Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Foundation Medicine, Inc. | d118961dex232.htm |

| EX-31.2 - EX-31.2 - Foundation Medicine, Inc. | d118961dex312.htm |

| EX-21.1 - EX-21.1 - Foundation Medicine, Inc. | d118961dex211.htm |

| EX-23.1 - EX-23.1 - Foundation Medicine, Inc. | d118961dex231.htm |

| EX-32.1 - EX-32.1 - Foundation Medicine, Inc. | d118961dex321.htm |

| EX-31.1 - EX-31.1 - Foundation Medicine, Inc. | d118961dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-36086

FOUNDATION MEDICINE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 27-1316416 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

150 Second Street

Cambridge MA, 02141

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, Including Area Code:

(617) 418-2200

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.0001 Par Value | The NASDAQ Global Select Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

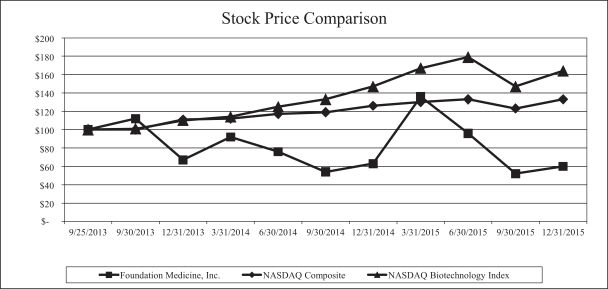

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant computed by reference to the last reported sale price of the registrant’s common stock on the Nasdaq Global Select Market as of such date was approximately $436.7 million. As of February 26, 2016 there were 34,540,998 shares of the registrant’s common stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2015. Portions of such definitive proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2015

Table of Contents

This Annual Report on Form 10-K, or this Annual Report, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the “safe harbor” created by those sections. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “seek,” “intends,” “plans,” “estimates,” “projects,” “anticipates,” or other comparable terms. These forward-looking statements involve risk and uncertainties. We cannot guarantee future results, levels of activity, performance or achievements, and you should not place undue reliance on our forward-looking statements. Our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those set forth in “Item 1A. Risk Factors” and elsewhere in this Annual Report. Except as may be required by law, we have no plans to update our forward-looking statements to reflect events or circumstances after the date of this Annual Report. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made.

Unless the content requires otherwise, references to “Foundation,” “the Company,” “we,” “our,” and “us,” in this Annual Report refer to Foundation Medicine, Inc. and its subsidiaries.

| ITEM 1. | BUSINESS |

Overview

We are a molecular information company focused on fundamentally changing the way in which patients with cancer are evaluated and treated. We believe an information-based approach to making clinical treatment decisions based on comprehensive genomic profiling will become a standard of care for patients with cancer. We derive revenue from selling products that are enabled by our molecular information platform to physicians and biopharmaceutical companies. Our platform includes proprietary methods and algorithms for analyzing specimens across all types of cancer, and for incorporating that information into clinical care in a concise and user-friendly fashion. Our products provide genomic information about each patient’s individual cancer, enabling physicians to optimize treatments in clinical practice and biopharmaceutical companies to develop targeted oncology therapies more effectively. We believe we have a significant first mover advantage in providing comprehensive genomic profiling and molecular information products on a commercial scale.

Our flagship clinical molecular information products, FoundationOne for solid tumors, and FoundationOne Heme for blood-based cancers, or hematologic malignancies, including leukemia, lymphoma, myeloma, and advanced sarcomas, are, to our knowledge, the only widely available comprehensive genomic profiles designed for use in the routine care of patients with cancer. To accelerate our commercial growth and enhance our competitive advantage, we are continuing to develop and commercialize new molecular information products for physicians and biopharmaceutical companies, strengthen our commercial organization, introduce new marketing, education and provider engagement efforts, grow our molecular information knowledgebase, called FoundationCORE, pursue reimbursement from regional and national third-party payors and government payors, publish scientific and medical advances, and foster relationships across the oncology community.

The cancer treatment paradigm is evolving rapidly, and we believe there is now widespread recognition that cancer is a disease of the genome, rather than a disease defined solely by its specific anatomical location in the body. Today, physicians increasingly use precision medicines to target cancers based on the specific genomic alterations driving their growth. We believe physicians need molecular information about their patients’ unique cancers to determine the optimal course of treatment.

We believe the oncology community needs comprehensive molecular information products that can assess the known biologically relevant genomic alterations from a patient’s tumor and distill complex molecular

1

Table of Contents

information into a concise and actionable format, and we designed FoundationOne and FoundationOne Heme to be such products. We believe a comprehensive approach to providing molecular information for use in clinical settings addresses an area of significant unmet medical need for patients suffering from advanced, or active metastatic, cancers. We estimate that there are approximately 1.1 million patients per year in the United States with newly-diagnosed or recurrent active metastatic cancers who fall into challenging treatment categories, including patients who have rare or aggressive diseases, patients whose disease has progressed after standard treatments, and patients who have tested negative under, or been ineligible for, traditional molecular diagnostic tests. We are initially focusing on these patients because we believe this patient population will benefit most from comprehensive molecular information products.

To maintain our market leadership position and offer physicians and biopharmaceutical companies a full suite of innovative molecular information solutions, we developed our third comprehensive genomic profiling product, FoundationACT (Assay for Circulating Tumor DNA), which we believe is a best-in-class, blood-based (liquid biopsy) assay to evaluate circulating tumor DNA, or ctDNA, which is DNA shed from tumors that circulates in blood plasma outside of cells. We launched FoundationACT for research use to our biopharmaceutical partners in December 2015. We plan to initiate the commercial launch of FoundationACT to ordering physicians in March 2016. We believe FoundationACT will become an important molecular information solution for oncologists because it will provide a new option for comprehensive genomic profiling when a tissue biopsy is not feasible or when tissue is not available. By analyzing cell-free DNA isolated from a patient’s blood, we can identify clinically relevant genomic alterations in the circulating tumor DNA and match these alterations to targeted therapies and clinical trials.

As the number of available targeted therapies expands and as physicians gain further experience using comprehensive molecular information in their routine treatment decisions, we believe that the potentially addressable market for comprehensive molecular information products will expand over the next five years to include most patients who have metastatic disease, patients with earlier stage disease, and patients from whom a tissue biopsy is not available. We estimate that this potential U.S. market expansion could include an additional 900,000 total patients for FoundationOne, FoundationOne Heme, and FoundationACT, bringing the total number of patients who could benefit from our approach in the U.S. to approximately 2 million on an annual basis.

We believe we have a significant first mover advantage in building the only commercially available molecular information platform that comprehensively assesses cancer simultaneously for all four classes of genomic alterations (i.e., base pair substitutions, copy number alterations, short insertions and deletions, or indels, and gene rearrangements) across all cancer-related genes with the sensitivity and specificity required for routine medical practice. We published our analytic validation for FoundationOne in Nature Biotechnology in October 2013, and we anticipate publishing a similar validation for FoundationOne Heme in 2016. We presented analytic validation data for FoundationACT at the 2016 Advances in Genome Biology and Technology Conference demonstrating that our assay achieves very high unique coverage from limited ctDNA input which enables accurate detection of base substitutions, indels, and genomic rearrangements at very low tumor content, as well as copy number amplifications with performance specifications equivalent to those for FoundationOne. FoundationOne and FoundationOne Heme deliver, and FoundationACT, when commercialized, will deliver this complex molecular information in a concise report that matches detected molecular alterations with potentially relevant treatment options, including clinical trials.

