Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KNOLL INC | a8-kxq12016investorpresent.htm |

© 2015 Knoll Inc. Knoll, Inc. First Quarter 2016 Investor Presentation the office network ANDREW COGAN, CEO CRAIG SPRAY, SVP & CFO March 4th, 2016

2© 2016 Knoll Inc. Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding Knoll, Inc.’s expected future financial position, results of operations, cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include words such as "anticipate," "if," "believe," "plan," “goals," "estimate," "expect," "intend," "may," "could," "should," "will," and other similar expressions are forward-looking statements. This includes, without limitation, our statements and expectations regarding any current or future recovery in our industry, our publicly announced plans for increased capital and investment spending to achieve our long-term revenue and profitability growth goals, our expectations with respect to our diversification strategy, our future performance in relation to our industry (BIFMA), and our expectations with respect to leverage. Such forward-looking statements are inherently uncertain, and readers must recognize that actual results may differ materially from the expectations of Knoll management. Knoll does not undertake a duty to update such forward- looking statements. Factors that may cause actual results to differ materially from those in the forward-looking statements include corporate spending and service-sector employment, price competition, acceptance of Knoll’s new products, the pricing and availability of raw materials and components, foreign exchange rates, transportation costs, demand for high quality, well designed furniture solutions, changes in the competitive marketplace, changes in trends in the market for furniture and coverings, the financial strength and stability of our suppliers, customers and dealers, access to capital, our success in designing and implementing our new enterprise resource planning system, our ability to successfully integrate acquired businesses, and other risks identified in Knoll’s Annual Report on Form 10-K, and other filings with the Securities and Exchange Commission, as well as other cautionary statements that are made from time-to-time in Knoll’s public communications. Many of these factors are outside of Knoll’s control. This presentation also includes certain non-GAAP financial measures. A “non-GAAP financial measure” is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We present Non-GAAP measures because we consider them to be important supplemental measures of our performance and believe them to be useful to display ongoing results from operations distinct from items that are infrequent or not indicative of our operating performance. We have provided reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure in the presentation below. These non-GAAP measures are not indicators of our financial performance under GAAP and should not be considered as an alternative to the applicable GAAP measure. These non-GAAP measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Our presentation of these non-GAAP measures should not be construed as an inference that our future results will be unaffected by unusual or infrequent items.

3© 2016 Knoll Inc. Knoll is a constellation of design-driven brands and people, working together with our clients to create inspired modern interiors. Knoll is: Knoll Office KnollStudio KnollTextiles KnollExtra Spinneybeck | FilzFelt Edelman Leather HOLLY HUNT

4© 2016 Knoll Inc. For over 75 years, Knoll has stood for modern design. 60s 60s 90s 90s60s 00s 00s 10s10s 10s Design, leadership, quality and innovation in both the contract and residential markets

5© 2016 Knoll Inc. Global Luxury Furnishings & Coverings High End $3.7bn, Relevant Market $37.6bn 2013 Knoll Estimate We are designing Knoll to solve for two distinct client segments with global potential. North American Workplace BIFMA 2015 $10.1bn US Production, Most Recent Full Year Source: BIFMA •Changing Work Style •Global Requirements •Cyclical Rebound •Competitive Intensity •Favorable Demographics •High Margin Opportunities •Fragmented Competitors Luxury Performance Mass Commercial Residential

6© 2016 Knoll Inc. Maximize office segment profitability and growth Target underpenetrated and emerging categories and markets for growth Expand reach into consumer and decorator channels around the world Build a responsive and efficient customer centric service and technology culture and infrastructure across our businesses Four strategic imperatives drive our growth.

7© 2016 Knoll Inc. $280 $372 $413 32.5% 35.4% 37.4% 2013 2014 2015 $55 $86 $114 6.4% 8.2% 10.3% 2013 2014 2015 Our strategy has generated significant growth in sales, margins and profits. Adjusted Gross Profit ($ Millions) and % Adjusted Operating Profit ($ Millions) and % Adjusted Earnings Per Share - Diluted Sales Growth YoY – ($ Millions) $862 $1,050 $1,104 2013 2014 5 $0.68 $1.09 $1.52 2013 2014 2015 +28% +47% +105% +124% Note: Adjusted Gross Profit, Adjusted Operating Profit, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of Adjusted Gross Profit, Adjusted Operating Profit, and Adjusted EPS to GAAP Gross Profit, Operating Profit, and EPS, see pages 19 - 20.

