Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 02-25-2016 - KADANT INC | kaiform8k02252016.htm |

Fourth Quarter and Fiscal Year 2015 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO

2 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our expected future financial and operating performance, demand for our products, and economic and industry outlook. Our actual results may differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the year ended January 3, 2015 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; the variability and uncertainties in sales of capital equipment in China; the effect of currency fluctuations on our financial results; our customers’ ability to obtain financing for capital equipment projects; changes in government regulations and policies; oriented strand board market and levels of residential construction activity; development and use of digital media; price increases or shortages of raw materials; dependence on certain suppliers; international sales and operations; disruption in production; our acquisition strategy; our internal growth strategy; competition; soundness of suppliers and customers; our effective tax rate; future restructurings; soundness of financial institutions; our debt obligations; restrictions in our credit agreement; loss of key personnel; reliance on third-party research; protection of patents and proprietary rights; failure of our information systems or breaches of data security; fluctuations in our share price; and anti-takeover provisions. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

3 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenues excluding the effect of acquisitions and foreign currency translation, adjusted operating income, adjusted net income, adjusted diluted EPS, and adjusted earnings before interest, taxes, depreciation, and amortization. A reconciliation of those numbers to the most directly comparable U.S. GAAP financial measures is shown in our 2015 fourth quarter earnings press release issued February 24, 2016, which is available in the Investors section of our website at www.kadant.com under the heading Recent News.

4 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. BUSINESS REVIEW Jonathan W. Painter President & CEO

5 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Q4 2015 Financial Highlights ($ Millions, except per share amounts) Q4 2015 Q4 2014 % CHANGE EXCL. FX Revenue $107.6 $105.2 2.3% 10.3% Gross Margin 43.1% 44.7% n.m. n.m. Net Income1 $10.4 $9.1 13.8% 26.1% Adjusted EBITDA1, 2 $17.2 $14.8 16.3% 28.1% Adjusted EBITDA/Revenue 16.0% 14.1% n.m. n.m. Diluted EPS1 $0.94 $0.82 14.6% 26.8% Adjusted Diluted EPS1, 2 $0.95 $0.81 17.3% 29.6% Bookings $75.5 $103.0 -26.7% -19.7% Cash Flow1 $12.3 $18.5 -33.2% -33.2% 1 Net income, diluted EPS, adjusted diluted EPS, adjusted EBITDA, and cash flow are from continuing operations. 2 Adjusted EBITDA and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our Q4 2015 earnings press release issued February 24, 2016. Percent change calculated using actual numbers reported in our Q4 2015 earnings release dated February 24, 2016.

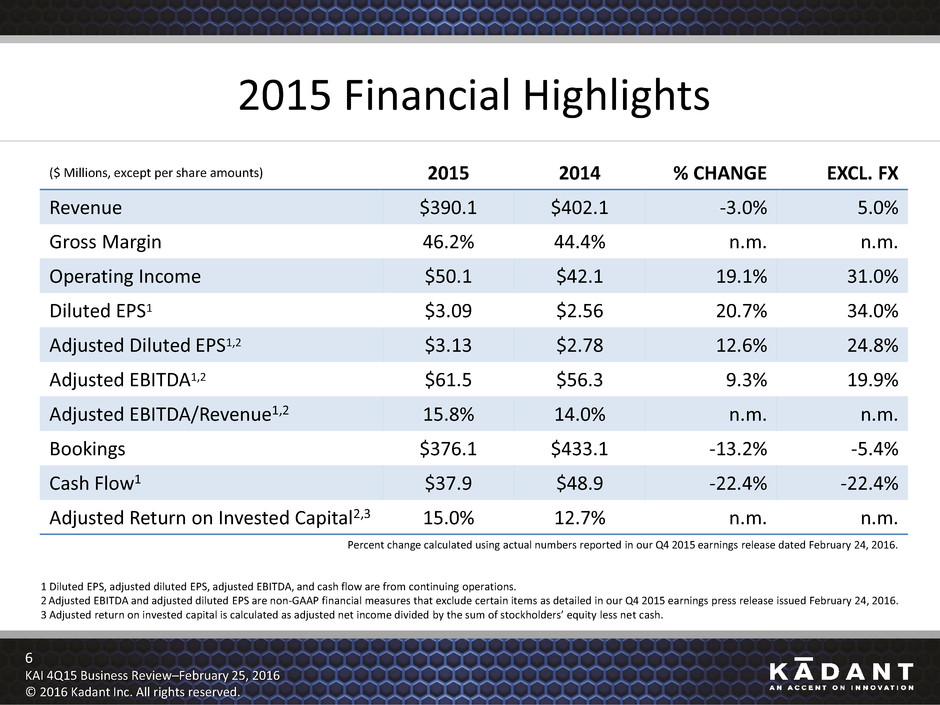

6 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. 2015 Financial Highlights ($ Millions, except per share amounts) 2015 2014 % CHANGE EXCL. FX Revenue $390.1 $402.1 -3.0% 5.0% Gross Margin 46.2% 44.4% n.m. n.m. Operating Income $50.1 $42.1 19.1% 31.0% Diluted EPS1 $3.09 $2.56 20.7% 34.0% Adjusted Diluted EPS1,2 $3.13 $2.78 12.6% 24.8% Adjusted EBITDA1,2 $61.5 $56.3 9.3% 19.9% Adjusted EBITDA/Revenue1,2 15.8% 14.0% n.m. n.m. Bookings $376.1 $433.1 -13.2% -5.4% Cash Flow1 $37.9 $48.9 -22.4% -22.4% Adjusted Return on Invested Capital2,3 15.0% 12.7% n.m. n.m. 1 Diluted EPS, adjusted diluted EPS, adjusted EBITDA, and cash flow are from continuing operations. 2 Adjusted EBITDA and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our Q4 2015 earnings press release issued February 24, 2016. 3 Adjusted return on invested capital is calculated as adjusted net income divided by the sum of stockholders’ equity less net cash. Percent change calculated using actual numbers reported in our Q4 2015 earnings release dated February 24, 2016.

