Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PACIFIC MERCANTILE BANCORP | pmbcinvestorpresentationma.htm |

INVESTOR PRESENTAT ION M A R C H 2 0 1 6 1

This presentation contains statements regarding our expectations, beliefs and views about our future financial performance and our business, trends and expectations regarding the markets in which we operate, and our future plans. Those statements constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, can be identified by the fact that they do not relate strictly to historical or current facts. Often, they include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may”. Forward-looking statements are based on current information available to us and our assumptions about future events over which we do not have control. Moreover, our business and our markets are subject to a number of risks and uncertainties which could cause our actual financial performance in the future, and the future performance of our markets (which can affect both our financial performance and the market prices of our shares), to differ, possibly materially, from our expectations as set forth in the forward-looking statements contained in this presentation. In addition to the risk of incurring loan losses, which is an inherent risk of the banking business, these risks and uncertainties include, but are not limited to, the following: the risk that the economic recovery in the United States, which is still relatively fragile, will be adversely affected by domestic or international economic conditions, which could cause us to incur additional loan losses and adversely affect our results of operations in the future; the risk that our results of operations in the future will continue to be adversely affected by our exit from the wholesale residential mortgage lending business and the risk that our commercial banking business will not generate the additional revenues needed to fully offset the decline in our mortgage banking revenues within the next two to three years; the risk that our interest margins and, therefore, our net interest income will be adversely affected by changes in prevailing interest rates; the risk that we will not succeed in further reducing our remaining nonperforming assets, in which event we would face the prospect of further loan charge-offs and write-downs of other real estate owned and would continue to incur expenses associated with the management and disposition of those assets; the risk that we will not be able to manage our interest rate risks effectively, in which event our operating results could be harmed; the prospect that government regulation of banking and other financial services organizations will increase, causing our costs of doing business to increase and restricting our ability to take advantage of business and growth opportunities. Additional information regarding these and other risks and uncertainties to which our business is subject are contained in our Annual Report on Form 10-K for the year ended December 31, 2014 which is on file with the SEC as well as subsequent Quarterly Reports on Form 10-Q that we file with the SEC. Due to these and other risks and uncertainties to which our business is subject, you are cautioned not to place undue reliance on the forward-looking statements contained in this news release, which speak only as of its date, or to make predictions about our future financial performance based solely on our historical financial performance. We disclaim any obligation to update or revise any of the forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. FORWARD LOOKING STATEMENTS 2

CORPORATE OVERVIEW _________________________________ PACIFIC MERCANTILE BANK IS A COMMUNITY-BASED COMMERCIAL BANK SERVING SOUTHERN CALIFORNIA Bank founded in 1999 $1.1 billion in total assets 9 offices in Southern California Focused on serving small- and middle-market businesses 33% owned by Carpenter Community BancFund CORPORATE HEADQUARTERS COSTA MESA, CALIFORNIA 3

BRANCH LOCATIONS _________________________________ CURRENT BRANCHES ONTARIO BEVERLY HILLS LA HABRA COSTA MESA NEWPORT BEACH SAN JUAN CAPISTRANO (closing in March 2016) LA JOLLA FUTURE BRANCH IRVINE (opening in May 2016) 4

INVESTOR HIGHLIGHTS _________________________________ Turnaround Bank in Attractive Growth Markets Comprehensive Client Engagement Outstanding Growth Market of Southern California Technology Entertainment Small/Medium Enterprises Improving Operational Leverage High insider ownership (approximately 40%) Opportunity to capitalize on late-stage turnaround transitioning to growth story Past Charge-offs Driving Significant Recovery Opportunities DTA Recovery in Q4 2015 Discounted Valuation Trading at 1.2x TBV 5

CORE MARKET OVERVIEW _________________________________ Southern California A LARGE ATTRACTIVE MARKET * Source: National Venture Capital Association ** Source: California Employment Development Department *** LA 5-County Area consists of Los Angeles, Orange, Riverside, San Bernardino and Ventura Counties **** Source: Los Angeles County Economic Development Corporation 5th largest market for VC investment in 2015 * Large addressable market for small- and middle-market banking 97,000 businesses with fewer than 500 employees** LA 5-County Area*** Expected to Add 158,000 Jobs in 2016 (2.1% employment growth)**** 6

