Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek US Holdings, Inc. | dk-8kxinvestorpresentation.htm |

Investor Presentation Delek US Holdings March 2016

Disclaimers 2 Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (defined as “we”, “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL” respectively, and, as such, are governed by the rules and regulations of the United States Securities and Exchange Commission. These slides and any accompanying oral and written presentations contain forward-looking statements that are based upon our current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: risks and uncertainties with the respect to the quantities and costs of crude oil, the costs to acquire feedstocks and the price of the refined petroleum products we ultimately sell; losses from derivative instruments; management's ability to execute its strategy through acquisitions and transactional risks in acquisitions; our competitive position and the effects of competition; the projected growth of the industry in which we operate; changes in the scope, costs, and/or timing of capital projects; operational hazards of our assets including, without limitation, costs, penalties, regulatory or legal actions and other affects related to releases, spills and other hazards inherent in transporting and storing crude oil and intermediate and finished petroleum products; general economic and business conditions, particularly levels of spending relating to travel and tourism or conditions affecting the southeastern United States; and other risks contained in our filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics Partners undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US believes that the presentation of EBITDA provides useful information to investors in assessing its financial condition, its results of operations and cash flow its business is generating. EBITDA should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA has important limitations as analytical tools because they exclude some, but not all items that affect net income and net cash provided by operating activities. Additionally, because EBITDA may be defined differently by other companies in its industry, Delek US' definitions of EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Please see reconciliations of EBITDA to its most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix.

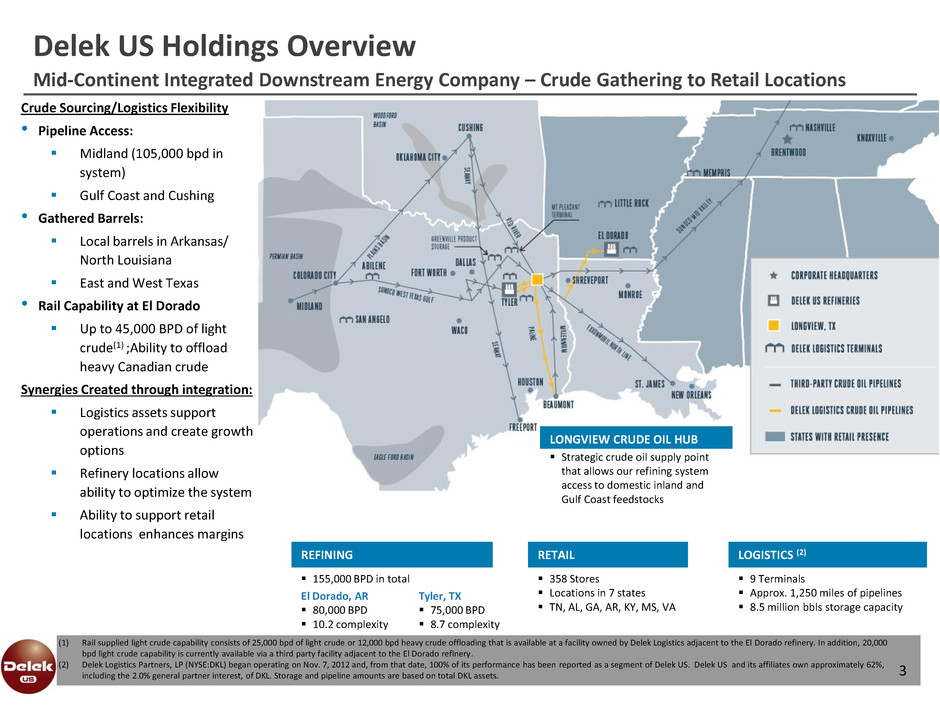

REFINING Delek US Holdings Overview 3 (1) Rail supplied light crude capability consists of 25,000 bpd of light crude or 12,000 bpd heavy crude offloading that is available at a facility owned by Delek Logistics adjacent to the El Dorado refinery. In addition, 20,000 bpd light crude capability is currently available via a third party facility adjacent to the El Dorado refinery. (2) Delek Logistics Partners, LP (NYSE:DKL) began operating on Nov. 7, 2012 and, from that date, 100% of its performance has been reported as a segment of Delek US. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL. Storage and pipeline amounts are based on total DKL assets. Crude Sourcing/Logistics Flexibility • Pipeline Access: Midland (105,000 bpd in system) Gulf Coast and Cushing • Gathered Barrels: Local barrels in Arkansas/ North Louisiana East and West Texas • Rail Capability at El Dorado Up to 45,000 BPD of light crude(1) ;Ability to offload heavy Canadian crude Synergies Created through integration: Logistics assets support operations and create growth options Refinery locations allow ability to optimize the system Ability to support retail locations enhances margins 155,000 BPD in total El Dorado, AR 80,000 BPD 10.2 complexity Tyler, TX 75,000 BPD 8.7 complexity 358 Stores Locations in 7 states TN, AL, GA, AR, KY, MS, VA RETAIL 9 Terminals Approx. 1,250 miles of pipelines 8.5 million bbls storage capacity LOGISTICS (2) Strategic crude oil supply point that allows our refining system access to domestic inland and Gulf Coast feedstocks LONGVIEW CRUDE OIL HUB Mid-Continent Integrated Downstream Energy Company – Crude Gathering to Retail Locations

Delek US Investment Highlights 4 • Crude nameplate capacity increased by 15 kbpd to 155 kpbd • Turnarounds completed and FCC reactors replaced at both refineries • Declining capital expenditure needs; No scheduled turnarounds until 2019/2020 Refining Increased capacity and improved flexibility • Achieved annual EBITDA of $96.5 million in 2015 • Distribution increased 12 consecutive quarters to $0.59/unit • In 50%/50% IDR splits for amounts above $0.5625/unit Logistics Growing EBITDA and distribution (Delek Logistics Partners (NYSE: DKL) (1) • Cash balance of approximately $302 million • Debt of approx. $976 million, including $352 million at DKL • Net debt (excl. DKL) of $322 million Conservative Financial Position (2) • Record contribution margin of $63.7 million in 2015 • 67 large format stores in 358 store network; expanding foot print • Approximately 70% of fuel needs supplied by refining segment Retail Expanding large-format store base • Acquired 48% of outstanding shares, of Alon USA Energy (NYSE: ALJ) (“Alon USA”) on May 14, 2015. • 4 third party logistics acquisitions; Exploring other opportunities • Proven ability to buy at right time and integrate into system Growth Focus Through Acquisitions 1) Delek Logistics Partners, LP (NYSE:DKL) began operating on Nov. 7, 2012 and, from that date, 100% of its performance has been reported as a segment of Delek US. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL. Annualized EBITDA based on 4Q15 results. 2) Based on 12/31/15 balance sheet.