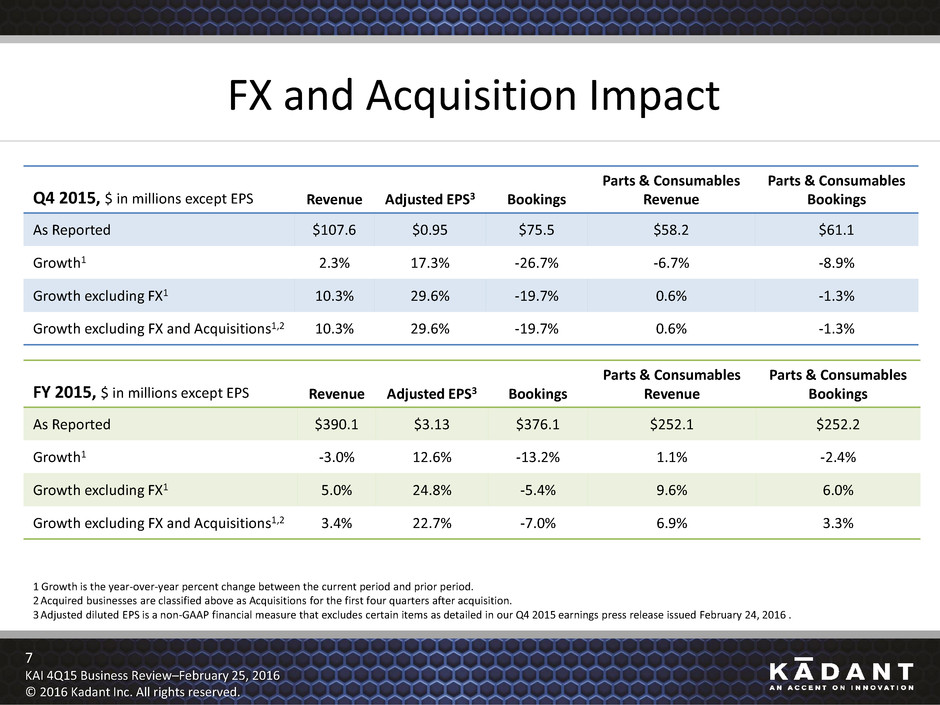

7 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. FX and Acquisition Impact Q4 2015, $ in millions except EPS Revenue Adjusted EPS3 Bookings Parts & Consumables Revenue Parts & Consumables Bookings As Reported $107.6 $0.95 $75.5 $58.2 $61.1 Growth1 2.3% 17.3% -26.7% -6.7% -8.9% Growth excluding FX1 10.3% 29.6% -19.7% 0.6% -1.3% Growth excluding FX and Acquisitions1,2 10.3% 29.6% -19.7% 0.6% -1.3% FY 2015, $ in millions except EPS Revenue Adjusted EPS3 Bookings Parts & Consumables Revenue Parts & Consumables Bookings As Reported $390.1 $3.13 $376.1 $252.1 $252.2 Growth1 -3.0% 12.6% -13.2% 1.1% -2.4% Growth excluding FX1 5.0% 24.8% -5.4% 9.6% 6.0% Growth excluding FX and Acquisitions1,2 3.4% 22.7% -7.0% 6.9% 3.3% 1 Growth is the year-over-year percent change between the current period and prior period. 2 Acquired businesses are classified above as Acquisitions for the first four quarters after acquisition. 3 Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our Q4 2015 earnings press release issued February 24, 2016 .

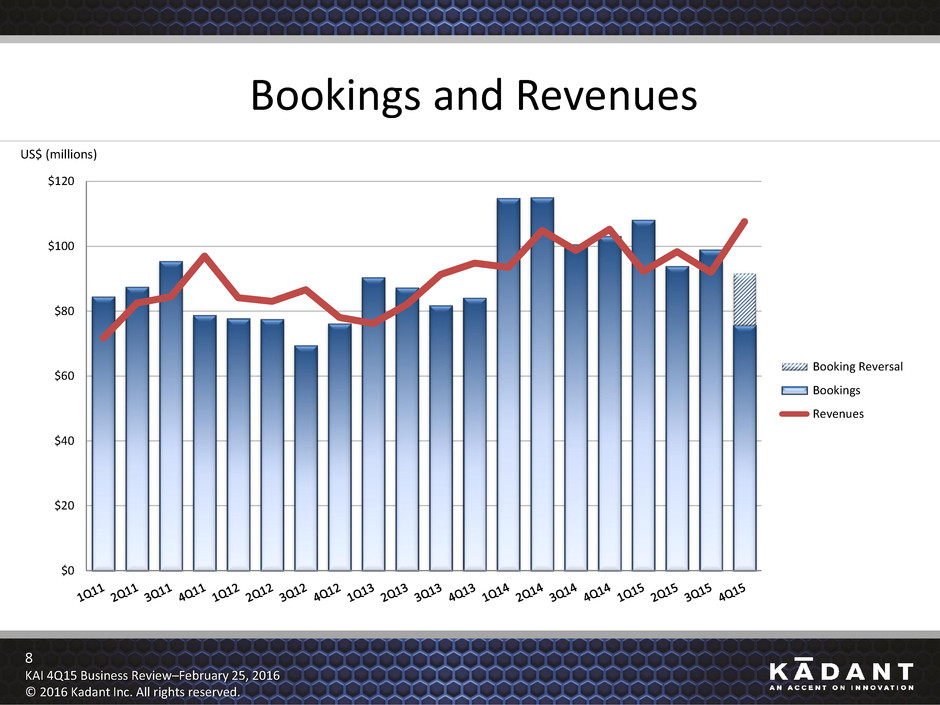

8 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Bookings and Revenues US$ (millions) $0 $20 $40 $60 $80 $100 $120 Booking Reversal Bookings Revenues

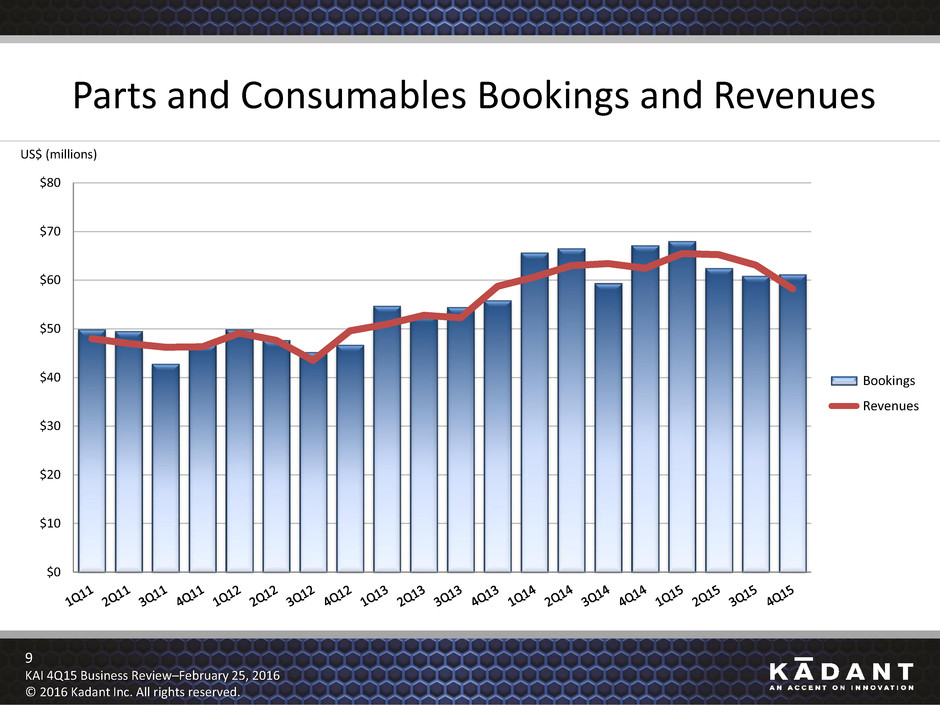

9 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Parts and Consumables Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

