Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - Gannett Co., Inc. | d143702dex21.htm |

| EX-23 - EX-23 - Gannett Co., Inc. | d143702dex23.htm |

| EX-31.1 - EX-31.1 - Gannett Co., Inc. | d143702dex311.htm |

| EX-31.2 - EX-31.2 - Gannett Co., Inc. | d143702dex312.htm |

| EX-32.2 - EX-32.2 - Gannett Co., Inc. | d143702dex322.htm |

| EX-32.1 - EX-32.1 - Gannett Co., Inc. | d143702dex321.htm |

| EX-2.12 - EX-2.12 - Gannett Co., Inc. | d143702dex212.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 27, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-36097

New Media Investment Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

38-3910250 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1345 Avenue of the Americas, New York, New York |

10105 | |

| (Address of principal executive offices) | (Zip Code) | |

Telephone: (212) 479-3160

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common stock, par value $0.01 per share | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant on June 28, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $795.9 million. The market value calculation was determined using a per share price of $18.23, the price at which the registrant’s common stock was last sold on the New York Stock Exchange on such date. For purposes of this calculation, shares held by non-affiliates excludes only those shares beneficially owned by the registrant’s executive officers, directors, and stockholders owning 10% or more of the registrant’s outstanding common stock (and, in each case, their immediate family members and affiliates).

As of February 22, 2016, 44,710,497 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive proxy statement, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days of the Company’s fiscal year-end, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

Table of Contents

NEW MEDIA INVESTMENT GROUP INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 27, 2015

| Page | ||||||

| Item 1 |

1 | |||||

| Item 1A |

50 | |||||

| Item 1B |

67 | |||||

| Item 2 |

67 | |||||

| Item 3 |

68 | |||||

| Item 4 |

68 | |||||

| Item 5 |

69 | |||||

| Item 6 |

71 | |||||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

75 | ||||

| Item 7A |

101 | |||||

| Item 8 |

103 | |||||

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

160 | ||||

| Item 9A |

160 | |||||

| Item 9B |

163 | |||||

| Item 10 |

164 | |||||

| Item 11 |

164 | |||||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

164 | ||||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

165 | ||||

| Item 14 |

165 | |||||

| Item 15 |

166 | |||||

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Certain statements in this report on Form 10-K may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect our current views regarding, among other things, our future growth, results of operations, performance and business prospects and opportunities, as well as other statements that are other than historical fact. Words such as “anticipate(s),” “expect(s)”, “intend(s)”, “plan(s)”, “target(s)”, “project(s)”, “believe(s)”, “will”, “aim”, “would”, “seek(s)”, “estimate(s)” and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements are based on management’s current expectations and beliefs and are subject to a number of known and unknown risks, uncertainties and other factors that could lead to actual results materially different from those described in the forward-looking statements. We can give no assurance that our expectations will be attained. Our actual results, liquidity and financial condition may differ from the anticipated results, liquidity and financial condition indicated in these forward-looking statements. These forward looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause our actual results to differ, possibly materially from expectations or estimates reflected in such forward-looking statements, including, among others:

| • | general economic and market conditions; |

| • | economic conditions in the Northeast, Southeast and Midwest regions of the United States; |

| • | our ability to grow our digital business and digital audience and advertiser base; |

| • | the growing shift within the publishing industry from traditional print media to digital forms of publication; |

| • | our ability to acquire local media print assets at attractive valuations; |

| • | declining advertising and circulation revenues; |

| • | the risk that we may not realize the anticipated benefits of our recent or potential future acquisitions; |

| • | the availability and cost of capital for future investments; |

| • | our indebtedness may restrict our operations and / or require us to dedicate a portion of cash flow from operations to the payment of principal and interest; |

| • | our ability to pay dividends consistent with prior practice or at all; |

| • | our ability to realize the benefits of the Management Agreement (as defined below); |

| • | the impact of any material transactions with the Manager (as defined below) or one of its affiliates, including the impact of any actual, potential or predicted conflicts of interest; |

| • | the competitive environment in which we operate; |

| • | our ability to recruit and retain key personnel. |

Additional risk factors that could cause actual results to differ materially from our expectations include, but are not limited to, the risks identified by us under the heading “Risk Factors” in Item 1A of this report. Such forward-looking statements speak only as of the date on which they are made. Except to the extent required by law, we expressly disclaim any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

ii

Table of Contents

| Item 1. | Business |

General Overview

New Media Investment Group Inc. (“New Media,” “Company,” “us,” or “we”), was formed as a Delaware corporation on June 18, 2013. Pursuant to the Restructuring (as defined below), Newcastle Investment Corp. (“Newcastle”) owned approximately 84.6% of New Media until February 13, 2014, upon which date Newcastle distributed the shares that it held in New Media to its shareholders on a prorata basis. New Media had no operations until November 26, 2013, when it assumed control of GateHouse Media, LLC (formerly known as GateHouse Media, Inc.) (“GateHouse” or “Predecessor”) and Local Media Group Holdings LLC (“Local Media Parent”). GateHouse was determined to be the predecessor to New Media, as the operations of GateHouse comprise substantially all of the business operations of the combined entities. Both New Media and Newcastle are externally managed and advised by an affiliate of Fortress Investment Group LLC (“Fortress”).

New Media is a company that owns, operates and invests in high quality local media assets. We have a particular focus on owning and acquiring strong local media assets in small to mid-size markets. With our collection of assets, we focus on two large business categories; consumers and small to medium size businesses (“SMBs”).

Our portfolio of media assets today spans across 489 markets and 31 states. Our products include 564 community print publications, 489 websites, 476 mobile sites and six yellow page directories. We reach over 19 million people per week and serve over 193,000 business customers.

We are focused on growing our consumer revenues primarily through our penetration into the local consumer market that values comprehensive local news and receives their news primarily from our products. We believe our rich local content, our strong media brands, and multiple platforms for delivering content will impact our reach into the local consumers leading to growth in subscription income. We also believe our focus on smaller markets will allow us to be a dominant provider of valuable, unique local news to consumers in those markets. We believe that one result of our local consumer penetration in these smaller markets will be transaction revenues as we link consumers with local businesses. For our SMB business category, we focus on leveraging our strong local media brands, our in-market sales force and our high consumer penetration rates with a variety of products and services that we believe will help SMBs expand their marketing, advertising and other digital lead generation platforms. We also believe our strong position in our local markets will allow us to develop other products that will be of value to our SMBs in helping them run and grow their businesses.

Our business strategy is to be the preeminent provider of local news, information, advertising and digital services in the markets we operate in today. We aim to grow our business organically through both our consumer and SMB strategies. We also plan to pursue strategic acquisitions of high quality local media assets at attractive valuation levels. Finally, we intend to distribute a substantial portion of our free cash flow as a dividend to stockholders through a quarterly dividend, subject to satisfactory financial performance, approval by our board of directors (the “Board of Directors” or “Board”) and dividend restrictions in the New Media Credit Agreement (as defined below). The Board of Directors’ determinations regarding dividends will depend on a variety of factors, including the Company’s U.S. generally accepted accounting principles (“GAAP”) net income, free cash flow generated from operations or other sources, liquidity position and potential alternative uses of cash, such as acquisitions, as well as economic conditions and expected future financial results.

