Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Ultragenyx Pharmaceutical Inc. | rare-ex311_8.htm |

| EX-23.1 - EX-23.1 - Ultragenyx Pharmaceutical Inc. | rare-ex231_7.htm |

| EX-31.2 - EX-31.2 - Ultragenyx Pharmaceutical Inc. | rare-ex312_9.htm |

| 10-K - 10-K - Ultragenyx Pharmaceutical Inc. | rare-10k_20151231.htm |

| EX-32.1 - EX-32.1 - Ultragenyx Pharmaceutical Inc. | rare-ex321_10.htm |

| EX-21.1 - EX-21.1 - Ultragenyx Pharmaceutical Inc. | rare-ex211_798.htm |

| EX-10.38 - EX-10.38 - Ultragenyx Pharmaceutical Inc. | rare-ex1038_797.htm |

| EX-10.34 - EX-10.34 - Ultragenyx Pharmaceutical Inc. | rare-ex1034_795.htm |

| EX-10.35 - EX-10.35 - Ultragenyx Pharmaceutical Inc. | rare-ex1035_796.htm |

Exhibit 10.43

LEASE AGREEMENT

BETWEEN

MARINA BOULEVARD PROPERTY, LLC,

AS LANDLORD,

AND

ULTRAGENYX PHARMACEUTICAL INC.,

AS TENANT

DATED

December 8, 2015

|

|

|

|

|

Page |

||

|

|

Definitions and Basic Provisions |

|

1 |

|||

|

2. |

|

Lease Grant |

|

1 |

||

|

3. |

|

Tender of Possession; Square Footage of Premises |

|

1 |

||

|

|

|

(a) |

Tender of Possession |

|

1 |

|

|

|

|

(b) |

Square Footage of Premises |

|

2 |

|

|

4. |

|

Rent; Abatement of Rent |

|

2 |

||

|

|

|

(a) |

Rent |

|

2 |

|

|

|

|

(b) |

Abatement of Rent |

|

3 |

|

|

5. |

|

Delinquent Payment; Handling Charges |

|

2 |

||

|

6. |

|

Letter of Credit |

|

2 |

||

|

|

|

(a) |

Application of Security |

|

3 |

|

|

|

|

(b) |

Transfer |

|

3 |

|

|

7. |

|

Services; Utilities; Common Areas |

|

3 |

||

|

|

|

(a) |

Services |

|

3 |

|

|

|

|

(b) |

Excess Utility Use |

|

3 |

|

|

|

|

(c) |

Common Areas |

|

4 |

|

|

8. |

|

Alterations; Repairs; Maintenance; Signs |

|

4 |

||

|

|

|

(a) |

Alterations |

|

4 |

|

|

|

|

(b) |

Repairs; Maintenance |

|

5 |

|

|

|

|

|

(i) |

By Landlord |

|

5 |

|

|

|

|

(ii) |

By Tenant |

|

6 |

|

|

|

|

(iii) |

Performance of Work |

|

6 |

|

|

|

(c) |

Mechanic’s Liens |

|

7 |

|

|

|

|

(d) |

Signs |

|

7 |

|

|

|

|

|

(i) |

General Signs |

|

7 |

|

|

|

|

(ii) |

Building Top Signs |

|

7 |

|

9. |

|

Use; Compliance with Laws |

|

8 |

||

|

|

|

(a) |

Use |

|

8 |

|

|

|

|

(b) |

Landlord’s Compliance with Laws |

|

8 |

|

|

10. |

|

Assignment and Subletting |

|

9 |

||

|

|

|

(a) |

Transfers |

|

9 |

|

|

|

|

(b) |

Consent Standards |

|

9 |

|

|

|

|

(c) |

Request for Consent |

|

9 |

|

|

|

|

(d) |

Conditions to Consent |

|

9 |

|

|

|

|

(e) |

Attornment by Subtenants |

|

10 |

|

|

|

|

(f) |

Permitted Transfers |

|

10 |

|

|

|

|

(g) |

Additional Compensation |

|

10 |

|

|

|

|

(h) |

Landlord’s Option |

|

10 |

|

|

11. |

|

Insurance; Waivers; Subrogation; Indemnity |

|

11 |

||

|

|

|

(a) |

Indemnity Agreement |

|

11 |

|

|

|

|

(b) |

Tenant’s Insurance |

|

11 |

|

|

|

|

(c) |

Landlord’s Insurance |

|

12 |

|

|

|

|

(d) |

No Subrogation |

|

12 |

|

|

12. |

|

Subordination; Attornment; Notice to Landlord’s Mortgagee |

|

12 |

||

|

|

|

(a) |

Subordination |

|

12 |

|

|

|

|

(b) |

Attornment |

|

13 |

|

|

|

|

(c) |

Notice to Landlord’s Mortgagee |

|

13 |

|

|

13. |

|

Rules and Regulations |

|

13 |

||

|

14. |

|

Condemnation |

|

13 |

||

|

|

|

(a) |

Total Taking |

|

13 |

|

|

|

|

(b) |

Partial Taking - Tenant’s Rights |

|

13 |

|

|

|

|

(c) |

Partial Taking - Landlord’s Rights |

|

13 |

|

|

|

|

(d) |

Award |

|

13 |

|

|

|

|

(e) |

Repair |

|

13 |

|

|

15. |

|

Fire or Other Casualty |

|

14 |

||

|

|

|

(a) |

Repair Estimate |

|

14 |

|

- i -

TABLE OF CONTENTS

(Continued)

|

|

|

|

|

Page |

||

|

|

|

(b) |

Tenant’s Rights |

|

14 |

|

|

|

|

(c) |

Landlord’s Rights |

|

14 |

|

|

|

|

(d) |

Repair Obligation |

|

14 |

|

|

|

|

(e) |

Abatement of Rent |

|

14 |

|

|

|

|

(f) |

Waiver of Statutory Provisions |

|

14 |

|

|

16. |

|

Personal Property Taxes |

|

14 |

||

|

17. |

|

Events of Default |

|

15 |

||

|

|

|

(a) |

Payment Default |

|

15 |

|

|

|

|

(b) |

Abandonment |

|

15 |

|

|

|

|

(c) |

Estoppel/Financial Statement/Commencement Date Letter |

|

15 |

|

|

|

|

(d) |

Insurance |

|

15 |

|

|

|

|

(e) |

Mechanic’s Liens |

|

15 |

|

|

|

|

(f) |

Other Defaults |

|

15 |

|

|

|

|

(g) |

Insolvency |

|

15 |

|

|

18. |

|

Remedies |

|

15 |

||

|

19. |

|

Payment by Tenant; Non-Waiver; Cumulative Remedies |

|

16 |

||

|

|

|

(a) |

Payment by Tenant |

|

16 |

|

|

|

|

(b) |

No Waiver |

|

17 |

|

|

|

|

(c) |

Cumulative Remedies |

|

17 |

|

|

20. |

|

Intentionally Omitted |

|

17 |

||

|

21. |

|

Surrender of Premises |

|

17 |

||

|

22. |

|

Holding Over |

|

17 |

||

|

23. |

|

Certain Rights Reserved by Landlord |

|

17 |

||

|

|

|

(a) |

Building Operations |

|

17 |

|

|

|

|

(b) |

Security |

|

18 |

|

|

|

|

(c) |

Prospective Purchasers and Lenders |

|

18 |

|

|

|

|

(d) |

Prospective Tenants |

|

18 |

|

|

24. |

|

[Intentionally Deleted] |

|

18 |

||

|

25. |

|

Hazardous Materials |

|

18 |

||

|

26. |

|

Miscellaneous |

|

19 |

||

|

|

|

(a) |

Landlord Transfer |

|

19 |

|

|

|

|

(b) |

Landlord’s Liability |

|

19 |

|

|

|

|

(c) |

Force Majeure |

|

20 |

|

|

|

|

(d) |

Brokerage |

|

20 |

|

|

|

|

(e) |

Estoppel Certificates |

|

20 |

|

|

|

|

(f) |

Notices |

|

20 |

|

|

|

|

(g) |

Separability |

|

20 |

|

|

|

|

(h) |

Amendments; Binding Effect |

|

20 |

|

|

|

|

(i) |

Quiet Enjoyment |

|

20 |

|

|

|

|

(j) |

No Merger |

|

21 |

|

|

|

|

(k) |

No Offer |

|

21 |

|

|

|

|

(l) |

Entire Agreement |

|

21 |

|

|

|

|

(m) |

Waiver of Jury Trial |

|

21 |

|

|

|

|

(n) |

Governing Law |

|

21 |

|

|

|

|

(o) |

Recording |

|

21 |

|

|

|

|

(p) |

Joint and Several Liability |

|

21 |

|

|

|

|

(q) |

Financial Reports |

|

21 |

|

|

|

|

(r) |

Landlord’s Fees |

|

21 |

|

|

|

|

(s) |

Telecommunications |

|

21 |

|

|

|

|

(t) |

Authority |

|

22 |

|

|

|

|

(u) |

Waiver |

|

22 |

|

|

|

|

(v) |

Tenant Representation |

|

22 |

|

|

|

|

(w) |

Transportation Management |

|

22 |

|

|

|

|

(x) |

CC&Rs; Disclosure |

|

22 |

|

|

|

(y) |

Disclosure |

|

22 |

||

- ii -

All exhibits and attachments attached hereto are incorporated herein by this reference. The following exhibits are attached to and made a part of this Lease:

|

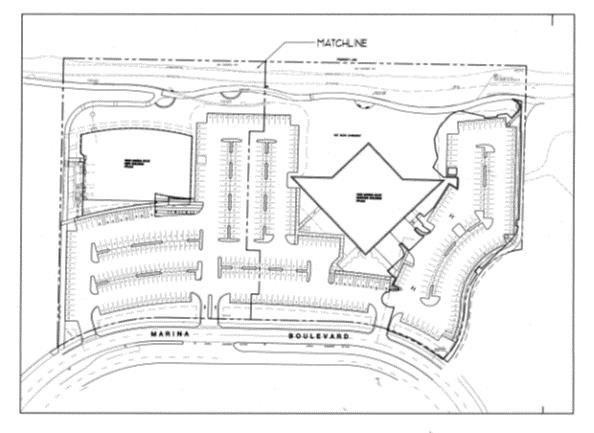

Exhibit A-1 - |

|

Site Plan Depicting Premises and Building |

|

Exhibit A-2 - |

|

Site Plan Depicting Complex |

|

Exhibit B - |

|

Legal Description of the Land |

|

Exhibit C - |

|

Additional Rent, Taxes and Insurance |

|

Exhibit D - |

|

Tenant Work Letter |

|

Exhibit E - |

|

Building Rules and Regulations |

|

Exhibit F - |

|

Form of Confirmation of Commencement Date Letter |

|

Exhibit G - |

|

Form of Tenant Estoppel Certificate |

|

Exhibit H - |

|

Renewal Option |

|

Exhibit I - |

|

Contractor Insurance Requirements |

|

Exhibit J - |

|

Environmental Questionnaire |

|

Exhibit K - |

|

Building Standards |

- iii -

This Basic Lease Information is attached to and incorporated by reference to a Lease Agreement between Landlord and Tenant, as defined below.

|

Landlord: |

|

MARINA BOULEVARD PROPERTY, LLC, a Delaware limited liability company |

|

|

|

|

|

Tenant: |

|

ULTRAGENYX PHARMACEUTICAL INC., a Delaware corporation |

|

|

|

|

|

Guarantor: |

|

None. |

|

|

|

|

|

Premises: |

|

An area comprising the entire rentable square feet of the building commonly known as 5000 Marina Boulevard, Brisbane, California 94005 (the “Building”), which Building and Premises contains approximately 63,048 rentable square feet in the aggregate, as depicted on Exhibit A-1, comprised of (i) 19,684 rentable square feet on the 1st Floor, (ii) 21,662 rentable square feet on the 2nd Floor, and (iii) 21,702 rentable square feet on the 3rd Floor. |

|

|

|

|

|

Land: |

|

The land on which the Building is located as described in Exhibit B. |

|

|

|

|

|

Project: |

|

The Building, the Land and the driveways, parking facilities, and similar improvements and easements associated with the Building, Land and the operation thereof. |

|

|

|

|

|

Complex: |

|

The Project and other buildings which comprise Marina Landing, a multi-building complex, subject to the conditions, covenants and restrictions as administered by owners’ associations applicable to the Project, as further set forth and described in Exhibit A-2. |

|

|

|

|

|

Term: |

|

One hundred twenty-two (122) months, commencing on the first day of the month following the Commencement Date (unless the Commencement Date is on the first day of the month, in which case the Term shall commence on the Commencement Date) and ending at 5:00 p.m. local time on the last day of the 122nd full calendar month following the Commencement Date, subject to adjustment and earlier termination as provided in the Lease. |

|

|

|

|

|

Commencement Date:

|

|

The earliest of: (a) the Substantial Completion of the initial Tenant Improvements in the Premises (including receipt of all required permits for the use thereof) as described in Exhibit D; or (b) the date the Tenant Improvements would have been substantially completed and the Premises would have been Ready For Occupancy except for Tenant Delays; or (c) occupancy of the Premises by Tenant for Tenant’s business purposes; or (d) May 1, 2016. The terms “Tenant Improvements,” “Ready for Occupancy” and “Tenant Delays” are defined in the Work Letter Agreement attached hereto as Exhibit D and made a part hereof. |

|

|

|

|

|

Estimated Delivery Date: |

|

May 1, 2016 |

|

Base Rent: |

Lease Month |

Annual Base Rent |

Monthly Base Rent |

Monthly Rental Rate Per RSF |

|

|

1 – 12* |

$2,042,755.20 |

$170,229.60 |

$2.70 |

|

|

13 – 24 |

$2,103,281.20 |

$175,273.44 |

$2.78 |

|

|

25 – 36 |

$2,163,807.30 |

$180,317.28 |

$2.86 |

|

|

37 – 48 |

$2,231,899.20 |

$185,991.60 |

$2.95 |

|

|

49 – 60 |

$2,299,991.00 |

$191,665.92 |

$3.04 |

|

|

61 – 72 |

$2,368,082.80 |

$197,340.24 |

$3.13 |

|

|

73 – 84 |

$2,436,174.70 |

$203,014.56 |

$3.22 |

|

|

85 – 96 |

$2,511,832.30 |

$209,319.36 |

$3.32 |

|

|

97 – 108 |

$2,587,489.90 |

$215,624.16 |

$3.42 |

|

|

109 – 120 |

$2,663,147.50 |

$221,928.96 |

$3.52 |

|

|

121 – 122 |

$2,746,370.80 |

$228,864.24 |

$3.63 |

|

|

|

* Monthly Base Rent shall be abated for the second (2nd) through and including the eleventh (11th) Lease Month pursuant to Section 4(b) of the Lease. |

|

|

|

|

- iv -

- v -

|

|

Ultragenyx Pharmaceutical Inc. 5000 Marina Boulevard Brisbane, CA 94005 Attention: Chief Business Officer Telephone: (415) 483-8800 Facsimile: (415) 483-8892 |

|

|

|

|

|

|

|

|

with a copy to: Ultragenyx Pharmaceutical Inc. 60 Leveroni Court Novato, California 94949 Attention: Executive Director, Legal Affairs Telephone: (415) 483-8800 Facsimile: (415) 483-8892 |

|

|

|

|

|

Landlord’s Address for Notices: |

|

Marina Boulevard Property, LLC c/o Westport Capital Partners LLC 2121 Rosecrans Avenue Suite 4325 El Segundo, California 90245 Attention: Eric Clapp, Managing Director Telephone: (310) 294-1239 Facsimile: (310) 643-7379 |

|

|

|

|

|

|

|

With a copy to: Marina Boulevard Property, LLC c/o Westport Capital Partners 40 Danbury Road Wilton, Connecticut 06897 Attention: Marc Porosoff, Esq. Telephone: (203) 429-8602 Facsimile: (203) 429-8599 |

|

|

|

|

|

|

|

Additional copy to: DLA Piper US LLP 550 South Hope Street, Suite 2300 Los Angeles, California 90071 Attention: Jackie Park, Esq. Telephone: (213) 330-7743 Facsimile: (213) 330-7543 |

|

|

|

|

|

Rent Payment Address: |

|

Marina Boulevard Property, LLC c/o Sentinel Development 18301 Von Karman, Suite 510 Irvine, CA 92612 |

The foregoing Basic Lease Information is incorporated into and made a part of the Lease identified above. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

- vi -

This Lease Agreement (this “Lease”) is entered into as of December 8, 2015, between MARINA BOULEVARD PROPERTY, LLC, a Delaware limited liability company (“Landlord”), and ULTRAGENYX PHARMACEUTICAL INC., a Delaware corporation (“Tenant”).