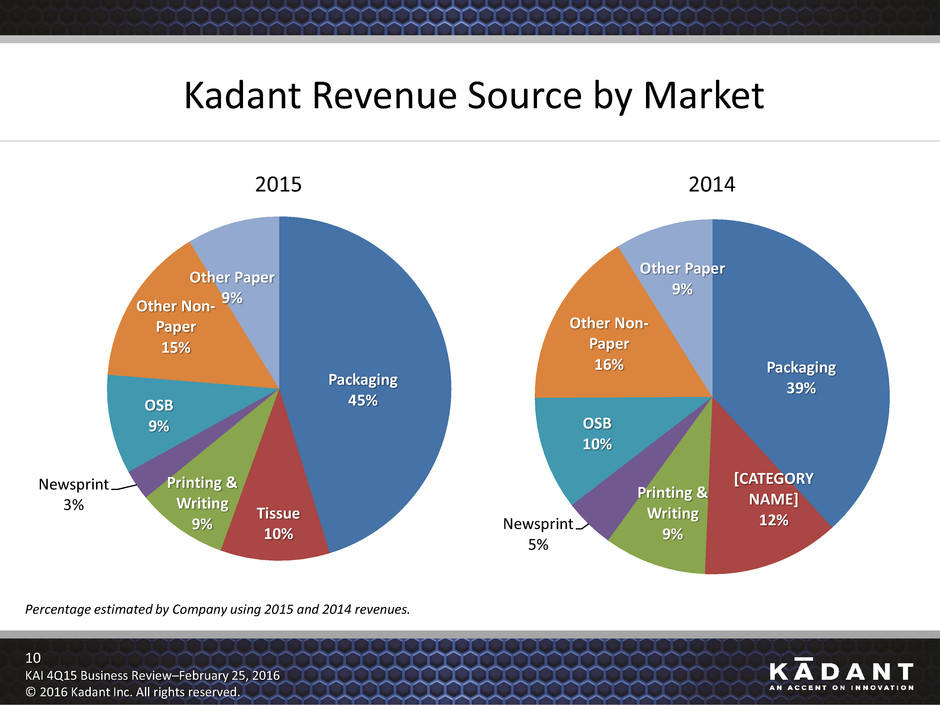

10 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Packaging 45% Tissue 10% Printing & Writing 9% Newsprint 3% OSB 9% Other Non- Paper 15% Other Paper 9% Kadant Revenue Source by Market Percentage estimated by Company using 2015 and 2014 revenues. 2015 2014 Packaging 39% [CATEGORY NAME] 12% Printing & Writing 9% Newsprint 5% OSB 10% Other Non- Paper 16% Other Paper 9%

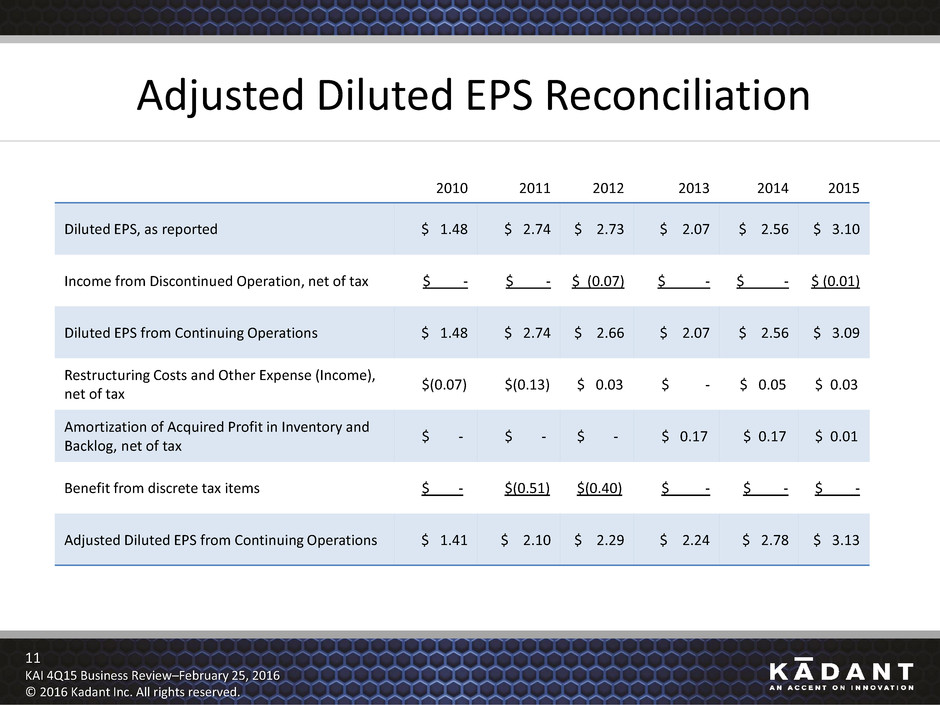

11 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Adjusted Diluted EPS Reconciliation 2010 2011 2012 2013 2014 2015 Diluted EPS, as reported $ 1.48 $ 2.74 $ 2.73 $ 2.07 $ 2.56 $ 3.10 Income from Discontinued Operation, net of tax $ - $ - $ (0.07) $ - $ - $ (0.01) Diluted EPS from Continuing Operations $ 1.48 $ 2.74 $ 2.66 $ 2.07 $ 2.56 $ 3.09 Restructuring Costs and Other Expense (Income), net of tax $(0.07) $(0.13) $ 0.03 $ - $ 0.05 $ 0.03 Amortization of Acquired Profit in Inventory and Backlog, net of tax $ - $ - $ - $ 0.17 $ 0.17 $ 0.01 Benefit from discrete tax items $ - $(0.51) $(0.40) $ - $ - $ - Adjusted Diluted EPS from Continuing Operations $ 1.41 $ 2.10 $ 2.29 $ 2.24 $ 2.78 $ 3.13

12 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Revenue and Adjusted Diluted EPS Performance US$ ( m ill ions ) $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2010 2011 2012 2013 2014 2015 Revenue Adjusted Diluted EPS 1 1 Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed on slide 11.

13 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. REGIONAL HIGHLIGHTS

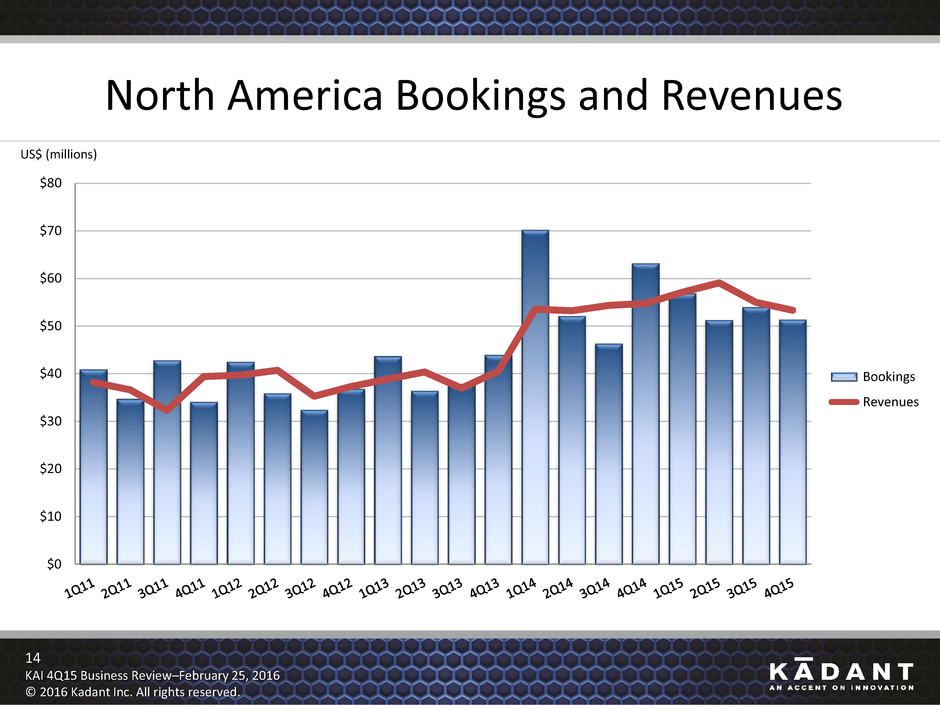

14 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. North America Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

