Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d147806d8k.htm |

| EX-99.1 - EX-99.1 - MYERS INDUSTRIES INC | d147806dex991.htm |

February 25, 2016 | Myers Industries, Inc. Fourth Quarter & Full Year 2015 Earnings Presentation Exhibit 99.2

Statements in this presentation concerning the Company’s goals, strategies, and expectations for business and financial results may be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on current indicators and expectations. Whenever you read a statement that is not simply a statement of historical fact (such as when we describe what we "believe," "expect," or "anticipate" will occur, and other similar statements), you must remember that our expectations may not be correct, even though we believe they are reasonable. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). You should review this presentation with the understanding that actual future results may be materially different from what we expect. Many of the factors that will determine these results are beyond our ability to control or predict. You are cautioned not to put undue reliance on any forward-looking statement. We do not intend, and undertake no obligation, to update these forward-looking statements. These statements involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the applicable statements. Such risks include: (1) Changes in the markets within the Company’s business segments (2) Changes in trends and demands in the markets in which the Company competes (3) Unanticipated downturn in business relationships with customers or their purchases (4) Competitive pressures on sales and pricing (5) Raw material availability, increases in raw material costs, or other production costs (6) Harsh weather conditions (7) Future economic and financial conditions in the United States and around the world (8) Inability of the Company to meet future capital requirements (9) Claims, litigation and regulatory actions against the Company (10) Changes in laws and regulations affecting the Company (11) The Company’s ability to execute the components of its Strategic Business Evolution process Myers Industries, Inc. encourages investors to learn more about these risk factors. A detailed explanation of these factors is available in the Company’s publicly filed quarterly and annual reports, which can be found online at www.myersind.com and at the SEC.gov web site. Safe harbor statement

Summary Financial Results Segment Results Summary & Outlook Q&A Appendix Agenda

Summary

2015 summary Fourth quarter: Consistent with Q3 results; below expectations Food and beverage end market was up sequentially; down YOY Auto aftermarket and Brazilian end markets softened in the quarter Commercial initiatives are taking longer than planned Favorable input costs and solid operational cost improvements Full year: Adjusted EPS increased 8% to $0.57 Net sales flat on a constant currency basis Incremental sales from Scepter acquisition offset lower sales in Ag end market Adjusted gross margin increased 350 basis points to 29.9% Free cash flow decreased from $27.6M to $25.6M Returned $46.7 million to shareholders through share repurchases and dividends Share repurchases of $30.0 million and dividends of $16.7 million Reduced net debt 20% to $186M Challenging end markets; improved margins and reduced debt

Financial Results

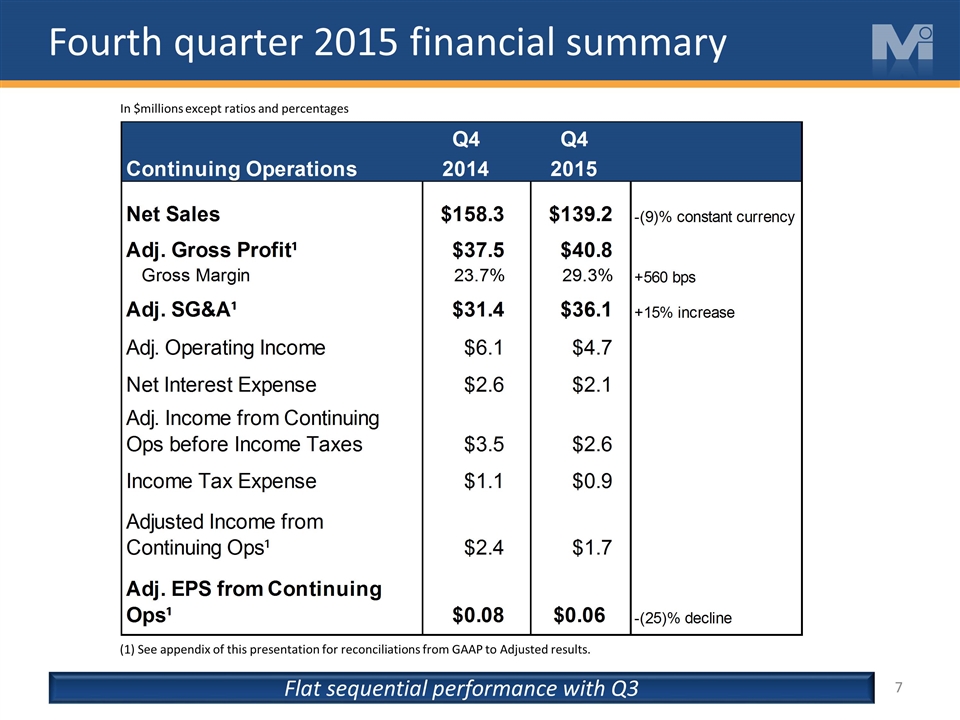

Fourth quarter 2015 financial summary Flat sequential performance with Q3 In $millions except ratios and percentages (1) See appendix of this presentation for reconciliations from GAAP to Adjusted results.