1. Definitions and Basic Provisions. The definitions and basic provisions set forth in the Basic Lease Information (the “Basic Lease Information”) executed by Landlord and Tenant contemporaneously herewith are incorporated herein by reference for all purposes. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control. Additionally, the following terms shall have the following meanings when used in this Lease: “Affiliate” means any person or entity which, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the party in question (as used herein, the term “control” shall mean the possession, direct or indirect, of not less than a majority of the voting rights attributable to the shares of Tenant and a majority of the outstanding capital stock of Tenant, or the power to direct or cause the direction of the management and policies of a Tenant, whether through the ownership of voting shares, by contract or otherwise); “Building’s Structure” means the Building’s exterior walls, roof, elevator shafts (if any), footings, foundations, structural portions of load-bearing walls, structural floors and subfloors, and structural columns and beams; “Building’s Systems” means the Premises’ and Building’s HVAC, life-safety, plumbing, electrical, and mechanical systems; “Business Day(s)” means Monday through Friday of each week, exclusive of Holidays; “Complex” shall collectively refer to the Building and any other buildings which comprise a multi-building complex owned by Landlord, if applicable and as further set forth in Exhibit A-1; “Holidays” means New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day, and any other nationally or regionally recognized holiday; “including” means including, without limitation; “Land” is the land on which the Building is located, as described on Exhibit B attached hereto; “Laws” means all federal, state, and local laws, ordinances, rules and regulations, all court orders, governmental directives, and governmental orders and all interpretations of the foregoing, and all restrictive covenants affecting the Project, and “Law” shall mean any of the foregoing; “Project” shall collectively refer to the Building, the Land and the driveways, parking facilities, and similar improvements and easements associated with the foregoing or the operation thereof; “Rent” shall collectively refer to Base Rent, Additional Rent, Taxes, and Insurance (each as defined in Exhibit C hereto), and all other sums that Tenant may owe to Landlord or otherwise be required to pay under the Lease; “Tenant’s Off-Premises Equipment” means any of Tenant’s equipment or other property that may be located on or about the Project (other than inside the Premises); and “Tenant Party” means any of the following persons: Tenant; any assignees claiming by, through, or under Tenant; any subtenants claiming by, through, or under Tenant; and any of their respective agents, contractors and employees.

2. Lease Grant. Subject to the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises (as defined in the Basic Lease Information). The Premises are outlined on the plan attached to the Lease as Exhibit A.

3. Tender of Possession; Square Footage of Premises.

(a) Tender of Possession. Landlord and Tenant presently anticipate that possession of the Premises will be tendered to Tenant in the condition required by this Lease on or about the Estimated Delivery Date. If Landlord is unable to tender possession of the Premises in such condition to Tenant by the Estimated Delivery Date, then: (i) the validity of this Lease shall not be affected or impaired thereby; (ii) Landlord shall not be in default hereunder or be liable for damages therefor; and (iii) Tenant shall accept possession of the Premises when Landlord tenders possession thereof to Tenant. If for any reason Landlord has not delivered possession of the Premise in the condition required by this Lease on or before November 1, 2016 as extended below (the “Outside Delivery Date”), Tenant shall have the right to terminate this Lease by delivery to Landlord of a notice (the “Termination Notice”), which termination shall be effective ten (10) business days after Tenant’s delivery of the Termination Notice to Landlord, unless within such ten (10) business day period Landlord shall deliver to Tenant the Premises in the condition required by this Lease. In the event Tenant shall elect to terminate this Lease as set forth herein by delivery of the Termination Notice to Landlord and Landlord shall not have delivered to Tenant the Premises in the condition required by this Lease within such ten (10) business day period, then Landlord shall promptly return the Letter of Credit to Tenant and neither Landlord nor Tenant shall have any further obligation to the other under this Lease. The Outside Delivery Date shall be extended one (1) day for each day of Tenant Delay (as hereinafter defined in the Tenant Work Letter attached hereto as Exhibit D) and Force Majeure Event (as hereinafter defined in Section 26(c)). By occupying the Premises, Tenant shall be deemed to have accepted the Premises in their condition as of the date of such occupancy, subject to the performance of punch-list items that remain to be performed by Landlord, if any. The date that the Premises are actually tendered to Tenant shall be referred to herein as the “Delivery Date.” Within ten (10) Business Days following the Commencement Date, Tenant shall execute and deliver to Landlord a letter substantially in the form of Exhibit F hereto confirming: (1) the Commencement Date (as defined in the Basic Lease Information) and the expiration date of the initial Term (as defined in the Basic Lease Information); (2) that Tenant has accepted the Premises; and (3) that Landlord has performed all of its obligations with respect to the Premises (except for punch-list items specified in such letter); however, the failure of the parties to execute such letter shall not defer the Commencement Date or otherwise invalidate this Lease. Tenant’s failure to execute such document within ten (10) days of receipt thereof from Landlord shall be deemed Tenant’s agreement to the contents of such document. Any use of the Premises by Tenant prior to the Commencement Date shall be subject to all of the provisions of this Lease excepting only those requiring the payment of Rent.

1

(b) Square Footage of Premises. For purposes of this Lease, the “rentable square feet” of the Premises and the Complex has been calculated by Landlord pursuant to the Building Owners and Managers Association International Standard Method for Measuring Floor Area in Office Buildings, ANSI Z65.1 - 2010 (the “BOMA Standard”). The rentable square footage of the Premises set forth in this Lease shall be deemed by Tenant to be the rentable square footage of the Premises for all purposes. In that regard, Tenant has been given an opportunity to measure the rentable square footage of the Premises prior to execution of this Lease and Tenant hereby waives any rights it may have following execution of this Lease to measure the Premises or claim that the rentable square footage of the Premises is other than as set forth in this Lease.

4. Rent; Abatement of Rent.

(a) Rent. Tenant shall timely pay to Landlord Rent, including the amounts set forth in Exhibit C hereto, without notice, demand, deduction or set-off (except as otherwise expressly provided herein), by good and sufficient check drawn on a national banking association at Landlord’s address provided for in this Lease or electronically via automatic debit or wire transfer to such account as Landlord designates in writing to Tenant, or as otherwise specified by Landlord. The obligations of Tenant to pay Base Rent (as defined in the Basic Lease Information) and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. Base Rent shall be payable monthly in advance. The first (1st) monthly installment of Base Rent shall be payable contemporaneously with the execution of this Lease; thereafter, Base Rent shall be payable on the first (1st) day of each month beginning on the first (1st) day of the second (2nd) full calendar month of the Term. The monthly Base Rent for any partial month at the beginning of the Term shall equal the product of 1/365 of the annual Base Rent in effect during the partial month and the number of days in the partial month, and shall be due on the Commencement Date. Payments of Base Rent for any fractional calendar month at the end of the Term shall be similarly prorated. Tenant shall pay Additional Rent, Taxes and Insurance (each as defined in Exhibit C) at the same time and in the same manner as Base Rent.

(b) Abatement of Rent. Notwithstanding anything to the contrary contained herein and provided that Tenant faithfully performs all of the terms and conditions of this Lease, Landlord hereby agrees to abate Tenant’s obligation to pay Tenant’s monthly Base Rent (the “Abated Rent”) for the second (2nd) through and including eleventh (11th) Lease Month of the initial Term (the “Abatement Period”), which total amount of Abated Rent is $1,702,296.00 (i.e., 10 months x $170,229.60 per month = $1,702,296.00). During the Abatement Period, Tenant shall remain responsible for the payment of all of its other monetary obligations under this Lease. If at any time during the Term an Event of Default by Tenant occurs (as defined in Section 17 below), all Abated Rent that is unamortized as of the occurrence of the Event of Default (such amortization to be computed over the number of full calendar months in the Term of the Lease from and after the Abatement Period through the expiration of the Term of the Lease, together with interest thereon at a rate equal to eight percent (8%) per annum) shall become immediately due and payable by Tenant to Landlord. The payment by Tenant of the unamortized portion of the Abated Rent following the occurrence of an Event of Default shall not limit or affect any of Landlord’s other rights or remedies upon the occurrence of an Event of Default by Tenant, whether pursuant to the Lease or at law or in equity.