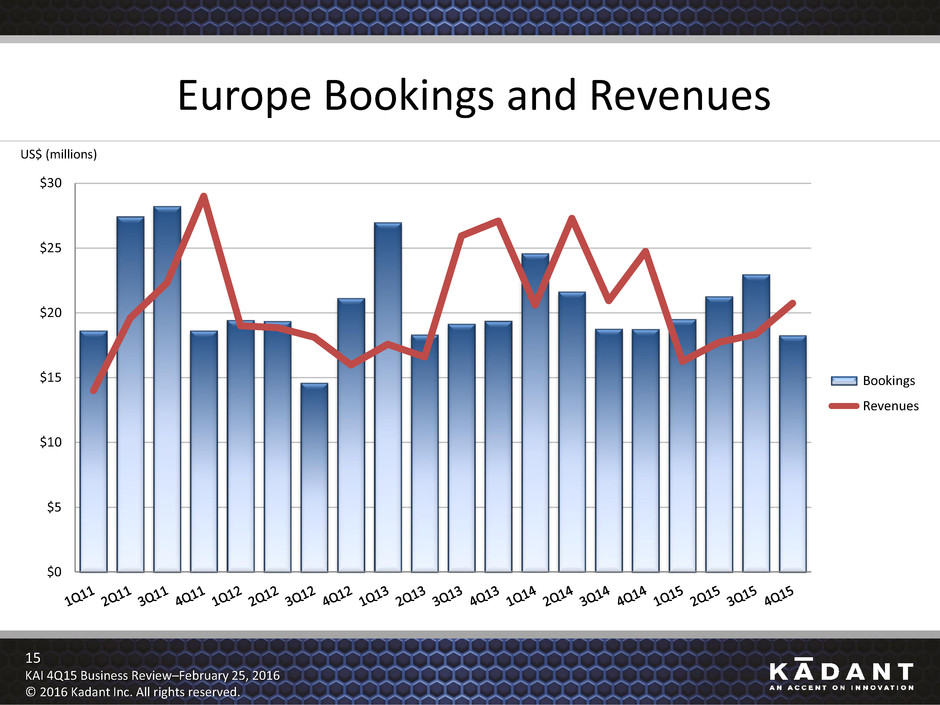

15 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Europe Bookings and Revenues US$ (millions) $0 $5 $10 $15 $20 $25 $30 Bookings Revenues

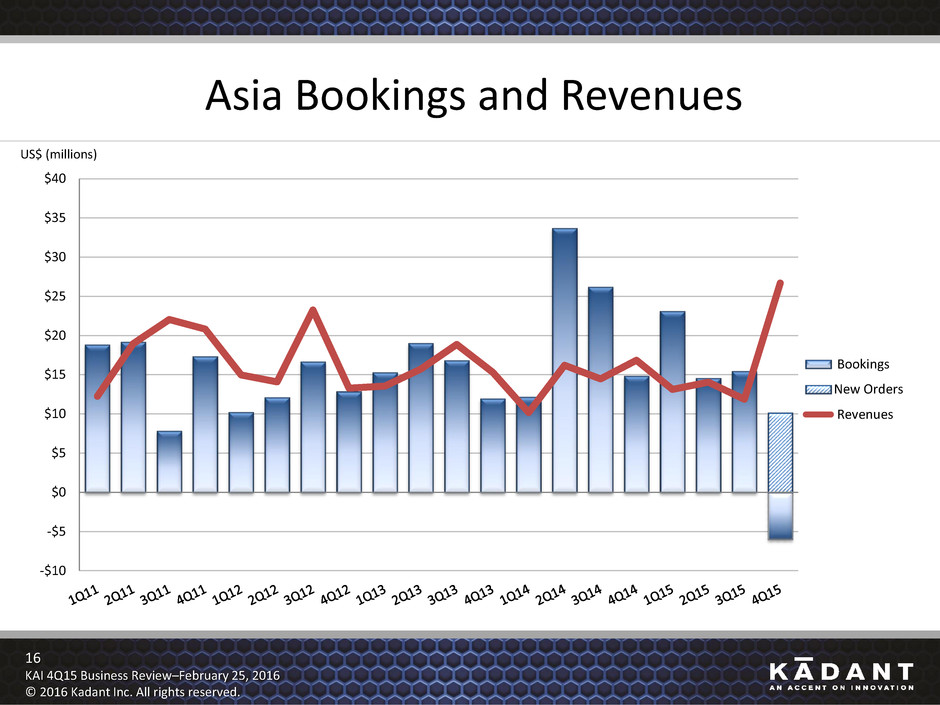

16 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Asia Bookings and Revenues US$ (millions) -$10 -$5 $0 $5 $10 $15 $20 $25 $30 $35 $40 Bookings New Orders Revenues

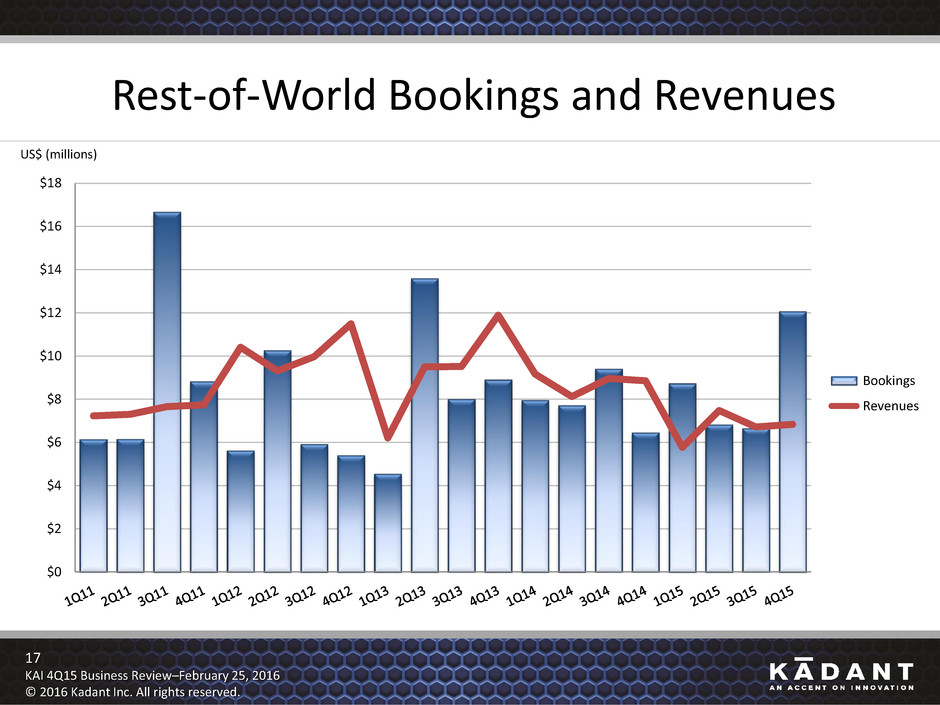

17 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Rest-of-World Bookings and Revenues US$ (millions) $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 Bookings Revenues

