Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Fluent, Inc. | d133918d8k.htm |

© 2016 IDI, Inc. All rights reserved. (NYSE MKT: IDI) Corporate Presentation March 2016 Exhibit 99.1

This presentation contains "forward-looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipate," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward-looking statements include non-historical statements about our expectations, beliefs or intentions regarding our business, technologies and products, financial condition, strategies or prospects. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: the risks set forth in IDI’s most recent Annual Report on 10-K, as may be supplemented or amended by IDI's Quarterly Reports on Form 10-Q, as well as the other factors described in IDI's filings that IDI makes with the SEC from time to time. You are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this presentation and speak only as of the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. 2 © 2016 IDI, Inc. All rights reserved. Forward-looking Statements

3 © 2016 IDI, Inc. All rights reserved. Company Overview (NYSE MKT: IDI) At IDI, we believe that time is your most valuable asset. Through powerful analytics, we transform data into intelligence, in a fast and efficient manner, so that our clients can spend their time on what matters most – running their organizations with confidence. Through leading-edge, proprietary technology and a massive data repository, our data and analytical solutions harness the power of data fusion, uncovering the relevance of disparate data points and converting them into comprehensive and insightful views of people, businesses, assets and their interrelationships. We empower clients across markets and industries to better execute all aspects of their business, from managing risk, conducting investigations, identifying fraud and abuse, and collecting debts, to identifying and acquiring new customers. At IDI, we are dedicated to making the world a safer place, to reducing the cost of doing business, and to enhancing the consumer experience.

Ryan Schulke – CEO & Co-Founder Prior to founding Fluent, Schulke headed up Product and Distribution at Clash Media and played an instrumental role in growing its US business. Earlier, he held positions at MediaWhiz Holdings, and Innovation Ads. Matt Conlin – President & Co-Founder Prior to founding Fluent, Conlin launched the US division of Clash Media, where he grew and developed a team of more than 30 employees across 2 offices and built a multi-million dollar business. Sean Cullen – EVP, Product & Technology Spearheads the development of Fluent’s visionary product and technology roadmap, and oversees the execution through the management of the engineering, design, project management, and performance teams. Before Fluent, Cullen worked at Clash Media. Matt Koncz – EVP, Media & Distribution Responsible for managing Fluent’s proprietary and third-party distribution network. His primary functions are to set and attain volume, spend, and margin targets, and new media discovery efforts. Formerly with Clash Media and Plattform Advertising, where he helped build out their media buying and business development teams. Deep and Experienced Leadership Teams Major Shareholder & Vice Chairman of the Board: Phillip Frost, M.D. Dr. Frost has been the CEO and Chairman of OPKO Health (NYSE: OPK) since March 2007. He served as Chairman of the Board of Teva Pharmaceuticals (NYSE: TEVA) from March 2010 to December 2014, and previously served as Vice Chairman from January 2006, when Teva acquired IVAX Corporation. Dr. Frost had served as Chairman of the Board of Directors and Chief Executive Officer of IVAX since 1987. He was named Chairman of the Board of Ladenburg Thalmann Financial Services Inc. (NYSE MKT: LTS) in July 2006. IDI Founder and Executive Chairman: Michael Brauser An investor and operator in the data fusion industry since its infancy, Brauser has built market-leading companies with revenue totaling over $2 billion. Additionally, Brauser has founded and led several successful digital marketing companies. Chief Executive Officer: Derek Dubner For 15 years, Dubner worked closely with the late Hank Asher, the creator of market leaders Seisint and TLO and often referred to as “the father of data fusion”. Most recently, Dubner served as general counsel of TLO from inception through the sale of substantially all of the assets to TransUnion in December 2013. Prior roles include vice president and associate group counsel at Equifax, general counsel and chief compliance officer at Naviant (acquired by Equifax) and corporate counsel at Seisint (acquired by Reed Elsevier’s LexisNexis). President and Chief Operating Officer: James Reilly Reilly has served in an executive management capacity within the data fusion industry for the last six years, with over 15 years of executive experience in data markets. Most recently, Reilly served as an executive with TLO and was responsible for building revenue from start-up to sale. Additionally, Reilly was responsible for all customer facing departments, the company’s strategic initiatives, and relationship management of key strategic partners and distributors. Chief Science Officer: Ole Poulsen Poulsen was the primary systems architect of leading data fusion products Accurint (now a LexisNexis offering) and TLOxp (now a TransUnion offering). The preeminent expert in this field, Poulsen’s experience, expertise and proven technology leadership enables rapid expansion and an advanced delivery platform. 4 © 2016 IDI, Inc. All rights reserved.

IDI’s Three Tier Approach 5 © 2016 IDI, Inc. All rights reserved. Risk Management Consumer Marketing Custom Analytics

6 © 2016 IDI, Inc. All rights reserved. Company Overview – Risk Management A data and analytics company providing information solutions within the data fusion industry, delivering otherwise unattainable insight into the ever-expanding universe of consumer- and business-centric data. Through its proprietary linking technology, advanced systems architecture and massive data repository, IDI addresses the rapidly growing need for actionable intelligence to support the risk management industry, including the following primary use cases: due diligence, risk assessment, prevention and detection of fraud and abuse, identity verification, legislative compliance and debt recovery. Additionally, IDI’s cross-functional core systems and processes are designed to deliver products and solutions to the marketing industry and to enable the public and private sectors to layer our solutions over their unique data sets, providing otherwise unattainable insight. (NYSE MKT: IDI)

Key target industries: 7 © 2016 IDI, Inc. All rights reserved. Banking and Financial Services Collection Agencies Attorneys / Law Firms / Legal Support Healthcare / Medical Law Enforcement & Government Insurance Retail Background & Investigative Agencies – Products / Markets ™ ™ ™

