Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Northern Tier Energy LP | q415nteearningsrelease.htm |

| 8-K - 8-K - Northern Tier Energy LP | form8-k_q415xearningsrelea.htm |

Fourth Quarter and Full Year 2015 Earnings Conference Call and Webcast February 25, 2016

Forward Looking Statements 1 This presentation contains forward-looking statements which reflect Northern Tier’s views and assumptions on the date of this press release regarding future events. The forward-looking statements contained herein include statements about, among other things, future: payment of distributions including the amount and timing thereof; comparability of 80% and 95% of our products to a 3-2-1 and 6-3-2-1 crack spread, respectively; Q1 2016 operating and capex guidance including total crude oil charge; total, other and heavy throughput including percentage of heavy crude oil throughput compared to total throughput; crude oil inventory; direct operating expenses; retail gallons sold through company-owned or franchise stores, fuel margin, merchandise sales, gross margin and direct operating expense; reserves, turnaround and related expenses; reserves for organic growth project expenditures; SG&A; depreciation & amortization; cash interest and current tax expenses; Q1 2016 and full year 2016 maintenance, regulatory, other discretionary projects, organic growth projects and other capital expenditures; and continued safe and reliable operations. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “are likely” or other similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate, and any and all of our forward-looking statements in this presentation may turn out to be inaccurate. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These statements are subject to the general risks inherent in our business. These expectations may or may not be realized, and may be based upon assumptions or judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized, or otherwise materially affect our financial condition, results of operations and cash flows. Other known, unknown or unpredictable factors could have material adverse effects on our future results. Additional information regarding such factors and our uncertainties, risks and assumptions are contained in our filings with the Securities and Exchange Commission. All forward-looking statements are only as of the date hereof, and we do not undertake any obligation to (and expressly disclaim any obligation to) update any forward looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events The presentation also includes non-GAAP measures. We believe that these non-GAAP financial measures provide useful information about our operating performance and should not be viewed in isolation or considered as alternatives to comparable GAAP measures. Our non-GAAP financial measures may also differ from similarly names measures used by other companies. See the disclosures included in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q for additional information on the non–GAAP measures used in this presentation and the Appendix to this presentation reconciliations to the most directly comparable GAAP measures. This presentation serves as a qualified notice to nominees and brokers as provided for under Treasury Regulation Section 1.1446-4(b). Please note that 100 percent of Northern Tier Energy LP’s distributions to foreign investors are attributable to income that is effectively connected with a United States trade or business. Accordingly, Northern Tier Energy LP’s distributions to foreign investors are subject to federal income tax withholding at the highest effective tax rate.

