wholesale distribution channel also continued to grow in 2015, with net sales in this channel increasing 7% as compared to 2014. Our wines are available in all states domestically through our network of 49 distributors, and our export team served customers in over 40 countries through independent importers and brokers during 2015.

Recent Developments

In December 2015, we opened the Estates Wine Room, an 1,800-square-foot urban tasting room located in Seattle’s historic Pioneer Square. The Estates Wine Room focuses on selling wines from Crimson's Northwest holdings – Double Canyon (Horse Heaven Hills, Washington), Archery Summit (Willamette Valley, Oregon) and in March of 2016 will add wines from Seven Hills Winery (Walla Walla, Washington).

3

On January 27, 2016, we entered into a purchase agreement pursuant to which we acquired, or have rights in, substantially all of the assets and certain liabilities with respect to Seven Hills Winery, located in Walla Walla, Washington. Seven Hills has established a storied wine program with a strong history of accolades for both Merlot and Bordeaux-style red blends, and the acquisition of Seven Hills Winery provides a strategic opportunity for Crimson to expand its portfolio.

Our Wineries and Vineyards

The following table summarizes the Company’s acreage as of December 31, 2015:

|

Plantable Acres |

|||||||

|

Owned |

Leased |

Total |

Currently Planted |

||||

|

Pine Ridge Vineyards (a) |

158 | 18 | 176 | 166 | |||

|

Archery Summit |

101 | 17 | 118 | 112 | |||

|

Chamisal Vineyards |

99 | 0 | 99 | 82 | |||

|

Seghesio Family Vineyards |

318 | 0 | 318 | 289 | |||

|

Double Canyon Vineyards |

184 | 0 | 184 | 91 | |||

|

Total |

860 | 35 | 895 | 740 | |||

(a) A lease for 16 plantable acres controlled by Pine Ridge Vineyards expired in February 2016.

Pine Ridge Vineyards

Pine Ridge Vineyards was acquired in 1991 and has been conducting operations since 1978. Pine Ridge Vineyards owns acreage in five Napa Valley appellations—Stags Leap District, Rutherford, Oakville, Carneros and Howell Mountain. The winery facility at Pine Ridge Vineyards has a permitted annual wine production capacity of up to 300,000 gallons, which equates to approximately 126,000 cases of wine; however, current fermentation and processing capacity is limited to approximately 80,000 cases without additional capital investment. The facility includes areas and equipment for crush, fermentation, aging and bottling processes, and also has a tasting room, hospitality center and administrative offices. Built into the hillside for wine barrel storage are approximately 34,000 square feet of underground caves with a capacity to store over 4,000 barrels. In addition, there are special event dining areas both indoors and outdoors as well as in the underground caves.

The Pine Ridge Vineyards estate business is focused primarily on the production of high quality Cabernet Sauvignon and Bordeaux-style blends sold by Crimson under the Pine Ridge Vineyards brand name. Pine Ridge Vineyards also produces Chenin Blanc + Viognier, which is sold by Crimson under the Pine Ridge brand name and is made from purchased grapes and bulk wine juice processed at a third party custom winemaking facility with a contracted capacity of up to 131,000 cases for the 2015 harvest year. Incremental capacity options are under consideration and available.

Archery Summit

Crimson started Archery Summit in 1993. Archery Summit owns acreage in the Willamette Valley appellation in Oregon. The winery facility at Archery Summit has a permitted annual wine production capacity of up to 50,000 gallons, which equates to approximately 21,000 cases of wine; however, current fermentation and processing capacity is limited to approximately 15,000 cases. The facility includes areas and equipment for crush, fermentation, aging and bottling processes, and also has a tasting room, hospitality center and administrative offices. The facility has approximately 8,300 square feet of underground caves for wine barrel storage with a capacity to store over 600 barrels. In addition, there are special event dining areas indoors as well as in the underground caves.

Archery Summit is focused primarily on producing estate grown, expressive single vineyard Pinot Noir from tightly spaced vines sold by Crimson under the Archery Summit brand name. Archery Summit also produces Vireton Pinot Gris, which is sold by Crimson under the Archery Summit brand name and is made from purchased grapes processed at a third party custom winemaking facility with available contract capacity of up to 5,000 cases for the 2015 harvest year.

Chamisal Vineyards

Chamisal Vineyards was acquired in 2008 and has been conducting operations since 1973. The Chamisal Vineyard was the first vineyard planted in the Edna Valley in 1973. The winery facility at Chamisal has a permitted annual wine production capacity of up to 480,000 gallons which equates to approximately 200,000 cases of wine. The facility includes areas and equipment for crush, fermentation, aging and bottling processes, as well as a tasting room, hospitality center and administrative offices. There are special event dining areas outdoors.

Chamisal is focused on producing estate grown, benchmark Chardonnay and single vineyard Pinot Noir as well as a Stainless Chardonnay produced from both purchased and estate grown grapes. The wines are sold by Crimson under the Chamisal Vineyards

4

brand name.

Seghesio Family Vineyards

Seghesio Family Vineyards was acquired in 2011 and has been conducting operations since 1895. Seghesio Family Vineyards owns acreage in two Sonoma County appellations—Alexander Valley and Russian River Valley. Seghesio Family Vineyards has a long history of growing and producing Zinfandel and Italian varietal wines in the Sonoma region of California. The winery facility at Seghesio Family Vineyards has a permitted annual wine production capacity of up to 404,000 gallons which equates to approximately 170,000 cases of wine. The facility includes areas and equipment for crush, fermentation, aging, bottling and warehousing processes, as well as a tasting room, private hospitality areas and administrative offices. There are indoor and outdoor special event dining areas. In Alexander Valley, Seghesio Family Vineyards also owns a historic non-operating winery, mansion and railroad depot, which Crimson intends to convert into educational, tasting, hospitality and potentially incremental production facilities.

Seghesio Family Vineyards is focused on producing estate grown, world class Zinfandel and Italian varietal wines as well as a heritage Old Vine Zinfandel and Sonoma County Zinfandel produced from both purchased and estate grown grapes. The wines are sold by Crimson under the Seghesio Family Vineyards brand name.