8© 2016 Knoll Inc. Today 38% of our sales and 61% of our profits come from outside our North American Office segment. 83% 11% 6% 62% 28% 10% 84% 8% 8% 39% 39% 22% 62%28% Office Studio Coverings 2001 2015 2001 2015 Net Sales Adjusted Operating Profit (1) Adjusted Operating Profit is a non-GAAP financial measure. For a reconciliation of Adjusted Operating Profit to GAAP Operating Profit, see reconciliation on pages 20 and 21

9© 2016 Knoll Inc. $29 $34 $22 $44 $44 $25 2014 2015 Office 2014 2015 Studio 2014 2015 Coverings $656 $279 $115 $687 $304 $114 2014 2015 Office 2014 2015 Studio 4 2015 Coverings Full Year 2015 results demonstrate the potential of our businesses and strategies. Net Sales ($ millions) Adjusted Operating Profit ($ millions) + Systems and Seating sales + Holly Hunt + Studio North America + Spinneybeck ADJ OP 6.5% ADJ OP 14.4% ADJ OP 22.3% + Volume + Foreign exchange + Price + Volume + Price across business lines + Foreign exchange + Price across business lines + Foreign exchange + Savings from production efficiencies +200 bps +220 bps +280 bps + Textiles +4.7% +8.8% (1.1)% +5.5% Constant Currency Sales +13.2% Constant Currency Sales (0.3)% Constant Currency Sales +51.4% +13.0% +27.8% Note: Adjusted Operating Profit and Constant Currency Sales are non-GAAP financial measures. For a reconciliation of Adjusted Operating Profit to GAAP Operating Profit and Constant Currency Sales to Net Sales, see pages 21.

10© 2016 Knoll Inc. $28 $22 $28 $29 $34 9.7% 8.4% 10.5% 11.0% 11.1% Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 35.9% 35.8% 37.7% 38.4% 37.7% Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 $286 $267 $269 $264 $306 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 +24% +16% +1% (2)% +7% $0.35 $0.36 $0.36 $0.38 $0.43 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Our key metrics continue to improve. Adjusted Gross Profit % Adjusted Operating Profit ($ Millions) and % Adjusted Earnings Per Share - Diluted Sales Growth YoY – ($ Millions) +8.4% Constant Currency Sales +180 bps +23% +7% +22% Note: Adjusted Gross Profit, Adjusted Operating Profit, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of Adjusted Gross Profit, Adjusted Operating Profit, and Adjusted EPS to GAAP Gross Profit, Operating Profit, and EPS, see pages 22 - 23.

11© 2016 Knoll Inc. $13 $9 $5 $17 $11 $6 Q4/14 Q4/15 Office Q4/14 Q4/15 Studio Q4/14 Q4/15 Coverings $184 $74 $28 $198 $81 $27 Q4/14 Q4/15 Office 4 Q4/15 Studio Q4/14 Q4/15 Coverings In Q4 2015, adjusted operating margins grew significantly across each of our reporting segments. Net Sales (millions) Adjusted Operating Profit (millions) (1) + Complementary Product Sales: * Adjustable Tables * Seating * Ergonomic Accessories + Holly Hunt + Europe + Studio North America + Spinneybeck - Edelman + Price + Foreign exchange + Operating Efficiencies + Price across business lines + Foreign exchange + Price across business lines + Restructured SG&A cost basis + Foreign exchange +7.2% +8.5% (1.3)% +8.4% Constant Currency Sales +11.7% Constant Currency Sales (0.7)% Constant Currency Sales +16.0% +20.4% +27.6% ADJ OP 8.7% ADJ OP 13.5% ADJ OP 21.5% +140 bps +90 bps +380 bps Note: Adjusted Operating Profit and Constant Currency Sales are non-GAAP financial measures. For a reconciliation of Adjusted Operating Profit to GAAP Operating Profit and Constant Currency Sales to Net Sales, see pages 23- 24.

