Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pure Storage, Inc. | pstg-8k_20160302.htm |

| EX-99.1 - EX-99.1 - Pure Storage, Inc. | pstg-ex991_6.htm |

Exhibit 99.2

Dietz on the Day: Pure Storage Q4 and Full Year Results

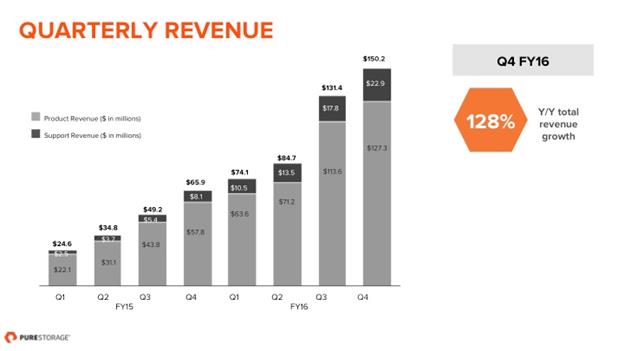

Our 4th quarter results wrap up another outstanding year for Pure Storage (NYSE: PSTG). Let me begin by quantifying our progress, and then turn to the road ahead.

We are thrilled with the overall performance of our business. We achieved new high water marks in revenues of $150 million, total customers at 1,650+, non-GAAP product gross margins of 68% and non-GAAP operating margin of -14%. For the first time in company history, we generated free cash flow, adding $32 million (21% of our 4th quarter revenues) to our balance sheet, which stands at over $600 million. And in fact, we now expect to reach cash flow break-even on a sustained basis in the second half of 2017 - ahead of our previous projection of 2018. While we continue to invest aggressively in the business - R&D was 27% of revenue in the latest quarter - our operating expenses are growing considerably more slowly year over year than our top line.

We now count among our customers 66 of the Fortune 500 (up from 59 last quarter). Among our top 25 customers, each initial $1 spent on Pure Storage led to greater than $12 in the next 18 months.

We continue to align with partners that share our vision for the modern data center, such as ePlus, Datalink and SHI, who are strategically leading with Pure. We are committed to working diligently empower the channel, driving win/win partnerships while maintaining our industry-best customer satisfaction.

In our view, the secular shifts to flash and cloud-friendly storage are dominating enterprise data storage. Pure is enjoying perhaps the greatest growth in industry history, during what some are considering to be a challenging market for IT spending, because our platform is purpose-built for both. Pure is winning because our innovations are transforming the storage industry.

In 2011, we launched FlashArray, arguing then that all performance applications belonged on flash rather than mechanical disk, and moreover that Pure’s recipe actually saved customers money. In recent weeks, EMC and NetApp made it clear that they agree, with NetApp’s George Kurian stating that “Flash is becoming the de facto technology for primary workloads.” When incumbents who lead the market for disk-based storage, and hence the vendors with the most to lose, endorse our position, it further validates Pure’s founding vision.

Despite legacy vendor claims to the contrary, we remain convinced the transition to solid-state flash memory and the simplicity and elasticity demanded by the cloud require a holistic redesign of storage technology and business model. Loading SSDs into twenty year old designs crafted for mechanical disk and for traditional, services intensive IT cannot deliver on the promise of flash and cloud (see our recent blog This Is Your Father’s Storage Industry, But Not for Long).

Pure Storage’s success in disrupting the storage landscape and our differentiation is built on four pillars of innovation:

|

|

· |

Purpose-built flash and cloud software; |

|

|

· |

Efficient and extensible flash hardware; |

|

|

· |

Proactive and predictive cloud automation; and |

|

|

· |

Our disruptive Evergreen™ business model. |

Evidence that Pure is unique in getting this right can be seen in our industry leading:

|

|

· |

Growth – Pure continues to grow faster than any systems vendor we have done compares with, including Cisco and Arista in networking, NetApp in storage, and Palo Alto Networks in security; |

|

|

· |

Customer satisfaction – Satmetrix validated a Net Promoter Score of 79 for Pure, best across enterprise tech, and dramatically higher than third party accountings of our competitors; |

|

|

· |

Repeat purchasing trends (cited above); and |

|

|

· |

Product gross margins (cited above). |

While others are trying to catch up, Pure is winning.

The cloud voyage ahead.

