Attached files

| file | filename |

|---|---|

| 8-K - FROM 8-K - Foundation Healthcare, Inc. | d143961d8k.htm |

| EX-99.1 - EX-99.1 - Foundation Healthcare, Inc. | d143961dex991.htm |

Stanton Nelson, CEO March 14-16, 2016 FOUNDATION HEALTHCARE Investor Presentation Exhibit 99.2

Forward Looking Statements This presentation includes forward looking statements. All statements other than statements of historical fact, including, without limitation, statements regarding future plans and objectives of Foundation Healthcare or the Corporation, are forward-looking statements that involve various risks, assumptions, estimates, and uncertainties. These statements reflect the current projections, expectations or beliefs of Foundation Healthcare and are based on information currently available to the Corporation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. All forward looking statements made in this presentation are qualified by these cautionary statements and the risk factors described above. All such statements are made as of the date this presentation is given and Foundation Healthcare assumes no obligation to update or revise these statements. An investment in Foundation Healthcare is speculative due to the nature of the Corporation's business. Investors must rely upon the ability, expertise, judgment, discretion, integrity, and good faith of the Management of the Corporation. Recipient acknowledges that Foundation Healthcare is subject to the reporting requirements of the Securities and Exchange Commission. Recipient further acknowledges that the financial information included in this presentation related to Foundation Healthcare is confidential until such time as the financial information has been filed with the SEC on Form 8-K. Recipient agrees not to use any confidential information to purchase, sell, or otherwise transfer or dispose of Foundation Healthcare’s common stock.

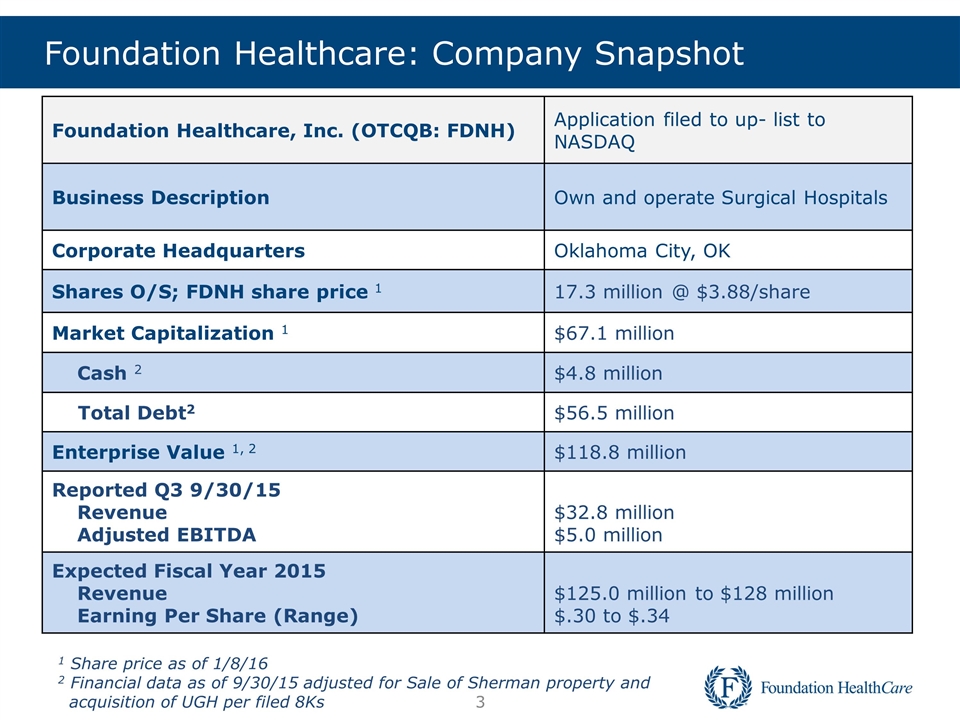

Foundation Healthcare: Company Snapshot Foundation Healthcare, Inc. (OTCQB: FDNH) Application filed to up- list to NASDAQ Business Description Own and operate Surgical Hospitals Corporate Headquarters Oklahoma City, OK Shares O/S; FDNH share price 1 17.3 million @ $3.88/share Market Capitalization 1 $67.1 million Cash 2 $4.8 million Total Debt2 $56.5 million Enterprise Value 1, 2 $118.8 million Reported Q3 9/30/15 Revenue Adjusted EBITDA $32.8 million $5.0 million Expected Fiscal Year 2015 Revenue Earning Per Share (Range) $125.0 million to $128 million $.30 to $.34 1 Share price as of 1/8/16 2 Financial data as of 9/30/15 adjusted for Sale of Sherman property and acquisition of UGH per filed 8Ks