We believe the genomic alterations identified for each patient should be accompanied by the most current and relevant scientific and medical literature related to those alterations, and that this information should be presented in a clear and concise manner. Our molecular information knowledgebase, FoundationCORE, stores this genomic alteration data and currently includes more than 68,000 genomic profiles. Test reports are now available to physicians using FoundationICE, the newest version of our online Interactive Cancer Explorer, which we made available to select providers in December 2014 and launched in May 2015 at the annual meeting of the American Society of Clinical Oncology, or ASCO. We believe FoundationICE will help physicians to more efficiently use our clinical products and will enhance the utility of comprehensive genomic profiling.

2

Table of Contents

We believe our unique and proprietary decision support applications are a competitive differentiator of our comprehensive molecular information solutions and may accelerate the broad adoption of our products and create an important network effect among users. These applications are designed to integrate with physician workflow and enhance the actionability of our molecular information, enabling physicians to make informed therapeutic decisions. For example, an important component of FoundationICE is PatientMatch, a technology application that enables physician-to-physician connections to facilitate sharing of treatment decisions and clinical outcomes data for patients with similar genomic profiles, in a manner compliant with the Health Insurance Portability and Accountability Act, or HIPAA. In September 2015, we announced the expansion of our suite of molecular information-based products with GeneKit. GeneKit is a pathology-focused genomics solution that facilitates rapid interpretation and report generation for next generation sequencing, or NGS, assays of up to 50 genes. GeneKit provides a reflex option to our assays, FoundationOne, FoundationOne Heme, and FoundationACT, should the more narrowly focused third-party molecular diagnostics tests fail to identify a genomic alteration in a patient’s biopsy.

Our molecular information solutions address significant unmet needs in the market and enable providers and their patients to identify relevant treatment options, including potential access to clinical trials. We believe the current system for patients to access clinical trials in the United States is highly inefficient. Approximately 3% of patients with cancer in the United States are enrolled in clinical trials. To overcome this challenge of patient access to clinical trials and precision therapies, we launched a pilot program in October 2015 called SmartTrials. This program provides physicians with information on certain enrolling studies of investigational, targeted therapies, and immunotherapies based on the genomic alterations identified in the patient’s tumor sample. We believe this program may be a catalyst for precision medicine by enabling greater patient access to personalized therapies and simultaneously, enabling our biopharmaceutical partners to accelerate drug development.

Our clinical products have been rapidly adopted in the marketplace, and several thousand physicians from large academic centers to community-based practices have ordered FoundationOne or FoundationOne Heme. We believe this rapid adoption, which has been accomplished in the early stages of our commercial growth, demonstrates the demand for and utility of our comprehensive solutions that help oncologists effectively implement the promise of precision medicine. We believe our current and future molecular information products address a market opportunity of $12-15 billion over the next five years.

We believe our suite of molecular information products have a sustainable competitive advantage because they:

| • | Provide comprehensive and reliable identification of clinically relevant information — FoundationOne currently assesses 315 biologically relevant cancer genes for all classes of genomic alterations with high sensitivity and specificity. We believe FoundationOne identifies genomic alterations that other commercially available diagnostic tests cannot. FoundationOne Heme employs RNA sequencing of 265 genes in addition to DNA sequencing of 405 genes to detect all classes of genomic alterations across genes known to be altered other than through inherited genetic characteristics, which are also known as somatic alterations, in hematologic malignancies, pediatric cancers, and sarcomas, which we believe also will lead to the identification of clinically relevant information. FoundationACT, which we launched to our biopharmaceutical partners in December 2015 for research use, identifies in a cancer patient’s blood all known clinically relevant alterations in 62 genes altered in human solid tumors that are validated targets for therapy or are unambiguous drivers of cancer. The assay has been optimized to overcome the tremendous challenges of detecting low quantities of ctDNA in blood and has been analytically validated for high accuracy across all classes of genomic alterations; |

| • | Promote physician interaction to create a powerful network effect — We are continually augmenting FoundationCORE and expanding the functionality of FoundationICE to allow for sharing of genomic and treatment data in a HIPAA-compliant fashion. We believe these efforts will create a network effect of more users and ultimately more actionable information; |

3

Table of Contents

| • | Incorporate the latest scientific and medical advances — We have extensive relationships across the scientific and medical oncology communities, including with key thought leaders and leading biopharmaceutical companies. These relationships help us incorporate new cancer genes, the latest scientific findings, newly available targeted therapeutics, and relevant clinical trials into FoundationOne, FoundationOne Heme, and FoundationACT test results; |

| • | Readily integrate into routine clinical practice — Our proprietary sample preparation processes and computational biology algorithms allow us to utilize small amounts of tumor tissue from a wide variety of sample types, including tissue with low tumor purity and from liquid (blood) biopsies, so as to allow for routine specimen collection. We detect and report the clinically relevant genomic alterations, generally within 11 to 14 days for FoundationOne and within 15 to 18 days for FoundationOne Heme, in each case from the time the specimen is received. We expect to report results in less than 14 days for FoundationACT once it is launched commercially. We are dedicated to providing high-quality support to our customers, from order initiation and sample acquisition through report delivery and follow-up with our medical affairs team; and |

| • | Provide clinically relevant information and decision support applications that physicians can use— In a concise report, our products communicate the relevant genomic alterations in a patient’s cancer and based on peer-reviewed literature and clinical and governmental databases, match these alterations with targeted therapies and relevant clinical trials. We continue to develop innovative new decision support applications, like PatientMatch, GeneKit, and SmartTrials, that support informed treatment decision-making and enable improved access to therapies. |

We believe we are a unique and highly differentiated molecular information company. The combination of our world-class lab, FoundationCORE, our bioinformatics capabilities, and our technology applications enable us to be a best-in-class and reliable partner to biopharmaceutical partners. Our molecular information platform is currently used by more than 25 biopharmaceutical partners to enhance their development of targeted oncology therapies, and we believe we are well positioned to capitalize on a market opportunity with biopharmaceutical partners in excess of $600 million over the next five years. Our biopharmaceutical partners leverage our molecular information platform in three primary ways:

| • | Molecular profiling: We use our core proprietary testing platform, computational biology, and information technology capabilities to analyze patient samples from both retrospective and prospective clinical trials. We provide our biopharmaceutical partners comprehensive genomic profiling to enable novel clinical trial designs, enhance patient selection, expand patient populations, and identify novel gene targets. We believe the market opportunity for molecular profiling services to biopharmaceutical partners is in excess of $200 million. A selection of our biopharmaceutical partners for molecular profiling includes Agios Pharmaceuticals, Inc., or Agios, Clovis Oncology, Inc., or Clovis, Novartis Pharmaceuticals Corporation, or Novartis, and Roche Holdings, Inc. and its affiliates, or Roche. |

| • | FoundationCORE Insights: We have more than 68,000 real-world, clinical profiles within FoundationCORE. We assist our biopharmaceutical partners with novel target identification, clinico-genomics data and unique analytic offerings. We believe the market opportunity for FoundationCORE Insights is in excess of $300 million. An example of one of our biopharmaceutical partners for FoundationCORE Insights includes Loxo Oncology, or Loxo. |

| • | Companion Diagnostics: We provide our partners with companion diagnostic development and support to help drive their precision medicine strategies. We utilize the FoundationOne laboratory platform under quality system regulation, or QSR, to enable access to individual targeted therapies with the aim of developing companion diagnostic assays having a premarket approval, or PMA, from the United States Food and Drug Administration, or FDA. We are currently working with Clovis and Mirati Therapeutics, Inc., or Mirati, among others, to develop their companion diagnostic approach. We believe the total addressable market for companion diagnostics is in excess of $100 million over the next five years. |

4

Table of Contents

We believe our companion diagnostic development work is an integral component of our regulated products strategy and the development of a “universal” companion diagnostic that is built on the FoundationOne platform. We believe that by enabling physicians in the future to use one, FDA-approved companion diagnostic platform for multiple drugs requiring a companion diagnostic, we can eliminate much of the guesswork from testing and provide assurance to physicians and their patients that they have the information necessary to make an informed treatment decision.

