Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LILIS ENERGY, INC. | f8k022616_lilisenergy.htm |

NASDAQ:LLEX Corporate Presentation FEBRUARY 2016 NASDAQ:LLEX

Disclaimer 2 This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, ind ica tes a forward - looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward - looking information. The identification in this presentation of factors that may affect the company ’s future performance and the accuracy of forward - looking statements is meant to be illustrative and by no means exhaustive . All forward - looking statements should be evaluated with the understanding of their inherent uncertainty. Factors that could caus e the company’s actual results to differ materially from those expressed or implied by forward - looking statements include, but are not limited to: The success of the company’s exploration and development efforts; the price of oil, gas and other produced gasses and liquids; the worldwide economic situ ati on; changes in interest rates or inflation; the ability of the company to transport gas, oil and other products; the ability of the company to raise add itional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; the company’ s c apital costs, which may be affected by delays or cost overruns; cost of production; environmental and other regulations, as the same presently exist or may later be amended; the company’s ability to identify, finance and integrate any future acquisitions; and the volatility of the company’s stock price . RESERVE/RESOURCE DISCLOSURE The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves th at meet the SEC’s definitions of such terms. Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports f ile d with the SEC. In this presentation, we sometimes also refer to broader, less precise terms when characterizing reserve estimates, such as “resource po tential” and “estimated ultimate recovery”, or “EUR”, which the SEC does not permit to be disclosed in SEC filings and are not intended to co nform to SEC filing requirements. Estimates of resource potential, which includes estimated probable and possible reserves that are less likely to be recovered than proved reserves , are based on internal estimates, are not reviewed by any third party and are subject to ongoing technical review. EUR is the sum of reserves remaining as of a given date and cumulative production as of that date. These estimates are by their nature more speculative than those disclosed in our SEC filings and thus are subject to substantially greater uncertainty of being realized. Actual quantities recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery of reserves include the scope of our actual drilling program, which wil l b e directly affected by the availability of capital, drilling and production costs, commodity prices (including prevailing oil and gas prices), availabil ity of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil an d natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates, and ot her factors. These estimates may change significantly as the development of properties provides additional data.

Cyclical Energy Downturn Creates Opportunities Due to the downturn in oil and gas prices, there is a unique opportunity not seen since 2003 to acquire high quality oil and gas assets at very attractive price levels This current distressed environment provides a unique opportunity for the Company to make excellent financial returns Balance sheet leverage, expiring hedges, bank borrowing base redeterminations, limited access to capital markets and depressed cash flow levels will force many E&P companies to be forced to divest properties or entire companies Drilling costs have decreased in proportion to the decline in commodity prices resulting in continuing attractive rate of returns today in certain key areas Limited capital available to small / micro cap companies results in no drilling Bankruptcies, foreclosures and bank redeterminations create acquisition opportunities 3

Company Overview Lilis Energy is a Denver - based independent oil and gas company that acquires, exploits, develops and explores for crude oil and gas through conventional and horizontal drilling in the Denver - Julesburg Basin focusing on the Wattenberg and Niobrara, and will expand into the Permian Basin with its pending merger with Brushy Resources, Inc. (“Brushy”). Dual Growth Strategy – Acquire & Develop Acquisition Initiatives: Targeting financially distressed companies with economic producing properties and acreage that are eco nomic in the current environment Drilling Program: Pursue drilling and recompletion opportunities on a highly selective basis, on existing properties and ad dit ional properties which are economic at today’s price deck Strong Foundation for Growth Initial execution of Lilis acquisition strategy focused on distressed acquisition opportunities of attractive assets which are burdened with over leverage Initial entry into Permian Basin (Delaware Basin) with properties that have attractive multi - stack resource plays along with spe cific economic advantages Permian properties are economic under the current oil and gas pricing environment due to attractive reservoir characteristics with the ability to utilize existing vertical well bores to employ “window pane” completion techniques Expanded management and operating teams with experience in core basins of the Permian and DJ Expected new management and board have extensive experience and track records of creating substantial shareholder value in distressed environments Expected recapitalization of the balance sheet and a significantly improved capital structure position allows the company to grow both through acquisitions and organically In summary, the Company has the core properties, management, board, financial position and technical expertise to capitalize on the current depressed oil price commodity environment 4

Positioned in Highly Attractive Basins Geology | Stacked pay/multiple horizons; substantial OOIP Activity | Sufficient drilling activity to garner industry best practices and ensure well control Inventory | Both conventional & unconventional drilling opportunities Economics | Ability to generate positive IRR’s even in a prolonged downturn 5 Denver Julesburg Basin Wattenberg Field, CO 1 Permian Basin Delaware Basin, TX & NM 2 Based on these criteria, the DJ Basin and Permian Basin are two key geographic areas of interest. With an established footprint in the DJ Basin, expansion into the Permian Basin remains a top priority.