Double Canyon Vineyards

Double Canyon Vineyards acquired land in 2005 and 2006 in the Horse Heaven Hills appellation in Washington. Starting with the 2010 vintage, Double Canyon Vineyards produced and bottled its first wine under the Double Canyon brand name. Since the launch of the Double Canyon brand name, Double Canyon Vineyards has developed a growth plan and significantly expanded production. During 2015, the majority of the grapes from the Double Canyon Vineyards were used for the Double Canyon brand. All of Double Canyon Vineyard’s production is performed in third-party custom crush facilities. Contracted capacity at Double Canyon Vineyards is up to 24,000 cases for the 2015 harvest year.

Double Canyon Vineyards is focused on producing estate grown, best of class Cabernet Sauvignon as well as a Horse Heaven Hills Cabernet Sauvignon from both purchased and estate grown grapes. The first vintage of the Horse Heaven Hills Cabernet Sauvignon was 2012 and launched in July 2014. Double Canyon Vineyards continues to increase its focus and volume in the wholesale channel for the Horse Heaven Hills Cabernet Sauvignon, including expansion across all U.S. markets in 2016.

Competition

The markets for ultra-premium and luxury products in the wine industry are intensely competitive. Crimson’s wines compete domestically and internationally with premium or higher quality wines produced in Europe, South America, South Africa, Australia and New Zealand, as well as in the United States. Crimson competes on the basis of quality, price, brand recognition and distribution capability, and the ultimate consumer has many choices of products from both domestic and international producers. A result of the intense competition has been, and may continue to be, upward pressure on Crimson’s selling and promotional expenses. Many of Crimson’s competitors are significantly larger with greater financial, production, distribution and marketing resources. The U.S. is dominated by three large wineries with production largely based in California, representing approximately 50% of the domestic U.S. case sales volume. Further, Crimson’s wines may be considered to compete with all alcoholic and nonalcoholic beverages.

Demand for ultra-premium and luxury wines can rise and fall with general economic conditions, and is also significantly affected by grape supply. Based on industry wide volume increases in these wine categories, Crimson believes more people are drinking wine than in the past. Crimson’s wines are typically sold at retail price points from $15 to $250 per bottle, however, in the wholesale channel, which represented 89% of Crimson’s case volume in the years ended December 31, 2015 and 2014 and 88% in the year ended December 31, 2013, the majority of volume is in the $15 to $25 range to our wholesale distributors.

Business Segments

Crimson reports operating results in two segments: Wholesale and Direct to Consumer. These business segments reflect how the Company’s operations are evaluated by senior management and the structure of its internal financial reporting. Both financial and certain nonfinancial data are reported and evaluated to assist senior management with strategic planning. The Company evaluates performance based on the gross profit of the respective business segments. Selling expenses that can be directly attributable to the segment are included, however, centralized selling expenses and general and administrative expenses are not allocated between operating segments. Therefore, net income information for the respective segments is not available. Based on the nature of the Company’s business, revenue generating assets are utilized across segments. Therefore, discrete financial information related to segment assets and other balance sheet data is not available and that information continues to be aggregated. Further information about segments, including sales, cost of sales, gross margin, directly attributable selling expenses, and contribution margin of the segments for the years ended December 31, 2015, 2014 and 2013, can be found in Note 14 to the consolidated financial statements.

5

Sales and Marketing

Crimson focuses on brand development and distribution to increase revenues and profitability, which has included acquisitions of vineyards and wineries and the development of new brands with existing assets.

Crimson’s sales and marketing team coordinates the sales and distribution of its various brands, maintains domestic and export distributor relationships and oversees the timing and allocation of new releases. The sales team has employees in major markets in the U.S. and internationally and, where required, as brokers in certain markets. Crimson’s wines are available through many principal retail channels for premium table wines, including fine wine restaurants, hotels, specialty shops, supermarkets and club stores, in all states domestically, as well as cruise lines and over 40 countries throughout the world.

Crimson believes that the quality and locations of its wineries and tasting facilities help to create demand for its brands at the consumer level which positively impacts sales to distributors as well. Crimson participates in many wine tasting and other promotional events throughout the country in order to increase awareness and demand for its products. Many of Crimson’s brands are issued ratings or scores by local and national wine rating organizations, and higher scores will usually translate into greater demand and higher pricing.

Wholesale

Crimson’s wines are primarily sold to distributors, who then sell to retailers and restaurants. Domestic sales of Crimson’s wines are made through 49 independent wine and spirits distributors. International sales are made through independent importers and brokers. During 2015, domestic distributor sales represented 54% of net sales and export sales represented 5% of net sales.

During 2015, Crimson’s wines were distributed predominantly by two distributors which in aggregate accounted for 25% of net sales.

Direct to Consumer

As permitted under federal and local regulations, Crimson has been placing increasing emphasis on direct sales to consumers, which it is able to do through the Internet, wine clubs, and at the wineries’ tasting rooms. During 2015, direct sales to consumers represented 35% of net sales. Approximately 62% of the direct to consumer net sales were through wine clubs, 24% were through the wineries’ tasting rooms and the balance from e-commerce, special events and reimbursement for freight expense. Members typically join our wine clubs after visiting our tasting rooms at our various facilities, or after hearing about our wine clubs from other members. Our tasting rooms are located in vacation areas that typically attract consumers interested in winemaking and touring the area. Direct sales to consumers are more profitable for Crimson as it is able to sell its products at a price closer to retail prices rather than the wholesale price received from distributors, however, for certain direct sales offers, some of the profit is offset by freight subsidies.

Grape Supply

Crimson controls approximately 895 acres of vineyards in the Napa Valley, Sonoma County and Edna Valley in California, the Willamette Valley in Oregon and the Horse Heaven Hills in Washington; approximately 740 acres of these vineyards are planted, with the majority of the unplanted acres in Washington. Crimson expects to continue vineyard development plans for the non-producing California and Oregon properties and there are plans in place to plant additional acres in Washington. Newly planted vines take approximately four to five years to reach maturity and vineyards can be expected to have a useful life of 25 years before replanting is necessary. Depending on the site, soil and water conditions and spacing, Crimson’s experience has been that it costs approximately $20,000 to $60,000 per acre over a three year period to develop open land into a producing premium wine grape vineyard, before taking into account the cost of the land. During 2015 the average cost per acre placed into service was approximately $40,000 per acre.

In 2015, approximately 31% of Crimson’s total grape supply came from Crimson controlled vineyards. Crimson purchases the balance of its supply from approximately 80 independent growers. The grower contracts range from one-year spot market purchases to intermediate and long term-agreements. During 2015, one grower represented 10% of Crimson’s grape supply and no other single grower represented 10% or more of Crimson’s grape supply.