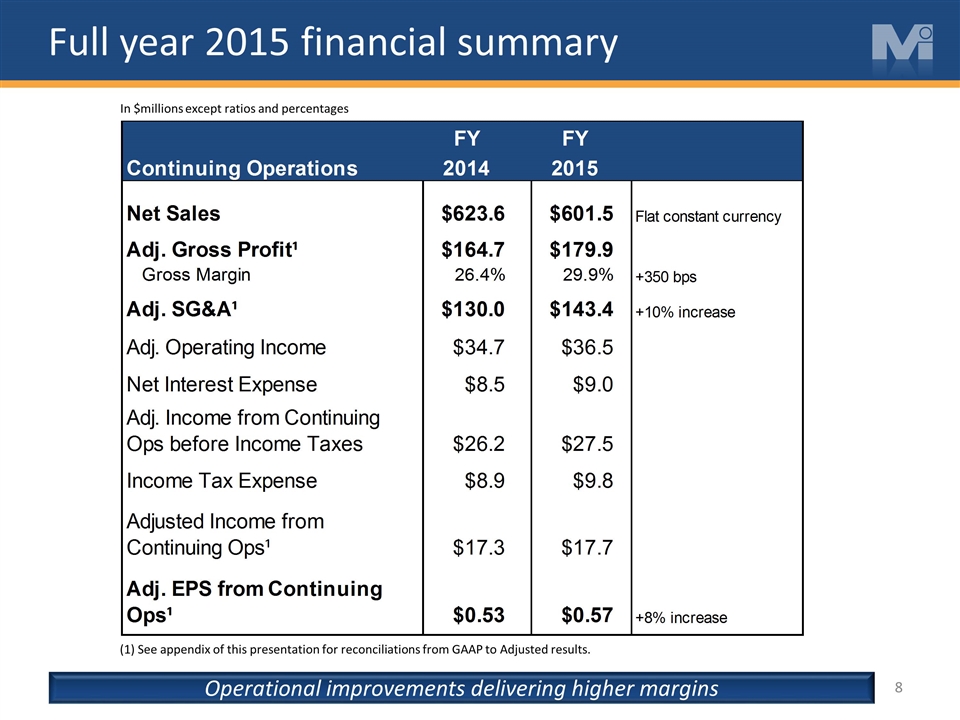

Full year 2015 financial summary Operational improvements delivering higher margins In $millions except ratios and percentages (1) See appendix of this presentation for reconciliations from GAAP to Adjusted results.