We believe that our focus on owning and operating dominant local-content-oriented media properties in small to mid-size markets puts us in a position to better execute our strategy. We believe that being the dominant provider of local news and information in the markets in which we operate and distributing that content across multiple print and digital platforms, gives us an opportunity to grow our audiences and reach. Further, we believe our strong local media brands and our in-market sales presence gives us the opportunity to expand our advertising and lead generation products with local business customers.

1

Table of Contents

Central to our business strategy are our digital marketing services products called Propel Marketing (“Propel”). We launched the products in 2012 and have seen rapid growth since then. Revenues have grown from $1 million in 2012 to $31.3 million in 2015. We believe Propel and our other digital marketing service products, combined with our strong local brands and in market sales force, position this product group to be a key component to our overall organic growth strategy.

We believe that Propel will allow us to capitalize on the following opportunities in the marketplace:

There are approximately 27.9 million SMBs in the U.S. according to the 2011 U.S. Census data. Of these, approximately 26.7 million have 20 employees or less.

Many of the owners and managers of these SMBs do not have resources or expertise to navigate the fast evolving digital marketing sector, but are increasingly aware of the need to establish and maintain a digital presence in order to stay connected with current and future customers.

Propel is designed to offer a complete set of turn-key digital marketing services to SMBs that provides transparent results to the business owners. Propel provides four broad categories of services: building businesses a presence, helping businesses to be located by consumers online, engaging with consumers, and growing their customer base.

We believe our local media properties and local sales infrastructure are uniquely positioned to sell these digital marketing services to local business owners and give us distinct advantages, including:

| • | our strong and trusted local brands, with 85% of our daily newspapers having been publishing local content for more than 100 years; |

| • | our ability to market through our print and online properties, driving branding and traffic; and |

| • | our more than 1,480 local, direct, in-market sales professionals with long standing relationships with small businesses in the communities we serve. |

Our core products include:

| • | 124 daily newspapers with total paid circulation of approximately 1.5 million; |

| • | 322 weekly newspapers (published up to three times per week) with total paid circulation of approximately 321,000 and total free circulation of approximately 2.0 million; |

| • | 118 “shoppers” (generally advertising-only publications) with total circulation of approximately 2.8 million; |

| • | 489 locally focused websites and 476 mobile sites, which extend our businesses onto the internet and mobile devices with approximately 226 million page views per month; |

| • | six yellow page directories, with a distribution of approximately 348,000, that cover a population of approximately 620,000 people; and |

| • | Propel digital marketing services. |

In addition to our core products, we also opportunistically produce niche publications that address specific local market interests such as recreation, sports, healthcare and real estate. Similarly, GateHouse Live, our events business, concentrates on local markets and interests.

Our print and online products focus on the local community from a content, advertising, and digital marketing perspective. As a result of our focus on small and midsize markets, we are usually the primary, and sometimes, the sole provider of comprehensive and in-depth local market news and information in the communities we serve. Our content is primarily devoted to topics that we believe are highly relevant and of interest to our audience such as local news and politics, community and regional events, youth sports, opinion and editorial pages, local schools, obituaries, weddings and police reports.

2

Table of Contents

More than 85% of our daily newspapers have been published for more than 100 years and 100% have been published for more than 50 years. We believe that the longevity of our publications demonstrates the value and relevance of the local information that we provide and has created a strong foundation of reader loyalty and a highly recognized media brand name in each community we serve. As a result of these factors, we believe that our publications have high local audience penetration rates in our markets, thereby providing advertisers with strong local market reach.

We believe the large number of publications we have, our focus on smaller markets, and our geographic diversity also provide the following benefits to our strategy:

| • | Diversified revenue streams, both in terms of customers and markets; |

| • | Operational efficiencies realized from clustering of business assets; |

| • | Operational efficiencies realized from centralization of back office functions; |

| • | Operational efficiencies realized from improved buying power for key operating cost items through our increased size and scale; |

| • | Ability to provide consistent management practices and ensure best practices; and |

| • | Less competition and high barriers to entry. |

The newspaper industry has experienced declining revenue and profitability dating back to 2007 due to, among other things, advertisers’ shift from print to digital media and general market conditions. Our Predecessor was affected by this trend and experienced a history of net operating losses.

The revenues derived from our SMB category come from a variety of print and digital advertising products, digital service products we offer through Propel, and commercial printing services. Our consumer category revenue comes primarily from subscription income as consumers pay for our deep, rich local contents, both in print and online, however primarily print today.

Our operating costs consist primarily of labor, newsprint, and delivery costs. Our selling, general and administrative expenses consist primarily of labor costs. Compensation represents just under 50% of our operating expenses. Over the last few years, we have worked to drive efficiencies through centralization of back office functions, outsourcing and leveraging our scale to purchase more effectively. Additionally, we have taken steps to cluster our operations, thereby increasing the usage of facilities and equipment while increasing the productivity of our labor force. We expect to continue to employ these steps as part of our business and clustering strategy.

Local Media Acquisition

Newcastle acquired Local Media Group Inc. (formerly known as Dow Jones Local Media Group, Inc.) (“Local Media”) on September 3, 2013 from News Corp. Inc. and contributed to New Media 100% of the stock of Local Media Parent (which owns all of Local Media’s stock) on GateHouse’s emergence from bankruptcy on November 26, 2013 (the “Effective Date”). In exchange for the contribution of Local Media, Newcastle received shares of common stock, par value $0.01 per share, of New Media (“New Media Common Stock” or our “Common Stock”), equal in value to the cost of the acquisition of Local Media by Newcastle (“Local Media Acquisition”). Local Media Parent became a wholly owned subsidiary of New Media.

GateHouse managed the assets of Local Media pursuant to a management and advisory agreement (“Local Media Management Agreement”). The agreement had a two-year term, with automatic renewal for successive two-year periods unless terminated. While the agreement was in effect, GateHouse received an annual management fee of $1.1 million, subject to adjustments (up to a maximum annual management fee of $1.2 million), and an annual incentive compensation fee based on exceeding EBITDA targets of Local Media. The Local Media Management Agreement was terminated effective June 4, 2014.

3

Table of Contents

Restructuring and Spin-off from Newcastle Investment Corp.

We acquired our operations as part of the restructuring (the “Restructuring”) of our Predecessor, GateHouse. On September 27, 2013, GateHouse commenced the Restructuring in which it sought confirmation of its bankruptcy plan sponsored by Newcastle, as the holder of the majority of the Outstanding Debt (as defined as follows). The Plan relates to the Restructuring of our Predecessor’s obligations under the amended and restated credit agreement by and among certain affiliates of GateHouse, the lenders from time to time thereto and Cortland Products Group, as administrative agent, dated February 27, 2007 (as amended, the “2007 Credit Facility”) and certain interest rate swaps (collectively, the “Outstanding Debt”). The U.S. Bankruptcy Court for the District of Delaware confirmed the reorganization plan (the “Plan”) on November 6, 2013 and GateHouse consequently emerged from Chapter 11 protection on November 26, 2013.

Pursuant to the Restructuring, Newcastle offered to purchase the Outstanding Debt in cash and at 40% of (i) $1,167 million of principal claims under the 2007 Credit Facility, plus (ii) accrued and unpaid interest at the applicable contract non-default rate with respect thereto, plus (iii) all amounts, excluding any default interest, arising from transactions in connection with interest rate swaps secured under the 2007 Credit Facility (the “Cash-Out Offer”) on the Effective Date. The holders of the Outstanding Debt had the option of receiving, in satisfaction of their Outstanding Debt, their pro rata share of the (i) Cash-Out Offer or (ii) New Media Common Stock and net proceeds, if any, of the GateHouse Credit Facilities. All pensions, trade and all other unsecured claims will be paid in the ordinary course.