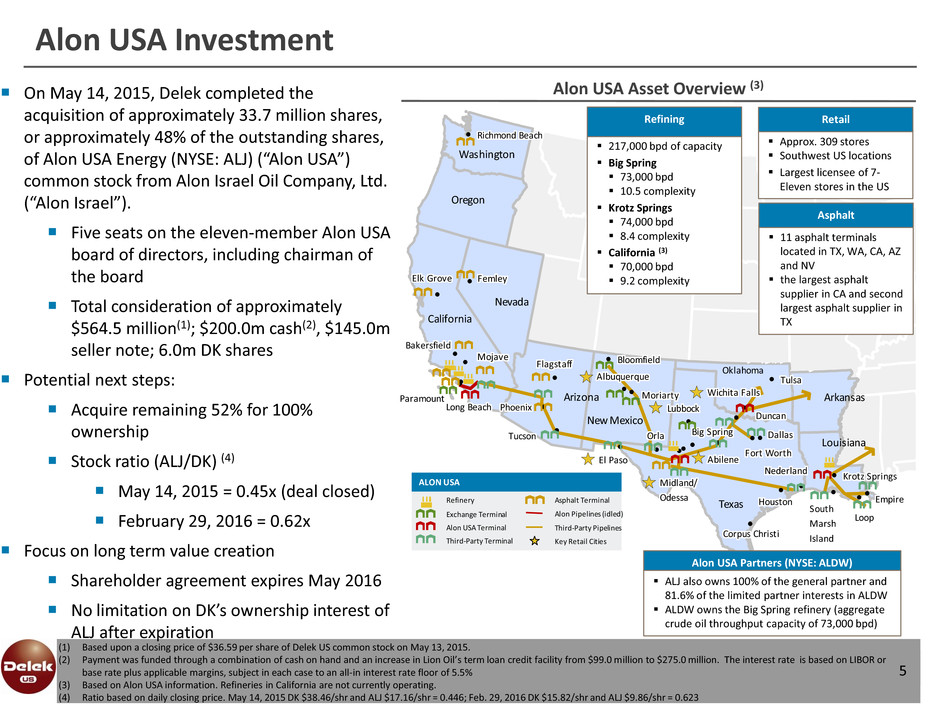

5 0 122 176 146 208 80 0 176 80 255 192 0 0 128 0 127 211 141 158 211 215 185 58 7 127 127 127 Alon USA Investment On May 14, 2015, Delek completed the acquisition of approximately 33.7 million shares, or approximately 48% of the outstanding shares, of Alon USA Energy (NYSE: ALJ) (“Alon USA”) common stock from Alon Israel Oil Company, Ltd. (“Alon Israel”). Five seats on the eleven-member Alon USA board of directors, including chairman of the board Total consideration of approximately $564.5 million(1); $200.0m cash(2), $145.0m seller note; 6.0m DK shares Potential next steps: Acquire remaining 52% for 100% ownership Stock ratio (ALJ/DK) (4) May 14, 2015 = 0.45x (deal closed) February 29, 2016 = 0.62x Focus on long term value creation Shareholder agreement expires May 2016 No limitation on DK’s ownership interest of ALJ after expiration (1) Based upon a closing price of $36.59 per share of Delek US common stock on May 13, 2015. (2) Payment was funded through a combination of cash on hand and an increase in Lion Oil’s term loan credit facility from $99.0 million to $275.0 million. The interest rate is based on LIBOR or base rate plus applicable margins, subject in each case to an all-in interest rate floor of 5.5% (3) Based on Alon USA information. Refineries in California are not currently operating. (4) Ratio based on daily closing price. May 14, 2015 DK $38.46/shr and ALJ $17.16/shr = 0.446; Feb. 29, 2016 DK $15.82/shr and ALJ $9.86/shr = 0.623 Key Retail Cities Asphalt Terminal Third-Party Terminal Alon USA Terminal Exchange Terminal Refinery Third-Party Pipelines ALON USA Alon Pipelines (idled) Oklahoma 638167_1.wor [NY0086JT] Texas California New Mexico Arizona Nevada Oregon Washington Arkansas Louisiana Midland/i l /aidl ndi li li li la /i l /ai ld ndd ndi li li l Odessassde assassadedeO Corpus Christi i ir s r stpu hCo C i i i i i i i ir r tr r ts is i i is s i iCo pu Chpu hCo Cr ri ti i ir r t i i Abileneilb eneA ilililililililAb eneb eneA ilililEl Pasol sE Pal ol l l l asl sal E P oE P ol l l Bakersfieldfi lrsake e dB fi li li li lr fr fak s i li lsak i lB e e de e dB r fi lfi lr fi l Mojavejaveojjjavavoj ej eoj Long Beach L g eacon B h L g ac L g ac on Be heon B h PhoenixiPh en xo iiiiixixiPhoenPh eno iii TucsonsTuc nocsscTu onTu no Paramountr tPa a unor tr ta aa aP ounP unor tr t SouthtS u ho ttSSou hu ho tt Marshrsa hrrssa ha hrr IslandI ls andI llllIIsllslandandI lI lI l Nederlandlrede andllllrrlalalede ndede ndN rllrl Houstonstu nHo ottssou onu no oH ttH LoopL pooLLooppoo Orlalr allllrrlalalOrllrl Moriartyir rta yo iiiir rtr rti yi yio aaori rtir rti LubbockLubb ckoL ckL ckubboubbo Big Springi irg Sp ngBi ii ii ii irrig S i gi ig S gi iB p np nBi rii iri i Wichita Fallsi i llt sc a Fai hi lli i lli i lli i llttic i a Fallsi i llsc a Fai i llhhi it li i lti i l Fort Worth rt rtF ho o rt rtrt rtF F o o hho ort rt rt rt Dallasll sa aD llllllllallasll sa allD llD l DuncancaDun ncacaun nun nDD Albuquerquel re eAlbuqu qulll rrlllA buque quee eA buqu qul rl rl EmpireirE p eiiiirriiiE p eE p eiriri Flagstaffl ffstF ag al fflll t fft ffFlags al sF ag all t fl ftl f Elk Grovel rE k vel ol l l rrlk vl k vl E o eE eol Grl rl FemleylFe eyllllF l ylF yle ee elll Richmond Beachi ch nd eachRi o Bi i i ic aci c aci R h ond Be hh nd e hR o Bi i i Krotz Springs ir tz r sK Sp ngo i i i ir t rr t rz S i gs iz sS g iK o p nK p nor t ri ir t r i Bloomfieldl fi leBloo fi ldl i ll i ll i lffl i ll i ll i lB oo e deB oo dl fi ll fi ll fi l TulsalsT aulllllsalsalTuTulll 217,000 bpd of capacity Big Spring 73,000 bpd 10.5 complexity Krotz Springs 74,000 bpd 8.4 complexity California (3) 70,000 bpd 9.2 complexity Refining Approx. 309 stores Southwest US locations Largest licensee of 7- Eleven stores in the US Retail 11 asphalt terminals located in TX, WA, CA, AZ and NV the largest asphalt supplier in CA and second largest asphalt supplier in TX Asphalt ALJ also owns 100% of the general partner and 81.6% of the limited partner interests in ALDW ALDW owns the Big Spring refinery (aggregate crude oil throughput capacity of 73,000 bpd) Alon USA Partners (NYSE: ALDW) Alon USA Asset Overview (3)

Refining Segment Operational Update

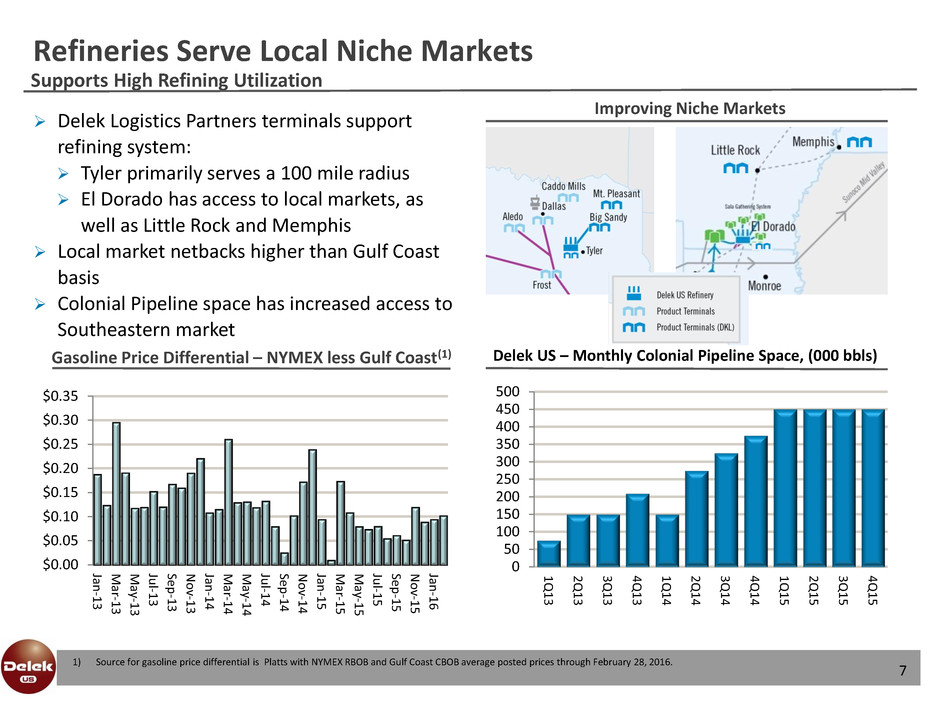

Supports High Refining Utilization Refineries Serve Local Niche Markets 7 0 50 100 150 200 250 300 350 400 450 500 1Q1 3 2Q 1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Delek Logistics Partners terminals support refining system: Tyler primarily serves a 100 mile radius El Dorado has access to local markets, as well as Little Rock and Memphis Local market netbacks higher than Gulf Coast basis Colonial Pipeline space has increased access to Southeastern market $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 Ja n -1 3 M ar-1 3 M ay-1 3 Ju l- 13 Sep- 1 3 No v-1 3 Ja n -1 4 M ar-1 4 M ay-1 4 Ju l- 14 Sep- 1 4 No v-1 4 Ja n -1 5 M ar-1 5 M ay-15 Ju l- 15 Sep- 15 No v-1 5 Ja n -1 6 Delek US – Monthly Colonial Pipeline Space, (000 bbls) Gasoline Price Differential – NYMEX less Gulf Coast(1) Improving Niche Markets 1) Source for gasoline price differential is Platts with NYMEX RBOB and Gulf Coast CBOB average posted prices through February 28, 2016.

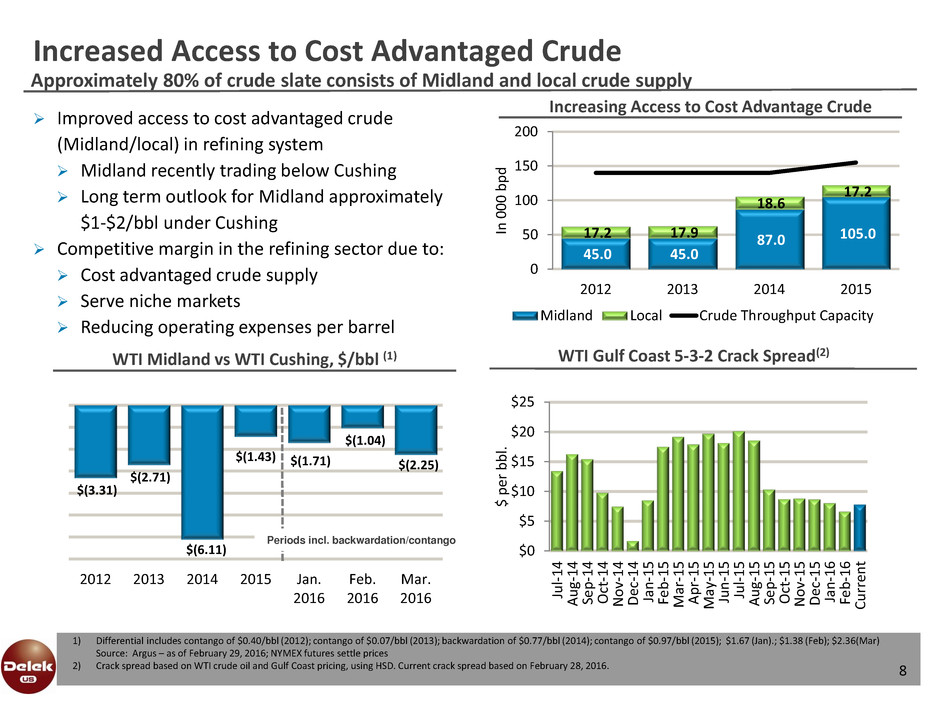

Approximately 80% of crude slate consists of Midland and local crude supply Increased Access to Cost Advantaged Crude 8 45.0 45.0 87.0 105.0 17.2 17.9 18.6 17.2 0 50 100 150 200 2012 2013 2014 2015 In 0 0 0 b p d Midland Local Crude Throughput Capacity $(3.31) $(2.71) $(6.11) $(1.43) $(1.71) $(1.04) $(2.25) 2012 2013 2014 2015 Jan. 2016 Feb. 2016 Mar. 2016 Improved access to cost advantaged crude (Midland/local) in refining system Midland recently trading below Cushing Long term outlook for Midland approximately $1-$2/bbl under Cushing Competitive margin in the refining sector due to: Cost advantaged crude supply Serve niche markets Reducing operating expenses per barrel WTI Midland vs WTI Cushing, $/bbl (1) Increasing Access to Cost Advantage Crude 1) Differential includes contango of $0.40/bbl (2012); contango of $0.07/bbl (2013); backwardation of $0.77/bbl (2014); contango of $0.97/bbl (2015); $1.67 (Jan).; $1.38 (Feb); $2.36(Mar) Source: Argus – as of February 29, 2016; NYMEX futures settle prices 2) Crack spread based on WTI crude oil and Gulf Coast pricing, using HSD. Current crack spread based on February 28, 2016. WTI Gulf Coast 5-3-2 Crack Spread(2) Periods incl. backwardation/contango $0 $5 $10 $15 $20 $25 Ju l- 1 4 A u g- 1 4 Se p -1 4 O ct -1 4 N o v- 1 4 D ec -1 4 Ja n -1 5 Fe b -1 5 M ar -1 5 A p r- 1 5 M ay -1 5 Ju n -1 5 Ju l- 1 5 A u g- 1 5 Se p -1 5 O ct -1 5 N o v-1 5 D ec -1 5 Ja n -1 6 Fe b -1 6 C u rr en t $ p er b b l.