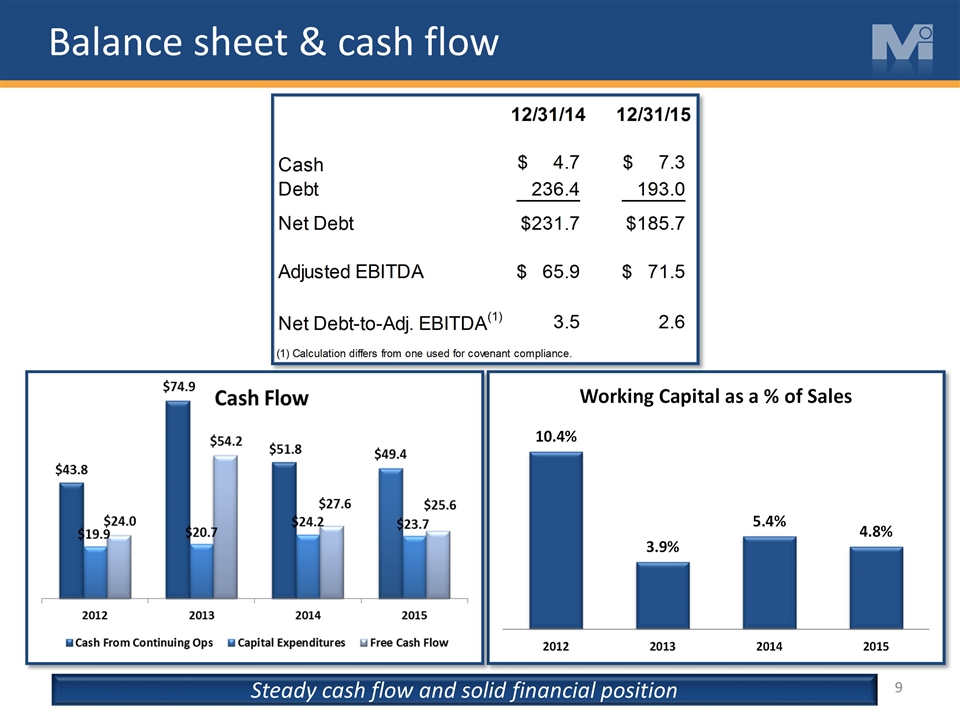

Balance sheet & cash flow Steady cash flow and solid financial position

Segment Results

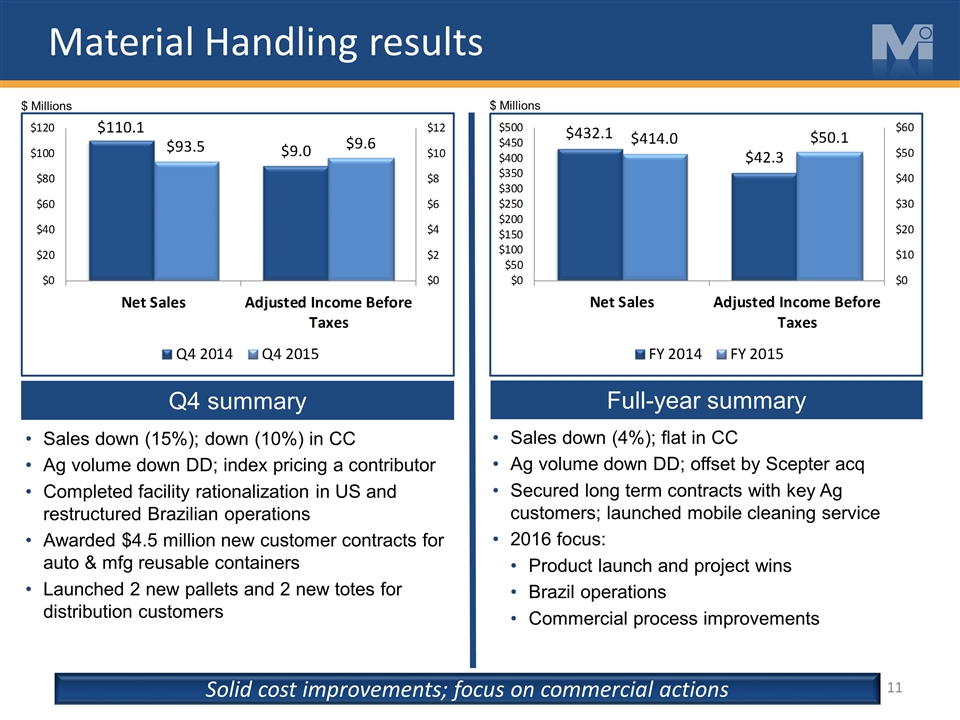

Material Handling results $ Millions Q4 summary Full-year summary Sales down (15%); down (10%) in CC Ag volume down DD; index pricing a contributor Completed facility rationalization in US and restructured Brazilian operations Awarded $4.5 million new customer contracts for auto & mfg reusable containers Launched 2 new pallets and 2 new totes for distribution customers Sales down (4%); flat in CC Ag volume down DD; offset by Scepter acq Secured long term contracts with key Ag customers; launched mobile cleaning service 2016 focus: Product launch and project wins Brazil operations Commercial process improvements $ Millions Solid cost improvements; focus on commercial actions