On the Effective Date (1) GateHouse became our wholly-owned subsidiary as a result of (a) the cancellation and discharge of the currently outstanding equity interests in GateHouse (the holders of which received warrants issued by New Media) and (b) the issuance of equity interests in the reorganized GateHouse to New Media; (2) Local Media Parent, which was a wholly-owned subsidiary of Newcastle, following the Local Media Acquisition became a wholly-owned subsidiary of New Media as a result of Newcastle’s transfer of Local Media Parent to New Media; (3) New Media entered into the Management Agreement (as defined below) with our Manager (as defined below), (4) New Media entered into the GateHouse Management and Advisory Agreement (the “GateHouse Management Agreement”) with GateHouse; and (5) all of GateHouse’s Outstanding Debt was cancelled and discharged and the holders of the Outstanding Debt received, at their option, their pro rata share of the (i) Cash-Out Offer or (ii) New Media Common Stock and the net proceeds of the two certain Term Loan and Security Agreements dated November 26, 2013 (the “GateHouse Credit Facilities”). Pursuant to the Cash-Out Offer, Newcastle offered to buy the claims of the holders of the Outstanding Debt. As a result of these transactions, Newcastle owned 84.6% of New Media as of the Effective Date. The GateHouse Management Agreement was terminated effective June 4, 2014.

On the Effective Date, New Media entered into a management agreement with FIG LLC (the “Manager”) (the “Management Agreement”) pursuant to which the Manager will manage the operations of New Media. The annual management fee is 1.50% of New Media’s Total Equity (as defined in the Management Agreement) and the Manager is eligible to receive incentive compensation.

On September 27, 2013, Newcastle announced that its board of directors unanimously approved a plan to spin-off our Company. Newcastle’s board of directors made the determination to spin-off our assets because it believed that our value can be increased over time through a strategy aimed at acquiring local media assets and organically growing our digital marketing business.

In order to effect the separation and spin-off of our Company, we filed a registration statement on Form S-1, as amended, which was declared effective by the Securities and Exchange Commission (the “SEC”) on January 30, 2014.

Each share of Newcastle common stock outstanding as of 5:00 PM, Eastern Time, on February 6, 2014, the Record Date, entitled the holder thereof to receive 0.07219481485 shares of our Common Stock (the

4

Table of Contents

“Distribution” or the “spin-off”). The spin-off was completed on February 13, 2014. Immediately thereafter, we became a publicly traded company independent from Newcastle trading on the New York Stock Exchange (the “NYSE”) under the ticker symbol “NEWM.”

Acquisitions

On February 28, 2014, we completed the acquisition of five publications from Freedom Communications for a total purchase price of $7.9 million, including working capital. The acquisition included two daily and three weekly publications serving Southern California with an aggregate circulation of approximately 56,000.

On June 30, 2014, we completed two acquisitions of 20 publications with a total purchase price of $15.9 million, including working capital. The acquisitions included six daily, ten weekly publications, and four shoppers serving areas of Texas, Oklahoma, Kansas and Virginia with an aggregate circulation of approximately 54,000.

On September 3, 2014, we completed the acquisition of The Providence Journal with a total purchase price of $48.7 million, including working capital. The acquisition included one daily and two weekly publications serving areas of Rhode Island with a daily circulation of approximately 72,000 and 96,000 on Sunday.

On December 1, 2014, we completed the acquisition of Foster’s Daily Democrat along with other publications and related assets for $5.4 million in cash, including working capital, from the Foster family. The publications are located around Dover, NH, and the daily newspaper has a circulation of approximately 12,000.

On January 9, 2015, we completed the acquisition of substantially all of the assets from Halifax Media Group for an aggregate purchase price of $285.4 million, including working capital and net of assumed debt. The acquisition included 24 daily publications, thirteen weekly publications, and five shoppers serving areas of Alabama, Florida, Louisiana, Massachusetts, North Carolina, and South Carolina with a daily circulation of approximately 635,000 and 752,000 on Sunday.

On March 18, 2015, we completed the acquisition of the assets of Stephens Media, LLC (“Stephens Media”) for an aggregate purchase price of $110.8 million, including working capital. The acquisition includes nine daily newspapers, 35 weekly publications and fifteen shoppers serving communities throughout the United States with a combined average daily circulation of approximately 221 and 244 on Sunday.

On June 15, 2015 and September 23, 2015, we acquired substantially all the assets, properties and business of publishing/operating certain newspapers for an aggregate purchase price of $52.0 million, including estimated working capital. The acquisitions included two daily newspapers, twenty-eight weekly publications, and two shoppers serving Central Ohio and Southern Michigan.

Dispositions

On December 10, 2015, we completed the sale of the Las Vegas Review-Journal and related publications (initially acquired in the Stephens Media acquisition), which are located in Las Vegas, Nevada for an aggregate sale price of $140,000 plus working capital adjustment of $1,000. As a result, a gain of $57.0 million is included in (gain) loss on sale or disposal of assets on the consolidated statement of operations and comprehensive income (loss) for this period.

Subsequent Events

Acquisitions

On December 31, 2015, we completed the acquisition of the Business Information Division of Dolan LLC (“Dolan”) for $35.0 million in cash, plus working capital. We funded the acquisition with cash on the balance sheet. Dolan is a leading provider of industry-specific news with 39 print and online publications and an audience of over 46,000 paid subscribers.

5

Table of Contents

On January 12, 2016, we completed the acquisition of substantially all of the publishing operations of the Times Publishing Company, including the Erie Times-News daily newspaper, for $11.5 million in cash, plus the assumption of the assumed liabilities. We funded the acquisition with cash on the balance sheet. Erie Times-News is a dominant source of local news and advertising in Erie, PA with an average weekday circulation of over 39,000 and 55,000 on Sunday.

Dividends

On February 25, 2016, the Company announced a fourth quarter 2015 cash dividend of $0.33 per share of New Media Common Stock. The dividend will be paid on March 17, 2016, to shareholders of record as of the close of business on March 9, 2016.

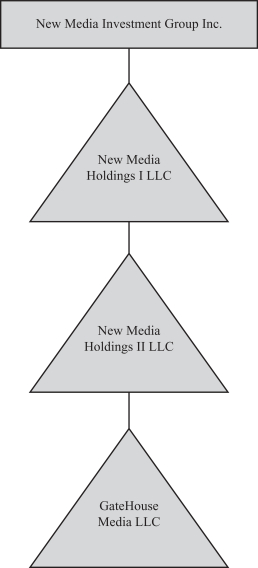

Corporate Entity Structure

The chart below sets forth our entity structure and that of our direct and indirect subsidiaries. This chart does not include all of our affiliates and subsidiaries or our Manager and, in some cases, we have combined separate entities for presentation purposes.

6

Table of Contents

Industry Overview

We operate in what is sometimes referred to as the “hyper-local” or community news market and market within the media industry. Media companies that serve this segment provide highly focused local content and advertising that is generally unique to each market they serve and is not readily obtainable from other sources. Local publications include community newspapers, websites, shoppers, traders, real estate guides, special interest magazines and directories. Due to the unique local nature of their content and audience, community publications compete for advertising customers with other forms of traditional media, including direct mail, directories, radio, television, and outdoor advertising. They also compete with new local and national digital and social media businesses for advertising, digital services and customers. We believe that local print and online publications in smaller markets are the most effective medium for local retail advertising, which emphasizes the price of goods in an effort to move inventory on a regular basis, in contrast to radio, broadcast and cable, television, and the internet, which are generally used for image or branding advertising. In addition, we believe local print and online publications generally have the highest local audience penetration rates, which allows local advertisers to get their message to a large portion of the local audience. Finally, national digital competitors tend to have no local in-market sales presence which we believe gives the local community publications an advantage when selling these types of products and services.

