Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Starwood Waypoint Homes | sfr-ex991_6.htm |

| 8-K - 8-K - Starwood Waypoint Homes | sfr-8k_20160229.htm |

Exhibit 99.2

On January 5, 2016, we completed the merger between Starwood Waypoint Residential Trust (“SWAY”) and Colony American Homes (“CAH”) (the “Merger”) and the internalization of SWAY’s manager (the “Internalization”), forming a company with a combined asset value of over $7 billion and over 30,000 homes. In connection with the merger, SWAY was renamed Colony Starwood Homes and began trading under the ticker symbol “SFR” on the New York Stock Exchange.

Consolidated financial statements as of and for the three months and year ended December 31, 2015 included herein primarily represent the pre-Merger consolidated financial position and results of operations of SWAY. We have also provided herein selected CAH financial and operating results as of and for the three months and year ended December 31, 2015.

|

|

|

|

|

Pages |

|

|

|

|

COMBINED COMPANY: SWAY & CAH |

1-3 |

|

|

|

|

ABOUT SWAY |

4-6 |

|

|

|

|

FINANCIAL INFORMATION: SWAY |

|

|

Selected Financial & Other Information |

7 |

|

Consolidated Balance Sheets |

8 |

|

Consolidated Statements of Operations |

9 |

|

NAREIT FFO, Core FFO & Core FFO as Adjusted |

10 |

|

NOI and Same Store Growth |

11 |

|

|

|

|

DEBT STRUCTURE: SWAY |

12 |

|

|

|

|

PORTFOLIO INFORMATION: SWAY |

|

|

Total Rental Homes Portfolio |

13 |

|

Rent Growth by Lease Category |

14 |

|

Leasing Statistics |

15 |

|

NPL Portfolio |

16 |

|

|

|

|

TRANSACTION ACTIVITY: SWAY |

|

|

Acquisitions |

17 |

|

|

|

|

DEFINITIONS AND RECONCILIATIONS |

18-22 |

|

|

|

Q4 2015 Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Achieved 63.2% net operating income (“NOI”) margin(1) on SWAY’s stabilized single-family rental (“SFR”)(2) portfolio |

|

||||||||||||||||||

|

Summary |

|

|

n Our Board increased our share repurchase program to $250 million |

|

||||||||||||||||||

|

|

|

|

n Our Board approved a $0.22 quarterly dividend, a 16% increase from SWAY pre-Merger |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Year Ended |

|

|

|

|

||||||||

|

|

|

|

|

December 31, 2015 |

|

|

|

|

|

December 31, 2015 |

|

|

|

|

||||||||

|

Financial Results: SWAY and CAH |

|

|

(in millions, except per share data) |

SWAY |

|

CAH |

|

|

|

|

|

SWAY |

|

CAH |

|

|

|

|

||||

|

|

|

Total Revenue |

$ |

64.9 |

|

$ |

80.9 |

|

|

|

|

|

$ |

271.8 |

|

$ |

303.7 |

|

|

|

|

|

|

|

|

Net Loss Attributable to Common Shareholders |

$ |

(29.8 |

) |

$ |

(14.3 |

) |

|

|

|

|

$ |

(44.4 |

) |

$ |

(37.8 |

) |

|

|

|

|

|

|

|

|

Core FFO as Adjusted(1) |

$ |

6.9 |

|

$ |

22.1 |

|

|

|

|

|

$ |

63.7 |

|

$ |

65.1 |

|

|

|

|

|

|

|

|

Core FFO as Adjusted per common share(1) |

$ |

0.18 |

|

|

|

|

|

|

|

|

$ |

1.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|||||||

|

|

|

|

|

As of December 31, 2015 |

|

|

December 31, 2015 |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Combined |

|

|

|

|

|

|

|

|

Combined |

|

||

|

|

|

|

|

SWAY |

|

CAH |

|

Company |

|

|

SWAY |

|

CAH |

|

Company |

|

||||||

|

Operations: SWAY and CAH |

|

|

SFR Portfolio Homes(3) |

|

12,881 |

|

|

17,796 |

|

|

30,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average monthly rent per home(3) |

$ |

1,510 |

|

$ |

1,503 |

|

$ |

1,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total portfolio occupancy(3)(4) |

|

89.5 |

% |

|

94.9 |

% |

|

92.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized occupancy(3)(5) |

|

93.2 |

% |

|

95.5 |

% |

|

94.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Renewal rent growth(3)(6) |

|

|

|

|

|

|

|

|

|

|

|

3.5 |

% |

|

5.7 |

% |

|

4.9 |

% |

|

|

|

|

Replacement rent growth(3) |

|

|

|

|

|

|

|

|

|

|

|

2.1 |

% |

|

4.1 |

% |

|

3.4 |

% |

|

|

|

|

Blended rent growth(3) |

|

|

|

|

|

|

|

|

|

|

|

2.6 |

% |

|

5.0 |

% |

|

4.2 |

% |

|

|

|

|

Retention(3) |

|

|

|

|

|

|

|

|

|

|

|

72.3 |

% |

|

76.8 |

% |

|

75.0 |

% |

|

|

|

|

Turnover(7) |

|

|

|

|

|

|

|

|

|

|

|

30.7 |

% |

|

33.3 |

% |

|

32.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

NOI margin and Core Funds from Operations (“FFO”) as Adjusted are non-generally accepted accounting principles (“GAAP”) measures. For explanations of these measures and reconciliations to the applicable GAAP measures, please refer to the “NAREIT FFO, Core FFO & Core FFO as Adjusted” and “Definitions and Reconciliations” pages of this presentation. |

(2)As used in this presentation, SFR refers to “single-family rental” homes and not the ticker symbol “SFR” under which our shares are traded subsequent to the Merger.