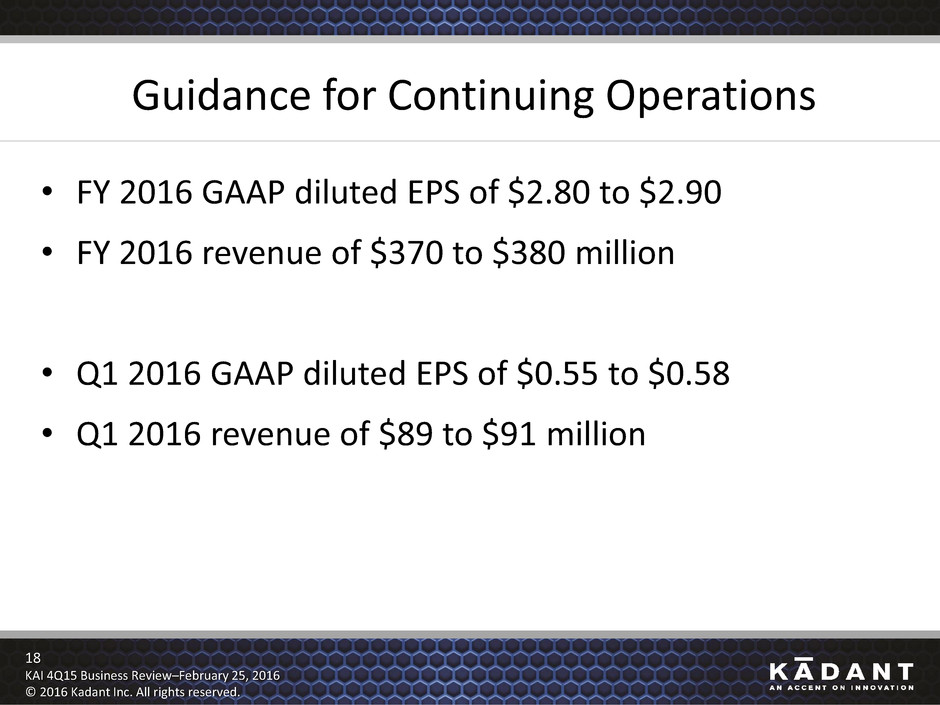

18 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Guidance for Continuing Operations • FY 2016 GAAP diluted EPS of $2.80 to $2.90 • FY 2016 revenue of $370 to $380 million • Q1 2016 GAAP diluted EPS of $0.55 to $0.58 • Q1 2016 revenue of $89 to $91 million

19 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. FINANCIAL REVIEW Michael J. McKenney Senior Vice President & Chief Financial Officer

20 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Quarterly Gross Margins 47.6% 45.7% 42.7% 38.6% 45.6% 43.7% 43.4% 43.0% 47.3% 48.6% 43.9% 43.9% 45.2% 43.0% 44.7% 44.7% 48.1% 46.5% 47.5% 43.1% 36% 38% 40% 42% 44% 46% 48% 50%

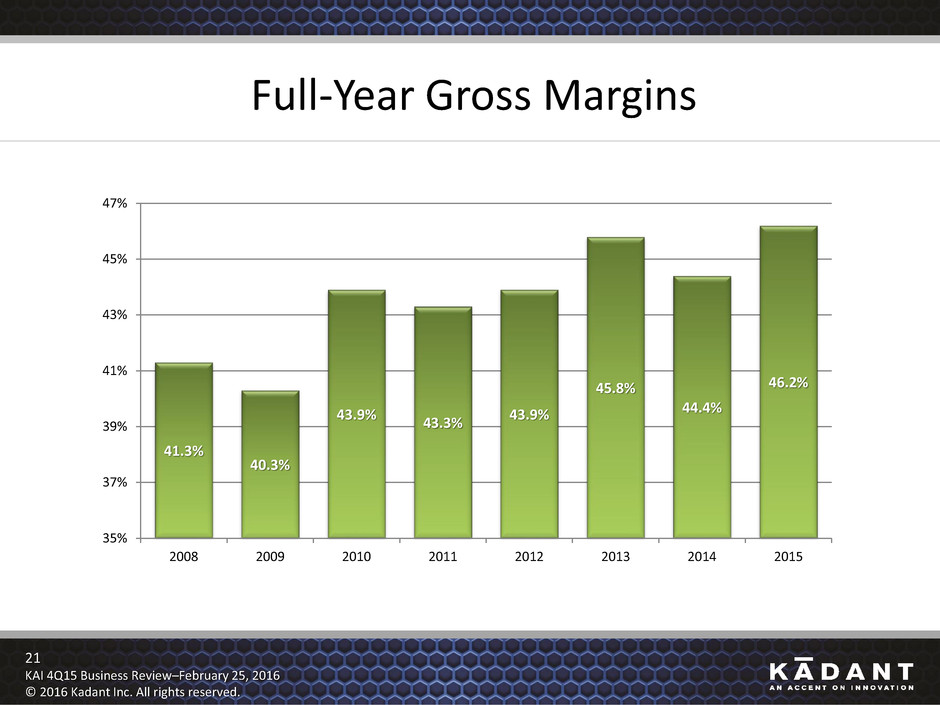

21 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Full-Year Gross Margins 41.3% 40.3% 43.9% 43.3% 43.9% 45.8% 44.4% 46.2% 35% 37% 39% 41% 43% 45% 47% 2008 2009 2010 2011 2012 2013 2014 2015

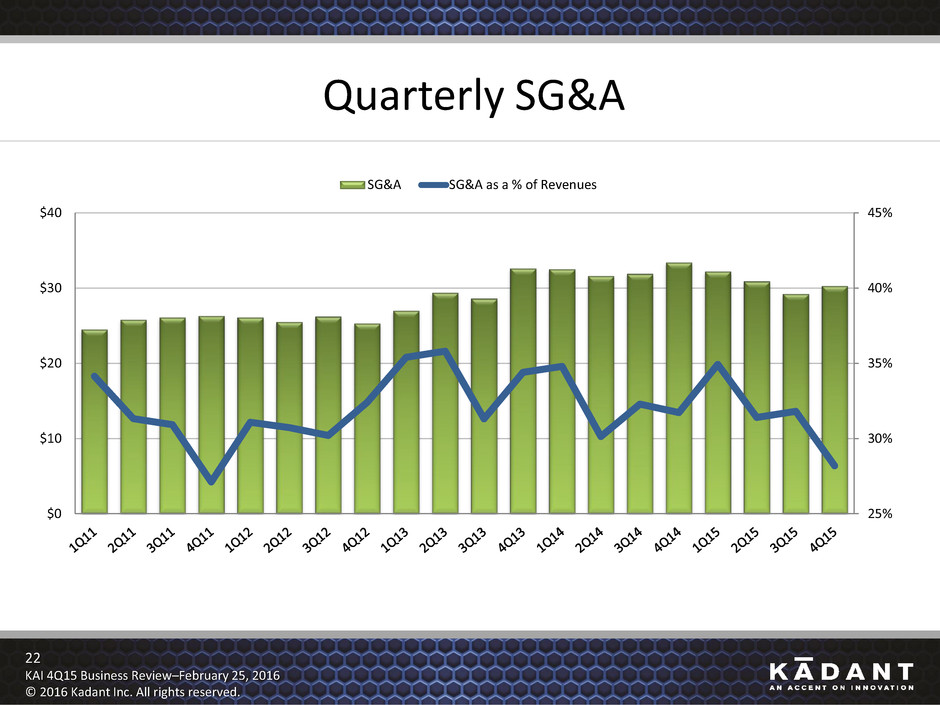

22 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Quarterly SG&A 25% 30% 35% 40% 45% $0 $10 $20 $30 $40 SG&A SG&A as a % of Revenues