In addition to generating revenue, these relationships often enable us to identify new cancer genes under investigation that can be incorporated into our platform at an early stage, as well as to participate in the development of the newest oncology therapeutics and practice. We are actively working to expand these relationships.

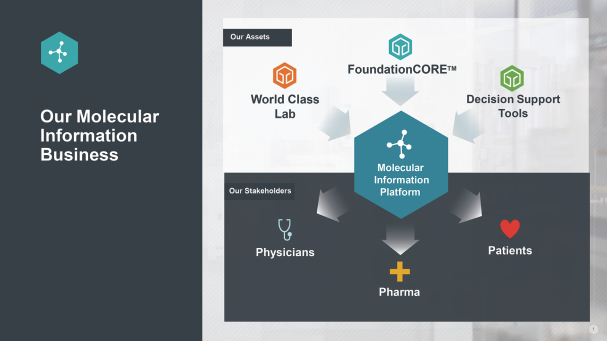

Our Molecular Information Business

We are dedicated to ongoing innovation in our molecular information platform and new product pipeline. Our product development investments have already yielded enhancements to FoundationOne and the platform generally, enabling us to analyze more genes, using less tissue, while reducing turn-around time. We also utilize RNA-based sequencing technology to analyze additional gene fusions commonly found in hematologic malignancies and sarcomas, and we launched FoundationOne Heme, which incorporates this technology, in December 2013. In addition, our efforts to reliably and accurately detect ctDNA led to the launch of FoundationACT for our biopharmaceutical partners for research use in 2015. We plan to commence our commercial launch of FoundationACT to ordering physicians in March 2016. We are exploring and developing new scientifically-advanced and clinically relevant products that include, for example, assays to analyze circulating tumor cells and products that expand our offerings into additional areas such as immune response and disease monitoring. We believe that our development of a suite of product offerings will be instrumental in providing patients and physicians with the comprehensive molecular information needed to evaluate a patient’s cancer and enable more informed treatment decisions.

The increasing availability and understanding of molecular information within the practice of oncology is driving a revolution in the treatment of cancer. We seek to leverage the vast array of genomic data generated by

5

Table of Contents

our molecular information platform together with clinical data to position ourselves at the nucleus of this new treatment paradigm. Our biopharmaceutical partners have already begun using our data to further refine clinical trial design and drug development. In an example of the power of our molecular information platform, after a biopharmaceutical partner’s Phase II trial that used a narrowly focused molecular diagnostic test to screen trial subjects failed to meet its primary endpoint, we performed our comprehensive genomic profile on the tissue collected from trial participants. Our analysis helped our biopharmaceutical partner predict a response to the drug and create new hypotheses to test in Phase III trials, which led to the subsequent U.S. and European approval of the drug and may have increased the target population who could benefit from this therapeutic approach.

Over time, we intend to expand our ability to capture, aggregate, analyze, and facilitate the broader exchange of genomic data across the global oncology community. We are investing in our technology architecture to allow oncologists to share clinical data. Through FoundationICE, PatientMatch, GeneKit, and SmartTrials, as well as data partnerships with leading technology and software companies such as Flatiron Health, Clinical Outcomes and Tracking Analysis, or COTA, and IMS Health, we are building a data platform that efficiently captures and allows for the analysis of data that we believe will create a network effect leading to more users and, in turn, more relevant genomic and clinical data. If we, in conjunction with oncologists, pathologists, biopharmaceutical companies, and academic researchers, can successfully capture and utilize this data, we believe we will play an even more integral role in transforming care for the millions of patients suffering from cancer.

Our Strategic Collaboration with Roche

On January 12, 2015, we announced a broad, strategic collaboration with Roche in the field of molecular information for oncology. The collaboration is a broad multi-part agreement that includes an R&D collaboration, a U.S. educational support collaboration, an ex-U.S. commercial collaboration, a binding term sheet for an in vitro diagnostic product development collaboration and an equity investment with certain governance provisions. We believe this strategic collaboration with Roche will accelerate many aspects of our business strategy and further advance our leadership position in molecular information solutions globally.

Under the terms of the R&D collaboration agreement, Roche may pay potentially more than $150 million over five years to access our molecular information platform and to fund R&D product development programs. Roche will utilize our molecular information platform to standardize its clinical trial testing, enable comparability of clinical trial results for R&D purposes, and better understand the potential for combination therapies. The initial focus of the R&D product development programs will be to develop genomic profiling tests for continuous blood-based monitoring and cancer immunotherapies, and to develop next generation companion diagnostics. As our capabilities increase through our collaboration with Roche, we expect to have more offerings available to existing and new clients.

The commercial collaborations are designed to significantly broaden our reach across international clinical and molecular information markets. Specifically, under the ex-U.S. commercial collaboration, Roche obtained ex-U.S. commercialization rights to our existing products and to future co-developed products. Under the U.S. educational support collaboration, while we remain solely responsible for commercialization of our products within the United States, Roche will engage its medical education team to provide non-branded information to pathologists across the United States specific to comprehensive genomic profiling in cancer.

We closed our strategic transaction with Roche on April 7, 2015. As a result of (1) a primary investment by Roche of $250 million in cash to purchase 5 million newly issued shares of our common stock at a purchase price of $50.00 per share and (2) a tender offer in which Roche acquired 15,604,288 outstanding shares of our common stock at a price of $50.00 per share, Roche became our majority shareholder, and as of December 31, 2015, Roche owned approximately 61% of our outstanding common stock. We maintain our operational independence, with Roche having minority representation on our Board of Directors, or the Board.