FDNH operates majority-owned Surgical Hospitals in partnership with physicians Currently own four surgical hospitals (three majority-owned) and seven ambulatory surgical centers (ASCs) Physician partners : 350+ owners and 165 non-owners Completed the acquisition of University General Hospital (UGH) in Houston on 12/31/15 Will be immediately accretive History of strong revenue and profit growth post acquisition Robust pipeline of potential hospital acquisitions in addition to UGH Management – experienced operators with strong bench strength Highly-scalable – many markets with opportunities to drive revenue growth with related services Foundation Healthcare: Company Overview 4

Foundation Healthcare: Management Objectives 5 Accelerate Growth. FDNH completed its most recent acquisition of UGH on 12/31/2015 UGH generated $70 million of revenue in 2014 Q3 revenue and adjusted EBITDA growth of 18.9% and 34.0%, respectively Annual revenue growth expected to exceed 20% Expect solid organic growth and robust acquisition pipeline Improve Stock Liquidity. 90%+ of shares are owned by insiders and other investors who have been owners for many years Application is pending for up-list to NASDAQ Improve Awareness. Management is actively seeking growth oriented investors and sell-side research firms Increase Shareholder Value. Management is focused on improving returns for shareholders Management owns 33% of the company

Foundation Healthcare: Management Team 6 Thomas Michaud Chairman of the Board Founded Foundation Surgery Affiliates, LLC (“FSA”) CEO of FSA and Foundation Surgical Hospital Affiliates, LLC Stanton Nelson CEO CEO since January 2010 Vice Chairman of Valliance Bank. Prior CEO of Monroe-Stephens Broadcasting and VP of Oliver Investments Jennifer Duke CDO Joined Company in 2015 with 15+ years of health care experience Scott Martin COO Joined Company in 2016 with 10+ Years of health care experience Former Group Vice President, Nueterra healthcare Hugh King CFO Joined Company in 2014 with 35+ years of hospital financial management experience Former Vice President and CFO at four multi-hospital systems. Travis Crenshaw CIO Joined Company in 2014 Former Vice President & Chief Information Officer, United Surgical Partners International Cindy Braly CNO Joined company in 2011 with 35+ years of leadership in acute care surgical nursing, quality management, and accreditation

Case Study: San Antonio – De Novo Development

Foundation Healthcare: San Antonio Diagnostic Imaging Centers Physical Therapists Wound Care 8 Foundation Surgical Hospital of San Antonio