Locally focused media in small and midsize communities is distinct from national and urban media delivered through outlets such as television, radio, metropolitan and national newspapers and the internet. Larger media outlets tend to offer broad based information to a geographically scattered audience, which tends to be more of a commodity. In contrast, locally focused media delivers a highly focused product that is often the only source of local news and information in the market it serves. Our segment of the media industry is also characterized by high barriers to entry, both economic and social. Small and midsize communities can generally only sustain one newspaper. Moreover, the brand value associated with long-term reader and advertiser loyalty, and the high start-up costs associated with developing and distributing content and selling advertisements, help to limit competition.

We also believe there is a growing need among small to mid-size businesses to be able to generate leads and interact with consumers across all the digital platforms, which takes many forms including websites, mobile sites, tablets and social media. These local business owners and managers lack the time, expertise and resources to capitalize on the potential of these new consumer-reaching channels. National competitors in this category do not generally have a local in-market presence. Newly formed competitors lack a known and credible brand name in addition to generally not having a local in-market presence. We believe this represents a substantial opportunity for our local media business.

Advertising Market

The primary sources of advertising revenue for local publications are small businesses, corporations, government agencies and individuals who reside in the market that a publication serves. By combining paid circulation publications with total market coverage (“TMC”) publications such as shoppers and other specialty publications (tailored to the specific attributes of a local community), local publications are able to reach nearly 100% of the households in a distribution area. As macroeconomic conditions in advertising change due to increasing internet and mobile usage and the wide array of available information sources, we have seen advertisers shift their focus to incorporate a digital advertising and services component into their overall local marketing strategy. To that end, in addition to printed products, the majority of our local publications have an online presence that further leverages the local brand, ensures higher penetration into the market, and provides a digital alternative for local advertisers to reach consumers. We also have strong digital marketing services, Propel.

Digital Media

The time spent online and on mobile devices each day by media consumers continues to grow and newspaper web and mobile sites offer a wide variety of content providing comprehensive, in-depth and up to the

7

Table of Contents

minute coverage of news and current events. The ability to generate, publish and archive more news and information than most other sources has allowed newspapers to produce some of the most visited sites on the internet. Newspaper websites have proven to be some of the most visited websites by online media news consumers.

We believe that our local publications are well positioned to capitalize on their existing market presence and grow their total audience base by publishing proprietary local content digitally: via the internet, mobile websites and mobile applications. Local digital media include traditional classifieds, directories of business information, local advertising, databases, audience-contributed content and mobile applications. We believe this additional community-specific content will further extend and expand both the reach and the brand of our publications with readers and advertisers. We believe that building a strong local digital business extends the core audience of a local publication.

The opportunity created by the digital extension of the core audience makes local digital advertising an attractive complement for existing print advertisers, while opening up opportunities to attract new local advertisers that have not previously advertised with local publications. In addition, we believe that national advertisers have an interest in reaching buyers on a hyper-local level and, although they historically have not been significant advertisers in community publications, we believe the digital media offers them a powerful medium to reach local audiences. This opportunity is further enhanced by our behavioral targeting products, which allow advertisers to reach specific demographics of our audience and follow that audience across multiple websites, delivering advertisements across the platforms. Further, digital marketing services businesses are poised to benefit from the rise in internet marketing spend, which grew 16% between 2013 and 2014, and 294% between 2005 and 2014, according to the 2014 IAB Internet Advertising Revenue Report issued in April 2015.

We believe that a strong digital business will enhance our revenues. In addition, we believe that we have the expertise and sales resources to help other businesses maximize their digital opportunities. Accordingly, we have launched our digital marketing services business, including Propel, which is designed to help SMBs utilize the digital space to generate leads, interact with consumers and grow their businesses. New Media’s digital revenue derived from advertising, circulation, and other revenue has grown since the launch of Propel in 2012. New Media’s digital revenue was $106.9 million for the year ended December 27, 2015, an 85% growth as compared with the same period in 2014, which had digital revenue of $57.9 million. Of this, $31.3 million, or 29% of digital revenue for the year ended December 27, 2015 was attributable to Propel. See “Risk Factors—Risks Related to Our Business—We have invested in growing our digital business, including Propel, but such investments may not be successful, which could adversely affect our results of operations.”

We anticipate that the digital marketing services sector will continue to grow as SMBs move from print to digital marketing in connection with consumers spending more time online. According to the 2011 U.S. Census data, there are approximately 27.9 million SMBs in the US, 26.7 million of the SMBs have 20 employees or less, and these businesses are expected to spend $42.6 billion on digital marketing by 2016 (according to the 2015 U.S. Local Media Forecast by BIA/Kelsey). Owners of these businesses often lack the resources and expertise to navigate the digital marketing services sector. A recent study done by SCORE Association in 2014 indicated that 97% of consumers search for local businesses online, 49% of SMBs do not have a website, 93% are not mobile compatible, and 27% of SMBs with websites were found to not have a phone number on their home page. Propel offers SMBs digital services, including website design, search engine optimization, mobile websites, social media, retargeting and other advertising services. Our Predecessor believed, and we too believe, that Propel is well positioned to assist SMBs in the digital space and expect Propel to contribute meaningfully to future revenue growth. Propel is also able to leverage our local media properties and local sales infrastructure and give us distinct advantages, including:

| • | our strong and trusted local brands, with 85% of our daily newspapers having been publishing local content for more than 100 years; |

| • | our ability to market through our print and online properties, driving branding and traffic; and |

8

Table of Contents

| • | our more than 1,480 local, direct, in-market sales professionals with long standing relationships with small businesses in the communities we serve. |

Circulation

Overall daily newspaper print circulation, including national and urban newspapers, has been declining slowly over the past several years. Small and midsize local market newspapers have generally had smaller declines and more stability in their paid print circulation volumes due to the relevant and unique hyper-local news they produce combined with less competition than larger markets. In addition, we believe this unique and valuable hyper-local content along with multiple delivery platforms now available will allow smaller market newspapers to continue to raise prices, leading to stable circulation revenues. Data and technology now available to newspapers allow them to target pricing more at the household level rather than purely by market. This will lead to more effective pricing strategies and enhance stability for circulation revenues. According to the Newspaper Association of America, pay meters and pricing helped the newspaper industry grow circulation revenue by 9% from 2011 to 2013.

Our Strengths

High Quality Assets with Leading Local Businesses. Our publications benefit from a long history in the communities we serve as one of the leading, and often sole, providers of comprehensive and in-depth local content. More than 85% of our daily newspapers have been published for more than 100 years and 100% have been published for more than 50 years. This has resulted in brand recognition for our publications, reader loyalty and high local audience penetration rates, which are highly valued by local advertisers. We continue to build on long-standing relationships with local advertisers and our in-depth knowledge of the consumers in our local markets. We believe our local news content is unique and highly valued by consumers who live in our markets, and there are limited, and in some cases no competing sources of local content for our target customers.