6

Table of Contents

Our Strategy

Our objective is to transform the care of patients with cancer by leading the development and commercialization of proprietary molecular information products that inform the diagnosis and treatment of cancer, and that enhance the development of cancer therapies. To achieve this objective, our strategy is to:

| • | Drive awareness and adoption of our suite of molecular information products including FoundationOne, FoundationOne Heme, FoundationACT, and future products we may develop — We have built an experienced, oncology-focused commercial organization, and we continue to collaborate with thought leaders to validate our platform and influence utilization of our products, promote physician interaction, engage with patient advocacy and other key oncology stakeholders, and continue to pursue payment and reimbursement for our products. |

| • | Empower the broader cancer community with molecular information — We are investing in technologies to allow oncologists and pathologists to collaborate and share treatment and other clinical information. We launched FoundationICE, and we continue to develop new and innovative decision support offerings, including PatientMatch, GeneKit and SmartTrials to further this goal. Over time, we intend to expand our capacity to capture, aggregate, analyze and facilitate the broader exchange of genomic and clinical data across the global oncology community—a strategy that we believe eventually will create a network effect encouraging physician participation and the development of substantial amounts of data that, in turn, will positively impact the treatment of cancer. |

| • | Demonstrate the value of our products to patients, physicians, and payors — To illustrate the value of our products, we are educating physicians and payors about the patients most likely to benefit from our products, conducting clinical trials and health economic studies, and communicating our data through peer-reviewed journals and conference presentations. |

| • | Enable biopharmaceutical companies to more effectively develop new cancer therapies — We are continuing to expand our commercial relationships with biopharmaceutical partners to enable us to discover and interrogate new cancer genes, to assist in the development of novel targeted therapeutics and companion diagnostic tests, to improve clinical trial efficiency and outcomes, and to continue our involvement at the cutting edge of cancer treatment. |

| • | Invest in product enhancements and new product innovations — We are developing new molecular information products and conducting research and development into potential products to evaluate and monitor disease progression and better understand markers of response to targeted therapies and immunotherapies. We are also investing resources to advance our companion diagnostics development and our FDA-regulated products strategy. |

Our Industry

Despite enormous investment in research and the introduction of new treatments, cancer remains a critical area of unmet medical need. According to the 2015 American Cancer Society report, “Cancer Facts & Figures 2015,” in 2014 in the United States, nearly 14.5 million people were suffering from cancer, and more than 1.6 million people were expected to be diagnosed with the disease during 2015. Hematologic malignancies, most commonly leukemias, lymphomas, and myelomas, are cancers that affect the body’s blood, lymphatic system, or bone marrow. Taken together, hematologic malignancies account for approximately 10% of new cancer diagnoses in the United States.

The global cancer burden is growing. The World Health Organization predicts in its Global Action Against Cancer publication that in 2020 there will be 16 million new cancer cases and 10 million cancer deaths globally. A recent report by the American Cancer Society, “The Global Economic Cost of Cancer,” estimates that the total annual economic impact of premature death and disability from cancer worldwide is approximately $900 billion.

7

Table of Contents

According to ASCO, there were more than 12,000 practicing oncologists treating patients with cancer in the United States in 2014. Whereas a small portion of oncologists practice in major academic-based cancer centers, the National Cancer Institute estimates that approximately 85% of the oncologists in the United States practice in community-based settings where the vast majority of patients with cancer are treated.

The diagnosis of cancer is complex and multidimensional. Practicing oncologists order multiple tests, including currently available molecular diagnostic tests, to better understand the genomic alterations that are driving their patients’ cancer growth.

Cancer Treatment is Evolving to a Molecular-Based Paradigm

Cancer is not a single disease. The term ‘cancer’ describes a class of diseases characterized by uncontrolled cell growth. Cells can experience uncontrolled growth if there are alterations to DNA, such as damage or mutations, and, therefore, disruption to the genes and proteins regulating cell division.

Surgery is often the first line of therapy for cancer where possible, and, according to the American Cancer Society, most patients with cancer will have some type of surgery. Surgery often presents the greatest chance for a cure, especially if the cancer has been detected early in its development and has not spread to other parts of the body. Many patients, however, require therapeutic intervention beyond surgery alone.

Physicians have used radiation as a cancer therapy since the early 20th century, and modern radiation techniques deliver therapy with significant precision. Nevertheless, even today, radiation’s use and efficacy is limited because the high doses necessary to kill cancer cells often cause damage to healthy cells in the treatment area and fail to kill all cancer cells, particularly if the cancer has spread to other parts of the body.

Physicians began using chemotherapy in the 1940s as a drug therapy approach that acts by killing cells that divide rapidly, one of the main properties of most cancer cells. These cytotoxic therapies are often prescribed by a trial and error approach — both because certain chemotherapies have limited efficacy in some patients and the treatment effect might thus be inconsistent, and because the therapies’ indiscriminate destruction of healthy cells involved in critical biological functions can cause severe toxic side effects in some patients.

More recently, oncologists are integrating a precision medicine approach by utilizing therapeutics that target cancers based on the specific genomic alterations driving their growth. We believe the oncology community is generally beginning to change clinical practice so that oncologists treat each individual’s cancer according to its unique genomic alterations that impact the underlying biological pathways within the patient’s cancer, rather than treating a patient’s cancer based solely on its initial anatomical location in the body, such as the breast, colon or lung. In addition, as a result of advancements in cancer biology and genomic technology that enable the identification of new cancer genes, biopharmaceutical companies are directing more research and development resources towards targeted therapies. There are currently more than 50 approved targeted oncology therapies on the market and approximately 3,100 active clinical trials. More than 830 compounds are in development for the treatment of cancer and, of these compounds, 73% are personalized medicines. In 2014, according to IMS Health, global sales of targeted oncology therapies totaled approximately $50 billion, compared to less than $4.4 billion in 2003.

The rapid increase in molecular information related to cancer, as well as the increasing array of targeted oncology therapeutics, is making it more difficult for physicians to make treatment decisions. The National Comprehensive Cancer Network estimates that 50% to 75% of cancer therapies in the United States are used off label, meaning that physicians prescribe therapies for clinical indications in manners different from those approved by FDA. Off-label usage of traditional cytotoxic therapies is often driven by physicians struggling to treat a patient’s disease after it fails to respond to initial treatment regimens. Targeted therapies are used off label by oncologists who have expertise in genomics or access to diagnostic tools that allow them to make informed decisions about off-label use of targeted therapies.

8

Table of Contents

In order to maximize the utility of diverse cancer-related molecular information to better guide the use of targeted therapies, we believe a new approach is needed. Specifically, the oncology community needs comprehensive genomic information products that can assess the known and biologically relevant genomic alterations, and distill complex molecular information into a concise and actionable format.

Current Challenges of Evaluating Cancer on a Molecular Level

Today, physicians are faced with numerous challenges when making decisions on how to best utilize currently available molecular diagnostics for cancer, including:

| • | the inherent limitations of certain molecular diagnostic tissue tests that analyze only a single or a limited number of genomic markers from tumor tissue and that only identify a subset of the four classes of genomic alterations found in cancers; |

| • | in the case of solid tumors, insufficient and/or poor quality tumor biopsy tissue relative to the amount and quality needed to perform all desired or required tests; and |

| • | difficulty of integrating existing molecular diagnostic tests into clinical practice, including the decisions about which tests to order and how to effectively match the genomic information provided by tests with current targeted therapies or clinical trials. |

Single-Marker or Limited Gene Tissue-based Hotspot Panel Tests Can Be Useful Tools But Often Miss Relevant Information

Most currently available molecular diagnostic tests are single-marker or limited gene “hotspot” panel tests that capture only one or a limited number of the most common, well-known gene alterations that these tests are designed to target. There are four classes of genomic alterations that are clinically relevant to the treatment of cancer: base pair substitutions; copy number alterations; short indels; and gene rearrangements and fusions. Hotspot panel tests generally are only able to identify base pair substitutions and specific gene rearrangements, do not routinely detect copy number alterations, and often lack the sensitivity to identify short indels. In addition, hotspot panel tests are typically incapable of detecting gene fusions, a type of alteration that is a common driver of hematologic malignancies, sarcomas and pediatric cancers, and certain solid tumors.

The following table summarizes the uses and inherent limitations of the current testing methods utilized in commercially available single-marker and hotspot panel tests for cancer, including the most commonly ordered according to results of a 2008 survey of oncologists and hematologists published in the Journal of Clinical Pathology article, “Molecular testing for somatic cancer mutations: a survey of current and future testing in UK laboratories.” Although oncologists may order these tests to look for one or a limited number of specific gene alterations, we believe the inherent limitations of tests using these methods are understood by pathologists and genomicists who perform the tests and the oncologists who order them.

| Name |

Uses |

Limitations | ||

| Polymerase chain reaction, or PCR-based tests, a technology used for amplifying DNA sequences | Enable the detection of short fragment DNA or RNA sequences. | Single-gene tests for specific and limited number of mutations.

Only identify known and select base substitutions and short indels, such as BRAF V600E. | ||

| Immunohistochemical, or IHC, stains, a process used to diagnose abnormal cells | Utilize antibody proteins to identify certain antigens that are unique to various types of cancer. | Only identify the expressed presence of a known and select protein or specific protein marker, such as HER2, related to a particular genomic alteration. | ||

9

Table of Contents

| Name |

Uses |

Limitations | ||

| FISH-based DNA probes, a mechanism for detecting DNA sequences through the use of fluorescent technology | Reveal specific genomic abnormalities, including insertion/deletions and rearrangements. | Only detect select gene rearrangements, such as EML4-ALK.

Difficult to test for multiple markers. | ||

| Flow Cytometry | Detection of tumor cell DNA aneuploidy, the analysis of tumor cell proliferation and the immunophenotyping of leukemias. | Only looks at a limited number of cells, and does not detect broader range of genomic alterations. | ||

| Cytogenetics | Determination of which chromosomal translocations and fusion genes are present in malignant cells. | Cannot detect other types of genomic abnormalities. | ||

Limited Tissue Availability and Poor Tissue Quality Restrict Testing Options

Many clinical tumor samples are provided from standard biopsies, needle biopsies or fine needle aspirates that yield very small tissue amounts. Small amounts of tissue samples limit the number of diagnostic tests a physician can order, and ordering one or a limited number of tests that look for one or a limited number of genomic alterations necessarily increases the likelihood that a physician may fail to identify other genomic alterations and ultimately therapeutic options.

Clinical tumor specimens also often have low tumor purity, meaning that the relevant genomic alterations occur in low frequencies within the sample and are difficult to detect. Moreover, the vast majority of clinical samples are stored as formalin-fixed and paraffin-embedded, or FFPE, specimens. FFPE preservation can damage DNA and RNA. Low tumor purity or damage to DNA or RNA may limit the availability of hotspot panel tests to identify certain genomic alterations.

A Growing Number of Molecular Diagnostics are Often Difficult to Integrate into Clinical Practice

Physicians today face an increasingly difficult decision about which single-marker or hotspot panel tests to order. There are a growing number of tests, each specific to a different cancer type and each having limited ability to detect multiple genomic alterations. Often, in the case of solid tumors, only a small amount of tumor biopsy is available, forcing the physician to order only a subset of desired diagnostic tests, often one test at a time in a serial manner. Furthermore, tests are usually selected based on the traditional treatment paradigm of the cancer’s location in the body or by simple trial and error. Integration of molecular diagnostics into clinical practice is particularly challenging with hematologic cancers in which lack of tissue distinctions within the cancers often lead to misdiagnosis, lack of prognostic information and, thus, mistreatment.

Running multiple, disjointed tests also poses logistical challenges associated with routing samples to several different laboratories and high costs associated with conducting multiple tests. Moreover, limited tissue availability may prevent relevant tests from being ordered, tests conducted may miss genomic alterations, and the results may not be delivered soon enough to be used during the typical treatment cycle for a patient. Even if a physician has enough cancer specimen to order a sufficient number of hotspot panel tests and single gene molecular tests to identify relevant genomic alterations and receives the results of all of these tests in a timely fashion, the physician would commonly receive a series of uncoordinated individual reports from different laboratories that are difficult for non-specialized pathologists or other physicians to interpret and synthesize. Compounding these challenges, especially in the community oncology setting, is how to effectively match the genomic information provided by tests with current targeted therapies or clinical trials for a particular patient. As a result of one or a combination of these current limitations, physicians may fail to identify or to prescribe a potentially appropriate targeted oncology therapy or to direct a patient to a potentially appropriate clinical trial.

10

Table of Contents

The Opportunity for a Single, Comprehensive Molecular Information Solution

In order to harness the potential of understanding the genomic drivers of a patient’s cancer and new therapies targeted at specific genomic alterations, we believe the oncology community needs a new approach: a single molecular information platform that can assess a solid tumor or hematologic malignancy for the presence of biologically relevant genomic alterations from either a tissue specimen or a liquid biopsy. This solution would also provide assistance to physicians in matching the genomic alterations identified in their patients’ cancers with relevant available therapeutic alternatives and clinical trials.

Our molecular information platform, which includes proprietary technology, methods and computational algorithms, is the product of years of research and development and significant capital investment. Through this platform we deliver comprehensive genomic profiling to support physicians in the improvement of clinical patient care and to support biopharmaceutical companies in the development of novel cancer therapeutics. The first molecular information products enabled by our platform are FoundationOne, which is optimized for use with solid tumors, FoundationOne Heme, which is optimized for hematologic cancers, including leukemia, lymphoma and myeloma, as well as many sarcomas, and FoundationACT, which is optimized for use with liquid (blood) samples when solid tumor tissue specimens are insufficient. FoundationOne, our initial clinical product launched in June 2012, is a comprehensive genomic profile that identifies the individual molecular alterations present in a patient’s cancer tumor and matches them with relevant targeted therapies and clinical trials. FoundationOne Heme, our second commercially available product, which we developed in collaboration with Memorial Sloan-Kettering Cancer Center, or MSKCC, and launched in December 2013, is a comprehensive genomic profile that identifies the individual molecular alterations present in a patient’s blood-based cancer and matches them with relevant targeted therapies and clinical trials. FoundationACT, our third molecular information product, enables comprehensive genomic profiling from a blood sample when a tissue biopsy cannot be obtained. FoundationACT was launched to our biopharmaceutical partners for research use in December 2015, and we plan to launch to ordering physicians in March 2016.

Our Suite of Molecular Information Products Integrates Complex Insights into Routine Clinical Care

FoundationOne, FoundationOne Heme, and FoundationACT are, to our knowledge, the first commercially available comprehensive genomic profiles used in the analysis of routine cancer specimens in a clinical setting. We believe these products are the only molecular information products that can comprehensively assess cancer tissue simultaneously for all four classes of genomic alterations with sufficient sensitivity and specificity for routine medical practice. Moreover, these products deliver this complex molecular information in a contextualized report that matches detected molecular alterations with potentially relevant treatment options and clinical trials. We perform our clinical tests in our laboratory located in Cambridge, Massachusetts, which is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, accredited by the College of American Pathologists, or CAP, and licensed by New York, Massachusetts and other states. Optimization and automation enable workflows to deliver medical reports to ordering physicians generally within 11 to 14 days for

11

Table of Contents

FoundationOne and within 15 to 18 days for FoundationOne Heme, in each case from the time the specimen is received. We expect to deliver medical reports to ordering physicians in less than 14 days for FoundationACT once it is launched commercially.

12

Table of Contents

A Comprehensive Clinical Assessment of Relevant Alterations in Cancer Genes from Tissue Biopsies

FoundationOne interrogates the genes known to be somatically altered in human solid tumors that are validated targets for therapy or are unambiguous drivers of cancer. We have selected this set of genes based upon the advice of an international group of key opinion leaders, or KOLs, in oncology and cancer biology, input offered by our biopharmaceutical partners and an extensive review of the relevant literature. The current version of FoundationOne interrogates the entire coding sequence of 315 cancer-related genes for base substitutions, short indels, and copy number alterations, as well as select intronic regions of 28 genes commonly involved in rearrangements. FoundationOne Heme interrogates genes somatically altered in hematologic malignancies and sarcomas that are validated targets for therapy or unambiguous drivers of cancer based on current scientific knowledge. The current version of FoundationOne Heme interrogates 265 cancer-related genes for gene fusions through RNA sequencing and 405 cancer-related genes through DNA sequencing for base substitutions, short indels, and copy number alterations, as well as certain intronic regions of 31 commonly rearranged genes. FoundationOne Heme has been specifically validated to detect gene fusions, a type of alteration that is a common driver in hematologic malignancies, sarcomas, and pediatric cancers, with high accuracy. Both tests include those genes implicated in cancers for which a targeted therapy is FDA-approved and for which targeted therapies are in current or near-term clinical development. We update our tests periodically to reflect new scientific and medical knowledge about cancer biology, including newly relevant cancer genes along with those genes for which there are newly available targeted therapeutics and clinical trials.

The ability of our molecular diagnostic products to identify genomics alterations is greater than other commercially available molecular tests, in part, because we believe our products:

| • | examine the entire coding region of each gene analyzed, enabling much broader interrogation of potential alterations for each gene; |

| • | are the only molecular diagnostic products that can comprehensively assess cancer tissue simultaneously for all classes of genomic alterations; |

| • | assess samples with high sensitivity and specificity across all four classes of genomic alterations for a wide array of cancer-related genes; and |

| • | interrogate more cancer-related genes than many other molecular diagnostic tests. |

A Validated and Highly Precise Process of Testing for Tissue and Liquid Biopsies

Our proprietary methods and workflow make our suite of clinical molecular products suitable for clinical use at a commercial scale. Standard biopsies and needle biopsies obtained in a clinical setting often yield very small tissue amounts that have a low concentration of tumor cells and are preserved in a FFPE format. We have developed proprietary techniques for optimizing pre-sequencing sample preparation and have built post-sequencing computational algorithms that enable our products to be sufficiently sensitive to perform comprehensive genomic profiling on routine clinical tumor samples. We have optimized our processes to maximize throughput, efficiency, and quality.

FoundationOne has undergone extensive analytic validation that demonstrates test performance using both reference specimens and hundreds of actual FFPE clinical cancer specimens having results derived from prior standard diagnostic tests. We performed validation studies in which FoundationOne testing was conducted on previously characterized cell lines known to contain various base substitutions and cancer specimens known to contain various indels and copy number alterations to evaluate whether FoundationOne was capable of detecting these pre-defined genomic alterations. FoundationOne was found to be highly sensitive in identifying these genomic alterations even where the percentage of cells in test samples containing the alterations (versus normal cells not containing the alterations) was very low. Specifically, FoundationOne was able to detect 99% of base substitutions contained in test samples in which less than 10% of the cells contained the base substitutions, 97% of indels in samples in which 10% to 20% of the cells contained the indels, and 99% of copy number alterations of at least 8-fold in which 30% of the cells contained the alterations. In aggregate, FoundationOne detected

13

Table of Contents

greater than 99% of the genomic alterations contained in the samples tested in the validation study. We believe these results demonstrate the importance of our proprietary methods, algorithms, and advanced bioinformatics, and are helping to set the industry standards for validation of comprehensive genomic profiling. The analytic validation results of our studies on FoundationOne were published in Nature Biotechnology in October 2013.

FoundationOne Heme has also undergone extensive analytic validation for both the DNA and RNA sequencing components of the test. Test performance of the DNA component matched the high accuracy achieved by FoundationOne for all classes of genomic alterations. Test performance of the RNA component demonstrated a sensitivity to detect greater than 99% of known gene fusions at 20% tumor content and 97% of known gene fusions at 10% tumor content. The results of our analytic validation studies on FoundationOne Heme were presented at the annual meeting of the American Society of Hematology, or ASH, in December 2013, and we are in the process of submitting this validation work for publication.

FoundationACT, an assay which enables genomic profiling of ctDNA, has undergone extensive analytic validation demonstrating that the assay exceeds requirements for clinical use. Circulating cell-free DNA is highly fragmented, present at very low concentrations in the blood, and contains only a small fraction of ctDNA. We believe many cancer patients may not shed enough detectable tumor DNA into their bloodstream and may thus test negative using ctDNA assays. Therefore, the isolation and identification of ctDNA is extremely challenging. Assay sensitivity and specificity is directly dependent on cell-free DNA extraction and circulating tumor evaluation, high efficiency sample preparation, and capture efficiency combined with custom low frequency variant calling algorithms. We have optimized FoundationACT for sensitivity and specificity of base substitutions, indels, genomic rearrangements, and copy number amplifications. The workflow for FoundationACT is highly reproducible, achieves the required turnaround time, and is compatible with whole blood, plasma and cell-free DNA inputs.

At the annual meeting of the Advances In Genome Biology and Technology, in February 2016, we reported on aspects of our analytic validation study in a presentation entitled, “Assessment of the Relative Clinical Utility of ctDNA and Tissue Biopsies for the Detection of Actionable Genomic Alterations in Routine Clinical Oncology Specimens.” Our analytic validation study demonstrated that FoundationACT results were 100% concordant with FoundationOne and digital droplet PCR results across 87 base substitutions (43 at <5% mutant allele frequency), 3 indels and 5 genomic alterations. The precision and sensitivity observed with FoundationACT passed target performance specifications. We believe, based on the analysis of the literature, that we have the most accurate, highly sensitive and specific, analytically validated assay to measure ctDNA from blood. We are in the process of submitting this analytic validation work for publication.

To support our commercial efforts for FoundationACT and to give providers confidence in using a liquid biopsy assay when tissue is not available, we launched a large, multi-center study to assess the potential utility of this test across various cancers and stages of the disease as well as to refine indications for use. The study will provide additional analytic validation by establishing concordance of the test in detecting genomic alterations from ctDNA as compared to alterations detected in tissue biopsies assessed by FoundationOne. We expect to publish results from this study.

Reports Physicians Can Readily Understand and Use to Guide Patient Care

We designed our test reports, in collaboration with leading oncologists, to deliver clinically relevant information in a manner that seamlessly integrates into their practices. We present the results from our tests in a medically relevant and, we believe, practice-friendly manner that empowers physicians to make informed treatment decisions. During a period of active treatment, patients typically visit their physician every three to four weeks. We report the clinically relevant genomic alterations to a physician for use, generally within 11 to 14 days for FoundationOne and within 15 to 18 days for FoundationOne Heme, in each case from the time the specimen is received. We expect to report results in less than 14 days for FoundationACT.