5. Delinquent Payment; Handling Charges. All past due payments required of Tenant hereunder shall bear interest from the date due until paid at the lesser of the “prime” rate as published in the Wall Street Journal plus two percent (2%) per annum or the maximum lawful rate of interest (such lesser amount is referred to herein as the “Default Rate”); additionally, Landlord, in addition to all other rights and remedies available to it, may charge Tenant a fee equal to five percent (5%) of the delinquent payment to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant’s delinquency. In no event, however, shall the charges permitted under this Section 5 or elsewhere in this Lease, to the extent they are considered to be interest under applicable Law, exceed the maximum lawful rate of interest.

Notwithstanding the foregoing, the foregoing late charge shall be waived for the first such late payment of Rent or other charges during each twelve (12) month period for the Term of this Lease, provided, that, such payment is made within ten (10) days of the date such payment is due.

6. Letter of Credit. Tenant shall deliver to Landlord, no later than 5:00 p.m. PST December 11, 2015, a Letter of Credit (as hereinafter defined) in the amount specified in the Basic Lease Information, as additional security for the faithful performance and observance by Tenant of the terms, covenants and conditions of this Lease. The Letter of Credit shall be in the form of a clean, irrevocable, non-documentary and unconditional letter of credit (the “Letter of Credit”) issued by and drawable upon any commercial bank, trust company, national banking association or savings and loan association with offices for banking purposes in Los Angeles, California and otherwise satisfactory to Landlord (the “Issuing Bank”), which has outstanding unsecured, uninsured and unguaranteed indebtedness, or shall have issued a letter of credit or other credit facility that constitutes the primary security for any outstanding indebtedness (which is otherwise uninsured and unguaranteed), that is then rated, without regard to qualification of such rating by symbols such as “+” or “-” or numerical notation, “Aa” or better by Moody’s Investors Service and “AA” or better by Standard & Poor’s Rating Service, and has combined capital, surplus and undivided profits of not less than $2,000,000,000. The Letter of Credit shall (a) name Landlord as beneficiary, (b) have a term of not less than one (1) year, (c) permit multiple drawings, (d)

2

be fully transferable by Landlord without the payment of any fees or charges by Landlord, and (e) otherwise be in form and content satisfactory to Landlord. The Letter of Credit shall provide that it shall be deemed automatically renewed, without amendment, for consecutive periods of one year each thereafter during the Term (and in no event shall the Letter of Credit expire prior to the forty-fifth (45th) day following the Expiration Date) unless the Issuing Bank sends duplicate notices (the “Non-Renewal Notices”) to Landlord by certified mail, return receipt requested (one of which shall be addressed “Attention, Chief Legal Officer” and the other of which shall be addressed “Attention, Chief Financial Officer”), not less than forty-five (45) days next preceding the then expiration date of the Letter of Credit stating that the Issuing Bank has elected not to renew the Letter of Credit. The Issuing Bank shall agree with all drawers, endorsers and bona fide holders that drafts drawn under and in compliance with the terms of the Letter of Credit will be duly honored upon presentation to the Issuing Bank at an office location in Los Angeles, California. The Letter of Credit shall be subject in all respects to the International Standby Practices 1998, International Chamber of Commerce Publication No. 590.

Effective on the fifth (5th) anniversary of the Commencement Date (“Reduction Date”) and as long as the Reduction Conditions (as hereinafter defined) have been satisfied by Tenant, the amount of the Letter of Credit shall be reduced to an amount equal to Six Hundred Eighty-Six Thousand Five Hundred Ninety-Two and 72/100 Dollars ($686,592.72). For purposes of this Section 6, the “Reduction Conditions” shall mean (a) no Event of Default has occurred under this Lease from the Commencement Date through and including the Reduction Date, and (b) for the thirty (30) day period ending on the Reduction Date, Tenant has maintained market capitalization above $2.0 Billion Dollars, as indicated on NASDAQ.

(a) Application of Security. If (a) an event of default by Tenant occurs in the payment or performance of any of the terms, covenants or conditions of this Lease, including the payment of Rent, or (b) Tenant fails to make any installment of Rent as and when due, or (c) Landlord receives a Non-Renewal Notice, Landlord shall have the right by sight draft to draw, at its election, all or a portion of the proceeds of the Letter of Credit and thereafter hold, use, apply, or retain the whole or any part of such proceeds, as the case may be, (x) to the extent required for the payment of any Rent or any other sum as to which Tenant is in default including (i) any sum which Landlord may expend or may be required to expend by reason of Tenant’s default, and/or (ii) any damages to which Landlord is entitled pursuant to this Lease, whether such damages accrue before or after summary proceedings or other reentry by Landlord, and/or (y) as a cash security deposit, unless and until, in the case of clause (c) above, Tenant delivers to Landlord a substitute Letter of Credit which meets the requirements of this Section 6. If Landlord applies or retains any part of the proceeds of the Letter of Credit, or cash security, Tenant, upon demand, shall deposit with Landlord the amount so applied or retained so that Landlord shall have the full amount thereof on hand at all times during the Term. If Tenant shall comply with all of the terms, covenants and conditions of this Lease, the Letter of Credit or cash security, as the case may be, shall be returned to Tenant not later than sixty (60) days after the Expiration Date and after delivery of possession of the Premises to Landlord in the manner required by this Lease.

(b) Transfer. Upon a sale or other transfer of the Building, or any financing of Landlord’s interest therein, Landlord shall have the right to transfer the Letter of Credit or the cash security to its transferee or lender. With respect to the Letter of Credit, within five (5) days after notice of such transfer or financing, Tenant, at its sole cost, shall arrange for the transfer of the Letter of Credit to the new landlord or the lender, as designated by Landlord in the foregoing notice or have the Letter of Credit reissued in the name of the new landlord or the lender. Upon such transfer, Tenant shall look solely to the new landlord or lender for the return of the Letter of Credit or such cash security and the provisions hereof shall apply to every transfer or assignment made of the Letter of Credit or such cash security to a new landlord. Tenant shall not assign or encumber or attempt to assign or encumber the Letter of Credit or such cash security and neither Landlord nor its successors or assigns shall be bound by any such action or attempted assignment, or encumbrance.

7. Services; Utilities; Common Areas.

(a) Services. Other than Landlord’s maintenance obligations expressly set forth in this Lease, Landlord shall not be obligated to provide any services to Tenant.

(b) Excess Utility Use. Tenant shall obtain all water, electricity, sewerage, gas, telephone and other utilities for the Premises directly from the public utility company furnishing same. Any meters required in connection therewith shall be installed at Tenant’s sole cost. Tenant shall pay all utility deposits and fees, and all monthly service charges for water, electricity, sewage, gas, telephone and any other utility services furnished to the Premises during the Term of this Lease. Tenant shall not install any equipment which exceeds or overloads the capacity of the utility facilities serving the Premises. If Tenant uses heat or air conditioning systems in excess of an average of sixty (60) hours per calendar week over a three (3) month period, Tenant shall pay to Landlord, upon billing, the cost of the increased wear and tear on existing equipment (including without limitation, the accelerated depreciation thereof) caused by such excess consumption as determined by Landlord. Amounts payable by Tenant to Landlord for such excess use of heat or air conditioning systems shall be deemed Additional Rent hereunder and shall be billed on a monthly basis.