Winemaking and grape growing are subject to a variety of agricultural risks. Various diseases, pests and certain weather conditions can materially and adversely affect the quality and quantity of grapes available to Crimson thereby materially and adversely affecting the supply of Crimson’s products and its profitability.

6

The table below summarizes Crimson’s wine grape supply and production from the last three harvests:

|

Harvest Year |

||||||

|

2015 |

2014 |

2013 |

||||

|

Estate grapes: |

||||||

|

Producing acres |

680 | 682 | 685 | |||

|

Tons harvested |

2,072 | 2,219 | 2,561 | |||

|

Tons per acre |

3.0 | 3.3 | 3.7 | |||

|

All grapes and purchased juice (in equivalent tons): |

||||||

|

Estate grapes |

2,072 | 2,219 | 2,561 | |||

|

Purchased grapes and juice |

4,564 | 4,703 | 4,149 | |||

|

Total (in tons) |

6,636 | 6,922 | 6,710 | |||

|

Total cases bottled |

425,000 | 387,000 | 352,000 | |||

Total cases shipped were approximately 349,000, 321,000 and 309,000 for the years ended December 31, 2015, 2014 and 2013, respectively. Cases shipped are disclosed for informational purposes, but do not necessarily correspond to the vintage year the grapes are grown and crushed. Depending on the wine, the production cycle to bottled sales is anywhere from one to three years.

Winemaking

Crimson’s winemaking philosophy includes the use of the latest industry winemaking advances to complement making wine in the traditional manner by starting with high quality fruit and handling it as gently and naturally as possible all the way to the bottle. Each of Crimson’s wineries is equipped with modern crush, fermentation and storage equipment as well as technology that is focused on producing the highest quality wines for each of the varietals it produces.

Government Regulation

Wine production and sales are subject to extensive regulation by the United States Department of Treasury Alcohol and Tobacco Tax and Trade Bureau (“TTB”), the California Department of Alcohol Beverage Control (“CABC”) and other state and federal governmental authorities that regulate interstate sales, licensing, trade and pricing practices, labeling, advertising and other activities. In recent years, federal and state authorities have required warning labels on beverages containing alcohol. Restrictions or taxes imposed by government authorities on the sale of wine could increase the retail price of wine, which could have an adverse effect on demand for wine in general. New or revised regulations or increased licensing fees or excise taxes on wine, if enacted, could reduce demand for wine and have an adverse effect on Crimson’s business, negatively impacting Crimson’s results of operations and cash flows.

Crimson is also subject to a broad range of federal and state regulatory requirements regarding its agricultural operations and practices. Crimson’s agricultural operations are subject to regulations governing the storage and use of fertilizers, fungicides, herbicides, pesticides, fuels, solvents and other chemicals. These regulations are subject to change and conceivably could have a significant impact on operating practices, chemical usage, and other aspects of Crimson’s business.

Seasonality

There is a degree of seasonality in the growing cycles, procurement and transportation of grapes. The wine industry in general historically experiences seasonal fluctuations in revenues and net income. Typically, Crimson has lower sales and net income during the first quarter and higher sales and net income during the fourth quarter due to seasonal holiday buying as well as wine club shipment timing. Crimson expects these trends to continue.

Employees

At December 31, 2015, Crimson employed 169 regular, full-time employees. Crimson also employs part-time and seasonal workers for its vineyard, production and hospitality operations. None of Crimson’s employees are represented by a collective bargaining unit and Crimson believes that its relationship with its employees is good.

Trademarks

Crimson maintains federal trademark registrations for its brands, proprietary products and certain logos, motifs and vineyard names. International trademark registrations are also maintained where it is appropriate to do so. Each of the United States trademark registrations is renewable indefinitely so long as the Company is making a bona fide usage of the trademark. The Company believes that its trademarks provide it with an important competitive advantage and has established a global network of attorneys, as well as branding, advertising and licensing professionals, to procure, maintain, protect, enhance and gain value from these registrations.

7

Investor Information

The Company is subject to the informational requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, the Company files periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding the Company and other issuers that file electronically.

The Company’s website is http://www.crimsonwinegroup.com. The Company also makes available through its website without charge its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are filed with or furnished to the SEC.

Cautionary Statement for Forward-Looking Information

Statements in this Report may contain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to current or historical facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “forecast,” “plan,” “intend,” “believe,” “may,” “should,” “would,” “could,” “likely,” and other words of similar expression.

Forward-looking statements give our expectations about the future and are not guarantees. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements to materially differ from any future results, performance and achievements expressed or implied by such forward-looking statements. We caution you, therefore, not to rely on these forward-looking statements.

Factors that could cause actual results to differ materially from any results projected, forecasted, estimated or budgeted that may materially and adversely affect the Company’s actual results include, but are not limited to, those set forth in Item 1A. Risk Factors.

These forward-looking statements are applicable only as of the date hereof. Except as may be required by law, we undertake no obligation to modify or revise any forward-looking statements to reflect events or circumstances occurring after the date of this Report.

Our business is subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included or incorporated by reference in this Report, before you decide whether to purchase our common stock. The risks set out below are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We are dependent on certain key personnel. Our success depends to some degree upon the continued service of Patrick DeLong, our President and Chief Executive Officer; Craig Williams, our Chief Operating Officer and Chief Winegrower; and our winemakers at our various facilities. The loss of the services of one or more of our key employees could harm our business and our reputation and negatively impact our profitability, particularly if one or more of our key employees resigns to join a competitor or to form a competing company.

We could experience significant increases in operating costs and reduced profitability due to competition for skilled management and staff employees. We compete with other entities for skilled management and staff employees, including entities that operate in different market sectors than us. Costs to recruit and retain adequate personnel could adversely affect results of operations.

Various diseases, pests and certain weather conditions could affect quality and quantity of grapes. Various diseases, pests, fungi, viruses, drought, frosts and certain other weather conditions could affect the quality and quantity of grapes, decreasing the supply of our products and negatively impacting our operating results. Future government restrictions regarding the use of certain materials used in grape growing may increase vineyard costs and/or reduce production. We cannot guarantee that our grape suppliers will succeed in preventing disease in their existing vineyards or that we will succeed in preventing disease in our existing vineyards or future vineyards we may acquire. For example, Pierce’s disease is a vine bacterial disease spread by insects which kills grapevines for which there is no known cure. If our vineyards become contaminated with this or other diseases, operating results would decline, perhaps significantly.