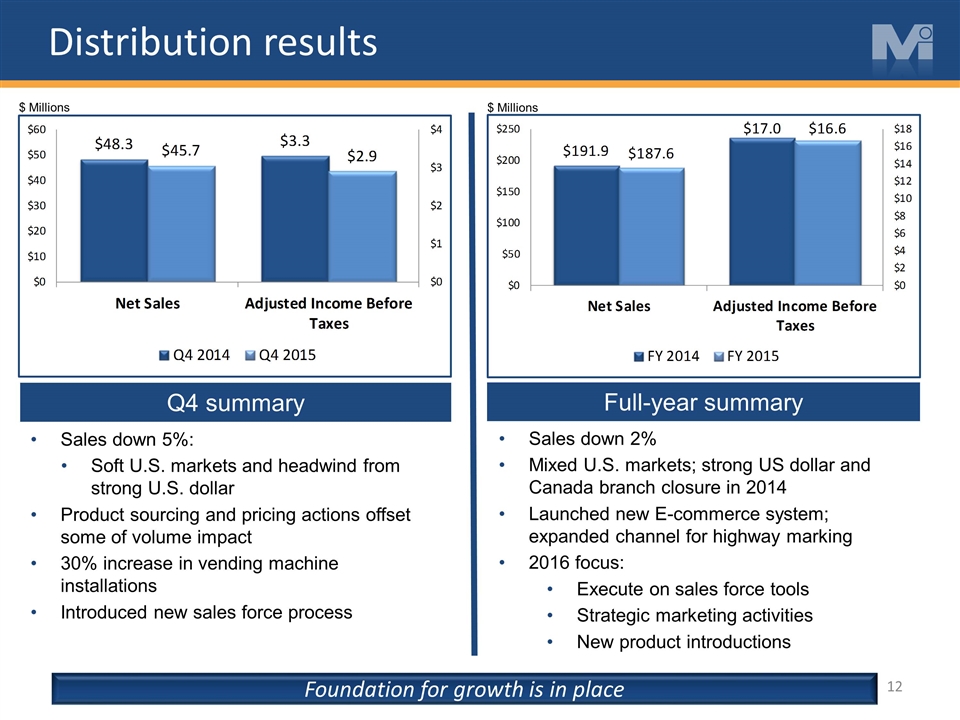

Sales down 5%: Soft U.S. markets and headwind from strong U.S. dollar Product sourcing and pricing actions offset some of volume impact 30% increase in vending machine installations Introduced new sales force process Distribution results $ Millions Q4 summary Full-year summary Sales down 2% Mixed U.S. markets; strong US dollar and Canada branch closure in 2014 Launched new E-commerce system; expanded channel for highway marking 2016 focus: Execute on sales force tools Strategic marketing activities New product introductions $ Millions Foundation for growth is in place

Summary & Outlook

2015 in review: Completed strategic re-alignment with sale of Lawn & Garden Challenging year commercially Ag market and Brazil down significantly Solid operational execution First impressions: On boarding process: Q1 – Listen and learn Q2 – Strategic planning Myers Industries strengths Great collection of brands Good ideas for growth; need better execution Focus for 2016 Execute on growth initiatives within each brand Understand end markets and planning ahead of changes Develop enterprise strategy CEO summary Transition from re-alignment to growth