3

(c) Common Areas. The term “Common Area” is defined for all purposes of this Lease as that part of the Project and/or Complex intended for the common use of all tenants, including among other facilities (as such may be applicable to the Complex), parking areas, private streets and alleys, landscaping, curbs, loading areas, sidewalks, lighting facilities, drinking fountains, meeting rooms, public toilets, and the like, but excluding: (i) space in buildings (now or hereafter existing) designated for rental for commercial purposes, as the same may exist from time to time; (ii) streets and alleys maintained by a public authority; (iii) areas within the Complex which may from time to time not be owned by Landlord (unless subject to a cross-access or common use agreement benefiting the area which includes the Premises); and (iv) areas leased to a single-purpose user where access is restricted. In addition, although the roof(s) of the building(s) in the Complex is not literally part of the Common Area, it will be deemed to be so included for purposes of: (x) Landlord’s ability to prescribe rules and regulations regarding same; and (y) its inclusion for purposes of Common Area Maintenance reimbursements. Landlord reserves the right to change from time to time the dimensions and location of the Common Area, as well as the dimensions, identities, locations and types of any buildings, signs or other improvements in the Complex, so long as access to the Premises is not materially adversely affected thereby. Tenant, and its employees and customers, and when duly authorized pursuant to the provisions of this Lease, its subtenants, licensees and concessionaires, shall have the non-exclusive right to use the parking spaces designated in the Basic Lease Information in the Common Area (excluding roof(s)) as constituted from time to time, such use to be in common with Landlord, other tenants in the Building and/or Complex, as applicable, and other persons permitted by the Landlord to use the same, and subject to rights of governmental authorities, easements, other restrictions of record, and such reasonable rules and regulations governing use as Landlord may from time to time prescribe. For example, and without limiting the generality of Landlord’s ability to establish rules and regulations governing all aspects of the Common Area, Tenant agrees as follows:

(i) Landlord may from time to time designate specific areas within the Project or Complex, as applicable, or in reasonable proximity thereto in which automobiles owned by Tenant, its employees, subtenants, licensees, and concessionaires shall be parked, provided that such designated parking spaces will at all times accommodate not fewer than 189 automobiles; and Tenant agrees that if any automobile or other vehicle owned by Tenant or any of its employees, its subtenants, its licensees or its concessionaires, or their employees, shall at any time be parked in any part of the Project or Complex, as applicable, other than the specified areas designated for employee parking, Landlord may have such vehicle towed at the cost of the owner of same.

(ii) Tenant shall not solicit business within the Common Area nor take any action which would interfere with the rights of other persons to use the Common Area.

(iii) Landlord may temporarily close any part of the Common Area for such periods of time as may be necessary to make repairs or alterations or to prevent the public from obtaining prescriptive rights, so long as access to the Premises is not materially adversely affected thereby and Tenant has the ability at all times to park not fewer than 189 automobiles.

(iv) With regard to the roof(s) of the building(s) in the Project or Complex, as applicable, use of the roof(s) is reserved to Landlord, or with regard to any tenant demonstrating to Landlord’s satisfaction a need to use same, to such tenant after receiving prior written consent from Landlord.

(v) Tenant shall have the right, at its sole cost and expense, to designate and mark twelve (12) parking spaces located in close proximity to the front door of the Building as reserved parking for Tenant’s visitors, which twelve (12) parking spaces are part of and included within the one hundred eighty-nine (189) parking spaces provided by Landlord to Tenant under this Lease. Tenant hereby acknowledges and agrees that (a) Tenant shall be responsible at its sole cost and expense for designating and marking such twelve (12) parking spaces and for monitoring the use thereof by Tenant’s visitors, and (b) Landlord shall have no responsibility or obligation for monitoring such parking spaces for Tenant’s visitors.

8. Alterations; Repairs; Maintenance; Signs.

(a) Alterations. Tenant shall not make any alterations, additions or improvements to the Premises (collectively, the “Alterations”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed, except for the installation of unattached, movable trade fixtures which may be installed without drilling, cutting or otherwise defacing the Premises. Tenant shall furnish complete plans and specifications to Landlord for its approval, which approval shall not be unreasonably withheld, conditioned or delayed, at the time it requests Landlord’s consent to any Alterations if the desired Alterations: (i) will affect the Building’s Systems or Building’s Structure; or (ii) will require the filing of plans and specifications with any governmental or quasi-governmental agency or authority; or (iii) will require a building permit or other federal, state, county or local approvals with respect thereto; or (iv) will cost in excess of Ten Thousand Dollars ($10,000.00). Subsequent to obtaining Landlord’s consent and prior to commencement of the Alterations, Tenant shall deliver to Landlord any building permit required by applicable Law and a copy of the executed construction contract(s). Tenant shall reimburse Landlord within ten (10) days after the rendition of a bill for all of Landlord’s reasonable out-of-pocket costs incurred in connection with any Alterations, including all management, engineering, outside consulting, and construction fees incurred by or on behalf of Landlord for the review and approval of Tenant’s plans and specifications and for the

4

monitoring of construction of the Alterations, together with a supervision coordination fee to Landlord in an amount equal to the product of (i) four percent (4%) and (ii) the costs of the Alterations. If Landlord consents to the making of any Alteration, such Alteration shall be made by Tenant at Tenant’s sole cost and expense by contractors and subcontractors approved in writing by Landlord in accordance with Section 8(b)(iii), which approval shall not unreasonably be withheld, conditioned or delayed. All Alterations shall conform, at a minimum, to the Building Standards attached hereto as Exhibit K, as the same may be modified by Landlord from time to time (the “Building Standards”). Without Landlord’s prior written consent, Tenant shall not use any portion of the Common Areas either within or without the Project or Complex, as applicable, in connection with the making of any Alterations. If the Alterations which Tenant causes to be constructed result in Landlord being required to make any alterations and/or improvements to other portions of the Project or Complex, as applicable, in order to comply with any applicable Laws, then Tenant shall reimburse Landlord upon demand for all costs and expenses incurred by Landlord in making such alterations and/or improvements. Any Alterations made by Tenant shall become the property of Landlord upon installation and shall remain on and be surrendered with the Premises upon the expiration or sooner termination of this Lease, except Tenant shall upon demand by Landlord, at Tenant’s sole cost and expense, forthwith and with all due diligence (but in any event not later than ten (10) days after the expiration or earlier termination of the Lease) remove all or any portion of any Alterations made by Tenant which are designated by Landlord to be removed (including without limitation stairs, bank vaults, and cabling, if applicable) and repair and restore the Premises in a good and workmanlike manner to their original condition, reasonable wear and tear and casualty not required to be repaired by Tenant excepted. Notwithstanding the foregoing, upon Tenant’s request at the time it seeks Landlord’s consent to an Alteration, Landlord agrees to indicate in writing whether it will require such Alteration to be removed upon the expiration or earlier termination of the Lease. All construction work done by Tenant within the Premises shall be performed in a good and workmanlike manner with new materials of first-class quality, lien-free and in compliance with all Laws, and in such manner as to cause a minimum of interference with other construction in progress and with the transaction of business in the Project or Complex, as applicable. TENANT AGREES TO INDEMNIFY, DEFEND AND HOLD LANDLORD HARMLESS AGAINST ANY LOSS, LIABILITY OR DAMAGE RESULTING FROM SUCH WORK, AND TENANT SHALL, IF REQUESTED BY LANDLORD, FURNISH A BOND OR OTHER SECURITY SATISFACTORY TO LANDLORD AGAINST ANY SUCH LOSS, LIABILITY OR DAMAGE (PROVIDED, HOWEVER, THAT NO BOND SHALL BE REQUIRED AS LONG AS NO EVENT OF DEFAULT SHALL HAVE OCCURRED UNDER THIS LEASE). The foregoing indemnity shall survive the expiration or earlier termination of this Lease. Landlord’s consent to or approval of any Alterations, additions or improvements (or the plans therefor) shall not constitute a representation or warranty by Landlord, nor Landlord’s acceptance, that the same comply with sound architectural and/or engineering practices or with all applicable Laws, and Tenant shall be solely responsible for ensuring all such compliance.

Notwithstanding the foregoing, Tenant shall not be obligated to receive the written consent of Landlord for interior Alterations to the Premises (i) where the estimated cost of the proposed Alteration is Fifty Thousand Dollars ($50,000.00) or less, (ii) if said Alterations do not affect the structural components of the Building, or adversely affect the systems and equipment or which can be seen from outside the Premises, or (iii) if said Alteration shall not require a building permit or any federal, state, county or local approvals.

(b) Repairs; Maintenance.