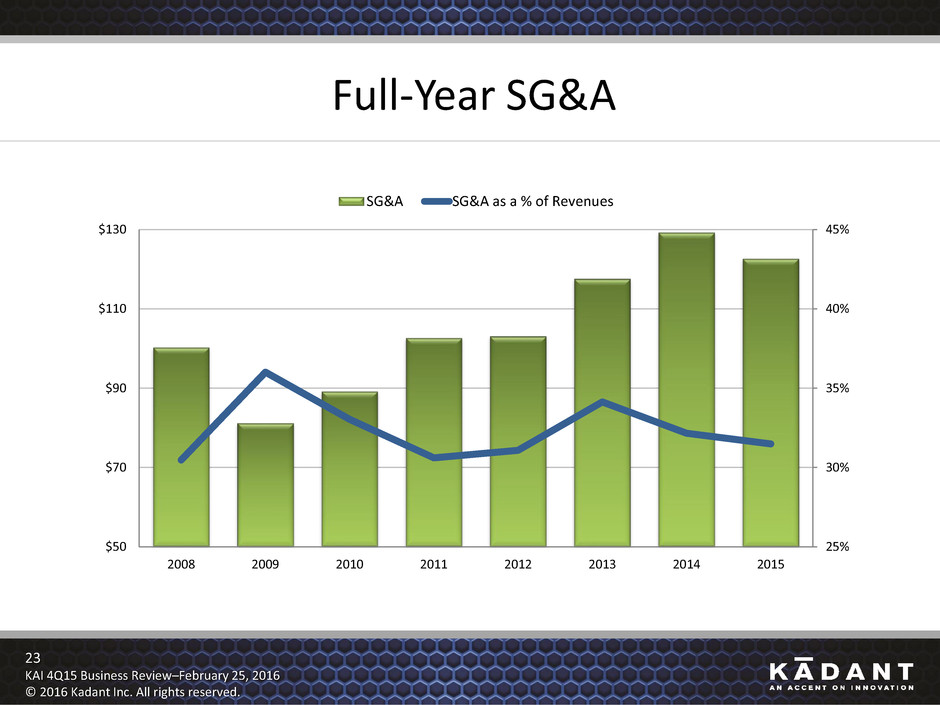

23 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Full-Year SG&A 25% 30% 35% 40% 45% $50 $70 $90 $110 $130 2008 2009 2010 2011 2012 2013 2014 2015 SG&A SG&A as a % of Revenues

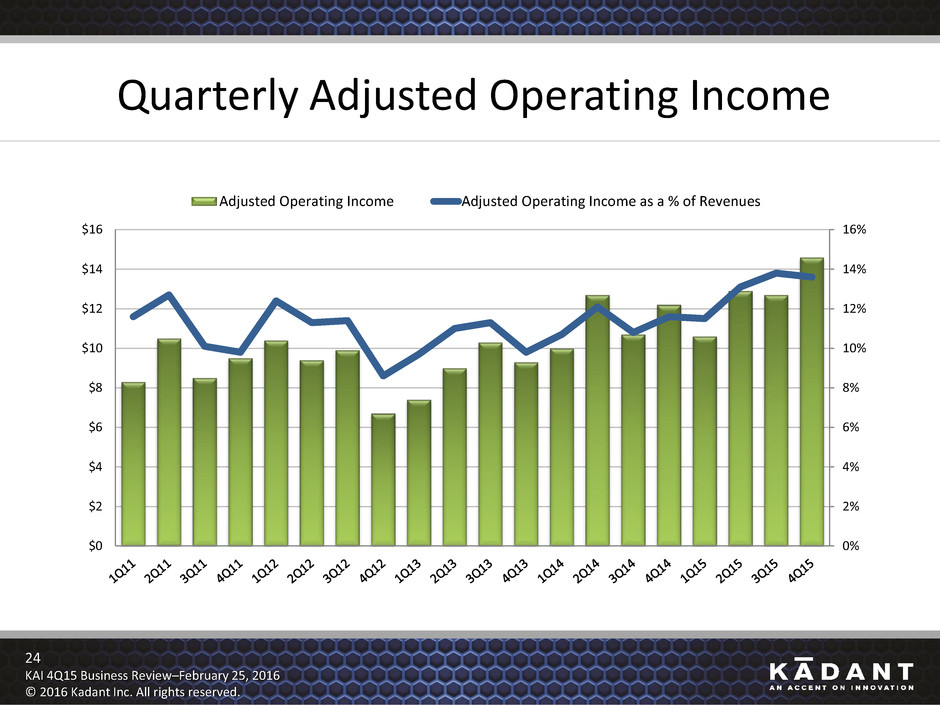

24 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Quarterly Adjusted Operating Income 0% 2% 4% 6% 8% 10% 12% 14% 16% $0 $2 $4 $6 $8 $10 $12 $14 $16 Adjusted Operating Income Adjusted Operating Income as a % of Revenues

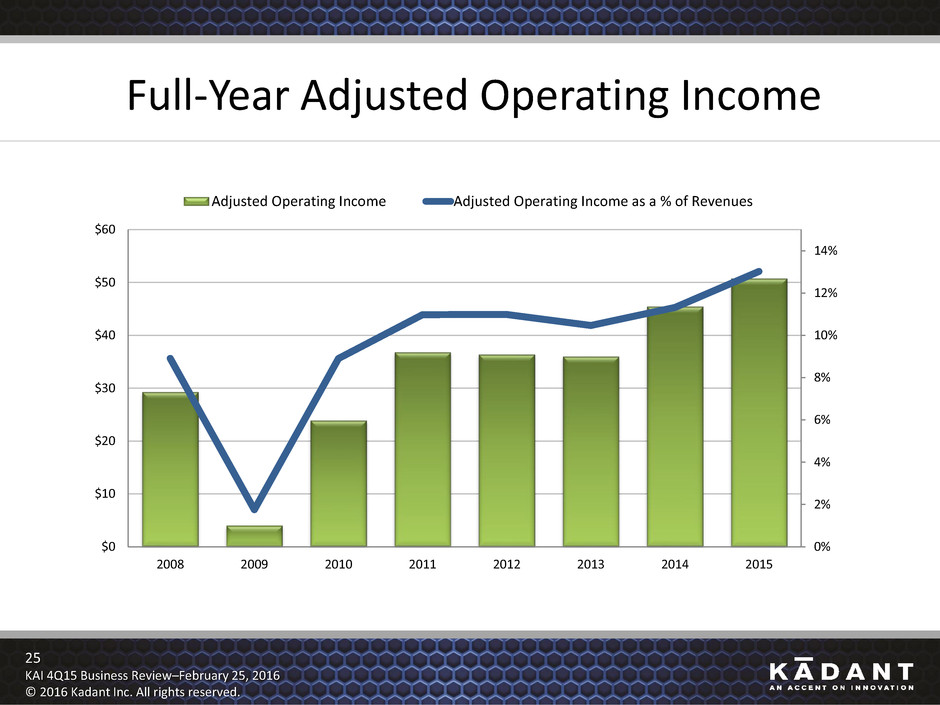

25 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Full-Year Adjusted Operating Income 0% 2% 4% 6% 8% 10% 12% 14% $0 $10 $20 $30 $40 $50 $60 2008 2009 2010 2011 2012 2013 2014 2015 Adjusted Operating Income Adjusted Operating Income as a % of Revenues

26 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. 4Q14 to 4Q15 Adjusted Diluted EPS from Continuing Operations $0.81 $0.20 $0.07 $0.01 ($0.11) ($0.03) $0.95 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25