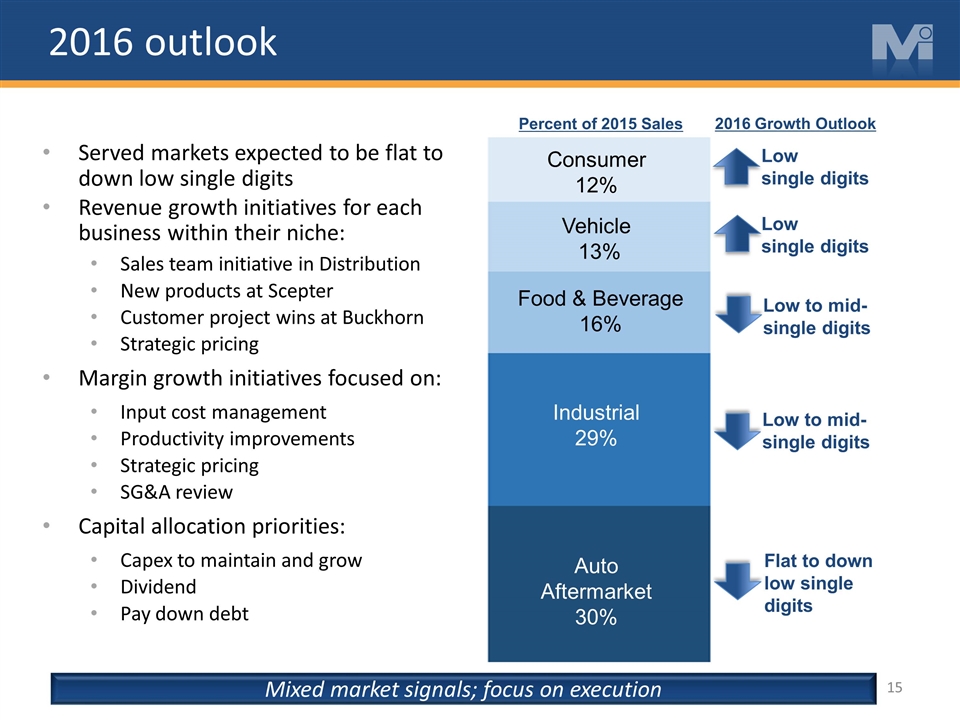

2016 outlook Served markets expected to be flat to down low single digits Revenue growth initiatives for each business within their niche: Sales team initiative in Distribution New products at Scepter Customer project wins at Buckhorn Strategic pricing Margin growth initiatives focused on: Input cost management Productivity improvements Strategic pricing SG&A review Capital allocation priorities: Capex to maintain and grow Dividend Pay down debt Mixed market signals; focus on execution Consumer 12% Vehicle 13% Food & Beverage 16% Auto Aftermarket 30% Industrial 29% Percent of 2015 Sales Low single digits Low single digits Low to mid- single digits Flat to down low single digits Low to mid- single digits 2016 Growth Outlook

Q&A

Appendix

2016 key assumptions Capital expenditures are expected to be $17 - $22 million Approximately 55% will be used for growth and productivity projects Interest expense forecasted to be $9 - $10 million Depreciation and amortization forecasted to be $35 - $37 million Anticipate effective tax rate for fiscal 2016 will be 35%

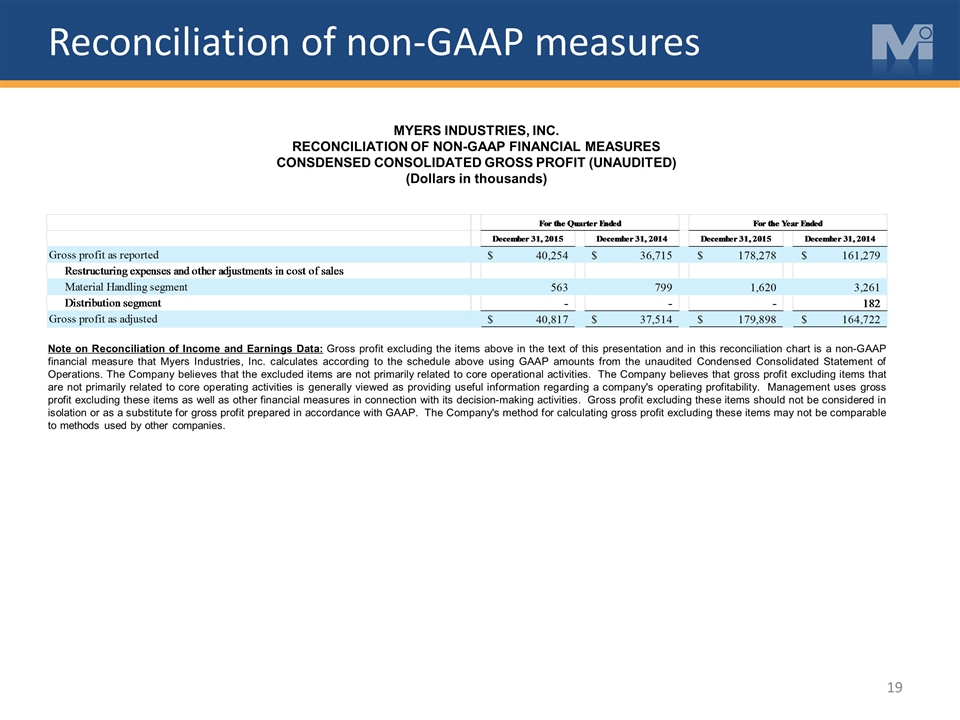

Reconciliation of non-GAAP measures MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES CONSDENSED CONSOLIDATED GROSS PROFIT (UNAUDITED) (Dollars in thousands) Note on Reconciliation of Income and Earnings Data: Gross profit excluding the items above in the text of this presentation and in this reconciliation chart is a non-GAAP financial measure that Myers Industries, Inc. calculates according to the schedule above using GAAP amounts from the unaudited Condensed Consolidated Statement of Operations. The Company believes that the excluded items are not primarily related to core operational activities. The Company believes that gross profit excluding items that are not primarily related to core operating activities is generally viewed as providing useful information regarding a company's operating profitability. Management uses gross profit excluding these items as well as other financial measures in connection with its decision-making activities. Gross profit excluding these items should not be considered in isolation or as a substitute for gross profit prepared in accordance with GAAP. The Company's method for calculating gross profit excluding these items may not be comparable to methods used by other companies. For the Quarter Ended For the Year Ended December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Gross profit as reported $40,254 $36,715 $,178,278 $,161,279 Restructuring expenses and other adjustments in cost of sales Material Handling segment 563 799 1,620 3,261 Distribution segment 0 0 0 182 Gross profit as adjusted $40,817 $37,514 $,179,898 $,164,722