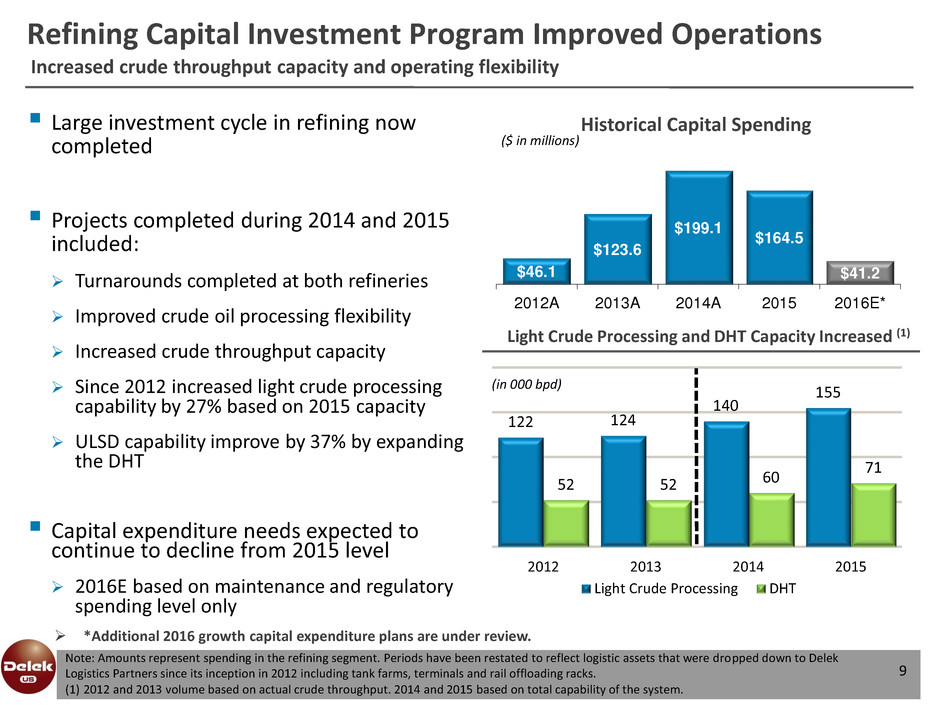

Increased crude throughput capacity and operating flexibility Refining Capital Investment Program Improved Operations 9 Large investment cycle in refining now completed Projects completed during 2014 and 2015 included: Turnarounds completed at both refineries Improved crude oil processing flexibility Increased crude throughput capacity Since 2012 increased light crude processing capability by 27% based on 2015 capacity ULSD capability improve by 37% by expanding the DHT Capital expenditure needs expected to continue to decline from 2015 level 2016E based on maintenance and regulatory spending level only $46.1 $123.6 $199.1 $164.5 $41.2 2012A 2013A 2014A 2015 2016E* Historical Capital Spending ($ in millions) Note: Amounts represent spending in the refining segment. Periods have been restated to reflect logistic assets that were dropped down to Delek Logistics Partners since its inception in 2012 including tank farms, terminals and rail offloading racks. (1) 2012 and 2013 volume based on actual crude throughput. 2014 and 2015 based on total capability of the system. 122 124 140 155 52 52 60 71 2012 2013 2014 2015 Light Crude Processing DHT (in 000 bpd) Light Crude Processing and DHT Capacity Increased (1) *Additional 2016 growth capital expenditure plans are under review.

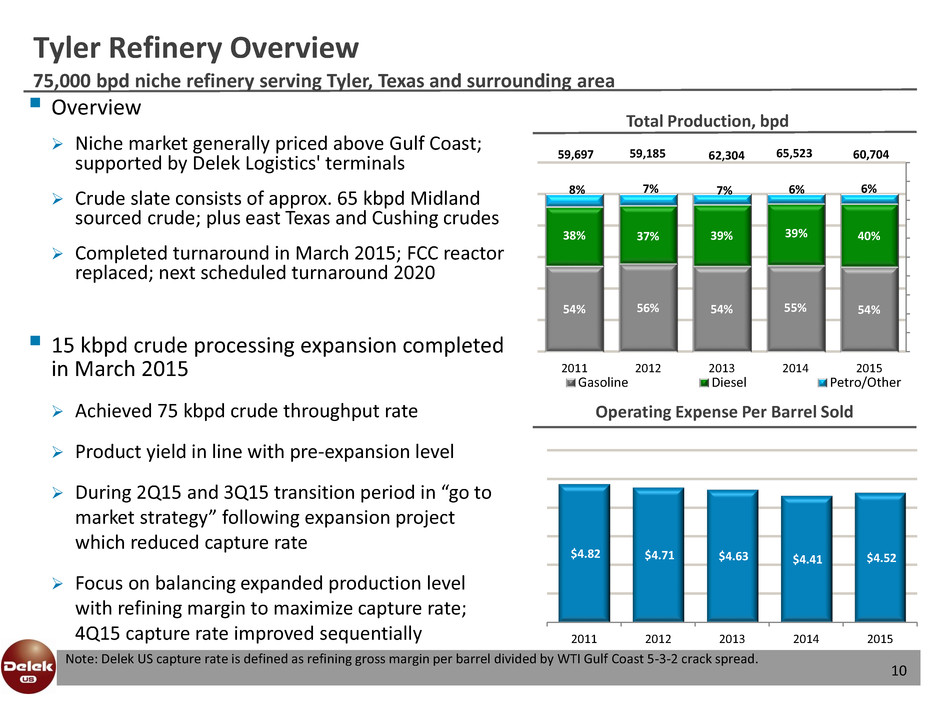

54% 56% 54% 55% 54% 38% 37% 39% 39% 40% 8% 7% 7% 6% 6% 59,697 59,185 62,304 65,523 60,704 56,000 57,000 58,000 59,000 60,000 61,000 62,000 63,000 64,000 65,000 66,000 0% 20% 40% 60% 80% 100% 120% 2011 2012 2013 2014 2015 Gasoline Diesel Petro/Other Tyler Refinery Overview 10 Overview Niche market generally priced above Gulf Coast; supported by Delek Logistics' terminals Crude slate consists of approx. 65 kbpd Midland sourced crude; plus east Texas and Cushing crudes Completed turnaround in March 2015; FCC reactor replaced; next scheduled turnaround 2020 15 kbpd crude processing expansion completed in March 2015 Achieved 75 kbpd crude throughput rate Product yield in line with pre-expansion level During 2Q15 and 3Q15 transition period in “go to market strategy” following expansion project which reduced capture rate Focus on balancing expanded production level with refining margin to maximize capture rate; 4Q15 capture rate improved sequentially 75,000 bpd niche refinery serving Tyler, Texas and surrounding area Total Production, bpd $4.82 $4.71 $4.63 $4.41 $4.52 2011 2012 2013 2014 2015 Operating Expense Per Barrel Sold Note: Delek US capture rate is defined as refining gross margin per barrel divided by WTI Gulf Coast 5-3-2 crack spread.

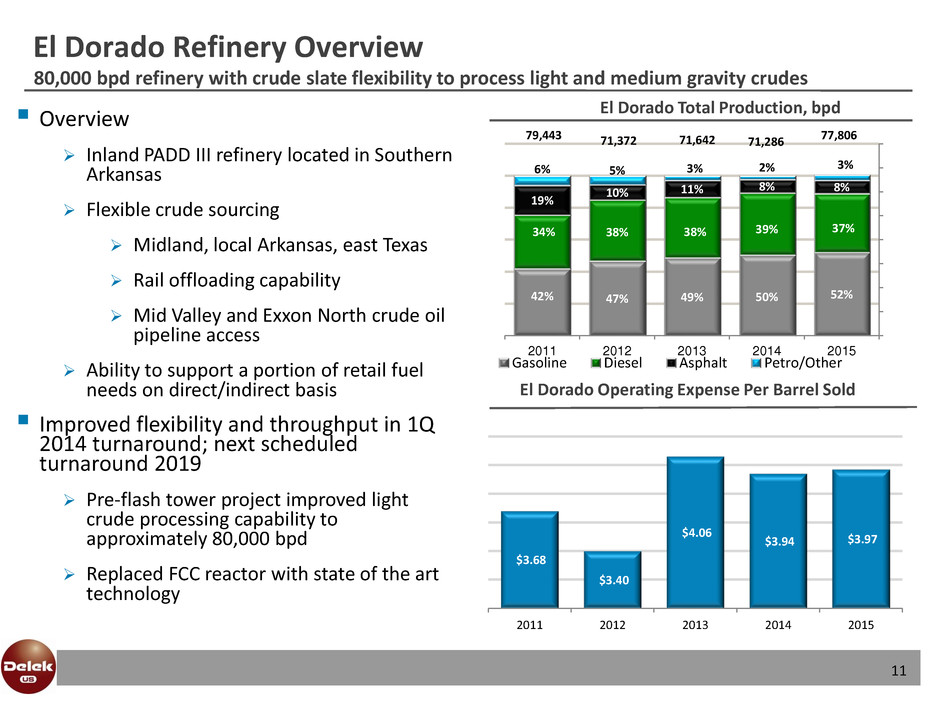

80,000 bpd refinery with crude slate flexibility to process light and medium gravity crudes El Dorado Refinery Overview 11 Overview Inland PADD III refinery located in Southern Arkansas Flexible crude sourcing Midland, local Arkansas, east Texas Rail offloading capability Mid Valley and Exxon North crude oil pipeline access Ability to support a portion of retail fuel needs on direct/indirect basis Improved flexibility and throughput in 1Q 2014 turnaround; next scheduled turnaround 2019 Pre-flash tower project improved light crude processing capability to approximately 80,000 bpd Replaced FCC reactor with state of the art technology 42% 47% 49% 50% 52% 34% 38% 38% 39% 37% 19% 10% 11% 8% 8% 6% 5% 3% 2% 3% 79,443 71,372 71,642 71,286 77,806 66,000 68,000 70,000 72,000 74,000 76,000 78,000 80,000 82,000 0 0 0 1 1 1 1 2011 2012 2013 2014 2015 Gasoline Diesel Asphalt Petro/Other El Dorado Total Production, bpd $3.68 $3.40 $4.06 $3.94 $3.97 2011 2012 2013 2014 2015 El Dorado Operating Expense Per Barrel Sold

Logistics Operational Update

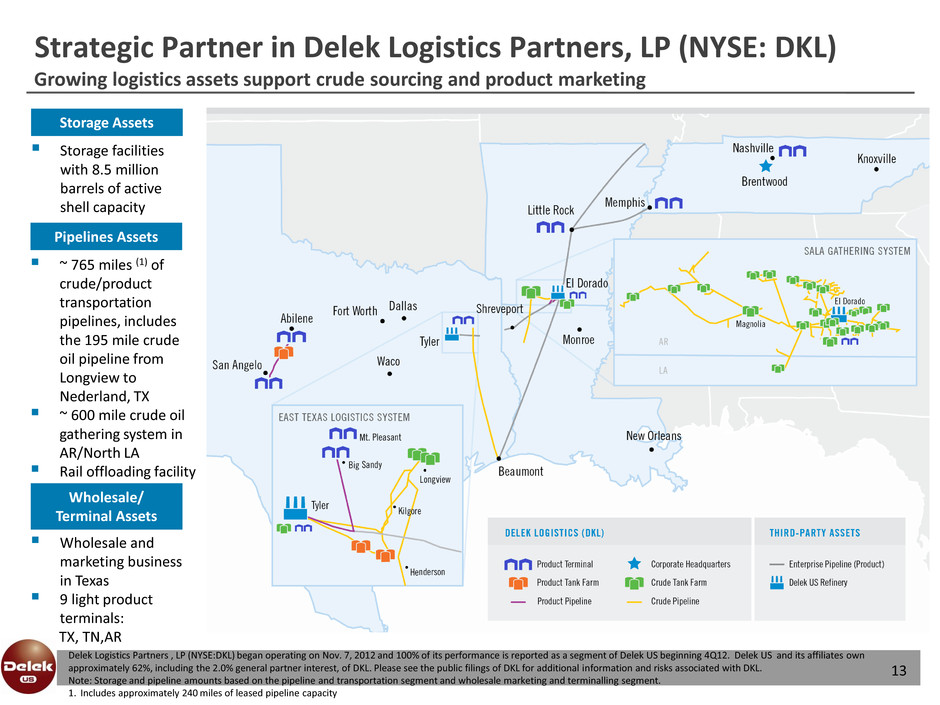

Strategic Partner in Delek Logistics Partners, LP (NYSE: DKL) 13 Delek Logistics Partners , LP (NYSE:DKL) began operating on Nov. 7, 2012 and 100% of its performance is reported as a segment of Delek US beginning 4Q12. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL. Please see the public filings of DKL for additional information and risks associated with DKL. Note: Storage and pipeline amounts based on the pipeline and transportation segment and wholesale marketing and terminalling segment. 1. Includes approximately 240 miles of leased pipeline capacity ~ 765 miles (1) of crude/product transportation pipelines, includes the 195 mile crude oil pipeline from Longview to Nederland, TX ~ 600 mile crude oil gathering system in AR/North LA Rail offloading facility Pipelines Assets Storage facilities with 8.5 million barrels of active shell capacity Storage Assets Wholesale and marketing business in Texas 9 light product terminals: TX, TN,AR Wholesale/ Terminal Assets Growing logistics assets support crude sourcing and product marketing