(i) By Landlord. Landlord shall, subject to reimbursement under Exhibit C, keep the foundation, the exterior walls (except plate glass; windows, doors and other exterior openings; window and door frames, molding, closure devices, locks and hardware; special store fronts; lighting, heating, air conditioning, plumbing and other electrical, mechanical and electromotive installation, equipment and fixtures; signs, placards, decorations or other advertising media of any type; and interior painting or other treatment of exterior walls), and roof structure of the Premises in good repair. Landlord, however, shall not be required to repair any damage resulting from the act or negligence of Tenant, its agents, contractors, employees, subtenants, licensees and concessionaires (including, but not limited to, roof leaks resulting from Tenant’s installation of air conditioning equipment or any other roof penetration or placement); and the provisions of the previous sentence are expressly recognized to be subject to the casualty and condemnation provisions of this Lease. In the event that the Premises should become in need of repairs required to be made by Landlord hereunder, Tenant shall give prompt written notice thereof to Landlord and Landlord shall have a reasonable time after receipt by Landlord of such written notice in which to make such repairs. Landlord shall not be liable to Tenant for any interruption of Tenant’s business or inconvenience caused due to any work performed in the Premises or in the Complex pursuant to Landlord’s rights and obligations under the Lease, provided, however, Landlord shall use commercially reasonable efforts to not disturb the normal conduct of Tenant’s business while performing such repairs and maintenance. In addition, Landlord shall maintain the Common Areas of the Project or Complex, as applicable, subject to reimbursement as set forth in Exhibit C. TENANT HEREBY WAIVES AND RELEASES ITS RIGHT TO MAKE REPAIRS AT LANDLORD’S EXPENSE UNDER SECTIONS 1941 AND 1942 OF THE CALIFORNIA CIVIL CODE OR UNDER ANY SIMILAR LAW, STATUTE OR ORDINANCE NOW OR HEREAFTER IN EFFECT.

(ii) By Tenant. Tenant shall keep the Premises in good, clean and habitable condition and shall at its sole cost and expense keep the same free of dirt, rubbish, ice or snow, insects, rodents, vermin and other pests and make all needed repairs and replacements, including replacement of cracked or broken glass, except for repairs and replacements required to be made by Landlord.

5

Without limiting the coverage of the previous sentence, but subject to the limitation set forth in the following sentence, it is understood that Tenant’s responsibilities therein include the repair and replacement in accordance with all applicable Laws of all lighting, heating, air conditioning, plumbing and other electrical, mechanical and electromotive installation, equipment and fixtures and also include all utility repairs in ducts, conduits, pipes and wiring, and any sewer stoppage located in, under and above the Premises, regardless of when or how the defect or other cause for repair or replacement occurred or became apparent. All repairs by Tenant shall conform, at a minimum, to the Building Standards attached hereto as Exhibit K, as the same may be modified by Landlord from time to time. All contractors and subcontractors shall be subject to Landlord’s written approval in accordance with Section 8(b)(iii). If any repairs required to be made by Tenant hereunder are not made or commenced within ten (10) days after written notice delivered to Tenant by Landlord (such time period not being subject to the notice and cure provisions of Section 17(f)), Landlord may at its option make such repairs without liability to Tenant for any loss or damage which may result to its stock or business by reason of such repairs, unless caused by the gross negligence or willful misconduct of Landlord, its employees, agents or contractors. Tenant shall pay to Landlord upon demand as Rent hereunder, the cost of such repairs plus interest at the Default Rate, such interest to accrue continuously from the date of payment by Landlord until repayment by Tenant. Notwithstanding the foregoing, Landlord shall have the right to make such repairs without notice to Tenant in the event of an emergency, or if such repairs relate to the exterior of the Premises. At the expiration of this Lease, Tenant shall surrender the Premises in good condition, excepting reasonable wear and tear and casualties not required to be repaired by Tenant. If Landlord elects to store any personal property of Tenant, including goods, wares, merchandise, inventory, trade fixtures and other personal property of Tenant, same shall be stored at the sole risk of Tenant. Unless caused by the gross negligence or willful misconduct of Landlord, its employees, agents or contractors, Landlord and its agents shall not be liable for any loss or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water or rain which may leak from any part of the Complex or from the pipes, appliances or plumbing works therein or from the roof, street or subsurface or from any other places resulting from dampness or any other cause whatsoever, or from the act or negligence of any other tenant or any officer, agent, employee, contractor or guest of any such tenant. It is generally understood that mold spores are present essentially everywhere and that mold can grow in most any moist location. Emphasis is properly placed on prevention of moisture and on good housekeeping and ventilation practices. Tenant acknowledges the necessity of housekeeping, ventilation, and moisture control (especially in kitchens, janitor’s closets, bathrooms, break rooms and around outside walls) for mold prevention. In signing this Lease, Tenant has first inspected the Premises and certifies that it has not observed mold, mildew or moisture within the Premises. Tenant agrees to promptly notify Landlord if it observes mold/mildew and/or moisture conditions (from any source, including leaks), and allow Landlord to evaluate and make recommendations and/or take appropriate corrective action. TENANT RELIEVES LANDLORD FROM ANY LIABILITY FOR ANY BODILY INJURY OR DAMAGES TO PROPERTY CAUSED BY OR ASSOCIATED WITH MOISTURE OR THE GROWTH OF OR OCCURRENCE OF MOLD OR MILDEW ON THE PREMISES, UNLESS SAME IS IN EXISTENCE ON THE DATE OF THIS LEASE OR IS CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF LANDLORD, ITS EMPLOYEES, AGENTS OR CONTRACTORS. In addition, execution of this Lease constitutes acknowledgement by Tenant that control of moisture and mold prevention are integral to its Lease obligations.

Notwithstanding Tenant’s repair and maintenance obligations pursuant to this Section 8(b)(ii), if any item of Tenant’s repair and maintenance obligations set forth herein involves a capital repair, replacement, improvement and/or equipment under generally accepted accounting principles consistently applied (“Tenant Repair Capital Item”), Tenant shall provide written notice thereof to Landlord. Landlord shall, pursuant to the receipt of such notice from Tenant, make such Tenant Repair Capital Item, and following completion thereof, provide Tenant with written notice of (i) the total cost of such Tenant Repair Capital Item (“Tenant Repair Capital Item Cost”), (ii) the estimated useful life of such Tenant Repair Capital Item per generally accepted accounting principles consistently applied (“Useful Life”), (iii) the amortization of such Tenant Repair Capital Item Cost over such Useful Life at an interest rate equal to the “prime rate” as announced from time to time by Bank of America, N.A., plus one percent (1%) per annum, and (iv) the monthly amount due and payable by Tenant to reimburse Landlord for that portion of the amortized Tenant Repair Capital Item Cost applicable to the remainder of the Lease Term, which monthly amount shall be paid by Tenant to Landlord concurrently with the payment by Tenant to Landlord of the monthly Base Rent.

(iii) Performance of Work. All work described in this Section 8 shall be performed only by contractors and subcontractors approved in writing by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. Tenant shall cause all contractors and subcontractors to procure and maintain insurance coverage naming Landlord and Landlord’s property management company as additional insureds against such risks, in such amounts, on such forms, and with such companies as Landlord may reasonably require as set forth on Exhibit I attached hereto. Tenant shall provide Landlord with the identities, mailing addresses and telephone numbers of all contractors and subcontractors performing work or supplying materials prior to beginning such construction and Landlord may post on and about the Premises notices of non-responsibility pursuant to applicable Laws. All such work shall be performed in accordance with all Laws and in a good and workmanlike manner so as not to damage the Building (including the Premises, the Building’s Structure and the Building’s Systems). All such work which may affect the Building’s Structure or the Building’s Systems, at Landlord’s election, must be performed by Landlord’s usual contractor for such work or a contractor approved by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. All work affecting the roof of the Building must be performed by Landlord’s roofing contractor or a contractor approved by Landlord, which approval shall

6

not be unreasonably withheld, conditioned or delayed, and no such work will be permitted if it would void or reduce the warranty on the roof. All work by Tenant shall conform, at a minimum, to the Building Standards attached hereto as Exhibit K, as the same may be modified by Landlord from time to time.