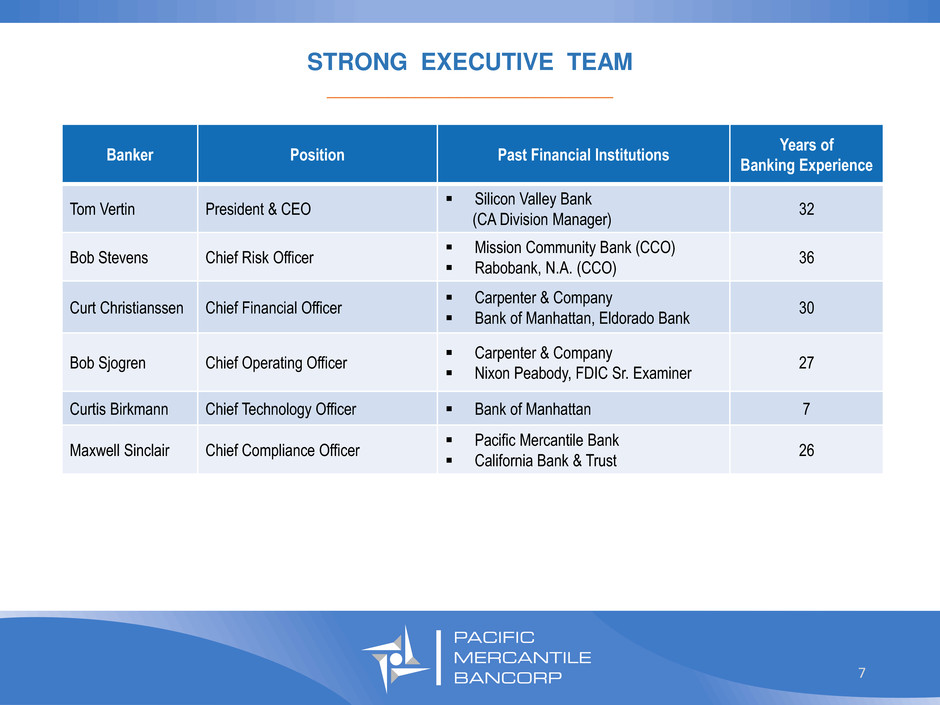

Banker Position Past Financial Institutions Years of Banking Experience Tom Vertin President & CEO Silicon Valley Bank (CA Division Manager) 32 Bob Stevens Chief Risk Officer Mission Community Bank (CCO) Rabobank, N.A. (CCO) 36 Curt Christianssen Chief Financial Officer Carpenter & Company Bank of Manhattan, Eldorado Bank 30 Bob Sjogren Chief Operating Officer Carpenter & Company Nixon Peabody, FDIC Sr. Examiner 27 Curtis Birkmann Chief Technology Officer Bank of Manhattan 7 Maxwell Sinclair Chief Compliance Officer Pacific Mercantile Bank California Bank & Trust 26 STRONG EXECUTIVE TEAM _________________________________ 7

STRONG COMMERCIAL BANKING TEAM _________________________________ Banker Position Past Financial Institutions Years of Banking Experience Kittridge Chamberlain Chief Banking Officer Silicon Valley Bank (Sr. Credit Officer, Western Div.) 30 Robert Anderson Head of Product and Market Development Silicon Valley Bank (Head of Orange County office) 20 Tom Wagner Chief Strategy Officer Silicon Valley Bank (Head of Corporate Finance) 30 Cindy Verity Head of Cash Management Silicon Valley Bank (Head of Treasury Management Sales) 30 Adrian Ward Head of Entertainment Industries Division National Bank of California (SVP, Entertainment) 23 8

MARKET POSITIONING _________________________________ Differentiating Markets / Products Entertainment Lending Technology Asset-Based Lending Horizon Analytics Financial Analysis Business Planning Modeling & Forecasting Balance Sheet Management “Business Banking Beyond the Obvious” Target Commercial Clients TECH NON-TECH V C -B A CK E D NO N - V C -B A CK E D 9

BALANCE SHEET OVERVIEW: Loans, Deposits, Asset Quality, Capital 10

LOAN PORTFOLIO FOCUS ON RELATIONSHIP LENDING _________________________________ CRE: all other 17% CRE: owner- occupied 23% Commercial 40% Residential: multi- family 10% Single-family 6% Other 4% $ 862 Million as of December 31, 2015 11