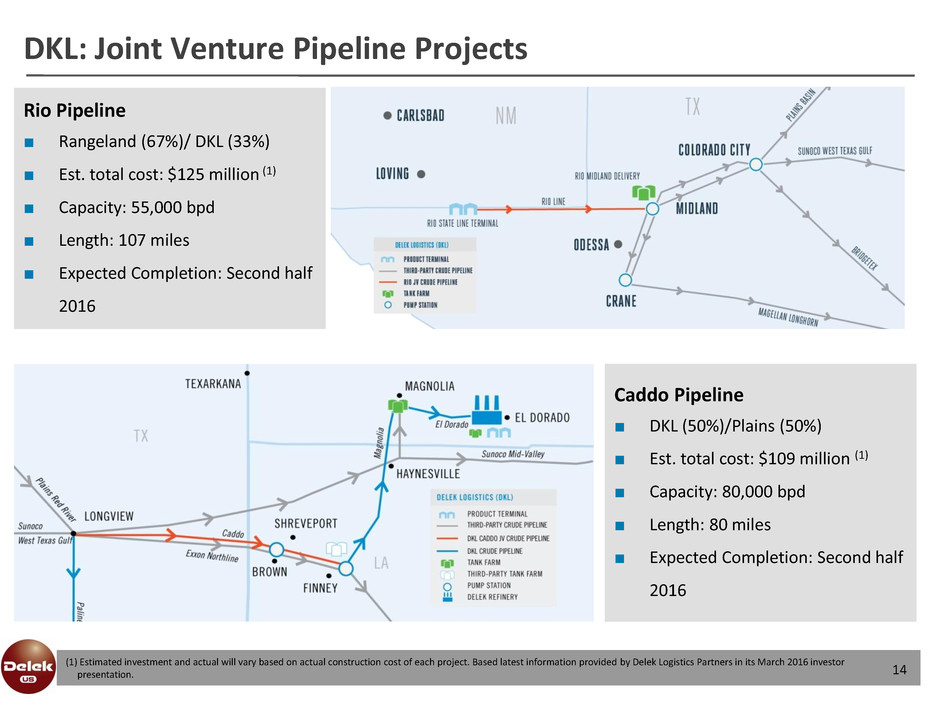

DKL: Joint Venture Pipeline Projects 14 Caddo Pipeline ■ DKL (50%)/Plains (50%) ■ Est. total cost: $109 million (1) ■ Capacity: 80,000 bpd ■ Length: 80 miles ■ Expected Completion: Second half 2016 Rio Pipeline ■ Rangeland (67%)/ DKL (33%) ■ Est. total cost: $125 million (1) ■ Capacity: 55,000 bpd ■ Length: 107 miles ■ Expected Completion: Second half 2016 (1) Estimated investment and actual will vary based on actual construction cost of each project. Based latest information provided by Delek Logistics Partners in its March 2016 investor presentation.

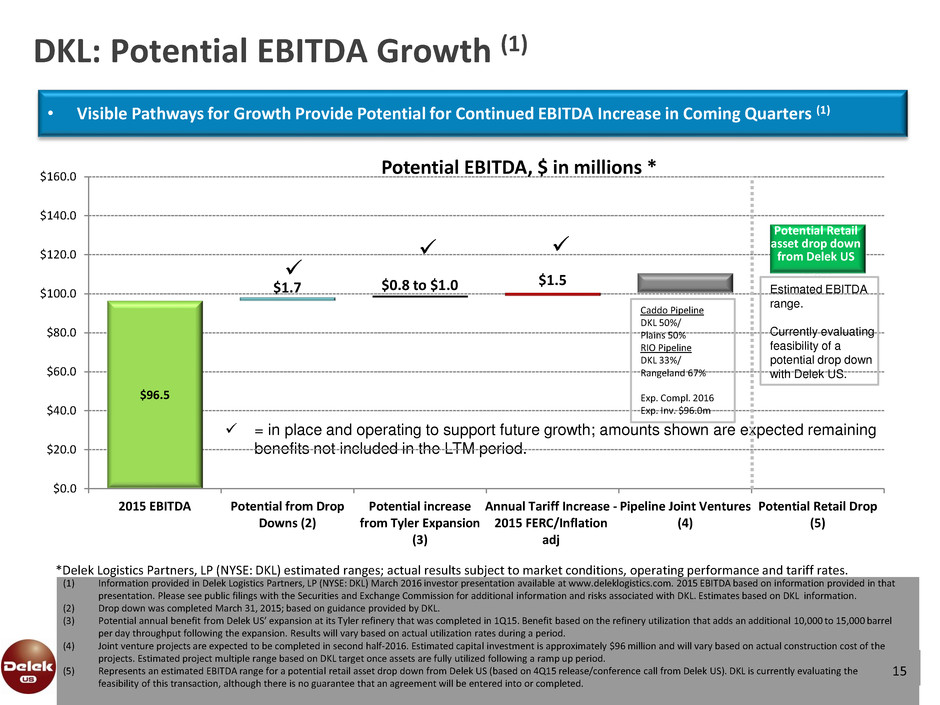

DKL: Potential EBITDA Growth (1) 15 (1) Information provided in Delek Logistics Partners, LP (NYSE: DKL) March 2016 investor presentation available at www.deleklogistics.com. 2015 EBITDA based on information provided in that presentation. Please see public filings with the Securities and Exchange Commission for additional information and risks associated with DKL. Estimates based on DKL information. (2) Drop down was completed March 31, 2015; based on guidance provided by DKL. (3) Potential annual benefit from Delek US’ expansion at its Tyler refinery that was completed in 1Q15. Benefit based on the refinery utilization that adds an additional 10,000 to 15,000 barrel per day throughput following the expansion. Results will vary based on actual utilization rates during a period. (4) Joint venture projects are expected to be completed in second half-2016. Estimated capital investment is approximately $96 million and will vary based on actual construction cost of the projects. Estimated project multiple range based on DKL target once assets are fully utilized following a ramp up period. (5) Represents an estimated EBITDA range for a potential retail asset drop down from Delek US (based on 4Q15 release/conference call from Delek US). DKL is currently evaluating the feasibility of this transaction, although there is no guarantee that an agreement will be entered into or completed. *Delek Logistics Partners, LP (NYSE: DKL) estimated ranges; actual results subject to market conditions, operating performance and tariff rates. • Visible Pathways for Growth Provide Potential for Continued EBITDA Increase in Coming Quarters (1) = in place and operating to support future growth; amounts shown are expected remaining benefits not included in the LTM period. 8x to 10x EBITDA Target $96.5 $1.7 $0.8 to $1.0 $1.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 2015 EBITDA Potential from Drop Downs (2) Potential increase from Tyler Expansion (3) Annual Tariff Increase - 2015 FERC/Inflation adj Pipeline Joint Ventures (4) Potential Retail Drop (5) Potential EBITDA, $ in millions * Caddo Pipeline DKL 50%/ Plains 50% RIO Pipeline DKL 33%/ Rangeland 67% Exp. Compl. 2016 Exp. Inv. $96.0m Potential Retail asset drop down from Delek US Estimated EBITDA range. Currently evaluating feasibility of a potential drop down with Delek US.

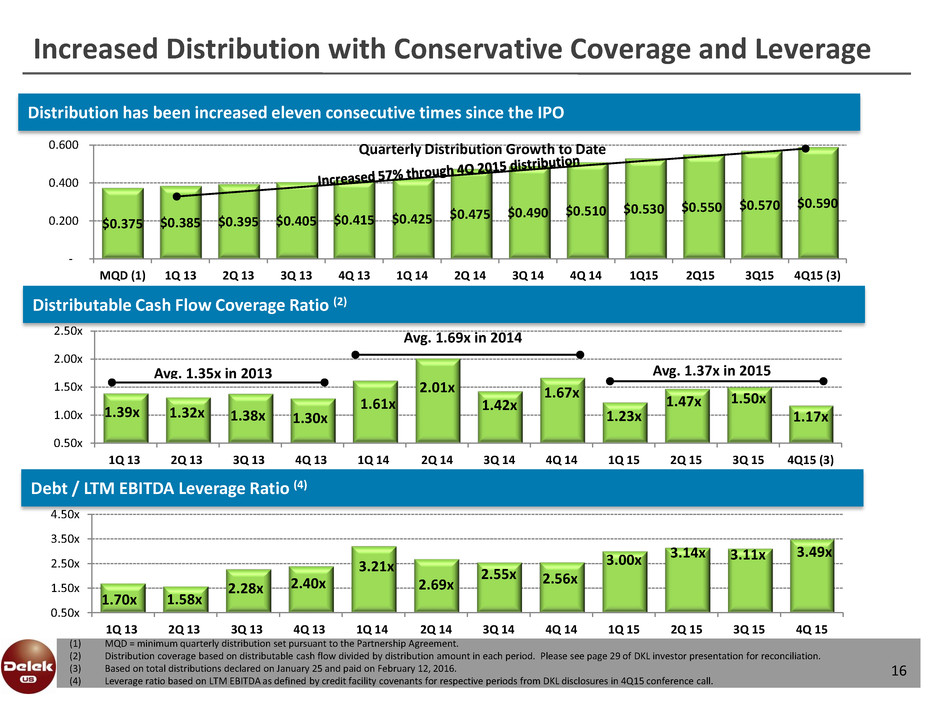

Increased Distribution with Conservative Coverage and Leverage 16 Distribution has been increased eleven consecutive times since the IPO Distributable Cash Flow Coverage Ratio (2) Debt / LTM EBITDA Leverage Ratio (4) (1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. (2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 29 of DKL investor presentation for reconciliation. (3) Based on total distributions declared on January 25 and paid on February 12, 2016. (4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods from DKL disclosures in 4Q15 conference call. 1.39x 1.32x 1.38x 1.30x 1.61x 2.01x 1.42x 1.67x 1.23x 1.47x 1.50x 1.17x 0.50x 1.00x 1.50x 2.00x 2.50x 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q15 (3) Avg. 1.35x in 2013 Avg. 1.69x in 2014 Avg. 1.37x in 2015 1.70x 1.58x 2.28x 2.40x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 0.50x 1.50x 2.50x 3.50x 4.50x 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 $0.375 $0.385 $0.395 $0.405 $0.415 $0.425 $0.475 $0.490 $0.510 $0.530 $0.550 $0.570 $0.590 - 0.200 0.400 0.600 MQD (1) 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q15 2Q15 3Q15 4Q15 (3) Quarterly Distribution Growth to Date

