Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - AutoWeb, Inc. | abtl8k_mar102016.htm |

| EX-99.1 - PRESS RELEASE DATED MARCH 10, 2016 - AutoWeb, Inc. | ex99-1.htm |

Exhibit 99.2

Autobytel Inc.

Moderator: Jeff Coats

March 10, 2016

5:00 p.m. ET

CORPORATE PARTICIPANTS

Sean Mansouri Liolios Group - IR AdvisorPrestopino

Jeff Coats Autobytel Inc. - President & CEO

Kimberly Boren Autobytel Inc. - CFO

CONFERENCE CALL PARTICIPANTS

Eric Martinuzzi Lake Street Capital Markets - Analyst

Austin Drake B. Riley & Co. - Analyst

Ed Woo Ascendiant Capital Markets LLC - Analyst

Gary Prestopino Barrington Research - Analyst

Patrick Lin Primarius Capital - Analyst

PRESENTATION

Operator

Good afternoon, everyone, and thank you for participating in today's conference call to discuss Autobytel's financial results for the fourth-quarter and full-year ended December 31, 2015. Joining us today are Autobytel's President and CEO, Jeff Coats; the Company's CFO, Kimberly Boren and the Company's outside Investor Relations Advisor, Sean Mansouri, with Liolios Group.

(Operator Instructions)

I would now like to turn the call over to Mr. Mansouri for some introductory comments.

Sean Mansouri - Liolios Group - IR Advisor

Thank you, Lauren. Before I introduce Jeff, I remind you that during today's call, including the question-and-answer session, any projections and forward-looking statements made regarding future events or Autobytel's future financial performance are covered by the Safe Harbor statements contained in today's press release, the slides accompanying this presentation and the Company's public filings with the SEC. Actual events may differ materially from those forward-looking statements.

Specifically, please refer to the Company's Form 10-K for the year ended December 31, 2015, which was filed prior to this call, as well as other filings made by Autobytel with the SEC from time to time. These filings identify factors that could cause results to differ materially from those forward-looking statements. There are slides included with today's presentation to help illustrate some of the points being made and discussed during the call.

The slides can be accessed by visiting Autobytel's website at www.autobytel.com. When there, go to Investor Relations and then click on Events and Presentations. Please also note that during this call and/or in the accompanying slides, management will be disclosing non-GAAP income and non-GAAP EPS, which are non-GAAP financial measures as defined by SEC Regulation G.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in today's press release and/or in the slides which are posted on the Company's website. And with that, I'll turn the call over to Jeff.

Jeff Coats - Autobytel Inc. - President & CEO

Thank you, Sean. Good afternoon, everyone. Thanks for joining us today to discuss our fourth-quarter and full-year 2015 results.

2015 was a pivotal year for Autobytel, highlighted by our acquisitions of Dealix and AutoWeb, growth in our higher-margin advertising business and lead program expansion with nearly all our OEM customers. As you can see on slide 3, for the year we set both revenue and non-GAAP EPS records and exited 2015 with the most technologically advanced capabilities in the history of Autobytel.

The fourth quarter was also particularly strong given overall lead volumes and strong click revenue from AutoWeb. While we remain in the early innings of integrating AutoWeb, the synergies across our technology platforms and data methodologies are beginning to ramp. In fact, we are in the process of finalizing our first AutoWeb-enhanced product solution which we expect to launch by the end of Q3.

This new product will combine a consumer lead with a click to visit a dealer or OEM website. We expect this combination of clicks and leads will give consumers a more in-depth experience and is just another way that we can leverage our technology to both enhance the dealer and OEM brands with consumers and help consumers as they move through the purchase process from online shopping to a dealership visit. Before commenting further on these exciting developments, I'd like to turn the call over to Kim and have her take us through the important details of our financial results. Kim?

Kimberly Boren - Autobytel Inc. - CFO

Thanks, Jeff, and good afternoon, everyone. For those of you following along with our earnings presentation, on slide 4 you can see our fourth quarter revenues increased 40% to a record $36.4 million compared to $26 million in the year-ago quarter. The increase was primarily driven by the acquisition of Dealix, expansion of most OEM programs and growth in advertising revenues.

Lead revenue from automotive dealers, our retail channel, increased 24% to $14 million compared to $11.3 million in the year-ago quarter, with the increase driven by Dealix. Lead revenue from automotive manufacturers and wholesale customers, our wholesale channel, increased 48% to $17.1 million compared to $11.5 million.

The strong lead growth in our wholesale channel was also driven by Dealix as well as higher volumes on several OEMs that expanded their leads program with us. Advertising revenues increased 125% to $3.7 million compared to $1.6 million in the year-ago quarter. The increase was due to growth in display advertising and direct marketing as well as a significant increase in click revenue.