Large Locally Focused Sales Force. We have large and well known “in-market” local sales forces in the markets we serve, consisting of over 1,480 sales representatives, including 42 dedicated to Propel and 17 third party sales affiliations. Our sales forces are generally among the largest locally oriented media sales forces in their respective communities. We have long-standing relationships with many local businesses and have the ability to be face to face with most local businesses due to these unique characteristics we enjoy. We believe our strong brands combined with our “in-market” presence give us a distinct advantage in selling and growing in the digital services sector given the complex nature of these products. We also believe that these qualities provide leverage for our sales force to grow additional future revenue streams in our markets, particularly in the digital sector.

Ability to Acquire and Integrate New Assets. We have created a national platform for consolidating local media businesses and have demonstrated an ability to successfully identify, acquire and integrate local media asset acquisitions. Together with our Predecessor, we have acquired over $2.2 billion of assets since 2006, including both traditional newspaper and directory businesses. We have a scalable infrastructure and platform to leverage for future acquisitions.

Scale Yields Operating Profit Margins and Allows Us to Realize Operating Synergies. We believe we can generate higher operating profit margins than our publications could achieve on a stand-alone basis by leveraging our operations and implementing revenue initiatives, especially digital initiatives, across a broader local footprint in a geographic cluster and by centralizing certain back office production, accounting, administrative and corporate operations. We also benefit from economies of scale in the purchase of insurance, newsprint and other large strategic supplies and equipment. Finally, we have the ability to further leverage our centralized services and buying power to reduce operating costs when making future strategic accretive acquisitions.

Local Business Profile Generates Significant Cash Flow. Our local business profile allows us to generate significant recurring cash flow due to our diversified revenue base and high operating profit margins and

9

Table of Contents

maintain our low capital expenditure and working capital requirements. As a result of the Restructuring, which extinguished GateHouse’s obligations under the 2007 Credit Facility and certain interest rate swaps secured thereunder on November 6, 2013, the confirmation date of the Plan, our interest and debt servicing expenses are significantly lower than our Predecessor’s interest and debt servicing expenses. As of December 27, 2015, our debt structure consists of the New Media Credit Agreement and Advantage Credit Agreements (as defined below). We currently estimate that we will have significant free cash flow totaling $115.0 million to $135.0 million in 2016, which we believe will lead to stockholder value creation through our investments in organic growth, investments in accretive acquisitions and the return of cash to stockholders in the form of dividends, subject to satisfactory financial performance, approval by our Board of Directors and dividend restrictions in the New Media Credit Agreement. We further believe the strong cash flows generated and available to be invested will lead to consistent future dividend growth.

Experienced Management Team. Our senior management team is made up of executives who have an average of over 20 years of experience in the media industry, including strong traditional and digital media expertise. Our executive officers have broad industry experience with regard to both growing new digital business lines and identifying and integrating strategic acquisitions. Our management team also has key strengths in managing wide geographically disbursed teams, including the sales force, and identifying and centralizing duplicate functions across businesses leading to reduced core infrastructure costs.

Our Strategy

We intend to create stockholder value through a variety of factors including organic growth driven by our consumer and SMB strategies, pursuing attractive strategic acquisitions of high quality local media assets, and through the distribution of a substantial portion of our free cash flow as a dividend, subject to satisfactory financial performance, approval by our Board of Directors and dividend restrictions in the New Media Credit Agreement. However, there is no guarantee that we will be able to accomplish any of these strategic initiatives.

A key component of our strategy is to acquire and operate traditional local media businesses and transform them from print-centric operations to dynamic multi-media operations through our existing online advertising and digital marketing services businesses. We will also leverage our existing platform to operate these businesses more efficiently. We believe all of these initiatives will lead to revenue and cash flow growth for New Media and will enable us to pay dividends to our stockholders. We intend to distribute a substantial portion of our free cash flow as a dividend to stockholders, through a quarterly dividend, subject to satisfactory financial performance, approval by our Board of Directors and dividend restrictions in the New Media Credit Agreement. The Board of Directors’ determinations regarding dividends will depend on a variety of factors, including the Company’s GAAP net income, free cash flow generated from operations or other sources, liquidity position and potential alternative uses of cash, such as acquisitions, as well as economic conditions and expected future financial results. The key elements of our strategy include:

Maintain Our Leading Position in the Delivery of Proprietary Local Content in Our Communities. We seek to maintain our position as a leading provider of unique local content in the markets we serve and to leverage this position to strengthen our relationships with both readers and local businesses, thereby increasing penetration rates and market share. A critical aspect of this approach is to continue to provide local content that is not readily obtainable elsewhere and to be able to deliver that content to our customers across multiple print and digital platforms.

Grow Our New Digital Marketing Services Business. We plan to scale and expand our digital marketing services, including Propel. We believe Propel will allow us to sell digital marketing services to SMBs both in and outside existing New Media markets. The SMB demand for digital service solutions is great and represents a rapidly expanding opportunity. According to the 2011 U.S. Census data, there are approximately 27.9 million SMBs in the U.S. and, according to a 2015 U.S. Local Media Forecast by BIA/Kelsey, digital revenues are expected to grow to $42.6 billion in 2016, representing a 3.8% growth rate. Owners of SMBs often lack the

10

Table of Contents

resources and expertise to navigate the digital marketing services sector, with 49% of SMBs not having a website and 93% not having mobile-friendly websites according to a SCORE Association Small Business Study in 2014. We believe local SMBs will turn to our trusted local media brands to help them navigate through developing their digital marketing presence and strategy. We believe our local media properties and local sales infrastructure gives us a distinct advantage to being the leading local provider of digital marketing services, through Propel.

Pursue Strategic Accretive Acquisitions. We intend to capitalize on the highly fragmented and distressed local print industries which have greatly reduced valuation levels. We initially expect to focus our investments primarily in the local newspaper sector in small to mid-size markets. We believe we have a strong operational platform as well as scalable digital marketing services, including Propel. This platform, along with deep industry specific knowledge and experience that our management team has can be leveraged to reduce costs, stabilize the core business and grow digital revenues at acquired properties. The size and fragmentation of the addressable print media market place in the United States, the greatly reduced valuation levels that exist in these industries, and our deep experience make this an attractive place for our initial consolidation focus and capital allocation. Over the longer term we also believe there may be opportunity to diversify and acquire these types of assets internationally, as well as other traditional local media assets such as broadcast TV, out of home advertising (billboards) and radio, in the United States and internationally. We also believe there may be opportunities to acquire other strong businesses that have strong local brands and local sales infrastructure or digital product companies, both of which could quickly scale for Propel.

Stabilize Our Core Business Operations. We have four primary drivers in our strategic plans to stabilize our core business operations, including: (i) identifying permanent structural expense reductions in our traditional business cost infrastructure and re-deploying a portion of those costs toward future growth opportunities, primarily on the digital side of our business; (ii) accelerating the growth of both our digital audiences and revenues through improvements to current products, new product development, training, opportunistic changes in hiring to create an employee base with a more diversified skill set and sharing of best practices; (iii) accelerating our consumer revenue growth through subscription pricing increases, pay meters for digital content and growth in our overall subscriber base; and (iv) stabilizing our core print advertising revenues through improvements to pricing, packaging of products for customers that will produce the best results for them, and more technology and training for sales management and sales representatives.