|

|

(3) |

Excludes 1,218 and 106 homes SWAY and CAH did not intend to hold for the long term as of December 31, 2015, respectively. |

|

|

(4) |

Represents number of homes occupied as of the last day of the period, divided by total SFR portfolio homes. |

|

|

(5) |

Represents occupied homes as of the last day of the period divided by homes that are currently occupied or have been occupied in prior periods. |

|

|

(6) |

Renewal rent growth includes rent growth from renewals and escalation clauses on multi-year leases. |

|

|

(7) |

Turnover is calculated as the annualized monthly average of total resident move-outs for the month divided by occupied homes at the end of the month. |

|

|

1 |

Portfolio and Leasing Trends

|

Total SFRs(1) |

|

% Occupied: Total Rental Portfolio(1) |

|

|

|

|

|

% Leased: Homes Owned 180 Days or Longer(1) |

|

% Occupied: Stabilized Home Portfolio(1) |

|

|

|

|

|

|

(1) |

SWAY values exclude 1,218, 1,421, 1,205, 1,151 and 909 homes that SWAY did not intend to hold for the long term as of December 31, 2015, September 30, 2015, June 30, 2015, March 31, 2015, and December 31, 2014, respectively. CAH values exclude 106, 180, 231, 331 and 34 homes that CAH did not intend to hold for the long term as of December 31, 2015, September 30, 2015, June 30, 2015, March 31, 2015, and December 31, 2014, respectively. Also, please refer to the “Definitions and Reconciliations” pages for units as a measure of SFR count and a roll-forward of homes we do not intend to hold for the long term. |

|

|

2 |

Financing Overview

|

SWAY 2015 Financing Activity(1) |

|

Combined Company Financing Activity (1) |

|

(in millions)

|

|

(in millions)

|

|

SWAY Total Capacity(1)(2) |

|

Combined Company Total Capacity(1)(2) |

|

|

|

|

|

|

(1) |

As of December 31, 2015. |

|

|

(2) |

Total Capacity figures reflect both SFR and non-performing loan (“NPL”) activity. |

|

|

(3) |

Amounts exclude principal-only bearing subordinate Certificates, Class G, in the amounts of $26.6 million and $33.7 million retained by SWAY and CAH, respectively. |

|

|

3 |

Financial and Operating Performance Trends

|

SFR Rental Revenue (in millions) |

|

Core FFO (1)(2) |

|

|

|

|

|

Stabilized Portfolio NOI Margin(1)(2) |

|

G&A as % Total Assets(3) |

|

|

|

|

|

|

(1) |

Core FFO and Stabilized Portfolio NOI margin are non-GAAP measures. For explanations of these measures and reconciliations to the applicable GAAP measures, please refer to the “NAREIT FFO, Core FFO & Core FFO as Adjusted” and “Definitions and Reconciliations” pages of this presentation. |

|

|

(2) |

Q4 2015 results, as shown, have been adjusted for certain “out of period” tax expenses. Please refer to the “NAREIT FFO, Core FFO & Core FFO as Adjusted” page of this presentation for details of this adjustment. |

|

|

(3) |

Represents annualized quarterly G&A expense divided by total assets at quarter end. |

|

|

4 |

NPL Resolution Activity

|

Total NPL Resolutions(1)(2) |

|

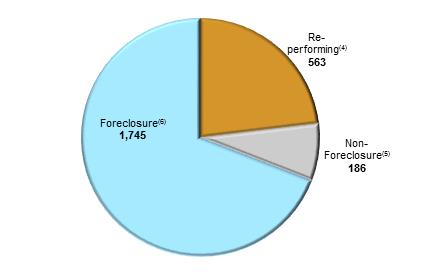

Resolutions by Type: Cumulative Since Q1 2014 |

|||||||

|

|

|

|

|||||||

|

% Resolutions by Year of Acquisition(3) |

|

||||||||

|

65% of all NPLs Acquired Have Been Resolved |

|

||||||||

|

|

|

||||||||

|

|

|

Target Allocation % |

|

Estimated |

|

Cumulative |

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

Re-performing(4) (~10-15% of loans) |

|

7 – 16 months |

|

12.1 months |

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

Non-Foreclosure(5) (~5-10% of loans) |

|

7 – 15 months |

|

13.7 months |

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

Foreclosures(6) (~75-85% of loans) |

|

12 – 21 months |

|

14.0 months |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Does not include repurchases, resolutions initiated prior to closing, or trailing deeds. Resolutions also exclude Q1 2015 bulk sale of 171 loans and one individual loan sale in that quarter, and Q3 2015 bulk sale of 461 re-performing loans (“RPLs”). |

|

|

(2) |

Of the 5,758 total NPLs acquired since 2012, 2,494 were resolved during the period Q1 2014 through Q4 2015 which are broken out by quarter in the top left graph above. An additional 1,283 NPLs were resolved prior to Q1 2014. |

|

|

(3) |

A total of 3,735 NPLs, 1,538 NPLs, and 485 NPLs were acquired in 2014, 2013, and 2012, respectively. No NPLs were acquired in 2015. |

|

|

(4) |

Defined as NPLs that were either modified or reinstated and were re-performing as of the end of December 31, 2015. All resolutions included in this category have either been sold as RPLs or remain held in our portfolio and were less than 60 days past due as of December 31, 2015. |

|

|

(5) |

Includes paid-in-full, short payoff, sold notes and short sales. |

|

|

(6) |

Includes foreclosure auction sales and real estate owned (“REO”) assets (including rental conversions). |

|

|

(7) |

Represents actual timing through Q4 2015. Average time to resolution could lengthen during the life of the NPL portfolio. |

|

|

5 |

NPL Performance

|

Returns by Resolution Type: Cumulative Since Q1 2014 |

|

REO Sold |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated |

|

Cumulative |

|

|

|

Since Q1 2014, a total of $137.4 million of REO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Re-performing(1) |

|

~1.20 – 1.45x |

|

9.5% current yield(6) |

|

|

|

Cumulative REO Sold(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Foreclosure(2) |

|

~1.15 – 1.35x |

|

1.40x |

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

Foreclosed and Sold(3) |

|

~1.20 – 1.30x |

|

1.21x |

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

(1) |

Defined as NPLs that were either modified or reinstated and were re-performing as of the end of the reported quarter. All loans in this category were less than 60 days past due at December 31, 2015 and exclude Q1 2015 resolutions of a bulk sale of 171 loans and one individual loan sale and Q3 2015 bulk sale of 461 RPLs. |

|

|

(2) |

Includes paid-in-full, short payoff, sold notes and short sales. |

|

|

(3) |

Includes foreclosure auction sales and REO assets (including rental conversions). Actual Total Return includes foreclosure auction sales and sold REO assets only. |