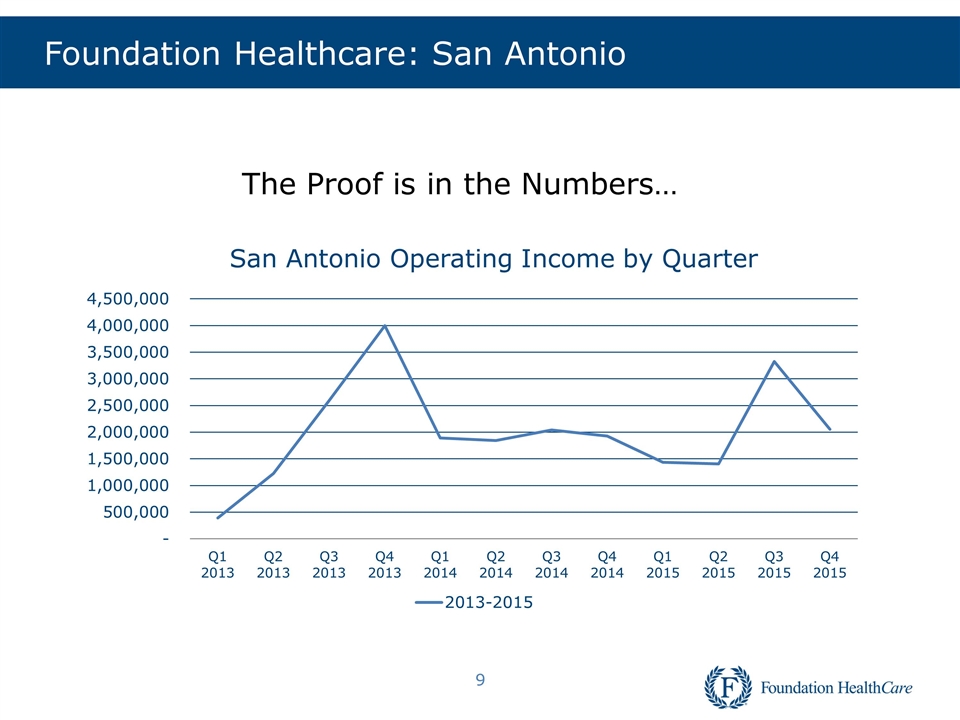

Foundation Healthcare: San Antonio 9 The Proof is in the Numbers…

Case Study: El Paso – Acquisition out of Bankruptcy

Foundation Healthcare: El Paso Surgical Centers Diagnostic Imaging Centers Physical Therapists Reference Lab Oncology Wound Care 11