The increase in click revenue was primarily driven by our commercial relationship with AutoWeb which we acquired in October 2015, as well as an increase in traffic from the acquisition of Dealix. A summary of our advertising relationships can be found on slide 5.

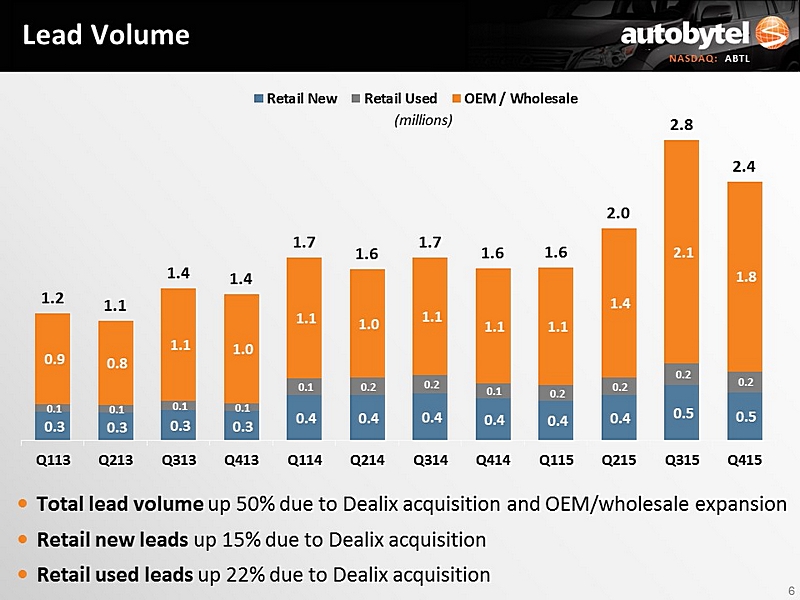

Moving now to slide 6, you will see that we delivered approximately $2.4 million automotive leads during the fourth quarter, a 50% increase over last year. Retail new leads increased 15% compared to the prior-year quarter while used leads increased 22%. 74% of leads were delivered to the wholesale channel with the remaining 26% to the retail channel. Dealix contributed to both the increase in our wholesale channel and used leads. However, as stated previously, our wholesale channel also benefited from the increased demand across several OEM lead programs.

Retail new leads invoiced per dealer was up 2% year-over-year in the fourth quarter of 2015 and retail used leads invoiced per dealer was up 11% in the same period. We delivered nearly 95,000 specialty finance leads during the fourth quarter, up 3% from 92,000 in the year-ago period. Specialty finance lead revenue was $1.6 million in the fourth quarter, up 2% from the year-ago period.

On slide 7 you will see dealer count stood at 4,753 as of December 31, which is a 14% increase from the year-ago quarter and a 2% decrease from September 30 with the sequential decrease driven by expected dealer churn from Dealix. As we stated in the past, we are making a concerted effort to raise the legacy Dealix lead quality to retain and grow the dealer base.

We continue to focus on quality from the Dealix acquisition, paring back where necessary. In the second half of 2015 alone, we eliminated $2 million to $3 million in revenue from Dealix leads, further reflecting our commitment to quality and ensuring our dealer and OEM customers can continue to rely on Autobytel for high-value, in-market consumer leads.