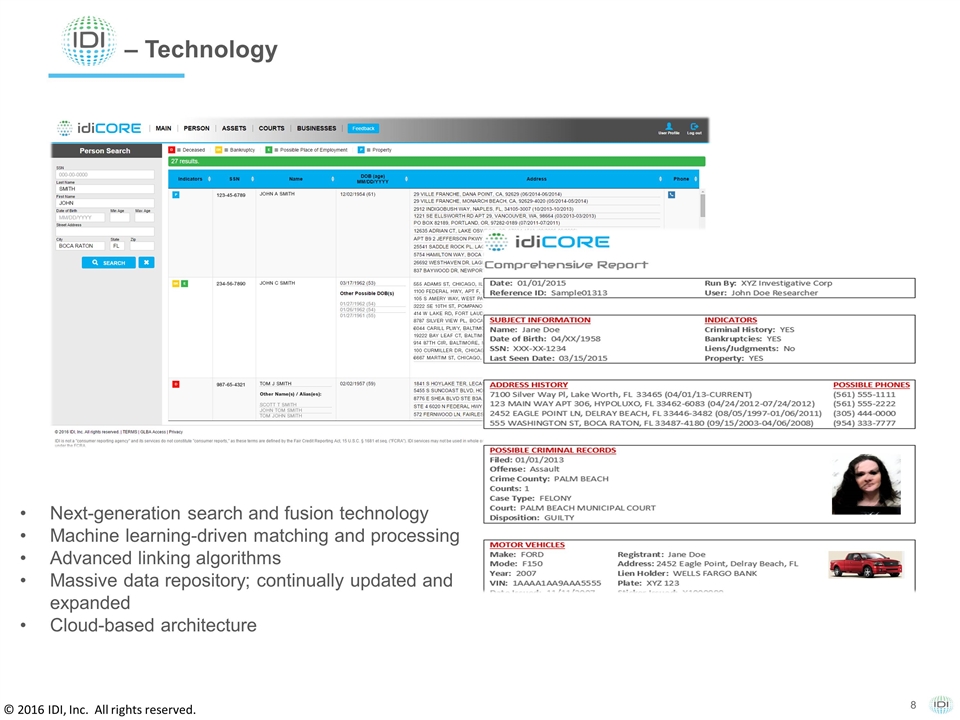

– Technology 8 © 2016 IDI, Inc. All rights reserved. Next-generation search and fusion technology Machine learning-driven matching and processing Advanced linking algorithms Massive data repository; continually updated and expanded Cloud-based architecture

- Overview 9 © 2016 IDI, Inc. All rights reserved. An industry leader in people-based digital marketing and customer acquisition, serving over 500 leading consumer brands and direct marketers. Fluent’s proprietary audience data and robust ad-serving technology enables marketers to acquire their best customers, with precision, at a massive scale. Leveraging compelling content, 1st-party data, and real-time survey interaction with consumers, Fluent has helped marketers acquire millions of new customers since its inception. People vs. Pixels Unique first-party data assets Performance-based platform

– Facilitates People-Based Marketing Across All Channels & Devices 10 © 2016 IDI, Inc. All rights reserved. CONFIDENTIAL Search Social Email Display Addressable TV

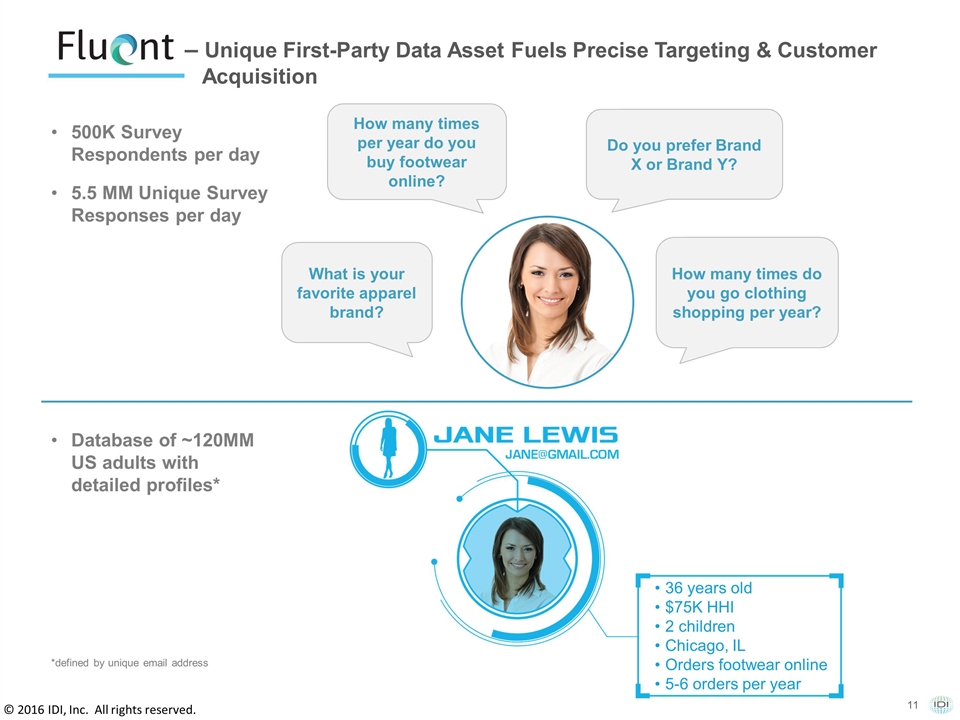

11 © 2016 IDI, Inc. All rights reserved. Do you prefer Brand X or Brand Y? How many times do you go clothing shopping per year? What is your favorite apparel brand? How many times per year do you buy footwear online? 36 years old $75K HHI 2 children Chicago, IL Orders footwear online 5-6 orders per year – Unique First-Party Data Asset Fuels Precise Targeting & Customer Acquisition 500K Survey Respondents per day 5.5 MM Unique Survey Responses per day Database of ~120MM US adults with detailed profiles* *defined by unique email address