12© 2016 Knoll Inc. Source: Conference Board / Bloomberg, BB&T Capital Markets Any reading above 50 indicates more positive than negative responses Source: BLS Source: Reis Inc. Vacancies continue to edge down Office Vacancy Rates Jobs growth strength continued through Q4 Change in Private Sector Payrolls Service sector continues to be growth driver Service Sector Employment (‘000s) Source: BLS, BB&T Capital Markets Completions and absorption projections still bullish Office Completions & Absorption (M sf) -1000 -800 -600 -400 -200 0 200 400 600 Source: REIS, BB&T Capital Markets 10% 12% 14% 16% 18% Other than CEO confidence, leading indicators remain positive. CEO confidence declined again in Q4 CEO Confidence -80 -40 0 40 80 Completions Absorption Architectural billings yo-yo but positive on average ABI Billing Index Source: American Institute of Architects 40 50 60 0 10 20 30 40 50 60 70 80 12,000 14,000 16,000 18,000 20,000

13© 2016 Knoll Inc. Translating strategy into action: Maximize Knoll Office segment profitability. Sales Force Productivity ONEKnoll ERP Implementation Supply Chain Transformation & Modernization + Global account focus + Strategic sales coverage + Visualization tools and technology + Front to back end integrated IT platform + Integrated data management + Centralized planning & scheduling + Dealer/client self service + Strategic sourcing + Wood processing optimization + Metal and panel optimization + Transitioning to a Lean manufacturing environment + Improved productivity and customer experience + Material cost savings + Reduced labor costs + Footprint efficiency

14© 2016 Knoll Inc. The acquisition of Holly Hunt has accelerated our multi-channel residential strategy and is highly accretive. Strategic Alignment + Scale › A major platform for the residential “to-the-trade” market › Significant size › Margin enhancing Culturally Parallel, with Minimal Risk › A close fit with Knoll › Diversified sales base › Knoll specialty expertise Potential for Growth › Scalable distribution model › Potential for industry consolidation › Significant market penetration opportunities HOLLY HUNT, Chicago HOLLY HUNT, Miami

15© 2016 Knoll Inc. 30% 11% 3%9% 42% 5% Technology Showrooms Europe Product Development Site Capacity All other We have the financial resources to deliver on these strategic initiatives. + We have a $490M credit facility that runs into May 2019 + Bank Net Leverage Ratio Q4 15 at 1.67:1 We estimate 2016 capital expenditures will be in the $35-$40 million dollar range as we continue to incur costs associated with our previously announced strategic initiative programs and technology infrastructure upgrades. 2015 capital expenditures totaled $31.6 million. + Strong free cash flow (1) Excludes outstanding letters of credit and guarantee obligations. (2) Bank Net Leverage Ratio is calculated by dividing (i) outstanding debt minus excess cash over $15.0 million by (ii) EBITDA (as defined in our credit facility) for the LTM. For details of the bank leverage ratio calculation, see page 25. (3) Free Cash Flow is defined as net income, plus depreciation and amortization and non-cash stock compensation, less capital expenditures. For details of free cash flow calculation, see page 26. Planned 2016 Capital Expenditures and Allocation of these Capital Expenditures Bank Debt ($ in millions)(1) Bank Net Leverage Ratio(2) Bank Free Cash Flow ($ in millions)(3) $173 $258 $222 $- $50 $100 $150 $200 $250 $300 $350 2.23 2.41 1.67 0.0 1.0 2.0 3.0 4.0 $21.0 $33.1 $70.6 $5 $15 $25 $35 $45 $55 $65 $75

16© 2016 Knoll Inc. Cash returned to Shareholders 2012–2015 accelerated with a 25% increase in dividends in Q4, 2015. Dividends Shares Repurchases ($ mi lli o n s)

17© 2016 Knoll Inc. For more information visit www.knoll.com

18© 2016 Knoll Inc. Thank You

19© 2016 Knoll Inc. Reconciliation of Non-GAAP Results 2013 2014 2015 Operating Profit ($mm) 41.4$ 76.8$ 101.0$ Add back (deduct): Intangible asset impairment charge 8.9 - 10.7 Pension Settlement and OPEB Curtailment - 6.5 - Restructuring charges 5.1 1.5 0.9 Seating Product Discontinuation - - 0.9 Acquisition Expenses - 0.7 - Remeasurement of FilzFelt Earn-out Liability - 0.5 - Adjusted Operating Profit 55.4$ 86.0$ 113.5$ Net Sales ($mm) 862.2$ 1,050.3$ 1,104.4$ Adjusted Operating Profit % 6.4% 8.2% 10.3% Years Ended December 31, 2013 2014 2015 Knoll Inc. Gross Profit 280.3$ 371.7$ 412.1$ Add back: Seating product discontinuation charge - - 0.9 Adjusted Gross Profit 280.3$ 371.7$ 413.0$ Net Sales 862.2$ 1,050.3$ 1,104.4$ Adjusted Gross Profit % 32.5% 35.4% 37.4% Years Ended December 31, ($ in millions)

20© 2016 Knoll Inc. 2015 % 2015 % Office 686.9$ 62% 44.5$ 39% Studio 303.8 28% 43.7 39% Coverings 113.7 10% 25.3 22% Knoll Inc. 1,104.4$ 100% 113.5$ 100% ($ in millions) Net Sales Adjusted Operating Profit ($ in millions) Reconciliation of Non-GAAP Results 2013 2014 2015 Earnings per Share - Diluted 0.49$ 0.97$ 1.36$ Add back (deduct): Intangible asset impairment charge 0.12 - 0.13 Pension Settlement and OPEB Curtailment - 0.08 Restructuring charges 0.07 0.02 0.01 Seating product discontinuation charge - - 0.01 Seating Product Discontinuation - - - Acquisition Expenses - 0.01 - Adjusted Earnings per Share - Diluted 0.68$ 1.09$ a/ 1.52$ a/ ` a/ Results do not sum due to rounding Years Ended December 31,

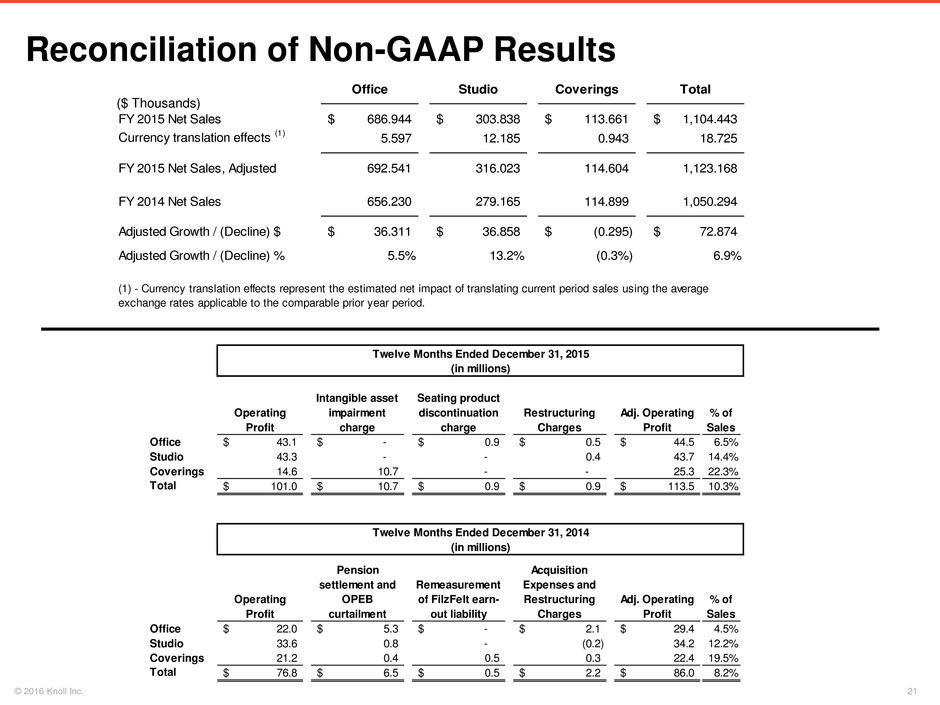

21© 2016 Knoll Inc. Reconciliation of Non-GAAP Results Office Studio Coverings Total FY 2015 Net Sales 686.944$ 303.838$ 113.661$ 1,104.443$ Currency translation effects (1) 5.597 12.185 0.943 18.725 FY 2015 Net Sales, Adjusted 692.541 316.023 114.604 1,123.168 FY 2014 Net Sales 656.230 279.165 114.899 1,050.294 Adjusted Growth / (Decline) $ 36.311$ 36.858$ (0.295)$ 72.874$ Adjusted Growth / (Decline) % 5.5% 13.2% (0.3%) 6.9% (1) - Currency translation effects represent the estimated net impact of translating current period sales using the average exchange rates applicable to the comparable prior year period. ($ Thousands) Operating Profit Intangible asset impairment charge Seating product discontinuation charge Restructuring Charges Adj. Operating Profit % of Sales Office 43.1$ -$ 0.9$ 0.5$ 44.5$ 6.5% Studio 43.3 - - 0.4 43.7 14.4% Coverings 14.6 10.7 - - 25.3 22.3% Total 101.0$ 10.7$ 0.9$ 0.9$ 113.5$ 10.3% Op rating Profit Pension settlement and OPEB curtailment Remeasurement of FilzFelt earn- out liability Acquisition Expenses and Restructuring Charges Adj. Operating Profit % of Sales Office 22.0$ 5.3$ -$ 2.1$ 29.4$ 4.5% Studio 33.6 0.8 - (0.2) 34.2 12.2% Coverings 21.2 0.4 0.5 0.3 22.4 19.5% Total 76.8$ 6.5$ 0.5$ 2.2$ 86.0$ 8.2% Twelve Months Ended December 31, 2015 (in millions) Twelve Months Ended December 31, 2014 (in millions)

22© 2016 Knoll Inc. Reconciliation of Non-GAAP Results Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Operating Profit ($mm) 20.0$ 22.3$ 28.3$ 28.7$ 21.8$ Add back (deduct): Intangible asset impairment charge - - - - 10.7 Seating Product Discontinuation Charge - - - - 0.9 Restructuring charges 0.7 - - 0.4 0.5 Pension settlement and OPEB curtailment 6.5 - - - - Remeasurement of FilzFelt earn-out liability 0.5 - - - - Adjusted Operating Profit 27.7$ 22.3$ 28.3$ 29.1$ 33.9$ Net Sales ($mm) 286.5$ 266.5$ 268.6$ 263.6$ 305.7$ Adjusted Operating Profit % 9.7% 8.4% 10.5% 11.1% 11.1% Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Gross Profit ($mm) 102.9$ 95.3$ 101.2$ 101.2$ 114.4$ Add back (deduct): Seating Product Discontinuation Charge - - - - 0.9 Adjusted Gross Profit 102.9$ 95.3$ 101.2$ 101.2$ 115.3$ Net Sales ($mm) 286.5$ 266.5$ 268.6$ 263.6$ 305.7$ Adjusted Operating Profit % 35.9% 35.8% 37.7% 38.4% 37.7%

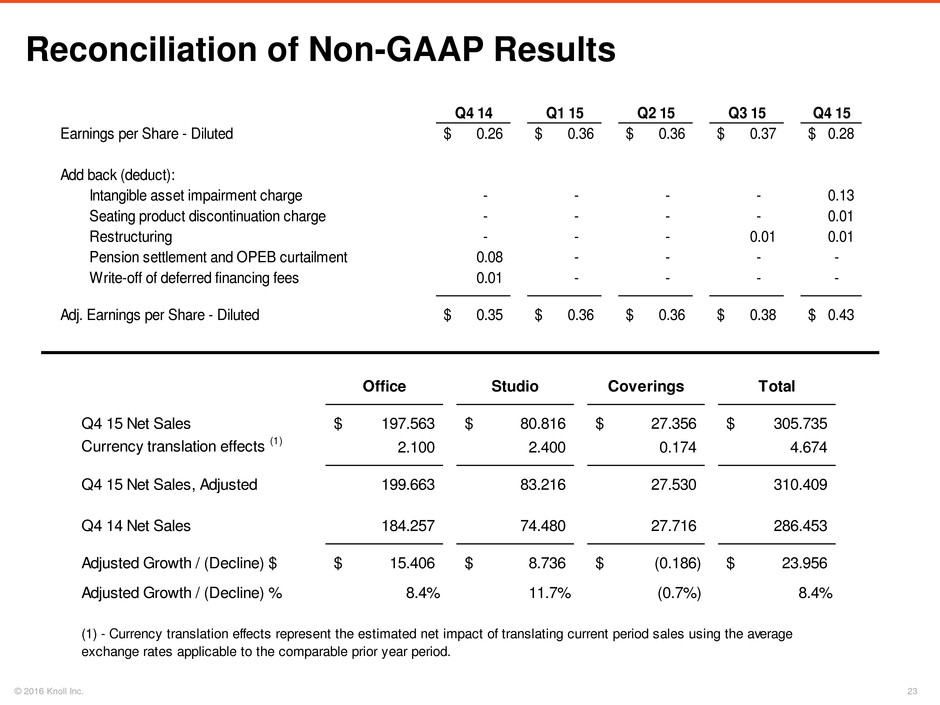

23© 2016 Knoll Inc. Reconciliation of Non-GAAP Results Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Earnings per Share - Diluted 0.26$ 0.36$ 0.36$ 0.37$ 0.28$ Add back (deduct): I tangible asset impairment charge - - - - 0.13 Seating product discontinuation charge - - - - 0.01 Restructuring - - - 0.01 0.01 Pension settlement and OPEB curtailment 0.08 - - - - Write-off of deferred financing fees 0.01 - - - - Adj. Earnings per Share - Diluted 0.35$ 0.36$ 0.36$ 0.38$ 0.43$ Office Studio Coverings Total Q4 15 Net Sales 197.563$ 80.816$ 27.356$ 305.735$ Currency transl tion effects (1) 2.100 2.400 0.174 4.674 Q4 15 Net Sales, Adjusted 199.663 83.216 27.530 310.409 Q4 14 Net Sales 184.257 74.480 27.716 286.453 Adjusted Growth / (Decline) $ 15.406$ 8.736$ (0.186)$ 23.956$ Adjusted Growth / (Decline) % 8.4% 11.7% (0.7%) 8.4% (1) - Currency translation effects represent the estimated net impact of translating current period sales using the average exchange rates applicable to the comparable prior year period.

24© 2016 Knoll Inc. Reconciliation of Non-GAAP Results Operating Profit Intangible asset impairment charge Seating product discontinuation charge Restructuring Charges Adj. Operating Profit % of Sales Office 15.7$ -$ 0.9$ 0.5$ 17.1$ 8.7% Studio 10.9 - - - 10.9 13.5% Coverings (4.8) 10.7 - - 5.9 21.5% Total 21.8$ 10.7$ 0.9$ 0.5$ 33.9$ 11.1% Operating Profit Pension settlement and OPEB curtailment Remeasurement of FilzFelt earn- out liability Restructuring Charges Adj. Operating Profit % of Sales Office 6.8$ 5.3$ -$ 1.3$ 13.4$ 7.3% Studio 9.5 0.8 - (0.9) 9.4 12.6% Coverings 3.7 0.4 0.5 0.3 4.9 17.7% Total 20.0$ 6.5$ 0.5$ 0.7$ 27.7$ 9.7% Three Months Ended December 31, 2015 (in millions) Three Months Ended December 31, 2014 (in millions)