Permian Basin Highlights Remains one of the oldest, largest and most productive of the petroleum provinces in the U.S. Multiple stacked pay zones – multiplier effect on surface acreage (net effective acres) with conventional and unconventional drilling locations Producers and investors looking to direct capital towards developing the high - return stacked pay potential across the basin Steady M&A activity in a depressed macro environment provides resource and catalyst rich landscape ripe for consolidation and growth Stacked pay potential and the broad Permian inventory profile provide after tax IRRs of ~ 40% based on a $35 flat oil price 6

Permian Basin Growth 7 The Permian Basin has restaked its claim as the foundation of U.S. crude supply Unlike the maturing oil fields of the Bakken and Eagle Ford, the Permian has maintained its upward trajectory A basin - wide transition to full - field development allows for continued Permian margin expansion in a lower - for - longer oil price environment Strong margins enabling the Permian producers to recycle cash flow back into a vast high - return drilling inventory at a rate faster than non - Permian peers Decline in Permian Well Costs vs. 2014 Peak (1) Permian Basin Oil Supply ( mbpd ) (1) As of November 2015

Brushy Resources | Well Situated in the Permian Basin Permian Basin Asset Overview ▪ 650 BOEPD / 7,217 Gross Acres / 3,458 Net Acres (1) ▪ 19 vertical wells & 2 Horizontal producing ▪ Currently producing formations include: Wolfcamp, Bell Canyon, Brushy Canyon, Strawn & Atoka ▪ 5 Behind Pipe, 10 Re - Entries, and 12 Proved Vertical Locations ▪ Over 500 possible Horizontal Locations with estimated EUR (2) of over 130 million BOE 8 (1) ~ 550 current net BOEPD with ~100 additional net BOEPD expected in the near term from recent Wolfe recompletion data (based on 3 rd party projections ) (2) See forward looking statements for explanations of EUR and resource potential

Permian Basin | Robust Drilling Activity and Offset Results 9

Permian Basin | Brushy Growth & Development Strategy Prove up multiple benches using existing vertical wellbores • Cost is less than 40 % of grassroots wells • 2 horizontal wells already drilled • A dditional 10 wellbores can be utilized Actively seek bolt - on acquisitions West and South of the lease to expand geographical footprint Brushy’s existing acreage position is described below: 10 Kudu #1H Wolfcamp A Wolfe #3H Brushy Canyon Lea – New Mexico Loving Winkler Mexico P Primary Term HBP

Highly Economical Properties 11 Brushy is positioned in the Delaware Basin in Winkler County with multiple stack resource play in Wolfcamp, Bell Canyon, Brushy Canyon, Strawn & Atoka Offset operators include: XTO, Anadarko, COG, EOG, Devon, OXY, Chevron, Matador, Endeavor, Silver Hills and RMR Brushy has over 500 possible locations which have positive economics, with the Re - Entry wells having an IRR of approximately 40%, at January 2016 price levels. Brushy has 12 vertical wellbores where it can utilize “window pane” completion technology to significantly reduce D&C costs • The purpose of this approach is to utilize the existing vertical wellbore and then cut a “window pane” through which horizontal drilling and completions can be accomplished at an estimated 40% cost savings Recent results from the use of this technology have been favorable (see Kudu #1H & Wolfe #3H, pages 13 - 14) Ability to create significantly enhanced IRRs due to substantially reduced drilling cost “Re - Entry” | Utilizes existing vertical wellbores; recompletes upper zones Well Type Grassroots D&C $MM Wolfcamp $8.0 Bone Springs $7.0 Avalon $6.5 “Grassroots” | Drilling new vertical wellbores to predetermined depth and kick off HZ 0% 10% 20% 30% 40% 50% $35 $45 $55 $65 Wolfcamp Bone Springs Avalon 0% 50% 100% 150% 200% $35 $45 $55 $65 Wolfcamp Bone Springs Avalon Well Type Re - Entry D&C $MM Wolfcamp $4.5 Bone Springs $4.0 Avalon $3.6