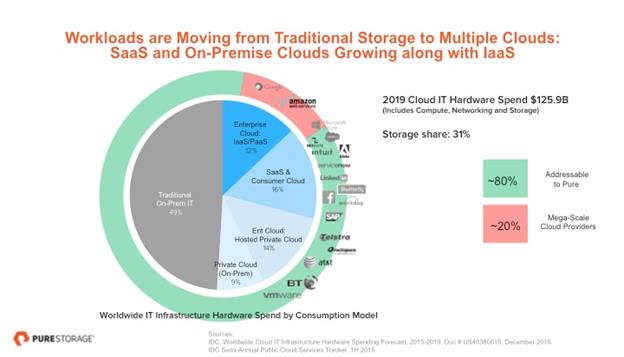

In parallel with leading the transition to all-flash, Pure has been focused since inception on building a storage platform and business model that enables cloud computing. As illustrated in our most recent blog post, the experts at IDC are forecasting that more than half of the data center spend is expected to move to the cloud model by 2019. This represents a massive opportunity for Pure. For years, we have been working closely with cloud customers like LinkedIn, Intuit and Workday to dramatically lower costs and deliver better customer experiences. IDC anticipates that the SaaS (Salesforce, ServiceNow) and Consumer cloud (Facebook, Apple) segments will

be larger than the public cloud. These vendors are building their own clouds in order to differentiate their products and because, at the scale at which they operate, they save money versus the public cloud alternatives. While we do not anticipate selling our current product offerings to public cloud hardcore “do it yourselfers” like AWS and Google, IDC’s analysis suggests 80% of the aggregate storage market is available to Pure in 2019.

To date, over a quarter of our business has been for cloud customers, including SaaS, IaaS, and consumer web properties. Moreover, within the SaaS, IaaS and Consumer cloud segment, the repeat purchase rate is approximately 50 percent higher than that of the rest of our customer base. Here are three recent illustrations of Pure’s cloud success:

|

|

· |

We added Neustar to our growing list of large storage customers in the fourth quarter. The real-time information services provider has been a long-time public cloud customer, and as their business grew, so did the bill from its cloud provider. In an effort to cut operating costs and gain competitive edge, Neustar decided to create a private cloud with Pure at the center. Ease of use, security and lower costs were all driving factors in implementing Pure. |

|

|

· |

Also in Q4, Cornerstone OnDemand selected Pure in continued support of its SaaS business. Cornerstone OnDemand is a leading global provider of cloud-based talent management software. It’s a rapidly growing business that’s constantly rolling out new features services to its customer base. Pure helps the company optimize feature delivery, meet customer service level agreements, add capacity and perform system maintenance non-disruptively while managing an increasing global workload and footprint supporting millions of users in 191 countries. |

|

|

· |

Pure continued to work with Granite Construction to accelerate its business in Q4. Granite is a full-service general contractor, construction management firm and construction materials producer that is consistently recognized as one of the top 25 largest construction companies in the United States. While not a cloud customer themselves, the company opted for Pure Storage instead of a public cloud to help them consolidate a sprawling data center while saving several millions dollars over a six year period. |

We couldn’t be more excited about our future—thanks to Pure’s uniquely simple, efficient and extensible storage platform, our world-class team and our fanatical customer-first approach, we are poised to continue our success.

Words of Thanks

Let me close with sincere gratitude for all those that have joined Pure along our journey. To our customers and partners: We will continue to give you our best—striving to deliver storage that pays for itself by both unleashing innovation in your business and substantially reducing cost of ownership. We know all we need to do is to continue to serve your businesses dramatically better than our competitors and our winning streak will continue.

Let me also thank our long-term investors. We appreciate your confidence in the Pure team, our products and strategy, and your enthusiasm for the opportunity before us, which is to win perhaps the biggest available market in B2B tech. To you, we promise to continue to do the right thing for the long term, maximizing growth while continuing to improve operating efficiency year over year.

To the Puritan Nation: we made tremendous progress in 2015 toward our ultimate goal of becoming the #1 global brand in storage. A heartfelt and sincere thanks to each and every one of you. While we are thrilled with our success to date, remember that this is only the beginning. Carpe diem Team Orange!

For the road ahead in 2016, let me just say that our innovation pipeline is bursting at the seams. Come join us at Pure’s Accelerate Conference to learn more!

Forward Looking Statements

This post contains forward-looking statements regarding industry and technology trends, our product innovation, technology differentiation and customer spending, our positioning, strategy and opportunity, and our products, business and operations, including our future margins, growth prospects and operating model. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption “Risk Factors” and elsewhere in our filings and reports with the U.S. Securities and Exchange Commission, including, but not limited to, our Quarterly Report on Form 10-Q for the quarter ended October 31, 2015 and the final Prospectus related to our initial public offering of Class A common stock filed pursuant to Rule 424(b) under the Securities Act of 1933 (Registration No. 333-206312), which are available on our investor relations website at investor.purestorage.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the fiscal year ended January 31, 2016. All information provided in this post is as of March 2, 2016, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures

This post contains certain non-GAAP financial measures about the company’s performance. For the most directly comparable GAAP financial measures and a reconciliation of these non-GAAP financial measures to GAAP measures, please see our earnings release issued on March 2, 2016, which includes tables captioned “Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures” and “Reconciliation from net cash provided by (used in) operating activities to free cash flow.”