The newspaper industry has experienced declining revenue and profitability over the past several years due to, among other things, advertisers’ shift from print to digital media following the consumer shift, and general market conditions. The Restructuring significantly reduced New Media’s interest expense. In addition, New Media intends to focus its business strategy on building its digital marketing business and growing its online advertising business, which we believe will offset some of the challenges experienced by GateHouse. With its improved capital structure and digital focus, combined with its strengths and strategy and dividend strategy, we believe that New Media will be able to grow stockholder value. However, there can be no assurance of this. See “Risk Factors” under Item 1A of this Annual Report on Form 10-K.

Challenges

We will likely face challenges commonly encountered by recently reorganized entities, including the risk that even under our improved capital structure, we may not be profitable.

As a publisher of locally based print and online media, we face a number of additional challenges, including the risks that:

| • | the growing shift within the publishing industry from traditional print media to digital forms of publication may compromise our ability to generate sufficient advertising revenues; |

| • | investments in growing our digital business may not be successful, which could adversely affect our results of operations; |

11

Table of Contents

| • | our advertising and circulation revenues may decline if we are unable to compete effectively with other companies in the local media industry; and |

| • | we may not be able to successfully acquire local print media assets at attractive valuations due to a rise in valuations from a more competitive landscape of acquirors. |

For more information about New Media’s risks and challenges, see “Risk Factors” under Item 1A of this Annual Report on Form 10-K.

Products

Our product mix consists of four publication types: (i) daily newspapers, (ii) weekly newspapers, (iii) shoppers and (iv) niche publications. Most of these publications have a digital presence as discussed in the following table. Some of the key characteristics of each of these types of publications are also summarized in the table below.

| Daily Newspapers |

Weekly Newspapers |

Shoppers |

Niche Publications | |||||

| Cost: |

Paid | Paid and free | Paid and free | Paid and free | ||||

| Distribution: |

Distributed four to seven days per week | Distributed one to three days per week | Distributed weekly | Distributed weekly, monthly or on annual basis | ||||

| Format: |

Printed on newsprint, folded | Printed on newsprint, folded | Printed on newsprint, folded or booklet | Printed on newsprint or glossy, folded, booklet, magazine or book | ||||

| Content: |

50% editorial (local news and coverage of community events, some national headlines) and 50% ads (including classifieds) | 50% editorial (local news and coverage of community events, some national headlines for smaller markets which cannot support a daily newspaper) and 50% ads (including classifieds) | Almost 100% ads, primarily classifieds, display and inserts | Niche content and targeted ads (e.g., Chamber of Commerce city guides, tourism guides and special interest publications such as, seniors, golf, real estate, calendars and directories) | ||||

| Income: |

Revenue from advertisers, subscribers, rack/box sales | Paid: Revenue from advertising, subscribers, rack/box sales | Paid: Revenue from advertising, rack/box sales | Paid: Revenue from advertising, rack/box sales | ||||

| Free: Advertising revenue only, provide 100% market coverage. | Free: Advertising revenue only, provide 100% market coverage | Free: Advertising revenue only | ||||||

| Internet Availability: |

Maintain locally oriented websites, mobile sites and mobile apps, for select locations | Major publications maintain locally oriented websites and mobile sites for select locations | Major publications maintain locally oriented websites | Selectively available online | ||||

Overview of Operations

We operate in three publication groups: Eastern US Publishing, Central US Publishing and Western US Publishing. We also operate over 489 related websites and 360 mobile sites.

12

Table of Contents

The following table sets forth information regarding our publications.

| Number of Publications | Circulation (1) | |||||||||||||||||||||||

| Operating Group |

Dailies | Weeklies | Shoppers | Paid | Free | Total Circulation |

||||||||||||||||||

| Eastern US Publishing |

38 | 135 | 15 | 972,914 | 1,261,140 | 2,234,054 | ||||||||||||||||||

| Central US Publishing |

42 | 86 | 42 | 507,002 | 2,322,001 | 2,829,003 | ||||||||||||||||||

| Western US Publishing |

44 | 101 | 61 | 327,279 | 1,215,305 | 1,542,584 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

124 | 322 | 118 | 1,807,195 | 4,798,446 | 6,605,641 | ||||||||||||||||||

| (1) | Circulation statistics are estimated by our management as of December 27, 2015. |

Eastern US Publishing. Eastern US Publishing operates in six publication group clusters: the (1) New England Publishing Group, (2) Cape Publishing Group, (3) Providence Publishing Group, (4) Mid-Atlantic Publishing Group, (5) South Atlantic Publishing Group, and (6) Coastal Publishing Group.

New England Publishing Group. We are one of the largest community newspaper publishers in Massachusetts by number of daily publications and also publish a large concentration of weekly newspapers, serving 113 communities in markets across eastern Massachusetts. The three largest daily newspapers in this region are: The Patriot Ledger (founded in 1837 with circulation of 23,800), the Enterprise (founded in 1880 with circulation of 13,314) and the MetroWest Daily News (founded in 1897 with circulation of 11,783). We also have over 170 web sites, with more than 3.5 million combined monthly unique visitors in Massachusetts.

Many of the towns within our Massachusetts footprint were founded in the 1600s and our daily and weekly newspapers in the region have long been institutions within these communities. In fact, our Massachusetts publications have 29 daily and weekly newspapers that are over 100 years old. The Boston designated market area (“DMA”) is the eighth largest market in the United States with 2.5 million households and 6.5 million people, and ranks first nationally in concentration of colleges and universities. Massachusetts has more than 1.0 million households in the region earning greater than $75,000, and a substantial homeownership rate. We reach 1.4 million readers in the eastern Massachusetts market. Eastern Massachusetts is also an employment center for technology, biotechnology, healthcare and higher education.

Cape Publishing Group. This cluster includes Worcester, Massachusetts, the Cape Cod Media Group, the Southcoast Media Group, and the Seacoast Media Group.

In Worcester, Massachusetts, the Telegram & Gazette has been the premier daily newspaper in Central Massachusetts since 1866. The Telegram & Gazette, with daily circulation of 46,634 and its website, telegram.com, covers all of Worcester county, as well as surrounding areas including editorial coverage and distribution in over 60 towns which represents over 20% of the towns in the state of Massachusetts. Coverage is in our primary market of Worcester county with secondary focus in Middlesex and Hampden counties.

The Cape Cod Media Group publishes one paid daily, one paid weekly newspaper and one shopper. The flagship publication of the Cape Cod Media Group is the Cape Cod Times. The Cape Cod Times, with a daily circulation of 29,750 is the premier daily and Sunday local paper on Cape Cod. The Barnstable Patriot, the paid weekly newspaper, has a weekly circulation of 2,068.

The Southcoast Media Group publishes one paid daily newspaper, four paid weekly newspapers and two shoppers. The flagship publication of the Southcoast Media Group is the Standard-Times. The Standard-Times, with a daily circulation of 16,993, is the premier daily and Sunday local paper in the New Bedford, MA area. The other paid weeklies, the Spectator, the Chronicle, the Middleboro Gazette and the Advocate, have weekly circulations of 3,096, 1,429, 2,697 and 640, respectively.

Seacoast Media Group publishes two paid daily and seven paid weekly newspapers. The flagship publication of the Seacoast Media Group is the Portsmouth Herald. The Portsmouth Herald, with a daily

13

Table of Contents

circulation of 8,438, is the premier daily and Sunday local paper in coastal New Hampshire. The Hampton Union and the Exeter News-Letter are weeklies with circulations of 2,442 and 1,973, respectively. The York County Coast Star and the York Weekly in southern Maine have weekly circulations of 2,181 and 1,450, respectively. In addition, the group publishes Foster’s Daily Democrat, 7,374 circulation, and the Rochester (NH) Times and Sanford (ME) News, both paid weeklies. Seacoast Sunday is a regional Sunday newspaper for the entire market with circulation of 11,581 and is the second largest Sunday paper in New Hampshire.