The lack of sufficient water due to drought conditions could affect quality and quantity of grapes. The availability of adequate

8

quantities of water for application at the correct time can be vital for grapes to thrive. Whether particular vineyards are experiencing water shortages depends, in large part, on their location. We are primarily dependent on wells accessing shared aquifers and shared reservoirs as a water source for our California vineyards and wineries. The current extended period of drought across much of California may put pressure on the use and availability of water for agricultural uses and in some cases governmental authorities have diverted water to other uses. The lack of available water could reduce our grape harvest and access to grapes and adversely impact results of operations. Scarcity of adequate water in our grape growing areas may also result in legal disputes among other land owners and water users causing the Company to expend resources to defend its access to water.

We may not be able to grow or acquire enough quality fruit for our wines. While we believe that we can secure sufficient supplies of grapes from a combination of our own production and from grape supply contracts with independent growers, we cannot be certain that grape supply shortages will not occur. Grape supply shortages resulting from a poor harvest can be caused by a variety of factors outside our control, resulting in reduced product that is available for sale. If revenues decline as a result of inadequate grape supplies, cash flows and profitability would also decline.

We face significant competition which could adversely affect our profitability. The wine industry is intensely competitive and highly fragmented. Our wines compete in several wine markets within the wine industry as a whole with many other domestic and foreign wines. Our wines also compete with comparably priced generic wines and with other alcoholic and, to a lesser degree, non-alcoholic beverages. A result of this intense competition has been and may continue to be upward pressure on our selling and promotional expenses. Many of our competitors have greater financial, technical, marketing and public relations resources than we do. There can be no assurance that in the future we will be able to successfully compete with our competitors or that we will not face greater competition from other wineries and beverage manufacturers.

We compete for shelf space in retail stores and for marketing focus by our independent distributors, most of whom carry extensive product portfolios. Nationwide we sell our products primarily through independent distributors and brokers for resale to retail outlets, restaurants, hotels and private clubs across the U.S. and in some overseas markets. Sales to distributors are expected to continue to represent a substantial portion of our net revenues in the future. A change in our relationship with any of our significant distributors could harm our business and reduce our sales. The laws and regulations of several states prohibit changes of distributors, except under certain limited circumstances, making it difficult to terminate a distributor for poor performance without reasonable cause, as defined by applicable statutes. Any difficulty or inability to replace distributors, poor performance of our major distributors or our inability to collect accounts receivable from our major distributors could harm our business. There can be no assurance that the distributors and retailers we use will continue to purchase our products or provide our products with adequate levels of promotional support. Consolidation at the retail tier, among club and chain grocery stores in particular, can be expected to heighten competitive pressure to increase marketing and sales spending or constrain or reduce prices.

Contamination of our wines could harm our business. We are subject to certain hazards and product liability risks, such as potential contamination, through tampering or otherwise, of ingredients or products. Contamination of any of our wines could cause us to destroy our wine held in inventory and could cause the need for a product recall, which could significantly damage our reputation for product quality. We maintain insurance against certain of these kinds of risks, and others, under various insurance policies. However, our insurance may not be adequate or may not continue to be available at a price or on terms that are satisfactory to us and this insurance may not be adequate to cover any resulting liability.

A reduction in consumer demand for wines could harm our business. There have been periods in the past in which there were substantial declines in the overall per capita consumption of wine products in our markets. A limited or general decline in consumption in one or more of our product categories could occur in the future due to a variety of factors, including: a general decline in economic conditions; changes in consumer spending habits; increased concern about the health consequences of consuming alcoholic beverage products and about drinking and driving; a trend toward a healthier diet including lighter, lower calorie beverages such as diet soft drinks, juices and water products; the increased activity of anti-alcohol consumer groups; and increased federal, state or foreign excise and other taxes on alcoholic beverage products. Reductions in demand and revenues would reduce profitability and cash flows.

A decrease in wine score ratings by important rating organizations could have a negative impact on our ability to create greater demand and pricing. Many of Crimson’s brands are issued ratings or scores by local and national wine rating organizations, and higher scores usually translate into greater demand and higher pricing. Although some of Crimson’s brands have been highly rated in the past, and Crimson believes its farming and winemaking activities are of a quality to generate good ratings in the future, Crimson has no control over ratings issued by third parties which may not be favorable in the future.

Climate change, or legal, regulatory or market measures to address climate change, may negatively affect our business, operations or financial performance, and water scarcity or poor quality could negatively impact our production costs and capacity. Our business depends upon agricultural activity and natural resources, including the availability of water. There has been much public discussion related to concerns that carbon dioxide and other greenhouse gases in the atmosphere may have an adverse impact on global temperatures, weather patterns and the frequency and severity of extreme weather and natural disasters. Severe weather events and climate change may negatively affect agricultural productivity in our vineyards. The quality and quantity of water available for use is important to the supply of grapes and our ability to operate our business. Adverse weather, measures enacted to

9

address climate change, and other environmental factors beyond our control could reduce our grape production and adversely impact our cash flows and profitability.

Environmental issues or hazardous substances on our properties could result in us incurring significant liabilities. We are subject to environmental regulations with respect to our operations, including those related to wastewater, air emissions, and hazardous materials use, storage and disposal. In addition, we own substantial amounts of real property that are critical to our business. If hazardous substances are discovered on any of our properties and the concentrations are such that the presence of such hazardous substances presents an unreasonable risk of harm to public health or the environment, we may be held strictly liable for the cost of investigation and remediation of hazardous substances. The cost of environmental remediation could be significant and adversely impact our financial condition, results of operations and cash flows.

Our indebtedness could have a material adverse effect on our financial health. In November 2015, our subsidiary, Pine Ridge Winery, LLC, entered into a senior secured term loan agreement with American AgCredit, FLCA (“FLCA”) for an aggregate principal amount of $16.0 million. We are guarantor of the term loan, which is collateralized by certain of our real property. In March 2013, we entered into a revolving credit facility with FLCA and CoBank, FCB as joint lenders that is secured by substantially all of our assets. We plan to rely upon the revolving credit facility for potential incremental capital project funding and in the future may use it for acquisitions. No amounts are currently outstanding under the revolving credit facility. Both the term loan and the revolving credit facility include covenants that require the maintenance of specified debt and equity ratios, limit the incurrence of additional indebtedness, limit dividends and other distributions to shareholders and limit certain mergers, consolidations and sales of assets. If we are unable to comply with these covenants, outstanding amounts could become immediately due and/or there could be a substantial increase in the rate of borrowing.