|

|

(4) |

Estimated return multiples are meant to illustrate an estimated return for a standard NPL resolution of a single asset. Ranges are affected by the equity percentage of each asset as well as other factors. |

|

|

(5) |

Total Return is defined as proceeds (net of selling costs but before conversion costs) divided by purchase price. Conversion costs vary by state but have averaged less than 10% (unlevered) for REO that has been sold. |

|

|

(6) |

Yield is defined as principal and interest payments as a percentage of purchase price. |

|

|

(7) |

Excludes 363 of REO held for sale as of December 31, 2015. |

|

|

6 |

Selected Financial & Other Information

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

||

|

(in thousands, except share and per share data) |

|

|

|

|

|

|

|

December 31, 2015 |

|

|

December 31, 2015 |

|

||

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

|

|

|

|

|

|

$ |

64,894 |

|

|

$ |

271,837 |

|

|

Net loss attributable to Starwood Waypoint Residential Trust shareholders |

|

|

|

|

|

$ |

(29,786 |

) |

|

$ |

(44,393 |

) |

||

|

Core FFO as Adjusted(1) |

|

|

|

|

|

|

|

$ |

6,915 |

|

|

$ |

63,697 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per common share - basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Starwood Waypoint Residential Trust shareholders |

|

|

|

|

|

$ |

(0.78 |

) |

|

$ |

(1.17 |

) |

||

|

Core FFO as Adjusted per common share(1) |

|

|

|

|

|

$ |

0.18 |

|

|

$ |

1.68 |

|

||

|

Dividends declared per common share |

|

|

|

|

|

$ |

0.19 |

|

|

$ |

0.66 |

|

||

|

Weighted-average shares outstanding - basic and diluted |

|

|

|

|

|

|

37,972,846 |

|

|

|

37,949,784 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized Portfolio NOI Margin(2) |

|

|

|

|

|

|

|

|

63.2 |

% |

|

|

64.1 |

% |

|

|

|

|

|

As of |

|

|||||||||||||

|

|

|

|

|

December 31, 2015 |

|

|

September 30, 2015 |

|

|

June 30, 2015 |

|

|

March 31, 2015 |

|

||||

|

Home Count: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized homes(3) |

|

|

|

|

12,326 |

|

|

|

12,016 |

|

|

|

11,822 |

|

|

|

10,970 |

|

|

Non-stabilized homes(3) |

|

|

|

|

555 |

|

|

|

718 |

|

|

|

740 |

|

|

|

1,247 |

|

|

Total Homes(4) |

|

|

|

|

12,881 |

|

|

|

12,734 |

|

|

|

12,562 |

|

|

|

12,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leased Percentages(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized homes |

|

|

|

|

94.9 |

% |

|

|

95.3 |

% |

|

|

96.6 |

% |

|

|

96.8 |

% |

|

Homes owned 180 days or longer |

|

|

|

|

94.1 |

% |

|

|

94.6 |

% |

|

|

95.7 |

% |

|

|

95.0 |

% |

|

Total rental portfolio |

|

|

|

|

91.5 |

% |

|

|

90.7 |

% |

|

|

92.2 |

% |

|

|

89.1 |

% |

|

(1) |

Please refer to the “Definitions and Reconciliations” pages of this presentation for a definition of Core FFO as Adjusted. Core FFO as Adjusted is a non-GAAP measure. For a reconciliation of Core FFO as Adjusted to net loss attributable to Starwood Waypoint Residential Trusts' shareholders determined in accordance with GAAP, please refer to the “NAREIT FFO, Core FFO & Core FFO as Adjusted” page of this presentation. |

|

(2) |

Stabilized portfolio NOI margin is a non-GAAP measure. For a reconciliation of stabilized portfolio NOI to net loss attributable to Starwood Waypoint Residential Trust shareholders determined in accordance with GAAP, please refer to the “Definitions and Reconciliations” pages of this presentation. |

|

(3) |

Please refer to the “Definitions and Reconciliation” pages of this presentation for a definition of stabilized and non-stabilized homes. |

|

(4) |

Excludes 1,218, 1,421, 1,205, and 1,151 homes that we did not intend to hold for the long term as of December 31, 2015, September 30, 2015, June 30, 2015, and March 31, 2015, respectively. Please refer to the “Definitions and Reconciliations” pages of this presentation for a definition of homes we did not intend to hold for the long term and a period end roll-forward schedule. |

|

|

7 |

Consolidated Balance Sheets

|

(in thousands) |

|

December 31, 2015 |

|

|

December 31, 2014 |

|

||

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Investments in real estate properties |

|

|

|

|

|

|

|

|

|

Land |

|

$ |

407,848 |

|

|

$ |

359,889 |

|

|

Building and improvements |

|

|

1,928,207 |

|

|

|

1,619,622 |

|

|

Total investments in real estate properties |

|

|

2,336,055 |

|

|

|

1,979,511 |

|

|

Less accumulated depreciation |

|

|

(109,403 |

) |

|

|

(41,563 |

) |

|

Investments in real estate properties, net |

|

|

2,226,652 |

|

|

|

1,937,948 |

|

|

Real estate held for sale, net |

|

|

79,669 |

|

|

|

32,102 |

|

|

Total investments in real estate properties, net |

|

|

2,306,321 |

|

|

|

1,970,050 |

|

|

Non-performing loans |

|

|

64,620 |

|

|

|

125,488 |

|

|

Non-performing loans held for sale |

|

|

— |

|

|

|

26,911 |

|

|

Non-performing loans (fair value option) |

|

|

380,613 |

|

|

|

491,790 |

|

|

Resident and other receivables, net |

|

|

17,670 |

|

|

|

17,270 |

|

|

Cash and cash equivalents |

|

|

87,485 |

|

|

|

175,198 |

|

|

Restricted cash |

|

|

84,542 |

|

|

|

50,749 |

|

|

Deferred financing costs, net |

|

|

26,375 |

|

|

|

34,160 |

|

|

Asset-backed securitization certificates |

|

|

26,553 |

|

|

|

26,553 |

|

|

Other assets |

|

|

13,500 |

|

|

|

17,994 |

|

|

Total assets |

|

$ |

3,007,679 |

|

|

$ |

2,936,163 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Senior SFR facility |

|

$ |

741,207 |

|

|

$ |

441,239 |

|

|

Master repurchase agreement |

|

|

274,441 |

|

|

|

454,249 |

|

|

Asset-backed securitization, net |

|

|

527,262 |

|

|

|

526,816 |

|

|

Convertible senior notes, net |

|

|

372,636 |

|

|

|

363,110 |

|

|

Accounts payable and accrued expenses |

|

|

58,105 |

|

|

|

52,457 |

|

|

Resident security deposits and prepaid rent |

|

|

23,151 |

|

|

|

17,857 |

|

|

Total liabilities |

|

|

1,996,802 |

|

|

|

1,855,728 |

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

|

Starwood Waypoint Residential Trust equity: |

|

|

|

|

|

|

|

|

|

Common shares, at par |

|

|

380 |

|

|

|

378 |

|

|

Additional paid-in capital |

|

|

1,132,308 |

|

|

|

1,133,239 |

|

|

Accumulated deficit |

|

|

(123,626 |

) |

|

|

(53,723 |

) |

|

Accumulated other comprehensive loss |

|

|

(170 |

) |

|

|

(70 |

) |

|

Total Starwood Waypoint Residential Trust equity |

|

|

1,008,892 |

|

|

|

1,079,824 |

|

|

Non-controlling interests |

|

|

1,985 |

|

|

|

611 |

|

|

Total equity |

|

|

1,010,877 |

|

|

|

1,080,435 |

|

|

Total liabilities and equity |

|

$ |

3,007,679 |

|

|

$ |

2,936,163 |

|

|

|

8 |

Consolidated Statements of Operations

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

||||||||||

|

(in thousands, except share and per share data) |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

||||||||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental revenues, net |

|

$ |

50,211 |

|

|

$ |

37,097 |

|

|

$ |

188,068 |

|

|

$ |

104,830 |

|

|

Other property revenues |

|

|

2,033 |

|

|

|

1,073 |

|

|

|

6,667 |

|

|

|

3,581 |

|

|

Realized gain on non-performing loans, net |

|

|

3,560 |

|

|

|

2,629 |

|

|

|

44,070 |

|

|

|

9,770 |

|

|

Realized gain on loan conversions, net |

|

|

9,090 |

|

|

|

6,994 |

|

|

|

33,032 |

|

|

|

24,682 |

|

|

Total revenues |

|

|

64,894 |

|

|

|

47,793 |

|

|

|

271,837 |

|

|

|

142,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating and maintenance |

|

|

12,393 |

|

|

|

8,633 |

|

|

|

45,493 |

|

|

|

31,252 |

|

|

Real estate taxes and insurance |

|

|

13,097 |

|

|

|

9,592 |

|

|

|

40,599 |

|

|

|

22,346 |

|

|

Mortgage loan servicing costs |

|

|

9,533 |

|

|

|

11,020 |

|

|

|

39,518 |

|

|

|

28,959 |

|

|

Non-performing loan management fees and expenses |

|

|

2,141 |

|

|

|

3,150 |

|

|

|

11,442 |

|

|

|

10,944 |

|

|

General and administrative |

|

|

4,609 |

|

|

|

4,866 |

|

|

|

16,436 |

|

|

|

19,307 |

|

|

Share-based compensation |

|

|

1,568 |

|

|

|

3,898 |

|

|

|

7,229 |

|

|

|

8,458 |

|

|

Investment management fees |

|

|

4,517 |

|

|

|

4,825 |

|

|

|

18,843 |

|

|

|

16,097 |

|

|

Acquisition fees and other expenses |

|

|

254 |

|

|

|

637 |

|

|

|

1,120 |

|

|

|

1,301 |

|

|

Interest expense, including amortization |

|

|

19,388 |

|

|

|

16,633 |

|

|

|

76,800 |

|

|

|

35,223 |

|

|

Depreciation and amortization |

|

|

23,305 |

|

|

|

19,918 |

|

|

|

80,080 |

|

|

|

41,872 |

|

|

Separation costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,543 |

|

|

Transaction-related expenses |

|

|

7,564 |

|

|

|

— |

|

|

|

11,852 |

|

|

|

— |

|

|

Finance-related expenses and write-off of loan costs |

|

|

2,370 |

|

|

|

940 |

|

|

|

4,547 |

|

|

|

7,715 |

|

|

Impairment of real estate |

|

|

2,261 |

|

|

|

171 |

|

|

|

3,122 |

|

|

|

2,579 |

|

|

Total expenses |

|

|

103,000 |

|

|

|

84,283 |

|

|

|

357,081 |

|

|

|

229,596 |

|

|

Loss before other income, income tax expense and non-controlling interests |

|

|

(38,106 |

) |

|

|

(36,490 |

) |

|

|

(85,244 |

) |

|

|

(86,733 |

) |

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized gain (loss) on sales of investments in real estate, net |

|

|

1,975 |

|

|

|

(148 |

) |

|

|

4,151 |

|

|

|

(224 |

) |

|

Realized loss on divestiture homes, net |

|

|

(3,870 |

) |

|

|

— |

|

|

|

(6,871 |

) |

|

|

— |

|

|

Unrealized gain on non-performing loans, net(1) |

|

|

9,954 |

|

|

|

27,247 |

|

|

|

44,385 |

|

|

|

44,593 |

|

|

Loss on derivative financial instruments, net |

|

|

(12 |

) |

|

|

(132 |

) |

|

|

(319 |

) |

|

|

(706 |

) |

|

Total other income |

|

|

8,047 |

|

|

|

26,967 |

|

|

|

41,346 |

|

|

|

43,663 |

|

|

Loss before income tax expense and non-controlling interests |

|

|

(30,059 |

) |

|

|

(9,523 |

) |

|

|

(43,898 |

) |

|

|

(43,070 |

) |

|

Income tax expense |

|

|

(281 |

) |

|

|

(44 |

) |

|

|

159 |

|

|

|

460 |

|

|

Net loss |

|

|

(29,778 |

) |

|

|

(9,479 |

) |

|

|

(44,057 |

) |

|

|

(43,530 |

) |

|

Net income attributable to non-controlling interests |

|

|

(8 |

) |

|

|

(79 |

) |

|

|

(336 |

) |

|

|

(165 |

) |

|

Net loss attributable to Starwood Waypoint Residential Trust shareholders |

|

$ |

(29,786 |

) |

|

$ |

(9,558 |

) |

|

$ |

(44,393 |

) |

|

$ |

(43,695 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted |

|

$ |

(0.78 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.17 |

) |

|

$ |

(1.13 |

) |

|

Dividends declared per common share |

|

$ |

0.19 |

|

|

$ |

0.14 |

|

|

$ |

0.66 |

|

|

$ |

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding - basic and diluted |

|

|

37,972,846 |

|

|

|

37,860,335 |

|

|

|

37,949,784 |

|

|

|

38,623,893 |

|

|

(1) |

For the three and twelve months ended December 31, 2015, upon the sale or other resolution of NPLs that resulted in the recognition of a realized gain or loss, we reclassified $5.4 million and $26.0 million, respectively, that had previously been recorded in unrealized (loss) gain on NPLs, net to realized gain on NPLs, net, or realized gain on loan conversions, net, compared to $3.5 million for both the three and twelve month periods in 2014. |