In addition, Coulter Press, publishers of two paid weeklies, The Item and The Banner, is older than Clinton, Massachusetts, the town it calls home. The Item, covering Clinton, Lancaster, Sterling, Bolton, Berlin and Boylston, was founded in July 1893, more than 120 years ago.

Providence Publishing Group. This cluster includes the Providence Journal Group, the Nantucket Island Media Group, and Norwich, Connecticut.

In Providence, Rhode Island, is our Pulitzer Prize winning publication The Providence Journal, which publishes one paid daily newspaper and one shopper. The Providence Journal is the preeminent newspaper in its market and the oldest continuously-published daily newspaper in the United States. Its market includes all of Rhode Island as well as seven cities and towns in Bristol county Massachusetts with a daily circulation of 85,323. With an evolving digital platform, the market’s top local media website providencejournal.com offers an online source for award-winning news, sports, lifestyles, entertainment, editorials, and more and has monthly page views of over 9.7 million.

The Nantucket Island Media Group publishes The Inquirer and Mirror. With a weekly circulation of 6,339, it has the largest circulation of any island newspaper.

Our Norwich, Connecticut publication, The Bulletin, with a daily circulation of 10,219, diversifies this group as the eastern Connecticut economy differs from the nation and New England markedly. Primary economic drivers include casinos, military submarine manufacture and pharmaceutical research. Major industrial employers in the region include General Dynamics, Pfizer, Dow Chemical, Dominion Resources and the United States Navy.

Mid-Atlantic Publishing Group. This cluster includes the Hudson Valley Media Group and the Pocono Mountains Media Group.

The Hudson Valley Media Group publishes one paid daily, two free weekly newspapers, and one shopper. The flagship publication of the Hudson Valley Media Group is the Times Herald-Record. With a daily circulation of 46,260, the Times Herald-Record is the premier daily newspaper serving Orange, Ulster and Sullivan counties in New York and Pike county, Pennsylvania. The Pocono Mountains Media Group publishes one paid daily, one free weekly newspaper, and one shopper. The flagship publication of the Pocono Mountains Media Group is the Pocono Record. The Pocono Record, with a daily circulation of 13,640, is the premier daily and Sunday local paper in the Pocono Mountains area. The Hudson Valley Media group’s commercial print division publishes 120 weekly, bi- weekly and monthly publications. They are endorsed by both NY and NJ Newspaper Publisher Association groups. Hudson Valley Media also produces Orange and Ulster Magazine. Both are perfect bound glossy magazines.

South Atlantic Publishing Group. This cluster includes publications in North Carolina, South Carolina, and Tennessee.

The North Carolina cluster publishes ten daily newspapers and two weekly newspapers. In western North Carolina, we publish the Times-News in Hendersonville (daily circulation of 9,763). Our Piedmont newspapers include The Star in Shelby (daily circulation of 8,268) and The Gaston Gazette in Gastonia (daily circulation of 20,298). Central North Carolina newspapers include The Dispatch in Lexington (publishing six days per week

14

Table of Contents

with daily circulation of 6,246), Times-News in Burlington (daily circulation of 15,200), and The Courier Tribune in Asheboro (publishing six day per week with daily circulation of 7,709). Coastal publications in North Carolina include The Free Press in Kinston (daily circulation of 6,153), Sun Journal in New Bern (daily circulation of 9,963), The Daily News in Jacksonville (daily circulation of 11,419), and Star News in Wilmington (daily circulation of 29,494). Combined, these newspapers won 151 editorial and advertising awards in the 2015 North Carolina Press Association contest of which 51 were first place awards including for Investigative Reporting, City/County Government Reporting, Deadline Reporting, Business Writing, Photography, and Overall Appearance and Design.

In South Carolina we operate one daily publication, Spartanburg Herald-Journal, with a daily circulation of 24,663. Spartanburg is the largest city, and the county seat of, Spartanburg county. The Herald-Journal’s primary distribution area is Spartanburg and Union counties. In 2015, the Herald-Journal won 43 awards issued by the South Carolina Press Association, including 12 first-place awards and the President’s Cup for overall excellence.

In Columbia, Tennessee our daily publication is the Columbia Daily Herald, with daily circulation of 7,476. The Columbia Daily Herald publishes six days a week (Sunday through Friday) and serves Maury county, Tennessee and the surrounding Middle Tennessee region. The Columbia Daily Herald also publishes one weekly newspaper and one shopper. In 2015, the Daily Herald won Tennessee Press Association awards for Best Education reporting, Sports Writing, Editorial and Breaking News.

Coastal Publishing Group. This cluster includes publications in Florida and Alabama.

The Florida cluster publishes nine daily newspapers, ten weekly newspapers, and four shoppers. On Florida’s east coast in Daytona Beach is our daily publication The Daytona Beach News-Journal, which serves Volusia and Flagler counties with a daily circulation of 57,008. The Daytona Beach News-Journal also publishes four shoppers with a total combined circulation of 185,163 and operates a successful website news-journalonline.com that receives monthly page views of over 3.5 million. To the north is our two-time Pulitzer Prize winning daily publication, The Gainesville Sun, with daily circulation of 24,042 and monthly page views of 4.6 million. The Gainesville Sun also produces GatorSports.com, our University of Florida athletics free website which has approximately 3.5 million monthly page views. To the south of Gainesville in the middle of Marion county is our daily publication, Ocala Star Banner, with daily circulation of 25,091. The Ocala Star Banner also publishes a successful website ocala.com which receives monthly page views of over 5.1 million and monthly unique visitors over 510,000. In Central Florida, The Ledger in Lakeland has daily circulation of 39,278 and operates a robust commercial print operation generating millions of dollars a year. Also in Central Florida, our Leesburg publication the Daily Commercial, with its daily circulation of 15,027, covers a region known for seaplanes, upscale retirement living and rural small towns. Located in an area contiguous to Orlando, the Daily Commercial also publishes a weekly newspaper, South Lake Press and two websites that are enjoying significant audience growth. On the West Coast of Florida serving Sarasota and Manatee counties is the Pulitzer Prize winning Herald-Tribune with daily circulation of 61,494 which operates a family of digital products anchored by the successful heraldtribune.com website that receives monthly page views of over 4.2 million. The Herald-Tribune was named a “2015 10 Newspapers That Do It Right” by Editor & Publisher.

In the northwest Florida panhandle, we publish two dailies and eight weeklies across a ten-county area stretching from Franklin in the east to Santa Rosa in the west, and north to the state line. Our daily in the East, the Panama City News Herald, with daily circulation of 15,851, was awarded a Pulitzer Prize in 1962 for investigative journalism and in 2015 won 20 awards in two statewide contests. It also operates a growing website, newsherald.com, which receives a monthly average of 2.0 million page views and over 312,000 monthly unique visitors.

To the west in Fort Walton Beach, the Northwest Florida Daily News, with a circulation of 18,904 also has a dominant website, nwfdailynews.com that receives monthly page views of over 4.0 million and 430,000 monthly unique visitors. Their staff also garnered statewide awards in 2015, including in categories like sports writing, column writing and headline writing.