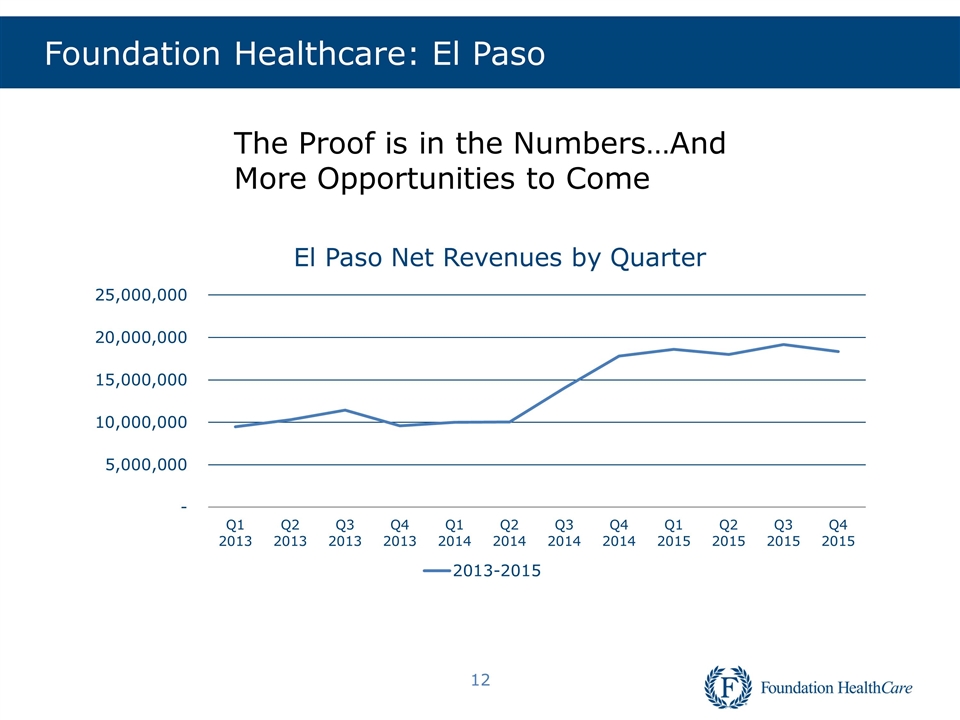

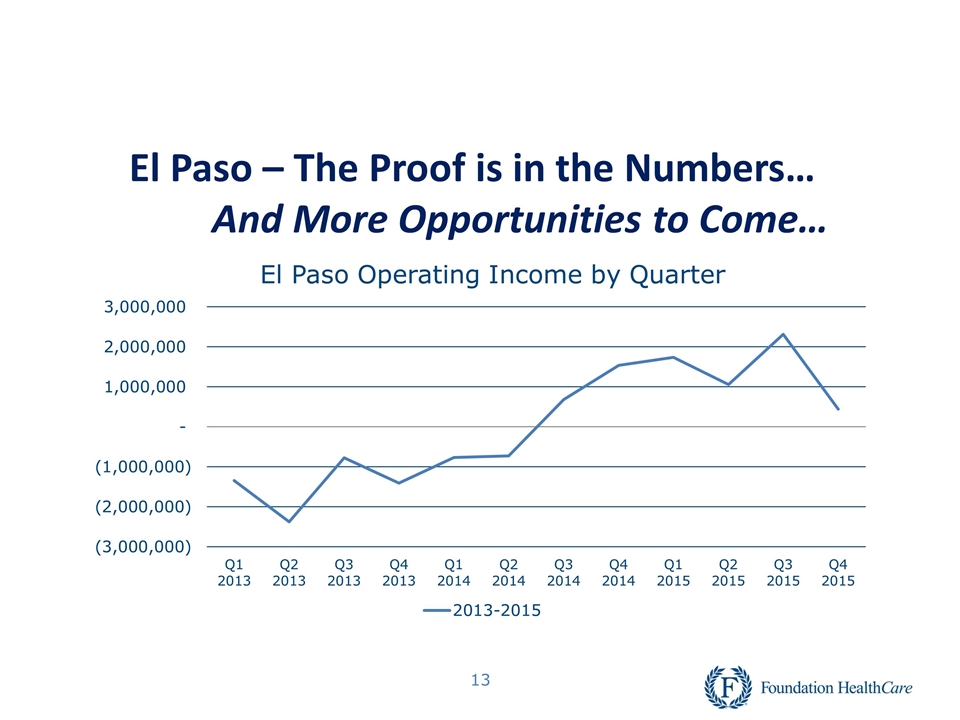

Foundation Healthcare: El Paso 12 The Proof is in the Numbers…And More Opportunities to Come

El Paso – The Proof is in the Numbers… And More Opportunities to Come… 13

UGH Opportunity

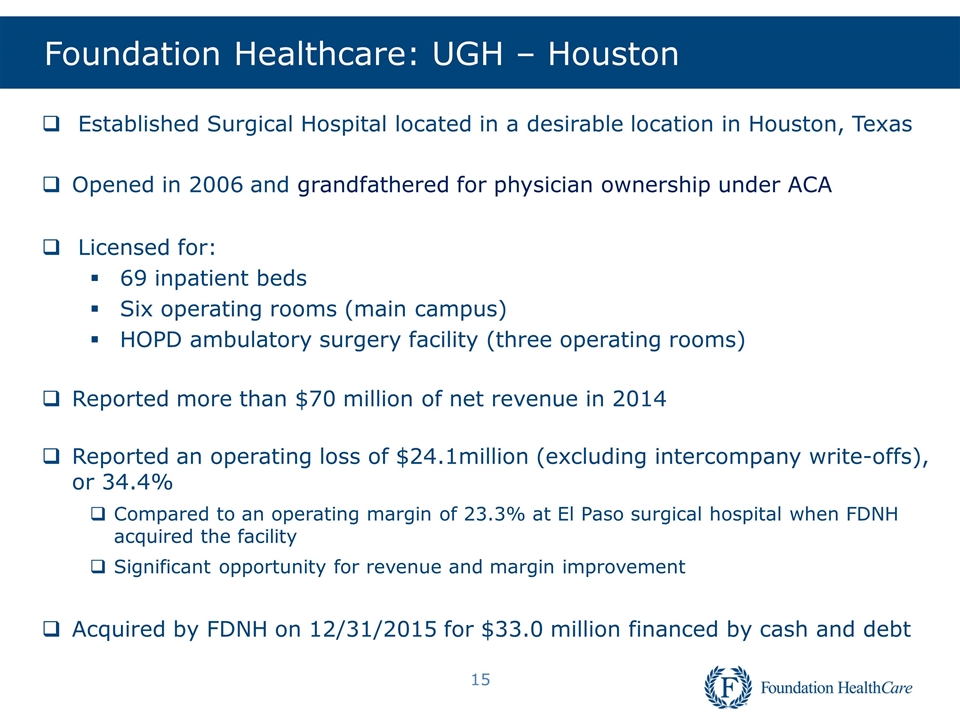

Foundation Healthcare: UGH – Houston Established Surgical Hospital located in a desirable location in Houston, Texas Opened in 2006 and grandfathered for physician ownership under ACA Licensed for: 69 inpatient beds Six operating rooms (main campus) HOPD ambulatory surgery facility (three operating rooms) Reported more than $70 million of net revenue in 2014 Reported an operating loss of $24.1million (excluding intercompany write-offs), or 34.4% Compared to an operating margin of 23.3% at El Paso surgical hospital when FDNH acquired the facility Significant opportunity for revenue and margin improvement Acquired by FDNH on 12/31/2015 for $33.0 million financed by cash and debt