Changes in domestic laws and government regulations or in the implementation and/or enforcement of government rules and regulations may increase our costs or restrict our ability to sell our products into certain markets. Government laws and regulations result in increased farming costs, and the sale of wine is subject to taxation in various state, federal and foreign jurisdictions. The amount of wine that we can sell directly to consumers outside of California is regulated, and in certain states we are not allowed to sell wines directly to consumers and/or the amount that can be sold is limited. Changes in these laws and regulations could have an adverse impact on sales and/or increase costs to produce and/or sell wine. The wine industry is subject to extensive regulation by the “TTB” and various foreign agencies, state liquor authorities, such as the “CABC”, and local authorities. These regulations and laws dictate such matters as licensing requirements, trade and pricing practices, permitted distribution channels, permitted and required labeling, and advertising and relations with wholesalers and retailers. Any expansion of our existing facilities or development of new vineyards or wineries may be limited by present and future zoning ordinances, environmental restrictions and other legal requirements. In addition, new regulations or requirements or increases in excise taxes, income taxes, property and sales taxes or international tariffs, could affect our financial condition or results of operations. Recently, many states have considered proposals to increase, and some of these states have increased, state alcohol excise taxes. New or revised regulations or increased licensing fees, requirements or taxes could have a material adverse effect on our financial condition, results of operations or cash flows.

We may not be able to insure certain risks economically. We may experience economic harm if any damage to our properties is not covered by insurance. We cannot be certain that we will be able to insure against all risks that we desire to insure economically or that all of our insurers will be financially viable if we make a claim.

We may be subject to litigation, for which we may be unable to accurately assess our level of exposure and which if adversely determined, may have a significant adverse effect on our consolidated financial condition or results of operations. Although our current assessment is that there is no pending litigation that could reasonably be expected to have a significant adverse impact, if our assessment proves to be in error, then the outcome of litigation could have a significant impact on our financial condition or results of operations or cash flows.

The payment of dividends in the future is subject to the discretion of our board of directors. We do not have a regular dividend policy and whether or not to pay any dividends will be determined each year by our board of directors.

If our intangible assets or goodwill become impaired, we may be required to record significant charges to earnings. We have substantial intangible assets and goodwill on our balance sheet as a result of acquisitions we have completed, in particular the acquisition of Seghesio Family Vineyards. We review intangible assets and goodwill for impairment annually or more frequently if events or circumstances indicate that these assets might be impaired. Application of impairment tests requires judgment. A significant deterioration in a key estimate or assumption or a less significant deterioration to a combination of assumptions or the sale of a part of a reporting unit could result in an impairment charge in the future, which could have a significant adverse impact on our reported earnings.

Our common stock is not listed on any securities exchange; as a result there may be a limited public market for our common stock. Prices for our common stock are quoted on the Over-The-Counter (OTC) Market. Securities whose prices are quoted on the OTC Market do not have the same liquidity as securities that trade on a recognized market or securities exchange. An active trading market for our common stock may not be sustained in the future. As a result, stockholders may find it more difficult to dispose of or obtain accurate quotations as to the market value of our common stock.

10

Our common stock price may experience volatility. The stock market has from time to time experienced extreme price and volume fluctuations that often have been unrelated to the operating performance of particular companies. Changes in earnings estimates by analysts, if any, and economic and other external factors may have a significant effect on the market price of our common stock. Fluctuations or decreases in the trading price of our common stock may also adversely affect the liquidity of the trading market for our common stock.

Future sales of our shares could depress the market price of our common stock. The market price of our common stock could decline as a result of sales of a large number of shares of our common stock in the market or the perception that these sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate. Any disposition by any of our large shareholders of our common stock in the public market, or the perception that such dispositions could occur, could adversely affect prevailing market prices of our common stock.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses. Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act, are creating uncertainty for companies such as ours. We are committed to maintaining appropriate corporate governance and public disclosure. As a result, we may see an increase in general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities, which could harm our business prospects.

We are an “emerging growth company” and we cannot be certain if we will be able to maintain such status or if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors. We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and have taken advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirement of holding a nonbinding stockholder advisory vote on executive compensation, frequency of approval of executive compensation and any golden parachute payments not previously approved. We will retain emerging growth company status until the earliest of: (1) the last day of the fiscal year following the fifth anniversary of the date we first sold securities pursuant to an effective registration statement under the Securities Act; (2) the last day of the fiscal year in which we first had total annual gross revenues of $1 billion or more (indexed pursuant to the JOBS Act); (3) the date on which we are deemed to be a “large accelerated filer” as defined in Exchange Act Rule 12b-2 (i.e., an SEC registered company with a public float of at least $700 million that satisfies other tests); or (4) the date on which we have, within the previous three years, issued more than $1 billion of nonconvertible debt. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. However, we have irrevocably elected not to avail ourselves of this extended transition period for complying with new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Additionally, we cannot predict if investors will find our common stock less attractive because we rely on these exemptions. If some investors find our common stock less attractive as a result of our reduced disclosures, there may be less active trading in our common stock and our stock price may be more volatile.

We may not be able to engage in certain corporate transactions after the Distribution. Under the tax matters agreement that we have entered into with Leucadia, we covenant not to take actions that would jeopardize the tax-free nature of the Distribution. Additionally, we are required to indemnify Leucadia and its affiliates against all tax-related liabilities caused by the failure of the Distribution to qualify for tax-free treatment for U.S. federal income tax purposes (including as a result of events subsequent to the Distribution that caused Leucadia to recognize gain under Section 355(e) of the Code) to the extent these liabilities arise as a result of actions taken by us or our affiliates (other than Leucadia) or as a result of changes in ownership of our common stock. If the Distribution is taxable to Leucadia, Leucadia would recognize gain, if any, equal to the difference between Leucadia’s tax basis in our Common Stock distributed in the distribution and the fair market value of our Common Stock. Leucadia does not expect that there would be significant gain, if any, recognized on the Distribution even if it were found to be taxable. This covenant (and, to some extent, this indemnification obligation) may limit our ability to pursue certain strategic transactions, including being acquired in a transaction for cash consideration or from engaging in certain tax-free combinations in which our shareholders do not ultimately possess a majority ownership interest in the combined entity.