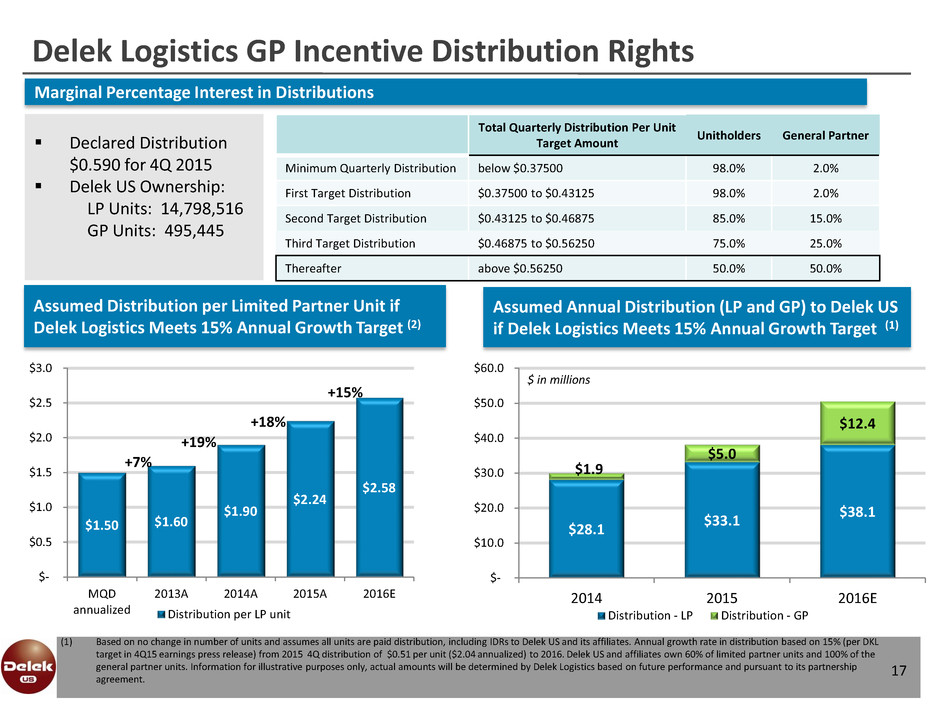

17 Marginal Percentage Interest in Distributions Assumed Distribution per Limited Partner Unit if Delek Logistics Meets 15% Annual Growth Target (2) Delek Logistics GP Incentive Distribution Rights Total Quarterly Distribution Per Unit Target Amount Unitholders General Partner Minimum Quarterly Distribution below $0.37500 98.0% 2.0% First Target Distribution $0.37500 to $0.43125 98.0% 2.0% Second Target Distribution $0.43125 to $0.46875 85.0% 15.0% Third Target Distribution $0.46875 to $0.56250 75.0% 25.0% Thereafter above $0.56250 50.0% 50.0% Declared Distribution $0.590 for 4Q 2015 Delek US Ownership: LP Units: 14,798,516 GP Units: 495,445 (1) Based on no change in number of units and assumes all units are paid distribution, including IDRs to Delek US and its affiliates. Annual growth rate in distribution based on 15% (per DKL target in 4Q15 earnings press release) from 2015 4Q distribution of $0.51 per unit ($2.04 annualized) to 2016. Delek US and affiliates own 60% of limited partner units and 100% of the general partner units. Information for illustrative purposes only, actual amounts will be determined by Delek Logistics based on future performance and pursuant to its partnership agreement. Assumed Annual Distribution (LP and GP) to Delek US if Delek Logistics Meets 15% Annual Growth Target (1) $1.50 $1.60 $1.90 $2.24 $2.58 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 MQD annualized 2013A 2014A 2015A 2016E Distribution per LP unit $28.1 $33.1 $38.1 $1.9 $5.0 $12.4 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2014 2015 2016E Distribution - LP Distribution - GP $ in millions +7% +19% +18% +15%

Retail Operational Update

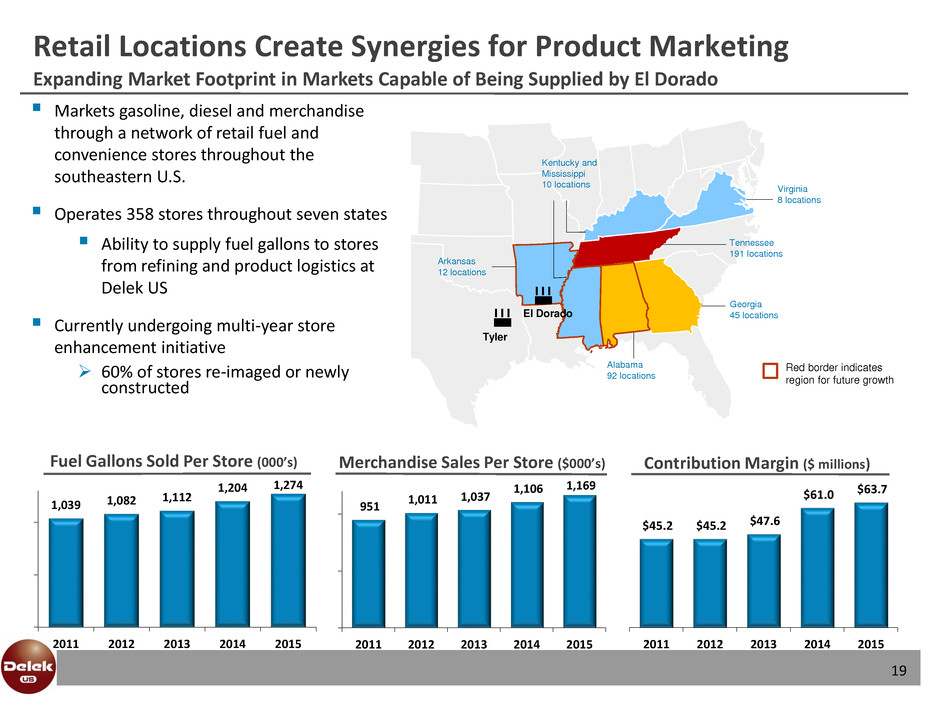

Fuel Gallons Sold Per Store (000’s) 1,039 1,082 1,112 1,204 1,274 2011 2012 2013 2014 2015 951 1,011 1,037 1,106 1,169 2011 2012 2013 2014 2015 Retail Locations Create Synergies for Product Marketing 19 Expanding Market Footprint in Markets Capable of Being Supplied by El Dorado Merchandise Sales Per Store ($000’s) Tennessee 191 locations Virginia 8 locations Kentucky and Mississippi 10 locations Arkansas 12 locations Tyler Georgia 45 locations El Dorado Red border indicates region for future growth Alabama 92 locations Markets gasoline, diesel and merchandise through a network of retail fuel and convenience stores throughout the southeastern U.S. Operates 358 stores throughout seven states Ability to supply fuel gallons to stores from refining and product logistics at Delek US Currently undergoing multi-year store enhancement initiative 60% of stores re-imaged or newly constructed $45.2 $45.2 $47.6 $61.0 $63.7 2011 2012 2013 2014 2015 Contribution Margin ($ millions)

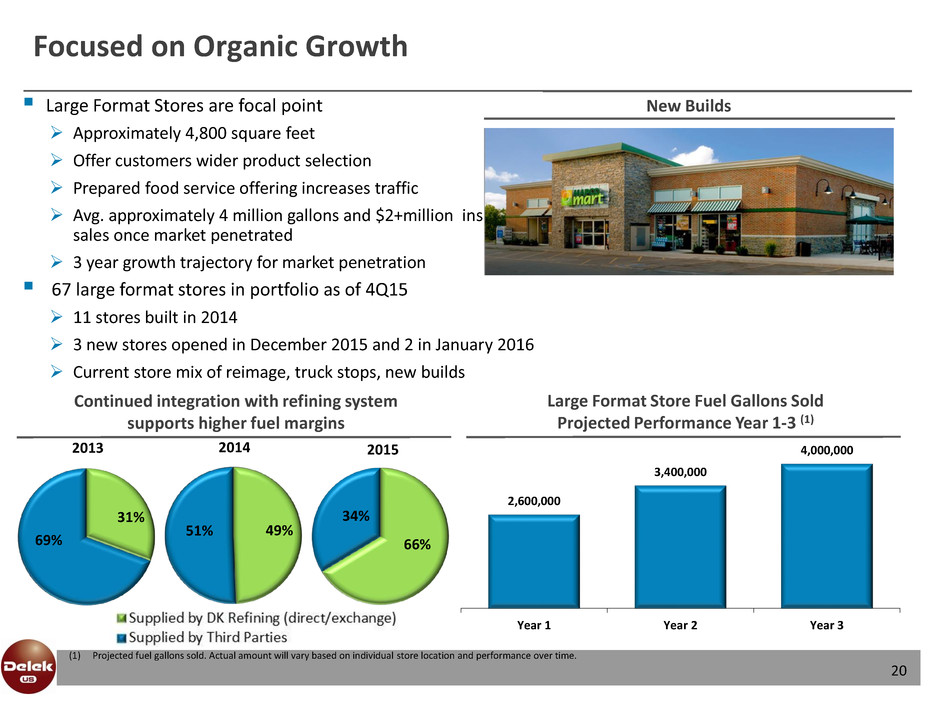

Focused on Organic Growth 20 Large Format Stores are focal point Approximately 4,800 square feet Offer customers wider product selection Prepared food service offering increases traffic Avg. approximately 4 million gallons and $2+million inside sales once market penetrated 3 year growth trajectory for market penetration 67 large format stores in portfolio as of 4Q15 11 stores built in 2014 3 new stores opened in December 2015 and 2 in January 2016 Current store mix of reimage, truck stops, new builds New Builds 2,600,000 3,400,000 4,000,000 Year 1 Year 2 Year 3 Large Format Store Fuel Gallons Sold Projected Performance Year 1-3 (1) (1) Projected fuel gallons sold. Actual amount will vary based on individual store location and performance over time. Continued integration with refining system supports higher fuel margins 31% 69% 2013 49% 51% 2014 66% 34% 2015