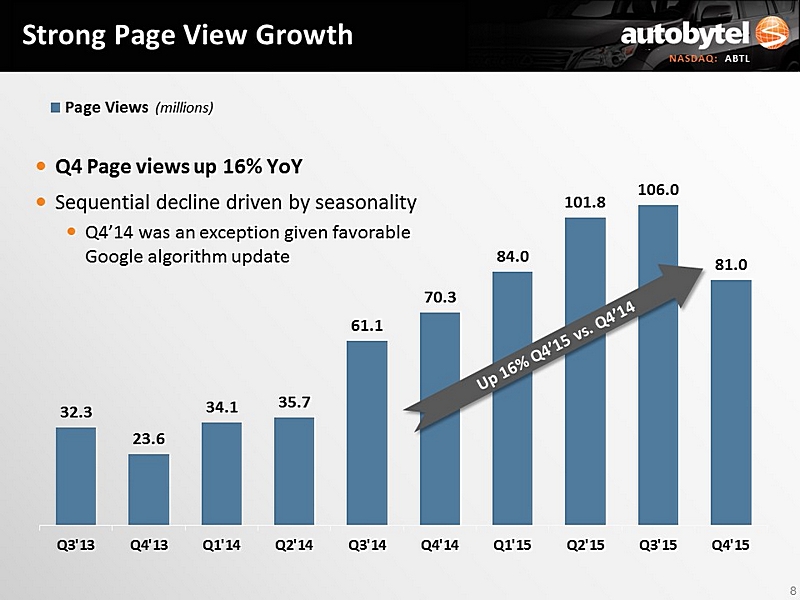

On slide 8, you will see that we continued to experience strong year-over-year page view grow in the fourth quarter with total page views up 16% to 81 million, demonstrating the strength of high-quality content across our sites. Note that the sequential decrease was expected given the seasonality of web traffic in our business with the exception of 2014 as we were seeing significant growth in our SEO traffic from what we believe were favorable Google algorithm updates. We plan to continue driving more traffic to our site as we build and adopt new data methodologies through the acquisitions of Dealix and AutoWeb.

Now moving to slide 9, gross profit during the fourth quarter increased 39% to $14.5 million compared to $10.4 million in the year-ago quarter. Gross margin decreased slightly to 39.7% compared to 40% one year ago. As noted earlier, the decline in gross margin was expected and primarily due to Dealix, which historically generated gross margin of approximately 32%, so we are pleased with the rate at which gross margin is returning to pre-acquisition levels.

Total operating expenses in the fourth quarter were $12.9 million compared to $8.5 million in the year-ago quarter. As a percentage of revenues, total operating expenses were 35.5% compared to 32.5% in the fourth quarter of 2014. Largely driven by an incremental $1.6 million or an equivalent of 4% of total revenues in acquisition costs and increased amortization of acquired intangibles. On a GAAP basis, net income increased 24% to $1.4 million or $0.10 per diluted share on 13.4 million diluted shares, compared to the $1.1 million or $0.11 per diluted share on 11.1 million diluted shares in last year's fourth quarter.

We expect our quarterly diluted share count in 2016 to remain around 13.4 million, contingent upon our share price and assuming current outstanding shares, warrants, options and convertible debt remain constant. For the fourth-quarter, non-GAAP income, which adds back amortization on acquired intangibles, non-cash stock-based compensation, acquisition costs, severance costs, gain on investment, litigation settlements and income taxes, increased 75% to a record $4.4 million or $0.33 per diluted share, compared to $2.5 million or $0.23 in the year-ago quarter. Contributing to this increase was a $0.5 million one-time payment received in November, 2015, related to the recovery of short swing profits from a stockholder pursuant to Section 16(b) of the Securities Exchange Act of 1934.

Cash provided by operations for the 2015 fourth quarter increased 100% to $4.6 million, compared to $2.3 million in the prior-year quarter. On slide 10 you will see that our cash balance remains strong with cash and cash equivalents of $24 million at December 31, 2015, which includes $2.1 million of cash we received from the AutoWeb transaction.

This compares to $20.7 million at the end of 2014. Total debt at December 31, 2015, grew to $27 million compared to $18 million at the end of 2014 due to our funding of Dealix. Its worth noting that we paid down approximately $3.8 million of bank debt over the course of 2015.

With that, I'll now turn the call back over to Jeff. Jeff?

Jeff Coats - Autobytel Inc. - President & CEO

Thanks, Kim. As I mentioned earlier, both our record Q4 and full-year were highlighted by key acquisitions, growth in our higher-margin advertising business and lead program expansion with nearly all of our OEM customers. Most importantly, we continue to provide dealers and OEMs with high-intent car buyers regardless of channel and helped their respective businesses grow.

This is further evidenced on slide 11 which shows that in 2015 we estimate that Autobytel and Dealix post-acquisition leads accounted for about 5%, or approximately 713,000 vehicles of all new light vehicle sales in the United States, a record for our Company. Also note that this excludes our used car volumes which we plan to provide on our next quarterly call.

In 2015 we expanded our leads program with nearly every major OEM on our platform. I remind listeners that we currently deliver leads to all major OEMs with the exception of one luxury brand that has yet to launch a leads program with its dealers. OEMs tend to be very selective in their digital marketing spend and they continue to demonstrate increasing demand for our high-quality leads. With our strong OEM relationship, our industry reach goes far beyond our retail network. In fact, when you account for leads that we deliver to OEMs, we are actually delivering leads to approximately 22,000 dealer franchises which includes all of our direct retail dealers.

These metrics illustrate the breadth of our dealer footprint and our expanding influence in the automotive industry. It also is further evidence that we are succeeding in our mission to bring consumers and dealers together. Dealer facing marketing and training remains a key initiative for us and is designed to highlight the value and ROI of Autobytel leads and also reminds dealers that the consumer price discussion is left up to them as Autobytel strives to build the dealer brand and not our own. We continue to ramp our sales and customer support teams to help drive this important initiative.