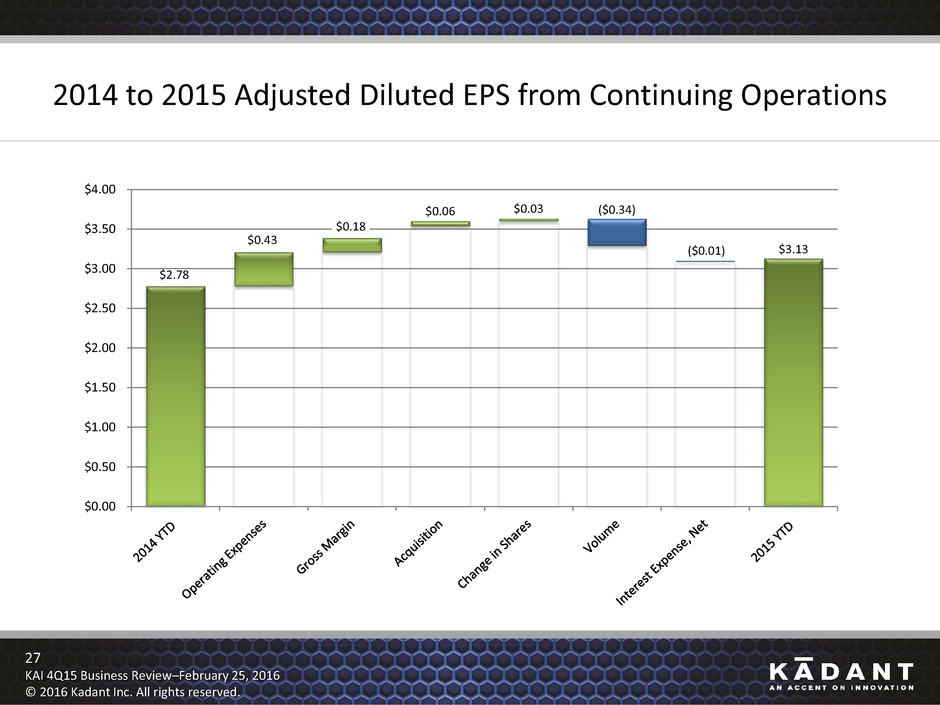

27 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. 2014 to 2015 Adjusted Diluted EPS from Continuing Operations $2.78 $0.43 $0.18 $0.06 $0.03 ($0.34) ($0.01) $3.13 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00

28 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Cash Flow ($ Millions) 4Q15 4Q14 2015 2014 Income from Continuing Operations $10.4 $9.2 $34.6 $29.1 Depreciation and Amortization 2.6 2.6 10.8 11.2 Stock-Based Compensation 1.2 1.6 5.7 5.8 Other Items (2.0) 2.7 (3.5) 2.5 Change in Current Assets & Liabilities (excl. acquisitions) 0.1 2.4 (9.7) 0.3 Cash Provided by Continuing Operations $12.3 $18.5 $37.9 $48.9

29 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Free Cash Flow Free cash flow is defined as cash flows from continuing operations less purchases of property, plant, and equipment. 13.2 40.3 24.9 26.3 26.2 33.7 42.1 32.4 0 5 10 15 20 25 30 35 40 45 2008 2009 2010 2011 2012 2013 2014 2015

30 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Stock Repurchases and Dividends ($ in Millions, except per share amounts) 2015 2014 2013 2012 2011 Common Stock Repurchases $9.9 $15.1 $5.4 $14.5 $16.1 Average Price per Share $43.12 $37.36 $30.67 $22.87 $21.52 Cash Dividends $7.2 $6.4 $4.2 - - Total Stock Repurchases and Dividends $17.1 $21.5 $9.6 $14.5 $16.1 Net Income from Continuing Operations $34.3 $28.7 $23.5 $30.9 $33.6 % of Net Income from Continuing Operations 50% 75% 41% 47% 48%

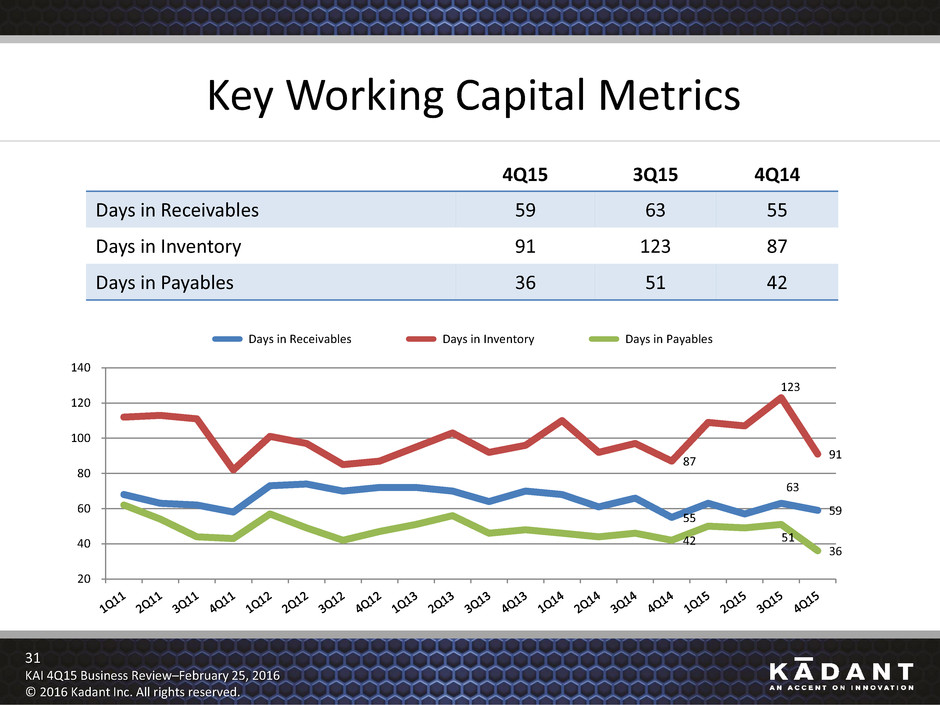

31 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Key Working Capital Metrics 4Q15 3Q15 4Q14 Days in Receivables 59 63 55 Days in Inventory 91 123 87 Days in Payables 36 51 42 55 63 59 87 123 91 42 51 36 20 40 60 80 100 120 140 Days in Receivables Days in Inventory Days in Payables