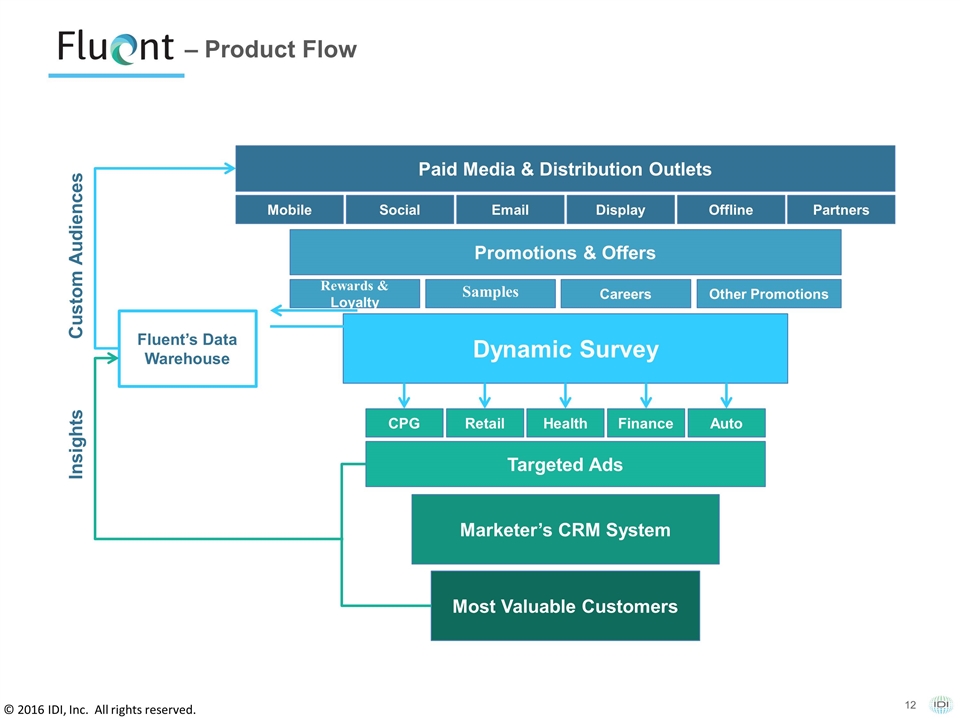

12 © 2016 IDI, Inc. All rights reserved. Paid Media & Distribution Outlets Mobile Social Email Display Offline Partners Promotions & Offers Rewards & Loyalty Careers Other Promotions Dynamic Survey CPG Retail Health Finance Auto Targeted Ads Marketer’s CRM System Most Valuable Customers Fluent’s Data Warehouse Custom Audiences Insights Samples – Product Flow

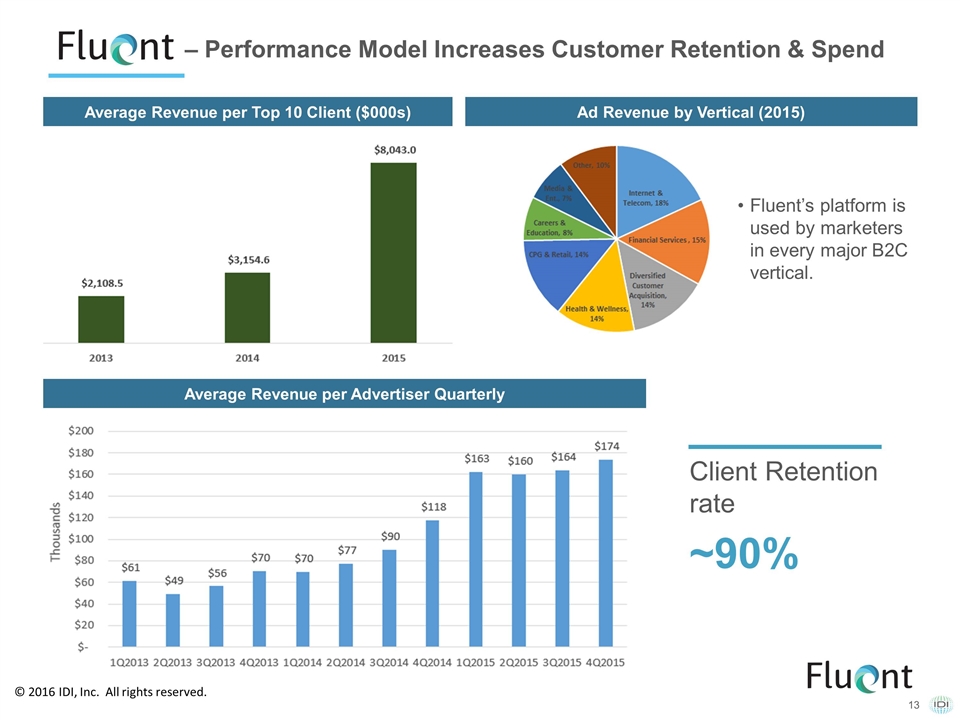

– Performance Model Increases Customer Retention & Spend 13 © 2016 IDI, Inc. All rights reserved. Ad Revenue by Vertical (2015) Average Revenue per Top 10 Client ($000s) Average Revenue per Advertiser Quarterly Fluent’s platform is used by marketers in every major B2C vertical. Client Retention rate ~90%