Brushy Permian Basin | Wellbore Inventory Vertical wellbore conversion opportunities provide access to new production growth at substantially lower costs 12 Well Name API # Wrk Int. Rev Int. Reservoir Grass Roots D&C Current D&C TUBB ESTATE 1 - 75 1 42 - 495 - 30127 0.5238587 0.40492217 1st Bone Springs 7,000 4,000 TUBB ESTATE 22 - 1 42 - 495 - 31858 0.814785 0.61403316 1st Bone Springs 7,000 4,000 TUBB 23 UNIT 1 42 - 495 - 11030 0.66855611 0.49604317 1st Bone Springs 7,000 4,000 TUBB ESTATE 25 - 1 42 - 495 - 10811 0.6795888 0.54863374 Avalon 6,500 3,600 TUBB ESTATE 22 - 3 42 - 495 - 32161 0.7513918 0.63865312 Avalon 6,500 3,600 TUBB 9 UNIT 1 42 - 495 - 10933 0.4723776 0.38445113 Wolfcamp 8,000 4,500 TUBB ESTATE 23 1 42 - 495 - 32042 0.66855611 0.49604317 Wolfcamp 8,000 4,500 TUBB ESTATE 25 - 2 42 - 495 - 30016 0.5075171 0.41029241 Wolfcamp 8,000 4,500 TUBB ESTATE 22 - 2 42 - 495 - 32161 0.7513918 0.63865312 Wolfcamp 8,000 4,500 TUBB 1 UNIT 1 42 - 495 - 30070 0.4648355 0.38104233 Wolfcamp 8,000 4,500 TUBB ESTATE 21 - 1 42 - 495 - 31979 0.59714861 0.44154911 Wolfcamp 8,000 4,500 WOLFE UNIT 2 42 - 495 - 10110 0.4814332 0.40404268 Wolfcamp 8,000 4,500 90,000 50,700

Case Study: Re - entry Permian Basin | KUDU #1H Wolfcamp A Formation IP 400 BOPD / 1,700 MCFPD Flowing up 4 - 1/2” casing @ 2,400 psi. 18/64 choke. Well being choked back to preserve EUR. Fracable Length – 4,495’ • 20 stages – 225’ per stage • 3.2MM #’s Proppant • 154 B Bbl slickwater AFE - $4.8MM 13

Case Study: Re - entry Permian Basin | Wolfe #3H Brushy Canyon Formation 4,200 ’ Horizontal 3,800’ Fracable length · 9 stages 430’ per stage · 3.4MM # Proppant · 65M BBLS water · 900# proppant / foot AFE - $3.5MM The jet pump commenced operation on Dec 29th and initial fluid production was 1,000 barrels per day. From December 29 th until January 12, of 2016, the response has been in line with expectations with oil production increasing from 10 to 160 barrels of oil per day. It is believed that this trend will continue with production increasing until it reaches the production levels typical of other Horizontal Brushy Canyon wells drilled in the area. Well is producing up 2 - 3/8” tubing using jet pump Jet Pumps are used to recover high volumes of water, typically to recover Frack loads, and establish a steady production rate and which point , if necessary, they can be switched out for an alternate artificial lift i.e . submersible pump or rod lift . The Crittendon Field vertical wells have made up to 120 MBOE, it is anticipated that a horizontal well will make multiples of that. Third Party Reserve engineers have given this well an initial allocation of 300 MBOE in proved Reserves. 14