Financial Update

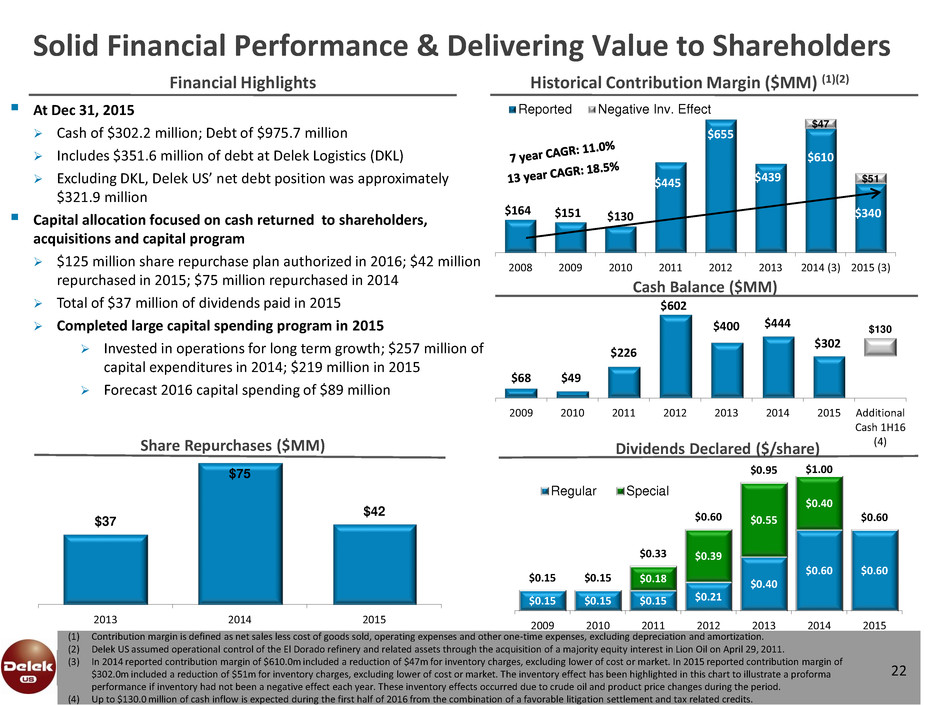

Financial Highlights $164 $151 $130 $445 $655 $439 $610 $340 $47 $51 2008 2009 2010 2011 2012 2013 2014 (3) 2015 (3) Reported Negative Inv. Effect At Dec 31, 2015 Cash of $302.2 million; Debt of $975.7 million Includes $351.6 million of debt at Delek Logistics (DKL) Excluding DKL, Delek US’ net debt position was approximately $321.9 million Capital allocation focused on cash returned to shareholders, acquisitions and capital program $125 million share repurchase plan authorized in 2016; $42 million repurchased in 2015; $75 million repurchased in 2014 Total of $37 million of dividends paid in 2015 Completed large capital spending program in 2015 Invested in operations for long term growth; $257 million of capital expenditures in 2014; $219 million in 2015 Forecast 2016 capital spending of $89 million Cash Balance ($MM) Solid Financial Performance & Delivering Value to Shareholders 22 (1) Contribution margin is defined as net sales less cost of goods sold, operating expenses and other one-time expenses, excluding depreciation and amortization. (2) Delek US assumed operational control of the El Dorado refinery and related assets through the acquisition of a majority equity interest in Lion Oil on April 29, 2011. (3) In 2014 reported contribution margin of $610.0m included a reduction of $47m for inventory charges, excluding lower of cost or market. In 2015 reported contribution margin of $302.0m included a reduction of $51m for inventory charges, excluding lower of cost or market. The inventory effect has been highlighted in this chart to illustrate a proforma performance if inventory had not been a negative effect each year. These inventory effects occurred due to crude oil and product price changes during the period. (4) Up to $130.0 million of cash inflow is expected during the first half of 2016 from the combination of a favorable litigation settlement and tax related credits. . . $68 $49 $226 $602 $400 $444 $302 $130 2009 2010 2011 2012 2013 2014 2015 Additional Cash 1H16 (4) Dividends Declared ($/share) Historical Contribution Margin ($MM) (1)(2) $0.15 $0.15 $0.15 $0.21 $0.40 $0.60 $0.60 $0.18 $0.39 $0.55 $0.40 $0.15 $0.15 $0.33 $0.60 $0.95 $1.00 $0.60 2009 2010 2011 2012 2013 2014 2015 Regular Special $37 $75 $42 2013 2014 2015 Share Repurchases ($MM)

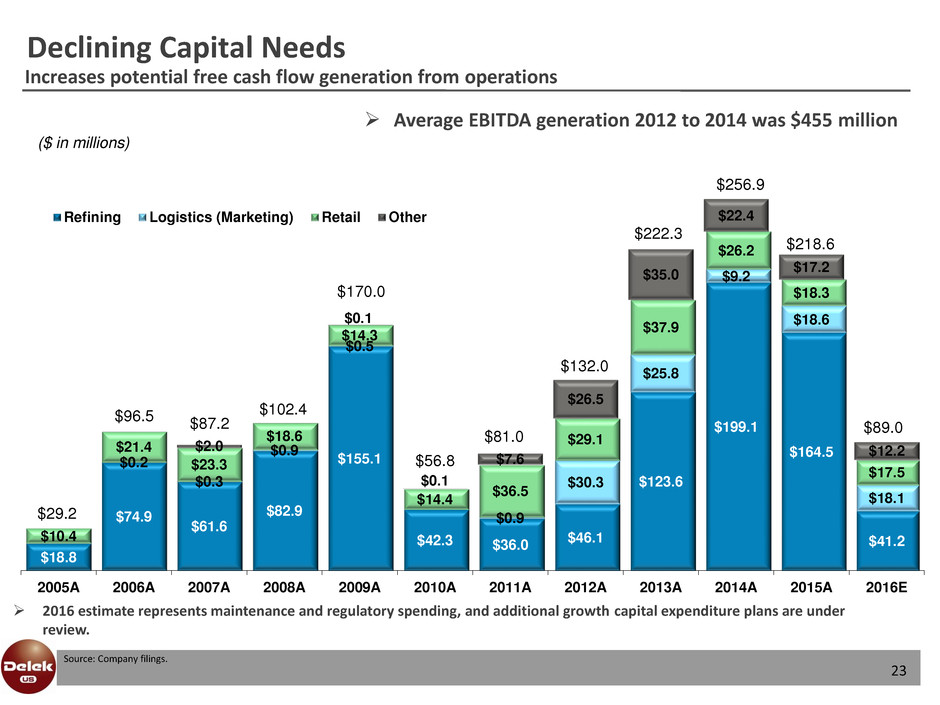

Increases potential free cash flow generation from operations $18.8 $74.9 $61.6 $82.9 $155.1 $42.3 $36.0 $46.1 $123.6 $199.1 $164.5 $41.2 $0.2 $0.3 $0.9 $0.5 $0.9 $30.3 $25.8 $9.2 $18.6 $18.1 $10.4 $21.4 $23.3 $18.6 $14.3 $14.4 $36.5 $29.1 $37.9 $26.2 $18.3 $17.5 $2.0 $0.1 $0.1 $7.6 $26.5 $35.0 $22.4 $17.2 $12.2 2005A 2006A 2007A 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A 2016E Refining Logistics (Marketing) Retail Other Declining Capital Needs 23 $56.8 $81.0 $132.0 $222.3 Source: Company filings. $256.9 $218.6 $170.0 $102.4 $87.2 $96.5 $29.2 ($ in millions) Average EBITDA generation 2012 to 2014 was $455 million 2016 estimate represents maintenance and regulatory spending, and additional growth capital expenditure plans are under review. $89.0

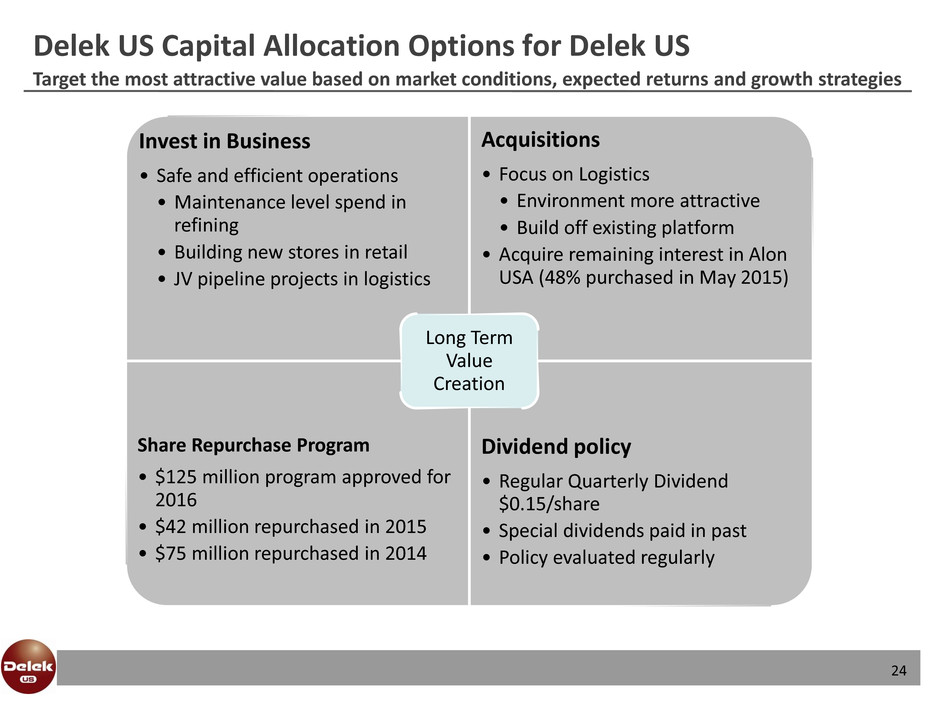

Delek US Capital Allocation Options for Delek US 24 Invest in Business • Safe and efficient operations • Maintenance level spend in refining • Building new stores in retail • JV pipeline projects in logistics Acquisitions • Focus on Logistics • Environment more attractive • Build off existing platform • Acquire remaining interest in Alon USA (48% purchased in May 2015) Share Repurchase Program • $125 million program approved for 2016 • $42 million repurchased in 2015 • $75 million repurchased in 2014 Dividend policy • Regular Quarterly Dividend $0.15/share • Special dividends paid in past • Policy evaluated regularly Long Term Value Creation Target the most attractive value based on market conditions, expected returns and growth strategies

