Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ALIMERA SCIENCES INC | pressrelease.htm |

| 8-K - 8-K - ALIMERA SCIENCES INC | alimera8-k.htm |

Exhibit 99.2 1

Results Conference Call Fourth Quarter 2015

FORWARD LOOKING STATEMENTS This presentation contains "forward-looking statements," within the meaning of the Private Securities Litigation Reform Act of 1995, regarding, among other things, the ability of the ILUVIEN J-code to drive use and market acceptance of ILUVIEN, the opportunity for further growth in 2016 for ILUVIEN, Alimera's ability to reach agreement with Hercules on an amendment to bring Alimera in compliance with its revenue covenant under the debt facility and Alimera's ability to complete an amendment with Hercules before Alimera files its Annual Report on Form 10K for the year ended December 31, 2015, that our benefit investigations and the uptick in benefits investigations will actually lead to sales of ILUVIEN or increases in sales of ILUVIEN. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-looking statements. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “contemplate,” “predict,” “project,” “target,” “likely,” “potential,” “continue,” “ongoing,” “will,” “would,” “should,” “could,” or the negative of these terms and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-looking statements. Meaningful factors which could cause actual results to differ include, but are not limited to, a decision by Hercules to call the debt facility and request immediate repayment of such amounts, accelerate amounts owing under the debt facility, other action taken by Hercules under the debt facility to the detriment of Alimera due to Alimera’s failure to comply with its revenue covenant, the ability of Alimera to negotiate an amendment to the debt facility that is on commercially reasonable terms or the cost of any amendment to the debt facility with Hercules which could materially affect Alimera’s ability to continue its commercial launch of ILUVIEN, and market acceptance of ILUVIEN in the U.S. and Europe, including physicians' ability to obtain reimbursement, the potential impact of the ILUVIEN J-code on U.S. revenues and revenue growth in 2016 and seasonality, as well as other factors discussed in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Alimera's Annual Report on Form 10K for the year ended December 31, 2014 and Alimera's Quarterly Report on Form 10Q for the quarter ended September 30, 2015, which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at http://www.sec.gov. Additional factors may also be set forth in those sections of Alimera's Report on Form 10K for the year ended December 31, 2015, to be filed with the SEC in the first quarter of 2016. In addition to the risks described above and in Alimera's Annual Report on Form 10K, Quarterly Reports on Form 10Q, Current Reports on Form 8K and other filings with the SEC, other unknown or unpredictable factors also could affect Alimera's results. There can be no assurance that the actual results or developments anticipated by Alimera will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Alimera. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved. All forward-looking statements contained in this presentation are expressly qualified by the cautionary statements contained or referred to herein. Alimera cautions investors not to rely too heavily on the forward-looking statements Alimera makes or that are made on its behalf. These forward-looking statements speak only as of the date of this presentation (unless another date is indicated). Alimera undertakes no obligation, and specifically declines any obligation, to publicly update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. 3

4 ILUVIEN® Launched in US 2015 Accomplishments 167% Annual Revenue Growth ILUVIEN® Launched in Portugal, ILUVIEN® Re-launch in Germany 167% 2015 Revenue Growth

5 Full Year Revenue $22.4M 2015 2014 $8.4M US Sales EU Sales Fourth Quarter Revenue $5.8M 4Q15 4Q14 $1.7M 99% EU 33.2% EU 66.8% US 99.8% EU 0.2% US 32.4% EU 67.6% US Sales Growth $15.2M 2015 US Revenue $7.3M 2015 EU Revenue 1.0% US

6 J-Code Approval in US (Active 1/1/16) US User Base Grew to 312 Accounts 4Q15 Highlights 241% Year-Over-Year Fourth Quarter Growth German Unit Demand Equivalent to Highest Previous Quarter Licensing Agreement Completed in Middle East 241% Q415 Revenue Growth