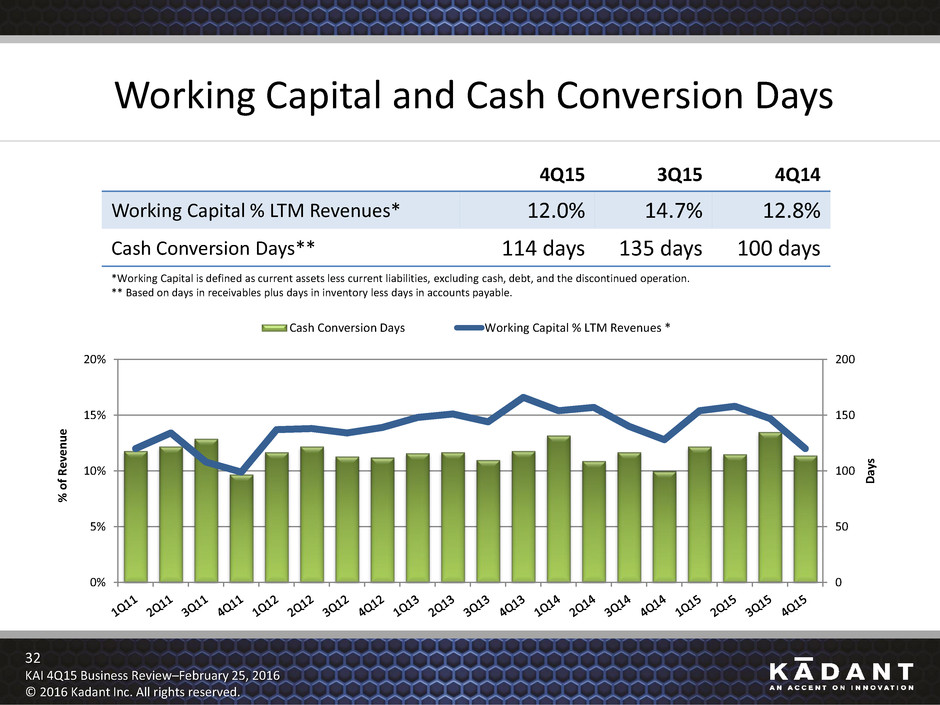

32 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Working Capital and Cash Conversion Days 4Q15 3Q15 4Q14 Working Capital % LTM Revenues* 12.0% 14.7% 12.8% Cash Conversion Days** 114 days 135 days 100 days *Working Capital is defined as current assets less current liabilities, excluding cash, debt, and the discontinued operation. ** Based on days in receivables plus days in inventory less days in accounts payable. 0 50 100 150 200 0% 5% 10% 15% 20% D ay s % o f R e ve n u e Cash Conversion Days Working Capital % LTM Revenues *

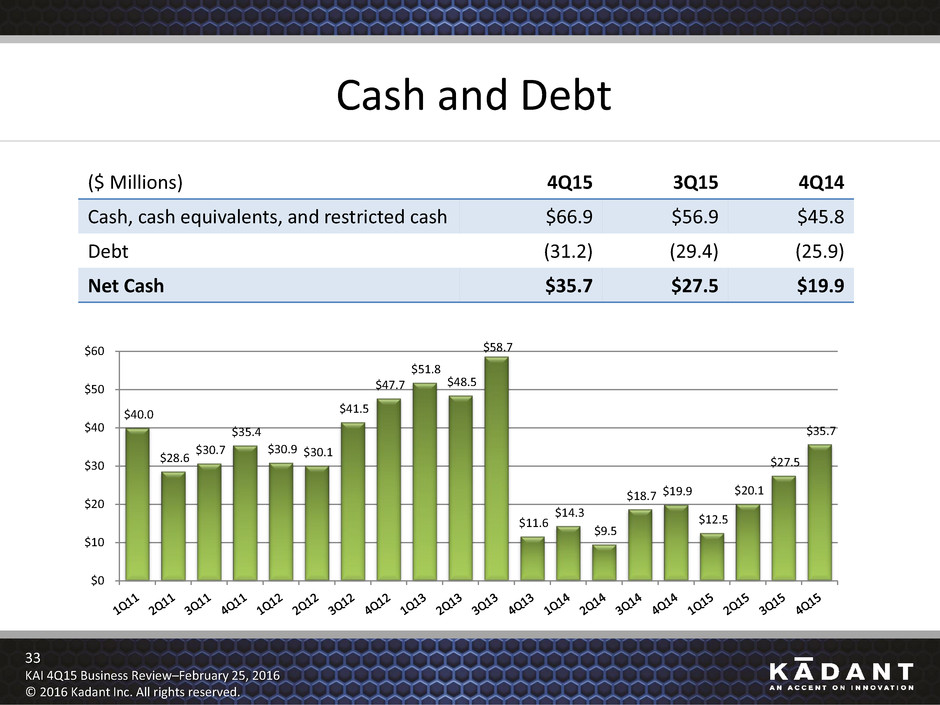

33 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Cash and Debt ($ Millions) 4Q15 3Q15 4Q14 Cash, cash equivalents, and restricted cash $66.9 $56.9 $45.8 Debt (31.2) (29.4) (25.9) Net Cash $35.7 $27.5 $19.9 $40.0 $28.6 $30.7 $35.4 $30.9 $30.1 $41.5 $47.7 $51.8 $48.5 $58.7 $11.6 $14.3 $9.5 $18.7 $19.9 $12.5 $20.1 $27.5 $35.7 $0 $10 $20 $30 $40 $50 $60

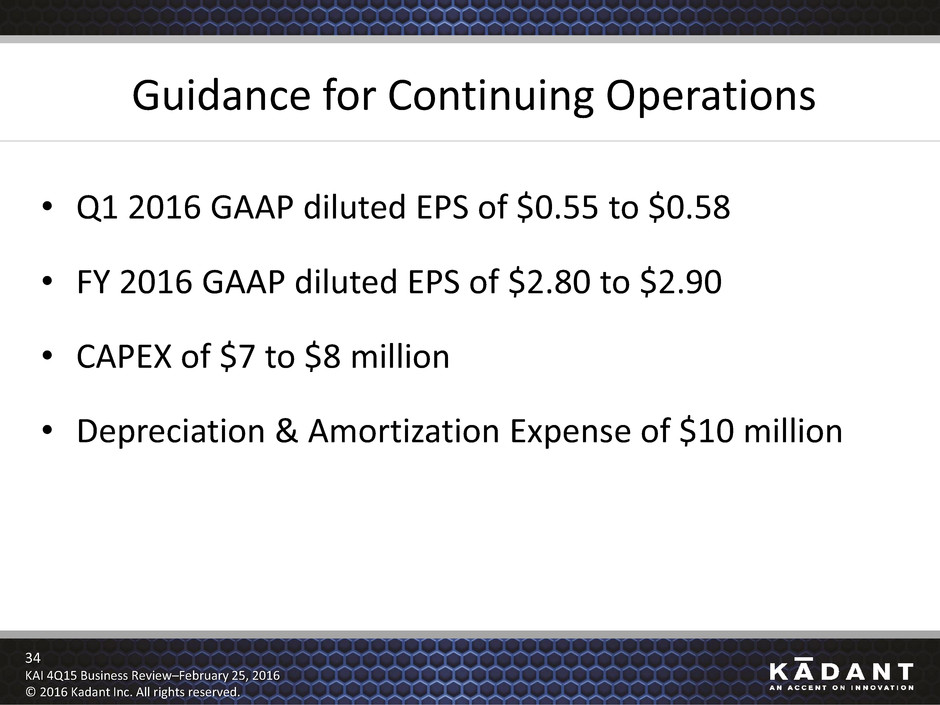

34 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Guidance for Continuing Operations • Q1 2016 GAAP diluted EPS of $0.55 to $0.58 • FY 2016 GAAP diluted EPS of $2.80 to $2.90 • CAPEX of $7 to $8 million • Depreciation & Amortization Expense of $10 million

35 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Questions & Answers To ask a question, please call 877-703-6107 within the U.S. or +1-857-244-7306 outside the U.S. and reference 83375884. Please mute the audio on your computer.

36 KAI 4Q15 Business Review–February 25, 2016 © 2016 Kadant Inc. All rights reserved. Key Take-Aways • Record gross margin, operating income, adjusted EBITDA, and diluted EPS performance in fiscal 2015 • 2016 expected to be another solid year

Fourth Quarter and Fiscal Year 2015 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO