Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DARLING INGREDIENTS INC. | d141404d8k.htm |

| EX-99.1 - EX-99.1 - DARLING INGREDIENTS INC. | d141404dex991.htm |

Fourth Quarter & Fiscal Year End 2015

Earnings Conference Call

March 2, 2015 Creating sustainable food, feed and fuel ingredients for a growing population Randall C. Stuewe, Chairman and CEO John O. Muse, EVP Chief Financial Officer

Exhibit 99.2 |

Creating sustainable food, feed and fuel ingredients for a growing

population Safe Harbor Statement

This presentation contains “forward-looking” statements

regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,”

“expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that

may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and

uncertainties beyond its control, each of which could

cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available

to the Company for payments on the Company's indebtedness

or other purposes; unanticipated costs or operating problems related to the acquisition and integration of Rothsay and Darling Ingredients International (including transactional costs and integration of the new enterprise resource planning

(ERP) system); global demands for bio-fuels and grain

and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to

the Company due to weak

margins in the meat production industry as a result of higher feed

costs, reduced consumer demand or other factors, reduced volume from food service establishments, reduced demand for animal feed, or otherwise; reduced finished product prices; continued decline in fat and

used cooking oil finished

product prices; changes to worldwide government policies relating to

renewable fuels and greenhouse gas emissions that adversely

affect programs like the

Renewable Fuel Standards Program (RFS2) and tax credits for biofuels

both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of Bird Flu

including, but not limited to H5N1 flu, bovine spongiform

encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the

existing or unforeseen new U.S. or foreign regulations

(including, without limitation, China) affecting the industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated with the renewable diesel

plant in Norco, Louisiana owned and operated by a joint

venture between Darling Ingredients and Valero Energy Corporation, including possible unanticipated operating disruptions; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s

pension and benefit plans, including multiemployer and

employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and

registrations; continued or escalated conflict in the

Middle East, North Korea, Ukraine or elsewhere; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global

economies, disturbances in world financial, credit,

commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the

Company's results of operations. Among other things,

future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or

discontinued at any time and purchases of shares under

the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time

to time in the Company’s filings with the Securities

and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

2 |

Creating sustainable food, feed and fuel ingredients for a growing

population 2015 Fourth Quarter and Year End Overview

• Strong performance by International while USA impacted by 4 th quarter pricing swing o Rendering raw material volumes remain strong globally o USA fat prices made significant bounce early in Q1 2016 anticipating improved demand from LCFS

o USA Protein premiums rebounded after collapsing in Q4 due to very strong slaughter and limited demand

o Europe fat prices improving while protein prices feeling similar glut situation

o Food Segment lead by Rousselot with improved demand, new capacity on line and solid margins

o Fuel Segment strong with core business and retroactive Canadian Tax Credit

• Reported Pro Forma Adjusted EBITDA--$103.1 million in Q4 vs.$107.4 million in Q3

o FX impact versus prior quarter of $1.6 million o Fats down 17% in Quarter while Proteins down 30% in USA o USA cash prices and premiums down even more, sharp rebound in Q1 of 2016 o Formula lag, lower UCO prices and inventory adjustments impacted USA o Feed segment expected to rebound in Q1 • Diamond Green Diesel (DGD) – produced 159 million gallons in 2015 – 25% increase from 2014 • 2015 EBITDA: $177 million entity level or $88 million Darling’s share

• Net debt in JV of $104.5 million • Accretive $0.435 cents per share for fiscal 2015 • Anticipate dividend in late Q1 of 2016 • Renewable diesel demand is strong with improving LCFS premiums throughout North America and Europe

3 |

Creating sustainable food, feed and fuel ingredients for a growing

population Q4 2015 paid down debt by $42.4 million; Fiscal 2015

total debt paid down of $118.2 million Reduced total debt in 2015

to $1.96 billion / Total Debt Leverage Ratio of 4.32 at year end

Targeting debt reduction of $150 million in 2016 / YE Target Total Debt

Leverage Ratio below 4.00 CAPEX of $229.8 million in

2015----inclusive of 3 new plants and 1 major expansion On schedule with two new U.S. rendering plants during Q3 – Q4 2016 Improved cash impact to Working Capital by $72.7 million in 2015 over 2014

Reduced SG&A by $52.0 million in Fiscal 2015 compared to Fiscal

2014 2016 focus on lowering debt, improving margins, cost

efficiencies, growing base business, and capitalizing on LCFS

margin opportunities 4

Continuing Long Term Strategy - “Delever and Grow” |

Creating sustainable food, feed and fuel ingredients for a growing

population January 2,

October 3, January 2, Janaury 3, 2016 2015 2016 2015 Revenues 809,675 $ 853,762 $ 3,397,446 $ 3,956,443 $ Gross profit 179,768 182,441 743,421 833,272 Selling, general and administrative expenses 76,623 75,026 322,574 374,580 Depreciation and amortization 69,934 67,327 269,904 269,517 Acquisition and integration costs 492 1,280 8,299 24,667 Interest expense 23,308 24,828 105,530 135,416 Foreign currency gain/(loss) (1,612) (2,461) (4,911) (13,548) Other income/(expense), net (6,135) 1,004 (6,839) 299 Equity in net income/(loss) of unconsolidated subsidiary 83,073 (12,021) 73,416 65,609 Income before taxes 84,737 502 98,780 81,452 Income tax expense/(benefit) (1,138) 7,859 13,501 13,141 Net income/(loss) 85,875 (7,357) 85,279 68,311 Net (income)/loss attributable in minority interests (1,446) (1,730) (6,748) (4,096) Net income/(loss) attributable to Darling 84,429 $ (9,087) $

78,531 $

64,215 $

Earnings/(loss) per share (fully diluted)

0.52 $

(0.06) $

0.48 $

0.39 $

Three Months Ended - Sequential

Twelve Months Ended - Year over Year

Earnings Summary

5 |

Creating sustainable food, feed and fuel ingredients for a growing

population Adjusted EBITDA and Pro Forma Adjusted EBITDA

(US$ in thousands) January 2, October 3, January 2, January 3, 2016 2015 2016 2015 Net income/(loss) attributable to Darling $ 84,429 $ (9,087) $ 78,531 $ 64,215 Depreciation and amortization 69,934 67,327 269,904 269,517 Interest expense 23,308 24,828 105,530 135,416 Income tax expense/(benefit) (1,138) 7,859 13,501 13,141 Foreign currency (gain)/loss 1,612 2,461 4,911 13,548 Other expense/(income), net 6,135 (1,004) 6,839 (299) Equity in net (income)/loss of unconsolidated subsidiaries (83,073) 12,021 (73,416) (65,609) Net income attributable to noncontrolling interests 1,446 1,730 6,748 4,096 Adjusted EBITDA $ 102,653 $ 106,135 $ 412,548 $ 434,025 Non-cash inventory step-up associated with VION Acquisition – – – 49,803 Acquisition and integration-related expenses 492 1,280 8,299 24,667 Darling Ingredients International - 13th week (1) – – – 4,100 Pro Forma Adjusted EBITDA (Non-GAAP) $ 103,145 $ 107,415 $ 420,847 $ 512,595 Foreign currency exchange impact $ 1,607 – $ 48,961 – Pro Forma Adjusted EBITDA to Foreign Currency (Non-GAAP) (2) $ 104,752 $ 107,415 $ 469,808 $ 512,595 DGD Joint Venture Adjusted EBITDA (Darling's Share) (3) $ 86,548 $ (8,309) $ 88,494 $ 81,639 Three Months Ended - Sequential Fiscal Year Ended Adjusted EBITDA (1) January 7, 2014 closed on VION Ingredients, thus the 13th week would be revenue adjusted for January 1, 2014

through January 7, 2014 (2) Foreign currency exchange rates held constant for comparable quarters (euro/USD 1.11303 rate October 3, 2015 quarter and euro/USD 1.31878 rate

January 3, 2015 twelve months). (3) Darling's Pro forma Adjusted EBITDA

(Non-GAAP) in the above table does not include the DGD Joint Venture adjusted EBITDA (Darling's share) if we had consolidated the DGD Joint Venture. 6 |

Creating sustainable food, feed and fuel ingredients for a growing

population Cash Flow Statement

7 Cash Flow Statement Year Ended (US$ in thousands) January 2, 2016 Adjusted EBIDTA $

412,548

Uses: Cap-Ex (229,848) Acquisitions (377) Proceeds from Stock Issuance 171 Stock Repurchase (5,912) Borrowings, net of repayments (107,021) Deferred Loan Costs (17,310) Cash Interest (10-K) (78,979) Cash Taxes (10-K) 3,035 Accounts Receivable 8,214 Income Tax 12,377 Inventory and Prepaid 34,536 Accounts Payable and Accrued Expenses (11,449) Increase in Cash (48,100) Distribution of Earnings from Unconsolidated Subsidiaries 26,589 NonControlling Interest, net (3,382) Other 4,908 Adjusted EBITDA $

(412,548) |

Creating sustainable food, feed and fuel ingredients for a growing

population Balance Sheet Highlights and Debt Summary

Debt Summary Balance Sheet Highlights Cash Debt Pay Down Leverage Ratios Net Debt on Balance Sheet January 2, 2016 Actual Credit Agreement Total Debt to EBITDA: 4.32 5.50 Secured Debt to EBITDA: 1.93 3.75 (US$, in thousands) January 2, 2016 Fourth Quarter 2015 42,394 $ Year-to-Date 118,201 $ (US$, in thousands) Fiscal 2014 Fiscal 2015 Total Debt 2,152,440 $ 1,960,000 $ Available Cash (108,784) $ (156,884) $ Year End Net Debt Balance 2,043,656 $ 1,803,116 $ Net Debt Reduction from 2014: 240,540 $ 8 (US$, in thousands) January 2, 2016 Cash (includes restricted cash of $331)

157,215 $ Accounts receivable 371,392 Total Inventories

344,583 Net working capital

931,788 Net property, plant and equipment

1,508,167 Total assets 4,789,602 $ Total debt 1,960,000 $ Shareholders' equity 1,974,610 $ (US$, in thousands) January 2, 2016 Amended Credit Agreement Revolving Credit Facility 9,358 $

Term Loan A

277,181 Term Loan B 589,500 5.375% Senior Notes due 2022 500,000 4.750% Euro Senior Notes due 2022 560,912 Other Notes and Obligations 23,049 Total Debt: 1,960,000 $ |

Creating sustainable food, feed and fuel ingredients for a growing

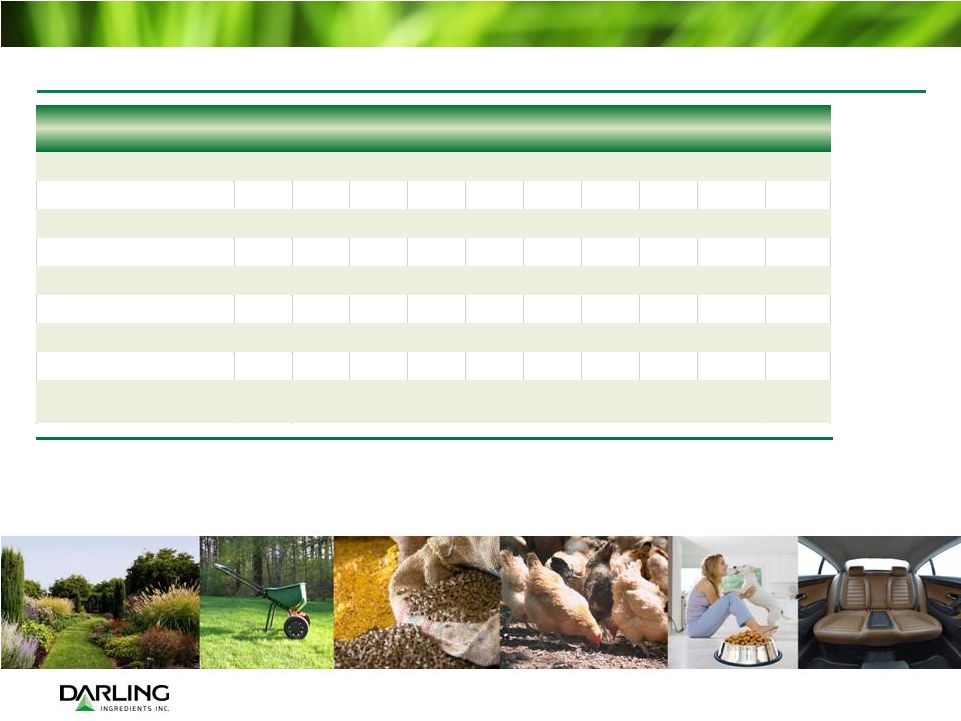

population Feed Segment

Operational Overview –

Q4 2015 2015 EBITDA Margin Feed 13.8% 14.3% 14.6% 11.5% • USA rendering impacted by non-formula business due to collapsing Q4 prices • Pet food premiums collapsed but have rebounded • UCO prices hit decade lows • Wet Pet Food start-up costs approx. $3 mm • Bakery solid performance • International rendering delivered as per plan • Global protein/meal glut developed in Q4…situation is improving • Fat markets have sharply bounced back with interesting developments in LCFS demand 9 Note: Cost of Sales includes raw material costs, collection costs and factory costs.

US$ and metric tons

(millions) Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Delta % Y over Y Revenue $2,421.5 $547.5 $529.4 $525.2 $472.2 $2,074.3 -14.3% Gross Margin 556.6 123.5 124.5 116.2 96.7 460.9 -17.2% Gross Margin % 23.0% 22.6% 23.5% 22.1% 20.5% 22.2% Operating Income 192.3 35.4 35.4 35.6 10.1 116.5 -39.4% EBITDA 351.1 75.5 75.9 76.5 54.4 282.3 -19.6% EBITDA/Revenue 14.5% 13.8% 14.3% 14.6% 11.5% 13.6% Raw Material Processed (million metric tons) 7.12 1.87 1.83 1.86 1.89 7.45 4.6% $351.1 ($321.4) $97.3 $153.8 $18.1 ($16.6) $298.6 $282.3 $0 $50 $100 $150 $200 $250 $300 $350 $400 EBITDA 2014 Price/Yield Volumes Cost of Sales Other Adjusted FX Impact EBITDA 2015 EBITDA

2015 EBITDA Bridge 2014 to 2015 (millions) 5 7 9 11 13 15 17 Q1 Q2 Q3 Q4 2015 2015 2015 2015 |

Creating sustainable food, feed and fuel ingredients for a growing

population Jacobsen, Wall Street Journal and Thomson Reuters

Historical Pricing Yellow Grease pricing

lower •

Pricing down 17% in Q4 but rebounding in early 2016

• Limited biofuel demand, warmer winter limiting feed demand Protein pricing down over 30% from 2014 • Over supply of soy meal, meat and bone meal, and poultry meals • Warmer winter limiting feed demand • Slow export demand • Poultry Meal Pet Food premiums narrowed QTR. Over QTR. Year Over Year Comparison Q3-2015 Q4-2015 % Q4-2014 Q4-2015 % Average Jacobsen Prices (USD) Avg. Avg. Change Avg. Avg. Change Bleachable Fancy Tallow - Chicago Renderer / cwt $29.42 $21.18 -28.0% $31.78 $21.18 -33.4% Yellow Grease - Illinois / cwt $21.48 $17.86 -16.9% $25.56 $17.86 -30.1% Meat and Bone Meal - Ruminant - Illinois / ton $354.91 $249.29 -29.8% $392.68 $249.29 -36.5% Poultry By-Product Meal - Feed Grade - Mid South/ton $391.55 $334.67 -14.5% $492.76 $334.67 -32.1% Poultry By-Product Meal - Pet Food - Mid South/ton $532.45 $469.49 -11.8% $746.52 $469.49 -37.1% Feathermeal - Mid South / ton $499.12 $367.06 -26.5% $672.63 $367.06 -45.4% Average Wall Street Journal Prices (USD) Corn - Track Central IL #2 Yellow / bushel $3.62 $3.64 0.6% $3.41 $3.64 6.7% Average Thomson Reuters Prices (USD) Palm oil - CIF Rotterdam / metric ton $558 $563 0.9% $718 $563 -21.6% Soy meal - CIF Rotterdam / metric ton $380 $352 -7.4% $486 $352 -27.6% USD/Euro Avg. Exchange Rates 1.113 1.094 -1.7% 1.328 1.094 -17.6% USD/Canadian Avg. Exchange Rates 0.763 0.749 -1.8% 0.916 0.749 -18.2% 2016 Finished Product Pricing Feed Segment Ingredients January Bleachable Fancy Tallow - Chicago Renderer / cwt $23.53 Yellow Grease - Illinois / cwt $19.03 Meat and Bone Meal - Ruminant - Illinois / ton $184.74 Poultry By-Product Meal - Feed Grade - Mid South/ton $247.11 Poultry By-Product Meal - Pet Food - Mid South/ton $498.03 Feathermeal - Mid South / ton $255.39 2016 Cash Corn Pricing Competing Ingredient for Bakery Feeds and Fats January Corn - Track Central IL #2 Yellow / bushel $3.58 European Benchmark Pricing 2016 January Palm oil - CIF Rotterdam / metric ton $565 Soy meal - CIF Rotterdam / metric ton $339 10 |

Creating sustainable food, feed and fuel ingredients for a growing

population Note: Cost of Sales includes raw material costs, collection

costs and factory costs. •

Strong performance by Rousselot

• New USA capacity on line • Increased raw material availability aided margins globally • China performance solid • South American margin improvement • CTH showed improved margins on hog casings and improved marketing of edible products • Sonac fat melting margins and volumes consistent Food Segment 2015 EBITDA Margin Food 10.4% 11.4% Operational Overview – Q4 2015 $100.1 $31.4 $23.8 $1.6 $152.5 $128.1 ($4.4) ($24.4) $50 $100 $150 $200 EBITDA 2014 Price/Yield Volumes Cost of Sales Other Adjusted EBITDA 2015 FX Impact EBITDA 2015 EBITDA Bridge 2014 to 2015 (millions) 11 US$ and metric tons (millions) Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Delta % Y over Y Revenue $1,248.4 270.2 283.4 269.2 272.1 $1,094.9 -12.3% Gross Margin 218.9 53.5 60.2 54.8 62.9 231.4 5.7% Gross Margin % 17.5% 19.8% 21.2% 20.4% 23.1% 21.1% Operating Income 26.9 10.8 15.5 11.6 23.3 61.2 127.5% EBITDA 100.1 28.0 32.3 28.7 39.1 128.1 28.0% EBITDA/Revenue 8.0% 10.4% 11.4% 10.7% 14.4% 11.7% Raw Material Processed (million metric tons) 1.05 0.27 0.28 0.26 0.26 1.07 1.9% 10.7% 14.4% 8 9 10 11 12 13 14 15 Q1 2015 Q2 2015 Q3 2015 Q4 2015 |

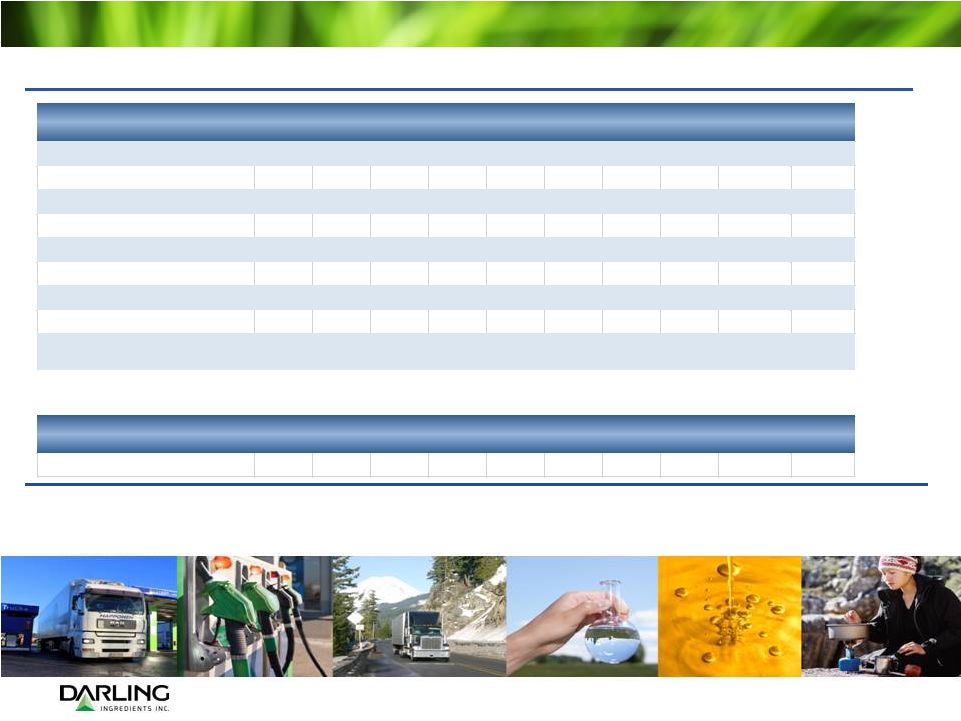

Creating sustainable food, feed and fuel ingredients for a growing

population Operational Overview –

Q4 2015 Fuel Segment *Excludes raw material processed at the DGD joint venture. 2015 EBITDA Margin Fuel • Canadian bio fuels delivered improved performance with reinstatement of blenders tax credit. Prospective 2016 credit will improve quarterly results. • Rendac—volumes strong and delivered improved results. • ECOSON—plant experienced fire in Q4. Business interruption insurance will mitigate impact. $49.2 ($43.8) $26.8 $19.8 ($0.1) ($8.0) $51.9 $43.9 $0 $20 $40 $60 EBITDA 2014 Price/Yield Volumes Cost of Sales Other Adjusted EBITDA 2015 FX Impact EBITDA 2015 EBITDA Bridge 2014 to 2015 (millions) 12 Note: Cost of Sales includes raw material costs, collection costs and factory costs.

US$ and metric tons

(millions) Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Delta % Y over Y Revenue $286.6 57.0 46.5 59.3 65.4 $228.2 -20.4% Gross Margin 57.8 13.2 6.3 11.4 20.2 51.1 -11.6% Gross Margin % 20.2% 23.1% 13.5% 19.2% 30.9% 22.4% Operating Income 21.3 2.5 2.0 0.2 12.5 17.2 -19.2% EBITDA 49.2 9.1 8.6 7.0 19.2 43.9 -10.8% EBITDA/Revenue 17.2% 16.0% 18.5% 11.8% 29.4% 19.2% Raw Material Processed * (million metric tons) 1.07 0.30 0.29 0.27 0.31 1.17 9.3% 18.5% 11.8% 29.4% 16.0% 5 10 15 20 25 30 35 Q1 2015 Q2 2015 Q3 2015 Q4 2015 |

Creating sustainable food, feed and fuel ingredients for a growing

population Diamond Green Diesel 2015 Highlights

(50% Joint Venture)

EBITDA of $177.0 million, record

earnings Cash balance of $44.2 million at year end

Total debt of $148.8 million in joint venture; net debt of $104.6 million

Produced 159

million gallons of renewable diesel in 2015

Biofuels Blenders Tax Credit made retrospective for 2015 and prospective for

2016 Expect to receive $157.0

million from tax credit by end of March 2016 Completed first plant

turn around in 18 days on February 18, 2016 Anticipate $30 - $35 million dividend for

2016 Contemplating major expansion to 18,000 barrels per day by end

of 2017 Number one priority is recapitalization of current credit

facility. 13

Diamond Green Diesel (50% Joint Venture)

US$ (millions) Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 EBITDA (Darling's share) $81.6 2.3 7.9 (8.3) 86.6 88.5 Gallons Produced 127.3 37.5 41.9 41.5 37.9 158.8 (US$, in thousands) Fiscal 2014 Fiscal 2015 Total Debt 212,787 $ 148,842 $ Available Cash 21,901 $ 44,247 $ Year End Net Debt Balance 190,886 $ 104,595 $ Net Debt Reduction from 2014: 86,291 $ DGD Net Debt on Balance Sheet |

Appendix –

Additional Information |

Creating sustainable food, feed and fuel ingredients for a growing

population Adjusted (Non-GAAP) Diluted EPS

Note: Adjustments to diluted earnings per share of acquisition related items are net of

tax. Calculations of all adjustment tax amounts were at the applicable

effective tax rate for the period, except for the impact of the biofuel tax incentives

and nonrecurring acquisition and integration costs. The effective tax rate used for calculating non GAAP Adjusted EPS in the above table for the years ended January 2, 2016 and January 3, 2015 was 42.2% and 37.1%,

respectively.

15 January 2, January 3, 2016 2015 Reported Earnings Per Share (fully diluted) $ 0.48 $ 0.39 Adjustments: Non-cash inventory step-up associated with VION Acquisition – 0.19 Acquisition and integration costs 0.03 0.13 Amortization of intangibles 0.29 0.32 Non-operating casualty losses and legal settlement 0.02 – Redemption premium on 8.5% Senior Notes and write off deferred loan costs – 0.12 Write-off deferred loan costs euro term loan B 0.03 – Foreign currency price risk VION Acquisition – 0.05 Adjusted diluted earnings per share attributable to Darling (Non-GAAP) $ 0.85 $ 1.20 Weighted average shares of common stock outstanding (in thousands) 165,119 165,059 Fiscal Year Ended |

Creating sustainable food, feed and fuel ingredients for a growing

population 16

Change in Net Sales -

YTD 2014 to 2015 Fats Proteins Used Cooking Oil Bakery Other Total Net sales full year ended January 3, 2015 659.0 $ 979.8 $ 190.3 $ 221.7 $ 370.7 $ 2,421.5 $ Changes: Increase in sales volumes 28.4 34.1 3.1 28.3 - 93.9 Decrease in finished good prices (124.1) (118.6) (37.6) (32.1) - (312.4) Decrease due to currency exchange rates (23.5) (66.8) (1.8) - (34.4) (126.5) Other change - - - - (2.2) (2.2) Total Change: (119.2) $ (151.3) $ (36.3) $ (3.8) $ (36.6) $ (347.2) $ Net sales full year ended January 2, 2016 539.8 $ 828.5 $ 154.0 $ 217.9 $ 334.1 $ 2,074.3 $ Change in Net Sales - 3Q15 to 4Q15 Fats Proteins Used Cooking Oil Bakery Other Total Net Sales Third Quarter 2015 136.1 $ 210.1 $ 39.6 $ 55.9 $ 83.5 $ 525.2 $ Changes: Increase/(Decrease) in sales volumes (0.2) 8.5 (2.6) (1.7) - 4.0 Increase/(Decrease) in finished good prices (18.3) (28.7) (1.7) (0.3) - (49.0) Decrease due to currency exchange rates (0.5) (1.4) (0.1) - (0.6) (2.6) Other change - - - - (5.4) (5.4) Total Change: (19.0) $ (21.6) $ (4.4) $ (2.0) $ (6.0) $ (53.0) $ Net Sales Fourth Quarter 2015 117.1 $ 188.5 $ 35.2 $ 53.9 $ 77.5 $ 472.2 $ Feed Ingredients Segment Change in Net Sales - Year over Year (2014 over 2015) and Sequential (3Q15 Quarter over 4Q15 Quarter) |

Creating sustainable food, feed and fuel ingredients for a growing

population Feed Ingredients Segment

Change in Net Sales - 2Q15 to 3Q15

Fats

Proteins Used Cooking Oil Bakery Other Total Net Sales Second Quarter 2015 139.9 $ 209.9 $ 43.1 $ 54.3 $ 82.2 $ 529.4 $ Changes: Increase/(Decrease) in sales volumes 1.1 5.0 (0.2) (0.5) - 5.4 Increase/(Decrease) in finished good prices (3.9) (2.6) (3.2) 2.2 - (7.4) Decrease due to currency exchange rates (1.0) (2.2) (0.2) - - (3.4) Other change - - - 1.3 1.3 Total Change: (3.8) $ 0.2 $ (3.6) $ 1.7 $ 1.3 $ (4.1) $ Net SalesThird Quarter 2015 136.1 $ 210.1 $ 39.6 $ 55.9 $ 83.5 $ 525.2 $ Change in Net Sales - 1Q14 to 1Q15 Fats Proteins Used Cooking Oil Bakery Other Total Net Sales First Quarter 2014 157.0 $ 233.2 $ 44.8 $ 54.2 $ 96.9 $ 586.1 $ Changes: Increase in sales volumes 10.1 7.0 0.9 10.9 - 28.9 Decrease in finished good prices (13.8) (3.1) (9.2) (11.3) - (37.4) Decrease due to currency exchange rates (6.6) (17.1) (0.4) - (10.4) (34.5) Other change - - - 4.4 4.4 Total Change: (10.3) $ (13.2) $ (8.7) $ (0.4) $ (6.0) $ (38.6) $ Net Sales First Quarter 2015 146.7 $ 220.0 $ 36.1 $ 53.8 $ 90.9 $ 547.5 $ 17 Change in Net Sales - Three Months Ended (Sequential Quarter over Quarter)

|

Creating sustainable food, feed and fuel ingredients for a growing

population Feed Ingredients Segment -

Change in Net Sales - 3Q14 to 3Q15

Fats

Proteins Used Cooking Oil Bakery Other Total Net Sales Third Quarter 2014 171.8 $ 249.6 $ 39.7 $ 54.1 $ 92.1 $ 607.3 $ Changes: Increase in sales volumes 11.7 14.7 3.0 7.4 - 36.8 Decrease in finished good prices (41.2) (36.6) (2.5) (5.6) - (85.9) Decrease due to currency exchange rates (6.2) (17.6) (0.6) - (8.4) (32.8) Other change - - - - (0.2) (0.2) Total Change: (35.7) $ (39.5) $ (0.1) $ 1.8 $ (8.6) $ (82.1) $ Net SalesThird Quarter 2015 136.1 $ 210.1 $ 39.6 $ 55.9 $ 83.5 $ 525.2 $ 18 Change in Net Sales - 4Q14 to 4Q15 Fats Proteins Used Cooking Oil Bakery Other Total Net Sales Fourth Quarter 2014 164.3 $ 245.1 $ 47.5 $ 54.0 $ 95.1 $ 606.0 $ Changes: Increase in sales volumes (5.7) 0.4 (2.2) (2.9) - (10.4) Decrease in finished good prices (37.0) (44.5) (9.6) 2.8 - (88.3) Decrease due to currency exchange rates (4.5) (12.5) (0.5) - (5.7) (23.2) Other change - - - - (11.9) (11.9) Total Change: (47.2) $ (56.6) $ (12.3) $ (0.1) $ (17.6) $ (133.8) $ Net Sales Fourth Quarter 2015 117.1 $ 188.5 $ 35.2 $ 53.9 $ 77.5 $ 472.2 $ Change in Net Sales - 2014 over 2015 (Qtr. over Qtr.) |

Creating sustainable food, feed and fuel ingredients for a growing

population Feed Ingredients Segment -

19 Change in Net Sales - 2014 over 2015 (Qtr. over Qtr.) Change in Net Sales - 2Q14 to 2Q15 Fats Proteins Used Cooking Oil Bakery Other Total Net Sales Second Quarter 2014 165.9 $ 251.9 $ 58.3 $ 59.4 $ 86.6 $ 622.1 $ Changes: Increase in sales volumes 12.3 12.0 1.4 12.9 - 38.6 Decrease in finished good prices (32.1) (34.4) (16.3) (18.0) - (100.8) Decrease due to currency exchange rates (6.2) (19.6) (0.3) - (9.9) (36.0) Other change - - - - 5.5 5.5 Total Change: (26.0) $ (42.0) $ (15.2) $ (5.1) $ (4.4) $ (92.7) $ Net Sales Second Quarter 2015 139.9 $ 209.9 $ 43.1 $ 54.3 $ 82.2 $ 529.4 $ Change in Net Sales - 1Q14 to 1Q15 Fats Proteins Used Cooking Oil Bakery Other Total Net Sales First Quarter 2014 157.0 $ 233.2 $ 44.8 $ 54.2 $ 96.9 $ 586.1 $ Changes: Increase in sales volumes 10.1 7.0 0.9 10.9 - 28.9 Decrease in finished good prices (13.8) (3.1) (9.2) (11.3) - (37.4) Decrease due to currency exchange rates (6.6) (17.1) (0.4) - (10.4) (34.5) Other change - - - 4.4 4.4 Total Change: (10.3) $ (13.2) $ (8.7) $ (0.4) $ (6.0) $ (38.6) $ Net Sales First Quarter 2015 146.7 $ 220.0 $ 36.1 $ 53.8 $ 90.9 $ 547.5 $ |

Creating sustainable food, feed and fuel ingredients for a growing

population Foreign Currency Impact

o The U.S. dollar has strengthened against most of the functional currencies used by the

Company’s non-domestic operations.

o Using actual results for fiscal year 2014 and comparing the yearly average rates to the

average rates for fiscal year 2015, the impact of the strengthened dollar would

result in an annual decrease in net sales and EBITDA of

approximately $383.2 million

and approximately

$49.0 million, respectively if the same amount of non-domestic operations

were attained in fiscal 2015.

o The U.S. dollar continues to strengthen at the time of this filing. The impact is mainly affected

by the drop in the Euro in comparison to the U.S. dollar.

Assumptions: 20 Exchange Rate: Avg. 2014 Avg. Q1 2015 Avg. Q2 2015 Avg. Q3 2015 Avg. Q4 2015 Avg. 2015 Euro/USD 1.31878 1.126696 1.105606 1.113029 1.093438 1.107754 CAD/USD 0.90395 0.803378 0.813084 0.763154 0.739957 0.774775 |

Creating sustainable food, feed and fuel ingredients for a growing

population (1)

Has impact of inventory step-up in

1 st and 2 nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International

13 th week. (3) Raw material process volumes have been adjusted to include additional blending materials.

(A) Quarters 1, 2 and 3 revenues have been adjusted for re-class

between sales and cost of sales. Feed

Segment - Historical 21 US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Revenue (A) $586.1 $622.1 $607.3 $606.0 $2,421.5 $547.5 $529.4 $525.2 $472.2 $2,074.3 Gross Margin (1) 142.5 165.4 132.5 132.5 572.9 123.5 124.5 116.2 96.7 460.9 Gross Margin % (1) 24.3% 26.6% 21.8% 21.9% 23.7% 22.6% 23.5% 22.1% 20.5% 22.2% Operating Income (2) 37.5 74.7 46.4 33.6 192.2 35.4 35.4 35.6 10.1 116.5 Adjusted Operating Income (1) 52.4 76.2 46.4 33.6 208.6 35.4 35.4 35.6 10.1 EBITDA (2) 76.1 114.6 84.2 76.4 351.3 75.5 75.9 76.5 54.4 282.3 Adjusted EBITDA (1) 90.9 116.1 84.2 76.4 367.6 75.5 75.9 76.5 54.4 282.3 Adjusted EBITDA/Revenue 15.5% 18.7% 13.9% 12.6% 15.2% 13.8% 14.3% 14.6% 11.5% 13.6% Raw Material Processed

(3) (millions of metric tons) 1.73 1.73 1.73 1.92 7.11 1.87 1.83 1.86 1.89 7.45 |

Creating sustainable food, feed and fuel ingredients for a growing

population Food

Segment - Historical (1) Has impact of inventory step-up in 1 st and 2 nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International 13 th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the

presentation of the second quarter figures.

(A) Quarters 1, 2 and 3 revenues have been adjusted for re-class

between sales and cost of sales. 22

US$ and metric tons

(millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Revenue (A) 293.5 331.4 301.4 322.0 1,248.3 270.2 283.4 269.2 272.1 1,094.9 Gross Margin (1) 62.3 65.3 64.2 63.4 255.2 53.5 60.2 54.8 62.9 231.4 Gross Margin % (1) 21.2% 19.7% 21.3% 19.7% 20.4% 19.8% 21.2% 20.4% 23.1% 21.1% Operating Income/(Loss) (2) (12.1) 11.3 14.0 13.7 26.9 10.8 15.5 11.6 23.3 61.2 Adjusted Operating Income (1) 19.8 14.7 14.0 13.7 62.2 10.8 15.5 11.6 23.3 61.2 EBITDA (2) 5.3 30.9 32.6 31.4 100.2 28.0 32.3 28.7 39.1 128.1 Adjusted EBITDA (1) 38.3 34.3 32.6 31.4 136.6 28.0 32.3 28.7 39.1 128.1 Adjusted EBITDA/Revenue 13.0% 10.4% 10.8% 9.7% 10.9% 10.4% 11.4% 10.7% 14.4% 11.7% Raw Material Processed (millions of metric tons) 0.25 (3) 0.27 0.26 0.28 1.06 0.27 0.28 0.26 0.26 1.07 |

Creating sustainable food, feed and fuel ingredients for a growing

population (1)

Has impact of inventory step-up in 1st quarter.

(2) Exclusive of non-cash inventory step-up and Darling Ingredients Int'l 13th week.

(3) Raw material process volumes for the first quarter have been adjusted to be consistent

with the presentation of the second quarter figures.

(A) Quarters 1, 2 and 3 revenues have been adjusted for re-class between

sales and cost of sales. Fuel

Segment - Historical 23 US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 Revenue $66.7 $77.7 $70.0 $72.2 $286.6 $57.0 $46.5 $59.3 $65.4 $228.2 Gross Margin 15.3 15.9 17.8 10.0 59.0 13.2 6.3 11.4 20.2 51.1 Gross Margin % 21.1% 20.5% 25.4% 13.9% 20.6% 23.1% 13.5% 19.2% 30.9% 22.4% Operating Income (2) 2.3 5.2 2.8 10.9 21.2 2.5 2.0 0.2 12.5 17.2 Adjusted Operating Income (1) 3.5 5.2 2.8 10.9 22.4 2.5 2.0 0.2 12.5 17.2 EBITDA (2) 9.7 11.1 11.5 16.9 49.2 9.1 8.6 7.0 19.2 43.9 Adjusted EBITDA (1) 10.9 11.1 11.5 16.9 50.4 9.1 8.6 7.0 19.2 43.9 Adjusted EBITDA/Revenue 16.3% 14.3% 16.4% 23.4% 17.6% 16.0% 18.5% 11.8% 29.4% 19.2% Raw Material Processed * (millions of metric tons) 0.23 (3) 0.24 0.26 0.33 1.07 0.30 0.29 0.27 0.31 1.17 *Excludes raw material processed at the DGD joint venture. Diamond Green Diesel (50% Joint Venture) US$ (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total 2015 EBITDA (Darling's share) $9.1 5.9 2.9 63.7 $81.6 2.3 7.9 (8.3) 86.6 $88.5 |

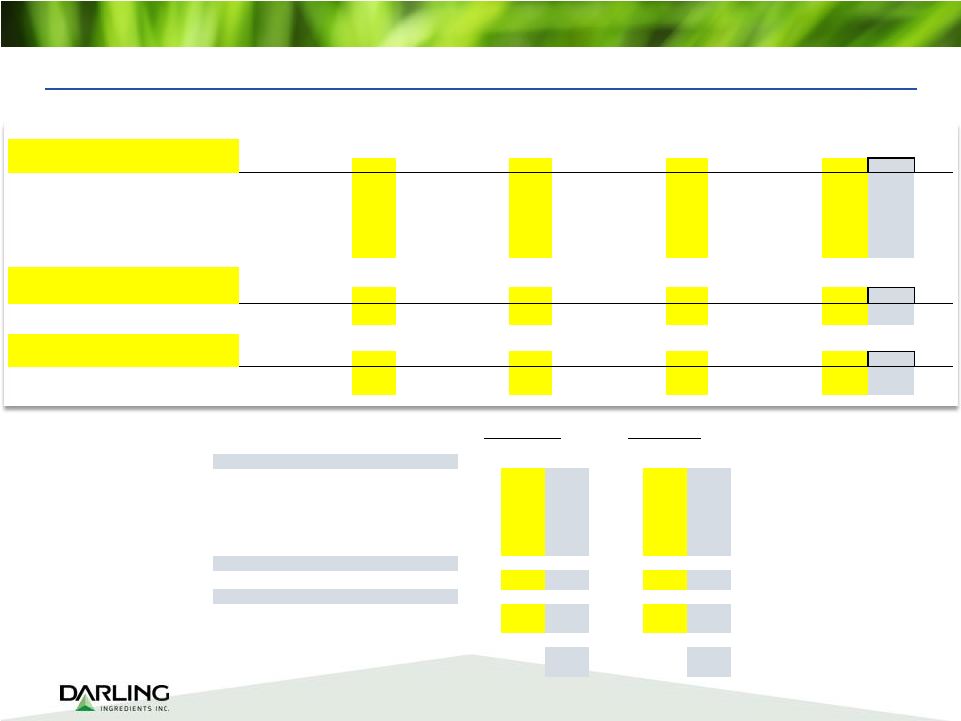

Creating sustainable food, feed and fuel ingredients for a growing

population QTR. Over QTR.

Year Over Year

Comparison Q3-2015 Q4-2015 % Q4-2014 Q4-2015 % Average Jacobsen Prices (USD) Avg. Avg. Change Avg. Avg. Change Bleachable Fancy Tallow - Chicago Renderer / cwt $29.42 $21.18 -28.0% $31.78 $21.18 -33.4% Yellow Grease - Illinois / cwt $21.48 $17.86 -16.9% $25.56 $17.86 -30.1% Meat and Bone Meal - Ruminant - Illinois / ton $354.91 $249.29 -29.8% $392.68 $249.29 -36.5% Poultry By-Product Meal - Feed Grade - Mid South/ton $391.55 $334.67 -14.5% $492.76 $334.67 -32.1% Poultry By-Product Meal - Pet Food - Mid South/ton $532.45 $469.49 -11.8% $746.52 $469.49 -37.1% Feathermeal - Mid South / ton $499.12 $367.06 -26.5% $672.63 $367.06 -45.4% Average Wall Street Journal Prices (USD) Corn - Track Central IL #2 Yellow / bushel $3.62 $3.64 0.6% $3.41 $3.64 6.7% Average Thomson Reuters Prices (USD) Palm oil - CIF Rotterdam / metric ton $558 $563 -0.9% $718 $563 -21.6% Soy meal - CIF Rotterdam / metric ton $380 $352 -7.4% $486 $352 -27.6% USD/Euro Avg. Exchange Rates 1.113 1.094 -1.7% 1.328 1.094 -17.6% USD/Canadian Avg. Exchange Rates 0.763 0.749 -1.8% 0.916 0.749 -18.2% 24 2016 January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. January Bleachable Fancy Tallow - Chicago Renderer / cwt $29.16 $29.14 $30.53 $29.66 $28.69 $28.95 $29.91 $29.18 $29.00 $29.64 $29.62 $29.42 $22.91 $20.00 $20.00 $21.18 $27.36 $23.53 Yellow Grease - Illinois / cwt $24.54 $24.34 $24.81 $24.58 $22.36 $22.84 $24.50 $23.24 $23.80 $21.19 $19.55 $21.48 $18.02 $17.51 $18.00 $17.86 $21.79 $19.03 Meat and Bone Meal - Ruminant - Illinois / ton $402.13 $375.53 $377.95 $385.12 $387.02 $359.75 $304.20 $348.88 $338.18 $385.00 $343.10 $354.91 $280.68 $251.58 $217.27 $249.29 $334.55 $184.74 Poultry By-Product Meal - Feed Grade - Mid South/ton $466.00 $460.26 $468.18 $465.00 $487.14 $427.25 $370.91 $426.94 $376.70 $399.64 $402.50 $391.55 $376.93 $334.74 $293.41 $334.67 $404.54 $247.11 Poultry By-Product Meal - Pet Food - Mid South/ton $712.50 $629.61 $625.00 $655.12 $607.74 $520.00 $446.59 $521.50 $478.18 $568.21 $557.14 $532.45 $477.27 $463.95 $467.61 $469.49 $544.64 $498.03 Feathermeal - Mid South / ton $538.63 $460.39 $565.00 $523.77 $579.17 $491.75 $430.57 $499.13 $467.95 $555.00 $476.67 $499.12 $404.20 $369.47 $329.43 $367.06 $472.27 $255.39 2016 January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. January Corn - Track Central IL #2 Yellow / bushel $3.65 $3.68 $3.66 $3.66 $3.55 $3.48 $3.49 $3.51 $3.81 $3.49 $3.56 $3.62 $3.65 $3.60 $3.68 $3.64 $3.61 $3.58 2016 January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. January Palm oil - CIF Rotterdam / metric ton $619 $698 $652 $656 $645 $653 $651 $650 $603 $505 $565 $558 $565 $555 $569 $563 $607 $565 Soy meal - CIF Rotterdam / metric ton $456 $442 $410 $436 $403 $392 $393 $396 $394 $381 $365 $380 $367 $353 $336 $352 $391 $339 2015 Finished Product Pricing Feed Segment Ingredients 2015 Cash Corn Pricing Competing Ingredient for Bakery Feeds and Fats European Benchmark Pricing 2015 2015 Average Jacobsen Prices (USD) 2015 Average Wall Street Journal Prices (USD) 2015 Average Thomson Reuters Prices (USD) Jacobsen, Wall Street Journal and Thomson Reuters Historical Pricing |

Creating sustainable food, feed and fuel ingredients for a growing

population Process

USA Canada Europe China S. America Australia Total: Rendering - (C3 By-products & UCO)

92 5 18 115 Bakery 10 10 Used Cooking Oil processing only 8 1 9 Disposal Rendering - (C1 & C2)

6 6 Food Grade Fat Processing 5 5 Blood Processing 1 4 5 1 11 Bone Processing 2 2 Bio Diesel 1 1 2 Renewable Diesel 1 1 Gelatin 2 4 4 3 13 Casings 4 1 5 Environmental Services 4 1 5 Fertilizer 1 1 Pet Food 3 1 4 Hides 3 3 6 126 6 49 10 3 1 195 Under Construction: Rendering 2 Locations by Continent and Process European categories for rendering of animal by-products: • C3 – food-grade material, for food and feed products • C2 – unfit for food or animal feed, can be used as fertilizer • C1 – must be destroyed; used to generate green energy * Note: List excludes administrative and dedicated sales offices. *Includes transfer stations and blending 25 |

Creating sustainable food, feed and fuel ingredients for a growing

population Adjusted EBITDA is presented here not as an alternative to net

income, but rather as a measure of the Company’s operating

performance and is not intended to be a presentation in accordance with GAAP. Since

EBITDA (generally, net income plus interest expenses, taxes, depreciation

and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this

presentation and represents, for any relevant period, net income/(loss) plus

depreciation and amortization, goodwill and long-lived asset

impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in

evaluating the Company’s operating performance compared to that of other companies

in its industry because the calculation of Adjusted EBITDA generally

eliminates the effects of financing income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary

purposes. However, Adjusted EBITDA is not a recognized measurement under GAAP, should

not be considered as an alternative to net income as a measure of

operating results or to cash flow as a measure of liquidity, and is not intended to be a presentation in accordance with GAAP. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance

with certain financial covenants under the Company’s Senior Secured Credit

Facilities and 5.375% Notes and 4.75% Notes that were outstanding at

January 2, 2016. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.375% Notes and 4.75%

Notes, as those definitions permit further adjustments to reflect certain

other non-recurring costs and non-cash charges and cash dividends

from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization.

In addition, the Company’s management used adjusted diluted earnings per share as

a measure of earnings due to the significant merger and acquisition

activity of the Company. However, adjusted earnings per share is not a recognized measurement under GAAP and should not be considered as an alternative to diluted earnings per share presented in accordance with GAAP. Adjusted

diluted earnings per share is defined as adjusted net income attributable to Darling

divided by the weighted average shares of diluted common stock. Adjusted

net income attributable to Darling is defined as a reconciliation of net income attributable to Darling, net of tax (i) adjusted for net of tax acquisition and integration costs related to merger and acquisitions, (ii) net of tax amortization of

acquisition related intangibles and (iii) net of tax certain

non-recurring items that are not part of normal operations. This measure is solely for the purpose of calculating adjusted diluted earnings per share and is not intended to be a substitute of presentation

in accordance with GAAP.

Non-U.S. GAAP Measures

26 |