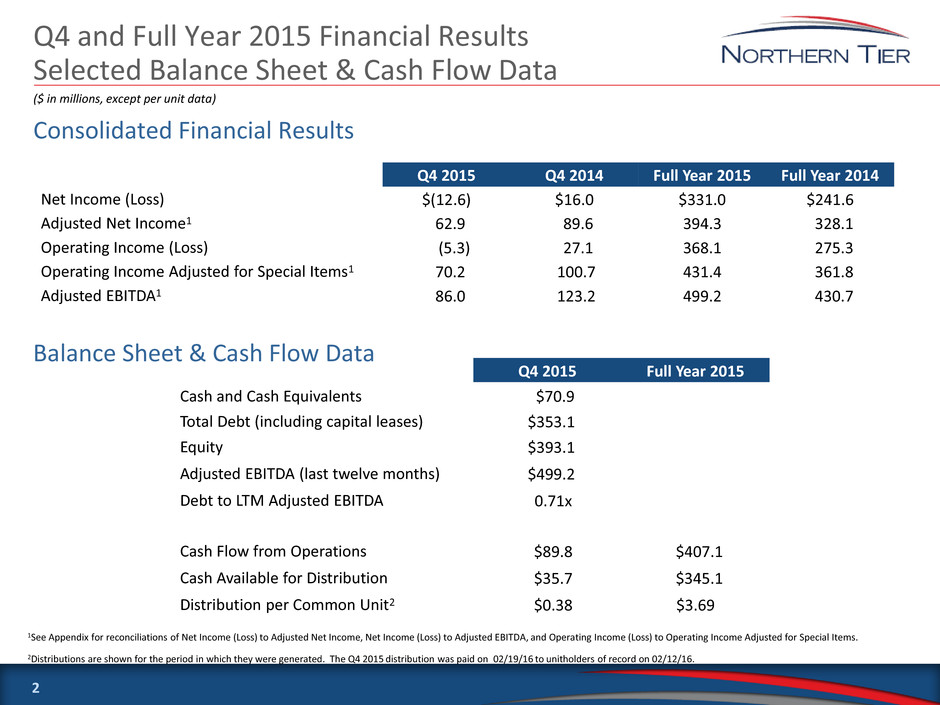

Q4 and Full Year 2015 Financial Results Selected Balance Sheet & Cash Flow Data 2 Consolidated Financial Results 1See Appendix for reconciliations of Net Income (Loss) to Adjusted Net Income, Net Income (Loss) to Adjusted EBITDA, and Operating Income (Loss) to Operating Income Adjusted for Special Items. 2Distributions are shown for the period in which they were generated. The Q4 2015 distribution was paid on 02/19/16 to unitholders of record on 02/12/16. ($ in millions, except per unit data) Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Net Income (Loss) $(12.6) $16.0 $331.0 $241.6 Adjusted Net Income1 62.9 89.6 394.3 328.1 Operating Income (Loss) (5.3) 27.1 368.1 275.3 Operating Income Adjusted for Special Items1 70.2 100.7 431.4 361.8 Adjusted EBITDA1 86.0 123.2 499.2 430.7 Q4 2015 Full Year 2015 Cash and Cash Equivalents $70.9 Total Debt (including capital leases) $353.1 Equity $393.1 Adjusted EBITDA (last twelve months) $499.2 Debt to LTM Adjusted EBITDA 0.71x Cash Flow from Operations $89.8 $407.1 Cash Available for Distribution $35.7 $345.1 Distribution per Common Unit2 $0.38 $3.69 Balance Sheet & Cash Flow Data

Key Refining Performance Metrics 3 1 Gross margin data includes the impact of the lower of cost or market inventory adjustment which is depicted by dotted lines. See Appendix for the components used in this calculation (revenue, cost of sales, and lower of cost or market inventory adjustment). 2Typically, 80% of our products are comparable to a 3-2-1 crack spread, while 95% of our products are comparable to a 6-3-2-1 crack spread. 3Total refinery throughput includes crude oil and other feedstocks. 4Direct operating expenses per barrel is calculated by dividing direct operating expenses by the total barrels of throughput for the respective periods presented. Gross Margin1 ($ per throughput barrel) Group 3 Benchmark Crack Spread2 ($ per barrel) Direct Operating Expenses4 ($ per throughput barrel) Total Refinery Throughput3 (thousands of barrels per day) 2015 2014

Cash Available for Distribution Reconciliation For the three months ended December 31, 2015 Net loss $(12.6) Adjustments: Interest expense 6.2 Income tax provision 1.1 Depreciation and amortization 11.4 EBITDA subtotal $6.1 Lower of cost or market inventory adjustment 73.0 Minnesota Pipe Line proportionate depreciation expense 0.8 Turnaround and related expenses 1.2 Equity-based compensation expense 2.4 Merger-related expenses 2.5 Adjusted EBITDA $86.0 Cash interest expense (7.1) Cash income taxes paid (3.4) MPL proportionate depreciation expense (0.8) Increase in working capital reserve (8.0) Capital expenditures (16.0) Cash reserve for turnaround and related expenses (7.5) Cash reserve for organic growth projects (7.5) Cash available for distribution $35.7 ($ in millions) 4

Operating and Capex Guidance 5 Q1 2016 Low High Refinery Statistics: Total crude oil charge (bpd) 94,000 96,500 Other throughput (bpd) 3,000 4,000 Total throughput (bpd) 97,000 100,500 Heavy crude oil throughput percentage of total throughput 26% 28% Crude oil inventory (thousands of bbls) 2,400 2,700 Direct operating expense, excluding turnarounds ($/throughput bbl) $4.65 $5.15 Retail Statistics: Forecasted gallons (in millions): Company-owned stores 73 76 Franchise stores 28 30 Retail fuel margin ($/gallon) $0.23 $0.25 Merchandise sales ($ in millions) $82 $84 Merchandise gross margin 26% 28% Direct operating expense ($ in millions) $33 $35 Other Guidance ($ in millions): Reserve for turnaround and related expenses $5 $10 Cash reserve for organic growth project expenditures $5 $10 SG&A $20 $22 Depreciation & amortization $11 $12 Cash interest expense $7 $8 Current tax expense $1 $2 Q1 2016 2016 Low High Full Year Capital Program ($ in millions): Maintenance, regulatory and other discretionary projects $ 10 $ 12 $ 40 Organic growth projects 20 23 60 Total planned capital expenditures $ 30 $ 35 $ 100