Permian Basin | MEXICO P - FEDERAL Behind Pipe Completion of Wolfcamp B & C IP 250 BOPD 500 MCFPD Flowing up 10 - 3/4” casing @ 600 psi. Well being choked back, 10/64 choke 420M #’s Proppant; 9 B Bbls of water Offset to Miro which has made 54MBO & 76MMCF Satisfied requirement by BLM to HBP 520 acre lease AFE - $250,000 Mexico P Federal #1 Sec 21 T26S R35E Well Name Location Arena Rojas Field 30-025-22405 API Lea County, New Mexico KB: 3179 County or Parish / State Elevation 28951 GL: 3153' DF: 3178 Serial Number 30" conductor set @ 33' 36" Hyole 20" set @ 803' cmt'd w/ 1700 sxs cmt 26" Hole 13 3/8" 61# 66# 72# J55 & S80 STC Butt @ 5320' cmt'd w/ 6700 sxs cmt 17 1/2" Hole 10 3/4" 60.7# set @ 13315' TOL @ 12488' cmt'd w/ 3400 sxs cmt 12 1/4" Hole Wolfcamp Perfs 13370 - 13380 13390 - 13410 13460 - 13480 13660 - 13690 13800 - 13950 Strawn Perfs Model D packer set by WL @ 14063' 14270'-14304' 14388'-14408' 15036'-15050' Atoka Bank Perfs Baker N-3 CIBP @ 15420' 15564'-15569' (47 shots) (2/25/90) 15572'-15594' 15598'-15606' 15608'-15616' Perf & Sqz'd 15666'-15670' TOL @ 17913' 7 5/8" 39# S-95 set @ 18605', cmt'd w/ 1200 sxs cmt Silurian Perfs 19214'-19225'; 19382'-19398' (11/13/1989) 5" 23# HOWCO EZ-SV 10' cmt on top @ 19452' 5" 23# P-110 w/ AB FL4S conn set @ 19531' cmt'd w/ 295 sxs cmt 6 1/2" hole TD: 22914' TD: 22914' PBTD: 19452' Impetro Operating LLC Operator 08/01/2015 ES Date Updated PROPOSED WOLFCAMP COMPLETION 15 Case Study: PDNP Completion

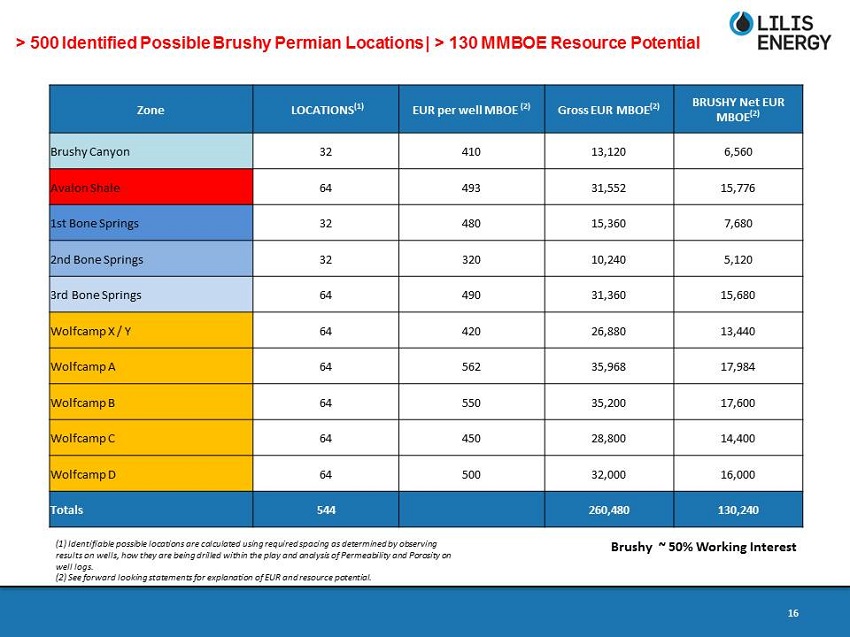

> 500 Identified Possibly Brushy Permian Locations | > 130 MMBOE Resource Potential Brushy ~ 50% Working Interest Zone LOCATIONS (1) EUR per well MBOE (2) Gross EUR MBOE (2) BRUSHY Net EUR MBOE (2) Brushy Canyon 32 410 13,120 6,560 Avalon Shale 64 493 31,552 15,776 1st Bone Springs 32 480 15,360 7,680 2nd Bone Springs 32 320 10,240 5,120 3rd Bone Springs 64 490 31,360 15,680 Wolfcamp X / Y 64 420 26,880 13,440 Wolfcamp A 64 562 35,968 17,984 Wolfcamp B 64 550 35,200 17,600 Wolfcamp C 64 450 28,800 14,400 Wolfcamp D 64 500 32,000 16,000 Totals 544 260,480 130,240 16 (1) (2) See forward looking statements for explanation of EUR and resource potential