|

|

9 |

NAREIT FFO, Core FFO, and Core FFO as Adjusted

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

||||||||||

|

(in thousands, except share and per share data, unaudited) |

|

|

2015 |

|

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

||

|

|

|

|

|

|

|

|

||||||||||

|

Reconciliation of net loss to NAREIT FFO, Core FFO and Core FFO as Adjusted(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Starwood Waypoint Residential Trust shareholders |

|

$ |

(29,786 |

) |

|

$ |

(9,558 |

) |

|

$ |

(44,393 |

) |

|

$ |

(43,695 |

) |

|

Add (deduct) adjustments from net loss to derive NAREIT FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization on real estate assets |

|

|

23,305 |

|

|

|

19,918 |

|

|

|

80,080 |

|

|

|

41,872 |

|

|

Impairment on depreciated real estate investments |

|

|

99 |

|

|

|

— |

|

|

|

99 |

|

|

|

15 |

|

|

Gain on sales of previously depreciated investments in real estate |

|

|

(1,975 |

) |

|

|

(253 |

) |

|

|

(4,151 |

) |

|

|

(280 |

) |

|

Non-controlling interests |

|

|

8 |

|

|

|

79 |

|

|

|

336 |

|

|

|

165 |

|

|

Subtotal - NAREIT FFO(1) |

|

|

(8,349 |

) |

|

|

10,186 |

|

|

|

31,971 |

|

|

|

(1,923 |

) |

|

Add (deduct) adjustments to NAREIT FFO to derive Core FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

1,568 |

|

|

|

3,898 |

|

|

|

7,229 |

|

|

|

8,458 |

|

|

Acquisition fees and other expenses |

|

|

254 |

|

|

|

637 |

|

|

|

1,120 |

|

|

|

1,301 |

|

|

Write-off of loan costs |

|

|

1,587 |

|

|

|

— |

|

|

|

1,587 |

|

|

|

5,032 |

|

|

Adjustments for derivative instruments, net |

|

|

(88 |

) |

|

|

42 |

|

|

|

(82 |

) |

|

|

485 |

|

|

Separation costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,543 |

|

|

Transaction-related expenses |

|

|

7,564 |

|

|

|

— |

|

|

|

11,852 |

|

|

|

— |

|

|

Severance expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

355 |

|

|

Non-cash interest expense related to amortization on convertible senior notes |

|

|

2,366 |

|

|

|

1,998 |

|

|

|

9,105 |

|

|

|

3,046 |

|

|

Subtotal - Core FFO(1) |

|

$ |

4,902 |

|

|

$ |

16,761 |

|

|

$ |

62,782 |

|

|

$ |

20,297 |

|

|

Add (deduct) adjustments to Core FFO to derive Core FFO as adjusted for out of period items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate taxes and insurance (2) |

|

|

2,013 |

|

|

|

722 |

|

|

|

915 |

|

|

|

722 |

|

|

Core FFO as Adjusted(1) for out of period items |

|

$ |

6,915 |

|

|

$ |

17,483 |

|

|

$ |

63,697 |

|

|

$ |

21,019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO as Adjusted per share |

|

$ |

0.18 |

|

|

$ |

0.46 |

|

|

$ |

1.68 |

|

|

$ |

0.54 |

|

|

Dividends declared per common share |

|

$ |

0.19 |

|

|

$ |

0.14 |

|

|

$ |

0.66 |

|

|

$ |

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares - basic and diluted |

|

|

37,972,846 |

|

|

|

37,860,335 |

|

|

|

37,949,784 |

|

|

|

38,623,893 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions to Core FFO as Adjusted per common share by segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SFR |

|

$ |

0.14 |

|

|

$ |

0.02 |

|

|

$ |

0.58 |

|

|

$ |

0.04 |

|

|

NPL |

|

$ |

0.04 |

|

|

$ |

0.44 |

|

|

$ |

1.10 |

|

|

$ |

0.50 |

|

|

Total Core FFO as Adjusted per common share |

|

$ |

0.18 |

|

|

$ |

0.46 |

|

|

$ |

1.68 |

|

|

$ |

0.54 |

|

|

(1) |

Please refer to the “Definitions and Reconciliations” pages of this presentation for definitions of NAREIT FFO, Core FFO and Core FFO as Adjusted. Core FFO and Core FFO as Adjusted are non-GAAP measures. |

|

(2) |

In the three and twelve months ended December 31, 2015, we recorded $2.0 million and $0.9 million of real estate tax expense, respectively, which related to periods prior to the three and twelve months ended December 31, 2015, respectively. The tax adjustments were primarily the result of tax assessment increases from the prior year by certain jurisdictions, and concentrated in the states of Texas and Florida. We excluded the impact of these "out-of-period" tax expenses from results for the three months and year ended December 31, 2015. |