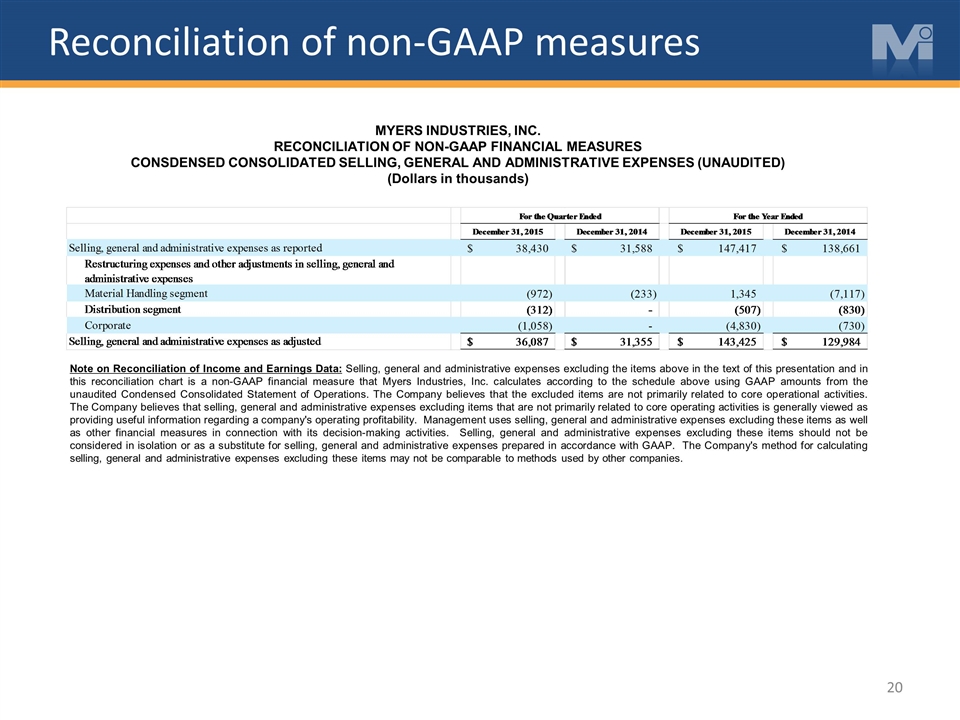

Reconciliation of non-GAAP measures MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES CONSDENSED CONSOLIDATED SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (UNAUDITED) (Dollars in thousands) Note on Reconciliation of Income and Earnings Data: Selling, general and administrative expenses excluding the items above in the text of this presentation and in this reconciliation chart is a non-GAAP financial measure that Myers Industries, Inc. calculates according to the schedule above using GAAP amounts from the unaudited Condensed Consolidated Statement of Operations. The Company believes that the excluded items are not primarily related to core operational activities. The Company believes that selling, general and administrative expenses excluding items that are not primarily related to core operating activities is generally viewed as providing useful information regarding a company's operating profitability. Management uses selling, general and administrative expenses excluding these items as well as other financial measures in connection with its decision-making activities. Selling, general and administrative expenses excluding these items should not be considered in isolation or as a substitute for selling, general and administrative expenses prepared in accordance with GAAP. The Company's method for calculating selling, general and administrative expenses excluding these items may not be comparable to methods used by other companies.