15

Table of Contents

In Alabama we publish two daily publications; The Tuscaloosa News and The Gadsden Times. Our Pulitzer Prize winning, daily publication, The Tuscaloosa News, has daily circulation of 21,668 and a successful website Tuscaloosanews.com with more than 1.9 million page views per month. The Tuscaloosa News also publishes TideSports.com, a paid subscription-based website that focuses on University of Alabama athletics. With daily circulation of 11,666, The Gadsden Times is the oldest continually operating business in Etowah county.

The following table sets forth information regarding the number of publications and production facilities in the Eastern US Publishing:

| Publications | Production Facilities |

|||||||||||||||

| State of Operations |

Dailies | Weeklies | Shoppers | |||||||||||||

| Massachusetts |

9 | 109 | 5 | 2 | ||||||||||||

| Florida |

9 | 10 | 4 | 6 | ||||||||||||

| North Carolina |

10 | 2 | 1 | 3 | ||||||||||||

| New Hampshire |

2 | 5 | 0 | 2 | ||||||||||||

| New York |

1 | 2 | 1 | 1 | ||||||||||||

| Pennsylvania |

1 | 3 | 1 | 0 | ||||||||||||

| Maine |

0 | 3 | 0 | 0 | ||||||||||||

| Tennessee |

1 | 1 | 1 | 1 | ||||||||||||

| Alabama |

2 | 0 | 0 | 1 | ||||||||||||

| Connecticut |

1 | 0 | 1 | 0 | ||||||||||||

| Rhode Island |

1 | 0 | 1 | 1 | ||||||||||||

| South Carolina |

1 | 0 | 0 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

38 | 135 | 15 | 18 | ||||||||||||

Central US Publishing. Our Central US Publishing operates in the states of Illinois, Ohio, New York, Michigan, Delaware, Pennsylvania, West Virginia, and Virginia.

From the western shore of Lake Michigan to the eastern shore of the Mississippi River and running over 400 miles north to south, Illinois is a picture of manufacturing, agricultural and recreational diversity. Coupled with major daily newspapers from our publications in Rockford, Peoria, and the state capital of Springfield, we are the largest publishing company in Illinois. Nineteen paid daily newspapers, 22 paid weekly newspapers, and sixteen shoppers provide coverage across the state which, is supported by four print production facilities.

Approximately 85 miles to the west of Chicago, Illinois is the Rockford Register Star supported by its 54,652 daily paid circulation base and its TMC product The Weekly, with six zoned editions. The Rockford Register Star operates successful websites that receives a monthly average of over 2.1 million page views.

The Journal (Freeport, IL) Standard is published Tuesday through Sunday. The newspaper’s coverage area includes Caroll, Jo Daviess, Ogle and Stephenson counties. The newspaper has a daily circulation of 5,565. The Journal Standard also publishes a website journalstandard.com and receives monthly page views of over 975,000 and average monthly unique visitors over 135,000.

The Peoria Journal Star with its daily paid circulation of 52,234 is the dominant newspaper in Peoria, Tazewell and Woodford counties and is also distributed in an additional 17 surrounding counties. There are two shoppers—The Marketplace and Pekin Extra—which have a combined weekly circulation of 94,981. The Peoria facility provides print services to our neighboring New Media publications and commercial printing for Lee Enterprises’ The Pantagraph. The market includes manufacturing facilities for Caterpillar and Komatsu, and higher education at Bradley University, Illinois Central College and Midstate College. Peoria has a large medical community including OSF Healthcare, Methodist Medical Center, Proctor Hospital, University Of Illinois College Of Medicine and St. Jude Children’s Hospital Midwest Affiliate. It has agricultural facilities Archer Daniels Midland, LG Seeds and the USDA Ag Lab. The Journal Star has pjstar.com and pjstar.mobi with combined monthly page views of over 6.0 million per month. The combined monthly unique visitors are over 935,000.

16

Table of Contents

The Springfield State Journal-Register with a daily paid circulation of 28,578 covers the state capital of Illinois. The daily paid circulation includes a branded edition of 2,351 of the Lincoln Courier. The State Journal-Register also has successful web sites with monthly page views of more than 5.0 million.

The Columbus Dispatch is a metropolitan daily newspaper and is the trusted source for comprehensive news, politics, sports and entertainment coverage across Central Ohio. One of the country’s strongest papers and the single daily in a top 40 media market, The Columbus Dispatch is located in Columbus, Ohio which is the largest city in Ohio and the fastest growing in the Midwest. The newspaper is distributed to homes and single copy outlets across Franklin county with a daily and Sunday circulation of 116,442 and 208,315, respectively. The Columbus Dispatch’s websites, which represent the primary online source for Columbus-area news, receives over 9.0 million monthly page views.

The Ohio cluster is anchored in Canton, Ohio and covers Stark and Tuscarawas counties. It is comprised of three daily newspapers, one weekly publication and two shoppers. The Repository is a 40,864 daily newspaper that covers the entire area of Stark county. The Dover New Philadelphia Times Reporter is a 13,914 daily publication located 40 miles south of Canton in Tuscarawas county. The Massillon Independent is a 7,225 circulation daily that circulates in western Stark county. The Suburbanite is a 32,600 weekly publication that circulates in the affluent northern Stark county area. The Ohio facility also provides commercial print services to the Akron Beacon Journal. The Ohio cluster has very successful web sites with more than 6.4 million combined monthly page views and more than 960,000 combined monthly unique visitors. Together the newspapers and web sites dominate their local markets.

Central New York is anchored by the Observer-Dispatch in Utica, New York which has circulation of 22,560 daily and 29,519 Sunday subscribers. The Utica operations include one daily and two weekly newspapers in Hamilton. Utica also has web sites with combined monthly unique visitors of more than 395,000. In addition to the Observer—Dispatch, Times-Telegram, which has a daily circulation of 2,922 covering both the towns of Herkimer and Little Falls, rounds out our coverage in the Mohawk Valley.

Also in New York we operate and own a combination of sixteen publications in Suburban Rochester that span four counties and have a combined circulation of 111,605. This market has a tourism industry and is known for boutique wineries and recreational activities. The flagship of Messenger Post Media is the 7,938 circulation Daily Messenger in Canandaigua.

In southwestern New York, our operations are centered around five publications based in Steuben county. In Corning, The Leader, a 5,791 circulation daily newspaper, dominates the eastern half of the county and shares its hometown namesake with Corning Incorporated. The Evening Tribune in Hornell circulates daily throughout the western half of the county. Situated directly between these two dailies in the county seat of Bath is the 10,850 circulation Steuben Courier, a free-distribution weekly. The Pennysaver Plus, a standalone shopper, solidifies this flagship group.

We also have a strong presence in the print advertising markets in three other New York counties that surround Steuben. In Allegany county to the west, the Wellsville Daily Reporter and its shopper, the Pennysaver Plus, cover most households. In Livingston county to the north, the Pennysaver Plus and the Genesee Country Express complement one another with combined circulation of 24,115. In Yates county to the north and east, The Chronicle-Express and Chronicle Ad-Visor shopper distribute weekly to nearly 13,421 households centered around the county seat of Penn Yan.

In nearby Chemung county, the 15,000 circulation Horseheads Shopper anchors our presence in this area. The majority of the southwestern New York cluster parallels Interstate 86 across the central southern tier of New York State, which is benefiting from continued improvement and expansion under an omnibus federal highway appropriations bill. Moreover, the cluster has several colleges and universities nearby, including Cornell University, Ithaca College, Elmira College and Houghton College.

17

Table of Contents