|

|

10 |

NOI and Same Store Growth

|

|

|

Three Months Ended December 31, 2015 |

|

|

Twelve Months Ended December 31, 2015 |

|

||||||||||||||||||||||||||

|

NOI(1) |

|

SFR |

|

|

|

|

|

|

|

|

|

|

SFR |

|

|

|

|

|

|

|

|

|

||||||||||

|

(in thousands, unaudited) |

|

Stabilized Portfolio |

|

|

Non-Stabilized Portfolio |

|

|

NPL |

|

|

Total |

|

|

Stabilized Portfolio |

|

|

Non-Stabilized Portfolio |

|

|

NPL |

|

|

Total |

|

||||||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental revenues, net |

|

$ |

50,211 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

50,211 |

|

|

$ |

188,068 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

188,068 |

|

|

Less bad debt expense(2) |

|

|

(531 |

) |

|

|

— |

|

|

|

— |

|

|

|

(531 |

) |

|

|

(2,061 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,061 |

) |

|

Total rental revenues as adjusted |

|

|

49,680 |

|

|

|

— |

|

|

|

— |

|

|

|

49,680 |

|

|

|

186,007 |

|

|

|

— |

|

|

|

— |

|

|

|

186,007 |

|

|

Other property revenues |

|

|

2,033 |

|

|

|

— |

|

|

|

— |

|

|

|

2,033 |

|

|

|

6,667 |

|

|

|

— |

|

|

|

— |

|

|

|

6,667 |

|

|

Realized gain on non-performing loans, net |

|

|

— |

|

|

|

— |

|

|

|

3,560 |

|

|

|

3,560 |

|

|

|

— |

|

|

|

— |

|

|

|

44,070 |

|

|

|

44,070 |

|

|

Realized gain on loan conversions, net |

|

|

— |

|

|

|

— |

|

|

|

9,090 |

|

|

|

9,090 |

|

|

|

— |

|

|

|

— |

|

|

|

33,032 |

|

|

|

33,032 |

|

|

Unrealized gain (loss) on non-performing loans, net |

|

|

— |

|

|

|

— |

|

|

|

9,954 |

|

|

|

9,954 |

|

|

|

— |

|

|

|

— |

|

|

|

44,385 |

|

|

|

44,385 |

|

|

Total revenues as adjusted |

|

|

51,713 |

|

|

|

— |

|

|

|

22,604 |

|

|

|

74,317 |

|

|

|

192,674 |

|

|

|

— |

|

|

|

121,487 |

|

|

|

314,161 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses(3) (4) |

|

|

20,297 |

|

|

|

2,649 |

|

|

|

— |

|

|

|

22,946 |

|

|

|

73,364 |

|

|

|

9,752 |

|

|

|

— |

|

|

|

83,116 |

|

|

Mortgage loan servicing costs |

|

|

— |

|

|

|

— |

|

|

|

9,533 |

|

|

|

9,533 |

|

|

|

— |

|

|

|

— |

|

|

|

39,518 |

|

|

|

39,518 |

|

|

Total expenses |

|

|

20,297 |

|

|

|

2,649 |

|

|

|

9,533 |

|

|

|

32,479 |

|

|

|

73,364 |

|

|

|

9,752 |

|

|

|

39,518 |

|

|

|

122,634 |

|

|

Total NOI |

|

$ |

31,416 |

|

|

$ |

(2,649 |

) |

|

$ |

13,071 |

|

|

$ |

41,838 |

|

|

$ |

119,310 |

|

|

$ |

(9,752 |

) |

|

$ |

81,969 |

|

|

$ |

191,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized portfolio NOI margin(5) |

|

|

63.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Same Store Growth(4)(6) |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

Q4 2015 vs. Q4 2014 |

|

|

Q4 YTD 2015 vs. Q4 YTD 2014 |

|

||||||||||||||

|

Stabilized prior to |

Total Number of Homes |

|

|

Revenues |

|

Operating Expenses |

|

NOI(1) |

|

|

Revenues |

|

Operating Expenses |

|

NOI(1) |

|

|||||||

|

1Q 2014 |

|

1,596 |

|

|

|

-4.6 |

% |

|

-18.0 |

% |

|

6.6 |

% |

|

|

-2.4 |

% |

|

-15.4 |

% |

|

6.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Total Stabilized Portfolio NOI, Total Non-Stabilized Portfolio NOI, Total NPL NOI, Total NOI and Same Store NOI are non-GAAP measures. For a reconciliation of these non-GAAP measures to net loss attributable to Starwood Waypoint Residential Trust shareholders determined in accordance with GAAP, please refer to the “Definitions and Reconciliations” pages of this presentation. |

|

(2) |

Allowance for doubtful accounts (“bad debt”) is included in property operating and maintenance expenses in the consolidated statements of operations in accordance with GAAP. However, we believe bad debt represents revenue lost and not an operating expense to the portfolio so for purposes of calculating margins we treat bad debt as a reduction of revenue. |

|

(3) |

Property operating expenses are defined as property operating and maintenance expenses, excluding bad debt, plus real estate taxes and insurance. |

|

(4) |

In the three months ended December 31, 2015, we recorded $2.0 million and $0.9 million of real estate tax which related to periods prior to the three and twelve months ended December 31, 2015, respectively. The tax adjustments were primarily the result of tax assessment increases from the prior year by certain jurisdictions, and concentrated in the states of Texas and Florida. We excluded the impact of these "out-of-period" tax expenses from results for the three and twelve months ended December 31, 2015. |

|

(5) |

NOI margin is calculated as total stabilized portfolio NOI divided by total rental revenues, as adjusted. |

|

(6) |

For an explanation of same store growth, please refer to the “Definitions and Reconciliations” pages of this presentation. |

|

|

11 |

|

As of December 31, 2015 (in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt |

|

|||||||||||||||||||||

|

Debt Maturities(1) |

|

Senior SFR Facility |

|

|

NPL Facility |

|

|

Securitization(2) |

|

|

Convertible Notes - 2019 Convertible Note |

|

|

Convertible Notes - 2017 Convertible Note |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