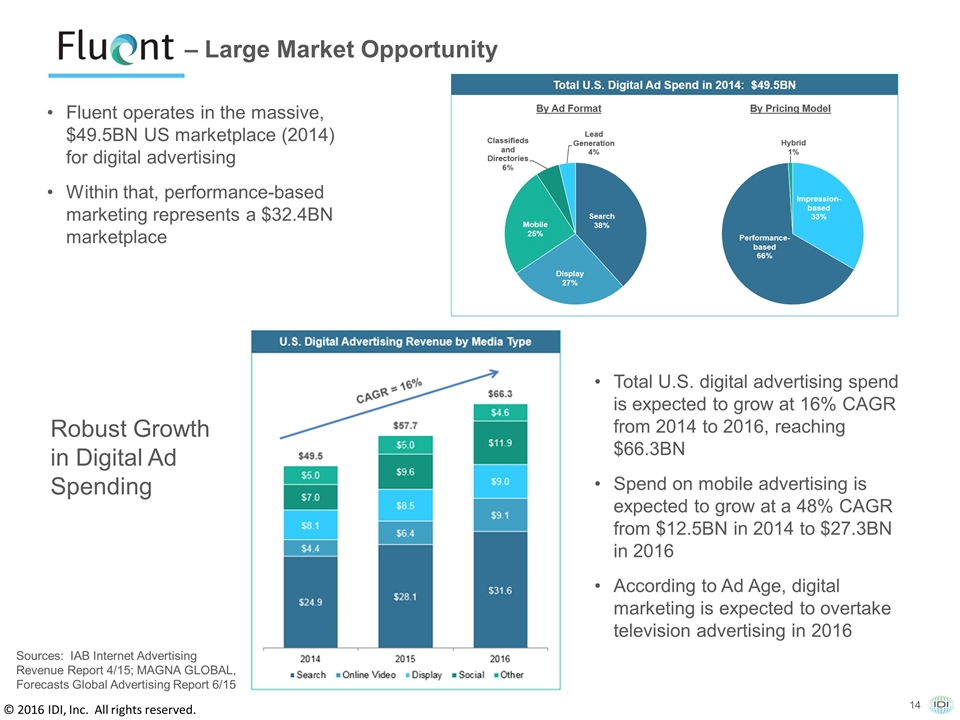

– Large Market Opportunity 14 © 2016 IDI, Inc. All rights reserved. Fluent operates in the massive, $49.5BN US marketplace (2014) for digital advertising Within that, performance-based marketing represents a $32.4BN marketplace Robust Growth in Digital Ad Spending Sources: IAB Internet Advertising Revenue Report 4/15; MAGNA GLOBAL, Forecasts Global Advertising Report 6/15 Total U.S. digital advertising spend is expected to grow at 16% CAGR from 2014 to 2016, reaching $66.3BN Spend on mobile advertising is expected to grow at a 48% CAGR from $12.5BN in 2014 to $27.3BN in 2016 According to Ad Age, digital marketing is expected to overtake television advertising in 2016

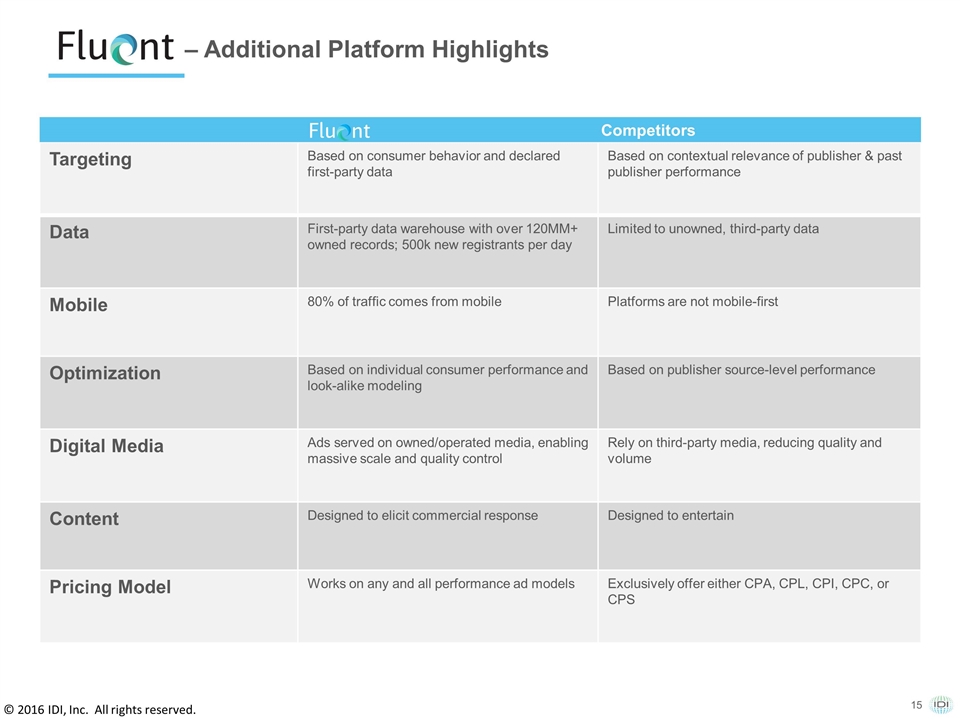

– Additional Platform Highlights 15 © 2016 IDI, Inc. All rights reserved. Targeting Based on consumer behavior and declared first-party data Based on contextual relevance of publisher & past publisher performance Data First-party data warehouse with over 120MM+ owned records; 500k new registrants per day Limited to unowned, third-party data Mobile 80% of traffic comes from mobile Platforms are not mobile-first Optimization Based on individual consumer performance and look-alike modeling Based on publisher source-level performance Digital Media Ads served on owned/operated media, enabling massive scale and quality control Rely on third-party media, reducing quality and volume Content Designed to elicit commercial response Designed to entertain Pricing Model Works on any and all performance ad models Exclusively offer either CPA, CPL, CPI, CPC, or CPS Competitors