Further illustrating the ROI from our leads, on slide 12 you will see that our estimated average buy rate for internally generated leads in the fourth quarter was 19%, which remains at the high end of our targeted range.

And on slide 13 as derived from IHS Automotive reports, these estimated buy rates have remained consistently strong for several years now, with Autobytel.com generating an average buy rate of 24% and all Autobytel internally generated leads at about 18%.

For those of you new to Autobytel, we remain confident in our estimated buy rates largely due to our comprehensive relationship with IHS Automotive which provides us with credible, consistent and quantifiable ways to measure the conversion of online leads and the actual vehicle sales. These higher conversion rates are confirmed by monthly sales match reporting which is offered to are retail dealers so they can review the actual return on investment from their Autobytel leads.

Autobytel's ongoing use of IHS vehicle registration information helps our analytics teams continually optimize lead conversion and provide valuable data to our partners and industry clients. Our leading edge SEM teams have also used this and other data to push our percentage of internally generated leads up to approximately 80% in the fourth quarter. To illustrate what this cost would look like to a dealer if they wanted to use a hypothetical pay-per-sale model instead of pay-per-lead, on slide 14 you will see that based on a 19% estimated buy rate for all Autobytel internally generated leads, a dealer would effectively paid $116 on a pay-per-sale basis for each new car sold, assuming a $22 price per lead. In comparison, you can see what some of our competitors charge on a pay-per-sale basis on the left-hand side of the chart.

Moving on to our used car business, used car lead revenue in the fourth quarter grew 39% year-over-year primarily due to Dealix, but decreased 7% sequentially due to the normal seasonal offset in our business. Our used car business remains the focal point for growth and we continue to increase the level of resources dedicated to sales and marketing as well as ramping the investment in our used car platforms for internal lead generation with special focus on the usedcars.com site which we acquired through Dealix last summer.

We've made numerous short-term upgrades to usedcars.com, however we expect a full relaunch of the brand-new usedcars.com site by the end of Q3. We anticipate that this newly relaunched site will include several technological upgrades and will serve as the center point of our used car lead generation which we believe will provide even higher-quality leads at better margins. As a reminder, retail used car leads only represent about 7% of our total leads business today and approximately 11% of revenue even though used car sales in the United States are two to three times better than new car sales by volume.

I'd also like to note that since we've migrated the majority of Dealix systems onto our platform we now have even better visibility on quality and expect to further optimized our lead supply from Dealix to ensure they meet our higher standards. As Kim mentioned earlier, we turned off about $2 million to $3 million of revenue from Dealix in 2015 as a result of eliminating several Dealix lead generation methodologies that yielded lower quality leads than we believe appropriate for our dealers.

While we plan to turn off another $2 million to $3 million from Dealix in 2016, we expect the benefit of our commitment to quality to outweigh the sacrificed revenue, especially as we continue to forge even greater relationships with our dealer and OEM customers.

Now moving on to the component of our advertising business that's powered by AutoWeb. As a reminder, AutoWeb is our pay-per-click programmatic advertising marketplace targeting the auto industry. We acquired AutoWeb in October 2015, whose platform provides dealers and OEMs with access to some of the highest intent car shoppers on the Internet and propels Autobytel into the fast growing pay-per-click market. As mentioned earlier, we are in the process of finalizing our first AutoWeb enhanced product which we expect to launch by the end of Q3. I look forward to providing more color on this exciting next generation product as we near the launch date.

Also, as a result of retaining key executives from AutoWeb, we realigned our Management team during the first quarter and paid out approximately $1 million of severance comprised of both cash and non-cash stock compensation. We believe this Management realignment was necessary to remove duplicative roles within our organization.