25© 2016 Knoll Inc. Bank Net Leverage Ratio (3) 12/31/2013 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 12/31/2015 Debt Levels (1) 178.8$ 289.8$ 287.8$ 283.7$ 275.5$ 316.7$ 290.7$ 274.2$ 238.7$ LTM Net Earnings ($mm) 23.2$ 25.0$ 27.7$ 34.8$ 46.6$ 56.2$ 62.6$ 64.8$ 66.0$ LTM Adjustments Interest 5.3 5.5 5.9 6.3 6.7 6.9 6.8 6.6 6.1 Taxes 15.7 16.0 17.5 21.8 29.2 35.0 37.2 39.1 37.5 Depreciation and Amortization 16.3 16.9 17.8 18.6 20.0 20.6 21.1 21.2 21.3 Non-cash Items and Other (2) 19.7 27.0 29.1 22.1 11.9 5.7 3.3 6.0 12.5 LTM Adjusted EBITDA 80.2$ 90.4$ 98.0$ 103.6$ 114.4$ 124.4$ 131.0$ 137.7$ 143.4$ Bank Leverage Calculation (4) 2.23 3.21 2.94 2.74 2.41 2.55 2.22 1.99 1.67 (1) - Outstanding debt levels include outstanding letters of credit and guarantee obligations. Excess cash over $15.0 million reduces outstanding debt per the terms of our credit facility, a copy of which was filed with the Securities and Exchange Commission on May 21, 2014. (2) - Non-cash and Other items includes, but is not limited to, stock-based compensation expenses, unrealized gains and losses on foreign exchange, a pension settlement and other postretirement benefits curtailment, and restructuring charges. (3) - Includes an annualized proforma EBITDA for HOLLY HUNT, which was acquired on February 3, 2014. (4) - Debt divided by LTM Adjusted EBITDA, as calculated in accordance with our credit facility. (3)(3) (3) (3) (3)

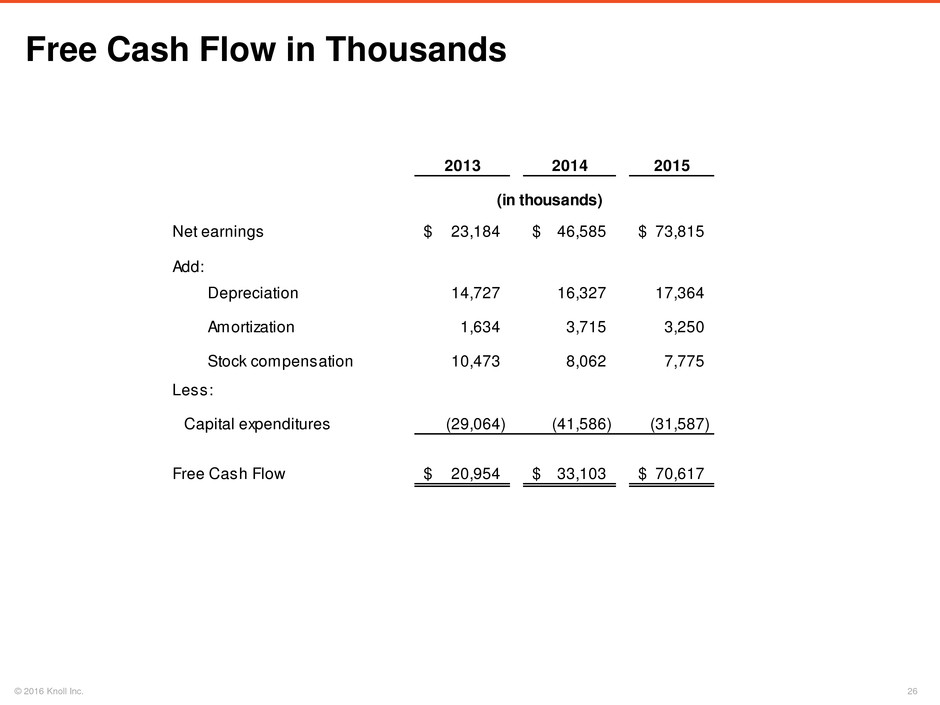

26© 2016 Knoll Inc. Free Cash Flow in Thousands 2013 2014 2015 Net earnings 23,184$ 46,585$ 73,815$ Add: Depreciation 14,727 16,327 17,364 Amortization 1,634 3,715 3,250 Stock compensation 10,473 8,062 7,775 Less: Capital expenditures (29,064) (41,586) (31,587) Free Cash Flow 20,954$ 33,103$ 70,617$ (in thousands)

27© 2016 Knoll Inc.