Significant influence over our affairs may be exercised by our principal stockholders. As of March 4, 2016, the significant stockholders of our company include our directors, Ian M. Cumming (approximately 9.3% beneficial ownership, including ownership by certain family members, but excluding Mr. Cumming’s charitable foundation), Joseph S. Steinberg (approximately 9.7% beneficial ownership, including ownership by trusts for the benefit of his respective family members, but excluding Mr. Steinberg’s private charitable foundation) and John D. Cumming (approximately 0.3% beneficial ownership). Accordingly, Messrs. Cumming and Steinberg could exert significant influence over all matters requiring approval by our stockholders, including the election or removal of directors and the approval of mergers or other business combination transactions.

11

We may not be fully insured against risk of catastrophic loss to wineries, production facilities or distribution systems as a result of earthquakes or other events, which may cause us to experience a material financial loss. A significant portion of Crimson’s controlled vineyards as well as supplier and other third party warehouses or distribution centers are located in California, which is prone to seismic activity. If any of these vineyards and facilities were to experience a catastrophic loss, it could disrupt our operations, delay production, shipments and revenue, and result in potentially significant expenses to repair or replace the vineyard or facility. If such a disruption were to occur, we could breach agreements, our reputation could be harmed, and our business and operating results could be adversely affected. Although we carry insurance to cover property damage and business interruption as well as certain production assets in the case of a catastrophic event, certain significant assets are not covered in the case of certain catastrophes as we believe this to be a prudent financial decision. We take steps to minimize the damage that would be caused by a catastrophic event, but there is no certainty that our efforts would prove successful. If one or more significant catastrophic events occurred damaging our own or third party assets and/or services, we could suffer a major financial loss.

Our business and reputation could suffer if we are unable to protect our information systems against, or effectively respond to, cybersecurity incidents or if our information systems are otherwise disrupted. We depend on information technology, including public websites and cloud-based services, for many activities important to our business, including to interface with our customers and consumers, to engage in digital marketing activities, to enable and improve the effectiveness of our operations, to order and manage materials from suppliers, to maintain financial accuracy and efficiency, to comply with regulatory, financial reporting, legal and tax requirements, to collect and store sensitive data and confidential information, and to communicate electronically with our employees and the employees of our suppliers and other third parties. If we do not allocate and effectively manage the resources necessary to build and sustain our information technology infrastructure, if we fail to timely identify or appropriately respond to cybersecurity incidents, or if our information systems are damaged, destroyed or shut down (whether as a result of natural disasters, fires, power outages, acts of terrorism or other catastrophic events, network outages, software, equipment or telecommunications failures, user errors, or from deliberate cyberattacks such as malicious or disruptive software, denial of service attacks, malicious social engineering, hackers or otherwise), our business could be disrupted and we could, among other things, be subject to: transaction errors; processing inefficiencies; the loss of, or failure to attract new, customers and consumers; the loss of revenues from unauthorized use, acquisition or disclosure of or access to confidential information; the loss of or damage to intellectual property or trade secrets, including the loss or unauthorized disclosure of sensitive data, confidential information or other assets; damage to our reputation; litigation; regulatory enforcement actions; violation of data privacy, security or other laws and regulations; and remediation costs. Further, our information systems and the information stored therein, could be compromised by, and we could experience similar adverse consequences due to, unauthorized outside parties intent on accessing or extracting sensitive data or confidential information, corrupting information or disrupting business processes or by inadvertent or intentional actions by our employees or agents. Similar risks exist with respect to the third-party vendors we rely upon for aspects of our information technology support services and administrative functions, including but not limited to payroll processing and health and benefit plan administration.

Item 1B. Unresolved Staff Comments.

None.

Crimson’s vineyards and winemaking facilities are described in Item 1. During 2014, the Company entered into a lease agreement in Napa, California to lease approximately 13,200 square feet of space for its administrative offices. The lease commenced July 1, 2014 for a term expiring June 30, 2020.

From time to time, Crimson may be involved in legal proceedings in the ordinary course of its business. Crimson is not currently involved in any legal or administrative proceedings individually or together that it believes are likely to have a significant adverse effect on its business, results of operations or financial condition.

Item 4. Mine Safety Disclosures.

Not applicable.

12

PART II

|

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

The Company’s common stock is traded in the over-the-counter market, OTC Market, under the symbol “CWGL.” The Company’s common stock is not listed on any stock exchange, and price information for the common stock is not regularly quoted on any automated quotation system.

The following table sets forth the high and low sales price of the Company’s common stock, as published by the National Association of Securities Dealers OTC Bulletin Board Service.

|

High |

Low |

||||

|

2014 |

|||||

|

First Quarter |

$ |

9.05 |

$ |

7.97 |

|

|

Second Quarter |

9.05 |

8.60 |

|||

|

Third Quarter |

9.78 |

8.76 |

|||

|

Fourth Quarter |

9.54 |

8.66 |

|||

|

2015 |

|||||

|

First Quarter |

$ |

9.49 |

$ |

8.80 |

|

|

Second Quarter |

9.80 |

9.05 |

|||

|

Third Quarter |

9.43 |

8.92 |

|||

|

Fourth Quarter |

9.42 |

8.30 |

On March 4, 2016, the closing sales price for the Company’s common stock was $8.45 per share. As of that date, there were 1,699 stockholders of record. The transfer agent for the Company’s common stock is American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038.

The Company and certain of its subsidiaries have net operating losses (“NOLs”) and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of its tax attributes, the Company's certificate of incorporation contains provisions which generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of five percent or more of the common stock and the ability of persons or entities now owning five percent or more of the common stock from acquiring additional common stock. The restrictions will remain in effect until the earliest of (a) December 31, 2022, (b) the repeal of Section 382 of the Internal Revenue Code (or any comparable successor provision) and (c) the beginning of a taxable year of the Company to which certain tax benefits may no longer be carried forward.