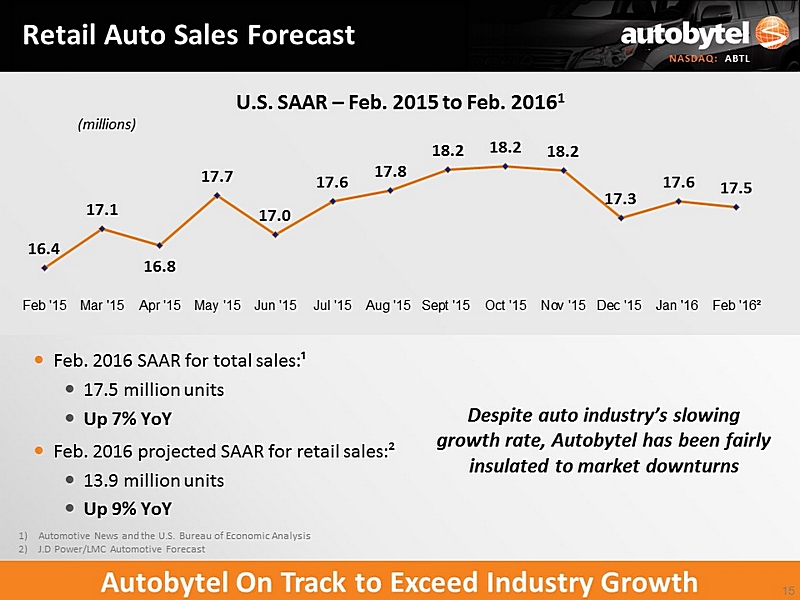

Moving on to the industry outlook, as you can see on slide 15, Automotive News and the US Bureau of Economic Analysis have the seasonally adjusted annual run rate, or SAAR, for total sales at 17.5 million units for February 2016, up 1.1 million units from one year ago and the highest February rate since the year 2000. This was slightly down from the 17.6 million SAAR in January 2016. For the full-year, LMC Automotive and J.D. Power estimate 2016 light vehicle sales to reach 17.8 million units, up from 17.5 million in 2015.

With regard to the overall auto industry, I would like to remind listeners about the somewhat countercyclical nature of our business as we are often asked how Autobytel would be impacted given a deceleration of growth in the SAAR, or even perhaps a decline. In the past, we've found that as overall sales slowdown at the OEM and dealership level, we generally see an increase in lead volume as dealers and OEMs turn to leads, their most profitable source of digital marketing. With that said, we've yet to see a decline in the overall car market as evidenced by the strongest February in more than 15 years.

Now moving on to our 2016 business outlook, highlighted on slide 16, despite our plans to eliminate more revenue from Dealix as well as our expectation for ongoing investments to accelerate growth, we expect revenue to range between $151 million and $155 million representing an increase of approximately 13% to 16% from 2015. We also expect non-GAAP diluted EPS to range between $1.39 and $1.43, an increase of approximately 14% to 17% from 2015.

In 2016 we anticipate that we will continue to drive growth and profitability through new and used car lead generation, our higher-margin advertising and clicks business and the continued development of value-added product offerings. We expect the execution of these initiatives will provide value to all of our dealer and OEM customers while driving enhanced value for our stockholders. At this time, operator, we would like to take questions.

QUESTION AND ANSWER

Operator

(Operator Instructions)

Eric Martinuzzi, Lake Street Capital.

Eric Martinuzzi - Lake Street Capital - Analyst

Thanks for taking my questions and congratulations on a very strong finish to 2015. The revenue outlook for 2016, it's a little bit ahead of where I was forecasting.

I know you are not in the business of quarterly guidance anymore, but just for now to think about seasonality. A year ago, your leads business was roughly flat Q4 to Q1, just wondering if, given now that you own Dealix and then some of the other investment efforts you're making in the business, what's the right way to think about lead seasonality for Q1?

Kimberly Boren - Autobytel Inc. - CFO

Sure, so typically, Eric, Q1 is a bit stronger than Q4, so I would expect to see that seasonal pattern repeat in 2016.

Eric Martinuzzi - Lake Street Capital - Analyst

Okay. Then the advertising business, that was, once again, very strong for you. You got, obviously, 100% ownership of AutoWeb now and the Jumpstart relationship continues to be strong. We've only got one quarter of full ownership of AutoWeb but they are also --what's the seasonality of the advertising business Q1 versus Q4?

Kimberly Boren - Autobytel Inc. - CFO

The advertising business behaves a little bit differently because on the display side, they are still getting creatives in, in the first quarter, so it tends to be a little bit slower than previous periods. And certainly Q4, historically, has been one of our stronger quarters with advertising revenues since the agencies and OEMs had left over budgets that they were looking to spend. So I would expect that Q1 will not be as robust as Q4, from a seasonal perspective.

Eric Martinuzzi - Lake Street Capital - Analyst

Okay. Then lastly on the operating expense side, I know one of your competitors, I guess maybe a competitor for dealer ad spend budget, is talking about initiating a dealer sales effort and I'm just curious to know, A, have you seen any impact from this new thrust for them into a direct relationship with dealers, i.e. or perhaps them coming after some of your dealer relations people? Or maybe dealers? Dealers shifting budget as this competitor tries to have a tighter relationship with them? Can you -- have you have seen any impact, can you comment on that?

Jeff Coats - Autobytel Inc. - President & CEO

Thus far, Eric, we have not seen any impact whatsoever. We've heard about this, we know it is in process, but we have not seen any impact.

Eric Martinuzzi - Lake Street Capital - Analyst

Fair enough. Thanks for taking my questions and congrats again on the quarter.

Jeff Coats - Autobytel Inc. - President & CEO

Thanks, Eric.

Kimberly Boren - Autobytel Inc. - CFO

Thanks, Eric. Take care.