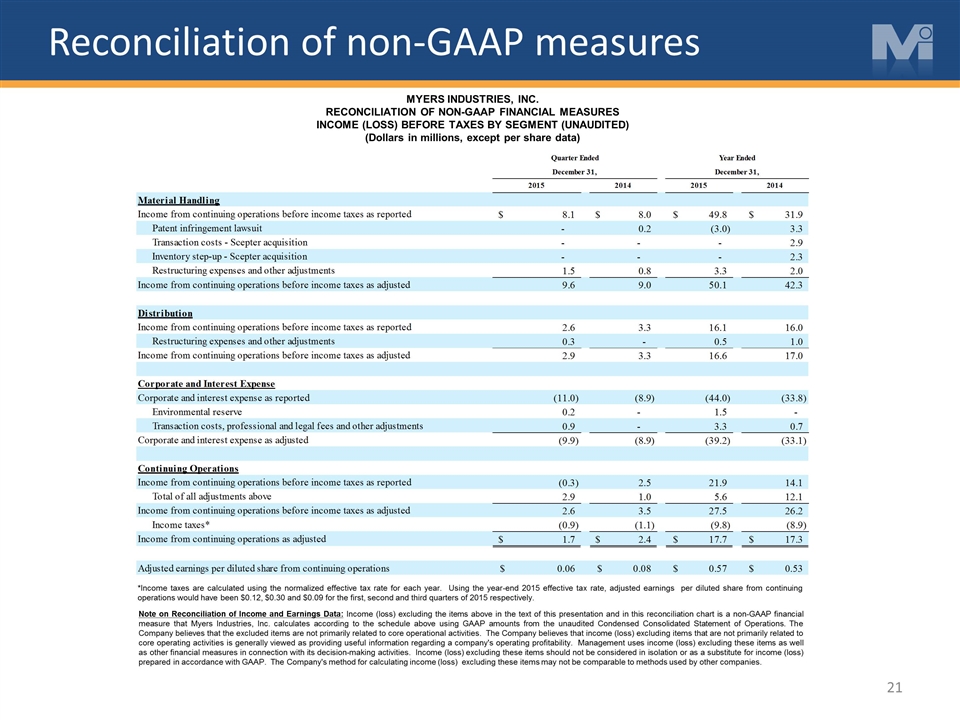

Reconciliation of non-GAAP measures MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES INCOME (LOSS) BEFORE TAXES BY SEGMENT (UNAUDITED) (Dollars in millions, except per share data) Note on Reconciliation of Income and Earnings Data: Income (loss) excluding the items above in the text of this presentation and in this reconciliation chart is a non-GAAP financial measure that Myers Industries, Inc. calculates according to the schedule above using GAAP amounts from the unaudited Condensed Consolidated Statement of Operations. The Company believes that the excluded items are not primarily related to core operational activities. The Company believes that income (loss) excluding items that are not primarily related to core operating activities is generally viewed as providing useful information regarding a company's operating profitability. Management uses income (loss) excluding these items as well as other financial measures in connection with its decision-making activities. Income (loss) excluding these items should not be considered in isolation or as a substitute for income (loss) prepared in accordance with GAAP. The Company's method for calculating income (loss) excluding these items may not be comparable to methods used by other companies. *Income taxes are calculated using the normalized effective tax rate for each year. Using the year-end 2015 effective tax rate, adjusted earnings per diluted share from continuing operations would have been $0.12, $0.30 and $0.09 for the first, second and third quarters of 2015 respectively. Quarter Ended Year Ended December 31, December 31, 2015 2014 2015 2014 Material Handling Income from continuing operations before income taxes as reported $8.1 $8 $49.8 $31.9 Patent infringement lawsuit 0 0.2 -3 3.2730000000000001 Transaction costs - Scepter acquisition 0 0 0 2.8559999999999999 Inventory step-up - Scepter acquisition 0 0 0 2.2730000000000001 Restructuring expenses and other adjustments 1.5230000000000001 0.8 3.3230000000000004 1.978 Income from continuing operations before income taxes as adjusted 9.6229999999999993 9 50.122999999999998 42.280000000000008 6.9222222222222074E-2 Distribution Income from continuing operations before income taxes as reported 2.6 3.3 16.100000000000001 16 Restructuring expenses and other adjustments 0.3 0 0.5 1 Income from continuing operations before income taxes as adjusted 2.9 3.3 16.600000000000001 17 Corporate and Interest Expense Corporate and interest expense as reported -11 -8.9 -44 -33.799999999999997 Environmental reserve 0.2 0 1.5 0 Transaction costs, professional and legal fees and other adjustments 0.85899999999999999 0 3.3 0.7 Corporate and interest expense as adjusted -9.9410000000000007 -8.9 -39.200000000000003 -33.099999999999994 Continuing Operations Income from continuing operations before income taxes as reported -0.3 2.5 21.9 14.1 Total of all adjustments above 2.8820000000000001 1 5.6230000000000002 12.079999999999998 Income from continuing operations before income taxes as adjusted 2.5820000000000003 3.5 27.523 26.18 Income taxes* -0.92177400000000009 -1.1025 -9.8257110000000001 -8.9012000000000011 Income from continuing operations as adjusted $1.6602260000000002 $2.3975 $17.697288999999998 $17.278799999999997 Adjusted earnings per diluted share from continuing operations $5.5088835245418882E-2 $7.5549990538525694E-2 $0.57191909834420851 $0.52833884723378877 Basic 29,856,894 31,366,016 30,616,485 32,232,965 Diluted 30,137,250 31,733,955 30,943,693 32,704,012