13

Purchases of equity securities

Share repurchase activity under the Company’s share repurchase program, on a trade date basis, as of December 31, 2015, was as follows:

|

Fiscal Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan |

Approximate Dollar Value of Shares that May Yet Be Purchased Under Publicly Announced Plan |

||||||

|

March 2014 - August 31, 2015 |

- |

$ |

- |

- |

$ |

2.0 | ||||

|

September 1-30, 2015 |

40,233 | 9.26 | 40,233 | 1.6 | ||||||

|

October 1 - 31, 2015 |

33,705 | 9.22 | 73,938 | 1.3 | ||||||

|

November 1 - 30, 2015 |

32,097 | 9.10 | 106,035 | 1.0 | ||||||

|

December 1-31, 2015 |

45,777 | 8.79 | 151,812 | 0.6 | ||||||

|

Total |

151,812 |

|

(1) |

In March 2014, the Board of Directors of the Company authorized a share repurchase program that provides for the repurchase of up to $2.0 million of outstanding common stock. The share repurchase program expires on the earlier of September 1, 2017 or the date that the aggregate purchase price of all shares repurchased reaches $2.0 million. Under the share repurchase program, any repurchased shares are constructively retired. In furtherance of the share repurchase program, on August 17, 2015, the Company adopted a 10b5-1 Plan to repurchase shares of the Company’s common stock. Under the 10b5-1 Plan, a broker will purchase up to $2.0 million of shares of the Company’s common stock at prevailing market prices with a maximum price per share of $9.50, subject to certain trading volume limitations. |

There have been no sales of unregistered securities by the Company within the past year. As of the last fiscal year end, the Company had not authorized any securities for issuance under any equity plans.

Dividend Policy

No dividends have been paid since the Distribution. The Company does not have a regular dividend policy and whether or not to pay dividends will be determined each year by our board of directors. The payment of dividends will also be subject to the terms and covenants contained in the Company’s revolving credit facility.

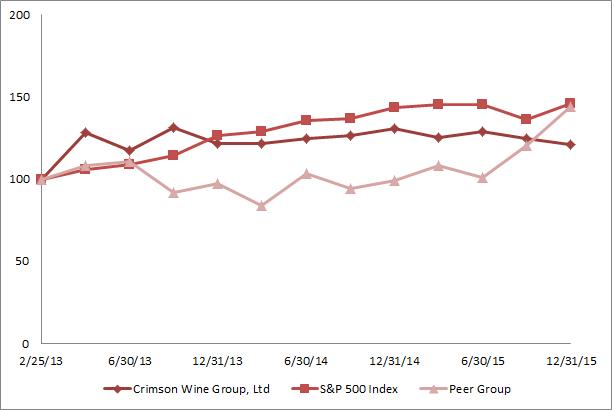

Stockholder Return Performance Graph

Set forth below is a graph comparing the cumulative total stockholder return on the Company’s common stock against the cumulative total return of the Standard & Poor’s 500 Stock Index and a peer group index (the “Peer Group Index”) for the period commencing February 25, 2013 to December 31, 2015. Index data was furnished by Standard & Poor’s Capital IQ. The graph assumes that $100 was invested on February 25, 2013 in each of our common stock, the S&P 500 Index and the Peer Group Index and that all dividends were reinvested.

14

|

INDEXED RETURNS |

|||||||||||||

|

Period Ending |

|||||||||||||

|

Company / Index |

Base Period 2/25/13 |

3/31/13 |

6/30/13 |

9/30/13 |

12/31/13 |

3/31/14 |

6/30/14 |

9/30/14 |

12/31/14 |

3/31/15 |

6/30/15 |

9/30/15 |

12/31/15 |

|

Crimson Wine Group, Ltd |

100 |

128.10 | 117.29 | 131.54 | 121.76 | 121.90 | 124.66 | 126.31 | 130.85 | 125.34 | 128.79 | 124.66 | 121.21 |

|

S&P 500 Index |

100 |

105.67 | 108.74 | 114.45 | 126.48 | 128.76 | 135.50 | 137.03 | 143.79 | 145.16 | 145.56 | 136.19 | 145.78 |

|

Peer Group |

100 |

108.22 | 110.49 | 91.77 | 97.40 | 84.23 | 103.66 | 94.28 | 99.37 | 108.06 | 100.86 | 120.58 | 143.90 |

The Peer Group Index is weighted according to the respective issuer’s stock market capitalization and is comprised of the following companies: Treasury Wine Estates; Truett Hurst, Inc. (included as of 6/20/2013 when it began trading); Vina Concha y Toro; and Willamette Valley Vineyards, Inc.

The stock price performance included in this graph is not necessarily indicative of future stock price performance. The Company neither makes nor endorses any predictions as to future stock performance.

Item 6. Selected Financial Data.

The following selected financial data have been summarized from the Company’s consolidated financial statements and are qualified in their entirety by reference to, and should be read in conjunction with, such consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations, contained in Item 7 of this Report. Subsidiaries and operations are reflected in the consolidated results from the date of acquisition, which was May 31, 2011 for Seghesio Family Vineyards.

|

Year Ended December 31, |

||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||

|

(In thousands, except per share amounts) |

||||||||||||||

|

SELECTED INCOME STATEMENT DATA |

||||||||||||||

|

Revenues |

$ |

60,977 |

$ |

58,114 |

$ |

56,472 |

$ |

48,774 |

$ |

39,306 | ||||

|

Gross Profit |

32,531 | 30,944 | 26,787 | 24,090 | 15,861 | |||||||||

|

Income (loss) from operations, inclusive of net gain/(loss) on the disposal of property and equipment (a) |

7,850 | 9,021 | 5,359 | 5,103 | (174) | |||||||||

|

Net income (loss) |

5,126 | 5,000 | 7,108 | 211 | (4,310) | |||||||||

|

Net income (loss) per share (b) |

0.21 | 0.20 | 0.29 | 0.01 | (0.18) | |||||||||

15

|

At December 31, |

||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||

|

(In thousands, except per share amounts) |

||||||||||||||

|

SELECTED BALANCE SHEET DATA |

||||||||||||||

|

Current Assets (c) |

$ |

107,364 |

$ |

85,256 |

$ |

74,231 |

$ |

54,138 |

$ |

49,922 | ||||

|

Property and equipment |

111,635 | 108,707 | 109,036 | 108,986 | 110,783 | |||||||||

|

Goodwill, intangible assets and other non-current assets |

16,947 | 18,353 | 19,873 | 21,079 | 22,593 | |||||||||

|

Total assets (c) |

235,946 | 212,316 | 203,140 | 184,203 | 183,298 | |||||||||

|

Due to Leucadia and its affiliates |

- |

- |

- |

152,183 | 151,441 | |||||||||

|

Long-term debt, including current maturities, net of unamortized loan fees |

15,915 |

- |

- |

- |

- |

|||||||||

|

Equity |

206,860 | 203,120 | 198,129 | 25,833 | 25,622 | |||||||||

|

Book value per share (b) |

8.51 | 8.30 | 8.10 | 1.06 | 1.05 | |||||||||

|

(a) |

Net (gain)/loss on the disposal of property and equipment was as follows: $(0.1) million in 2015, $(1.6) million in 2014, $(0.6) million in 2013, $0.3 million in 2012 and $0.1 million in 2011. Net (gain)/loss on the disposal of property and equipment previously reported in the years ended December 31, 2013, 2012 and 2011 was reclassified as a component of income from operations to conform with current year's presentation. |