Operator

Sameet Sinha, B. Riley.

Austin Drake - B. Riley & Company - Analyst

Hi, this is Austin on for Sameet. As you enter 2016 with a full platform of services for the auto industry, can you share with us some anecdotes of the receptivity the suite is getting in the industry?

Jeff Coats - Autobytel Inc. - President & CEO

Generally, it has gotten very good receptivity. We are actually in the process of overhauling the suite of products. Based on the acquisitions that we did last year we are integrating some of the ones combining some of the ones that we acquired and/or reshaping them for the future, so I would say the initial receptivity of what we've been doing has been very positive.

Certainly the introduction of the Autobytel direct product, which is a click product, last summer has been extremely well received. The dealers that have signed up for it have tended to stay with it, so we have seen very little dealer churn with that product. A surprisingly low amount, given dealer experience historically.

That's probably about as good as I can let you know right now, Austin. We are gearing up for some new bundling approaches as we look at some of our products in 2016, but we have not yet launched that.

Austin Drake - B. Riley & Company - Analyst

Okay, that's helpful. Then as you look into 2016 and then into 2017, where do you expect leads growth to come from? Is it new OEMs or new dealers or where is that?

Jeff Coats - Autobytel Inc. - President & CEO

I think it will be a combination of adding more dealers to the direct retail product. It will also be a function of increases with our manufacturer customers. And we are launching an enhanced used car product this year. We are focusing more and more on used lead generation with our usedcars.com site, which we are launching a brand-new site this summer in the third quarter. So I think probably the largest single growth driver will be increases in the used car program in the second half of 2016 and during 2017.

Austin Drake - B. Riley & Company - Analyst

Okay. And then True Car indicated that the mix of dealers in its network skewed smaller than previously and hence their conversion rates dropped. How would you guys characterize your network?

Jeff Coats - Autobytel Inc. - President & CEO

I would say we have a pretty representative sample of large and small dealers. I would say for the most part, we would tend to focus more on the larger dealer groups or operations. That's not across the board necessarily.

It really depends upon the make and the geography in part. But you can look at our overall average leads per dealer on both the new and used side, which are both up for us, which will give you an idea that we are doing business with larger groups overall.

Austin Drake - B. Riley & Company - Analyst

Okay, that's it from us, thanks for taking our questions.

Operator

Ed Woo, Ascendiant Capital.

Ed Woo - Ascendiant Capital Markets LLC - Analyst

Thank you for taking my question and congratulations on a great year. My question is, you mentioned that auto sales remained very strong so far in 2016 and obviously with low oil prices you would think that people would buy bigger vehicles and trucks. Do you think that, that allows you to have a better pricing power as those vehicles tend to be more profitable?

Jeff Coats - Autobytel Inc. - President & CEO

I would say -- that's interesting. Nobody's ever asked me that question before. Logically you would think that the answer to that would be yes. But I would point out that we don't think that will necessarily be a big driver at all. We are in the process of raising our prices where it makes sense, particularly as we sign up new dealers.

If you look at the return on investment that dealers get from our leads today, it's substantially higher than it is ever really been. The dealers and the manufacturers are getting a really great return on investment. So part of our dealer training and communications exercises are focused on making sure that the dealers and the manufacturers understand the return on investment that they are getting from our leads so that they are more open to pricing adjustments over time.

And of course, given that we generate our leads through our search engine marketing operation and we continue to invest strongly in that and our other leads generation capabilities, that allows us to be able to generate higher volumes of leads, if we can charge a slightly higher price for it.

So I would say, Ed, in general the larger vehicles are definitely driving car sales these days. Americans definitely would rather drive a larger vehicle, an SUV, even a crossover SUV, because it's got more room for the soccer moms and for everybody else. I think we get used to having room to carry stuff around in our vehicles and we don't really want to go back to a Volkswagen bug like some of us drove when we were kids.

Ed Woo - Ascendiant Capital Markets LLC - Analyst

Well, I'm waiting for them to relaunch the Hummer myself so -- (Laughter)

Great and going back to search engine marketing, you guys obviously done a very good job and that was a big reason you guys acquired AutoWeb. Have you have seen any changes or potential changes that may provide some disruption, either good or bad, coming up near-term? From the big search engines?

Jeff Coats - Autobytel Inc. - President & CEO

Nothing. We have not seen anything, we haven't identified anything good or bad from that standpoint. I would say we keep our heads down in our search engine marketing operation. We continue to wear a white hat from a Google standpoint. We play by all the rules and we think because of that, we are able to generate high-quality leads at a really good margin.

Which is what we've been doing now for several consecutive years since we acquired CyberVentures back about 5 1/2 years ago. And it really has positioned us very nicely. Nothing negative on the horizon to our knowledge.