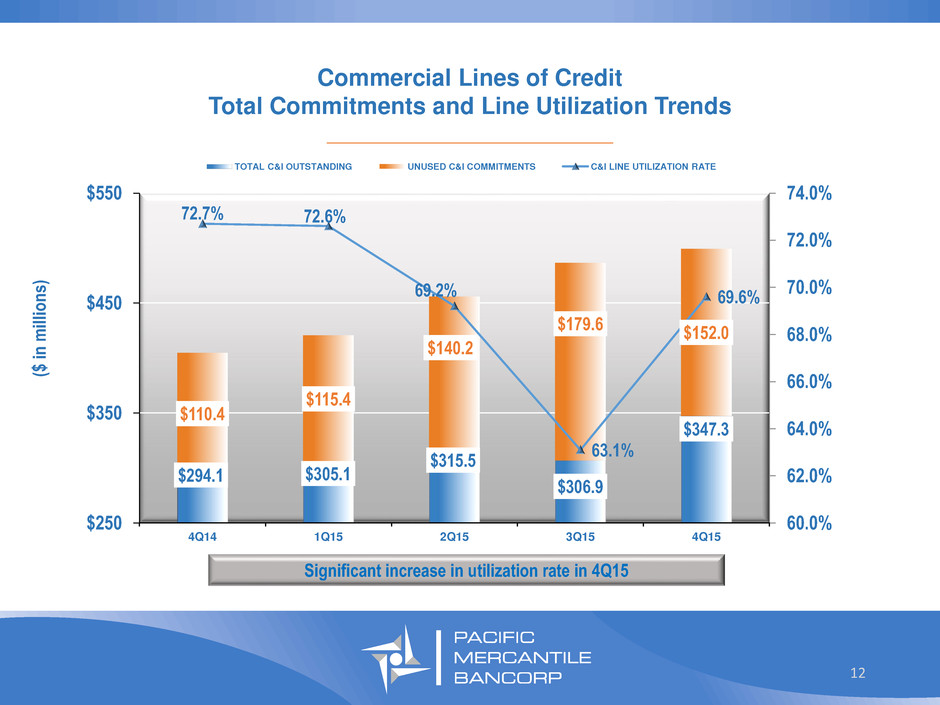

Commercial Lines of Credit Total Commitments and Line Utilization Trends _________________________________ $294.1 $305.1 $315.5 $306.9 $347.3 $110.4 $115.4 $140.2 $179.6 $152.0 72.7% 72.6% 69.2% 63.1% 69.6% 60.0% 62.0% 64.0% 66.0% 68.0% 70.0% 72.0% 74.0% $250 $350 $450 $550 4Q14 1Q15 2Q15 3Q15 4Q15 TOTAL C&I OUTSTANDING UNUSED C&I COMMITMENTS C&I LINE UTILIZATION RATE ($ in m ill io n s) Significant increase in utilization rate in 4Q15 12

STRONG GROWTH IN RELATIONSHIP LOANS _________________________________ $169 $174 $170 $191 $197 $213 $212 $203 $198 $196 $188 $226 $229 $253 $265 $302 $313 $323 $322 $347 47.8% 51.6% 51.3% 55.1% 56.3% 61.4% 62.4% 63.2% 62.7% 63.0% 30% 35% 40% 45% 50% 55% 60% 65% $100 $150 $200 $250 $300 $350 $400 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 CRE OWNER-OCCUPIED C&I RELATIONSHIP LOANS AS A PERCENTAGE OF TOTAL LOANS 13

LOAN PORTFOLIO WELL POSITIONED FOR RISING INTEREST RATES _________________________________ 30 32 34 36 38 40 42 44 46 48 2012 2013 2014 2015 Loan Portfolio Duration (in months) Pacific Mercantile Bank California Commercial Banks U.S. Commercial Banks $500M-$1B 23% decrease in loan portfolio duration since 2012 14

DEPOSIT COMPOSITION: FOCUSED ON CORE DEPOSITS _________________________________ $894 Million as of December 31, 2015 Non-interest bearing 24% Interest checking 4% Savings/Money Market 19% Certificates of Deposit 53% Continuing to attract non-interest bearing deposits Shifted balances out of CDs into savings and money market accounts Savings and money market balances tend to be stickier and less price sensitive than CDs Non-interest bearing 28% Interest checking 6% Savings/Money Market 35% Certificates of Deposit 31% $857 Million as of March 31, 2014 15