The first page of the report clearly illustrates the test’s key findings. Specifically, it lists the analyzed cancer’s relevant genomic alterations and matches them with either FDA-approved therapies or open clinical

14

Table of Contents

trials for therapies targeting these alterations. The report also identifies noteworthy absences of genomic alterations typically associated with anatomical tumors of the same type. In addition, the report includes summaries of and references to supporting data from peer-reviewed publications and clinical trial information. All of the information on the report can also be accessed by ordering physicians through the newest version of our online Interactive Cancer Explorer, FoundationICE.

An Example of Page One Findings from a FoundationOne Report

| PATIENT RESULTS |

TUMOR TYPE: BLADDER

UROTHELIAL | |

| 4 genomic alterations |

Genomic Alterations Identified† | |

| 4 therapies associated with potential clinical benefit 0 therapies associated with lack of response 8 clinical trials |

NF2 Y153fs*1 ATM V2119fs*8 ATR splice site 7349+2T>C TP53 R280K | |

|

†For a complete list of the genes assayed, please refer to the Appendix *See Appendix for details |

| THERAPEUTIC IMPLICATIONS

|

|

| ||||

| Genomic Alterations Detected |

FDA Approved Therapies (in patient’s tumor type) |

FDA Approved Therapies (in another tumor type) |

Potential Clinical Trials | |||

| NF2 Y153fs*1 |

None | Everolimus Lapatinib Temsirolimus Trametinib |

Yes, see clinical trials section | |||

| ATM V2119fs*8 |

None | None | Yes, see clinical trials section | |||

| ATR splice site 7349+2T>C |

None | None | Yes, see clinical trials section | |||

| TP53 R280K |

None | None | Yes, see clinical trials section | |||

Note: Genomic alterations detected may be associated with activity of certain FDA-approved drugs; however, the agents listed in this report may have varied clinical evidence in the patient’s tumor type. Neither the therapeutic agents nor the trials identified are ranked in order of potential or predicted efficacy for this patient, nor are they ranked in order of level of evidence for this patient’s tumor type.

We deliver our test reports along with easy access to current information about the reported genomic alterations, associated therapies, and clinical trials. We intend to continue updating our Interactive Cancer Explorer with new important features and applications, such as our recently implemented PatientMatch application, as we gather feedback from our ordering clients over time.

Strong Evidence of Clinically Relevant Findings with FoundationOne

We designed our suite of molecular information products to address challenges associated with the everyday clinical management of patients diagnosed with cancer. We have experienced rapid adoption of our clinical products, and several thousand physicians from large academic centers and community-based practices have ordered FoundationOne or FoundationOne Heme.

15

Table of Contents

We believe that the following case studies illustrate the power of FoundationOne to impact treatment regimens for patients in a clinical setting.

Case Study 1: FoundationOne Heme Identifies a Clinically Relevant Genomic Fusion in Sarcmoa—Patient Receives Targeted Therapy in Clinical Trial

A 41-year-old woman presented with a firm mass in her left groin, which was diagnosed on biopsy as a sarcoma. This tumor was 10 cm in greatest dimension. Multiple nodules ranging in size from 4-13 mm were present in both lungs, and were consistent with widely disseminated disease.

After the initial diagnosis, she began an aggressive treatment plan, including enrolling in a clinical trial with a non-genomically matched targeted therapy, chemotherapy, pre-operative radiation, and limb-sparing surgery. The primary tumor was excised and demonstrated 90% necrosis after five weeks. However, imaging of her chest showed worsening metastatic disease, and the largest nodule was 18 mm. The disease continued to progress and subsequent imaging showed multiple lung nodules greater than 3 cm, with the largest nearly 7 cm, a large increase in size. A FoundationOne Heme test was administered and detected an NTRK1 fusion. Based on this information, the patient enrolled in a Phase I trial of an investigational NTRK inhibitor. Prior to enrolling in this trial, the patient had significant shortness of breath on exertion and required supplemental oxygen. Moreover, imaging showed continued tumor progression with multiple nodules in both lungs. After one cycle of the investigational NTRK inhibitor, the patient exhibited a partial response. After the fourth cycle of this therapy, the patient no longer required supplemental oxygen and imaging demonstrated almost complete tumor disappearance.

Case Study 2: FoundationOne Identifies Clinically Relevant Mutation in Endometrial Cancer—Patient is Enrolled in Clinical Trial of a Check Point Inhibitor

A 54 year old woman presented with irregular vaginal bleeding and was diagnosed with endometrial cancer. She underwent a hysterectomy and was diagnosed with an early stage but high grade endometrioid-type endometrial cancer. The patient declined to undergo radiation therapy and thereafter rapidly developed new abdominal masses, with biopsy showing recurrent cancer. She was then treated with a combination of chemotherapy and radiation therapy, and did well for two years. At that time, the patient developed bulky lymph nodes near her neck, which when biopsied showed a second recurrence of the endometrial tumor. Imaging showed the disease encased the large veins from the lower half of her body, resulting in swelling of both legs, which significantly impeded her quality of life.

The patient then enrolled in a clinical trial of a check point inhibitor. Following administration with the check point inhibitor, she rapidly felt better, as the swelling in her legs was dramatically reduced. Imaging showed a partial response at 8 weeks, and this response has been maintained for 10 months.

To understand this dramatic response, the primary tumor was sent for FoundationOne testing. There were 32 genomic alterations (GA) identified which is a high number relative to an average of 3-5 across cancers. Also, a mutation in DNA polymerase epsilon (POLE) was identified, which impairs how this enzyme corrects errors in the tumor genome. This GA could thus explain the hypermutated phenotype. This is about -5-10 times higher than the ‘average’ tumor. In addition, there were 113 “variants of unknown significance”, also a very high number relative to other cancer cases. Therefore, this patient’s tumor exhibits an extraordinarily high mutation burden consistent with the hypermutator phenotype described for POLE mutant endometrial cancers, which likely correlates to durable clinical benefit she received from a checkpoint inhibitor.

Our Platform for Biopharmaceutical Research and Development

For many of the same reasons our products provide information that is well suited for the clinical setting, our molecular information platform enhances the ability of our biopharmaceutical partners to develop targeted

16

Table of Contents

oncology therapies. We deploy our molecular information platform to analyze tissue samples provided by biopharmaceutical partners from their clinical trials, and we provide our partners access to our FoundationCORE knowledgebase to provide insight into molecular information derived from our analysis. We use our core proprietary platform testing, computational biology, and information technology capabilities to provide our biopharmaceutical partners with comprehensive genomic profiling and information relevant to precision medicine strategies for both retrospective and prospective clinical studies and other drug development activities. Our platform capabilities enable our biopharmaceutical partners to:

| • | accelerate clinical development timelines and increase the likelihood of patient response by prospectively analyzing tumor specimens to identify patients with certain genomic alterations for enrollment in clinical trials for targeted cancer therapeutics; |

| • | understand complex combinations of genomic alterations to facilitate development of companion diagnostic tests that may be necessary to bring a targeted cancer therapeutic to market; |

| • | guide usage and inform future development opportunities for experimental and marketed therapies by retrospectively analyzing clinical trial patients to stratify them as responders or non-responders based on the presence or absence of certain genomic alterations; |

| • | create opportunities for drug combination studies or new target discovery by identifying mechanisms of primary and acquired resistance; and |

| • | inform improvements to clinical trial design by contributing to the understanding of why some clinical studies did not meet their primary endpoints. |

We currently have ongoing relationships with more than 25 biopharmaceutical partners, many of which are leaders in developing targeted cancer therapies, and those relationships have expanded over time. Our publicly announced biopharmaceutical customers include Agios, ARIAD Pharmaceuticals, Inc., Array BioPharma Inc., AstraZeneca UK Limited, Celgene, Clovis, Eisai Co., Ltd., Loxo, Johnson & Johnson, Mirati, Novartis, and Roche.