|

(b) |

For the year ended December 31, 2015, basic and fully diluted weighted-average shares outstanding was 24,433,684, and as of December 31, 2015 there were 24,306,556 common shares outstanding. For all other periods presented, basic and fully diluted weighted-average shares outstanding for each period and shares outstanding as of each year-end was 24,458,368. As appropriate, amounts presented in this Report give retroactive effect to the Distribution for all periods presented, including net income (loss) per share, book value per share and shares outstanding. Both before and after the Distribution, there were no dilutive or complex equity instruments or securities outstanding at any time. |

|

(c) |

The company adopted FASB ASU 2015-17, Income Taxes (Topic 740), which requires an entity to classify all deferred tax assets and liabilities as noncurrent on the balance sheet instead of separating into current and noncurrent amounts, during 2015, and applied the new guidance retrospectively to all prior periods presented in the financial statements and Selected Financial Data presented in this Item 6. As a result of the adoption, current deferred income tax assets of $3.2 million and $3.0 million were reclassified as a reduction of non-current deferred tax liabilities in our December 31, 2014 and 2013, respectively, consolidated balance sheets. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The purpose of this section is to discuss and analyze the Company’s consolidated financial condition, liquidity and capital resources and results of operations. This analysis should be read in conjunction with the consolidated financial statements, related footnote disclosures and “Cautionary Statement for Forward-Looking Information,” which appear elsewhere in this Report.

Overview of Business

The Company generates revenues from sales of wine to wholesalers and direct to consumers, sales of bulk wine and grapes, special event fees, tasting fees and retail sales.

Our wines are primarily sold to wholesale distributors, who then sell to retailers and restaurants. As permitted under federal and local regulations, we have also been placing increased emphasis on generating revenue from direct sales to consumers which occur through wine clubs, at the wineries’ tasting rooms and through the internet and direct outreach to customers. Direct sales to consumers are more profitable for the Company as it is able to sell its products at a price closer to retail prices rather than the wholesale price sold to distributors. From time to time, we may sell grapes or bulk wine, because the wine does not meet the quality standards for the Company’s products, market conditions have changed resulting in reduced demand for certain products, or because the Company may have produced more of a particular varietal than it can use. When these sales occur, they may result in a loss.

Cost of sales includes grape and bulk wine costs, whether purchased or produced from the Company’s controlled vineyards, crush costs, winemaking and processing costs, bottling, packaging, warehousing and shipping and handling costs. For the Company controlled vineyard produced grapes, grape costs include annual farming labor costs, harvest costs and depreciation of vineyard assets. For wines that age longer than one year, winemaking and processing costs continue to be incurred and capitalized to the cost of wine, which can range from 3 to 36 months. Reductions to the carrying value of inventories are also included in costs of sales.

At December 31, 2015, wine inventory includes approximately 0.8 million cases of bottled and bulk wine in various stages of the aging process. Cased wine is expected to be sold over the next 12 to 36 months and generally before the release date of the next vintage.

Seasonality

As discussed in Item 1 of this Form 10-K, the wine industry in general historically experiences seasonal fluctuations in revenues and net income. The Company typically has lower sales and net income during the first quarter and higher sales and net income during the fourth quarter due to seasonal holiday buying as well as wine club shipment timing. We anticipate similar trends in the future.

Critical Accounting Estimates

Crimson’s discussion and analysis of its financial condition and results of operations are based upon its consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). The preparation of these financial statements requires Crimson to make estimates and assumptions that affect the reported amounts in the financial statements and disclosures of contingent assets and liabilities. On an on-going basis, Crimson evaluates all of these estimates

16

and assumptions. The following areas have been identified as critical accounting estimates because they have the potential to have a significant impact on Crimson’s financial statements, and because they are based on assumptions that are used in the accounting records to reflect, at a specific point in time, events whose ultimate outcome won’t be known until a later date. Actual results could differ from these estimates.

Inventory—Inventories are stated at the lower of cost or market, with cost being determined on the first-in, first-out method. Costs associated with winemaking, and other costs associated with the manufacturing of products for resale, are recorded as inventory. In accordance with general practice within the wine industry, wine inventories are included in current assets, although a portion of such inventories may be aged for periods longer than one year. As required, Crimson reduces the carrying value of inventories that are obsolete or in excess of estimated usage to estimated net realizable value. Crimson’s estimates of net realizable value are based on analyses and assumptions including, but not limited to, historical usage, future demand and market requirements. Reductions to the carrying value of inventories are recorded in cost of sales. If future demand and/or pricing for Crimson’s products are less than previously estimated, then the carrying value of the inventories may be required to be reduced, resulting in additional expense and reduced profitability. Inventory write-downs of $0.3 million, $0.5 million and $0 were recorded during the years ended December 31, 2015, 2014 and 2013, respectively.

Vineyard Development Costs—Crimson capitalizes internal vineyard development costs when developing new vineyards or replacing or improving existing vineyards. These costs consist primarily of the costs of the vines and expenditures related to labor and materials to prepare the land and construct vine trellises. Amortization of such costs as annual crop costs is recorded on a straight-line basis over the estimated economic useful life of the vineyard, which can be up to 25 years. As circumstances warrant, Crimson re-evaluates the recoverability of capitalized costs, and will record impairment charges if required. Crimson has not recorded any significant impairment charges for its vineyards during the three year period ended December 31, 2015.

Review of Long-Lived Assets for Impairment—For intangible assets with definite lives, impairment testing is required if conditions exist that indicate the carrying value may not be recoverable. For intangible assets with indefinite lives and for goodwill, impairment testing is required at least annually or more frequently if events or circumstances indicate that these assets might be impaired. Crimson currently has no intangible assets with indefinite lives. Substantially all of Crimson’s goodwill and other intangible assets result from the acquisition of Seghesio Family Vineyards in May 2011. Amortization of intangible assets is recorded on a straight-line basis over the estimated useful lives of the assets, which range from 7 to 20 years. Crimson evaluates goodwill for impairment at the end of each year, and has concluded that goodwill is not impaired.