STABLE ASSET QUALITY _________________________________ > 40% OF NPAS RELATE TO ONE CREDIT 0.63% 0.58% 0.52% 0.61% 1.15% 1.32% 1.36% 1.36% 1.17% 1.04% 0.37% 0.35% 0.38% 0.35% 0.23% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 4Q14 1Q15 2Q15 3Q15 4Q15 NPAS/TOTAL ASSETS Other One Credit PMAR -0.08% 0.14% 0.04% 0.01% -0.05% -0.20% -0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 4Q14 1Q15 2Q15 3Q15 4Q15 NCOS/GROSS LOANS 16

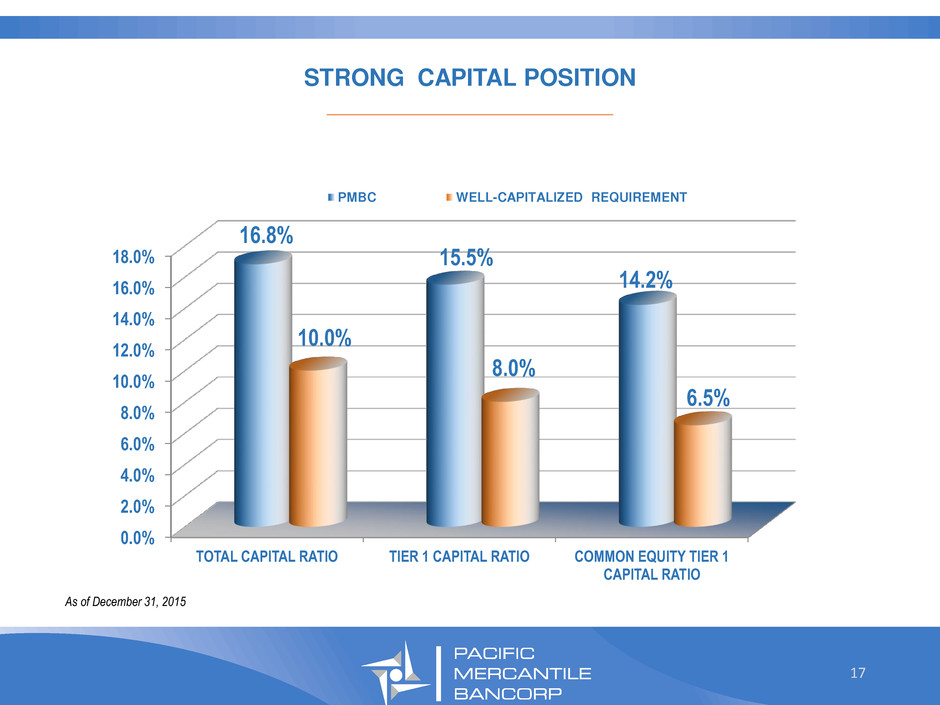

STRONG CAPITAL POSITION _________________________________ 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% TOTAL CAPITAL RATIO TIER 1 CAPITAL RATIO COMMON EQUITY TIER 1 CAPITAL RATIO 16.8% 15.5% 14.2% 10.0% 8.0% 6.5% PMBC WELL-CAPITALIZED REQUIREMENT 17 As of December 31, 2015

OUTLOOK 18

SIGNIFICANT CHANGES IN THE CALIFORNIA LANDSCAPE _________________________________ RBC acquisition of City National Bank Pacific Premier Bancorp acquisitions of Independence Bank and Security Bank of California Western Alliance acquisition of Bridge Bank PacWest Bancorp acquisition of Square 1 Bank California United Bank merger with 1st Enterprise Bank Disruption creating opportunities to add customers and productive banking teams 19

Strategic Changes to Operating Model _________________________________ Transitioning from full branches to smaller banking offices in certain markets Cash management products and commercial client base reduce need for full-service branches Cost savings from transition will be redeployed into more production staff Planned addition of relationship managers during 2016 20

2016 OUTLOOK _________________________________ Targeting double-digit loan growth Continued focus on growing commercial banking relationships Expanded production staff will enable deeper penetration of core markets Expectation for improving net interest margin Cost of funds declining Loan-to-deposit ratio increasing Higher non-interest income New commercial customers using more treasury management products Relatively stable expense levels Continuing expense discipline Increase in production staff cost offset by office transition Meaningful recovery opportunities should keep provision requirements modest for 2016 Steady increase in profitability 21

I n v e s t o r R e l a t i o n s : C u r t C h r i s t i a n s s e n ( 7 1 4 ) 4 3 8 - 2 5 3 1 C u r t . c h r i s t i a n s s e n @ p m b a n k . c o m 22