2017 |

|

|

— |

|

|

|

274,441 |

|

|

|

— |

|

|

|

— |

|

|

|

172,500 |

|

|

|

446,941 |

|

|

2018 |

|

|

741,207 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

741,207 |

|

|

2019 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

230,000 |

|

|

|

— |

|

|

|

230,000 |

|

|

2020 |

|

|

— |

|

|

|

— |

|

|

|

529,011 |

|

|

|

— |

|

|

|

— |

|

|

|

529,011 |

|

|

Thereafter |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total |

|

$ |

741,207 |

|

|

$ |

274,441 |

|

|

$ |

529,011 |

|

|

$ |

230,000 |

|

|

$ |

172,500 |

|

|

$ |

1,947,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average coupon rate |

|

|

3.38% |

|

|

|

2.80% |

|

|

|

2.79% |

|

|

|

3.00% |

|

|

|

4.50% |

|

|

|

3.19% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average remaining maturity in years |

|

|

2.1 |

|

|

|

1.7 |

|

|

|

4.0 |

|

|

|

3.5 |

|

|

|

1.8 |

|

|

|

2.7 |

|

|

Market equity |

|

|||||||||||

|

Security |

|

Shares |

|

|

Price |

|

|

Value |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

37,973,989 |

|

|

$ |

22.64 |

|

|

$ |

859,731 |

|

|

NAV(3) |

|

|

37,973,989 |

|

|

$ |

34.32 |

|

|

$ |

1,303,337 |

|

|

Debt Metrics |

|

|||

|

Total debt to total gross assets(4) |

|

|

62.1 |

% |

|

Net debt to total estimated fair value of assets(4) |

|

|

59.6 |

% |

|

(1) |

Maturity dates include optional extension terms. |

|

(2) |

Amount includes a principle-only bearing subordinate Certificate, Class G, in the amount of $26.6 million, retained by Starwood Waypoint Residential Trust. |

|

(3) |

NAV is a non-GAAP measure. Our methodology for estimating NAV excludes average Turn 2 cost for stabilized homes from estimated renovation reserves. For an explanation of this measure and a reconciliation to the applicable GAAP measure, please refer to the “Definitions and Reconciliations” pages of this presentation. |

|

(4) |

Total debt to total gross assets and net debt to total estimated fair value of assets exclude the principle bearing subordinated Certificate, Class G, of $26.6 million, as noted in footnote 2 above. For definitions of gross assets, net debt, and estimated fair value of assets please refer to the “Definitions and Reconciliations” pages of this presentation. |