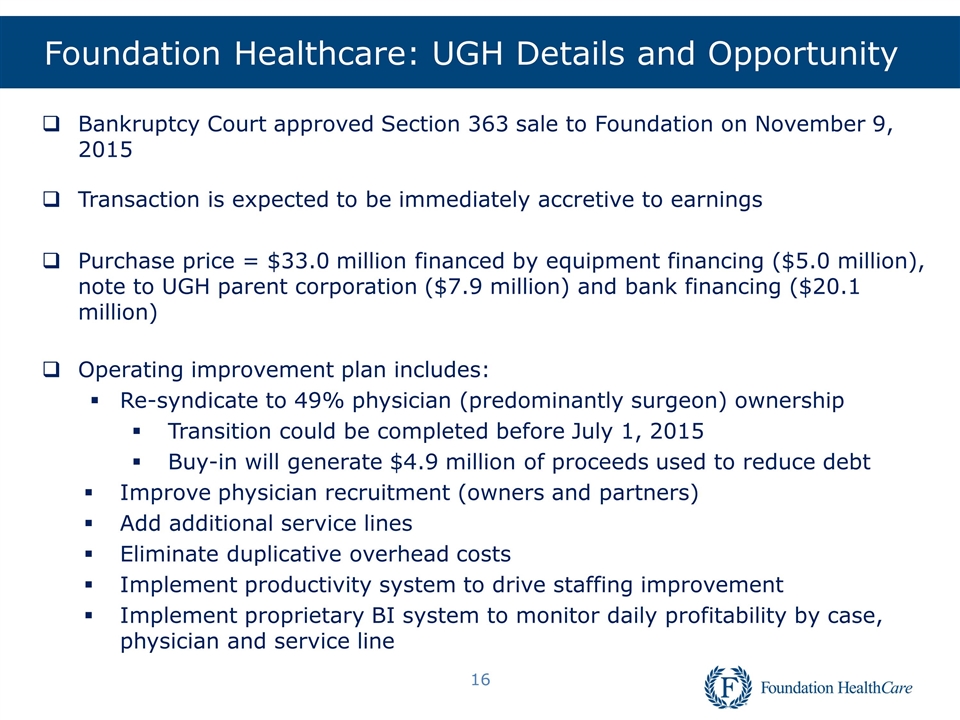

Foundation Healthcare: UGH Details and Opportunity Bankruptcy Court approved Section 363 sale to Foundation on November 9, 2015 Transaction is expected to be immediately accretive to earnings Purchase price = $33.0 million financed by equipment financing ($5.0 million), note to UGH parent corporation ($7.9 million) and bank financing ($20.1 million) Operating improvement plan includes: Re-syndicate to 49% physician (predominantly surgeon) ownership Transition could be completed before July 1, 2015 Buy-in will generate $4.9 million of proceeds used to reduce debt Improve physician recruitment (owners and partners) Add additional service lines Eliminate duplicative overhead costs Implement productivity system to drive staffing improvement Implement proprietary BI system to monitor daily profitability by case, physician and service line