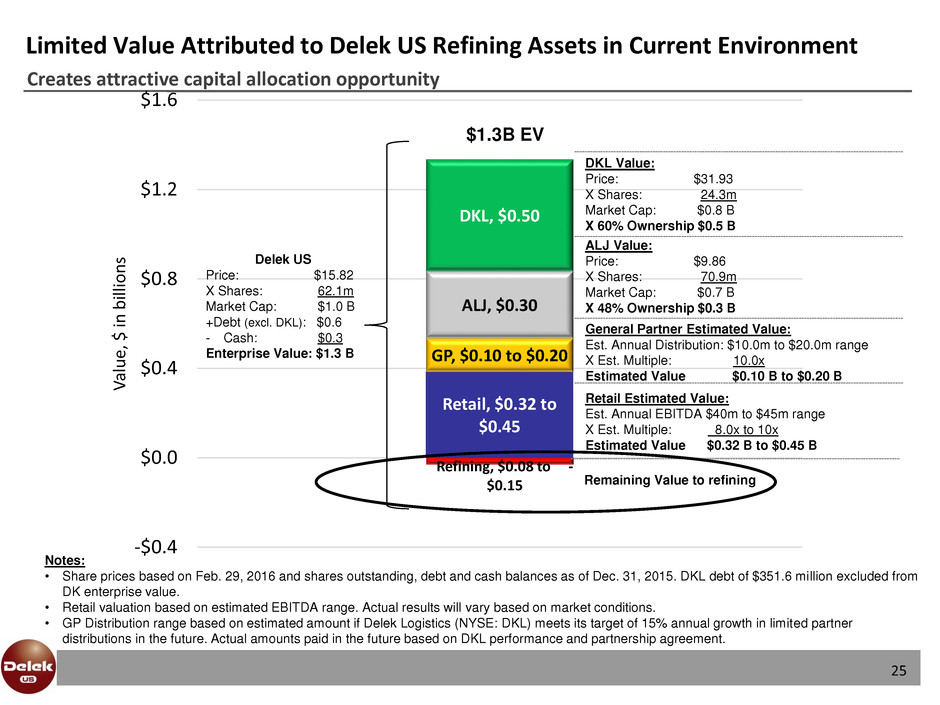

Limited Value Attributed to Delek US Refining Assets in Current Environment 25 Creates attractive capital allocation opportunity Refining, $0.08 to - $0.15 Retail, $0.32 to $0.45 GP, $0.10 to $0.20 ALJ, $0.30 DKL, $0.50 -$0.4 $0.0 $0.4 $0.8 $1.2 $1.6 V al u e, $ in b ill ion s Delek US Price: $15.82 X Shares: 62.1m Market Cap: $1.0 B +Debt (excl. DKL): $0.6 - Cash: $0.3 Enterprise Value: $1.3 B DKL Value: Price: $31.93 X Shares: 24.3m Market Cap: $0.8 B X 60% Ownership $0.5 B ALJ Value: Price: $9.86 X Shares: 70.9m Market Cap: $0.7 B X 48% Ownership $0.3 B General Partner Estimated Value: Est. Annual Distribution: $10.0m to $20.0m range X Est. Multiple: 10.0x Estimated Value $0.10 B to $0.20 B Retail Estimated Value: Est. Annual EBITDA $40m to $45m range X Est. Multiple: 8.0x to 10x Estimated Value $0.32 B to $0.45 B Remaining Value to refining $1.3B EV Notes: • Share prices based on Feb. 29, 2016 and shares outstanding, debt and cash balances as of Dec. 31, 2015. DKL debt of $351.6 million excluded from DK enterprise value. • Retail valuation based on estimated EBITDA range. Actual results will vary based on market conditions. • GP Distribution range based on estimated amount if Delek Logistics (NYSE: DKL) meets its target of 15% annual growth in limited partner distributions in the future. Actual amounts paid in the future based on DKL performance and partnership agreement.

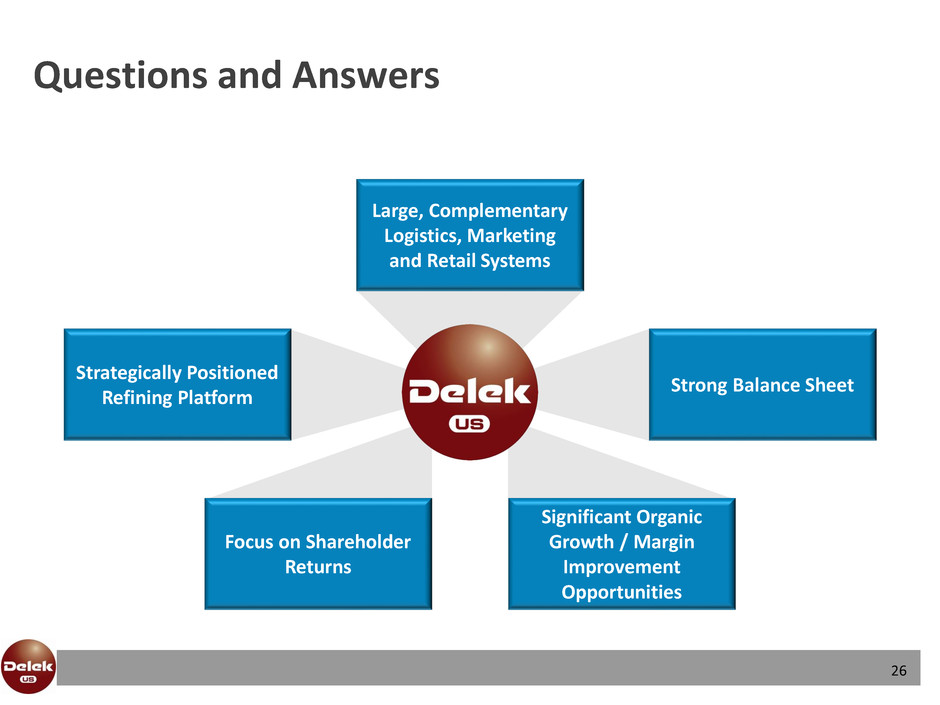

26 Large, Complementary Logistics, Marketing and Retail Systems Significant Organic Growth / Margin Improvement Opportunities Focus on Shareholder Returns Strong Balance Sheet Strategically Positioned Refining Platform Questions and Answers

Appendix Additional Data

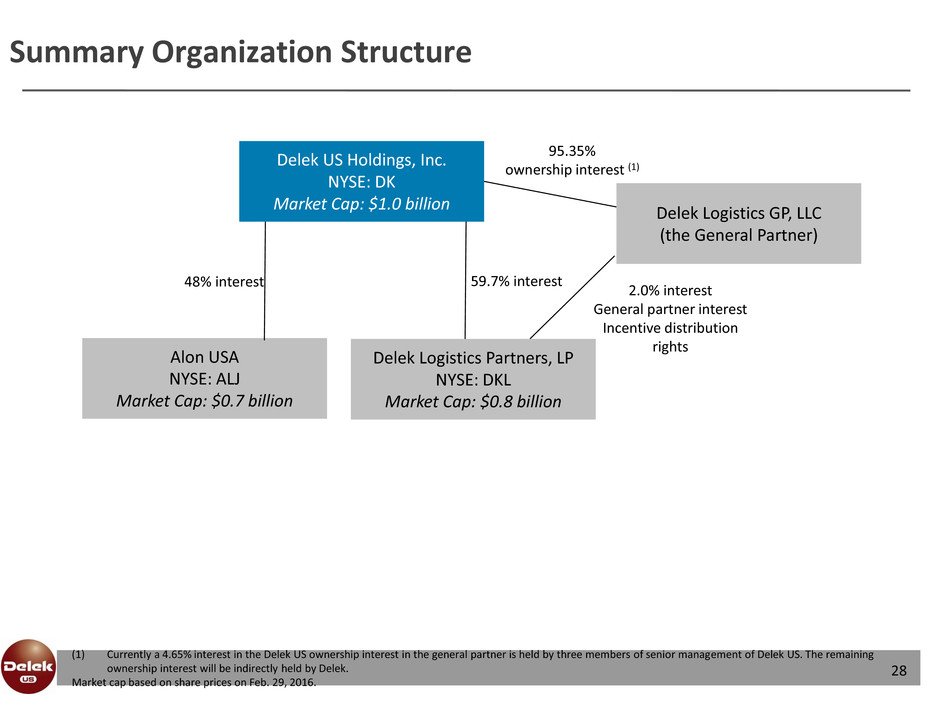

28 Summary Organization Structure (1) Currently a 4.65% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The remaining ownership interest will be indirectly held by Delek. Market cap based on share prices on Feb. 29, 2016. 95.35% ownership interest (1) 2.0% interest General partner interest Incentive distribution rights Delek Logistics Partners, LP NYSE: DKL Market Cap: $0.8 billion Delek Logistics GP, LLC (the General Partner) Delek US Holdings, Inc. NYSE: DK Market Cap: $1.0 billion 59.7% interest Alon USA NYSE: ALJ Market Cap: $0.7 billion 48% interest

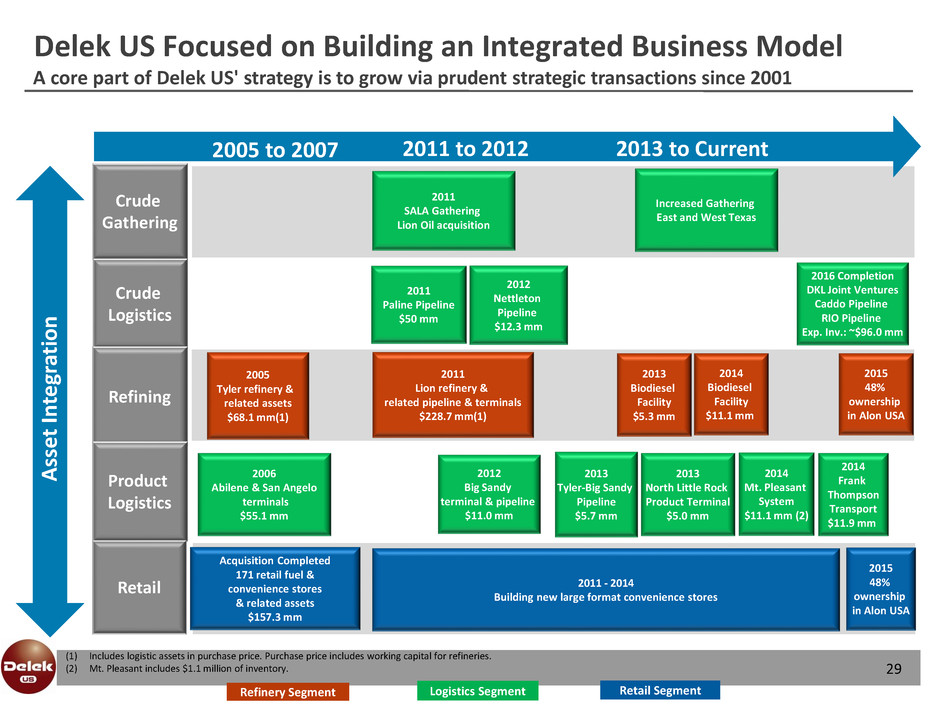

Delek US Focused on Building an Integrated Business Model A core part of Delek US' strategy is to grow via prudent strategic transactions since 2001 (1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries. (2) Mt. Pleasant includes $1.1 million of inventory. 2006 Abilene & San Angelo terminals $55.1 mm 2012 Nettleton Pipeline $12.3 mm 2011 Paline Pipeline $50 mm Acquisition Completed 171 retail fuel & convenience stores & related assets $157.3 mm 2005 to 2007 2011 to 2012 2013 to Current Crude Gathering 2013 Biodiesel Facility $5.3 mm 2011 Lion refinery & related pipeline & terminals $228.7 mm(1) 2005 Tyler refinery & related assets $68.1 mm(1) 2011 - 2014 Building new large format convenience stores 2013 Tyler-Big Sandy Pipeline $5.7 mm 2014 Biodiesel Facility $11.1 mm Logistics Segment Retail Segment Refinery Segment Crude Logistics Refining Product Logistics Retail 2012 Big Sandy terminal & pipeline $11.0 mm 2013 North Little Rock Product Terminal $5.0 mm 2011 SALA Gathering Lion Oil acquisition Asset In te gr at io n Increased Gathering East and West Texas 29 2014 Mt. Pleasant System $11.1 mm (2) 2014 Frank Thompson Transport $11.9 mm 2016 Completion DKL Joint Ventures Caddo Pipeline RIO Pipeline Exp. Inv.: ~$96.0 mm 2015 48% ownership in Alon USA 2015 48% ownership in Alon USA