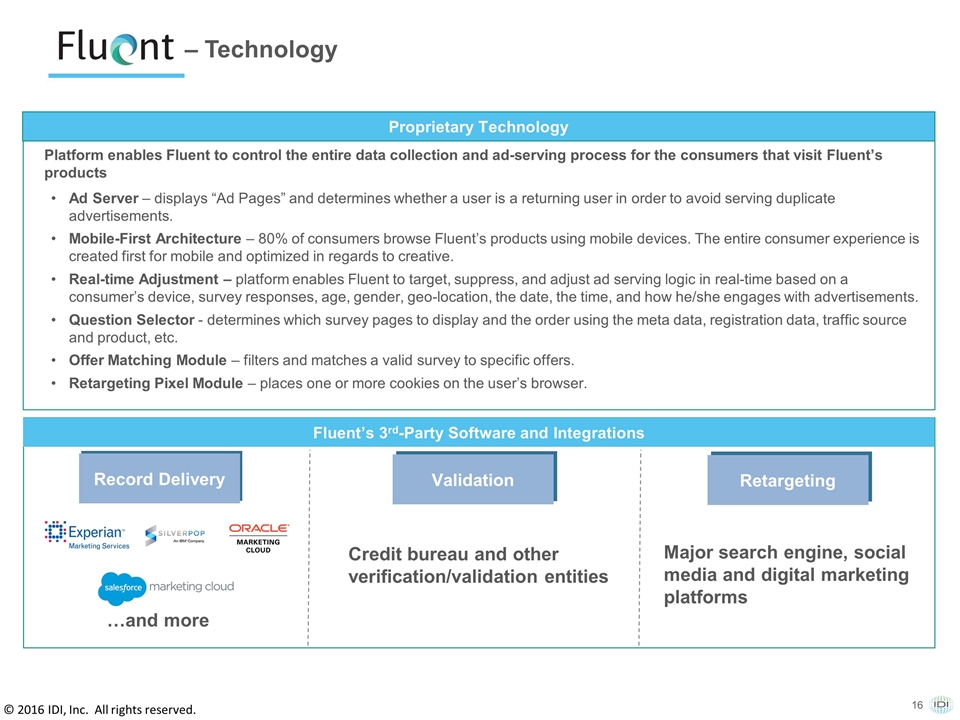

– Technology 16 © 2016 IDI, Inc. All rights reserved. Platform enables Fluent to control the entire data collection and ad-serving process for the consumers that visit Fluent’s products Ad Server – displays “Ad Pages” and determines whether a user is a returning user in order to avoid serving duplicate advertisements. Mobile-First Architecture – 80% of consumers browse Fluent’s products using mobile devices. The entire consumer experience is created first for mobile and optimized in regards to creative. Real-time Adjustment – platform enables Fluent to target, suppress, and adjust ad serving logic in real-time based on a consumer’s device, survey responses, age, gender, geo-location, the date, the time, and how he/she engages with advertisements. Question Selector - determines which survey pages to display and the order using the meta data, registration data, traffic source and product, etc. Offer Matching Module – filters and matches a valid survey to specific offers. Retargeting Pixel Module – places one or more cookies on the user’s browser. Proprietary Technology Fluent’s 3rd-Party Software and Integrations Record Delivery Validation Retargeting …and more Credit bureau and other verification/validation entities Major search engine, social media and digital marketing platforms

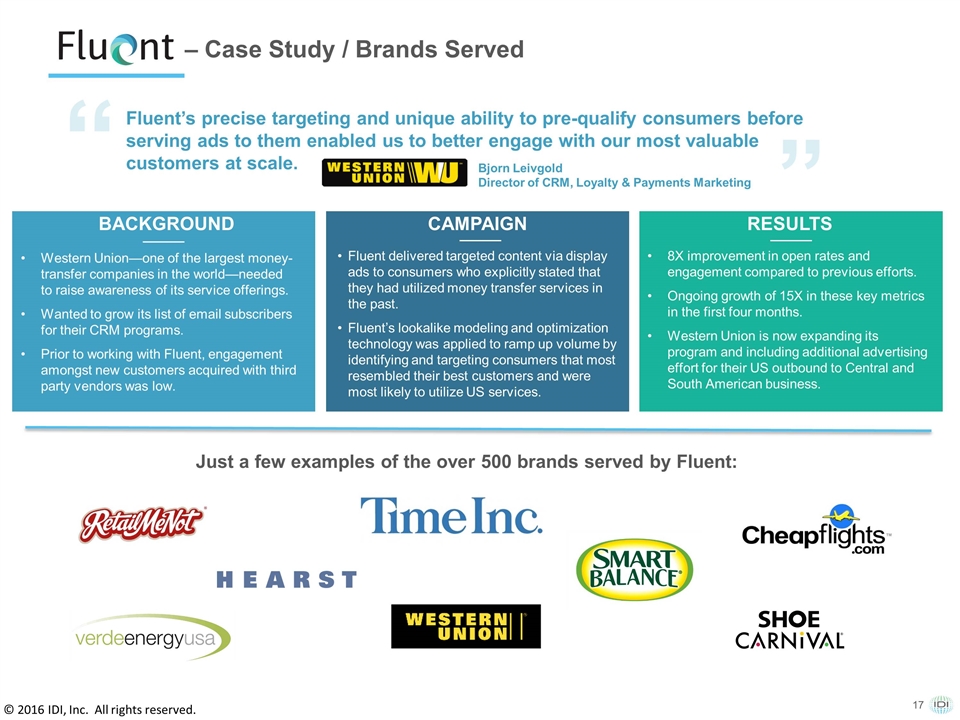

– Case Study / Brands Served 17 © 2016 IDI, Inc. All rights reserved. Fluent’s precise targeting and unique ability to pre-qualify consumers before serving ads to them enabled us to better engage with our most valuable customers at scale. Bjorn Leivgold Director of CRM, Loyalty & Payments Marketing BACKGROUND Western Union—one of the largest money-transfer companies in the world—needed to raise awareness of its service offerings. Wanted to grow its list of email subscribers for their CRM programs. Prior to working with Fluent, engagement amongst new customers acquired with third party vendors was low. CAMPAIGN Fluent delivered targeted content via display ads to consumers who explicitly stated that they had utilized money transfer services in the past. Fluent’s lookalike modeling and optimization technology was applied to ramp up volume by identifying and targeting consumers that most resembled their best customers and were most likely to utilize US services. RESULTS 8X improvement in open rates and engagement compared to previous efforts. Ongoing growth of 15X in these key metrics in the first four months. Western Union is now expanding its program and including additional advertising effort for their US outbound to Central and South American business. Just a few examples of the over 500 brands served by Fluent:

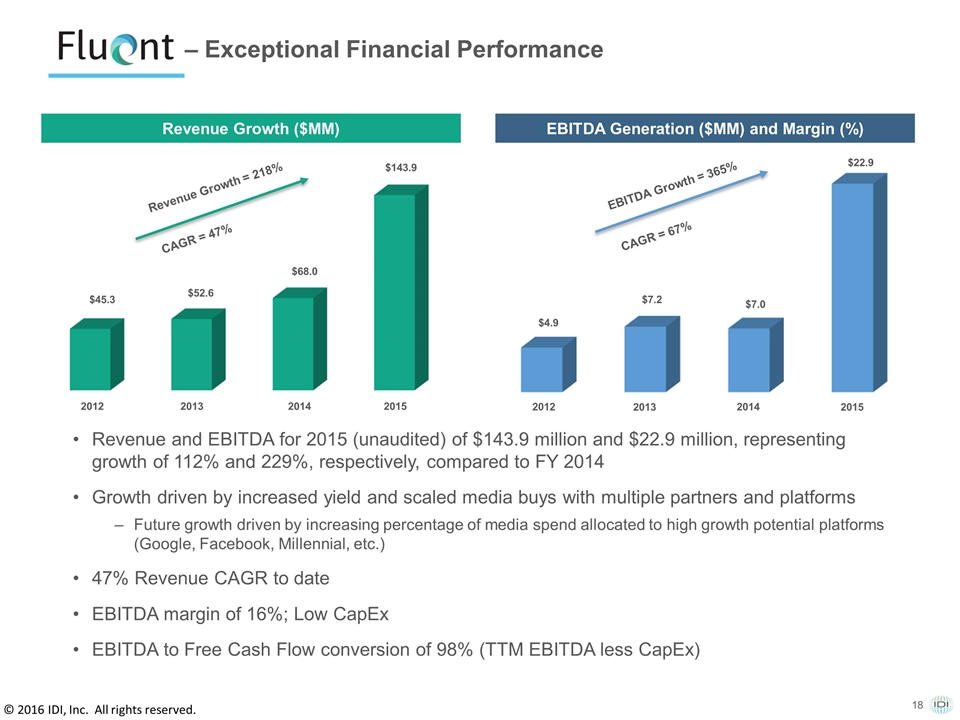

– Exceptional Financial Performance 18 © 2016 IDI, Inc. All rights reserved. Revenue and EBITDA for 2015 (unaudited) of $143.9 million and $22.9 million, representing growth of 112% and 229%, respectively, compared to FY 2014 Growth driven by increased yield and scaled media buys with multiple partners and platforms Future growth driven by increasing percentage of media spend allocated to high growth potential platforms (Google, Facebook, Millennial, etc.) 47% Revenue CAGR to date EBITDA margin of 16%; Low CapEx EBITDA to Free Cash Flow conversion of 98% (TTM EBITDA less CapEx) Revenue Growth ($MM) EBITDA Generation ($MM) and Margin (%) 2012 2015 2014 2013 2012 2015 2014 2013 $45.3 $52.6 $68.0 $143.9 $4.9 $7.2 $7.0 $22.9 Revenue Growth = 218% CAGR = 47% EBITDA Growth = 365% CAGR = 67%

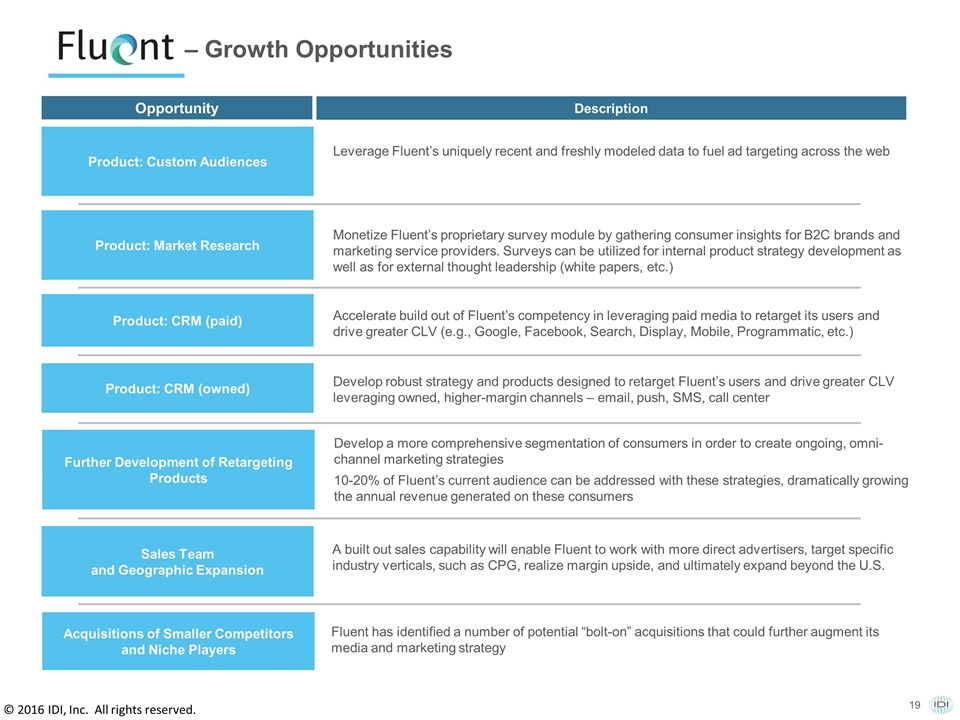

– Growth Opportunities 19 © 2016 IDI, Inc. All rights reserved. Opportunity Description Leverage Fluent’s uniquely recent and freshly modeled data to fuel ad targeting across the web Product: Custom Audiences Monetize Fluent’s proprietary survey module by gathering consumer insights for B2C brands and marketing service providers. Surveys can be utilized for internal product strategy development as well as for external thought leadership (white papers, etc.) Product: Market Research Accelerate build out of Fluent’s competency in leveraging paid media to retarget its users and drive greater CLV (e.g., Google, Facebook, Search, Display, Mobile, Programmatic, etc.) Product: CRM (paid) Develop robust strategy and products designed to retarget Fluent’s users and drive greater CLV leveraging owned, higher-margin channels – email, push, SMS, call center Product: CRM (owned) Develop a more comprehensive segmentation of consumers in order to create ongoing, omni-channel marketing strategies 10-20% of Fluent’s current audience can be addressed with these strategies, dramatically growing the annual revenue generated on these consumers Further Development of Retargeting Products A built out sales capability will enable Fluent to work with more direct advertisers, target specific industry verticals, such as CPG, realize margin upside, and ultimately expand beyond the U.S. Sales Team and Geographic Expansion Acquisitions of Smaller Competitors and Niche Players Fluent has identified a number of potential “bolt-on” acquisitions that could further augment its media and marketing strategy