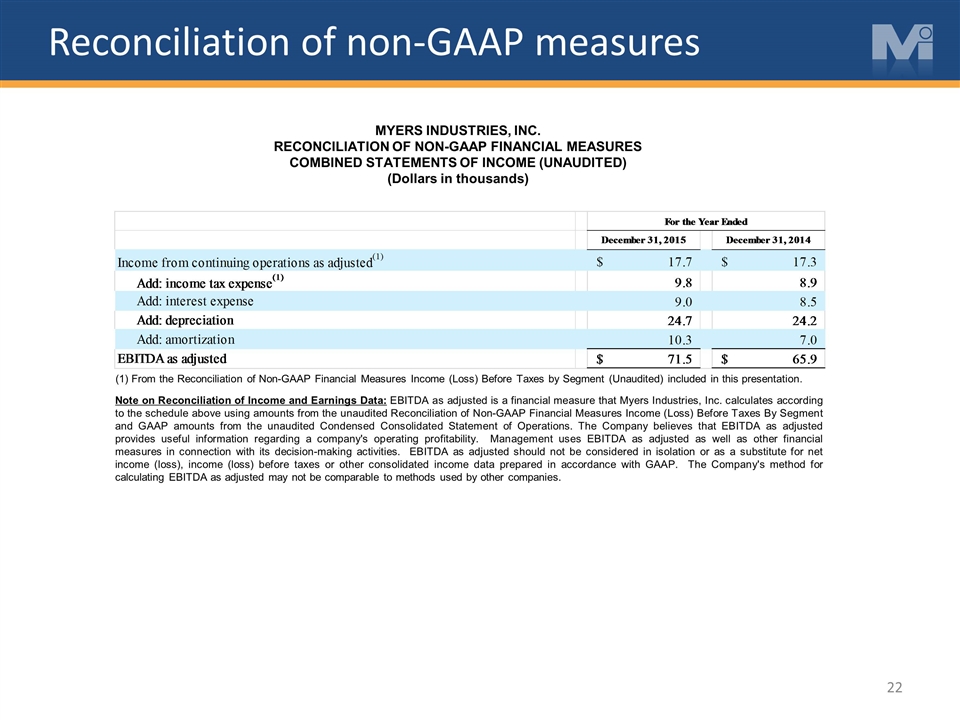

Reconciliation of non-GAAP measures MYERS INDUSTRIES, INC. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES COMBINED STATEMENTS OF INCOME (UNAUDITED) (Dollars in thousands) Note on Reconciliation of Income and Earnings Data: EBITDA as adjusted is a financial measure that Myers Industries, Inc. calculates according to the schedule above using amounts from the unaudited Reconciliation of Non-GAAP Financial Measures Income (Loss) Before Taxes By Segment and GAAP amounts from the unaudited Condensed Consolidated Statement of Operations. The Company believes that EBITDA as adjusted provides useful information regarding a company's operating profitability. Management uses EBITDA as adjusted as well as other financial measures in connection with its decision-making activities. EBITDA as adjusted should not be considered in isolation or as a substitute for net income (loss), income (loss) before taxes or other consolidated income data prepared in accordance with GAAP. The Company's method for calculating EBITDA as adjusted may not be comparable to methods used by other companies. (1) From the Reconciliation of Non-GAAP Financial Measures Income (Loss) Before Taxes by Segment (Unaudited) included in this presentation. For the Year Ended December 31, 2015 December 31, 2014 Income from continuing operations as adjusted(1) $17.697288999999998 $17.278799999999997 Add: income tax expense(1) 9.8257110000000001 8.9012000000000011 Add: interest expense 8.99 8.5350000000000001 Add: depreciation 24.712 24.172999999999998 Add: amortization 10.266999999999999 6.9989999999999997 EBITDA as adjusted $71.49199999999999 $65.887