7 J-Code Loaded in Majority of Systems Benefit Investigations Strong in Q1 2016 United States

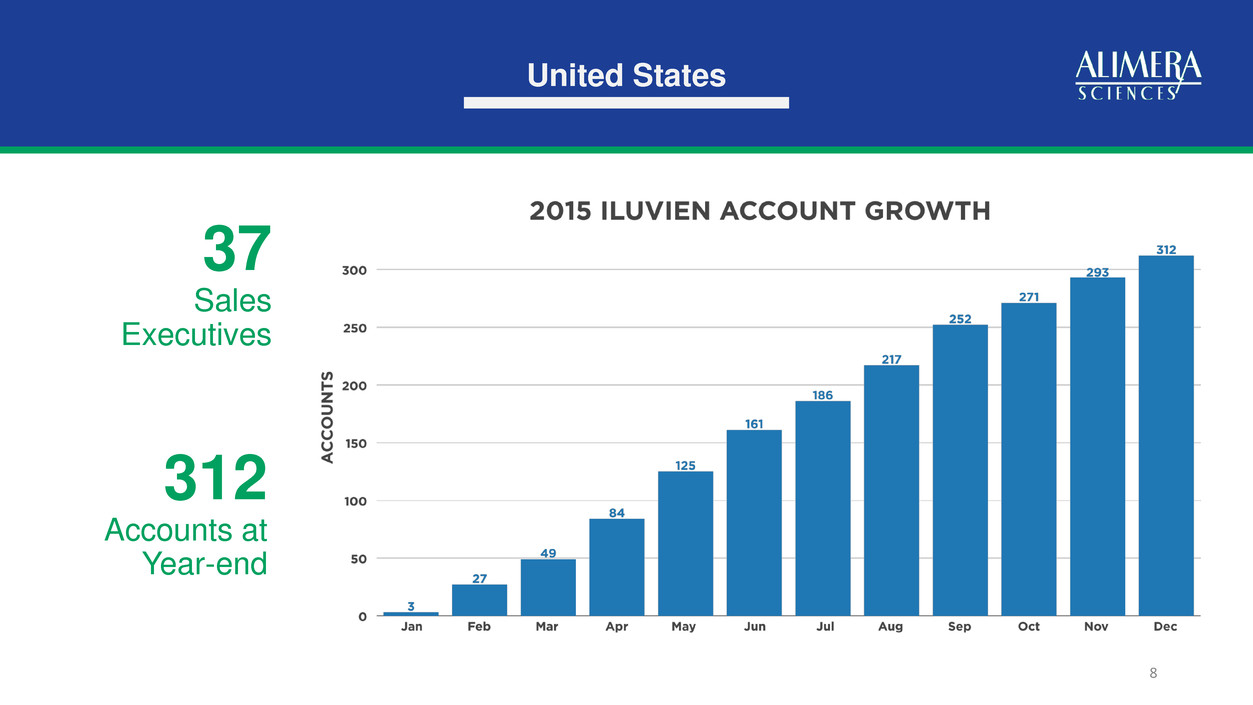

United States 8 37 Sales Executives 312 Accounts at Year-end

9 Europe Germany Volume up 63% in Q4 2015 Versus Q4 2014 Reimbursement Coverage Continues to Grow

10 Portugal finished 2015 with record quarterly sales Slowdown in UK sales continues due to NICE endorsement Measures in place; moving toward growth again Europe Slowdown in UK Sales Continues Due to NICE Endorsement of Competitor Products Portugal Finished 2015 With Record Quarterly Sales

Financial Overview Rick Eiswirth

12 (000’s) Three Months Ended December 31 2015 Three Months Ended December 31 2014 12 Months Ended December 31 2015 12 Months Ended December 31 2014 Revenue $5,823 $1,741 $22,438 $8,423 Gross Profit $5,354 $1,611 $20,767 $6,981 Gross Margin 92% 93% 93% 83% Net Loss from Operations ($9,761) ($10,920) ($38,999) ($32,947) Net Loss ($10,713) ($9,258) ($30,645) ($35,910) Select Income Statement Data $31.1M Cash at Year End

Closing Remarks Dan Myers

14 Summary Initiated Commercial Operations in US EU Progressing Well, Will be Leveraging Real- World Data Middle East Expansion/International Expansion

Question & Answer Session