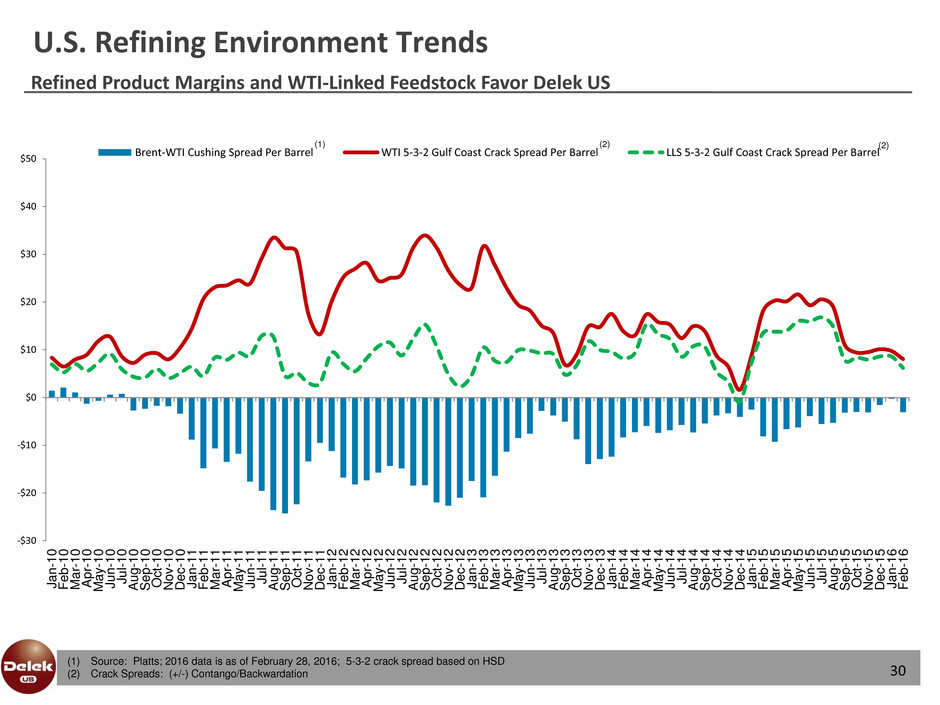

-$30 -$20 -$10 $0 $10 $20 $30 $40 $50 J a n -1 0 F e b -1 0 M a r- 1 0 A pr -1 0 M a y -1 0 J u n -1 0 J u l- 1 0 A u g -1 0 S e p -1 0 O c t- 1 0 No v -1 0 De c -1 0 J a n -1 1 F e b -1 1 M a r- 1 1 A pr -1 1 M a y -1 1 J u n -1 1 J u l- 1 1 A u g -1 1 S e p -1 1 O c t- 1 1 No v -1 1 De c -1 1 J a n -1 2 F e b -1 2 M a r- 1 2 A pr -1 2 M a y -1 2 J u n -1 2 J u l- 1 2 A u g -1 2 S e p -1 2 O c t- 1 2 No v -1 2 De c -1 2 J a n -1 3 F e b -1 3 M a r- 1 3 A pr -1 3 M a y -1 3 J u n -1 3 J u l- 1 3 A u g -1 3 S e p -1 3 O c t- 1 3 No v -1 3 De c -1 3 J a n -1 4 F e b -1 4 M a r- 1 4 A pr -1 4 M a y -1 4 J u n -1 4 J u l- 1 4 A u g -1 4 S e p -1 4 O c t- 1 4 No v -1 4 De c -1 4 J a n -1 5 F e b -1 5 M a r- 1 5 A pr -1 5 M a y -1 5 J u n -1 5 J u l- 1 5 A u g -1 5 S e p -1 5 O c t- 1 5 No v -1 5 De c -1 5 J a n -1 6 F e b -1 6 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel U.S. Refining Environment Trends Refined Product Margins and WTI-Linked Feedstock Favor Delek US (1) Source: Platts; 2016 data is as of February 28, 2016; 5-3-2 crack spread based on HSD (2) Crack Spreads: (+/-) Contango/Backwardation (1) (2) (2) 30

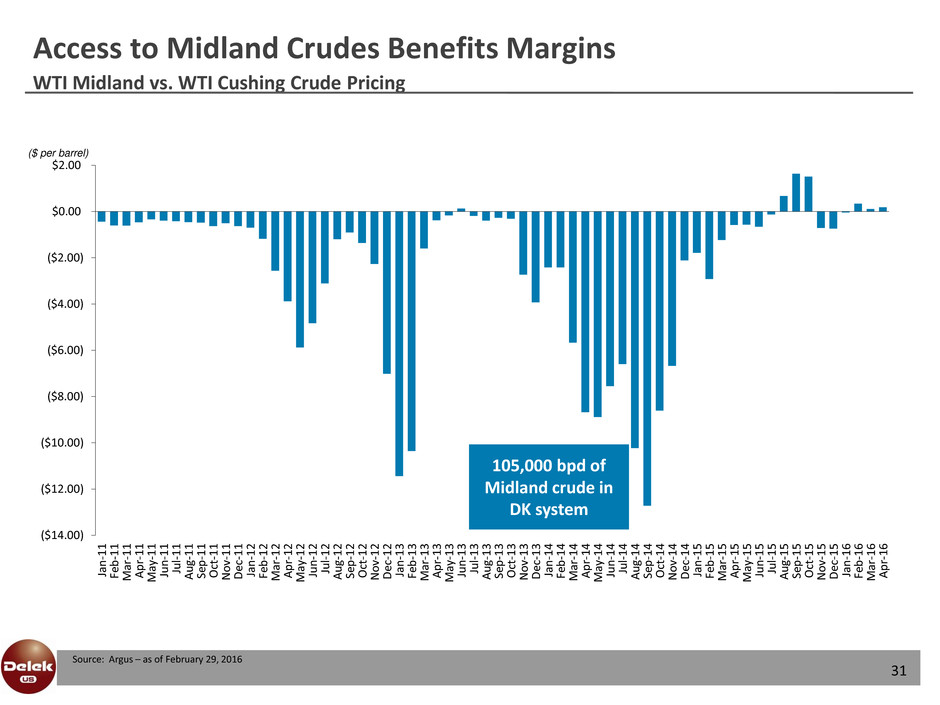

($14.00) ($12.00) ($10.00) ($8.00) ($6.00) ($4.00) ($2.00) $0.00 $2.00 Ja n -1 1 Fe b -1 1 M ar -1 1 A p r- 11 M ay -1 1 Ju n -1 1 Ju l-1 1 A u g- 1 1 Se p -1 1 O ct-1 1 N o v- 1 1 De c- 1 1 Ja n -1 2 Fe b -1 2 M ar -1 2 A p r- 12 M ay -1 2 Ju n -1 2 Ju l-1 2 A u g- 1 2 Se p -1 2 O ct-1 2 N o v- 1 2 De c- 1 2 Ja n -1 3 Fe b -1 3 M ar -1 3 A p r- 13 M ay -1 3 Ju n -1 3 Ju l-1 3 A u g- 1 3 Se p -1 3 O ct-1 3 N o v- 1 3 De c- 1 3 Ja n -1 4 Fe b -1 4 M ar -1 4 A p r- 14 M ay -1 4 Ju n -1 4 Ju l-1 4 A u g- 1 4 Se p -1 4 O ct-1 4 N o v- 1 4 De c- 1 4 Ja n -1 5 Fe b -1 5 M ar -1 5 A p r- 15 M ay -1 5 Ju n -1 5 Ju l-1 5 A u g- 1 5 Se p -1 5 O ct-1 5 N o v- 1 5 De c- 1 5 Ja n -1 6 Fe b -1 6 M ar -1 6 A p r- 16 WTI Midland vs. WTI Cushing Crude Pricing Access to Midland Crudes Benefits Margins ($ per barrel) 105,000 bpd of Midland crude in DK system 31 Source: Argus – as of February 29, 2016

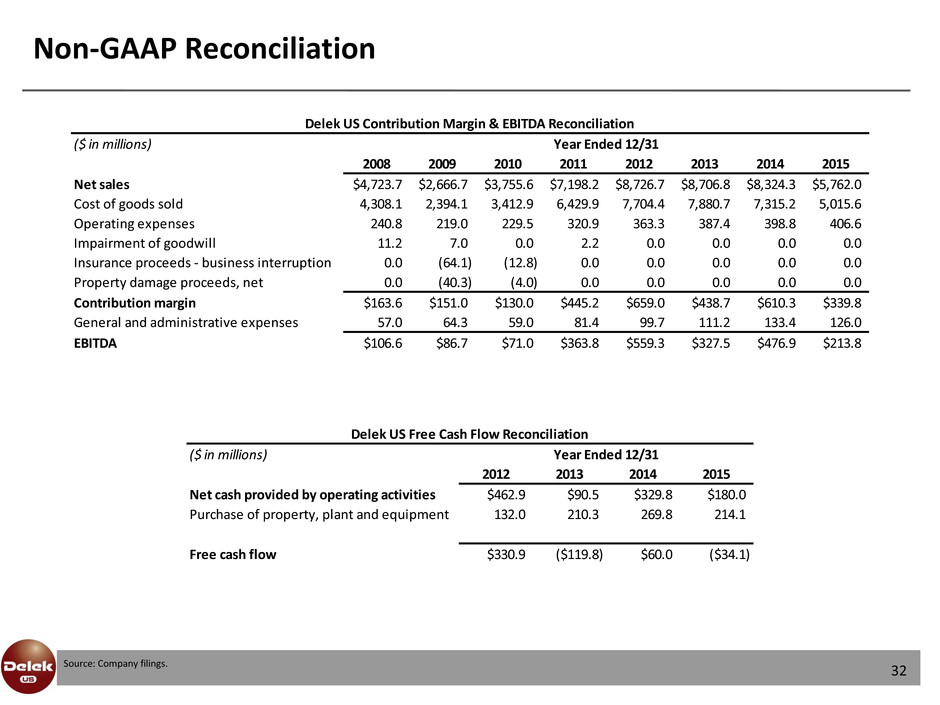

Non-GAAP Reconciliation 32 Source: Company filings. ($ in millions) 2008 2009 2010 2011 2012 2013 2014 2015 Net sales $4,723.7 $2,666.7 $3,755.6 $7,198.2 $8,726.7 $8,706.8 $8,324.3 $5,762.0 Cost of goods sold 4,308.1 2,394.1 3,412.9 6,429.9 7,704.4 7,880.7 7,315.2 5,015.6 Operating expenses 240.8 219.0 229.5 320.9 363.3 387.4 398.8 406.6 Impairment of goodwill 11.2 7.0 0.0 2.2 0.0 0.0 0.0 0.0 Insurance proceeds - business interruption 0.0 (64.1) (12.8) 0.0 0.0 0.0 0.0 0.0 Property damage proceeds, net 0.0 (40.3) (4.0) 0.0 0.0 0.0 0.0 0.0 Contribution margin $163.6 $151.0 $130.0 $445.2 $659.0 $438.7 $610.3 $339.8 General and administrative expenses 57.0 64.3 59.0 81.4 99.7 111.2 133.4 126.0 EBITDA $106.6 $86.7 $71.0 $363.8 $559.3 $327.5 $476.9 $213.8 Delek US Contribution Margin & EBITDA Reconciliation Year Ended 12/31 ($ in millions) 2012 2013 2014 2015 Net cash provided by operating activities $462.9 $90.5 $329.8 $180.0 Purchase of property, plant and equipment 132.0 210.3 269.8 214.1 Free cash flow $330.9 ($119.8) $60.0 ($34.1) Delek US Free Cash Flow Reconciliation Year Ended 12/31

Investor Relations Contact: Assi Ginzburg Keith Johnson Chief Financial Officer Vice President of Investor Relations 615-435-1452 615-435-1366