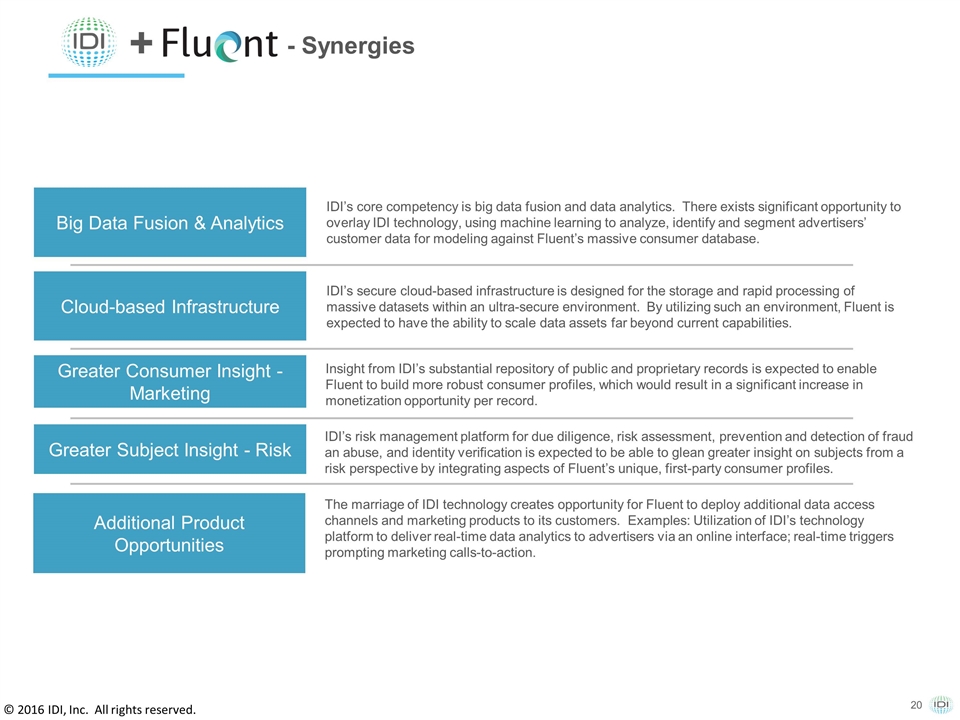

- Synergies 20 © 2016 IDI, Inc. All rights reserved. IDI’s core competency is big data fusion and data analytics. There exists significant opportunity to overlay IDI technology, using machine learning to analyze, identify and segment advertisers’ customer data for modeling against Fluent’s massive consumer database. Big Data Fusion & Analytics IDI’s secure cloud-based infrastructure is designed for the storage and rapid processing of massive datasets within an ultra-secure environment. By utilizing such an environment, Fluent is expected to have the ability to scale data assets far beyond current capabilities. Cloud-based Infrastructure Insight from IDI’s substantial repository of public and proprietary records is expected to enable Fluent to build more robust consumer profiles, which would result in a significant increase in monetization opportunity per record. Greater Consumer Insight - Marketing IDI’s risk management platform for due diligence, risk assessment, prevention and detection of fraud an abuse, and identity verification is expected to be able to glean greater insight on subjects from a risk perspective by integrating aspects of Fluent’s unique, first-party consumer profiles. Greater Subject Insight - Risk The marriage of IDI technology creates opportunity for Fluent to deploy additional data access channels and marketing products to its customers. Examples: Utilization of IDI’s technology platform to deliver real-time data analytics to advertisers via an online interface; real-time triggers prompting marketing calls-to-action. Additional Product Opportunities +

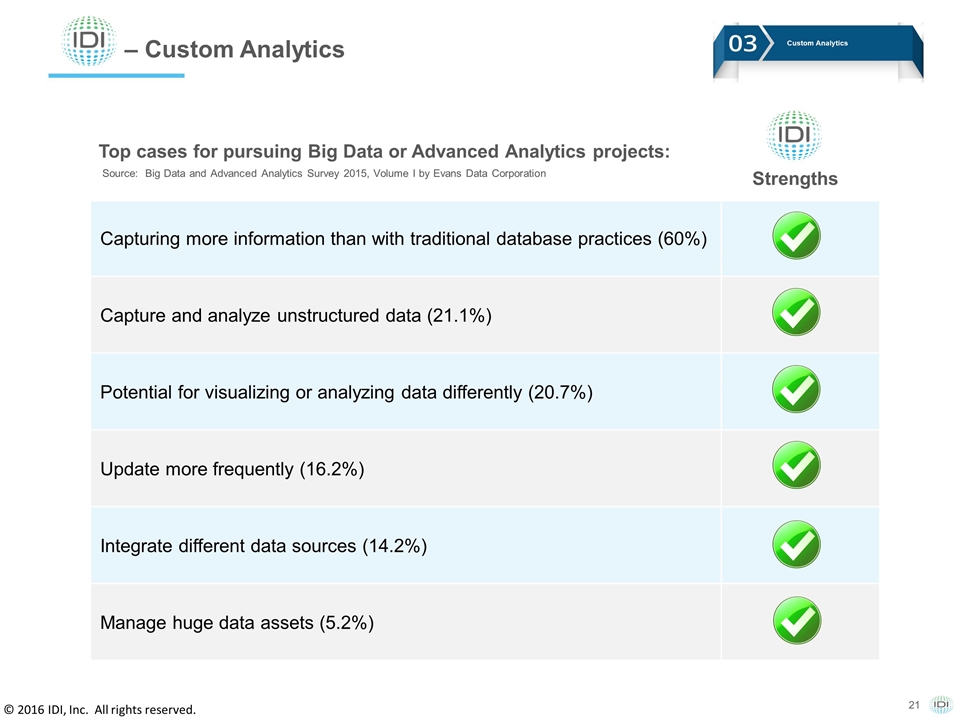

– Custom Analytics 21 © 2016 IDI, Inc. All rights reserved. Capturing more information than with traditional database practices (60%) Capture and analyze unstructured data (21.1%) Potential for visualizing or analyzing data differently (20.7%) Update more frequently (16.2%) Integrate different data sources (14.2%) Manage huge data assets (5.2%) Top cases for pursuing Big Data or Advanced Analytics projects: Source: Big Data and Advanced Analytics Survey 2015, Volume I by Evans Data Corporation Strengths