FDNH Financial Appendix 17

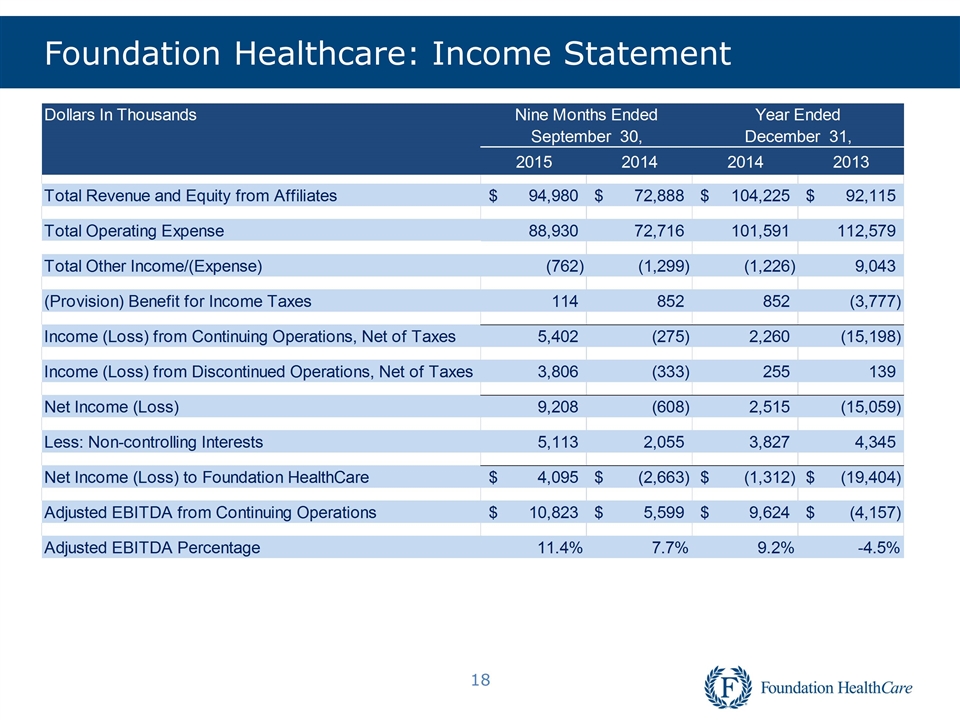

Foundation Healthcare: Income Statement 18 Dollars In Thousands Nine Months Ended Year Ended September 30, December 31, 2015 2014 2014 2013 Total Revenue and Equity from Affiliates $94,980 $72,888 $,104,225 $92,115 Total Operating Expense 88930 72716 101591 112579 Total Other Income/(Expense) -762 -1299 -1226 9043 (Provision) Benefit for Income Taxes 114 852 852 -3777 Income (Loss) from Continuing Operations, Net of Taxes 5402 -275 2260 -15198 Income (Loss) from Discontinued Operations, Net of Taxes 3806 -333 255 139 Net Income (Loss) 9208 -608 2515 -15059 Less: Non-controlling Interests 5113 2055 3827 4345 Net Income (Loss) to Foundation HealthCare $4,095 $-2,663 $-1,312 $,-19,404 Adjusted EBITDA from Continuing Operations $10,823 $5,599 $9,624 $-4,157 Adjusted EBITDA Percentage 0.11395030532743736 7.7% 9.2% -4.5%