|

|

|

|

12 |

Total Rental Homes Portfolio – December 31, 2015

|

Markets |

|

Stabilized Homes |

|

|

Non-Stabilized Homes |

|

|

Total Homes(1)(2) |

|

|

Total Homes Leased (%) |

|

|

Total Homes Occupied (%) |

|

|

Average Acquisition Cost per Home |

|

|

Average Investment per Home(3) |

|

|

Aggregate Investment (in millions) |

|

|

Average Home Size (sq. ft.) |

|

|

Weighted Average Age (year) |

|

|

Average Year Purchased |

|

Average Monthly Rent Per Leased Home(4) |

|

|||||||||||

|

South Florida |

|

|

2,478 |

|

|

|

122 |

|

|

|

2,600 |

|

|

|

93.0% |

|

|

|

90.7% |

|

|

$ |

141,094 |

|

|

$ |

177,164 |

|

|

$ |

460.3 |

|

|

|

1,587 |

|

|

|

46 |

|

|

2014 |

|

$ |

1,660 |

|

|

Atlanta |

|

|

2,431 |

|

|

|

44 |

|

|

|

2,475 |

|

|

|

93.5% |

|

|

|

91.1% |

|

|

$ |

102,648 |

|

|

$ |

133,576 |

|

|

|

330.6 |

|

|

|

1,938 |

|

|

|

23 |

|

|

2014 |

|

$ |

1,228 |

|

|

Houston |

|

|

1,566 |

|

|

|

41 |

|

|

|

1,607 |

|

|

|

91.8% |

|

|

|

89.9% |

|

|

$ |

132,095 |

|

|

$ |

151,657 |

|

|

|

243.7 |

|

|

|

2,032 |

|

|

|

28 |

|

|

2014 |

|

$ |

1,552 |

|

|

Tampa |

|

|

1,433 |

|

|

|

49 |

|

|

|

1,482 |

|

|

|

93.3% |

|

|

|

91.1% |

|

|

$ |

106,001 |

|

|

$ |

128,029 |

|

|

|

189.7 |

|

|

|

1,465 |

|

|

|

41 |

|

|

2014 |

|

$ |

1,294 |

|

|

Dallas |

|

|

1,355 |

|

|

|

76 |

|

|

|

1,431 |

|

|

|

92.4% |

|

|

|

90.6% |

|

|

$ |

144,597 |

|

|

$ |

166,214 |

|

|

|

237.9 |

|

|

|

2,168 |

|

|

|

20 |

|

|

2014 |

|

$ |

1,618 |

|

|

Denver |

|

|

713 |

|

|

|

101 |

|

|

|

814 |

|

|

|

84.3% |

|

|

|

82.6% |

|

|

$ |

206,340 |

|

|

$ |

233,271 |

|

|

|

189.9 |

|

|

|

1,628 |

|

|

|

33 |

|

|

2014 |

|

$ |

1,804 |

|

|

Chicago |

|

|

730 |

|

|

|

55 |

|

|

|

785 |

|

|

|

84.5% |

|

|

|

83.8% |

|

|

$ |

122,123 |

|

|

$ |

152,069 |

|

|

|

119.4 |

|

|

|

1,593 |

|

|

|

37 |

|

|

2014 |

|

$ |

1,688 |

|

|

Orlando |

|

|

630 |

|

|

|

55 |

|

|

|

685 |

|

|

|

87.0% |

|

|

|

84.5% |

|

|

$ |

116,461 |

|

|

$ |

143,855 |

|

|

|

98.4 |

|

|

|

1,588 |

|

|

|

38 |

|

|

2014 |

|

$ |

1,335 |

|

|

Southern California |

|

|

440 |

|

|

|

9 |

|

|

|

449 |

|

|

|

88.6% |

|

|

|

87.1% |

|

|

$ |

243,735 |

|

|

$ |

257,310 |

|

|

|

115.5 |

|

|

|

1,651 |

|

|

|

39 |

|

|

2014 |

|

$ |

1,875 |

|

|

Northern California |

|

|

269 |

|

|

|

1 |

|

|

|

270 |

|

|

|

96.3% |

|

|

|

94.8% |

|

|

$ |

214,603 |

|

|

$ |

228,225 |

|

|

|

61.6 |

|

|

|

1,505 |

|

|

|

47 |

|

|

2013 |

|

$ |

1,757 |

|

|

Phoenix |

|

|

244 |

|

|

|

2 |

|

|

|

246 |

|

|

|

97.6% |

|

|

|

96.3% |

|

|

$ |

139,661 |

|

|

$ |

158,732 |

|

|

|

38.7 |

|

|

|

1,536 |

|

|

|

41 |

|

|

2014 |

|

$ |

1,209 |

|

|

Las Vegas |

|

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

|

81.1% |

|

|

|

81.1% |

|

|

$ |

152,650 |

|

|

$ |

164,678 |

|

|

|

6.1 |

|

|

|

1,908 |

|

|

|

30 |

|

|

2013 |

|

$ |

1,269 |

|

|

Total/Average |

|

|

12,326 |

|

|

|

555 |

|

|

|

12,881 |

|

|

|

91.5% |

|

|

|

89.5% |

|

|

$ |

135,717 |

|

|

$ |

162,458 |

|

|

$ |

2,091.8 |

|

|

|

1,764 |

|

|

|

34 |

|

|

2014 |

|

$ |

1,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status |

|

Total Homes(1)(2) |

|

|

Total Homes Leased (%) |

|

|

Average Acquisition Cost |

|

|

Average Investment per Home(3) |

|

|

Aggregate Investment (in millions) |

|

|

Average Home Size (sq. ft.) |

|

|

Weighted Average Age (year) |

|

|

Average Year Purchased |

|

|

Average Monthly Rent Per Leased Home(4) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Stabilized(5) |

|

|

12,326 |

|

|

|

94.9% |

|

|

$ |

134,302 |

|

|

$ |

160,978 |

|

|

$ |

1,984.2 |

|

|

|

1,758 |

|

|

|

34 |

|

|

2014 |

|

|

$ |

1,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-stabilized(5) |

|

|

555 |

|

|

|

14.6% |

|

|

$ |

167,136 |

|

|

$ |

195,619 |

|

|

|

107.6 |

|

|

|

1,891 |

|

|

|

32 |

|

|

2015 |

|

|

$ |

1,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total/Average |

|

|

12,881 |

|

|

|

91.5% |

|

|

$ |

135,717 |

|

|

$ |

162,458 |

|

|

$ |

2,091.8 |

|

|

|

1,764 |

|

|

|

34 |

|

|

2014 |

|

|

$ |

1,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Excludes 1,218 homes that we did not intend to hold for the long-term as of December 31, 2015. |

|

(2) |

Effective January 1, 2015, we measure homes by the number of rental units as compared to our previous measure by number of properties. Although historically we have primarily invested in SFRs, and expect to do so in the foreseeable future, this change takes into account our investments in multi-family properties and, we believe, provides a more meaningful measure to investors. |

|

(3) |

Includes acquisition costs and actual and estimated upfront renovation costs. Actual renovation costs may exceed estimated renovation costs, and we may acquire homes in the future with different characteristics that result in higher renovation costs. As of December 31, 2015, the average estimated renovation costs per acquired home were approximately $26,700. |

|

(4) |

Represents average monthly contractual cash rent. Average monthly cash rent is presented before rent concession and incentives (i.e. free rent and other concessions). To date, rent concessions and incentives have been utilized on a limited basis and have not had a significant impact on our average monthly rent. If the use of rent concessions or other leasing incentives increases in the future, they may have a greater impact by reducing the average monthly rent we receive from leased homes. |

|

(5) |

Please refer to the “Definitions and Reconciliation” pages of this presentation for a definition of stabilized and non-stabilized homes. |

|

|

13 |

Rent Growth by Lease Category – Three Months Ended December 31, 2015

|

|

|

Escalations on Multi-year Leases |

|

|

Renewal |

|

|

Replacement |

|

|

Total Weighted Average |

|

||||||||||||

|

|

|

Total |

|

Average |

|

|

Total |

Average |

|

|

Total |

Average |

|

|

Total |

|

Average |

|

||||||

|

Market |

|

Leases |

|

Rent Change (1) |

|

|

Leases |

Rent Change (2) |

|

|

Leases |

Rent Change (3) |

|

|

Leases |

|

Rent Change |

|

||||||

|

Atlanta |

|

131 |

|

|

2.9 |

% |

|

109 |

|

3.7 |

% |

|

148 |

|

1.6 |

% |

|

|

388 |

|

|

2.6 |

% |

|

|

South Florida |

|

149 |

|

|

3.0 |

% |

|

76 |

|

4.0 |

% |

|

150 |

|

3.1 |

% |

|

|

375 |

|

|

3.1 |

% |

|

|

Houston |

|

72 |

|

|

3.0 |

% |

|

80 |

|

1.5 |

% |

|

107 |

|

-1.0 |

% |

|

|

259 |

|

|

0.8 |

% |

|

|

Dallas |

|

75 |

|

|

3.0 |

% |

|

52 |

|

2.9 |

% |

|

85 |

|

3.8 |

% |

|

|

212 |

|

|

3.3 |

% |

|

|

Tampa |

|

57 |

|

|

3.1 |

% |

|

88 |

|

3.4 |

% |

|

94 |

|

3.0 |

% |

|

|

239 |

|

|

3.1 |

% |

|

|

Chicago |

|

47 |

|

|

3.0 |

% |

|

29 |

|

5.1 |

% |

|

29 |

|

1.9 |

% |

|

|

105 |

|

|

3.1 |

% |

|

|

Denver |

|

47 |

|

|

3.0 |

% |

|

20 |

|

5.3 |

% |

|

37 |

|

2.0 |

% |

|

|

104 |

|

|

3.0 |

% |

|

|

Orlando |

|

19 |

|

|

3.0 |

% |

|

28 |

|

4.4 |

% |

|

31 |

|

1.2 |

% |

|

|

78 |

|

|

2.7 |

% |

|

|

Southern California |

|

15 |

|

|

3.0 |

% |

|

17 |

|

3.1 |

% |

|

37 |

|

3.5 |

% |

|

|

69 |

|

|

3.1 |

% |

|

|

Northern California |

|

23 |

|

|

3.1 |

% |

|

10 |

|

4.5 |

% |

|

22 |

|

2.3 |

% |

|

|

55 |

|

|

2.6 |

% |

|

|

Phoenix |

|

7 |

|

|

3.0 |

% |

|

15 |

|

3.9 |

% |

|

15 |

|

1.8 |

% |

|

|

37 |

|

|

2.5 |

% |

|

|

Las Vegas |

|

|

— |

|

|

|

|

|