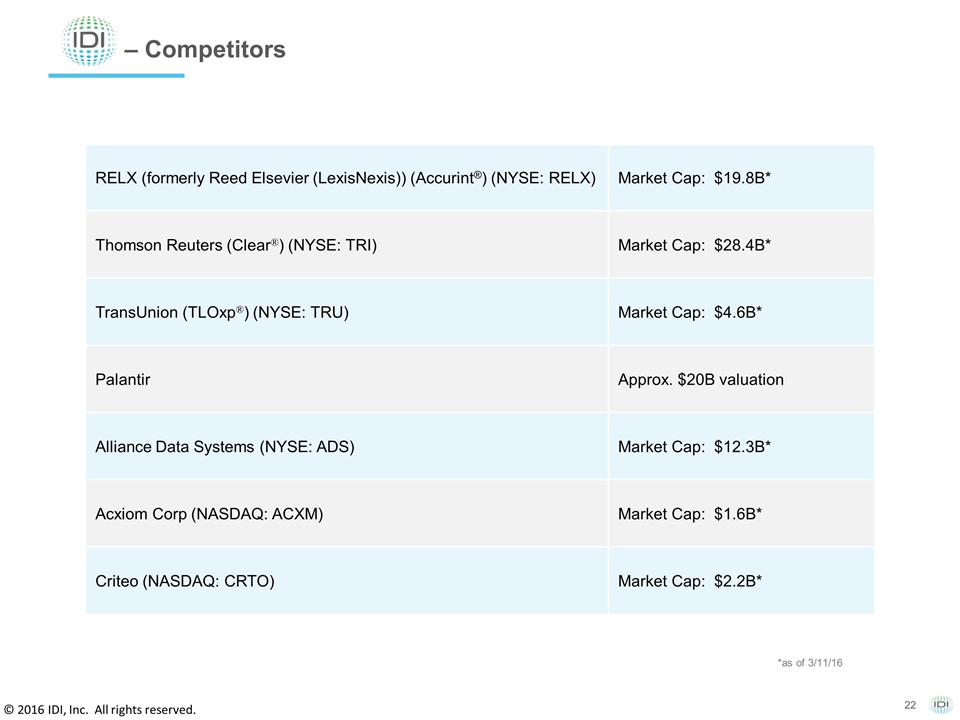

– Competitors 22 © 2016 IDI, Inc. All rights reserved. RELX (formerly Reed Elsevier (LexisNexis)) (Accurint®) (NYSE: RELX) Market Cap: $19.8B* Thomson Reuters (Clear®) (NYSE: TRI) Market Cap: $28.4B* TransUnion (TLOxp®) (NYSE: TRU) Market Cap: $4.6B* Palantir Approx. $20B valuation Alliance Data Systems (NYSE: ADS) Market Cap: $12.3B* Acxiom Corp (NASDAQ: ACXM) Market Cap: $1.6B* Criteo (NASDAQ: CRTO) Market Cap: $2.2B* *as of 3/11/16

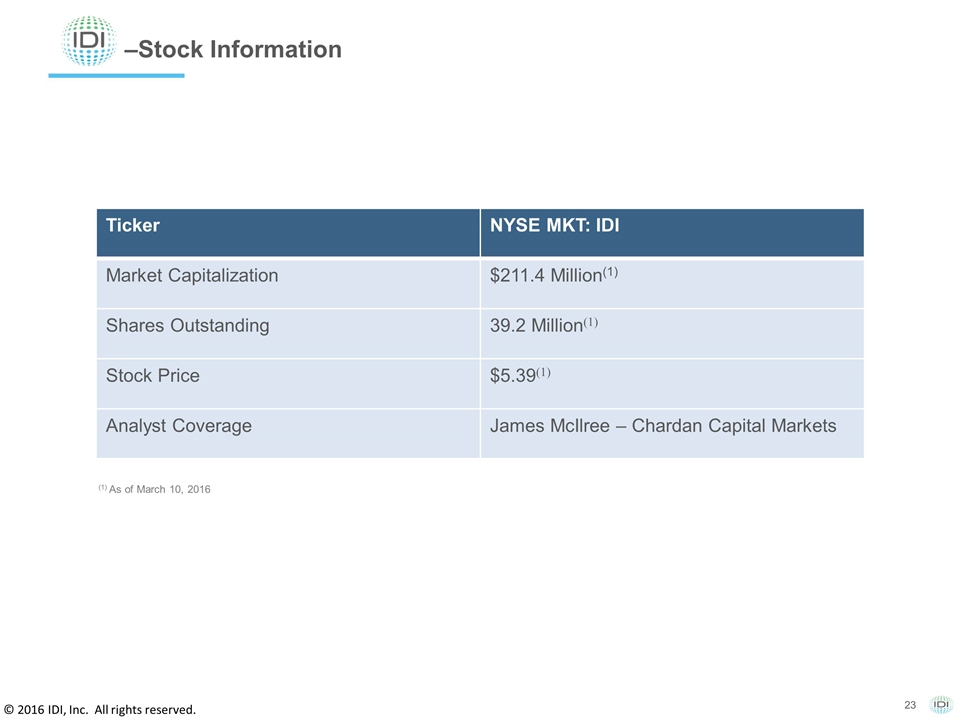

–Stock Information 23 © 2016 IDI, Inc. All rights reserved. Ticker NYSE MKT: IDI Market Capitalization $211.4 Million(1) Shares Outstanding 39.2 Million(1) Stock Price $5.39(1) Analyst Coverage James McIlree – Chardan Capital Markets (1) As of March 10, 2016