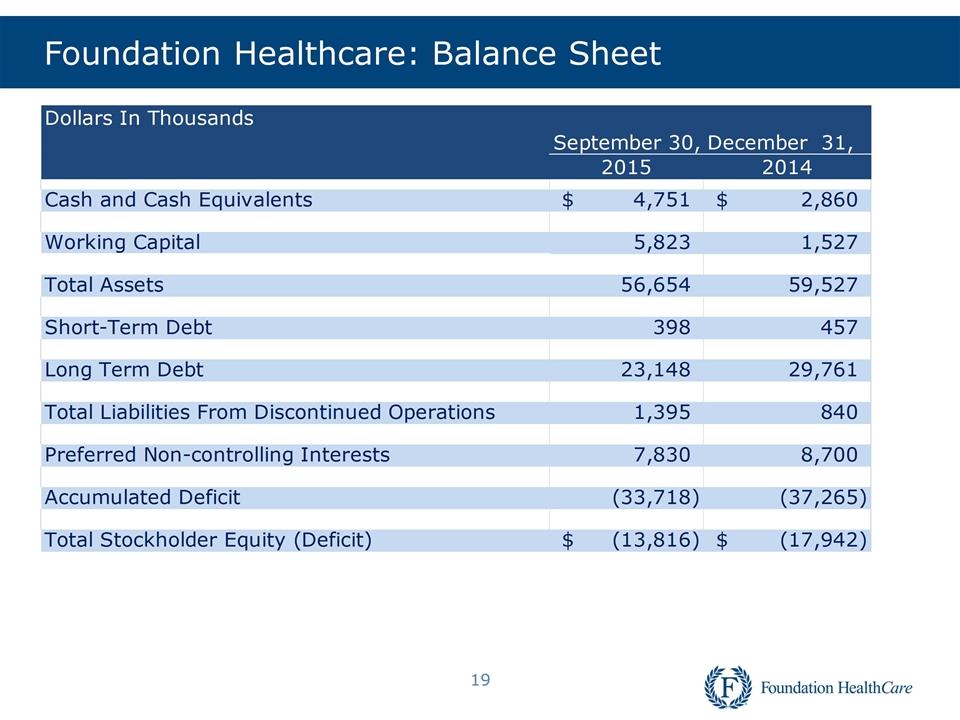

Foundation Healthcare: Balance Sheet 19 Dollars In Thousands September 30, December 31, 2015 2014 Cash and Cash Equivalents $4,751 $2,860 Working Capital 5823 1527 Total Assets 56654 59527 Short-Term Debt 398 457 Long Term Debt 23148 29761 Total Liabilities From Discontinued Operations 1395 840 Preferred Non-controlling Interests 7830 8700 Accumulated Deficit -33718 -37265 Total Stockholder Equity (Deficit) $,-13,816 $,-17,942

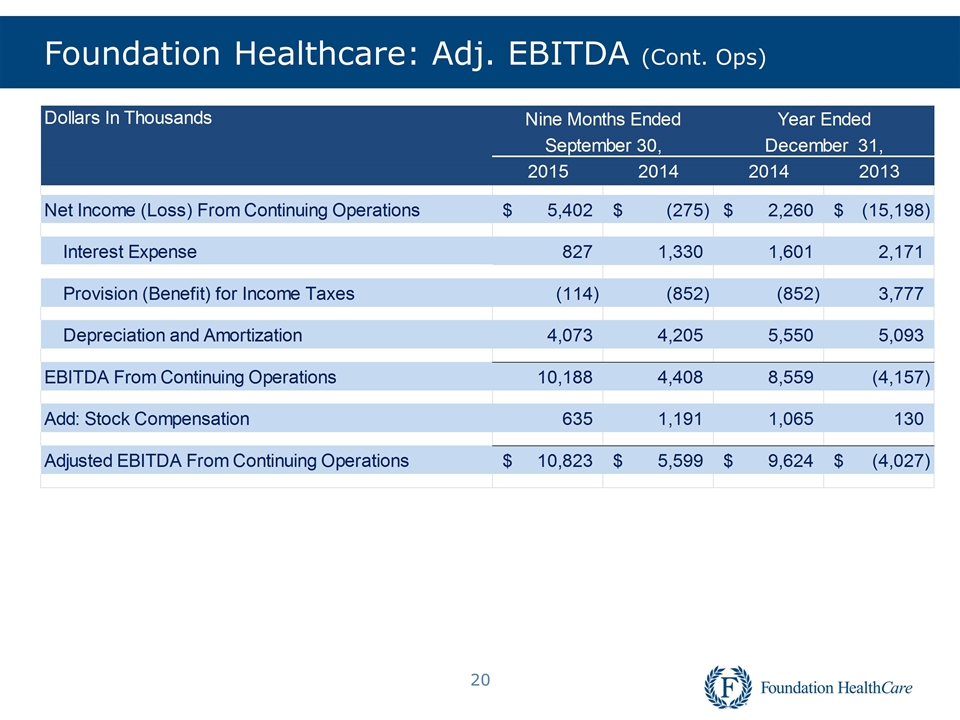

Foundation Healthcare: Adj. EBITDA (Cont. Ops) 20 Dollars In Thousands Nine Months Ended Year Ended September 30, December 31, 2015 2014 2014 2013 Net Income (Loss) From Continuing Operations $5,402 $-,275 $2,260 $,-15,198 Interest Expense 827 1330 1601 2171 Provision (Benefit) for Income Taxes -114 -852 -852 3777 Depreciation and Amortization 4073 4205 5550 5093 EBITDA From Continuing Operations 10188 4408 8559 -4157 Add: Stock Compensation 635 1191 1065 130 Adjusted EBITDA From Continuing Operations $10,823 $5,599 $9,624 $-4,027

Foundation HealthCare 14000 N. Portland Ave., Suite 200 Oklahoma City, OK 73134 800.783.0404 www.fdnh.com 21