APPENDIX

Adjusted EBITDA Reconciliation 7 2014 2015 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net Income (Loss) $71.5 $57.9 $96.2 $16.0 $111.2 $128.9 $103.5 $(12.6) Adjustments: Interest Expense 6.2 6.2 6.7 7.5 7.5 7.5 7.5 6.2 Income Tax Provision 0.1 1.5 1.9 3.6 0.8 2.9 3.6 1.1 Depreciation and Amortization 9.9 10.2 10.7 11.1 10.8 10.8 11.0 11.4 EBITDA Subtotal $87.7 $75.8 $115.5 $38.2 $130.3 $150.1 $125.6 $6.1 Minnesota Pipe Line Proportionate Depreciation 0.7 0.7 0.7 0.8 0.7 0.7 0.7 0.8 Turnaround and Related Expenses 0.5 0.9 4.6 8.9 0.4 1.2 7.8 1.2 Equity-based Compensation Expense 7.4 2.9 2.0 1.7 2.6 2.9 2.4 2.4 Lower of Cost or Market Inventory Adjustment - - - 73.6 (10.8) (38.2) 36.8 73.0 Reorganization and Related Costs 6.3 1.8 - - - - - - Merger-Related Expenses - - - - - - - 2.5 Adjusted EBITDA $102.6 $82.1 $122.8 $123.2 $123.2 $116.7 $173.3 $86.0

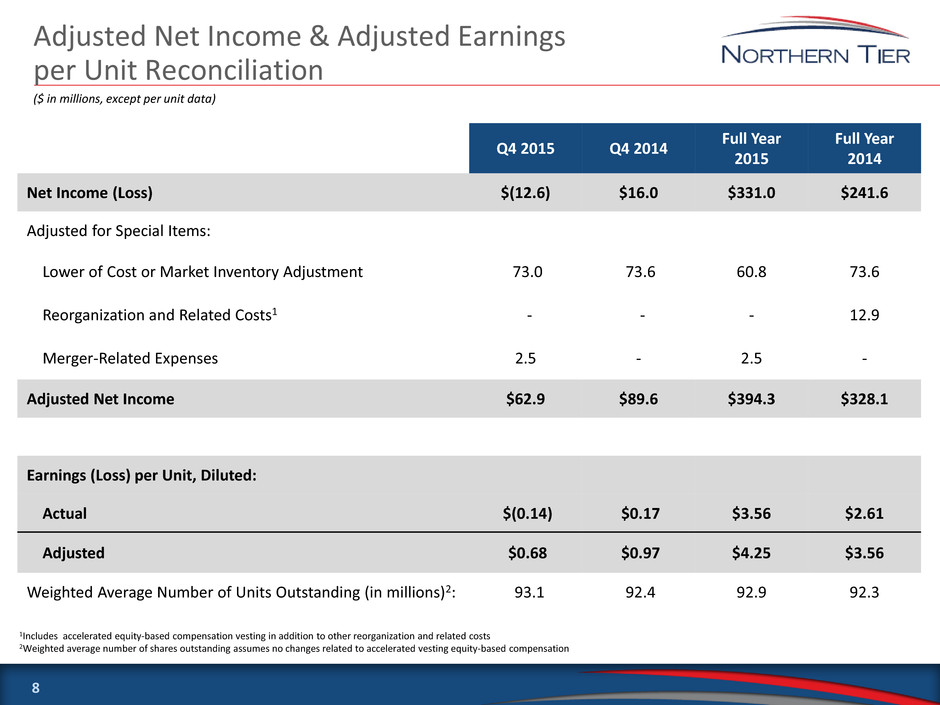

Adjusted Net Income & Adjusted Earnings per Unit Reconciliation 8 ($ in millions, except per unit data) 1Includes accelerated equity-based compensation vesting in addition to other reorganization and related costs 2Weighted average number of shares outstanding assumes no changes related to accelerated vesting equity-based compensation Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Net Income (Loss) $(12.6) $16.0 $331.0 $241.6 Adjusted for Special Items: Lower of Cost or Market Inventory Adjustment 73.0 73.6 60.8 73.6 Reorganization and Related Costs1 - - - 12.9 Merger-Related Expenses 2.5 - 2.5 - Adjusted Net Income $62.9 $89.6 $394.3 $328.1 Earnings (Loss) per Unit, Diluted: Actual $(0.14) $0.17 $3.56 $2.61 Adjusted $0.68 $0.97 $4.25 $3.56 Weighted Average Number of Units Outstanding (in millions)2: 93.1 92.4 92.9 92.3

Operating Income (Loss) Reconciliation 9 ($ in millions) Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Operating Income (Loss) $(5.3) $27.1 $368.1 $275.3 Adjusted for Special Items: Lower of Cost or Market Inventory Adjustment 73.0 73.6 60.8 73.6 Reorganization and Related Costs - - - 12.9 Merger-Related Expenses 2.5 - 2.5 - Operating Income Adjusted for Special Items $70.2 $100.7 $431.4 $361.8