In addition to customary clinical settings in which physicians prescribe an FDA-approved therapy, approximately 3% of patients with cancer in the United States are currently enrolled in clinical trials of new experimental therapies sponsored by biopharmaceutical companies. By broadening our relationships with our biopharmaceutical partners, we expect to deploy our molecular information platform for an increasing portion of patients with cancer enrolled in clinical trials both inside and outside the United States. In 2014, we announced a collaboration with WuXi PharmaTech Inc., or WuXi, who is performing the laboratory component of our tests for our biopharmaceutical partners in its laboratories in Shanghai. Our partnership with WuXi allows us to offer our comprehensive genomic profiles to biopharmaceutical companies conducting clinical trials in China. We expect our biopharmaceutical partner relationships will continue to expand and will provide more opportunities to sell our molecular information products for companion diagnostic development, research and development projects, and new target discovery and validation. In addition, we believe our strategic collaboration with Roche represents a significant opportunity to further standardize clinical trial testing across many cancer therapeutics development programs, develop additional companion diagnostic products, and grant access to our molecular information knowledgebase, FoundationCORE.

In addition to generating near and long term revenue, we believe our relationships with our biopharmaceutical partners provide us with important strategic opportunities, including enabling us to identify new genes under investigation that can be incorporated early into our molecular information platform and our products, and more broadly allowing us to actively participate in the newest oncology therapeutics and practice. For example, we are providing comprehensive genomic profiling for the Novartis Signature program, which rapidly matches patients to treatments that target their tumor’s molecular alterations and brings the trial to the patient rather than the patient traveling to a trial site. We are also participating in the Lung Cancer Master Protocol (LUNG-MAP) trial, a genomically-driven clinical trial sponsored by a unique collaboration of various

17

Table of Contents

public and private entities. We believe our activities with leading drug development companies that are focused on cancer therapeutics further our relationships with the broader oncology community, including thought leaders who are important to the adoption of our commercial products.

Market Opportunities for FoundationOne, FoundationOne Heme, and FoundationACT

We believe our suite of comprehensive molecular information products will continue to serve as a valuable tool for a greater number of physicians. Aggregating and delivering complex molecular, medical and scientific information in a single report that can be understood and acted upon has become increasingly important, especially as a majority of our test volume is driven by physicians in community-based practices rather than academic medical centers. Physicians in the community setting often see patients across a wide spectrum of cancer types, which can be particularly challenging as new data emerges that is specific to each cancer type. In 2013, approximately 30% of our test volume was driven by physicians in community practices. In each of 2014 and 2015, approximately 60% of our test volume was driven by community physicians. Approximately 80% of patients with cancer in the United States today are treated in community practice settings.

As we deploy our commercialization strategy, we continue to work with our growing network of oncology thought leaders to identify the subsets of patients with metastatic cancer for whom FoundationOne, FoundationOne Heme, and FoundationACT are most likely to positively inform treatment decisions. We are focused on driving awareness of the potential utility of our tests in these subsets of patients, defined as:

| • | patients who test negative under traditional single marker or hotspot panel tests for their tumor type, such as negative for alterations in the genes EGFR, ALK, and KRAS in non-small cell lung cancer, or NSCLC; |

| • | patients from whom a tissue biopsy cannot be obtained or who have insufficient available tissue to perform multiple hotspot panel tests, such as patients with NSCLC with very little tumor tissue left in archive; |

| • | patients for whom standard treatments have been tried and failed, such as patients whose breast cancer continues to progress despite multiple chemotherapy regimens; |

| • | patients with rare or uncommon tumors, such as certain sarcomas or non-colon/small-bowel gastrointestinal tumors, for whom no standard treatment approach exists; and |

| • | patients who have aggressive disease and failed conventional chemotherapy but who maintain adequate functional status, such as some individuals with urothelial cancers or choangiocarcincoma. |

While these groups are not mutually exclusive, we estimate that annually in the United States there are approximately one million patients who suffer from the above-described or similar cancers and who would most benefit from FoundationOne testing, and another approximately one hundred thousand patients who would most benefit from FoundationOne Heme. These estimates are based upon a combination of feedback from our network of oncology thought leaders, data published by the National Cancer Institute in the Cancer Statistics Review, and focused market research that we commissioned.

As the number of available targeted therapies expands and as physicians gain further experience using comprehensive genomic profiling in their routine treatment decisions, we believe that the potential addressable market for comprehensive genomic profiling will expand over the next five years to include most patients who have metastatic disease, not only those patients limited to the challenging treatment categories noted above. These patients may include, for example, those who are earlier in the treatment cycle, those who suffer from a broader set of disease conditions, those patients diagnosed with rare and uncommon cancers regardless of stage, and those for whom tissue is not available and who would benefit from a liquid biopsy assay. We estimate that this potential market expansion in the United States could include an additional 900,000 total patients for FoundationOne, FoundationOne Heme, and FoundationACT annually based upon the same combination of

18

Table of Contents

sources of information we used to estimate the size of the patient population we are initially targeting. Although we expect existing and future diagnostic testing providers to also target these patient populations, we believe our tests are currently the only commercially available comprehensive genomic profiles that comprehensively assess cancer tissue simultaneously for all four classes of genomic alterations across all cancer-related genes with the sensitivity and specificity required for routine medical practice. In addition, we believe that our ex-U.S. commercialization agreement with Roche provides us with expert access to global markets and an estimated additional two million patients worldwide.

Commercialization Strategy

We continue to create awareness and drive adoption of our comprehensive molecular information products through our commercialization strategy to:

| • | build an experienced, fully-integrated, oncology-focused commercial organization in the United States; |

| • | expand our footprint globally through our ex-U.S. commercial agreement with Roche; |

| • | collaborate with oncology thought leaders, leading academic institutions, and community-based oncology networks/practices on FoundationOne, FoundationOne Heme and FoundationACT clinical cases, clinical research, publications, and product development; |

| • | drive broader adoption and increased ordering frequency per physician by offering differentiated programs, ongoing product innovation, new technology tools, applications, and services such as FoundationICE, PatientMatch, GeneKit, and SmartTrials, that provide easier access to clinically relevant information and an active medical affairs team to build and support new and ongoing client relationships; |

| • | publish important medical and scientific data in top-tier peer-reviewed journals and present at major industry conferences; |

| • | demonstrate improved clinical outcomes and health economic data to support broad reimbursement from third-party and government payors for comprehensive genomic profiling; |

| • | work with patient advocacy groups and medical societies to create greater awareness of our products and the importance of incorporating molecular diagnostics into cancer treatment; and |

| • | facilitate broader access to care through our patient assistance and access programs, including FoundationACCESS, and our technology tools and applications. |