MANAGEMENT (1) Abraham “ Avi ” Mirman , Chief Executive Officer and Director | 20 - year background in the securities industry and was appointed CEO in April 2014 , after serving as the Company’s President beginning in September 2013 . He was appointed to Lilis Energy’s Board of Directors in September 2014 . Previously, Mr . Mirman served as the Managing Director, Investment Banking at T . R . Winston & Company, LLC from April 2013 to October 2014 . He and TRW completed over $ 85 . 0 million of financing and debt restructuring for Lilis Energy . Between 2006 and 2011 , Mr . Mirman served as Chairman of the Board of Cresta Capital Strategies LLC ; between 2011 and 2012 , he served as Head of Investment Banking at BMA Securities ; and between 2012 and February 2013 , he served as Head of Investment Banking at John Thomas Financial . Mr . Mirman has extensive experience in financial and securities matters, and obtaining financing for and providing financial advisory services to micro - cap public companies, including oil and gas and other energy companies . He graduated from the State University of New York at Buffalo with a B . S . in Political Science . Michael Pawelek, CEO and President of Brushy | Over 27 years of exploration and production and oilfield services industries experience . Prior to Starboard, he was the CEO and President of Impetro Resources LLC as well as its predecessor, South Texas Oil Company, a public company . He began his career as a geophysicist with Clayton Williams Company ; was a district geophysicist with TXO Production Corporation ; founded CPX Petroleum which drilled over 60 wells under his management ; founded and was the CEO of Universal Seismic Associates, Inc . , which generated annual revenue of $ 65 million and had over 400 employees ; served as VP of Operations of Amenix USA, Inc . , a private exploration and production company focused on oil and natural gas exploration in Louisiana ; was President of BOSS Exploration & Production Corporation, a privately held Gulf Coast production company ; and served as President of Sonterra Resources, Inc . , a company that has oil and natural gas assets in Texas state waters in Matagorda Bay . He received a BS degree in Engineering from Texas A&M . Ed Shaw, COO Brushy | Mr . Shaw serves as the COO of Starboard Resources . He began his career as a systems analyst before becoming involved in the oil and gas industry . He has prior experience in Saudi Arabia and in New Zealand researching and developing methods of monitoring oil wells to optimize production, including using existing products integrated with emerging telemetry technologies . With a strong background in computing and software, Mr . Shaw ensures that the company takes advantage of all softwares and technological advances in the industry . He holds a Diploma in Electrical Engineering . Kevin Nanke, Executive Vice President and Chief Financial Officer | Joined Lilis Energy in March 2015 . Mr . Nanke has served in diverse finance and accounting executive positions in the oil and gas industry for more than 25 years . He previously served as Treasurer and Chief Financial Officer of Delta Petroleum Corporation from 1999 to 2012 , and as its Controller from 1995 to 1999 . During his tenure, Mr . Nanke helped raise $ 1 . 4 billion in public and private financings and was instrumental in preserving a $ 1 . 3 billion tax loss carry - forward when the company successfully completed a reorganization and emerged as Par Petroleum Corporation in 2011 . Concurrent to his positions, Mr . Nanke served as Treasurer and CFO of Delta’s E&P subsidiary, Amber Resources, and as Treasurer, CFO and Director of Delta’s E&P subsidiary, DHS Drilling Company . Prior to joining Delta, Mr . Nanke was employed by KPMG LLP, a leading global audit, tax and advisory firm . Mr . Nanke received a Bachelor of Arts degree in Accounting from the University of Northern Iowa in 1989 and is a Certified Public Accountant (inactive) . Ariella Fuchs, General Counsel & Secretary | J oined Lilis Energy in March 2015 . Previously, Ms . Fuchs served as an associate with Baker Botts L . L . P . from April 2013 to February 2015 , specializing in securities transactions and corporate governance . From January 2010 to March 2013 , she was an associate at White & Case LLP and Dewey and LeBoeuf LLP in the firm’s mergers and acquisitions groups . Ms . Fuchs received a J . D . degree from New York Law School and a B . A . degree in Political Science from Tufts University . Kent B . Lina – Corporate Engineering | A Professional Engineer (PE), Kent Lina is a 30 - year veteran engineering manager with 23 years’ experience in the DJ Basin where he has directed numerous drilling and production operations . Mr . Lina has performed reserve evaluations on various DJ Basin geological formations including the D, J and Codell sands and Niobrara Shale . His past affiliations include Amoco, Mesa Petroleum, Delta Petroleum, and mid - size exploration and development companies . Mr . Lina instigated and completed studies on Codell /Niobrara frac and re - frac production performance and reserves early on, in 1995 , and his experience with horizontal drilling began in 1990 by drilling some of the first horizontal wells in the Austin Chalk . Mr . Lina received a Bachelor of Science in Civil Engineering from the University Of Missouri - Rolla (Missouri School Of Mines ) . ( 1 ) Intended to be representative of the expected post - merger management team 17