(c) Mechanic’s Liens. All work performed, materials furnished, or obligations incurred by or at the request of a Tenant Party shall be deemed authorized and ordered by Tenant only, and Tenant shall not permit any mechanic’s liens to be filed against the Premises or the Project in connection therewith. Upon completion of any such work, Tenant shall deliver to Landlord final lien waivers from all contractors, subcontractors and materialmen who performed such work. If such a lien is filed, then Tenant shall, within thirty (30) days (unless Landlord is in the process of selling the Building or obtaining financing, in which case Tenant shall within ten (10) days) after Landlord has delivered notice of the filing thereof to Tenant (or such earlier time period as may be necessary to prevent the forfeiture of the Premises, Project or any interest of Landlord therein or the imposition of a civil or criminal fine with respect thereto), either: (1) pay the amount of the lien and cause the lien to be released of record; or (2) diligently contest such lien and deliver to Landlord a bond or other security reasonably satisfactory to Landlord. If Tenant fails to timely take either such action, then Landlord may pay the lien claim, and any amounts so paid, including expenses and interest, shall be paid by Tenant to Landlord within thirty (30) days after Landlord has invoiced Tenant therefor. Landlord and Tenant acknowledge and agree that their relationship is and shall be solely that of “landlord-tenant” (thereby excluding a relationship of “owner-contractor,” “owner-agent” or other similar relationships). Accordingly, all materialmen, contractors, artisans, mechanics, laborers and any other persons now or hereafter contracting with Tenant, any contractor or subcontractor of Tenant or any other Tenant Party for the furnishing of any labor, services, materials, supplies or equipment with respect to any portion of the Premises, at any time from the date hereof until the end of the Term, are hereby charged with notice that they look exclusively to Tenant to obtain payment for same. Nothing herein shall be deemed a consent by Landlord to any liens being placed upon the Premises, Project or Landlord’s interest therein due to any work performed by or for Tenant or deemed to give any contractor or subcontractor or materialman any right or interest in any funds held by Landlord to reimburse Tenant for any portion of the cost of such work. TENANT SHALL INDEMNIFY, DEFEND AND HOLD HARMLESS LANDLORD, ITS PROPERTY MANAGER, ANY SUBSIDIARY OR AFFILIATE OF THE FOREGOING, AND THEIR RESPECTIVE OFFICERS, DIRECTORS, SHAREHOLDERS, PARTNERS, EMPLOYEES, MANAGERS, CONTRACTORS, ATTORNEYS AND AGENTS (COLLECTIVELY, THE “INDEMNITEES”) FROM AND AGAINST ALL CLAIMS, DEMANDS, CAUSES OF ACTION, SUITS, JUDGMENTS, DAMAGES AND EXPENSES (INCLUDING REASONABLE ATTORNEYS’ FEES) IN ANY WAY ARISING FROM OR RELATING TO THE FAILURE BY ANY TENANT PARTY TO PAY FOR ANY WORK PERFORMED, MATERIALS FURNISHED, OR OBLIGATIONS INCURRED BY OR AT THE REQUEST OF A TENANT PARTY. The foregoing indemnity shall survive termination or expiration of this Lease.

(d) Signs.

(i) General Signs. Tenant shall not place or permit to be placed any signs upon: (i) the roof of the Premises; or (ii) the Common Areas; or (iii) any exterior area of the Building without Landlord’s prior written approval, which approval shall not be unreasonably withheld, conditioned or delayed provided any proposed sign is placed only in those locations as may be designated by Landlord, and complies with the sign criteria promulgated by Landlord from time to time and applicable Law. Upon request of Landlord, Tenant shall promptly remove any sign or other materials which Tenant has placed or permitted to be placed upon the exterior or interior surface of any door or window inside the Premises, or the exterior of the Building, if: (i) required in connection with any cleaning, maintenance or repairs to the Building; or (ii) placed without Landlord’s prior written approval as set forth above. If Tenant fails to do so, Landlord may without liability unless caused by the gross negligence or willful misconduct of Landlord, its employees, agents or contractors, remove the same at Tenant’s expense. Tenant shall comply with such regulations as may from time to time be promulgated by Landlord governing signs, advertising material or lettering of all tenants in the Project or Complex, as applicable. Tenant shall be responsible for the repair, painting or replacement of the Building fascia surface or other portion of the Building where signs are attached, upon vacation of the Premises, or the removal or alteration of its sign for any reason. If Tenant fails to do so, Landlord may have the sign removed and the cost of removal shall be payable by Tenant within thirty (30) days of invoice.

(ii) Building Top Signs. Subject to the terms of this Section 8 and applicable laws, Landlord hereby grants Tenant and Tenant’s Permitted Transferee (as hereinafter defined in Section 10(f)) the exclusive right, at Tenant’s sole cost and expense and as long as Tenant fulfills the Occupancy Requirement (as hereinafter defined), to install the maximum building top signage allowed under applicable Law at a location or locations reasonably approved by Landlord (which may include both Tenant’s name, which shall be restricted to only Ultragenyx and corporate logo) (“Building Top Sign”).

Tenant’s Building Top Sign shall be subject to all applicable Law and the sign criteria promulgated by Landlord from time to time. The content, size, design, graphics, materials, colors and other specifications of the Building Top Sign (including without limitation, the exact location of any and all of the Building Top Sign), and all contractors or subcontractors utilized by Tenant in connection therewith, shall be subject to the approval of Landlord, which shall not be unreasonably withheld, conditioned

7

or delayed, and shall be consistent with the exterior design, materials and appearance of the Building and the signage program of the Building, if any. Tenant shall be responsible for all costs and expenses incurred in connection with the design, construction, installation, repair, operation, maintenance, compliance with laws, utilities (including the costs of metering such utilities usage and the cost of the meter) and removal of the Building Top Sign. Tenant shall also be responsible for the cost of all utilities (if any) utilized in connection with the Building Top Sign. Should the name of Tenant be changed to another name (the “New Name”), Tenant shall be entitled to modify, at Tenant’s sole cost and expense, Tenant’s name on the Building Top Sign to reflect Tenant’s New Name, so long as (a) the New Name is not an “Objectionable Name”, (b) Landlord shall have granted its consent to such New Name (which consent shall not be unreasonably withheld), (c) Tenant’s New Name shall be subject to the then existing signage rights of any tenant or occupant within the Complex, and (d) Tenant’s New Name shall not cause Landlord to be in violation of an exclusivity granted to another tenant at the Complex. The term “Objectionable Name” shall mean any name which relates to an entity which is of a character or reputation, or is associated with a political orientation or faction, which is inconsistent with the quality of the Complex, or which would otherwise reasonably offend a landlord of buildings comparable to and in the vicinity of the Building. In addition, Tenant’s right to maintain any of the Building Top Sign shall terminate at any time during the Lease Term during which the Occupancy Requirement is no longer satisfied or an Event of Default by Tenant has occurred under this Lease. Upon the expiration of the Lease Term or the earlier termination of Tenant’s signage rights under this Section 8(d)(ii), Tenant shall, at Tenant’s sole cost and expense, remove the Building Top Sign and repair any and all damage to the Building caused by such removal.

For purposes of this Section 8(d)(ii), “Occupancy Requirements” shall mean that Tenant or Tenant’s Permitted Transferee is leasing and physically occupying at a minimum fifty percent (50%) of the Premises and no Event of Default by Tenant has occurred under this Lease.

9. Use; Compliance with Laws.

(a) Use. Tenant shall continuously occupy and use the Premises only for the Permitted Use (as set forth in the Basic Lease Information) and shall comply with all Laws relating to the use, condition, access to, and occupancy of the Premises and will not commit waste, overload the Building’s Structure or the Building’s Systems or subject the Premises to any use that would damage the Premises. Tenant, at its sole cost and expense, shall obtain and keep in effect during the Term, all permits, licenses, and other authorizations necessary to permit Tenant to use and occupy the Premises for the Permitted Use in accordance with applicable Laws. Notwithstanding anything in this Lease to the contrary but subject to the provisions of Section 9(b) below, as between Landlord and Tenant: (i) from and after the Delivery Date, Tenant shall bear the risk of complying with Title III of the Americans With Disabilities Act of 1990, any state laws governing handicapped access or architectural barriers, and all rules, regulations and guidelines promulgated under such laws, as amended from time to time (the “Disabilities Acts”) in the Premises; and (ii) Landlord shall bear the risk of complying with the Disabilities Acts in the Common Areas (subject to reimbursement as set forth in Exhibit C), other than compliance that is necessitated by the use of the Premises for other than the Permitted Use or as a result of any alterations or additions made by Tenant (which risk and responsibility shall be borne by Tenant). The Premises shall not be used for any purpose which creates strong, unusual, or offensive odors, fumes, dust or vapors; which emits noise or sounds that are objectionable due to intermittence, beat, frequency, shrillness, or loudness; which is associated with indecent or pornographic matters; or which involves political or moral issues (such as abortion issues). Tenant shall conduct its business and control each other Tenant Party so as not to create any nuisance or unreasonably interfere with other tenants or Landlord in its management of the Building. Tenant shall store all trash and garbage within the Premises or in a trash dumpster or similar container approved by Landlord as to type, location and screening; and Tenant shall arrange for the regular pick-up of such trash and garbage at Tenant’s expense (unless Landlord finds it necessary to furnish such a service, in which event Tenant shall be charged an equitable portion of the total of the charges to all tenants using the service). Receiving and delivery of goods and merchandise and removal of garbage and trash shall be made only in the manner and areas prescribed by Landlord. Tenant shall not operate an incinerator or burn trash or garbage within the Project or Complex, as applicable. Tenant shall not knowingly conduct or permit to be conducted in the Premises any activity, or place any equipment in or about the Premises or the Building, which will invalidate the insurance coverage in effect or increase the rate of fire insurance or other insurance on the Premises or the Building.

(b) Landlord’s Compliance with Laws. Landlord shall ensure that the Premises and the Building are in compliance with all applicable Laws, including, but not limited to the Disabilities Acts as of the Delivery Date. In the event that as of the Delivery Date (i) the Premises are not in compliance with all such federal, state and local laws and regulations, without regard to Tenant’s use of the Premises or the Tenant Improvements subsequently constructed on or installed in the Premises (herein the “Compliance Condition”), and (ii) Tenant delivers to Landlord written notice of the existence of the Compliance Condition (the “Non-Compliance Notice”) by the date which is one hundred eighty (180) days after the Commencement Date (the “Non-Compliance Outside Date”), then Tenant’s sole remedy shall be that Landlord shall, at Landlord’s sole cost and expense which expense shall not be included in Additional Rent, do that which is necessary to put the applicable components of the Premises and the Building described in the Non-Compliance Notice into the Compliance Condition within a reasonable period of time after Landlord’s receipt of the Non-Compliance Notice; provided, further, that to the extent any such work is required or triggered by Tenant’s proposed use of the Premises or the Tenant Improvements to be constructed therein, then Landlord shall perform such work, but Tenant shall pay Landlord for the cost of

8

such work within thirty (30) days after invoice by Landlord. If Tenant fails to deliver the Non-Compliance Notice to Landlord on or prior to the Non-Compliance Outside Date, Landlord shall have no obligation to perform the work described in the foregoing provisions of this Section 9(b); provided that Landlord shall remain responsible for making all alterations and improvements which are Landlord’s responsibility to repair and maintain pursuant to Section 8(b)(i) above.

10. Assignment and Subletting.

(a) Transfers. Tenant shall not, without the prior written consent of Landlord, which consent shall not unreasonably be withheld, conditioned or delayed: (1) assign, transfer, or encumber this Lease or any estate or interest herein, whether directly or by operation of law; (2) permit any other entity to become Tenant hereunder by merger, consolidation, or other reorganization; (3) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current control of Tenant; (4) sublet any portion of the Premises; (5) grant any license, concession, or other right of occupancy of any portion of the Premises; or (6) permit the use of the Premises by any parties other than Tenant (any of the events listed in Section 10(a)(1) through Section 10(a)(6) being a “Transfer”).

(b) Consent Standards. If a proposed transferee does not meet the following conditions, Landlord shall not be deemed to have been unreasonable in withholding its consent to a Transfer (provided that the following list shall not be deemed the exclusive factors for review): (1) in the case of a Transfer that is an assignment or a sublease of the entirety of the Premises, the transferee has a Tangible Net Worth (hereinafter defined) which is not less than the lesser of (i) the Tangible Net Worth of Tenant as of the date of execution of this Lease and (ii) the Tangible Net Worth of Tenant on the date immediately prior to such assignment; (2) has a good reputation in the business community; (3) will use the Premises for the Permitted Use and will not use the Premises in any manner that would conflict with any exclusive use agreement or other similar agreement entered into by Landlord with any other tenant of the Project or Complex, as applicable; (4) will not use the Premises, Project or Complex in a manner that would materially and unreasonably increase the pedestrian or vehicular traffic to the Premises, Project or Complex; (5) is not a governmental entity, or subdivision or agency thereof; (6) is not another occupant of the Building or Complex, as applicable; (7) is not another occupant of the Building or Complex, as applicable, whose lease is scheduled to expire within three (3) years of the proposed date of the Transfer; and (8) is not a person or entity with whom Landlord is then, or has been within the three (3) month period prior to the time Tenant seeks to enter into such assignment or subletting, negotiating to lease space in the Building or Complex, as applicable, or any Affiliate of any such person or entity. In the cases of items (6) and (8) above, they shall be applicable only to the extent Landlord has comparable space in the Complex available to lease to such proposed transferee.

(c) Request for Consent. If Tenant requests Landlord’s consent to a Transfer, then, at least thirty (30) days prior to the effective date of the proposed Transfer, Tenant shall provide Landlord with a written description of all terms and conditions of the proposed Transfer, copies of the proposed pertinent documentation, and the following information about the proposed transferee: name and address; reasonably satisfactory information about its business and business history; its proposed use of the Premises; banking, financial, and other credit information; and general references sufficient to enable Landlord to determine the proposed transferee’s creditworthiness and character (collectively, the “Transfer Notice”). Concurrently with the Transfer Notice, Tenant shall pay to Landlord a fee of $1,000 to defray Landlord’s expenses in reviewing such request, and Tenant shall reimburse Landlord immediately upon request for its reasonable attorneys’ fees incurred in connection with considering any request for consent to a Transfer.

(d) Conditions to Consent. If Landlord consents to a proposed Transfer that is an assignment of the Tenant’s entire interest in the Lease, then the proposed transferee shall deliver to Landlord a written agreement whereby it expressly assumes Tenant’s obligations hereunder; provided, however, any transferee of less than Tenant’s entire interest in the Lease shall be liable only for the obligations under this Lease that are properly allocable to such Transfer for the period of the Transfer in which event the proposed transferee shall deliver to Landlord a written agreement whereby such sublease shall be subject and subordinate to the Lease. No Transfer shall release Tenant from its obligations under this Lease, but rather Tenant and its transferee shall be jointly and severally liable therefor. Landlord’s consent to any Transfer shall not be deemed consent to any subsequent Transfers. If an Event of Default occurs while the Premises or any part thereof are subject to a Transfer, then Landlord, in addition to its other remedies, may collect directly from such transferee all rents becoming due to Tenant and apply such rents against Rent. Tenant authorizes its transferees to make payments of rent directly to Landlord upon receipt of notice from Landlord to do so following the occurrence of an Event of Default hereunder. Tenant shall pay for the cost of any demising walls or other improvements necessitated by a proposed subletting or assignment.

(e) Attornment by Subtenants. Each sublease by Tenant hereunder shall be subject and subordinate to this Lease and to the matters to which this Lease is or shall be subordinate, and each subtenant by entering into a sublease is deemed to have agreed that in the event of termination, re-entry or dispossession by Landlord under this Lease, Landlord may, at its option, either terminate the sublease or take over all of the right, title and interest of Tenant, as sublandlord, under such sublease, and such subtenant shall, at Landlord’s option, attorn to Landlord pursuant to the then executory provisions of such sublease, except that Landlord shall not be: (1) liable for any

9

previous act or omission of Tenant under such sublease; (2) subject to any counterclaim, offset or defense that such subtenant might have against Tenant; (3) bound by any previous modification of such sublease or by any rent or additional rent or advance rent which such subtenant might have paid for more than the current month to Tenant, and all such rent shall remain due and owing, notwithstanding such advance payment; (4) bound by any security or advance rental deposit made by such subtenant which is not delivered or paid over to Landlord and with respect to which such subtenant shall look solely to Tenant for refund or reimbursement; or (5) obligated to perform any work in the subleased space or to prepare it for occupancy, and in connection with such attornment, the subtenant shall execute and deliver to Landlord any instruments Landlord may reasonably request to evidence and confirm such attornment. Each subtenant or licensee of Tenant shall be deemed, automatically upon and as a condition of its occupying or using the Premises or any part thereof, to have agreed to be bound by the terms and conditions set forth in this Section 10(e). The provisions of this Section 10(e) shall be self-operative, and no further instrument shall be required to give effect to this provision.

(f) Permitted Transfers. Notwithstanding Section 10(a), Tenant may Transfer all or part of its interest in this Lease or all or part of the Premises (a “Permitted Transfer”) to the following types of entities (a “Permitted Transferee”) without the written consent of Landlord:

(1) an Affiliate of Tenant;