Refining Operating Information Per Barrel of Throughput Reconciliation 10 Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Refinery Gross Margin per Barrel of Throughput Refinery Revenue $645.1 $942.0 $2,936.8 $5,097.7 Refinery Costs of Sales 586.4 844.4 2,332.2 4,554.7 Refinery Gross Margin $58.7 $97.6 $604.6 $543.0 Lower of Cost or Market Inventory Adjustment 71.8 72.2 60.1 72.2 Adjusted Refinery Gross Margin $130.5 $169.8 $664.7 $615.2 Total Refinery Throughput (millions of bbls) 9.4 8.5 35.2 34.1 Refinery Gross Margin per Barrel of Throughput ($/bbl) $6.23 $11.54 $17.16 $15.91 Adjusted Refinery Gross Margin per Barrel of Throughput ($/bbl) $13.86 $20.07 $18.87 $18.04 Refinery Direct Operating Expense per Barrel of Throughput Refinery Direct Operating Expense $43.6 $50.7 $166.0 $163.0 Total Refinery Throughput (millions of bbls) 9.4 8.5 35.2 34.1 Refinery Direct Operating Expense per Barrel of Throughput ($/bbl) $4.63 $5.91 $4.71 $4.77 ($ in millions, unless otherwise indicated)

Retail Fuel Gross Margin per Gallon Reconciliation 11 Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Retail Gross Margin per Gallon Retail Fuel Revenue $167.7 $218.5 $729.4 $1,012.0 Retail Fuel Cost of Sales 149.7 196.8 658.1 945.5 Retail Fuel Gross Margin $18.0 $21.7 $71.3 $66.5 Lower of Cost or Market Inventory Adjustment 1.2 1.4 0.7 1.4 Adjusted Retail Fuel Gross Margin $19.2 $23.1 $72.0 $67.9 Retail Fuel Gallons Sold (in millions) 76.8 77.3 304.5 306.8 Retail Fuel Gross Margin per Gallon ($/gallon) $0.23 $0.28 $0.23 $0.22 Adjusted Retail Fuel Gross Margin per Gallon ($/gallon) $0.25 $0.30 $0.24 $0.22 ($ in millions, unless otherwise indicated)

Non-GAAP Measures This presentation includes Non-GAAP financial and performance measures, including: EBITDA and Adjusted EBITDA Adjusted EBITDA is defined as net income (loss) before interest expense, income taxes and depreciation and amortization, adjusted for depreciation from the Minnesota Pipe Line operations, lower of cost or market inventory adjustments, turnaround and related expenses, equity-based compensation expense, and merger- related expenses. Adjusted EBITDA is not a presentation made in accordance with GAAP and our computation of Adjusted EBITDA may vary from others in our industry. In addition, Adjusted EBITDA contains some, but not all, adjustments that are taken into account in calculating the components of various covenants in the agreements governing our 2020 Secured Notes and the ABL Facility. We believe the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. The calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes and the accounting effects of significant turnaround activities which many of our peers capitalize and therefore exclude from Adjusted EBITDA. Adjusted EBITDA should not be considered as an alternative to operating income or net income as measures of operating performance. In addition, Adjusted EBITDA is not presented as, and should not be considered, an alternative to cash flow from operations as a measure of liquidity. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. Cash Available for Distribution Cash available for distribution is a non-GAAP performance measure that we believe is important to investors in evaluating our overall cash generation performance. Cash available for distribution should not be considered as an alternative to operating income or net income as measures of operating performance. In addition, cash available for distribution is not presented as, and should not be considered, an alternative to cash flow from operations as a measure of liquidity. As shown in the tables in this Appendix, we have reconciled cash available for distribution to Adjusted EBITDA and in addition reconciled Adjusted EBITDA to net income (loss). Cash available for distribution has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. Our calculation of cash available for distribution may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Cash available for distribution for each quarter will be determined by the board of directors of our general partner following the end of such quarter. Refining Gross Margin Refining gross margin is calculated by subtracting refining costs of sales from total refining revenues. Refining gross margin excluding lower of cost or market (“LCM”) inventory adjustment is calculated by adding back the non-cash LCM inventory adjustment to refining gross margin. Refining gross margin and refining gross margin excluding LCM are non-GAAP measures that we believe are important to investors in evaluating our refining segment performance as a general indication of the amount above its cost of products that is able to sell refined products. NTI’s calculation of refining gross margin and refining gross margin excluding LCM may differ from similar calculations by other companies in our industry, thereby limiting its usefulness as a comparative measure. 12