Ed Woo - Ascendiant Capital Markets LLC - Analyst

Great. Thank you and best of luck this year.

Jeff Coats - Autobytel Inc. - President & CEO

Thanks, Ed.

Operator

Gary Prestopino, Barrington Research.

Gary Prestopino - Barrington Research - Analyst

Hi, good afternoon. Most of my questions have been answered but, Jeff, is it -- when you said 7% of your leads and 11% of your revenues were used car-related, is that in the fourth quarter or is that for the entire year?

Kimberly Boren - Autobytel Inc. - CFO

Yes. That was fourth quarter. But it is roughly consistent for the year, Gary.

Gary Prespopino - Barrington Research - Analyst

Okay. Well, is it beyond the realm of possibility that, given you've got Dealix and you've got usedcars.com, that you could see a doubling of both of those metrics this year? If you are saying that, that's going to be one of the bigger growth drivers?

Jeff Coats - Autobytel Inc. - President & CEO

It would probably be aggressive to say that we would see a doubling this year, Gary. A lot of the upside is back loaded in a second half of the year. We have spent a lot of time in a second half of last year getting ready and beginning to do the integration for Dealix and AutoWeb.

We are still finalizing the integration of Dealix. The very complicated systems, multiple lead engines, it just takes time to do it the right way because we have pipes into every manufacturer and every dealer that we do business with and it just takes a while. So we are consolidating everything behind one lead engine, one approach to doing things.

We decided not to task the first half of 2016 with anything beyond finishing that and preparing to continue to scale. Our development teams are also beginning to rebuild or to build a new usedcars.com. The launch of that new site in the third quarter will be the primary driver of our used car volume going forward from an internal lead generation capability as we continue to do that, ramp that up, in conjunction with purchases of used car leads we make from our good quality suppliers on the outside. So it is going to take us a little bit of time. I think we will see a run rate that could be a doubling by the end of the year, but I don't think we will quite get there this year.

Gary Prestopino - Barrington Research - Analyst

Okay, so if I read it right, there's still a little work to be done here, and the ramp starts in the back half of this year?

Jeff Coats - Autobytel Inc. - President & CEO

Yes, that's how we -- yes.

Gary Prestopino - Barrington Research - Analyst

Okay. And then in general, as your salesmen are out in the field, have they been seeing an increased appetite from, not only your dealers -- your actual dealer base, but dealers that are not clients yet, or prospective clients, in taking some of these lead programs? Just in terms of that, it is going to become more competitive for car sales this year based on some of these estimates that are out there?

Jeff Coats - Autobytel Inc. - President & CEO

I don't -- I would say we are seeing a better profile from a churn standpoint this year than we were last year and certainly dramatically better than we were in 2014. One could extrapolate from that, that we are in fact seeing more dealers open to buying more leads.

I think it is also the fact, we are continuing to do our communication out there with dealers and manufacturers. Our trade-focused advertising and marketing to make sure that the dealers and manufacturers understand the quality of the leads. Even though we are all focused on it all the time, of course, we need to make sure that more and more dealers understand that. So it is a work in progress, but we do generally see more receptivity to it, yes.

And candidly, the new product that I mentioned on the call that we'll be launching in the third quarter of this year, we believe is going to be extremely well received by the dealers and the manufacturers. In some of our preliminary conversations with people doing a little bit of testing, a little bit of inquiry we've gotten really robust response to it. So, I would say that's going to be a primary driver of the business going forward once we get it launched and fully vetted.

Gary Prestopino - Barrington Research - Analyst

Okay. And then as you talk to your dealer-base, or talk to people in the industry, is there a little more caution this year versus, we've had four or five years of really great car sales, or is that rhetoric just coming from the investment side of the business, research side of the business, is that be careful -- be cautious this year?

Jeff Coats - Autobytel Inc. - President & CEO

Honestly, you don't hear too many people in the automotive industry talking about 2016 being anything other than a great year. Certainly all you stock market guys think that way, maybe the larger public automotives have been affected negatively by that, certainly the smaller public stocks like ourselves have been negatively affected by that. But candidly, we don't see anything in our business currently that would lead us to think that this year will be anything other than a very robust year, nor in any of our conversations with customers.

Normally by this time we would have been to the National Automobile Dealers Association convention that normally takes place around Super Bowl weekend. This year it is actually the very end of March and early April, and so that's really where we will get a better feel for the temperature and outlook from people. But I can tell you, given some of that meetings we've been party to and some of the conversations we've had with customers and other vendors in this space, we are not seeing it currently.

Gary Prestopino - Barrington Research - Analyst

Okay. And then just a couple housekeeping questions. You said you paid close to $1 million in severance this quarter, cash and stock?

