Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PERDOCEO EDUCATION Corp | ceco-8k_20160229.htm |

| EX-99.1 - EX-99.1 - PERDOCEO EDUCATION Corp | ceco-ex991_6.htm |

CAREER EDUCATION CORPORATION FISCAL FOURTH quarter 2015 investor conference call February 29, 2016 Dave Rawden Interim Chief Financial Officer Ashish Ghia Vice President, Finance Todd Nelson President & Chief Executive Officer Exhibit 99.2

This presentation contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by (see, for example, Slide 6), and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “believe,” “intend,” “will,” “expect,” “estimate,” “continue to,” “look forward to” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item 1A,“Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2015 and our subsequent filings with the Securities and Exchange Commission that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or any of the forward-looking statements to reflect future events, developments, or changed circumstances or for any other reason. Certain financial information is presented on a non-GAAP basis. The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the Company's results have underperformed or exceeded expectations. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of this presentation, and this presentation (including the reconciliation) has been posted to our website. Cautionary Statements & Disclosures

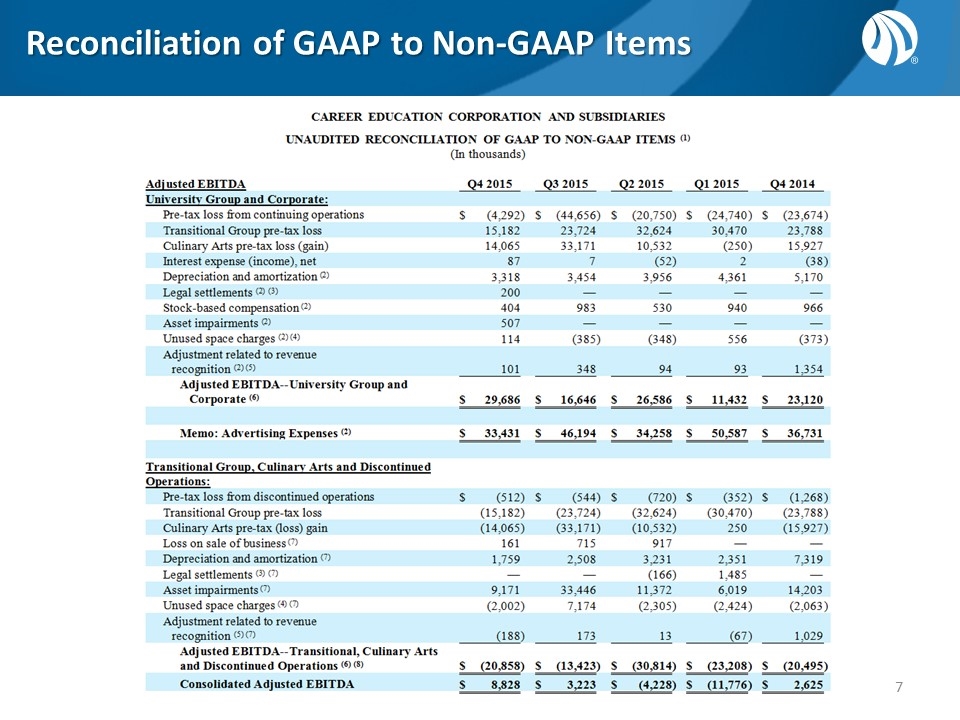

Fourth-Quarter Highlights University Group revenue increased by 8.2 percent year-over-year (or 4.2 percent when adjusted for prior year accounting change), primarily driven by a 4.4 percent increase in total enrollments at CTU University Group operating income increased 36.8 percent year-over-year to $31.5 million (or 29.6 percent when adjusted for prior year accounting change), primarily driven by increased revenues and our transformation initiatives Achieved positive total company adjusted EBITDA(1) for the second quarter in a row with adjusted EBITDA for University and Corporate being the highest in the past eight quarters Fourth quarter cash usage from operations was negative $0.7 million, compared to cash usage of negative $17.5 million in the fourth quarter of 2014 Please refer to Slides 7 and 8 at the end of this presentation for a reconciliation of GAAP to non-GAAP amounts.

Full Year Highlights Full year 2015 operating expenses for continuing and discontinued operations were roughly $152 million lower year-over-year, which was primarily driven by the impact of the Company’s transformation efforts Full year adjusted EBITDA from University and Corporate(1) was $84.4 million, representing an improvement of $25.0 million or 42.2 percent compared to 2014, driven by 2.7 percent revenue growth within University and execution of the Company’s transformation strategy Full year 2015 cash usage from operations was negative $21.7 million, compared to cash usage of negative $118.6 million for full year 2014 Ended 2015 with $201.0 million of cash, cash equivalents, restricted cash and available-for-sale short-term and long-term investments, net of borrowings Please refer to Slides 7 and 8 at the end of this presentation for a reconciliation of GAAP to non-GAAP amounts.

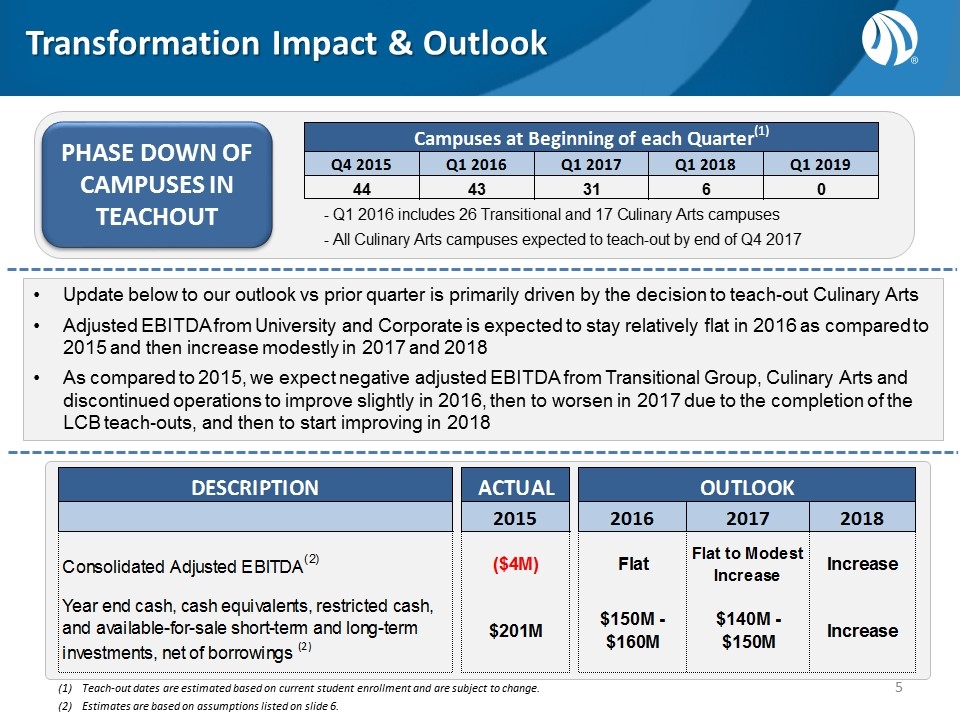

Transformation Impact & Outlook Teach-out dates are estimated based on current student enrollment and are subject to change. Estimates are based on assumptions listed on slide 6. PHASE DOWN OF CAMPUSES IN TEACHOUT Update below to our outlook vs prior quarter is primarily driven by the decision to teach-out Culinary Arts Adjusted EBITDA from University and Corporate is expected to stay relatively flat in 2016 as compared to 2015 and then increase modestly in 2017 and 2018 As compared to 2015, we expect negative adjusted EBITDA from Transitional Group, Culinary Arts and discontinued operations to improve slightly in 2016, then to worsen in 2017 due to the completion of the LCB teach-outs, and then to start improving in 2018

Key Transformation Assumptions Achievement of the transformation strategy and its estimated results included within these slides are based on the following key assumptions and factors, among others: Flat-to-modest total enrollment growth within the University Group while achieving the intended University Group efficiencies Teach-outs to occur as planned and performance consistent with historical experience Achievement of recovery rates for our real estate obligations and timing of any associated lease termination payments consistent with our historical experiences Right-sizing of our Corporate expense structure to serve primarily online institutions No material changes in the legal or regulatory environment and excludes legal or regulatory settlements Consistent working capital movements in line with historical operating trends and potential impact of teach-out campuses on working capital in line with expectations Although these estimates and assumptions are based upon management’s good faith beliefs regarding current events and actions that we may undertake in the future, actual results could differ materially from estimates.

Reconciliation of GAAP to Non-GAAP Items

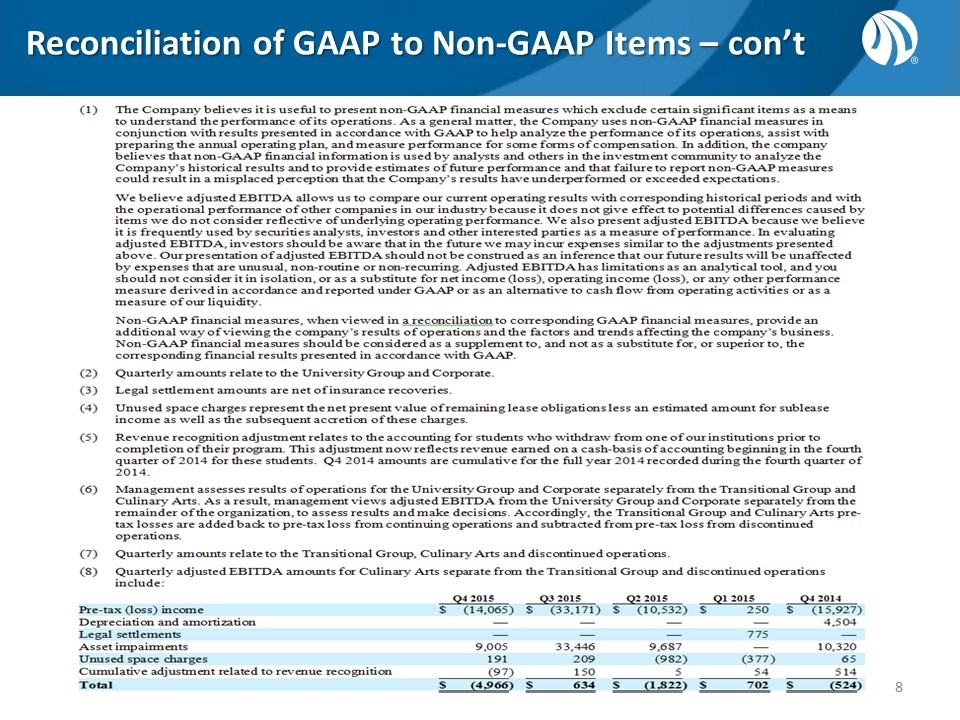

Reconciliation of GAAP to Non-GAAP Items – con’t

End of Presentation