PROPOSED BOARD OF DIRECTORS (1) Ronald D . Ormand, Chairman of the Board brings more than 33 years' of industry experience and has completed over $ 25 billion of capital markets and $ 10 billion of financial advisory transactions as both a principal and banker . Mr . Ormand was a Co - founder and senior executive at Magnum Hunter Resources Corporation (NYSE : MHR) . While with MHR, Mr . Ormand executed a strategy to grow MHR from sub - $ 30 million enterprise value to over $ 3 . 2 billion in 4 ½ years . Mr . Ormand has served as a member of numerous Board of Directors, most recently the Executive Chairman of the Board of MLV & Co . , where he oversaw and led the acquisition of MLV by FBR Capital Markets (NASDAQ : FBRC) . Nuno Brandolini , appointed to Lilis Energy’s Board of Directors beginning in February 2014 . Mr . Brandolini is a general partner of Scorpion Capital Partners, L . P . , a private equity firm organized as a small business investment company (SBIC) . General Merrill A . McPeak (USAF Retired) served as the fourteenth chief of staff of the U . S . Air Force and flew 269 combat missions in Vietnam during his distinguished 37 - year military career . Following retirement from active service in 1994 , General McPeak launched a second career in business . Abraham “ Avi ” Mirman has a 20 - year background in the securities industry . He was appointed Chief Executive Officer of Lilis Energy in April 2014 , after serving as the Company’s President beginning in September 2013 . R . Glenn Dawson, brings 35 years of oil and gas and management experience in North American hydrocarbon basins . He is the founder of several TSX listed oil and gas companies and has successfully built and sold to larger entities at significant multiples to invested capital . Michael Pawelek has over 27 years of exploration and production and oilfield services industries experience . Prior to Starboard, he was the CEO and President of Impetro Resources LLC as well as its predecessor, South Texas Oil Company . Peter Benz brings more than 25 years of experience in investment banking and corporate advisory services for emerging growth companies in the areas of financing, mergers and acquisition, funding strategy and general corporate development. Mr. Benz currently serves as Chief Executive Officer of Viking Asset Management, LLC. (1) Intended to be representative of the expected post - merger board of directors 18

Conclusion 19 Initial execution of Lilis acquisition strategy focused on distressed acquisition opportunities of attractive assets which are burdened with over leverage Initial entry into Permian Basin (Delaware Basin) with properties that have attractive multi - stack resource plays along with specific economic advantages Permian properties are economic under the current oil and gas pricing environment due to attractive reservoir characteristics with the ability to utilize existing vertical well bores to employ “window pane” completion techniques Expanded management and operating teams with experience in core basins of the Permian and DJ Expected new management and board have extensive experience and track records of creating substantial shareholder value in distressed environments Expected recapitalization of the balance sheet and a significantly improved capital structure position allows the company to grow both through acquisitions and organically In summary, the Company has the core properties, management, board, financial position and technical expertise to capitalize on the current depressed oil price commodity environment

Appendix

Lilis / Brushy Merger Summary Highlights 21 On Dec. 30, 2015, Lilis Energy, Inc. announced that it had signed a definitive agreement to merge with Brushy Resources, Inc. (“Brushy”) a San Antonio - based oil and gas company with primary operations in the Delaware Basin in West Texas Brushy offers stacked pay o pportunities in two highly prolific and economic U.S. basins, Wattenberg / Niobrara & Permian The consideration paid in the merger is comprised of the issuance of Lilis shares of common stock representing approximately 50% of the post - closing common stock outstanding, and refinancing of ~$11.4 million in debt At the closing, Brushy will divest certain of its assets in South Texas to an affiliate of its subordinated lender in exchange for the extinguishment of $20.5 million in subordinated debt, payment of $500,000 in cash, and the issuance of a $1.0 million subordinated note by Lilis At the closing, Lilis will convert ~$6.8 million in debentures into common stock at a conversion price of $0.50. Lilis is acquiring approximately 3,500 core net acres in the prolific Permian Southern Delaware Basin in the Crittendon Field of Winkler County, Texas, with over 500 potential drilling locations Total net daily production on the assets being acquired is approximately 650 barrels of oil equivalent, with approximately 47% oil (1) Lilis expects the merger to close early in the second quarter of 2016 (1) ~550 current net BOEPD with ~100 additional net BOEPD expected in the near term from recent Wolfe recompletion data (based on 3 rd party projections )

NASDAQ:LLEX Avi Mirman Chief Executive Officer Amirman@lilisenergy.com 303.893.9000 Ron Ormand Chairman of the Board