Jeff Coats - Autobytel Inc. - President & CEO

Yes.

Gary Prestopino - Barrington Research - Analyst

Is that in the sales and marketing line?

Jeff Coats - Autobytel Inc. - President & CEO

It will be in the --

Kimberly Boren - Autobytel Inc. - CFO

It will be combination of product, technology and G&A. And some sales and marketing. It is going to be spread, Gary.

Gary Prestopino - Barrington Research - Analyst

Okay. And then in terms of -- just if we can get maybe some help here, the amortization of acquired intangibles went up pretty dramatically this quarter. Was that due to the AutoWeb acquisition and that's an anomaly?

Kimberly Boren - Autobytel Inc. - CFO

Yes, and that will continue. That's the amortization on AutoWeb, you are right. And you will see in our 10-K that the intangibles had a pretty significant value on that valuation. Typically we'd see more goodwill as a percentage of the deal value, but it was high on AutoWeb.

Gary Prestopino - Barrington Research - Analyst

So should that continue throughout 2016?

Kimberly Boren - Autobytel Inc. - CFO

Yes.

Gary Prestopino - Barrington Research - Analyst

Okay. Then could you give us some idea of what you are thinking in terms of the stock comp for this year?

Kimberly Boren - Autobytel Inc. - CFO

Stock comp will be a little bit higher than it was last year. I don't have the number in front of me but I want to say it is into the mid-$300,000 range.

Gary Prestopino - Barrington Research - Analyst

Okay, that's fine. That's helpful. Thank you very much.

Jeff Coats - Autobytel Inc. - President & CEO

Thanks, Gary.

Operator

(Operator Instructions)

Patrick Lin, Primarius Capital.

Patrick Lin - Primarius Capital - Analyst

Hi, guys, congrats on the quarter as well. I wanted to just ask a couple quick questions. One, can you give more color on this used car product in terms of why you think it's either differentiated or different and how this could be a big growth driver for you guys? And wondered if you factored in very much in terms of revenues in your guidance?

And then the second thing is, can you talk about what your dashboard or visibility looks like this year? Jeff, you've done this for many years now and I'm just curious, in terms of your excitement and confidence level in running Autobytel, how does this year compare to prior years when you are looking at the year from the beginning of the year? Thank you.

Jeff Coats - Autobytel Inc. - President & CEO

I will answer the second one first. Honestly, I would say this year I've entered the year more excited than at anytime in the seven years I've been doing this. Finally completing AutoUSA two years ago, Dealix last May and AutoWeb in October, just positions us so incredibly well to continue to do our job, connect consumers with dealers. We -- not putting our brand out there in front of the dealers and the manufacturers.

Now getting into the clicks business through the AutoWeb acquisition and to answer your first question, and really beginning to ramp up our used car business. It is very exciting. It is extremely exciting.

I would say, Patrick, the way we look at our used car product, if you think about usedcars.com, we are generating leads off of that website. So we will have inventory posted on it from our own direct dealer relationships, other inventory feeds that we do business with in the space and then it will be all about generating leads. Either for some of those providers of those inventory feeds which we believe we will be able to do at extremely attractive quality given because we know how to generate good quality leads. We've demonstrated that year-over-year now for quite a few years on the new car side.

We will be applying the same type of methodologies to what we're doing on the used car side. So we believe strongly we will be able to generate higher volumes, excellent quality leads, and we should be able to continue to do it at very attractive margins, for ourselves. Now evolving into leads and clicks and doing that both on the used car side as well as on the new car side is extremely attractive.

Providing a customer's information through a lead and then landing that same customer on a vehicle description page on somebody's website or on a dealer special page or something like that, no one is doing that today, not many people can do that. We are very excited about it and we really think that's going to be a game changer in the industry on both the used car side and the new car side as we go forward.

Patrick Lin - Primarius Capital - Analyst

In terms of, how much expectations do you have embedded into your guidance for 2016 on the used car revenues, please?

Jeff Coats - Autobytel Inc. - President & CEO

There is a conservative, reasonable amount built into it. We are careful.

Patrick Lin - Primarius Capital - Analyst

Terrific, thank you.

Operator

At this time this concludes our question and answer session. I would now like to turn the call back over to Mr. Coats for closing remarks.

Jeff Coats - Autobytel Inc. - President & CEO

Thanks to everybody for joining the call today. We will appreciate it. As I said, apropos of Patrick's question, we are very bullish about 2016. I would like to thank our dedicated team of employees and we look forward to talking with you all on our first-quarter earnings call in early May. Thank you.

Operator

Ladies and gentlemen, this does conclude our conference call. You may now disconnect. Thanks for your participation.